This paper highlights the relationship between taxation, accounting and transparency for achieving disclosure and efficiency. Research takes into consideration taxation costs and legislation in order to discern an optimized business level of transparency. The data collected from questionnaires were analyzed by descriptive statistical analysis, followed by factor analysis and reliability testing that led to relationships between tax authorities’ efficiency, financial framework reliability, and accounting assisted control systems. A close relation was found between a country’s fiscal framework and accounting assisted transparency that may lead to a better cooperation between state law, efficient taxation, required transparency and collaboration of accounting in auditing procedures. Modern business and audit environments abide to a steady set of values. However, instead of a clear positive effect on accounting assisted transparency, there seems to be a different tendency. The factors seem to push tax authorities and businesses to reach international market levels of auditing. This study confirms that accounting and tax systems can be handled in a unified way and enable at an E.U. level, creating scale economies for corporations and citizens.

Financial information practices are increasingly developing in order to respond to the needs of capital markets. On the contrary, tax practices are always a matter of law and formed in order to manage the objectives of social policy. States may lose revenue as a result of tax misconducts, wrong transfer invoicing, risk counterbalance, overuse of tax motives and other tax planning systems (Sikka, 2017). It is of crucial matter to correctly plan taxation in a state.

The taxation of companies is an important financial issue for all states. Countries with low revenue depend on taxation for at least 16% of their total revenue, in contrast to the 8% of the wealthy countries (Crivelli et al., 2015).

Brock (2011) argues that in developing countries lacking disclosure requirements concerning sales prices for resources allows corruption to flourish and facilitates leaders' ability to siphon money away from developing

countries. In the U.S., losses because of tax evasion used to range between 77 and $111 billion in measurements up until 2012 (Clausing, 2015). According to estimations made by the IMF, the long-term loses for advanced economies are of the percentage of 0.6% of their GDP, but proportionally they are three times higher for developing countries (Crivelli et al., 2015). Many of the techniques of international tax evasion entail the use of a tax shelter and the system of confidentiality of off-shore areas (Panel, 2015). According to Christian - Aid (2009), companies utilize accounting rules to transfer money and to reduce or avoid their tax obligations. We find that there is a need to maintain an equal distance to the aspects of profit in case of application or non-application of accounting systems such as the International Financial Reporting Standards (IFRS). When companies choose transparency they have to part with some of the benefits from accessing more and cheaper capital against the cost of a bigger tax burden (Ellul et al., 2011). Developing countries should have tax rules which do not demand great specialization from the staff to avoid bias and subjectivity.

Transparency, access to capital markets and company investment must be positively associated, especially for companies with high sensitivity to the fluctuations of an economy, either state or sector based, since it is probable to witness cases of limited funding due to high capital demands. However, this can only happen in countries where capital markets are developed in such a level that the accounting transparency of companies is rewarded with plenty and cheap external funding (Ellul et al., 2011). Transparency, compared to ethics is positively affecting taxation as long as it encourages black economy (Canibano and Ucieda, 2006).

This paper aims to highlight the relationship between taxation, accounting and transparency in a small developed country in order to achieve efficient disclosure. Greece has been selected, due to the prevalence of tax non-compliance cases and persistent fiscal deficiencies. The study argues that taxation and legislation factors (time, cost, human resources) are utilized in order to achieve transparency and a minimum of bureaucratic issues. Through questionnaires administered to undergraduates and graduates of financial universities the relationships between tax authorities’ efficiency, a country’s financial framework, and the existing accounting assisted control systems are tested. The research investigates a country’s current fiscal framework as well as the measures accounting assists transparency for achieving better cooperation between law, taxation, required transparency and auditing procedures.

This paper contributes to the study of transparency, taxation and accounting as a mean to an efficient end, in Greece as well as in the European Union. It opens a path for utilizing a state’s taxation and auditing transparency, to achieve financial and to the point results. Furthermore, is demonstrates how accounting can support the private and public sector, especially for cases of complicated and broad legislature.

There is a strong correlation between accounting and taxation which is located in the taxation of profit and depreciation of non-current assets. It can be considered as a relation of conflict under the notion that the principles, the regulations and their settings have different objectives and the convergence can be difficult (Grosanu et al., 2012). Their objective is the provision of information for the financial state of the company but with a different view.

In order to evaluate the interaction between accounting and taxation, we must understand the aspects of all sectors, the behavior of the bodies of accounting and taxation, as well as the national peculiarities of the different states (Strapuc and Cazacu, 2016). A company facing high tax pressure has a greater motive to choose low accounting transparency. Bushman et al. (2004), while talking about planning and measurement of company transparency at country level, have classified information mechanisms for the reinforcement of company transparency in three categories: a) company reports, b) obtaining classified information and c) spreading information (Wang, 2010). Yet still, liquidity represents an important element through which transparency is related to the lowest capital cost and highest evaluation. Cumulatively, the results show that a focus on transparency is possible and could contribute to fully understand the decreases of liquidity due to fiscal depression periods (Lang et al., 2012).

The calculations of taxes are based on accounting profits surely adjusted based on factors such as capital rights, depreciations, donations, grants, credits, capital profits, etc. (Sikka, 2017). Depending on the country there can be high, partial or low dependence of the finance related to accounting and taxation monetary amounts and variations (Richard, 2012). Accounting is the starting point for the taxation of businesses (Nurnberg, 2006). The factors that influence directly the accounting result and indirectly the tax result must be recognized. These are either subjective, such as the nature of the financial system or the company administrative methods or objective, such as understanding the determination of the accounting result or the accounting policies (Grosanu et al., 2012). They also report that the details which influence directly the dimension of the accounting result and indirectly the tax result are:

(1) Creative accounting

(2) Taxation

(3) Inflation phenomenon.

Accountants are tasked to present a reliable, objective and real image of financial performance in order to inform all interested parties. On the other side, tax officials’ objective is the calculation of the taxes that correspond to the financial success of the financial entity and their collection (Bacanu, 2016).

One of the duties of accounting is the administration, upon proper processing, of a series of information according to the needs of the users. The financial authorities are in the privileged position to use these financial states through regulative actions. However, they do not have the quality of the main user of the accounting information. Essentially, the method of collecting information and their administration is the cycle of accounting that is all the consecutive stages of processing of accounting information (Lepadatu et al., 2014).

One of the biggest differences between accounting and taxation is the fact that accounting is framed by certain set of rules (International Accounting Standards, International Financial Reporting Standards, General Accepted Accounting Principles), unified for a groups of countries and states (e.g. EU, USA), while taxation is focused to a more narrow framework (Lepadatu et al., 2014). Also, the accounting performance and examination of financial states of a company are connected with taxation issues upon a merge or a buy-out, while taxation is a factor that influences the choice of company form and structure (Belz et al., 2019).

A specific example of the difference between the principles of accounting and taxation are depreciations, while there is not a unique approach to the matter. Additionally, the bodies responsible are usually unwilling to combine harmoniously the profits of society and financial factors (Cojocari and Cojocari, 2014). Practically, the period of value regains of fixed assets, for tax reasons, can be extended multiple times, increasing the working costs of accountants. In this way the fundamental rule of political depreciation promoted by the state is underestimated compare to the operational duration of the fixed assets. Additionally, the calculated period of depreciation of non-current assets, for tax reasons, is increased, as well as the cost of inflows of the elements included in a category of immovable property (Cojocari and Cojocari, 2014).

EU countries have separate tax issues, taking into consideration the community legislations of indirect tax. Accounting is used today in decision taking by professional bodies in making the rules. Taxation though is determined by the authorities of public power of each state. Accounting is a part of a regulatory framework, while taxation is part of the regulatory public system and is applicable based on national rules (Lepadatu et al., 2014)

Cuzdriorean et al. (2012) analyzed the relation between taxation and accounting by recognizing 6 factors of effect: 1) Dependent relation. In these cases there are no deferred tax regulations and thus alternative solutions are allowed. Personal and unified accounts are affected by tax regulations (Belgium, Italy), 2) Dependent relation. Few deferred tax regulations and tax effects, (France, Germany), 3) Dependent relation with wanted dissolution of their relation. There are no strict regulations related to the deferred taxation (Sweden, Finland), 4) Typically independent, but in practice they have a strong relation. Few strict regulations are related to deferred taxation (Poland, Czech Republic), 5) Independent relation. Alternative regulation allows for deferred taxation (Denmark), 6) Independent relation. Special regulations related to deferred taxation (Ireland, UK, Norway).

Gallegro (2004) has examined the relation between accounting and taxation to imported Spanish businesses and has recognized the income tax, the social welfare systems, the provision for pensions, the monetary correction, the succeeded depreciation or exemption for reinvestment as a point of difference between accounting and tax profit.

Strapuc and Cazacu (2016) found that in Denmark and the Netherlands the two notions are independent as accounting is separated from taxation. In fact, the tax basis is formulated based on results. On the other hand, Austria, Belgium, France, Germany, Italy, Spain and the United Kingdom belong to the category of countries where taxation depends from accounting, since the tax system is formulated based on financial results and situations. Greece is an example of country where accounting depends on taxation. On the other hand, in context of evaluating policy measures to tackle evasion undeclared work, Greece focuses on the implementation of measures while adopting policy incentives, in a greater extent than other countries of the European Economic Area. From an organizational point of view, accounting is considered to be a variable of fiscal administration that offers information for an effective and safe tax operation. Due to the differences between accounting and tax authorities there is a disconnection between financial and fiscal accounting (Strapuc and Cazacu, 2016). The synchronization of accounting and taxation based on the development of financial reports and the increase of commercial balance demands a standardized methodology which eliminates the errors of accounting presentation to which there should be a balance between financial and accounting relations.

According to Strapuc and Cazacu (2016) the most relevant approaches for the relation between taxation and accounting is the regulative and the practical. Accounting must be performed based on its principles without being influenced by adaptations due to taxation. For this to happen, the fiscal recognition of some expenses should not be dependent by their accounting printing. A binding relation between accounting and taxation is an impediment in the balance of accounting (Blake et al., 1997).

In another study, Gogol (2016) studied the development of accounting and taxation in developing countries, systems that connect them and their impact to small businesses and economies of the states. The most appropriate mechanism for the determination of tax basis and the finding of the amounts of the taxes is considered the adaptation of tax elements according to the rules of tax legislation while the respective primary documents are the basis for tax or accounting use. The comparative analysis of accounting methods and systems may contribute to the determination of typical models of development that may influence provision and care for problems a great deal. There are two models of coexistence for tax and accounting systems:

(i) The European model

(ii) The Anglo-American model

The European model (Italy, Switzerland, Germany), the amount of accounting revenue should correspond to the income that has to do with taxes. For this reason, common accounting and tax accounting must coincide and the accounting system should focus on the cover of fiscal needs of the state, while the regulation of the accounting methods should be implemented at a national level (Gogol, 2016).

Countries that use the Anglo-American model (U.S.A., UK), believe that the amount of accounting incomes differs from income for tax purposes. In these countries there is a simultaneous financial and tax accounting and financial information focuses on a wide range of users, while financial principles, regulations and standards are developed by professional accounting bodies. Financial information mainly address the informative needs of stakeholders and criteria are based on their usefulness in decision taking, accuracy and impartiality.

In American standards the process ends with a written financial report of the business. With the report a cohesive and continuous record of financial sources and obligations is secured (Gogol 2016). Based on this model, the rules of taxation and accounting are established by different bodies and report on taxation is considered separate information from the financial report.

In countries that use the European model, the effect of taxation on accounting is wide and is expressed with the completion of accounting books and financial information for the tax basis. The main goal to reflect the profits of a state is through regulative acts and codes for the implementation of principles (Gogol, 2016). The accounting standards in the US support tax practices, so that there are closer to the principle of maintaining the financial capital (Sikka, 2017). The financial bodies are lead to the presentation of a distorted image of themselves in order to succeed the minimum taxation of their revenues. This violates accounting principles and standards (Bacanu, 2016). From the analysis of the notions, accounting and transparency, there are studies in the literature which have mainly examined the effect of the application of the IFRS to the so called succeeding of transparency, the effect of the frequent changes to the regulations and rules that govern the standards and the implementation of accounting information systems.

Some studies deal with the way that transparency improves the performance of the company through supervision and discipline. Francis and Martin (2010) examined the supervisory role that conservative accounting profits have in case of a buyout. They find that businesses that perform a timelier acknowledgment of damages make more profitable buyouts and it is less possible to participate to cessions after the buyout.

Barth et al. (2013) have studied the impacts of the capital market to the improvement of transparency of the profits through the financial states of imported businesses. Ye et al. (2018) have examined the impact of the transparency of profits to the auditory market by studying the impact this has in conditions of balance of auditory mechanisms and processes. Based on the results of their study, the adoption of new accounting standards reduces the negative relation between transparency of income and audit expenses, a fact that shows that the increase of the complexity of the audit leads to the increase of the transparency of income while at the same time it increases the balance of audit expenses.

Several studies were based on assumptions and models as the one of Duffie and Lando (2001), by assuming that transparency was increased due to the application of total accounting standards, such as international standards. Bhat et al. (2016) noted that the adoption of IFRS increased transparency. They justify the increase of the transparency as a result of conciseness and clarity even for specialized accounts of financial situations. A special emphasis is given to logical value and not historical. According to Vyas (2011), evaluation based on logical value offers more information and signs that warn for possible changes to the current market expectations and have to do with credit risk. Finally, they are based on general rules and not instructions, allowing for greater freedom and independence in businesses without affecting the profits of investors.

On the other hand, there are studies which conclude to the existence of a negative relation between accounting and transparency. Anderson (2018) examined the effect of the obligatory adoption of IFRS in transparency for investors measuring the increase in profit management during the time period after the adoption. By comparing the businesses that were obligated to adopt IFRS with others through the power of legal imposition, the markers of accounting and market value, they concluded that IFRS decrease the quality of financial information and transparency for the investing public and do not serve efficiency in international markets. The relation of transparency with the operation of accounting information systems is also examined. Nias Ahmad et al. (2016) studied how transparency, the vision of administration and the technology of information affect the performance of a business and they found out that the effect of accounting information systems to the performance of the business was partly moderated by the transparency of information. The presentation of a right image of a financial entity includes the application of the accounting principles and rules. Transparency is also necessary for such a result to arise (Bacanu, 2016).

Research hypothesis

Based on the categorization of factors found in literature that influence directly the accounting result, a model of determination of accounting profits and taxation is created.

Financial authorities efficiency

In the analysis of taxation aforementioned different sides of the issue were examined, as this covers various forms of the financial life of businesses. Initially, for taxation systems to be successful, trust must be placed upon tax authorities. Tax evasion undermines the public's trust to the legality of taxation (Brock, 2011). As long as citizens have trust towards the tax authorities, their level of conformity to the laws increases (Muehlbacher and Kirchler, 2010; Torgler and Schneider, 2005). It was decided, within this same framework, to examine the way the public is served by tax authorities. It is required for tax authorities to take measures so as to improve their relation with citizens so that their reliability and efficiency is improved (Kirchler et al., 2008). Thus, another question that examines the variable of taxation has to do with the level of service and another with the quality of work of tax authorities.

Additionally, an important factor of service is the speed of responding to the requests that reach tax authorities either live or digitally. The objective of speed increase and quality of service is also included within the national strategy for Administrative Reform 2017-2019 of the Greek state (Ministry of Finance, 2019). It is important for citizens to feel that their tax authorities serve them right and efficiently, with respect and fairness (Feld and Frey, 2007; Pitters et al., 2007). Thus, it was hypothesized that the effectiveness of tax authorities should be measured. Finally, the audit mechanism of audit authorities and the independence of the body must be examined.

Financial framework reliability

The tax system of Greece is directly connected to the accounting print of the financial results of businesses and citizens' income. The tax system, especially in periods of fiscal shortages that serves the needs of the state. Thus, the need to study the reliability of fiscal system, as responsibility of the auditors is to protect and maintain the authority, the reliability, the professionalism and the integrity of the audit (Makkawi and Schick, 2003).

In order for this to happen the ability adequacy of audit authorities based on their educational training, their distinction for principles and values that are related to the transparency and the demonstration of skills needed for them to exercise their profession (Eilifsen, 1998). The fiscal framework is also judged by the social justice that discerns the tax system. Also, the reliability of the fiscal framework is judged by the existence of clarity to the case law and legislation that has to do with the enforcement of taxes. The State may lose revenue as a result of tax misconducts, wrong transfer invoicing, risk counterbalance, overuse of tax motives and other systems of tax planning (Sikka, 2017). Personal ethics plays a basic role and tax ethics is a part of personal ethics in the meaning of performance. According to Miller (1999), the decrease of tax authorities’ ethics arises from the asymmetry of interests between public and private interest.

Finally, the state should support tax authorities effectively and to provide security to the citizens. The ability of the state to impose efficiently the collection of taxes is one of the founding elements of the governing ability and it is also a driving force of financial development as tax evasion creates distortions and losses in public revenue (Slemrod, 2007). From the literature the study is led to a certain hypothesis:

H1: The efficiency of tax authorities affects the reliability of the fiscal framework.

Accounting- supported transparency

A basic question is the methods in which accounting standards and different regulations determine the method of application of accounting serve the assurance of transparency. Standards and regulations are continuously improved in order for the transparency grade to be further increased (Hlaciuc et al., 2010). As such, it is important to find the degree to which changes in accounting standards serve transparency.

According to Canibano and Ucieda (2006), with international standards, information is more unified, credible and comprehensive. It is expected that as long as these standards are applicable, necessary corrections and additions will be made in line with the increase of transparency. Additionally, these last years, technology has contributed to the implementation of the standards that exist each time in order to make easier both the accounting and the audit process. As such, it is important to know to what degree has technology contributed to the increase of transparency through the spread of use of accounting information systems.

Finally, related to the connection of accounting with transparency, the regular publication of financial states of businesses serves the purposes of transparency and timely location of errors or omissions. According to Bacanu (2016), possible investors and the interested parties are informed of the characteristics of financial entity so that investment decisions and other decisions can be made. From the literature the study is led to certain hypotheses:

H2: Transparency that is supported by accounting influences the efficiency of tax authorities.

H3: Transparency that is supported by accounting influences the reliability of the fiscal framework.

Modern audit systems

Many businesses seem to choose the path of tax evasion or declare false taxed income. We need to monitor to what extent this concealment damages instead of benefiting these businesses. Modern auditing systems depend greatly on personality, character and professionalism on the side of auditors. According to Bushman et al. (2004) these promote transparency through submission of financial reports, determining high level values and standards, adding reliability to the notifications that they create.

The process of introduction of international accounting and auditing standards, the internationalization of businesses and globalization contributed at a theoretical level to spreading transparency. We need to examine the extent to which internationalization of transactions prevents corruption. According to Brock (2011), the internationalization of businesses and transactions may deter or diminish incidents of corruption as they serve to the harmonization of tax systems of the countries of the transacting businesses.

Finally, it is important to examine the role of the banking system of the country to the maintenance and spread of transparency. According to Bushman (2016), transparency can promote the stability of banks by enforcing the market's discipline on risk taking. Lack of transparency may increase the concern of investors for the value of bank shares and concealment of information and opacity. Thus, we need to check to what degree the bank system advances and promotes transparency so that it encourages businesses that complete their transactions through it to apply it. The study of these four factors as they were identified while studying the literature, is particularly important and should deal with them as a unified total, allowing for the application of a new way of dealing with these notions by citizens, businesses, the audit mechanism each time and the state. It is very important to locate the exact relations and correlations between them. Thus, suggestions of improvement of the auditing mechanism and the tax system shall emerge. From the analysis of literature the study is led to certain hypotheses:

H4: The modern audit systems affect the reliability of the fiscal framework.

H5: The modern audit systems affect the efficiency of tax authorities.

H6: Transparency that is supported by accounting influences modern audit systems.

Questionnaire drafting

The use of literature was used as framework for the questionnaire, as well as a source of information of assessment in combination with interviews with specialists. For the codification of information deductive reasoning was adopted. The theoretical issues that were investigated had to do with the threefold of 1) Transparency, 2) Taxation and 3) Accounting.

A review of the initial deposit of data was realized by the researcher and 5 academics, so as to ensure the content validity (Bollen, 1989; Waltz et al., 2005), together with adequacy and representativeness (Lynn, 1986; Bollen, 1989; Haynes et al., 1995). Specialists were able to make observations and additions, which excluded 7 questions out of 36, as they did not satisfy the content validity, as well as in changes to drafting the questions and the addition of 3 questions. The questionnaire consisted of 4 parts and 36 questions. Questions were formulated to a five-degree scale Likert type. The three parts have to do with the respective 3 variables. The last part consists of questions of demographic characteristics. The population group consists of 364 students and graduates of administrative and financial Universities from Greece. For the purpose of the survey, random sampling was chosen as the most appropriate method as the purpose of the research was to refine information in order to understand the factors that influence the behavior of financial educated citizens towards taxation and transparency, as well as the trends created at this stage.

Data analysis

Descriptive statistical analysis

The frequencies and percentages for personal and demographic data of the respondents are presents here. Table 2 presents the work status of the respondents. Almost half of the respondents are students and graduates (45.1%), a 23.9% are private sector employees, a 12.1% are public sector employees, a 9.6% are freelancers, while a 4.7% are pensioners. Unemployed take the smallest percentage, which were 16 persons in absolute size, which corresponds to a percentage of 4.4%. Table 3 presents the percentages of education level of the respondents.

In matters of accounting, the respondents in their majority agreed to the positive advantages of development of information systems on transaction transparency. However, a big percentage remained neutral about it. This can be correlated to the weakness of some in matters of technology. With the fact that the literature supports in some cases the opposite or the difficulty it creates. For the questions in transparency, the answers do not provide a positive answer that would be explained as trust to the abilities of organizations and motives of the citizens. In contrast however, they do not believe that the problem stems from regulations or tactics. On the contrary, the biggest percentages believe that inadequacy in matters of human staff is imperative in matters of transparency (Lois et al., 2019).

As far as taxation is concerned, a strong belief that the tax system is weak was observed. This can be confirmed by comparative studies between Greek and European or International tax systems. It has been observed that the Greek tax system is far more complex in comparison to that of developed countries. It is particularly interesting that the questions show a reduced trust towards Greek audit and tax authorities and high risk of tax evasion. In general, the results cannot be characterized as negative in matters of transparency and effort needs, but the factor analysis which focuses on the factors of problems is interesting. In six cases we notice problems that relate only to taxation and more specifically to units that concern:

(1) Bureaucracy of tax authorities.

(2) Taxation Social Justice.

(3) Increase of taxation as a means of combating tax evasion.

(4) Possibility of combating tax evasion in a period of financial crisis.

(5) Citizen trust to the tax authorities.

(6) Speed of work completion from tax authorities.

However, these divergences may be due to the fact that the assessment itself as a notion includes the subjective element to a greater degree.

Exploratory factor analysis

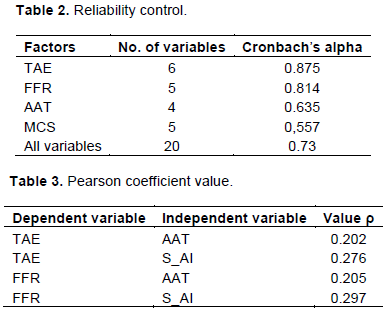

For the exploration and identification (of the teams) that may be formed by the three examined variables of the questionnaire the exploratory factor analysis was used. First, the variables were checked with the coefficient Pearson for any presence of their correlation. Initially, the marker K-M-O receives a value bigger than 0.7 and the Bartlett's test is statistically important, a fact that shows that factor analysis can be implemented on the sample of observations. Table 1 presents the results of factor analysis with the method of Principal Component Analysis. Varimax rotation technique has located 4 grouped factors, with eigenvalues>1. The four factors interpret the 57.63% of the total variability of data.

The data of the questionnaire excluded by the factors did not show factorial loads >0.4. Additionally, communalities that determine the size of variability of variables interpreted by each data of the questionnaire are big (≥ 0.50). An element maintained in the fourth factor had to do with the question regarding the extent to which concealment of data hurts businesses financially even though its value was slightly below 0.4 (0.396) The element maintenance is explained as it initially explains in a better way the sample, while at the same time it is confirmed by literature research.

The six first elements that seem to correlate to the characteristics of the Greek tax and audit authorities, have to do with the way the participants understand the method of operation of the tax authorities and was consequently named “Tax Authority Efficiency” (TAE). The second factor was given the title “Fiscal Framework Reliability (FFR)” and it consists of five elements of connection between ethics and justice of the fiscal framework of tax services provision. The third factor, “Accounting Assisted Transparency (AAT)”, includes four elements, which show the assistance of the modern accounting tools (IAS, technology, Disclosure) to transparency. Finally, the fourth factor (five elements) has to do with the auditor and the current auditing service in matters of subjectivity, everyday mechanisms and modern difficulties Modern Audit Systems (MCS). Factor analysis presented strong factors where 20 grouped data distributed to the four theoretical fields of literature review were maintained at an important degree, transferred to the final factors. As construct validity of measurement model and the reliable synthesis of factors have been confirmed, we can develop the model of structural equations.

By examining existed literature and the statistical analysis, correlations were created in order to confirm or reject their plausibility. It arises that the second, third, fourth, and fifth research hypotheses are not confirmed. A possible cause for this result is that one the one hand one or more factors may operate as mediators or regulators for the relations that were confirmed in the end and are analyzed below and are not a pair of codependency and interaction. Another possible cause may be the fact that MCS are not affected either by the TAE or the reliability of the FFR but since the respondents see them as identical notions they provided similar answers to the questions that corresponded to these variables.

However, by these results it arises that two of the correlations were found significant as shown in Figure 1. More specifically, it arises that there is a relation between the efficiency of the TAE and the reliability of the FFR resulting to the confirmation of the third research hypothesis. A possible explanation for this result is that there is no separation in the mind of the respondents between the tax authority and the fiscal framework.

On the contrary, there is the underlying notion that there is trust to the fiscal framework as a group of rules but not to its dynamic. One could argue that the reliability of the FFR symbolizes something static which is affected by the efficiency of TAE due to the human-centered character of this factor as well as due to the fact that it is supported by the same characteristic persons. Also, it was found that there is a relation between transparency that is supported by accounting (AAT) and MCS, confirming the sixth hypothesis. The accounting system secures, with a better registration of transactions, better audit results, as the reliable accounting files correlate with the respective bank files. They are used more easily by auditing bodies, while at the same time the smooth business operation is ensured and the accounting print of the processes of the business-organization is harmonized with the international audit standards and the international business activity. This is due to the fact that it is expected from a business to be consistent with international and domestic practices.

In this part it was considered useful to compare the results of the correlation checks between the four that were realized for the purposes of the analysis. By the comparison of the results with the use of the correlation coefficient Kendall's tau_b as well as with the use of the coefficient of Spearman's rho, it is indicated that there is a weak positive relation (0.3 up to 0.7) to a level of statistical significance α=0.01 between the following factors:

(i) ΤΑΕ and FFR (value 0.460 Kendall's tau_b, value 0.587 Spearman's rho), and

(ii) AAT and MCS (value 0.309 Kendall's tau_b, value 0.397 Spearman's rho)

Correlation analysis

From the correlations table with the use of the correlation coefficient kendall’s tau-b and the correlation coefficient Spearman a positive correlation arises between the variables TAE and FFR with values of the aforementioned variables 0.460 and 0.587 respectively at a level of statistical importance α=0.001. Between the rest of the variables as it arises from the respective table the correlations are few or non-existent.

Regression analysis and correlations study

From the analysis of regression it arises that the aforementioned analysis of correlation is verified. More specifically, in the cases below, the value of the coefficient Pearson is set out in Table 3. Consequently, due to the low value of the coefficient, the aforementioned correlations are considered few or non-existent. The following two correlations are considered strong. More specifically:

(i) Dependent variable TAE with FFR independent variable

When examined, the dependent variable of TAE with FFR as independent, a positive correlation arises (value ρ = 0.611 at a level of statistical importance α = 0.001). The typical error of the evaluation is 3.548.

The table ANOVA shows the total importance of the model. F=215.250 is statistically important at a level of statistical importance α=0.001. Thus, the model is statistically important. T-test examines the importance of coefficient b. T value is 7.919 which is equally important at a α=0.001 level. Besides, the values tolerance (1.000) and VIF (1.000) show that there is no multicollinearity. Additionally, values eigenvalues do not refer to a problem of multicollinearity (they are not near value 0). Additionally, from the histogram we can see a normal distribution of the remnants, a fact that is also confirmed by the diagram of the normal probability plot.

(ii) Dependent variable FFR with TAE independent variable

The dependent variable of TAE with FFR independent a positive correlation arises (value ρ = 0.611 at a level of statistical importance α = 0.001). The typical error of the evaluation is 2.884. ANOVA shows the total importance of the model. F=215.250 is statistically important at a level of statistical importance α=0.001. Thus, the model is statistically important. T-test examines the importance of coefficient b. T value is 10.143 which is equally important at a α=0.001 level. Besides, the values tolerance (1.000) and VIF (1.000) show that there is no multicollinearity. Additionally, values eigenvalues do not refer to a problem of multicollinearity (they are not near value 0). Additionally, from the histogram we can see a normal distribution of the remnants, a fact that is also confirmed by the diagram of the normal probability plot.

Of the six hypotheses which inspired this study it seems that only one has specificity. Hypothesis Η1, “The Efficiency of tax authorities and reliability of fiscal framework” shown in Figure 2, demonstrates a reciprocal relation between TAE and FFR. This can be interpreted as the fact that efficiency of tax authorities influences but is also influenced by the reliability of the financial framework of the country where it exercises its activities.