Full Length Research Paper

ABSTRACT

The purpose of this study is to utilise social cognitive theory to investigate and establish through empirical study, the confidence levels of taxpayers with ‘Making Tax Digital’ and further to facilitate an assessment of the readiness of taxpayers to be compliant with making tax digital requirements by industrial sector. This study used a survey instrument to collect data from 202 businesses in the Northwest of the United Kingdom. The data were analysed statistically through descriptive statistics and inferential analysis using SPSS. The result from the study suggests and supports the notion that a transition to Making Tax Digital is industry sensitive and therefore any reform must consider the specific taxpayers in each industry. Consistent with prior research, the authors also find changes to a tax system are sensitive and need to be assessed against a practical criterion to gauge its full impact. Furthermore, this study finds that multi-industry sectors need clearer guidance on compliance. This has to be backed by a strong anti-avoidance business support system for sole proprietary businesses to enable them adapt to new way of reporting and paying taxes. It is further recommended that HMRC develops a strong communication strategy that encourages and helps sole trader overcome challenges of Making Tax Digital. This is one of the few studies aimed to explore the impact on how well different industrial sectors will transition to Making Tax Digital. This study carries out a comparison to ascertain if there is a significant difference in the levels of confidence between industry sectors transitioning to Making Tax Digital.

Key word: Making tax digital, taxation, social cognitive theory, United Kingdom.

INTRODUCTION

Digitalisation is transforming how individuals and corporations around the world conduct their tax affairs. Tax authorities globally are digitising tax systems that originated in the 19th and 20th Centuries; however, this revolutionary change does present challenges (Rachinger et al., 2018). The proposal to introduce making tax digital (MTD) in the United Kingdom has brought with it some apprehension from key stakeholders. The Federation of Small Businesses (FSB) expressed concerns that taxpayers’ workloads would increase if tax reporting moved from annual to quarterly reporting (Smith, 2018).

The MTD Vision as captured by IRIS Software Limited (2017) aims to revolutionise the way businesses, landlords, individuals and tax agents interact with Her Majesty’s Revenue and Customs (HMRC). MTD is intended to aid the government’s tax simplification agenda which commits to making the UK tax system fully digitalised by the year 2020.

The breakthroughs recorded in the spheres of ICT had led to the introduction of an e-tax system. This is credited for an appreciable improvement of the level of tax compliance and at the same time lowering the cost of tax administration (Mustapha and Sheikh, 2014). ‘Making Tax Digital’ leverages on the gains of E-tax and E-filing systems and though it is still a work-in-progress with many practicalities needing fine-tuning, it seems to have gained traction. The digitalisation of the taxation system in varied forms but centred on an on-line tax assessment and payments have been adopted in many nations notably Canada, Taiwan, Australia, Malaysia, Singapore, Kenya, and South Africa among others (Obid and Bojuwon, 2014). Generally, the argument for tax digitalisation by the foregoing countries as well as the UK cites convenience, timesaving, tax simplification, cost reduction, and the closure of the tax gap (McLure et al., 1990). In the UK, ‘Making Tax Digital’ for all categories of individual and corporate taxpayers is founded on four core concerns it aims to accommodate. These as listed by Sadiq (2021) are: (i) It is aimed at making Tax compliance and monitoring much simpler; (ii) It aims to have unhindered access at all times to Information enabling tax liabilities to be more quickly and efficiently determined; (iii) Information on both individuals and businesses income-generating activities will be stored in one place such that all taxes are bunched up into a single digital Tax Account; and finally, (iv) It is also aimed to make digital communications with Her Majesty's Revenue and Customs (HMRC) available at all times thus providing taxpayers convenience and greatly reduce the necessity for phone or post contact

Expectedly, such a significant and far-reaching overhaul of the taxation system will have its attending challenges, technical glitches, and sometimes out-rightly conflicting provisions. HMRC has made efforts to address several of these areas of concern by outsourcing the review and assessment of the

LITERATURE REVIEW

The sweeping reforms in the UK Taxation System under the Making Tax Digital initiative launched in August 2015 have been reviewed several times to ensure it meets its requirements of being easy to adopt and cost-effective for everyone.

Specific interest is changes tailored to ‘Make Tax Digital for Businesses’ (MTDfb). A most useful effort in this direction is the HMRC commissioned Research titled ‘Making Tax Digital for Business: Survey of small businesses and Landlords’ which was published in November 2017 as HM Revenue and Customs Research Report 480. The report authored by Tu et al. (2017), a quantitative survey carefully selected 3000 businesses taken as representative of all in its class, provides credible information about the pre-implementation tax practices. Key findings as given by the authors are as follows: (i) Three in four (74%) sought help for their accounts and tax from an external, paid accountant. (ii) External tax agents were used mainly in calculating tax payable while about only one out of five (20%) used external paid agents for record-keeping; (iii) A large majority (about 80%) were recording their transactions, invoices, and receipts real-time or at least quarterly; while one in five did all their record-keeping at the end of the tax year; (iv) Use of Spreadsheets or paperwork was more widespread than software; Software users come to as low as 26% (v) One in five were not using software because they lacked confidence with technology: (vi) A significant number of persons who are non-users of software were emotionally attached to their method of record keeping and account filing which they considered accurate and met HMRC requirements. (vii) 68% had digital capability and access but about one in five of these or 14% of all were either upbeat about poor internet services (and so not sure to meet the demand of quarterly report) or were not comfortable using technology for business because they were worried about data security. (viii) All (including those not using tax agents) were most likely to ask an accountant/agent for advice and support.

Changes from the above (especially the (i) to (vii)) seen in the current tax dispensation provide a platform for studying the impacts of ‘Making Tax Digital’ on taxpayers. It is worth noting that the consultation did not focus specifically on any industry sectors. To further explore these impacts, the contributions of selected four (4) authors will now be reviewed and briefly evaluated. Although everything that used to be done on paper was adapted to computers, it seems that is where it stayed. However, with the introduction of MTD reform, paper bookkeeping is on its way out. Gottschalk’s (2017), assessment of the challenges accountants face when adopting new technology such as the one posed by MTD is that they are inevitable, daunting but surmountable. He then dismissed the idea of the reform displacing accountants by stating that ‘Technology won’t take your job, but it will change the way it is done. ‘Administrative accounting will eventually be phased out and replaced with technology that does the job faster and more efficiently’. Furthermore,

Gottschalk reports that published data from 2016 suggests that the unemployment rate of accountants has fallen to 2.2% compared to the National average of 4%.

According to the same publication, the most attractive workers have skills that cannot be replaced with computers. He, however, concludes by emphasising the importance of the younger generation of accountants engaging in further professional training and self-improvement programs.

Sian (2018), in a recent paper canvas on the importance of moving in compliance with the vision of MTD. ‘Going digital should be a bonus, not a burden’. He argues that accountants can provide timely tax and other professional advice to businesses that adopt some form of digital record keeping. In his opinion, accountancy practices that lead their clients in the direction of early compliance with the HMRC digital tax initiative would have taken good advantage of MTD and opened their firms to businesses that seek efficient Management Consultancy. He added that Tech-savvy cloud-accounting firms ‘are likely to be in high demand as the deadline’ for mandatory compliance approaches.

Sain (2018) further asserted that the prosperity of a nation on one hand and its economic decline on the other have always had a bearing on tax policy. The author further opines that whereas taxes are what we pay for civilised society, how we tax and spend determine on whether we are prosperous or poor.

The present UK taxation system consisting of various shades of direct and indirect tax structures has a very long history to it; spanning at least two centuries. Particularly in the past 100 years, a period that has witnessed two World Wars, it has evolved through changing reforms as the government continues to think and rethink what is both effective and efficient tax administration and what is convenient for taxpayers.

Studies indicate that in the past two decades, “substantial progress has been made by the U.K. Government in developing an effective e-taxation system”. As of 2006 through the creation of a “fully automated tax portfolio; tax payments can now be made in 48 h” (Nisar, 2006:113). This level of achievement has stimulated HMRC to invest in further research.

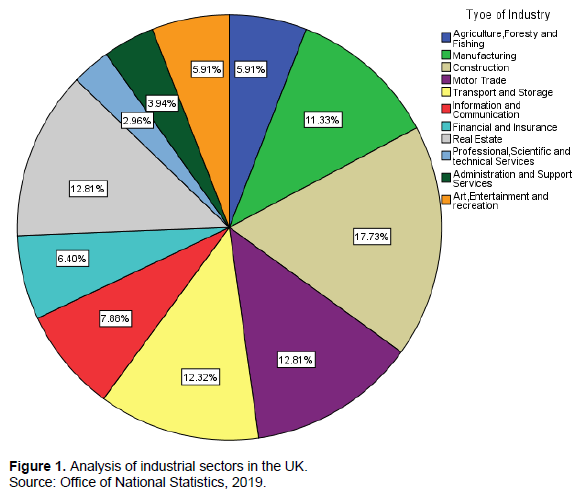

It is important to highlight that SMEs represent a significant part of the UK economy. This part of the study summarises the contributions made by SMEs in data obtained from the Department for Business, Energy and Industrial Strategy, and Business Population Estimates 2017. The research suggests that the dominant industry sectors such as construction (18%) which account for 34% of SME turnover (Figure 1). The basis of the study focuses on impact of MTD by industrial sectors. Figure 1 depicts spread of industry by sector.

RESEARCH METHODOLOGY

This empirical research employs a pragmatic paradigm. This is in line with the fact that the knowledge and reality of taxation are based on beliefs and habits that are socially constructed. Furthermore, pragmatism is representative of a mixed method; however this study will be quantitative dominant using a research instrument (Appendix 1) and therefore is most suitable for this research. Hence, this research is primarily deemed to be explanatory in nature and thus adopts a deductive strategy. Questionnaires were employed to collect raw data from a sample of 202 taxpayers. The data were analysed statistically through descriptive statistics and inferential analysis using the Statistical Product and Service Solution IBM SPSS software (Hejase and Hejase, 2013). Furthermore, a discussion of the reliability and validity of the primary data discussed the quality of the data. Firstly, the sample unit was defined. To ascertain the confidence levels of taxpayers in the Greater Manchester region, the sample unit would be taxpayers operated a business within that region.

Secondly, a sample framework was obtained listing SMEs in the region. Due care was taken to ensure that the sample frame error was minimised by using the latest information held within the public record.

Thirdly, the sample size was determined. With the confidence level set at 95%, a sample size of 203 was the most convenient size based on the limitations of research.

Fourthly, the sample size was selected using a cross-sectional study design. The 202 taxpayers were selected based on inclusion and exclusion criteria (Setia, 2016).

FINDING AND DISCUSSION

This examination will test the hypothesis that if MTD is introduced, taxpayers in the construction and transport industries will be weaker in terms of levels of readiness for MTD.

The contribution of industry to the United Kingdom’s economy can be measured in various ways, such as the number of companies in the sector, contribution to the economic output, and employment rates. This study attempts to ascertain if there is any statistically significant difference between industry sectors with regards to confidence levels transitioning and their readiness for MTD. The pie chart depicted in Figure 1 shows the sector sample sizes in each industry sector.

This diagram illustrates that the spread of industries ranging from the lowest sector Professional, Scientific, and Technical Services (2.96%) to the highest industrial sector construction (17.73%) and the potential implications on tax revenues of non-compliant behaviour post the implementation of MTD. This examination attempts to ascertain whether there is a statistically significant difference between these sectors with regard to tax compliance and readiness for making tax digital. This will help HMRC implement anti-avoidance and early intervention strategies to support these sectors.

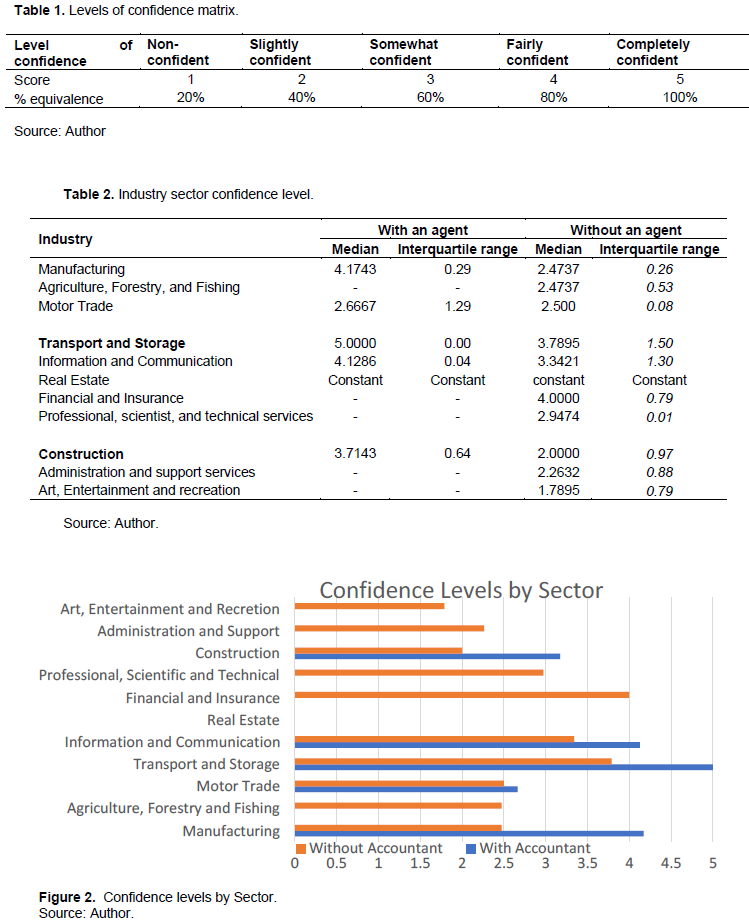

Based on the results presented in Table 2, the results of manufacturing sector suggest respondents who use the services of an agent responded that they were fairly confident (Table 1) with the transition to Making Tax Digital.

These included aspects of preparing, meeting quarterly deadlines and paying taxes quarterly, and tests for readiness for Making Tax Digital. The results demonstrated taxpayers in this industry who did not use the services of an agent indicated that they were slightly confident to somewhat confident. This average confidence level presents an overall test of the readiness of taxpayers for MTD. Furthermore, Motor Trade results suggest that respondents in this sector who used an agent demonstrated they were somewhat confident. Those taxpayers who did not use the services on agent indicated that they were only slightly confident about the transition. Additionally, the Transport and Storage results presented in Table 2 and Figure 2 suggest that respondents who used the services of an agent in the Transport and Storage sectors indicated that they were completely confident and thus were in a good position to transition to Making Tax Digital. Those respondents who did not use an agent indicated that they are confident. The Information and Communication findings suggest that taxpayers who used the services of an agent in the Information and Communication industry indicated a test average of being fairly confident. Those in this sample who did not use the services of an agent indicated that they were somewhat confident of the transition. In other sectors such as the Financial and Insurance, results demonstrate that taxpayers who did not use an agent indicated that they were fairly confident.

No data were available for respondents who used an agent. In addition, professional, scientist, and technical services suggest that taxpayers in this sector who did not use the services of an agent indicated that they were somewhat confident. No data were available in this study for respondents who did not use an agent. The finding for the Construction sector suggests that respondents who used the services of an agent were fairly confident with transitioning to MTD. For those who did not use the services of an agent predictors of non-compliance markers indicated that an average taxpayers slightly confidence in this sector. Furthermore, Administration and Support services suggest that taxpayers demonstrated average confident level indicated that taxpayers who did not use the services of an agent were slightly confident with compliance markers in this sector. No data were available for those that did not use an agent, due to sample sizes. Lastly, Art, Entertainment, and Recreation suggest respondents who did not use the services of an agent in this sector revealed that taxpayers on average lay between not confident at all and slightly confident. No data were available for those who used accountants in this sector due to sample restrictions. To further test the validity of the above results Kruskal Wallis Hypothesis test was also conducted.

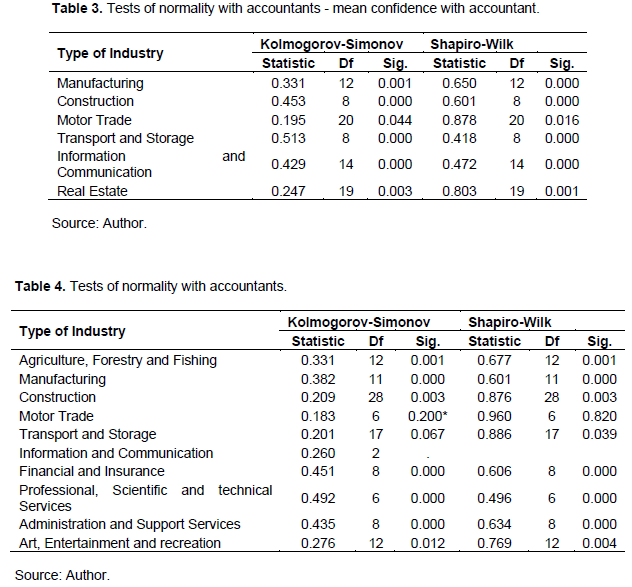

Test of normality for taxpayers with accountants

To assess the type of test most suitable to ascertain the differences with respect to their beliefs about MTD’s impact on taxpayers categorised by an organisational status a Shapiro-Wilk test of normality was performed for the two groups separately; these both indicated that the data for the two groups differed significantly from normality. For taxpayers who were manufacturers S-W statistic = 0.650, p <.001 (df=12). For Construction S-W statistic = 0.601, p<.001 (df =8), Motor trade S-W statistic = 0.878, p <.061 (df=20), Transport and Storage S-W statistic = 0.418, p <.0.00 (df=8), Information and Communication S-W statistic = 0.472, p <.000 (df=14, Real Estate S-W statistic = 0.803, p <.001 (df=19) Table 3.

Test of normality for taxpayers without accountants

To assess the type of test most suitable to ascertain the differences with respect to their beliefs about MTD impact on taxpayers categorised by organisational status a Shapiro-Wilk test of normality was performed for the two groups separately, these both indicated that the data for the two groups differed significantly from normality.

For taxpayers who were Agriculture, Forestry and Fishing manufacturers S-W statistic = 0.677, p <.001 (df=12). For Construction S-W statistic = 0.876, p<.003 (df =28), Motor trade S-W statistic = 0.960, p <.0.820 (df=6) , Transport and Storage S-W statistic = 0.886, p <.0.39 (df=17), Financial and Insurance S-W statistic = 0.606, p <.000 (df=8), Professional and Scientific S-W statistic = 0.496, p <.000 (df=6) Administration and Support Services S-W statistic = 0.634, p <.000 (df=8) Art Entertainment and recreation S-W statistic = 0.769, p <.004 (df=12) Table 4.

Hypothesis test

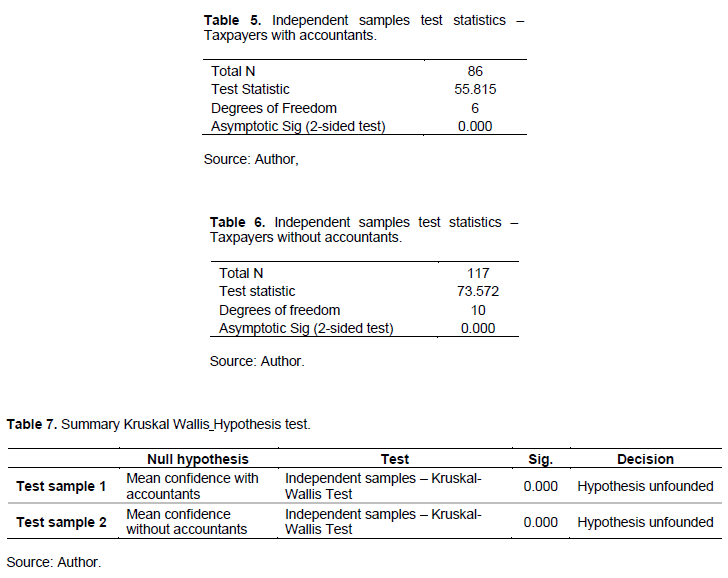

The results of the statistical hypothesis test results demonstrate that the Kruskal Wallis test with accountants (Table 5) showed a statistically significant difference in mean overall confidence across types of industry h, =55.82, df = 6, p ≤ 0.001 l two-tailed. The results demonstrated that the probability of obtaining a test statistic of 55.815 with 6 degrees of freedom (7-1), the statistical significance level is less than p=0.001. The result of the experiment therefore proves that there is a difference between the groups and therefore the null hypothesis is rejected (Table 5).

Additionally, Kruskal Wallis test without accountants (Table 6) showed a statistically significant difference in mean overall confidence across types of industry h,= 73.572, df = 10, p=<.001 two tailed.

The results demonstrated that the probability of obtaining a test statistic of 73.572.815 with 10 degrees of freedom (11-1), the statistical significance level is less than p=0.001.

The result of the experiment therefore proves that there is a difference between the groups and therefore the null hypothesis is rejected (Table 7).

CONCLUSION

These findings support the notion that a transition to MTD is industry sensitive and therefore any reform must consider the circumstances of the industry and its taxpayers. The rollout of MTD will need to supported by accounting/other practitioners. This study supports that tax payers transitioning to MTD who employ the services of an accountant are confident in the initiative. This resonates well with other research findings conducted by Paul (2020) that suggests that HMRC review the implementation to date before proceeding with full MTD rollout. A significant factor in confidence in compliance promotion would be that successful tax reform is one in which can be defined as one which the aims and objectives of the reforms are achieved by the government. Tax reforms need not seem difficult to achieve. Brooks and Noble (1996) describe an efficient and effective tax system as a system that does not distort economic decision-making and that cost of compliance and administration are kept to a minimum. A tax system should not deter incentives to work, innovate, save, and take risks and should be in line with the macro-economic policy. History has shown us that, for a tax system to survive it must be equitable.

It is interesting to note that the reform of a tax system may appear as a systematically easy process, but the desired results and outcomes have been proven to frequently fail.

From this standpoint therefore a ‘good dose of local knowledge’ gives any proposed tax reform the level of knowledge that would provide relevant information for tax administration to implement, control, and monitor the transition to Making Tax Digital. The findings of this study confirm other recent studies such as the Institute of fiscal studies’ report 2019: asserts that among those taxpayers who have self-employment income (43% of all self-assessment taxpayers), non-compliance is highest among those in the construction, transport, and hospitality sectors. In these sectors, around 60% of taxpayers were noncompliant. In revenue terms, non-compliant taxpayers in hospitality owe by far the most, at an average of almost £4,500. Across other industries, the amount owed varies between £2,500 and £3,200. Taxpayers in both hospitality and transport under-reported the largest shares of the total tax they owed, at 54% in both cases.

RECOMMENDATION

It is recommended that future study should focus on a study of the real cost of compliance based on the actual hour’s taxpayers spend on preparing and filing quarterly self-assessments. Additionally, a study that measures the potential saving of tax losses due to errors because of the new making tax digital framework should be done.

CONFLICT OF INTERESTS

The author has not declared any conflict of interests.

REFERENCES

|

Brooks R, Noble J (1996). Tax Increment Financing. Diane Publishing Company. Available at: |

|

|

Department for Business, Energy and Industrial Strategy and Business Population Estimates (2017). Business population estimates for the UK and regions 20 Department for Business, Energy and Industrial Strategy (2017). Available at: |

|

|

Gottschalk K (2017). 5 Things You Need to Know about the Future of Accounting. Available at: |

|

|

Hejase AJ, Hejase HJ (2013). Research Methods: A Practical Approach for Business Students (2nd edition). Philadelphia, PA, USA: Masadir Incorporated. |

|

|

McLure CE (1990). The Theory of Taxation for Developing Countries (Book Review) Newbery D, Stern N (eds.), Economic Development and Cultural Change P 426. |

|

|

Mustapha B, Sheikh SNB (2014). The influence of technology characteristics towards an online tax system usage: the case of Nigerian self-employed taxpayer. International Journal of Computer Applications 105(14):30-36. |

|

|

Obid SNBS, Bojuwon M (2014). Reengineering Tax Service Quality Using a Second Order Confirmatory Factor Analysis for Self-Employed Taxpayers. International Journal of Trade, Economics and Finance 5(5):429-434. |

|

|

Office for National Statistics (2019). The industrial Analysis. Available at: |

|

|

Paul A (2020). Making tax digital, taking stock. Tax Journal. Available at: |

|

|

Rachinger M, Rauter R, Müller C, Vorraber W, Schirgi E (2018). Digitalization and its influence on business model innovation. Journal of Manufacturing Technology Management 30(8):1143-1160. |

|

|

Sadiq M (2021). Impact of making tax digital on small businesses. Kuwait Chapter of the Arabian Journal of Business and Management Review 10(3):123-134. |

|

|

Setia MS (2016). Methodology series module 3: Cross-sectional studies. Indian Journal of Dermatology 61(3):261. |

|

|

Sian K (2018). Xero Approved by HMRC for MTD. Available at: |

|

|

Smith E (2018). Guide to making tax digital for businesses: What is required under making tax digital initiative and how will the regime affect businesses? Available at: |

|

|

Tu T (2017). Making Tax Digital for Business: Survey of Small Businesses and Landlords. HMRC Report 480. London: Mori. FF. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0