Full Length Research Paper

ABSTRACT

The topic about institutional investor being a monitoring role has been widely discussed but different results exist in previous empirical studies. Along with their progressively development, institutional investors are now playing more important role in Chinese capital market. Using samples from Chinese capital market, this paper collects fraud data and data of mutual funds’ ownership in listed firms between 2008 and 2015 to examine the monitoring function of institutional investors against accounting fraud. To go deep into the monitoring incentives of investors that fall into different categories, mutual funds are further classified as heterogeneous groups according to their investment strategy and investment durations. The monitoring role of mutual funds in different groups and their influence as the disincentive to accounting fraud of listed firms are investigated in the paper. Mutual fund ownership is found to be able to curb the incidence of accounting fraud. Active mutual funds are able to conduct more effective monitoring when compared with passive mutual funds. It is also reported that short-term mutual funds are more significant than long-term mutual funds in monitoring. Policy makers may need to normalize institutional investments by quantified indicators or in other reasonable ways.

Key words: Accounting fraud, institutional investors, investment duration, monitoring role.

INTRODUCTION

Corporate governance of listed firms has always been an issue of concern in both finance and accounting literature as poor corporate governance may have serious impacts on listed firms as well as a large number of investors, even the operation of capital market. Poor corporate governance consists of poor monitoring and poor decisions. The poor monitoring and weak control systems can negatively impact the company’s performance and value. Poor decisions can lead to failure in the evaluation of performance and companies might face difficulties with future forecasting and cash flow planning. Scholars’ discussions on this topic are varied and complex and the focal points of their work has covered issues related to transparency and responsibility of listed firms, board structure, etc. (Aguilera and Crespi-Cladera, 2016). However, based on previous studies, it is still far from enough to figure out all of these problems. The failure in corporate governance often comes with a series of irregular behaviors of listed firms and one of the most important irregularities is accounting fraud. In the simplest terms, accounting fraud is intentional manipulation of financial statements to beautify a company’s financial status for various reasons like getting credit funds or boosting the share price (Tutino and Merlo, 2019). Financial statements, which are designed to help investors or regulators in decision-making, are unable to reflect factual information when a fraud is taking place in a company.

Fraud cases which involved enormous amount in listed firms have resulted in a strong motivation of researchers around the world to explore solutions for disciplining irregular behaviors and deterring accounting fraud. In external governance mechanisms, people began to pay attention to different monitoring roles other than regulators or auditors in recent years. Since they are likely to suffer the most due to accounting frauds, investors are thought reasonable to be more prudent in order to help themselves from deceitful financial information and even monitor managements’ behaviors (Montesdeoca et al., 2019). In most cases, individual investors are not capable to monitor as they are subject to their diffuse ownership and significant cost pressure. However, institutional investors and those who hold a large position in shares of listed firms are capable of supervising management behaviors and affecting their decision making with their resource and abilities (Chung et al., 2002). The development of institutional investments made great progress in US financial markets since 1990s. Sias and Starks (1998) show that, by the end of 1994, the ownership held by institutions shot up to marginally below 50 from 24.2% in 1980. In emerging economies like China, institutional investors have been enjoying a huge growth in capital markets since early 2000s since China joined World Trade Organization (WTO) in 2001 and integrated into the international capital market, the total market value has grown from 1 trillion Yuan in 1997 to more than 50 trillion Yuan after 2015. Mutual fund operated and managed by institutions is definitely one of the principal components among those investors and it has been expected to play a part in monitoring for external corporate governance yet, in the light of the results from previous studies, there are opposite views on the monitoring role of mutual fund. Generally speaking, mutual funds are able to stop clients’ wrongdoings and promote compliance from the standpoint as a ‘gatekeeper’ (Coffee, 2006). Conversely, some academics believe that mutual funds are not actively engaged in monitoring in general (Shi et al., 2016). In this case, mutual funds are also speculative investors who may choose to ‘vote with their feet’ if the investee firms have poor performance.

Due to the mixed results, further discussions about this topic are still needed. By dividing institutional investors into different categories, this study looks into the impacts of different types of institutions’ monitoring function against accounting fraud. In particular, two criteria are used in the classification process. Firstly, mutual funds are split into active investors and passive investors based on their investment strategies. Following different strategies, investors may act differently in their governance activities. Active investors tend to engage with investee firms through meetings or other means of communication as they care about the corporate governance. Mutual funds can also be split into long-term investors and short-term investors based on their investment durations. Compared with the myopia ones, those who hold their investments for long are probably inclined to look at the interests of investee firms in the long run instead of current earnings performance. Consequently, it is reasonable to predict that mutual funds that adopt active investment strategy and hold for long duration can prevent fraudulent activities more effectively.

This study tries to figure out the linkage between mutual fund investments and accounting fraud and then testify to the monitoring function of institutional investors. So far, most previous studies about this are based on the United States data. Data used in this paper are selected from the enterprises in China because China provides a different country context. As the world’s second largest economy, the booming capital market in China has been eye-catching. However, despite its striking speed in economic development, accounting fraud cases of listed firms from time to time and it becomes a big concern for stakeholders. For example, latest news about Zhangzidao Group Co., Ltd, a Chinese company being brought into the focus of media these years for suspected fraud activities, is another alarm bell for the capital market. Scholars also try hard to find new factors in the governance mechanism because of Chinese relatively weak legal environment and investor protection. In recent years, Chinese government has been encouraging institutional investments in financial markets as institutional investors are turning into a great force in promoting economic transformation. Although the proportion of institutional ownership is relatively low in Chinese listed firms compared with that in developed capital markets, mutual funds and other institutional investors are becoming increasingly important and growing rapidly in China. Therefore, it is of great significance for us to study the influences of institutional investors on fraud issues as well as the factors which may affect their effectiveness. The results may show implications for other emerging economies.

Cooper et al. (2013) emphasize that people should comprehend accounting fraud in a social, legal, political and economic background. It means that these factors can make big differences in the causes and consequences of accounting fraud. As one of the most important emerging economies, China has developed its national economy with great success which leads the development of capital markets. However, it is also characterized by its comparatively inadequate legal system and weak protection for shareholder (Allen et al., 2005). In China, the current legal system as well as the private enforcement of law is not forceful enough to well ensure investors’ interest and prevent potential fraudulent activities (Xu et al., 2017). In addition, compare with the amounts involved in fraud cases, the minor fines handed down by the CSRC seem to be ineffective to deter misconducts so that securities law in China tend to have low impacts (Wang, 2018). For these reasons, Chinese markets provide an interesting setting for examination of corporate governance mechanism against fraud. In fact, internal governance has been given much of the attention of the studies on fraud deterrence in China (Chen et al., 2013) and external governance are under-researched when it is related to fraud issue. Dyck et al. (2010) found that actors like media and employees, who are often left out by traditional views in external governance, can take an important position in monitoring, in the United States. Unlike the western countries, many listed firms as well as the media are under relatively strict control of the government in China (Besley and Prat, 2006). In the given situation, it would be beneficial to find new way out in external governance when dealing with accounting fraud.

RESEARCH PROBLEMS AND HYPOTHESES

Previous studies with regard to whether institutional investors effectively monitor managements of listed firms have shown mixed evidence. Theoretically, mixed results can be attributed to different choices institutions face when investee firms underperform during a given period. Hirschman (1971) has defined these choices as: exit, loyalty and voice. They may ‘vote with their feet’ by simply unloading the stocks; they may keep the shares and keep silence; or they can call for a better executive team in the firm and expect its outperformance in the future. Given the distinctive characteristics of capital markets around the world, practices of investors should be observed with careful consideration. Generally, individual investors are not willing to engage in managements because of their limited resources and the monitoring costs. However, there are existing evidences which support the idea that large shareholders like institutional investors tend to have incentives in monitoring managers. Large investors can benefit from monitoring in a liquid market (Maug, 1998) and the demand for reputation-building may also be a motivation for them to maximize investee firm’s value (Gomes, 2000). Mutual funds, as a typical group in institutional investors, are considered to be beneficial for corporate governance. Fund managers are smart and they can get supports from experts such as professional analysts for monitoring purpose. In addition, with relatively high level of investments, mutual funds usually have more power than other investors to exert influence on the board. Under monitoring of mutual funds in the firms’ activities, it is much harder for managers to misconduct or commit fraud. Thus, in the first place, this study predicts that:

H1. Mutual fund ownership in a firm is negatively correlated to its incidence of accounting fraud.

It is worth mentioning that most precious studies (Sias and Starks, 1998; Ryan and Schneider, 2002) have done their research based on the idea that institutional investors all act in the same way. Actually, they are differentiated from each other by investment characteristics. This study investigates the monitoring role of mutual funds as well as the monitoring effectiveness of diverse types of fund investors.

Institutional investors using different investment strategies will manage their investments in specific ways. Under active management, investors are tending toward above-market returns and fund managers actively act in time depending on current and future performance of investee firms (Ryan and Schneider, 2002). Therefore, mutual funds adopting an active strategy tend to engage with investee firms and continuously monitor their activities to exploit profitability. As for passive index strategy, these investors may be unwilling to have impacts on a company because of high costs of the intervention which are considered to exceed the gains (Pozen, 1994). Instead of actively monitoring, passive investors would like to pull money out of investee firms with poor performance to make it cost-effective. Overall, active mutual funds are believed to be more prominent in monitoring firms’ behaviors. This study predicts that:

H2. Active fund ownership in a firm is negatively correlated to its incidence of accounting fraud, whereas passive fund ownership has little impact on fraud behavior.

Investment duration is another factor worth thinking about in investments. Long-term investors make investments with the intention of holding onto it for several years, while short-term investors make more transient investments and put short term gains first. For future developments of a company, long-term investors may consciously take actions in monitoring its activities as it takes some time before investors can see the payoff of corporate governance. Besides, large shareholders would mitigate the issue of free-rider by holding on to the investments for long (Chidambaran and John, 2000). On the contrary, a firm’s manager may be eager to meet near term target through fraudulent behaviors in order to satisfy short-term investors’ expectations. This study predicts that:

H3. Long-term fund ownership in a firm is negatively correlated to its incidence of accounting fraud, whereas short-term fund ownership has little impact on fraud behavior.

LITERATURE REVIEW

Accounting fraud, which is known as a type of “White Collar Crime”, has been a worldwide challenge in economic and social development. On one hand, fraud cases to varying degrees always end with un-ignorable economic losses in an industry, even in a country. On the other hand, financial cheating indicates failure in both corporate governance and corporate social responsibility, which will greatly damage public confidence in market. According to the report from the ACFE (Association of Certified Fraud Examiners) for the year 2018, fraud results in losses amounting to 5% of yearly income in organizations and accounting fraud probably causes the largest costs (Montesdeoca et al., 2019). In 2002, the US government approved the Sarbanes-Oxley Act to change the negative situations of markets due to the Enron case. After that, people were all centered on measures against accounting fraud. Over the last decade, the Chinese markets have been attacked by signal irregularity cases. The case of Yinguang Xia, which caused a tremendous shock in stock markets, has been called China’s Enron (Zhu and Gao, 2011).

Many studies have arrived at conclusions about the supervision of institutional investors. Some research shows that efficient monitoring by blockholders like institutional investors have beneficial effects on company governance (Franks and Mayer, 2001; Kang and Shivdasani, 1995; Shleifer and Vishny, 1986). Many of the studies about institutional investors’ role in corporate governance focus on its association with firm performance, stock price or executive compensation. For example, Hartzell and Starks (2003) give supports to the supervision function of institutional investors and demonstrate it by its influence on executive compensation. More recent studies also show that the institutional shareholdings improve Investee Company’s governance (Chung and Zhang, 2011). Governance environment can directly or indirectly influence the occurrence of fraud, as well as the fraud detection. Therefore, institutional ownership can also be linked to fraud deterrence. Based on a sample which covers fraud and non-fraud firms, Sharma (2004) finds that the probability of fraudulent behaviors in a company decreases with increasing institutional ownership which is not business-related. Still, there is an obvious problem that we can simply collect the cases that has been discovered in traditional fraud analyses. Wang (2013) attempts to address the partial observability in his analysis, by adopting a new model and finally provides evidence suggesting that factors which decrease the probability of committing fraud can bring higher probability of detecting fraud.

In China, mutual funds came into the public eyes at the end of the twenty century and have achieved substantially advancement with supports from the government. Their managing institutions are becoming the largest tradable shareholders in Chinese stock markets (Chi et al., 2014). Yao and Liu (2009) opine that Chinese institutional investors play the part in disciplining corporate governance of listed firms through restricting insider expropriation. Ding et al. (2011) also discover that the share price informativeness is improved with the expansion of mutual fund shareholdings in listed firms, which can promote the corporate environment of information. Recent years, some studies also begin to discuss the linkage between institutional investments and fraudulent behaviors of listed firms. For example, Wu et al. (2016) observe that firms with larger proportion of institutional investments in their shares are less possible to suffer from the regulatory actions against fraud. It is suggested that mutual fund investments of a firm result in significantly higher probability in fraud detection as well as lower propensity to conduct fraud and open-end funds appear to be powerful in disciplining managers (Wang et al., 2019). At the same time, the effectiveness of mutual fund monitoring has been challenged. Concerns are mainly about the mutual fund investments in small scale and it could be a potential cause of insufficient incentive of investors to engage in activism (Jiang and Kim, 2015). It is reported that a serious problem of information asymmetry in Chinese markets may be a barrier for mutual fund monitoring because of the expensively monitoring costs (Lin et al., 2017).

However, different types of institutional investors act like heterogeneous communities. When it comes to accounting fraud, their monitoring impacts are likely to vary among different groups. For instance, Cornett et al. (2007) show that only those institutions (such as mutual funds) which are pressure-insensitive have positive impacts on firms’ operating performance. In contrast, pressure-sensitive institutional ownership (such as pension funds and insurance companies) is unrelated with company performance because of the current or latent business ties between them and investee firms. And this kind of relationship is believed to be the hindrance during their monitoring. Aggarwal et al. (2015) find Chinese listed firms with lower occurrence of fraud commission usually have got larger investments of mutual fund. Yet, such relation can’t be found when between fraud and ownership of grey institutions which may have business ties with investee firms. Further on, open-end mutual funds significantly outperform closed-end ones in detecting accounting fraud as well as reducing fraud commission (Wang, 2018).

It is universally accepted that investment strategy and investment duration are both important characteristics of institutional investments. Active institutional investors manage to intervene in management guided by shareholder activism (McLaren, 2004). Nevertheless, those adopting a passive strategy take actions with “rational ignorance” (Buchanan and Tullock, 1962). Wang (2014) also concludes that institutional investors with ownership as large as 10-20 percent and those who hold on to their investments for two years or even longer discourage the application of abnormal accruals for higher reported earnings. Moreover, compared with short-term investors, long-term mutual funds turn out to be more effective in monitoring which can better improve earnings quality in listed firms (Dai et al., 2013).

RESEARCH METHODOLOGY

This paper collects fraud cases that occurred during the period from 2008 to 2015. This paper chooses 2008 as the beginning year for the reason that China carried out an accounting standard reform in 2007 which can have a visible influence on some of the variables and fraud data. The sanction reports of detected fraud are usually released in two to three years after the fraud year and two more years of mutual fund ownership data after the study period need to be collected to sort mutual fund investors by their durations. Therefore, it is practicable to choose 2015 as the closing year. We have access to China Securities Regulatory Commission (CSRC), Shanghai Stock Exchange, Shenzhen Stock Exchange as well as mainstream financial websites for the resources of fraud data and data is obtained according to the administrative punishment reports. Data of mutual fund ownership and other control variables is downloadable on the China Stock Market Accounting Research (CSMAR) database. Moreover, the sample set is composed by listed firms from specific industries including real estate, computer, software services and medicine manufacturing for the reason that these industries are given relatively more attention by the general public and financial departments. Finally, this study has excluded observations with missing data and unavailable data. The existence of missing values can mainly due to those new listing sample firms which went public after 2015. The dependent variable is an indicator variable which stands for accounting fraud. It is set to 1 if the firm is notified of an administrative punishment for committing fraud in the year and 0 if otherwise.

The study is supposed to provide insights into the influence of mutual fund investments on accounting fraud and how their investment strategy and investment duration can affect this association. Correspondingly, three sets of independent variables are tested. To test Hypothesis 1, the first set of independent variable to be included is mutual fund ownership. The shareholdings of all the other institutions (trusts, insurance firms, pensions, etc.) are also captured for comparison. To test Hypothesis 2, mutual funds are split into active funds and passive funds based on investment targets. Active funds hold a portfolio of stocks, fixed income investment tools and cash that try to outperform the market benchmarks. Passive funds hold shares that try to track the performance of a particular index or hold alternative investment tools to replicate the particular index. Fund information can be obtained from CSMAR if it holds shares in a listed firm, so its investment target can be clearly classified by fund name. To test Hypothesis 3, mutual funds are split into long-term group and short-term group based on investment durations. Previous studies normally sort institutional investors by their average portfolio turnovers (Bushee, 2001). However, this measurement may get us an inaccurate result because the average portfolio turnover of a year is sometimes inconsistent with duration of the investment in a firm (Wang, 2014). In this study, institutional investors which have held investments for years or above are considered as long-term investors. Those that have investment duration less than two year are considered as short-term investors. However, it is time-consuming to investigate each investor’s duration in data processing. There are hundreds of fund investors, most of which are holding trivial shares and unlikely to exert influence on a firm. The bulk of ownership of a firm can be attributed to top 10 shareholders. Therefore, to estimate the investment duration, the study collects mutual fund ownership in the range within top10 shareholders in the investee firm. Time period has to be extended in this process. If the base year is  shares in the investee firm for two consecutive years or above in their time interval. Their investments beyond this interval are not under consideration, because these investments are less likely to affect firms’ management in the base year.

shares in the investee firm for two consecutive years or above in their time interval. Their investments beyond this interval are not under consideration, because these investments are less likely to affect firms’ management in the base year.

A set of control variables that may influence fraud activities are included in our tests. Firstly, this study controls for a series of corporate governance variables including:

1. Firm size- compared to large companies, small companies is more likely to have financial problems in fund raising which may lead to misstatements. But companies of large scale provide more transparent information and build relatively perfect mechanism to avoid occurrence of fraud;

2. Proportion of independent directors- it is selected as one of the control variables as it is shown that fraudulent behaviors can be reduced by increasing independent board members (Chen et al., 2006);

3. CEO duality- it is controlled as it may make it more convenient for CEOs in listed firms to conduct accounting fraud (Aggarwal et al., 2015);

4. Board meeting frequency- it is included as the frequency which can, to some extent, reflect the internal management level of a listed firm;

5. Supervisory board size- it is controlled as more supervisors on the board increase the possibilities of positively monitoring and standing up against fraudulent activities (Firth et al., 2007).

Secondly, this study also controls the following variables:

6. Firm leverage;

7. Sales growth- firms with high leverage or high sales growth rate easily attract attention from the regulators and may be subject to regulatory scrutiny frequently;

8. Stock returns- poor or abnormal stock performance of a firm often faces complaints from investors and triggers investigation by the regulators (Chen et al., 2006);

9. R and D investment- Wang (2013) concludes that the uncertainty in research and development investments is connected to lower probability of fraud detection and stronger incentive to commit fraud;

10. Audit quality- auditors are important external monitors of firms. In general, auditors directly play a part in fraud detection through mandatory auditing procedure and they can affect firms’ behavior by disciplining managers. Auditors from a Big 4 accounting firm are often used as a proxy for high audit quality.

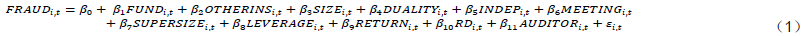

To testify to three hypotheses in this study, we analyze the sample with following binary probit models with match pairs, which capture the collusion of fraud. Model (1) will be built to test hypothesis 1, which hypothesizes the mutual fund ownership is negatively associated with the incidence of accounting fraud as follow:

Where FRAUD, the dependent variable, is an indicator variable, which is coded 1, if the management of a company commits accounting fraud and 0, if otherwise. FUND is the proportion of total shareholdings of mutual funds and OTHERINS is the proportion of total shareholdings of other institutional investors. SIZE is calculated by the natural logarithm of total assets of the company. DUALITY is an indicator variable which is coded 1 if the CEOs double as chairmen in listed firms and 0 otherwise. INDEP is the number of independent board members. LEVERAGE ratio is equal to total liabilities divided by total assets of the company. MEETING is the yearly frequency of holding a board meeting. SUPERSIZE is the number of supervisors. RETURN is annual stock return of a firm. RD is a ratio which is equal to research and development expense divided by total assets. AUDITOR is an indicator variable which is coded 1 if auditors of the company are from a BIG 4 accounting firm and 0 otherwise.

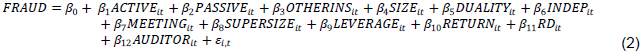

To test hypothesis 2, which hypothesizes active fund ownership in a firm is negatively related to its incidence of accounting fraud but passive fund ownership has little impact. The proportion of firms’ shares has been computed separately according to being held by active mutual funds and passive mutual funds and model (2) will be built as follow:

Where, ACTIVE is the proportion of total shareholdings of active funds and PASSIVE is the proportion of total shareholdings of passive funds. The definitions of other variables include in model (2) are identical to that of model (1).

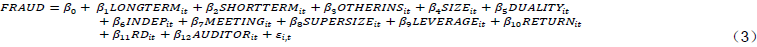

To test hypothesis 3, which hypothesizes long-term fund ownership in a firm is negatively related to its incidence of accounting fraud, but short-term ownership has little impact. The proportions of firms’ shares have also been calculated separately, according to the investment duration, and model (3) will be built as follow:

Where, LONGTERM is the proportion of total shareholdings of funds which have kept their investments for more than or equal to two years and SHORTTERM is the proportion of total shareholdings of funds which make relatively transient investments. The definitions of other variables included in model (3) are identical to that of model (1). Sale growth, which is originally considered as a control variable, has been excluded from the equations. Sales growth of a firm is usually measured by average growth rate in a year, but there are many observations with missing data of growth rate in CSMAR. Therefore, it has been removed to make sure there are adequate observations in our tests.

EMPIRICAL RESULTS

The summary statistics of the variables, the results of the regression models (1) – (3) and the discussions of these results, as well as the results of the robust test for the models are provided in this section.

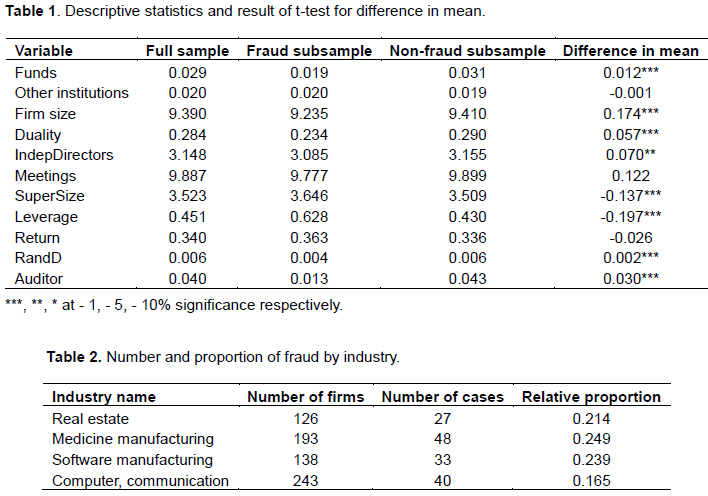

Table 1 shows the result of descriptive statistics. In the full sample column, mutual funds are the largest institutional shareholders which hold 2.9% of shares in investee firms, while other institutions hold 2% of shares as a whole. On average, each company has 3.148 independent directors on the board and has 3.523 supervisors. The leverage rate of the firms is 45.1%. Variables of fraudulent firms and non-fraudulent firms are listed in next two columns. Many of them have got a significant difference in mean tested by an independent sample t-test. The total mutual fund shareholdings in non-fraudulent firms significantly exceed the shareholdings in fraudulent ones, which suggest that firms with higher fund ownership have lower incentive to commit fraud. Positive difference of firm size exists between non-fraudulent firms and fraudulent firms; it implies that large-scale companies are less likely to be caught in fraud. Also, the leverage rates of non-fraudulent firms are observably higher than the rates of fraudulent ones. Table 2 presents the number of collected fraud cases of 4 specific industries and their respective proportion. The full sample includes 700 firms and 148 fraud cases. As shown in the second column, there are 48 fraud cases found in the medicine manufacturing industry. Taking into consideration the different quantities of observable firms from different industrial sector, the medicine manufacturing industry turn out to be the most high-risk industry of being involved in fraud.

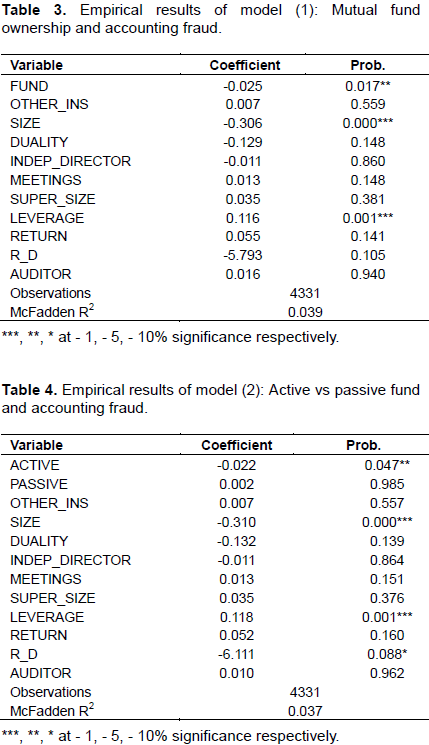

Table 3 shows the results of model (1) for testing hypothesis 1. The coefficient of fund ownership is significantly negative, which implies that higher mutual fund investments are connected to lower incidence of accounting fraud. Mutual funds are proven to be with strong incentive to supervise management in this study. On the other hand, the coefficient of other institutions’ ownership turns out to be positive. This supports the idea that many ‘grey institutions’ are not able to deter the occurrence of accounting fraud (Aggarwal et al., 2015). Move on to control variables, the coefficient of firm size is significantly negative as expectation. Also, firms that are highly leveraged are more possible to be caught committing accounting fraud. The coefficients of board meeting and supervisory board size are both positive. This suggests that frequent board meetings do not always come with better corporate governance because the directors might meet more often when the firm is running into many problems. The coefficient of supervisory board size reflects the fact that supervisory board in some listed firms is ineffective in performing their functions.

Table 4 presents the results of model (2) for testing hypothesis 2. Fund ownership has been divided into two parts. The coefficients of active fund and passive fund are -0.022 and 0.002, respectively. The negative association between ownership of active fund and incidence of fraud is significant, which supports the assumption in hypothesis 2. The difference of monitoring effectiveness between active fund and passive fund can be due to their different investment targets. The active fund managers can receive the incentive according to their stock selecting abilities. So they will do more investigations in the operations and checking of the accounting figures to make sure there are no financial fraud problems in their selecting stocks. This may explain why the probability of incurring accounting fraud is lower for the companies which are invested by active mutual funds. The regression coefficients of control variables are basically consistent with the results in model (1). However, we may point out the coefficient of research development expense ratio is -6.111 and it is at a marginally significant level. It shows that firms which put much in research and development might be less likely to be spotted by the regulators for accounting fraud.

Table 5 presents the results of model (3) for testing hypothesis 3. Fund ownership is divided into long-term group and short-term group in this case. However, the results seem to belie the assumption in hypothesis 3. As a result, short-term fund ownership is negatively connected to the incidence of fraud at 1% significant level which shows that, at least from the limited observations, short-term investors play a more significant role than long-term investors. Owing to the unsoundness of Chinese stock markets, speculative behaviors have been seen on many of investors, including institutions. This can lead to the situation in which transient investors are dominating to the extent that impacts of investors with long term horizons may be hided. At the same time, short-term institutional investors want to have more control on the financial performance and corporate behaviors to obtain higher returns in the short-run and subsequently change their portfolios.

In summary, the results of the regression models give us a picture of the monitoring role on detecting the accounting fraud. The incidence of accounting fraud of listed companies can be more detected if their shares are being held by mutual funds, active mutual funds and mutual funds in short-term.

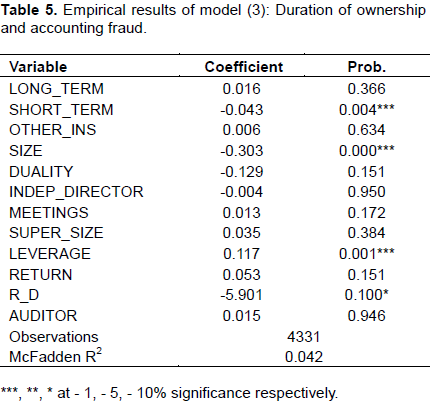

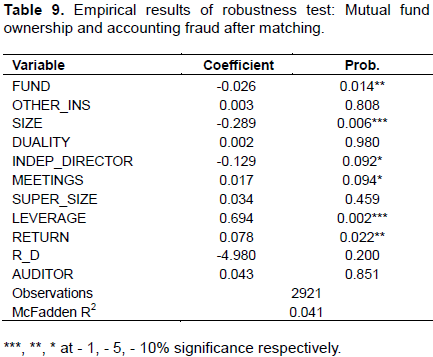

The results are confirmed by following robustness tests. First, corporate fraud takes the place of accounting fraud in the model. This study focuses on the influences by mutual fund on restraining accounting fraud. However, institutional investors are supposed to influence the corporate governance on an overall level. To re-evaluate their monitoring effects, this test goes beyond the scope of accounting fraud and chooses corporate fraud as the dependent variable. Corporate fraud, which includes accounting fraud, is illegal activities or dishonest manipulation conducted by individual or groups in a firm that are harmful to the public interests. Table 6 shows the results which prove that mutual fund ownership is also negatively connected to incidence of corporate fraud. The final results agree with that of model (1). Next, obvious differences exist among firms invested by varying mutual funds’ investments. According to Aggarwal et al. (2015), mutual funds would like to invent money in firms that are featured by good financial performance and good corporate behaviors. Therefore, prior results may be biased because of endogeneity of mutual fund ownership.

Propensity score matching is a common method to address endogeneity problem. Following Wang et al. (2019), this study creates an indicator variable (HI_fund) that is coded 1 if mutual fund investors own no less than 5% of shares of a firm and 0 otherwise in order to pick out those with large proportion of mutual funds. These firms serve as treated group. Propensity score of each firm is obtained through a logistic regression in which HI_fund serves as the dependent variable and the independent variables are two specific financial indicators. Financial variables include firm leverage and stock returns as they are strongly related to the financial performance of a firm. Then, propensity score is used to pair each firm in control group with another firm in treated group. This matching process is carried out by the nearest neighbor matching method (one to one matching).

Matching results are presented in Table 7. Before matching, statistical value of the significant difference that exists between treated group and control group is -0.020. The ATT (Average treatment effect for the treated) changes to -0.021 and is still significant after the matching process. It is implied that high proportion of mutual funds can make considerable influence on corporate governance. The balancing has also been tested. Test results are shown in Table 8. Two financial control variables appear to be both statistically insignificant after matching which means there is no much difference among firms from either group in terms of financial condition. Also, the %bias of financial control variables are both within 10% in matched samples. Model (1) is re-evaluated in use of the new sample and the results are presented in Table 9. The coefficient of fund ownership remains significantly negative and it is consistent with prior results.

CONCLUSIONS AND IMPLICATIONS

In summary, mutual fund ownership as a whole can curb the incidence of accounting fraud of listed firms in Chinese capital markets. Active mutual funds are able to conduct more effective monitoring when compared with passive mutual funds. At the same time, it is reported that short-term mutual funds are more significant than long-term mutual funds in monitoring. Institutional investors have become an outstanding role in Chinese markets. Good governance of listed firms and institutional investments support each other and the relationship between them is mutual promotion. This study shows evidence of the idea that mutual funds play a monitoring function in listed firms and high level of mutual fund ownership, which is able to decrease the incidence of accounting fraud in a firm. However, other institutions like insurance companies and trusts are not active in monitoring, which is consistent with previous literature that close business connections between institutions and firms may hamper their monitoring actions.

Furthermore, this study finds that the monitoring effects of differentiate mutual fund investors influence company management to different degrees. Compared to the management teams of passive funds, active fund management teams appear to be the main force that takes monitoring actions in listed firms. This is consistent with the view of McLaren (2004) who concludes that active investors try to make influences on management because of shareholder activism. Relatively speaking, long-term mutual funds are predicted to be more effective in monitoring fraudulent behaviors in the hypothesis. Based on the sample set in this paper, it turns out that short-term mutual funds affect the fraud behaviors in a more prominent way. This can be interpreted as a symbol of speculative behavior in Chinese markets. In spite of institutions’ growing proportion of shareholdings in the market, there are still many short-sighted investors among them. Even those transient institutional investors want to have further control on the financial performance and corporate governance to gain short-term profit before changing their portfolios.

To verify the robustness of results, fraud is measured in an alternative way. It reveals that institutional investments at scale are beneficial to the overall governance of company, as there are less corporate fraud cases in firms with larger mutual fund shareholdings. The propensity score matched samples are obtained due to possible endogeneity problem in mutual fund ownership. Results remain the same, so the monitoring effect of mutual fund is verified after mitigating endogeneity. To conclude, strengthening corporate governance thereby to reduce fraud incidence are of great significance and it has been investigated by experts around the world. Still, more attention should be given to market forces like institutional investors.

The findings of this study bring new insights. In the first place, the overall results give a positive reply to the CSRC’s initiatives in developing institutional investors in China and institutional investors other than mutual fund should improve their own capabilities, which is essential in corporate governance. There are differences in the effectiveness of deterring fraud between the mutual funds under active management and mutual funds under passive management; between funds which make long-term investments and those make short-term investments provide more insights into the monitoring role of mutual fund as follows. Active mutual funds should be encouraged to cultivate more talents who have abilities to involve in managements of their investee firms. There are also speculators among institutional investors. Policy makers may need to normalize institutional investments by quantified indicators or in other reasonable ways.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Aggarwal R, Hu M, Yang J (2015). Fraud, market reaction and role of institutional investors in Chinese listed firms. Journal Portfolio Management 41(5):92-109. |

|

|

Aguilera RV, Crespi?Cladera R (2016). Global corporate governance: On the relevance of firms' ownership structure. Journal of World Business 51(1):50-57. |

|

|

Allen F, Qian J, Qian M (2005). Law, finance and economic growth in China. Journal of Financial Economics 77(1):57-116. |

|

|

Besley T, Prat A (2006). Handcuffs for the grabbing hand? Media capture and government accountability. American Economic Review 96(3):720-736. |

|

|

Buchanan J, Tullock G (1962). The calculus of consent. University of Michigan Press. |

|

|

Bushee B (2001). Do institutional investors prefer near term earnings over long-run value? Contemporary Accounting Research 18:207-246. |

|

|

Chen G, Firth M, Gao DN, Rui OM (2006). Ownership structure, corporate governance and fraud: evidence from China. Journal of Corporate Finance 12(3):424-448. |

|

|

Chen J, Cumming D, Hou W, Lee E (2013). Executive Integrity, Audit Opinion and Fraud in Chinese Listed Firms. Emerging Markets Review 15:72-91. |

|

|

Chidambaran N, John K (2000). Relationship Investing and Corporate Governance. Tulane University and New York University Working Paper. |

|

|

Chi J, Yang J, Young M (2014). Mutual funds' holdings and listed firms' earnings management: evidence from China. Journal of Multinational Financial Management 28:62-78. |

|

|

Chung KH, Zhang H (2011). Corporate governance and institutional ownership. Journal of Financial and Quantitative Analysis 46(1):247-273. |

|

|

Chung R, Firth M, Kim J (2002). Institutional monitoring and opportunistic earnings management. Journal of Corporate Finance 8:29-48. |

|

|

Coffee JC (2006). Gatekeepers: The Professions and Corporate Governance. Oxford University Press, New York. |

|

|

Cooper DJ, Dacin T, Palmer D (2013). Fraud in accounting, organizations and society: Extending the boundaries of research. Accounting, Organizations and Society 38(6):440-457. |

|

|

Cornett MM, Marcus AJ, Saunders A, Tehranian H (2007). The impact of institutional ownership on corporate operating performance. Journal of Banking and Finance 31:1771-1794. |

|

|

Dai Y, Kong D, Wang L (2013). Information asymmetry, mutual funds and earnings management: evidence from China. China Journal of Accounting Research 6(3):187-209. |

|

|

Ding S, Jia C, Li Y, Yu Z (2011). Reactivity and passivity after enforcement actions: Better late than never. Journal of Business Ethics 95:337-359. |

|

|

Dyck A, Morse A, Zingales L (2010). Who blows the whistle on corporate fraud? Journal of Finance 65:2015-2444. |

|

|

Firth M, Fung PM, Rui OM (2007). Ownership, two-tier board structure and the informativeness of earnings: evidence from China. Journal of Accounting and Public Policy 26(4):463-496. |

|

|

Franks J, Mayer C (2001). Ownership and control of German corporations. Review of Financial Studies 14(4):934-977. |

|

|

Gomes A (2000). Going public without governance: Managerial reputation effects. Journal of Finance 55:615-646. |

|

|

Hartzell JC, Starks LT (2003). Institutional investors and executive compensation. Journal of Finance 58:2351-2374. |

|

|

Hirschman A (1971). Exit, Voice and Loyalty: Responses to Decline in Firms, Organizations and States. Cambridge, MA, Harvard University Press. |

|

|

Jiang F, Kim KA (2015). Corporate governance in China: A modern perspective. Journal of Corporate Finance 32:190-216. |

|

|

Kang J, Shivdasani A (1995). Firm performance, corporate governance and top executive turnover in Japan. Journal of Financial Economics 38(1):29-58. |

|

|

Lin T, Chen Y, Tsai H (2017). The relationship among information asymmetry, dividend policy and ownership structure. Financial Research Letter 20:1-12. |

|

|

Maug E (1998). Large shareholders as monitors: Is there a trade-o? between liquidity and control? Journal of Finance 53(1):65-98. |

|

|

McLaren D (2004). Global stakeholders, corporate accountability and investor engagement. Corporate Governance: An International Review 12(2):191-201. |

|

|

Montesdeoca MR, Medina ASJ, Santana FB (2019). Research topics in accounting fraud in the 21st century: A state of the art. Sustainability 11(6):1570. |

|

|

Pozen RC (1994). Institutional investors: The reluctant activists. Harvard Business Review 72(1):140-149. |

|

|

Ryan LV, Schneider M (2002). The antecedents of institutional investor activism. Academy of Management Review 27(4):554-573. |

|

|

Sharma VD (2004). Board of director characteristics, institutional ownerships and fraud: Evidence from Australia. Auditing: A Journal of Practice and Theory 23(2):105-118. |

|

|

Shi W, Connelly BL, Hoskisson RE (2016). External corporate governance and financial fraud: Cognitive evaluation theory insights on agency theory prescriptions. Strategic Management Journal 38(6):1268-1286. |

|

|

Shleifer A, Vishny R (1986). Large shareholders and corporate control. Journal of Political Economy 94(3, Part 1):461-488. |

|

|

Sias R, Starks L (1998). Institutional investors in equity markets. Unpublished working paper, Washington State University. |

|

|

Tutino M, Merlo M (2019). Accounting fraud: A literature review. Risk Governance and Control: Financial Markets and Institution 9(1):8-25. |

|

|

Wang M (2014). Which types of institutional investors constrain abnormal accruals? Corporate Governance: International Review 22(1):43-67. |

|

|

Wang Y, Ashton JK, Jaafar A (2019). Does mutual fund investment influence accounting fraud? Emerging Markets Reviews 38:142-158. |

|

|

Wang TY (2013). Corporate securities fraud: Insights from a new empirical framework. Journal of Law, Economics and Organization 29(3):535-568. |

|

|

Wang Y (2018). The causes and consequences of accounting fraud in China. Bangor University Digital Repository. |

|

|

Wu W, Johan SA, Rui OM (2016). Institutional investors, political connections and the incidence of regulatory enforcement against corporate fraud. Journal of Business Ethics 134(4):709-726. |

|

|

Xu W, Chen J, Xu G (2017). An empirical analysis of the public enforcement of securities law in China: Finding the missing piece to the puzzle. European Business Organization Law Review 18(2):367-389. |

|

|

Yao Y, Liu Z (2009). Can institutional investors play a monitoring role in China? Journal of Financial Research 6:128-143. |

|

|

Zhu J, Gao SS (2011). Fraudulent financial reporting: Corporate behavior of Chinese listed companies. Accounting in Asia 11:61-82. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0