Full Length Research Paper

ABSTRACT

This paper investigates the impact of directors’ political experience, acquired on the financial performance of listed companies, after the Tunisian revolution of 2011. We also emphasize the directors’ strategic experience, and the board of directors’ demographic and structural characteristics. Our data are based on a sample of 22 Tunisian companies listed on the Tunisian stock exchange during the period 2012 to 2018. This period is characterized by a high corruption. We use two different regression models to examine the impact of the directors’ political experience on the firm’s performance. Especially, two measures of the financial performance, namely the ROE and the Tobin’s Q are considered. The results show that political experience is insignificant when considering the ROE while it has a negative impact on performance when it is measured by the Tobin’s Q. Nevertheless, strategic experience, the presence of women and the frequency of meetings moderate this negative impact and increase performance.

Key words: Political experience, performance, Tunisian revolution, board of directors, corruption.

INTRODUCTION

Ho (2005) defines corporate governance as the structure and processes involving the board of directors, shareholders, top management and other stakeholders; it also involves the roles of the stewardship process, exercising strategic leadership, and the objectives of assuring accountability and improving performance. Relevant corporate governance studies consider the board of directors as a decision-making group that improve the effectiveness of shareholders’ control (Van den Berghe and Levrau, 2004). Thus, the board of directors is one of internal governance mechanisms that are intended to ensure a good decision making. The good functioning of the board relies on many classical characteristics related specially to its size, the separation of its function, the independence of its directors and the meeting frequency (Fernandez et al., 2014).

Several papers present evidence suggesting that effective governance and firms’ performance increase with board experience and impove strategic decision-making (Roberts et al., 2005). More recently, board diversity is thus perceived as a stimulus for a company’s value (Carter et al., 2003; Carter et al., 2010). Indeed, the impact of board diversity on performance is a salient subject that has a great academic interest (Kramarz and Thesmar, 2006; Ruigrock et al., 2006; Lee, 2018; Giannetti et al., 2015; Conyon and He, 2016; Green and Homroy, 2018). Another related leterature on governance precisely cognitive theories sheds light on directors‘ role experience on firms’ performance (Lambert and Ghaya, 2016; Hope et al., 2017). Directors’ political experience improves firms’ reputation by the development of professional relational network and lobbying (Charreaux, 2003; Nam et al., 2018). In this case, many researchers highlight a close link between the passage in ministries and the access to high responsibility positions on the board of directors. Bencheikh and Boulila (2017) conducted a study on the effect of political connexion in a democratic environment on firms’ performance after the 2011 revolution. Their results show that political connections increase performance and political relations provide access to privileges regardless of the political atmosphere. Since the revolution, Tunisia has not stopped improving its democratic way and its fight against corruption. Finally, other researchers reveal that the introduction of strategically experienced administrators makes it possible to offset managerial imperfections of entrepreneurs (Lynall et al., 2003; Dou et al., 2015)

A question, therefore, arises as to whether the political and the strategic experience of directors acquired after the 2011 revolution affects the listed companies’ performance. Our paper contributes to the existing literature in two ways. First, we deal with this issue in an innovative context, namely the Tunisia context. Tunisia underwent a deep change in the political and constitutional environment since the revolution of 2011. Still, the political landscape changed and several directors became able to exercise their right of political belonging. Hence, there was a huge lobbying emergence and a great flexibility of access to Tunisian ministerial cabinets. Second, we analyze the impact of the board of directors’ diversity on the relationship between performance-politic experience.

Still, in order to choose the appropriate regression method, specific tests were done. A questionnaire was used to collect data relative to the political and strategic experience. Following the methodology of Muller (2014) and Arora and Sharma (2016), first the impact of the directors’ experience on listed Tunisian companies’ performance measures was highligted. Second, the structural and demographic characteristics of the board of directors were introduced in order to assess the interaction between these factors and the couple directors’ experience-performance. The board’s size, the duality and the company’s size as control variables commonly used were added (Terjesen et al., 2015). Using a sample of 22 Tunisian companies listed on the Tunisian stock exchange during the period 2012-2016, we find that the political experience has a negative impact on performance measured by the Tobin’s Q, in a Tunisian context characterized by high corruption.

Nevertheless, strategic experience, the presence of women and the frequency of meetings moderate this negative impact and increase performance.

LITERATURE OVERVIEW

An effective board of directors must have members with different skills and knowledge (Charreaux, 2000). This capital called experience presents a source of creativity, learning, innovation, adaptation and performanceIn this study, political experience (Goldman et al., 2009) and strategic experience (Lambert and Ghaya, 2016) are situated in the core of the theoretical construction. Since the board of directors has been considered as the centre of social links, it includes the resources mobilized by the directors to ensure the good functioning of the company in terms of efficiency and performance (Rouby, 2008).

Political experience

The political experience is a determining factor in the choice of directors as much as it increases the chance of access to top management within large firms (Figueiredo and Silverman, 2006 ; Mian et al., 2010). Directors’ political experience improves the firm’s reputation by the development of professional relational network and lobbying (Charreaux, 2003; Nam et al., 2018).

In this case, many researchers highlight a close link between the passage in ministries and the access to high responsibility positions on the board of directors. Li and Zhang (2007) show that political networking and experience can be beneficial to new firms in a transition economy and confirm the positive relationship between political experience and performance is moderated by the type of ownership of the firms and the level of competition in their environments. Actually, politically connected firms grant loans with preferential rates benefit from lower taxes and dominate the local market. Therefore, political affiliation affects positively the firm value in the post-election period owing to economic favor allowed to some firms (Faccio, 2006).

Otherwise, other researches have shown that the doubtful interaction between the political systems and performance exceeds countries with a high level of corruption and became remarkable even in the United States after the 2008 crisis (Goldman and al. 2009). Despite the strong US legal system, the political connections of boards have a positive and significant impact on the allocation of government resources and the award of government contracts (Goldman et al., 2017). Also Sharma et al. (2020) explore the differences in the impact of political connections on the performance of Chinese exporter and non-exporter firms and find significant positive effects of political connections on Chinese firms' decisions to enter export markets and their subsequent performance.

In another research area, the negative impact of directors' political experience on performance can be seen in countries with a weak legal system and a high level of corruption (Faccio and Parsley, 2006; Hope et al., 2017). In this way, Indonesian companies whose directors have family ties with the president meet a stock market price tumble in their shares following the announcements of the deteriorating of the president’s health (Fisman, 2001). Similarly, China, which banned civil servants from holding a director position in an anti-corruption company in 2013 has seen an improvement in the quality of accounting figures and the level of financial performance (Lambert and Ghaya, 2016; Hope et al., 2017).

Likewise, Dou et al. (2015) show that firms with government-owned managers have a significantly lower return on assets ROA than those with no political linkage, particularly in non-regulated industries (Leong et al., 2015). This negative political affiliation’s impact is explained by the diversion of resources and their inefficient use since they have been attained from corruption and favoritism. This situation leads to a decrease in performance given that managers conspire with politicians to protect themselves from the threat of takeover. On the other hand, another line of research denies any relationship between political experience and firms’ performance. Hillman (2005), by using the accounting measures of performance in his empirical study, did not find any impact. Similarly, Choi et al. (2007) and Ding et al. (2013) have shown a negative, but no significant impact of the political experience on performance in the Korean and Singaporean context. Tunisia is also considered as a country in which corruption is high. Moreover, during the post-electoral period, we remark a strong interaction between politics and business. Thus the following hypothesis:

H1. The political experience of directors has a negative impact on firms’ performance.

Strategic experience

The cognitive theory of governance shows that the board’s effectiveness depends on its members’ skills and knowledge (Godard and Schatt, 2000). Thus, the directors' experience is a source of creativity, innovation, adaptation, and performance. For this, some researchers advocate the existence of a significant positive relationship between the presence of experienced directors in the strategic field and the performance of the company (Lambert and Ghaya, 2016). Consequently, the strong involvement of these directors and the taking of adequate strategic decisions is a source of value creation. In this sense, Godard (2006) shows that the role of directors in creating value is achieved through their affiliation in strategic committees that contribute to the innovation process by creating investment opportunities. Recently, Wen et al. (2020) show a significantly negative association between directors with foreign strategic experience and tax avoidance. This suggests that these directors can help constrain their firms' tax aggressiveness and impact their performance.

In addition, the introduction of strategically experienced administrators makes it possible to offset managerial imperfections of entrepreneurs (Lynall et al., 2003; Dou et al., 2015) and their expertise enriches financial transparency and positively influences the firm value (Davidson et al., 2004; Agrawal and Chadha, 2005; Defond et al., 2005; Kaplan et al., 2012; Benmelech and Frydman, 2015; Bernile et al., 2017). Al-Matari et al., (2019) confirms the positive relationships between the strategic experience of top executive management and the board of Omani listed firm and corporate performance.

Other researchers reveal that experienced directors do not abandon the company during periods of crisis, which explains the increase in the proportion of experienced administrators when the ROA is low (Dou et al., 2015). Thus, experienced directors make a valuable contribution to the firm’s corporate governance (Marlin and Geiger, 2011). In light of what was exposed in literature, we propose the following hypothesis:

H2. The directors’strategic experience has a positive impact on firms’ performance.

The second part of this paper consists in introducing board characteristics in order to detect their influence on the existing relationship between directors’ experience and firms’ performance. Thus, board diversity can improve the decision making of the board and leads to better firms’ performance (Iren, 2016).

Impact of board diversity

The board heterogeneity and the diversity in the composition of its members constitute an element favoring its effectiveness and a stimulant of performance (Carter et al., 2010; Hafsi and Turgut, 2012). In order to identify this impact, we subdivide characteristics in demographics relative to gender and percentage of foreign, structural relative to independence and frequency of meetings (Lee, 2018; Giannetti et al., 2015). We suppose then:

H3. The characteristics of the board of directors moderate the relationship between political experience and firms’ performance.

Concerning the strategic experience, we maintain its positive impact on the relation between political experience and performance. Therefore, we formulate the following hypothesis:

H3.1. The strategic experience of directors positively affects the relationship between political experience and firms’ performance.

In addition, the board feminization (St-Onge and Magnan, 2013) is a widely debated question by the literature. Some suggest that women engage less in non-ethical behaviors (Croson and Gneezy, 2009), favoring a horizontal structure and a participative management mode based on power-sharing and decreasing agency costs (Adam and Ferreira, 2009; Rhode and Packel, 2014). Thereby, the announcement of women introduction within the board of directors is often the origin of the stock market return’s improvement (Kang et al., 2007) and firms’ reputation.

In this way, the presence of women within the board of directors of Australian (Nguyen and Faff, 2007), American (Conyon and He, 2016) Chinese (Liu et al., 2014) and English (Muravyev, 2016) firms positively affects their performance (MijntjeLückerath-Rovers, 2013) and value (Carter et al., 2003). Nevertheless, some researchers predict that the feminization of the board can reduce performance by complicating the decision-making process (Gulet et al., 2011) and by accentuating men/women conflicts (Adams and Ferreir, 2009, Randoy et al., 2006). Others do not raise any effects of the gender diversity of the board on performance advice (Rose, 2007; Bohren and Strom, 2010; Carter et al., 2010).

Adams and Ferreir (2009) explain these mixed results by differences in performance measures, used methodologies, contextual problems and the complexity of human capital theory. For this, Carter et al. (2010) suggest that only gender and ethnic diversity can have an effect on performance measures. We have, thus, adopted the position of the majority of studies and we assume that:

H.3.2. Women’s presence within the board of directors positively affects the relationship between political experience and performance.

Moreover, the literature has shown that the presence of foreigners on the board of directors has a significant impact on companies’ performance (Van Veen and Marsman, 2008; Agrawal et al., 2011). Yagli and Lu (2016) explain the positive association by the fact that foreign directors generally come from a country with better legal institutions, more efficient governance standards, and therefore have better international expertise and skills (Miletkova et al., 2017). Colpan (2011) add that the performance of independent directors depends on the degree of foreign ownership. When this property is high, the directors will have more incentives to protect the interests of the shareholders (Kimura and Kiyota, 2007; Firth et al., 2007; Martins and Schilpzand, 2011). For other researchers, this international diversity has a negative impact on performance since the lack of coordination and involvement of foreign members does not make it possible to improve the functioning of the board of directors and intragroup cohesion (Madani and Khlif, 2010; Masulis et al., 2012). Hahn and Lasfer (2016) even report an underperformance due to the excessive remuneration of foreign directors within English companies.

In this sense, Giannetti et al. (2015) add that directors with foreign experience do not pay close attention to the value of firms in the long-term or the evolution of corporate social responsibility. In the light of what has been– preceded, we assume that:

H.3.3. A high proportion of foreign directors positively affects the relation between political experience and performance.

Like foreign directors, the presence of external directors, which is considered among the best corporate governance mechanisms, has a significant impact on performance measures. Thus, the independence of directors has made it possible to mitigate the problem of interests, conflicts between managers and shareholders (Alexandre and Paquerot, 2000), to improve the quality of the disclosed information (Chen and Jaggi, 2000; Lefort and Urzúa, 2008), and also to increase the firm value (Lee, 2018) and the effectiveness of its control (Dahya et al., 2008).

On the other hand, independent directors are able to put pressure on auditors to obtain more detailed reports, which reduces the risk of misconduct. Thus, this positive relationship can be explained by the fact that independent directors detect more easily early signs of risk, but leave the company before the deterioration of performance (Kutum, 2015). Supporting the literature, the following hypothesis is proposed:

H.3.4. A high proportion of independent directors positively affects the relation between political experience and performance.

Consequently, the frequency of board meetings leads to better communication between managers and directors. Studies confirm a positive relationship between the number of board meetings and the financial performance of companies. (Kang and al. 2011; Gavrea and Stegerean, 2012; Chou et al., 2013; Xu and Jiraporn, 2013; Al-Matari et al., 2014; Masulis et al., 2017). Ntim and Osei (2011) add that boards that meet more frequently have an increased ability to effectively advise, monitor and discipline, which can improve the companies’ financial performance.

However, several researchers confirm that the high number of board meetings negatively affects the effectiveness of its role of control and decision. Thus, Garcia-Sanchez (2010) has shown that the board with a high meeting frequency can be a signal of the decline in share prices of the company. Because of time and budget restrictions, the market perceives badly boards that do not meet frequently. For this, the following hypothesis is adopted:

H.3.5. The meeting frequency of the board of directors positively affects the relation between political experience and performance.

Data

In order to proceed with the empirical validation, we used a sample of 22 Tunisian companies listed on the Tunisian stock exchange during the period 2012-2018. The financial data are collected from official bulletins available in the financial market council (CMF) while the information concerning directors is collected from a questionnaire addressed to the boards of directors.

METHODOLOGY

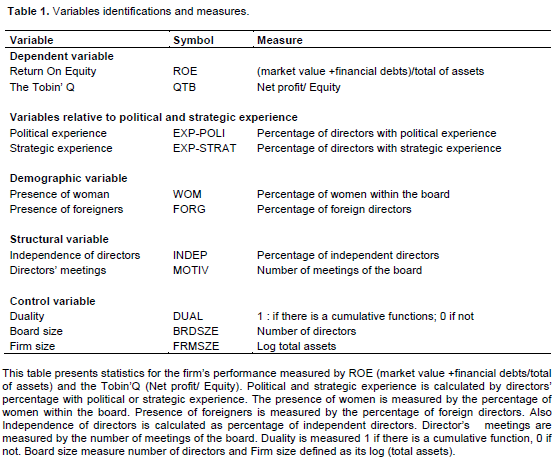

This section describes the methodology which involves three steps. First, the dependent and independent variables were described. Initially four performance measures were adopted. They are categorized into accounting metrics which are ROA and ROE, and financial metrics which are Tobin’s Q and BPA. However, the regression model was only significant with the two variables finally retained which are the ROE and the Tobin’S Q. Our final choice was limited to these two variables. We supported our choice by referring to the literature. Indeed, some researches such as Elsayed and Paton (2005), Rassier and Earnhart (2010) and Perez Calderon (2012) reached a consensus on the determination of the most used indicators in studying the relationship between environmental and financial performance. These indicators would be: Tobin's Q, price-to-book ratio-PBR, Return on capital employed- ROCE, Return on own-funds -ROE and ROI. Relevant measures were used for the politic experience (Leong et al., 2015), strategic experience (Lambert and Ghaya, 2016), demographic variables (Muller, 2014), structural variables (Arora and Sharma, 2016) and control variables (Terjesen et al., 2015). The study variables were chosen from previous studies by characterizing them in terms of availability and measurement. Second, descriptive statistical tests and specification tests were carried out. Third, two different regression models were used to examine the impact of the directors’ political experience on firms’ performance.

The first model shows the impact of political and strategic experience on the firm performance while taking the board’s size, duality and company’s size as variables of control. In the second model, demographic variables and structural variables were also considered. The hypotheses were tested on panel data processed by the STATA 13 software. This one is proved to be a reference software for specific data management such as financial and accounting data in panel. The specificity tests did not follow the normal distribution in our Tunisian context. These tests are the Fisher's homogeneity test used to justify the use of panel data, the Hausman test used to distinguish the individual effects, and the Breush-Pagan test used to test for heteroscedasticity.

Variables description

Dependent variables: Measuring performance

Several researchers use the Tobin’s Q as a performance measure (Beiner et al., 2006; Bhagat et al., 2008; Campbell and Minguez-Vera, 2008; Adams and Ferreira, 2009; Zouari and Taktak, 2014; Martín and Herrero, 2018; Song et al., 2020). Also, Wang et al. (2014), Liu et al. (2015) and Salah (2020) use the ROE as a performance measure. Also Ghosh (2006), Borlea et al. (2017) and Nouri et al. (2018) use ROE and Tobin’s Q to measure performance.

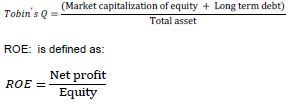

Tobin’s Q: measure of firm’s growth opportunities. It is defined as the ratio:

Independent variables

Political and strategic experience

Political experience: Defined as the percentage of directors with political experience (Faccio, 2006; Leong et al., 2015).

Strategic experience: Defined as the percentage of directors with strategic experience (Godard, 2006; Lambert and Ghaya, 2016).

Demographic variables

Presence of women: Defined as the percentage of women within the board (Kang et al., 2007; Conyon and He, 2016; Green and Homroy, 2018).

Presence of foreigners: Defined as the percentage of foreign directors (Schilpzand and Martins, 2010; Miletkov et al., 2017).

Structural variables

Independence of directors: Defined as the percentage of independent directors (Godard and Schatt, 2004; Aggarwal et al., 2011).

Directors meetings: Measure number of the board’s meetings (Fuller and Jensen, 2002; Kutum, 2015).

Control variables

Duality: Measured 1 if there is a cumulative function, 0 if not (Kang and Chun, 2009).

Board size: Measures the number of directors (Adams and Mehran, 2003; Masulis et al., 2012).

Firm size: Defined as log (total assets) (Baker, 2016).

Statistics tests

In this part, descriptive statistics was first presented. Then correlation coefficients was performed to verify multicollinearity. Finally, the necessary specification tests were done in a particular Tunisian context in which the variables’ normality were not guaranteed. The interpretation of results of exploratory research depends on the contextual data which, despite their instability, can be available later for a "normative” purpose. These tests include the Fisher's homogeneity used to justify the use of panel data, the Hausman test used to distinguish the individual effects, and the Breush-Pagan test used for heteroscedasticity.

Multivariate analyses

Two different regression models were used to examine the directors’ political experience impact on the firm’s performance. We use multivariate regression defined as a method used in statistical modeling to perform prediction analysis on a group of independent variables towards a dependent variable. We regress in a first model the firm ‘sperformance on the political experience and the directors’ strategic experience, while taking the board’s size, duality and the company’s size as variables of control. In the second model, demographic variables and structural variables were considered. The study models are based on several models taken from the literature. We arrive at this combination taking into account the availability of variables (Table 1).

Model 1: PERFit= α+ β1EXP_POLIit + β2 EXP_ STRAit + β3DUALit+ β4 TAI CAit+ β5TA+ ?it(1)

We regress performance on politic experience, strategic experience and control variables.

Model 2: PERFit=α+β1EXP_POLIit+β2 EXP_ STRAit+β3FEMMit+ β4ETRANit +β5INDEPit +β6MOTIVit +β7DUALit +β8TAICAit +β9TAit +?it(2)

We regress performance on politic experience, strategic experience, demographic variables, structural variables and control variables. Taking into consideration that PERFit is the financial performance of firm i in the year t which has two measures, namely, ROE and Tobin’s Q. EXP_POLIit, EXP_ STRAit, FEMMit, AGEit, ETRANit, INDEPit, MOTIVit, DUALit, TAitCAit, are explanatory variables, β (β1……. β9) is the vector of parameters to estimate, ?it is the error term.

Empirical results

The results of the descriptive statistics and multi-varied analyses are prested here. According to Fortin et al. (2020), any prevision must be adjusted using past observations. The statistical régression is a stochastic model. So Statistical linear régression is only applicable for long term prevision since it requires independent and identically distributed observations. It is a simple method of prevision, and its hypothèses can be validated a posteriori if sufficient data are available.

Descriptive statistics

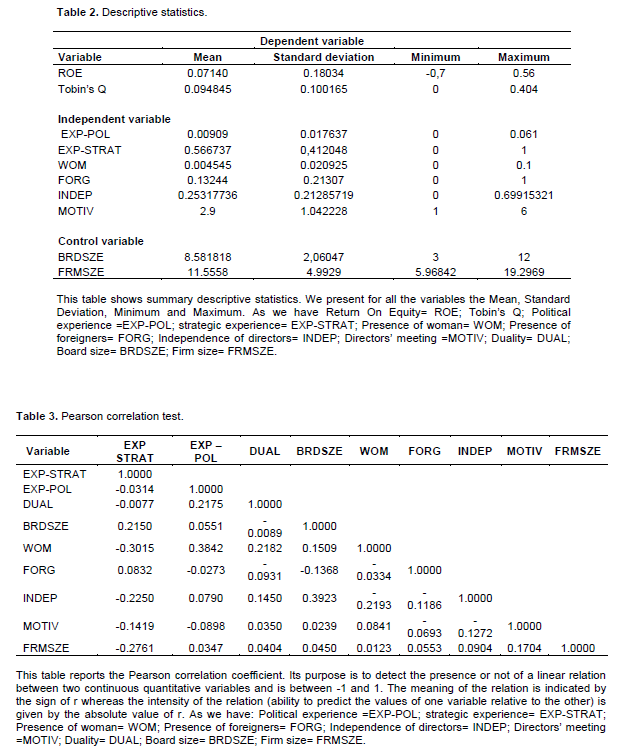

Results in Table 2 show that the ROE and Tobin’s Q of Tunisian listed firms present respectively an average of 7.14 and 9.4845%. On average, 0.909% of directors have political experience and 56. 67% have a strategic experience. In addition, foreigners are present at an average of 13.24%, which proves that the boards of Tunisian companies contain a small percentage of foreigners. In the same way, women have only a weak presence, on average a percentage of 0.454%. Results also show that the percentage of independent directors is on average around 25.3177% and that the boards of directors meet on average 2.9 times.

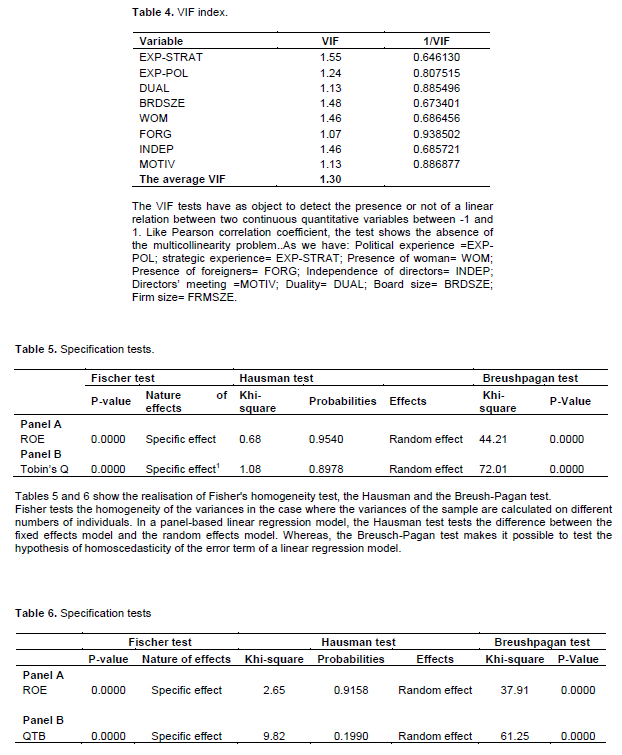

Multicolinearity tests

Table 3 reports the Pearson correlation coefficient. The results of the Pearson test show that the majority of the correlation coefficients are not high and do not exceed 0.8 (Kennedy, 1992) and 0.9 (Bohrstedt and Knoke, 1994). It is concluded that there is no multicollinearity problem. Table 4 displays the VIF test results. The purpose is to detect the presence or not of a linear relations between two continuous quantitative variables. A strong positive linear relationship between x and y value is 1.55 and the average VIF is 1.30. Moreover, all VIF values are less than 5 in line with Dimitrova (2005)’s recommendations. It is, therefore, concluded that there is no multicollinearity problem.

Specification tests

Tables 5 and 6 report the realization of Fisher's homogeneity test, and Hausman and Breush-Pagan test. As a gobal measure of the significance of the model, the Fisher test is used, under the hypothesis 0 which stipulates that the regression coefficients are zero and therefore the non-significance of the explanatory variables. The results of the regression reveal that The Fisher test has a significant value at the level of 1. Thus, it can be concluded that there is the existence of a specific effect. Subsequently, the Hausman test revealed that the probability of the null hypothesis’ acceptance is greater than 5% for the two panels’ models. It is deduced that the random effect model is the most appropriate and that the Least Generalized Squares estimator is recommended.

In addition, the Breush- Pagan test revealed a problem of Heteroscedasticity. As a result, this problem was corrected with Feasible Generalized Least Square for the random effect model.

REGRESSIONS RESULTS AND DISCUSSION

Model 1

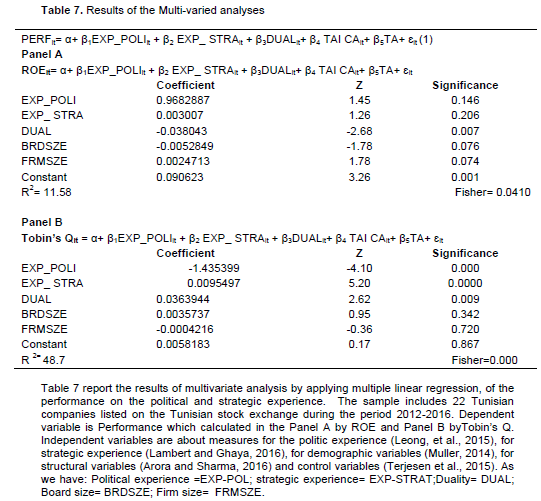

Table 7 shows the results of the performance’s regression on the political and strategic experience, the board size, duality, and firm size. Panel A of Table 7 presents results when performance is measured by ROE. It shows that the coefficient associated with political experience is positive, but statistically insignificant. This proves that the directors’ political experience has no impact on Tunisian listed companies’ performance.

This result contradicts the first hypothesis which stipulates that directors’ political experience has a negative impact on firms’ performance. This result also confirms the studies of Hillman (2005) who concluded that there is no relationship when performance is estimated by accounting measures. Still, Choi et al. (2007) and Ang et al. (2013) find that in South Korea and Singapore, political experience has no impact on firms’ value.

Panel A of Table 7 shows the strategic experience. We find a positive, but not significant coefficient. This result contradicts the second hypothesis which stipulates that strategic experience of directors has a positive impact on firms’ performance. The result also confirms the studies of Ferris et al. (2003). These results can be explained by the limited size of the sample and the nature of the ROE measure that does not have a high reactivity.

Duality has a significant negative coefficient at the level of 1%, which implies that the combination of two functions by the CEO has a negative effect on the firms’ performance (Iren, 2016; Kalsie and Shrivastay, 2016). Similarly, board size proves to be significantly negative at the level of 10% which is consistent with the studies of Carter et al. (2003), Hermalin and Weisbach (2003), and Rizwan et al. (2016). In turn, the firm size has a positive coefficient and it is significant at a level of 10%. This implies that large companies can achieve high levels of performance (Iren, 2016).

The empirical results of Panel A of Table 7 estimated by the accountant measure show that neither political nor strategic experience has any impact on the performance of Tunisian companies.

Large boards have a negative impact on performance due to the existence of agency problems and the board's inability to play a supervisory and advisory role, especially in the presence of the dual functions by the CEO.

Panel B of Table 7 presents results when performance is measured by Tobin’s Q. It shows that the political experience has a negative and significant impact at a level of 1% on financial performance. This confirms the hypothesis which stipulates that the directors’ political experience has a negative impact on firms’ performance. This result is shown in the literature by Faccio (2006), and Dou et al. (2015). Thus, in the Tunisian context which is characterized by a strong corruption and a lack of transparency, the political connection is misused by directors to divert resources and harm the company’s interests by undertaking investments at the expense of the firm value.

The strategic experience has a positive and significant effect at the level of 1%. This confirms the second hypothesis which stipulates experience has a positive impact on firms’ performance. It is also consistent with the results of Pérez-González (2006), Bennedsen et al. (2007), Kaplan et al. (2012), Benmelech and Frydman (2015), and Bernile et al. (2017). The percentage of directors with strategic experience, as defined by Godard (2006) has a positive impact on performance. The result moderates the negative impact of the political experience. The significance of the political experience and strategic experience is due to the high reactivity of the Tobin’s Q performance measure compared to the ROE measure.

Panel B of Table 7 shows the negative impact of the directors’ political experience. Taking into account a context in which corruption prevails. The administrators’ strategic experience and duality are two factors that moderate the negative impact of the directors' political experience on the performance of Tunisian companies.

Model 2

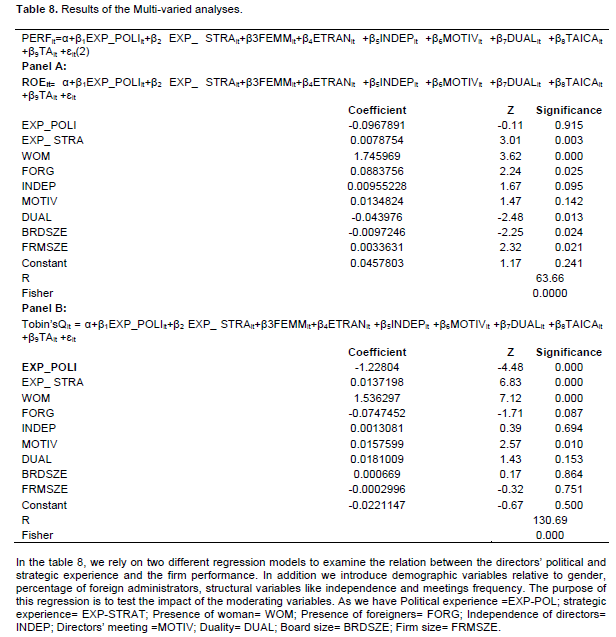

Table 8 shows the results of the performance’s regression on political and strategic experience, presence of women and foreigners, independence of directors, number of meetings, board size, duality and firm size. Table 8 Panel A presents the result of regression when performance is measured by ROE. It shows that the political experience has no impact on performance. In addition, strategic experience has a positive impact on the existing relationship between political experience and performance. This confirms the hypothesis which stipulates that directors’ strategic experience positively affects the relationship between political experience and firm performance.

The demographic characteristics relating to the presence of women and foreigners have a positive impact (significant at the level of 1 and 5%) on the relationship between political experience and performance. These results confirm the hypotheses which stipulate that presence of women and a high proportion of foreign directors within the board of directors positively affect the relationship between the political experience and performance. These results are shown in literature by Erhardt et al. (2003), Carter et al. (2003), Conyon and He (2016); Green and Homroy (2018); Adams and Ferreira, (2009), Anderson et al. (2011) and Miletkova et al. (2017).

In addition, for structural characteristics, only the independence of directors has a positive and significant coefficient at the level of 10%. This confirms the hypothesis which stipulates that a high proportion of independent directors positively affects the relation between political experience and performance. This is consistent with the results of Dahya et al. (2008), Aggarwal et al. (2011) and Bruno and Claessens (2010).

Nevertheless, the number of meetings of the board is not statistically significant which does not affirm the hypothesis which stipulates that the board of administration’s meetings frequency positively affects the relation between political experience and performance. It aligns with the results of Kutum (2015). With the accountant measure in Panel A of T able 8, we can conclude that even in the presence of foreign and female directors, the political experience of the directors does not affect the performance while the strategic experience improves this performance. In fact, the presence of foreign directors reinforces the independence of the board of directors, neutralizes the role of directors' meetings and helps companies to adopt good governance practices, especially if their countries of origin have good governance practices. These foreign directors will protect the interests of shareholders by increasing the firm value. In the same way, the presence of female directors increases the diversity of opinions and allows making good financial decisions and so increasing the firm performance. On the other hand, if the CEO combines the dual functions on a large board of directors, the financial performance of the company becomes damaged.

Table 8 Panel B presents the result of regression when performance is measured by Tobin’s Q. It proves that political experience has a significant negative impact on performance (Faccio, 2006; Fan et al., 2007; Dou et al., 2015). The strategic experience has a positive coefficient and it is statistically significant at a level of 1%, which confirms the hypothesis which stipulates that directors’ strategic experience positively affects the relationship between political experience and firms’ performance.

Regarding demographic characteristics, the presence of women has a significantly positive coefficient of around 1%, thus confirming the hypothesis which stipulates that women’s presence within the board of directors positively affect the relationship between the political experience and performance. This is proved in the literature by Carter et al. (2003), Conyon and He (2016) and Green and Homroy (2018).

On the other hand, foreigners have a negative coefficient and it is statistically significant at a level of 10%. This invalidates hypothesis which stipulates that foreigners within the board of directors positively affect the relationship between the political experience and performance. This result aligns with those of Madani and Khlif (2010), Masulis et al. (2012); Hahn and Lasfer (2016).

In addition, for structural variables, only the number of meetings of the board has a positive coefficient and it is statistically significant at a level of 5%; thus confirming the hypothesis which stipulates that the meeting frequency of the board of directors positively affects the relation between political experience and performance. This is in line with the studies of Kang and Kim (2011), Gavrea and Stegerean (2012), Xu and Jiraporn (2013), Al-Matari et al. (2014) and Masulis et al. (2017).

The result aligns with the results of Nouri et al. (2018) who have shown conflicting results by adopting an accounting performance measure such as ROE and a financial measure such as Tobin’s Q. These contradictory results show how political experience interacts with board diversity and affects the company’s performance. This interaction depends on the business environment and the companies’ characteristics. So, the Tobin’s Q integrates environmental specificities and provides an unbiased estimate of firm value while accounting- based measures are ex post approaches over the sample periods which require the adjustment for risks and may not address unexpected changes appropriately (Ju et al., 2020).

We can conclude that in a context with a high level of corruption, the political experience has a negative impact on performance. The presence of foreign directors proves to be costly since they cannot get to be involved, and to require a good coordination between all directors especially in the presence of those with political experience. Consequently, they fail to preserve the firm value, which leads to a deterioration in financial performance. On the other hand, the directors’ strategic experience, the presence of women on the board of directors and the frequency of board meetings moderate this decrease and boost the company's performance.

CONCLUSION

In this paper, we analyze the impact of the political experience of directors on the Tunisian firms’ performance. We also emphasize the impact of board diversity on the relationship between performance and political experience. This diversity was appreciated through the strategic experience, the demographic diversity represented by gender and the presence of foreigners and the structural diversity represented by the independence of the directors and the frequency of meetings.

As part of our empirical approach, we used multivariate analysis by applying multiple linear regressions. Results show that the political experience has no impact on the financial performance when the latter is measured by ROE. However, strategic experience, the presence of women, foreigners and independents boost performance. Still, we find that in a context of corruption, the political experience has a negative impact on performance as measured by Tobin's Q. Nevertheless, the strategic experience, women’s presence and the meeting’s frequency moderate this negative impact and boost performance.

The newly established democracy in Tunisia has failed to decrease corruption (Faccio and Parsley, 2006; Hope et al., 2017). So, the imposition of rapid neoliberal economic reforms in a state like Tunisia, where democratic institutions are new and weakly institutionalized, will likely result in expanded rather than reduced opportunities for economics captured by Tunisian elite networks (Murphy, 2013). Therefore, we can judge that the non-introduction of a variable that measures corruption may limit this study. A second study is recommended in which we will take this measurement into account. Corruption has damaged the Tunisian economy. Researchers are trying to determine the factors that can decrease this level for political experience to become a strong suit for Tunisian firms’ performance.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interests.

REFERENCES

|

Adam R, Mehran H (2003). Is Corporate Governance Different for Bank Holding Companies. Economic Policy Review 9(1):123-141. |

|

|

Adams RB, Ferreira D (2009). Women in the board room and their impact on governance and performance. Journal of Financial Economics 94(2):291-309. |

|

|

Aggarwal R, Erel I, Ferreira, M, Matos P (2011). Does governance travel around the world? Evidence from institutional investors. Journal of Financial Economics 100(1):154-181. |

|

|

Agrawal A, Chadha S (2005). Corporate Governance and Accounting Scandals. Journal of Law and Economics 48(2):371-406. |

|

|

Agrawal R, Erel I, Ferreira M, Matos P (2011). Does governance travel around the world? Evidence from institutional investors. Journal of Financial Economics 100(1):154-181. |

|

|

Alexandre H, Paquerot M (2000). Efficacité des structures de contrôle et enracinement des dirigeants. Finance Contrôle Stratégie 3(2):5-29. |

|

|

Al-Matari EM, Al-Swidi AK, Fadzil FH (2014). The Moderating Effect of Board Diversity on the Relationship between Executive Committee Characteristics and Firm Performance in Oman: Empirical Study. Asian Social Science 10(12):1911-2025. |

|

|

Al-Matari EM, Al-Swidi AK, Hanim F, AL-Matari Y (2019). The Impact of board characteristics on Firm Performance: Evidence from Nonfinancial Listed Companies in Kuwaiti Stock Exchange. International Journal of Accounting and Financial Reporting 2(2):310-332. |

|

|

Anderson RC, Reeb DM, Upadhyay A, Zhao W (2011). The economics of director heterogeneity. Financial Management 40(1):5-38. |

|

|

Arora A, Sharma C (2016). Corporate governance and firm performance in developing countries: evidence from India. Corporate Governance 16(2):420-436. |

|

|

Baker JD (2016). The Purpose, Process, and Methods of Writing a Literature Review. AORN Journal 103(3):265-269. |

|

|

Beiner S, Drobetz W, Schmid MM, Zimmermann H (2006). An integrated framework of corporate governance and firm valuation. European Financial Management 12(2):249-283. |

|

|

Bencheikh F, Boulila Taktak N (2017). Effect of Political Connections on the Firm Performance in a Newly Democratised Country Mediterranean Journal of Social Sciences 8(4):40-46. |

|

|

Benmelech E, Frydman C (2015). Military CEOs. Journal of Financial Economics 117(1):43-59. |

|

|

Bennedsen M, Nielsen KM, Perez Gonzalez F, Wolfenzon D (2007). Inside the Family Firm: The Role of Families in Succession Decisions and Performance. The Quarterly Journal of Economics 122(2):647-691. |

|

|

Bernile G, Bhagwat V, Raghavendra P (2017). What Doesn't Kill You Will Only Make You More Risk-Loving: Early-Life Disasters and CEO Behavior. The Journal of American Finance Association 72(1):167-206. |

|

|

Bhagat S, Bolton B, Romano R (2008). The promise and peril of corporate governance indices. Columbia Law Review 108:1803. |

|

|

Bohren O, Strom RO (2010). Governance and politics: Regulating independence and diversity in the board room. Journal of Business Finance and Accounting 37(9?10):1281-1308. |

|

|

Bohrstedt G, Knoke D (1994). Statistics for Social Data Analysis. Peacock Publishers. |

|

|

Borlea SN, Achim MV, Mare C (2017). Board characteristics and firm performances in emerging economies. Lessons from Romania Economic Research 30(1):55-75. |

|

|

Bruno V, Claessens S (2010). Corporate governance and regulation: Can there be too much of a good thing? Journal of Financial Intermediation 19:461-482. |

|

|

Campbell K, Mínguez-Vera A (2008). Gender diversity in the boardroom and firm financial performance. Journal of Business Ethics 83(3):435-451. |

|

|

Carter BJ, Simkins W, Simpson G (2003). Corporate Governance, Board Diversity, and Firm Value. The Financial Review 38(1):33-53. |

|

|

Carter D, D'Souza F, Simkins B, Simpson W (2010). The Gender and Ethnic Diversity of US Boards and Board Committees and Firm Financial Performance. Corporate Governance. An International Review 18(5):396-414. |

|

|

Charreaux G (2000). Le conseil d'administration dans les théories de la gouvernance. Revue du financier 127:6-17. |

|

|

Charreaux G (2003). Le gouvernement d'entreprise. Encyclopédie des Ressources Humaines, Vuibert, Paris pp. 628-640. |

|

|

Chen CJ, Jaggi B (2000). Association between independent non-executive directors, family control and financial disclosures in Hong Kong. Journal of Accounting and Public Policy 19(4):285-310. |

|

|

Choi JJ, Park SE, Yoo SS (2007). The outside directors in Korea: evidence from corporate governance reform in Korea. Journal of Financial and Quantitative Analysis 42(4):941-962. |

|

|

Chou H, Chung, H, Yin X (2013). Attendance of board meetings and company performance: Evidence from Taiwan. Journal of Banking and Finance 37(11):4157-4171. |

|

|

Colpan AM (2011). Shareholder Heterogeneity and Conflicting Goals: Strategic Investments in the Japanese Electronics Industry. Journal of Management Studies 48(3):591-618. |

|

|

Conyon MJ, He L (2016). Firm performance and boardroom gender diversity: A quantile regression approach. Journal of Business Research 79:198-211. |

|

|

Croson R, Gneezy U. (2009). Gender Differences in Preferences. Journal of Economic Literature 47(2):1-27. |

|

|

Dahya J, Dimitrov O, McConnel OJ (2008). Dominant shareholders, corporate boards, and corporate value: A cross-country analysis. Journal of Financial Economics 87(1):73-100. |

|

|

Davidson WN, Jiraporn P, Kim YS, Nemec C (2004). Earnings management following duality-creating successions: Ethnostatistics, impression management and agency theory. Academy of management journal 47(2):267-275. |

|

|

Defond ML, Hann RN, Hu X (2005). Does the market value financial expertise on audit committees of boards of directors. Journal of Accounting Research 43(2):153-193. |

|

|

Dimitrova D (2005). The Relationship between Exchange Rates and Stock Prices: Studied in a Multivariate Model. Issues in Political Economy14 p. |

|

|

Ding CG, Wu CH, Chang PL (2013). The influence of government intervention on the trajectory of bank performance during the global financial crisis: A comparative study among Asian economies. Journal of Financial Stability 9(4):556-564. |

|

|

Dou Y, Sahga S, Zhang EJ (2015). Should Independent Directors Have Term Limits? The Role of Experience in Corporate Governance. Financial Management 44(3):583-621. |

|

|

Elsayed K, Paton D (2005). The impact of environmental performance on firm performance: static and dynamic panel data evidence. Structural Change and Economic Dynamics 16(3):395-412. |

|

|

Erhardt NL, Werbel JD, Shrader CB (2003). Board of director diversity and firm financial performance. Corporate governance: An International Review 11(2):102-111. |

|

|

Faccio M (2006). Politically Connected Firms. American Economic Review 96(1):369-386. |

|

|

Faccio M, Parsley DC (2006). Sudden Deaths: Taking Stock of Geographic Ties. Journal of Financial and Quantitative Analysis 44(3):683-718. |

|

|

Fan PH, Wong TJ, Zhang T (2007). Politically connected CEOs, corporate governance, and Post-IPO performance of China's newly partially privatized firms. Journal of Financial Economics 84(2):330-357. |

|

|

Fernandez M, Alonso S, Rodriguez J (2014). Board characteristics and firm performance in Spain. Corporate Governance 14(4):485-503. |

|

|

Ferris S, Jagannathan M, Pritchard AC (2003). Too Busy to Mind the Business? Monitoring by Directors with Multiple Board Appointments. Journal of Finance 58(3):1087-1112. |

|

|

Figueiredo JM, Silverman B (2006). Academic earmarks and the returns to lobbying. Journal of Law and Economics 49(2):597-625. |

|

|

Firth M, Fung PM, Riu M (2007). How Ownership and Corporate Governance Influence Chief Executive Pay in China's Listed Firms. Journal of Business Research 60(7):776-785. |

|

|

Fisman R (2001). Estimating the Value of Political Connections. American Economic Review 91(4):1095-1102. |

|

|

Fortin V, Ouarda TBMJ, Rasmussen PF, Bobée B (2020). A review of stream flow forecasting methods. Revue des sciences de l'eau / Journal of Water Science 10(4):461-487. |

|

|

Fuller J, Jensen M (2002). Just say No to Wall street: Putting a stop to the earning game. Journal of Applied Corporate Finance 14(4):41-46. |

|

|

Garcia-Sanchez IM (2010). The effectiveness of corporate governance: Board structure and business technical efficiency in Spain. Central European Journal of Operations Research 18(3):311-339. |

|

|

Gavrea C, Stegerean R (2012). Business strategy structure and organizational performance. Pakistan Economic and Social Review 54(1):97-122. |

|

|

Giannetti C, Ransing MR, Ransing RS, Bould DC, Gethin DT, Sienz J (2015). Organisational knowledge management for defect reduction and sustainable development in foundries. International Journal of Knowledge and Systems Science 6(3):18-37. |

|

|

Godard L (2006). Les spécificités des comités stratégiques et de leurs membres: Le cas de la France. Recherches et Publications en Management 23(3):165-188. |

|

|

Godard L, Schatt A (2000). Faut-il limiter le cumul des fonctions dans les conseils d'administration? La Revue du Financier 127:36-47. |

|

|

Godard L, Schatt A (2004). The Determinants of" Quality" of the French Board of Directors. Working Paper FARGO, University of Burgundy. |

|

|

Goldman E, Rocholl J, So J (2009). Do politically connected boards affect firm value? Review of Financial Studies 22(6):2331-2360. |

|

|

Goldman E, Rocholl J, So J (2017). Politically Connected Boards of Directors and The Allocation of Procurement Contracts. Review of Finance 17(5):1617-1648. |

|

|

Green C, Homroy S (2018). Female directors, board committees and firm performance. European Economic Review 102(C):19-38. |

|

|

Hafsi T, Turgut G (2012). Boardroom Diversity and its Effect on Social Performance: Conceptualization and Empirical Evidence. Journal of Business Ethics 112(3):463-479. |

|

|

Hahn P, Lasfer M (2016). Impact of foreign directors on board meeting frequency. International Review of Financial Analysis 46:295-308. |

|

|

Hermalin B, Weisbach M (2003). Boards of directors as an endogenously determined institution: a survey of the economic literature. Economic Policy Review pp. 7-26. |

|

|

Hillman RA (2005). On-Line Consumer Standard-Form Contracting Practices: A Survey and Discussion of Legal Implications. Cornell Legal Studies Research pp. 5-12. |

|

|

Ho CK (2005). Corporate Governance and Corporate Competitiveness: an international analysis. Corporate Governance an international Review 13(2):211-253. |

|

|

Hope OK, Heng Y, Zhong Q (2017). Do Politically Connected Directors Affect Accounting Quality? Evidence from China's Anti-Corruption Campaign (Rule 18). Rotman School of Management Working Paper No. 2899403, 5. |

|

|

Iren P (2016). Gender Diversity of Boardrooms and Firm Financial Performance. Risk Governance and Control: Financial Markets and Institutions. Special issue Risk Management and Corporate Governance in Arab Countries 6:3. |

|

|

Ju X, Ferreira FA, Wang M (2020). Innovation, agile project management and firm performance in a public sector-dominated economy: Empirical evidence from high-tech small and medium-sized enterprises in China. Socio-Economic Planning Sciences 72:100779. |

|

|

Kalsie A, Shrivastay SM (2016). Analysis of Board Size and Firm Performance: Evidence from NSE Companies Using Panel Data Approach. Indian Journal of corporate governance 9(2):148-172. |

|

|

Kang H, Cheng M, Gray SJ (2007). Corporate governance and board composition: Diversity and independence of Australian boards. Corporate Governance: An International Review 15(2):194-207. |

|

|

Kang SA, Chun SB (2009). Has The informativeness of accounting numbers improved after accounting regulations in Korea?. International Business and Economics Research Journal 8(7):29-44. |

|

|

Kang SA, Kim YS (2011). Effect of Corporate Governance on Real Activity-Based Earnings Management: Evidence from Korea. Journal of Business Economics and Management 13(1):29-52. |

|

|

Kaplan SN, Klebanov MM, Sorensen M (2012). Which CEO Characteristics and Abilities Matter? Journal of the American Finance Association 67(3):973-1007. |

|

|

Kennedy P (1992). A guide to Econometrics. Cambridge MA, The MIT Press. |

|

|

Kimura F, Kiyota K (2007). Foreign-owned versus Domestically-owned Firms: Economic Performance in Japan. Review of Development Economics 11(1):31-48. |

|

|

Kramarz F, Thesmar D (2006). Social Networks in the Boardroom. Journal of the European Economic Association 11(4):780-807. |

|

|

Kutum I (2015). Board characteristics and firm performance: Evidence from Palestine. European Journal of Accounting Auditing and Finance Research 3(3):32-47. |

|

|

Lambert G, Ghaya H (2016). L'implication du conseil d'administration dans le processus stratégique des entreprises: le particularisme français. Revue de Management International 20 (4) :176-187. |

|

|

Lee S (2018). Employee turnover and organizational performance in US federal agencies. The American Review of Public Administration 48(6):522-534. |

|

|

Lefort F, Urzúa FI (2008). Board Independence, Firm Performance and Ownership Concentration: Evidence from Chile. Journal of Business Research 61(6):615-622. |

|

|

Leong SW, Paramasivam A, Sundarasen S, Rajagopalan U (2015). Board Composition and Companies' Performance: Does Political Affiliation Moderate the Relationship? International Journal of Business and Management 10(10):216-232. |

|

|

Li H, Zhang Y (2007). The Role of Managers' Political Networking and Functional Experience in New Venture Performance: Evidence from China's Transition Economy. Strategic Management Journal 28(8):791-804. |

|

|

Liu Y, Miletkov MK, Wei Z, Yang T (2015). Board independence and firm performance in China. Journal of Corporate Finance 30:223-244. |

|

|

Lückerath-Rovers M. (2013). Women on Board and Firm Performance. Journal of Management and Governance 17(2):491-509. |

|

|

Lynall MD, Golden BR, Hillman AJ (2003). Board Composition From Adolescence To Maturity: A Multi-theoritic View. Academy of Management Review 28: 416-431. |

|

|

Madani W, Khlif W (2010). Effets de la structure de propriété sur la performance des entreprises tunisiennes. La Revue des Sciences de Gestion 243-244:192. |

|

|

Marlin D, Geiger S (2011). The Composition Of Corporate Boards Of Directors: Pre- And Post-Sarbanes-Oxley. Journal of Business and Economics Research 9(2):73-77. |

|

|

Martín C, Herrero B (2018). Boards of directors: composition and effects on the performance of the firm. Economic Research-Ekonomska Istraživanja 31(1):1015-1041. |

|

|

Martins LL, Schilpzand MC (2011). Global virtual teams: Key developments, research gaps, and future directions. In Research in personnel and human resources management. Emerald Group Publishing Limited. |

|

|

Masulis RW, Wang C, Xie F (2017). Corporate Governance and Acquirer Returns. Journal of American Finance Association 62(4):1851-1889. |

|

|

Masulis RW, Wang C, Xie. (2012) Globalizing the boardroom: The effects of foreign directors on corporate governance and firm performance. Journal of Accounting and Economics 53(3):527-554. |

|

|

Mian A, Sufi A, Trebbi F (2010). The Political Economy of the US Mortgage Default Crisis. American Economic Review 100(5):1967-1998. |

|

|

Miletkov M, Poulsen A, Wintoki B (2017). Foreign independent directors and the quality of legal institutions. Journal of International Business Studies 48(2):267-292. |

|

|

Muller-Kahler MI (2014). Board structure: an empirical study of firms in Anglo-American governance environments. Managerial Finance 40(7):681-699. |

|

|

Muravyev D (2016). Order Flow and Expected Option Returns. The Journal of American Finance Association 71(2):673-708. |

|

|

Murphy EC (2013). The Tunisian Elections of October 2011: A Democratic Consensus. The Journal of North African Studies 18(2):231-247. |

|

|

Nam J, Liu X, Lioliou E, Jeong M (2018). Do board directors affect the export propensity and export performance of Korean firms? A resource dependence perspective. International Business Review 27(1):269-280. |

|

|

Nguyen H, Faff R (2007). Impact of board size and board diversity on firm value: Australian evidence. Corporate Ownership and Control 4(2):24?32. |

|

|

Nouri FA, Nikabadi MS, Olfat L (2018). Developing the framework of sustainable service supply chain balanced scorecard (SSSC BSC). International Journal of Productivity and Performance Management 68(1):148-170. |

|

|

Ntim CG, Osei KA (2011). The Impact of Corporate Board Meetings on Corporate Performance in South Africa. African Review of Economics and Finance 2(2):83-103. |

|

|

Pérez-González F (2006). Inherited Control and Firm Performance. American Economic Review 96(5):1559-1588. |

|

|

Randoy T, Thomsen S, Oxelheim L (2006). A Nordic perspective on corporate board diversity Age. Nordic Innovation Centre 390:5428. |

|

|

Rassier DG, Earnhart D (2010). Does the porter hypothesis explain expected future financial performance? The effect of clean water regulation on chemical manufacturing firms. Environmental and Resource Economics 45(3):353-377. |

|

|

Rhode D, Packel A (2014). Diversity on Corporate Boards: How Much Difference Does Difference Make? Delaware Journal of Corporate Law 39(2): 377-426. |

|

|

Rizwan M, Asrar H, Siddiqui NA, Usmani WU (2016). The Impact of Corporate Governance on Financial Performance: An Empirical. |

|

|

Roberts J, McNulty T, Stiles P (2005). Beyond agency conceptions of the work of the non-executive director: Creating accountability in the boardroom. British Journal of Management 16(1):5-26. |

|

|

Rose C (2007). Does female board representation influence firm performance? The Danish evidence. Corporate Governance in International Review 15(2): 404-413. |

|

|

Rouby E (2008). Le lien composition/rôle du conseil d'administration : une analyse en termes de capital social. Finance Contrôle Stratégie 11(2):29-50. |

|

|

Ruigrock W, Peck S, Greve P, Tacheva S (2006). The Determinants and Effects of Board Nomination Committees. Journal of Management and Governance 10(2):119-148. |

|

|

Salah W (2020). The international financial reporting standards and firm performance: A systematic review. Applied Finance and Accounting 6(2):1-10. |

|

|

Schilpzand MC, Martins LL (2010). Cognitive Diversity and Team Performance: The Roles of Team Mental Models and Information Processing. Academy of Management Annual Meeting Proceedings 1:1-6. |

|

|

Sharma P, Cheng LTW, Leug TY (2020). Impact of political connections on Chinese export firms' performance - Lessons for other emerging markets. Journal of Business Research 106:24-34. |

|

|

Song HJ, Yoon YN, Kang KH (2020). The relationship between board diversity and firm performance in the lodging industry: The moderating role of internationalization. International Journal of Hospitality Management 86:102461. |

|

|

St-Onge S, Magnan M (2013). Les femmes au sein des conseils d'administration:bilan des connaissances et voies de recherche futures. Revue Finance Contrôle Stratégie 16(1):25-47. |

|

|

Terjesen S, Couto EB, Maurais P (2015). Does the presence of independent and female directors impact firm performance? A multi-country study of board diversity. Journal of Management and Governance 20(3):447-483. |

|

|

Van den Berghe L, Levrau A (2004) Evaluating Boards of Directors: What Constitutes a Good Corporate Board? Corporate Governance: An International Review 12(4):461-478. |

|

|

Van Veen K, Marsman VL (2008). How international are executive boards of European MNCs? Nationality diversity in 15 European countries. European Management Journal 26(3):88-198. |

|

|

Wang D, Sun D, Yu X, Zhang Y (2014). The impact of CEO duality and ownership on the relationship between organisational slack and firm performance in China. Systems Research and Behavioral Science 31(1):94-101. |

|

|

Wen W, Cui H, Yun K (2020). Directors with foreign experience and corporate tax avoidance. Journal of Corporate Finance 62(C):101624. |

|

|

Xu QLP, Jiraporn P (2013). Board characteristics and Chinese bank performance. Journal of Banking and Finance 37(8):2953-2968. |

|

|

Yagli I, Unlu U (2016). Corporate Governance and Brand Value. European Journal of Business and Management 8(15):65-73. |

|

|

Zouari SBS, Taktak NB (2014). Ownership structure and financial performance in Islamic banks: Does bank ownership matter?. International Journal of Islamic and Middle Eastern Finance and Management 7(2):146-160. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0