Full Length Research Paper

ABSTRACT

This paper deals with the process of accumulating overdue tax debts in Greece and brings out its main features. It focuses on the consistently high collection gap ratios that have led to the accumulation of tax arrears and, although the role of tax administration and debt stock management are acknowledged as crucial factors in reducing the collection gap and the stock of arrears respectively, it explores the role that fiscal policy could play. While the literature usually centres on the administrative side of collection efficiency, the present paper shows that tax policy variables such as the tax burden may play a crucial role. The analysis makes use of data never employed before to the best of our knowledge, so that various aspects of the tax debt accumulation process are revealed. We employ a simple simultaneous equation model that focuses on tax policy aspects and we conclude that increasing tax assessments boosts collection gaps. This creates a vicious circle whereas collection gaps push to higher tax assessments and so forth. Given the fiscal constraints of the economy we conclude that although the stock of tax debt may be significantly reduced only through extensive write-offs of non-performing debts and penalties and improvement of the tax administration, tax policy, although a non-sufficient condition can ensure to a certain extent that tax debt increases are checked.

Key words: Tax administration, tax debt, tax collection, tax penalties, collection gap, compliance gap.

INTRODUCTION

The object of the present analysis is to examine the role of tax policy rather than tax administration in the formation of tax collection gaps and the subsequent piling up of tax debt. The tax collection gap which is a subset of the overall tax gap, whereas national tax administrations and international organizations use various approaches to measure the tax gap, mainly in the VAT and corporate tax domains. For a thorough review of definitions and methodologies regarding the tax gap see European Commission (2016). In general, the tax gap is estimated on the basis of the amounts that should have been collected in theory, given the tax base and tax policy parameters and, therefore, it includes tax evasion (at least to some extent). The collection gap is a narrower concept based on actual tax assessments (“normal” or through audits) and the respective payments made on time (gross collection gap) or later, usually through some kind of enforcement measures (net collection gap).

Unless otherwise stated, the concept of gross collection gap is used throughout the paper, albeit with a twist, since late payments made within the reference period are considered as timely payments.

Tax debt in Greece has traditionally belonged to and has been managed by the Ministry of Finance (MoF). In 2012, however, as the economic crisis culminated it was agreed with the lenders of the State that tax collection and the resulting arrears be transferred to the General Secretariat for Public Revenues, later (2016) turned to the Independent Authority for Public Revenues (IAPR). IAPR is in effect an autonomous body in the sense that it enjoys full operational freedom, although the Ministry of Finance may control or affect targets and strategies. IAPR lacks legal form (being part of the core Executive), while it may be more exposed to government rather than Parliamentary review (Δημητρ?ου, 2016; Κουτνατζ?ς, 2018). IAPR regulates and manages tax and other debts to the State, which in 2019 stood at €105 or 57% of GDP. However, IAPR is not involved with social security collections and arrears which are managed by the National Social Security Agency (EFKA), whose Social Contributions Collection Centre (KEAO) keeps track of about €35bn. (2019) of overdue debt. To put uncollected receipts of the public sector in its right perspective, one should also count in the €69 bn. of (non-performing) overdue private debt to the banks (Hellenic Parliamentary Budget Office, 2020). Collecting public revenue in Greece has always been a weak point of the country’s tax administration (Khwaja and Iyer, 2014). This weakness combined with the recent economic crisis led to a rapid accumulation of arrears and Greece to the top of the OECD countries with a debt exceeding 200% of receipts against an average of 32% (OECD, 2021). Enhancing the performance of tax administrations has always been a matter of concern to policy makers (OECD, 2017, 2019), given the fact that the outstanding debt to tax administrations globally is estimated at €2.1 trillion for 2019 (OECD, 2021).

LITERATURE REVIEW

It is almost common knowledge nowadays that low tax compliance imposes unnecessary fiscal constraints, degrades the effectiveness of policies, undermines growth and competitivenes and boosts inequity. There is a huge literature on the issue starting long before Tanzi and Shome (1993) and extending beyond Murphy (2019). Tax collection is strongly related to both external and internal factors, especially during profound crisis periods. According to Brondolo (2009) the economic impact of a crisis tends to influence negatively a country’s tax compliance. For this reason, the state has to take preemptive action (such as upgrading services to the taxpayers, focusing on high-risk debtors, adopting statutory and organizational changes, as well as convincing taxpayers about the necessity of reforms) in order to avoid a future inability to restore normality and tax equality caused both directly by the economic slowdown and indirectly by tax policies and administration measures taken in response. In this sense, as the pandemic is anticipated to cause a major decline in tax revenue in most countries, revenue agencies will have to be ready to restore their operations, safeguard tax collection and restore taxpayers’ compliance at least to the pre-crisis levels (IMF, 2020).

Collecting taxes in Greece remains a most important facet of fiscal policy, and thereof, additional and immediate measures are required (Angerer, 2018). It is easily understood that, given the deficit constraints at any time, non-collection of assessed revenues, as part of the overall tax gap, may lead to higher tax rates which affect the whole of the economy. In the face of the economic consequences of the pandemic, various priorities and policies for the tax administration have been suggested (de Mooij et al., 2020; Betts et al., 2021). As already pointed out, the role of tax administration has been amply demonstrated in the literature, yet it is worth exploring the role of core tax policy in the formation of collection gaps and the accumulation of tax debt.

METHODS

Profiling overdue debt

For the purposes of this paper, our definition of overdue debt includes all amounts assessed by IAPR, due for payment, but not collected. The respective amount include taxes and various non-tax items, as well as guarantees extended to entities outside the general government sector and called, while they exclude Social Security Contributions. This is not the case for all countries (OECD, 2011) and, therefore, comparisons should be made with caution. Also, overdue debt includes tax penalties (which follow non-payment), but not surcharges (such as interest), which are assessed when payment is made. The main features of the overdue debt can be summarized as follows:

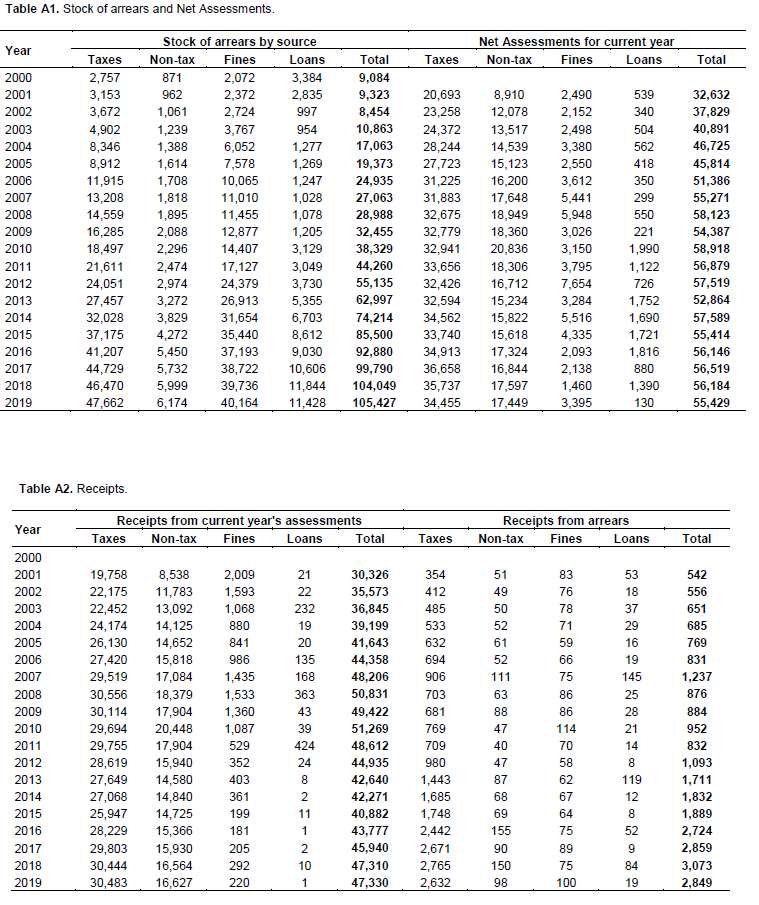

a) Rapid buildup during the crisis. As shown in the Appendix Table A1), the stock of debt built up rapidly since 2000, bringing the total from €9 bn. to €105 bn. in 2019 (or from 6% to around 57% of GDP). In 2008, at the outset of the economic crisis, the stock of overdue debts stood at 12% of (GDP) compared to around 2% of the Eurozone average (OECD, 2011).

b) The composition of the debt shows that non-collected tax penalties constitute a considerable part of arrears (Appendix Table A1). In particular, the share of tax penalties rose from 23% in 2000 to a peak of 44% in 2012 and marginally subsided to 38% in 2019. On the other hand, the share of loan guarantees called accounted for about ? of the total in 2000. By the beginning of the crisis this share had fallen to below 4% (owing to the extensive debt write-offs of guarantees extended to the National Social Security Entity), only to gradually rise again to more than 10% (due to the assumption of the called guarantees of the Greek Railways debt). The combination of all the above has left the share of principal arrears for tax and non-tax obligations, i.e. excluding tax penalties and loans, to fluctuate rather stably around 50% over the last two decades.

c) In 2019, the distribution of arrears by the size of individual debt showed that large debtors (we have arbitrarily set the threshold for large debtors at €1m.), their number not exceeding 0.2% of the total number of debtors, accounted for 81% of total arrears (Karavitis et al., 2021). A sizeable chunk of this particular amount comprises the Greek Railways debt mentioned earlier. Also, having in mind point (b) above, we should mention that almost 58% of this subtotal consists of tax penalties. In general, the problem is traced to the corporate sector that comprises 11% of the debtors but 65% of the debt (ibid.).

d) In 2019, about 47% of all collections of arrears referred to debt generated within the year, 27% to debt of one year of maturity, while collections fall sharply thereof to 6% in the second year and fade off to practically zero for higher maturities (ibid.).

Given the significant size of the debt to IAPR, the relevant question is whether and how its upward trend can be checked and eventually reversed. To explore the issue we first need to know the identity that produces the stock of arrears for a given period t:

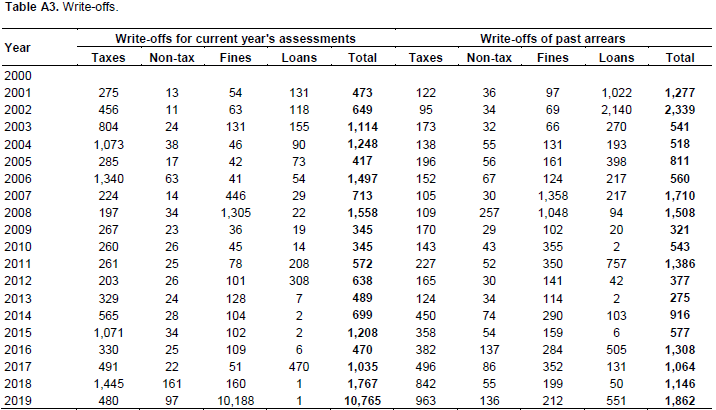

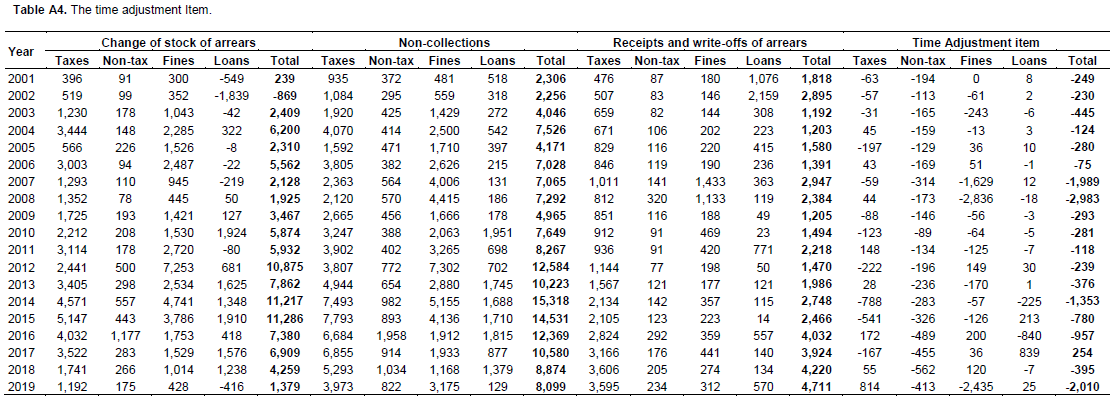

(Stock of arrears)t ≡ (Stock of arrears)t-1 +(collection gap)t –(write-offs of arrears)t −(collection of arrears)t + (time adjustment item)t ,whereas the collection gap stands for the amounts due for payment within the period but not collected, consisting of assessments net of write-offs minus the respective collections (Appendix Tables A1, A2 and A3). The time adjustment item refers to a correction term since the stock sizes are recorded on 1 December, while transactions are recorded on 31 December, and at times it may be sizeable, especially regarding tax penalties (Appendix Table A4). Given the sources of creation of the stock of arrears (also presented in the Appendix), we can conclude from the above identity that the stock of arrears can be reduced only through write-offs and recovery of arrears, while the collection gap not only should it be lower than write-offs plus recoveries but it should practically approach zero so that no new tax arrears accumulate. Also, Karavitis et al. (2021) have shown that significant write-offs should be in order since removal of all non-performing items (including arrears of insolvent debtors and assumptions of debt of public enterprises by the State) would significantly reduce the stock of arrears form €105 m. to €61 m. Yet, this would still leave us with a stock of about €34m of taxes arrears, €22m of tax penalties arrears and another €5 m of other non-tax arrears (about 32% of GDP altogether; still a substantial amount). Bearing this in mind, we can now turn to some metrics in order to determine the degree of recoverability of these amounts.

Data on debt from arrears

Source: IAPR. All data are in €m.

Notes:

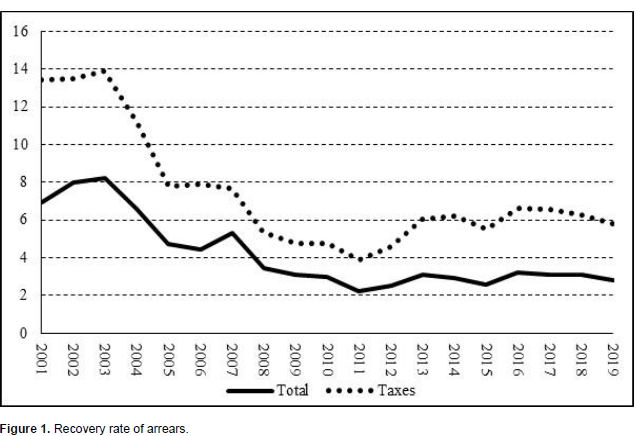

Based on the primary data in the appendix, we can see that not only is the recovery of arrears (defined as the ratio of receipts over the stock of arrears of the previous period net of write-offs) very low but it has deteriorated over the years (Figure 1). The case for the subtotal of taxes in arrears is somewhat better, presenting a modest improvement in the last decade, but just as discouraging, while regarding tax penalties, their rate of recovery (not shown in Figure 1) has practically reached zero (same for loans).

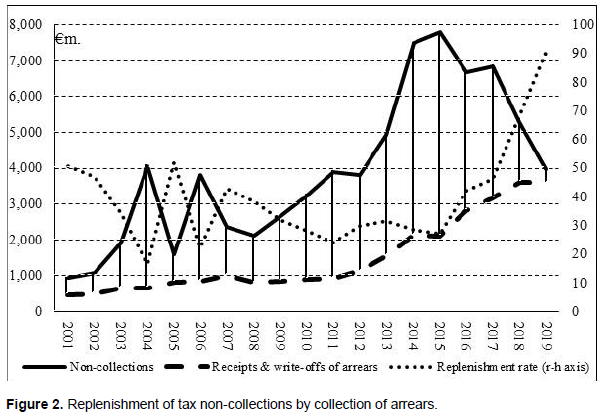

The result of the low recovery rate is that currently receipts and write-offs of arrears are far from compensating for the collection gap. In particular, although this replenishment rate of tax non-collections has improved significantly since 2015 (Figure 2) (due to tax arrears collections rather than write-offs, as the data in the Annex reveal), it still is below 100%, leaving amounts of non-collections that are not covered (shown by the shaded area).

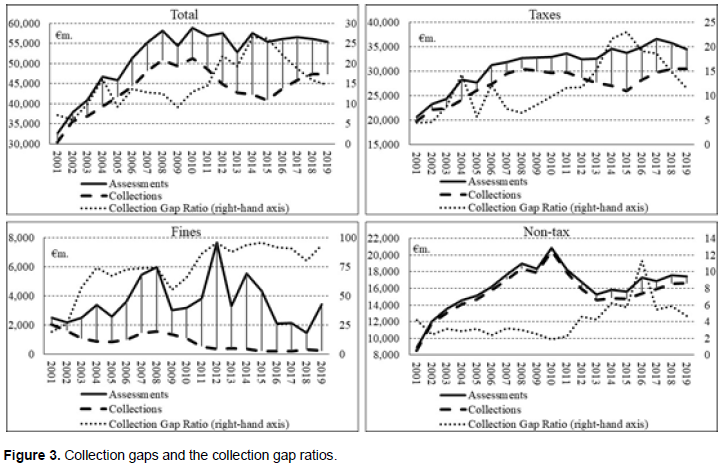

As mentioned earlier, it is important that the collection gap be curbed so that no new arrears pile up. The collection gap has two components, (net) assessments and collections. Figure 3 presents the collection gaps and the respective collection gap ratios, the latter defined as (1-collections/net assessments), for the main sources of arrears (loans are excluded as irrelevant to taxation). Here we can notice that the collection gap for taxes expanded significantly until 2015 when it reached almost ¼ of net assessments. Despite its reduction in the years that followed, more than 10% of assessments (more than 2% of GDP) are still not being collected. However, there is not adequate information about the part of these amounts that are produced through audits and/or are in legal dispute. The analysis above makes it clear that debt write-offs are essential to reducing the overall stock of arrears, yet this operation will not be sustainable unless non-collections are minimized.

Modeling the collection gap

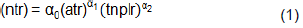

In what follows we try to connect the collection gaps of currently (i.e. within the reference year) assessed taxes and fines to the tax burden. On the one hand, we model the taxpayers’ behaviour through two functions showing the non-collection rates of taxes (ntr) and tax penalties (npr), respectively. On the other hand, we assume that the behaviour of the tax authorities is expressed through a notional average tax rate (atr) and the implicit average penalty rate (apr). More specifically, the basic economic model stands as follows (all variables refer to time period t unless otherwise stated):

Where (ntr) is the tax non-collection rate, which is calculated as the ratio of non-collected revenue (NT) over net assessments (ASST), or (ntr)=(NT/ASST). On the right hand side, we have α0 (a constant) and (atr) as a proxy for the tax burden, equal to the ratio of net tax assessments over GDP, or (atr)=(ASST/GDP), whereas it is expected that α1>0. Also, (tnplr) is a proxy for the pressure that net tax assessments as a ratio of non-performing bank loans (NPL) may or may not exert on non-collections, or (tnplr)=(ASST/NPLt-1). The rationale of “may not” is that the explosive increase of NPLs during the crisis and the subsequent non-payment of debt servicing may have facilitated tax collections (in this sense, it might be more appropriate to have unpaid debt servicing in the denominator of (tnplr), but data for such a variable are not available). Nevertheless, (tnplr) serves to indicate the current tax burden relative to total non-served debt to the banking sector (of period t-1, roughly reflecting notional debt servicing in period t). In general, the literature provides extensive work carried out on the issue of the macroeconomic (and other) determinants of NPLs (indicatively Charalambakis et al., 2017) and NPLs’ dynamics in times of crisis (Ari et al., 2020). These growth-led finance approaches, however, are counterbalanced by supply-leading and bi-directional approaches (SenGupta, 2020), which lead us to believe that to the extent that NPLs have an impact on financing costs and liquidity (and subsequently investment, growth, employment etc), then servicing bank debt may “compete” with tax obligations (the rationale of “may”). In practice, this is verified by Directive (EU) 2019/1023 of the European Parliament and of the Council as applied in Greece by Law 4738/2020 (which provides for across-the-board private debt arrangements) which also extends its scope beyond the corporate sector. Hence, the intuition is that to the extent that NPLs reflect sluggish generation of incomes and inadequate liquidity of the economy, then tax collection is affected accordingly. In this sense we expect that α2 will be also positive rather than negative.

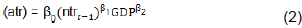

The tax burden, however, expressed by (atr) is not exogenous to the system, as it is specified as:

Where, according to (2), the implicit tax rate (atr) is assumed to depend on the non-collection rate of the previous period (ntrt-1) and income (approximated by GDP), while β0 is the constant term. The rationale is that the inability to collect assessed taxes drives the tax authorities to increased assessments in the next period (by increasing tax rates, intensifying tax audits etc). If this is true, it is expected that β1>0, which intuitively seems more plausible than the opposite case (the policy maker reducing the tax burden in response of a rising non-collection rate, despite any fiscal constraints). Moreover, normally one would anticipate the overall progressivity of the tax system to lead to higher (lower) (atr) as incomes rise (fall), or β2>0 (where, in fact, (1+ β2) is the buoyancy of (assessed) taxes). On the other hand, rising incomes may lead to relaxing tax policies or, conversely, falling incomes may drive to higher tax rates in order to replenish tax revenues (β2<0). Therefore, the sign of β2 may go either way.

Turning to penalties, (3) shows the non-collection rate of penalties (npr) which is the ratio of the difference of (net) assessments less collections (NP) over penalties assessed (ASSP), or (npr)=(NP/ASSP). The specification below shows (npr) as a function of the tax non-collection rate (ntr) and the implicit penalty rate (apr), whereas (apr)=(ASSP/NT) and γ0 is a constant.

It is expected that as non-collections of taxes rise so do non-collections of penalties since this is the logical order of things (a penalty is imposed after a tax obligation is not met), therefore γ1>0, while it is tested whether tax payers react to rising penalty rates by not paying them (γ2>0).

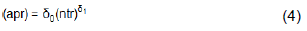

Finally, (4) shows how the tax authorities respond to the non-collection rate of taxes (ntr) by adjusting the penalty rate (apr) which is the ratio of assessed penalties imposed (ASSP) over their bas of non-collections of taxes, or (apr)=(ASSP/NT).

One may expect that as the non-collection rate rises, the implicit penalty rate would either be raised in an effort of the tax authorities to enforce compliance (δ1>0) or be reduced in order to facilitate payment of penalties (δ1<0) (δ0 is the constant term).

EMPIRICAL TESTING AND RESULTS

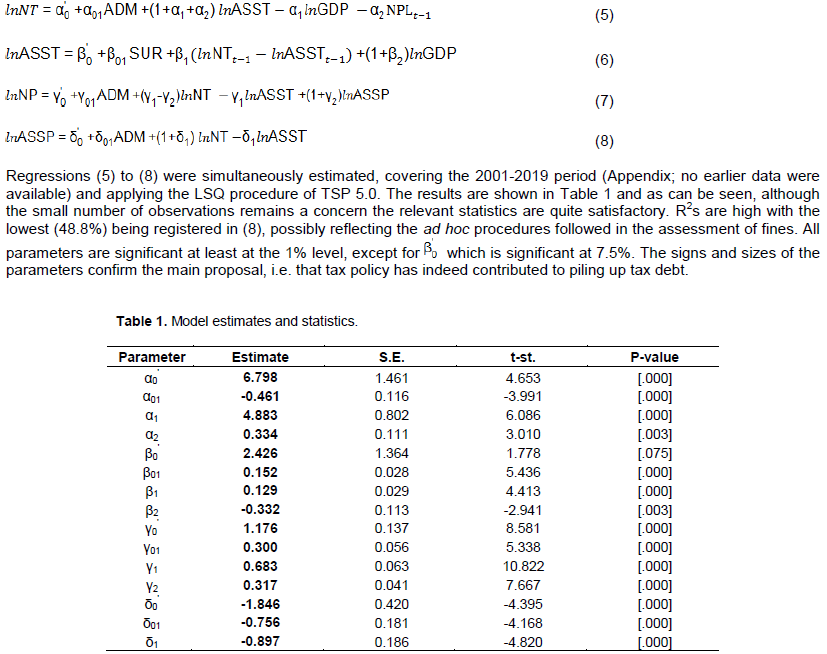

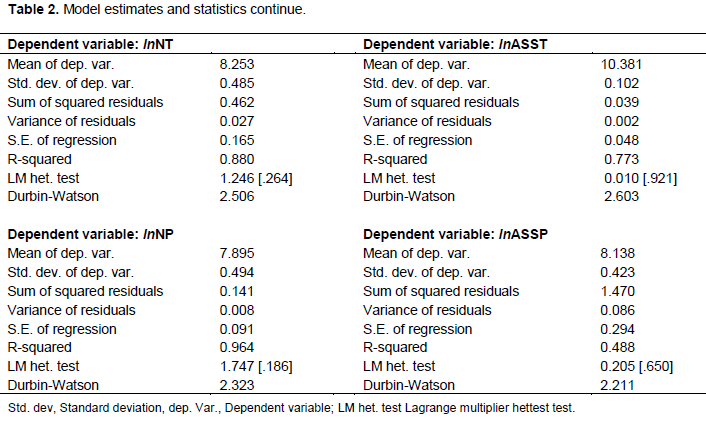

Taking logarithms of functions (1) to (4) we arrive at a system of loglinear regressions. Since all dependent variables are ratios, their logs will be differences of the logs of nominators from the logs of the denominators with the latter being rearranged to the left-hand side of the relations. A further transformation is introduced at this stage by bringing in a dummy variable (ADM) to catch a possible effect of the establishment of IAPR in 2016 (1 from 2016 onwards, 0 otherwise). This is an attempt to test whether IAPR has played a significant role in shaping the non-collection rate for taxes and penalties (in functions (1) and (3)) and in exercising whatever discreet powers it has in imposing and collecting penalties (function (4)). Moreover, since most assessments are the direct result of tax policy dictated by the Ministry of Finance rather than IAPR and given that the deep fiscal crisis of the previous decade was addressed mainly through taxation (Karavitis, 2018) another dummy variable, (SUR), has been introduced in function (2) to test for the effect of the surveillance regimes from 2010 onwards (when SUR takes the value of 1, 0 otherwise). Thus, a system of semilog regressions can be written as follows (ln denotes natural log):

In particular, we notice that α1, the elasticity of the non-collection rate relative to the implicit tax rate, is strikingly high at 4.9. On the other hand, β1 is low at 0.13 but not zero and the combination of the two shows that the overall feedback process is far from negligible. In practice, every reduction of one percentage unit of (ntr) (which corresponds to a reduction of 8.3%) could lead to a decrease of near 0.2 percentage units for (atr) which in turn would lead to a further reduction of (ntr) by 0.6 percentage units (assuming that on average (ntr)=12% and (atr)=16.5%). This may not seem much at first sight but, nevertheless, for collection inefficiencies alone, it is a considerable impact on revenues (Table 2).

Furthermore, it is worth noticing the effect of NPLs on non-collections with α2=0.334 being significantly different from zero and negative. This finding indicates that a subsidence of NPLs would also contribute to reducing the non-collection rate of taxes. Finally, we can discern the positive effect of establishing IAPR since α01 is negative and quite large. However, due attention must be paid to the true size of the estimates of the parameters of the dummy variables ADM and SUR (Halvorsen and Palmquist, 1980). In this case, following Kennedy (1981), the true size of α01 is -0.374. Also, the true size of β01 is 0.164 which confirms that during the surveillance period there was an extra pressure in raising tax assessments. In (6) we can also see that β2 is negative which leads us to accept that tax policy has been procyclical.

Turning to tax penalties, the parameter estimates of (7) and (8) indicate that the collection gap for penalties follows that of taxes (γ1=0.683), which is quite natural, while taxpayers react to higher penalty rates by not paying (γ2=0.317). On the other hand, the tax authorities tend to respond to a rising (falling) penalties collection gap by reducing (increasing) the implicit penalty rate (δ1=-0.897). Also, the coefficients of ADM in (7) and (8) show although IAPR has been more “lenient” in imposing penalties (δ01=-0.756, true size -0.538), it has not been able to collect these amounts (γ01=0.3, true size 0.347). All the above indicate that although the tax authorities respond correctly by reducing the relative size of penalties, this reduction is not adequate to allow for significant progress in collecting them, rendering the whole process of penalties rather ineffective. However, more information is required regarding disputes, individual cases (outliers) etc, in order to have a more complete picture.

CONCLUSION

As argued earlier, the stock of IAPR-related arrears can and should be significantly reduced through a thorough clear-out of non-performing debts. This should not be seen as a one-off but rather as a continuous screening process that will prevent the accumulation of “bad” debts in the future. This would involve, of course, improvements in the administrative arm of tax collection, as indicated by the values of the ADM parameters. Yet, it becomes clear that possible reductions of the average tax and penalty rates would also improve their respective collection rates. Our results make apparent that increasing the tax burden relative either to income or NPLs deteriorates the collection rate of taxes.

As confirmed by the findings of the empirical analysis, the establishment of IAPR has had a positive impact so far, although there certainly is ample room for improvements, especially in the area of penalties. A more efficient tax administration brings about fewer non-collections. The results show that such an improvement will feed back to lower tax assessments and non-collection of penalties. Lower tax non-collections will certainly alleviate the pressure on tax payers and soften the strains on the stock of debt, while there may be spillover effects to the extent that higher collection rates signify a potential for lower tax rates. This could also help tax policy regain its anticyclical character. Having in mind that non-collection rates are higher for large debtors (mainly found in the corporate sector) further appropriately targeted research, maybe in the vein of Canada Revenue Agency (2016), may prove quite useful. In addition, the deepening of the holistic approach to private debt (i.e. including social security and bank NPLs), recently activated under Act 4738/2020, could assist to rationalize the collection procedures and make the system more equitable and efficient along the lines suggested by Bird (2015).

ACKNOWLEDGEMENTS

This research was co-financed by Greece and the European Union (European Social Fund-ESF) through the Operational Programme «Human Resources Development, Education and Lifelong Learning 2014-2020» in the context of the project “Best practices in tax arrears management in post-MOU Greece: economic and institutional risks and opportunities” (MIS 5049109). The authors would like to thank Panteion University for supporting this paper and the Independent Authority for Public Revenues (IAPR) for sharing the necessary data for the production of this paper.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Angerer J (2018). Tax collection in Greece: State of play-June 2018. Depth Analysis, Economic Governance Support Unit, European Parliament. |

|

|

Ari A, Chen S, Ratnovski L (2020). The dynamics of non-performing loans during banking crises: a new database. Working Paper No. 2395. |

|

|

Betts S, De Mets P, Ossa R, Rojas E (2021). Postcrisis Revenue Generation for Tax Administrations. Fiscal Affairs: Special Series on COVID-19. |

|

|

Bird RM (2015). Improving Tax Administration in Developing Countries. Journal of Tax Administration 1(1):23-45. |

|

|

Brondolo J (2009). Collecting taxes during an economic crisis: challenges and policy options. IMF Staff Position Notes, 2009(017). |

|

|

Canada Revenue Agency (2016). Payment Tax Gap and Collection Efforts. Available at: |

|

|

Charalambakis E, Dendramis Y, Tzavalis E (2017). On the determinants of NPLs: lessons from Greece. Working Paper 220, Bank of Greece. |

|

|

de Mooij R, Fenochietto R, Hebous S, Leduc S, Osorio-Buitron C (2020). Tax Policy for Inclusive Growth after the Pandemic. Fiscal Affairs: Special Series on COVID-19. IMF. |

|

|

European Commission (2016). The Concept of Tax Gaps: Report on VAT Gap Estimations by FISCALIS Tax Gap Project Group (FPG/041). Brussels. Available at: |

|

|

Halvorsen R, Palmquist R (1980). The Interpretation of Dummy Variables in Semilogarithmic Equations. The American Economic Review 70(3):474-475. |

|

|

Hellenic Parliamentary Budget Office (2020). First Quarterly Report 2020. Athens. Available at: |

|

|

IM (2020). Revenue Administration: Reinvigorating Operations to Safeguard Collection and Compliance. Fiscal Affairs, IMF: Special Series on Fiscal Policies to Respond to COVID-19. Available at: |

|

|

Karavitis N (2018). Fiscal adjustment and debt sustainability: Greece 2010-2016 and beyond. Working Paper No. 245, Bank of Greece. |

|

|

Karavitis N, Paipetis K, Priniotaki M (2021). Overdue tax debts in Greece. International Conference on Business and Economics of the Hellenic Open University 2021. |

|

|

Kennedy PE (1981). Estimation with Correctly Interpreted Dummy Variables in Semilogarithmic Equations. The American Economic Review 71(4):801. |

|

|

Khwaja M, Iyer I (2014). Revenue Potential, Tax Space, and Tax Gap A Comparative Analysis. World Bank Policy Research Working Paper (No 6868). Available at: |

|

|

Murphy R (2019). The European Tax Gap: A report for the Socialists and Democrats Group in the European Parliament. Available at: |

|

|

OECD (2011). Tax Administration in OECD and Selected Non-OECD Countries. Center for Tax Policy and Administration, Forum on Tax Administration: Comparative Information Series (2010). OECD. Available at: |

|

|

OECD (2017). Measuring Tax Gaps. In Tax Administration 2017: Comparative Information on OECD and other Advanced and Emerging Economies. Paris, France: OECD Publishing. |

|

|

OECD (2019). Tax Administration 2019: Comparative Information on OECD and other Advanced and Emerging Economies. Paris, France: OECD Publishing. |

|

|

OECD (2021). Tax Administration 2021: Comparative Information on OECD and other Advanced and Emerging Economies. Paris: OECD Publishing. |

|

|

SenGupta S (2020). An empirical analysis on the impact of non-performing loans on investment and economic growth and the role of political governance. Indian Journal of Economics and Development, 8 (IJED-2020-27). |

|

|

Tanzi V, Shome P (1993). A Primer on Tax Evasion. IMF, Working Papers No.21. |

|

|

Δημητρ?ου Σ (2016). Η αναζ?τηση εν?ς πρ?τυπου διοικητικ?ς μεταρρ?θμισης και ?ρια του: Το παρ?δειγμα της Ανεξ?ρτητης Αρχ?ς Δημοσ?ων Εσ?δων. ?μιλος «Αριστ?βουλος Μ?νεσης». Available at: |

|

|

Κουτνατζ?ς ΣΙΓ (2018). Η ανεξαρτησ?α της φορολογικ?ς διο?κησης: Δοκιμ?ζοντας τα ?ρια της κοινοβουλευτικ?ς αρχ?ς. ?μιλος «Αριστ?βουλος Μ?νεσης». Available at: |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0