Full Length Research Paper

ABSTRACT

Fraud prevention and detection methods in the public sector are vital for improved performance and service delivery in the public. However, in Tanzania, there is a paucity of knowledge on the effectiveness of these methods. The main objective of this study was to examine the effectiveness of fraud prevention and detection methods in the public sector, a case of Tanzania Rural and Urban Roads Agency (TARURA) Morogoro region. A purposeful sampling technique was used in selecting a sample size of 77 respondents comprising accountants and auditors. Major results showed that process control involving internal control review and improvement, cash reviews, inventory observation and inspection and bank reconciliation ranked first in effectiveness; followed by communication towards staff; integrated fraud control; organizational policy; continuous monitoring; inspection tools and methods; and protection software/application. Based on the conclusion, the study recommends that the government should improve by revisiting the performance of methods such as integrated fraud control; organizational policy, continuous monitoring, inspection tools and methods as well as protection software/application as they ranked low in their effectiveness.

Key words: Fraud, detection, public, control, TARURA.

INTRODUCTION

Every year there are huge losses of trillions of dollars in the world due to fraudulent activities (Denman, 2019; Olweny and Kimani, 2011). When considering developing countries, such fraud losses could be higher than in developed countries (Denman, 2019). Globally, the occurrences of fraud scandals in public entities have resulted in erosion of investors and other stakeholders. Therefore, it has recently gained particular attention by researchers (PWC, 2018; Othman et al., 2015). This has raised attention regarding fraud prevention and detection in the private and public sectors (Bierstaker et al., 2006). Association of Certified Fraud Examiners (ACFE, 2018) reported that 88% of fraud cases perpetrated against government entities have resulted in misappropriation of assets. These cases caused a median loss of USD 100,000, while financial statement fraud schemes accounted for 6% of government cases with a median loss of USD 315,000. Moreover, corruption schemes occurred in 47% of cases and led to a median loss of USD 400,000. The greatest number of government cases in this report occurred in the United States, Sub-Saharan Africa, and the Asia Pacific region. In the case region-wise, Latin America and the Caribbean had the highest government fraud scandals with a median loss of USD 862,000, followed by the Sub-Saharan Africa region which had a median loss of USD250,000 (ACFE, 2018).

In Tanzania, some of the fraud scandals include but are not limited to DECI, TPA losses, Tegeta Escrow, EPA, and BAE radar fraud (Zuberi and Mzenzi, 2019). Other prominent fraud scandal in the Tanzanian Local Government Authorities (LGAs) was evidenced at Kishapu District Council in 2012. As per the special audit conducted in the stated LGAs, missing payment vouchers amounted to TZS 1.17 billion at minimum, forged bank statements and cheques amounted to TZS 235 million and TZS 502 million respectively. In addition, there was inadequate segregation of duties, poor internal controls systems, and non-functioning of the internal audit unit (Audit Report, 2012). This implies the existence of weak internal controls in Tanzanian organizations.

While studies on fraud prevention and detection mechanism are vital for enhanced policy formulation with regard to fraud prevention to both public and private sectors, a number of studies (Bierstaker et al., 2006; Smith, 2012; Apostolou and Crumbley, 2008; Alleyne and Horward, 2005; Rahman and Anwar, 2014) have mainly focussed on private sectors, neglecting the public sectors where massive of frauds are taking place resulting in retardation of development initiatives. On the other hand, in Tanzania, there are controls on the issue of fraud; however, there is a paucity of information with regard to its effectiveness as fraud cases are still prevailing. This study therefore aimed at investigating the effectiveness of the fraud prevention and detection methods in selected Tanzanian public sector entities, especially in the TARURA-Morogoro region. The findings of the study will help in strengthening of fraud prevention organs as well as formulation of proper and working policies geared at controlling of fraud in the country.

MATERIALS AND RESEARCH METHODS

Description of the study area

The study was conducted at TARURA in the Morogoro region. This region consists of six districts. For the aim of achieving study objectives, the study covered regional and district offices of TARURA namely Morogoro municipality, Mvomero, Ulanga, Gairo, Kilosa, and Morogoro rural. In other words, the area of the study was at the TARURA regional and district offices. The researcher considered financial restriction, limitation of time, and accessibility as the factors for selecting the Morogoro region. Geographically, the Morogoro region is surrounded to the north by the Tanga Region, to the east by the Pwani and Lindi Regions, to the south by the Ruvuma Region, and to the west by the Iringa and Dodoma Regions.

Research design

Since the main objective was to examine the effectiveness of fraud prevention and detection methods in the Tanzanian public sector, a descriptive cross-sectional research design was used. Descriptive research design is defined as the design which describes an accurate portrayal of or accounts of the characteristics like behavior, opinions, beliefs, opinions, and knowledge of a particular individual and the situation of the group (Maxwell, 2012).

Study population and unit of analysis

Since the study aimed at collecting enough data from the six district offices of TARURA in the Morogoro region, the study population comprised of all internal auditors and accountants which amounted to 90 in total in the six districts of study.

Sampling design and sample size

The non-probability sampling technique method was used to select the sample from the population. The researcher applied convenience and purposive sampling techniques as the number of the internal auditors and accountants are limited. According to Shausi et al. (2019), to avoid bias and making the study more representative convenience, sampling techniques are suggested in finding answers to the problems whose answers are to be collected from the respondents depending on the awareness and availability of the information and people. To obtain data from the field, the study purposively selected all the population of the study as their number was limited (90), all from TARURA Morogoro region.

Data collection

The researcher employed both sources of data collection in conducting this research. Therefore, primary and secondary sources of data collection were used to answer the research questions.

Primary data

A structured questionnaire was used as the primary method of data collection for the aim of obtaining answers to the research questions. This was attributed to the fact that a structured questionnaire is the most excellent and systematic way to obtain information for variables that are difficult to monitor and inexpensive access in the diverse population (Kothari, 2004). It is also considered as an appropriate way of investigating and meeting the large and diverse population of the research, to get the relevant answers to the research questions (Spira and Page, 2003; Mwonge and Naho, 2021).

Secondary data

A secondary data collection method was applied using reviewing previous and relevant documentation related to the effectiveness of fraud prevention and detection methods in the public sector. This method contains already existing information such as journals, books, newspapers, and the previous statements of financial information. It also consists of other unpublished documents such as unpublished bibliography. Data related to the fraud triangle and discussions of the findings of all specific objectives were obtained through online papers, international standards of auditing and other related documentation like books and periodicals. In addition, the review of the CAG reports also amounts to secondary data collection methods.

Data collection tools

To examine the effectiveness of fraud prevention and detection in the selected study area, the researcher develops a study questionnaire. Such a questionnaire was used to collect data from the respondents to obtain primary data for the stated research questions and objectives.

Data analysis

It should be noted that the major aim of this study was to examine the effectiveness of fraud prevention and detection methods in the Tanzanian public sector, particularly in the TARURA Morogoro region. To find answers to the research questions a Likert scale was employed and the fraud detection and prevention methods in public sectors were ranked in order of their effectiveness.

RESULTS AND DISCUSSION

Respondents’ demographic information

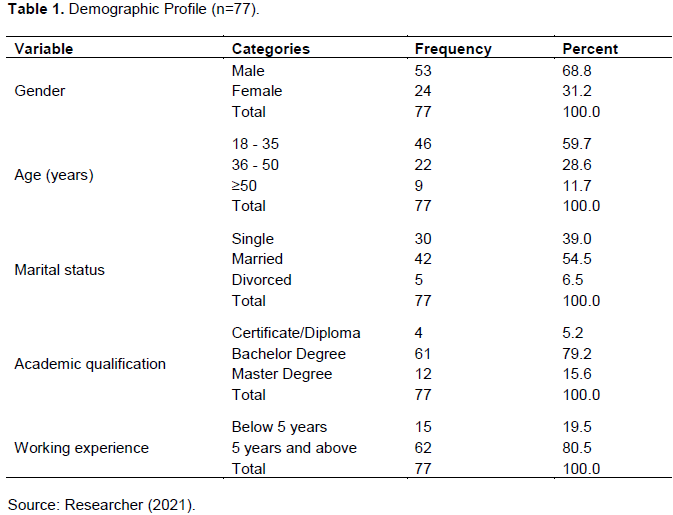

Demographic information of respondents involved the study on gender, age, marital status, academic level, and working experience. The study results are summarized in Table 1.

Gender

As presented in Table 1, two categories of gender were examined and the results indicated that 68.8% equivalents to 53 respondents were male while 31.2% representing 24 respondents were female. This suggests that most of the respondents were male, although the difference is not significant.

Age

Three categories of age groups were used to examine the age of the respondents. From Table 1, under the age category of 18-35 years, there were 46 respondents’ equivalents to 59.7%; while under the category of 36 -50 years, 22 respondents were standing for 28.6%. Under the last category, 50 years and above there were 9 respondents’ equivalents to 11.7%. Generally, most of the respondents were under the age category of 18-35 years, which has 46 respondents representing 59.7%.

Marital status

This was examined by considering three categories namely single, married, and divorced. As shown in Table 1, single respondents were 30 (39%), while married respondents were 42 (54.5%), while divorced respondents were 5 (6.5%). This means that more than half of the respondents were married.

Academic qualification

Results in Table 1 shows that, most of the respondents about 61 respondents (79.2%) had bachelor's degrees, followed by 12 (15.6%) who had a Master's degrees, while only 4 respondents equivalents to 5.2% had a certificate/diploma. The results imply that most of the accountants and auditors had an education at degree level. This level of education can enable them to have rational judgments with regard to their duties.

Working experience

As presented in Table 1, two categories of working experience were used. Respondents with working experience below five years were 15 (19.5%), while those with working experience five years and above were 62 respondents (80.5%). For this case, most of the respondents are well experienced in performing their jobs.

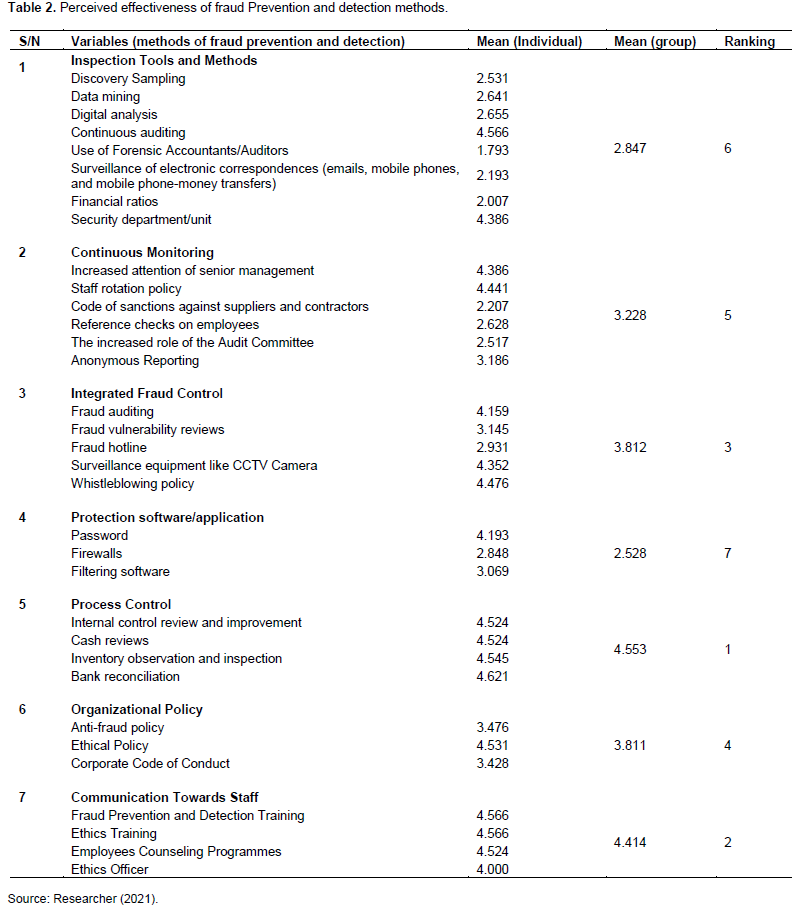

Effectiveness of fraud detection and prevention methods in the public institutions

To examine the perceived effectiveness of fraud prevention and detection methods in public institutions, particularly the methods used in preventing and detecting fraud, the researcher grouped the methods of fraud prevention and detection into seven groups. These are inspection tools and methods, continuous monitoring, integrated fraud control, protection software/application, process control, organizational policy, and communication towards staff. Such grouping followed past studies on fraud prevention and detection (Bierstaker et al., 2006; Rahman and Anwar, 2014; Othman et al., 2015; Siregar and Tenoyo, 2015). The study results are presented in Table 2.

In general Table 2 shows that process control was the most effective method in fraud prevention and detection with a mean score of 4.553. This means that process control including specific methods of fraud prevention and detection such as internal control review and improvement, cash reviews, inventory observation, and inspection as well as bank reconciliation is the highly used and very effective method in preventing and detecting fraud in the public institution. Individually, under process control, bank reconciliation scored the highest mean of 4.621, followed by inventory observation and inspection (Mean=4.545). Internal control review and improvement scored a similar mean of 4.524 and Cash reviews (Mean = 4.524). For the aim of preventing and detecting fraud in public institutions, our findings show that, individually under this category, bank reconciliations are the most effective method of infighting against fraud in an organization. This is consistent with previous studies like Rahman and Anwar (2014) and Bierstaker et al. (2006).

Apart from process control, the second effective method was communication towards staff with a mean score of 4.414. This means that to prevent and detect fraud in an organization, communication towards staff should be highly used since it is very effective in preventing and detecting fraud. As shown in the analysis under Table 2, under this category, individually training on fraud prevention and detection as well as ethics training collectively were ranked as the most effective method of preventing and detecting fraud (Mean = 4.566). This is followed by employees counseling programs (Mean = 4.524) and ethics officers (Mean = 4.000). Being the second most effective method of preventing and detecting fraud, communication towards staff should be highly practiced by any organization. This suggests that conducting fraud awareness creates strong immune against fraud scandals in an organization. In addition, the provision of employees counseling programs accompanied by the presence of an ethics officer adds value to preventing and detecting fraud. A review of past studies indicates that employees are imparted with good faith in their organization when they are frequently trained on fraud prevention and detection (Rahman and Anwar, 2014). On the other hand, such practices encourage creating a culture of honesty and self-awareness against fraud scandals in an entity (Bierstaker et al., 2006). This is also consistent with Shanmugam et al. (2012) and Bierstaker et al. (2006) who collectively recommended that various training workshops on moral values, anti-fraud awareness, and ethical conduct keeps on reminding employees in preventing and detecting fraud in an entity. Specifically, Bierstaker et al. (2006) insisted that frequently trained auditors on fraud prevention and detection have more ability to identify and detect red flags compared with the others, who don’t have training on the same.

The third and fourth effective method was integrated fraud control and organizational policy with a mean score of 3.812 and 3.811 respectively. As indicated in their mean scores, these two methods had a slight difference in their mean, meaning that their effectiveness in preventing and detecting fraud is the same. As shown in Table 2, integrated fraud control involved five methods and the most effective one was whistle-blowing policy (Mean = 4.476), followed by the use of surveillance equipment like CCTV Camera (Mean = 4.352), and fraud auditing (Mean = 4.159). Also, fraud vulnerability review with a mean value of 3.145 and fraud hotline with a mean score of 2.931 was ranked as the least methods in preventing and detecting fraud in the selected public institution in Tanzania. Our findings imply that the presence of a whistleblowing policy and the application of surveillance equipment like CCTV cameras are highly effective in preventing and detecting fraud in the selected public institution. The whistle-blowing policy enables employees and non-employees to provide information related to fraud intentions or fraud scandals hence enabling an organization to prevent or detect fraud in an early environment. Also, the employment of CCTV cameras and other similar equipment works collectively in preventing and detecting fraud in an organization.

For the case of organizational policy like anti-fraud policy, ethical policy, and corporate code of conduct, it is shown that ethical policy is the most effective method in preventing and detecting fraud (Mean = 4.531) followed by anti-fraud policy (Mean = 3.476) and corporate code of conduct (Mean = 3.428). Therefore, as per our results, the application of fraud policies like anti-fraud policy, ethical policy, and corporate code of conduct play a significant role in preventing and detecting fraud in public institutions. In the view of reducing fraudulent activities, management should emphasize and place more efforts on professional ethics starting from top to bottom levels (Shanmugam et al., 2012).

Continuous monitoring was also ranked as the fifth method with a mean score of 3.228. This involved increased attention of senior management (Mean = 4.386), staff rotation policy (Mean = 4.441), anonymous reporting (Mean = 3.186), code of sanctions against suppliers and contractors (Mean = 2.207), and reference checks on employees (Mean = 2.628), as well as the increased role of the audit committee (Mean = 2.517). Other methods which were perceived not to be effective in fraud prevention and detection were inspection tools and methods as well as protection software/application. These methods scored a mean of 2.847 and 2.528 respectively. As per ranking in Table 2, inspection tools and methods as well as protection software/application were ranked as the sixth and seventh method respectively, indicating that they are not effectively used methods in fraud prevention and detection methods in the public institutions in Tanzania. Our findings show that inspection tools such as discovery sampling, data mining, digital analysis, use of forensic accountants/auditors, and surveillance of electronic correspondences (emails, mobile phones, and mobile phone-money transfers) are not frequently used in preventing and detecting fraud in the public institutions. According to Shanmugam et al. (2012), forensic accountant focuses on investigation, discovering fraud, recovering assets fraudulently taken by fraudsters as well as tracking of assets. This makes a note that, public institutions have not invested much in the application of the stated inspection tools in preventing and detecting fraud. For example, using a forensic accountant is highly beneficial in large organizations like a small one, due to budget challenges. This is in agreement with Rahman and Anwar (2014) and Othman et al. (2015). On the other hand, our results show that the use of financial ratios, continuous auditing, and security department/unit have much impact on fraud prevention and detection. Previous studies recommend that continuous auditing and application of digital analysis as well as data mining should be highly encouraged and organizations should invest much in the use of forensic accountants and auditors (Bierstaker et al., 2006).

CONCLUSION AND RECOMMENDATIONS

The aim of this study was to assess the perceived effectiveness of fraud prevention and detection methods in the public sector in Tanzania. General results showed that Process Control involving Internal control review and improvement, cash reviews, inventory observation and inspection and bank reconciliation ranked the first in its effectiveness; followed by communication towards staff; integrated fraud control; organizational policy; continuous monitoring; inspection tools and methods; and protection software/application, respectively.

Based on the conclusion, the study recommends that the government should improve by revisiting the performance of methods such as integrated fraud control; organizational policy, continuous monitoring, inspection tools and methods as well as protection software/ application as they were ranked low in their effectiveness.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Alleyne VGP, Howard M (2005). An exploratory study of auditors' responsibility for fraud detection in Barbados. Managerial Auditing Journal 1(4):1-16. |

|

|

Apostolou N, Crumbley DL (2008). Auditors' Responsibilities concerning Fraud: A Possible Shift? The CPA Journal 78(2):23-44. |

|

|

Association of Certified Fraud Examiners (ACFE) (2018). Report to the Nations Global Study on Occupational Fraud and Abuse Government. New York: Association of Certified Fraud Examiners. |

|

|

Audit Report (2012). Annual General Report of the Controller and Auditor General: On the Audit of the Financial Statements of Donor Funded Projects for the year ended 30th June, 2012. |

|

|

Bierstaker JL, Brody RG, Pacini C (2006). Accountants' perceptions regarding fraud detection and prevention methods. Managerial Auditing Journal 1:1-14. |

|

|

Denman DS (2019). Machiavelli and the Fortress City. Political Theory 47(2):203-229. |

|

|

Kothari CR (2004). Research Methodology Methods and Techniques. 2nd Edition, New Age International Publishers, New Delhi. |

|

|

Maxwell A (2012). The development practioners Handbook, London, Pluto Publishing Press. |

|

|

Mwonge LA, Naho A (2021). Determinants of credit demand by smallholder farmers in Morogoro, Tanzania. African Journal of Agricultural Research 17(8):1068-1080. |

|

|

Olweny TO, Kimani D (2011). Stock market performance and economic growth empirical evidence from Kenya using causality test approach. Advances in Management and Applied Economics 1(3):153-196. |

|

|

Othman R, Aris NA, Mardziyah A, Zainan N, Amin NM (2015). Fraud detection and prevention methods in the Malaysian public sector: Accountants' and internal auditors' perceptions. Procedia Economics and Finance 28:59-67. |

|

|

PWC (2018). Pulling fraud out of the shadows Global Economic Crime and Fraud Survey. UK: PWC. |

|

|

Rahman RA, Anwar ISK (2014). Types of Fraud among Islamic Banks in Malaysia. International Journal of Trade Economics and Finance 5(2):176-179. |

|

|

Shanmugam JK, Che Haat MH, Ali A (2012). An Exploratory Study of Internal Control and Fraud Prevention Measures in SMEs. International Journal of Business Research and Management 3(2):90-99. |

|

|

Shausi GL, Ahmad AK, Abdallah JM (2019). Factors Determining Crop Farmers' Willingness to Pay for Agricultural Extension Services in Tanzania: A Case of Mpwapwa and Mvomero Districts. Journal of Agricultural Extension and Rural Development 11(12):239-247. |

|

|

Siregar SVNP, Tenoyo B (2015). Fraud awareness survey of private sector in Indonesia. Journal of Financial Crime 22(3):329-346. |

|

|

Smith GS (2012). Can an auditor ever be a first responder to financial frauds? Journal of Financial Crime 1(4):14-34. |

|

|

Spira LF, Page M (2003). Risk management: The reinvention of internal control and the changing role of internal audit, Accounting, Auditing and Accountability Journal 16(4):640-661. |

|

|

Zuberi O, Mzenzi SI (2019). Analysis of employee and management fraud in Tanzania. Journal of Financial Crime 4(3):92-111. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0