ABSTRACT

This paper examines the effect of board characteristics on bank financial performance. Tracing the Greek financial crisis during the period of 2008 to 2018, the paper investigates whether board size, board independence, CEO duality, female directors, and foreign directors affect banks performance. The empirical evidence shows that board structure has a significant effect on bank performance. Specifically, board size, board independence and chairman independence were found to exert a positive effect on bank performance. The effect of diversity on performance was ambiguous, since the effect of female directors was positive; but the effect of foreign directors was negative. These findings can potentially help banks improve performance by considering the features found significant in this study. Moreover, regulators can draw insight from the findings to design rules that strengthen corporate governance effectiveness.

Key words: Bank corporate governance, board characteristics, financial performance, Greek systemic banks.

The aim of this paper is to investigate the relationship between corporate governance and financial performance of Greek systemic banks from 2008 to 2018, a period encompassing the outbreak, development and ending of the sovereign debt crisis in Greece. What makes Greece an interesting setting is that an otherwise developed economy and Eurozone member country suffered a severe fiscal crisis, was involved in the biggest haircut in the history of sovereign debt and subsequently experienced a financial crisis that transformed the structure of its banking industry (Georgantopoulos and Filos, 2017; Kalemli?Özca et al., 2016; Koutoupis et al., 2020). These conditions led to significant changes taking place in the regulatory framework and the governance of the banking industry. In this context, there was a requirement for compliance of the Greek systemic banks with the existing corporate governance frameworks, imposing rules for more efficient functioning of the board of directors. The study of the impact of corporate governance on the effectiveness of banks in time of crisis has been a topic of interest in the literature (Orazalin et al., 2016).

This study complements the existing literature by exploring the impact of board structure in bank performance in an environment with the political, fiscal, financial, and institutional elements of Greece. The sample sample consists of the four systemic Greek banks. The analysis is based on arguments about the importance of board structure characteristics that have been identified in the literature and the quantitative analysis is carried out with a panel-data regression model. In this context, the fundamental corporate governance characteristics were investigated as determinants of bank performance as proxied in the literature, such as board size, independence of board members, board diversity and chairman’s independence. Specifically, board size (Andres and Vallelado, 2008; Gaur et al., 2015) and independent directors (Andres and Vallelado, 2008; Georgantopoulos and Filos, 2017; Liang et al., 2013) were expected to be positively associated with performance. Regarding board diversity, it was expected that female directors positively affect performance (García-Meca et al., 2015; Gulamhussen and Santa, 2015) and outside directors positively or negatively affect bank performance (Almutairi and Quttainah, 2020; Choi and Hasan, 2005; García-Meca et al., 2015; Rafinda et al., 2018). Finally, a negative effect of CEO duality on bank performance was expected (Kaymak and Bektas, 2008; Liang et al., 2013). The results indicate that board size, board independence, chairman independence and female directors have a positive effect on bank performance; whereas the presence of foreign directors has a negative association with performance.

The Greek banking industry during the financial crisis

The Greek crisis occurred in the aftermath of the 2008 international financial crisis. Initially, the global crisis did not deliver an immediate blow impact on the Greek economy, mainly because Greek banks were not substantially exposed to the global environment of financial engineering and toxic financial instruments. In the decade leading to the crisis, bank profitability exhibited substantial fluctuations. The return on assets (ROA) fell from 20.3% in 2000 to 5.7% in 2004, then increased to 17.9% in 2007 and subsequently fell to 10.1% in 2008 when the first signs of the global financial crisis cast their shadow on the Greek economy. The return on equity (ROE) exhibited a similar trend. It fell from 1.8% in 2000 to 0.4%, then rose to 2.1% in 2007 and subsequently declined to 1 in 2008 (European Commission [EC], 2020). It should be noted, however, that Greek banks were among the last to experience the effects of the global crisis, mainly due to their limited exposure to financial engineering and international capital markets. Their profitability was higher than most of their European counterparts in 2008, only to plummet in 2009 and 2010 in the wake of the sovereign debt crisis.

Several factors contributed, subsequently, to Greece’s vulnerability: the loosening of the country’s fiscal policy from 2004 to2010, combined with the fall in investments as well as private consumption; and the limited competitiveness of the Greek economy resulted in the increase of public debt and budget deficit, as well as a high and growing current account deficit (Andreou et al., 2017). The fast downgrading of Greece government’s credit rating resulted in a dramatic rise in the government’s borrowing costs and the exclusion of Greek banks from accessing international financial markets. Greek government’s decision to request financial aid from the European Union(EU) and the International Monetary Fund (IMF) led to the formation of the Troika (European Union, European Central Bank [ECB] and International Monetary Fund) and the provision of financial support, to avoid sovereign default. The largest part of the funds granted were incorporated to repay debt to international financial institutions and to recapitalize the Greek banks (Bortz, 2019).

The recapitalization of the Greek banking system was based on a combination of private funding and European Financial Stability Facility (EFSF) funding, at three different points in time, 2010, 2012 and 2015, with the signing of the three Memoranda of Understanding. The funds granted were tunneled through the Hellenic Financial Stability Fund (HFSF) and used exclusively for the rescue of the four systemic banks (National Bank of Greece, Alpha Bank, Bank of Piraeus and Eurobank); whereas, the rest were forced to take reorganizational measures or to merge (Tampakoudis et al., 2019). The restructuring of the banking industry resulted in the severe contraction of the market and a subsequent reduction in the number of banking institutions from 36 in 2008 to 18 in 2016, with the four systemic banks possessing more than 95% of the domestic banking market (European Stability Mechanism [ESM], 2018).

Corporate governance and Greek banks

The main characteristic of corporate governance in Greece at the beginning of the crisis was the existence of a multitude complex of laws and regulations (such as, L.2190/1920, L. 3016/2002, L.3601/2007, L.3606/2007, L.3864/2010) (Nerantzidis and Filos, 2014; Kourdoumpalou 2016). However, the operational quality of corporate governance mechanisms appeared low compared to international practices (Lazarides and Drimpetas, 2011). According to Lazarides and Drimpetas (2011), the banking industry performed slightly better, because in addition to the Hellenic Capital Market Commission, the banks were also subject to supervision by the Bank of Greece (Act 2577/2006 and all relating Acts issued by the Bank of Greece) and the ECB, which placed heavy emphasis on mitigating risks and fraud. The inclusion of the systemic banks in the HFSF recapitalization program was accompanied by strict compliance requirements, concerning both their policies and governance (ESM, 2018). One of these conditions was the requirement for compliance of the Greek systemic banks with the existing corporate governance frameworks and the provisions of the Relationship Framework Agreement. The reform in corporate governance-imposed rules for more efficient functioning of the board of directors, strict distinction between executive and non-executive members of the board and independence of the chairmen of the most important committees of the boards.

There is extant research on the impact of corporate governance on bank performance during the Greek crisis. Georgantopoulos and Filos (2017) studied the impact of corporate governance on the performance of Greek banks from the beginning of the crisis in 2008 until the second recapitalization in 2014 and found a positive contribution of the applied corporate governance regulatory framework to the value of Greek banks. In a similar study in the period of 2006-2016, Koutoupis et al. (2020) found a positive relationship between banks' performance with some elements of corporate governance (independent members of the Board of Directors and corporate governance committees) and a negative relationship with CEO duality. Relevant studies are also available in other national markets facing financial crises. Orazalin et al. (2016) studied the performance of Russian banks during the period of 2004-2012 and observed a positive impact of good corporate governance on the performance of Russian banks before and after the financial crisis, while during the crisis better governance did not yield higher performance to Russian banks. Similarly, Anderson and Campbell (2004) examined the internal and external corporate governance activity observed in Japanese banks from 1985-1996 and concluded that some aspects of corporate governance exacerbated the Japanese banking crisis of the 1990s.

In the light of the ongoing debate on the effect of corporate governance on bank performance in times of crisis, the aim of this paper is to explore the performance of Greek systemic banks vis-à-vis a set of critical corporate-governance characteristics during the 2008-2018 periods. This study extends and complements prior research on banks and corporate governance in Greece. While previous studies have examined the period until 2016, this paper examines the entire period of the crisis, including the landmark end of the sovereign debt crisis on August 20, 2018, when Greecesuccessfully exited its final, three-year bailout program. This study focuses on the four systemic banks and not all the Greek banking system, since these banks were catalysts in recapitalization, regulatory reform, and corporate governance changes in the banking sector. In addition to comprising 95% of the Greek banking market, it was the systemic banks that received restructuring funds via the Hellenic Financial Stability Fund (HFSF) and were placed under strict governance framework. The third economic adjustment program (EAP) in 2016 was conditioned upon the implementation of the HFSF’s review for the boards and committees of the systemic banks, with the "fit and proper" criteria. These strict set criteria have brought about an improvement in the effectiveness of banking governance in systemic banks (European Commission, 2020).The remainder of the paper is organized as follows. The next section provides the theoretical background and develops the hypotheses, the third section presents the methodology, the fourth section contains the empirical results and the discussion, and the fifth section concludes the paper.

Corporate governance remains a central topic of interdisciplinary research for more than two decades, partly owing its rise to academic and regulatory spotlight prominence to the impact of a series of notorious corporate scandals, including Enron, Parmalat, Worldcom, Tyco etc. A key question remains whether corporate governance, apart from being a mechanism for protecting and promoting shareholders’ interests (Shleifer and Vishny, 1997), also influences company financial performance. Although many studies have established a link between corporate governance and firm performance (Adams and Mehran, 2012; Larcker, Richardson and Tuna, 2007), a coherent and consistent set of results, concerning specific corporate governance mechanisms, is still lacking (Larcker et al., 2007). According to Kiel and Nicholson (2003), this is largely because it is impossible for a sole theory (agency theory, stewardship theory, resource dependency theory, stakeholder theory or other) to adequately respond to the questions of corporate governance. On the other hand, Rodriguez-Fernadez et al. (2014) and Gaur et al. (2015) suggest that a combined approach should be followed instead. Corporate governance is important for banks because the latter exert a substantial (implicit or explicit) impact on the corporate governance of other firms, either as creditors or as equity holders (Staikouras et al., 2007). The regulations, business model and the economic impact of the banking industry have spawned a fruitful debate of the corporate governance of banks and its effect on financial performance. Banks bear certain characteristics, which distinguish their governance model from that of non-financial firms (Haan and Vlahu, 2016; Kose et al., 2016). Relevant studies by Kose et al. (2016) and Haan and Vlahu (2016) identify the regulatory framework and the complexity and opacity of banking activities as critical characteristics. In addition, Haan and Vlahu (2016) also identify banks’ capital structure as an important difference; whereas Kose et al. (2016) highlight the conflict of interest between equity holders and creditors. Furthermore, Adams and Mehran (2005) as well as Kose et al. (2016) argue that a set of earlier empirical results on corporate governance of non-financial firms cannot be verified for banks as well. Haan and Vlahu (2016) also find that the results of the relationship between corporate governance and several performance measures are ambiguous at best, if not contradictory.

Many studies also focus on the relationship between board composition and bank performance (Adams and Mehran, 2005, 2012; Andres and Vallelado, 2008; Choi and Hasan, 2005; Mamatzakis and Bermpei, 2015; Pathan and Faff, 2013). Adams and Mehran (2005) studied the relationship between board structure and the performance of a sample of American banks over the period of 1959-1999. In contrast to the empirical findings of non-financial corporations, they found that the existence of large boards does not imply lower performance and suggests that the constraints of the board of directors in the banking industry can be counterproductive. In contrast, Mamatzakis and Bermpei (2015) in a study conducted in American investment banks during the period of 2000-2012 found that the size of the board has a negative impact on performance, especially in banks with a board size of more than ten members. A negative relationship between operational complexity and performance is, furthermore, indicated. In addition, the CEO power has a positive effect on performance. Staikouras et al. (2007) examined the relationship between board size and performance, as well as the proportion of non-executive board members and performance in 58 major European banks during the period of 2002-2004. The results indicated a negative relationship between performance and board size, while the effect of board composition was rather weak. Al-Saidi and Al-Shammari (2013) studied nine Kuwaiti banks during 2006-2010 and found a significant relationship between board composition and bank performance.

According to their results, the board size and the percentage of non-executive directors affects bank performance adversely; on the contrary, the CEO duality affects bank performance positively. Love and Rachinsky (2015) studied the relationship between corporate governance and the performance of 107 Russian and 50 Ukrainian banks from 2003-2006. They found that the relationship between corporate governance and bank performance is not particularly strong in Russian and Ukrainian banks. Prior research has identified four basic structure elements, namely the board size, the independence of its members, the board diversity and the chairman’s independence, as the main features associated with performance.

Hypothesis development

Board size has been extensively studied in prior research providing mixed results. A well-staffed board may be more effective in the performance of its duties. Especially in banks, their complexity necessitates large boards (Kose et al., 2016). On the contrary, an excessive number of board members can cause problems and may reflect the inefficiency of the organizational structure of the institution (Pathan and Faff, 2013). In line with this last argument, Rodriguez-Fernandez et al. (2014) and Pathan and Faff (2013) found a negative relationship between board size and performance, in financial and non-financial firms, respectively. On the contrary, several studies on the effect of board size on performance came up with a positive effect result (Andres and Vallelado, 2008; Gaur et al., 2015). For example, Gafoor et al. (2018) investigated banks in India and found a positive impact of board size on bank performance (ROA), supporting the result in the argument that a large board adds more expertise to the bank in decision-making. Adams and Mehran (2012) provide evidence for a positive relation between board size and bank performance suggesting that larger boards have more directors with subsidiary directorships which may suit the complexity of such institutions. In addition, Andres and Vallelado (2008) found positive effect of board size on bank performance (Tobin’s Q), arguing however, that there is a point (19 directors) at which the addition of a new director ends up reducing the value οf the bank. Drawing on these arguments the following hypothesis is formulated:

H1 Firm performance is positively associated with board size.

Another element of board structure that has been extensively investigated is board independence. In studies that examined the effect of independent directors on the performance of listed firms, the results were mixed, finding positive (Shahrier et al., 2020), negative (Gaur et al., 2015) and no effect (Syriopoulos and Tsatsaronis, 2011).Studies focusing on the banking industry also provide conflicting results. Pathan and Faff (2013) in a study of large US banks found that board independence reduces bank performance, while Liang et al. (2013) in a sample of large Chinese banks reported a significantly positive impact of independent directors on bank performance (ROA). Andres and Vallelado (2008) as well as Georgantopoulos and Filos (2017), in surveys conducted in international banks and Greek Banks, respectively, came to a similar conclusion to that of Liang, but stressed that an excessive proportion of independent directors could reduce their positive impact on bank performance. Despite the conflicting findings of the literature, a positive effect of board independence on performance is expected in this study, arguing that independent directors increase the board’s ability to oversee the management. Therefore, in line with corporate governance codes (Institute of Directors [IOD], 2009) proposing to increase the independence of the board, the following hypothesis is formulated:

H2 Firm performance is positively associated with the independence of the board.

Many studies have investigated the impact of board diversity on firm-level outcomes (Terjesen et al., 2015). Prior research has shown that board diversity is associated with financial performance (Lückerath-Rovers, 2011; Tampakoudis et al., 2020). Indeed, the growing literature on the effectiveness of board diversity has acknowledged a relationship between a gender-diverse board and performance underlining that firms perform significantly better with female directors (Adams and Ferreira, 2009). Terjesen et al. (2015) found that firms with more female directors have a higher firm performance measured by market-based (Tobin’s Q) and accounting (return on assets) measures. Sarhan et al.(2019) found that the relationship between board diversity as measured by gender and corporate performance is stronger in better-governed firms than their poorly governed counterparts and also have a positive effect on financial performance. In the field of banks, Gulamhussen and Santa (2015) in a sample of large banks from OECD countries found that female directors in boards have a positive influence on bank performance. In the same direction, Garcia-Meca et al. (2015) analyze the effect of board diversity on bank performance in nine countries and concluded the positive effect of female directors on performance, in terms of Tobin’s Q and ROA. Drawing on these arguments the following hypothesis is formulated:

H3 Firm performance is positively associated with the existence of female directors in the board.

Another variable of board diversity that has been investigated in the literature is foreign directors (Liang et al., 2013; Masulis et al., 2012; Oxelheim and Randøy, 2003). The results are ambiguous as different studies show a positive, negative or no effect of this variable on various evaluation measures. Oxelheim and Randøy (2003) indicate a significantly higher value for firms that have foreign Anglo-American board member(s). Masulis et al. (2012) found that, while foreign directors make better cross-border acquisitions when they relate to their region of origin, foreign directors also show poor participation in the meetings of the board. Research in banking industry yielded similar results. The picture remains blurred. Almutairi and Quttainah (2020) indicating that while the presence of foreign directors in Islamic Banks increases boards’ effectiveness in reducing management opportunistic behavior, in conventional banks the existence of foreign directors reduces this ability. Choi and Hasan (2005), exploring the Korean bankingindustry, indicate that foreign directors are associated with better performance, in terms of bank return and risk. Finally, regarding the effect of foreign directors on bank performance, in terms of ROA, ROE and Tobin’s Q, it has been argued that this effect is negative (García-Meca et al., 2015; Rafinda et al., 2018). Due to the conflicting results, the following hypothesis is formulated:

H4 Firm performance is positively or negatively associated with the existence of foreign directors.

Having different people serving as Chairman of the board and Chief Executive Officer (CEO) is essential in corporate governance and it is clearly advocated in corporate governance best practices (IOD, 2009). If the same person holds both positions (CEO duality) there may be problems in the board’s effectiveness in monitoring the management and preventing speculative behavior against shareholders’ interests, especially small ones. On the contrary, according to the stewardship theory, powerful CEOs, who also hold the position of chairman could act as benevolent and powerful stewards of the firm resources and thus contribute to the effective corporate governance (Donaldson and Davis, 1991). In line with the latter argument, studies in listed companies have shown that CEO duality can have a positive impact on firm performance (Gaur et al., 2015; Mamatzakis and Bermpei, 2015). On the other hand, Shahrier et al. (2020) found a significantly negative impact of CEO duality on firm performance (ROA and ROE) in listed firms in Tanzania and Malaysia, respectively. Finally, research in the banking industry also found a negative effect of CEO duality on performance (Kaymak and Bektas, 2008; Liang et al., 2013) in line with agency theory, according to which CEO duality reduces the effective treatment of the conflict of interest among stakeholders. Drawing on these arguments the following hypothesis is formulated:

H5 Firm performance is negatively associated with CEO duality.

Sample

The sample consists of the four Greek systemic banks (National Bank of Greece - NBG, Alpha Bank - ALPHA, Bank of Piraeus - PIR and Eurobank - EUROB). To assemble the data set, information on performance measures and board characteristics was obtained from banks’ annual reports and websites from 2008-2018. This process yielded a total of 44 bank-year observations.

Research design

Τhe fixed effect panel data Model was selected to conduct theempirical analysis, subsequent to a Hausman (1978) test application to compare the coefficient estimates under fixed and random effects (Baltagi, 2005). The fixed effects model (FEM) considers the fact that although some variables differ across different cases (heterogeneity), they do not vary over time, (that is, they are time invariant). Following previous literature, we use return on assets (ROA) as a measure of bank financial performance, calculated as net income over total assets (Kaymak and Bektas, 2008; Liang et al., 2013; Pathan and Faff., 2013). This measure is used extensively in the literature because it is a measure of the firm’s effectiveness in generating returns on its assets without being influenced by managerial financing decisions.

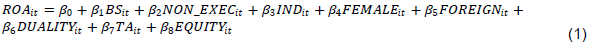

Where, i = bank and t = year. The Model combines board structure variables (predictor variables) with bank characteristics (control variables). Predictor variables test the argument of this study as outlined in section 3; the predictor variables that were employed in testing H2 (directors’ independence) were and . The distinction between non-executive and independent members is based on the KING III framework (IOD, 2009).Control variables are based on the literature and involve factors that can potentially affect bank’s performance. Following previous studies, two control variables are included, namely bank size and bank equity. Bank size ( ) is measured by total assets at year-end (Choi and Hasan, 2005; Liang et al., 2013); bank equity ( ) is measured by total equity as a percentage of total assets (Liang et al., 2013; Pathan and Faff. 2013). Table 1 provides definitions for all the variables in the Model.

Descriptive statistics

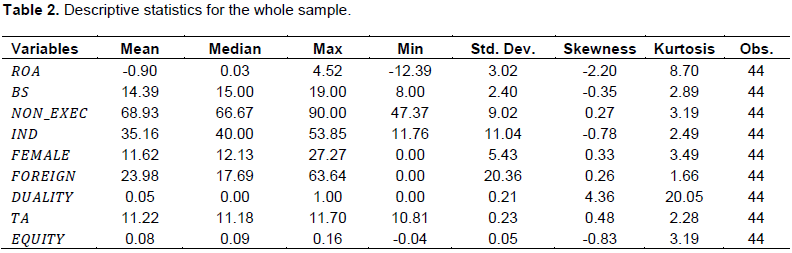

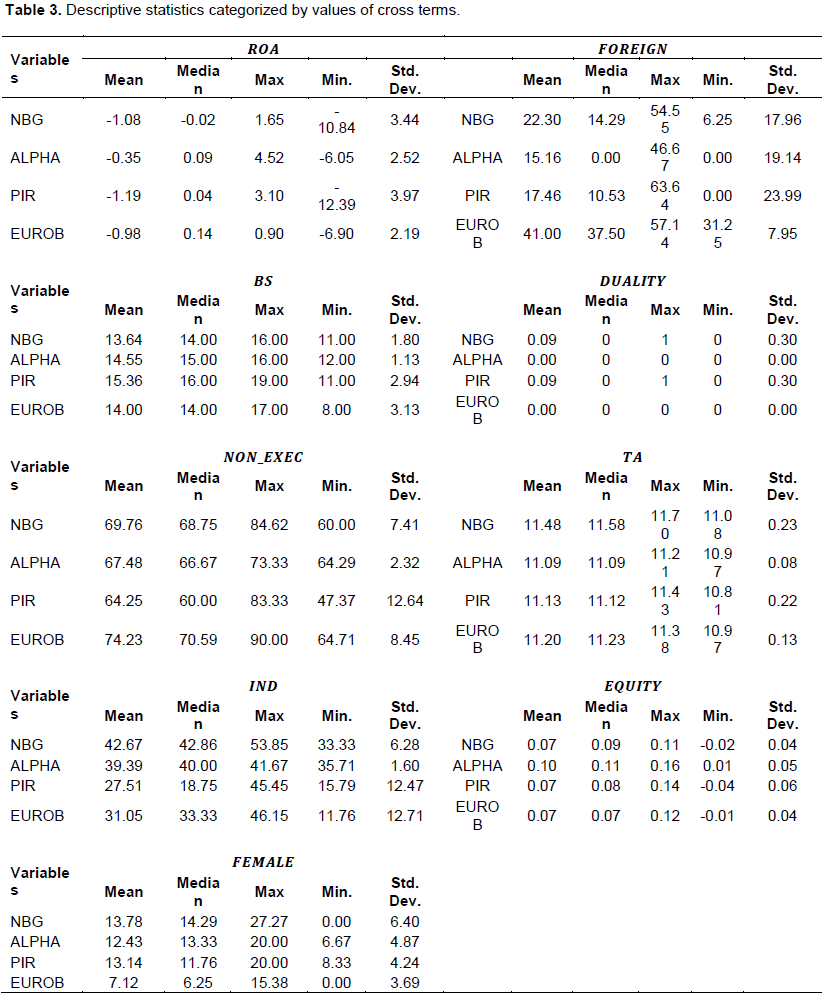

Table 2 provides descriptive statistics for the dependent and independent variables (predictor and control) for the whole sample dataset (44 observations) and Table 3 provides descriptive statistics categorized by values of cross terms. The results show that the mean (median) of bank performance (ROA ) is -0.90 (0.03), possibly attributed to the crisis that has plagued the Greek economy during the sample period. This result provided further support for the findings of Georgantopoulos and Filos (2017) (mean : -2.07), the improvement observed is probably due to the extension of the investigation period in this study to the years of de-escalation of the Greek crisis. The mean of the board size is 14.39, which is comparable with other studies (Liang et al., 2013: 13.08; Pathan and Faff, 2013: 12,68). Furthermore, Table 2 shows that the mean percentage of non-executive board directors on the whole sample is 68.93%, which is much higher than the mean percentage of independent directors that is 35.16%. Finally, the participation of female directors in the board is not strong (11.62%) (Liang et al., 2013: 11%); with participation of foreign directors at slightly higher levels (23.98%). This latest result is consistent with other studies (Almutairi and Quttainah, 2020: 20%), or even higher than others (Liang et al., 2013: 6%). From the findings Table 3, it is worth noting that the Greek bank with the lowest (mean) percentage of female directors (Eurobank: 7.12%) is also the bank with the highest percentage of foreign directors (41%).

Panel regression results

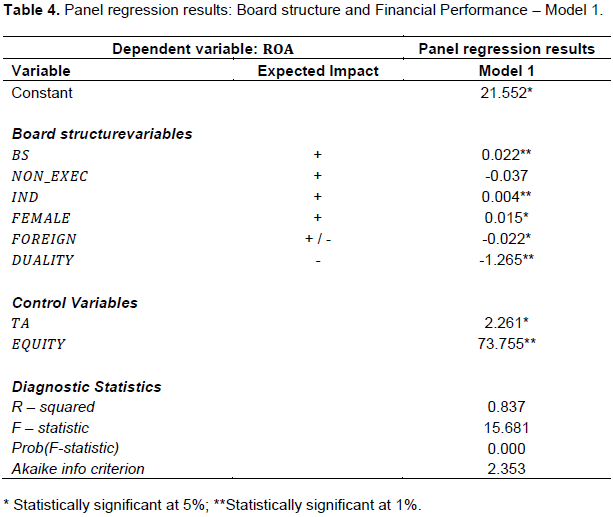

Table 4 provides results from the fixed effect panel data for Model 1. Table 4 shows that 83.7% of dependent variable variability is explained by the selected explanatory variables. The necessary residual tests for cross-sectional heteroskedasticity and period heteroskedasticity problems were performed and no evidence of heteroskedasticity was detected in the data set. The results indicate an overall strong association between board structure and bank performance since it was found to be a strong support for all research hypotheses of this study (H1-H5). Regarding board size (BS), the results showed a positive effect on bank performance (0.022) at a level of significance 1%, indicating that banks with more directors on board are likely to have increased performance. A positive effect on bank performance was also found for board independence (IND). This argument suggests that having more independent board directors could potentially improve bank’s performance. On the other hand, no evidence was found for the impact of non-executive directors on bank performance, since no statistically significance was found for this variable (NON-EXEC).

With respect to the predictor variables of board diversity, the findings indicate a statistically significant impact on bank performance (FEMALE and FOREIGN, p<0.05). Specifically, it was found that the presence of female directors in the board increases bank performance (0.015), while the participation of foreign directors is found to be negatively associated with bank performance (-0.022), at a significance level of 5%. Regression results also indicate a strong relationship between CEO duality and bank performance. Specifically, in line with expectations, it was found that CEO duality (DUALITY) have a significantly negative impact on performance (-1.265, p<0.01).

Regarding control variables, regression results support the hypothesis that the size of the bank, in terms of total assets (EQUITY), has a positive effect on bank performance (2.261), at a level of 5% significance. A positive relationship was also found between bank’s equity ( ) and performance (73.755, p < 0.01). These findings suggest that larger and less leveraged banks are more likely to operate effectively.

Additional analysis

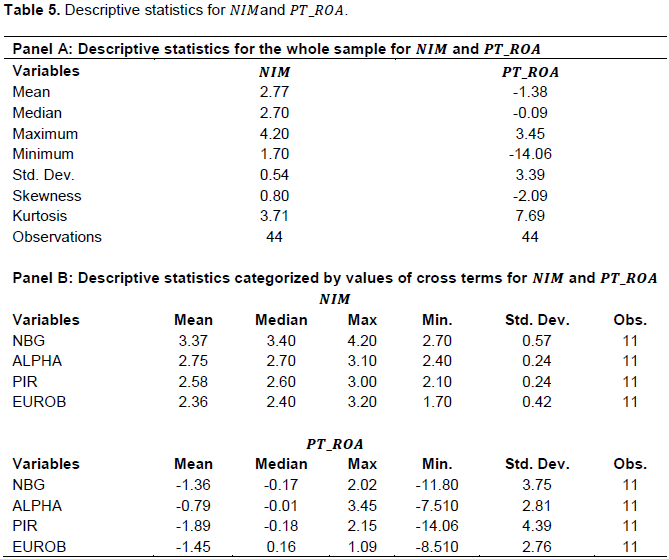

To test the robustness of the analysis based on , two alternative measures of bank performance were applied: net interest income as a percentage of average earnings assets (ΝΙΜ) and earnings before tax as a percentage of average book-value of total assets (PT_ ROA).

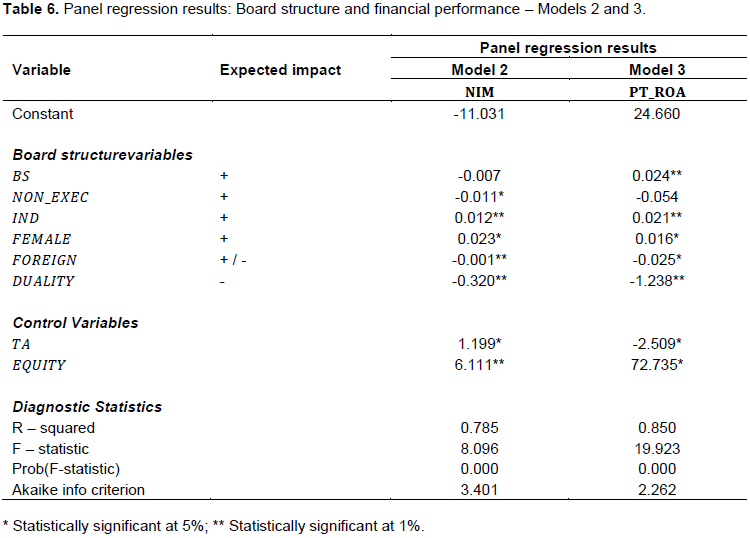

Model 2 and Model 3 combined board structure variables (predictor variables) and bank characteristics (control variables) with performance measures as follows: Where,i = bank, t = year, NIM is measured as the net interest income as a percentage of average earning assets and PT_ROA as the earnings before tax as a percentage of average book-value of total assets. Independent variables of Models 2 and 3 are presented in Table 1. Table 5 provides descriptive statistics for ΝΙΜ and . Panel A provides descriptive statistics for the whole sample (44 observations) and Panel B provides descriptive statistics categorized by values of cross terms.

Table 6 provides results from the fixed effect panel data for Model 2 and Model 3. Table 6 shows that dependent variable variability is explained by explanatory variables at a level of 78.5 and 85% in Model 2 and Model 3, respectively. The necessary residual tests were performed for cross-section heteroskedasticity and period heteroskedasticity problems; and no evidence of heteroskedasticity was detected in the data set. Overall, the results confirm the hypotheses with the board structure variables having a statistically significant effect on bank performance. Regarding Model 2 (NIM), the results for most variables were similar to those of Model 1, with small differences in coefficients values (IND, FEMALE, DUALITY, TA, EQUITY). One difference is the negative effect of the board size on the performance measure (NIM) (-0.007), in contrast to the positive effect found for in Model1 which, however, in Model 2, did not appear to be statistically significant (p>5%).

Additionally, the results indicate a significantly negative effect of non-executive directors (NON_EXEC) on NIM (-0.011, p<5%), suggesting that having more non-executive board directors could potentially decrease bank’s performance. Finally, a stronger effect was found in Model 2, in the same direction with Model 1, of foreign directors (FOREIGN) on bank performance with statistically significant at the level of 1% compared to the significance of Model 1 (5%).

Regarding Model 3, in which bank performance was measured with earnings before tax as a percentage of average book-value of total assets (PT_ROA), the findings confirmed those of Model 1 (ROA) in all board structure variables. These findings did not produce different outcomes in terms of significance or sign for all predictor variables (BS, IND, FEMALE, FOREIGN, DUALITY), supporting research hypotheses (H1-H5). Regarding control variables, in the investigation of the effect of the bank size (TA) on bank performance (PT_ROA) the results showed a negative effect (-2.509) at a significance level of 5. Finally, the findings of Model 3, in relation to Model 1, indicate weaker but still statistically significant positive relationship between bank equity (EQUITY) and performance (72.735, p<5%).

The results of the study are expected and consistent with prior research. The significant positive relationship between board size and bank performance corroborates the findings of prior studies which also found a positive relationship (Gafoor et al. 2018; Adams and Mehran, 2012; Andres and Vallelado, 2008). This result reinforces the argument that most board directors add expertise and contribute to the effective management of the complex banking institutions. In addition, the positive effect of the independent directors on bank performance is in line with findings in prior research (Andres and Vallelado, 2008; Georgantopoulos and Filos, 2017; Liang et al., 2013), indicating that an increase in independent directors is associated with an increase in positive bank performance. On the other hand, no evidence is found in support of the impact of non-executive directors on bank performance. A possible explanation may be that, although non-executive directors do not deal with the day-to-day management and do not maintain some form of employment relationship with the bank, they still do not meet some additional independence criteria, such as independent directors do.

Regarding board diversity, the results indicate that the presence of female directors on board increases bank performance, similarly to Gulamhussen and Santa (2015) and Garcia-Meca et al. (2015). With respect to foreign directors, it was found that their participation in the board is negatively associated with bank performance, in line with other studies in the banking sector (Garcia-Meca et al., 2015; Rafinda et al., 2018). A possible explanation may be potential communication constraints and frictions, and foreign directors’ inaccessibility to obtain updated vital corporate information. Additionally, it was found that CEO duality has a significantly negative impact on performance, in convergence with similar past empirical findings (Kaymak and Bektas, 2008; Liang et al., 2013). This finding, which is in line with agency theory, suggests that in cases where the same person holds the positions of the Chairman of the board and of the CEO, agency conflicts are not adequately mitigated, resulting to a lower corporate performance.

Regarding control variables, the results support the hypothesis that bank size, in terms of total assets, has a positive effect on bank performance. These findings are consistent with previous studies, suggesting that highly capitalized banks (Liang et al., 2013; Pathan and Faff, 2013) and banks with more assets (Georgantopoulos and Filos, 2017;KaymakandBektas, 2008) perform better. Finally, one possible explanation for the negative effect, as opposed to the positive effect of independent directors in model 2, is that the average percentage of non-executive directors in the sample is particularly high (the mean value for non-executive directors is 68.93% and the maximum is 90%). According to Andres and Vallelado (2008, p.2572), “an excessive proportion of non-executive directors could damage the advisory role of boards since it might prevent bank executives from joining the board”.

This paper examines the impact of key board structure characteristics on bank performance. Exploring evidence from Greek systemic banks during 2008-2018, a strong association between board structure characteristics and bank performance was found. Specifically, the empirical findings provide evidence of a positive effect of board size, board independence and female directors on bank performance, whereas the effect foreign directors and CEO duality is found to be negative.

The study contributes a set of innovative findings to the debate of corporate governance mechanisms on bank performance (Choi and Hasan, 2005; Andres and Vallelado, 2008; Adams and Mehran, 2012; Pathan and Faff, 2013). The results also enrich and expand the past literature (Aebi et al., 2012; Orazalin et al., 2016) by exploring the impact of board structure on bank performance in the volatile, extensively restructured and challenging case of Greek banks, in a domestic market severely hit by the global financial crisis contagion effects. An otherwise developed economy and Eurozone member country, Greece, has experienced a profound banking crisis that was the offspring of an unprecedented sovereign debt crisis, which triggered in turn institutional reforms and resulted in the largest haircut in sovereign debt history.

The results of this study have interesting implications for the banking industry by identifying areas in the corporate governance arena with substantial impact on bank performance. Regulatory and supervisory authorities can improve performance by considering the features found significant in this study. Moreover, regulators can benefit from these empirical results to strengthen corporate governance effectiveness. Features such as board independence and CEO separation from the chairman of the board have been identified as important elements to affect bank performance. Therefore, more attention should be invested towards these issues.

This study is subject to a limitation related to the sample of the survey. The conditions Greece have faced in the recent years at the economic level has created an interesting field of research, but at the same time the characteristics of this environment may limit the possibility of generalizing the results. Future studies in other environments with similar characteristics may complement the results. Furthermore, it is interesting to implement the research question to an extended sample across the financial industry, including insurance and financial services.

The author has not declared any conflict of interests.

REFERENCES

|

Adams RB, Mehran H (2005). Corporate performance, board structure, and their determinants in the banking industry. Working paper. Available at:

View

|

|

|

|

Adams RB, Mehran H (2012). Bank board structure and performance: Evidence for large bank holding companies. Journal of Financial Intermediation 21(2):243-267.

Crossref

|

|

|

|

|

Adams RB, Ferreira D (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics 94(2):291-309.

Crossref

|

|

|

|

|

Almutairi AR, Quttainah MA (2020). Foreign directors and corporate governance in Islamic banks. Journal of Islamic Accounting and Business Research 11(3):765-791.

Crossref

|

|

|

|

|

Al-Saidi M, Al?Shammari B (2013). Board composition and bank performance in Kuwait: an empirical study. Managerial Auditing Journal 28(6):472-494.

Crossref

|

|

|

|

|

Anderson CW, Campbell TL (2004). Corporate governance of Japanese banks. Journal of Corporate Finance 10(3):327-354.

Crossref

|

|

|

|

|

Andreou A, Andrikopoulos A, Nastopoulos C (2017). Debt Markets, Financial Crises, and Public Finance in the Eurozone: Action, Structure, and Experience in Greece. In: F. Economou, K. Gavriilidis, G. Gregoriou and V. Kallinterakis. 1st Edition, Handbook of Investors' Behavior During Financial Crises pp. 3-28.

Crossref

|

|

|

|

|

Andres P, Vallelado E (2008). Corporate governance in banking: The role of the board of directors. Journal of Banking and Finance 32(12):2570-2580.

Crossref

|

|

|

|

|

Aebi V, Sabato G, Schmid M (2012). Risk management, corporate governance, and bank performance in the financial crisis. Journal of Banking and Finance 36(12):3213-3226.

Crossref

|

|

|

|

|

Baltagi BH (2005). Econometric Analysis of Panel Data. 3rd Edition, John Wiley & Sons Inc., New York.

|

|

|

|

|

Bortz PG (2019). The Destiny of the First Two Greek "Rescue" Packages: A Survey. International Journal of Political Economy 48(1):76-99.

Crossref

|

|

|

|

|

Choi S, Hasan I (2005). Ownership, Governance, and Bank Performance: Korean Experience. Financial Markets, Institutions and Instruments 14(4).

Crossref

|

|

|

|

|

Donaldson L, Davis JH (1991). Stewardship Theory or Agency Theory: CEO Governance and Shareholder Returns. Australian Journal of Management 16(1):49-64.

Crossref

|

|

|

|

|

European Commission (2020). Study on the financial sector in Greece during the economic adjustment programmes: 2010-2018.

|

|

|

|

|

European Stability Mechanism (2019). 2018 Annual Report. Retrieved from

View

|

|

|

|

|

Gafoor CA, Mariappan V, Thyagarajan S (2018). Board characteristics and bank performance in India. IIMB Management Review 30(2):160-167.

Crossref

|

|

|

|

|

García-Meca E, García-Sánchez IM, Martínez-Ferrero J (2015). Board diversity and its effects on bank performance: An international analysis. Journal of Banking and Finance 53:202-214.

Crossref

|

|

|

|

|

Gaur SS, Bathula H, Singh D (2015). Ownership concentration, board characteristics and firm performance. Management Decision 53(5):911-931.

Crossref

|

|

|

|

|

Georgantopoulos A, Filos I (2017). Corporate governance mechanisms and bank performance: evidence from the Greek banks during crisis period. Investment Management and Financial Innovations 14(1):160-172.

Crossref

|

|

|

|

|

Gulamhussen MA, Santa SF (2015). Female directors in bank boardrooms and their influence on performance and risk-taking. Global Finance Journal 28:10-23.

Crossref

|

|

|

|

|

Haan DJ, Vlahu R (2016). Corporate Governance of Banks: A survey. Journal of Economic Surveys 30(2):228-277.

Crossref

|

|

|

|

|

Institute of Directors Southern Africa (2009). King III: Report on Corporate Governance for South Africa. Retrieved from

View

|

|

|

|

|

Kalemli-Özcan S, Reinhart C, Rogoff K (2016). Sovereign Debt and Financial Crises: Theory and Historical Evidence. Journal of the European Economic Association 14(1):1-6.

Crossref

|

|

|

|

|

Kaymak T, Bektas E (2008). East Meets West? Board Characteristics in an Emerging Market: Evidence from Turkish Banks. Corporate Governance: An International Review 16(6):550-561.

Crossref

|

|

|

|

|

Kiel GC, Nicholson GJ (2003). Board Composition and Corporate Performance: how the Australian experience informs contrasting theories of corporate governance. Corporate Governance 11(3):189-205.

Crossref

|

|

|

|

|

Kose J, De Masi S, Paci A (2016). Corporate Governance in Banks. Corporate Governance: An International Review 24(3):303-321.

Crossref

|

|

|

|

|

Kourdoumpalou S (2016). Do corporate governance best practices restrain tax evasion? Evidence from Greece. Journal of Accounting and Taxation 8(1):1-10.

Crossref

|

|

|

|

|

Koutoupis A, Kyriakogkonas P, Kampouris C (2020). Exploring the interrelation between Corporate Governance and Financial Performance: Evidence from Greek Systemic Banks. Actual Problems of Economics 1(223):14-25.

|

|

|

|

|

Larcker DF, Richardson SA, Tuna I (2007). Corporate Governance, Accounting Outcomes, and Organizational Performance. The Accounting Review 82(4):963-1008.

Crossref

|

|

|

|

|

Lazarides T, Drimpetas E (2011). Evaluating corporate governance and identifying its formulating factors: the case of Greece. Corporate Governance: The international journal of business in society, pp. 136-148.

Crossref

|

|

|

|

|

Liang Q, Xu PT, Jiraporn P (2013). Board Characteristics and Chinese Bank Performance. SSRN Electronic Journal pp. 2953-2968.

Crossref

|

|

|

|

|

Love I, Rachinsky A (2015). Corporate Governance and Bank Performance in Emerging Markets: Evidence from Russia and Ukraine. Emerging Markets Finance and Trade 51(2):101-121.

Crossref

|

|

|

|

|

Lückerath-Rovers M (2011). Women on boards and firm performance. Journal of Management and Governance 17(2):491-509.

Crossref

|

|

|

|

|

Mamatzakis E, Bermpei T (2015). The Effect of Corporate Governance on the Performance of US Investment Banks. Financial Markets, Institutions and Instruments 24(2-3):191-239.

Crossref

|

|

|

|

|

Masulis RW, Wang C, Xie F (2012). Globalizing the boardroom - The effects of foreign directors on corporate governance and firm performance. Journal of Accounting and Economics 53(3):527-554.

Crossref

|

|

|

|

|

Nerantzidis M, Filos J (2014). Recent corporate governance developments in Greece. Corporate Governance 14(3):281-299.

Crossref

|

|

|

|

|

Orazalin N, Mahmood M, Jung Lee K (2016). Corporate governance, financial crises and bank performance: lessons from top Russian banks. Corporate Governance: The International Journal of Business in Society 16(5):798-814.

Crossref

|

|

|

|

|

Oxelheim L, Randoy T (2003). The impact of foreign board membership on firm value. Journal of Banking and Finance 27(12):2369-2392.

Crossref

|

|

|

|

|

Pathan S, Faff R (2013). Does board structure in banks really affect their performance? Journal of Banking and Finance 37(5):1573-1589.

Crossref

|

|

|

|

|

Rafinda A, Rafinda A, Witiastuti RS, Suroso A, Trinugroho I (2018). Board Diversity, Risk and Sustainability of Bank Performance: Evidence from India. Journal of Security and Sustainability Issues 7(4):793-806.

Crossref

|

|

|

|

|

Rodriguez-Fernandez M, Fernandez-Alonso S, Rodriguez-Rodriguez J (2014). Board characteristics and firm performance in Spain. Corporate Governance 14(4):485-503.

Crossref

|

|

|

|

|

Sarhan AA, Ntim CG, Al?Najjar B (2019). Board diversity, corporate governance, corporate performance, and executive pay. International Journal of Finance and Economics 24(2):761-786.

Crossref

|

|

|

|

|

Shahrier NA, Ho JSY, Gaur SS (2020). Ownership concentration, board characteristics and firm performance among Shariah-compliant companies. Journal of Management and Governance 24(2):365-388.

Crossref

|

|

|

|

|

Shleifer A, Vishny RW (1997). A Survey of Corporate Governance. The Journal of Finance 52(2):737-783.

Crossref

|

|

|

|

|

Staikouras PK, Staikouras CK, Agoraki MEK (2007).The effect of board size and composition on European bank performance. European Journal of Law and Economics 23(1):1-27.

Crossref

|

|

|

|

|

Syriopoulos T, Tsatsaronis M (2011). The corporate governance model of the shipping firms: financial performance implications. Maritime Policy and Management 38(6):585-604.

Crossref

|

|

|

|

|

Tampakoudis I, Andrikopoulos A, Nerantzidis M, Kiosses N (2020). Does boardroom gender diversity affect shareholder wealth? Evidence from bank mergers and acquisitions. International Journal of Finance and Economics, pp. 1-30.

Crossref

|

|

|

|

|

Tampakoudis I, Nerantzidis M, Subeniotis D, Soutsas A, Kiosses N (2019). Bank mergers and acquisitions in Greece: the financial crisis and its effect on shareholder wealth. International Journal of Managerial Finance 16(2):273-296.

Crossref

|

|

|

|

|

Terjesen S, Couto EB, Francisco PM (2015). Does the presence of independent and female directors impact firm performance? A multi-country study of board diversity. Journal of Management and Governance 20(3):447-483.

Crossref

|

|