ABSTRACT

This study analyzed the interdependencies between employment and accounting measures, in order to evaluate the merger effects during the period of the economic crisis in Greece. More specifically, the study analyses five accounting measures in comparison to the total number of employees, as financial ratios, from a sample of all Greek listed firms in the Athens Exchange that executed one merger in the period from 2009 to 2013 as acquirers. From the analysis of the results, it is clear that the mergers had no effect on employment and labor productivity for the whole sample firms merged from 2009 to 2013 and the productivity of workers have not improved significantly after the mergers. Lastly, the study examined the industry differentiation of labor productivity after mergers. The results reveal, in general, a better performance for the commerce and services (CMS) firms from the sample in contrast to the three other basic industry categories: Primary sector (PRI), industrial sector (IND), and constructions and building materials (CNΒ).

Key words: Mergers, employment, labor productivity, ratios.

Mergers have been a worldwide business development tactic and commonly accepted as one of the mechanisms by which firms gain access to new resources and via resource redeployment, increase revenues and reduce cost (Leepsa and Mishra, 2013; Omoye and Aniefor, 2016). How decision makers agree or disagree on strategic issues is an important topic for discussion over to organizations and many researchers and business practitioners are confident and enthusiastic for mergers, despite the fact that many others regard with scepticism this hypothesis (Rodionov and Mikhalchuk, 2016; Tao et al., 2017). Furthermore, there is always an impact of mergers on business activity and firms’ human factor (the workers at every management level), which are one of the most valuable assets of an organization.

According to Liu et al. (2015), the labor market effects of mergers and acquisitions (M&As) are worth intensive empirical investigation, besides the important policy implications for the host country, as the theoretical analyses do not reach a consensus. While the existing literature on mergers analyzes their impact on business activity and human factor from several aspects and using several methodologies, “there is very little systematic empirical evidence on the employment effects of mergers and almost none outside the USA” (Conyon et al., 2002: 32). An explanatory study for the UK market was conducted by Conyon et al. (2002), while till now there are few studies outside the US and UK market that examine the impact of mergers on employment effects. Also, there are many research methods (both qualitative and quantitative) over the last years for the examination of an empirical problem, such as the employment effects from merger activities. However, Conyon et al. (2002) argue that the limited extant literature on US market exhibits a variety of sampling procedures and methodologies, while there is no clear consensus on research methodology, as well as on expected findings from a research.

Furthermore, from January 2005, all the listed firms in the EU member states were required to prepare their financial statements according to the International Accounting Standard (IAS) and International Financial Reporting Standards (IFRS). Moreover, employee benefits are described by the IAS 19 (Amended 2011), which outlines the accounting requirements for employee benefits, including short-term benefits (e.g. wages and salaries, annual leave), post-employment benefits such as retirement benefits, other long-term benefits (e.g. long service leave) and termination benefits. The IAS 19 outlines how each category of employee benefits are measured, providing detailed guidance in particular about post-employment benefits (Giovanis et al., 2016; Deloitte: http://www.iasplus.com/en).

Last, in Greece, after the U.S crisis in mid-2007, there was an evolving economic crisis, which started at the end of 2009 and everyone noticed that this crisis due to public debt was not temporary and affects several industry sectors (Georgantopoulos and Filos, 2017; Pazarskis et al., 2017). The Greek government resorted to the ‘support mechanism’ to cover its public debt and actually, from 2010 it has begun in Greece the era of ‘troika’: the European Central Bank, the European Union and the International Monetary Fund are for the first time in European history parts of the ‘troika’. Thus, it is quite interesting to examine mergers effects on employment and productivity and their status in the period of this economic crisis, as was the outbreak of the sovereign debt crisis in Greece, mainly in 2009 and during the following years of economic crisis in Greece till now (Giovanis et al., 2016).

Considering that the most valuable asset of an organization is its staff, the aim of the study is to investigate the impact of mergers on employee’s productivity before and after the merger period during the economic crisis in Greece. In order to examine the employment effects and labor productivity of Greek firms after mergers activities, this study proceeds to an analysis ofa sample of firms, listed at the Athens Exchange in Greece that executed one merger in a five-year-period (from 2009 to 2013), using accounting measures and computing five ratios.

Many past studies on merger performance that employed accounting data or ratios and labor productivity were conducted diachronically and concluded on ambiguous results (Giovanis et al., 2016). Over the last years, the majority of the studies are concentrated at the US market, while there are few studies on this subject for other countries (Conyon et al., 2002). Also, regarding the research methods (both qualitative and quantitative) there is no clear consensus on research methodology, as well as on expected findings from a research on this subject. Several past studies for the examination of the employment effects from merger activities are presented here.

One initial research that examines the labor effects of M&As in China was carried out by Liu et al. (2015). They examined the causal effect of foreign acquisitions on the labor market in China and their sample consists of 496 foreign completed acquisition deals in China over the period of 1998 to 2007. Their results showed that the impacts of foreign acquisitions in China are different from but also comparable to those in developed countries found in the literature. Specifically, Liu et al. (2015) argued that foreign acquisitions have significant positive effects on the levels of wage and employment of target firms.

For the Canadian market, Oldford and Otchere (2016) examined labor market effects of cross-border acquisitions using a large sample of acquired Canadian firms. Their sample includes all the Canadian firms involved in cross-border acquisitions from 1980 to 2008. For benchmarking, they use a sample of firms involved in domestic acquisitions for the same time period. Their final sample consists of 362 firms acquired in cross-border M&As and 342 firms acquired by domestic bidders. Oldford and Otchere (2016) presented financial data analysis for each target firm five years before and five years after the completion of their deal. Their results implied that the targets reduced employment levels and increased wages after the acquisitions, while productivity and efficiency improved significantly after the foreign acquisition.

Regarding the Japanese market, Hosono et al. (2009) investigated the impact of mergers on productivity. Their study analysed fifty five mergers during the period of 1995 to 1999 of a sample of Japanese acquiring firms in the manufacturing sector, with firms’ data analysis for on year before and three years after the merger events. Hosono et al. (2009) found a significant increase in the debt-to-asset ratio, while the total factor productivity decreases immediately after mergers and does not capture the pre-merger level within the next three years after mergers. They argued that the costs of business integration are large and persistent for the merger decision in Japan. Hosono et al. (2009) further analyzed the post-merger performance by classifying the M&As into several merger types and industries: they claimed that the recovery of total factor productivity after mergers is significant for mergers across industries and only horizontal M&As lead to better results, as the merged firms are within the same business group and this implies for a synergy effect in this type of mergers.

For the EU market, Furlan et al. (2016) examined a large sample of European M&As for post-M&A employment effects with firm level analysis according to their balance sheet information and profit and loss accounts. Their sample consists of 1.350 firms and the study examined period is between 2003 and2010.Furlan et al. (2016) found in the full sample positive employment effects for all levels of acquired ownership above 25%. They also try to capture the main patterns of M&A-induced employment effects with specific subsamples: Furlan et al. (2016) claimed for domestic M&As significant employment effects only observable above 75% of acquired ownership, while there is significant positive employment effects for cross-border M&As above the 25% ownership of shares.

For the UK market, Schiffbauer et al. (2017) examined the causal link between foreign acquisitions and firm productivity in the UK and they analyzed the productivity of acquired firms from the UK over the period from 1999 to 2007. Their sample consists of over 10.000 M&As transactions (25% of these transactions were international M&As). They concluded that the productivity of foreign-acquired firms depends on characteristics of acquiring and acquired firms, while there is a significant heterogeneity in the total factor of productivity effects of foreign M&A at the industry level. More specifically, productivity gains are linked to acquisitions by foreign firms operating in industries intensive in R&D, but are less likely when foreign acquirers operate in marketing-intensive industries. Another study for the UK market of Conyon et al. (2002) examined the effects of M&As activity on firm employment at a sample of 400 M&As transactions during the period from 1967 to 1996. Conyon et al. (2002) found significant rationalizations in the use of labor cost and increase efficiency in the post-merger period, in particular for related mergers and even more for hostile mergers.

As M&As transactions attract the interest of researchers worldwide and are worth intensive empirical investigation, while there are important policy implications for every host country of international M&As, Dessaint et al. (2017) studied the employment protection and takeovers from a comprehensive sample that covers 21 developed countries: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, the UK, and the US. They examined 45.696 M&As deals during the period of 1985 to 2007 from these countries and their final sample included M&As that the transaction value is at least fifty million US dollars and the bidding firm try to acquire over 50% of shares. Dessaint et al. (2017) claimed that labor restructuring is a key driver of takeovers, as major increases in employment protection reduce takeover activity by 14 to 27% and the combined firm gains (synergies) by over half. The results of Dessaint et al. (2017) are providing evidence that workforce restructuring is a significant source of cost synergies.

Also, there are some studies that examined the employment effects from merger activities only for one European Union’s member state. Thus, for Sweden, Bandick and Karpaty (2011) investigated the employment effects of foreign acquisitions in acquired firms in Swedish manufacturing during the period of 1993 to 2002. From a sample that includes all manufacturing firms with 20 employees or more (over 5.000 firms), they studied a sample of 464 target firms. They found some evidence of positive employment effects in acquired firms. Also, Bandick and Karpaty (2011) claimed for positive employment effects more pronounced in acquired non-Multinational Enterprises (MNEs) than in Swedish MNEs. Another study for Sweden in the 1990s, a period characterized by a dramatic increase in foreign ownership, is carried out by Siegel and Simons (2010), which analysed in one model after M&As firms, plants and workers, as parts of the M&As process. They have studied virtually the entire population of Swedish manufacturing firms and employees during the period from 1985 to 1998. Siegel and Simons (2010) claimed, consistent with human capital theory, that M&As lead to improvements in firm performance and plant productivity, and simultaneously, M&As result in downsizing of firms.

In Germany, Weche (2015) studied foreign and domestic acquisitions to account for a general takeover effect. His study covered all enterprises of manufacturing sectors with at least 20 employees and the time period was from 2007 to 2009. From a preliminary sample of 255 foreign and 894 domestic takeovers in Germany, after controlling identification failures at the data to eliminate his sample (which errors are excluded), he examined 133 foreign and 155 domestic takeovers. His results indicated a negative impact of foreign takeovers on employment and no productivity improvements. Last, Lehto and Bockerman (2008) examined the employment effects of M&As on targets by using matched establishment-level data from Finland. Their data analysis concentrated over the years 1989 to 2003 at several cross-border and domestic M&As, which are further sub-tracked, in order to analyse the employment effects at several different types of M&As. Their study considered three different industry blocks, which are:(a) considered three different industry blocks, which are: (a) manufacturing (including utility industries), (b) construction and other services, and (c) trade (including hotels and restaurants). Lehto and Bockerman (2008) argued that cross-border M&As have a negative impact only in manufacturing firms and that domestic M&As with foreign-owned purchasers have a substantial negative impact on employment in construction and other services industries.Many past studies on merger performance that employed accounting data or ratios and labor productivity were conducted diachronically and concluded on ambiguous results (Giovanis et al., 2016). Over the last years, the majority of the studies are concentrated at the US market, while there are few studies on this subject for other countries (Conyon et al., 2002). Also, regarding the research methods (both qualitative and quantitative) there is no clear consensus on research methodology, as well as on expected findings from a research on this subject. Several past studies for the examination of the employment effects from merger activities are presented here.

One initial research that examines the labor effects of M&As in China was carried out by Liu et al. (2015). They examined the causal effect of foreign acquisitions on the labor market in China and their sample consists of 496 foreign completed acquisition deals in China over the period of 1998 to 2007. Their results showed that the impacts of foreign acquisitions in China are different from but also comparable to those in developed countries found in the literature. Specifically, Liu et al. (2015) argued that foreign acquisitions have significant positive effects on the levels of wage and employment of target firms.

For the Canadian market, Oldford and Otchere (2016) examined labor market effects of cross-border acquisitions using a large sample of acquired Canadian firms. Their sample includes all the Canadian firms involved in cross-border acquisitions from 1980 to 2008. For benchmarking, they use a sample of firms involved in domestic acquisitions for the same time period. Their final sample consists of 362 firms acquired in cross-border M&As and 342 firms acquired by domestic bidders. Oldford and Otchere (2016) presented financial data analysis for each target firm five years before and five years after the completion of their deal. Their results implied that the targets reduced employment levels and increased wages after the acquisitions, while productivity and efficiency improved significantly after the foreign acquisition.

Regarding the Japanese market, Hosono et al. (2009) investigated the impact of mergers on productivity. Their study analysed fifty five mergers during the period of 1995 to 1999 of a sample of Japanese acquiring firms in the manufacturing sector, with firms’ data analysis for on year before and three years after the merger events. Hosono et al. (2009) found a significant increase in the debt-to-asset ratio, while the total factor productivity decreases immediately after mergers and does not capture the pre-merger level within the next three years after mergers. They argued that the costs of business integration are large and persistent for the merger decision in Japan. Hosono et al. (2009) further analyzed the post-merger performance by classifying the M&As into several merger types and industries: they claimed that the recovery of total factor productivity after mergers is significant for mergers across industries and only horizontal M&As lead to better results, as the merged firms are within the same business group and this implies for a synergy effect in this type of mergers.

For the EU market, Furlan et al. (2016) examined a large sample of European M&As for post-M&A employment effects with firm level analysis according to their balance sheet information and profit and loss accounts. Their sample consists of 1.350 firms and the study examined period is between 2003 and2010.Furlan et al. (2016) found in the full sample positive employment effects for all levels of acquired ownership above 25%. They also try to capture the main patterns of M&A-induced employment effects with specific subsamples: Furlan et al. (2016) claimed for domestic M&As significant employment effects only observable above 75% of acquired ownership, while there is significant positive employment effects for cross-border M&As above the 25% ownership of shares.

For the UK market, Schiffbauer et al. (2017) examined the causal link between foreign acquisitions and firm productivity in the UK and they analyzed the productivity of acquired firms from the UK over the period from 1999 to 2007. Their sample consists of over 10.000 M&As transactions (25% of these transactions were international M&As). They concluded that the productivity of foreign-acquired firms depends on characteristics of acquiring and acquired firms, while there is a significant heterogeneity in the total factor of productivity effects of foreign M&A at the industry level. More specifically, productivity gains are linked to acquisitions by foreign firms operating in industries intensive in R&D, but are less likely when foreign acquirers operate in marketing-intensive industries. Another study for the UK market of Conyon et al. (2002) examined the effects of M&As activity on firm employment at a sample of 400 M&As transactions during the period from 1967 to 1996. Conyon et al. (2002) found significant rationalizations in the use of labor cost and increase efficiency in the post-merger period, in particular for related mergers and even more for hostile mergers.

As M&As transactions attract the interest of researchers worldwide and are worth intensive empirical investigation, while there are important policy implications for every host country of international M&As, Dessaint et al. (2017) studied the employment protection and takeovers from a comprehensive sample that covers 21 developed countries: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, the UK, and the US. They examined 45.696 M&As deals during the period of 1985 to 2007 from these countries and their final sample included M&As that the transaction value is at least fifty million US dollars and the bidding firm try to acquire over 50% of shares. Dessaint et al. (2017) claimed that labor restructuring is a key driver of takeovers, as major increases in employment protection reduce takeover activity by 14 to 27% and the combined firm gains (synergies) by over half. The results of Dessaint et al. (2017) are providing evidence that workforce restructuring is a significant source of cost synergies.

Also, there are some studies that examined the employment effects from merger activities only for one European Union’s member state. Thus, for Sweden, Bandick and Karpaty (2011) investigated the employment effects of foreign acquisitions in acquired firms in Swedish manufacturing during the period of 1993 to 2002. From a sample that includes all manufacturing firms with 20 employees or more (over 5.000 firms), they studied a sample of 464 target firms. They found some evidence of positive employment effects in acquired firms. Also, Bandick and Karpaty (2011) claimed for positive employment effects more pronounced in acquired non-Multinational Enterprises (MNEs) than in Swedish MNEs. Another study for Sweden in the 1990s, a period characterized by a dramatic increase in foreign ownership, is carried out by Siegel and Simons (2010), which analysed in one model after M&As firms, plants and workers, as parts of the M&As process. They have studied virtually the entire population of Swedish manufacturing firms and employees during the period from 1985 to 1998. Siegel and Simons (2010) claimed, consistent with human capital theory, that M&As lead to improvements in firm performance and plant productivity, and simultaneously, M&As result in downsizing of firms.

In Germany, Weche (2015) studied foreign and domestic acquisitions to account for a general takeover effect. His study covered all enterprises of manufacturing sectors with at least 20 employees and the time period was from 2007 to 2009. From a preliminary sample of 255 foreign and 894 domestic takeovers in Germany, after controlling identification failures at the data to eliminate his sample (which errors are excluded), he examined 133 foreign and 155 domestic takeovers. His results indicated a negative impact of foreign takeovers on employment and no productivity improvements. Last, Lehto and Bockerman (2008) examined the employment effects of M&As on targets by using matched establishment-level data from Finland. Their data analysis concentrated over the years 1989 to 2003 at several cross-border and domestic M&As, which are further sub-tracked, in order to analyse the employment effects at several different types of M&As. Their study considered three different industry blocks, which are:(a) considered three different industry blocks, which are: (a) manufacturing (including utility industries), (b) construction and other services, and (c) trade (including hotels and restaurants). Lehto and Bockerman (2008) argued that cross-border M&As have a negative impact only in manufacturing firms and that domestic M&As with foreign-owned purchasers have a substantial negative impact on employment in construction and other services industries.

Research design

Sample selection

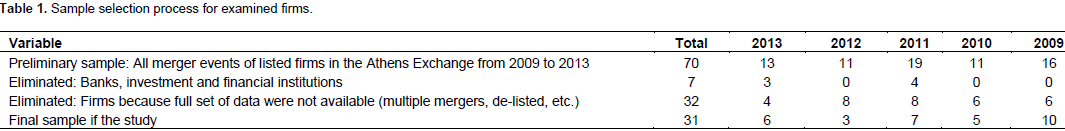

All merger events of listed firms in the Athens Exchange (Greece) at the period from 2009 to 2013 are tracked on the web site of the Athens Exchange; this is a preliminary sample of seventy firms. As the study examines only the performance of listed firms, the merger transactions of their subsidiaries are excluded from the sample. From this preliminary sample, the firms of the financial sector are excluded for further analysis (seven firms). Also, the firms with multiple merger activities in the period from 2009 to 2013, as well as some firms that have been de-listed from the Athens Exchange for various reasons (bankruptcy, not meeting the standards of the market, etc.) are excluded from the sample (thirty two firms). Thus, the final sample consists of thirty one firms listed in the Athens Exchange that executed one merger action as acquirers in Greece in the period 2009 to 2013 (Table 1).

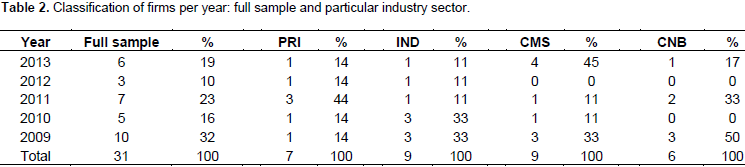

The study proceeds to an analysis only of listed firms as their financial statements are published and it is easy to find them and evaluate from them firm’s performance (Giovanis et al., 2016). The available data of this study (accounting measures) are computed from the financial statements of the merger-involved firms. The merger events of our sample, the financial statements and any other data (total number of employees) were received from the published data on the Athens Exchange’s website. Furthermore, the study categorizes the sample firms from their industry type into four basic industry categories: primary sector (PRI), industrial sector (IND), commerce and services (CMS), and constructions and building materials (CNΒ) (Table 2).

Accounting measures-quantitative variables

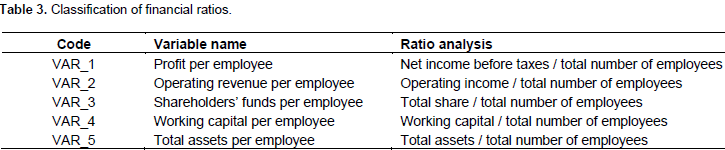

Accounting data analysis with financial statements and ratios provide useful information regarding companies’ merger decisions in general. The aim of the study is to analyze the total number of employees of the sample firms in relation with several basic accounting measures, such as firm’s profitability (net income before taxes, operating income), capital adequacy (shareholders’ funds, total assets), and firm’s liquidity (working capital). The ratios chosen (VAR_1-VAR_5) for the analysis and evaluation of the sample, in accordance with the methodologies following previous studies that employed accounting measures (Hosono et al., 2009; Liu et al., 2015; Schiffbauer et al., 2017), describe basically the employment effects and the efficiency of labor (labor productivity) of a company. More specifically, the ratios of the present study study are presented at Table 3.

Evaluation of merger effects on employment and labor productivity

While the existing literature on mergers analyses their impact on business activity and human factor from several aspects, “…there is very little systematic empirical evidence on the employment effects of mergers and almost none outside the USA…” (Conyon et al., 2002:32). Over the last years, there are many research methods (either qualitative or quantitative), for the examination of an empirical problem, such as the employment effects from merger activities. However, Conyon et al. (2002) argues that the limited extant literature on US market exhibits a variety of sampling procedures and methodologies, while there is no clear consensus on research methodology, as well as on expected findings. This study with quantitative analysis attempts to evaluate the efficiency of the workforce, employment effects and labor productivity of a company after mergers for the Greek market, a small open economy that it is now during an economic crisis. More analytically, the study considers that the merger action of each firm from the sample is an investment decision that affects several business aspects. Based on this viewpoint, the study proceeds to its analysis and regards the impact of the merger action similar to the impact of any other important issue on the firm performance and accounting value to its ratios over the specific period of merger time (Healy et al., 1992, 1997; Leepsa and Mishra, 2013; Oruc and Erdogan, 2014). The crucial research question that is investigated by examining the aforementioned ratios is the following: “Is employment effects of mergers different in the post-merger period than it is in the pre-merger period in the period of economic crisis?”. From this point of view, in this study the following first hypothesis has been formulated:

H1: Mergers are not expected to have any employment effect in the post-merger period of the acquiring firms.

The selected ratios for each company of the sample over a one-year period before, namely: year (t - 1), or after, namely: year (t + 1), the merger events are calculated and the mean from the sum of each financial ratio for the years (t - 1) is compared to the equivalent mean from the years (t + 1), respectively. In this study, the mean from the sum of each financial ratio is computed than the median, as this could lead to more accurate research results, and this argument is consistent with many other researchers (Neely and Rochester, 1987; Sharma and Ho, 2002; Marfo and Kwaku, 2013; Muhammad and Zahid, 2014). The study does not include the year of merger event (t = 0) in the comparisons, because this usually presents a number of events with influence firm’s accounting performance as one-time merger transaction costs, necessary for the deal (Healy et al., 1992; Oruc and Erdogan, 2014). Last, in order to test the difference in accounting performance in the post-merger period than in the pre-merger period two independent sample mean t-tests for unequal variances are applied.

Mergers, labor productivity and different industry types

Schiffbauer et al. (2017) argued that the employment effects and labor productivity of foreign acquisitions vary across industries and this implies to industry differentiation of labor productivity after mergers. Lehto and Bockerman (2008) provided similar indices; they argued that cross-border M&As have a negative impact only in manufacturing firms and that domestic M&As with foreign-owned purchasers have a substantial negative impact on employment in construction and other services sectors. In order to analyze any possible impact on the sample firms from the industry type, the merger impact over the four basic industry categories mentioned earlier were examined: primary sector (PRI), industrial sector (IND), commerce and services (CMS), and constructions and building materials (CNΒ). So, the second hypothesis that has been formulated is the following:

H2: Employment effects and labor productivity have a relative change on the post-merger performance of the acquiring firms from different industries

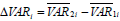

Thus, the sample firms from their industry type are categorized into four separate groups: (a) PRIM: 7 firms, which is 21% of the sample, (b) INDU: 9 firms and 29%, respectively, (c) CΜS: 9 firms and this gives 29%, and (d) CNB: 6 firms that is21%ofoursample.Afterwards,the study computed the differences between the means of post-merger and pre-merger examined ratios and Δ represents the change in every ratio before and after the merger event. A modified methodology of Ramaswamy and Waegelein (2003) and Francis and Martin (2010), was applied where change in acquirer’s performance is measured as the change in a ratio

from before to after the merger

. More specifically,

is equal to the average of a ratio from year after (

t + 1) and before the merger event (

t - 1) for the sample firms, while

t = 0 denotes the merger year and the ratio change is computed as:

where

calculate the differences between the means of post-and pre-merger ratios, refers to the examined ratios

of a sample firm, while

presents the mean of pre-merger examined ratios and

is the mean of post-merger examined ratios. Then, for these data, after the rejection of the null hypothesis that the data sample has the normal distribution, a non-parametric test is applied, as non-parametric tests imply that there is no assumption of a specific distribution for the data population: the Kruskall-Wallis test. The Kruskall-Wallis test is a nonparametric test, alternative to a one-way ANOVA, which the study uses for the analysis of accounting measures in mergers. The test does not require the data to be normal, but instead uses the rank of the data values rather than the actual data values for the analysis (Pazarskis et al., 2017).

Evaluation of merger effects on employment and labor productivity

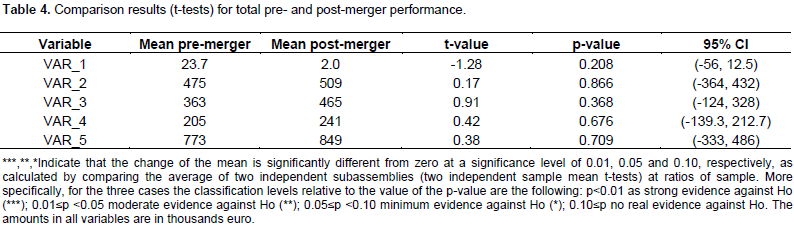

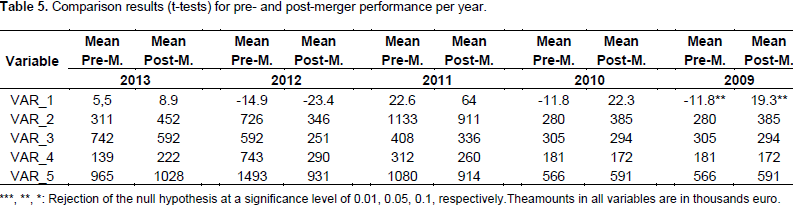

The sample firms were assessed on the basis of five ratios and after statistical analysis (two independent samples mean t-tests) no statistically significant change was presented. More analytically, the ratios VAR_1-VAR_5 did not show a statistical significant change before and after the mergers of the firms. Table 4 presents the comparison results (t-tests) of accounting measures and employees’ the number used for the evaluation of the pre- and the post-merger performance, while Table 5 presents more analytically the research results per year.

The result of this study is not consistent with the results of some past studies that found improved labor productivity immediately after the merger transaction (Conyon et al., 2002; Siegel and Simons, 2010; Bandick and Karpaty, 2011; Furlan et al., 2016; Oldford and Otchere, 2016; Schiffbauer et al., 2017) or, in general, an important negative effect after mergers (Lehto and Bockerman, 2008; Hosono et al., 2009; Weche, 2015). All-in-all, as mergers have not any employment effect in the post-merger period of the acquiring firms, the earlier stated proposition of the hypothesis H1 is accepted.

Mergers, labor productivity and different industry types

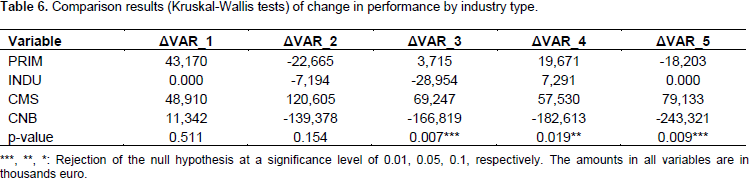

The findings of the study for the change (Δ) in every ratio at the pre- and post-merger period and after the Kruskall-Wallis test are tabulated in Table 6. As the inferences of the analysis indicated that three (ΔVAR_3-ΔVAR_5) out of five variables are statistically significant, this could reveal a different accounting performance in the post- merger period for the examined industry types. In particular, the ratiosΔVAR_3, ΔVAR_4andΔVAR_5 that measure the change in total share, working capital and total assets to total number of employees ratios from before to after the merger is statistically significant (p < 0.01, the first and the third ratio and p < 0.05 the second, respectively). This reveals, in general, a better accounting performance for the commerce and services (CMS) firms from our sample in contrast to the three other basic industry categories: primary sector (PRI), industrial sector (IND), and constructions and building materials (CNΒ).Similar results with industry differentiation of labor productivity after mergers found Schiffbauer et al. (2017) that argued that the employment effects and labor productivity of foreign acquisitions vary across industries.

Also, Lehto and Bockerman (2008) implied that employment effects and labor is different among industries. Their study explored the effect of M&As on employment in three different industry blocks: (a) manufacturing (including utility industries), (b) construction and other services, and (c) trade (including hotels and restaurants). Lehto and Bockerman (2008) argued that cross-border M&As have a negative impact only in manufacturing firms and that domestic M&As with foreign-owned purchasers have a substantial negative impact on employment in construction and services industries. Another study for the Japanese market of Hosono et al. (2009) found differentiation of labor productivity after mergers that vary across industries. Hosono et al. (2009), as they analyzed the post-merger performance by classifying the M&As into several merger types and industries, claimed that the recovery of total factor productivity after mergers is significant for mergers across industries and only horizontal M&As lead to better results, as the merged firms are within the same business group and this implies for a synergy effect in this type of mergers. All-in-all, as there are employment effects and labor productivity with a relative change on the post-merger performance of the acquiring firms from different industries, the stated proposition of the hypothesis H2 is accepted.

Mergers considered important business transactions and a very attractive research field for economists, specialists in business issues and policy makers, but there is not a common agreement for their final result (Rodionov and Mikhalchuk, 2016). Also, recent international developments (enlargement of European Union) and global integration of markets prompted companies to search worldwide for new partners and merger deals in order to profit by reducing production costs, expanding their distribution network and ultimately increasing profits (Tao et al., 2017). This study analyzes the effect of mergers on employment and labor productivity with the analysis of acquiring firms after the merger transactions. The final sample of the study includes thirty one Greek firms listed on the Athens Exchange (Greece) with a merger event during a five-year-period (from 2009 to 2013).

The study proceeds to ratio analysis of the sample for one year before and after the merger event. For the evaluation of the effect of mergers on employment and labor productivity five ratios were used, as extracted from firms’ financial statements and other published data on the Athens Exchange’s website. More analytically, the study analyzes the total number of employees of the sample firms in relation with several basic accounting measures, such as firm’s profitability (net income before taxes, operating income), capital adequacy (shareholders’ funds, total assets) and firm’s liquidity (working capital). The ratios’ analysis reveals that mergers had no effect on labor productivity, as there are not any statistically significant changes in the examined ratios. Also, the merger events of the involved firms and the impact of different industry type were examined according to their performance. The findings of the study indicate a statistically significant change in three out of five accounting measures to total number of employees at the post-merger period and a different performance of the examined basic industry categories. Last, the research results could be used: (a) to accounting research for the evaluation of the efficiency of the workforce, employment effects and labor productivity after the merger decision. Furthermore, alternative examined samples could be analyzed (not only of merger-involved listed firms in the Athens Exchange, but also non-listed firms) or within different time intervals or firms involved in international merger activities and (b) as a recent empirical result of the merger activity and labor productivity in Greece during the economic crisis for policy makers, tax and other state authorities or investors for their potential investments.

The authors have not declared any conflict of interests.

Early version of this paper was presented at the 11th MIBES International Conference held in Heraklion, Greece (22-24 June, 2016). The authors are grateful to the participants for their constructive comments and criticisms that resulted in significant improvements in the present version.

REFERENCES

|

Bandick R, Karpaty P (2011). Employment effects of foreign acquisition. Int. R. Econ. Financ. 20(1):211-224.

Crossref

|

|

|

|

Conyon M, Girma S, Thompson S, Wright P (2002). The Impact of Mergers and Acquisitions on Company Employment in the United Kingdom", Eur. Econ. Rev. 46(1):31-49.

Crossref

|

|

|

|

|

Dessaint O, Golubov A, Volpin P (2017). Employment protection and takeovers. J. Financ. Econ. 125(2):369-388.

Crossref

|

|

|

|

|

Deloitte "IAS 19 Employee Benefits". Retrieved from

View

|

|

|

|

|

Francis J, Martin X (2010). Acquisition profitability and timely loss recognition. J. Account. Econ. 49(1-2):161-178.

Crossref

|

|

|

|

|

Furlan B, Oberhofer H, Winner H (2016). A note on merger and acquisition evaluation. Ind. Corporate Change 25(3):447-455.

Crossref

|

|

|

|

|

Georgantopoulos A, Filos I (2017). Corporate governance mechanisms and bank performance: evidence from the Greek banks during crisis period. Investm. Manage. Financ. Innov. 14(1-1):160-172.

Crossref

|

|

|

|

|

Giovanis N, Pantelidis P, Pazarskis M, Tairi E (2016). An Empirical Investigation during the Economic Crisis on the Labor Productivity after Mergers in Greece. 11th MIBES International Conference, June 22-24, 2016, Heraklion, Greece. Retrieved from View

|

|

|

|

|

Healy P, Palepu K, Ruback R (1992). Does Corporate Performance Improve After Mergers? J. Financ. Econ. 31(2):135-175.

Crossref

|

|

|

|

|

Healy P, Palepu K, Ruback R (1997). Which Takeovers are Profitable: Strategic of Financial? Sloan Manage. Rev. 38(4):45-57. Retrieved from

View

|

|

|

|

|

Hosono K, Takizawa M, Tsuru K (2009). Mergers, Innovation, and Productivity: Evidence from Japanese manufacturing firms. RIETI Discussion Paper Series, no. 09-E-017, The Research Institute of Economy, Trade and Industry (RIETI). Retrieved from

View

|

|

|

|

|

Leepsa NM, Mishra CS (2013). Wealth creation through acquisitions. Decision 40(3):197-211.

Crossref

|

|

|

|

|

Lehto E, Bockerman P (2008). Analysing the employment effects of mergers and acquisitions. J. Econ. Beh. Organ. 68(1):112-124.

Crossref

|

|

|

|

|

Liu Q, Lu R, Zhang C (2015). The labor market effect of foreign acquisitions: Evidence from Chinese manufacturing firms. China Econ. Rev. 32(1):110-120.

Crossref

|

|

|

|

|

Marfo OI, Kwaku AS (2013). Mergers and Acquisition and Firm Performance: Evidence from the Ghana Stock Exchange. Res. J. Financ. Account. 4(7):99-107. Retrieved from

View

|

|

|

|

|

Muhammad A, Zahid A (2014). Mergers and Acquisitions: Effect on Financial Performance of Manufacturing Companies of Pakistan. Middle-East J. Sci. Res. 21(4):.689-699. Retrieved from

View

|

|

|

|

|

Neely W, Rochester D (1987). Operating Performance and Merger Benefits: The Savings and Loans Experience. Financ. Rev. 22(1):111-130.

Crossref

|

|

|

|

|

Omoye AS, Aniefor SJ (2016). Mergers and Acquisitions: The Trend in Business Environment in Nigeria. Account. Financ. Res. 5(2):10-19.

Crossref

|

|

|

|

|

Oldford E, Otchere I (2016). Are cross-border acquisitions enemy of labor? An examination of employment and productivity effects. Pacific-Basin Financ. J. 40(2):438-455.

Crossref

|

|

|

|

|

Oruc EE, Erdogan M (2014). Effect of Acquisition Activity on the Financial Indicators of Companies: An Application in BIST. Int. J. Bus. Soc. Res. 4(7):17-22.

|

|

|

|

|

Pazarskis M, Drogalas G, Koutoupis A (2017). Mergers, Taxation and Accounting Performance: Some Evidence from Greece. J. Account. Tax. 9(9):119-130.

Crossref

|

|

|

|

|

Ramaswamy KP, Waegelein J (2003). Firm Financial Performance Following Mergers. Rev. Quant. Financ. Account. 20(2):115-126.

Crossref

|

|

|

|

|

Rodionov I, Mikhalchuk V (2016). M&A Synergies in Domestic M&A Deals in Russia in 2006-2014. Russian Manage. J. 14(2):3-28.

Crossref

|

|

|

|

|

Schiffbauer M, Siedschlag J, Ruane F (2017). Do foreign mergers & acquisitions boost firm productivity? Int. Bus. Rev. 26(6):1124-1140.

Crossref

|

|

|

|

|

Sharma D, Ho J (2002). The Impact of Acquisitions on Operating Performance: Some Australian Evidence. J. Bus. Financ. Account. 29(1-2):155-200.

Crossref

|

|

|

|

|

Siegel D, Simons K (2010). Assessing the effects of mergers and acquisitions on firm performance, plant productivity, and workers: new evidence from matched employer-employee data. Strat. Manage. J. 31(8): 903-916.

Crossref

|

|

|

|

|

Tao F, Liu X, Gao L, Xia Ε (2017). Do cross-border mergers and acquisitions increase short-term market performance? The case of Chinese firms. Int. Bus. Rev. 26(1):189-202.

Crossref

|

|

|

|

|

Weche GJ (2015). The impact of foreign takeovers: Comparative evidence from foreign and domestic acquisitions in Germany. Appl. Econ. 47(8):739-755.

Crossref

|

|

from before to after the merger

from before to after the merger  . More specifically,

. More specifically,  is equal to the average of a ratio from year after (t + 1) and before the merger event (t - 1) for the sample firms, while t = 0 denotes the merger year and the ratio change is computed as:

is equal to the average of a ratio from year after (t + 1) and before the merger event (t - 1) for the sample firms, while t = 0 denotes the merger year and the ratio change is computed as: calculate the differences between the means of post-and pre-merger ratios, refers to the examined ratios

calculate the differences between the means of post-and pre-merger ratios, refers to the examined ratios  of a sample firm, while

of a sample firm, while  presents the mean of pre-merger examined ratios and

presents the mean of pre-merger examined ratios and  is the mean of post-merger examined ratios. Then, for these data, after the rejection of the null hypothesis that the data sample has the normal distribution, a non-parametric test is applied, as non-parametric tests imply that there is no assumption of a specific distribution for the data population: the Kruskall-Wallis test. The Kruskall-Wallis test is a nonparametric test, alternative to a one-way ANOVA, which the study uses for the analysis of accounting measures in mergers. The test does not require the data to be normal, but instead uses the rank of the data values rather than the actual data values for the analysis (Pazarskis et al., 2017).

is the mean of post-merger examined ratios. Then, for these data, after the rejection of the null hypothesis that the data sample has the normal distribution, a non-parametric test is applied, as non-parametric tests imply that there is no assumption of a specific distribution for the data population: the Kruskall-Wallis test. The Kruskall-Wallis test is a nonparametric test, alternative to a one-way ANOVA, which the study uses for the analysis of accounting measures in mergers. The test does not require the data to be normal, but instead uses the rank of the data values rather than the actual data values for the analysis (Pazarskis et al., 2017).