Full Length Research Paper

ABSTRACT

This research studies the impact of leverage on the earnings management levels of firms and investigates the role it plays in determining the choice of earnings management methods utilized by managers. This study is conducted within the context of European countries. Multiple panel regressions are run with leverage against various measures of earnings management. The results indicate that leverage curtails earnings management but this is only limited to discretionary accruals. Firms make a switch to real earnings management in cases of high leverage. The results indicate a positive impact of leverage on total earnings management and leverage moderates the choice between the two forms of earnings management. In the face of high leverage, managers make more use of real earnings management. This study broadens the scope of literature on leverage and earnings management by being the first study to investigate the impact of leverage on the total earnings management of firms and how leverage moderates the choice between the two forms of earnings management.

Key words: Earnings management, leverage, discretionary accruals, real earnings management, trade-off.

INTRODUCTION

The earnings reported by the managers of companies have always been of great importance to stakeholders. However, over the years major scandals that have led companies to bankruptcy have reduced the level of confidence stakeholders have in the quality of reported financial information (García-Meca and Sánchez-Ballesta, 2019). These scandals highlighted the need for quality financial information and effective control mechanisms in financial reporting to secure the trust that should exist between managers and stakeholders of companies (Dilger and Graschitz, 2015). This research assesses the quality of financial reporting from the perspective of earnings management through real activities and discretionary accruals. Managers have the motivation to take opportunistic advantage of the level of discretion available to them to massage earnings or to draw a wrong picture of the organization’s future and this is what is known as earnings management (Christie and Zimmerman, 1994). The occurrence of this act is further corroborated by Aini et al. (2006) where evidence is found that managers have incentives to manipulate financial statements to paint a financial image that aligns with their interests. This reduces the quality of financial statements being published. Besides the usage of discretionary accruals where managers make use of accounting methods to manipulate earnings, Graham et al. (2005) explain that firms make use of actual financial and production decisions to yield preferred results. They detail that about 80% of their survey respondents stated that they make certain economic decisions such as minimizing certain expenses to meet their companies’ profit objectives. This is what Roychowdhury (2006) describes as ‘real activity manipulation’ which is popularly termed as real earnings management (REM). In the view of Roychowdhury (2006), even though this style of managing earnings is detrimental to the growth of the firm in its entirety, managers are motivated to adopt this tactic because it is more difficult to trace.

One notable incentive for earnings management prevalent in the literature is the need to avoid the violation of debt covenants (Healy and Wahlen, 1999). The association between the manipulation of financial information and lending contracts as established by various scholars makes it necessary to investigate the sort of relationship that may exist between earnings management and the leverage of companies. Various researchers who have worked on this link have observed contradictory results. Some studies that have found a positive relationship between leverage and earnings management have supported their argument by explaining that firms increase their levels of earnings management to put companies in better positions to obtain debt financing and also to avoid the violation of debt terms and conditions thereafter (Chamberlain et al., 2014; Iatridis and Kadorinis, 2009; Rodríguez-Pérez and Van Hemmen, 2010; Lazzem and Jilani, 2018). Conversely, another theory suggests that financial institutions and creditors serve as an external monitoring mechanism in a bid to protect their interests. Studies that have made this conclusion observed negative associations between leverage and earnings management (Alsharairi and Salama, 2012; Kutha and Susan, 2021 Rodríguez-Pérez and van Hemmen, 2010; Vakilifard and Mortazavi, 2016; Zamri et al., 2013).

Other spectrums of literature concerning earnings management also establish the existence of schemes where there is a trade-off between accruals earnings management (AEM) and real earnings management (REM). These studies suggest that firms sometimes alternate between AEM and REM depending on the specific circumstance the firms find themselves in (Cohen et al., 2008; Zang, 2012). In this light, Ewert and Wagenhofer (2005) document how managers prefer the use of REM in the event of regulators being stricter on accounting standards. This is a critical position for companies to be in because REM does not only affect the financial books but poses a real-time danger to the existence of the firms. This is because most company managers are ready to misuse resources and forego viable projects to meet certain aims that may not be in the best interest of stakeholders (Graham et al., 2005).

In this research, the aim is to establish what sort of relationship exists between the leverage of firms and their levels of earnings management. This is done by first observing the impact of leverage separately on the two forms of earnings management and then observes this impact on the overall level of earnings management. The study also tries to observe the nature of trade-offs between AEM and REM. This research contributes to the existing literature by building on the established frameworks to explore how leverage impacts total earnings management and how it influences the choice of earnings management between AEM and REM. Some studies have just discussed the impact of leverage on AEM or REM but this research goes a step further to analyze and understand what role leverage plays when companies alternate between the two methods of earnings management. The study is also conducted on a European sample where there is the mandatory adoption of the IFRS which is a principle-based accounting system as compared to the other prominent studies conducted in the US where there is the use of the US GAAP which is a law-based accounting system. The results acquired from this analysis serve as a guide for creditors and debt holders who rely on the quality of financial information. It will generate a sense of cautiousness about the ability of managers to manipulate earnings given specific circumstances.

LITERATURE REVIEW

Earnings management has been documented to be an inevitable part of companies. From a practical point of view, several executives who participated in a survey conducted by Graham et al. (2005) admit that earnings management activities are present in every company. In circumstances where these activities are pervasive, Leuz et al. (2003) state that it limits the ability of primary external stakeholders to effectively oversee the company. Previous studies have documented that firms perpetuate two forms of earnings management. They either decide to focus on AEM and/or REM. In the case of AEM, managers use the judgment accorded them to find loopholes within the accounting system and tweak accounting policies and estimates to align with their goals (Christie and Zimmerman, 1994). On the other hand, real earnings management entails firms deviating from their usual operations and affecting real-time cash flows to lure interested parties into thinking that financial objectives have been accomplished (Roychowdhury, 2006).

According to the free cash flow theory by Jensen (1986), leverage plays the role of a control mechanism by imposing limitations on managers’ access to cash flows and also regulating the discretionary accruals of the firm. This is what is known as the Jensen control hypothesis. By so doing, leverage alleviates the occurrences of agency conflicts between managers and shareholders. Despite leverage having the ability to reduce agency problems and information asymmetry, it also poses a problem of diverging interest between shareholders and debt holders (Lazzem and Jilani, 2018). In the light of this conflict of interest, debt holders initially negotiate their debt contract to include conditions that stipulate profitability thresholds of the companies. When companies fall below these thresholds, debt holders have the right to renegotiate the terms of the original contract to include terms that are less favourable to the companies. Indeed, accounting figures and results form the basis of these terms and conditions and firms will be penalized in the event of breaching any of them. The cost of breaching these covenants may be too hefty for the organization. From this perspective, mangers have a major incentive to manage earnings. This perspective is contrary to the control hypothesis as leverage is rather providing incentives for managers to manipulate earnings.

Many studies have concluded on a mix of results that define the relationship between leverage and earnings management. Studies that have discovered a negative relationship between the two concepts have used the control hypothesis as the reason for their result. In the study of Ahn and Choi (2009) where they observed the role of banks in monitoring the corporate governance practices of their clients, it was concluded that the earnings management of firms’ decreases as the strength of the bank monitoring increases. This conclusion was attained after observing that the reputation of the bank giving out the loan as an ‘institutional investor’ of a sort plus the magnitude of the loan are sufficient factors to limit the earnings management activity of a firm.

Alsharairi and Salama (2012) found a negative association between earnings management and leverage. In their case of studying non-cash mergers and acquisitions, only the low-level leverage group of non-cash acquirers showed significant signs of earnings management. They are of the view that debtors play a vital monitoring role in firms which further increases the credibility of financial reporting and limit the use of management discretion to manipulate accounting figures before business projects like mergers and acquisitions. Zamri et al. (2013) provide evidence to support the view that leverage reduces REM. By following Roychowdhury's (2006) approach to estimating REM, they arrive at results that suggest that leverage limits the occurrence of REM and improves the quality of financial reporting. Contrary to the negative relationship between leverage and earnings management established by the mentioned studies, some other studies have found a positive association. Iatridis and Kadorinis (2009) study the motivating factors that encourage UK listed firms to engage in earnings management and conclude that leverage has a positive impact on earnings management. This result was attained through an analysis of the earnings management inclination of firms that try to match or beat the forecasts made by financial analysts and the results attained indicate that firms that are highly leveraged are more likely to engage in earnings management. A similar result is obtained by Lazzem and Jilani (2018) who studied the impact of leverage on accruals based earnings management within the context of French listed companies. Their results are consistent with the debt covenant hypothesis with leverage having a positive impact on earnings management. This result is also consistent with that of Khanh and Thu (2019) and Obeidat (2016). Tulcanaza-Prieto et al. (2020) also attained a positive association between leverage and REM in the context of Korean firms. In their study, they divided firms into classes of “suspicious” and “non-suspicious” firms. Firms that had a scaled net income of 0.005 or below were considered suspicious and otherwise, non-suspicious. They found a positive and significant impact of leverage on REM among suspicious firms and an insignificant result for non-suspicious firms.

Another interesting study on the subject was done by Rodríguez-Pérez and Van Hemmen (2010) where they studied the impact of debt on earnings management within the context of more and less diversified firms. They postulate that diversity increases the complexity of a firm and this leads to firms becoming less transparent. Their results show that in less diversified firms which are more transparent, debt reduces earnings management and in more diversified firms that are less transparent, debt has a positive impact on earnings management. For them, an increase in debt provides an incentive to manage earnings and diversification provides the needed context to achieve it.

The trade-off between AEM and REM

Studies have provided evidence that firms make strategic decisions between the two methods of earnings management. One prominent work in this field is by Cohen et al. (2008) where they analysed both AEM and REM before and after the passage of the Sarbanes Oxley Act (SOX). Their study observed the increasing nature of AEM before the SOX and its decrease after the SOX was passed as opposed to the decreasing nature of REM before the SOX and its increase after the SOX had been passed. Their study suggests that firms can choose which model of earnings management to enforce to suit their need. In circumstances where one form of earnings management become too costly to perform, managers engage more in the other form. In the study of Elkalla (2020), the findings buttress this point and indicate that managers make use of these two methods of earnings management to complement each other. In studying the case of reverse mergers in the context of Chinese and non-Chinese firms Zhu et al. (2015) also provide results that support the idea that managers use the two forms of earnings management as substitutes. It is unclear as to whether highly leveraged firms are likely to switch from AEM to REM or vice versa. Company executives in the US have admitted that they would prefer the usage of REM over the usage of AEM to achieve desired earnings (Graham et al., 2005). This idea is confirmed by the results obtained by Anagnostopoulou and Tsekrekos (2017) and Gao et al. (2017). This is rather a more grievous choice since REM actually affects business activities and would decrease the future financial performance of the firm or even threaten its going concern (Cohen and Zarowin, 2010). Due to the mixed result already discussed where leverage has the capacity of both limiting and encouraging both AEM and REM, it is necessary to investigate the trade-off between the two methods of earnings management. This investigation is currently lacking in the literature.

HYPOTHESES DEVELOPMENT

Despite the mixed theories of how leverage impacts earnings management, it is expedient to assume the validity of one of the theories to serve as the base for the multivariate analyses. Several studies are in favour of the debt covenant violation hypothesis. Stemming from the fact that accounting figures are used as the basis for most parts of debt covenants, managers are motivated to manipulate these figures to avoid the cost of violation. Given this:

H1: Leverage has a positive impact on AEM.

A similar case can be argued for REM. As documented by Ewert and Wagenhofer (2005), even though REM has more damaging impacts on the firm, managers do prefer the usage of REM to achieve earnings goals because they are relatively more difficult to trace. Given that this mode of earnings management is more elusive to regulators and auditors, it will be logical to expect that most managers will make use of it to avoid the violation of debt covenants. Given this:

H2: Leverage has a positive impact on REM.

A major gap in this stream of literature is ascertaining the impact of leverage on the overall earnings management of a company. The few studies that have analysed both forms of earnings management only did so independently and not jointly. By still leaning on the debt covenant violation theory we test the effect leverage has jointly on AEM and REM. Given that firms will use any means of earnings management to avoid the violation of debt covenants, we expect a positive relationship between leverage and the overall earnings management of a firm. Given this:

H3: Leverage has a positive impact on the overall earnings management of firms.

Instead of just increasing or decreasing AEM and REM, leverage may also shape their trade-off. Cohen et al. (2008) document that manager’s use AEM and REM as substitutes but there is no clear evidence of which form of earnings management firms use within the context of leverage. However, Graham et al. (2005) do confirm that managers generally prefer to use REM. Given this:

H4: Highly leveraged firms are more likely to engage in REM than in AEM.

SAMPLE AND METHODOLOGY

Sample

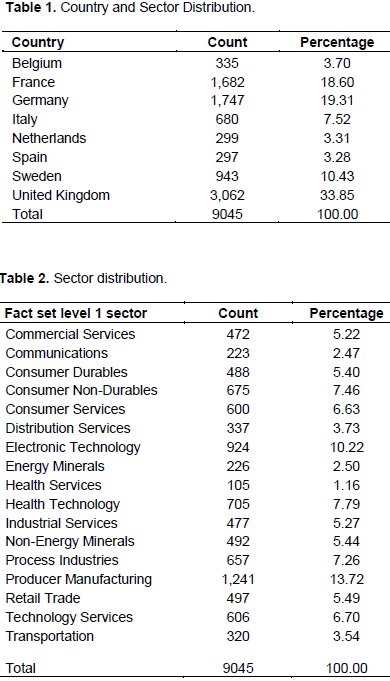

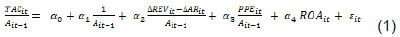

This work focuses on European listed firms. The sample is made up of firms from 8 European countries (Belgium, France, Germany, Italy, Netherlands, Spain, Sweden, and the United Kingdom*). Table 1 shows the country distribution where it can be noted that the highest representation is from the UK making up 38.85% of the sample. Spain on the other hand has the lowest representation, making up 3.28% of the sample. Firms from 17 sectors using the FactSet Level 1 Sector Code as a base of classification and for a period from 2009 to 2016 are studied. The sector distribution is reported in Table 2. The producer manufacturing sector has the highest representation making up 13.72% of the sample while the health service sector has the lowest representation, making up 1.16% of the sample. After eliminating firms in the finance and utility sectors because of the specific regulations that govern these sectors and firms with missing data there is a total of 9045 firm-year observations. All estimates and actual firm data collected for this research are sourced from the FactSet Database with all monetary values quoted in US dollars.

Variable measurement

Accruals earnings management (AEM)

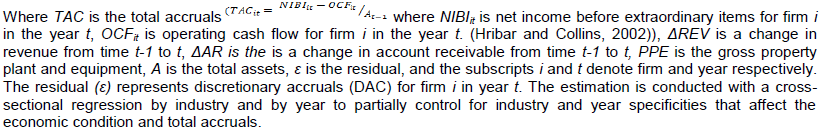

Total accruals are split into two: discretionary accruals which are influenced by the discretion of managers and non-discretionary accruals, which arise as a result of the nature of the company (Mangala and Isha, 2017). AEM estimation generally focuses on discretionary accrual. To estimate AEM as a proxy for earnings management, the study makes use of a version of the performance matched discretionary accruals developed by Kothari et al. (2005). The model is defined as:

Real earnings management (REM)

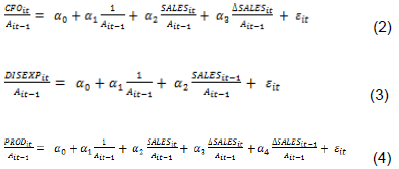

REM is estimated per Roychowdhury (2006). The study measures total REM by using an aggregate model that combines different proxies of REM. The proxies of REM as postulated by Roychowdhury are the abnormal cash flow from operations (Abn_CFO), the abnormal discretionary expenditure (Abn_DisExp) and the abnormal production cost (Abn_Prod). The author argues that firms may try to augment sales figures upwards by providing more sales discounts and more lenient credit terms. This would increase sales but will have an adverse effect on the cash flow from operations. This abnormal cash flow from operations is estimated in Equation 2. Also, the reduction of discretionary expenses is another way through which firms boost their earnings. Research and Development costs (R&D), selling, general and administrative expenses (SGA) and advertising expenses (ADVT) are reduced in an attempt to increase earnings. The estimation of the abnormal discretionary expense is defined in Equation 3. Finally, companies also take advantage of the principle of economies of scale to manage earnings through overproduction. The fixed costs per unit are reduced through this means and earnings increased. The abnormal production is estimated in Equation 4.

Where i and t represent firm and year respectively, CFO = cash flow from operations, DISEXP = discretionary expense which is estimated by summing R&D, SGA and ADVT, PROD = production cost estimated by summing the cost of goods sold and the change in inventory, A = total assets, SALES = total sales, ΔSALES = the change in total sales, ε = the residuals, which is the estimation of Abn_CFO, Abn_DisExp and Abn_Prod.

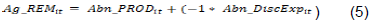

These proxies of REM are then aggregated into one proxy representing the total REM engaged in by firms. To generate total REM (Ag_REM) the methods of Bozzolan et al. (2015) and Zang (2012) are followed. Ag_REM is estimated by summing abnormal production costs and the inverse of abnormal discretionary expenses which is defined as follows

The greater the value the more total REM has been employed by firms. The abnormal cash flow from operations is excluded from the aggregate REM because of some insignificant results obtained in further tests (more details of this in the empirical analyses section).

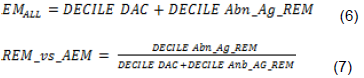

Total earnings management and the trade-off between AEM and REM

To analyse the impact of leverage on total earnings management and the role it plays in shaping the trade-off between AEM and REM, the metrics developed by Bozzolan et al. (2015) are used. To estimate these metrics, all values of AEM and REM are classified into deciles. The metrics are defined as:

EM_ALL is a measurement of total earnings management activity engaged in by a firm whether it is AEM or REM. On the other hand, REM_vs_AEM estimates the firm’s usage of REM in proportion to the total earnings management engaged in by the firm. To interpret this, the greater the value of REM_vs_AEM the greater use of REM in proportion to AEM.

Leverage

Leverage is calculated using total debts scaled by total assets. The formula is defined as:

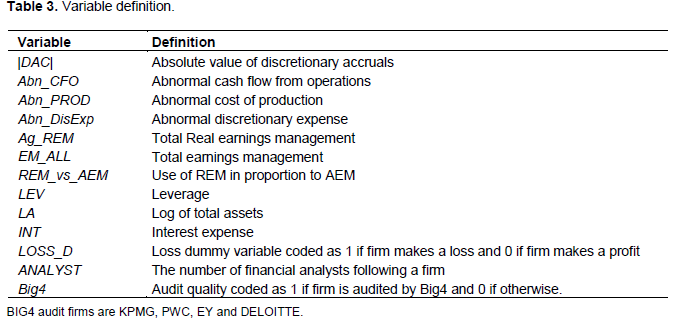

Control variables

Firm size is controlled using the log of total assets. There are conflicting theories to explain the impact firm size has on earnings management. Large firms have big reputations to protect so are willing to put in place strategies to avoid losses that will negatively affect stock prices (Bozzolan et al., 2015). However, other studies have observed a negative relationship between firm size and earnings management because small firms do not draw much attention to themselves and are free to manage earnings (Balsam et al., 2003). Also as a control variable is the interest expense. Jelinek (2007) argues that high interest payments would lead to low net income and to compensate for this, firms may actively manage earnings upwards and therefore a positive relationship between interest expense and earnings management is expected. The interest expense is scaled by the lagged total assets. To control for performance, a loss dummy is included because firms that incur losses have been found to manage earnings more (Francis et al., 2004). Financial analysts limit earnings management in firms because they act as external monitors (Aubert and Grudnitski, 2012; Dyck et al., 2010; Yu, 2008). Finally, the study includes audit quality using the Big4 dummy variable. While Alhadab and Clacher (2018) and Alzoubi (2018) argue that audit quality can restrain the activities of earnings management, Piot and Janin (2007) argue that audit quality makes no difference in levels of earnings management (Table 3).

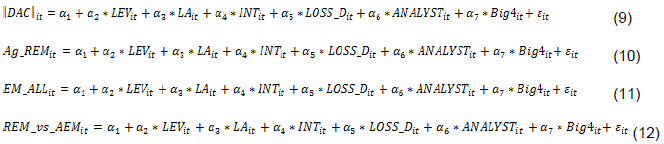

Multivariate model

To test the various hypotheses of this, leverage as the independent variable is regressed against the varying measures of earnings management estimated as the dependent variable. The models are defined as:

The regressions are panel regressions with industry, year and country fixed effects with VCE industry clusters. The VCE industry clusters cater for the issues of heteroskedasticity and autocorrelation issues observed from untabulated tests. The absolute value of DAC is used because with discretionary accruals it is more relevant to focus on the magnitude of earnings management and not the direction.

RESULTS AND DISCUSSION

Descriptive statistics and correlation matrix

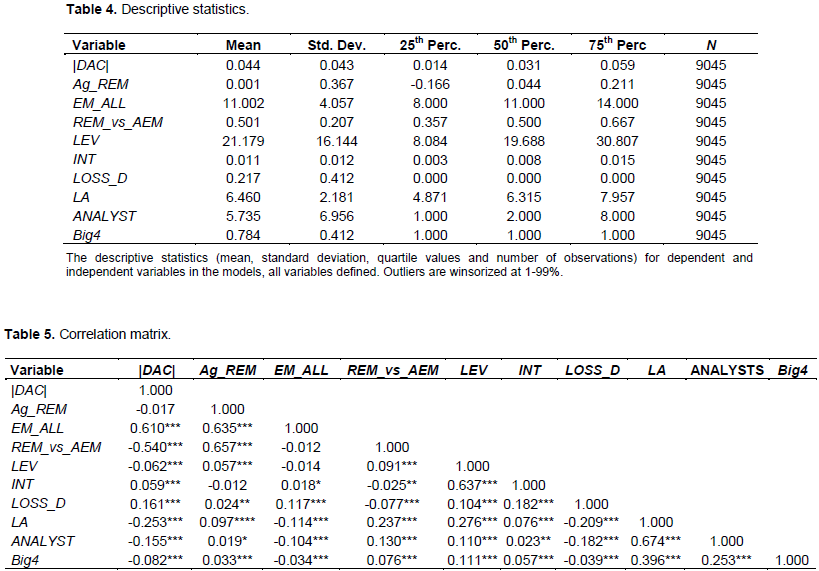

As shown in Table 4, the mean values of both discretionary accruals and real earnings management are close to zero, which is an indication of good model estimations. The estimations of EM_ALL and REM_vs_AEM do not share this characteristic because of the nature of the metrics used (deciles). The mean leverage of firms in the sample is 21.179 and that of the natural log of total assets is 6.460. It is also interesting to note that 21.7% of the samples are loss-making firms. Firms in the sample are averagely followed by 5.735 financial analysts and 78.4% of firms are audited by the Big4. This indicates the fairly large size of firms in the sample. Table 5 shows the correlation that exists between the variables in the analyses. The highest correlation coefficient estimated is 0.674 indicating that multicollinearity will not be a problem in the model. This is supported by the fact that the highest Variance Inflation Factor (VIF) estimated is 2.27.

Multivariate analyses

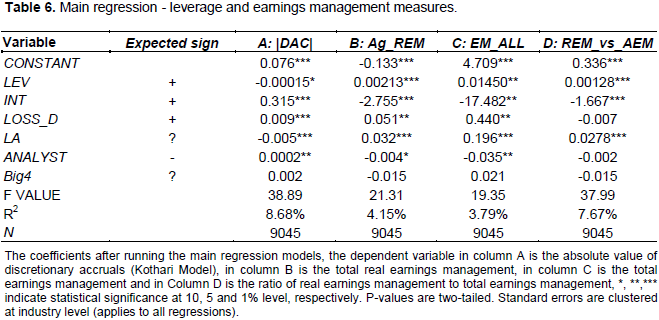

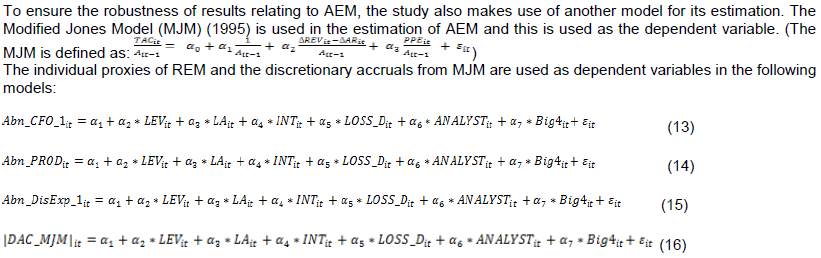

Results for the various main multivariate models are reported in Table 6. H1 is tested in the first multivariate model as defined by Equation 9 where the absolute value of discretionary accruals (|DAC|) is used as the dependent variable and results are reported in Column A of Table 6. The negative and significant leverage coefficient (significant at p<0.1) attained signifies that firms with high levels of leverage are less likely to engage in AEM. This is not consistent with H1 which states that leverage has a positive impact on AEM. The result goes contrary to the claim that firms with high leverage manage earnings for the fear of debt covenant violations. This is consistent with the results of Lazzem and Jilani (2018). Based on the results obtained for Equation 9 where the H1 of the study is rejected, there is an indication that the control hypothesis is effective to the extent of AEM. This may be as a result of the ease with which activities of AEM are noted as stated by Graham et al. (2005). Managers will have to find more elusive ways to manage earnings without leaving obvious trails. Even though this result is inconsistent with H1, it does not conclusively rule out the validity of debt covenant violation theory that states that managers engage in earnings management to avoid the violation of debt covenants. This is because of the other methods of managing earnings and this is investigated by H2.

H2 is tested in the second model which is defined by Equation 10 and results are reported in Column B of Table 6. Here, the measure of REM (Ag_REM) is the dependent variable. Consistent with Tulcanaza-Prieto et al. (2020), the positive and significant leverage coefficient (significant at p<0.01) attained signifies that firms with high levels of leverage engage in high levels of REM. The H2 of the study which states that leverage has a positive impact on REM is validated. The result is consistent with H2 and the debt covenant violation theory which suggests that firms manage earnings to avoid violation. The opposing results of Equations 9 and 10 give meaning to the findings of other studies that suggest that firms use the two methods of earnings management as substitutes and pick whichever one fulfils their need. Especially in this case, firms prefer the usage of REM to AEM which may be due to the difficulty in tracing activities of REM. Managers can elude stakeholders more easily by using this form of earnings management. To fully understand this phenomenon, it is imperative to a have metric that estimates the overall earnings management activity of a firm.

Following the metric designed by Bozzolan et al (2015), the overall earnings management activity of firms is estimated to investigate the H3 of the study. The H3 of the study which states that leverage has a positive impact on the overall earnings management of firms is tested in the third multivariate model defined by Equation 11 where the variable EM_ALL is used as reported in Column C of Table 6. The positive and significant coefficient of leverage (significant at p<0.05) supports the hypothesis that firms with high leverage are likely to engage in more activities of earnings management. This is in support of the debt covenant violation theory described by Healy and Wahlen (1999). Indeed, the findings until this point indicate that AEM decreases with increases in leverage and REM increases with the increase in leverage but the result after testing H3 indicates that firms’ usage of REM outweighs their decrease in the usage of AEM. This result makes it interesting to explore the notion that, in the face of high leverage, firms prefer the usage of REM over the usage of AEM.

To investigate the trade-off between AEM and REM in the presence of leverage, the H4 of the study is tested by using the aggregate portion of REM in comparison to AEM as the dependent variable (REM_vs_AEM). This fourth model is defined by Equation 12, and results are reported in Column D of Table 6. The positive and significant coefficient of leverage (significant at p<0.01) is consistent with the H4 of the study and indicates that highly leveraged firms are more likely to make use of REM rather than AEM. This is in line with the assertions of managers in the study of Graham et al. (2005) where they indicated that they preferred the usage of REM to AEM. These results lead us to reject H1 and accept H2, H3 and H4.

Additional analyses and robustness check

Individual REM proxies and Modified Jones

The study of Roychowdhury (2006) proposed three proxies of REM and many studies following have made use of the aggregation of these proxies. Since REM is an aggregation of individual proxies, an investigation into these individual proxies may be relevant to ascertain which of them firms are more likely to engage in to protect their interests.

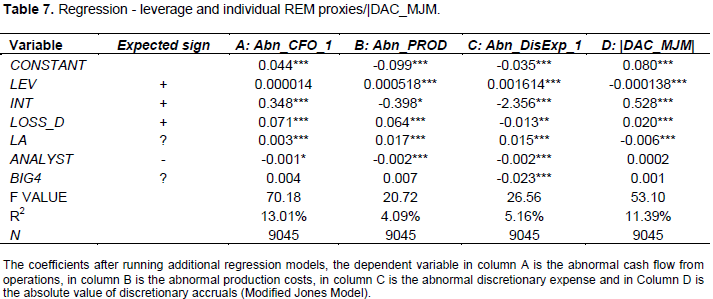

Where Abn_CFO_1 and Abn_DisExp_1 both stand for the inverses of abnormal cash flow from operations and abnormal discretionary expenses respectively (all other variables already defined). Panel A of Table 7 indicates an insignificant result for Abn_CFO_1. It is difficult to justify this result and this is the reason for its exclusion from the estimation of Ag_REM. Even though this is not enough justification for its exclusion, it is consistent with methods used by Bozzolan et al. (2015) and Zang (2012). These studies excluded the abnormal cash flow from operations while estimating total REM. Results for Abn_PROD are reported on Panel B of Table 7. The positive and significant leverage coefficient attained (p<0.01) in this model signifies that firms are likely to use overproduction as a form of REM to attain desired earnings in cases of high leverage. Panel C of Table 7 indicates the results for Abn_DisExp_1 where a positive and significant leverage coefficient is attained as well (p<0.01). This is also consistent with the H2 of the study and indicates that firms are likely to use the reduction of discretionary expenses to manage earnings in cases of high leverage. In Panel D of Table 7, results for |DAC_MJM| are reported where the negative and significant leverage coefficient (p<0.01) obtained is consistent with the results of the main regression model. Leverage has a negative impact on AEM.

Earnings management from the perspective of financial analysts

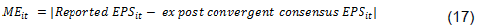

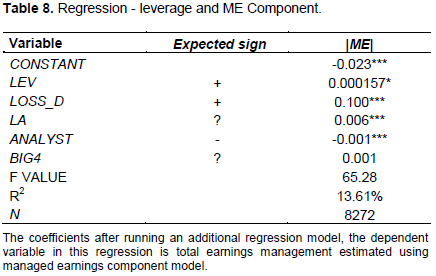

For further analyses, earnings management is estimated from the perspective of financial analysts as defined in the model proposed by Aubert and Grudnitski (2012). This is defined as:

Where, ME represents the managed earnings component which is a measure for earnings management. Reported EPS is the Earnings Per Share published by companies. The Ex post convergent consensus EPS represents the recalculated EPS estimates made by financial analysts after firms have published their financial statements and more information is made available. The median of these ex-post estimates is used. To further corroborate the findings of the main analyses, the additional analysis makes use of the ME Component as a dependent variable. In this case, the ME Component is recognized as the total earnings management engaged in by firms. The ME is scaled by the prior year closing stock price as done by Aubert and Grudnitski, (2012). Also, the absolute values of the ME are used because the interest is in the degree of earnings management and not the direction of earnings management. This results in the following model:

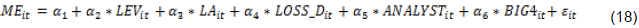

The result of the model defined in Equation 18 reported in Table 8 corroborates the results of the main analyses and supports the H3 of the study. The positive and significant coefficient of leverage attained ( p<0.1) indicates that firms with high leverage are more likely to manage their earnings.

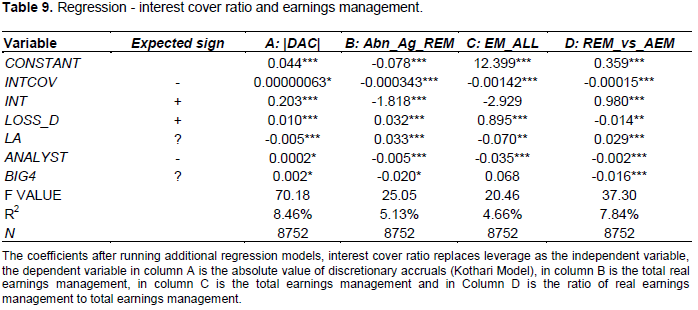

Interest cover ratio

The results of the main models suggest that firms with high leverage are likely to engage in higher levels of earnings management and they do this preferring REM

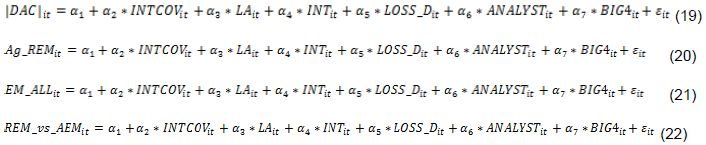

over AEM; the supporting theory being that firms with high leverage manage earnings to prevent debt covenant violations. Interest coverage covenant is one of the widely used debt covenants by financial institutions when giving out loans. Dichev and Skinner (2002) documented that the median interest coverage ratio is lower for firms that fall within their threshold of firms classified as debt covenant violators. From this, it is logical to assume that firms with lower interest cover ratios are closer to debt covenant violations. Firms with a low interest coverage ratio are more likely to manage earnings to avoid violation. This leads to the following models:

Where, INTCOV represents the interest coverage of firms.

Results of these models defined in Equation 19 to 22 are reported in Table 9. The results indicate almost a neutral relationship between discretionary accruals and interest coverage ratio. Even though this does perfectly not match the expectation, the results is still positive and indicate that firms do not manage earnings through AEM as their interest coverage ratio decreases and they get closer to debt covenant violation. However, in the case of REM, a negative and significant coefficient signifies that firms that have low interest coverage ratios have higher levels of REM to manipulate their earnings. This result is consistent with the major theory of this study which is the debt covenant violation theory. With the case of the overall earnings management engaged in by firms, a negative and significant relationship with interest cover is found. Firms that are closer to violation of covenants (low interest cover ratio) have higher levels of total earnings management. Similarly, a negative relationship between the levels of REM used in proportion to AEM and interest cover is found. This indicates that the more firms are close to debt covenant violation, the more they make use of REM to manage earnings.

CONCLUSION

This study investigates the impact of leverage on the earnings management strategy of firms. This is done by: testing the impact of leverage on AEM; testing the impact of leverage on REM; testing the impact of leverage on the total earnings management activity; investigating how leverage moderates the usage of REM and AEM. This study contributes to the current stream of literature by providing deeper insights into how leverage affects the quality of financial reporting. Analysing the impact of leverage on total earnings management and also studying how leverage moderates the trade-off between REM and AEM is a study that had not been conducted and this research makes this contribution to literature. Two major theories support results obtained in this stream of research. One is the control hypothesis by Jensen (1986) and the other is the debt covenant violation hypothesis also covered by Healy and Wahlen (1999) and many researchers thereafter. The results of this study provide insights into both theories. First, the tests on AEM indicate that the control hypothesis is in force. The results show that firms with high leverage are less likely to manage their earnings using AEM procedures. However, further tests on REM indicate that the fear of debt covenant violation urges firms to manage their earnings through REM. The second insight is that the role leverage plays in shaping firms’ choices between AEM and REM has been established. AEM has been noted to be more easily traceable as compared to REM. Leverage can control the level of earnings management but this ability is only limited to AEM. Instead of firms succumbing to the monitoring mechanism of leverage, managers rather find other ways to manage earnings. The fear of violating debt covenants provides a much stronger incentive to manage earnings over the control hypothesis. Firms, therefore, opt for REM which is much harder to trace because this mode of earnings management affects the day-to-day operations of the firm and not just directly cooking the books. A positive relationship between leverage and the total earnings management levels of firms is therefore found. This result is strengthened by the fact that regressions using the ratio of REM to total earnings management are run and this shows firms’ preference for REM over AEM. Also, further analysis including the individual proxies of REM provides additional evidence. Two out of the three proxies indicate increases in REM as leverage increases.

These results may be of interest to a variety of stakeholders of firms. First, potential and current debt holders must pay close attention to the operations and decisions made by managers of firms with specific regard to production volumes and discretionary expenses. There should be an interest in ascertaining the regularity of these operations and decisions. Indeed, REM activities are more difficult to trace, but debt holders should not rely on their ability to limit AEM but also enquire further into REM activities which are better concealed to make sure that firms are not violating debt covenants. Secondly, shareholders must be concerned about the choice of managers to prefer the use of REM in high leverage situations. REM seems the worse option out of the two modes of managing earnings. This is because real-time operations of the firms are affected and in the long run this would threaten the going concern of firms. Managers’ preference of REM in the face of high leverage despite the adverse effects on the continuity of firms indicates how strong the fear of debt covenant violation is.

This study does indeed have certain limitations that should not be overlooked. There are several measures of leverage but to simplify the analysis because of the multiple tests ran, this study only makes use of total debt. It may be interesting to compare the relationship that may exist between other forms of leverage and earnings management and also ascertain the key reasons for the differences that may be observed. Another avenue would be to study the impact of leverage changes in firms on the quality of financial reporting instead of using the raw leverage levels as done in this study.

CONFLICT OF INTEREST

The authors have not declared any conflict of interest.

REFERENCES

|

Ahn S, Choi W (2009). The role of bank monitoring in corporate governance: Evidence from borrowers' earnings management behaviour. Journal of Banking and Finance 33(2):425-434. |

|

|

Aini A, Iskandar T, Pourjalali H, Teruya J (2006). Earnings management in Malaysia: a study on effects of accounting choices. Malaysian Accounting Review 5(2):185-209. |

|

|

Alhadab M, Clacher I (2018). The impact of audit quality on real and accrual earnings management around IPOs. British Accounting Review 50(4):442-461. |

|

|

Alsharairi M, Salama A (2012). Does high leverage impact earnings management? Evidence from non-cash mergers and acquisitions. Journal of Financial and Economic Practice 12(1):17-33. |

|

|

Alzoubi ESS (2018). Audit quality, debt financing, and earnings management: Evidence from Jordan. Journal of International Accounting, Auditing and Taxation 30(12):69-84. |

|

|

Anagnostopoulou SC, Tsekrekos AE (2017). The effect of financial leverage on real and accrual-based earnings management. Accounting and Business Research 47(2):191-236. |

|

|

Aubert F, Grudnitski G (2012). Analysts' estimates; What they could be telling us about the impact of IFRS on earnings manipulation in Europe. Review of Accounting and Finance 11(1):53-72. |

|

|

Balsam S, Krishnan J, Yang J (2003). Auditor Industry Specialisation And Earnings Quality. Auditing: A Journal of Practice and Theory 22(2):71-97. |

|

|

Bozzolan S, Fabrizi M, Mallin CA, Michelon G (2015). Corporate Social Responsibility and Earnings Quality: International Evidence. International Journal of Accounting 50(4):361-396. |

|

|

Chamberlain TW, Butt UR, Sarkar S (2014). Accruals and Real Earnings Management around Debt Covenant Violations. International Advances in Economic Research 20(1):119-120. |

|

|

Christie A, Zimmerman JL (1994). Efficient and Opportunistic Choices of Accounting Procedures: Corporate Control Contests. Accounting Review 69(4):539-566. |

|

|

Cohen DA, Dey A, Lys TZ (2008). Real and Accrual-Based Earnings Management in the Pre- and Post-Sarbanes-Oxley Periods. The Accounting Review 83(3):757-787. |

|

|

Cohen D, Zarowin P (2010). Accrual-based and real earnings management activities around Seasoned Equity Offerings. In Journal of Accounting and Economics 50(1):2-19. |

|

|

Dichev ID, Skinner DJ (2002). Large-Sample Evidence on the Debt Covenant Hypothesis. Journal of Accounting Research 40(4):1091-1123. |

|

|

Dilger T, Graschitz S (2015). Influencing Factors on Earnings Management Empirical Evidence from Listed German and Austrian Companies. International Journal of Business and Economic Sciences Applied Research 8(2):69-86. |

|

|

Dyck A, Morse A, Zingales L (2010). Who Blows the Whistle on Corporate Fraud? Journal of Finance 65(10):2213-2253. |

|

|

Elkalla T (2020). Do firms substitute earnings management methods? The case of the MENA region. Journal of Research in Emerging Markets 3(1):32-43. |

|

|

Ewert R, Wagenhofer A (2005). Economic effects of tightening accounting standards to restrict earnings management. The Accounting Review 80(4):1101-1124. |

|

|

Francis J, Lafond R, Olsson PM, Schipper K, Lafond R, Schipper K (2004). Costs of Equity and Earnings Attributes. The Accounting Review 79(4):967-1010. |

|

|

Gao J, Gao B, Wang X (2017). Trade-off between real activities earnings management and accrual-based manipulation-evidence from China. Journal of International Accounting, Auditing and Taxation 29:66-80. |

|

|

García-Meca E, Sánchez-Ballesta JP (2019). Corporate governance and earnings management: A meta-analysis. Iconic Research and Engineering Journals 2(12):212-214. |

|

|

Graham JR, Harvey CR, Rajgopal S (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics 40(1-3):3-73. |

|

|

Healy PM, Wahlen JM (1999). A Review of the Earnings Management Literature and Its Implications for Standard Setting. Accounting Horizons 13(4):365-383. |

|

|

Hribar P, Collins DW (2002). Errors in Estimating Accruals: Implications for Empirical Research. Journal of Accounting Research 40(1):105-134. |

|

|

Iatridis G, Kadorinis G (2009). Earnings management and firm financial motives: A financial investigation of UK listed firms. International Review of Financial Analysis 18(4):164-173. |

|

|

Jelinek K (2007). The Effect of Leverage Increases on Earnings Management. Journal of Business and Economic Studies 13(2):24-46. |

|

|

Jensen MC (1986). Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers. The American Economic Review 76(2):323-329. |

|

|

Khanh MTH, Thu AP (2019). The effect of financial leverage on real and accrual-based earnings management in Vietnamese firms. Economics and Sociology 12(4):299-312. |

|

|

Kothari SP, Leone AJ, Wasley CE (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics 39(1):163-197. |

|

|

Kutha NM, Susan M (2021). Institutional Ownership, External Auditor Reputation, Financial Leverage, and Earnings Management. Journal of Economics and Business 4(1):93-99. |

|

|

Lazzem S, Jilani F (2018). The impact of leverage on accrual-based earnings management: The case of listed French firms. Research in International Business and Finance 44:350-358. |

|

|

Leuz C, Nanda D, Wysocki PD (2003). Earnings management and investor protection: An international comparison. Journal of Financial Economics 69(3):505-527. |

|

|

Mangala D, Isha A (2017). Influence of corporate characteristics on extent of disclosure in published annual reports in India. Amity Journal of Finance 1(2):22-34. |

|

|

Obeidat MIS (2016). Capital Structure Effect on the Practices of Earnings Management Phenomenon? The Evidence of Listed Firms in Abu Dhabi Securities Exchange. Asian Journal of Finance and Accounting 8(2):171-193. |

|

|

Piot C, Janin R (2007). External Auditors, Audit Committees and Earnings Management in France. European Accounting Review 16(2):37-41. |

|

|

Rodríguez-Pérez G, Van Hemmen S (2010). Debt, diversification and earnings management. Journal of Accounting and Public Policy 29(2):138-159. |

|

|

Roychowdhury S (2006). Earnings management through real activities manipulation. Journal of Accounting and Economics 42(3):335-370. |

|

|

Tulcanaza-Prieto AB, Lee Y, Koo JH (2020). Effect of leverage on real earnings management: Evidence from Korea. Sustainability 12(6):1-20. |

|

|

Vakilifard H, Mortazavi MS (2016). The impact of financial leverage on accrual-based and real earnings management. International Journal of Academic Research in Accounting, Finance and Management Sciences 6(2):53-60. |

|

|

Yu F (2008). Analyst coverage and earnings management. Journal of Financial Economics 88:245-271. |

|

|

Zamri N, Rahman RA, Isa NSM (2013). The Impact of Leverage on Real Earnings Management. Procedia Economics and Finance 7:86-95. |

|

|

Zang AY (2012). Evidence on the trade-off between real activities manipulation and accrual-based earnings management. The Accounting Review 87(2):675-703. |

|

|

Zhu T, Lu M, Shan Y, Zhang Y (2015). Accrual-based and real activity earnings management at the back door: Evidence from Chinese reverse mergers. Pacific Basin Finance Journal 35(12):317-339. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0