Full Length Research Paper

ABSTRACT

This study focuses on analysing financial ratios to identify the company’s (ABC Group) problems and the means by which financial fraud was committed. It proposes recommendations and solutions for the corporate governance of IPO enterprises in China’s Growth Enterprise Market. This study finds that imperfect corporate governance led to financial fraud being committed by ABC Group. Many other IPO enterprises in the Growth Enterprise Market suffer from the same corporate governance flaws as ABC Group, including an over-concentrated ownership structure, ineffective board of directors and supervisors, lack of management morality and other internal governance issues, external governance issues such as imperfect capital market system, insufficient supervision, and lack of independence of intermediary agencies. Results indicate that enterprises should optimize their equity structure, improve the relevant mechanisms of the board of directors and supervisors, and increase the moral constraints on management.

Key words: Corporate governance, financial fraud, auditor independence, accounting.

INTRODUCTION

China’s rapid economic development has provided significant entrepreneurial opportunities. Many enterprises hope to achieve effective financing through listing so as to broaden development channels, expand development scale, win social reputation and establish brand image. The Growth Enterprise Market (GEM), also known as the Second Board Market, was established in 2009 and plays an important role in China’s securities market. It provides financing opportunities for small and medium-sized enterprises that are not listed on the main board. Review is easier and market entry barriers are lower in the GEM than in the main board. Therefore, more and more enterprises with financing needs choose to enter the GEM. Till date, China’s GEM has more than 700 enterprises that have successfully completed an initial public offering (IPO).

Research problem and motivations of this study

Sound corporate governance ensures the normal and efficient operation of enterprises. This study selects a

specific case to address some principal questions What are the methods of financial fraud used by enterprises seeking IPO in the GEM? How can the occurrence of financial fraud be reduced by improving the corporate governance structure? This research article uses a case study to examine the real situation faced by a large company in China.

Although the number of listed companies and financings has increased significantly in China, IPO financial fraud is an increasingly serious problem. In recent years, the China Securities Regulatory Commission (CSRC) has issued 381 penalties, 48 of which relate to financial fraud in the GEM. The extent of financial fraud in the GEM indicates that the inadequate corporate governance system has had an adverse impact on firms’ performance and economic development. Public media have also reported a string of corporate governance scandals in the GEM, and there has been frequent criticism of its high proportion of state-owned shares and low transparency of governance. This reflects the seriousness of corporate governance issues and the need to solve these problems in order to avoid financial fraud.

Aim of this study

ABC Group was the first listed company in the GEM to be suspended as an administrative punishment, and it was also the first listed company in China’s securities market to be delisted as a result of fraudulent issuance. The case has attracted wide attention and discussion in relation to fraudulent issuance, illegal disclosure of information and, especially, poor corporate governance. The company’s illegal behavior has had an adverse influence on the market, has undermined the order of the domestic capital market, and has damaged the legitimate rights and interests of investors. Therefore, we examined ABC Group in this study to help analyze the financial fraud and make recommendations to improve the situations. The Chinese government can also use the recommendations in this study to regulate markets and govern enterprises to promote healthier economic development.

Contribution of this study

This study contributes to improving the corporate governance mechanism of listed companies and to reducing the risk of financial fraud in the IPO enterprises on the GEM board. It does not analyze the causes of financial fraud or how to identify and prevent it; instead, it analyzes financial fraud from the perspective of corporate governance. On the basis of the ABC group case, it discusses how to optimize corporate governance. Furthermore, by investigating defects in corporate governance, it provides a theoretical basis and research ideas for future governance of financial fraud and improvement of internal controls. By rectifying and improving defects in corporate governance, it is possible to optimize the allocation of market resources, improve investor confidence and standardize the securities market. In addition, rectification and reform of the corporate governance system can help to detect and prevent financial fraud in a timely way, while also improving the quality of the financial reports of listed companies.

Background and corporate governance of ABC group

Prior to 2016, the CSRC had only used public warnings and fines to punish listed companies. In 2016, however, faced with the extremely serious fraudulent issuance event of ABC group, the CSRC used the measure of forced delisting for the first time.

Founded in March 1993, ABC group has 560 employees, a registered capital of 70 million yuan, and assets worth nearly 200 million yuan. The company’s main business is the production of transformers and grid performance optimization equipment. It has many international suppliers and customers, including in India and Kazakhstan. The company mainly provides electrical equipment and solutions for the power grid system. The goal is to produce high-efficiency, low-energy, safe and environmentally friendly energy-saving substation equipment, reactive power compensation equipment and other emerging equipment. ABC Group’s main customers are highly cyclical industries closely related to the economic development situation. Therefore, cyclical fluctuations have a great impact on the company’s operating income. For example, from 2013 to 2015, the transformer industry was in a downturn, and the decrease in customer demand led to a decrease in ABC Group’s operating income.

LITERATURE REVIEW

Scholars from various countries have conducted research on the impact of corporate governance on financial fraud focusing on three main areas: board structure, ownership structure and incentive mechanisms.

Research on board structure: Independent directors

Kong et al. (2019) found that independent directors with local backgrounds significantly reduce the likelihood of a firm’s committing fraud. An empirical study by Beasley (1996) found that companies with financial fraud have a lower proportion of independent directors in their board structure than companies without fraud. This indicates that the proportion of independent directors on the board correlates negatively with the possibility of financial fraud. Forker (1992) also found that the establishment of independent directors can reduce the occurrence of corporate fraud. The larger the proportion of independent directors, the easier it is to supervise the enterprise and the lower the possibility of financial fraud. In a study on China, Li (2012) showed that independent directors have a significant influence on the quality of accounting information and can reduce financial fraud. The higher the proportion of independent directors, the lower the possibility of financial fraud and the higher the quality of accounting information.

Tian (2014) concluded that a listed company with a larger board of directors is more likely to have financial fraud. Huang (2015) also found that equity concentration is significantly positively correlated with the risk of material misstatement; that is, excessive equity concentration makes financial fraud more likely. Yuan et al. (2014) analyzed the influence of management incentives on calculated actual earnings management behaviors in the context of Chinese listed enterprises. Their results show that the proportions of managerial ownership and total compensation are significantly negatively correlated with real earnings management, and significantly positively correlated with accrued earnings management.

METHODOLOGY

This research adopts a case study approach to examine the real situation that happened in China. A case study approach can show the factual situations occurred in a fraudulent case .Taking ABC Group as an example, it uses financial ratio analysis to identify factors in and methods of the company’s financial fraud. Finally, solutions, measures and recommendations are proposed for listed companies to improve their corporate governance and avoid financial fraud.

RESULTS

Analytical model of corporate governance

The corporate governance analytical model is based on the seven essential functions of corporate governance which is used to analyze ABC Group. A well-balanced performance of these interrelated functions results in responsible corporate governance, reliable financial reports and credible audit services. The managerial function is assumed by management, the oversight function is delegated to the board of directors, the compliance function comprises a set of laws and regulations, the monitory function is performed by shareholders, the advisory function provides legal and financial advice, and the auditing function is exercised by auditors. This model is effective both for analyzing the internal and external aspects of corporate governance and for identifying defects in corporate governance.

Financial ratio analysis

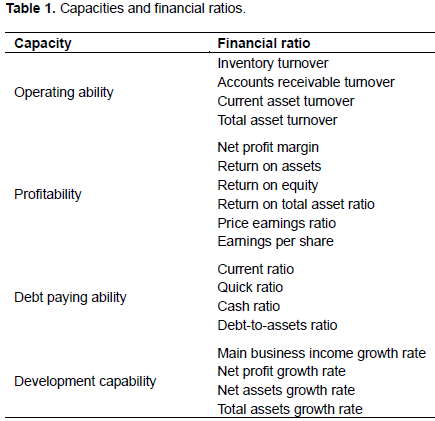

As Table 1 shows, this study collected and calculated several crucial financial ratios to measure four capacities of the company: operation capacities, profitability, debt paying ability and development capacity. Data were collected from the China Stock Market and Accounting Research database (CSMAR WIND). The data spanned the period from 2011 to the present, covering the three stages of pre-IPO, post-IPO and post-delisting to the present. Analysis of the financial data of ABC Group allows its financial problems to be identified accurately and effectively; this, in turn, enables analysis of how the financial fraud occurred.

Financial ratio analysis of ABC group

Companies use a variety of sophisticated methods to make financial data look convincing. However, no matter what steps are taken to conceal it, financial fraud will be reflected in the company’s financial data, as financial statements and changes in financial ratios will appear abnormal. This section analyzes ABC Group’s debt paying ability, operating ability, profitability and development capacity through financial indicators in order to identify signs of financial fraud and determine the nature of the company’s problems.

Debt paying ability

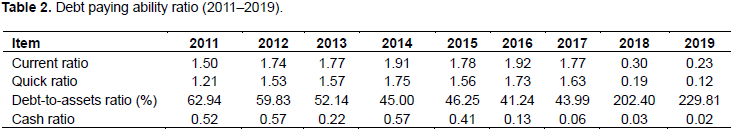

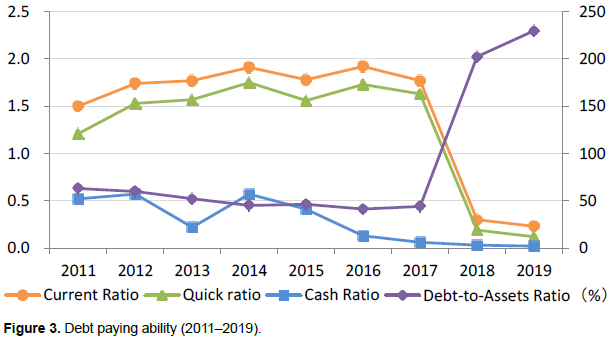

The main indicators in Table 2 for evaluating the debt paying ability of the enterprise are current ratio, quick ratio, debt- to-assets ratio and cash ratio.

Generally, the current ratio of an enterprise is greater than 2, and its quick ratio greater than 1. As a consequence, the short-term debt repayment ability of enterprises is better. As can be seen from Table 2, from 2011 to 2017 the average current ratio of ABC Group was approximately 1.75, and the average quick ratio was approximately 1.6. This indicates that the amount of current assets and liquid assets was much higher than the amount of current liabilities, and that short-term solvency was relatively good during this period. However, it is worth noting that although from 2011 to 2014 the current rate and quick ratio were on an upward trend, after 2015 they declined continuously, which raises doubts about the company’s financial status. If there is no major incident, there will be no sudden decrease or increase in the solvency of a company. However, in this case the current ratio and quick ratio declined sharply after 2018. The average current ratio was 0.26, and the average quick ratio was 0.15. Thus, the short-term solvency decreased significantly, indicating that the risk of short-term debt default was extremely high in these two years. The main reason is that ABC Group was exposed for fraudulent issuance and financial fraud, and the company entered the bankruptcy reorganization process in 2018. Income underwent great changes, and the amount of debt increased sharply in that year. Thus, there was a serious decline in short-term solvency.

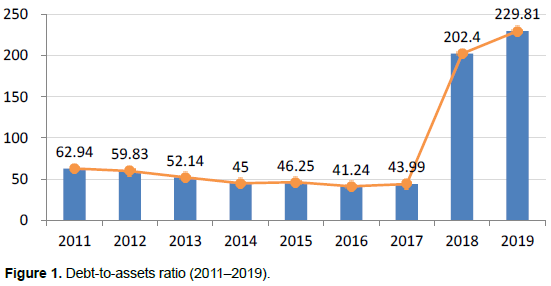

Debt-to-assets ratio

The debt-to-assets ratio of the enterprise from 2011 to 2017 was acceptable. The ratio declined gradually, and the company’s long-term solvency increased gradually. However, after the bankruptcy reorganization in 2018, the asset–liability ratio soared to 202.40% and the debt increased sharply. The undisclosed debts and contingent liabilities of previous years increased sharply, which made the debt repayment risk extremely high. From a long-term point of view, this greater debt-to-asset ratio indicated that the company’s debt burden would become heavier in future (Figure 1).

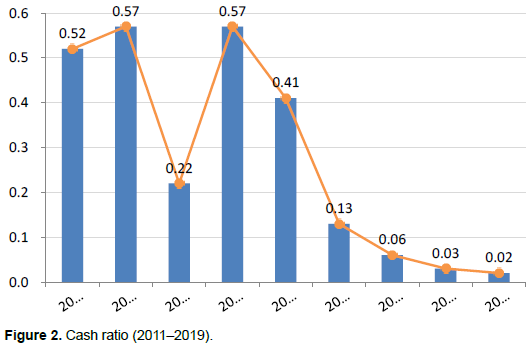

Cash ratio

The cash ratio of the company also declined year on year from 2011 to 2019, from 0.52 in 2011 to 0.02 in 2019, a reduction of more than 90%. Only 2% of the cash balance in 2019 could be used to repay short-term liabilities, and the risk of short-term debt was extremely high. Moreover, in 2013 the company’s cash ratio plummeted to 0.22. This sudden increase of debt repayment risk caused investors to question whether the management of ABC Group had committed any illegal behaviors in that year (Figure 2).

Comprehensive debt paying ability

Before 2017, the performance of ABC Group’s short-term debt repayment index was generally acceptable. However, the debt risk already existed during these years, even if it was not yet reflected in the enterprise’s financial data. For example, the trend of debt repayment indicators changed significantly around 2015, indicating the existence of relevant solvency risks, although the data indicators were still normal. After the initiation of bankruptcy proceedings in 2018, the previously accumulated debt was released all at once, the corporate solvency index declined sharply, and the debt risk increased significantly. Hence, the company’s debt paying ability did not provide grounds for optimism about the future (Figure 3).

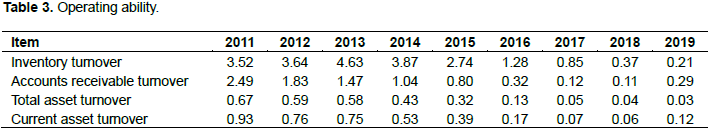

Operating ability

The main indicators in Table 3 are inventory turnover, accounts receivable turnover, total asset turnover and current asset turnover. The purpose is to evaluate the operating ability of enterprises.

The inventory turnover rate shows a gradual downward trend from 2011 to 2019, from 3.52 in 2011 to 0.21 in 2019, a decrease of approximately 94%. However, from 2011 to 2013, the company’s inventory turnover rate increased. The inventory turnover of this period was acceptable, which means the operating ability of the company was good. However, after the company went public in 2014, the ratio declined, indicating that the inventory backlog was increasingly serious after IPO. The inventory balance increased sharply, and the inventory turnover rate declined sharply. The decline in inventory turnover rate showed that ABC Group’s operating capacity was far from ideal. For example, the average inventory turnover in 2019 was 1,738 days, the turnover rate was very slow, and the capital cost occupied by inventory was very high.

The turnover of accounts receivable also declined gradually, from 2.49 in 2011 to 0.29 in 2019, a decrease of nearly 90%. The average turnover of accounts receivable in 2019 was 1,258 days, and the average recovery time for accounts receivable was more than 3 years. Recovery of accounts receivable is extremely difficult, and the rate of bad debts was extremely high.

Even by the time the company went public, the turnover time had increased nearly threefold through recycling the company’s large number of fictitious accounts receivable. It can be concluded from this that the turnover of enterprise assets was poor. In addition, although the operating income was increasing steadily, the inventory turnover rate was declining, which is obviously contradictory. Thus, there were issues with the enterprise’s financial statements and a serious problem with its operational capacity.

The total asset turnover rate showed a downward trend year on year from 2011 to 2019, from 0.67 in 2011 to 0.03 in 2019, a decrease of more than 95%. The total asset turnover rate in 2019 was only 0.03, and the turnover period was 12,166 days. This ratio indicates that the total assets generated almost no income. With the exposure of the company’s financial fraud in 2015, its total asset turnover rate plummeted, reflecting investors’ loss of confidence in the company. Current asset turnover showed a downward trend year on year, from 0.93 in 2011 to 0.12 in 2019, a decrease of nearly 90%. The average turnover period for current assets in 2019 was 2,958 days, with a turnover period of more than 8 years. As with the change in total asset turnover, the current asset ratio dropped sharply after 2015, reflecting the existence of problems in the company’s operational capabilities and generating doubt about the authenticity of its previous liquid asset turnover rate.

In conclusion, from 2011 to 2019 the operating indicators of ABC group declined sharply. Analysis of various indicators clarifies concerns about the company’s overall operating capabilities. Poor operating ability led to an extremely long turnover period, and the operating efficiency of assets was extremely low. Moreover, signs of corporate financial fraud were evident from the trend of the data. After the corporation was exposed for fraudulent issuance, its financial data indicators fell sharply.

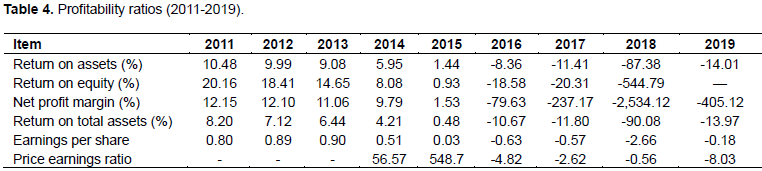

Profitability

The main indicators in Table 4 for evaluating the profitability of enterprises are return on assets, return on equity, net profit margin, return on total assets, earnings per share and price earnings ratios.

The rates of return on assets and return on equity declined year by year from 2011 to 2019. However, before the revelation of financial fraud in 2015, the company’s indicators were good. In 2011, in particular, the rate of return on equity was 20.16%, meaning that for each yuan invested by shareholders the company generated 0.20 yuan of income for them, which indicates relatively good profitability. However, the rate was negative for the four years from 2016. Going public exposed ABC Group’s real profitability, showing that its business activities had not brought positive benefits to the enterprise. In particular, in 2018, because of the bankruptcy and reorganization, assets were sold on a large scale to repay debts. At that point, the return on assets and return on equity fell to -87.38% and -544.79%, respectively, indicating that there was basically no profitability in the enterprise’s production.

The rate of net profit margin and the rate of return on total assets showed the same trend as the rate of return on assets and return on equity, which were also negative from 2016. These findings reflect ABC group’s real poor profitability, as enterprises cannot effectively use assets to generate benefits. According to the financial data for 2018, the return on equity was -544.79%, the net profit margin was -2,534.12%, and the return on total assets was -90.08%, all of which were the lowest over the ten years. The bankruptcy and reorganization of the company resulted in asset impairment losses of 117 million yuan and non-operating expenses of 272 million yuan in that year. Thus, the profitability of the company declined substantially.

ABC Group’s earnings per share decreased gradually from 2011 to 2019, from 0.80 yuan per share in 2011 to -0.18 yuan per share in 2019, falling as low as -2.66 yuan per share in 2018. As the corporate financial fraud surfaced, corporate valuations fell sharply, with the price earnings ratio falling from 56.57 in 2014 to -8.03 in 2019. Financial fraud was discovered in the enterprise in 2015, and the performance of various profit indicators of before 2015 was fair. As shown, the earnings per share of the enterprise were 0.80 yuan, and the profit performance was good. However, the indicators of the enterprise began to decline sharply as the preliminary signs of corporate fraud emerged.

In conclusion, most of ABC group’s financial indicators, reflect its year-on-year decline in profitability. Analysis of the changes in the different indicators shows that the major profitability indicators, such as net profit margin, all experienced a significant decline after 2014, the year when the company joined the GEM. Since then, its profitability index decreased significantly every year. It can also be seen that after the company achieved its listing, its true financial data gradually emerged and the real profitability of the business was also gradually revealed. The profit indicators declined sharply after the company entered the bankruptcy reorganization process in 2018, and all indicators were subsequently at their lowest for nearly a decade. Moreover, as ABC Group’s tax incentives had always accounted for a large proportion of its net profits, the profitability of the company was even worse after these were deducted.

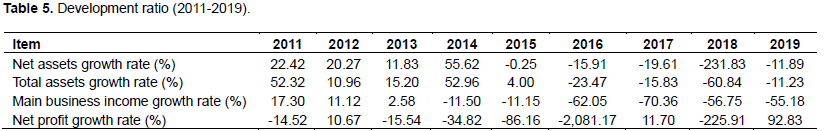

Development capability

Growth ability refers to the company's future development trend and development speed. The purpose is to explain the long-term development capability of the enterprise and the future production and operation strength of the enterprise. The main indicators for evaluating the growth ability of enterprises are main business income growth rate, net profit growth rate, net assets growth rate and total assets growth rate (Table 5).

The net asset growth rate of ABC Group also showed a gradual downward trend from 2011 to 2019, from 22.42% in 2011 to -11.89% in 2019, decreasing by as much as 231.83% in 2018 compared with the same period of the previous year. The growth rate of net assets declined gradually from positive to negative after 2015. Since then, the rate declined year on year, and the scale of net assets shrank gradually. This shows that the business scale of the company was reduced, thereby decreasing the profitability prospects for future development. The company is no longer good at using idle funds and cannot create profit through management and operation. The growth rate of total assets also showed a gradual downward trend, from 52.32% in 2011 to -11.23% in 2019. Total assets increased in 2015 but shrank thereafter. This confirms that the total assets and net assets of ABC GROUP had not increased but were in fact reduced by the ongoing sale of assets in bankruptcy to pay off debts from the financial fraud.

Nature of the problems at ABC group

Intentional reduction of accounts receivable

Through analysis of the financial data, we have determined that ABC Group was not in a good operating condition before it went public. The overstock of inventory had led to a substantial risk of bad debts. In order to improve its business conditions, the enterprise used credit sales to expand its sales on a large scale, thereby generating a large number of accounts receivable. Normally, a decline in customer quality would have led to a decline in the rate of receivables recovery, but before the company went public, that rate had been rising. The recovery speed of accounts receivable not only determines the strength of an enterprise’s operating capacity but is also one of the conditions of its IPO listing. Moreover, the deliberate reduction of accounts receivable led to undercounting and inadequate provision for bad debts, falsely inflating the company’s profits. Therefore, the recovery of fictitious accounts receivable was one of the main fraudulent mechanisms that ABC Group used to go public.

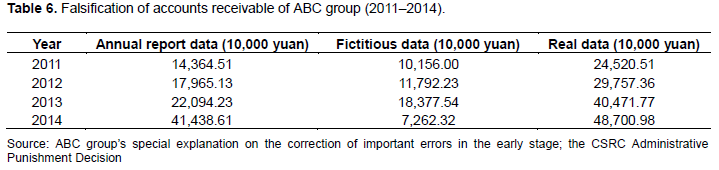

As Table 6 shows, ABC Group began to forge accounts receivable before it went public in 2011, and such fraud still existed in its financial statements after the listing. Its main fraudulent methods were false borrowing, internal circulation of funds and forging bank receipts and invoices.

In the first method, false borrowing, chairman borrowed money, and when making cash payment, he filled in the name of the customer company as the payer, which was regarded as payment collected from the customer company. Although this method does not cause abnormalities in the financial statements at the end of the period, the company needs to pay interest expenses on borrowing, which can easily generate financial pressure for enterprises with weak profitability and tight capital flow. In the second method, the internal circulation of funds, ABC group transferred its own funds to customers in the form of payment for goods to suppliers, and customers transferred the funds back in the name of payment for product purchase, so as to realize the circulation mode of ABC Group. In both cases, accounts receivable were reduced during the reporting period and given back at the beginning of the next accounting period. In the third method, forging bank bills, the amount of accounts receivable was reduced by direct falsification of bank receipts and invoices. Direct forging of bank documents avoids having to pay interest on the loan and does not generate financial pressure, but it is usually easy for auditors to find. However, the external auditors of ABC Group failed to identify the material misstatement risk, which led to doubts concerning the objectivity and independence of the auditors, and even suspicions of collusion between the external auditors and the management of the enterprise.

Intentional reduction of costs

To achieve its goal of going public, ABC Group glossed over profit targets in its financial statements. In addition to the method, discussed above, of intentionally reducing receivables to increase the company’s profits, ABC Group understated material costs to increase profits, thereby misleading investors by fabricating a trend of stable and rising profitability. As ABC Group is an electric production enterprise, raw materials account for more than 92% of its production costs. Hence, fluctuations in raw material prices are the main reason for fluctuations in the main business cost. For example, in 2011 the purchase price of silicon steel sheeting was 14,906 yuan per ton, the quantity purchased was 6,310 tons, and the total cost was 94.05 million yuan. However, consultation of the industry data for the steel market shows that the average price of silicon wafers in the market in that year was 19,500 yuan per ton, and the lowest price was 17,000 yuan/ton; thus, the price was never as low as the purchase price reported by ABC Group. The price of the silicon steel sheeting purchased by ABC Group was 12% lower than the lowest price in the market and 22% lower than the average price in the market, making the purchase price in the prospectus 25.83 million yuan lower than the actual purchase price. In 2011, the disclosed annual net profit was 59.03 million yuan. However, after deducting the falsely reduced material cost of 25.83 million yuan, the true net profit for that year was 33.2 million yuan. Thus, the company inflated its net profit by 44%.

Failure to disclose in a timely manner the use of funds by affiliated parties

From the CSRC’s punishment report, we find that ABC group had a large number of undisclosed transactions with affiliated parties. First, the chairman and actual controller borrowed more than 60 million yuan from the company over a few years. However, this transaction was not publicly disclosed in the 2014 financial statements. The chairman also tried to hide the fact that he was working for private interests on the grounds of non-operational occupation. In the second half of 2015, he sold property rights in the company’s name to his family, a transaction that was neither approved by the board of directors and the board of supervisors nor disclosed in the current financial statements in a timely manner. A number of other transactions with affiliated parties were not effectively monitored by corporate governance or truthfully disclosed by the company’s financial personnel. The supervision defects of corporate governance and the dereliction of duty of senior management abetted the manipulation of profits by the management, which led to the occurrence of financial fraud.

Penalties and outcomes

In 2015, the CSRC and the relevant regulatory authorities found that ABC group had committed financial fraud, and the company was forced to undergo the delisting procedure starting on July 8, 2016. In August of the same year, trading in ABC Group’s shares was suspended. In June 2017, the Shenzhen Stock Exchange decided to terminate the listing of ABC group, which subsequently entered the delisting period. At the same time, various penalties and fines were imposed on the relevant responsible persons of ABC Group, along with the legal responsibility to pay for the fraud. The company’s sponsor, XX Securities, was given a warning by the CSRC in relation to the case. The confiscated illegal gains and fines amounted to 12 million yuan and 24 million yuan, respectively. Employees of XX Securities involved in the financial fraud case have been punished to varying degrees with warnings, confiscation of illegal earnings, fines, and cancelation of employment licenses. The auditors of ABC Group were ordered to correct its illegal behavior. The illegal income in relation to this case was confiscated, and the firm was fined, in the amounts of 3,224,400 yuan and 9,673,200 yuan, respectively. The accounting firms and related parties involved were warned, fined or banned from the market, leaving a stain on their careers and affecting their credibility and business development in the industry.

Why did corporate governance fail to monitor the problems?

Sound corporate governance should satisfy the seven functions of the corporate governance model simultaneously. They are the oversight function, board of management function, managerial function, regulatory function, external auditor function, internal auditor function and compliance function. Failure to perform any of these functions effectively will result in the failure of corporate governance and increase the risk of financial fraud. Drawing on the corporate governance model, the model shows that all the seven functions failed to monitor effectively ABC Group’s financial fraud.

DISCUSSION

As shown in the ratio analysis above, all financial ratios of ABC Group were not in satisfactory conditions from 2011 to 2019. For example, profitability ratios decreased from 12.15% in 2011 to -405.12% in 2019 whereas return on assets ratios decreased from 10.48 to -14.01% in 2019. In recent years, fraud has occurred frequently in China, and its impact on the country’s securities market has been severe. The strict penalties imposed by the CSRC on ABC Group have also sounded the alarm for other companies that intend to go public. Drawing on the financial fraud case of ABC group from the perspective of corporate governance, this study puts forward recommendations for listed companies with similar problems and for the relevant industry regulatory authorities, so as to strengthen the corporate governance of listed companies and improve the quality of information in their corporate financial reports.

Optimizing the shareholding structure and system

Over-concentration of shareholding structure is not conducive to the development of enterprises. In the case of ABC Group, over-concentration of equity and over-dispersion of the remaining equity gave complete control of the company to one individual, which paved the way to financial fraud.

Developing more institutional investors

A first response to this issue would be to introduce multiple institutional investors, such as securities, trusts, insurance companies and banks, to avoid excessive concentration of equity. The professionalism of such organizations gives them a unique advantage in the field of information collection and processing, which would further encourage enterprises to disclose accounting information more accurately and transparently.

Improving the shareholder voting system

A second response would be to improve the voting system to ensure that non-controlling shareholders can participate meaningfully in corporate decision-making. For example, in terms of voting for major decisions concerning the company’s future operations, a one-person-one-vote system for the top ten shareholders could be adopted instead of voting in accordance with the proportion of shares they hold. At the same time, opportunities for minority shareholders to participate in corporate decision-making should be actively increased. Small and medium shareholders should be allowed to participate in shareholder meetings and voting online, so that the voting results of the shareholders’ meetings will better reflect the interests of all the shareholders.

Improving the board of directors system

This analysis of the corporate governance structure of Xintai Electric has shown that China’s listed companies have a serious problem with senior executives serving concurrently on the board of directors and thus failing to be independent.

Optimizing the structure of the board of directors

A first way to address this issue would be to optimize the structure of the board of directors to avoid directors serving concurrently as management. Listed companies can modify corporate rules and regulations to allow employee representatives and minority shareholders to become directors and to participate in decision-making, thereby reducing the control of the internal board of directors and increasing the supervision effect.

Enhancing the independent directors system

Another solution involves improving the system of independent directors by changing their recruitment. Candidates for the role of independent director should be able to present themselves only after their résumés and academic records have been fully verified and made public by the enterprise. In addition, during the recruitment period, public investors should have the right to review, supervise and report on the unqualified independent director candidates, ensuring that the people selected have the relevant competence and qualifications. The voting procedure for independent directors should also be changed to a one-person-one-vote system so that all shareholders have a real and fair right to choose. Only independent directors selected in this way can be considered as representative of the interests of all shareholders.

Improving the supervisory board mechanism

The board of supervisors of ABC Group failed to fulfill its oversight function, which meant that financial fraud was not detected or stopped for four consecutive years. Therefore, it is necessary to improve the mechanism of the board of supervisors in order to ensure better corporate governance.

Developing a minority shareholders representative supervisor

The composition of the board of supervisors should be diversified. In addition to supervisors who represent employees and major shareholders, supervisors who represent small and medium-sized shareholders should be included so that the interests of all parties can be checked and balanced effectively. Moreover, an independent supervisory system should be introduced to ensure that independent supervisor roles are held only by highly professional personnel, and the nomination process should be open and transparent. With such diversification of the board of supervisors, their decision-making can achieve and maintain independence, impartiality and objectivity.

Enhancing the competence of supervisors

The importance of examining the qualifications and professional skills of supervisors is clear. Whether they represent employees, major shareholders or small and medium-sized shareholders, they should be assessed for professional quality and required to have a full understanding of the company’s operational decision-making and strategic planning. They should also be required to have professional knowledge of accounting, management and law, and to demonstrate a strongly professional approach to the role.

Optimizing the management mechanism

From ABC Group’s failure in corporate governance, we can see a close connection between the moral integrity of managers and a company’s risk of fraud. The assessment mechanism for management suffers from major flaws. Therefore, it is necessary for management to improve its moral and legal awareness, and for the company to optimize its mechanism for evaluating its management.

Enhancing management’s moral and legal awareness

When the management has good moral integrity and sound legal awareness, the overall culture of the company will be one of compliance and respect for the law. To improve the moral and legal awareness of the management, we should first strengthen their moral education to include regular training, timely assessment, and promotion of ethical rules and behavioral norms. Second, to establish a positive corporate management atmosphere, penalties for illegal business activities should be increased, and good ethical and legal behaviors are promoted. Third, a pre-job assessment system should be implemented, requiring the management of listed companies to pass a basic test of professional ethics and legal awareness. Finally, professionals with legal knowledge should be hired as internal legal counsel to enhance the enterprise’s internal legal awareness.

Optimizing the management evaluation and incentive mechanism

Many companies take profit as the evaluation index for executives. Therefore, when the management cannot meet their own performance targets by normal means, they will be tempted to use financial fraud to whitewash the company’s statements. Changing the evaluation system for executives could effectively reduce this phenomenon; for example, more rounded performance appraisal tools, such as the so-called balanced scorecard, could be introduced, and a more diverse range of indicators (including economic added value, market added value and residual income) could be taken into account. There is also scope to improve hiring standards, compensation mechanisms and incentive mechanisms for management. For instance, combining short-term incentives with longer-term incentives and introducing non-financial indicators would help to ensure the fairness and effectiveness of the system.

Changing the IPO legal system

At present, the stock issuance system in China adopts an approval process in which the regulatory authorities examine the compliance conditions of the listing of enterprises, and IPO enterprises in China’s GEM must meet certain conditions in terms of profitability and growth.

However, many enterprises cannot meet these rigid requirements and are tempted to commit financial fraud as a result. In contrast, many other countries use a registration system according to which the regulatory authorities conduct a formal review of the filing. In the review, enterprise assets, profit situation and other indexes are not regarded as rigid requirements; the question of whether the issuing company’s stock is good and whether it is worth investing in is decided by the market. Under that system, all companies have the opportunity to go public, listing is no longer a scarce good, and there is less incentive to resort to fraud. Demands on investors and regulators are greater; for example, investors need to have superior investment knowledge, and regulators need to be more closely involved in market supervision. Thus, a registration system is an effective means to improve the listing mechanism of enterprises and to enhance the construction of the capital market while making fraudulent activity less attractive. It is therefore recommended that ChiNext should adopt a registration system for stock issuance.

Enhancing the role of regulatory institutions

Compared with many other countries, punishments given to listed companies for financial fraud in China are relatively light. In the case of ABC group, the fine was 8.32 million yuan, less than 5% of the capital raised by the enterprise in the capital market even after the financial fraud was identified. Most punishment of financial fraud cases in China is still at the administrative level, and there is no substantial deterrent. In foreign countries, however, the system clearly states that enterprises that violate the information disclosure system will not only be subject to administrative punishment but will also be investigated for administrative and criminal responsibility. In China, the definition of this aspect remains vague, and the relevant punishment measures need to be improved. Thus, it is vital for the government and the relevant regulatory departments to increase the cost of illegal activities and gradually improve the accountability mechanism so that the law can effectively prevent offenders from committing further fraud.

Improving the regulatory functions of intermediaries

Implementing rotation of accounting firms in IPO audit

Auditors lacked independence and repeatedly issued unqualified opinions on fraudulent financial statements. As a result, investors suffered significant losses. If a change of audit firm were mandatory after the listing of a company, accounting firms that assisted in an IPO would not be affected by the continuation of the subsequent business and would thus have greater independence. Requiring certified public accountants to check the audit opinions of previous accounting firms would also increase the capacity to detect and prevent fraud.

Implementing a mutual check mechanism for financial sponsor institutions

The lack of independence of intermediaries is one of the significant factors affecting financial fraud. In the case of ABC Group, XX Securities lost its basic professionalism and turned a blind eye to the falsity of the listing materials, which laid the groundwork for financial fraud. If the XX Securities had joined a peer inquiry link as part of the sponsorship process, these problems might have been identified in time.

Similarly, when the company manipulated the data in relation to receivables and payables by fabricating bank statements, bank staff not only failed to find and stop this activity in time but facilitated it. This strongly suggests that the bankers in this case also lacked independence. To prevent the recurrence of such problems, the frequency of mutual inspection between banks should be increased and the scrutiny of business authorities should be strengthened.

LIMITATIONS

Many aspects of this research area remain to be covered in greater detail. For example, the level of the research problem and the perspective on the research problem are limited. The occurrence of financial fraud is jointly determined by many factors, far more than the single reason of corporate governance can be explained. The overall economic environment, corporate culture, personal behavior and so on will provide a push to the generation of financial fraud. Future research needs to study the causes of IPO financial fraud and its linear relationship in multi-faceted and multivariable areas. It is to be hoped that the work done here will be supplemented and improved in subsequent study and research.

CONCLUSIONS

Drawing on the conclusions of previous studies and the corporate governance model, the case of ABC Group has been analyzed from the perspective of corporate governance and financial statement analysis, confirming that financial fraud is closely related to defects in corporate governance. Through analysis of the governance structure and the methods of financial fraud used, the following conclusions are reached. Defects in corporate governance structure are the institutional reason for financial fraud. This study of the corporate governance defects at ABC Group suggests that many enterprises with poor corporate governance face issues with excessive concentration of equity, and with the lack of independence, professional ethics and professional competence of independent directors. As a result, corporate governance fails in its monitoring, oversight and management functions, thereby increasing the risk of financial fraud. In terms of external factors, problems are posed by the imperfect listing and delisting systems of China’s GEM, a lack of independence of intermediary agencies, and ineffective government supervision. Under such circumstances, the audit, advisory and compliance functions of corporate governance cannot be implemented in a timely manner, and this makes corporate governance scandals more likely.

In order to achieve listing, ABC Group committed financial fraud including fictitious accounts receivable, fictitious cost reduction and undisclosed related party transactions. However, these measures were possible largely because of defects in corporate governance. Therefore, the key to reducing the occurrence of financial fraud is to strengthen corporate governance. First, companies should optimize their ownership structure and develop institutional investors to improve the voting system, asking non-controlling shareholders to participate in the management of the company and thus enhancing the monitoring function of corporate governance. Second, the board system should be improved and its oversight functions enhanced by increasing the independence of the board members and improving the operating mechanism of the board of supervisors. Finally, the management should improve their professional ethics and professional ability so that they can better perform their corporate governance functions. In terms of external factors, the capital market should improve the relevant systems, and intermediary organizations should accord more weight to their obligations of professionalism and independence. Promotion of the corporate governance of enterprises will enable them to fulfill their advisory, compliance and audit functions more effectively.

With the late development of the capital market in China, the defects in the internal and external governance structure of listed companies are more serious, providing many opportunities and loopholes for financial fraud. Based on analysis of the IPO financial fraud of ABC Group, this study identifies ways to optimize the corporate governance structure and provides suggestions for the prevention of financial fraud from the perspective of corporate governance. If the corporate governance system is improved, financial fraud can be detected and prevented in time, the quality of financial reporting of listed companies can be improved, the system of the capital market can be standardized, and investor confidence in the capital market can be restored.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interests.

REFERENCES

|

Beasley MS (1996). An empirical analysis of the relation between the board of director composition and financial statement fraud. Accounting Review 71(4):443-465. |

|

|

Forker J (1992). Corporate governance and disclosure quality. Accounting and Business Research 22(86):111-124. |

|

|

Huang W (2015). Research on the Correlation between Corporate Governance Characteristics and Material Misstatement Risks. Shandong University. |

|

|

Kong D, Xiang J, Zhang Y (2019). Politically connected independent directors and corporate fraud in China. Accounting and Finance 58(5):1347-1383. |

|

|

Li D (2012). Correlation Analysis between characteristics of board of Directors and authenticity of Accounting Information--Empirical data from Listed Companies in China. Finance and Accounting Newsletter. |

|

|

Tian JJ (2014). Board monitoring and endogenous information asymmetry. Contemporary Accounting Research 31(1):136-151. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0