Previous studies indicated that most organizations do not invest in AIS because they do not know the importance of AIS to their organizational growth, while some that invested do not know it impacts on their organizational growth. This study examined investment in accounting information system and its effect on sales growth of Nigeria Small and Medium Enterprises (SMEs). The specific objectives of the study are to; identify the factors that influence sales growth, and examine the relationship between investment in Accounting Information System (AIS) and sale growth. A total of 120 questionnaires were administered to management staff of each selected Small and Medium Enterprise (SME) in Lagos State, Nigeria. Both descriptive and inferential statistics were employed for the study. The descriptive statistics employed include percentage frequency and charts to achieve the study objectives. The inferential statistics employed is multiple regression analysis while ANOVA was used to examine the relationship between investment in accounting information system and sales growth. Findings revealed that AIS investment, non AIS labor and AIS labor accounted for 82% of the variation in sale growth in the study area and that there is a relationship between investment in accounting information system and sale growth. Furthermore, it was revealed that AIS investment have the highest impact on sales growth (beta value = 0.944) followed by AIS labor (beta value = -0.018) while the variables that had the least impact on sales growth was Non AIS labor (beta value = -0.052). Conclusively, it was affirmed that a relationship existed between investment in AIS and sales growth. Consequently, government should implement a policy that will stimulate the investment in AIS by SME in order to improve their sales and in return have positive impact on economy development of the nation.

Small and Medium Enterprises (SME) are an important vehicle that address the challenges of job creation, sustainable economic growth, equitable distribution of income and the overall stimulation of economic

development in developing nations. The main objective of any business set-up; be it small, medium or large is to maximize profit either in terms of improving performance and increases in business productivity and sales or by achieving rapid expansion in market shares domination (Harash et al., 2014). In order to achieve this main objective, SMEs need to be responsive to the changes in the environments as well as technology, in particular to the use of Accounting Information System (AIS). Today, using AIS in business is a must for it is difficult to gain competitive advantage and survive without some adoption or implementation of this advancement in technological products. Thus, AIS is most widely used in businesses, specifically in financial reporting aspects (Harash et al., 2014). AIS is defined by Saira et al. (2010) as a system that processes data and transactions to provide users with information. Business needs to be planned and controlled before operation is carried out. Lallo and Selamat (2014) said it is the system that processes data and transactions to provide users with information. In this case, AIS is seen as a happening process that helps management in planning and controlling processes by providing relevant and reliable information for decision making.

The needs for decision making cut across all the department of any organization, with sale department inclusive. The sale department needs strategic approach to operationalize sale. Sale is the act of selling something; the exchange of goods, services, or property for money. Furthermore, it is the total amount of money that a business received from selling goods or services. In similar manner, sale is any activity related to selling or the amount of goods or service sold at a given time or period, the seller and the buyer complete a sale in response to acquisition, appropriation and requisition or a direct interaction with the buyer at the point of sale. One would not be mincing words to say that sale is the act of transferring the ownership of goods or delivering service to customer or consumer, for the fact that this is a way of exchange for mutual benefit to both the seller and the buyer. This sale relies on proper accounting information system.

According to Hadi (2014), the use of accounting information system should include planning and managing business activities. They further said accounting information system could be used as a mechanism for controlling financial and non-financial operation such as budgeting planning. Thus, it is salient to look into the import of investment in accounting information system and its effect on sale growth.

Modern literature shows that AIS characteristics such as: reliability, relevance, and timeliness have significant effects on the use of AIS and SMEs' performance (Harash, 2014). Furthermore, prior researches have shown that it is crucial for SMEs to use AIS to ensure business continuity and survival in the increasingly competitive environment and to enhance their business operations capability and efficiency. In other words, since sale is the major source of revenue, for organization to continue to exist, AIS is germane to organization survival. The work of Grande et al. (2011) show that large companies were more likely to use AIS than SMEs, although the work was not being centered on sale growth. Large companies are more likely to perform well and are more likely to use accounting information system than SMEs because companies with greater sales and higher revenue from using AIS are better able to cover the costs.

Taiwo (2016) said ICT has been a major factor of efficient accounting system and great organizational performance recently, and that it has been used to augment the reliability of accounting information and organizational performance. They opined that organizational performance was related to ability to meet set goals and actions. The study further put it forward that, to maximize the benefits of information technology systems, the appropriate implementation and adoption procedures have to be used, or else, there will be little or no impact of these technologies on the earlier mentioned variables. Again, the research work of Taiwo (2016) reported that there is a significant positive relationship between ICT system and accounting system with a significant positive relationship between ICT and organizational performance.

The present study is that it focused on one of the major indicators of performance measures, which is sales growth and how AIS investment could be used to improve this performance indicator. Researchers are yet to exploit this problem, thus, this research will bridge the gap in the literature. Also, apart from financial and non-financial performance indicators like: profitability, quality of service and productivity that researchers like Ajanthan et al. (2013), Korir and Imbaya (2013), Uadiale and Fagbemi (2012), Özer (2012), Sacristán-Navarro et al. (2011), and Thrikawala (2011) have worked on, sales is also important because without sales there is no profit. Moreover, most organizations have invested in AIS without knowing whether it has really contributed to their sales growth or not. Thus, that is why it is Germane to research into this research topic.

Most organizations do not invest in AIS because they do not know the importance of AIS to their organizational growth and some invested in AIS but do not know it effect on their organizational growth. However, according to Harash (2014), the use of AIS has certainly played an important role that contributes to company’s value added by providing internally generated input, that is, financial statements, such information should help the company make better strategic plan. Therefore, investment in AIS must be strategically aligned with organization policy in order to have a positive effect on the organizational sales. Thus, it is pertinent to research into this topic, to inform those companies that have not invested in AIS of the need to know the effect and value of it on their sales growth in other to statistically align investment in AIS to their company policy.

Sales concept

This is a concept or an idea that emphasized sale of goods and services and not underlying need or want of customers. It does not really consider whether the products are actually needed by the customer or not. The focus is on sales (profit) first and then on marketing. Another term for sales concept is selling concept where the sole aim is sales, and not whether the product is actually required. It is one of the parts of the marketing concept. Profitability is achieved through sales volume but it is not favorable in a competitive environment. Here, the buyer beware concept is followed where buyer should be vigilant because making sales becomes the primary concern of companies and customer satisfaction is secondary. Operating under the sales concept, a business would produce goods that it anticipated a profitable return from and then attempt to persuade consumers to purchase them by using advertising and other sales techniques.

Sales growth model

Liu (2009), in his work said, the establishment of sales growth model based on the theory of marketing force firstly, introduced a physical model as a body M moves following the path L. He said, if the quantity is not taken into consideration, there are only two main factors determining the body’s speed. The first is the ΣF and the second is the length of L (assuming it is S). Suppose the circular frequency is Q. Then,

Q=ΣF/S (1)

He further introduced another model into the marketing static circular system. In the marketing static circular system, the product’s circular speed determines the growth of sales. Q stands for the sales growth, which is related with the forces and the perimeter S. He then said the relationship is similar to the physical model namely:

Q=ΣF/S (2)

Forces exert different effects in different enterprises, for different products, at different time, and under different market conditions. Therefore, suppose the weight of each force is Kn, then:

ΣF=k0f0+k1f1+k2f2+k3f3 (3)

S stands for the path of the circular system. It represents the middlemen between products and demands. It is the distance for starting a new cycle by the repetitive force of quality and service.

S = S0+S1 (4)

Where,

S0 - psychological distance,

S1 - spatial distance and time distance.

Liu (2009) sums up to conclude that:

Q= K× ε ×[ΣF1/S1+ΣF2/S2+……+ΣFn/Sn] (5)

Here, k is the resource coefficient; ε is the channel barrio coefficient which reflects the impact of channel conflicts on sales growth.

Subjected to 0<ε≤1.

As no channel conflicts, ε=1;

As channel conflicts exist, 0≤ε<1.

Liu (2009) also quantitatively analyzed marketing force and sales growth by taking two products, A and B, in one brand in an enterprise. Before listing in market, analyze their sales growth trend and compare the possibility of their successes. Make quantitative analysis of elements in marketing static circular system. He discovered that future sales growth of product static pulling force is bigger than that of product without static pulling force, in which investment in accounting information system is paramount.

Small and Medium Enterprises (SME)

SMEs have various definitions which vary from country to country, and organization to organization. Thus, there is no universally accepted definition of SMEs because it is impossible to capture all the characteristics of SMEs or to highlight the differences between firms in different industrial sectors or countries. Most definitions of SMEs are based on the number of employees, capital base of the firm, market share, sales turnover and the infrastructure of the firm (Nyoni, 2018).

The European Commission (2016) defines SMEs as firms which hire fewer than 250 employees and has sales turnover of not more than EUR 50 million, and annual financial position (balance sheet) total not more than EUR 43 million.

According to Nyoni (2018), in Japan an SME is defined using three criteria which are type of industry, number of paid employees and paid up capital. In manufacturing, in order for a firm to be defined as small it must have paid up capital of 100 million yen and 300 employees; in the wholesale industry, a company is regarded as small or medium enterprise if it has 30 million capital and it hires 100 employees; in the service and retail industry, a company is regarded as small if it employs 50 employees and the paid up capital is 10 million yen. In USA, for a firm to qualify as a small firm, it must have fewer than 500 employees. In Canada, a small firm is defined as one with 100 and less employees.

In Jordan, SMEs are defined using one criterion which is number of employees, and further distinguishes between small and medium enterprise. The Ministry of Planning and International Cooperation (2014) in Jordan, define small enterprises as those with less than 20 employees, and medium enterprises as those with between 20 to 99 employees.

In developing countries, like Nigeria, SMEs is defined as an organisation that hires not more than 50 employees while a medium enterprise is one hiring 75 to 100 employees. Small Enterprise Development Corporation (SEDCO) (2010) does not highlight any differences between small and medium entities. It defined Small and Medium Enterprise as an entity that has less than 100 personnel with maximum annual sales revenue of US$830 000.

Importance of Accounting Information System (AIS)

Harsh (2014) postulated a definition for AIS, as ‘a system that processes data and transactions to provide users with information needed to plan, control and operate their businessesʼ. Here, AIS is viewed as a system that helps management in planning and controlling processes by providing relevant and reliable information for decision making. It suggests that AISʼs functions are not solely for the purpose of producing financial reports. Its role goes beyond this traditional perspective. AIS should be utilized to include planning and managing business activities. It could also be used as a controlling mechanism such as budgeting. Therefore, full adoption of the system is essential to fully attain the system’s benefits. AIS usage has certainly played an important role that contributes to company’s value added by providing internally generated input, that is, financial statements, such information should help the company make better strategic plan (Harash, 2014). Developments in the areas of accounting and information system (IS) over the last decades of twentieth century have widened the range and roles of AIS (Abdallah, 2014; Emeka-Nwokeji, 2012). Amidu et al. (2011, and Grande et al. (2011) found out that SMEs used AIS for the preparation of management accounting information, but usually not to their full potential.

The data generated from the respondents and the extraction made from the record was the base for analysis in this work. The variables (AIS investment, non AIS labor, AIS labor and sales) in monetary term were extracted from the record while the respondents’ opinion was collected alongside. The opinion was based on yearly view of the respondent on what transpired within each year understudy.

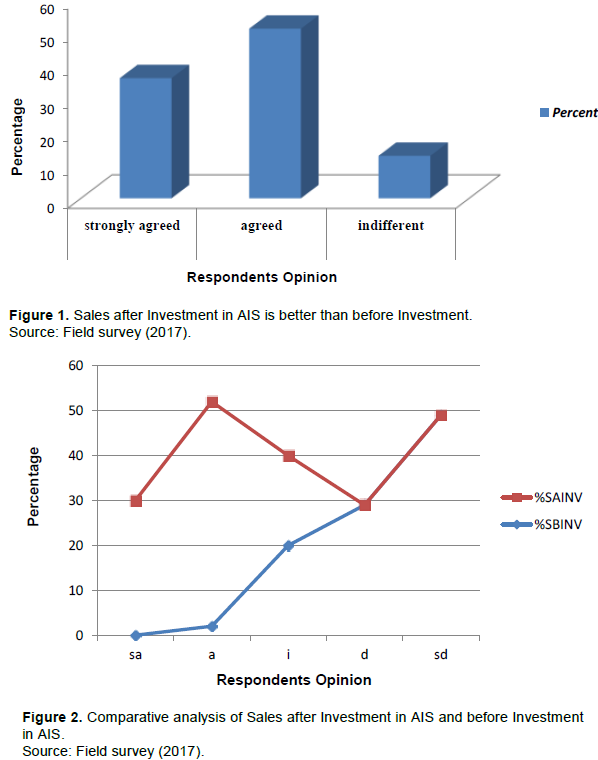

Figure 1 presented the respondents view on sale after investment in AIS is better than before investment in AIS. 20 percent accounted for indifferent, 50 percent accounted for agreed while 30 percent accounted for strongly agreed. It was observed from Figure 1 that the respondents were of the opinion that investment in AIS influence growth in sale in the organization. This was in line with the finding of Saeidi (2014).

Figure 2 revealed that the comparative analysis of the respondents’ views showed that sale before investment is better than after investment. It was observed that 30% of the sampled respondents strongly agreed, 50% agreed and 20% were indifferent to sale after investment is better than sale before investment. On the other hand, 2, 20, 29 and 49% agreed, indifferent, disagreed and strongly disagreed respectively to the question on sale before investment is better than sales after investment. Since the trend for sale after has higher positive response value, while sales before investment in AIS has higher negative response value, it was adduced that, the opinion of the respondent was that sale after investment in AIS was better that sale before investment in AIS.

Table 1 presented the view of the respondents on factors that influence sale growth. It was interesting to know that the entire respondents concurred to the fact that company policy influence sale growth. This is obvious as 8.3% accounted for strongly agreed and 91.6% of the sampled population accounted for agreed. It was deduced that company policy influenced growth in sales.

Also, another factor is that investment in AIS enhances sales growth which was presented. 27.8% of the respondents strongly agreed while 72.2% agreed to the fact that investment in AIS enhance sales growth. It was deduced that investment in AIS influence sales growth.

In similar manner, it was revealed that price of product influence sale growth as all the respondents concurred positively to the fact that price of product influence sale. 13% strongly agreed and 87% agreed.

It also presented the respondents view on government policy influence sale growth. 15.75% strongly agreed, 75% agreed and 9.25% indifferent. It was generalized that government policy influenced sales growth in the study area.

Furthermore, the respondents’ view on increase in population influenced sales growth showed that 58.3% of the respondents accounted for strongly agreed and 41.7% accounted for agreed. It was observed that the respondents were of the opinion that increases in population influence sales growth, and is in agreement with the work of Olugbenga et al. (2013).

The coefficient of determinant of the relationship between investment in accounting information system and sales growth have a value of R2 = 0.828. This implied that, the extent to which the independent variables (AIS investment, AIS labor and non AIS labor) explain the variation in the dependent variable (Sale Growth) is 82%. In other words, the proportion of variance in sale growth in the study area that is predictable by AIS investment, AIS labor and non AIS labor is 82%. It can also be explained that AIS investment, AIS labor and non AIS labor accounted for 82% of the variation in sale growth in the study area (Table 2).

In order to examine the relationship between investment accounting information and sales growth, ANOVA was employed. The golden rule stated that when the critical p-value is lower than 0.05 level of significance the null hypothesis is rejected. The F-ratio value was 1914.870 while the critical p-value was 0.000 which is lower than the 0.05 level of significance. Thus, the null hypothesis which stated that there is no relationship between investment in accounting information system and sales growth was rejected. While on the other hand, the alternative hypothesis which was that there is a relationship between investment in accounting information system and sale growth was accepted (Table 3).

Also, the individual impact of the variables was examined in Table 4. it was observed that AIS investment have the highest impact on sales growth with beta value of 0.944 followed by AIS labor with beta value of -0.018 while the variables that had the least impact on sales growth was non AIS labor with beta value of -0.052. The impact of the variables was based on the beta value as presented in Table 4. Thus, the regression formula;

S = 263.785 – 0.083NAISL - 0.153AISL +1.246INVAIS

(6)

Equation 1 explains the predicting value and impact of investment in AIS on sales growth (Table 4).