Domestic revenue generation occupies a central domain in most countries, leading to continuous mapping of strategies towards its enhancement. Taxation is a dependable and foreseeable avenue to generate revenue for governments to fulfil their key obligations of employment creation, economic growth and infrastructural development, poverty reduction and state security. Despite these plausible arguments, tax revenues are minimal and tax bases narrow in developing countries. Contemporary tax debates point out that informal sector represents a lucrative fountain of tax revenue for governments, yet opponents of taxing the sector suggest that taxation might cripple small firms. Zimbabwe introduced presumptive tax in 2005, further enforcing to expand the tax base by including the sector into the tax basket in 2011. Researchers have focused on tax evasion and non-tax compliance when studying this sector, this paper focuses on the stakeholders perceptions on the impact of informal sector taxation on revenue generation and growth. This study adopted a sequential exploratory mixed method approach, argued to be ideal for under-researched areas such as this one. Key findings were that the current one size fit all tax framework suffocates small firms. Governments have to strike a balance between revenue mobilisation and the sector’s key economic contributions, without crippling informal firms.

In developing countries, the Informal Sector (IS) plays a central role, accounting for a projected share that is between 50-80% of GDP and a bigger share of employment between 60 to 80% and representing 90% of new jobs (Bhorat et al., 2017; Dickerson, 2014). Zimbabwe’s informal sector is estimated to be the second largest in the world contributing 60.6% of GDP after Bolivia’s 62.3% contribution (Medina and Schneider, 2018). Mangwana (2016) expresses that more than 75% of the labour force is employed by Small to Medium Enterprises (SMEs) and the IS and this accounts for an estimated 5.7million people. From the statistics shown on the sector’s contribution to GDP, economic activity and employment, the exigency to bring this sector into the tax net in Zimbabwe is apparent. According to Joshi et al. (2013, 2014) and Rogan (2019), there seems to be a consensus amongst revenue authorities, governments, development organisations such as the World Bank, African Development Bank and the International Monetary Fund (IMF) that African governments would have to work industriously to bring the informal sector into the tax basket. Researchers concur that the IS occupies the most complex domain with regards to taxation, due to its characteristics such as the hidden nature, small scale, ease of tax evasion and mobility as well as diversity, yet they disagree on the impact of taxation on the viability of the sector’s activities (Joshi et al., 2014; Ligomeka, 2019; Maina, 2017; Munjeyi, 2017). The sector represents an understudied yet promising group of potential taxpayers. The size of the sector and its socio-economic implications as well as the exogenous inhibitions to feasible taxation policies have generated extraordinary academic and policy interest by both developed and developing country governments especially SSA country governments. Efforts by these governments endeavour to help augment the tax base, increase tax revenues, enhance economic development and reduce the reliance on donor funding if the full revenue potential of this sector is exploited. Joshi et al. (2014) and Mbiliayi (2012) allude to the fact that revenue lost in SSA countries from not taxing the sector ranges between 35 to 55% of total revenues, implying that the losses could be even higher for Zimbabwe if the size of the sector and contribution to GDP are anything to go by. Developing countries introduced presumptive taxes to widen the tax base, bring the non-paying IS into the tax net and address equity consideration. These efforts have been argued to be unsuccessful and faced with considerable hindrances impeding effective taxation of this sector. Tax revenues from this sector are argued to be very inconsequential and worryingly low in comparison with the sector’s magnitude and contribution to GDP (Ligomeka 2019; Maina, 2017). Researchers such as Prichard (2009) and Masarirambi (2013) are quick to point out that a large chunk of this sector continues to slip through the noose of tax authorities, even as governments continue to grapple with the problem of how to manage this or even to efficiently and effectively collect tax revenues from the sector. However, while the subject of informal sector taxation has goaded considerable attention, this has not been without controversy.

Contention has surrounded whether informal sector taxation should indeed be a policy priority for these fiscally constrained developing countries in view of the potentially low revenue yields, high administrative costs as well as huge costs of collection (Joshi et al., 2013, 2014). Debate has also surrounded the benefits to be derived from taxing this sector versus the costs and challenges associated with such a move. Researchers have called for taxation of the IS to broaden the tax base, boost revenue generation to fund economic development (Joshi et al., 2014; Rogan, 2019), yet others have queried the logic of taxing the IS in view of its small scale nature, minimal and erratic incomes, lucid nature, heterogeneity and difficulties tracking players, aggressive nature of operators in the sector and low tax morale (Kundt, 2017; Meagher, 2018; Sebele-Mpofu, 2021). Opponents of IS taxation have further argued against taxing it, suggesting it is a means of subsistence and its taxation might be regressive and lead to the closure of small firms, crippling the very activities that are essential for poverty alleviation, employment creation and the provision of a livelihood for the disadvantaged. Political, economic and administrative constraints have been tabled as formidable challenges that make taxation of the IS unattractive and if at all a feasible option. Meagher (2018) questions whether any meaningful revenues can be mobilised from the sector, arguing that the current efforts to tax the sector represent an increase in the tax burden, as the IS in Africa is already paying multiple formal and informal taxes to local authorities. Pimhidzai and Fox (2011) argue that any increased efforts towards taxing the sector are likely to be regressive to the growth of small firms. This casts doubt on whether taxation of this sector is indeed a way to attain an expansive tax base. On the contrary, it could be crippling the existence and survival of the informal firms. At the same time the tax gap, operational problems faced by governments due to huge budget deficits and the uneven distribution of the tax burden cannot be ignored (Dalu et al., 2013; Munjeyi et al., 2017; Masarirambi, 2013). The importance of raising tax revenues on a sustainable basis cannot be overemphasised. In view of this, it is essential for research to review and critically evaluate the implications of IS taxation through presumptive taxes on revenue mobilisation, economic growth as well the growth of small firms and to consider alternative strategies of taxing the IS. Is informal sector taxation an avenue for broadening the tax base, curtailing of IS activities and impeding growth of small firms or both? In light of the arguments above, this question begs for answers. It still remains incomprehensible whether government can collect any meaningful tax revenue from the sector without suffocating these small firms or adversely incorporating them into the formal sector as questioned by Meagher and Lindell (2013). Machemedze et al. (2018) raise thought provoking questions with regards to presumptive taxes used to tax the IS, asking, “is this a fair system of tax, we are assuming government is making certain presumptions about the earnings of these operators, is this a good approach? What is the effect of the tax system on SMEs and the informal economy? Is the tax system designed to enhance SMEs growth? Does the system discourage growth of SMEs?” Submissions and conclusions remain inconclusive and paradoxical. Ojeka (2011) postulates that SMEs are bedrocks for employment generation, innovation and competition in developing economies which ultimately lead to poverty alleviation and national growth and contends that tax policy must not be an encumbrance to SME growth but foster voluntary compliance.

Zimbabwe is described by Ligomeka (2019) as one of the few countries that are slowly but increasingly taxing the IS. The country introduced presumptive taxes in 2005 and further enforced them in 2011 in terms of the Zimbabwe Income Tax Act, Chapter 23.06 (Government of Zimbabwe, 2005). Commenting on presumptive taxes, Mangwana (2016) alludes to the fact that the Zimbabwean government must balance the efforts to mobilise revenue from the sector and the sector’s other irrefutable contributions such as providing survival income, employment and value creation, being a driver and source of novel technological advancements, centre piece of economic growth and poverty alleviation. Zimbabwe therefore, becomes an ideal platform to evaluate IS taxation hence the question whether IS taxation in Zimbabwe is a widening of the tax base, stifling of informal firms or both? The objectives of the study are therefore, to explore the design of the informal sector taxation system in Zimbabwe as well as to evaluate stakeholder perceptions on the impact of IS tax administration on revenue generation and on the survival and growth of informal firms. Since this study is an exploratory study that assessed perceptions of various stakeholders, it also sought to design a conceptual framework to guide future researchers in evaluating the impact of taxation on growth of small firms. Fulfilment of these objectives would lead to contributions to the body of knowledge on IS taxation and to policy and practice with regards to IS taxation which is contemporary topic among developing counties governments, policymakers and revenue authorities. Revenue generation appears to be the most emphasised motive and studies have focused on the motives of and the need for IS taxation, without paying attention on the impact of such tax administration on other taxation motives such as governance, growth and wealth distribution. The focus on the evaluation and the outcomes of this appraisal of the IS tax framework would assist policymakers in improving IS tax policy. Maina (2014, 2017) points to a dearth in research that evaluates the current presumptive taxes’ appropriateness in mobilising tax revenues from the IS, provide justifications why they are performing below expectations and provide suggestions to ameliorate the handicaps. Joshi et al. (2014), suggests that, there is also a lacuna in literature that advances research in legal, regulatory and administrative reforms in informal sector taxation. Von Soest (2007) points to the insufficiency of studies concentrating on tax, its administration and impact in the African continent. Therefore, this research sought to contribute to the paucity in literature on IS taxation, especially its impact on the survival and growth of small firms. This paper evaluates perceptions on the impact of IS taxation in Zimbabwe in terms of revenue generation and survival and growth implications on these informal firms.

Informal sector background

The informal sector is undeniably a consequential component of developing economies and has been a part of the Zimbabwean economy since time immemorial. It has however been suggested that the sector has grown exponentially in recent years (Sikwila et al., 2016). Schneider et al. (2010) describe it as “all market based legal production of goods and services that are deliberately concealed from public authorities to avoid payment of income tax, value added tax and other taxes”. Pimhidzai and Fox (2011) proclaim that the contribution of the IS in providing employment and income opportunities is very fundamental in reducing the extent and intensity of poverty in developing countries especially Sub-Saharan Africa (SSA). IS taxation is a turbulent topic with connotations on taxation, economic development and growth that has generated strong discussions in recent years in developing countries. The paradox is how to tax the IS without crippling the sector and frustrating poverty alleviation efforts and the majority of people’s livelihoods especially in Zimbabwe where the economy is largely informal (Ayee, 2007; Moyi and Ronge, 2006).

Taxation in the informal sector

Resource mobilisation lies at the heart of economic development, if not the “blood life” of any economy, yet the “capability” to collect taxes continues to be a fundamental shortcoming of African nations (von Svoest, 2007). Fifty percent or more of potential tax revenue goes untapped in developing countries. In the wake of fiscal crises of the states in sub-Saharan Africa, designing tax systems that can provide incentives for growth, can ensure equity, stimulate economic growth as well as preserve the survival of firms and can increase revenue collection is central to state viability and effectiveness (Toye, 2000; Munjeyi, 2017; Munjeyi et al., 2017; Rogan, 2019). Revenue collection is said to be negatively impeded by the existence of a large heterogeneous informal sector, corruption, low tax compliance and heightened tax evasion and feeble taxation administration in developing countries especially Sub-Saharan African countries (Joshi and Ayee, 2008; Ligomeka, 2019). The features of the IS makes it hard to tax the sector, as the actors are mostly unregistered, so mobile, not recorded in official statistics, small scale operators, deal mainly in cash transactions, unwilling to keep records and have little or no access to the formal markets. The sector is usually made up of small scale traders, small scale manufacturing operations, garage owners, restaurants, small scale miners and repair workshops among others. The current trend has leaned towards individual professionals such as lawyers, doctors, accountants, economists and engineers being players in this sector (Fajnzylber et al., 2009).

The statistics on the sector’s contribution points to an urgent need to tax the IS. Controversy arises as to whether to tax or not to tax the IS as proponents against such taxation have attributed the growth of the IS to rising tax burden and strict labour market regulations coupled with a declining tax morality and loyalty towards government. Contention also surrounds the enormity of the potential “tax gap”, which is the difference between tax potential and actual tax collected. Others allude to its vastness (Dube, 2014), yet others argue that erosion of the tax base is considerable, though not as huge as usually purported by governments (Pimhidzai and Fox, 2011). Amid the disputations, presumptive tax frameworks aimed at taxing the IS are slowly becoming an inescapable component of developing economies’ tax systems and Zimbabwe is no exception having introduced the tax framework in 2005.

Informal sector taxation in Zimbabwe background

The Zimbabwean system adopted presumptive tax rates depending on the industry (http://www.zimra.co.zw) in an attempt to magnify the tax base and increase revenues in 2005 as shown in Tables 2 and 3. Hairdressing salons and cross-border traders were added in 2008, and cottage industry and bottle-store operators in 2009.

Should the IS be tax or not taxed?

Tax bases are narrow in SSA as they rely on few taxpayers. The large taxpayers, who make less than 1% of the potential taxpayers, contribute more than 70% or more of the total revenue whereas small and medium taxpayers contribute as little as between 0-25% (Gerxhani, 2004; Gordon and Li, 2009; Udoh, 2015). Taxation of the sector could also be a solution to reduce government-donor budget overreliance. Millin and Coetzee (2007) citing Xaba et al. (2002) suggest that formal employment and output growth have been stagnant in most African countries, while informal employment and its share of GDP have been steadily increasing. With the informal sector growing more rapidly than the formal sector, if not taxed then how would government increase revenue from a slowly dwindling formal sector especially in countries like Ghana, Kenya, Uganda, Nigeria and Zimbabwe? Various scholars focusing on tax policy regard IS taxation as challenging, hence less attention and interest is given to it. They argue that the mismatch between the formidable efforts required taxing the sector versus the paltry revenue realised as the major reason (Joshi and Ayee, 2008). Di John (2009) laments the paucity of literature that provides a clear guide on how to tax the IS, presumably because the sector is heterogeneous. Pimhidzai and Fox (2011) have questioned the logic of taxing the informal sector, querying whether such a move is local economic development or taking from the poor and stifling growth of small firms. Their argument is premised on the view that microenterprises in the informal sector are a major source of livelihoods in developing countries. The researchers argue that policy recommendations pushing for formalisation of the sector in order to increase government revenue through taxes could be misconceived.

A view shared by Rogan (2019) who argues that perhaps for large informal firms, formalisation might be beneficial but on the contrary for smaller firms it might have adverse effects. Using the case of Uganda Pimhidzai and Fox (2011) show that contrary to the widely held misconceptions that view the IS as tax evaders, the IS pays taxes- albeit not to central government but to local governments in the various fee payments. The single-minded focus on tax collection towards the IS, regardless of size or profitability ignores the role played by these enterprises in local economic development (Fox and Pimhidzai, 2011). Proponents for taxation of the sector (McKenzie and Sakho, 2010; Perry et al., 2007; Schneider and Enste, 2013; Torgler and Schneider, 2009), have pointed to potential benefits of increased revenue, growth and governance gains as resultant products of IS taxation.

Rutasitara (2014) questions whether informal sector taxation is a feasible exercise that can be sustainable in the future by these developing country cash strapped governments. Taxing the IS raises equity, efficiency and administrative issues (Dube, 2014). Taxes skew economic judgements as they create welfare loss over and above the revenues collections (Pimhidzai and Fox, 2011). It is therefore indisputable that the question whether IS taxation is indeed a route for widening the tax and thus should a policy priority still adjures for answers.

The question whether informal sector taxation increases revenue collections or destroys the growth of informal firms which is key to economic growth and sustainable development also remains unanswered. An evaluative review of the myriad factor by factor arguments aimed at unpacking this contentious subject is synthesised below.

Informal sector taxation and revenue mobilisation

Di John (2009) portends that domestic revenue mobilisation has not moved with the same strides with the rising public government expenditure. Therefore, there is greater need to take into account what governments should do or know better in order to raise revenue from the IS. Sharing the same view, Ebeke and Ehrhart (2012) assert that the ever ballooning public expenditure needs and budget deficits signal that revenue from the formal sector and foreign aid are not sufficient, making the IS a competing option for expanding domestic revenue. The argument is that the expansion of the non–tax paying IS undermines domestic revenue mobilisation and equity. Moyi and Ronge (2006) concur by pointing out that to enlarge the tax base and enhance equity, it is necessary to bring the IS into the tax net.

As underscored by Bhattacharya and Akbar (2014), steps towards expanding the tax base and enhancing revenue mobilisation should thoughtfully consider taxing the burgeoning IS. Benjamin and Mbaye (2012) assert that, despite the importance of the IS in African economies, it only contributes 3% of overall tax revenue collections. The size and magnitude of the informal sector, implies the need to tax it if developing country governments are to remain afloat and be able to collect enough revenue to finance public expenditure (Munjeyi et al., 2017; Van den Boogaard et al., 2018). De Mel et al. (2013) and Bruhn and McKenzie (2014) adduce that it is unlikely that taxing the informal sector would bring in noteworthy revenues at least in the short and medium term. The researchers observe that formalisation and registering for tax can facilitate opportunities to get credit or funding, offer possibilities to engage with larger firms and government, reduce harassment by police and government officials. In addition, the steps can heighten chances to access to training and support programmes availed to the formal sector. These benefits in the long run will foster increased productivity and improved profits, ultimately resulting in a surge in tax revenues. Fox (2009) and Fox and Pimhidzai (2011) question the taxable capacity of the informal sector in developing country conditions. They point to the measly direct revenue possibilities from the IS. IS activities are characteristically constrained by their small scale operation and hence minimal levels of profits. Since tax revenues, are a product of profits, the lower the profits simply implies diminished tax revenues.

Therefore direct revenue benefits of IS taxation are likely to be relatively modest or comparatively low (Joshi et al., 2014), and implications of equity prospectively adverse (Leoprick, 2009). From a distance, taxation of the IS appears to be a promising source of government revenue considering its size and growing share of GDP (Schneider, 2002; Schneider and Enste, 2013; Buehn and Schneider, 2012). However, in practice, the cost and benefit analysis tells a different story. Individual incomes within the sector are meagre, tax rates correspondingly low, while the costs of collection are substantial owing to the heterogeneity of the firms operating in this sector as well as the large number of individual firms and the difficulty in monitoring them (Ayee, 2007). Bird and Wallace (2003) state that the ease of tax evasion and hiding from other regulations by the IS makes tax collection from this sector on a sustainable basis a pressing task. Consequently, many tax experts are sceptical of whether any meaningful value can be derived from committing significant scarce resources in developing countries on IS taxation, given the inconsequential revenue yields, huge administrative costs and the questionable value of taxing low income individuals (Joshi et al, 2014; Kanbur and Keen, 2014; Keen, 2012). Fox and Pimhidzai (2011) observe that formalisation for tax purposes might not lead to higher revenue generation in some economies as the IS already pays some forms of tax anyway through licence fees and other local authority charges. They argue that the majority of enterprises will remain too small to pay central government taxes such as VAT, even if registered for taxes.

In order for governments in developing countries to reap any meaningful enlarged revenues from this sector, they have to equally invest into it and nurture it. There is a great potential to grow the contribution of the informal sector to revenue mobilisation and economic growth if necessary institutional support is availed to them to foster their productive capacity (Bruhn and Loeprick, 2014; Bruhn and McKenzie, 2014). An enhanced tax base can only become a reality when governments start supporting the productive capabilities of IS activities through innovative formalisation activities that also address the growth constraints faced by the sector (Arosanyin et al., 2009; Gerxhani, 2004). It is argued that Governments of developing countries only want to tax this sector and not invest first in it in order to boost its productivity and profitability and then tax later. Pimhidzai and Fox (2011) suggest that to address the dilemma of informal sector taxation, government policy should thus aim to raise revenues through local economic development rather than pursue the short term strategies that only focus on revenue collection through tax, risking the failure of small firms.

Informal sector taxation, poverty reduction and equity concerns

The contributions by Smith (1776) to economic theory on taxation are still regarded highly in economics and taxation. His propagation of the canons of taxation can be hardly exceeded in clarity and simplicity. The four canons of “Equity, Certainty, Convenience and Economy”, are still regarded as yardsticks of a good tax system. IS taxation raises equity concerns. Equity issues have to do with fairness. Horizontal equity is treating people on the same economic level equally for tax purposes and vertical equity is when those at different levels are treated differently (Dube, 2014). Players in the IS are said to have low incomes as well as low profits. Taxation of such firms is tantamount to disproportionately burdening the poor and is potentially regressive (Pimhidzai and Fox, 2011; Rogan, 2019). Fox (2009) argues that the single minded drive towards collecting more tax revenue from the sector could be counterproductive and at the same time worsen the vulnerability of the IS firms and individuals. Opportunities of poverty reduction would be lost in the process and the growth of small firms suppressed. Joshi et al. (2014) suggest that efforts to tax the IS also exacerbate the risk of coercive and corrupt behaviour by tax officials. Arguments have been raised in favour of IS taxation, basing on the fact that if IS players are willing to pay bribes to tax officials and endure the inconvenience of harassment, why not pay taxes and operate freely (Pimhidzai and Fox, 2011; Prichard, 2009).

According to Pimhidzai and Fox (2011), SSA governments as well as the body of knowledge on economic development hold an “ambivalent” perspective towards the IS. The behaviour of the IS players and their role in economic development is often misunderstood, their actual and potential contribution to poverty reduction and provision of employment often overlooked (Biles, 2008; Evans et al., 2006; Fjeldstad et al., 2006; Fox and Pimhidzai, 2011). It is a fact that this sector is an indispensable part of people’s means of subsistence on the continent and a major driver for poverty reduction (Wafula Wanyama, 2013). Employment creation and poverty reduction are some of the major macro-economic objectives of government yet this contribution made by the sector to governments’ responsibilities are often ignored. From an equity point of view there have been suggestions for almost total exemption of the informal sector from paying direct taxes (Prichard, 2009). Pimhidzai and Fox (2011) contend that non- formal enterprises including those above the tax thresholds pay taxes at local level and their compliance is high. They are an important tax base, but for local governments. It is therefore unfair to view them as tax evaders. Their contribution should be acknowledged and reciprocated in better institutional and tax policy environment if equity can be achieved.

With regards to equity also, taxation of this sector is said to be a step towards ensuring equity. According to Smith (1776), equity is defined as the situation when the subjects of every state contribute towards the support of government as nearly as possible in proportion to their respective abilities. That is in proportion to the revenue which they enjoy under the protection of the state. Basing on the statistics presented by Bhorat et al. (2017) who put the IS sector in African countries between the ranges of 20% for South Africa and above 50% of economic activity for countries such as Lesotho, Liberia, Zimbabwe, Tanzania and Zambia, not taxing such a significant chunk of the economy will equally violate the equity principles. Despite that taxation of the IS would yield little revenue in the short to medium term, it will serve to bring the IS into the tax net in the long term, thus ensuring equity (Joshi et al, 2014; Terkper, 2003; Torgler and Schneider, 2009). The IS would be equally contributing (no matter however negligible the contributions might be) to government coffers in order to finance the public utilities, infrastructure and protection which enables the sector to function and make profits. Formal firms are financing the above through payment of taxes, therefore the troubling question would be, is there equity if the IS players become free riders? The playing field is arguably not level as the firms in the formal sector would have their goods expensive because of the VAT tax fraction yet the informal firms will have their goods affordable less the same fraction. The tax fraction would in turn make the formal goods less competitive hence tilting the scale towards the IS, giving the IS undue competitive advantage over the formal (Torgler, 2005; Rogan, 2019). As a result, the market share of registered operators would be lost due to pricing issues and the registered operator sales reduction would ultimately culminate in reduced VAT collections denying government the much needed revenue.

As observed by Benjamin and Mbaye (2012), systematic studies on the IS in Africa are lacking as some important dimensions are misapprehended and misread. According to these researchers these studies overlook the existence of “large informal firms” with sales and profits that rival those of formal firms yet these operate in ways that are similar to small informal firms. They “appear formal” in all dimensions but do not pay taxes. For these large firms for which formalisation is feasible, regulations and taxation should be systematically applied and enforced. For the smaller ones, improvements in support services and easing of burdensome regulations are in order (Benjamin and Mbaye, 2012; Maloney, 2004). Failure to tax the IS may be viewed by formal firms as unfair and as a breach of the canons of taxation. To exhibit the hallmarks of a sound tax system (equity, fairness and neutrality), taxation regimes must ensure compliance from both the formal and IS (Mpapale, 2014). Tax burden should not be shifted to the formal sector only when the two sectors benefit from social infrastructure, service provision and related investments funded by taxes collected. Taxing formal employed individuals and not taxing the informally employed ones, creates inequalities and perpetuates tax injustice. Redistributive taxation may be seen as the best alternative to lower the inequality and provide tax justice as well as fairness. IS taxation is therefore not only a matter of revenue mobilisation but also tax justice.

Joshi et al. (2014) portend that formalisation for tax purposes might offer small firms a measure of predictability and protection. The researchers are quick to point out that the power inequities between the state and the IS may equally make the small firms vulnerable to unequal treatment and exploitation by state authorities as they will be now more visible, thus leading to their collapse. Overall potential equity benefits of IS taxation can be pictured, but the pitfalls of such a move are visible too, especially the concerns of disrupting precarious livelihoods, increased vulnerability and stifling growth of small firms as previously argued by Pimhidzai and Fox (2011). Restrictive institutions impose barriers to formality that reduce growth rate of small firms and sometimes impose inequalities. Redistributive taxation lowers inequalities but blunts the incentives to accumulate capital, lowering growth (Davis, 2007). Examined through purely revenue and equity lens, justification for amplifying the base by taxing the IS rests to a greater degree on implicit and incidental connections such as tax compliance gains, growth and governance gains. These potential advantages remain only weakly studied and documented empirically as alluded to by Joshi et al (2014).

Informal sector taxation and growth exposition

Growth is viewed as the major target for businesses and also a fundamental yardstick for businesses and also a fundamental yardstick for business viability as well as a pivotal determinant of wealth creation, employment and economic development (Neneh and Vanzyl, 2014). The insinuations of a broadened tax base for growth of small firms are as prominent to the argument of IS taxation as the immediate revenue implications (Joshi et al., 2013, 2014). Neneh and Vanzyl (2014) and Douglas (2013) explain growth from the entrepreneur’s angles as referring to increase in the sales, number of employees, profits, assets, firm value and general internal development. Penrose and Penrose (2009) define growth in the view of geographical expansion, diversification into new products and markets, acquisitions and increase in branches. Irrespective of how growth is defined, along with the growth arguments comes into play the need to cogitate about issues of employment creation and poverty reduction among lower income earners and the unemployed (Pimhidzai and Fox, 2011),long term economic development and the development of a larger tax base over time. The connections between these vital vectors are often misconstrued. The major issue of consideration by tax experts is that, a rise in the tax rates or tax burden could hinder growth, threaten viability of the small firms and push people into poverty ultimately reducing the tax revenue even further. The costs may be far greater than the tax collections in the sector. The argument is instinctively compelling (Keen, 2012; Pimhidzai and Fox, 2011). Borrowing from the literature, the dualist view sees the IS as purely marginal, subsistence and a safety net for the poor (Sabot, 1973), arguing for an empowerment approach before any taxation can be considered (Fox, 2009). In support of the argument against taxing the IS, the notion that informality is actually driven by the burdensome regulations and bureaucracies of regulatory authorities takes centre stage. Informal firms are informal because they are trying to survive by cutting loose the suffocating burdens of formality (exiting) as proposed by the legalist/exit view. However, despite these cogent arguments, a growing body of research knowledge expostulates otherwise, proclaiming that, formalisation, which entails being captured into the tax net as the central component may bring about significant growth gains contrary to hindering growth.

While informality helps firms avoid certain costs, it also comes with a variety of costs for example, it precludes access to certain opportunities available to formal firms, including greater access to credit and financing. Benefits such as increased opportunities to engage with large formal firms, access to government contracts, reduced harassment by government officials and municipal officers and access to training and other support programmes might be lost (Prichard, 2009). Formalisation alone will not yield any purposeful perquisites to attract the IS. Therefore developing country governments have to partner SME organisations through stakeholder consultations as well as show palpable benefits from formalisation.

Informal firms are often viewed as “parasites”. This school of thought considers informal firms as a threat to formal firms and as a stumbling block to economic growth. Impediments to growth are viewed from two angles: firstly, the small scale nature of informal operations leads to inefficient and uneconomic production coupled with the incentive to remain in the “shadows” to avoid detection by public authorities (Ordóñez, 2014; Woodruff, 2013). As a result the inability to fund technological changes and capital expenditure confines informal firms to an “informality low productivity trap” which adversely affect the overall productivity growth of a country (Kenyon and Kapaz, 2005). Low revenues from the IS may lead to over taxing the formal firms hence fuelling more informality and tax evasion. La Porta and Shleifer (2014), table that the lower productivity has nothing to do with formality but has a lot to do with the proportionately small size, poor education levels, scarcity of economies of scale and shortage of avenues to export which characterise the IS. Secondly, tax evasion and regulatory non-compliance enjoyed by the informal firms allows them to impinge on the market share of their formal counterparts. The unfair competition that the formal firms are subjected to reduces their incentive to invest, expand and improve productivity. This line of thought might hold water for larger informal firms competing with comparable formal firms with like incomes and characteristics (Benjamin and Mbaye, 2012; Dube and Casale, 2016); otherwise, La Porta and Shleifer (2014) contradict the argument, adducing that informal firms are too inefficacious and non-identical to formal ones to constitute a possible challenge to the formal firms. Interestingly, Perry et al (2007) submit that informal firms are cognisant of their inhibitions with regards to scale, capital, skills and distribution channels; thus, they tend to ply sectors where they operate efficiently on a limited scale. The reasoning is why not find a means of taxing them without forcing them to formalise and risk asphyxiating them. There is need to support them rather than view them as harmful to the existence of formal firms.

Despite the fact that the IS plays an predominant role by significantly contributing to employment and output in developing countries, in addition to providing a livelihood for millions, there are mixed views on its impact on whether it enhances economic growth (Fourie, 2018). On the contrary, it may obstruct and slow economic growth. Proponents for this view propose the need for stronger fiscal and regulatory enforcements, while opponents to the view argue that firm level surveys do not find enough evidence to support the suffocating of economic growth logic (Fajnzylber et al., 2009; Maloney, 2004). Opponents to the argument suggest that the provision of low cost goods and services to the public can be reckoned as enhancing household savings which ultimately results in physical and human capital accumulations. Positive implications for growth may follow (Fajnzylber et al., 2009; Fox and Pimhidzai, 2011). Maybe results mask variations across countries and firms or they depend on the institutional and regulatory variations across nations. This could be evident as argued by Munjeyi (2017) citing Gurtoo (2009) who attribute the divergent perspectives to developing and developed country context where the informal sector is adjudged differently. Developed countries perceive the sector as a “resource” to be harnessed, supported and nurtured through policy prescriptions in order to graduate into the formal sector. On the contrary for developing countries it is viewed as an evil to be extinguished yet it remains a fact that this sector contributes immensely to employment creation and poverty alleviation efforts (World Bank, 2011).

According to Mpapale (2014) and the IEA’s Budget Focus (2011), tax reforms are by no means strategies aimed at stifling growth or suffocating the very existence of informal firms, but reforms targeted at unlocking the ultimate potential of the sector, create new avenues for the poor to realise their potential and raise national competitiveness. These differing frames of reference open room for more debate especially on the causal relationship between formalisation, firm growth, profitability, taxation and firm survival. Another area of interest is the question, why is it that, despite these supposed benefits the informal sector is rapidly growing in developing countries and Zimbabwe in particular? Could it be because these costs and benefits vary across firms and across countries or is it a question of the legal, political and regulatory environments that are disparate across countries? Could it be the tax rates are too high and stifle the growth of small firms forcing them to operate informally to evade them?

Empirical findings on formalisation for tax purposes, taxation and growth

A variety of studies have explored the causal relationship between formalisation and growth with varying conclusions. Fajnzylber et al. (2009) provide evidence that in Mexico formalisation in the form of access to credit, training, tax payments and participation in business associations had positive effects on firm growth, survival and profits. De Mel et al. (2013) exhibit benefits that have to do largely with greater legitimacy and freedom of operation by informal firm owners in Sri Lanka as by-products of formalisation. The researchers found significant growth benefits for a small group of firms, while most firm incomes were largely unaffected. In Bolivia, McKenzie and Sakho (2010) conclude that formalisation, especially registration with tax authorities increase firm profitability, but only for medium enterprises. In Uganda, Pimhidzai and Fox (2011) come to the conclusion that, any tax increases or additional taxes will hurt smaller firms and increase their risk of failure. Analogously, Ocheni and Gemade (2015) pronounce the negative impact of multiplicity of taxes on the survival of SMEs noting that the size of the firm also has an impact on its propensity to honour its tax obligations. The smaller the firm, the higher the risk of failure to pay taxes and the risk of failure. This would increase the vulnerability of households surviving through the IS (basically killing the goose that lays the egg). The increased risk of failure would see the same strategy aimed at growing small firms and increasing the prospects of tax revenues, resulting in their failure and reduced revenues respectively. The prominent argument coming out here is that growth benefits indeed exist but they are meagre for small firms. McCulloch and Grover (2010) point that in Indonesia, the impact of formalisation for tax purposes was heterogeneous across firms, with medium sized ones gaining remarkable profits increase and the small firms indeed citing exposure and pronounced harassment from tax officials. De Mel et al. (2009) argue that the benefits of formalisation though real are too sketchy to convince firms to formalise. They are not appreciable enough or exclusive enough to argue a case towards formalisation as concurred by Bruhn and McKenzie (2014). While studying how tax incentives influence SME growth in Rwanda, Twesige and Gasheja (2019), concluded that that there is a strong positive relationship between tax incentives and firm growth in SMEs. Notable from the different findings is that probably the impact of informal sector taxation on the growth of informal firms is heterogeneous across firm types and nations.

The inconsistencies in findings might be because preferences differ for small and larger informal firms. The latter might be operated by individuals who are still job hunting or just operating them to supplement employment income. These might not have a motivation for formalising and deem it an unnecessary costly exercise (Bruhn, 2013; Maloney, 2004). Fajnzylber et al. (2009) state that the dynamics of “inclusion or exclusion” might privilege other firms while disadvantaging some. Literature evidence has produced controversial and contradictory findings, while broader economic gains seem plausible, whether small firms are likely to benefit still remains haze. Equally uncertain is the best strategy to tax the informal sector firms without compromising their economic survival. Solutions to the challenges of IS taxation and its impact to economic growth will differ across nations and should be tailored to fit the local context (Heggstad et al., 2011). Conclusively, it is imperative to recognise that the actual benefits of improved profits, predictability, access to credit and training and support are likely to vary across firms and across countries. This is because power relations and political networks that link the state and individual firms dissimilar across nations and also vary in particular contexts.

Impact of IS on tax compliance

Compliance is perception based, linked to expectations and attitudes ordered differently by taxpayers. It depends on how taxpayers judge fairness, trust in political situations, governance, institutional quality and delivery of public services, together these influence tax morale (Martinez-Vazquez and Bird, 2014; Torgler and Schneider, 2009). Despite the tax revenue potential of the IS being small, equity and growth benefits being questionable, it is highly possible that IS taxation might ensure high tax compliance overtime. Paying little or no attention towards IS activities lowers tax morale and increases the risk of non- compliance in the formal firms (Ayee, 2007; Joshi and Ayee, 2008; Terkper, 2003; Joshi et al., 2014). More simply, it is a matter of establishing tax compliance among the firms in IS. According to Joshi et al. (2014), the moment tax is viewed as a source of unfairness; this will lower the morale and reduce tax compliance among formal firms leading to a reduction in government revenues. Several researchers share this view and document this by providing evidence that tax morale is lower in countries with a large IS (Benjamin and Mbaye, 2012; De Paula and Scheinkman, 2011; Torgler and Schneider, 2009). Mutsapha et al. (2015), while studying tax compliance in Nigeria, concluded that fairness has an impact on tax compliance. Perry et al. (2007) provide extensive evidence that failure to tax the IS builds up a “pervasive culture of noncompliance” where large informal firms use “fixers” to manage their relationship with the state for a fee ensuring these firms do not pay taxes but remain camouflaged from tax authorities. In Latin America, evidence pointed to the fact that tax compliance is inversely related to the size of the IS (Perry et al., 2007). In Tanzania, Rutasitara (2014) found out that the reason why people work informally is because they want to avoid taxation and other regulatory costs. In West Africa, Benjamin and Mbaye (2012) document the presence of large firms which are “formal” in all dimensions (registered, have a fixed location and are able to access financing in the form of bank loans) but do not pay taxes. This has negative impacts on tax compliance. In Uganda, Pimhidzai and Fox (2011) found no evidence on whether the size or persistence of informal sector has an impact on tax compliance or drives tax evasion. These connections remain largely unexplored.

The impact of taxation on the survival and growth of small firms/informal firms

IS growth is curtailed by a myriad of challenges such as lack of technology, poor managerial skills, inadequate financial resources to fund expansion, capital constraints, low productivity and above all unfavourable taxation policies that are argued to compromise the growth of these small firms (Ocheni and Gemade, 2015). Alluding to the performance of presumptive taxes in Zimbabwe, Mangwana (2016) expressed that “very few fiscal benefits have been received by the government of Zimbabwe from the current SMEs because many do not pay taxes. Those that pay taxes are not happy as they find ZIMRA to be a big boulder on their necks pushing them under water”. The presumed nature of presumptive taxes or basing on assumed baseline results in a mismatch of the fixed presumptive tax amounts and incomes; hence this is seen as retrogressive and suffocating to small firms. Taxation has continually been cited as a major constraint to the survival and expansion of small businesses. High SMEs’ mortality rates have been attributed to tax matters, ranging from the huge tax burden to the multiplicity of taxes. Tax policy greatly impacts on the business fraternity. The more supportive and progressive the tax laws, the higher the opportunities of breeding stable and expanding businesses. This in turn steers economic growth. There is an interdependent relationship between business growth, survival and tax policy (Atawadi and Ojeka, 2012b; Ocheni and Gemade, 2015). Taxation is a vital tool for government to exploit for development, government funding, control the supply of money in the economy and resource distribution. On the one hand government seeks to broaden the tax base by incorporating the IS into the tax, yet on the other this same move increases the financial burden for the small firms.

According to Atawadi and Ojeka (2012b), the size and nature of small firms distinguish them from formal ones, therefore policy makers especially with regards to tax policy need to pay close attention to this distinction. These small firms are often viewed as minute and contributing very little in terms of both economic growth and tax revenues, but their great potential is overlooked. Tax policy should carefully consider a balance between the need for survival and the need to collect tax income, hence to tax and still “leave” adequate profits to foster business expansion. Charema (2014) submits that high levels of tax rates, penalties and the rigid licensing requirements were a huge stumbling block hindering SMEs growth in Zimbabwe. Tax policy should be aimed at minimising tax evasion and fostering compliance without leaving the taxpayer worse off (economy principle). These arguments call for the evaluation of the relationship between tax policy and the growth of small firms. Shahrodi (2010) suggests that for tax policy to be able to achieve its objective of maximising tax revenues without crippling the activities of small firms, it must be effective. The researcher expostulates that an efficient and effective tax system is one with appropriate and logical tax rates, easy to administer, has lower exemption amounts, is not overly burdensome to taxpayers and above all strengthens efforts to curb corruption and tax evasion.

According to Ocheni and Gemade (2015), developing countries should actually come up with favourable tax policies that aid the growth of small firms. Tax policy must be enabling with provisions such as tax holidays and exemptions. The researchers give references to SME tax policies in China which they argue have been crafted to be favourable to SMEs, encouraging their financing by granting tax exemptions from business tax for financial corporations that provide guarantee for loans to SMEs. The tax policy in China also award tax deductions to the tune of 70% of the investment amount to market entities and venture capitalists that invest in high tech SMEs (Ocheni and Gemade, 2015).

A positive relationship between taxation and economic development has been alluded to (Twesige, Gasheja, and Barayendema, 2020), yet on the other hand, studies point to the negative relationship between payment of taxes and survival and growth of informal businesses (Evans, Hansford, Hasseldine, Lignier, Smulders, and Vaillancourt, 2014; Adebisi and Gbegi, 2013). Those that point to a favourable relationship argue that as SMEs take advantage of tax incentives, it reduces their tax liability and in the process frees funds for expansion and growth (Feyitimi et al., 2016; Twesige and Gasheja, 2019). Problems brought by taxation for example complexity of tax laws, high rates of tax, multiple taxes and dearth in tax education and awareness have compounded the negative relationship (Ocheni and Gemade, 2015; Ojeka, 2011). Affirming this concern, Ocheni and Gemade discussing the impact of multiplicity of taxes in Nigeria describe multiple taxes as a “worm that eats deeply on the large chunk of revenues generated by SMEs for their growth and survival”. Multiplicity of taxes impedes the survival and growth of small businesses. Discussing the negative impact of taxes on SME growth, Machira (2007) advances that tax policy has unfavourable influence on the viability of the sector, as it reduces sales, capital, profits and employment levels. Atawadi and Ojeka (2012a) propose simplification of informal sector taxation frameworks, filing of returns and tax payment procedures in order to reduce compliance costs. They also recommend that developing countries must deal with multiple taxes on one income challenge, increase tax education and training for taxpayers to appreciate the incomes, deductions, exemptions and incentives they are eligible for if they register for tax purposes.

Omare and Erickson (2015) present the inability to purchase assets after committing the bulky of the resources to tax payments as a major hindrance to small business expansion, yet asset accumulation is an imperative measure firm growth and performance. Masato (2009) points out that an overly complicated tax system or “opaque administration” breeds undue burden on its taxpayers, especially informal firms and this distorts economic decisions made by these taxpayers. This has a distortionary impact on the development of these firms. Farzbod (2000) suggests that a poorly administered tax framework brings inefficiencies, increased collection costs, non-optimal allocation of resources and ultimately results in lower tax revenues. Reiterating the above concerns, Mungaya et al. (2012) opine that tax payments constitute a tax cash outflow, resulting in the reduction in the purchasing power of a company as more cash is channelled to the tax obligations instead of using it for business expansion efforts. Empirical evidence points to a negative relationship between payment of taxes, the costs of compliance and growth of small firms. Giving evidence of the negative impact of taxation, Tee et al. (2016) establish that taxation has an adverse impact on growth of SMEs and recommended the need for tax policy review and its alignment to the growth needs of SMEs. Resources committed to tax compliance could otherwise have been channelled to investment, reinvestment as well growth opportunities (Ocheni and Gemade, 2015; Tomlin, 2008). Observing a disproportionate burden as a result of tax compliance costs, Tomlin (2008) opines that the costs of complying with taxes for smaller firms are comparatively higher than those of larger formal firms. Ojeka (2011) further suggests a reduction in taxes and improved revenue authorities support services through tax education, training and awareness programs. Ocheni and Gemade (2015) posit the need for developing country governments to come with tax initiatives such as tax rebate for SMEs that locally acquire their inputs, add value to commodities and those that export. Ameyaw et al. (2016) submit that tax policy reforms should be aimed at bringing an alignment of the incomes made by SMEs to their tax obligations.

Holban (2007) interestingly views the negative impact of taxes on informal firms from the tax planning angle, bringing to light that informal firms may fail to leverage on tax planning advantages to avoid taxes or minimise their liability within the confines of the law due to lack of tax knowledge or professional expertise. Therefore when confronted by multiple taxes as well as high tax rates, the failure to exploit this key vector affects the growth and survival of small firms. Ocheni and Gemade (2015), exhibit a negative impact of taxation on the survival of SMEs, using ANOVA analysis and Ebere et al. (2016) affirm the negative impact of taxes on profitability, turnover and liquidity, ultimately affecting survival and growth. According to Atawadi and Ojeka (2012b), taxes impact on a business’ propensity to survive and enlarge its operations. The researchers point to a negative correlation between tax and the small business’s propensity to grow and even augment its activities. Higher tax rates swallow funds earmarked for business growth and lack of investment funds results in curtailed business expansion. On the other hand lower taxes allow for higher retained earnings and working capital resources to sustain a business’ going concern ability (Atawadi and Ojeka, 2012b). Affirming the negative impact of taxes, (Engelschalk, 2007; Engelschalk and Loeprick, 2016), notes that taxes reduced the rate at which the rate of growing for small firms as most businesses choose to forego their contemplated capital budgeting projects because after evaluation they find the possible after tax gain not worth the risk of undertaking the projects. Liu (2011) expresses that tax payments led to a reduction in working capital and deferring tax payments to reserve money to finance working capital results in accumulated tax debt and penalties that eventually makes it harder for small firms to survive leading closures or collapse (Nanthuru et al., 2018). To enhance the growth of small firms, tax policy has to be apt and not a hindrance to the growth of small firms.

In addition to the tax rates and penalties discussed above constituting significant outflows that affect the survival, profitability and growth of the business, compliance costs are another issue that cannot be ignored. Due the complexity of most developing country systems the informal sector is often faced with huge compliance burdens. Compliance costs refer to expenditure incurred in adhering to government regulations and tax legislation. These include planning, costs for keeping accounting records, preparation of returns, filing of returns and paying of taxes. These compliance costs come in the form of monetary costs (payment to tax professional, accountants and experts who help with tax matters or even expenses on tax legislation material such as books and study guides) and time costs (time dedicated to record keeping, preparation of tax returns or dealing with tax professionals and tax authorities. They also include psychological costs such as anxiety, harassment by tax authorities and dealing with the demands for bribes (Sandford et al., 1989). These compliance costs, along with the fines and penalties as well as the potential risks of being inspected and extortionist demands of revenue authority officers and politicians often demotivated companies from wanting to grow and instead encourages them to hide from tax authorities as much as possible (Meagher, 2018; Sebele-Mpofu and Msipa, 2011). These costs in a way diminish competiveness of businesses and even the attractiveness of the country’s investment climate.

The study found out that Zimbabwe adopted a fixed presumptive tax system whereby various informal taxpayers were grouped into stratas and different quarterly fixed presumptive tax rates levied as shown in Table 1 and 2. It was also evident from participants that they considered that increasing government revenues through more tax collections as the major reason behind the implementation of the presumptive tax policy. Despite taxation being administered with several objectives such as to reduce market externalities, help government and citizens engage, stimulate economic growth and support the growth of firms, participants highlighted that these were not prioritised by government ( the majority of IS associations members and tax experts). The study found out that creating a conducive environment for the survival and growth of SMEs through inclusive tax policy at the same time compelling tax compliance was an arduous task facing many nations especially Zimbabwe. The informal sector was described by the majority of participants as a fountainhead for economic entrepreneurship, economic growth, modernisation, competition and employment creation hence the need to try and balance the revenue collection needs and the importance of this sector in the economy. The key findings were explicated in detail below.

Design of presumptive tax systems

It was established from literature and from the findings that Zimbabwe used a fixed presumptive tax system. The structure of the presumptive tax framework was presented in Table 1 and 2 in the literature review section. According to the ZIMRA officers and Tax Experts, the tax rates were designed based on a study done in the early 2000s on the transport sector and that no further study was done. There was consensus among the IS associations members, ZIMRA officers and Tax Experts that the tax rates were not considering the actual profitability of these operators, thus being advantageous to those who were more profitable and unfair to those whose incomes could not sustain the tax rates. This resonates with arguments by Machemedze et al. (2018) and Dube (2014) who called for the need to consider the ability to pay principle.

Perceptions on the impact of IS taxation on revenue generation, survival and growth of small firms

Low tax revenue contributions from the sector

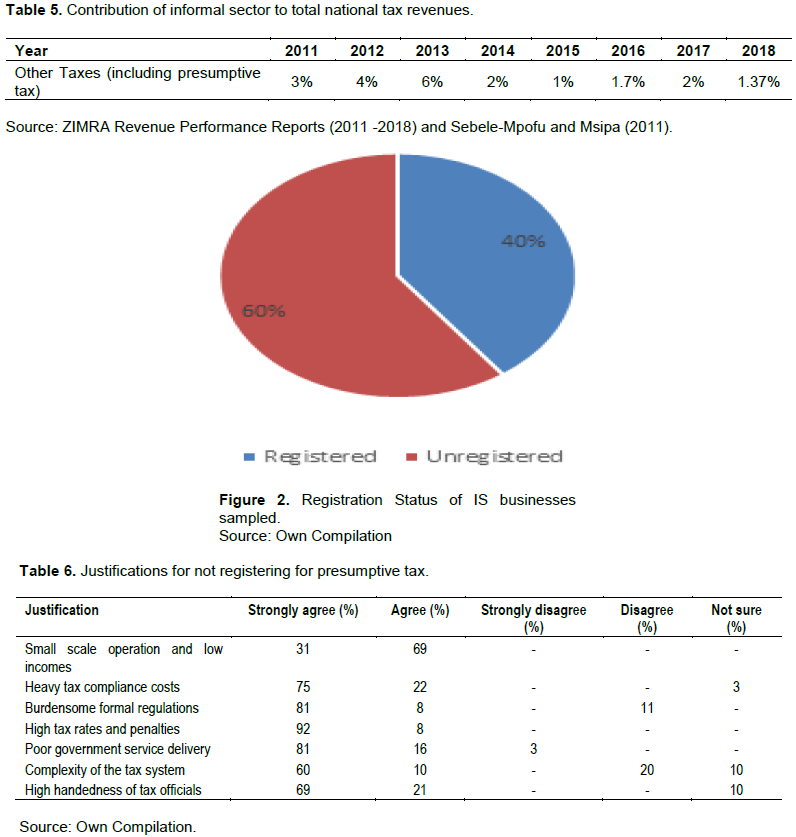

The revenue mobilised from the sector in comparison to its magnitude in terms of economic activity and more than 60% of the GDP in Zimbabwe as suggested by Medina and Schneider (2018) was found to be relatively minimal. According to Sebele-Mpofu and Msipa (2011), “If GDP contribution could be translated into revenue contribution, largely through tax compliance, the government would witness a significant revenue appreciation”. Information from the ZIMRA reports and Sebele-Mpofu and Msipa (2011) show that the sector’s contribution to total national tax revenues. ZIMRA officers explained the fact that the effort and costs associated with tracing players in the IS to tax them is not commensurate with the little revenues collected, hence they concentrate on the easy to tax formal sector which yields worthwhile tax revenues. ZIMRAO1 argues that “the informal sector is difficult to capture in the tax net, they are too mobile and can easily hide from tax authorities, sometimes looking at the cost and a benefit assessment it is not sensible to commit our small resources and time chasing the elusive players”. This appears to be placing the burden unfairly on the formal sector. TEX1 expressed a contradictory opinion on the low tax revenues pointing out that “the general feeling among tax officials is that the informal sector evades tax, but I don’t think this is wholly correct. The incomes in the sector are just very low to collect any substantial taxes”. The two opinions may possibly explain the low tax revenue collections displayed in Table 5. The views also resonates with submissions by Cheeseman and Griffiths (2005) who advance that the scope for realising significant tax revenue increases by taxing the IS in the short term is less likely due to the high levels of poverty and the elusiveness of the IS.

An obvious irregularity in these Revenue Performance figures is the miniature share of “Other Taxes” (including presumptive tax) to the overall taxes. There is no proportion indicatively linked to presumptive tax in the presentations as extracted from ZIMRA reports, it is aggregated under other taxes. This demonstrates the fact that due to the inconsequential nature of the contribution, ZIMRA saw it fit to group it with other taxes. TEX2 asseverated that the fact that the presumptive taxes are lumped together with other taxes might possibly suggest the little attention that tax authorities attach to presumptive tax administration due to the likely high costs of collections for low tax revenues. Tax authorities tend to pay more attention to the large taxpayers, who are few, organised and easy to tax and yield substantial tax revenues. This was considered to be unfair on the formal sector and the few informal operators that are tax compliant lowered. TEX5 avowed that “this lack of prioritisation of the informal for tax purpose diminished tax morale among those who religiously pay their tax obligation. It is indeed seen as a source of unfairness and unequal treatment”. The minute tax revenues collected as displayed in Table 5 could be connected to the fact that the IS operators make low incomes or that the majority of them are not registered for tax purposes as shown in Figure 2.

Reasons for registering/not registering for tax purposes

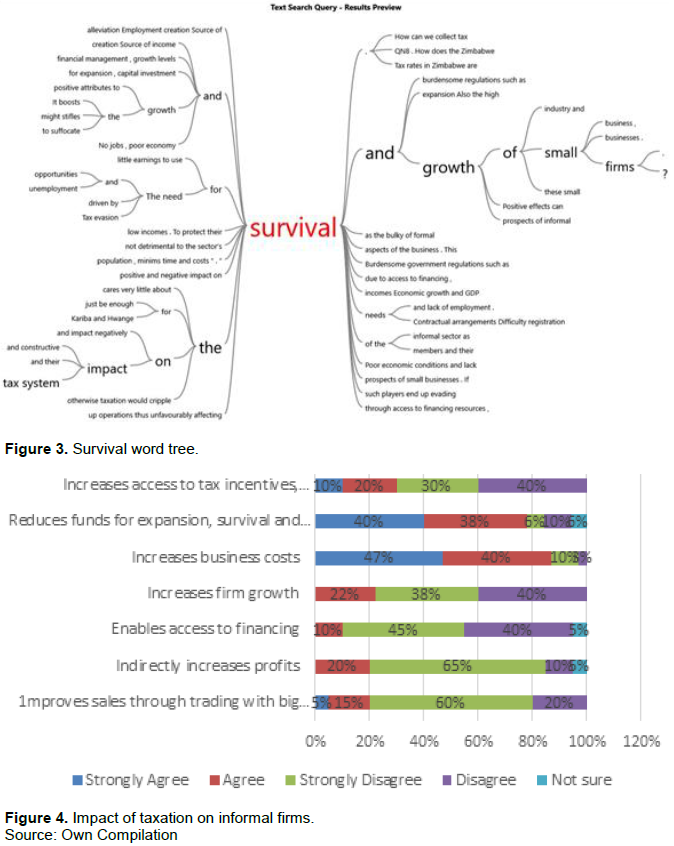

The researcher further explored the reasons for registering and those for registering for tax who were registered and not registered respectively. For those who were registered, the reasons offered include: access to government tenders and trading with large formal companies who ask for tax clearance certificates, access to financing and government tenders, fear of penalties and garnishes, fulfilling a moral obligation and religiosity. The reasons proffered by the registered informal operators were also echoed during the discussions by participants from the three interviewee groups as some of the benefits that ultimately contributed to the growth of informal firms. The benefits were noted as access to finance and government tenders as well as trading with big companies which leads to the growth of the turnover base and profits. The sentiments were mixed on these advantages. Very few firms were said to have been able access funding from the banks. According to TEX6 the general feeling shows the loss of confidence on the Zimbabwe bank sector by not only the IS but the formal one as well, due to policy inconsistencies, erratic currency and monetary policy changes. For those that were not registered, the reasons that were given were as follows: low incomes and small scale nature of the operations, excessive compliance burden and formal regulations, high tax rates and penalties, unhappiness with service delivery, complicated tax system as well as the high. The responses were presented in Table 6. High tax rates and penalties were the highly ranked, with all respondents agreeing to them as a rationale (92% strongly agreed and 8% agreed). 81% strongly concurred on burdensome formal regulations and poor service delivery. Results for other factors are as presented in Table 6. The prominence of the high tax rates and penalties was also pointed out by the majority of tax experts and ISAMs during interviews. They linked the burdensome nature of tax to the high failure rates of informal businesses. Similarly literature alluded to this pervasive impact (Atawadi and Ojeka, 2012a; Ojeka, 2011, Ocheni and Gemade, 2015).

Relationship between business growth, survival and tax policy

There were mixed perception on the relationship between tax payment and growth and survival of small firms. Others pointed to a positive impact and the majority of participants referred to negative ramifications. Taxation of the IS was found to negatively affect the operations of informal firms. Overly onerous tax regimes abrade the profitability of IS firms, compounding the failure rates and essentially reducing tax yields. According to ISAM2 “most of our members own small and medium enterprise, the majority of these enterprises cannot afford to pay tax and survive. Several of them have collapsed due to taxes and garnishees from ZIMRA”. 80% of the tax expert participants argued that tax rates and tax policy have an undesirable impact on the growth of firms. The majority of IS association members suggested that tax is a cost that eats into profits so in most cases small firms are forced to either increase the costs of their products or reduce the number of employees in order to reserve cash flows to pay taxes. The former strategy makes IS business products pricey and less competitive reducing their sales, paralysing their survival and the after effects are reduced tax revenues. The view was also shared by TEX5 who expressed that “competition is very stiff in the IS and among SMEs because of ease of entry and exit in the market, so any increases in the prices to take care of the tax component will lead to a loss of customers”; the latter leads to loss of employment and compromising poverty alleviation efforts. Similar findings were tabled by Ojeka (2011) in Nigeria where he established a negative relationship between SMEs growth and Tax policy. The other 20% of tax experts (TEX 6 and 7), proclaimed that some of the informal firms were now able to tender for government contracts and trade with big companies due to the visibility brought about by tax registration and them holding valid tax clearances certificates which are often a pre-requisite.

They also suggested that those SME who registered for tax purposes could now access financing in the form of loans from the banks as their properly kept books of accounts could show the viability and performance of their businesses. ISA members on the contrary argued that the demand for collateral still made access to financing difficult even for taxpaying SMEs. The ISA members further expressed that even government support in the form of services, work spaces and funding was still inaccessible even for the tax compliant small firms. Similar concerns were expressed by Pimhidzai and Fox, 2011 in Uganda and Meagher (2018) in Nigeria. ZIMRAO 6, 8, 9 and 10 despite agreeing that tax rates are high in relation to incomes earned by the IS and that the fixed presumptive tax system was not ideal, they officers contended that it was rather unfair to solely attribute the collapse of IS firms to tax and ZIMRA garnishees as there are other factors that have nothing to do with tax that can explain their high mortality rates such as poor accounting and risk management skills, high competition, economic challenges, misuse of funds and lack of capital among others. The discussion on the impact of taxes on the growth and survival of small firms crystallised itself in the word tree extract from NVIVO analysis as shown in Figure 3. From the top left of the word tree, verbatim extracts of conversations from the study participants show mixed perceptions on the impact of IS taxation on the survival and growth of small informal businesses. The visible conversations are: “it boosts the growth and the survival”, “positive attributes to growth and survival”, “might stifles the growth and survival”, “to suffocate the growth and survival”, “little earnings to use for survival and growth of small firms”. From the bottom left others apparent statements are: “not detrimental to the sector’s survival and growth of small businesses”, “positive and negative impact on the survival prospects of small businesses”, “and impact negatively on the survival and growth of small businesses” and “constructive impact on the survival aspects of the business”. The views on the unfavourable consequences of tax administration on the IS expressed in the discussions in the word tree are analogous to the advancements by Charema (2014) quoting the president of SMEs Chamber Daniel Chiremba who pointed out that “Presumptive taxes demanded by ZIMRA are too high for most of the growing SMEs. Almost 10 SMEs in Zvishavane alone have collapsed after failing to pay presumptive taxes and many more countrywide are collapsing”.

Negative impact on the survival and growth of small firms

High tax rates and tax laws were fingered as one of the major contributors of high SME mortality rates in Zimbabwe, in addition to lack of funding. The fixed presumptive tax rates were described by tax experts and 50% of ZIMRA officials as overburdening the IS. The fact that these rates are fixed does not take into consideration actual sales made (incomes), the cost incurred in making the income (allowable deductions) and ultimately the taxable income. Hence it becomes unfair to taxpayers who are assumed to have made income and hence a tax obligation arises. Failure to pay the taxes and accruing penalties has seen many small firms closing shop. The high tax rates are pointed to be inhibiting the growth of SMEs because as they focus on building cash flow reserves to meet tax obligations, they fail to reserve funds to finance business development, growth and survival. This signals an interrelationship between tax policy and capital investments. A relationship affirmed by Manyani et al. (2014) who used the transport sector in Bindura to evaluate the “Effectiveness of Presumptive and its impact on profitability of SMEs in Zimbabwe” and established a negative relationship. Presumptive tax was found to ambivalently affect the viability of SMEs. A similar view was expressed by SMEs Minister, Sithembiso Nyoni who laid the blame for decreased SMEs growth and increased failure rates on exorbitant taxes and penalties levied by ZIMRA. TC 2 expressed that “the unfavourable impact of taxes on the growth and continued survival of SMEs is worsened further by the liquidity crunch, high cost of money and short term lending costs due to the volatile economic environment, the inconsistent monetary and currency and exchange risk issues”. In spite of their acknowledgement of the negative ramifications of IS taxation on the growth and survival of small firms tax experts (TEX3, 6, 7 and 10) pointed to some advantages that could accrue to informal firms that are properly registered as SMEs for tax purposes. TEX3 advanced that the ITA, Zimbabwe has a provision that the Commissioner General of Taxes may “on application of a taxpayer who qualifies as a small and medium enterprise” permit such a taxpayer to pay provisional income tax on a monthly basis, that is one month in advance”. Income tax refers to corporate tax in this context. This is as opposed to the general provision in respect of corporate tax that that requires taxpayers to tax provisional tax in advance quarterly in relation to the quarterly payments dates (QPDs)at instalments of 10, 25, 30 and 35% for the first to the last quarter in ascending dates. If taxpayers were to take advantages of this provision and accordingly apply and be granted reprieve, it can be good for capital working management. TEXs 6 and 7 tabled that registered SMEs were eligible for the Special Initial Allowance tax depreciation on assets (constructed immovable and purchased movable assets) at a rate of 50% on the first year of use, 25% on the second year and 25% on the third year. This allows the taxpayer to write off an eligible capital asset in three years as opposed to the 25% for four years awarded to big companies. TEX10 on the other hand, pointed out that the small scale miners’ payments for gold proceeds were subject to 3% mining royalty deduction, which is generally 2% lower than the general rate of 5% applicable to other enterprises. Some of these benefits for formalisation for tax purposes were highlighted by Tax Matrix (2019). Notwithstanding these notable advantages the IS associations members and some the ZIMRA officers and tax experts felt that formalisation requirements and tax payments suffocated informal firms. ISAM5 argued that “the IS firms do not have enough working capital not to even talk about purchasing any assets to enjoy the capital allowances. Sometimes the IS operators have no knowledge of these tax advantages or even how to claim them”. The negative influence of tax policy on firm growth, survival, performance and expansion was also highlighted by IS questionnaire respondents as presented in Figure 4.

Multiplicity of taxes unfavourably affecting informal operators

The multiplicity of taxes was raised as another source of controversy on the IS taxation and firm growth puzzle. Tax experts pointed out that the taxes faced by the IS were multiple on the same income for example presumptive tax, VAT withholding taxes on transactions that exceed $250 with a registered operator, the recently introduced 2% transaction tax and this is compounded by licences fees and other fees that they pay to the local authorities and their associations. ISAM2 expressed this fact by saying “the taxes faced by businesses in Zimbabwe are generally too many and for our members there is presumptive tax, the 2% intermediary monetary transaction tax (IMTT) that is charged on money transfers, income tax on employment and VAT for those meeting the thresholds. The incomes made by our members cannot sustain these many taxes.” In light of all this IS taxation was found to be regressive to the growth of small firms, a view shared by Pimhidzai and Fox (2011) in Uganda. TEX5 asseverate that “the impact of the 2%IMTT is impacting badly not only on companies but on disposable incomes of individuals especially in an environment whether there are significant cash shortages as Zimbabwe. Assume you make a transfer of $500 000, the 2% IMTT is $10 000. That’s a lot of money for small firms”. Despite acknowledging the multiple taxes badly affecting the performance of small firms and taking money for investment and expansion needs, other tax experts were quick to point out that for those small firms who managed to register for VAT, even voluntarily, they are able to claim VAT input tax and also avoid the 10% withholding tax on tenders deducted for not having a valid clearance certificate. This thus positively affects small firms’ cash flows and ultimately their profitability levels. “Theoretically that is the case but practically it’s a different story altogether as ZIMRA takes for ever to process VAT refunds or worse still your refund claim can be an “invitation” to come and scrutinise your transactions” said TEX3. A view affirmed by the majority of the tax experts and all IS association members. ZIMRA officers on the other hand acknowledged the multiplicity of taxes but argued that those taxes must be viewed differently as income tax on employment was tax on employees’ incomes and VAT was merely a transmission of tax collected to consumers to ZIMRA. ZIMRAO5 asseverated that “perhaps presumptive taxes and the 2% transaction tax can be argued to be from the same income but VAT is paid by consumers of products and employment income is in principle being paid by the employees as it is part of their gross income anywhere.” In light of the discussion it was apparent that the multiplicity of taxes is burdensome on the informal firms this crippling their operations and leaving little or no funds for working capital, growth and continuity needs. This observation is similar to submissions by Cheeseman and Griffiths (2005) who expressed the negative impact of formalisation and tax administration on the IS positing that informal firms exist because if they were to be formalised, they would fail to achieve profitability and collapse resulting in the loss of “informal jobs”. TEX5 insisted that despite the heavy burden imposed by the 2% IMTT, if registered for tax purposes and formalised, an informal firm’s payment of remuneration of are exempt from the 2% tax. Considering the informal firms are very small and pay very low incomes the exemption would still be very minimal amounts.

Disincentive to investment