ABSTRACT

Acquisition and restructuring strategies are some of the growth and retrenchment strategies that firms employ with the aim of achieving competitive advantage in form of superior financial sustainability position. In this study, we set out to provide a descriptive framework for acquisition and restructuring strategies as corporate level strategies and to investigate the ability of these strategies to help organizations improve their financial sustainability. Acquisition was recommended as an effective diversification strategy due to its benefit of increasing barriers to entry. Horizontal and vertical integration were particularly recommended as effective market development strategies by way of acquisition of unique resources and competitors’ market share. However, few authors also discouraged acquisition strategy on the grounds of increase in external reliance for critical resources. Restructuring strategies were recommended as an effective part of a turnaround strategy as opposed to being implemented in isolation.

Key words: Acquisition strategy, restructuring strategy, competitive advantage, financial sustainability, diversification, market development, turnaround strategy.

Strategic planning is one of the first stages of any strategic process in business. This stage often involves establishing the ultimate goals of the business and assessing one’s position and capacity towards achieving such goals. The planning process involves an internal and external analysis of the business environment in order to assess the resources and capabilities as well as its opportunities and threats (Haque et al., 2021). These two stages have popularly been summarized with the following questions: where are we going (Establishment of goals) and where are we at the moment (Internal and external analysis)? Once these two questions have been adequately addressed, then the company will need to devise a strategy that will help them achieve the set goals (that is how do we get there?). Acquisition and restructuring strategies are some of those strategies that can help the company to achieve its goals. The major goal of any organization is to attain and sustain competitive advantage and this competitive advantage is reflected in the financial performance and sustainability position of such organizations (Haseeb et al., 2019). The ability of companies to achieve and sustain competitive advantage can be observed from their financial sustainability position. Financial sustainability relates to the ability of organizations to maintain above-average financial performance for a long period of time (Imhanzenobe, 2020). When a firm is able to maintain profits that are above the industry average for a long period of time, it indicates that the firm possesses resources and capabilities that are inimitable and help it to outperform its competitors.

Drawing from the above premises, this study tries to provide an answer to the question: to what extent can managers implement acquisition and restructuring strategies in achieving competitive advantage and financial sustainability? Most studies that address financial sustainability often focus on local governments and other government parastatals (Carmeli, 2008; Wallstedt et al., 2014), while ignoring the private sectors. Also, most of the previous studies do not consider or merge with the results of other authors. The review approach is used in this study to merge the findings of several authors that have investigated the subject. In this study, we look at the implementation of acquisition and restructuring strategies in achieving competitive advantage, either by acquiring critical resources or adjusting the existing business model respectively, and the effect of these strategies on the financial sustainability of the organization. To achieve this, the study provides a descriptive framework of acquisition and restructuring strategies as corporate level strategies. The study also discusses how these strategies can help to achieve competitive advantage and reviews existing empirical literature on the impact of the implementation of these strategies on the competitive advantage as well as the overall organizational financial performance and sustainability.

According to Porter (1996), a strategy is the creation of a unique and valuable position, through different set of activities, in order to help the organization achieve its specified short and long term goals. He differentiates strategy from operational effectiveness which is the ability of an organization to perform similar activities better than its competitors. Strategy involves performing different activities or similar activities in a different way from competitors (Zerfass et al., 2018). These activities are geared towards achieving competitive advantage (and superior financial performance in the long run) by creating a directional path for the overall organization, developing new products or enhancing existing products and services that serve a particular market and at the right price, and optimum allocation of the organization’s resources and capabilities. Strategy implementation often involves opportunity costs (that is sacrificing something else) and these activities must align with the overall goals of the organization. There are three common levels of strategies; corporate level strategies, business level strategies and functional level strategies. Corporate level strategies provide direction to the overall organization, business level strategies provide ways of gaining competitive advantage for each of the organization’s product or service in line with the selected corporate level strategies, while functional level strategies try to identify the optimum allocation of resources and capabilities within each department in supporting the corporate and business level strategies (Beard and Dess, 1981; Sage, 2019).

One of the earliest definitions of corporate strategy is that of Alfred Chandler Jr, who defined corporate level strategies as the determination of the basic long-term goals and objectives of an organization, adoption of courses of action, and the allocation of resources for carrying out the determined goals. His emphasis was on how organizations adapt their administrative structure to fit their chosen corporate strategies (Chandler, 1962; Heracleous, 2003). Corporate strategy has also been described as the identification of an organization’s goals and the major policies for achieving them, stated in a way that clarifies what the business is and what it wants to become (Heracleous, 2003; Learned et al., 1965). This definition is closely linked with the concepts of corporate vision and mission statements and is quite similar with the definition of Andrews (1980) who defined corporate strategy as the determination of an organization’s goals and objectives, the businesses it intends to pursue, the kind of human and financial organization it wants to be, and the nature of financial and non-financial contribution it intends to make to its stakeholders. This definition can be applied to corporate strategy even on a national level. Ansoff (1965) believed that corporate strategy addresses five perspectives of an organization (product-market scope, growth prospect, competitive advantage, and internally generated synergy and make or buy decisions) and these five perspectives are interrelated. When strategies are made at the corporate level, the organization is seen as a whole and strategic decisions are made that consider all of the firm's business activities in other to identify the best way to create value. According to Nickols (2016a), formulation and implementation of corporate strategy rests with the senior management (‘the strategy wheel gets the executive grease’) and other levels of strategy ought to align with the corporate strategy. One of the most popular corporate level strategies are the grand strategies.

Grand strategies

The concept of ‘grand strategy’ originated from the British military and can be traced to Sir Basil Henry Liddell Hart (Nickols, 2016a). He described grand strategies from a war context as a nation’s choices in matters of theaters of war, international alliances, distribution of resources among various military departments, and the kinds of ammunition to produce that will optimize the use of those resources. Other definitions of grand strategy include those of Paul Kennedy, who described grand strategy as consisting of policies and capacity of the nation’s leaders to combine both military and non-military resources for the preservation and enhancement of the nation’s long-term goals (Lissner, 2018). Some characteristics of grand strategies that can be deduced include the fact that they are targeted at the organization’s long-term goals, and are holistic in their scope of influence (they affect the entire organization). The aspect of strategy implementation that involves allocation of resources constitutes the link between organization strategy and military strategy (Nickols, 2016b).

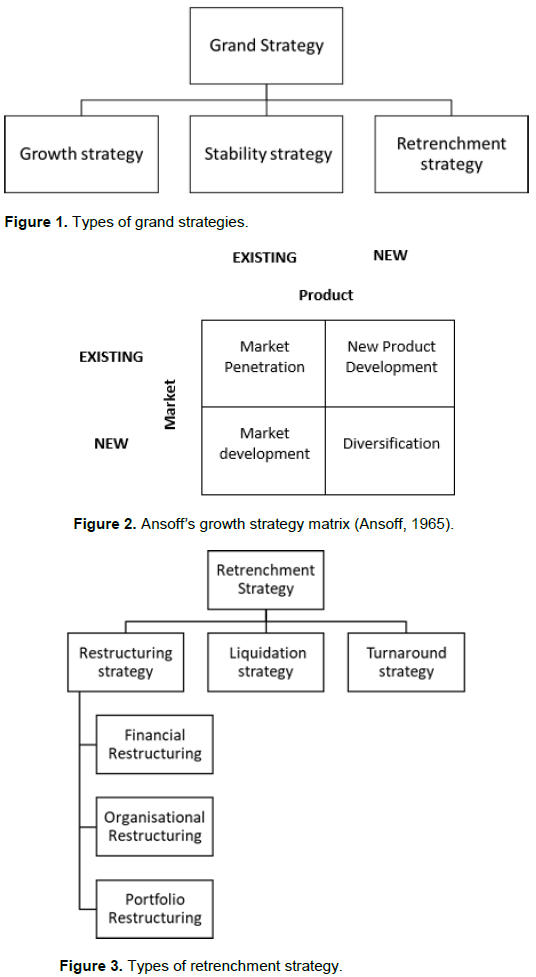

In business, grand strategies are corporate level strategies that reflect a firm’s choice of actions with regards to the overall direction that it intends to follow in achieving its long-term goals. The concept of grand strategy has often been used interchangeably to refer to corporate level strategy. Grand strategy tries to provide answers to three main questions about an organization’s strategic direction: how do we intend to grow? How do we intend to maintain/sustain our current position? How do we cut back if needed (Sage, 2019)? Consequently, we have three major types of grand strategies: growth/expansion strategy, stability strategy and retrenchment strategy (Figure 1) (Theintactone, 2018).

Acquisition and restructuring strategy are typical examples of growth and retrenchment strategies respectively that can help an organization to achieve its goals. The goal of every organization, often times, is to attain and sustain competitive advantage that will lead to superior financial performance in relation to competitors. Organizations can achieve this by acquiring critical resources or adjusting the existing business model. This could demand cutting off aspects of the business that are not beneficial to the overall organization.

Acquisition as a growth strategy

Growth strategy is a general term used to refer to a category of grand strategies that help a firm to expand its scale operations. In the famous Ansoff’s growth strategy matrix, Igor Ansoff suggests that firms can grow either internally or externally (Figure 2). Acquisition is an example of an external growth strategy. An acquisition is a strategy through which one firm buys up all or a controlling interest in another firm with the intention of making the acquired firm a subsidiary business unit within its portfolio (Hitt et al., 2007). Unlike mergers, which are peaceful and solicited, acquisitions may be peaceful or not peaceful. Unsolicited acquisitions are often called takeovers.

Restructuring as a retrenchment strategy

Retrenchment strategy is another type of grand strategy that involves reductions in the scope or size of an organization (Boyne, 2004). The term retrenchment strategy also has a military origin. When armies were being attacked in an insurmountable manner, they would retreat back to the trenches from which they advanced, thus retrenchment refers to going back to the trench from which you came (Edwards, 2018). This strategy is often carried out as a response to a series of negative performance to ensure the overall survival of the company. Retrenchment strategies often involve reducing the overall cost of the organization or cutting off cancerous business units by making adjustments to the existing business model. There are three major types of retrenchment strategy; restructuring strategy, liquidation strategy and turnaround strategy (Figure 3). Turnaround strategies are strategies that are used to reverse the effects of a previously implemented strategy (often called an ‘undo strategy’). Liquidation strategy involves the shutting down the operations of the entire organization and disposal of its assets at their realizable value. Liquidation is often considered only when all other strategies have failed.

Restructuring strategy is a strategy that involves making changes to the existing structures of the organization with the aim of improving its efficiency and effectiveness (Robbins and Pearce, 1992). Restructuring strategies may involve making changes to the financial structure (that is capital structure), organizational structure (that is operations, human resources, management hierarchy), or portfolio structure (that is strategic business units). Capital reconstruction is an example of a financial restructuring strategy that involves changing the mix of debt and equity with the aim of optimizing the overall cost of capital. Downsizing is a common organizational restructuring strategy that involves reducing the number of employees or other operating units with the aim of minimizing overhead costs and other administrative expenses. Similarly, downscoping is an example of a portfolio restructuring strategy in which an organization decides to stick strictly to its core business and sell off or shut down other product lines or strategic business units.

This strategy is quite similar with divestment in which an organization sells off business units that have been unprofitable for a subsequent period of time.

Competitive advantage and financial sustainability through acquisition and restructuring strategy

The ultimate aim of choosing and implementing a strategy is to achieve and sustain competitive advantage in view of future profits. Porter (1980) defined competitive advantage as the ability, gained through attributes and resources, to perform at a higher level than others in the same industry or market. According to Porter, sustainable competitive advantage is fundamental for above-average financial performance in the long run. This competitive advantage results from the ability of an organization to maximize their strengths and minimize their weaknesses (Hayes and Jaikumar, 1988). Several authors and theories have tried to identify the critical factors that create competitive advantage. Porter’s theory of strategic groups attributes competitive advantage to industry structure and positioning. However, the ability to sustain competitive advantage often fades quickly because sustainable competitive advantage cannot be achieved merely by taking advantage of opportunistic deals and escaping threats in the business environment but from resources and capabilities that are under the control of the organization. Barney’s resource-based view theory attributes competitive advantage to these unique and inimitable internal resources that are under the control of the organization (Hoskisson et al., 1999; Ployhart, 2021). A study by McKinsey Consultants discovered that out of 208 companies in various industries, only 3 could sustain their competitive advantage in terms of ability to earn above-average profits over a ten year period (Ghemawat, 2002).

Companies can obtain and sustain competitive advantage by implementing growth and retrenchment strategies and this can improve their financial performance and sustainability position. Both internal and external growth strategies can be used, however, the external growth strategies have to be such that the company has significant control over the targeted firm. This is often the case with an acquisition. Also, restructuring as a retrenchment strategy can be used to minimize weaknesses and thus create competitive advantage.

Competitive advantage through acquisition strategy

Acquisition is commonly used as a diversification strategy (Figure 2), in which case, a firm acquires another firm that offers a different product or service and to a different customer (for instance Amazon’s acquisition of Whole Foods in 2017). However, acquisition can serve as a market penetration strategy when a company engages in acquisition solely to increase market share. The company can do this by acquiring a firm that is into a similar business and serves similar customers (for instance Access bank’s acquisition of Intercontinental Bank plc. in 2011 and Diamond bank in 2018). This is common in monopolistic and oligopolistic industries. Similarly, acquisition can serve as a market development strategy when a company engages in acquisition solely to diversify its market. The company can do this by acquiring a firm that is into a similar business but serves different customers (for instance Access bank’s acquisition of Kenya's Transnational Bank in 2020). Cross-border acquisitions can help to achieve competitive advantage and improve consolidated revenues by overcoming entry barriers to new markets. An acquisition can also serve as a product development strategy. In this case, instead of producing a new product, the company acquires an existing company that produces the new product or service (for instance Facebook’s acquisition of WhatsApp in 2014). The product or service in this case is not too different from what the organization is already offering (more like an upgrade). Where the product is completely different, it would constitute a diversification strategy. This kind of acquisition can help create competitive advantage and improve financial performance by avoiding the costs, risks and delays associated with new product development (similar with a make or buy investment decision). When an acquisition involves companies in similar or related industry, it is often referred to as integration (He et al., 2017). Horizontal integration involves the acquisition of a firm by a competitor in the same industry. Horizontal integration is often done with the aim of increasing market share. Vertical integration refers to a case where a firm is acquired by a firm in a related industry (either a supplier or a customer). Forward integration is where a firm acquires another firm in its customer industry while backward vertical integration is when a firm acquires another firm in its supplier industry. Vertical integration is often done to take advantage of economies of scale (Koch et al., 2017).

Competitive advantage through restructuring strategy

Restructuring is often used as a retrenchment strategy (Figure 3). Capital reconstruction is a common financial restructuring strategy. It is often implemented to take advantage of cheaper costs of capital or when the leverage position of an organization is found to be alarmingly high. Debt refinancing is a capital reconstruction strategy that involves replacing a firm’s existing debts with newer debts that have more favorable conditions (lower interest rate, longer maturity date etc.).

A debt-to-equity swap is another capital reconstruction strategy that involves converting debt into equity by getting bondholders and creditors to accept shares as settlement for the debt. Downsizing can be used as an organizational restructuring strategy for cost reduction. It involves cutting off unnecessary infrastructures and employees (Kim et al., 2021). Although downsizing can help reduce the overall cost of the organization, some disadvantages have been identified. The learning curve effect may be lost when employees are fired since new employees will have to be retrained (Imhanzenobe, 2019). In the early 1990s, the advent of the new age banks caused the Nigerian banking sector to experience a period of rampant downsizing as older banks were forced to cut cost to be able to compete with the newer ones. Divestment tends to have more positive effect on firm performance in the long run. It is a portfolio restructuring strategy that involves selling off a cancerous business unit to save the overall company. This is often due to under performance of the divested unit for a reasonably long period of time. Coca-Cola recently had to shut down its operations in Lebanon due to its series of losses and the general economic downturn in the country (Arabnews, 2020). Downscoping is quite related to divestment. It refers to a case where a company streamlines its portfolio to its core businesses only (Fuhrmann and Madlener, 2020). Typical example of downscoping was Microsoft’s announcement to stop developing new operating systems every few years but to adopt the Apple-like approach of only providing updates on the already existing Windows 10 version and focus more on producing computer hardware (Nguyen, 2015).

The aim of this study was investigated by reviewing existing empirical literature. Several authors have carried out empirical investigation on the ability of acquisition and restructuring strategies to create competitive advantage and found mixed results. Most of the studies measured the ability of companies to achieve and sustain competitive advantage through their financial sustainability position (that is their ability to maintain above-average financial performance for a long period of time). When a firm is able to maintain profits that are above the industry average for a long period of time, it indicates that the firm possesses resources and capabilities that are inimitable and help it to outperform its competitors. Rhoades (1973) did a study on the effect of diversification on industry profit performance in 241 manufacturing industries. The author discovered that diversified firms enjoy competitive advantage in form of increased barriers to entry for potential competitors. These barriers to entry are of two kinds; ability to use profits from one business unit to subsidize low price strategy in another business unit, and ability to hide attractive returns in one of their product market using consolidated financial reporting. However, in a different study (Rhoades, 1974) the author discovered a slightly negative relationship between diversification and profitability. In this study, they measured diversification with the number of industries that the companies belonged to and the proportion of firm’s sales outside their primary business compared to total sales. The author attributed the difference in results to the industrial aggregation rather than measures of diversification. Beard and Dess (1981), in their study discovered that the implementation of acquisition and restructuring as corporate level strategies can lead to sustainable profitability and competitive advantage in the long run. He attributed the success of the corporate strategies to the firm specific resources. This result is similar with those of Heracleous (2003), who supported the resource based view and suggested that competitive advantage can be obtained by acquiring firms that have unique resources which cannot be easily imitated. He also suggested that tangible resources are easier to imitate compared to intangible resources. Thus, firms can use acquisition strategies to obtain competitive advantage especially in services industries and other industries that thrive on intangible assets. Cording et al. (2008) did a study on the impact of integration acquisition and performance. They identified several factors that influence the success of such acquisition. Factors like integration depth and speed, market focus and internal reorganization tend to have positive effect on the successful implementation of integration strategy while factors like top management turnover have negative effect on the successful implementation of such acquisition strategy. Anderibom and Obute (2015) carried out an investigation on the effects of mergers and acquisition on the performance of Nigerian commercial banks using United Bank for Africa as a case study. They used a paired sample t-test to test for differences in the performance of the bank before and after its acquisition of Standard Trust Bank. The study showed that the performance of United Bank for Africa improved after the acquisition. A very similar result was discovered by Sujud and Hachem (2018) in their study on the effect of mergers and acquisition on the performance of commercial banks in Lebanon. A comparative analysis was done on the financial performance of Audi-Saradar Group before and after the acquisition (Bank Saradar signed a merger agreement with Bank Audi Sal, but Saradar was entitled to become the largest shareholders of the new Audi Saradar Group). The earnings per share improved significantly after the acquisition. The return on asset also increased but not significantly.

On the other hand, a study by Gort (1962) found that acquisition as a diversification strategy had no significant relationship on competitive advantage in terms of profitability. Christensen and Montgomery (1981) tried to test the relationship between the relatedness of business portfolios of conglomerate firms and economic performance as a way of evaluating the impact of diversified acquisition strategy on competitive advantage and financial sustainability. They discovered that there was a negative relationship between the unrelatedness of business portfolios and financial sustainability in terms of market share, thus discouraging acquisition as a diversification strategy. Hopkins (1987) carried out a study on acquisition strategy and market positioning of acquiring firms. In this study, the author evaluated the impact of the different forms of acquisition strategy (that is conglomerate acquisition, technology-related acquisition and market-related acquisition) on competitive advantage, in terms of market positioning of the acquirer after acquisition. The study suggested that unrelated diversification through acquisitions often resulted in unfavorable market positions. However, the results also showed that, while acquisitive growth is generally associated with a decline in market position, the market-related strategy (acquisition for market development) will often lead to superior market position for the acquiring firm and this will eventually improve revenues and profits. Hayes and Jaikumar (1988), in their study, suggested that acquisition and other strategies that create external linkages and dependencies can lead to autonomy-control tension (especially in cross-border acquisitions). Thus, they promoted the importance of building specific organizational competencies by encouraging companies to develop their own technologies and resources instead of depending on external intervention. This position is similar with that of Lanctot and Swan (2000). According to Lanctot and Swan (2000), external reliance on product and process technologies has a negative impact on firm success. They also identified geographical barriers as a hindrance to the effectiveness of technology acquisition strategies in achieving competitive global market position.

Some authors have also investigated the impact of restructuring strategies on the performance and competitive position of organizations. A study by Robbins and Pearce (1992) analyzed the effectiveness of restructuring as a retrenchment strategy. The study investigated 32 textile manufacturers and showed that downsizing and divestment strategies resulted in the highest average level of turnaround performance. Chowdhury and Lang (1996) did a study on turnaround actions and firm profitability. They divided retrenchment strategy into cost-cutting (reduction in operational expenses) and asset reduction strategies (asset disposal and divestment). The results showed that profitability was more responsive to the efficiency strategies like asset divestment and employee productivity. Boyne (2004) did an investigation on the effectiveness of restructuring strategies (in terms of downsizing, downscoping, divestment and management reorganization) to effectively achieve a turnaround in failing public service organizations. They recommended that the highlighted strategies were crucial stages in the overall effectiveness of a turnaround strategy in public service organizations. They also emphasized that divestment in this case doesn’t necessarily refer to exiting the market (since they are compelled to provide such services by law) but by partnering with other agencies and private sector organizations.

Some other authors have found negative or absence of relationship between some restructuring strategies and firm competitive advantage. Sudarsanam and Lai (2001) carried out a study on the effectiveness of restructuring strategies in achieving corporate recovery. They examined 166 potentially bankrupt UK firms drawn from 1985 to 1993 and observed their turnaround strategies (operational, asset, managerial and financial restructuring) for a period of three years from distress. The results showed that both recovery and non-recovery firms adopted very similar sets of restructuring strategies. The strategies of the non-recovery firms were more intensive than those of the recovery firms and yet did not help them recover. The major difference was that the recovery firms also adopted some growth-oriented strategies while the non-recovery firms had more of a fire-fighter approach. Marques et al. (2011) also did a study to investigate the effectiveness of downsizing strategy on boosting firm performance. They tested a sample of 1,357 Portuguese firms and concluded that firms that downsize largely maintain their underperformance compared to those that do not downsize. This result is similar with that of Imhanzenobe (2019) who discovered that changes in number of employees had no significant impact on the financial sustainability position of companies. Carriger (2018) also did a study that investigated the effectiveness of downsizing. They differentiated forced employee attrition (downsizing) from temporary or natural attrition. The found no significant relationship between forced attrition and financial performance. However, they suggested temporary attrition as a better alternative as it leads to positive immediate and long-term effect.

From the review of existing literature, we can identify mixed results on the ability of acquisition and restructuring strategies to achieve and sustain competitive advantage and improve financial sustainability. Some authors identified a positive impact of acquisition on firms’ competitive advantage and overall financial performance (Rhoades, 1973; Beard and Dess, 1981; Heracleous, 2003; Cording et al, 2008; Anderibom and Obute, 2015; Sujud and Hachem, 2018) while others identified a negative impact (Rhoades, 1974; Christensen and Montgomery, 1981; Hopkins, 1987; Hayes and Jaikumar, 1988; Lanctot and Swan, 2000). Acquisition as a diversification strategy was supported on the basis that diversified businesses have the advantage of being able to conceal abnormal profits through consolidated financial reporting as well as charge low prices and subsidize such losses with profits from other businesses (Rhoades, 1973). Acquisition as a market development strategy (vertical and horizontal integration) was even more encouraged as it serves as an effective means of expanding market share and acquiring unique resources that cannot be internally generated (Beard and Dess, 1981; Heracleous, 2003; Anderibom and Obute, 2015; Sujud and Hachem, 2018). Although, several author identified positive effect of acquisition, some authors also acknowledged the fact that acquisitions create external reliance on other organizations for resources that are critical for their survival and this could harm the organization in the long run (Hayes and Jaikumar, 1988; Lanctot and Swan, 2000). Also, during the implementation process of acquisition and restructuring strategies, managers ought to consider how to deal with some of the challenges that come with it. Challenges like changes in organizational culture and value, lack of actualization of predicted synergy and top management turnover ought to be managed with caution as these could also have significant effects on the successful implementation of such strategies (Cording, Christmann and King, 2008).

Some authors identified a positive impact of restructuring strategies on firms’ competitive advantage and overall financial performance (Robbins and Pearce, 1992; Chowdhury and Lang, 1996; Sudarsanam and Lai, 2001; Boyne, 2004) while some others identified a negative impact (Sudarsanam and Lai, 2001; Imhanzenobe, 2019). A potential explanation for this discrepancy is that some authors investigate restructuring as an isolated strategy, whereas others investigated it as the first stage in the process of a turnaround strategy (Arogyaswamy et al., 1995). Downsizing, downscoping and divestment were found to be significant determinants of the successful implementation of organizations’ turnaround strategy (Robbins and Pearce, 1992; Chowdhury and Lang, 1996; Sudarsanam and Lai, 2001). However, when applied alone or as a fire-fighter approach, they were found to be insignificant (Sudarsanam and Lai, 2001; Imhanzenobe, 2019). The results of the reviewed studies are in line with the theory of grand strategies which suggests that acquisition and restructuring strategies, when implemented correctly can improve the competitive advantage and financial sustainability position of organizations.

This study sets out with the aim of providing a descriptive framework for acquisition and restructuring strategies as corporate level strategies and investigating the ability of these strategies to help organizations to achieve competitive advantage and improved financial sustainability. The concept of acquisition and restructuring strategies where linked to the grand strategies of growth and retrenchment strategies respectively. The arguments on how these strategies can lead to competitive advantage and superior financial performance was also discussed and empirical studies on the subject were reviewed.

Some authors identified acquisition as an effective diversification strategy because it has the advantage of increasing barriers to entry through low price subsidization and concealing of abnormal profit through consolidated reporting. Several recommended horizontal and vertical integration as effective market development strategies with the argument that it helps the firm acquire unique resources and acquire competitors’ market share. A few authors also discouraged acquisition strategy on the grounds that it increases external reliance on other organizations for critical resources.

Restructuring strategies have been recommended by several authors as an effective part of a turnaround strategy. However, when implemented alone may not be effective in improving the survival of organizations. Restructuring strategies ought to be implemented as part of a bigger picture and possibly accompanied with some growth strategies to produce positive and significant impact of firms’ performance. The above findings have some practical implications for management research and practice. Managers who want to expand their businesses can carry out acquisition strategies. Although acquisition strategies are fairly effective for diversification purpose, they are even more effective for market development as they help in acquiring unique resources without having to build from scratch. Although the problem of relying on external organizations for acquiring unique resources exists, managers can reduce anticipate this problem by gaining substantial control over the acquired firm. During times of financial crisis, managers can also employ restructuring strategies in reviving the company. However, choices of restructuring techniques matter. Downsizing is a very common technique that managers are quick to use but which research has shown to be seldom effective. Restructuring strategies may not be very effective when applied in isolation. There ought to be a big picture for the overall turnaround of the firm which could comprise some restructuring strategies. Restructuring strategies cannot be used as a ‘magic wand’. They ought to be used in combination with other growth and/or stability strategies to yield effective results.

Also, in the implementation of acquisition and restructuring strategies, some other factors like organizational culture, employee satisfaction, and management structure and style ought to be considered and managed properly to yield positive and significant results. Further empirical research could be carried out to investigate the impact of such mediating variables on the competitive advantage and financial sustainability of firms.

The author has not declared any conflict of interest.

REFERENCES

|

Anderibom AS, Obute CO (2015). The effects of mergers and acquisitions on the performance of commercial banks in Nigeria: Evidenced from United Bank for Africa (UBA) plc. International Journal of Education and Research 3(4):93-112.

|

|

|

|

Andrews K (1980). The Concept of Corporate Strategy, 2nd Edition: Dow-Jones Irwin.

|

|

|

|

|

Ansoff HI (1965). Corporate strategy: An analytic approach to business policy for growth and expansion. McGraw-Hill Companies.

|

|

|

|

|

Arabnews (2020). Coca-Cola fizzles out in Lebanon with economic downturn. Available at:

View

|

|

|

|

|

Arogyaswamy K, Barker VL, Yasai?Ardekani M (1995). Firm turnarounds: an integrative two?stage model. Journal of Management Studies 32(4):493-525.

Crossref

|

|

|

|

|

Beard DW, Dess GG (1981). Corporate-level strategy, business-level strategy, and firm performance. Academy of Management Journal 24(4):663-688.

Crossref

|

|

|

|

|

Boyne GA (2004). A '3Rs' strategy for public service turnaround: retrenchment, repositioning and reorganization. Public Money and Management 24(2):97-103.

Crossref

|

|

|

|

|

Carmeli A (2008). The fiscal distress of local governments in Israel. Administration and Society 39(8):984-1007.

Crossref

|

|

|

|

|

Carriger M (2018). Do we have to downsize-does the empirical evidence suggest any alternatives? Journal of Strategy and Management 11(4):449-460.

Crossref

|

|

|

|

|

Chandler AD (1962). Strategy and structure: Chapters in the history of the industrial empire.

|

|

|

|

|

Chowdhury SD, Lang JR (1996). Turnaround in small firms: An assessment of efficiency strategies. Journal of Business Research 36(2):169-178.

Crossref

|

|

|

|

|

Christensen HK, Montgomery CA (1981). Corporate economic performance: Diversification strategy versus market structure. Strategic Management Journal 2(4):327-343.

Crossref

|

|

|

|

|

Cording M, Christmann P, King DR (2008). Reducing causal ambiguity in acquisition integration: Intermediate goals as mediators of integration decisions and acquisition performance. Academy of Management Journal 51(4):744-767.

Crossref

|

|

|

|

|

Edwards J (2018). Mastering Strategic Management: 1st Canadian Edition: BCcampus OpenEd publisher.

|

|

|

|

|

Fuhrmann J, Madlener R (2020). Evaluation of Synergies in the Context of European Multi-Business Utilities. Energies 13(24):6676.

Crossref

|

|

|

|

|

Ghemawat P (2002). Competition and business strategy in historical perspective. Business History Review 76(1):37-74.

Crossref

|

|

|

|

|

Gort M (1962). Diversification and Integration in American Industry. National Bureau of Economic Research, Inc.

|

|

|

|

|

Haseeb M, Hussain HI, Kot S, Androniceanu A, Jermsittiparsert K (2019). Role of social and technological challenges in achieving a sustainable competitive advantage and sustainable business performance. Sustainability 11(14):3811.

Crossref

|

|

|

|

|

Haque MG, Nurjaya N, Affandi A, Erlangga H, Sunarsi D (2021). Micro Financial Sharia Non-bank Strategic Analysis: a Study at BMT Beringharjo, Yogyakarta. Budapest International Research and Critics Institute (BIRCI-Journal). Humanities and Social Sciences 4(2):1677-1686.

Crossref

|

|

|

|

|

Hayes RB, Jaikumar R (1988). New technologies, obsolete organizations. Harvard Business Review 66(5):77-85.

|

|

|

|

|

He MD, Leckow MB, Haksar MV, Griffoli MM, Jenkinson N, Kashima MM, Khiaonarong T, Rochon C, Tourpe H (2017). Fintech and financial services: initial considerations. International Monetary Fund.

|

|

|

|

|

Heracleous L (2003). Strategy and organization: Realizing strategic management: Cambridge University Press.

Crossref

|

|

|

|

|

Hitt MA, Ireland RD, Hoskisson RE (2007). Strategic Management: Competitiveness and Globalization (Concepts and Cases) (7th ed.). Thomson South-Western.

|

|

|

|

|

Hopkins HD (1987). Acquisition strategy and the market position of acquiring firms. Strategic Management Journal 8(6):535-547.

Crossref

|

|

|

|

|

Hoskisson RE, Wan WP, Yiu D, Hitt MA. (1999). Theory and research in strategic management: Swings of a pendulum. Journal of Management 25(3):417-456.

Crossref

|

|

|

|

|

Imhanzenobe JO (2019). Operational efficiency and financial sustainability of listed manufacturing companies in Nigeria. Journal of Accounting and Taxation 11(1):17-31.

Crossref

|

|

|

|

|

Imhanzenobe JO (2020). Managers' financial practices and financial sustainability of Nigerian manufacturing companies: Which ratios matter most?. Cogent Economics and Finance 8(1):1724241.

Crossref

|

|

|

|

|

Kim MH, Hong JH, Park HS (2021). Divergent Effects of Cutback Strategies on Organizational Capacities: Evidence from US Counties. Public Performance and Management Review 44(3):1-28.

Crossref

|

|

|

|

|

Koch TG, Wendling BW, Wilson NE (2017). How vertical integration affects the quantity and cost of care for Medicare beneficiaries. Journal of Health Economics 52:19-32.

Crossref

|

|

|

|

|

Lanctot A, Swan KS (2000). Technology acquisition strategy in an internationally competitive environment. Journal of International Management 6(3):187-215.

Crossref

|

|

|

|

|

Learned EP, Christensen CR, Andrews KR, Guth WD (1965). Business policy: text and cases homewood. Ill.: Irwin.

|

|

|

|

|

Lissner RF (2018). What Is Grand Strategy? Sweeping a Conceptual Minefield. Texas National Security Review 2(1):53-73.

|

|

|

|

|

Marques T, Suárez-González I, Cruz P, Portugal-Ferreira, M (2011). Downsizing and Profitability: An Empirical Study of Portuguese Firms in 1993-2005. International Journal of Business and Economics 10(1):13-26.

|

|

|

|

|

Nguyen C (2015). Microsoft confirms there will be no Windows 11. Available at:

View

|

|

|

|

|

Nickols F (2016a). Liddell-Hart's eight maxims of Strategy. Available at:

View

|

|

|

|

|

Nickols F (2016b). Strategy, Strategic Planning, Strategic Thinking, Strategic Management. Available at:

View

|

|

|

|

|

Ployhart RE (2021). Resources for what? Understanding performance in the resource-based view and strategic human capital resource literatures. Journal of Management 01492063211003137:1-16.

|

|

|

|

|

Porter ME (1980). Competitive strategy. New York: Free Press.

|

|

|

|

|

Porter ME (1996). What is strategy?. Harvard business review 74(6):61-78.

|

|

|

|

|

Rhoades SA (1973). The effect of diversification on industry profit performance in 241 manufacturing industries: 1963. The Review of Economics and Statistics 55(2):146-155.

Crossref

|

|

|

|

|

Rhoades SA (1974). A further evaluation of the effect of diversification on industry profit performance. The Review of Economics and Statistics 56(4):557-559.

Crossref

|

|

|

|

|

Robbins DK, Pearce JA (1992). Turnaround: Retrenchment and recovery. Strategic Management Journal 13(4):287-309.

Crossref

|

|

|

|

|

Sage S (2019). The three levels of Strategy. Available at:

View

|

|

|

|

|

Sudarsanam S, Lai J (2001). Corporate financial distress and turnaround strategies: An empirical analysis. British Journal of Management 12(3):183-199.

Crossref

|

|

|

|

|

Sujud H, Hachem B (2018). Effect of mergers and acquisitions on performance of Lebanese banks. International Research Journal of Finance and Economics 166:69-77.

Crossref

|

|

|

|

|

Theintactone (2018). Grand Strategies. Available at:

View

|

|

|

|

|

Wallstedt N, Grossi G, Almqvist R (2014). Organizational solutions for financial sustainability: A comparative case study from the Swedish municipalities. Journal of Public Budgeting, Accounting and Financial Management 26(1):181-218.

|

|

|

|

|

Zerfass A, Ver?i? D, Nothhaft H, Werder KP (2018). Strategic communication: Defining the field and its contribution to research and practice. International Journal of Strategic Communication 12(4):487-505.

Crossref

|

|