Full Length Research Paper

ABSTRACT

This study investigates the potential for internationalisation of the naira in the quest for a common West African currency, despite some weak institutional challenges attributed to Nigeria. We employed a two-stage currency internationalisation modelling approach, where the first stage estimates the model, and the second stage employs ‘counterfactual simulations’ to predict the trend in the currency ratio of the proposed currency for internationalisation (in this case, the naira). We also account for the ‘tipping effect’ and ‘network externalities’, as recommended in the literature. The results provide evidence that supports the ‘tipping effect’ and ‘network externalities’, which show that accounting for ‘network externalities’ may cause inconsistency in the results. Our simulation exercise shows that improvements in the financial and macroeconomic development levels are prerequisites for the internalisation of the naira in West Africa. The results of the policy simulation also show that the reserve ratio of the naira is consistently higher than that of the CFA franc, which indicates that the naira is a better reserve currency anchor for the proposed single currency in West Africa, compared with the CFA franc. This is also reinforced by evidence that the naira in its worst performing period is better than the CFA franc in its best performing period.

Key words: Currency internationalisation, institutional reform, naira, ECOWAS, Nigeria.

INTRODUCTION

Currency internationalisation refers to a sovereign currency that performs functions of a currency used by other countries in international trade, capital flows, and foreign exchange reserves, that is, one that is used and held outside the borders of the host nation (Yonghong et al., 2013). The configuration of the international monetary system is such that the global reserve is concentrated in a few currencies, with the U.S. dollars currently accounting for about 61.82% of the global reserves. The Euro, Japanese Yen, and British Pounds account for 20.24, 5.25, and 4.54%, respectively, while the Chinese RMB, the latest entry in the monetary system, and accounts for about 1.95%. Notably, emerging and developing economies have remained passive and complacent when it comes to creating alternative reserve currency, largely because of the orthodox 'prerequisite’ approach to currency internationalisation, which made it seem impossible for countries to satisfy the pre-conditions for currency internationalisation.

Meanwhile, the concentration of the international monetary system in a few currencies made it impossible to achieve efficient global risk-sharing in the face of global financial crisis of 2007–2008, European debt crisis, and the associated contagion (Maziad and Kang, 2012; Chey and Li, 2016). This reveals the weaknesses and vulnerabilities of the global economy shocks, which provides justification for emerging markets to consider internationalising their currencies (Cui, 2013). In response to this, countries are bracing up to integrate into the global currency value chain, while countries with the existing international reserve currencies push to deepen further their economic and socio-political influence. The unfolding events arising from the Chinese experiment has ignited a paradigm shift from trade wars to a combination of trade–currency wars.

Apparently, notable foreign reserve currencies at present are the U.S. dollar, euro, Japanese yen, British pounds, and recently, the Chinese yuan renminbi (RMB). These currencies are esoteric to the African continent, and the use of anyone of them as anchor for the proposed single currency for West Africa may be considered derogatory to the socio-economic sovereign status of West Africa as a region. Thus, the objective of this study is to examine the potential of Naira to serve as a currency to be used across West Africa, or rather, as a currency to be adopted as a regional currency under the West African currency union arrangement. Therefore, this study relies on the experience of what could be referred to as the ‘Chinese Experiment of renminbi internationalisation (RMB-I)’ to provide an argument for naira internationalisation in the West African sub-region, which, in addition, provides a good basis for enhanced institutional reforms in Nigeria and the intra-Economic Community of West African States (ECOWAS) trade.

This study contributes to the literature on currency internationalisation from an empirical viewpoint. Specifically, it examines the potential for naira internationalisation within the ECOWAS region by predicting the performance of the naira as the anchor foreign reserve currency for the proposed ECOWAS common currency, while holding constant the institutional challenges faced by Nigeria. Considering the naira as the anchor currency for the proposed common West African currency is justified based on the relative size and significance of Nigeria in the ECOWAS union. With a population of over 200 million, Nigeria accounts for more than half of the ECOWAS’s population; it contributes about 67% of the region’s GDP and accounts for more than 50% of the total ECOWAS trade (Tule, 2010). Nigeria also has political influence in notable countries such as the apartheid South Africa, Liberia, Sierra Leone, and recently, Gambia, which is expected to give Nigeria’s currency, the naira, sufficient ‘externalities network’ should it be used as the reserve currency for the region. Nigeria taking a lead would be akin to the experience of the euro zone where the Deutsche mark played a unifying role in the period preceding the introduction of the euro. It is in this context that the naira is often seen as the likely anchor currency for the ECOWAS (Ordu, 2019).

The need to hold constant the institutional challenges faced by Nigeria rests on the ‘unorthodox’ approach, which believes that sustainable growth drives institutional reforms rather than the ‘orthodox’ approach, which believes that institutional reforms drive sustainable growth. Specifically, while the inside-out (the orthodox) approach suggests that the institutional reforms recommended by international institutions should be achieved before currency internationalisation, the Chinese experience has shown that this might not necessarily be the case. China has internationalised its currency without fully liberalizing its capital account. It has achieved this by allowing the renminbi to be used in cross-border trade with North Korea, Vietnam, Nepal, Hong Kong, Macau, and so on and by engaging in currency swap arrangements with countries worldwide such as Brazil (Eichengreen, 2011). As such, naira internationalisation, as is the case with China, should be as a strategy to drive institutional reform, exchange rate stability, and a positive balance of payment (Bowles and Wang, 2013).

In terms of methodology, this study employs the counterfactual simulation approach following the work of Wu et al. (2014), who examined the conditions and potential for Chinese RMB internationalisation. Specifically, this study models naira internationalisation using linear and nonlinear panel regression, and simulates the performance of naira as a foreign reserve anchor for the ECOWAS region. The linear and nonlinear panel regressions are structured in static and dynamic models. This allows sufficient robustness checks for the results, while the dynamic model also captures the ‘network externalities’ of the country of the proposed foreign reserve currency—Nigeria. This modelling approach is considered appropriate as it accounts for economic size and trade size, which have been considered important determinants of currency internationalisation in earlier studies (Wu et al., 2014). However, unlike Wu et al. (2014) who considered global internationalisation of the RMB, this study works on the regional internationalisation, as naira is only being considered for use within the ECOWAS region. Thus, rather than simulating the proposed currency for internationalization based on all existing reserves currencies (as in Wu et al., 2014), naira internationalisation was examined relative to the two reserve currencies (the U.S. dollar and euro) currently serving as reserve currencies for countries in West Africa. As such, this study provides new evidence on currency internationalisation based on selected geo-political regions.

STYLISED FACTS ON ECOWAS, AND THE PROPOSED COMMON CURRENCY

This section discusses the ECOWAS and its proposed common currency, and the significance of Nigeria in the ECOWAS region, which is the basis for examining the potential for the Naira internationalisation in the region.

ECOWAS and the proposed common currency—the ECO

There is no denying that the adoption of a common monetary policy has, over the years, formed part of the process of economic integration across the globe. Following the formation of the European Monetary Union (EMU) in particular, quite a number of region unions have continued to express their interest in forming a similar union, which has to do with member countries giving up their independent monetary policies to pave the way for a common central bank that will be responsible for the conduct of monetary policy for the member states. One of such regional unions is the ECOWAS. Founded in 1975, ECOWAS is an organisation of fifteen (15) members that already includes a monetary union of the former French colonies—West Africa Economic and Monetary Union (WAEMU), also known as UEMOA in its French acronym. In April 2000, ECOWAS, according to Tsangarides and Qureshi (2008), adopted the strategy of a two-track approach to launching the common currency in the region. Accordingly, the non-WAEMU members of ECOWAS planned to form a second monetary union known as the ‘West African Monetary Zone (WAMZ)’ in the first track, with the second track being the subsequent merging of WAEMU and WAMZ. Same as the EMU, one of the main purposes of this second track is to have a common currency across all the member countries in the ECOWAS region.

One of the frameworks often used in the monetary unification literature to evaluate the costs and benefits of forming or joining a monetary union (Capie and Wood, 2003) is the optimum currency area (OCA) theory. Pioneered by Mundell (1961) and McKinnon (1963), the OCA theory places emphases on four key criteria that would impinge on the benefits of adopting a common currency. These are: (i) the degree of openness and intra-regional trade, (ii) the degree of labour and factor mobility, (iii) the symmetry of shocks across countries, and (iv) the system of risk sharing. Depending on the extent to which these criteria are met, individual economies may suffer or benefit by joining a currency union. Thus, a monetary union that meets OCA criteria tends to be beneficial to all members in such forms as reduced transaction costs, end of the beggar-thy-neighbour policies, elimination of exchange rate uncertainty, and more transparent prices, among other things (De Grauwe, 2000). However, the inability to fulfil these OCA conditions is likely to be costly to the member countries of the monetary union in such forms as loss of the country’s sovereignty over monetary policy, loss of control over monetary policy instruments, or shock absorbers such as exchange rate and interest rate (Tsangarides and Qureshi, 2008; De Grauwe and Polan, 2005).

Historically, it has already been 20 years since the quest to form a monetary union was initiated amongst the ECOWAS member countries of sub-Sahara Africa, yet the region has not been able to achieve its target. The initial launch date for the single currency by WAMZ in 2003 was postponed to 2005, with hope that member countries would improve their economic status (Nkwatoh, 2018). Realising that the actualisation of the single currency was not forthcoming even in 2005; the launch date was further postponed to 2009. In this light, the ECOWAS suffered postponement between 2003 and 2005 because of (i) persistence of fiscal dominance, (ii) high inflation, and (iii) low levels of foreign exchange reserves. Thus, the designation for the unification of ECOWAS monetary policy and the quest for a common currency were later set to be implemented in 2015 but only to be further shifted to 2020. Despite having undergone a series of deliberations, meeting, and policies to create a single currency named ‘Eco’, it is regrettable that the ECOWAS’s vision of 2020 as the designated year of monetary unification and launching of the ECOWAS’s common currency might not be feasible.

Although quite a number of the member countries have not been able to satisfy some of the OCA criteria as required for monetary unification and common currency, the union is faced with the determination of what currency to serve as the anchor or reserve for the proposed common currency. Already, the choice of two existing reserve currencies is plausible, as the U.S. dollar and euro currently serve as the reserve currency for the WAMZ and WAEMU countries, respectively. Meanwhile, the use of an alternative reserve currency of regional origin appears more plausible, as it tends to retain the benefits attributable to reserves, particularly siegniorage, within the region (Chinn and Frankel, 2005). There is growing consideration of the relative gigantic size of the Nigerian economy as another dimension to the actualisation of a common currency in the region via the internationalisation of the Nigerian currency (naira). Using the words of Hafner and Jager (2013), the OCA is a regional grouping of countries that peg their currencies to the same anchor currency. As Nigeria has the largest GDP and accounts for the largest regional trade for which the proposed currency would be used, the proposition of naira internationalisation in the ECOWAS region or, in other words, the proposition for the use of Nigerian naira as the reserve anchor for the proposed ECOWAS common currency can be justified.

Nigeria and the potential of naira internationalisation in the ECOWAS sub-region

In this section, we review the economic position of Nigeria in the ECOWAS region, which serves as the basis for considering the naira as the currency anchor for West African currency or the examination of the potential of naira internationalisation in the region. Large economic size and trade size have been described as part of the veritable conditions for currency internationalisation (see Wu et al., 2014). Thus, we explore the viability of naira internationalisation in the ECOWAS sub-region by comparing the size of the economy and trade of Nigeria relative to that of other West African countries (among other economic indicators of countries within the ECOWAS region).

Economic consideration

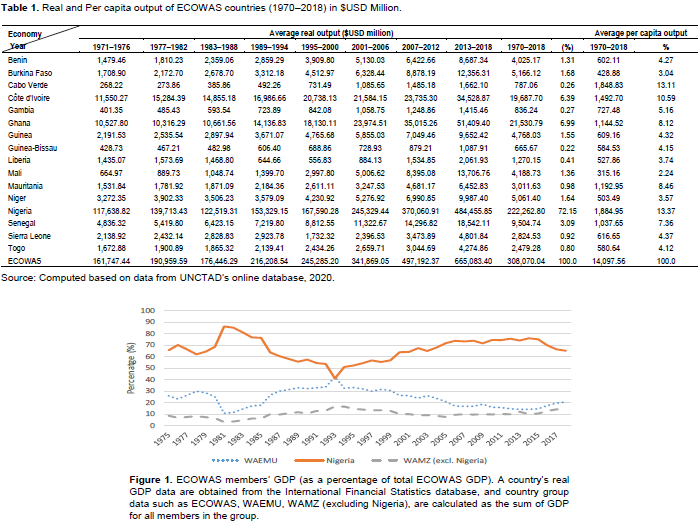

Table 1 shows that Nigeria, in addition to being the largest economy in Africa, is about 72.2% of the ECOWAS economy, which, in real terms, is approximately three times the size of the economy of other member countries, including Mauritanian who is a non-ECOWAS member country but may benefit from such a currency arrangement. This also means that with a population of over 200 million people, Nigeria is a large market, both for global and ECOWAS intra-trade. Furthermore, Figure 1 shows that Nigeria’s contribution to ECOWAS is above 80% in the early 1980s, fell to a minimum of above 40% in 1993, and increased slowly to 75.15% in 2015. The 2014 oil price crash appears to have affected Nigeria’s GDP, causing its contribution to ECOWAS GDP to fall to about 65.17% in 2018. The Figure also shows that the contribution of all UEMOA/WAEMU countries to ECOWAS’s GDP is, on average, less than 30%. It is however greater than the contribution of WAMZ countries (excluding Nigeria). In terms of per capital output, Table 1 shows that Nigeria is marginally above Cabo Verde, with a per capital output of $1,885 and $1,859, respectively. This reveals the implications of a growing population and the ability of the economy to produce for the teeming population. This is one of the important areas in which the internalization of the naira will benefit the economy—by inducing the active population to produce and meet the market demand in Nigeria that arise from the demand for the currency to meet the requirements for the expected improvement in the global and intra-ECOWAS trade. The importance of naira internationalisation in the whole region relates to the size of the economy and the market, which reflects the consuming population that creates market for Nigeria, hence increasing economic demand, with attendant effect on welfare.

Trade consideration

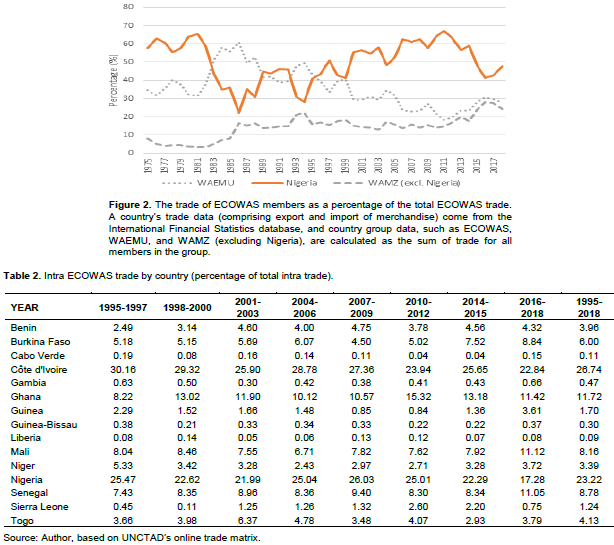

The potential of currency internationalisation has also been found to depend on a country’s relative trade size (Wu et al., 2014). Evidence from Onyekwena and Oloko (2016) revealed that Nigeria is the main driver of ECOWAS’s international trade (where ‘international’ refers to countries outside ECOWAS) and takes second position (after Cote D’Ivoire) in terms of contribution to intra-ECOWAS trade. As evident from the study, Nigeria’s contribution to ECOWAS’s international trade was 60.51%, 64.73%, and 67.71% in the periods 2001–2004, 2005–2009, and 2010–2014, respectively. Meanwhile, its contribution to intra-ECOWAS trade was 28.2%, 26.87%, and 24.7% for the periods 2001–2004, 2005–2009, and 2010–2014, respectively, as shown in Figure 2 and Table 2. Figure 2 shows the trade contribution of Nigeria, WAEMU, and WAMZ countries (excluding Nigeria) to ECOWAS’s total international trade. The figure reveals that the contribution of Nigeria to ECOWAS’s international trade has declined sharply and has remained below 50% since 2015. This fall may be attributed to the fall in global oil price, as oil export accounts for more than 85% of Nigeria’s total mechanised exports. Meanwhile, the figure shows that the contribution of WAEMU countries and WAMZ countries (excluding Nigeria) rose after 2011; however, they are less than 30%. This suggests that Nigeria remains the largest contributor to ECOWAS trade, which means that the naira could function as the anchor currency for regional trade. However, this potential may be hampered by the country’s high level of dependence on crude oil, which makes its trade contribution volatile. Thus, effective economic/export diversification may enhance the naira’s potential to function as the anchor currency in the ECOWAS region. Table 2 reveals three big players in intra-ECOWAS trade, namely, Côte d'Ivoire, Nigeria, and Ghana. These countries control about 61.7% of intra-ECOWAS trade since 1995, with Nigeria accounting for about 23.2%, and Côte d'Ivoire and Ghana about 26.7 and 11.72%, respectively. However, a deeper analysis of the trade flow by classification of imports, exports, and merchandise balance shows that Nigeria plays a more dominant role in terms of a favourable balance of merchandise traded, compared with Côte d'Ivoire and Ghana (Figure 3). The results show that it has a dominant role and favourable trade balance amounting to 24.5% of the total intra trade balance, while Côte d'Ivoire and Ghana have a merchandise balance (deficit) of about 5.6 and 9.0%, respectively. A further breakdown of the data shows that Nigeria accounts for 35% of the total export trade within ECOWAS and about 10% of the total average import since 1995-equivalent to $2.26 billion of exports and $630.21 of imports.

Macroeconomic stability

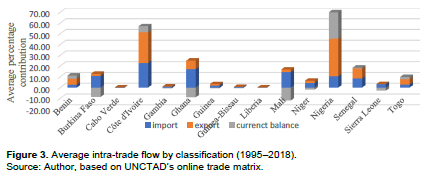

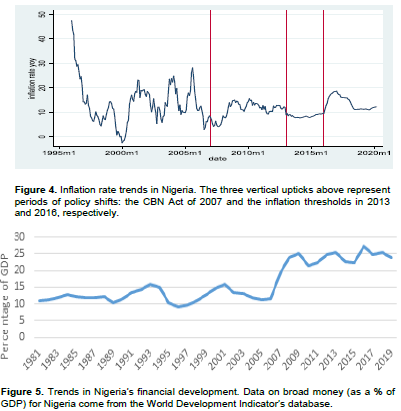

Another factor linked to the measure of currency stability for a currency internationalisation-seeking country is the relative macroeconomic stability (Wu et al., 2009). Our review of trends in the macroeconomic indicators of Nigeria suggests that Nigeria’s macroeconomic environment has experienced turbulence in the past but is becoming fairly stable because of various efforts by the government (Tule et al., 2019). This situation has been mostly attributed to the large dependence on crude oil or commodities, which is a problem common to all countries belonging to ECOWAS (Onyekwena and Oloko, 2016). Evidence from Figure 4 shows that except in recent years, Nigeria’s inflation has been unstable. Nigeria is not an inflation-targeting country but has successfully used its monetary targeting framework to keep inflation in check. In the periods after independence and even in the early 1990s, the average year-on-year inflation, with some element of deflationary pressures in the late and early 2000s, was about 25.2% (Figure 4). This was largely because of the fixed exchange rate (tied to the British pounds) of the Nigerian pound and the loss of monetary policy independence of the central bank of Nigeria. Inflation was fairly stable and remained at single digit between 2013 and 2016; however, the 2016 oil price crash caused drastic increase in inflation, but inflation has since reduced and remained fairly stable after 2016. Fairly stable changes in the price level in Nigeria suggest that the Nigerian currency, the naira, can serve as a good reserve currency for the ECOWAS region. Furthermore, the trends in Nigeria’s financial development level, measured in terms of broad money as a percentage of GDP, are presented in Figure 5. In summary, the figure shows that Nigeria’ financial development level has increased over time—from about 10% in 1981 to about 25% in 2018. This also indicates that the naira has potential to serve as the reserve currency, which supports the internationalisation of the naira within the ECOWAS region.

REVIEW OF THE LITERATURE

Two major approaches have been adopted in the conceptualisation of currency internationalisation: the functional and political economy approaches. Cohen (1971) introduced the functional approach to the concept of currency internationalisation using the role of money in the economy. The analysis of Cohen’s functional approach of international currency has two components. The first component describes the international function of money (that is, unit of account, medium of exchange, and store of value).

The second component classifies currency internationalisation into two broad categories: fully developed international currencies and partial international currencies. Under the former, international currency performs all the roles that money plays in the economy; under the latter, it performs only a few roles (Chey, 2013; and Kenen, 1983). As part of updating his classification of international currencies, Cohen (1997) included geographical range in the conceptualisation of currency internationalisation and increased the categories of currency internationalisation into seven from two broad categories.

The political economy approach to the conceptualisation of currency internationalisation, pioneered by (Strange, 1972), focuses on the politics of international currencies and the political consequences of their use, either for all or for only monetary purposes. In this context, international currencies are classified into four categories: master, top, negotiated, and neutral currencies; these underscore both the economic and political factors that form the nature of currencies’ international uses.

While the views held by the functionalists and political economists continue to be relevant in the discussion of currency internationalisation, some aspects of the literature argue that these views are necessary but not sufficient conditions. Moreover, the experiences of countries like the United Kingdom, United State, Japan, Korea, Germany and more recently, the euro zone, have shown that there is a combination of several economic and political factors that are important determinants of currency internationalisation. This orthodox view is that there are pre-conditions for currency internationalisation; otherwise, it will be wishful thinking if those conditions are not met. The first is the issue of currency convertibility, which enhances the desirability of currency internationalisation for the host country. Consequently, several specific factors must be met to achieve a comprehensive international use of a currency. These factors include financial depth and domestic financial system efficiency, developed legal and regulatory institutions, and economy size. Other factors include the size of the economy, regional importance, trade volume, and macroeconomic stability (Genberg, 2009; Matsuyama et al., 1993; Wright and Trejos, 2001; Ahmed et al., 2011).

Apart from the economic and financial condition, there is also the political institution angle, which the literature argues should precede internationalisation. This aspect of orthodox literature believes that to be a currency leader, a country must adopt a conservative monetary policy approach that is entrenched in her domestic political and economic institutions. Such a conservative influence over the banks is expected to enhance financial market deepening and in turn, the internationalisation of the currency as in the case of the British pounds sterling (Schmitt, 1964; Walter, 2006). Moreover, even if these conditions are met, the hierarchical and asymmetric architecture of the international monetary system imposes a ‘survival constraint’ and unless these structures are dismantled, internationalisation might be difficult for intending countries. It is in the context of these exogenous factors that countries attempt to adopt a development approach that prioritizes exports and investment relative to domestic consumption. Consequently, internationalisation cannot be undertaken in isolation but rather, is tied to a broader economic policy, political mediation, and payments management (Angrick, 2018).

However, an emerging literature attempts to refute the orthodox view of setting preconditions for currency internationalisation. It leans on the RMB experiment as a practical implementation of ‘putting the cart before the horse approach’ that worked and may continue to work for countries that wish to internationalise their currency. This view’s proponents have argued that external preconditions are not only wrongly carried out but also misspecified (Germain and Schwartz, 2017). That is, countries can first internationalise and subsequently put into motion factors that promote it, rather than attempting to remove the constraints before delving into promoting its currency internationally (Chey and Li, 2020). Notwithstanding, some authors were also quick to observe that even though reforms, as a preparatory framework for its currency internationalisation, were not carried out in the case of China, key policies and reforms implemented by the country in the past and the increasing interconnectedness of the global economy paved the way for a greater role of the RMB (Lam et al., 2017).

In between the conventional and the unconventional approaches to currency internationalisation is the concept of drivers of internationalisation. That is, rather than discussing the pre- and post-conditions for internationalisation the authors do not see the financial and non-financial factors as pre-conditions but rather, as motivations for international currency status. Considering that these drivers are the motivation for the push for international currency status, conditions for internationalisation have in fact already been acquired (Yanjing, 2012).

Whether a country adopts the orthodox or unorthodox approach, the consensus is that successful internationalisation of a currency includes potential costs and benefits to the issuing country. Arguably, the most important benefits include lower costs of transaction, shared and reduced exchange rate risk, and the issuance of international debt at more competitive rates (Ahmed et al., 2011). Currency internationalisation also affects monetary policy management. It requires reform of the domestic financial system to enable absorption of capital into the system and management of increased volatility arising from capital inflows and shifts in investment portfolios.

Despite these costs and the confusion created by the quest for the preferred approach, between the pre-condition and the motivation approach, internationalisation could be a win-win situation. That is, in addition to the interest in reforming the financial and non-financial sectors, it could also be used primarily to achieve domestic policy goals (Volz, 2013). Implicitly, placing economic and institutional reform as a pre-condition for internationalisation seems illogical if one is to assess it within the context of globalisation. Institutional reforms in Africa for example, have failed because they are rooted in theoretical strategies rather than competition and the transfer of knowledge (Schneider, 1999; Heidhues and Obare, 2011). Moreover, some of these reforms have failed because they are not based on the theoretical knowledge of Africa’s specific political and economic circumstances—the lack of ownership, ineffectual consultation with stakeholders, inhumanity, and the general insensitivity of the programme to locals (Ganahl, 2013; Ndaguba et al., 2018). Therefore, it will be more beneficial to seek for a home-grown policy based on self-motivation on how to fit into the global value chain. Even the much-touted aid to Africa, instead of helping in the continent’s development, contributed to trapping many countries in the continent into a cycle of corruption, slower economic growth, and poverty, of which cutting off the flow would be far more beneficial (Moyo, 2009; Moyo and Myers, 2009).

Being the largest country in West Africa, this study considers Nigeria as having the required economic and financial development status to function as a reference country for West African countries. Thus, we simulate the potential of the Nigerian currency to serve as the reserve currency for the proposed common currency for West African countries; this is technically defined as the internationalisation of the naira within the West African region. This study fills an important gap in the literature, as earlier studies on the feasibility of an ECOWAS monetary union have not considered the issue of reserve currency for the proposed single currency for West Africa.

METHODOLOGY

Methodological framework

This study employs a linear and dynamic pooled OLS regression (POLS) to examine the potential for the use of the naira outside the shore of Nigeria or as a common currency for West African countries, referred to as naira internationalisation. There are at least two possible frameworks to examine the potential for naira internationalisation: the internationalisation indicator system, credited to Yonghong et al. (2013) and Cui (2013), and the descriptive statistics based on Wu et al. (2014). The former estimates the degree of internationalisation by compiling and estimating an internationalisation indicator system based on the pricing, trading, and reserve functions of international currency, while the later estimates the potential for internationalizing a currency.

In this study, we adopt the potential approach, which is built on the currency internationalisation theory and examines the macroeconomic and financial variables that determine the international position of a reserve currency. These include the size of the economy and trade of the home country, development of the domestic financial market, stability of the currency value, as well as the ‘network externalities’ (or ‘inertia’) developed in the international trade and financial transactions (Wu et al., 2014). Since the naira is not yet an international currency, two stages of analysis are involved. The first stage involves determining the global internationalisation model, which involves estimating the internationalisation model based on the ratio of the international currency reserves of the global central banks (which, in the case of ECOWAS countries are the U.S. dollar and the euro). The second stage involves determining the potential for the internationalisation of the proposed reserve currency (in this case, the naira), which is achieved by conducting a ‘counter-factual simulation’ based on the best fit global model (Wu et al., 2014).

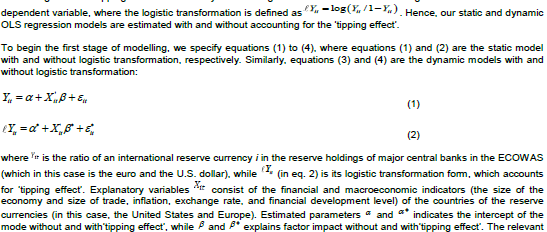

This study estimates linear and dynamic OLS regressions, while lagged dependent variable in the dynamic model measures the significance of the ‘network externalities’. Thus, the analysis is technically conducted with and without accounting for ‘network externalities’ (Wu et al., 2014). Moreover, following Wu et al. (2014), we examine whether accounting for the ‘tipping effect’ matters by considering an alternative model with logistic transformation of the

financial and macroeconomic indicators considered are the size of the economy (that is, the U.S. and euro area GDP as a percentage of the world GDP) and the trade size (that is, the trade level of the country having its currency as international reserves as a percentage of the total world trade). The domestic inflation, changes in exchange rate, and changes in financial development level (proxied by the market capitalization of listed domestic companies as a percentage of GDP) are also considered. Apparently, equation (1) is the static linear regression model without logistic transformation or ‘tripping effect’, while equation (2) is the static linear regression model with logistic transformation or ‘tripping effect’. A bigger size of the economy and trade is expected to enhance the reserve currency ratio; hence, economic size and trade size are expected to have positive effects on the reserve currency ratio. An open and mature financial market will not only offer opportunities for low-cost borrowings, but also provide diversified financial services to international investors. Hence, financial development is also expected to have a positive effect on the reserve currency ratio. Meanwhile, higher inflation and instability in or higher exchange rate (depreciation) indicates economic instability and are expected to reduce the value of the reserve currency or the potential of the currency to become a reserve currency (Dobson et al., 2009; Wu et al., 2014). The institutional reform is kept constant in this study; hence, a positive and significant constant term would suggest that better institutional reforms will enhance the country’s potential to serve as an international currency.

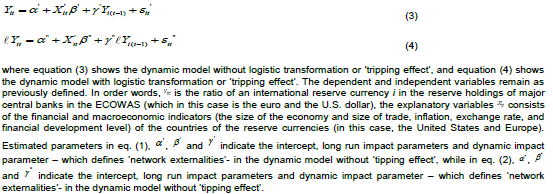

The dynamic models in respect of equations (1) and (2) are presented as follows:

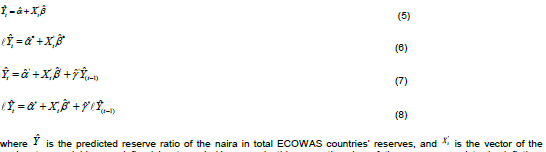

As discussed earlier, the coefficient of the lagged dependent variable is expected to define the ‘network externalities’ of the country whose currency is being held as the foreign reserve. This is expected to capture the extent to which countries are willing to use the country’s currency as their reserve currency, as people are inclined to use the currency that most other people are using in international trade and financial transactions. Hence, a positive relationship is expected between currency reserve ratio and its lag if many countries are willing to use the currency for international transactions (Wu at al., 2014).The second stage of the analysis deals with the potential for naira internationalisation, which is the main subject of this study. However, this relies on ‘counter-factual simulation’, as the naira is not yet an international currency. Therefore, in the second stage of the modelling, the estimated parameters obtained from the global model (in the first stage) are used to forecast the potential of naira internationalisation. The resulting estimated regression models are as follows:

explanatory variables as defined in stage 1. However, in this case, the size of the economy and trade, inflation, exchange rate, and financial development level are defined relative to Nigeria. In the case of trade size and economic size, these are defined in terms of the ratio of Nigeria’s trade and economic size relative to all ECOWAS countries (see Figures 1 and 2). Notably, equations 5-8 are estimated version of equations 1-4 (no more error term), the estimated parameters of the optimal among these models are used for ‘counter-factual simulation’ of the dependent variable, which is expected to generate the reserve ratio of the naira in total ECOWAS countries’ reserves (Wu et al., 2014).

Based on the primary estimation (in stage 1), all the models listed above (equations 5–8) are usable; however, only the optimal model (determined based on relevant statistical indicators such as R-square and log likelihood) is used. This serves as the basis for the ‘counter-factual simulation’ for assessing the potential of naira internationalisation within the ECOWAS region. As the in-sample period for this study ends in 2018, the forecast period is 2019–2026, selected to have sufficient information to observe the trend of the naira as a currency reserve for West Africa.

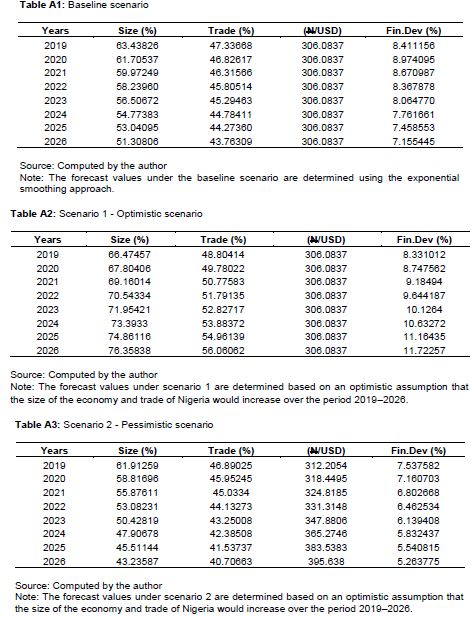

The assumptions of the model simulation are used to formulate three scenarios and generate forecast values for the exogenous variables under each scenario. First, we have the baseline scenario, where the size, trade, exchange rate, and financial development level of Nigeria are expected to remain on their natural path. Second is the optimistic assumption. This is a situation where, for example, a positive external shock occurs between 2019 and 2026. Accordingly, the size, trade, and financial development level of Nigeria increase and its exchange rate is stabilised. The third scenario is a pessimistic one. It is a situation where, for example, a negative external shock, occurring between 2019 and 2026, leads to a fall in the size, trade, financial development, and loss of exchange rate value (currency depreciation).

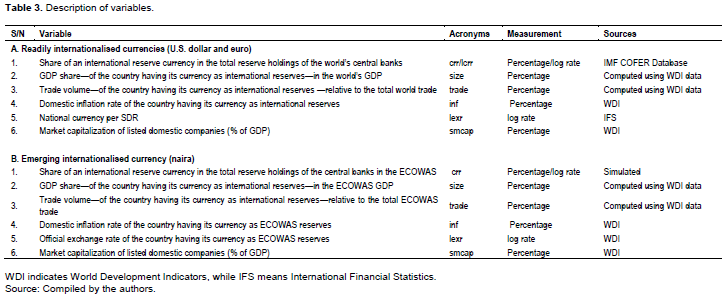

This study uses annual data from 2000 to 2018. Since countries in West Africa have their foreign reserves either in U.S. dollar (non-WAEMU countries) or in euro (the WAEMU countries), these currencies are the focus reserves in this study. Hence, the potential economic indicators of the United States and the euro area, for determining the level of internationalisation of the U.S. dollar and euro, are estimated. The time scope for the study is chosen based on the launching time for the euro (that is 1999) while the end period is the last period for which data is available. The data for empirical analysis come from the World Development Indicators (WDI), IMF COFER Database, and International Financial Statistics (IFS). Detailed description of the data, including acronyms, units of measurement, and data sources, are presented in Table 3.

RESULTS AND DISCUSSION

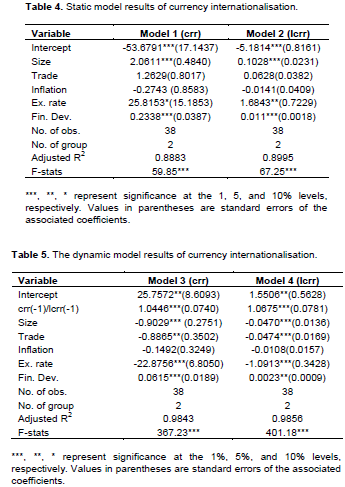

Tables 4 and 5 present the results from the static and dynamic models for analysing naira internationalisation within the West African region. As discussed earlier, both static and dynamic models are expressed with and without logistic transformation, which implies with and without accounting for the ‘tipping effect’, respectively (equations 1, 2, 3 and 4). The dynamic model also accounts for ‘network externalities’, while the static model does not. The results from the static linear model (with and without the ‘tipping effect’) are presented in Table 4 (see eq. 1 and 2). As evident, the results show that the currency internationalisation model with the ‘tipping effect’ is better, as it has higher F-statistic and R-square. This suggests that accounting for the ‘tipping effect’ is important. Moreover, the results from the two models are consistent. Specifically, the results show that the economy’s size has a positive and statistically significant effect on the currency reserve ratio, which indicates that the bigger the size of the economy, the more the currency is held as reserves. This is consistent with the result from earlier studies such as Petkova (2013) and Wu et al. (2014). Meanwhile, the result for the trade size has no significant impact on the currency reserve ratio. This suggests that trade size is not as important as the economy’s size in determining the currency reserve ratio.

Furthermore, the results show that the inflation rate does not have a significant effect, but the exchange rate and financial development level have positive and significant impacts on currency internationalisation. This suggests that the exchange rate and financial development level are more relevant than the inflation rate as macroeconomic and financial indicators in determining currency internationalisation. Specifically, the results show that exchange rate appreciation and enhanced financial development promote currency internationalisation, which is consistent with the findings from previous studies on currency internationalisation (Wu et al., 2014).

The results from the dynamic model with and without the ‘tipping effect’ (logistic transformation) is presented in Table 5 (3 and 4). Notably, the dynamic model accounts for ‘network externalities’ (through the lag of the dependent variable). Similar to the results from the static model, the results from the dynamic model show that the currency internationalisation model with the ‘tipping effect’ is better, as it has higher F-statistic and R-square. Hence, both static and dynamic models indicate that accounting for the ‘tipping effect’ is important. This suggests that the behaviour of currency internationalisation truly follows the ‘tipping effect’.

Nevertheless, the results from the two models are similar. They show that the lagged currency reserve ratio is positive and statistically significant, suggesting that accounting for ‘network externalities’ is important. However, the results in respect of the size of the economy, size of trade, and exchange rate become inconsistent. However, the results for inflation rate and financial development remain consistent. The intercept is also positive and statistically significant, which suggests that some factors held constant in this study, such as institutional reforms, have an important role to play in determining currency internationalisation. Thus, our results indicate that accounting for ‘network externalities’ may cause inconsistency in the results (Wu et al., 2014).

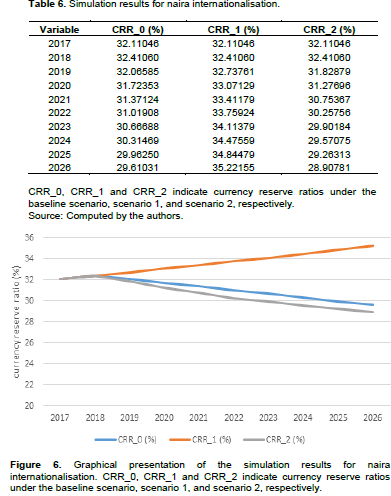

The result of the ‘counterfactual simulation’ for naira internationalisation is presented in Table 6 and Figure 6. The scenarios for naira internationalisation can be simulated using any of the models in equations 5 to 8 (which are based on the estimated parameters from equations 1 to 4, respectively). However, we base our simulation on equation 6, as model 2 (which equation 6 uses its estimated coefficients) appears to be the best model for the currency internationalisation conditions. This is apparent as the model produced the expected signs for all the macroeconomic and financial variables being considered. Meanwhile, following Wu et al. (2014) inflation rate is dropped for not having significant predictive power. A summary of the economic situation under these scenarios are presented in Tables A1–A3 (in the appendix).

The simulation results presented in Table 6 and Figure 6 reveal that if the financial status and macroeconomic development level of Nigeria within the ECOWAS region do not improve (baseline scenario), the naira reserve holdings would start falling from its first year of implementation. Specifically, the naira reserves ratio is projected to fall consistently from about 32% in 2018 to less than 30% of the total ECOWAS reserves in 2026. The results project the situation to get worse if Nigeria’s financial status and macroeconomic development level worsen (pessimistic scenario). The only situation where the naira reserve ratio is projected to increase consistently is under the optimistic scenario. In this case, the proportion of the naira in the total ECOWAS reserves is projected to increase from about 32% in 2018 to more than 35% in 2026. The relative relationship between the results from the optimistic and the baseline scenarios indicate that improvement in Nigeria’s financial status and macroeconomic development level is important for the naira to become a good reserve currency anchor for the proposed single currency in West Africa, and this must be done before its adoption.

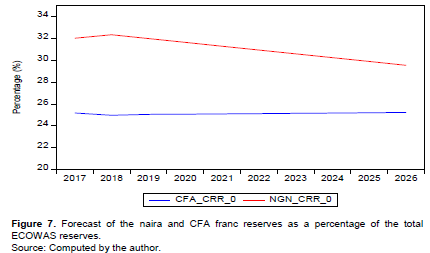

For completeness and policy relevance, we compare the naira internationalisation with that of the West African CFA franc to determine the CFA franc’s potential as an alternative to the naira as the reserve currency anchor for the proposed single currency in West Africa. The simulation result is presented in Figure 7. The figure shows that the reserve ratio of the naira is consistently higher than that of the CFA franc, which indicates the naira’s superiority as a reserve currency anchor. This evidence is reinforced by the results for 2026, where the reserve ratio for the naira is at its worst performance, but it is still better than that of the CFA franc, which is at its best performance. This result is not surprising, as the economy’s size is one of the major factors in currency internationalisation, and the size of Nigeria’s economy in West Africa is more than twice that of the WAEMU countries (Figure 1).

CONCLUSION AND POLICY IMPLICATIONS/ RECOMMENDATIONS

This study investigates the potential for naira internationalisation in the quest for a common currency for West Africa, despite the existence of some weak development indicators in Nigeria. Our preliminary analysis reveals that despite the existence of some weak development indicators in Nigeria, Nigeria is still the largest economy in West Africa. It has the largest international trade ratio of West African trade and the second largest intra-regional trade ratio (after Cote D’Ivoire). The financial and macroeconomic conditions of the country are also improving gradually amidst unavoidable crude oil price shocks, as evident from the fairly stable inflation rate and financial development experienced by the country recently. These indicators show that Nigeria meets some conditions for currency internationalisation, even though not perfectly, which is what this study uncovers.

Since the naira is not ready as a reserve currency, this study relies on a currency internationalisation model, which has been used to evaluate the potential for the Chinese renminbi internationalisation by Wu et al. (2014). This method has two stages of analysis. The first stage deals with the estimation of the currency internationalisation model, while the second stage employs a ‘counterfactual simulation’ approach to predict the trend in the currency ratio of the proposed currency for internationalisation (the naira). Using annual data from 1999 to 2018 for the estimation and the period 2019–2026 for the forecast period, we employ both linear and dynamic least squares regression models. While the dynamic model captures the ‘network externalities’ of the country proposing currency internationalisation, the static model does not. We also use a model with and without logistic transformation, which corresponds to the use of a currency internationalisation model with and without the ‘tipping effect’. Our model captures economic size and trade size, which are the fundamental conditions for currency internationalisation. It also captures financial and macroeconomic indicators such as the inflation rate, exchange rate, and financial development level.

The results from both the static and dynamic models indicate that accounting for the ‘tipping effect’ is important. This suggests that the behaviour of currency internationalisation truly follows the ‘tipping effect’. Moreover, the size of the economy has a positive and statistically significant effect on the currency reserve ratio, which means that the bigger the size of the economy the more the currency is held as reserves. However, we observe that the trade size is not as important as the economy’s size in determining the currency reserve ratio. The results further show that exchange rate appreciation and enhanced financial development promote currency internationalisation. These results are consistent with the findings from previous studies on currency internationalisation (Petkova, 2013; Wu et al., 2014). In the same vein, compared with the inflation rate, the exchange rate and financial development are seen to be more relevant as macroeconomic and financial conditions for determining currency internationalisation.

The results from the dynamic model suggest that accounting for ‘network externalities’ is important, as the lagged currency reserve ratio is positive and statistically significant. The constant term is also positive and statistically significant, which suggests that some factors held constant in this study, such as institutional reforms, may have an important role in determining currency internationalisation. However, the sign of some variables in the model becomes inconsistent in the dynamic model. This suggests that accounting for ‘network externalities’ may cause inconsistency in the results (Wu et al., 2014).

The results from the simulation exercise specifically deals with the projected behaviour of the naira as a potential reserve currency for West Africa. This simulation relies on the static model with logistic transformation, which appears to be the optimal model for our analysis. The result shows that naira reserve holdings would start falling from its first year of implementation if the financial status and macroeconomic development level of Nigeria within the ECOWAS region does not improve (baseline scenario). The situation would get worse if Nigeria’s financial status and macroeconomic development level worsen (pessimistic scenario). However, the naira reserve ratio is found to increase consistently under the optimistic scenario. Hence, improvement in the financial status and macroeconomic development level is important for the naira to serve as a good reserve currency anchor for the proposed single currency in West Africa, and this has to be done before its adoption.

An alternative policy simulation is also conducted to relate internationalisation of the naira with that of the West African CFA franc to determine the CFA franc’s potential as an alternative to the naira. We find that the reserve ratio of the naira is consistently higher than that of the CFA franc, which indicates that the naira is a better reserve currency anchor for the proposed single currency in West Africa than the CFA franc. The evidence is reinforced, as the reserve ratio for the naira in its worst performance (in 2026) is better than the best performance of the CFA franc (in the same period).

Limitation of Study

The main limitation of this study is the issue of data and methodology. Although macroeconomic and financial data are available for West African countries from 1980, the analysis was constrained to start from 1999. This is due to the fact that operationalization of Euro, the reserve currency currently being used by the WAEMU countries, started in 1999. This study also employed linear and dynamic least square estimator using pooled OLS (POLS) regression following similar study by Wu et al. (2014). While this method allows for easy comparison between the results of the model with and without “network externalities”, recent panel dynamic modelling approach may perform better when modelling dynamic relationship. Hence, further research may consider the use of recent dynamic modelling approach such as one-step and two-step Difference Generalized Method of Moment (Difference - GMM) by Arellano and Bond (1991) and System Generalized Method of Moment (System - GMM) by Blundell and Bond (1998) for modelling the dynamic relationship, while POLS (or fixed and random effect models) can still be used for modelling static relationship.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Ahmed F, Wang S, Lago IM, Maziad S, Segal S, Farahmand P, Das US (2011). Internationalization of Emerging Market Currencies: A Balance Between Risks and Rewards. International Monetary Fund Staff Discussion Notes P 25. |

|

|

Angrick S (2018). Structural conditions for currency internationalization: international finance and the survival constraint. Review of International Political Economy 25(5):699-725. |

|

|

Arellano M, Bond S (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The review of economic studies 58(2):277-297. |

|

|

Blundell R, Bond S (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of econometrics 87(1):115-143. |

|

|

Bowles P, Wang B (2013). Renminbi Internationalization: A Journey to Where? Development and Change 44(6):1363-1385. |

|

|

Chey HK (2013).The Concepts, Consequences, and Determinants of Currency Internationalization. National Graduate Institute for Policy Studies (GRIPS) Discussion Paper pp. 13-03. |

|

|

Chey Hk, Li YW (2016). Bringing the Central Bank into the Study of Currency Internationalization: Monetary Policy, Independence, and Internationalization. National Graduate Institute for Policy Studies (GRIPS) Discussion Paper pp. 15-23. |

|

|

Chey HK, Li YW (2020). Chinese Domestics Politics and the Internationalization of the Renminbi. Political Science Quarterly 135(1):37-65. |

|

|

Chinn M, Frankel J (2005). Will the Euro Eventually Surpass the Dollar as Leading International Reserve Currency? NBER Working Paper 11510. |

|

|

Cohen BJ (1971). The future of sterling as an international currency. London; New York: London: Macmillan; New York: St. Martin's Press. |

|

|

Cui Y (2013). The Internationalization of the RMB: Where Does the RMB Currently Stand in the Process of Internationalization. Asian?Pacific Economic Literature 27(2):68-85. |

|

|

Grauwe PD, Polan M (2005). Is Inflation Always and Everywhere a Monetary Phenomenon? Scandinavian Journal of Economics 107(2):239-259. |

|

|

De Grauwe P (2000). Exchange Rates in Search of Fundamentals: The Case of the Euro-Dollar Rate. International Finance 3(3):329-356. |

|

|

Eichengreen B (2011). It may be our currency, but it's your problem. Australian Economic History Review 51(3):245-253. |

|

|

Fekete J (1980). Crisis of the International Monetary System - Impact of World Economic Changes on Hungarian Economic Policy. Acta Oeconomica 24(3/4):233-250. |

|

|

Ganahl JP (2013). Corruption, good governance, and the African state: A critical analysis of the political-economic foundations of corruption in Sub-Saharan Africa (Vol. 2). Universitätsverlag Potsdam. |

|

|

Genberg H (2009). Currency Internationalisation: Analytical and Policy Issues. HKIMR Working Paper No. pp. 31-2009. |

|

|

Germain R, Schwartz HM (2017). The political economy of currency internationalisation: the case of the RMB. Review of International Studies 43(4):765-787. |

|

|

Hafner KA, Jager J (2013). The Optimum Currency Area Theory and the EMU. Intereconomics 48(5):315-322. |

|

|

Heidhues F, Obare G (2011). Lessons from Structural Adjustment Programmes and their Effects in Africa. Quarterly Journal of International Agriculture 50(1):55-64. |

|

|

Kenen PB (1983). The Role of the Dollar as an International Currency. The Group of Thirty. No. 12, Ocassional Papers P 13. |

|

|

Lam WR, Rodlauer M, Schipke A (2017). Renminbi Internationalization. In Modernizing China: Investment in Soft Infrastructure. International Monetary Fund. |

|

|

Matsuyama K, Kiyotaki N, Matsui A (1993). Toward a Theory of International Currency. The Review of Economic Studies 60(2):283-307. |

|

|

Maziad S, Kang JS (2012). RMB Internationalization:Onshore/Offshore Links. International Monetary Fund Working Paper pp. 12-133. |

|

|

McKinnon RI (1963). Optimum Currency Areas. The American Economic Review 53(4):717-725. |

|

|

Moyo D (2009). Why Foreign Aid Is Hurting Africa. Retrieved from The Wall Street Journal: |

|

|

Moyo D, Myers JJ (2009). Dead Aid: Why Aid Is Not Working and How There Is a Better Way for Africa. Global Public Health 5(2):1-2. |

|

|

Mundell RA (1961). A Theory of Optimum Currency Areas. The American Economic Review 51(4):657-665. |

|

|

Ndaguba EA, Hanyane B, Read R (2018). The peril of international development in local context and the misfit of poverty analysis in Africa. Cogent Social Sciences 4(1). |

|

|

Nkwatoh LS (2018). Appraisal of the preparedness of ECOWAS towards a common currency. Journal of Perspectives on Financing and Regional Development 6(1):125-142. |

|

|

Onyekwena C, Oloko T (2016). Regional Trade for Inclusive Development in West Africa. West African Think Tank Network (WATTNet) Inaugural Conference, La Palm Royal Beach Hotel, Accra, Ghana. |

|

|

Ordu AU (2019). Africa in focus: An evaluation of the single currency agenda in the ECOWAS region. Retrieved from BROOKINGS: |

|

|

Petkova I (2013). Financial deplomacy the internationalization of Chinese Yuan. Himalayan and Central Asian Studies 17(3-4):23-37. |

|

|

Schmitt HO (1964). Political Conditions for International Currency Reform. International Organisation 18(3):543-557. |

|

|

Schneider H (1999). Participatory governance for poverty reduction. International Development 11(4):521-534. |

|

|

Strange S (1972). Sterling and British Policy:A Political Study of an International. International Journal 27(4):621-623. |

|

|

Tsangarides CG, Qureshi MS (2008). Monetary union membership in West Africa: A cluster analysis. World Development, 36(7):1261-1279. |

|

|

Tule MK (2010). National Income Policy in a Deregulated Economy: the Nigerian perspective. Bullion 34(1):19-26. |

|

|

Tule MK, Salisu AA, Ebuh GU (2019). A test for inflation persistence in Nigeria using fractional integration and fractional cointegration techniques. Economic Modelling 87:225-237. |

|

|

Walter A (2006). Domestic sources of international monetary leadership. In D. M. Andrews, International Monetary Power. (pp. 51-71). Ithaca, USA: Cornell University Press. |

|

|

Wright R, Trejos A (2001). International Currency. The B.E. Journal of Macroeconomics 1:1. |

|

|

Wu J, Pan Y, Zhu Q (2014). The conditions and potential of RMB as an international reserve currency. China Finance Review International 4(2):103-123. |

|

|

Yanjing L (2012). The Quantitative Analysis on the Evolution of the International Reserve Currency-Also on the Feasibility of the Internationalization of RMB. Studies of International Finance. P. 04. |

|

|

Yonghong T, Wensheng D, Xueqing Z (2013). RII: A New Index for Assessing Internationalization of Chinese Currency. International Conference on Operations Research and Statistics (ORS) Proceedings (pp. 69-75.). Singapore: Global Science and Technology Forum. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0