Full Length Research Paper

ABSTRACT

Developing economies have often relied on developmental finance (aid) in improving the welfare and social being of their citizenry. However, the developmental effect of aid on developing economies has sparked a lot of interest among scholars and policymakers. The objective of the study is to examine the welfare effect of aid in Nigeria for the period of 1981 to 2017. The study employed the autoregressive distributed lag (ARDL) approach in analysing the data. The study confirmed that in the short-run and long-run, aid positively influences welfare. Based on the findings from the study, the government should design and implement policies that will encourage the inflow of aid to spur growth and increase welfare in the country. More so, the government should ensure that the inflow of aid is judiciously used to ensure continuous improvement of citizen welfare in the country.

Key words: Aid, welfare, autoregressive distributed lag (ARDL).

INTRODUCTION

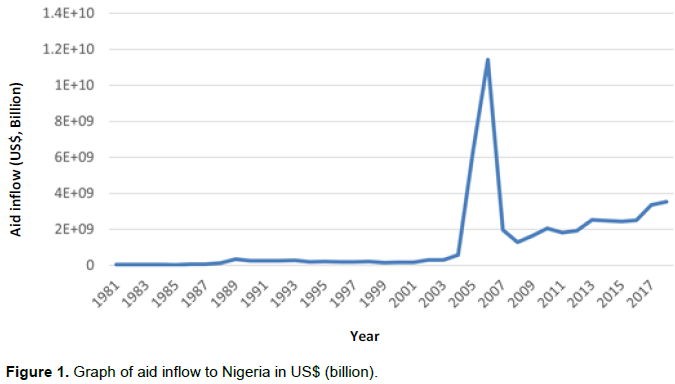

Aid within the growth literature has been recognised as one of the key sources of external finance to developing economies. According to the literature, these external sources of funds have played a crucial role in boosting growth in developing economies. Developmental economists generally believed that through the availability of these external funds (aid), developing economies can achieve the needed resources that will propel them to achieve sustainable growth. Based on the World Bank report, the inflow of aid to emerging economies has grown tremendously in the last couple of years (Kurihara, 2014; Raza et al., 2021a). More so, the developmental effect of aid on developing economies has sparked a lot of interest among scholars and policymakers on the effect of these external funds on the growth of an economy. Hence, this paper attempts to address the welfare effect of aid in Nigeria, since available records and statistics have shown that the country has been one of the major recipients of foreign aid among the Sub-Saharan African continent (World Bank, 2021), as shown in Figure 1. Empirical studies have shown that aid have the capacity to enhance growth and reduce poverty in developing economies (Kurihara, 2014; Setargie, 2015; Moolio, 2015; Salahuddin and Gow, 2015; Chowdhury, 2016; Akter, 2016; Meyer and Shera, 2017; Jawaid and Saleem, 2017). However, while the growth effect of aid flows have been widely recognised in the available literature, the welfare effect of aid had remained largely unexplored in the country. Hence, this study fills the gap in the literature. In a bid to address the research objective, the study employed an ARDL framework to estimate the welfare effect of aid in Nigeria. The rest of the study is sub-divided into the following section. Section two examines the model and econometrics issues. Section three present and discuss the outcome of the research findings. The final section presents the conclusion of the study.

REVIEW OF THEORIES AND LITERATURE REVIEW

Several theories in the literature have been used to explain why aid flow to developing economies is paramount. The two-gap theory advanced by Chenery and Strout (1968) showed that developing economies need external fund because most of them are usually faced with savings and foreign exchange constraint which have hindered them in embarking developmental project that is required to enhanced productivity and ensure sustainable growth. The two-gap model provides the justification for foreign aid into developing economies. The big push model introduced by Paul Rosenstein-Rodan (1943) also provides the need for foreign aid into developing countries. According to the theory, less developing countries needs large amount of investment, and the inflow of aid is needed to serve as a big push for developing economies to attain sustained growth and reduce poverty (Raza et al., 2021b). The poverty trap theory concept which was propounded by Nelson (1956) has also been used to explain the significance of external capital inflows (aid) to developing economies (Lensink and White, 2001; Mcmillan, 2011; Harms and Lutz, 2004; Kraay and Raddatz, 2005; Hokmeng and Moolio, 2015, Raza et al., 2021b). According to the theory, most developing economies’ growth is stalled by poverty traps due to poor savings, low production among others which limits the capacity of an economy growing (Kraay and Raddatz, 2005).

The theory thus postulates that for an economy to move out of the poverty trap, the growth rate of income needs to rise above the rising population rate. Thus an inflow of external capital is required to raise the growth rate of income.

In the empirical literature, there exists a mixed finding on the welfare effect of aid. While the following studies advocate the flow of aid to developing economies (Kurihara, 2014; Setargie, 2015; Moolio, 2015) because of its developmental impact on recipient economies, others documented that aid retards growth (Lensink and White, 2001; Moyo, 2009; Tadesse, 2011; Ndambiri et al., 2012; Abd El Hamid, 2013; Girma, 2015; Omoruyi and Meibo, 2016) because it makes developing economies to be over-dependence on aid which have trapped them in a vicious cycle and poverty.

Besides, while the majority of the literature has examined the growth effect of aid, the welfare effect of aid had remained largely unexplored. Hence, the need to understand the welfare effect of aid in the country. Thus, this study fills the gap in the literature by employing an ARDL framework to estimate the welfare effect of aid on welfare in Nigeria.

MODEL AND ECONOMETRIC ISSUES

MODEL AND ECONOMETRIC ISSUES

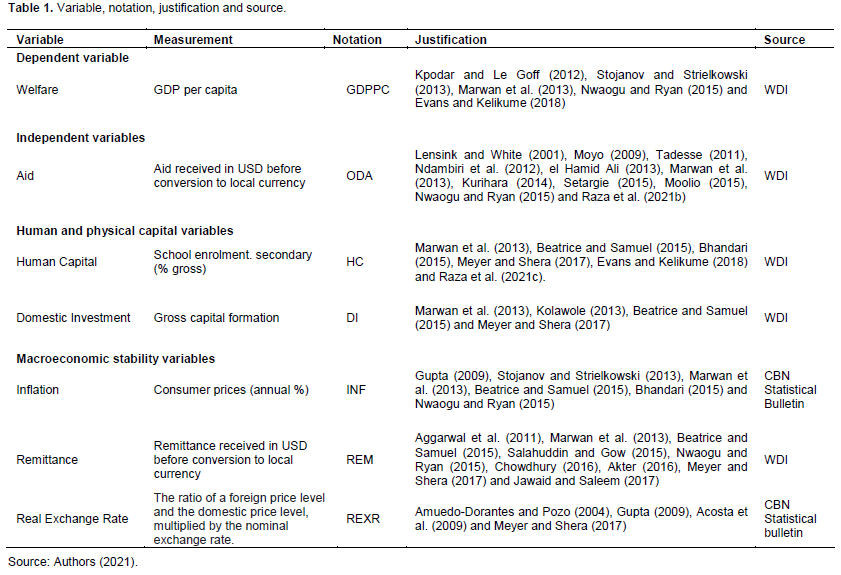

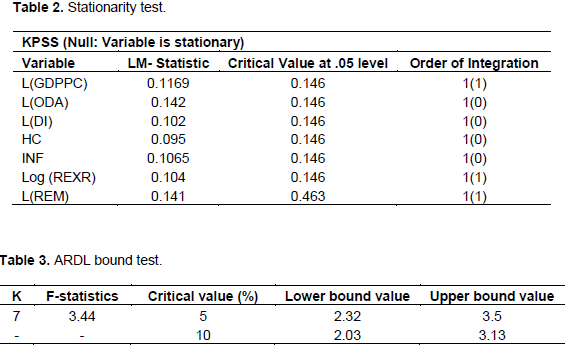

Data

The study employed yearly time series data between the periods 1981 to 2017. Data on workers’ remittance received (REM), official development assistance (ODA), human capital (HC), welfare was measured using GDP per capita (GDPPC) as a proxy, Domestic Investment (DI) were sourced from World Bank (World Bank, 2018) world development indication while data on inflation and real effective exchange rate was sourced from CBN statistical bulletin. Table 1 shows the variables, notation, justification and sources of all the variables used in the study.

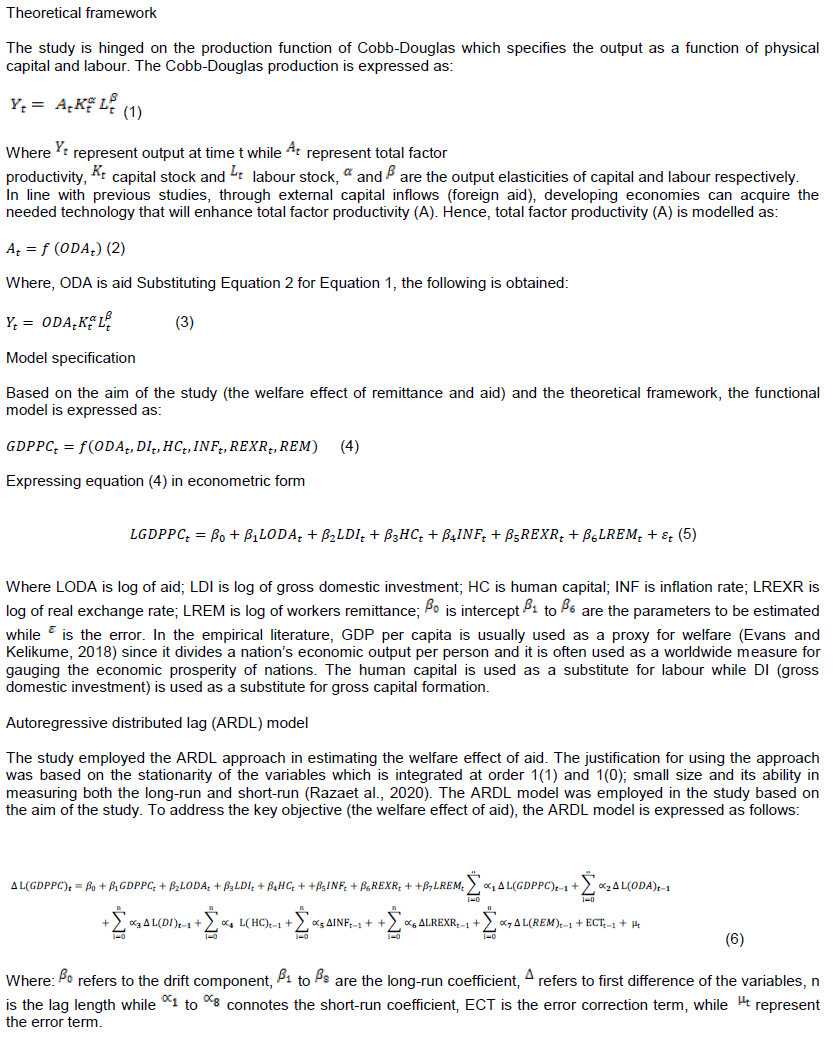

Employing the ARDL bound test, the null hypothesis of no long-run link is accepted if the calculated F-statistic is lesser than the critical value of the lower bound 1(0) while the null hypothesis is rejected if the calculated F-statistic exceeds the critical value of the upper bound 1(1). In a situation when the calculated F-statistic is within 1(0) and 1(1) the result becomes inconclusive.

EMPIRICAL RESULTS

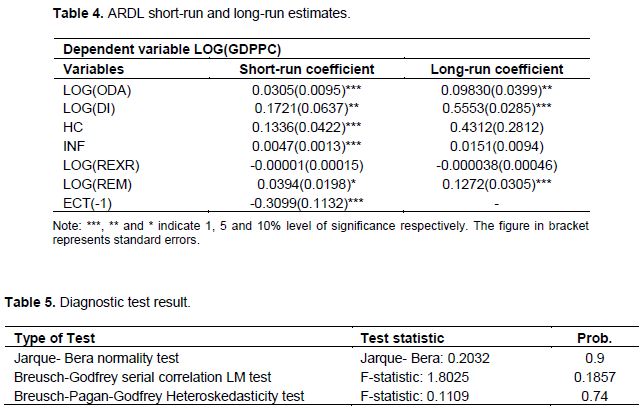

The stationarity property of the variable was first examined before the model was estimated. The study employed Kwiatkowski-Phillips-Schmidt-Shin (KPSS). As revealed in Table 2, the result of the unit root test showed that the variables are integrated at 1(1) and 1(0). This suggests that the variables have a mix of 1(1) and 1(0) which is suitable for the ARDL technique. The ARDL bound test was carried out if the variables are cointegrated as shown in Table 3 having confirmed that the variables are a mix of 1(1) and 1(0). Table 3 presents the ARDL bound test. The ARDL bound test revealed that the calculated F-statistic is within 1(0) and 1(1) at 5% indicating inconclusiveness while at 10% the calculated F-statistic exceeds 1(1) showing that the variables are cointegrated. Table 4 depicts the ARDL short-run and long-run estimates. The result revealed that foreign aid exerts a positive effect on welfare in the short-run and long-run. This implies that foreign aid improved welfare. The results confirm previous empirical work (Kurihara, 2014; Setargie, 2015; Moolio, 2015; Evans and Kelikume, 2018) who concluded that aid affects welfare positively. Furthermore, the human capital, domestic investment, inflation and remittances variables all have a positive effect with welfare in the short-run and long-run except the real exchange rate variable that has an adverse effect on welfare in the short-run and long-run. The lagged error term, ECT (-1) in Table 4 is equal to -0.3099 and is negative and significant at 1% level of significance. This indicates that the deviation from the long-run is corrected by 31% in the following year. The study also carried out a diagnostic test in Table 5 to ascertain the normality test, autocorrelation test and heteroscedasticity test. The result from table 5 indicates that the regression residual followed a normal distribution. Also, the outcome of Table 5 showed that the model is free from autocorrelation and heteroscedasticity.

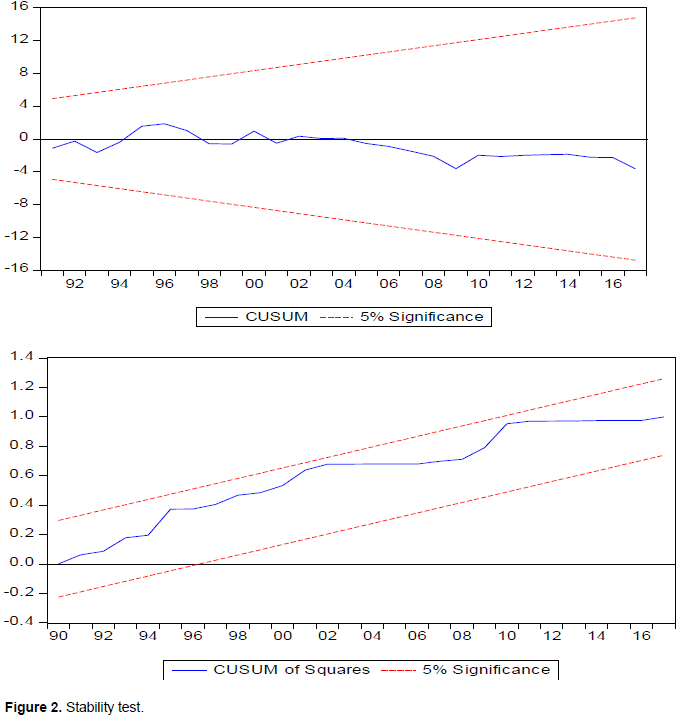

The stability test in Figure 2 revealed the stability and reliability of the model which suggests that the outcome of the study can be used for policy-making.

DISCUSSION

Empirical evidence from the data analysed revealed that in the short and long-run, foreign aid affects welfare positively. In addition, the research outcome also showed that in the long run, foreign aid also affects welfare in the country positively. The results support previous empirical work (Kurihara, 2014; Setargie, 2015; Moolio, 2015; Evans and Kelikume, 2018) that advocate the need for aid in supplementing domestic resources in a bid to achieve sustainable growth.

CONCLUSION

The study employed the ARDL technique between the periods 1981 to 2017 to address the research objective of estimating the welfare effects of aid in Nigeria. The outcome of the ARDL results revealed that aid affects welfare positively in the short-run and long-run. The findings from the study posed significant policy implications. Firstly, the government should design and implement policies that will encourage the inflow of aid to spur growth and increase welfare in the country. Secondly, the government should ensure that the flow of aid into the country is judiciously utilized, and a higher portion directed to preferred sector of the economy. Besides, the donor country should design policy framework on the utilization of fund and ensure that the aid provided meant its purpose.

LIMITATION AND AREAS FOR FUTURE STUDIES

The study investigated the effect aid on welfare using Nigeria as a point of reference. This study is a single-country study. For future study, it is recommended that this study be carried out on a regional level, for instance, in Sub-Saharan African (SSA) economies to unravel the welfare effect of aid.

CONFLICT OF INTERESTS

The author has not declared any conflict of interest.

REFERENCES

|

Abd El Hamid H (2013). Foreign aid and economic growth in Egypt: A cointegration analysis. International Journal of Economics and Financial Issues 3(3):743-751. |

|

|

Acosta PA, Baerg NR, Mandelman FS (2009). Financial development, remittances, and real exchange rate appreciation. Economic Review 94(1):2-12. |

|

|

Aggarwal R, Demirgüç-Kunt A, Pería MSM (2011). Do remittances promote financial development? Journal of Development Economics 96(2):255-264. |

|

|

Akter S (2016). Remittance inflows and its contribution to the economic growth of Bangladesh. Niigata University Graduate School of Contemporary Social Culture 62(3):215-245. |

|

|

Amuedo-Dorantes C, Pozo S (2004). Workers' remittances and the real exchange rate: a paradox of gifts. World Development 32(8):1407-1417. |

|

|

Beatrice NM, Samwel NM (2015). The effect of remittances on economic growth in Kenya. International Journal of Microeconomics and Macroeconomics 3(1):15-24. |

|

|

Bhandari B (2015). Impact of remittance in developing countries South Asian countries (Master's thesis, University of Agder). |

|

|

Chenery HB, Strout AM (1968). Foreign assistance and economic development: Reply. The American Economic Review 58(4):912-916. |

|

|

Chowdhury M (2016). Financial development, remittances and economic growth: Evidence using a dynamic panel estimation. The Journal of Applied Economic Research 10(1):35-54. |

|

|

Evans O, Kelikume I (2018). The effects of foreign direct investment, trade, aid, remittances and tourism on welfare under terrorism and militancy. International Journal of Management, Economics and Social Sciences 7(3):206-232. |

|

|

Girma H (2015). The impact of foreign aid on economic growth: empirical evidence from Ethiopia (1974-2011) using ARDL approach. Journal of Research in Economics and International Finance 4(1):1-12. |

|

|

Gupta S, Pattillo CA, Wagh S (2009). Effect of remittances on poverty and financial development in Sub-Saharan Africa. World Development 37(1):104-115. |

|

|

Harms P, Lutz M (2004). The macroeconomic effects of foreign aid: A survey. University of St. Gallen Economics Discussion Paper No, (2004-11). |

|

|

Hokmeng H, Moolio P (2015). The Impact of Foreign Aid on Economic Growth in Cambodia: A co-integration approach. KASBIT Business Journal 8(1):4-25. |

|

|

Jawaid ST, Saleem SM (2017). Foreign capital inflows and economic growth of Pakistan. Journal of Transnational Management 22(2):121-149. |

|

|

Kolawole BO (2013). Foreign assistance and economic growth in Nigeria: The two-gap model framework. American International Journal of Contemporary Research 3(10):153-160. |

|

|

Kpodar MK, Le Goff MM (2011). Do remittances reduce aid dependency?. International Monetary Fund. |

|

|

Kraay A, Raddatz C (2005). Poverty Traps. Aids and Growth, The World Bank, Washington, DC. |

|

|

Kurihara Y (2014). Does foreign aid promote economic growth? Global Business and Economics Research Journal 3(4):20-30. |

|

|

Lensink R, White H (2001). Are there negative returns to aid? Journal of Development Studies 37(6):42-65. |

|

|

Marwan NF, Kadir NA, Hussin A, Zaini AA, Rashid ME, Helmi ZA (2013). Export, aid, remittance and growth: Evidence from Sudan. Procedia Economics and Finance 7:3-10. |

|

|

McMillan L (2011). Foreign aid and economic development. School of Doctoral Studies European Union Journal 3:158-165. |

|

|

Meyer D, Shera A (2017). The impact of remittances on economic growth: An econometric model. EconomiA 18(2):147-155. |

|

|

Moolio P (2015). The Impact of Foreign Aid on Economic Growth in Cambodia: A co-integration approach. KASBIT Business Journal (KBJ) 8(1):4-25. |

|

|

Moyo D (2009). Dead aid: Why aid is not working and how there is a better way for Africa. Macmillan. |

|

|

Ndambiri HK, Ritho C, Ng'ang'a SI, Kubowon PC, Mairura FC, Nyangweso PM, Cherotwo FH (2012). Determinants of economic growth in Sub-Saharan Africa: A panel data approach. International Journal of Economics and Management Sciences 2(2):18-20. |

|

|

Nelson RR (1956). A Theory of the Low-Level Equilibrium Trap in Underdeveloped Economies. The American Economic Review 46(5):894-908. |

|

|

Nwaogu UG, Ryan MJ (2015). FDI, foreign aid, remittance and economic growth in developing countries. Review of Development Economics 19(1):100-115. |

|

|

Omoruyi EMM, Meibo H (2016). Fostering economic development: is external finance responsible for the poor economic growth in sub-Saharan Africa? Global Economy Journal 16(2):313-347. |

|

|

Raza A, Akbar S, Raza Z (2021a). Does Greenfield-foreign direct investment inflow contribute in socioeconomic development? Empirical evidence from developing countries. Pakistan Journal of Humanities and Social Sciences 9(3):469-481. |

|

|

Raza A, Azam M, Tariq M, Sadiqa BA (2021c). An Empirical data investigation of the Greenfield investment: Welfare nexus from low-income countries. International Journal of Innovation, Creativity and Change 15(8):820-835. |

|

|

Raza A, Azam MK, Tariq M (2020). A Panel Data Investigation of Greenfield Investment on the Welfare of African Developing Countries. International Review of Social Sciences 8(8):41-57. |

|

|

Raza A, Iqbal M, Hussain N (2021b). Is Greenfield investment greener for the welfare of lower-middle income countries? Market-based empirical analysis with GMM approach. Journal of Marketing Strategies 3(3):194-206. |

|

|

Rosenstein-Rodan PN (1943). Problems of industrialisation of eastern and south-eastern Europe. The Economic Journal 53(210):202-211. |

|

|

Salahuddin M, Gow J (2015). The relationship between economic growth and remittances in the presence of cross-sectional dependence. The Journal of Developing Areas 49(1):207-221. |

|

|

Setargie F (2015). The impact of foreign aid on economic growth of Ethiopia. Journal of Economics and Sustainable Development 6(7):121-131. |

|

|

Stojanov R, Strielkowski W (2013). The role of remittances as more efficient tool of development aid in developing countries. Prague Economic Papers 22(4):487-503. |

|

|

Tadesse T (2011). Foreign aid and economic growth in Ethiopia: A co-integration analysis. The Economic Research Guardian 1(2):88-108. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0