Full Length Research Paper

ABSTRACT

The study examines whether the quality of international Financial Reporting Standards (IFRS) based published financial information in Nigeria increased in the post-IFRS era. The study examines the quality of IFRS-based financial reports in improving the information required from financial statements. In other words, it evaluates the quality of published financial reports after IFRS adoption in Nigeria using annual reports of 87 non-financial companies for 10 years (2007-2016). We find that information provided in post-IFRS published financial statements is of higher value to investors/shareholders. The result was confirmed using trend analysis of and pre-and post-IFRS adjusted R2, which confirm that public financial statements in the post-IFRS era have increased value relevance. These findings imply that adopting IFRS in Nigeria is justifiably undertaken as the objective of possible channelling funds, for investment purposes, to the right channel is achieved. The finding indicates positive changes after IFRS adoption. Based on these findings, we recommend that the Nigerian Financial Reporting Council, Stock Exchange, Securities and Exchange Commission and other relevant authorities in the country should ensure compliance with the ethos of IFRS adoption to ensure that the improved quality of financial reporting achieved is consistently maintained.

Key words: IFRS, accounting information, value relevance, accounting data, N-GAAP.

INTRODUCTION

The major objective of accounting records collected and analysed is to provide valuable information to users. The information provided will enable users of financial statement, such as investors and auditors to have access to firms in order to evaluate their true financial position and performance. Isa (2014) enumerated the objectives of Nigerian’s adoption of the IFRS to include reliability, relevance, and comparability to aid investors’ (users) decisions. These objectives include increased value relevance, improved transparency and reduced earnings manipulations. Besides, improved financial reporting quality leads to presentation of reliable financial information comparable with other capital markets in a globalized and competitive marketplace where scarce resources are directed towards area of best possible returns (Wurgler, 2000). On this note, Umoren and Enang (2015) explained that the extent a financial statement would be able to competently influence the decision of investors depend on the value of information contained in that financial statement. Vishnani and Shah (2008) explained that value relevance is concerned with the financial information ability to explain the stock market.

Holthausen and watts (2001) grouped the study of value relevance studies into: comparative relationship investigations, incremental relationship investigations and marginal information investigations. The comparative relationship investigations compare accounting numbers that are prepared with different sets of accounting standard and the relationship existing between stock market returns or value. With these categories of studies, research on value relevance usually focuses on net income and equity book-value because they represent the main drivers of a company’s valuation. Incremental relationship investigation help to ascertain if accounting figures deemed useful in elucidating stock market returns and this numbers are deem to be value relevant if its statistical regression coefficients are considerably different from zero. While, The marginal information investigation studies is used to examine if accounting numbers disclosed are correlated with market returns variations. Market price reactions are presumed to be proof of value relevance (Li, 2010). The study examines whether the quality of international Financial Reporting Standards (IFRS)-based published financial information in Nigeria increased in the post-IFRS era. This study applies the comparative relationship investigation and the marginal information investigation approach. Consequently, the study examines the relationship between figures prepared using adopted IFRS and the value relevance of financial information.

This study contributes to the literature by empirically examining the effect of the adoption of IFRS in Nigeria on the quality of published financial statements through transparent and qualitative value relevance financial information. In reviewing related literatures, no researcher specifically addressed the measurement of improved value relevance of published financial data except the study of Umoren and Enang (2015) who examined IFRS Adoption and Value Relevance of Financial statements of Nigerian listed banks. However, the study of Umoren and Enang (2015) was directed at the banking industry excluding sectors of the economy. Other researchers either did an exploratory study with questionnaires administered or a conceptual study such as Edogbanya and Kamardin (2014). It can be argued that administration of questionnaires does not capture the real state of activities of firms which are only available in published annual reports. Furthermore, questionnaires are targeted at individuals whose responses are guided by their subjective norms and cannot reflect behaviour of firms in real market.

Thus, the impact of value relevance is not effectively examined in emerging markets regarding the adaptation of IFRS. Therefore, this study will examine the effect of the adoption of IFRS in Nigeria on the quality of published financial statements through transparent and qualitative value relevance financial information. The study examines the quality of IFRS-based financial reports in improving the information required from the financial statements. The rest of the paper is structured thus: Section two provides a literature review of related studies and the hypotheses of the research. Section three presents the methodology of the study. Section four discusses the empirical findings and policy implications while section five is conclusions and recommendations.

RELEVANCE OF PUBLISHED FINANCIAL STATEMENTS

The relevance value of financial accounting information is determined mostly by its quality which makes accounting information of great interest to its users such as managers, shareholders, investors and customers (Barth et al., 2008). For example, for a reporting company, better-quality accounting information can translate into lower cost of capital (Sengupta, 1998) whilst to an investor, it can translate into a more profitable allocation of capital (Barth et al., 2008). Accounting quality has been defined as the quality of accounting information as the capability of accounting measures to reflect a company’s true economic position and the level of its performance (Verleun et al., 2011; Barth et al., 2008; Penman and Zhang, 2002; Watts, 2003). Their definition focuses on relevance of accounting information reported by entities only when the information they provide ensures reliability; such that it protects users of the information from any form of management opportunistic behaviour. Other definitions focus on relevance of information which is equally important (Li, 2010; Irvine and Lucas, 2006). Balance must be stricken between these two for accounting information to be of quality hence, its usefulness to stakeholders. The friction generated in balancing these two (accounting information and accounting quality) has existed for many years as they appear contradictory rather than complementary (Barth et al., 2008). Barth et al. (2008) resolve this conflict when they view accounting quality as relating to both a company’s true economic position as well as its performance which means that the quality of accounting information does affect both the statement of financial position as well as the income-statements of a company. Consequently, they argue that it is possible that an increase in value relevance of information in the statement of financial position may as well come along with an increase in reliability in the financial income statement information reported. Due to the possibility of increase in both relevance and reliability, we provide multiple measures in this study to capture this.

In principle, the quality of accounting information is not something that can be detected easily in the financial statements, appropriate proxies have to be formulated or developed (Kargin, 2013). Consequently, prior empirical studies have identified a number of accounting quality measures like forecast made by securities analysts, value-relevance, conservatism and earning management (Barth et al., 2008; Lang et al., 2003). More-also, Muhibudeen (2015) rates value relevance as measures with better ability to measure accounting quality as it enables financial information disclosed to explain how a firm value is measured. Therefore, we adopt value relevance measures using the financial information reported and the stock market value (Kargin, 2013). Iatridis (2010) has studied the impact of IFRS adoption in the United Kingdom and established that the application of IFRS does strengthen the quality of accounting statements and it improves the value relevance of accounting information reported. The value relevance measures we are using in this study, is in line with the accounting quality explanation provided by Barth et al. (2008). The empirical study of Abubakar et al. (2017) study examines the relationship between accounting disclosure and market value under new accounting reporting. The study finds that disaggregated assets and liabilities strongly correlate with the stock price. Similarly, it concludes that adjusted R2 has a more significant association with a stock price after adopting IFRS.

The study of Aderin and Otakefe (2015) evaluates the impact of the adaptation of IFRS on Nigerian firms' quality of financial reporting. The study uses 23 listed companies for four (4) years, using regression analysis to evaluate R2 statistics.

The results show that financial reporting quality increased after the adaptation of IFRS. In addition, Iatridis (2010) focuses on the value relevance in adopting IFRS from GAAP in the United Kingdom. The study suggests less information asymmetry and earning manipulation would lead to more relevant accounting measures. Similarly, Kargin (2013) concludes that value relevance has improved in the post-IFRS period in Turkish firms. In the same vein, Müller (2014) investigated the impact of mandatory adaptation of IFRS on the listed firms on the European stock markets of London, Paris, and Frankfurt stock exchanges. The results show increased value relevance after adopting IFRS, leading to better compliance with corporate governance principles, disclosure quality, and transparency.

Hypothesis of the study

As a result of the above, the study will consider these two hypotheses (in their null forms):

Ho1: Financial statements prepared using IFRS are not more value relevant than financial statements prepared under the Nigerian GAAP.

Ho2: Financial statements prepared over the period of the study did not show increasing trend in value relevance.

Signalling theory

This paper uses signalling theory to underpin the research. The golden idea behind signalling theory describes a situation when company management decides to send information about their performance to stakeholders or other financial statements users to attract their attention (Watts and Zimmerman, 1978). Signalling theory is mainly focused on problems involving information asymmetry in the market, at the same time, how this information asymmetry can be abridged by the party that has the most information signalling to the other party (Morris, 1987). Consistently, we would argue that the eventual value of the shares of these companies will be closer to their intrinsic value arising from possibly bridging information gaps between the companies and their shareholders from pre- to post- IFRS era.

METHODOLOGY

This study adopts a longitudinal research design in seeking to describe the pattern of variation that exists in the quality of financial statements in lieu of the adoption of IFRS in Nigeria. To achieve meaningful results, the time periods used in this study were divided into two: (a) Before IFRS adoption in Nigeria (also known as N-GAAP years), and (b) After IFRS adoption. The population of the study consist of 172 companies listed on the Nigeria Stock Exchange (NSE). The sample, therefore, consisted of 87 companies. The study used archival data from secondary source. Financial and insurance companies were exempted due to the peculiarity of their financial reports and additional regulations. Accounting variables were hand-sourced from the annual reports of the sampled firms for the period 2007 to 2016. The share prices were sourced from NSE fact book, Data Stream, and publications of the Nigerian Securities and Exchange Commission (SEC).

The Ohlson (1995) model is classified as the most popular valuation model use for measuring value relevance (Verleun et al., 2011). The model is usually applicable when value relevance is investigated over several periods of time because it is very compatible with inter-periods comparison. The study adopted Ohlson (1995) value relevance model as modified by Müller (2014) to see the improvements on value relevance of quality of accounting information in the pre- and post-IFRS periods. The model consists of two key indicators from financial statements report (that is, Statement of financial position and Income statement) on stock price. The model is defined as follows:

(Pre-IFRS) SPit= β0 + β1BVit+β2EPSit +β3CFit + β4NAit+ β5NIit + εit ………………………….. (1)

(Post-IFRS) SPit = β0 + β1BVit +β2EPSit +β3CFit +β4NAit+ β5NIit + εit ………………………….. (2)

where:

SPIT= share price at the fiscal year (proxy for quality of published financial information)

BVit = book value of company in year t

NIit = net income/share of company i in year t

NAit = net assets of company in year t

CFit = cash flow of parent company/share of company i in year t

EPSit = earnings per share of company i in year t

The combined value relevance metrics is measured by the adjusted-R2 and the regression coefficients of the Ohlson (1995) model. Thus, after the accounting numbers are obtained for both pre- and post-IFRS adoption a comparison can then be made between these periods. In this manner, it can then be thoroughly investigated whether there has been a change in the quality of published financial information after the mandatory adoption of IFRS in Nigeria. Given the fact that IFRS is a more principle-based regulation, we expect an increase in value relevance after the mandatory adoption of IFRS.

Since the study seeks to ascertain the effect of accounting information on share price, and more than one accounting information variable is employed, the study used the ordinary least square (OLS) multiple regression method. However, the data gathered has both cross-sectional and time series properties; essentially a panel data.

RESULTS AND DISCUSSION

Descriptive statistics

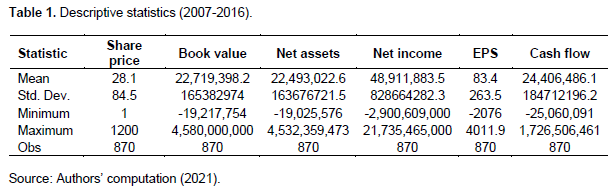

Descriptive statistics is used to show trend behaviour of the variables. The descriptive statistics for the preliminary statistical properties of the variables considers the full sample size (2007-2016) and the results are shown in Table 1. During the period under study, the highest mean value was recorded by net income with a value of 48.9 million. This is mainly attributed to the magnitude of the earnings by the firms during the period. Companies’ activities tended to boost quality control thereby making their stocks perform well in the capital market and hence, the earnings were significantly larger during the period. Next in the series is the cash flow of companies with a mean value of 24.4 million. The book value of the company’s equity, net assets of companies all maintained positive averages within the period of study. It is also worth noticing that the share price during this period maintained a relatively healthy mean value. On the fluctuation pattern, the net income was the most fluctuating during the period which is understandable because the period combines both pre- and post-IFRS years and also, considering the volatility of the capital market during these years, it is no surprise that the net income, net assets, cash flow and book values exhibited such volatility. The net income in this period had staggering minimum and maximum values at -2.9 billion and 21.7 billion respectively.

Empirical analysis of estimation results

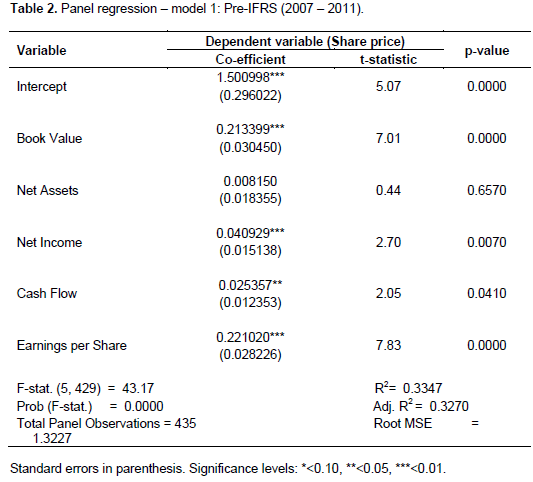

Having looked at the descriptive statistics which explained trend behaviour in the last paragraph, an empirical analysis and estimation of the models earlier specified will be done in this section. Due to the nature of the data, for the first two models, the natural logarithm (LN) of all the data were computed and used for the panel regression. This was done to contain the degree of extremes noticed in the data. The interpretation of the panel regression results is done based on statistical and econometric criteria. The model included the basic factors affecting share price namely book value, Net assets, net income, cash flow and earnings-per-share in the pre-IFRS era. All the variables in the model conform to the expected signs because of the positive influence they have on share price. We cannot at this point observe the effect of the adoption of IFRS on share price and value relevance until we make an analysis of the post-IFRS but before then, we take a look at the regression coefficients, that is, the effects of the independent variables on share price during this period (Table 2). From the result, it can be seen that all the independent variables impact share price positively. The t-ratios and their respective p-values reveal that all the coefficients of net income, book value, earnings-per-share and the intercept are statistically significant at 1% significance level that of cash flow is significant at 5%, while the coefficient of net asset is not statistically significant. The model has relatively decent explanatory and predictive powers as suggested by the R2 and the adjusted R2 values respectively considering the fact that the regression is cross-sectional in nature. The R2 value of 0.3347 suggests that about 33.47% of the systematic variations in share prices can be explained jointly by book value, net income, net assets, cash flow and earnings- per-share.

The adjusted R2 value of 32.70% shows that the model has a relatively good predictive power. The goodness-of-fit of the model is further emphasized by the statistical significance of the F-statistics which is 43.17 with a p-value of 0.0000 this means that all the explanatory variables taken together are significant. In summary, in the pre-IFRS era, the model is good and the explanatory variables are good instruments for attaining a high and positive share price. Next, we consider the post-IFRS panel regression in Table 3.

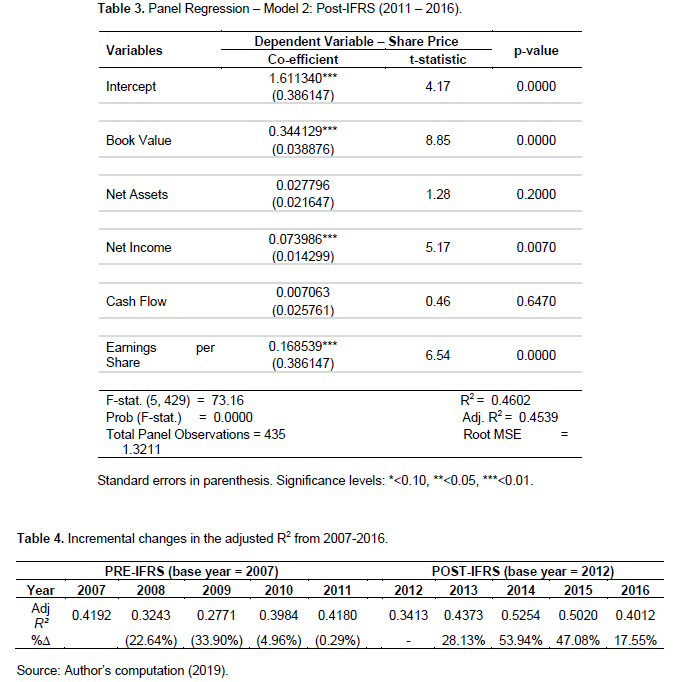

First, looking at the regression coefficients, the result here is quite like the earlier one in that all the independent variables have a positive impact on share price. However, upon further observation, it is found that book value increases its influence on share prices under IFRS with a positive and significant impact as a percentage increase in book value leads to 34.41% increase in share price. This is consistent with Paglietti (2009) findings in a study that examined the effects of mandatory adoption of IFRS on Italian listed companies. Likewise, net income, cash flow, net assets, and earnings per share impacts share price. There is a general observation that share price always moves up with an increase in earnings per share and since this holds in both the pre and post adoption periods, a major deciding factor on the importance of IFRS adoption will depend on whether value relevance is increased post-adoption or not. However, the higher association between accounting numbers and share prices in the post-adoption period indicates that investors consider accounting information useful for their economic decisions. Asymmetric information on the quality of financial information is effectively bridged in both pre- and post- IFRS with the gap closer in the pre- era to justify the adoption of IFRS. The intercept value of 1.6113 implies that without all the independent variables used in this regression or if they are held constant, then share price will be 1.6113. It can be noticed that this value is higher than it was in the pre-IFRS era. Using the coefficients t-statistic and their respective p-values, the test of individual significance reveals that the coefficients of book value, net income, earnings per share and the intercept are statistically significant at 1% level of significance, while the coefficient of net assets and cash flow are not significant. The magnitude of adjusted R2 in the post-IFRS period is larger than that of the pre-IFRS era. This suggests that our variable of interest provide information of higher value to investors/shareholders for their investment decision in post-IFRS era than in pre-IFRS era. It is, however, interesting to note that in the pre and post adoption periods, book value, net income and earnings per share have significant effects on the share price thereby solving the problem of information asymmetry. We document greater use of information in the financial statements produced by the companies by their shareholders which brings the market value of the shares to its intrinsic state. Aderin and Otakefe (2015) also had such findings and their rationale for it was because these variables are very important indicators to investors of a firm’s performance. If this is the case, then the value relevance provided by such information cannot be overemphasised because this is what will guide investors in making decisions in the capital market.

The model has good explanatory and predictive powers as suggested by the R2 and the adjusted R2 values. The adjusted R2 in this era is higher than the one in pre-IFRS era. This indicates that in this era, there is an increase in value relevance of firms and hence higher quality of information and this suggests that IFRS adoption has a significant positive effect on the quality of published financial information. This agrees with the findings of Iatridis, 2010; Kargin, 2013; Müller, 2014; Aderin and Otakefe, 2015; Abubakar et al., 2017. Similarly, the adjusted R2 value being higher in the post-IFRS era suggests that the adoption of IFRS has a significant and positive effect on the quality of published financial information. Müller (2014) and Aderin and Otakefe (2015) also made such discovery.

Robustness checks: value relevance test using trend analysis

In this section, we look at the adjusted R2 from the pre-adoption period (2007-2011) to the post-adoption period (2012 – 2016). Using 2007 as base year for pre-IFRS and 2012 for post-IFRS, the percentage changes in adjusted R2 was consistently negative for pre-IFRS period and consistently positive for post-IFRS period. The result is presented in Table 4. The essence of this analysis is to be able to answer the second research question which asks if there have been incremental changes in value relevance over the years due to the adoption of IFRS. For the pre-adoption period, the percentage change all through this era is negative, while in the post-IFRS period, in 2013 precisely, a 28.13% (positive) increase was noticed immediately after adoption and the percentage increase in this entire period remained positive. However, in 2016, there was a significant decrease in the percentage change in the adjusted R2 and just like we explained in the previous section, this decrease can be linked to the fact that Nigeria officially entered into recession in 2015, this incidentally had some impact on the financial performance of firms listed on the Nigerian Stock Exchange. Essentially, given how the percentage change in value relevance remained positive all through the post-adoption period, we can infer from the result that financial statements prepared over the period of the study showed increasing trend in value relevance in the post-adoption years, so the null hypothesis is rejected, however, due to economic factors such as the recession, there was a decline in this trend and as a result, we cannot ascertain if the increase in value relevance have continued if there was no recession.

CONCLUSION AND RECOMMENDATIONS

The need for high quality financial reports cannot be overemphasised. This research focuses on the effect of adoption of IFRS on the quality of financial reporting. Consistent with the finding adaptation, IFRS is beneficial to listed companies and enhance financial reporting quality; high-quality financial reports will motivate investors to invest more in companies in anticipation of more important and qualitative disclosure. Adequate financial disclosure will mitigate information asymmetry between managers and shareholders, thereby increasing the intrinsic value of listed firms. Furthermore, it should be noted that the ultimate purpose of improving financial reporting quality is to ensure that investors channel funds into best use for the purpose of growth and development of the economy. Thus, improving the quality of financial reporting is not an end, but a means to an end. To achieve this end, government must be totally committed to providing enabling environment for investors, both local and foreign, to use high quality financial statements for investment decision. In sum, high quality reports are not enough to guarantee economic development. The government must ensure political and religious peace, provision of infrastructure and security of lives of properties.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Abubakar MY, Abdulsallam N, Alkali MY (2017). The Impact of the New Accounting Reporting Among Listed Firms in Nigerian Stock Market. Asian Journal of Social Sciences and Management Studies 4(1):1-9. |

|

|

Aderin A, Otakefe JP (2015). International financial reporting standards and financial reporting quality in Nigeria. Journal of Science and Technology (Ghana) 35(3):73-83. |

|

|

Barth ME, Landsman WR, Lang MH (2008). International accounting standards and accounting quality. Journal of Accounting Research 46(3):467-498. |

|

|

Edogbanya A, Kamardin H (2014). Adoption of international financial reporting standards in Nigeria: Concepts and Issues. Journal of Advanced Management Science 2(1):72-75. |

|

|

Holthausen RW, Watts RL (2001). The relevance of the value-relevance literature for financial accounting standard setting. Journal of Accounting and Economics 31(1):3-75. |

|

|

Iatridis G (2010). International Financial Reporting Standards and the quality of financial statement information. International Review of Financial Analysis 19(3):193-204. |

|

|

Irvine HJ, Lucas N (2006). The rationale and impact of the adoption of International Financial Reporting Standards: the case of the United Arab Emirates. In: Proceedings of the 18th Asian-Pacific Conference on International Accounting Issues. California State University, The Sid Craig School of Business pp. 1-22. |

|

|

Isa MA (2014). Dimensions of IFRS Transition Roadmap's Information Content in LDCs: A Case of Nigeria. Procedia - Social and Behavioral Sciences 164:621-626. |

|

|

Karg?n S (2013). The impact of IFRS on the value relevance of accounting information: Evidence from Turkish firms. International Journal of Economics and Finance 5(4):71-80. |

|

|

Lang M, Raedy JS, Yetman MH (2003). How representative are firms that are cross?listed in the United States? An analysis of accounting quality. Journal of Accounting Research 41(2):363-386. |

|

|

Li S (2010). Does mandatory adoption of International Financial Reporting Standards in the European Union reduce the cost of equity capital?. The Accounting Review 85(2):607-636. |

|

|

Morris RD (1987). Signalling, agency theory and accounting policy choice. Accounting and business Research 18(69):47-56. |

|

|

Muhibudeen L (2015). International financial reporting standard and value relevance of accounting information in quoted cement firms in Nigeria. International Journal of Sciences: Basic and Applied Research 22(1):81-95. |

|

|

Müller VO (2014). The impact of IFRS adoption on the quality of consolidated financial reporting. Procedia-Social and Behavioral Sciences 109:976-982. |

|

|

Ohlson JA (1995). Earnings, book values, and dividends in equity valuation. Contemporary Accounting Research 11:661-687. |

|

|

Paglietti P (2009). Investigating the effects of the EU mandatory adoption of IFRS on accounting quality: Evidence from Italy. International Journal of Business and Management 4(12):3. |

|

|

Penman SH, Zhang XJ (2002). Accounting conservatism, the quality of earnings, and stock returns. The Accounting Review 77(2):237-264. |

|

|

Sengupta P (1998). Corporate disclosure quality and the cost of debt. Accounting Review 73(4):459-474. |

|

|

Umoren AO, Enang ER (2015). IFRS adoption and value relevance of financial statements of Nigerian listed banks. International Journal of Finance and Accounting 4(1):1-7. |

|

|

Verleun M, Georgakopoulos G, Sotiropoulos I, Vasileiou KZ (2011). The Sarbanes-Oxley Act and accounting quality: a comprehensive examination. International Journal of Economics and Finance 3(5):49-64. |

|

|

Vishnani S, Shah BK (2008). Value relevance of published financial statements-with special emphasis on impact of cash flow reporting. International Research Journal of Finance and Economics 17(1):84-90. |

|

|

Watts RL, Zimmerman JL (1978). Towards a positive theory of the determination of accounting standards. Accounting Review 53(1):112-134. |

|

|

Watts RL (2003). Conservatism in accounting part I: Explanations and implications. Accounting Horizons 17(3):207-221. |

|

|

Wurgler J (2000). Financial markets and the allocation of capital. Journal of Financial Economics 58(1):187-214. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0