ABSTRACT

The objective of this study is to examine the determinants of profit shifting by multinational enterprises in Rwanda. The study specifically sought to determine the extent to which finance costs, intra group transactions / services costs and royalty expense influence profit shifting by multinational companies in Rwanda. Profit shifting was measured on the basis of total cost as well as taxable income reported by multinational enterprises (MNEs). The study was guided by theory of optimal transfer prices, agency theory, and accounting theory. The study adopted a quantitative research design. The target population was 72 MNEs registered in large taxpayer office. Data were collected from the audited financial statements using documentation. Inferential statistics were used to ascertain the determinants of profit shifting. The study found out that there is a positive and significant relationship between intra group transactions / services. The study also shows that there was a negative and significant relationship between finance cost and taxable income. The study also found out that there is a negative and significant relationship between intra group transactions / services and taxable income. The study concludes that a unit change in independent variables influence the total costs as well as taxable income. The study recommends that RRA should come up with a clear law or legislation on transfer pricing.

Key words: Profit shifting, transfer pricing, multinational companies, intra group transactions, Rwanda.

In the light of globalization, there is no country, industry and nation, which were not touched by its positive or negative externalities (Pryma, 2017). Multinational corporations are key players in the changing economic environment due to their ambiguous role in globalization process (Pryma, 2017). The relationship between multinationals and states are becoming more and more complex. One of the aspects of current interest is referred to taxation of the international corporations and particularly income tax.

Several studies have identified the creative use of transfer prices to shift profits from higher tax locations to more desirable locations. The Chinese Government‘s official website stated that, tax evasion through transfer pricing accounts for 60% of total tax evasion by multinational companies. A survey by Richardson and Taylor (2015) showed the association between a series of income shifting incentives including multinational transfer pricing aggressiveness, thin capitalization, intangible assets and tax haven utilization. Their empirical analysis was based on a sample of 286 multinational U.S. firms over the 2006-2012 periods. Their regression results showed that multinational, transfer pricing aggressiveness; thin capitalization and intangible assets are positively associated with tax haven utilization.

Using a firm-level panel dataset covering the universe of Danish exports between 1999 and 2006, Cristea and Nguyen (2016) found robust evidence for profit shifting by multinational corporations (MNC) through transfer pricing in a study entitled “Transfer pricing by multinational firms: New evidence from foreign firm ownerships”. They observed that once owning an affiliate in a country with a corporate tax rate lower than in the home country, Danish multinationals reduce the unit values of their exports there between 5.7 to 9.1%, on average. This reduction corresponds to $141 million in underreported export revenues in year 2006, which translates into a loss in tax income equal to 3.24% of Danish MNEs' tax returns.

In a 2015 survey carried out by Clausing (2015) on the effect of profit shifting on the corporate tax base in the United States and beyond reveals that using Bureau of Economic Analysis survey data on U.S. multinational corporations over the period 1983 to 2012, the analysis estimates the sensitivity of foreign incomes to tax burdens for major foreign direct investment destinations. The researcher finds that taxable income is very sensitive to corporate tax rates. Estimates of tax sensitivity are used together with data on reported foreign income to calculate how much “extra” income is booked in low-tax countries due to profit shifting; he then estimated what the tax base would be in the United States without profit shifting. He found that profit shifting was likely costing the U.S. government between $77 and $111 billion in corporate tax revenue by 2012, and these revenue losses have increased substantially in recent years. These findings are consistent with the stylized facts about large quantities of income booked in tax havens.

In a 2018 study carried out by Blouin et al. (2018) on “Conflicting Transfer Pricing Incentives and the Role of Coordination” revealed that either the presence of a coordinated income tax and customs enforcement regime or coordination between the income tax and customs functions alters transfer prices for these firms. Their analyses had implications for both firms and taxing authorities. Specifically, their findings suggested that MNCs might decrease their aggregate tax burdens by increasing coordination within the firm, or that governments might increase their aggregate revenues by improving coordinating enforcement across taxing authorities.

Richardson et al. (2013) revealed that tax havens may impose none, or only nominal amounts of corporate tax, have laws or administrative practices which prevent the effective exchange of information between tax authorities, and lack transparency on financial and tax arrangements (e.g. regulatory, legal and administrative provisions), and access to financial records (OECD, 2010). Tax havens also promote tax avoidance via transfer pricing by permitting the reallocation of taxable income to low-tax jurisdictions, and by reducing the amount of domestic taxes paid on foreign income (PWC, 2011). Specifically, tax avoidance can be achieved through transfer pricing manipulation by transferring goods to countries with low income tax rates (e.g. tax havens) at the lowest possible transfer price and by transferring goods out of these countries at the highest possible transfer price. Tax havens may thus facilitate transfer pricing aggressiveness by acting as a conduit for the flow of goods and services between countries with established operations and parent firms domiciled in higher taxed countries (OECD, 2014). It is possible that utilization of tax havens may act as a substitute to transfer pricing aggressiveness in terms of achieving reduced group tax liabilities.

KPMG (2014) noted that, the adoption of profit-shifting strategies by MNEs is identified as one of the main causes of base erosion. Transfer pricing forms a significant portion of the tax planning strategies. According to the OECD (2010) report, abusive tax avoidance by MNEs raises serious issues of fairness and compliance. Transfer prices serve to determine the income of both parties involved in the cross-border transaction. The transfer price therefore tends to shape the tax base of the countries involved in cross-border transactions.

Flows of goods and services among related entities of an MNE across different tax jurisdictions are referred to as intra-firm trade and the prices at which these good and services are transferred are called the transfer prices (OECD, 2010). Multinationals operate in different tax jurisdictions and as such the commercial transactions will be subject to different market forces which will influence the nature of relationships among them. To enhance compliance and fair distribution of the tax base among the related entities in a multinational, it is imperative that the transactions among the related entities are carried out at an arms’ length set up (OECD, 2014). Failure to comply with this principle may lead to double taxation where tax authorities from both sides insist on taxing the profits generated to get their share. To avoid this, multinationals set to come up with means to reduce their tax liabilities through manipulation of transfer prices (Azemar and Corcos, 2009).

In Rwanda, most multinational enterprises make loss and their income tax payable on a self-assessment basis is very low. In addition, the controlled transaction entered into with their affiliates abroad has always gone untested to confirm whether they respected the arm’s length principle. It is also a big challenge for the Rwandan tax administrations to obtain pertinent information located outside Rwanda in situations of risks assessment, audits or investigations regarding controlled cross border transactions.

Figures 1 and 2 show how multinational enterprises in different sectors make losses or very low profit due to untested high expenses incurred even after the expected break even period. The information used is sourced from filed income tax returns for the period from 2010 to 2017. From Figure 1 above, the telecommunication sector contributed almost no income tax to the tax administration during the periods from 2010 to 2017. It can be noted that, in some instances, expenses have exceeded the sales whereas losses have been persistent. These are all multinational enterprises whose cost and operating expenses originate from their ultimate parents. This may be due to huge investments but also transfer prices should be tested.

Figure 2 demonstrates how the mining sector in Rwanda is less productive in terms of contribution to income tax. Sales are most of the time equal to expenses incurred. This situation is sometimes normal due to high exploration and analysis expenses. However for the companies which were established some years before 2010, they should be breaking even and getting profits or else they sell to themselves abroad. Most of the transactions taking place in this sector need to be tested and confirm whether they respect the arm’s length principle (Figure 3). The construction sector in Rwanda is booming but it is shocking how less profitable it is and most of the companies contract with the government. In this sector, expenses grow as the turnover grows over the years. However, profits are very low and hence income tax contribution is insignificant. Most of the services and materials are imported from related parties whose prices can easily be manipulated. Construction sites in Rwanda mostly last for more than six months but the tax administration has never endeavored to determine existence of PEs in this regard so that profits attributable to such PEs can be taxed in Rwanda.

Therefore all those transactions need to be tested (Figure 4).

The banking sector shows a growth trend in turnover/sales but profitability seems to be very low and hence income tax payable is very small. This is due to the continuous growth of expenses yet banks do not undertake huge investments other than softwares which are mainly purchased by the parent company and the cost is shared by all the group companies. The cost sharing mechanism may be not at arm’s length. From all the figures elaborating each sector’s contribution to income tax per year in Rwanda, one thing in common is that, most of them incurring losses for a long period may be because of huge investments but also the causes might be profit shifting through service fees, business restructuring, transfer pricing, duplication of some expenses to mention but a few.

Readhead (2016)’s study of public finance policy in developing nations showed that although MNCs contributed to government revenue in form of taxes, they generally tend to pay much less than what they ought to pay due to long tax concession periods, transfer pricing practices, huge investment allowances, disguised public subsidies and tariff protection from the government. These companies lobby using their economic power for policies that are unfavourable for development and they can avoid local taxation and shift profits to affiliates in low tax jurisdictions. This causes a negative effect on the revenues collected by the government from taxation and therefore developing countries are unable to effectively fund their development goals.

According to Niyibizi (2017), in 2013 the value of transaction between associated enterprises was, in average 82.3% in relation to total expenses whereas in 2013, the value was 63.3%. This confirms that MNEs operating in Rwanda have business relationship with their affiliates and the question is to know if their transactions are carried at arm’s length standard. Transacting with related party is not illegal at all, but the tax administration has to ensure that those transactions are at arm’s length. This study therefore examines the determinants of profit shifting by multinational companies in Rwanda. The study was guided by the following research questions:

(i) What are the determinants of taxable profits by multinational companies in Rwanda?

(ii) What are the determinants of total costs of the multinational companies in Rwanda?

THEORETICAL AND CONCEPTUAL FRAMEWORK

Profit shifting can be in the form of tax evasion or tax avoidance. These two practices are used to reduce or avoid tax obligation. Tax evasion refers to failure to pay taxes which are legally due and therefore is a criminal offence, the variable involves practices like: deliberate non-payment of taxes due, declaration of less income, profits or gains in the returns and overstating deductions in the financial returns produce for tax purpose in order to achieve noncompliance (Uwimbabazi, 2017).

Determinants of profit shifting by multinational companies

In a global economy where MNEs play a prominent role, governments need to ensure that the taxable profits of MNEs are not artificially shifted out of their jurisdiction and that the tax base reported by MNEs in their country reflects the economic activity undertaken therein (OECD, 2010). The OECD (2010) has adopted the arm’s length principle in article 9 of the OECD model tax convention to ensure that transfer prices between related companies are established on a market value basis. In this context, the principle means that prices should be the same as they would have been, had the parties to the transaction not been related to each other. This is often seen as being aimed at preventing profits being systematically deviated to lowest tax countries.

The arm’s length standard is instrumental to determine how much of the profits should be attributed to one entity and, consequently, the extent of a country's tax claim on such entity. The OECD (2010) has developed thorough guidelines on how the arm's length principle should be applied in this context. Under this approach, a price is considered appropriate if it is within a range of prices that would be charged by independent parties dealing at arm's length. This is generally defined as a price that an independent buyer would pay an independent seller for an identical item under identical terms and conditions, where neither is under any compulsion to act.

Intra group transactions

According to OECD (2010), companies have the requirements to conduct their related party transactions at arm’s length. This means that the conditions made or imposed between two or more CTPs in their commercial or financial relations should be similar with those which would be made between independent enterprises. Broadly, related party transactions may be grouped into four categories as follows: (i) Tangible goods: this relates to transactions involving purchase/sale of finished goods, raw materials, fixed assets, spare parts etc. (ii) Intangible property: this involves know how (professional and technical supports), trademark, trade name and (iii) Financing arrangement: this will include transactions such as loans, guarantees, cash pooling arrangements and the likes.

Existing corporate tax systems permit deduction of interest payments from the tax base, whereas equity returns to investors are not tax-deductible (Mintz, 2004). This asymmetric treatment of alternative means of financing investment offers firms a fundamental incentive to increase their reliance on debt finance (Mintz, 2004). For multinational companies this incentive is further strengthened by the opportunity to use internal debt as a means to shift profits from high-tax to low-tax countries. Most of the time, debts are in foreign currency and from there, foreign currency risk is obvious. By foreign currency risk we mean the risk that an investment’s value may change due to changes in the value of two different currencies (Engel, 2015). Foreign exchange fluctuation loss on outstanding foreign currency loans is allowed as business expenditure in accordance with chapter 2, section 3(23) of Rwanda income tax law No 016/2018 of 13 April 2018.

Recent empirical research provides conclusive evidence that international tax differentials affect multinationals' financial structure in a way that is consistent with overall tax minimization (Desai et al., 2004; Egger et al., 2009; Huizinga et al., 2008). Moreover, while profit shifting within multinationals can occur through a variety of channels, there are clear empirical indications that the use of financial policies plays an important role in this process (Grubert, 2003; Mintz, 2004; Mintz and Smart, 2004). For this reason, international debt is suspected to be a core factor behind empirical findings that multinational firms seem to pay substantially lower taxes, as a share of pre-tax profits, as compared to nationally operating firms (Egger et al., 2010).

Intangible assets

An increasing number of MNEs’ tax planning strategies imply the relocation of intangible property to low tax affiliates (Dischinger and Riedel, 2011). Others found trademark holding companies in tax havens that own and administer the group brands and licenses. Several studies have so far attempted to explain how MNEs shift intangible related profits from high tax to low tax countries. Fuest et al. (2013) discuss prominent models for IP-based profit shifting. In a nutshell, the parent transfers the right to use its intellectual property to a subsidiary located in a low tax country at a reasonable price and “reasonable tax payment” because determining the arm’s length price for partially developed intangibles is quite difficult.

The other companies in the group will then pay high tax-deductible royalties for the use of the IP held by the IP holding company. The IP holding company will pay little or no tax because it is located in a tax haven for tax purposes. For the jurisdictions where the operating companies are located there will be little or no corporation tax paid as well. According to Fuest et al. (2013), multinational corporations set up branches and subsidiaries in Africa that make a lot of profits, which are “shifted” away along such avenues.

Determinants of profit shifting

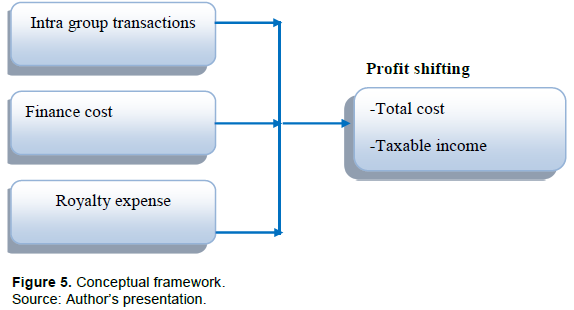

The model proposed in this study (Figure 5) was made up of variables from the tested models of the previous studies. The independent variables of the study are factors of transfer pricing while the dependent variable are profit shifting by MNEs which was measured on the basis of total cost and taxable profits/losses. Independent variables are factors of transfer pricing which contain the elements like intra group transactions / services, finance costs and royalty expenses.

According to OECD (2010), intra group transactions are financial or commercial transactions which involve two companies of the same group simultaneously. The most common example is the issuing of a sales invoice for the supply of goods and services (OECD, 2010). The company issuing the invoice will recognize a receivable in its balance sheet and revenue from the sale on the income statement whereas the purchasing company will have a payable on its balance sheet and an expense on the income statement.

Financing cost (FC), also known as the cost of finances (COF), is the cost, interest and other charges involved in the borrowing of money to build or purchase asset (Mintz, 2004). In this research, finance costs include interests, foreign exchange losses accruing from debt finance and other financing fees involved in the borrowing of money. Royalty fee can be defined as the periodic charge that the owner of a franchised business needs to pay to remain part of the franchise system that provides branding, advertising and administrative support (OECD, 2010).

Here shows the methods and techniques that were used in data collection.

Research design

The study adopted a quantitative research design. According to Hajase and Hajase (2003), the quantitative research design is used when the study involves analysis of numerical data. Since this study involved analysis of numerical figures relating to costs and profits, a quantitative design was considered appropriate.

Study population and sampling

The study population with regard to this study was 72 multinational companies registered on corporate income tax reported by large taxpayer office under the domestic taxes department. This population only consisted of MNEs registered as large taxpayers. Due to the small number of the population, all companies were considered as the sample.

Data sources and research instrument

Data were gathered from audited financial statements. These included income statements, balance sheet, statement of cash flow and statement of changes in equity. Quantitative data on intra group service / transaction, foreign exchange risk and royalty expense were collected from secondary sources (audited financial statements) to measure their effect on profit shifting by MNEs in Rwanda. Also data derived from statistical abstracts (NISR) as well as data from Rwanda Revenue Authority systems were used.

Data analysis

The study used inferential statistics using the Statistical Product and Service Solutions SPSS, an IBM software (Hejase and Hejase, 2013). Data were analyzed by applying a multiple regression analysis. The use of multiple regression analysis was to investigate the extent to which independent variables are associated with dependent variables (Hejase and Hejase, 2013). The findings were presented using tables and graphs. The following multiple regression model was used to analyze the relationship between the dependent and independent variables.

Multicollinearity test

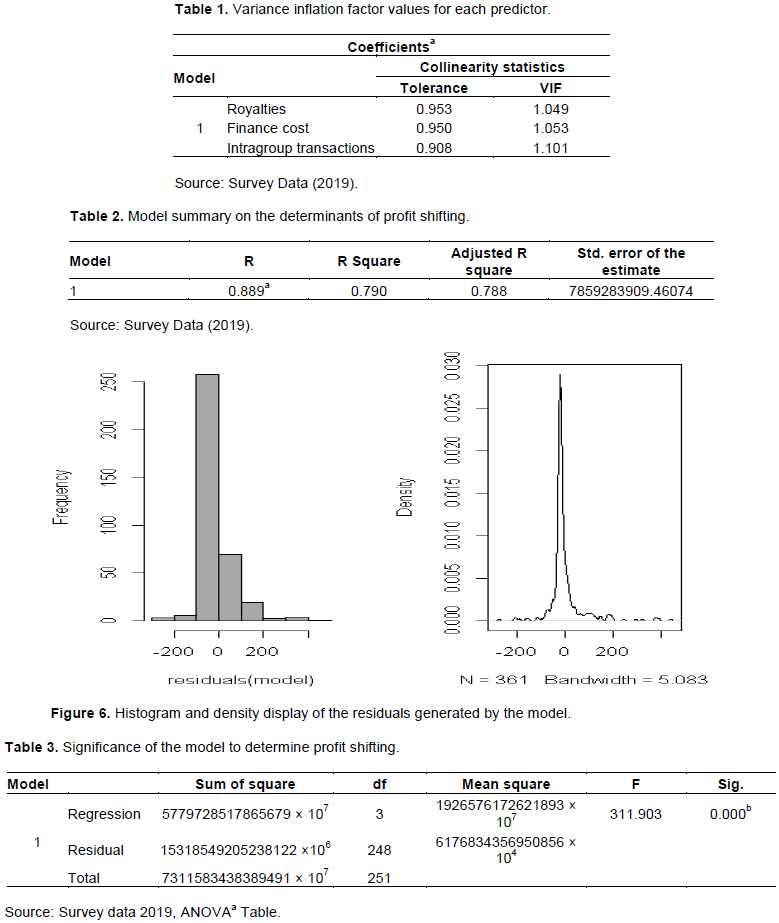

In the following lines, the presence of linear relationship of all the predictors used in the model and their coefficient estimates is examined (Table 1). Variance Inflation Factor (VIF) was analyzed to test for the existence of multicollinearity. Multicollinearity occurs when “two or more independent variables (or combination of independent variables) in a multiple linear regression are highly correlated with each other” (Hejase and Hejase, 2013: 482), meaning that one can be linearly predicted from the others with a substantial degree of accuracy. This leads to problems with understanding which independent variable contributes to the variance explained in the dependent variable, as well as technical issues in calculating a multiple regression model. The VIF for each predictor is quite low compared to the maximum acceptable value of 5, hence absence of co-linearity among them.

Testing violation of the normality assumption of the error term in the model

In the line that follows, the assumption on the error terms in model is examined. These have been assumed to be normally distributed with constant variance. Reading from Figure 6 reveals that these are close to being normally distributed. In fact, the right hand side figure reveals that the standard deviation of the residual is small, since their density tends to conglomerate around the center or the mean. Hence one concludes that there has not been any violation of the normality assumption of the error terms in the model.

In this model validation, it has been confirmed that all predictors used have no linear relationship among them, that is, there are not collinear with respect to one another.

Moreover, the normality assumption on the error terms in the model has been checked and findings reveal that these are close to normal distribution. Hence the model is valid and its results can be trusted.

Determinants of profit shifting and total cost

The purpose of this study is to examine the determinants of profit shifting in multinational companies in Rwanda. Table 2 shows the correlation coefficient and the coefficient of determination. From the table the correlation coefficient is very high (0.889). This means that transfer pricing factors and total cost are highly positively correlated. The coefficient of determination is 0.790 which implies that 79% of the variation of total cost is determined by the variations in intragroup transactions, finance charges and royalties.

ANOVA was conducted to assess whether the data are consistent with the model assumptions or not. This was done on the basis of the null hypothesis stated that “there is no difference between the model without independent variables and the model with independent variables”. From Table 3, the P-Value (0.000) is less than the significance level (0.05), thus there is enough evidence for rejecting the null hypothesis. We can therefore conclude that there is a significant statistical difference between the model without independent variables and the model with independent variables hence the model fits the data.

Table 4 shows the significance of the independent variables. This was done on the basis of the null hypothesis that “the independent variable has no effect on total cost”. The table shows that the P-Values for intragroup transaction/service and finance cost is (0.000) which is smaller than the significance level (0.05), thus there is enough evidence to reject the null hypothesis for these independent variables. We can therefore conclude that intragroup transaction/service and finance cost has significant effects on total cost. The coefficients of these variables are positive meaning that their increase leads to the increase in total costs. The P-Value for royalties (0.221) is greater that the significance level (0.05) we can therefore conclude that royalties has no significant effect on total costs and therefore may be removed from the equation.

The study findings agrees with Bennett (2015)’s report which says that aggressive intra group pricing especially for debt and intangibles has played a major role in corporate tax avoidance and it was one of the issues identified when the OECD released its BEPS’s action plan in 2013. Also Niyibizi (2017)’s research findings confirmed that in 2013 the value of transaction between associated enterprises was, on average, 82.3% in relation to total expenses whereas in 2013, the value was 63.3%. The study confirms that MNEs operating in Rwanda have business relationship with their affiliates and the question was to know if their transactions are carried at arm’s length standard,

TC = 2004136077 + 1.271 (Financecost) + 0.995 (Intrgrtrans) (3)

From the regression Equation 3, we can say that: A unit change in finance cost increases TC by 1.271 units and vice versa keeping all other variables constant. A unit change in intra group transactions / services increases TC by 0.995 units and vice versa keeping all other variables constant.

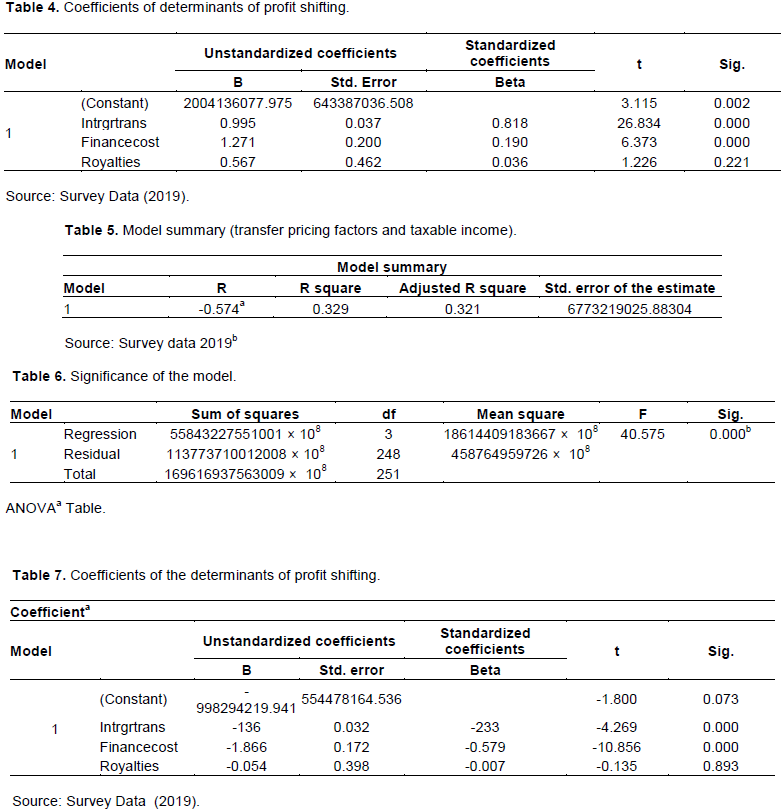

Determinants of profit shifting and taxable income in MNEs in Rwanda

Table 5 shows the correlation coefficient and the coefficient of determination. From the table the correlation coefficient is -0.574. This means that transfer pricing factors and taxable income are negatively correlated. The coefficient of determination is 0.329 which implies that 32.9% of the variation of taxable income is determined by the variations in transfer pricing factors. This means that variations in the intragroup transaction, finance cost and royalty costs only explain 32.9% of the variation in the taxable income.

ANOVA was conducted to assess whether the data are consistent with the model assumptions or not. This was done on the basis of the null hypothesis stated that “there is no difference between the model without independent variables and the model with independent variables”. Table 6 shows that P-value (0.000) is less than the significance level (0.05), thus there is enough evidence for rejecting the null hypothesis. We can therefore conclude that there is a significant statistical difference between the model without independent variables and the model with independent variables hence the model fits the data.

Table 7 shows the significance of the independent variables. This was done on the basis of the null hypothesis that “the independent variables have no effect on taxable income. The table shows that the P-Values for intragroup transaction/service and finance cost is (0.000) which is less than the significance level (0.05), thus there is enough evidence to reject the null hypothesis for these independent variables. We can therefore conclude that intragroup transaction/service and finance cost have significant effects on taxable income. The coefficients for intragroup transaction/service and finance cost are negative meaning than an increase in these variables leads to a decrease in taxable income and vice versa. The P-value for royalties (0.893) is greater that the significance level (0.05), we can therefore conclude that royalties has no significant effect on taxable income and therefore may be removed from the equation.

The study findings agrees with Bennett (2015)’s report which says that aggressive intra group pricing especially for debt and intangibles has played a major role in corporate tax avoidance and it was one of the issues identified when the OECD released its BEPS’s action plan in 2013. Also in Clausing (2015)’s report confirmed that one of the tools used by MNEs is to issue big loans to subsidiaries resulting in thin capitalization and this leads to tax avoidance. A survey by Richardson and Taylor (2015) showed the association between a series of income shifting incentives including multinationality, transfer pricing aggressiveness, thin capitalization, intangible assets and tax haven utilization,

TI = -998294219 – 1.866(Financecost) - 136(Intrgrtrans) (4)

From the regression Equation 4, we can say that: A unit change in finance cost leads to a decreases of TI by 1.866 units and vice versa keeping all other variables constant. A unit change in intra group transactions / services leads to a decreases of TI by 136 units and vice versa keeping all other variables constant.

The study investigated the effect of transfer pricing factors on profit shifting by MNEs in Rwanda. It was conducted on taxpayers registered in large taxpayer’s department. They were all registered on corporate income tax operate. A survey was made on 72 multinational companies (registered on corporate income tax reported by large taxpayer office under the domestic taxes department) were selected. This population only consisted of MNEs registered as large taxpayers. The study used secondary data with the objectives to assess the effect of intra group transactions, to determine the effect of finance costs, to examine the effect of royalty charge and to predict profit shifting in Rwanda. Five quantitative models were tested in this research, after descriptive statistics of the data. The research findings suggest that profit shifting is highly affected by finance costs and intra group transactions / services as the greatest determining factor according to the study results.

POLICY IMPLICATIONS AND RECOMMENDATIONS

Based on the research findings the recommendations are put forward to check on profit shifting as the tax administration strives to increase the tax compliance level of MNEs especially on corporate income tax so as to be able to raise to the government the required tax revenue to finance national expenditure. The recommendations from this study include but are not limited to:

(i) RRA should look at the loopholes that are in current ITA especially on thin capitalization rule which sets limit on interest deductible on loan from related parties that is currently set at 4:1 the amount of equity. This should be the same on foreign exchange losses accruing from interest bearing loans as well as free interest loans. This will limit the finance costs normally claimed by MNEs.

(ii) RRA should closely follow up on the Rwanda treaty policy as regards selecting who to conclude a treaty with, when to conclude it, what to forego, what to achieve from the concluded treaty and when to terminate a treaty. There is also the need to closely monitor the country’s treaty network for RRA to better understand how the tax base is being narrowed and/ or expanded.

(iii) The tax administration has to have in place a clear mechanism of accessing current information regarding international taxation where most multinationals post information regarding their businesses. Those include data bases to mention, but a few. Information exchange tools and procedure will be an important aspect to be taken into consideration at an earlier stage since information needed during the audit process cannot be available only within the country (Rwanda).

(iv) There should be a focus on the use of intangible property by Rwandan subsidiaries of foreign MNEs to ensure that no royalties are paid above what would be paid under an arm’s length consideration.

(v) RRA should put in place the transfer pricing guidelines that will guide MNEs on how to prepare and keep contemporaneous transfer pricing documentation. The preparation and maintenance of transfer pricing documentation will show that the related party transactions are conducted at arm's length and will facilitate reviews by tax authorities and therefore help resolve any transfer pricing issues that may arise.

The authors have not declared any conflict of interests.

REFERENCES

|

Azemar C, Corcos G (2009). Multinational firms' heterogeneity in tax responsiveness: the role of transfer pricing. World Economy 32(9):1291-1318.

Crossref

|

|

|

|

Bennett M (2015). Part II: OECD as a Standard-Setting Organization: Questions Remain on Cultural Acceptance. Tax Executive 67:22.

|

|

|

|

|

Blouin JL, Robinson LA, Seidman JK (2018). Conflicting transfer pricing incentives and the role of coordination. Contemporary Accounting Research 35(1):87-116.

Crossref

|

|

|

|

|

Clausing KA (2015). The effect of profit shifting on the corporate tax base in the United States and beyond. Available at SSRN 2685442.

Crossref

|

|

|

|

|

Cristea AD, Nguyen DX (2016). Transfer pricing by multinational firms: New evidence from foreign firm ownerships. American Economic Journal: Economic Policy 8(3):170-202.

Crossref

|

|

|

|

|

Desai MA, Foley CF, Hines Jr JR (2004). A multinational perspective on capital structure choice and internal capital markets. The Journal of Finance 59(6):2451-2487.

Crossref

|

|

|

|

|

Dischinger M, Riedel N (2011). Corporate taxes and the location of intangible assets within multinational firms. Journal of Public Economics 95(7-8):691-707.

Crossref

|

|

|

|

|

Egger P, Eggert W, Keuschnigg C, Winner H (2009). Corporate Taxation, Debt Financing and Foreign Plant Ownership (No. 2009-01). Department of Economics, University of St. Gallen.

|

|

|

|

|

Egger P, Eggert W, Winner H (2010). Saving taxes through foreign plant ownership. Journal of International Economics 81(1):99-108.

Crossref

|

|

|

|

|

Engel C (2015). Exchange Rates and Interest Parity, Handbook of International Economics vol. 4. Gopinath G,. Helpman E, Rogoff K (eds.).

Crossref

|

|

|

|

|

Fuest C, Spengel C, Finke K, Heckemeyer J, Nusser H (2013). Profit shifting and 'aggressive' tax planning by multinational firms: Issues and options for reform. ZEW-Centre for European Economic Research Discussion Paper, (13-078).

Crossref

|

|

|

|

|

Grubert H (2003). Intangible income, intercompany transactions, income shifting, and the choice of location. National Tax Journal 56:221-242.

Crossref

|

|

|

|

|

Hejase A, Hejase H (2013). Research Methods: A Practical Approach for Business Students (2nd edition). Philadelphia, PA, USA: Masadir Inc.

|

|

|

|

|

Huizinga H, Laeven L, Nicodµeme G (2008). Capital structure and international debt shifting. Journal of Financial Economics 88(1):80-118.

Crossref

|

|

|

|

|

KPMG International (2014). Planning for the recovery: Examining transfer pricing in the current environment and beyond. Available at:

View

|

|

|

|

|

Mintz J (2004). Conduit entities: Implications of indirect tax-efficient financing structures for real investment. International Tax and Public Finance 11(4):419-434.

Crossref

|

|

|

|

|

Mintz J, Smart M (2004). Income shifting, investment, and tax competition: theory and evidence from provincial taxation in Canada. Journal of Public Economics 88(6):1149-1168.

Crossref

|

|

|

|

|

Niyibizi O (2017). La problématique des prix de transfert dans le contrôle des sociétés multinationales au Rwanda: dispositifs et méthodologies de contrôle (Unpublished Master's dissertation). Universite Alioune Diop De Bambey, Cameroun.

|

|

|

|

|

Organisation for Economic Co-operation and Development (OECD) (2010). Transfer Pricing Guidelines for Multinational Enterprises and Tax Administration 2010, para.0.18. Paris: OECD Publishing. Available at:

View

|

|

|

|

|

Organisation for Economic Co-operation and Development (OECD) (2014). Part I of a Report to G20 development working group on the impact of BEPS in low income countries. OCDE (pp. 1-37). Available at:

View

|

|

|

|

|

Pryma K (2017). Transfer pricing and its effect on financial reporting and taxation (Unpublished diploma thesis). Mendel University, Brno.

|

|

|

|

|

PwC (2011). Transfer Pricing and Developing Countries - Final Report. EuropeAid - Implementing the Tax and Development policy agenda (pp. 1-119). Available at:

View

|

|

|

|

|

Readhead A (2016). Preventing tax base erosion in Africa: a regional study of transfer pricing challenges in the mining sector. London: Natural Resources Governance Institute.

|

|

|

|

|

Richardson G, Taylor G (2015). Income Shifting Incentives and Tax Haven Utilization: Evidence from Multinational U.S. Firms. International Journal of Accounting 50(4):458-485.

Crossref

|

|

|

|

|

Richardson G, Taylor G, Lanis R (2013). Determinants of transfer pricing aggressiveness: Empirical evidence from Australian firms. Journal of Contemporary Accounting and Economics 9(2):136-150.

Crossref

|

|

|

|

|

Uwimbabazi H (2017). The determinants of tax compliance on corporate income tax in Rwanda (Unpublished Master's dissertation). INES Ruhengeri, Musanze.

|

|