Full Length Research Paper

ABSTRACT

The present paper examines the tax and financial reporting behaviour of Greek public companies after the adoption of International Financial Reporting Standards. Corporate tax aggressiveness is measured on the basis of tax audit data whereas the extent of financial earnings manipulation is captured by total and discretionary accruals. The findings suggest that earnings quality has deteriorated as firms engage in non-conforming earnings management by concurrently manipulating both their tax and accounting earnings. The results are robust for the alternative specifications of earnings management. These non-conforming reporting strategies are depicted in a high level of book-tax differences that has been considered a red flag for corporate misreporting. The research focuses on public firms in an emerging market and a code law country. The findings contradict previous studies in code law countries and highlight the need to analyse the different institutional characteristics among jurisdictions when investigating corporate reporting behaviour. Furthermore, the research reveals extensive earnings manipulation in an accounting environment with strict tax and accounting audit enforcement. The constraints imposed by the clientelistic political system in Greece and the lack of a strong accounting and auditing oversight board are considered to limit the enforceability of tax and accounting regulations.

Key words: Earnings management, tax evasion, book-tax conformity, accrual models, International Financial Reporting Standards (IFRS).

INTRODUCTION

According to the deductive method of reasoning in accounting, different accounting standards may be necessary in order to meet different reporting needs and satisfy different objectives. Hence, the rules for determining the taxable income may be different in many aspects from the generally accepted principles for the determination of financial income (Hendriksen, 1970). Firms prepare their financial statements in accordance with financial standards (e.g. U.S.). Generally accepted accounting principles or international financial reporting standards) in order to provide useful information to investors and creditors (Lyon et al., 2021).

At the same time they report taxable income and tax paid on their tax returns according to domestic laws and regulations. The discretion provided in both systems enables the managers to affect the reporting under each system (Mills, 2019). Firms have two distinct inceptives: to report higher book income for financial reporting purposes and to report lower taxable income for tax reporting purposes (Lee, 2016). Reporting strategies that reduce taxable income but not book income or inflate book income but not taxable income constitute non-conforming earnings management (Hanlon and Heitzman, 2010; Badertscher et al., 2019). Likewise, reporting strategies that reduce both taxable and book income (that is, tax reporting aggressiveness) or inflate both book and taxable income (that is, financial reporting aggressiveness) constitute conforming earnings management (Hanlon and Heitzman, 2010).

The mandatory adoption of International Financial Reporting Standards (IFRS) in numerous countries worldwide has been one of the most noteworthy regulatory changes in recent years (Mao and Wu, 2019). The application of IFRS has increased the gap between book income and taxable income in most of these countries and has directly affected reporting aggressiveness (Dokas et al., 2021). The trade-off between taxes and financial earnings management has motivated a number of research papers (Mills, 2019). The present study builds on extant literature by examining the tax and financial reporting behaviour of Greek public companies after the adoption of International Financial Reporting Standards which reduced the level of book-tax conformity and disconnected the financial and tax earnings. For the purposes of the present paper, tax reporting aggressiveness is measured on the basis of tax audit data whereas financial reporting aggressiveness is estimated both by total and discretionary accruals. The results indicate that firms take advantage of the opportunity provided by the dual reporting system and simultaneously manipulate both accounting and taxable earnings.

The research makes the following contributions to the literature. First, it answers to calls for further examination of the connection between aggressive financial and tax reporting (Lennox et al., 2013). The findings complement prior research by Karampinis and Hevas (2013) who document that the adoption of IFRS in Greece attenuated tax-induced incentives of public firms and released financial reporting aggressiveness. The findings also support previous studies reporting a positive relation between financial and tax reporting aggressiveness (Frank et al., 2009; Wilson, 2009; Lisowsky, 2010; Amidu et al, 2016; Chan et al., 2021). Secondly, corporate tax aggressiveness is examined by relying on tax audit data. Relevant research is limited as the outcomes of the tax audits are confidential in most countries.

Thirdly, the relative performance of alternative discretionary accruals models and their association with tax aggressiveness are evaluated, contributing in this line of research. Consistent with Jones et al. (2008), total accruals are found to be a low cost alternative to many commonly used measures of discretionary accruals in examining aggressive reporting behaviour. Furthermore, the paper extends previous research on the usefulness of book-tax differences (BTDs) as a proxy for tax aggressiveness. Similar to Wilson (2009) and Cappellesso and Rodrigues (2019), the results indicate that firms that are actively engaged in tax aggressiveness also exhibit larger ex post book-tax differences.

Fourthly, the present study contributes to the growing literature examining the impact of tax enforcement on corporate reporting behaviour. Atwood et al. (2012) and Hoopes et al. (2012) provide evidence that firms undertake less aggressive tax positions when tax enforcement is stricter while Hanlon et al. (2014) report that higher tax enforcement by the tax authority is closely linked to enhanced financial reporting quality. The results of the present research contradict previous findings as Greek public firms appear to undertake aggressive tax and financial positions despite the compulsory nature of tax audits. A possible explanation is provided by Slemrod et al. (2001) who posit that high-income taxpayers evade more taxes when they are certain that they will be audited by the IRS in order to ensure that their after-audit tax liability remains stable. In a similar vein, Hoopes et al. (2012) parallel the tax reporting behaviour of firms to that of wealthy individuals, undertaking more aggressive tax positions when a tax audit is likely to occur so as to provide some negotiating room. Another possible explanation is provided by Lin et al. (2018), who argue that tax enforcement is less effective when corporations have strong political connections to the government. Caramanis et al. (2015) provide a thorough analysis of the constraints imposed by the clientelistic political system in Greece on establishing a strong accounting and auditing oversight board.

LITERATURE REVIEW

The book-tax conformity debate has been examined in the literature under different perspectives, with the majority of the studies focusing on the manipulation of financial earnings upwards whereas a smaller number of studies examine tax aggressiveness. Since the level of book-tax conformity cannot be measured directly, researchers either employ an indicator variable to measure conformity or exploit a regulation framework. A wide range of proxies has also been developed in order to estimate financial reporting aggressiveness or corporate tax avoidance. However, as Hanlon and Heitzman (2010) note, not all measures are appropriate for all research questions. Earnings management proxies are not substitutes and researchers should evaluate the appropriateness of certain measures when examining the quality of a firm’s earnings (Dechow et al., 2010). On the other hand, many proxies may actually capture the same thing and researchers should be aware which measures should yield the same results and which shouldn’t and why (Hanlon and Heitzman, 2010).

The extent of book-tax differences (BTDs) in the entity level has served as a useful proxy both for earnings management and for tax reporting aggressiveness. Hanlon (2005) provides evidence that large book-tax differences are associated with aggressive financial reporting. Cappellesso and Rodrigues (2019) analysed the G-20 group and reported a positive association between book-tax differences and tax avoidance for all member countries. On the other hand, Desai and Dharmapala (2009) and Wilson (2009) associate BTDs with tax sheltering. Frank et al. (2009) develop a measure of tax aggressiveness by estimating the discretionary part of the permanent BTDs and provide evidence of a strong, positive relation between aggressive tax and financial reporting.

A large body of research has also sought to detect earnings management by using various accrual measures as proxies for managerial discretion. Starting from Healy (1985), the mean of total accruals (TA) scaled by lagged total assets is used as the measure of nondiscretionary accruals. Similar to Healy, DeAngelo (1986) uses last period’s total accruals scaled by lagged total assets as the estimate of nondiscretionary accruals. Contrary to Healy and DeAngelo models, who assume that nondiscretionary accruals are constant, Jones (1991) attempts to control for the effect of the changing economic circumstances on accounting accruals by regressing total accruals on the change in revenues and gross property, plant and equipment. Dechow et al. (1995) propose a modification to the Jones model, by adjusting it for the change in receivables, in order to capture manipulation in the reported sales. Larcker and Richardson (2004) add two additional independent variables (the book-to-market ratio and operating cash flows) to the modified Jones model (Dechow et al., 1995) in order to mitigate measurement error associated with the discretionary accruals. Kothari et al. (2005) argue that accruals are correlated with a firm’s contemporaneous and past performance and propose the inclusion of a performance variable, such as the return on assets (ROA), in the Jones model.

While aggressive financial reporting has been thoroughly explored in the literature, aggressive tax reporting has been examined to a lesser extent as it is subject to inherent limitations. Tax audit data is considered to be the most reliable source of information but the outcome of the tax audits is confidential in most countries. Consequently, researchers have developed and employed a wide variety of proxies for measuring tax avoidance based on publicly available financial statement data. The most common of these proxies are the effective tax rates and the extent of a firm’s book-tax differences (Hanlon et al., 2007).

Karampinis and Hevas (2013) argue that prior to the implementation of IFRS firms had powerful incentives to restrict upward accounting earnings management due to direct tax implications, which dissipate under the IFRS regime. They find that tax pressure, as captured by effective tax rate, exhibits a significant negative relationship with discretional accruals in the pre-IFRS period but not in the post-IFRS period. Kourdoumpalou (2017) provides corroborative evidence that tax incentives prevail over financial reporting incentives in a highly-aligned book-tax system. By relying on tax-audit data, she finds that tax evasion was widespread among Greek public firms before the application of IFRS, constituting downward earnings management. Kapoutsou et al. (2015) document a significant positive correlation between the level of discretionary accruals and the level of taxation for the Greek listed companies after the implementation of IFRS. On the other hand, Dimitropoulos et al. (2013) find that the introduction of IFRS contributed to less earnings management. Ferentinou and Anagnostopoulou (2016) provide evidence that Greek companies turned from accrual earnings management to real earnings management after the adoption of IFRS.

MATERIALS AND METHODS

Research design and sample selection

Estimation of corporate tax aggressiveness

The potential benefits and costs associated with book-tax conformity have been extensively examined and debated in the literature (Sundvik, 2017). However, the vast majority of the studies refer to Anglo-Saxon countries (USA and UK) whereas other countries and jurisdictions have been rather neglected (Chytis, 2019). Mills (2019) calls for greater research on noisy point estimates that can be sensitive to specification, regulatory regime, time period or variable measurement. Greece provides an institutional context for examining how decreased book-tax conformity, as the result of the mandatory adoption of IFRS, influences a firm’s tax and financial reporting behaviour in an emerging market and a code law country. The results of this research may be generalized to other countries with similar regulatory and institutional characteristics.

Public companies in Greece have been using IFRS since January 2005. Prior to the mandatory adoption of IFRS, the accounting environment was characterized by a high level of book-tax conformity as Greek GAAP applied both for financial and tax reporting purposes. The adoption of IFRS reduced book-tax conformity as public companies prepare their financial statements under IFRS but apply Greek GAAP to accommodate the calculation of taxable income and prepare the tax statement. Greek listed companies have to prepare up to three accounting statements: the tax statement, the parent-only financial statement and the consolidated financial statement (in case of subsidiaries). Each company of the consolidated group (either the parent company or a subsidiary) is treated as a single entity for tax purposes and prepares a separate tax report.

Up to 2010 the Greek pubic companies were obligated, in compliance with Athens Stock Exchange Regulation, to be frequently audited by the Internal Revenue Service and to disclose the outcome of the tax audit on the Official List of Announcements of the Athens Stock Exchange. These announcements, which are under the scrutiny of the Hellenic Capital Market Commission, constitute the source of information for estimating the extent of tax evasion. In line with previous literature (Chan et al. 2010; Hanlon et al. 2007), tax noncompliance is estimated in the present study as the magnitude of the tax audit adjustments (that is, additional tax assessments) required by the tax authorities.

Following Circular 1159/22.07.2011 of the Greek Ministry of Finance, all public companies in Greece were obliged to have their tax returns attested by the statutory auditors for all fiscal years ending on or after 30/6/2011. After the completion of the tax audit, the certified auditors issue a “Tax Certificate” regarding the firm’s compliance with the tax legislation. A firm could be further audited by the tax authorities either on a sample basis or under certain conditions, such as the revelation of fictitious tax records or transactions with non-existent companies. The present study examines corporate tax compliance for the years prior to the mandatory certification of tax statements by audit firms, serving as a benchmark for evaluating alternative tax auditing procedures.

Estimation of earnings management

For the purposes of the present study, both total accruals and discretionary accruals are examined in order to capture the extent of earnings management. Total accruals are calculated using the cash flow approach proposed by Hribar and Collins (2002), defined as operating income minus operating cash flows. Discretionary accruals are estimated by applying five competing discretionary-accruals models frequently used in the literature. Specifically, these are the DeAngelo model (DeAngelo, 1986); the Jones model (Jones, 1991); the modified Jones model (Dechow et al., 1995); the modified Jones model with book-to-market ratio and cash flows as additional independent variables (Larcker and Richardson, 2004) and the modified Jones Model with return on assets included as an additional independent variable (Kothari et al., 2005). The cross-sectional approach of the models is chosen over their time-series counterparts as the adoption of IFRS in 2005 places serious restrictions on the length of the estimation period. The models are described below.

The DeAngelo model

The De Angelo (1986) model measures the extent of non-discretionary accruals as follows:

NDAt = TAt-1 / A t-2 (1)

Where NDA stands for non-discretionary accruals; TA is total accruals; A is total assets and t is a year subscript indicating the event year. The discretionary portion of accruals is then estimated as the difference between total accruals in the event year t scaled by At-1 and NDAt.

The Jones model

Jones (1991) proposes the following expectation model for total accruals:

TAτ / Aτ-1 = a1(1 / Aτ-1) + b1 (ΔREVτ / Aτ-1) + b2 (PPEτ / Aτ-1) + eτ (2)

Where TA is total accruals; A is assets; ΔREV is revenues in year τ less revenues in year τ-1; PPE is gross property, plant and equipment; τ is a year subscript and e is the residual.

The model controls for the changes in non-discretionary accruals that are caused by the economic performance of the firm by including the change in revenues and the amount of gross property, plant and equipment in the expectation model. Ordinary least squares regression analysis is applied in order to obtain the firm-specific estimates α1, β1 and β2 of a1, b1 and b2 respectively. The non-discretionary accruals are estimated in the event year t as:

NDAt / At-1 = α1(1 / At-1) + β1 (ΔREVt / At-1) + β2 (PPEt / At-1) (3)

The modified Jones model

In the modified Jones model (Dechow et al. 1995), the non-discretionary accruals are estimated as follows:

NDAt / At-1 = α1(1 / At-1) + β1 (ΔREVt / At-1 - ΔRECt / At-1) + β2 (PPEt / At-1 (4)

Where REC is net receivables in year t less net receivables in year t-1. The firm-specific parameters α1, β1, β2 are those obtained from the original Jones model and not from the revised one. All other variables are as reported in equation (2). The only amendment to the original model is that the change in revenues in the event period is adjusted for the change in receivables.

The modified Jones model with book-to-market ratio and cash flows

Larcker and Richardson (2004) added two additional independent variables (the book-to-market ratio and operating cash flows) to the modified Jones model (Dechow et al. 1995) so as to mitigate measurement error associated with the discretionary accruals. In model form, it is expressed as follows:

TAτ / Aτ = b0 (1 / Aτ) + b1 (ΔREVτ - ΔRECτ)/ Aτ + b2 (PPEτ / Aτ) + b3 BM + b4 CFO/Aτ + eτ (5)

Where, BM stands for book-to-market ratio and CFO stands for operating cash flows. All other variables are as previously defined. The coefficient estimates from equation (5) are then used to estimate the firm-specific non-discretionary accruals:

NDAt / At = β0 (1 / At) + β1 (ΔREVt - ΔRECt)/ At + β2 (PPEt / At) + β3 BM + β4 CFO / At (6)

The modified Jones model with ROA

Kothari et al. (2005) modify the Jones model by including return on assets (ROA) as a proxy for firm performance. The model is developed as follows:

TAτ / Aτ-1 = b0 + b1(1 / Aτ-1) + b2 (ΔREVτ / At-1) + b3(PPEτ / Aτ-1) + b4(ROAτ) + eτ (7)

All variables are as previously defined. The coefficient estimates from equation (7) are then used to estimate the firm-specific non-discretionary accruals:

NDAt / At-1 = β0 + β1(1 / At-1) + β2 (ΔREVt / At-1) + β3(PPEτ / At-1) + β4(ROAt) (8)

Sample selection

The sample comprises of the listed companies on the Athens Stock Exchange (ASE) from 2005 to 2010. The total number of firms amounts to 237. Firms that were eventually delisted are included to avoid any survivorship bias in the results (Karampinis and Hevas, 2013). Following previous literature, firms from the banking, insurance, real estate and financial services sector are excluded since their financial structure is not comparable to those of other industries. Firms from the shipping industry are also excluded as they are subject to a special tax based on the total gross tonnage of their ships. The reduced sample comprises 199 listed companies.

Tax audit data were hand-collected from the Athens Stock Exchange Official List of Announcements. This procedure yielded results for a total of 141 companies. However, a number of firms announced only the aggregate amount of the tax audit without disclosing the additional taxes that were imposed separately on each of the audited years. These observations are excluded from the analysis. Loss firms are also excluded from the analysis since the outcome of the tax audit revealed underreporting of income without levying additional taxes. This procedure resulted in a final sample of 78 firms and 204 firm-years.

Model development

The relation between tax and financial reporting aggressiveness is examined by estimating the following ordinary least squares regression for the pooled sample:

Tax Aggressiveness = βο + β1 Earnings Management + Σβ2 Control + e (9)

The model is specified as follows:

Log (Tax_Evasion) = b0 + b1 Log (Accruals) + b2 Log (Size) + b3 Liquidity+ b4 Leverage + b5 ROA + b6 CFO + b7 Log (BTD) + b8 NOL+ b9 Audit+ e (10)

(10)

The variables are defined as follows:

Log (Tax_Evasion) = the log of the additional tax assessments

Log (Accruals) = the log of the earnings management proxy employed in the model

Log (DA_DeAngelo) = the log of the absolute value of discretionary accruals derived from the DeAngelo model

Log (DA_Jones) = the log of the absolute value of discretionary accruals derived from the Jones model

Log (DA_Modified_Jones) = the log of the absolute value of discretionary accruals derived from the Modified Jones model

Log (DA_CFO) = the log of the absolute value of discretionary accruals derived from the Modified Jones model with book-to-market ratio and cash flows

Log (DA_ROA) = the log of the absolute value of discretionary accruals derived from the Modified Jones model with ROA

Log (Total_Accruals) = the log of total accruals

Log (Size) = the log of total sales

Liquidity = current assets divided by current liabilities

Leverage = total liabilities divided by total assets

ROA = return on assets

CFO = cash flow from operations divided by total assets

Log (BTD) = the log of the absolute value of book-tax differences

NOL = a dummy variable coded 1 if firm has net operating loss carry forward and 0 otherwise

Audit = a dummy variable coded 1 if firm is audited by the largest Greek audit firm, SOL SA and 0 otherwise

The scope of the present study is to examine corporate reporting aggressiveness in the absence of book-tax conformity. The variable Tax_Evasion serves as the proxy for tax aggressiveness and is estimated as the magnitude of the tax audit adjustments (that is, tax deficiencies) required by the tax authorities (Hanlon et al., 2007; Chan et al, 2010).

Six (6) proxies for earnings management are used and subsequently six (6) different regression models are run. The amount of total accruals serves as one of the proxies whereas the other five (5) proxies derive from the discretionary accrual models previously presented. Consistent with prior research (Hanlon et al., 2014) the overall propensity to earnings management is measured by estimating discretionary accruals in absolute value as accruals can be used opportunistically either to inflate or reduce earnings.

Based on extant literature, eight (8) control variables are included in the model. The variable Log (Size), the natural logarithm of sales revenue, controls for firm size (Hanlon et al., 2007; Perols and Lougee, 2011; Hoopes et al., 2012).

The variable Liquidity, defined as current assets scaled by current total liabilities, is included because a positive relationship has been reported both between liquidity and abnormal accruals and between liquidity and tax evasion (Butler et al., 2004; Caramanis and Lennox, 2008). Following previous studies (Hanlon et al., 2012; Karampinis and Hevas, 2013; Sundvik, 2017), Leverage is estimated as the sum of liabilities to total assets. Return on Assets (ROA) is included to control for the underlying economic activity of the firm (Frank et al., 2009; Wilson, 2009; Lisowsky, 2010; Perols and Lougee, 2011; Armstrong et al., 2012; Hoopes et al., 2012; Sundvik, 2017).

The variable CFO is the cash flow from operations scaled by total assets and is included to control for the potential correlation between tax planning and cash flows (Larcker and Richardson, 2004; Armstrong et al., 2012) as well as between accruals and cash flows (Tsipouridou and Spathis, 2012; Karampinis and Hevas, 2013). For the purpose of the study, the unsigned book-tax differences, denoted as Log (BTD), is regarded as a more appropriate measure of manipulation than their signed values since a firm with positive BTDs does not necessarily imply that its extent of manipulation is larger than that of a firm with negative BTDs (Tang and Firth, 2012). previous literature has documented that the book-tax gap, defined as the difference between book income and taxable income, is consistent with manipulation of earnings reported to capital markets (Hanlon, 2005), tax aggressiveness (Lisowsky, 2010) or some combination of these two activities (Frank et al., 2009).

The existence of a net operating loss carry forward (NOL) is included in the model and has been found to be associated with earnings quality (Frank et al., 2009; Hoopes et al., 2012). Lastly, the quality of the external audit, commonly proxied by auditor size or reputation, is believed to be related to the quality of earnings (Perols and Lougee, 2011). First, audit quality is examined by analyzing whether a firm has been audited by the largest Greek auditing firm, the company of Certified Public Accountants Auditors (S.O.L. S.A. – Synergazomenoi Orkotoi Logistes A.E.). In supplemental analysis, it is examined whether the big-4 auditing firms, which are believed to provide higher quality audits, are able to prevent opportunistic accounting practices.

RESULTS

Univariate analysis

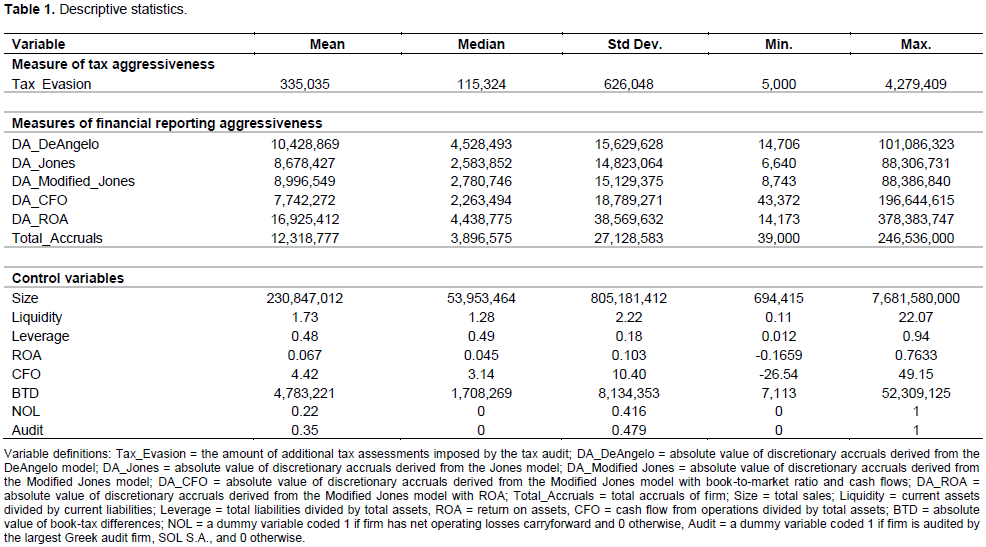

Table 1 presents descriptive statistics on corporate tax evasion, discretionary and total accruals and on the financial characteristics of sample firms. On average, the extent of tax evasion is estimated at €335,035 whereas the average absolute discretionary accruals range from €7,742,272 (Modified Jones model with book-to-market ratio and cash flows) to €16,925,412 (the Modified Jones model with ROA). The mean (median) absolute value of total accruals and book-tax differences reaches €12.3 million (€3.8 million) and €4.7 million (€1.7 million) respectively. The average firm has sales of €230 million (size) and is profitable with a mean (median) ROA of 6.7% (4.5%). The mean current ratio is equal to 1.73 (liquidity) and the mean cash flow to assets ratio is 4.42 (CFO) signalling that the average firm does not encounter liquidity problems. The mean value of total debt to assets is estimated at 48%, showing that no more than half of the average company’s assets are financed by debt. One fifth of the sample (45 out of 204) reports a net operating loss carry forward (NOL). Over one-third of the sample is audited by SOL SA (72 out of 204 firm-year observations) whereas one fifth is audited by a Big-4 audit firm (49 out of 204).

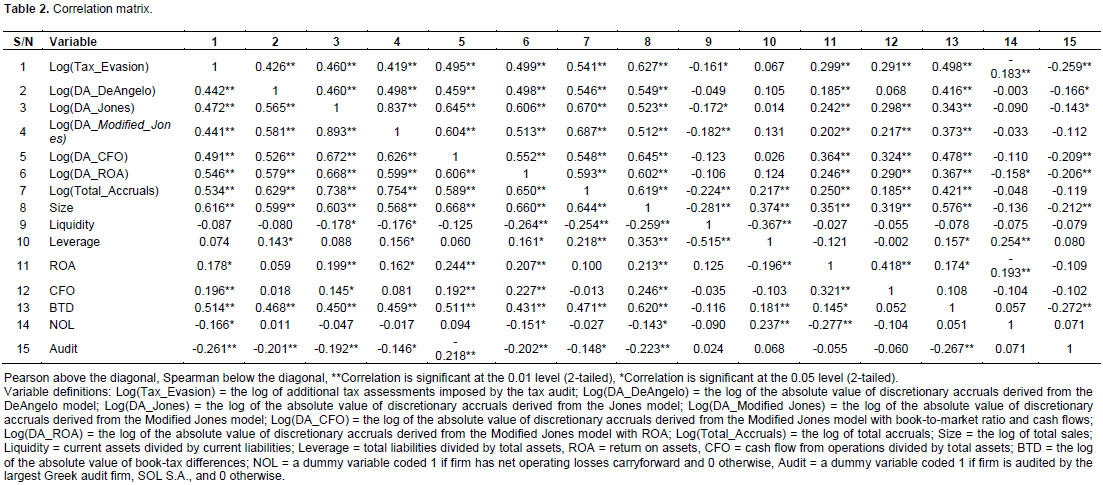

Table 2 presents the pairwise Pearson (Spearman) correlation coefficients above (below) the diagonal for the (logged) variables that are included in the regression analysis. The results reveal a positive and significant correlation between tax evasion and earnings management. Specifically, the pearson correlation between Log(Tax_evasion) and the five (5) alternative models of discretionary accruals, namely Log(DA_ DeAngelo), Log(DA_Jones), Log(DA_Modified_ Jones), Log (DA_CFO) and Log (DA_ROA), is 0.426, 0.460, 0.419, 0.495, 0.499 and 0.541 respectively, significant at the 0.01 level. Tax evasion is also positively and significantly correlated with total accruals. Contrary to Hanlon et al. (2014), all the discretionary accruals measures as well as total accruals are significantly correlated, suggesting that the measures are not different from each other and they probably capture same attributes of reporting quality.

Audit firm is significantly negatively correlated with tax evasion, discretionary accruals proxies, total accruals and book-tax differences, implying that SOL SA, the largest Greek audit company, provides higher quality audits that prevent earnings management.

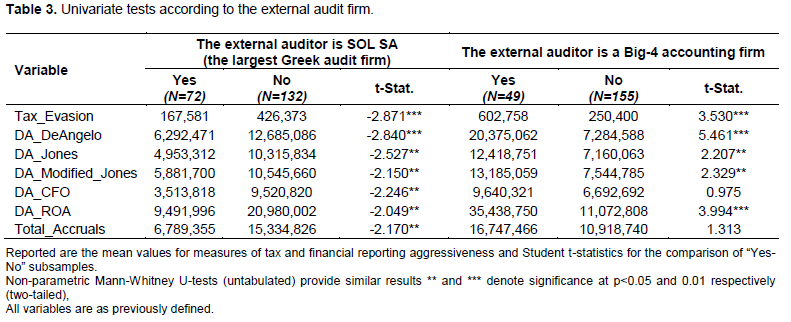

Table 3 reports univariate tests on tax evasion, discretionary accruals and total accruals after having partitioned the sample according to the type of the external auditor. The results indicate that corporate tax evasion and financial reporting aggressiveness, in absolute values, are significantly lower for companies audited by SOL SA. Specifically, the mean differences between the two groups of firms are statistically significant at the 0.05 levels or better for Tax_Evasion, DA_DeAngelo, DA_Jones, DA_Modified_Jones, DA_CFO, DA_ROA and Total_Accruals. If the sample is split into firms that have used a Big-4 auditor or not, it is found that both tax and financial aggressiveness is significantly larger for the firms with a Big-4 audit firms. These results are contrary to the widely held belief that the brand name audit networks are more conservative in their opinions and are more likely to constain opportunistic accounting practices.

Multivariate tests

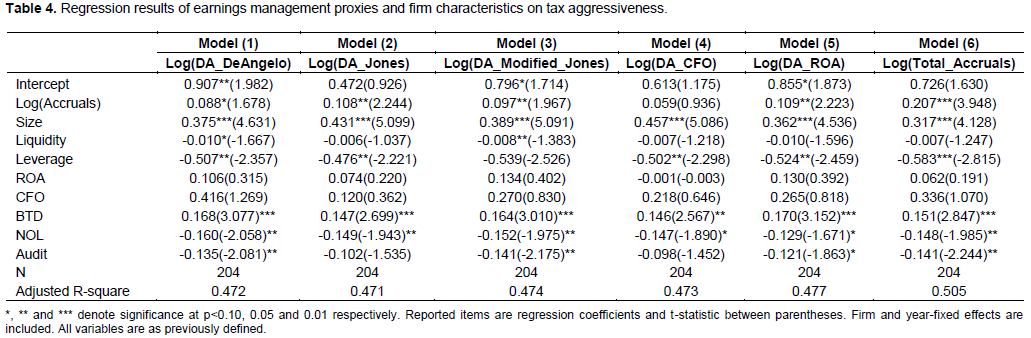

The results for the six (6) estimations of Equation (10) are presented in Table 4. In all estimations, the dependent variable is Tax_Evasion whereas the measure of financial reporting aggressiveness alternates between DA_DeAngelo, DA_Jones, DA_Modified_Jones, DA_CFO, DA_ROA and Total_Accruals. The coefficient on accruals is positive and significant in 5 out of the 6 regressions (p<0.01 for Total_Accruals, p<0.05 for DA_Jones, DA_Modified_Jones and DA_ROA, and p<0.10 for DA_DeAngelo), demonstrating a positive relation between tax and financial reporting aggressiveness. Comparing across regressions, the adjusted R square is higher (0.505) in model six (6), which examines the total accruals, than in the regressions with other measures of financial reporting aggressiveness. Nonetheless, all specifications are associated with a relatively good explanatory power. Consistent with Jones et al. (2008), the results suggest that total accruals could be a low cost alternative to many commonly used measures of discretionary accruals in examining tax aggressiveness.

Regarding the control variables, tax aggressiveness appears to be positively and significantly related to the size of the firm and the magnitude of book-tax differences (BTD) and negatively related to leverage, the presence of net operating losses carry forward (NOL) and the audit firm (Audit). A significant negative coefficient estimate is found for liquidity in 2 models (DA_DeAngelo and DA_Jones) whereas the variables ROA and CFO do not appear to be significant in any of the models. The negative association between the leverage ratio and tax aggressiveness is consistent with the notion that the greater the firm’s tax shield of debt, the lower the need for incremental tax planning (Armstrong et al., 2012). The negative association between auditor type and tax aggressiveness indicates that auditor type mitigates corporate misreporting. This is consistent with the results reported in Table 3, showing that the firms audited by SOL SA, the largest Greek audit firm, exhibit significantly less earnings management. In additional analysis, the impact of a Big 4 audit firm (instead of SOL SA) on earnings management is investigated. However, no significant association has been found (untabulated results).

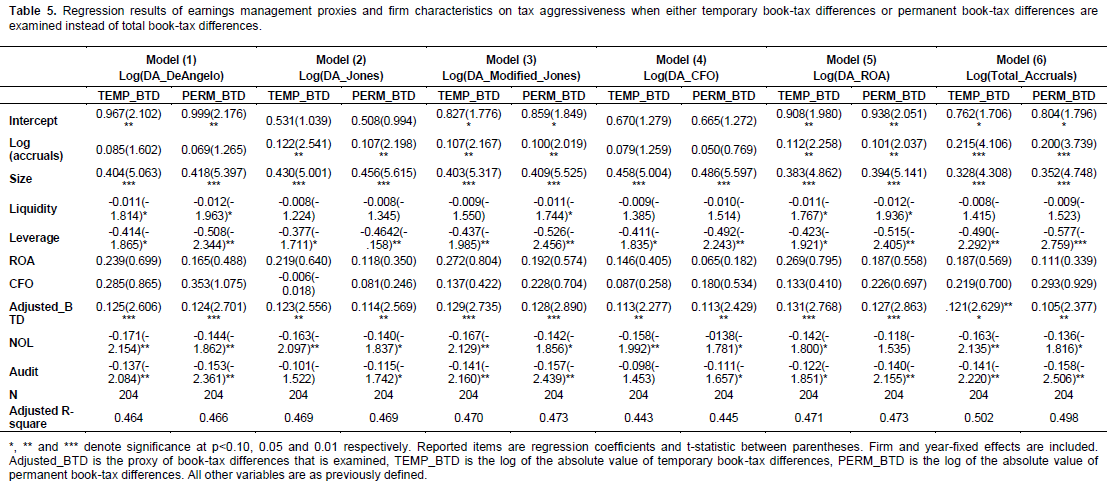

The positive association between book-tax differences and tax evasion suggests that Greek public firms are engaged in non-conforming tax avoidance. Furthermore, this positive association is reported after controlling for accruals in all the models examined. In additional analysis, the effect of temporary and permanent book tax differences is examined separately as each measure suggests a different underlying reason of what is driving the association between tax aggressiveness and book-tax differences (Hanlon et al., 2012). Temporary differences are calculated as the deferred tax expense grossed up by the applicable tax rate whereas permanent BTDs are calculated by subtracting the temporary component of BTDs from the total BTD measure. In Table 5, the results of estimating Equation (10) are presented, but rather than the absolute value of total book-tax differences the absolute value either of temporary book-tax differences (TEMP_BTD) or permanent book-tax differences (PERM_BTD) is included. The results are reported for the six (6) estimations of Equation (10) with the measure of financial reporting aggressiveness alternating between DA_DeAngelo, DA_Jones, DA_Modified_Jones, DA_CFO, DA_ROA and Total_Accruals. In agreement with previous studies (Wilson, 2009), it is found that both components of the BTD measure are positively and significantly associated with tax evasion. The signs and significance of the rest of the control variables remain mostly the same.

DISCUSSION

The findings of the present study suggest that the decreased book-tax conformity, as the result of the IFRS adoption, has deteriorated earnings quality in Greece. Public companies exploit the different accounting regimes for tax and financial accounting purposes and manipulate both their tax and accounting earnings. The results contradict previous studies (Dayanandan et al., 2016; Cappellesso and Rodrigues, 2019), that report a reduction in earnings management in code law countries after the introduction of IFRS. However, according to Dimitropoulos et al. (2013), Greece presents a unique economic environment which differs significantly from other code-law countries. Its accounting framework is characterized by a long history of historical-accounting principles (Dimitropoulos et al., 2013), the Greek accounting setting is heavily based on state regulation (Tsalavoutas and Evans, 2010) and the majority of public firms is characterized by concentrated ownership (Kapoutsou et al., 2015).

The results indicate that larger firms (measured by revenue) manipulate their tax earnings to a greater extent in order to reduce their tax obligations. This finding is consistent with previous studies showing that larger, more complex firms have more opportunities or higher incentives for tax noncompliance (Hanlon et al., 2007; Dyreng et al., 2008) or are engaging in tax shelter activities (Frank et al., 2009; Wilson, 2009; Lisowsky, 2010).

Previous literature has noticed a widening gap between accounting and taxable income as an increasing number of countries has adopted IFRS (Mao and Wu, 2019). The present study reports a positive association between book-tax differences and tax evasion suggesting that Greek public firms are engaged in non-conforming tax avoidance.

Furthermore, this positive association is reported after controlling the accruals in all the models examined. Taking into account that book-tax differences are regarded as an alternative or incremental proxy for accruals (Hanlon et al., 2012), the positive and significant coefficients on both BTDs and (discretionary or total) accruals suggest that the book-tax difference variable is incrementally useful beyond discretionary (and total) accruals in predicting tax evasion. Similarly, discretionary (and total) accruals are incrementally useful to book-tax differences (Badertscher et al., 2009). The fact that the Greek public firms are engaged in non-conforming tax avoidance while concurrently exhibiting significant abnormal accruals indicates that the book-tax gap captures both tax avoidance activities and financial reporting manipulation.

The findings are consistent with previous studies. Wilson (2009) finds that firms actively engaged in tax sheltering exhibit larger ex post book-tax differences and more aggressive financial reporting. Frank et al. (2009) find that total book-tax differences are significant in explaining tax shelter activity whereas they also find a strong, positive relation between aggressive tax and financial reporting. Lisowsky (2010) finds that book-tax differences alone are an informative measure for corporate tax sheltering. Tang and Firth (2011) demonstrate that book-tax differences may be used to capture both financial accounting and tax manipulations. Cappellesso and Rodrigues (2019), examined G-20 countries and provide evidence that the greater the discretion between book and taxable income, the higher the extent of tax avoidance. Mao and Wu (2019) have found using panel data of 137 countries, that the mandatory IFRS adoption has resulted in increased tax avoidance.

The research provides corroborative evidence to previous studies reporting a significant negative association between tax sheltering and leverage (Frank et al., 2009; Wilson, 2009; Lisowsky, 2010; Amidu et al., 2019). A possible explanation, supported in the literature, is that leverage and tax shelter activity are serving as substitutes and thus companies that are tax-avoiders are not highly leveraged. The presence of NOL carryforwards appears to be negatively related to tax aggressiveness. It must be noted that all firms in the sample are in a taxable position after controlling for net operating loss carryforwards. The loss firms had been initially excluded from the analysis. As expected, the NOL carryforwards reduce the taxable income and thus weaken managerial incentives for avoiding more taxes.

The public companies that have been audited by SOL SA, the largest Greek audit firm, appear to be engaged in less earnings manipulation. The results are consistent with previous studies examining the impact of SOL SA on the tax reporting aggressiveness of Greek public companies prior to the introduction of IFRS (Kourdoumpalou and Karagiorgos, 2012). Tsipouridou and Spathis (2012), Karampinis and Hevas (2013) and Ferentinou and Anagnostopoulou (2016) examine the relation between the audit firm and the extent of earnings management (that is, level of discretionary accruals) of Greek companies. No significant association was found in either study. In the international context, the results are contradicting. Jones et al. (2008) find that the use of a Big 4 auditor mitigates accounting fraud and Badertscher et al. (2009) show that misstatement firms are less likely to use a big 4/5/6 auditor. On the other hand, Lisowsky (2010) finds that the use of a Big 5 audit firm is positively related to tax shelter activities. Kanagaretnam et al. (2016) find strong evidence that auditor quality is negatively associated with the likelihood of tax aggressiveness. However, there results are more pronounced in countries where investor protection is stronger, auditor litigation risk is higher and capital market pressure is higher.

CONCLUSIONS

The purpose of this study is to investigate the corporate reporting behaviour of Greek public companies after the mandatory introduction of International Financial Reporting Standards. Using unique tax audit data, the research provides evidence that firms exploit the different accounting regimes that apply for tax and financial accounting purposes and simultaneously manipulate their tax earnings downwards and their accounting earnings upwards (that is non-conforming earnings management). These non-conforming reporting strategies result in a high level of book-tax differences that has been considered a red flag for corporate misreporting (Mills, 2019).

The study contributes to the debate on the costs and benefits of the dual reporting system. First, it examines tax aggressiveness by relying on tax audit data. Relevant research is limited as data from tax returns and audits are not widely available and researchers resort to the development of corporate tax avoidance measures by using financial statement data (Hanlon and Heitzman, 2010; Mills, 2019). Second, whereas there is extensive research either on financial reporting aggressiveness or tax reporting aggressiveness, studies that examine if there is a trade-off between these manipulations or if they are performed simultaneously are rather scarce (Cappellesso and Rodrigues, 2019). The present paper contributes to this line of research.

Third, the sample consists of public firms in an emerging market and a code law country. The findings contradict previous studies in code law countries and highlight the need to analyse the different institutional characteristics among jurisdictions when investigating corporate reporting behaviour. In this context, the paper also empirically answers to calls for greater research on noisy point estimates that can be sensitive to regulatory regime and time period (Mills, 2019). Fourth, the study reveals extensive earnings manipulation in an accounting environment with strict tax (that is, compulsory tax audits) and accounting (that is, audited financial statement) audit enforcement. The constraints imposed by the clientelistic political system in Greece and the lack of a strong accounting and auditing oversight board (Caramanis et al., 2015) may limit the enforceability of tax and accounting regulations.

The results of this study are subject to certain limitations. First, the focus of this study is only accrual-based earnings management. Real earnings management, which is another opportunity for earnings manipulation, is not considered in the analysis. Second, in contrast to the harmonized accounting standards that allow for cross-country comparison, the corporate tax legislation varies greatly from country to country. As a result, the findings may not be generalized to other jurisdictions and further research is warranted.

Future research could incorporate real earnings management in the analysis in order to provide more insight into the tax planning strategies employed by the corporations. Moreover, to further deepen the analysis, future research could focus on private firms that are less subject to the capital market pressures and thus are more likely to adopt book-tax conforming tax strategies (Badertscher et al., 2019). The information regarding tax reporting aggressiveness both of private and public companies in different countries may enhance the policymakers in their attempts to introduce a Common Consolidated Corporate Tax Base in the European Union.

CONFLICT OF INTERESTS

The authors have not declared any conflicts of interests.

REFERENCES

|

Amidu M, Coffie W, Acwuash PH (2019). Transfer prising, earnings management and tax avoidance of firms in Ghana. Journal of Financial Crime 26(1):235-259. |

|

|

Amidu M, Kwakye TO, Harvey S, Yorke SM (2016). Do firms manage earnings and avoid tax for corporate social responsibility? Journal of Accounting and Taxation 8(2):11-27. |

|

|

Armstrong CHS, Blouin JL, Larcker DF (2012). The incentives for tax planning. Journal of Accounting and Economics 53(1-2):391-411. |

|

|

Atwood TJ, Drake MS, Myers JN, Myers LA (2012). Home country tax system characteristics and corporate tax avoidance: international evidence. The Accounting Review 87(6):1831-1860. |

|

|

Badertscher BA, Katz SHP, Rego SO, Wilson RJ (2019). Conforming tax avoidance and capital market pressure. The Accounting Review 94(6):1-30. |

|

|

Badertscher BA, Phillips JD, Pincus M, Rego SO (2009). Earnings management strategies and the trade?off between tax benefits and detection risk: to conform or not to conform? The Accounting Review 84(1):63-97. |

|

|

Butler M, Leone A, Willenborg M (2004). An empirical analysis of auditor reporting and its association with abnormal accruals. Journal of Accounting and Economics 37(2):139-165. |

|

|

Cappellesso G, Rodrigues JM (2019). Book-tax Differences as an Indicator of Earnings Management and Tax Avoidance: An Analysis in the G-20 Countries. Contabilidade Gestão e Governança 22(3):352-367. |

|

|

Caramanis C, Dedoulis E, Leventis ST (2015). Transplanting Anglo-American accounting oversight boards to a diverse institutional context. Accounting, Organizations and Society 42:12-31. |

|

|

Caramanis C, Lennox C (2008). Audit effort and earnings management. Journal of Accounting and Economics 45(1):116-138. |

|

|

Chan KH, Lin KZ, Mo PLL (2010). Will a departure from tax-based accounting encourage tax noncompliance? Archival evidence from a transition economy. Journal of Accounting and Economics 50(1):58-73. |

|

|

Chan KH, Lin KZ, Mo PLL, Wong PW (2021). Does IFRS convergence improve earnings informativeness? An analysis from the book-tax tradeoff perspective. Accounting and Business Research 2021:1-27. |

|

|

Chytis E (2019). The informative value of taxes: The case of temporal differences in tax accounting. Journal of Accounting and Taxation 11(8):130-138. |

|

|

Dayanandan A, Donker H, Ivanof M, Karahan G (2016). IFRS and accounting quality: legal origin, regional, and disclosure impacts. International Journal of Accounting and Information Management 24(3):296-316. |

|

|

DeAngelo LE (1986). Accounting numbers as market valuation substitutes: a study of management buyouts of public stockholders. The Accounting Review 61(3):400-420. |

|

|

Dechow P, Ge W, Schrand C (2010). Understanding earnings quality: a review of the proxies, their determinants and their consequences. Journal of Accounting and Economics 50(2-3):344-401. |

|

|

Dechow P, Sloan R, Sweeney A (1995). Detecting earnings management. The Accounting Review 70(2):193-225. |

|

|

Desai MA, Dharmapala DH (2009). Earnings management, corporate tax shelters and book-tax alignment. National Tax Journal 62(1):169-186. |

|

|

Dimitropoulos E, Asteriou D, Kousenidis D, Leventis ST (2013). The impact of IFRS on accounting quality: Evidence from Greece. Advances in Accounting 29(1):108-123. |

|

|

Dokas I, Leontidis CH, Eriotis N, Hazakis K (2021). Earnings management. An overview of the relative literature. Bulletin of Applied Economics 8(2):25-55. |

|

|

Dyreng SD, Hanlon M, Maydew EL (2008). Long-run corporate tax avoidance. The Accounting Review 83(1):61-82. |

|

|

Ferentinou AC, Anagnostopoulou SC (2016). Accrual-based and real earnings management before and after IFRS adoption: The case of Greece. Journal of Applied Accounting Research 17(1):2-23. |

|

|

Frank MM, Lynch LJ, Rego SO (2009). Tax reporting aggressiveness and its relation to aggressive financial reporting. The Accounting Review 84(2):467-496. |

|

|

Hanlon M (2005). The persistence and pricing of earnings, accruals and cash flows when firms have large book-tax differences. The Accounting Review 80(1):137-166. |

|

|

Hanlon M, Heitzman S (2010). A review of tax research. Journal of Accounting and Economics 50(2-3):127-178. |

|

|

Hanlon M, Hoopes JL, Shroff N (2014). The effect of tax authority monitoring and enforcement on financial reporting quality. The Journal of the American Taxation Association 36(2):137-170. |

|

|

Hanlon M, Krishnan GV, Mills LF (2012). Audit fees and book-tax differences. The Journal of the American Taxation Association 34(1):55-86. |

|

|

Hanlon M, Mills L, Slemrod J (2007). An empirical examination of corporate tax noncompliance. In: Auerbach A, Hines J, Slemrod J (eds.). Taxing Corporate Income in the 21st Century. New York: Cambridge University Press pp. 171-210. |

|

|

Healy PM (1985). The effect of bonus schemes on accounting decision. Journal of Accounting and Economics 7(1-3):85-107. |

|

|

Hendriksen ES (1970). Accounting theory. Richard D. Irwin Incorporated. Illinois. |

|

|

Hoopes JL, Mescall D, Pittman JA (2012). Do IRS audits deter corporate tax avoidance? The Accounting Review 87(5):1603-1639. |

|

|

Hribar P, Collins DW (2002). Errors in estimating accruals: implications for empirical research. Journal of Accounting Research 40(1):105-134. |

|

|

Jones J (1991). Earnings management during import relief investigations. Journal of Accounting Research 29(2):193-228. |

|

|

Jones KL, Krishnan GV, Melendrez KD (2008). Do models of discretionary accruals detect actual cases of fraudulent and restated earnings? An empirical analysis. Contemporary Accounting Research 25(2):499-531. |

|

|

Kanagaretnam K, Lee J, Lim CHY, Lobo GJ (2016). Relation between auditor quality and tax aggressiveness: Implications of cross-country institutional differences. Auditing, a Journal of Practice and Theory 35(4):105-135. |

|

|

Kapoutsou E, Tzovas CH, Chalevas C (2015). Earnings management and income tax evidence from Greece. Corporate Ownership and Control 12(2-5):511-529. |

|

|

Karampinis N, Hevas D (2013). Effects of IFRS adoption on tax-induced incentives for financial earnings management: evidence from Greece. The International Journal of Accounting 48(2):218-247. |

|

|

Kothari SP, Leone AJ, Wasley CE (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics 39(1):163-197. |

|

|

Kourdoumpalou ST (2017). Detecting tax evasion when tax and accounting earnings match. Corporate Ownership and Control 14(2):279-288. |

|

|

Kourdoumpalou ST, Karagiorgos TH (2012). Extent of corporate tax evasion when taxable earnings and accounting earnings coincide. Managerial Auditing Journal 27(3):228-250. |

|

|

Larcker DF, Richardson SA (2004). Fees paid to audit firms, accrual choices and corporate governance. Journal of Accounting Research 42(3):625-658. |

|

|

Lee HA (2016). The usefulness of the tax avoidance proxy: evidence from Korea. Journal of Applied Business Research 32(2):607-620. |

|

|

Lennox Cl, Lisowsky P, Pittman J (2013). Tax aggressiveness and accounting fraud. Journal of Accounting Research 51(4):739-778. |

|

|

Lin KZ, Mills L, Zhanf F, Li Y (2018), Do political connections weaken tax enforcement effectiveness? Contemporary Accounting Research 35(4):1941-1972. |

|

|

Lisowsky P (2010). Seeking shelter: empirically modelling tax shelters using financial statement information. The Accounting Review 85(5):1693-1720. |

|

|

Lyon SC, Kelley T, Margheim L (2021). Does the importance of relevance and faithful representation differ between GAAP and tax reporting? A discussion of the trade-offs between cash-basis, accrual-basis, and fair value accounting methods. Journal of Accounting and Taxation 13(3):144-152. |

|

|

Mao CHW, Wu WCH (2019). Does the government-mandated adoption of international financial reporting standards reduce income tax revenue? International Tax and Public Finance 26(1):145-166. |

|

|

Mills LF (2019). Pursuing relevant (tax) research. The Accounting Review 94(4):437-446. |

|

|

Perols JL, Lougee BA (2011). The relation between earnings management and financial statement fraud. Advances in Accounting 27(1):39-53. |

|

|

Slemrod J, Blumenthal M, Christian CH (2001). Taxpayer response to an increased probability of audit: evidence from a controlled experiment in Minnesota. Journal of Public Economics 79(3):455-483. |

|

|

Sundvik D (2017). Book-tax conformity and earnings management in response to tax rate cuts. Journal of International Accounting, Auditing and Taxation 28:31-42. |

|

|

Tang T, Firth M (2011). Can book-tax differences capture earnings management and tax management? Empirical evidence from China. The International Journal of Accounting 46(2):175-204. |

|

|

Tang T, Firth M. (2012). Earnings persistence and stock market reactions to the different information in book-tax differences: Evidence from China. The International Journal of Accounting 47(3):369-397. |

|

|

Tsalavoutas I, Evans L (2010). Transition to IFRS in Greece: Financial statement effects and auditor size. Managerial Auditing Journal 25(8):814-842. |

|

|

Tsipouridou M, Spathis CH (2012). Earnings management and the role of auditors in an unusual IFRS context: The case of Greece. Journal of International Accounting, Auditing and Taxation 21(1):62-78. |

|

|

Wilson RJ (2009). An examination of corporate tax shelter participants. The Accounting Review 84(3):969-999. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0