Full Length Research Paper

ABSTRACT

Nigeria, a host to almost all the MNCs in the world, has continued to experience a significant loss in revenue through profit shifting techniques, which have increased public debt from N8.32 trillion in September 2013 to N36.3 trillion as at May 2021. The study aimed at examining the impact of transfer pricing on revenue generation and debt profile in Nigeria. Other objectives of this paper are to review the adequacy of the transfer pricing regulations regarding revenue generation, as well as the debt profile. It uses a qualitative research methodology relying on document review for analysis and interpretation to give more insight into transfer pricing regulation in Nigeria. Findings showed that the revised transfer pricing regulations pose some challenges that should be looked at, and also that debt servicing has denied Nigeria infrastructural development. The study recommended that the Federal Inland Revenue Service should issue a statement for clarity of purpose to avoid conflict that may arise from implementing transfer pricing regulations 2018, and also, for debt/revenue ratio to be analyse before loans are taken.

Key words: Transfer pricing, debt profile, debt servicing, multinational companies, Nigeria.

INTRODUCTION

Nigeria is a country blessed with both human and natural resources. It has a population of over 200 million people, ranked the ninth-largest country in the world in terms of natural gas reserves, and eleventh in crude oil production.?The nation represents over 70% of the market shares in the West African countries, and one of the most sort after destination for investors (Odutola, 2019). In spite of these enormous resources, Nigeria is ranked among one of the poorest country in the world. The decline in the price of crude oil in the world’s market has added more pressure on the government to seek alternative means of revenue. Due to this, the government reviewed its tax laws, among which are the Income Tax (Transfer Pricing). Regulations 2012, which was replaced by the Income Tax (Transfer Pricing) Regulations 2018. The aim among other is to increase the revenue base of the government by blocking loopholes and bringing more taxpayers into the tax net (Income Tax (Transfer Pricing) Regulations, 2018).

Transfer Pricing (TP) by all standards is a coherent business practice where inter-related companies transact under the arm’s length principle (ALP). On the contrary, it is suspicious. Through TP abuse, Multinational Companies (MNCs) move their profits offshore, leaving behind a dwindling tax base in their host countries by exploiting mismatch between tax jurisdictions (Vijayakumar, 2016). For example, selling goods or services to subsidiaries in low-tax areas at a reduced price resulted in low revenues for the high-tax area companies and high revenues and profits in the low tax jurisdiction. Wong et al. (2011) posit that the tax authority of the subsidiary will not complain about this abuse because of the tax revenue accruing to them whereas the parent company will consider it unacceptable.

Nigeria, a host to some of the MNCs in the world, has continued to experience a significant loss in revenue through profit shifting techniques which have increased public debt. Debt profile is N36.3 trillion and it will continue to rise if nothing urgent is done to address these revenue losses (Babatunde, 2021). MTN in 2013 set aside N11.398 billion and paid to MTN Dubai. Similarly, MTN confirmed it made unauthorized payments of N37.6 billion to MTN Dubai between 2010 and 2013 (Maya, 2015). These transfers out of Nigeria through a sophisticated tax planning strategy have left the government with no other option rather than seeking loans from bilateral, multilateral creditors as well as domestic loans.

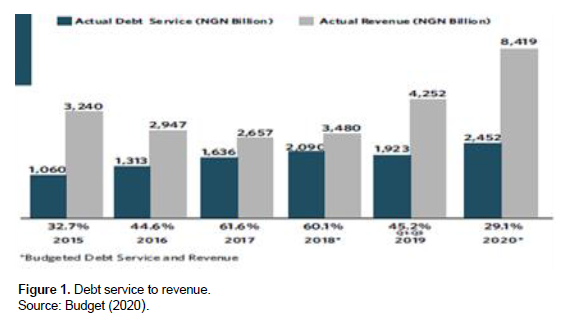

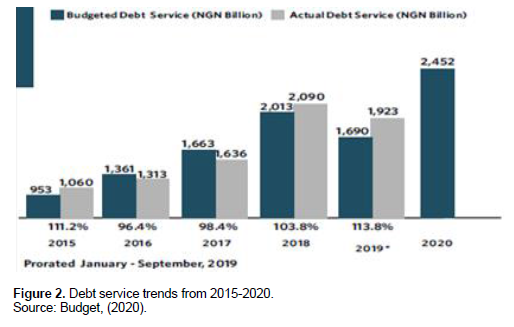

In 2015, the federal government of Nigeria paid the total sum of N1.06 trillion on debt servicing. And in 2016 and 2017 respectively Nigeria paid up to 96 and 98% of the debt service projection. Similarly, in 2018, the amount paid on debt servicing was 2.084 trillion, and by the end of the 3rd quarter of 2019 the government had paid the sum of N1.92 trillion which is 11.98% higher than the budgeted debt servicing amount. In 2020, the government paid N 3.26 trillion on debt servicing which is 24.85% higher than the target of N2.45 trillion, which constitutes 82.92% of revenue (Budget, 2020).

Studies have been carried out on TP and related concepts in Nigeria. For instance, Osho et al. (2020) studied the impact of taxation on TP in Nigeria economy. Olaoye and Aguguom (2017) examined tax base erosion and profit shifting through TP evidenced from Nigeria. Adum (2015) studied the impact of TP on financial reporting: a Nigerian study. Also, Obasi (2015) examined the impact of TP on economic growth in Nigeria. OlatunjiIsau (2014) studied TP: the Nigerian perspective. Similarly, Akhidime (2011) examined the international TP regulation: Nigerian experience. Aruomoaghe and Atu (2010) studied the multinational TP: issues and effects on the Nigerian economy.

However, the studies reviewed were not comprehensive in the examination of the impact of TP is a thorough literature review of transfer pricing which has been organized to cover the evolution of transfer pricing, the arm’s length principle in transfer pricing, transfer pricing methods, transfer pricing in Nigeria, transfer pricing and business restructuring, and issues and challenges associated with transfer pricing.

The paper contributes to filling the gap that exists in literature by being the first to link TP to debt profile in Nigeria. It uses a qualitative research methodology relying on document review for analysis and interpretation to give insight into TP laws in Nigeria. The rest of the paper is organized to cover the concept of TP, Nigeria transfer pricing regulations (TPRs) and revenue generation, the major difference between the income tax TPRs 2012 and the income tax TPRs 2018, challenges of the income tax TPRs 2018, methodology, analysis of Nigeria’s debt profile, conclusion, and recommendations.

Concept of transfer pricing

TP is the price at which entities within a group trade. MNCs are birthed when an entity moves beyond its border and acquire another company to create a competitive edge. Market advantage is attained by reducing cost of production, efficiency in management and operations (Barker and Brickman, 2017). These functional business transactions are regarded as controlled transactions as distinct from uncontrolled transactions between companies that are not related and can be assumed to operate independently in reaching terms of transactions.

TP is not restricted to taxation but when used in the perspective of international tax, it signifies the artificial manoeuvring of internal prices within a multinational group to create a tax advantage (Miller and Oats, 2012). On the other hand, Sheppard (2012) affirms that TP is not illegal, what is abusive is transfer mispricing.

TP is important to all the parties involved (the taxpayers and tax authorities) because its affect the income and expenses as well as the taxable profits in the different tax areas in which the entity operates. It is often used to boost the overall profit of the head office which is at a disadvantage to the associate companies which operate in other countries with different tax jurisdictions. For example, a head office located in Ireland with a tax rate of 12.5% and it subsidiary in Nigeria with a tax rate of 30%. When the Nigeria subsidiary sells goods to the Ireland company, the subsidiary taxable profit is reduced and the tax paid is completely eroded. This leads to a loss of revenue for the country. Whereas, the sales will increase the taxable profit of the head office, which will be taxed at 12.5%, which is low as compared to 30%.

Nigeria transfer pricing regulations and revenue generation

The Nigeria Transfer Pricing Regulations (TPRs) came into being on September 21, 2012. However, the ALP has been in existence in the companies' income tax Act (CITA) as far back as in the 1990s. Onyeukwu (2007) asserts that CITA 1990 empowers the Federal Inland Revenue Service (FIRS) (previously called “the Revenue”) to make adjustments to transactions where it deems that prices do not reflect the market price. Nigeria developed its TPRs based on the Organisation for Economic Co-operation and Development (OECD) TP, and the United Nations TP Manual. It became effective from September 2012, and it was known as The Income Tax (Transfer Pricing) Regulations No. 1, 2012 (Taiwo et al. 2013).

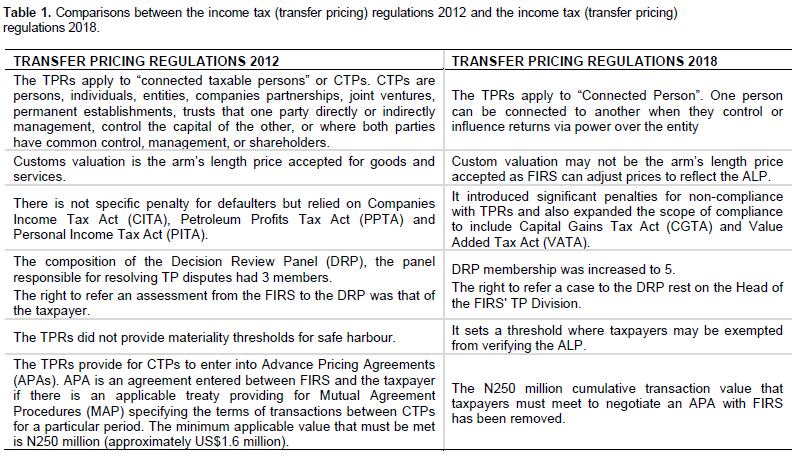

In 2017, the OECD Guidelines and the UN Manual were revised to tackle Base Erosion and Profit Shifting (BEPS). In the same vein, the FIRS released the Income Tax (Transfer Pricing) Regulations 2018. The Regulations took effect from 12 March 2018, and revoke the Income Tax (Transfer Pricing) Regulations 2012. Comparisons between the income tax (transfer pricing) regulations 2012 and the income tax (transfer pricing) regulations 2018 is stated in Table 1.

Other key features in the income tax (transfer pricing) regulations 2018

An intangible asset right when transfer, it will be restricted

to 5% of earnings before interest, tax, depreciation, and amortization (EBITDA). Service fees charged within a corporate group would now be subjected to a benefit test and a shareholder activity test. Under the benefit test, service fees would only be deemed consistent with the ALP if and only if they are charged: for service rendered; the service has economic or commercial value to the recipient; if it were an uncontrolled comparable transaction between independent parties, the recipient is willing to pay the same amount for the service rendered. On the other hand, the shareholder test is aimed at determining if a service charge is in respect of an activity that has been performed by a company solely in its capacity as a shareholder in a related group.

Entities within groups that are capitalized with high amounts of equity (capital-rich, low-function companies) but cannot necessarily control the risk associated with their funding activities. The Regulations state that those companies will be entitled to a risk-free return for their activities. In the event of a merger, a connected person is mandated to update the TP declaration form that will be submitted to FIRS. Also, when directors retire or are appointed, notification should be made to the service (PWC, 2018).

Challenges of the income tax (transfer pricing) regulations 2018

It posed the risk of economic double taxation. This is because Nigeria does not have a wide double taxation treaty agreement with other developed and developing countries, which make access to MAP difficult. There is no clarification on the anarchy and the potential double taxation that will arise if FIRS rejects a valuation accepted by the Nigerian Customs Service and on which import duties are paid to the port.

The right granted to the FIRS to adjust the valuation reported and accepted by the Nigerian Customs Service may lead to the bickering of supremacy between the two government revenue-generating agencies. The right given to the Head of the FIRS TP Division to refer a case to the DRP may not go down well with some taxpayers who may be denied access to a fair hearing by the Head of the FIRS TP Division and may decide to seek an injunction from a competent court of jurisdiction (PWC, 2018).

METHODOLOGY

The study uses a qualitative research methodology relying on document review for analysis and interpretation to give insight into TP laws in Nigeria. This approach is best fit because data on TP are unavailable in Nigeria.

ANALYSIS OF NIGERIA’S DEBT PROFILE

Nigeria’s total public debt profile over the space of seven years has continued to rise geometrically, from N8.32 trillion in September 2013 to N33 trillion as of March 2020 and if nothing urgent is done to curtail it, Nigeria may be in a serious debt crisis in the future. Urama et al. (2018) assert that the World Bank and the International Monetary Fund (IMF) warned the country of the economic consequences of such huge debt. Even the Debt Management Office (DMO) warned that Nigeria’s high debt service to revenue ratio could trigger a debt crisis.

Debt Financing has far-reaching implications. With the advent of the novel coronavirus disease 2019 (COVID-19), economic activities around the world have been crippled and it poses a serious threat for debt servicing. This is as the Director-General, DMO, Mrs Patience Oniha, at a one-day public lecture organized by the National Institute for Legislative and Democratic Studies (NILDS), on Public Debt in Nigeria: Trend, Sustainability and Management expressed fears that the economic effects of the coronavirus pandemic might deprive Nigeria of servicing its N2.45 trillion debts timely. She further expressed, “Actual Debt Service to Revenue Ratio has been high at over 50% since 2015, although it dropped to 51% in 2018 from 57% in 2017 (Figure 1). The relatively high Debt Service to Revenue Ratio is the result of lower revenues and higher debt service figures”. Federal government debt servicing expense was as high as 45.2% of its revenue, as of September 2019 (Umoru, 2020).

The consequence of these borrowings as a result of shortfalls in revenue over the years makes it almost impossible for the government to provide for basic amenities without further borrowings. By March 2020, public debt rose from N26 trillion as at September 2019 to N33 trillion. This has impacted greatly on the infrastructural deficit over the years as allocation for capital projects has continued to suffer setbacks. According to Budget (2020) in 2017, 2018 and 2019 respectively, the government allocated about 19.22, 31.36 and 23.43% of its total budget to capital spending because even when there is a shortfall in revenue, debts must be serviced and paid back at the expense of capital projects. Figure 2 shows the debt service trends from 2015-2020.

CONCLUSION

Nigeria is keeping pace with the rest of the world in adopting global best practices relating taxation. With the implementation of the TPRs 2018, in conformity to the OECD Guidelines and the UN Manual 2017, the country is on the path of tackling TP issues used by MNCs to evade tax payment, which resulted in low revenue; although the new TPRs have some challenges, which may result in conflict. However, it brings more taxpayers known as connected persons into the tax net which can expand the tax base and revenue in the future.

Notwithstanding, Nigeria has continued to furnishing an increased budgets with the aim for deficit financing. This has impacted negatively on Nigerians as a result of dwindling revenue, because debts must be serviced and paid back at the expense of capital projects. With the review of TPRs, and loopholes reduced, it is believed that MNCs will pay more taxes to the government, and this will help reduce the Debt/Revenue ratio and translate into economic growth and development.

RECOMMENDATIONS

The following recommendations were drawn from the conclusion of the study: public enlightenment and clarification is necessary on the part of FIRS to simplify the complexity in the TPRs 2018 to avoid conflict with other parastatals of government; the debt/revenue ratio should be critical analysed by the DMO, to avoid excessive interest payment on loan borrowed.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Adum O (2015). The impact of transfer pricing on financial reporting: A Nigerian study. Research Journal of Finance and Accounting 6(16):208-218. |

|

|

Akhidime E (2011). International transfer pricing regulation: Nigerian experience. Journal of Research in National Development 9(1):350-357 |

|

|

Aruomoaghe A, Atu O (2010). Multinational transfer pricing: Issues and effects on the Nigerian economy. The Nigerian Academic Forum 19(1):1-5. |

|

|

Babatunde O (Leadership May 19, 2021). Nigeria's debt profile to hit N36.3trn as President Buhari seeks fresh N2.3trn loan. |

|

|

Barker J, Brickman S (2017). Transfer pricing as a vehicle in corporate tax avoidance. The Journal of Applied Business Research 33(1):9-16. |

|

|

Budget (2020). Budget analysis and opportunities. |

|

|

Maya E (2015). Investigation: how mtn ships billions abroad, paying less tax in Nigeria. |

|

|

Income Tax (Transfer Pricing) Regulations (2018). Federal republic of Nigeria official gazette, 105(38):113-140. Available at: |

|

|

Income Tax (Transfer Pricing) Regulations, (2012). Federal republic of Nigeria official gazette pp. 815-839. Available at: |

|

|

Miller A, Oats L (2012). Principles of International Taxation (3rd ed.). Bloomsbury Publishing. |

|

|

Obasi N (2015). The Impact of Transfer Pricing on Economic Growth in Nigeria. International Journal of Academic Research in Business and Social Sciences 5(12):127-138. |

|

|

Odutola A (2019). How the Chinese are taking over Nigeria's economy. |

|

|

Olaoye A, Aguguom A (2017). A tax base erosion and profit shifting through transfer pricing: Evidence from Nigeria. Journal of Business Administration and Management Sciences Research 6(1):1-12. |

|

|

Onyeukwu H (2007). Transfer pricing in the Nigerian context. selected works. |

|

|

Osho A, Efuntade A, Jemiseye-Dav R (2020). The impact of taxation on transfer pricing in Nigeria economy. International Research Journal of Finance and Economic pp. 1450-2887. |

|

|

PWC (2018). Nigeria publishes new transfer pricing regulations: key changes you should know about (part 1). |

|

|

Sheppard L (2012). Transfer pricing is the leading edge of what is wrong with international tax. |

|

|

Taiwo O, Anthony C, Elizabeth S, Robert S (2013). The impact of Nigeria's new transfer pricing rules on multinational enterprises. |

|

|

Umoru H (2020). Nigeria's total debt now N 33trn. |

|

|

Urama N, Ekeocha Q, Iloh C (2018). Nigeria's debt burden: implications for human development. African Heritage Institution. |

|

|

Vijayakumar S (2016). What's base erosion and profit sharing? |

|

|

Wong H, Nassiripour S, Mir R, Healy W (2011). Transfer price setting in multinational corporations. International Journal of Business and Social Science 2(9):10-14. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0