Full Length Research Paper

ABSTRACT

Value added tax (VAT) discouraged consumption, encouraged savings, and generated higher economic growth. Evidence on the actual effectiveness of consumption taxes in changing the consumption patterns and stimulating savings is limited. This study used an ex-post facto research design to assess the impact of VAT on goods and services on the buying behavior of consumers in UAE. It analyzed the changes that consumers in UAE have made in their buying behavior after the imposition of VAT. Data used for the analysis was obtained using a survey questionnaire which examined the consumption patterns of the respondents. The study selected a random sample of 240 respondents from UAE. Segments of the UAE population have absorbed the additional costs of VAT without changing their spending habits but would likely change them in the future if the VAT rate increased, while lower-income households and those with greater than or equal to 5 were more impacted by VAT. The study is expected to shed light on the impact of VAT on the consumption behavior of households in the UAE and can give some insight to other Gul Cooperation Council countries who have implemented or are about to implement VAT.

Key words: Value-added taxation; consumption taxation; household consumption expenditures; savings; economic growth; empirical investigation, Gul Cooperation Council.

INTRODUCTION

Implementing VAT is a daunting task for any economy and has for long given a hard time to tax experts and economists in trying to determine its impact on a country’s economy. Carroll (2010) has identified VAT as crucial enough to impact the overall economic situation of a country. The Gulf Cooperation Council countries started imposing taxes to reduce the budget deficit, which has become particularly noticeable since 2015 due to a drop in oil prices from $115 per barrel to less than $30 per barrel in early 2016 (Augestine, 2016). Saudi Arabia and the UAE were the first two GCC countries which introduced VAT in January 2018. Bahrain started applying VAT on the 1st of January 2019. Qatar was expected to be the fourth Arab Gulf state to introduce a 5% VAT in January 2020, while Oman declared that it will not apply VAT until at least 2021. Therefore, understanding the effects that VAT has on the buying behavior of consumers in the UAE and how they have reacted to VAT is important (Saadi, 2018).

Challenges in the implementation of VAT have remained a debatable issue in the last few decades as more and more countries try to implement it on a wide range of products (Kadir et al., 2016). VAT was first introduced in France 1954, and after that VAT was adopted in Western Europe and Latin America during the 1960s and 1970s. The rise of the VAT in Western Europe was accelerated by a series of European Economic Community directives requiring member states to adopt VAT once they become part of the European Union. Then VAT was adopted from the late 1980s in other industrialized countries such as Australia, Canada, Japan, and Switzerland. This phase also witnessed the massive expansion of VAT in transitional and developing economies, most notably in Africa and Asia. The IMF and the World Bank were linked with the rapid adoption of VAT among these countries (James, 2011). However, in the GCC countries, namely in the UAE, companies started paying VAT for the first time in 2018, and thus all the lessons learned from the UAE VAT experience need to be explored and shared with the rest of the GCC countries and the world.

The main research question was addressed by dividing it into three research questions:

Q1. What is the influence of VAT on consumers’ lifestyle in the UAE?

Q2. What is the impact of VAT on the consumers’ purchasing power in the UAE?

Q3. What is the impact of VAT on the changes in consumers’ buying behavior in the UAE?

Q4. What are the predictors of all the previously mentioned impacts?

LITERATURE REVIEW

The Kingdom of Saudi Arabia and the United Arab Emirates were the first two countries in the Gulf Cooperation Council to introduce taxes. VAT was introduced in the UAE in January 2018. Prior to the introduction of VAT, the excise tax was implemented in 2017 and the tourism tax in 2014 in addition to fees on governmental services plus a few other types of taxes that existed before such as the corporate tax on oil companies and foreign banks (D'Cuhna, 2019). However, the UAE does not levy income tax on individuals, and it has for a long time been known as a tax haven for individuals and most businesses because they didn’t have to pay taxes; the only taxes that were imposed before the VAT have been the corporate tax on oil companies and foreign banks. Today, and despite the introduction of taxes in the UAE, it is still believed that the UAE is more tax efficient than other tax-driven countries which charge big amounts of taxes. A 5% VAT rate is still significantly less than the average VAT rate of 20% in some counties (D'Cuhna, 2019).

It was the recommendation of IMF that oil-exporting countries in the Gulf introduce VAT to raise non-oil revenue. In the GCC, the UAE and Saudi Arabia were the first two countries to launch VAT from January 1, 2018, while other countries are believed to follow suit in the coming years. According to IMF officials, and based on experiences from around the world, the imposition of VAT is not expected to have a big effect on inflation or GDP growth (D'Cuhna, 2019). On the other hand, Akber Naqvi, executive director and head of asset management at Al Masah Capital, said that VAT has proved to contribute significantly to the generation of revenues in many advanced and developing economies and thus help in accelerating economic growth. He believes that the implementation of VAT in the UAE has been timely and is expected to help the UAE's “GDP growth to retract from the adverse impact it had suffered in the last three years due to low oil prices.”

With the introduction of VAT, there was a need to create and implement a federal VAT Law. Sheikh Hamdan Bin Rashid Al Maktoum, Deputy Ruler of Dubai, UAE Minister of Finance and Chairman of the Federal Tax Authority said:

“The Federal Decree-Law issued by HH Shaikh Khalifa Bin Zayed is the bedrock of the UAE’s planned tax system, which was designed to meet the most stringent of standards and best practices.” VAT, also known as goods and services tax in some countries, is defined as a consumption tax. It is imposed on a product at each stage of production, before the final sale, and it is calculated as a percentage of the selling price. VAT is normally applied as a percentage of the value of the goods or services that have been purchased or used. The VAT taxes the value added by businesses at each point in the production chain. It can be applied to both manufactured goods and services. It is a form of indirect tax and the purpose of VAT is to provide revenue for a government. Since the implementation of VAT in the UAE in January 2018, a constant rate of 5% has been applied to calculate VAT (Al-Mulla, 2017).

Given the implication of VAT on the prices of goods and services, it is important to find out how VAT would influence the behavioral pattern of consumers. Thus the price effect of VAT on consumption behavior is of relevance to the Gulf countries which have recently adopted VAT. The cost of living in the UAE is expected to rise about 1.5% in 2018.

However, analysts believe that VAT will not have a big impact on the cost of living in the UAE as the rate is one of the lowest in the world (D'Cuhna, 2019). Analysts said that the lower-income class is already aware of its income and expenses, so they know what and where to spend. However, the bigger impact could be on middle-income residents whose monthly income is around AED 20,000 as their grocery, fuel, kids' school costs and others will increase marginally. Meanwhile, the high-earning class will not feel the impact considering their high incomes and low inflation (Abbas, 2018). A study which investigated the effects of a consumption tax on effective demand under stagnation found that a consumption tax does not influence effective demand in the case of a homogeneous household under stagnation.

Several studies have examined the various issues involved when implementing a VAT in developing and developed countries (Erbill, 2001). Nellor as cited by Erbil (2001) showed that VAT has an important effect on tax-GDP ratio.

In a previous study of the relationship between VAT and savings, consumption, or economic growth, Freebairn (1991) found that the short run effects of VAT on aggregate savings in Australia are small but positive. Regarding especially its impact on saving, Metcalf (1995) emphasizes that there is no clear cut answer on whether implementing the VAT would increase savings rate. (Andrikopoulos et al., 1993) assessed the short run effects of VAT on consumption in Greece and found that VAT affected individual commodity prices, the consumer price index, and the allocation patterns of consumption expenditures among different groups of products.

In some cases, experts have gone to another extreme in their analysis by saying that VAT could lead to some items being altered or withdrawn from the market to substitute the products for similar but untaxed products. This has been supported by a study by Matsuzaki (2003) in Nairobi, which showed that most consumers had to buy fewer supplies on a regular basis as a result of the imposition of VAT on goods and services. They also have had to compromise on the quality of supplies they buy regularly in order to manage their budget. Another study showed that price increases make consumers replace the products with similar but cheaper ones (Masoom et al., 2015).

Some studies have focused on the contribution of VAT to economic growth and development with little empirical evidence about its effect on consumption behavior. Alm and El-Ganainy (2013) investigated the impact of VAT on the aggregate consumption of fifteen European Union countries over the period of 1961 to 2005 and found that a one percentage point increase in the VAT rate leads approximately to a one percent reduction in the level of aggregate consumption. In the short run and to a somewhat larger reduction in the long run Alm and El-Ganainy, 2013; Ebiringa and Yadirichukwu, 2012).

In a study about the effect of VAT on the consumption behavior of households in Nigeria, it was found that households’ consumption expenditure on durable and non-durable goods decreases as the VAT rate increases (Obiakor et al., 2015).

In yet another study on the impact of VAT increase on consumers’ reactions in the UK; it was found that VAT increase has a significant impact on consumers’ consumption habits (Masoom et al., 2015). To ensure a successful

Implementation of VAT, there has to be other measures taken to make up for the consumers so as not to negatively affect their consumption behavior, especially where income tax is another concern for consumers (Terfa and Ereso, 2017).

Scope of taxes in UAE

In UAE, as per the regulations, there are taxable supplies that are subject to the 5% rate of VAT, and these are referred to as the standard-rated supplies. This includes food and beverages, clothes, utility bills, gasoline, private transport services, hotel services, entertainment, electronics, school uniforms, commercial rents, cars and jewelry, among others.

There are zero-rated taxable supplies as well, and these are subject to a 0% VAT rate. This includes exports of goods and services from the UAE, transport of goods and passengers provided outside the UAE, supply of metal as an investment, new residential, converted, and charity buildings, and education and healthcare. Additionally, there are categories that have been totally exempted from VAT such as financial services, medicines, tuition fee, local transport, residential rents, surgery and certain government services. Finally, there are items that are outside the scope of VAT such as intra-group transactions and the sale of a business as a going concern (Daou, 2017).

Consumer behavior

The theory that drove this research work is that consumer behavior is explained by

a) Absolute Income hypothesis

b) Life cycle hypothesis

c) Permanent income hypothesis

In his Absolute Income Hypothesis (AIH), Keynes explains that consumption will rise as income rises, but not necessarily at the same rate (Alimi, 2013). Keynes’ hypothesis focuses more on the short run rather than the long run behavior of consumers. The implication of the theory is that an increase in aggregate after tax income will yield an increase in consumption, given that nothing else is affecting consumption expenditure. In Duisenberg’s theory known as the Relative Income Theory (RIH), an individual’s attitude to consumption and to saving as well is seen as being controlled by the individual’s income in relation to the income of other people with similar conditions rather than just by the general standard of living. He further hypothesizes that the present consumption is not influenced merely by present levels of absolute and relative income, but also by levels of consumption attained in the past; hence, it is difficult for a household to reduce their level of consumption once they have reached and got used to a certain one. Thus, the theory emphasizes long run rather than short run consumption behavior.

The Life Cycle Hypothesis (LCH), which was proposed by Italian economist Franco Modigliani and his student Richard Brumberg in 1957, suggests that individuals even out their consumption in the best possible manner over their life cycles (Deaton, 2005). The hypothesis assumes that young people usually have several productive years ahead of them because they have higher chances for employment, so they tend to borrow money to fund their education and consumption needs; however, people who are older tend to be more conservative about their borrowing and spending habits because they expect fewer chances for employment in the future. Thus, the LCH concludes that the average propensity to consume is greater in both early and late stages since they are borrowing against future income or using up savings. During the middle stage, the individuals have greater propensity to save and lower propensity to consume, enhanced by a typically higher income. Thus, the LCH also emphasizes long run rather than short consumption behavior.

According to the Permanent Income Hypothesis (PIH) formulated by Friedman in 1957 people base consumption on what they consider their regular and somehow long-term permanent income (Mohabbat and Wood, 1972). In doing this, they attempt to maintain a fairly constant standard of living even though their incomes may vary considerably from one period to another. As a result, temporary increases and decreases in income have little effect on their spending. The idea behind the permanent-income hypothesis is that consumption depends on what people expect to earn over a considerable period of time. As in the life-cycle hypothesis, people smooth out fluctuations in income so that they save during periods of unusually high income and spend from their savings during periods of unusually low income. The hypothesis implies that changes in consumption behavior are not predictable because they are based on individual expectations. A person should have a higher level of consumption than another person if both have the same current income but the first one looks ahead to a much higher future income, and consumes accordingly. Another implication is that economic policies such as increasing or decreasing VAT rate, might not affect consumer spending until individuals reform expectations about their future incomes. Thus, the PIH also emphasizes long run rather than short term consumption behavior.

METHODOLOGY

The population of the UAE is approximately 9.7 million (World Bank, 2018) employing a 95% confidence interval with a margin of error of 6.5%. The margin of error is relatively high due to the variations in the population sampled. This would result in an approximate sample size of 227. The actual sample size was 240 which was the number at the deadline date for the survey.

As discussed, beforehand, this study analyzed the impact of VAT on the buying behavior of households in the UAE. A random sample of employees working in seven different private and governmental companies throughout the UAE in different sectors was utilized. Questionnaires were sent to them via emails. The pre-approval to conduct the survey was taken from those companies. The email addresses of all the employees in the random sample were taken based on a predefined sample size calculation. An email was sent to them with a link to the survey and a reminder was also sent to the employees one week after the first email. The sample size of the sample was done based on a calculation random sample based on sample size calculated, which was 227 for this study. This is calculated with a 95% confidence interval with a margin of error of 6%. The population of the UAE is approximately 8,000,000.

The first part of the questionnaire consisted of questions about demographics such as gender, age, level of education, income, and household members. It also consisted of a set of questions intended to be used to assess the consumption behavior of the respondents. The questionnaire was based on a revised version of the original questionnaire that was developed by Matsuzaki (2003) in his research with minor modifications in the wording to suit the UAE environment and the requirements of the study. The questionnaire consisted of 23 questions including certain basic demographic information. This information was collected for examining whether those demographic factors, such as gender and age and GPA, reflect on respondents’ answers to the questions related to the consumption behavior in the rest of the survey.

Following the development of the questionnaire, a pilot study was conducted to test its validity as well as its reliability. A convenient sample of 10 participants responded and completed the questionnaire twice to test the clarity of the questions. The questionnaire was sent to experts in the fields of taxes and surveys and changes were made based on their comments about the clarity of the questions.

After the descriptive analysis, all the data were coded and analyzed using SPSS version 26. Descriptive statistics are reported as frequency with percentages for categorical variables. Chi square was run to see the differences of socio-demographic characteristics on consumption and buying capacity after VAT. Logistic regression was used and odds ratio (OR) with 95% CIs is reported, Variables having p-value 0.25 and less at univariate level and other variables which are shown to be associated with VAT in literature were considered at multivariable level. Predictors are reported with adjusted OR and CIs.

RESULTS

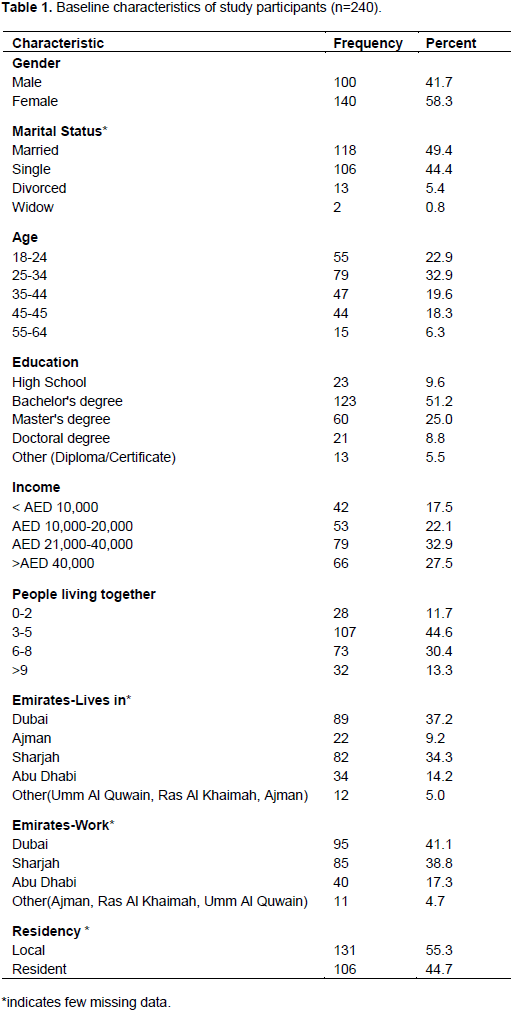

Data were collected from 240 participants, of whom 140(58.3%) were female, 118(49.2%) were married, 134 (55.8%) were aged 34 or below, 123(51.2%) had a Bachelor’s degree, and 107(44.6%) reported that from 3 to 5 people were living together in their houses. More than one third of the respondents were living and working in Dubai (37.2% and 41.1% respectively), and more than half of those who participated in the survey were Emirati (locals) (n=131, 54.6%) (Table 1).

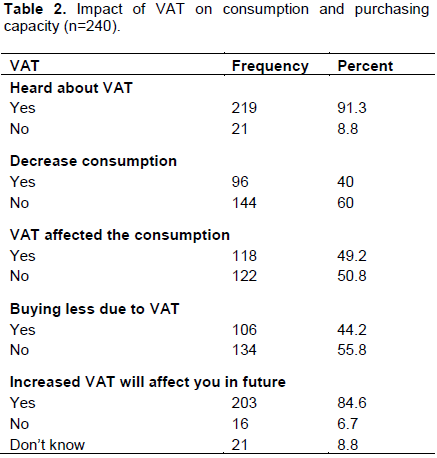

Of the total number of participants, 219(91.3%) reported that they knew about VAT. When asked about the items they usually buy, 201(83.8%) reported that they bought groceries, whereas 151(62.9%) reported clothes, 101(42.1%) reported shoes, 87(36.3%) reported electronics, and around 10% reported furniture (26; 10.8%) and cigarettes (n=30; 12.5%), while 27.1% reported buying miscellaneous objects. Regarding the use of certain services, the majority of the participants reported using communication services and banking services¾82.5% and 56.3% respectively. Less than half of the participants (96; 40%) believed that their consumption had decreased due to VAT. Nearly half reported that VAT had affected their consumption (118; 49.2%) while the other half believed that VAT had no impact on it (n=122; 50.8%). More than half reported that VAT has not affected their buying habits (n=134; 55.8%). When asked about about the effect of increased VAT on future buying, 203 of the respondents (84.6%) replied affirmatively (Table 2).

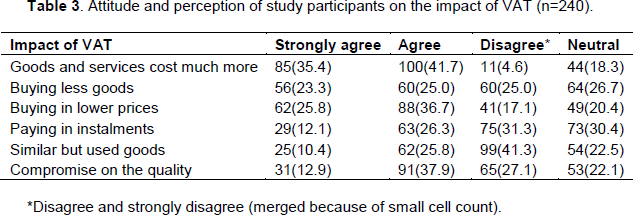

Of the total number of respondents, 77.1% agree and strongly agree that VAT has greatly increased the costs of goods and services, 48.3% agree and strongly agree that they are buying less because of VAT, while only 25% disagree with this. However, 62.5% agree and strongly agree that it is because of VAT that they are buying goods from suppliers who offer lower prices while 17.1% disagree with this. Out of the total number of respondents, 38.3% agree and strongly agree that they are buying goods from suppliers that allow payment in instalments, while 31.3% disagree with this. 41.3% of the total number of respondents believed that despite having to pay VAT, they are not buying used items; while 36.3% agree and strongly agree that they are buying used items because of VAT. Additionally, around half of the respondents (50.8%) agree and strongly agree that they are compromising the quality of goods in order to manage their budgets that have been affected by VAT (Table 3).

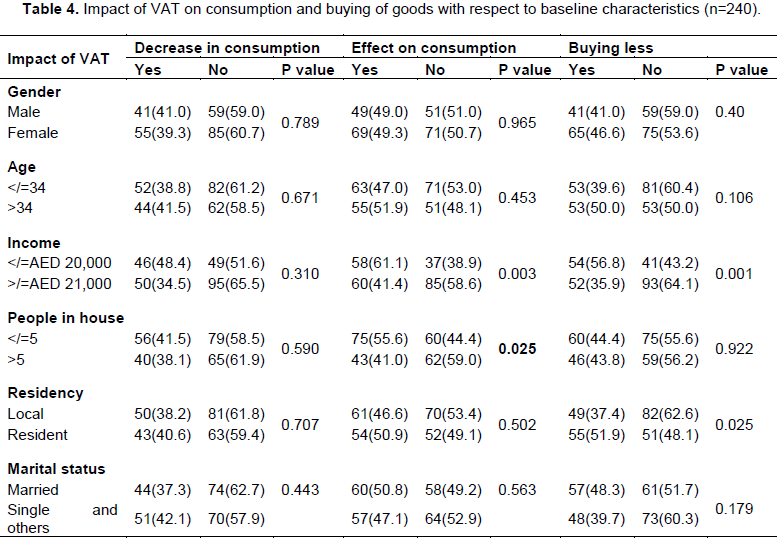

There was no difference in consumption and buying behaviour with respect to gender, age and marital status. However, a significant difference was seen with respect to income. For those individuals with income </=20,000AED, VAT had a significant effect on their consumption (p value 0.003), and they were buying significantly less than those who were earning more (p value 0.001). Moreover, participants with 5 or fewer people living in the same house reported that VAT had a significant impact on consumption (p value 0.025). Likewise, those who reported themselves as residents have reported that VAT had a major impact on their buying ability and they were significantly buying less compared to the locals (p value 0.025) (Table 4).

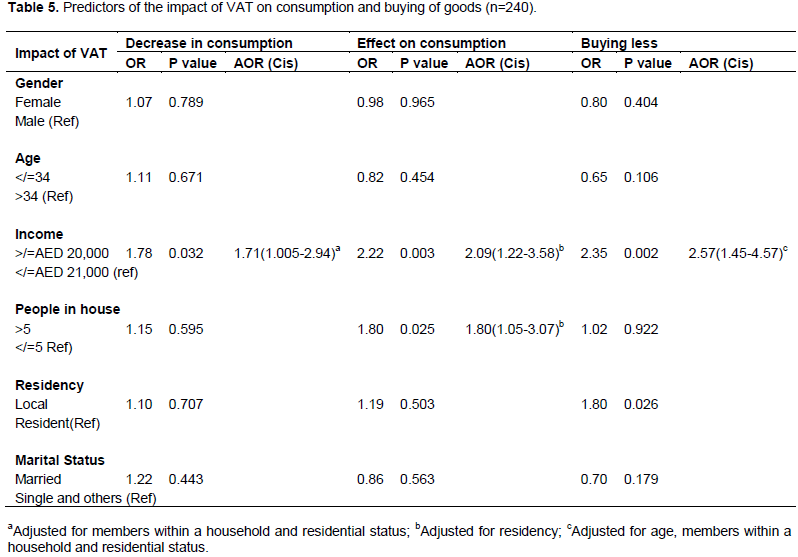

Univariate and multivariate analyses were done, and it was found that the consumption and buying patterns of those earning an income are more than or equal to 20000 AED were more affected by VAT than the consumption of those who were earning less. Moreover, only households with more than 5 members had their consumption significantly affected by VAT (1.08 95%CI: 1.05-3.07) (Table 5).

DISCUSSION

The results showed that most participants were aware of VAT. Less than half of the respondents believed that their consumption decreased due to VAT, and only half of them believed that it had any effect at all. On the other hand, majority did believe that it increased the costs of goods and services and the majority believes they are purchasing goods from suppliers who offer lower prices as a result of the implementation of VAT. While less than half of the participants agreed they were buying used items because of VAT, the majority contended that they were compromising the quality of the items they were buying in order to decrease the price that had risen because of VAT. The main factor causing a difference in consumption as a result of VAT was annual income, with those with lower incomes significantly buying less than those with higher incomes. However, age, gender and marital status did not seem to affect buying habits significantly.

The main limitation of this study was the lack of response from some of the respondents. The possibility of nonresponse bias might have affected the randomness of the sample. Another limitation of this study is that it is hard to generalize the results to all GCC countries because data were collected from UAE. Moreover, a lower response rate was obtained from the online survey as compared to what was expected probably because respondents had other engagements at the time of the study. The time element was another limitation. However, the study did have a number of strengths as well. One main strong point of this study is that it is the first piece of research in the UAE to assess the impact of VAT on Emirati households. It also includes a multitude of variables to strengthen the results. Furthermore, because it was conducted in 2019, participants had ample time to properly understand VAT and its implications.

The results of this study defy the expectations by D’Cuhna (2019), which predicted that VAT would not have a significant effect on Emirati living costs as the UAE has one of the lowest rates in the world, but this study shows that it, in fact, did affect Emirati’ consumption though this effect was more in some groups as compared to others. Further, it differed with Obiakor et al. (2015) that VAT significantly affected spending habits since only half of the participants believed their consumption had changed. However, this supports the Permanent Income Hypothesis, which implies that VAT would not have an impact on consumer spending in the short-term (Friedman, 1957). In addition, these results do fall in line with the prediction that it would not significantly affect higher income families (Abbas, 2018). The results also align with a study previously conducted in Nairobi, which showed that VAT led to consumers buying fewer items and compromising the quality of their goods (Matsuzaki, 2003). Moreover, the results of this study, in which participants have stated that they have resorted to buying used items and a UK study which stated that consumers would buy similar, cheaper items instead of the ones they regularly buy agreed with those of Masoom et al. (2015).

The findings of this study have several implications. For instance, the study shows that since there was no significant effect on consumption overall, the VAT was implemented smoothly. However, it implies that certain salaries should be increased as low-income respondents and ones with larger families were disproportionately affected by the VAT. They also show that the majority of households would be greatly affected if there were to be a future increase in VAT.

CONCLUSION

This study showed that only half of people living in UAE believed that VAT had an effect on their consumption, showing its effect was not significant for the time being, but would have a greater impact if increased in the future. It also provided evidence that lower-income household, as well as those with five individuals or more, faced greater difficulties in regards to the implementation of VAT. A suggested area for further research can be the difference in the effects of VAT on the spending of consumers living in the different Emirates as well as between different income groups. Additionally, further research should assess whether savings were impacted by VAT in the UAE.

CONFLICT OF INTERESTS

The authors have not declared any conflicts of interests.

REFERENCES

|

Abbas W (2018). Broadening tax horizons. Khaleej Times. Available at: |

|

|

Alimi RS (2013). Keynes' Absolute Income Hypothesis and Kuznets Paradox. |

|

|

Alm J, El-Ganainy A (2013). Value-added taxation and consumption. International Tax and Public Finance 20(1):105-128. |

|

|

Al-Mulla A (2017). UAE VAT Laws. VATUAE. |

|

|

Andrikopoulos AA, Brox JA, Georgakopoulos TA (1993). A short-run assessment of the effects of VAT on consumption patterns: the Greek experience. Applied Economics 25(5):617-626. |

|

|

Augestine BD (2016). GCC oil revenues are projected to be lower by $400 billion in 2016. Khaleej Times. Available at: |

|

|

Daou J (2017). An introduction to Value Added Tax in the GCC. PWC. |

|

|

D'Cuhna SD (2019). UAE and Saudi Arabia End Tax-Free Living, Roll Out 5% VAT as Oil Revenue Slump. Forbes. |

|

|

Deaton A (2005). Measuring poverty in a growing world (or measuring growth in a poor world). Review of Economics and Statistics 87(1):1-19. |

|

|

Erbill LP (2001). The Modern VAT. Washington D.C: International Monetary Fund. |

|

|

Freebairn J (1991). Some effects of a consumption tax on the level and composition of Australian saving and investment. Australian Economic Review 24(4):13-29. |

|

|

Friedman M (1957). The permanent income hypothesis. NBER Chapters. pp. 20-37. |

|

|

James K (2011). Exploring the origins and global rise of VAT. The VAT Reader (Tax Analysts) pp. 15-22. |

|

|

Kadir JB, Yusof ZB, Hassan MA (2016). Goods and services tax (GST) in Malaysia: Behind successful experiences. International Journal of Economic Perspectives 10(4):126-138. |

|

|

Mohabbat KA, Wood J (1972). Permanent Income Hypothesis and the Demand for Durable Goods. Swiss Journal of Economics and Statistics 108(II):169-175. |

|

|

Masoom A, Fazluz Z, Samaduzzaman M (2015). VAT Increase and Impact on Consumers' Consumption Habit. Asian Journal of Finance and Accounting 7(1):105-115. |

|

|

Matsuzaki D (2003). The effects of a consumption tax on effective demand under stagnation. The Japanese Economic Review 54(1):101-118. |

|

|

Metcalf GE (1995). Value-added taxation: A tax whose time has come?. Journal of Economic Perspectives 9(1):121-140. |

|

|

Obiakor R, Kwarbai J, Okwu A (2015). Value Added Tax and Consumption Expenditure Behaviour of Households in Nigeria: An Empirical Investigation. International Review of Social Research 3(6):1-13. |

|

|

Carroll RC (2010). The Macroeconomic Effects of an Add-on Value-Added Tax. Ernst and Young. |

|

|

Saadi D (2018). Four GCC states need more time on VAT. Available at: |

|

|

Terfa A, Ereso T (2017). Assessment of the effect of value added tax on consumption behavior: The case of Nekemte town, Wollega. EcoForum. |

|

|

Ebiringa OT, Yadirichukwu E (2012). Analysis of tax formation and impact on economic growth in Nigeria. International Journal of Accounting and Financial Reporting 2(2):367 |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0