This paper investigated the effect of capital structure on corporate financial distress of manufacturing firms in Nigeria by employing panel corrected standard error (PCSE) technique. The variables used in the study are corporate financial distress, capital structure, firm size, assets tangibility, revenue growth, profitability and age of firms. The outcome of the research reveals that capital structure affects corporate financial distress negatively while company age from listing years, profitability and asset tangibility affects corporate financial distress positively. The result further revealed that firm growth and firm size affects financial distress negatively. Policy implication from the study is that managers have to be cautious when designing their capital structure. Also, government should encourage firms to use internally generated fund than external fund by granting preferential tax treatment on their retained earnings. This will encourage investment in growth-oriented strategies. In addition, the Central Bank of Nigeria should direct banks to lower the cost of borrowing for manufacturing firms to ensure financial stability.

Financial distress has become a topical issue in almost all the markets in the world. The world in the past two decades has witnessed numerous cases of financial distress and subsequent failure among globally reputable firms. The sudden failure of some firms (Enron, 2001; Swissair, 2001; Pacific Gas and Electric Ltd, 2001; WorldCom, 2002; Conseco, 2002; Parmalat, 2003; Delta Airlines, 2005; General Motors, 2009; The CIT Group, 2009) who once represented the icons of corporate financial stability prior to filing for bankruptcy affected the world greatly and questioned the fundamentals of most of these firms (Muigai, 2016).

Financial distress, which is referred to as a situation where a firm is unable to generate sufficient fund to meet its financial obligations as at when due (Andrade and Kaplan, 1998; Ross et al., 2008; Andualem, 2015), usually arise when firms fail to honour their financial obligation to suppliers and creditors (Eboiyehi and Ikpesu, 2017).

In literature, several empirical studies have accounted for the cause of financial distress in firms to include insufficient cash flows, volatile profitability and decline in assets-liability ratio, loss of confidence by the creditors and suppliers, poor capital structure, weak corporate governance, and severe competitions for factors of production and markets (Outecheva, 2007; Muigai, 2016; Eboiyehi and Ikpesu, 2017). Research findings by Rajan and Zingales (1995) showed that financing decision plays a critical and vital role in determining the interim financial performance of a firm as well as its long-run survival. Empirical studies on financial distress have recognised capital structure as a key variable that influences and determines financial distress (Ohlson, 1980; Altman, 2000; Muigai, 2016; Eboiyehi and Ikpesu, 2017; Muigai and Muriithi, 2017). According to Chen (2007), capital structure refers to the way a firm finances its operation through a mixture of debt and equity or combination of both. It is also referred as the mix of the various forms of financing employed by firms to fund their operations (Fabozzi and Drake, 2009).

Findings by Frank and Goyal (2008) as well as Baimwera and Muriuki (2014), indicates that a high degree of financial leverage exposes firms to high financial risk which often leads to financial distress. This corroborates the assertion of Turaboglu et al. (2017) that capital structure decisions are key element of financial failure. The several cases of failure among globally reputed firms and corporations have tremendously surprised the world and this situation is of grave concern to stockholders, lenders, employees, and stakeholders who include managers, and the government at large. A lot of jobs, personal reputation, the organization’s reputation, basic livelihood are in jeopardy as a result of a firm’s failure (Altman, 2000).

In Nigeria, financial distress has also been a prevalent issue, especially in the banking sector. Between the era 1940s and 1950s, 1989 and 1998, and 2007 to 2010 many of the banks failed in the country due to poor capital structure, assets mismanagement, inadequate skilled personnel, and poor capital base among others (Osaze and Anao, 1990; Ailemen, 2003; Sanusi, 2010). The Nigerian manufacturing sector has also experienced distress, although the distress syndrome appears to be more noticeable and extensive in the banking sector in recent years. The reasons for this development ranged from exchange rate problems, inflation, instability of government policies, poor infrastructural facilities, and other disequilibria in the macro economy. One of the primary causes of financial distress in the country is due to inappropriate capital mix and inadequate capital which are often employed by firms (Salawu, 2007).

The association between capital structure and financial distress has generated a mixed outcome in the literature. For instance, research conducted by Umar et al. (2012); Perinpanatham (2014); Vishnu et al. (2014) as well as Muigai and Muriithi (2017) revealed that capital structure affects financial distress negatively; while studies carried out by Velnampy (2013) and Ogundipe et al. (2012) showed that capital structure affects financial distress positively. In addition, the studies by Kodongo et al. (2015) and Pratheepkanth (2011) revealed that capital structure has no effect on financial distress. Furthermore, various empirical researches conducted by Ogundipe et al. (2012) and Ogbulu and Emeni (2012), revealed that leverage was employed to mitigate firm financial distress; while studies carried out by Modigliani and Miller (1958), and El-Sayed Ebaid (2009) showed that firm financing decision does not affect and determine financial distress. Memba and Nyanumba (2013) on the other hand, argued that in the corporate sector, financing decision is the major cause of financial distress. Ohlson (1980) concluded based on his research findings that the key determinant of corporate financial distress is capital structure. Muigai (2017) research findings showed that debt impact financial distress negatively and significantly but became positive and significant as the firm size increases.

The contradiction in empirical observation is puzzling and provides a need to carry out an incisive investigation on the link between capital structure and corporate financial distress in the country. This study, therefore, investigates the effect of capital structure on corporate financial distress of manufacturing firms within the Nigerian context, using the Altman’s Z-score of corporate financial distress.

The remaining part of this paper is sub-divided as follows: section 2 presents the theoretical review and literature review while section 3 presents econometric issues and model. Section 4 presents and discusses the research outcome, while section 5 presents the conclusion of the research paper.

THEORETICAL REVIEW OF LITERATURE

In reviewing the theoretical literatures, the study focuses on Pecking order theory and trade-off theory as the two leading school of thought in investigating the effect of capital structure on corporate financial distress of firm.

Pecking Order Theory

Donaldson in 1961 was the first to propose this theory. However, Myers and Majluf (1984) modified and popularised the pecking order theory. This theory argued that the financing cost rises with asymmetric information since managers are more knowledgeable in terms of the value, risk, and prospects of the firm than outside investors. The theory asserts that firms prefer to use internal financing than external financing and it is only when the internal financing is exhausted that firms exploit other forms of external financings such as debt and finally equity. Although the pecking order theory has not been able to determine the optimal capital structure of firms, however it supports the need for managers to preserve the financial stability of firms by balancing the different sources of financing option available them (Muigai, 2017).

Trade-off Theory

The trade-off theory which is an extension of the MM theory hypothesizes that the optimal capital structure of firm’s result from the influences of firms and agency, bankruptcy costs and personal taxes. A corporation must, therefore, choose the level of debt that maximizes the benefits from the tax shield. The theory also states that there are associated benefits when a firm is financed with debt (such as tax shield and agency cost benefits) and cost, using debt financing (such as financial distress and agency costs). Thus for a firm to maximise its value, there is need to offset its costs against its benefit of debt financing, when taking a capital structure decision. Ross et al. (2008) opined that a firm can optimize its value when there is equality between marginal costs of debt and marginal benefits of debt.

Lending credence to the trade-off theory, Cook and Tang (2010) in their empirical findings revealed that in those economies that have good economic conditions, firms tend to move faster to their target debt rate when compared to those economies that experience poor economic conditions. When a firm utilizes too much debt to finance its operations, defaulting on its debt exposes such firm to distress costs (Eboiyehi and Ikpesu, 2017). Based on this fact, the trade-off theory proposed the need for tax shield benefit of financing using debt to be adjusted for cost of distress that may arise with a rise in debt level (Brounen and Eichholtz, 2001).

Review of empirical literature

Studies abound in the literature, investigating the effect of firm capital structure on financial distress. One of such studies is the work by Outecheva (2007) who concluded that leverage affects financial distress negatively. Chancharat (2008) research findings showed that while an increase in the debt ratio of firm increases the likelihood of financial failure, the increase in stock return reduces the probability of financial failure. Similarly, Vishnu et al. (2014) research findings revealed that while debt affects financial distress negatively, equity, on the other hand, affects financial distress positively. However, their research findings were inconsistent with previous empirical work of Hadlock and James (2002), who found a positive association between leverage and financial distress of firms.

El-Sayed Ebaid (2009) research findings showed thatthe effect of financial leverage on financial distress is insignificant for firms listed in Egypt stock exchange. In addition, Mule and Mukras (2015) concluded that firm size has a positive relationship with financial distress of listed firms in Kenya during the period 2010 to 2014. Muigai and Muriithi (2017) concluded that firm size has a significant moderating effect between capital structure and financial distress in Kenya non-financial firms. In addition, the study further revealed that financial leverage affects financial distress negatively. In a similar vein, the result of Turaboglu and Topaloglu (2017) research findings also confirmed that in Turkey, debt affects financial distress negatively. This result is also consistent with the trade-off theory that financial leverage increases the chance of financial distress in firms.

Research findings by Velnampy and Nimalathasan (2010) showed that in Sri Lanka, there is a negative link between the size of bank and the probability of financial distress. Their result was ascribed based on the fact that big banks are more spread in their operations and this tends to lower the likelihood of default. Employing a fixed effect dynamic panel model, Chang and Lee (2009) concluded based on the result from their research findings that firm sizes have no association with financial distress. Findings by Maina and Ishmail (2014) showed that asset tangibility affects financial distress negatively. This finding is consistent with the research findings of Muigai and Muriithi (2017) who also found that assets tangibility affects financial distress negatively. Eboiyehi and Ikpesu (2017) concluded in their research findings that capital structure and size of firms affects business distress negatively, while asset tangibility affects business distress positively.

ECONOMETRIC ISSUES AND MODEL

Following similar studies, theoretical postulations and review of relevant literature, and also taking into account the heterogeneity of the coefficient, the variables of interest (Capital structure and corporate financial distress) and other control variables, the empirical model adopted for this study is expressed as:

Where, ALTMA is corporate financial distress, αi is constant, CAPS is capital structure which is represented as the ratio of long-term loan to total asset, and X is a vector of control variables such as Firm size (SZ), Assets Tangibility (ASTANG), Revenue growth (FGROWTH), Profitability (PROFIT), and Age of firms (AGE). The εit is the error term while β, and θ are the parameter coefficients to be estimated in the study.

The panel corrected standard error (PCSE) technique was used in the estimation of the above model. The PCSE technique is used in the estimation of the dynamic heterogeneous panel because it is less sensitive to outlier estimates and it provides an estimate that is free from serial correlation. The technique is employed when working with time-series and cross-sectional data and it produces accurate standard error estimates (Reed and Webb, 2010; Bailey and Katz, 2011; Millo, 2014; Eboiyehi and Ikpesu, 2017).

Data and variable definition

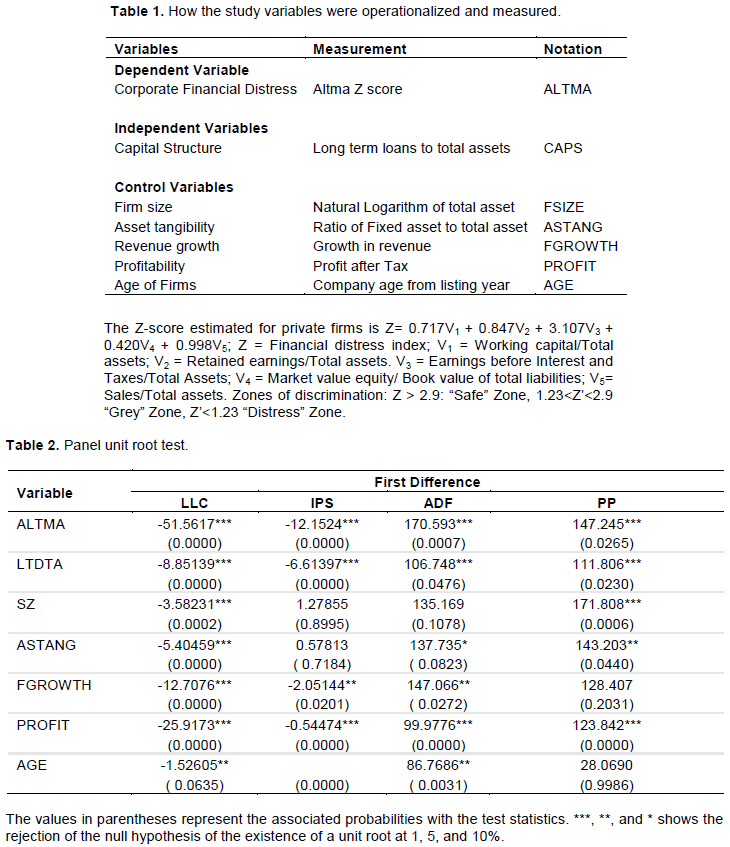

Annual data covering the period 2010 to 2016 for 58 manufacturing firms listed in the Nigerian stock exchange was employed in this study. The covering period and selection of firms in the study were based on the availability of data. The data was sourced from the audited financial statement of the listed firms. The dependent variable used in the study is corporate financial distress (ALTMA) while capital structure (CAPS) is the independent variable. A set of control variables [Firm size (SZ), Assets Tangibility (ASTANG), Revenue growth (FGROWTH), Profitability (PROFIT), and Age of firms (AGE)] were included in the study in line with previous studies. Table 1 shows the variables, definition, and sources of all the variables used in the study.

The stationarity properties of the variables were first examined as a preliminary test prior to investigating the effect of capital structure on financial distress. As shown in Table 2, the result showed that all the variables became stationary at the first difference; hence, the null hypothesis of the existence of unit root test is rejected.

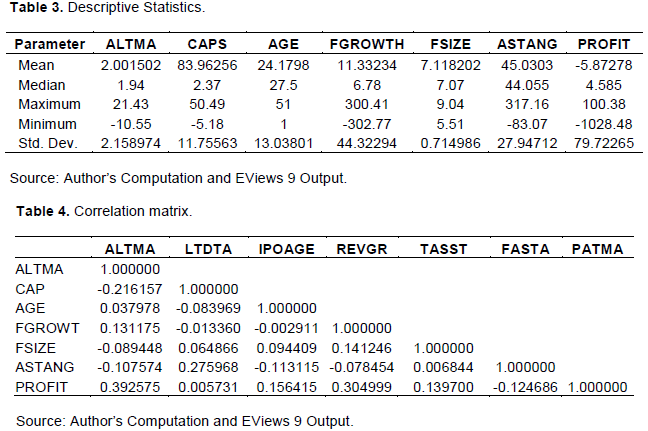

Table 3 shows the descriptive statistics result. This revealed that on the average, the corporate financial distress (ALTMA) of manufacturing firm in the country is 2 years which indicates that manufacturing firms in the country are in Grey Zone. Being in the Grey Zone is an indication that the firms are not in the distress zone and have exceeded the probability of becoming distressed within 2 years.

The result further revealed that the average debt ratio is 84% which indicate the average debt utilized by firms in the country. This implies a high gearing ratio position by the firms with a relatively high variability which could be attributable to the high cost of borrowing due to the prevailing high-interest rate in the country. The average company age from listing year is 24 years as shown in Table 4. The firm revenue growth shows an average of 11.33%. This indicates the growth in the revenue as the listed manufacturing firm in the country grew by 11.33%. The listed manufacturing firm held an average of N7.12 billion worth of total assets with a minimum of N5.51 billion and a maximum of N9.04 billion. This shows that the firms were relatively large. In addition, the result revealed that the average assets tangibility is 45%, which indicates that 45% of the firm’s asset is fixed assets. Also, the average profitability of the firms showed a loss of 5.87%.

Table 4 shows the correlation matrix of all the variables used in the study. The result revealed that the correlation coefficient of all the independent variables is less than 0.8 which suggest that the variables do not have a severe multi-collinearity problem. The result revealed that there is a negative correlation between capital structure and corporate financial distress, firm size, assets tangibility and financial distress, while a positive correlation exist between company age from listing years, firm growth, profitability and corporate financial distress.

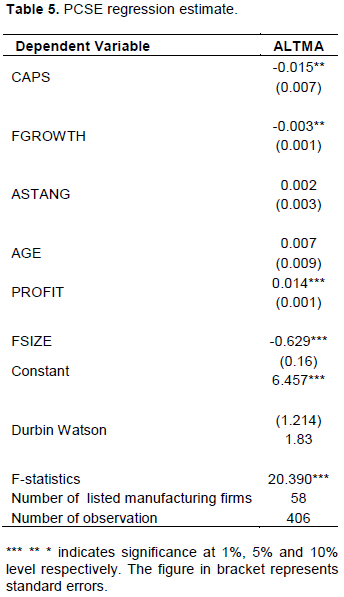

The panel corrected standard error (PCSE) result shown in Table 5 reveals that capital structure affects corporate financial distress negatively. The result of the research could be linked to the high cost of debt financing in the country due to the high-interest rate charged on the borrowed fund. Majority of the manufacturing firm utilizes bank loan in financing their operation which results in a high leverage; however, over-reliance on debt financing exposes the firms to financial distress.

The result of the research findings corroborates with previous research work done by (Umar et al., 2012; Perinpanatham, 2014; Vishnu et al., 2014; Muigai and Muriithi, 2017). The result further showed that the coefficient of listing age of firms is positive and insignificant. This implies that company age from listing years does not play a significant role in determining corporate financial distress of manufacturing firms in the country. Furthermore, the result showed that revenue growth affects corporate financial distress negatively. The implication of this is that firms with positive earnings growth employ less debt financing, hence they experience a lower level of financial distress (Thim et al., 2011).

The study also revealed that firm’s size affects corporate financial distress negatively which implies that large firms will experience a lower level of financial distress compared to smaller firms. The result also shows a positive relationship between assets tangibility and corporate financial distress. The research is consistent with the trade-off theory which posits a positive relationship between assets tangibility and leverage since tangible assets are easier to collateralize and they suffer less loss in value when firms go into distress (Harc, 2015). The findings negate the research outcome of Maina and Ishmail, (2014) as well as Muigai and Muriithi (2017). The PCSE estimates also showed that profitability affects financial distress positively. This suggests that the profitability of firms determines or influence corporate financial distress of manufacturing firms in Nigeria. The Durbin Watson figure of 1.83 indicates that the model is free from autocorrelation. In addition, the p-value of the F-statistics showed that the whole regression is significant and a good fit.