ABSTRACT

It has remained a paradox whether people will be motivated if they believe that strong effort will lead to good performance and good performance will lead to desired rewards. Studies in this area have reported conflicting findings. To this end, the study examines the effect of executive compensation and share ownership on financial performance of listed Deposit Money Banks in Nigeria. Executive compensation variables were proxied with Chief Executive Officer (CEO) Pay, Chairman’s compensation and highest paid director, while percentage of shares owned by executive represent the share ownership. Financial performance was measured using net interest margin. Robust Ordinary Least Square regression technique was used for the estimation, while Stata 13 was employed as tool of data analysis. Secondary source of data was utilized and were obtained from the annual reports and accounts of the banks over the period 2007-2018. Robustness tests such as normality test of error term, multicollinearity and heteroscedasticity tests were conducted to validate the results. The findings reveal that, CEO Pay has significant positive effect on financial performance of banks, while chairmen compensation and highest paid director have negative influence on financial performance of banks. Furthermore, the increase in share ownership of the executives in the banking sector is an effective means through which the financial performance of the banks could be enhanced. It is therefore recommended that the management should tie the payment of CEO of the banks to performance. The regulators such as Central Bank of Nigeria and Securities and Exchange Commission) should encourage the banks management to be mindful when increasing the level of compensation paid to chairmen and highest paid directors without commensurate share ownership in the banks by them as they may become complacent towards encouraging increased financial performance.

Key words: Net interest margin, executive compensation, share ownership and pay-performance theory.

Executive compensation is composed of the financial and non-financial compensation or rewards received by an executive from their firm for services rendered to the organization (Farouk et al., 2015). Executive

compensation differs substantially from typical pay packages for either hourly workers or salaried management and professionals in that executive pay is heavily biased toward rewards for actual results. Hence if a company underperforms, the executives typically receive a smaller fraction of their potential pay. Executives who are improperly compensated may not have the incentive to perform in the best interest of shareholders, which can be costly for those shareholders. Series of empirical studies have been conducted to assess executive compensation importance on organizational financial performance.

However, there is still lack of agreement on the main characteristic of executive compensation and performance concepts as to what it really represent (Bebchuk et al., 2002). This may be due to the vagueness and intangibility of the terms (Ferri and Meber, 2009), its ambiguity (Eriksson, 2005) or simply to the fact that, compared to other reward systems, executive compensation appeared as a legitimate area of inquiry in the main stream management literature in most recent time in Africa (Denis et al., 2006).

The question on executive compensation and how much to be paid is increasingly becoming a target by media, shareholders, policy makers and government regulators which saw the Central Bank of Nigeria (CBN) in its prudential guidelines for deposit money banks requiring all compensations and bonuses paid and payable to executive directors of all banks including profit sharing arrangements and share options to be fully disclosed in the annual audited financial statements. It has been questioned why executives continue to receive bonuses and other benefits despite the fact that their companies are making losses and decreasing shareholder value (Aduda, 2011).

In the recent years there has been a debate about the level of compensation and the bonuses given to CEOs triggering their rationality and justifications. One may ask, are these CEOs being paid for their performance or is it just a trend everyone is following? In the past we have seen that the CEOs’ pay has been increased without being justified by their performances (Ferri and Maber, 2009). They further asserted that countries like Britain have developed new legislations like “say on pay” to control the pays of the chief executive officer and influence it through the voice of the shareholders.

However, the debate of CEOs being paid exorbitant sums is not a new one. Investors expect the CEO who is being paid high to perform and prove his worth. According to Deysel and Kruger (2015), the average CEO compensation is about 209 times that of a typical U.S factory worker. Although in other countries like Germany and Japan, it is not that high (25 and 20 times respectively), but still great disparity exists between the two classes. Conventionally the executive compensation had been linked to performance and it was deemed that the high pay for a CEO (for his/her expertise) was justified. But there has been an exponential increase in all the pay levels of CEOs irrespective of their performances (Deysel and Kruger, 2015).

It is also believed that when executives own large shares in the organization in which they manage, their interest may become aligned with that of other shareholders and as such act in the best interest by ensuring higher financial performance. Higher percentage of shares held by executive directors is expected to translate into higher return for them. With this in mind, the executive will pursue increased financial performance in order for their investment through share ownership to attract higher return.

The decision to focus on the deposit money banks (DMBs) stems from the point that the banking is one of the vibrant sectors that drive the economy of Nigeria. There is a need for adequate focus on such sector. Also, the justification for choosing DMBs is premised on the fact that, it is still an area with paucity of studies on this topic also particularly in terms of investigating the banks based on high and low levered categories.

The listed deposit money banks in Nigeria cannot be exonerated from the bogus executive’s compensation as witness in other parts of the world. Omoregie and Kelikume (2017) argued that there is an increasing interest towards the relationship between executive compensation and bank performance in Nigeria in recent years following the profligate lifestyle of some bank executives. This has raised the question of whether the banking sector performance justifies bank executives' compensation. Hence, the need for this study to examine the effect of executive compensation and share ownership on financial performance of listed deposit money banks in Nigeria. The findings from this study contributed to both practice and theory. The study importance emerged from the fact that the banking sector plays a significant role in enhancing the country economy, and providing critical services for people in Nigeria. As such, the continuous existence and financial strength is very paramount, hence the need for the study in examining factors that enhances the banks financial performance. The remaining part of the paper covers empirical literature review and review of theory underpinning the research. Methodology adopted was also discussed followed by the results and discussion of the findings. The paper ends with conclusion and recommendations from the findings.

LITERATURE REVIEW AND THEORETICAL FRAMEWORK

Yamina and Mohamed (2017) examine the impact of firms’ performance on executive compensation in France with a sample of 90 companies included in the SBF 120 over 2004 and found that the level of total executive compensation that is linked with relatively improved performance. Yuan et al. (2017) examine the relationship between financial characteristics; corporate governance; executive compensation; say on pay votes and found that there is a stronger association between high CEO pay and low say-on-pay vote support for firms with negative financial performance. It was documented that poor performance in an organization is associated with increase in the sensitivity of CEO pay. Adegoroye et al. (2017)’s findings from majority of the studies show that the executive compensation has a significant effect on firms’ performance. Qiao and Wang (2016) examine the effect of executive compensation of State-owned listed companies on corporate financial performance of 80 companies in Shanghai and Shenzhen between 2013 and 2015 and it was found that a relationship exists between executive compensation and financial performance.

Lindström and Svensson (2016) examine if there is a relationship between the top management variable compensation and firms’ performance in Swedish context and it was found that incentive systems of the top management have no significant effect on firms’ performance. Rampling (2015) investigates the relationship between executive director and CEOs’ remuneration and corporate performance of USA, UK and Australia firms ending 2001 – 2012 of 305 public listed companies. The results revealed that there are significant relationships between corporate financial performance and CEO remuneration. Kutum (2015) reveals no significant relationship could be established between CEO remuneration and bank performance except a weak positive relationship with ROA.

Buachoom (2015)’s study shows that compensation of executives in Thai firms corresponds to firms’ performance, and compensation of executives leads to an improvement in subsequent performance of Thai listed firms.

Hong et al. (2015) findings provide evidence identifying corporate governance as a determinant of managerial incentives for social performance. Demirer and

Yuan (2013) examine effect of executive compensation on firms’ performance in the U.S. restaurant industry. Their results also reveal that compensation in the form of salary affects restaurant firms’ performance negatively. Berthelot et al. (2013) results show that although the tenure of independent directors has a positive impact on senior executives’ compensation, it has no significant impact on corporate financial performance. Manders (2012) research shows that firms’ performance is positively related to the percentage of compensation of CEOs that is equity-based. It also found a much stronger relationship between equity-based compensation and companies’ performance than total compensation and companies’ performance.

Oyerogba et al. (2016) results revealed that a significant positive relationship exists between the directors’ cash incentives, bonus issue of share and earnings per share. The relationship between non cash incentive and earnings per share was insignificant implying that non-cash incentive does not significantly influence earnings per share of companies in Nigeria. Ruparelia and Njuguna (2016) find a significant relationship between board remuneration and DY, but not ROA, ROE, and EPS. Ogbeide and Akanji (2016) find that executive remuneration has negative but insignificant effect on firms’ performance. Sheikh and Khursheed (2016) investigate whether compensation (that is, salary, bonus and allowances) offered to chief executive officers and an executive affects the performance of Takaful (Islamic insurance) companies in Pakistan. Their results indicate that compensation offered to CEOs and executives is statistically significant and negatively related to all performance measures. Kyalo (2015) established that a unit increase in executive compensation has a commensurate decline in ROA for the firms to the extent of 0.027. Based on the aforementioned reviews, the study therefore hypothesized that:

Ho1: CEO Pay has no significant effect on the financial performance of listed deposit money banks in Nigeria;

Ho2: Chairman compensation has no significant effect on the financial performance of listed deposit money banks in Nigeria;

Ho3: Highest paid director has no significant effect on the financial performance of listed deposit money banks in Nigeria.

Ho4: Executive share ownership has no significant effect on the financial performance of listed deposit money banks in Nigeria.

Theoretical framework

The rationale behind pay-for-performance theory is that connecting pay to performance can inspire people to accomplish or manage more noteworthy performance levels (Heneman and Werner, 2005). Along these lines, various types of pay-for-performance plans have been advanced (Park, 2008). The parts of CEO pay are significantly heterogeneous in pay practice over firms and industries. Most executive pay bundles contain four fundamental segments: a base salary, a yearly bonus connected to accounting performance, stock choices, and long-term motivator plans. Additionally, executives take an interest in employee advantage plans furthermore get exceptional advantages, for example, life insurance and supplemental executive retirement plans (Murphy, 1986).

The discussion over CEO remuneration mirrors an observation that CEOs viably set their own pay levels. In many organizations, the last choices over executive pay are made by individuals outside the board of directors who are definitely mindful of the irreconcilable circumstances in the middle of managers and shareholders over the level of pay. Be that as it may, the CEOs and other top managers apply in any event some impact on the level and on the structure of their pay (Jensen and Murphy, 1990). Moriarty (2009) demonstrated that CEOs are, actually, not paid like civil servants, but rather that there is a solid relationship between firms’ performance and CEO compensation. It is additionally enticing to recommend that these issues can be explained by better compensation conspires or enhanced strategies to connection CEO pay to stock performance (Nulla, 2015).

The study adopted the Ex-post facto research design. The design for the study is considered appropriate, in that, it is better in determining the effect of executive compensation on financial performance in our study which permitted prediction. The population of the study was the fourteen listed deposit money banks in Nigeria listed on the Nigeria Stock Exchange (NSE) as at December 31st, 2018. Census approach was adopted by using the entire population to achieve a desirable of precision. This study utilizes secondary data source and data were obtained basically from the published annual reports and accounts of the listed Deposit Money Banks in Nigeria. The robust ordinary least square regression was used. To validate the results from the regression, robustness tests which include multicolinearity test, normality test, heteroscedasticity test and normality test of the standard error were estimated.

Model specification

The following models have been developed following the literatures reviewed in respect of the variables. First the model showing direct relationship between the independent variable and dependent variable is presented and followed by the models where the independent variables were moderated with share ownership as against financial performance.

NIMit = βo + β1CEOPit + β2CCOMit + β3 HPDIit + β4 TCOMit + β5ESOWit + β6FSZit + εit

Where:

NIM= Net Interest Margin (Financial Performance), TQ= Tobin’s Q (Financial Performance), CEOP= CEO Pay, CCOM= Chairman’s Compensation, HPDI= Highest Paid Director,TCOM=Total Compensation, ESOW= Executive Share Ownership, FSZ= Firm Size, ε= Error term, i and t = banks i and year t.

Descriptive statistics

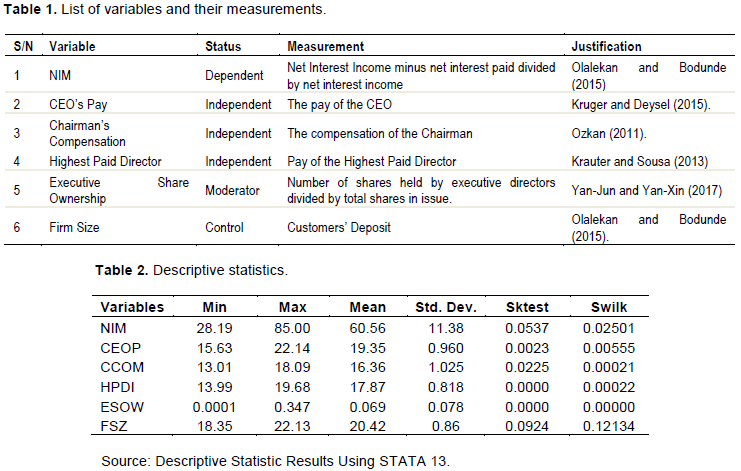

Hejase and Hejase (2013) posit that “Descriptive Statistics deals with describing a collection of data by condensing the amounts of data into simple representative numerical quantities or plot” (p. 272) (Table 1). The descriptive statistics obtained in this research are presented in Table 2 showing the minimum, maximum, mean, Standard deviation, Skewness, Kurtosis and Shapiro wilk of the variables of the study. Data used in this research which were mostly in Naira were converted. For the purpose of analysis, the raw data (Naira) were used.

Table 2 shows the minimum value for financial performance proxied with net interest margin (NIM) which is 28.19 implying that the least value for financial performance was 0.2819 within the banks and period. When compared with the highest level of financial performance, it depicts that NIM was at its highest to the tune of 0.85. The mean value further substantiates the fact that financial performance measured using net interest margin was high within the study period. CEO pay recorded a minimum value of 15.63 and maximum value of 22.14, implying that within the banking sector and the study period, there were banks that pay their Chief executive officer below a million naira indicating the least pay. While the highest pay for CEOs was about 4 million naira within the study period.

Chairman’s compensation had a minimum value of N1,500,000 and a maximum value of N6, 600,000 implying that the lowest amount paid by banks to their chairman on board of directors was at one million five hundred thousand naira; the highest amount paid to the chairman of the board within the study period stood at about six million naira. Highest Paid Director had a minimum value of N1,700,000 and a maximum value of N6,850,000 implying that there was a board of directors whose least pay amongst the highest paid director stood at one million, seven hundred thousand Naira, while, the highest amount recorded for highest paid director amongst the board members was about six million naira.

Executive share ownership recoded a minimum value of much less than 1% and a maximum value of 34.7 for all the banks within the study period. The mean value of about 6.9 implies that, on the average, most of the banks directors occupy at least 7% of the entire shares held in the banks within the study period. The p-value from the Jacque Bera test for normality indicates that only highest paid director and executive ownership variable are normally distributed. This does not in any way affect the inferences to be made from the result.

Correlation analysis

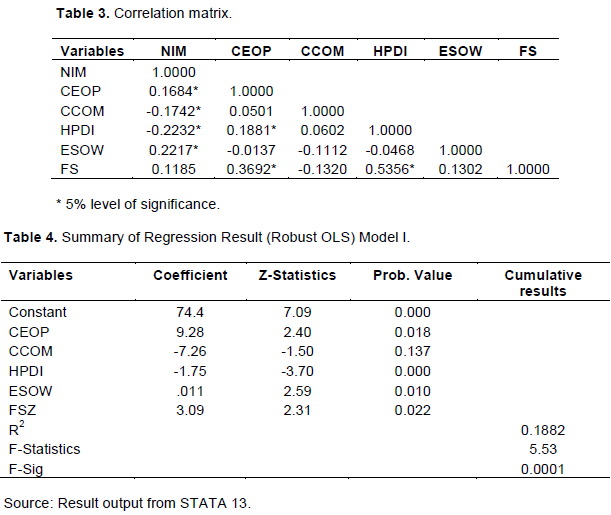

Table 3 shows the Pearson’s correlation values between the dependent and the independent variables. It also shows the relationship amongst the independent variables. Table 3 shows that financial performance represented with NIM is positively correlated with Chief Executive Officer Pay to the tune of about 17%. This implies that financial performance has direct correlation with CEO Pay. Chairman’s compensation is found to have negative relationship with financial performance to the tune of 17% which imply an indirect correlation between the two variables. Financial performance recorded a negative relationship with highest paid director variable at a magnitude of 22%. This shows a correlation between the two variables moves in opposite direction. Executive share ownership has a positive correlation with financial performance of banks in Nigeria thus implying a direct relationship at a magnitude of 22%. Firm size has positive correlation with financial performance at a magnitude of about 11% implying direct relationship between firm size and financial performance.

Generally, the relationships among the independent variables of the study were found to be mostly insignificant as expected. Therefore, on the overall, according to Cassey and Anderson (1999), to establish the presence of multicolinearity, the Variance Inflation Factor (VIF) and tolerance values were estimated (Appendices figures), and thus indicate absence of multicollinearity. To further substantiate this position, the mean VIF of 1.29 was used and it indicates that multicollinearity is not a problem. The allowable VIF is that it must be consistently less than 10 in all situations to be adjudged free from multicolinearity problem. VIF results are similar to what Chehimi et al. (2019) obtained in their research, values of VIF (as shown in this paper’s Appendix) show that these do not exceed 2 indicating no multicollinearity presence. Therefore, “there is no correlation or bidirectional relationship among the predictor variables, and all the predictor or explanatory variables are suitable to form a causal relationship using regression” (p.1911).

Presentation and interpretation of regression results

This section presents the regression results of the parsimonious models of the study. This is followed by its interpretation, analysis, discussion and test of hypotheses. The cumulative R2 of 0.1882 for the study model, which is the coefficient of determination, gave the proportion of the total variation in the dependent variable as explained by the independent variable jointly (Table 4). Hence, it is signified that 18.82% of the total variation in financial performance of listed Deposit Money Banks in Nigeria is accounted for by the variation in CEO pay, Chairman Compensation, highest paid director, executive ownership and the total assets of the banks.

The Fisher Exact Statistics value of 5.53, for the model which is significant at one percent, indicates that executive compensation, share ownership and financial performance model is fit. It implies that for any change in executive compensation and share ownership of the listed Deposit Money Banks in Nigeria, their financial performance will be affected directly. The P-value of Fisher exact test which is statistically significant at a level of 0.0000 for the model implies that there is 99.9 percent probability that the relationship among the variables were not due to mere chance. As such, the results from the regression can be relied upon. In addition, it implies that the independent variables reliably predict the dependent variable of the study.

CEO pay and financial performance

From Table 4, it was observed that the t-value for Chief Executive Officer Pay (CEOP) was 2.40, while the coefficient value was 9.28 with a significant value of 0.018. This signifies that CEO pay has a statistically significant and positive effect on financial performance of listed deposit money banks in Nigeria. This implies that for every increase in the amount of pay to CEO on banks, their financial performance will increase by the coefficient value. This may be because compensation policy is one of the most important factors in an organization’s success which may likely shape the behaviour of the Chief Executive Officers and also helps attract good and competent CEOs. This invariably may lead to higher performance. Based on the findings on the variable, the null hypothesis is hereby rejected.

Chairman’s compensation and financial performance

The regression results revealed that Chairman compensation, as shown in Table 4, have a t-value of -1.50 and a coefficient value of -7.26 which is not statistically significant at 5% level. This indicates that chairman’s compensation has a negative but insignificant effect on financial performance of banks. This implies that for every increase in the amount of chairman’s compensation of listed deposit money banks in Nigeria, the financial performance of banks decreases insignificantly by the coefficient value. This may be as a result of the fact that most pay to chairman are done based on increase in bank size. It is most likely that such pays increase is pegged to bank size and therefore, this translates into reduced performance. Based on the findings in respect of the variable, the null hypothesis two failed to be rejected.

Highest paid director and financial performance

The highest paid director variable has a t-value of -3.70 and a coefficient value of -1.75 which is significant at 1% level. This shows that highest paid director has statistically significant and negative effect on financial performance of banks. This connotes that an increase in the amount received by highest paid director on the board; will decrease the level of financial performance of listed deposit money banks significantly. This may happen if the highest paid director does not contribute to the financial wellbeing of the bank to justify its pay. Ideally, the pay is expected to serve as motivation to do more in terms of efficiency and effectiveness in service delivery. Judging from the findings on the variable, the hypothesis is rejected based on the evidence of impact of the highest paid director on financial performance.

Executive ownership and financial performance

Executive ownership recorded a t-value of 2.59 and a beta value of .011 which is significant at 1%. This indicates that the executive ownership of banks is statistically significant and positively influences their financial performance. This implies that when the amount of shares held by the board of directors’ increases, the financial performance of banks increases significantly. This may be attributed to the fact that when the amount of shares held by managers is increased, their interest may become more aligned with that of other minority shareholders and thereby protect the interest of other shareholders by engaging in activities that will bring about higher return to his investment thereby benefitting other minority share owners. This is expected to affect the financial performance of banks positively. This finding is in line with the studies of Oyerogba, Riro and Memba (2016). However, it is in contrast to those of Abubakar et al. (2018) and Adegoroye et al. (2017).

Bank size and financial performance

The size of the bank measured by their total assets recorded a t-value of 2.31, while the coefficient, in respect of bank size, is 3.09. This is significant at 5% level. It signifies that bank size has statistically significant and positive effect on financial performance of banks. This implies that for every increase in the size of the bank, the financial performance of listed deposit money banks will increase by the coefficient value significantly. This may be as a result of the fact that the level of activity of a bank is important in enhancing its effectiveness in improving performance and, hence, provide the much needed room to accommodate the various executive pays.

Robustness tests

This section presents the results from the robustness tests conducted. The robustness tests include: heteroscedascticity test, multicolinearity test and normality test of error term.

Heteroscedasticity test

Results obtained from the heteroscedasticity tests conducted for the regression indicates heteroskedasticity was not present among the panel of the study. This makes the interpretation of Robust Ordinary Least Square (OLS) because of the non-violation of one the essential assumptions of OLS. According to Chehimi et al. (2019), “If sig-value is less than 0.05, reject the null hypothesis. In this case Breusch-Pagan P=0.87 (Sig P > α = 5%), therefore accepting the Null hypothesis and heteroscedasticity is not present. Therefore, the variance of the errors from the regression is not dependent on the values of the independent variables” (p. 1914).

Normality of the error term (Kernel density)

Normality of the error term was conducted using the kernel density estimate and was found to be tolerably mild and neither skewed to the left or right. It also shows Peakedness of the distribution and the diagram lie almost at the centre of the distribution (See Appendix).

Multicolinearity test

The Variance Inflation Factor (VIF) and the Tolerance test estimated were found to be consistently smaller than ten and one respectively for all the variables (Appendices figures) indicating that multicolinearity was not a problem (Tabachnick and Fidell, 1996).

CONCLUSION AND RECOMMENDATIONS

From the presentation of results, interpretation, analysis and discussions, the study reached the following conclusions that:

(i) High payment to chief executive officers of banks is associated with increased financial performance.

(ii) High compensation to chairmen of the banks’ board is a not guarantee for increased financial performance as it allows the chairman to become complacent over its oversight functions to attract higher performance to the bank.

(iii) Highest paid director compensation increase is associated with less financial performance of listed deposit money banks in Nigeria. Most of the directors who received highest pay are foreign directors; their inability to influence financial performance positively could be their low interest in the banks in terms of share ownership.

(iv) Increase in share ownership of the executives in the banking sector is an effective means through which the financial performance of the banks could be enhanced. This is because the executive high ownership interest in the banks makes them become aligned with that of the minority shareholders thereby protecting interest of the bank by pursuing higher return via increased financial performance.

Following this conclusions, the following recommendations are made in order to enhance financial performance of listed Deposit Money Banks in Nigeria.

(i) On the payment of CEO of the banks, the management should tie their pay to performance. This is expected to increases the level of performance by CEO since their pay is tied to performance.

(ii) The regulators such as Central Bank of Nigeria and Securities and Exchange Commission) should encourage the banks management to be mindful when increasing the level of compensation paid to Chairmen as this may make them become complacent towards encouraging increased financial performance.

(iii) On highest paid directors, the management should decrease the amount paid to them as compensation and increase their ownership stake as this is expected to enhance the financial performance. The banks should give a condition of increased performance as a basis to get higher pay in order to encourage the directors to do more in attracting their performance.

The authors have not declared any conflict of interests.

REFERENCES

|

Abubakar A, Isah S, Usman H (2018). Effect of Firms Characteristics on Financial Performance of Listed Insurance Companies in Nigeria. African Journal of History and Archaeology 3(1):1-9.

|

|

|

|

Adegoroye E, Sunday OM, Soyinka KA, Ogunmola JO (2017). Executive Compensation and Firm Performance: Evidence from Nigeria Firms. International Journal of Advanced Academic Research, Social and Management Sciences 3(7):23-39.

|

|

|

|

|

Adegoroye E, Sunday OM, Soyinka KA, Ogunmola JO (2017). Executive Compensation and Firm Performance: Evidence from Nigeria Firms. International Journal of Advanced Academic Research Social and Management Sciences 3(7):23-39.

|

|

|

|

|

Aduda J (2011). The relationship between executive compensation and firm performance in the Kenyan banking sector. Journal of Accounting and Taxation 3(6):130-139.

|

|

|

|

|

Bebchuk L, Fried J, Walker D (2002). Managerial power and rent extraction in the design of executive compensation. University of Chicago Law Review 69:751-846.

Crossref

|

|

|

|

|

Berthelot S, Bilodeau J, Davignon K (2013). The impact of directors' tenure on executive Compensation and corporate financial Performance. Corporate Ownership and Control 10(2):164-172.

Crossref

|

|

|

|

|

Chehimi MM, Saeed A, Ahmad A, Ahmed AM (2019). Development of Latent Fingerprint: An XPS Study. An Accounts of Chemical Research 4(7):11-19.

|

|

|

|

|

Demirer I, Yuan JJ (2013). Executive Compensation Structure and Firm Performance in the U.S. Restaurant Industry: An Agency Theory Approach. Journal of Food Service Business Research 16(5):421-438

Crossref

|

|

|

|

|

Denis D, Hanouna P, Sarin A (2006). Is there a dark side to incentive compensation? Journal of Corporate Finance 12(3):467-488.

Crossref

|

|

|

|

|

Deysel B, Kruger J (2015). The relationship between South African CEO compensation and company performance in the banking industry. Southern African Business Review 19(1):137-169.

Crossref

|

|

|

|

|

Eriksson T (2005). Managerial pay and executive turnover in the Czech and Slovak Republics. Economics of Transition 13(4):659-677.

Crossref

|

|

|

|

|

Farouk MA, Nafiu MB, Shehu UH (2015). Executive Compensation and earnings management of listed chemical and paints firms in Nigeria. Journal of Global Accounting 3(2):147-153.

|

|

|

|

|

Ferri F, Maber D (2009). Say on pay vote and CEO compensation: Evidence from the UK.

Crossref

|

|

|

|

|

Hejase AJ, Hejase HJ. (2013). Research methods: A practical approach for business students. Masadir Incorporated.

|

|

|

|

|

Heneman RL, Werner JM (2005). Merit pay - linking pay to performance in a changing. Greenwich: IAP.

|

|

|

|

|

Hong B, Li ZF, Minor D (2015). Corporate Governance and Executive Compensation for Corporate Social Responsibility. Journal of Business Ethics 1(2):23-34.

Crossref

|

|

|

|

|

Jensen MC, Murphy KJ (1990). Performance pay and top-management incentives. Journal of Political Economy 98(2):225-264.

Crossref

|

|

|

|

|

Krauter E, da Sousa AF (2013). Executive compensation and corporate financial performance: Empirical evidences on Brazilian industrial companies. Journal of Modern Accounting and Auditing 9(5):650.

Crossref

|

|

|

|

|

Kutum I (2015). Is there a Relation between CEO Remuneration and Banks Size and Performance? International Journal of Accounting and Financial Reporting 5(1):272-285.

Crossref

|

|

|

|

|

Kyalo BW (2015). Relationship between executive compensation and financial performance of commercial state owned Enterprises in the energy sector in Kenya. Being a Master of Business Administration (MBA) Research, School of Business, University of Nairobi.

|

|

|

|

|

Lindström A, Svensson J (2016). Top management compensation and firm performance -A matter of context? Master's Thesis 30 credits Department of Business Studies Uppsala University.

|

|

|

|

|

Manders T (2012). Executive compensation structure and company performance. Being a Premaster Finance, Tilburg University, Bachelor Thesis.

|

|

|

|

|

Moriarty J (2009). How Much Compensation Can CEOs Permissibly Accept? Business Ethics Quarterly 19(2):235-250.

Crossref

|

|

|

|

|

Murphy KJ (1986). Incentives, Learning and Compensation: A Theoretical and Empirical Investigation of Managerial Labor Contracts. Rand Journal of Economics 17:59-76.

Crossref

|

|

|

|

|

Nulla YM (2015). Pay for Performance: An Empirical Review. Corporate Ownership and Control 12(4):86-117.

Crossref

|

|

|

|

|

Ogbeide S, Akanji B (2016). Executive Remuneration and the Financial Performance of Quoted Firms: The Nigerian Experience. Management and Economics Review 1(2):229-242.

|

|

|

|

|

Olalekan OC, Bodunde OO (2015). Effect of CEO Pay on Bank Performance in Nigeria: Evidence from a Generalized Method of Moments. British Journal of Economics Management and Trade 9(2):1-12.

Crossref

|

|

|

|

|

Omoregie OK, Kelikume I (2017). Executive Compensation and Banking Sector Performance: Evidence from Nigeria. Journal of Developing Areas 51(2):1-15.

Crossref

|

|

|

|

|

Oyerogba EO, Riro GK, Memba FS (2016). The perceived relationship between executive compensation package and profitability of listed companies in Nigeria. European Journal of Business, Economics and Accountancy 4(3):11-22.

|

|

|

|

|

Ozkan N (2011). CEO compensation and firm performance: An empirical investigation of UK panel data. European Financial Management 17:260-285.

Crossref

|

|

|

|

|

Park S (2008). The Relative Effects of Pay-For-Performance Plans on Future Performance. A Thesis Presented to the Faculty of the Graduate School of Cornell University.

|

|

|

|

|

Qiao L, Wang L (2016). An Empirical Study of Executive Compensation of State - owned Listed Companies on Corporate Financial Performance. Advances in Computer Science Research 59:233-237.

|

|

|

|

|

Rampling PN (2015). CEO and Executive Director Remuneration Practice and Corporate Financial Performance: A Comparison of Practices in the USA, UK and Australia. Being a PhD thesis submitted to Southern Cross University, Lismore, NSW.

|

|

|

|

|

Ruparelia R, Njuguna A (2016). Relationship between Board Remuneration and Financial Performance in the Kenyan Financial Services Industry. International Journal of Financial Research 7(2):247-255.

Crossref

|

|

|

|

|

Sheikh NA, Khursheed A (2016). Impact of CEO and Executive Compensation on Performance of Takaful: Evidence from Pakistan. Pakistan Journal of Islamic Research 17(2):103-109.

|

|

|

|

|

Tabachnick BG, Fidell LS (1996). Using multivariate statistics . Northridge. Cal.: Harper Collins.

|

|

|

|

|

Yamina A, Mohamed B (2017). The Impact of Firm Performance on Executive Compensation in France. Mediterranean Journal of Social Sciences 8(2):63-69.

Crossref

|

|

|

|

|

Yan-Jun X, Yan-Xin C (2017). Executive compensation and real earnings management: Perspective of managerial power. International Journal of Advances in Management and Economics 6(2):37-47.

|

|

|

|

|

Yuan X, Lin W, Oriaku EA (2017). Financial Characteristics; Corporate Governance; Executive Compensation; Say on Pay Votes. International Journal of Business and Economic Development 5(1):85-94.

|

|