ABSTRACT

Drawing on Institutional and Economic Network Theories, this study investigated factors influencing International Financial Reporting Standards (IFRS) implementation success in Ethiopian business organizations identified as Public Interest Companies by the government which were expected to adopt IFRS for the year ending June 30, 2018. The study adopted explanatory method to answer the research questions and test hypotheses stated. Data were collected from 123 respondents in 22 first time IFRS adopting business organizations using questionnaires. The findings of the study revealed that economic factors, project governance factors and cultural factors were found to influence project success at 5% level of significance whereas influence of institutional pressures was accepted at 10% level of significance (sig=0.055, closer to 5% of course). Contrary to the literature, economic factors were not positively correlated to IFRS project success as the firms were predominantly operating locally and due to IFRS implementation costs. Project governance factors were found to contribute significantly for IFRS project success in the firms studied. This was in line with the project management literature that proper project governance will turn even a highly risky project into a success. In addition, there was no statistically significant difference in the IFRS project implementation success of private and public firms. Future research shall consider additional variables that influence IFRS project success and other firms that implemented IFRS in the next years as well as regional level public enterprises.

Key words: International financial reporting standards (IFRS), regulatory body, public interest company, project governance, project success.

Accounting practice and business operations are highly intertwined as organizations, whatever their form, mobilize scarce resources to realize their strategic objectives and survive for long. This is much more critical for business organizations whose survival depends on their profitability and wealth creation for the shareholders. Performance measurement and evaluation using accounting systems is a key and inevitable process. Even though accounting reflects economic, social, political, cultural and other local environmental conditions, the development of the accountancy profession itself is influenced by a range of factors such as institutional, political, cultural and economic ones (Perera, 1989).

According to Zeghal and Mhedhbi (2006), with the growing internationalization of economic trade, businesses in general and financial markets in particular, financial information prepared according to a national accounting system may no longer satisfy the needs of users whose decisions are more and more international in scope. In some ways, purely domestic information may even be a handicap for businesses as well as investors. They have further argued that conscious of this reality as well as the need to adapt accountancy to the new global environment and to the new requirements of decision makers, accounting regulating authorities have sought out solutions that allow for the improvement and advancement of financial accounting and its principal outputs. Although several initiatives have been put forward, harmonization of accounting standards and practices on an international scale has been the fundamental change in recent years. Al-Htaybat (2017) stated that uniform global accounting standards allow investors to make better-informed decisions, and reduce risks for investors, which ultimately reduces the cost of capital as well-developed accounting regulation system plays an important role in most economies in actively supporting economic development, and giving economies a competitive advantage by providing the right business infrastructure that creates an attractive investment climate to encourage both domestic and foreign investors. Zeghal and Mhedhbi (2006) clearly asserted that the International Accounting Standards Board (IASB) has prepared and published international accounting standards (IASs and IFRSs), which have become the reference for the entire world to realize the objective of international harmonization of accountancy practice.

Modern Accounting Practice is more than one century old profession in Ethiopia. However, there were no Accounting and Auditing Standards at country level for so long (Mihret et al., 2012). Mihret and Bobe (2014) claimed that the growing accounting history literature explains how the craft of accounting and models for professional organization of accountants have been transferred to developing countries like Ethiopia in the context of imperial connection. Mihret et al. (2012) as well as Mihret and Bobe (2014) further stressed that as of 2011, Ethiopia’s accounting practice, education and professional licensing was characterized by a lack of an overarching proclaimed frame of reference. Tertiary accounting education draws on the US model; professional accountancy certifications was imported from the UK; and accounting practice, while not making explicit reference to any financial reporting framework, tends to have been influenced largely by the UK system. Hence, there was a serious need for accounting and auditing standards to be enforced as national standards.

This resulted in considering International Financial Reporting Standards (IFRS) as a solution for Ethiopia.

Ethiopia has been undertaking various economic policy reforms along the lines of neo-liberal economic concepts (Peterson, 2001; Tesema, 2003) and as a result, Ethiopia is one of the many African countries that have adopted IFRS (Zori, 2011), with companies in the Ethiopian banking sector being given the option and at least claiming to report according to IFRS since 2008 (Government of Ethiopia, 2008). IFRS adoption has also been under consideration for reporting entities in other sectors than the finance industry such as for instance members of the Ethiopian Commodity Exchange Markets which was response to Ethiopia’s continued trialing various policy responses largely driven by requirements of international funding agencies and continued dependence on imported accounting expertise and shifting agendas of transnational stakeholders (Mihret and Bobe, 2014).

As per Mihret and Bobe (2014), while the importation of Western accounting education and professional certification continued, the globalization era produced new dynamics that called for Ethiopia’s adoption of IFRS. Serious consideration of IFRS came into reality only few years back when Accounting and Auditing Board of Ethiopia (AABE, 2014a) has been established via Proclamation 847/2014 and Regulation 332/2014 to regulate the accountancy profession in Ethiopia demanding IFRS as the country’s reporting standard (AABE, 2014). Hence, IFRS implementation process was being undertaken by first time adopters as a project with special team dedicated for the task either from the company itself or from outside the firm on consultation basis or a combination of both. The success of the project was often influenced by various factors one of which is the governance mechanisms the project passes through. IFRS implementation projects are, therefore, undertaken by government owned business organizations and private business enterprises in three phases based on their public impact (AABE, 2014).

IFRS implementation projects like any other projects such as IT projects demanded the governance requirements for any project. According to Musawir et al. (2017), many projects are not able to meet their objectives and only 40% of project objectives are aligned with their organizational strategy that qualifies as project failure. They further indicated that many organizations continue to struggle with the implementation of a comprehensive benefits management approach and therefore fail to maximize the return on their project investmentsas only 17% of organizations report a high level of benefits realization maturity and this figure has remained unchanged. Badewi (2016) emphasized that delivering project outputs within time and budget was the main concern for project managers for so long (in 1960 up to the 1980s) and suggests that Benefits Management (BM) and Project Management (PM) were two interrelated approaches to the success of projects. IFRS adoption changes from one emerging economy to another where the decision to adopt IFRS by a country does not necessarily mean a full adoption or a partial adoption. It is noteworthy that the nature of IFRS adoption by a country varies across jurisdictions and across time. Musawir et al. (2017) argued that strong governance framework provides the structures, roles, and accountabilities that enable effective project implementation and success. This should, as a result, ensure that project outputs and outcomes are continuously aligned with the benefits envisioned in the project’s business case. They added that there is a lack of understanding in the existing literature regarding the governance mechanisms that facilitate the adoption and implementation of benefits management practices. It is not also clear if a comprehensive benefits management approach enabled by effective project governance would actually translate into a significant and positive impact on overall project success.

IFRS adoption research takes different scopes such as comparison of various countries, assessment of the case of a single country or specific organizational level study. Pricope (2016) claimed that Marquez-Ramos (2011) shifted the focus of IFRS implementation research from firm-level analysis to country-level analysis and investigated the process of IFRS adoption within national economic environments. Subsequently, country level analyses focused on the particular case of developed countries and pay very little attention to the drivers and effects of the IASB standards in the developing world. Likewise, in Ethiopia, even if studies were conducted on opportunities and challenges of IFRs as well as their effect on reporting quality, there was no comprehensive study about factors that influence mandatory IFRS implementation success at country level. Therefore, this study had assessed what factors critically influenced successful first time adoption and diffusion of IFRS projects in Ethiopia. The research questions answered in this study were:

RQ1: What was the influence of variables identified from the extant literature (institutional pressures, economic factors, project governance factors and cultural factors) on the adoption of IFRS in Ethiopia?

RQ2: Is there significant difference in the IFRS project implementation success of private and private firms?

There were prior studies about opportunities and challenges of IFRS adoption as well as perceptions of managers as to how IRFS would affect individual organizations, but there were no empirical studies that identified what factors influenced the adoption of IFRS in Ethiopia observing several projects at country level. This is partly due to the fact that the first phase of truly adopting IFRS started only on June 30, 2018. In addition, considering the IFRS adoption as a project and observing the role of project governance in the IFRS implementation success is a new paradigm observed in this study. Lastly, while different authors considered each factor affecting IFRS implementation independently, bringing the constructs in this research model together incorporating the influence of culture is another unique contribution in this research.

The study has covered the first phase adopter business organizations that have implemented IFRS as their reporting standards as of June 30, 2018. According to AABE, all banks, insurance companies and public enterprises fall in this category. Hence, those organizations whose headquarters are located in Addis Ababa (the Capital of the Country, Ethiopia) were within the scope of this study. The study does not include microfinance institutions as head quarters of most of them were out of Addis Ababa.

REVIEW OF RELATED LITERATURE AND HYPOTHESES

Theoretical background

The institutional theory and the theory of economic regulation are the fundamental theoretical frameworks for this research. According to Sellami and Gafsi (2017), institutional and economic network theories focus on the effect of institutional as well as economic pressures on the organizations’ practices and more generally on the strategic decisions of nations seeking to legitimize national practices via adopting world-accepted models which includes mandatory adoption of IFRSs. Al-Htaybat (2017) claimed that the accounting system projects are subject to many factors, both internal and external. He also stressed that it is important to note that different accounting regulation systems react to these environmental factors differently. For instance, in the emerging economies context, the framework of accounting practices and regulation systems lacks basic requirements and guidance for what should be and how it should be.

Organizational pressures and the diffusion of IFRS

Previous literature has consistently provided evidence that the environmental factors at a country-level have an important influence on accounting development and have led to accounting diversity. As per Mihret et al. (2012) and Mihret and Bobe (2014), in a globalized environment, the interactions between nation-states have greatly increased and the diffusion of best accounting practices, including IFRS, has been accomplished through the contribution of international organizations such as the WB and IMF. This asserts that institutional factors significantly influence successful IFRS adoption. Hence, a number of institutional factors (political, legal, educational and religious) that influence IFRS adoption can be considered. This is stated for instance by Al-Htaybat (2017) who claimed that institutional theory also provides an explanatory framework for accounting change. Sellami and Gafsi (2017) asserted that institutional theory can be used as lens to explore the process of IPSAS adoption in emerging economies which is equally applicable for IFRS adoption. This is because there has been an increasing interest in the institutional theory in many areas and the theory has been adopted in accounting literature as a valuable framework to explain the country-specific factors affecting emerging economies’ decisions to permit the use of IPSAS. As IPSAS and IFRS are issued by the same institution (IASB) and applied in a similar context, it also works for IFRS adoption. According to Hao et al. (2013) however, the existing accounting literature on institutional factors primarily use cross-country settings to investigate the impact of institutional differences on accounting information quality and hence, regional differences on levels of institutional development within a single country has yet to be determined. Pricope (2016) as well as Sellami and Gafsi (2017) argued that pressures due to institutional factors or institutional isomorphism occur through three mechanisms:

(1) Coercive isomorphism occurs when both formal as well as informal pressures are exerted on reporting organizations by other organizations upon which they are dependent, say the government. This may as well include cultural expectations in the society within which organizations function.

(2) Mimetic isomorphism is where organizations tend to model themselves after similar organizations in their field that they perceive to be more legitimate or successful which is often known as the follower advantage; and

(3) Normative isomorphism is a situation where the collective struggle of members of a profession has power to define the conditions and methods of their work, to control the production of producers and to establish a cognitive base and legitimization for their professional autonomy. Ali and Al-Alkawi (2018) also assured the aforementioned by stating that it is perceived that in nations where the government depicts a noteworthy quality, the accounting standards, which are IFRSs in this study, are broadly actualized. They further argued that among the numerous natural variables (financial, legitimate, social and political), political factor apply the most critical effect on the advancement of accounting practices. Hence, it can be hypothesized as follows:

H1: Institutional pressures influence positively and significantly IFRS project implementation success.

Economic network theory and IFRS adoption

Shima and Yang (2012) stated that a single set of high quality accounting standards such as IFRSs would provide a great deal of support by availing timely and accurate financial information for international investors to evaluate the performance of companies across national boundaries. That is, IFRS standards are likely to lower transaction and capital costs for foreign users of financial statements. They also argued that factors relating to political and economic ties, reliance on foreign-source of debt create contracting incentives for IFRS adoption which takes globalized business as a precondition.

This implies that the benefits that a given country derives from IFRS adoption can be explained by the magnitude of its economic relations with other partner-countries that have already adopted IFRS. In this sense, IFRS standards are considered a network-dependent product (Sellami and Gafsi, 2017). From the perspective of economic theory of networks, it is expected that the extent of IFRS adoption in an emerging economy like Ethiopia will increase due to the magnitude of trade relations with IFRS adopter partner-countries. But Al-Htaybat (2017) empirically found out that the political element can also be an obstacle in successful IFRS project implementation, as internal adoption of an external regulatory system can be met with resistance which is typical of mandatory IFRS implementation in Ethiopia. This implies that even if the literature stated that IFRS adoption will have economic motives, practically this may not be the case in some circumstances. Hence, it can be hypothesized as follows:

H2: Economic factors will positively and significantly influence IFRS project implementation success.

Project governance and IFRS implementation success

Mashiloane and Jokonya (2018) studied the governance of IT projects and stated that greater attention needs to be given to the governance and management of IT projects further claiming that if governance of IT project is not well addressed, successful implementation of them will continue to be a real challenge. This argument equally applies to any other type of project and IFRS implementation project cannot be an exception. In addition, IFRS implementation mostly involves modernizing the IT support of the accounting and finance functions of the organizations. Ekung et al. (2017) defined Project Governance as an internal control framework established to properly safeguard the interests of the owner and mitigate risks throughout the project lifecycle. The term has been used contextually to refer to a set of management systems, rules, protocols, relationships and structure that provide the framework within which key managerial decisions are made for project development and implementation to achieve the intended business or strategic objectives.

Sirisomboonsuk et al. (2018) also stated that one mechanism that could be used for behavioral monitoring in projects, like IFRS implementation projects, was project governance. They mentioned the experience of several researchers and practitioners who regarded project governance as a subset of corporate governance that emphasizes on the project activities particularly. That is, project governance was directly involved in performance of the project. Due to this, various researchers and practitioners suggested that one of the reasons for poor project performance was the lack of effective project governance. Mashiloane and Jokonya (2018) also added that project governance plays a critical role in the implementation of IT projects. This applies for all types of projects as they argued that the required structures, processes and controls are in place if there is properly defined project structure with clear reporting lines, alignment of the structure with the strategic vision of the project, decision rights being distributed, communication strategy being well defined, risks being managed and proper reporting structures to the project team. Effective governance structures and processes are critical to ensure that IT projects are completed successfully on time, within budget and according to specifications and project objectives. Hence, it can be hypothesized that:

H3: Effective project governance influences positively and significantly IFRS project implementation success.

Cultural factors

In many systems literature, cultural factors are believed to influence the level of diffusion and utilization of an information systems project. IFRS implementation could also be subject to cultural factors the environment the project operates in. Al-Jumeily and Hussain (2014) identified three primary continuums drawn from the cultural dimensions theory of Hofstede that are used to identify the differences in the cultural factors: individualism/collectivism, uncertainty avoidance, and power distance. Individualism/Collectivism is the degree to which individuals are integrated within any group. In individualism, the emphasis is on individual roles and rights, where individuals are expected to stand up for themselves, their own family and their own affiliations. In contrast, in collectivism, individuals behave as members of an organization or group, so that their family is that group or organization to which they pay unquestioning loyalty. Uncertainty avoidance is defined as the tolerance of a society for uncertainty. It measures the extent of coping with anxiety by avoiding uncertainty. High uncertainty-avoidance cultures implement rules and laws to support plans that are followed step-by-step to minimize unknown and ambiguous circumstances. On the other hand, low uncertainty-avoidance cultures have as few rules as possible, they tolerate changes and accept a changeable environment and situations; these cultures tend to be pragmatic cultures (Hofstede and Bond, 1984). Power distance reflects the way people accept and perceive power differences. High power-distance cultures accept autocratic power relationships, where people are not equal to each other, and their positions are classified hierarchically from superior to subordinates (Akour et al., 2006). In contrast, low power-distance cultures experience more democratic relationships, and equality is practiced by all members of the society, who have the right to criticize and change the decision making of those who are in power (Teo et al., 2008). Al Hasani et al. (2017) argued that cultural factors do not have any significant direct effect on Project Success. However, these factors have significant indirect effects on Project Success through the mediating constructs of External and Internal Risks and Communication. But Aronson et al. (2004) stated that project culture emphasizing initiative and cooperation predicts project success. Jetu and Riedl (2013) also asserted this by stating that personally or individually focused cultural values (openness to change) rather than socially focused cultural values (such as self-transcendence) have the most significant positive influence on project team performance. Hence, it can, therefore, be hypothesized that:

H4: Cultural factors influence positively and significantly IFRS project implementation.

Project success

According to Badewi (2016), delivering project outcomes within time and budget is a major concern for all project managers globally and a lot needs to be done to realize project success. Hence, closing a project within budget, time and expected quality can be considered as success criteria. Atkinson (1999) claimed that more than the Iron triangle, a Square Root should be used to evaluate project success. Based on the literature, Figure 1 shows the conceptual framework developed for this research.

The study adopted explanatory research method to answer the research questions and test the hypotheses stated. It observed the effect of explanatory variables (independent variables) that influenced the adoption and detailed diffusion of IFRS (dependent variable). Explanatory research determines the causal relationships among variables (Saunders et al., 2012). The survey method was used to gather information that was employed in quantitative analysis generating data used in the analysis. With the help of the survey strategy, it gave the researcher more control over the search process by administering self administered questionnaire for the data collection (Saunders et al., 2012).

Prior studies were limited to describing the opportunities and challenges of IFRS adoption or perception of managers about the costs and benefits in a case study approach for a specific organization. Explanatory design would help understand the antecedents of IFRS project implementation success thereby providing relevant recorded information for future implementation success of IFRS, IFRS for SMEs and IPSAS. For this purpose, quantitative data were collected based on Likert Scale questionnaires about the factors influencing IFRS implementation and the degree of success in the process of IFRS implementation. Such data were relevant in assessing the relationship between the independent variables (institutional pressures, economic factors, project governance factors and cultural factors) and the dependent variable (IFRS implementation success) as well as the combined effect of the former on the later (Saunders et al., 2012).

The target population of this study included all business organizations that were required to adopt IFRS on June 30, 2018 as first phase IFRS adopters (as Ethiopian firms were required to adopt in three phases-June 30, 2018, June 30, 2019 and June 30, 2020 based on their nature such as Public Interest Companies and size measured in terms of number of employees, sales turnover and profit information). Accounting and Auditing Board of Ethiopia (AABE, 2014b) database was used for the list of first phase adopters. However, because some of those required to adopt IFRS have not yet done properly, only those that submitted their reports to AABE were considered. Of these again, those located in Addis Ababa (the Capital City of the country) were the population from which a sample was taken. 22 Public Enterprises, Banks and Insurance Companies (including both public and private ones) were selected for this study using simple random sampling method (on lottery basis) out of 53 business organizations that were expected to adopt IFRS for the first time. Once a first time adopter firm is selected, all IFRS Project Office Team Members were involved in the survey on a census basis.

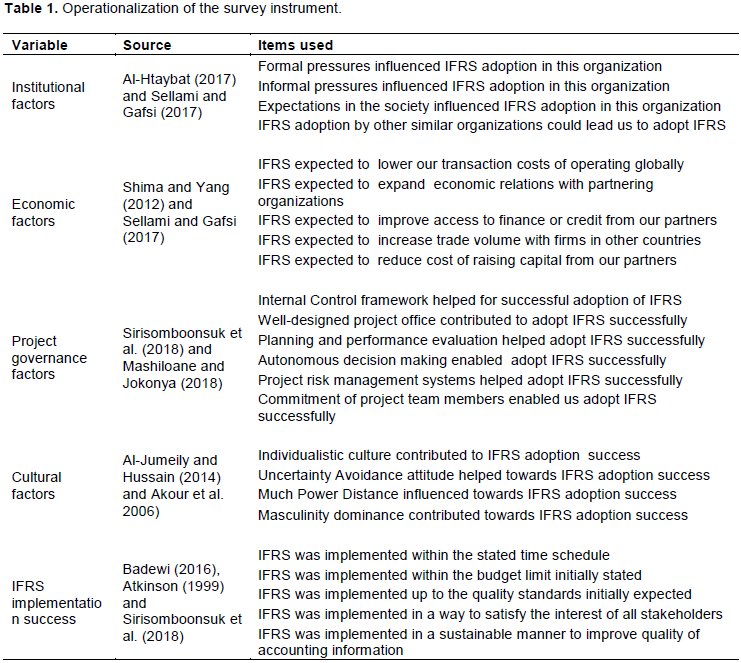

The survey instrument for this study was developed from prior studies which treated each construct individually and based on the extant IFRS literature reviewed. It is presented on the next page. The instrument was developed on a 5 point Likert Scale basis from strongly disagree to strongly agree. The instrument was pretested by requesting expert opinion (accounting academics and IFRS implementation support consultants) on its content and face validities and invaluable inputs were incorporated in this process. The reliability of the variables was also tested using Cronbach’s alpha where all of them passed the cut of point (0.7). The plan to incorporate interview and secondary data was not possible due to various constraints. The data collected using the questionnaire were analyzed using descriptive statistics (mean and standard deviation), correlation and multiple linear regression analysis methods to test the relationship of variables (independent and dependent variables) using SPSS software (version 22). Test of equality of means using 2 Tailed T-Test in IFRS project success between different groups of organizations (Public vs. Private) were also tested. Based on the findings of the study, candid recommendations and directions for future research were given to policy makers, managers utilizing the implemented projects and other firms that are yet to implement similar projects in the next two phases (June 30, 2019 and June 30, 2020) (Table 1).

In this part, the data collected from the respondents were presented and analyzed using descriptive and inferential statistics. The demographic background of the respondents was presented first followed by brief summary of the constructs in terms of mean and standard deviation. Finally, correlation and simple linear regression analysis were presented.

Demographic background of respondents

The respondents were asked their demographic data to check if they are the right respondents for this research. The list of organization visited was annexed at the end as the list is lengthy. Table 2 presents overall background of the respondents.

As indicated in Table 2, the data for this research were collected from 123 respondents from 22 IFRS First Time Adopting Business Organizations (both public and private firms including financial and nonfinancial institutions that were identified by the government as Public Interest Entities). These data are believed to be representative of all subjects of the study as there is homogeneity in the regulatory and operating environments the organizations operate in. All public enterprises are under the supervision of a single regulatory body (public Enterprises and Privatization Agency) and all banks and insurance companies operate under the strict control of National Bank of Ethiopia.

The qualification of majority of respondents was BA Degree (53.7%) followed by MA holders (46.3%). This indicated that the respondents were able to understand the issues in the questionnaire and provide appropriate responses about IFRS project and its implementation process. As indicated earlier, the majority of the respondents have 6 to 10 years of experience (32.5%) followed by those from 11 to 15 years of experience (24.4%). Of course, quite good number of respondents (22%) also has experience of up to 5 years. The experience of the respondents, like their academic qualification, indicated that they are fit for participating in the research process and providing sufficient data for the study.

The managerial position of the respondents indicated that the top level managers were very few (17.9%) as they are at the top of the pyramid and naturally low in number in any organization. Large number of respondents was from middle level managerial position (46.3%) followed by lower level managers (33.3%). This implies that the respondents were the proper targets of IFRS project implementation as well as future operation and use.

Testing model-data fitness

Test of co-linearity

Co-linearity was tested by checking variance inflation factor for the factors used in the study as indicated in Table 3.

As indicted the Table 3, variance inflation factor of less than 10 indicates no problem of co- linearity.

Test of normality

The data should be tested for normality before analyzing it. According to Ghasemi and Zahediasl (2012), large sample size (more than 30 respondents as rule of thumb) is believed to be normally distributed. They further stated that with large enough sample sizes, the violation of the normality assumption should not cause a major problem which implies that we can conduct parametric tests even when the data may not be normally distributed. If we have samples consisting of hundreds of observations, they assured that we can ignore the distribution of the data. According to the central limit theorem, if the sample data are approximately normal then the sampling distribution too will be normal and in large samples (>40), the sampling distribution tends to be normal, regardless of the shape of the data and means of random samples from any distribution will themselves have normal distribution. As the current study had used 123 respondents from 22 organizations, the data tended to be normally distributed.

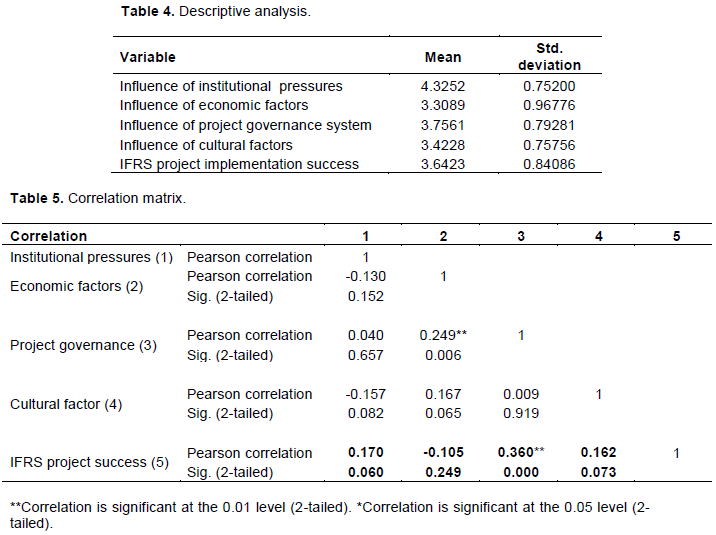

Then the descriptive statistics is presented and followed by correlation and regression analysis of the findings. The descriptive analysis part of the data analysis includes the mean and standard deviation analyses of independent and dependent variables.

Descriptive analysis of factors influencing IFRS project implementation

Table 4 shows the descriptive analysis of factors influencing IFRS Project Implementation Success.

(1) Influence of institutional pressures has the highest mean result and lowest standard deviation indicating that the government mandatory legal requirement to implement IFRS by the target firms is the very source of the project idea. It is a key requirement for tax filing and license renewal for private firms. Hence, this is in line with prior studies such as Pricope (2016) as well as Sellami and Gafsi (2017) which claimed that institutional pressures are key inputs for IFRS implementation.

(2) Influence of economic factors indicated the least mean result and the highest standard deviation. Even if one solid foundation for adopting IFRS was considered to be economic advantage and cost saving (Shima and Yang, 2012) for instance, findings by Al-Htaybat (2017) indicated the political intervention by governments resulted in resistance and IFRS adopters considered it as cost. In addition, IFRS project is costly investment at the beginning and for firms not having significant international trade, foreign branches, subsidiaries or affiliates, economic reasons did not demand the implementation of IFRS.

Economic justification works for international firms having so many branches and subsidiaries abroad. Wagaw et al. (2019) also examined the unique nature of IFRS adoption in Ethiopia using the neo-Gramscian theory of globalization and the state. They concluded from their study that this theoretical lens enables incorporating a broad range of factors than market-based explanations of IFRS adoption which prior research has emphasized. However, their study was a qualitative one which should be empirically tested. The findings of this study were, therefore, in line with their proposition.

(3) Influence of project governance systems has higher mean value next to influence of institutional pressures and contributes a lot to put on the ground whatever a project idea at hand. This is again in line with the literature that proper project governance contributes to project success even when the project deemed to be highly risky (Mashiloane and Jokonya, 2018).

(4) The influence of cultural factors of team members also indicated moderate mean value having its own contributions in all stages of the project life cycle (from conception to closure). In most public enterprises particularly, the project was undertaken by foreign consultants where the cultural issues of team members would be critical success factor. This is as well in line with the literature as for instance Aronson et al. (2004) who stated that project culture predicts project success.

Correlation matrix

Table 5 shows how each of the independent variables correlates with each other and with the dependent variable individually. As can be seen from the following correlation matrix table, except economic reasons which does not have meaningful correlation with IFRS implementation success, all the independent variables were positively correlated to IFRS Project success. This finding was the same as that of the descriptive analysis mention earlier and the hypotheses stated except for economic reasons (as justified earlier). This implies that properly understanding and handling these factors will lead to project success in the future IFRS (both IFRS as well as IFRS for SMEs) and IPSAS projects.

Project governance factors were strongly correlated to IFRS implementation success at 1% level of significance. While economic factors were not correlated with IFRS implementation success, institutional pressures and cultural factors were also correlated with IFRS implementation success at 10% level of significance.

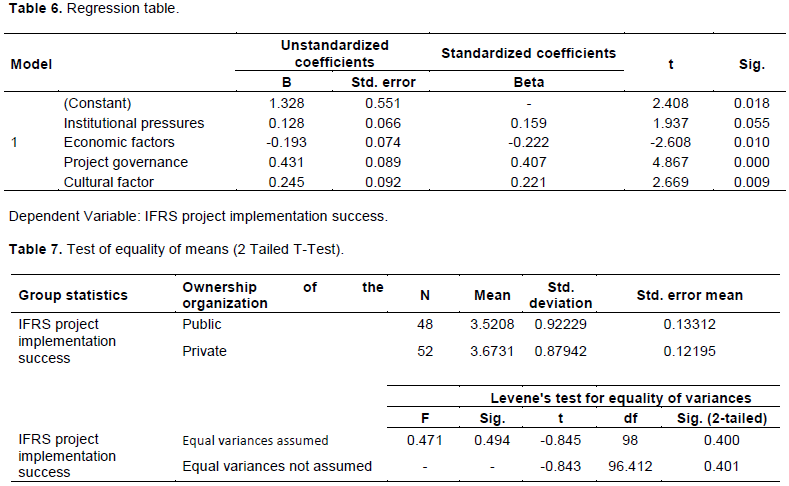

Regression analysis

Table 6 shows the regression results indicating the influence of the independent variables (institutional pressures, economic factors, project governance factors and cultural factors) on the dependent variable (IFRS project implementation success).

Table 6 shows that all the independent variables except economic factors influence positively IFRS project success. As per Sellami and Gafsi (2017), institutional pressures influence the adoption of IFRS in Ethiopian business organizations studied at 5.5% level of significance. Even though institutional pressures were key factors to initiate the IFRS project, their influence towards successful completion may be questioned by the IFRS project stakeholders. Though this is a little higher than the cutoff point (5%), the researcher would like to accept the hypothesis and suggest future research to further confirm it instead of rejecting. This was in line with the extant literature and as per hypothesis 1 which the data support it to accept. The findings of Pricope (2016) also support the same. Hence countries need to strengthen their legal frameworks and supervision process to enforce business and other organizations successfully adopt IFRS. This should be used in upcoming implementations as well.

Economic factors as well influence IFRS implementation success but were not positively correlated with IFRS project success contrary to the literature as per Shima and Yang (2012). The aforementioned evidence showed that hypothesis 2 was not accepted. This may be partly because the Ethiopian context is different from the other environments in that most firms operate predominantly locally not properly feeling the value of IFRS in reducing transaction costs of doing business globally. In addition, the respondents might have seen the significant initial cost that adopting IFRS involves instead of the long term benefits that it might have brought in the future. As there is no secondary stock market in Ethiopia and as the national tax office (Ministry of Revenues) does not accept IFRS based financial reports as the base for assessing tax liability of the business organizations, the economic benefit of adopting IFRS could not be visible for business people in Ethiopia in the short term. This was also in line with the study of Wagaw et al. (2019) who concluded that there are a broad range of factors (social and political, for instance) other than pure monetary and market-based explanations of IFRS adoption in Ethiopia. The work of Riahi and Khoufi (2015) which concluded that behavioral factors related to government decision makers, mainly corruption, influence more than economic factors the decision of adopting or not IFRS by developing countries, may also justify that. Al-Htaybat (2017) also stated that more legal and political intervention by the government results in resistance to the extent of denying economic benefits and observing only the short term burden as a cost (both in money terms as well as psychologically). In the medium term such as five years and in the long term (say up to 10 years), however, adopting IFRS will eventually bring economic benefits as well in relation to establishment of secondary stock market and possibilities of securing loans from abroad.

Project governance was also found to influence project success positively and more significantly than other factors as stated by Mashiloane and Jokonya (2018) who studied the governance of IT projects and who advised that great attention needs to be given to the governance and management of IT projects for their successful implementation. As IFRS implementation is a project by itself as well as it involves changing the information technology applications in the accounting and finance functions, this argument was equally applicable for IFRS project implementation success.

The view of Ekung et al. (2017) internal control and governance framework established to help protect the interests of the owner and mitigate risks of a project also justifies the role of project governance for project success, one of which is IFRS implementation project. This was also asserted by Sirisomboonsuk et al. (2018) who claimed that the reasons for poor project performances were lack of effective project governance. Contrary to the argument by Al Hasani et al. (2017) who claimed that there is no direct effect of culture on project success and as per the findings of Aronson et al. (2004), cultural factors did have significant positive effect on project success in this study. This was also in line with many prior studies in information systems projects (Jetu and Riedl, 2013) for instance. As the concept of IFRS is imported from the Western environments (Mihret et al., 2012; Mihret and Bobe, 2014) and most of the big public companies used consultants were recruited from these environments, the role of culture in IFRS project success should be given due weight. This circumstance will continue in future projects as well and project planners and implementers should be aware of these facts. The business organizations in this study were both private as well as public (state owned and state controlled business organizations). Whether the form of ownership has impact on IFRS project implementation was considered as a control variable. The data also indicated that there were no significant statistical differences in the IFRS project implementation success of public and private firms as shown in Table 7.

This implies that the form of ownership and thereby the related project management practice including the consultant recruitment process did not have significant effect on IFRS project implementation success. Hence, the aforementioned research model that was empirically tested in this research would be equally applicable for all forms of organizations.

POLICY AND MANAGERIAL IMPLICATIONS

The research was conducted to assess the influence of various factors on IFRS Project Implementation success of first phase adopter business organizations in Ethiopia. Except economic factors which were not positively correlated with IFRS project success, institutional pressures, project governance systems and cultural factors contributed positively for IFRS project success. Managers in future IFRS Implementation Projects shall consider these factors to successfully implement their projects within time, budget and customer expectations as well as regulatory requirements. This study will have significant contributions to various stakeholders. Primarily, it helps policy makers, managers as well as practitioners to better adopt and operate IFRS, IFRS for SMEs and IPSAS in Ethiopia. Secondly, it will help accounting education to better design the curricula and improve the content delivery process. It will also contribute to accounting theory by identifying new variables that influence IFRS adoption. Finally, it will serve as a base for future research on IFRS adoption in Ethiopia and other Eastern African countries with similar social, political and economic contexts to Ethiopia.

LIMITATIONS AND DIRECTIONS FOR FUTURE RESEARCH

As the target population was busy in day to day operations and year end closings during the data collection period, securing the required volume of data was a basic limitation in this study. In addition, respondents might have provided the socially desirable response instead of the real situation on the ground. Extra effort of data collection was used to minimize the effect of these limitations. Future research may consider replicating the same study on other firms in Ethiopia as well as other Eastern African countries, include other variables that influence project success based on the extant literature, incorporating organizations in the regions within Ethiopia and firms that are expected to implement IFRS in the next two phases (June 30, 2019 and 2020). The same research may also be conducted for NGOs which are expected to implement International Public Sector Accounting Standards (IPSAS) which is the NGO version of IFRS.

The authors have not declared any conflict of interests.

REFERENCES

|

Accounting and Auditing Board of Ethiopia-AABE (2014a). Proclamation to Adopt IFRS in Ethiopia, No. 847/2014.Negarit Gazette, Addis Ababa.

|

|

|

|

Accounting and Auditing Board of Ethiopia-AABE (2014b). Regulation to Adopt IFRS in Ethiopia, No. 332/2014.Negarit Gazette, Addis Ababa.

|

|

|

|

|

Akour I, Alshare K, Miller D, Dwairi M (2006). An exploratory analysis of culture, perceived ease of use, perceived usefulness, and internet acceptance: The case of Jordan. Journal of Internet Commerce 5(3):83-108.

Crossref

|

|

|

|

|

Al Hasani H, Tularam M, Regan A (2017). Impacts of cultural risk factors on project success in the UAE construction industry, 22nd International Congress on Modeling and Simulation, Hobart, Tasmania, Australia.

|

|

|

|

|

Al-Htaybat K (2017). IFRS Adoption in Emerging Markets: The Case of Jordan. Australian Accounting Review 28(1):28-47.

Crossref

|

|

|

|

|

Ali BJA, Al-Alkawi T (2018). Accountants' perception on the factors affecting the adoption of IFRS in Gulf Cooperation Council. International Journal of Economics, Commerce and Management 6(8):393-401. Available at:

View

|

|

|

|

|

Al-Jumeily D, Hussain A (2014). The impact of cultural factors on technology acceptance: A technology acceptance model across eastern and western cultures. International Journal of Enhanced Research in Educational Development 2(4):37-62.

|

|

|

|

|

Aronson ZH, Lechler TG, Dominick PG (2004). The influence of project team culture on project success. Conference: Society for Industrial Organizational Psychology. Available at:

View

Crossref

|

|

|

|

|

Atkinson R (1999). Project Management: Cost, Time and Quality, Two best guesses and a phenomenon, it's time to accept other success criteria. International Journal of Project Management 17(6):337-342.

Crossref

|

|

|

|

|

Badewi A (2016). The impact of project management (PM) and benefits management (BM) practices on project success: Towards developing a project benefits governance framework. International Journal of Project Management 34(4):761-778.

|

|

|

|

|

Ekung S, Agu L, Iheama N (2017). Influence of Project Governance on Project Performance: Evidence from Nigerian Case Studies. PM World Journal Influence of Project Governance on Project Performance 6:1-19.

|

|

|

|

|

Ghasemi A, Zahediasl S (2012). Normality Tests for Statistical Analysis: A Guide for Non-Statisticians. International Journal of Endocrinal Metabolism 10(2):486-489.

Crossref

|

|

|

|

|

Government of Ethiopia (2008). Banking Business Proclamation No. 592/2008.Negarit Gazette, Addis Ababa.

|

|

|

|

|

Hao J, Sun M, Yin J (2019). Convergence to IFRS, accounting quality, and the role of regional institutions: evidence from China. Asian Review of Accounting 27(1):29-48.

Crossref

|

|

|

|

|

Hofstede G, Bond MH (1984). Hofstede's Culture Dimensions: An Independent Validation Using Rokeach's Value Survey. Journal of Cross Cultural Psychology 15(4):417-433.

Crossref

|

|

|

|

|

Jetu FT, Riedl R (2013). Cultural values influencing project team success: An empirical investigation in Ethiopia, International Journal of Managing Projects in Business 6(3):425-456.

Crossref

|

|

|

|

|

Marquez-Ramos L (2011). European Accounting Harmonization: Consequences of IFRS Adoption on Trade in Goods and Foreign Direct Investments. Emerging Markets Finance and Trade 47(4):42-57.

Crossref

|

|

|

|

|

Mashiloane RE, Jokonya O (2018). Investigating the Challenges of Project Governance Processes of IT Projects. Procedia Computer Science 138:875-882,

Crossref

|

|

|

|

|

Mihret DG, Bobe BJ (2014). Multiple informal imperial connections and the transfer of accountancy to Ethiopia (1905 to 2011). Accounting History 19(3):309-331.

Crossref

|

|

|

|

|

Mihret DG, James K, Mula JM (2012). Accounting professionalization processes amidst alternating state ideology in Ethiopia. Accounting, Auditing and Accountability Journal 25(7):12061233.

Crossref

|

|

|

|

|

Musawir A, Serra CEM, Zwikael O, Ali I (2017). Project governance, benefit management, and project success: Towards a framework for supporting organizational strategy implementation. International Journal of Project Management 35(8):1658-1672.

Crossref

|

|

|

|

|

Perera MHB (1989). International Accounting Standards and the Developing Countries: A Case Study of Sri Lanka, Research reports. Department of Accounting and Finance, Glasgow Business School, University of Glasgow, UK.

|

|

|

|

|

Peterson SB (2001). Financial Reform in a devolved African country: Lessons from Ethiopia. Public Administration and Development 21(2):131-148.

Crossref

|

|

|

|

|

Pricope CF (2016). The role of institutional pressures in developing countries: Implications for IFRS, Theoretical and Applied Economics 13(2):27-40.

|

|

|

|

|

Riahi O, Khoufi W (2015). The role of the economic and behavioral circumstances in the IAS/IFRS's adoption (the case of developing countries). International Journal of Accounting and Economics Studies 3(1):69-77.

Crossref

|

|

|

|

|

Saunders M, Philip L, Adrian T (2012). Research Method for Business Students. (6Ed.). Pearson Education New York.

|

|

|

|

|

Sellami YM, Gafsi Y (2017). Institutional and economic factors affecting the adoption of international public sector accounting standards. International Journal of Public Administration 42(2):119-131.

Crossref

|

|

|

|

|

Shima KM, Yang DC (2012). Factors affecting the adoption of IFRS, International Journal of Business 17(3):276-298.

|

|

|

|

|

Sirisomboonsuk P, Gu VC, Cao RQ, Burns JR (2018). Relationships between project governance and information technology governance and their impact on project performance. International Journal of Project Management 36(2):287-300.

Crossref

|

|

|

|

|

Teo T, Luan WS, Sing CC (2008). A cross-cultural examination of the intention to use technology between Singaporean and Malaysian pre-service teachers: an application of the Technology Acceptance Model (TAM). Journal of Educational Technology and Society 11(4):265-280.

|

|

|

|

|

Tesema A (2003). Prospects and challenges for developing securities markets in Ethiopia. An Analytical Review, R&D Management 15(1):50-61.

|

|

|

|

|

Wagaw YM, Mihret DG, Obo DD (2019). IFRS adoption and accounting regulation in Ethiopia. Accounting Research Journal 32(4):662-677.

Crossref

|

|

|

|

|

Zeghal D, Mhedhbi K (2006). An Analysis of the Factors Affecting the Adoption of International Accounting Standards by Developing Countries. International Journal of Accounting 41:373-386.

Crossref

|

|

|

|

|

Zori SG (2011). IFRS in the African continent: A look at Ghana. Available at:

View

|

|