Full Length Research Paper

ABSTRACT

The study aimed to determine the role of document completeness as a moderating variable in the relationship between knowledge of tax relaxation and taxpayer compliance and the relationship between tax relaxation policy socialisation and Small and Medium Enterprises (SMEs) taxpayer compliance registered at the North Malang - East Java - Indonesia Primary Tax Service Office. The moderation test in this study used WarpPLS, with a unit of analysis of 158 SMEs with micro business groups 62.1% worked all day, 29% worked during the day and 8.9% worked at night. This research was conducted by combining experiments and survey strategies using questionnaires. Moderation test using WarpPLS to determine how much the document completeness variable strengthened the relationship between tax relaxation knowledge and policy outreach to SMEs taxpayer compliance applying for tax relaxation. The results showed that business legality, bookkeeping, financial reports and transcripts of financial report elements improved the relationship between tax relaxation knowledge and policy outreach to SMEs taxpayer compliance during the Covid-19 pandemic. To get maximum results, the R-Squared results make it possible to add variables that have not been included in this study. To get maximum research results, the next researcher should add other variables outside the variables studied.

Key words: Knowledge, socialisation, completeness of documents, compliance.

INTRODUCTION

Why must SMEs comply with their tax obligations? Because taxes have an important function in the economic system of a country. First, taxes supply government funds for development, both central and nearby governments. Both taxes function as a device that regulates government policies in the socio-economic field. The proportion of tax income has improved appreciably, each nominal and as a share of the total

kingdom revenue.

On the other hand, the taxpayers’ share is very small compared to Indonesia’s total population. This aspect shows that the Indonesian people’s focus on paying taxes is low. SMEs have a sizeable role in the country’s monetary growth. The contribution of SMEs to the Indonesian economic system is capable of soaking up 97% of the complete workforce and acquiring up to 60.4% of the total investment. Based on records from the Directorate General of Taxes, and the Ministry of Finance, the contribution of SMEs to the Gross Domestic Product reached 61.41%. MSMEs managed to absorb almost 97% of the wholewide group of workers and in terms of the number of business units, 99.99% of the complete commercial enterprise actors. In Indonesia, it is around 62.9 million units, while massive companies are solely 5,400 devices (0.01%). Therefore, the Indonesian financial system is growing hastily thru the SMEs sector.

Highlighting the consequences of a survey via the Malang City Cooperative Industry and Trade Office in 2021 that the contribution of SMEs to the East Java economic system that Malang City is in the fifth location out of 38 cities and regencies in East Java whilst the first area is Surabaya City, Sidoarjo City, Pasuruan City, Gresik City. The contribution of SMEs in Malang City reached 69.87 of 57.25% of East Java’s Gross Regional Domestic Product from a whole of 113.132 SMEs unfolded over five sub-districts and fifty-seven wards. Of the five sub-districts in Malang City, the Lowokwaru sub-district is the most densely populated-because various public and private universities are in the area, so MSMEs in the place thrives. However, Many SMEs do not have enterprise legality starting from the Business license, Certificate of Company Registration, Micro Small Business License, Industrial Business Permit, Deed of Business Establishment, Principle Permit, and Stock Keeping Unit. By having a commercial enterprise legality or business license, MSMEs can use it for the capacity of criminal protection, the potential of promotion, and proof of compliance with the rule of law, making it simpler to get an undertaking and facilitate enterprise development.

The massive effect of Covid-19 pandemic that used to be felt through SMEs were caused by a reduction in the stage of public consumption due to the policy of enforcement of the community activity restrictions policy beginning from self-isolation work from home. Ensuring a limit on the personnel involved in production activities, limiting business which reasons a limit in income turnover to shut its operational activities. One of the impacts of SMEs experienced was a reduction in earnings and turnover, and economic constraints affected workers due to the fact decrease in operational things to do regularly ended with a reduction in the quantity of personnel (Utami, 2021).

According to the government’s fiscal policy throughout the Covid-19 pandemic were extra focused on three things. First, a centre of attention on efforts to address the public fitness aspect. Fiscal units for the fitness sector have to be a problem to forestall transmission, monitoring, care, availability of facilities, and therapy research. Second, fiscal units need to play a position in supporting events affected with the aid of the monetary downturn. Third, they want to motivate complete demand (aggregate demand). One of the most felt influences of the COVID-19 pandemic is Micro, Small and Medium Enterprises, due to the fact that Micro, Small, and Medium Enterprises have a sizable contribution to employment and growth of job opportunities because this group has verified to be capable withstanding quite a number sorts of monetary shocks. In China (Liu, 2021), Nigeria (Aladejebi, 2018)and Korea (Choi et al., 2022)determined three effects of economic severity throughout the Covid-19 pandemic in Korea divided into three scenarios: a reduction in gross domestic product, an make bigger in government spending and an expansion in tax income; in Indonesia (Noviyanti and Azam, 2021;Listiyowati et al., 2021; Zulfikar et al., 2021). The influence of the Covid-19 pandemic on micro, small and medium commercial enterprise taxpayers who take gain from tax incentives (Budiman et al., 2020; Wardani and Wati, 2018; Sitorus, 2021). The compliance of taxpayers in carrying out tax duties required with the aid of the use of the law is formal compliance and material compliance.cloth compliance is greatly influenced by the skill of expertise of taxpayers in calculating methods, tax topics and objects, methods for filing objections and the lack of archives when enacting insurance plan policies (Rahayu et al., 2017). Then again there are a few forms of compliance per the community’s behavioural intentions, especially voluntary compliance and compelled compliance. Previous researchers who studied formal, material, voluntary and enforced compliance had been carried out with the aid of way of (Alm et al., 2020; Rahayu et al., 2017; Müller and Rau, 2021).

Some of the limitations confronted with the resource of MSMEs when they pick to get tax incentives: a) lack of statistics of taxpayers about tax rest (Kilo et al., 2022)now no longer having a Tax ID vast variety or to register for a Tax ID number, however the requirement to register Tax ID range for SMEs is to have a business permit, company registration certificate, micro and small business permit, industrial business permit, business establishment deed, principle permit; b) task gaining access to and reaching choices throughout the large-scale social restrictions; c) data asymmetry related to tax incentive insurance plan policies at companies backyard the Directorate General of Taxes (DGT), e) granting a Letter of request for explanation of data and/or informations and requests for corrections that are however being carried out via skill of DGT, it is quintessential that this look up is carried out to gain records greater accurate and to reap preferences to enhance tax compliance for SMEs.

LITERATURE REVIEW

The impact of the Covid-19 pandemic has resulted in the weakening of the foundations of the Indonesian economy. To decrease the unfolding of the virus, the government issued insurance policies ranging from imposing restrictions on community things to do to large-scale social restrictions. This coverage influences the survival of micro, small and medium agencies ensuing in a decrease in sales turnover, to termination of employment, in particular commercial enterprise actors who are not contributors of on-line couriers such as GoFood and GrabFood.

The decline in turnover resulted in micro, small and medium enterprises being unable to pay all operational charges and worker salaries, so there have been many employee reductions. The tax rest policy or the provision of tax incentives is given through the authorities as a shape of help to recover throughout the pandemic. Tax incentives are policies carried out by way of the government in the shape of lowering the tax burden borne by taxpayers or taxes borne by way of the government.

Tax incentives can make public spending bigger, because the rate of a product in the market will be relatively lower due to tax incentives (Amah et al., 2021). Tax relaxation provides tax incentives aimed at investors, business actors and individuals. This coverage is predicted to grant convenience and encourage taxpayers to comply with their tax duties throughout the pandemic and in the future (Guo and Shi, 2021). Two tax incentives are enforced in Indonesia: Tax holiday is a facility to supply a reduction in company earnings tax, and Tax allowance is an income tax facility for investment in positive agencies and regions (Warsito and Samputra, 2021). The policy of imparting tax incentives is expected to amplify investment in Indonesia and taxpayers’ pastime in growing their businesses in Indonesia. There are numerous reason why SMEs are lazy to pay taxes. First, the lack of socialisation of the tax authorities on the duties and ease of paying taxes for Micro, Small and Medium Enterprises. Second is the lack of assistance from the Regional Government to help micro, small and medium enterprises. The third is the pattern of micro, small and medium enterprises transferring from offline to digital platforms. Unlike what was once finished (Wijoyo et al., 2021). It was once found that SME enterprise actors do now not understand the type of tax stimulus because what is regarded as a tax stimulus is a pre-employment assistance, the family hope program.

The socialisation of tax relaxation is needed as an effort to socialise government insurance policies so that taxpayers are better acknowledged and understood, thinking that tax rest is transient because the tax relaxation policy is issued employing the government for taxpayers who are below economic pressure or are affected with the aid of the COVID-19 pandemic. The benefits of socialisation include the skill of disseminating the coverage and the purpose of socialising tax rest so that taxpayers recognise the approaches for filing tax relaxation, the types of tax relaxation, and taxpayers taking a positive role. Wardani and Wati (2018)found empirical proof that taxation socialisation has an impact on individual taxpayer compliance. Kilo et al. (2022)found that tax justice had no impact on SMEs taxpayer compliance, while tax appreciation had a fantastic effect on SMEs taxpayer compliance and tax socialisation. Sukesi and Yunaidah (2020)located that there was once the effectiveness of tax socialisation on taxpayer pleasure and compliance.

Completeness of tax relaxation files is a prerequisite for submitting functions for taxpayers to take advantage of tax relaxation. Minister of Finance Regulation Number 44/PMK.03/2020 regarding incentives for taxpayers affected by using the 2019 Corona Virus Disease Pandemic. The necessities for SMEs that will apply for tax rest or tax incentives have gross profits of not extra than 4.8 billion per year, put up a PP23 certificate, the application submits a document on the realisation of the last PPh borne with the aid of the government via the www.pajak.go.id. (Leong et al., 2020). Evidence is that some SMEs in Malaysia attempt to enhance and get financial assistance from the authorities and that ordinary respondents are comfortable with the help provided by using the authorities at some stage in the Covid-19 period.

Taxpayer compliance is a person’s conduct in pleasurable tax obligations and carrying out all his tax rights (Ambarwati et al., 2021). With the tax leisure policy during the COVID-19 pandemic observed that appreciation of guidelines and the benefits obtained from the tax rest policy impacted taxpayer compliance in reporting Article 21 Income Tax Returns. Alm et al. (2020), located tax compliance via the usage of a behavioural approach that attitudes toward behaving, subjective norms and behavioral manage affect taxpayer compliance (Lestary and Yudianto, 2021; Saad and Abdullah, 2014). The taxation socialisation and understanding of taxation positively affect SMEs taxpayers’ compliance.

RESEARCH METHODOLOGY

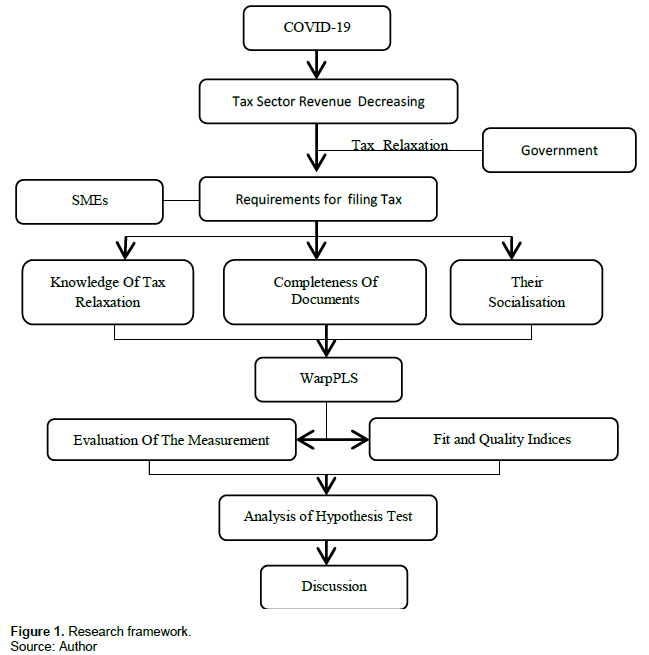

This research is carried out to identify the cause and effect of the relationship between expertise variables of tax relaxation, socialisation and completeness of documents on SMEs taxpayer compliance, a pattern of 172 micro, small and medium enterprises in Malang City, which is engaged in the culinary business, fashion, tutoring institutions, automotive, agribusiness, tour and travel, creative products, tournament organisers, cleaning services, had been requested to fill out a questionnaire, but a complete of 158 data may want to be processed. The micro, small and medium enterprises group consists of 62.1% working all day, 29% at some point of the day and 8.9% working at night. A sequence of questions associated with relevant records and information, this research was conducted by combining experimental and survey strategies using a questionnaire about the expertise of tax relaxation, completeness of submitting documents, coverage socialisation and taxpayer compliance. Questionnaires submitted to respondents consist of 1. Demographics of respondents, inclusive of name, gender, income, age, education, and line of business, have been utilised for tax incentives; two Instruments as a capacity of measuring Information: a) Knowledge of tax relaxation; b) completeness of documents; c) coverage socialisation and 4) Compliance with: punctual payments, well-timed reports, no arrears, by no means audits and a slow economy. Respondents were requested to fee the instrument using a Likert scale with 1 for strongly disagreeing to 5 for strongly agreeing with answers. Data evaluation and moderation look at used SEM-PLS with WarpPLS model 7.0 approach. WarpPLS analysis does not require the assumption that the data is usually disbursed with a sample resampling of at least 100, so the Central Limit Theorem has been fulfilled, that is, the large the sample, the data will strategies the ordinary distribution of the research framework presented in Figure 1.

RESULTS

This study was carried out in the Lowokwaru sub-district, Malang City, the findings of this study were grouped into: (1) respondent profile on the effects of the identification of SMEs showed that from a whole of 158 SMEs obtained: a) 68.98% male, and 31.02% female; b) age thirthy to forty-five years via 37.24% and 46 to 61 by using 62.76%; c) High college schooling of 41.77%; Bachelor’s degree of 38.36%; d) enterprise sector: meals and beverage using 54.84%, grocery keep by using 28.05%; others using 17.11% and e) income turnover per year between 250,000,000 to 500,000,000 via 68.86%; turnover of 500,000,000 to 1,000,000,000 by using 27.89%; and above 1,000,000,000 via 4.25%. (2) The summary of the check consequences is introduced as follows:

Result evaluation of the measurement model (Outer model)

Convergent validity

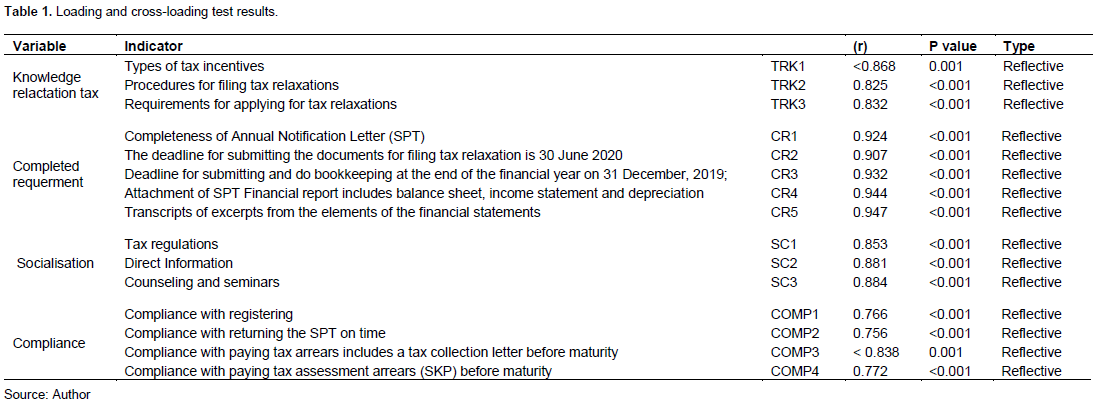

Validity of the measurement model was a reflective warning signs based totally on a component loading approach, and indicators measuring latent variables that show indications of tax leisure knowledge, document completeness, socialisation and taxpayer compliance have mirrored the latent variable with a correlation coefficient price > 0.4. SMEs taxpayers’ ability to know the kinds of tax relaxation on how to practice tax rest and the requirements for acquiring tax relaxation services have reflected the measurement of tax rest knowledge (TRK). Indicators: the completeness of the Annual Tax Return (SPT), SMEs comprehend the deadline for submitting the completeness of the tax relaxation submission record on 30 June 2020, the deadline for submitting the Annual Tax Return on 30 April 2019 for the company and non-public taxpayers who do bookkeeping at the top of the economic yr on 31 December 2019, SPT attachments Financial statements include stability sheets, income statements and depreciation lists and transcripts of quotations from the elements of the financial statements reflecting the measurement of document completeness (CR).

Indicators: tax regulations, direct information and counselling and seminars have mirrored the dimension of the socialisation of the tax relaxation coverage (SC). Indicators: compliance with registering, compliance with returning tax returns on time, compliance with paying tax arrears together with Tax Collection Letters (STP) before maturity and compliance with paying tax evaluation arrears (SKP) before maturity has reflected the dimension of taxpayer compliance (COMP). Summary of loading take a look at the effects in Table 1.

Based on Table 1, the indicators for every latent variable have reflected the dimension of tax leisure knowledge, coverage socialisation, report completeness and taxpayer compliance, namely the loading thing fee > 0, four.

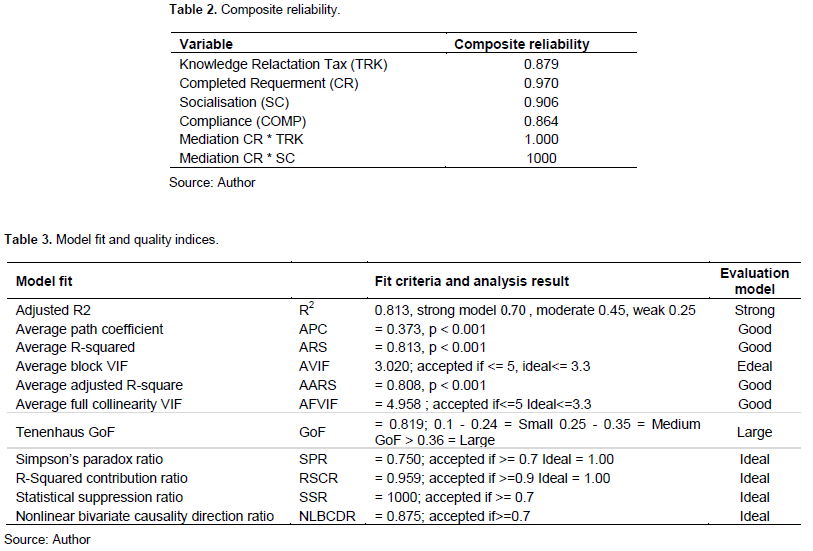

Composite reliability

Summary of composite reliability takes a look at outcomes introduced in Table 2. Based on Table 2, the know-how variable tax rest (TRK), coverage socialisation (SC), record completeness (CR), and taxpayer compliance (COMP) have a composite reliability price of 0.7. This indicates that all symptoms of each variable have correct reliability to the latent variable.

Fit and quality indices

Based on Table 3, the standards for the goodness of the mannequin show that the mannequin was fashioned by using the completeness of the mediating record of the relationship between the expertise of tax rest and its socialisation on taxpayer compliance is good. P-value <0.001 from ARS and AARS potential that the mannequin formed is excellent and vast according to ARS and AARS. Meanwhile, based on R-squared, the value of 0.813 was obtained once. The consequences of the WarpPLS analysis in this study confirmed that the magnitude of the variety of data from an understanding of relaxation, coverage socialisation, and completeness of archives that can be explained via the mannequin is 81.3% while the final 18.7% is defined by way of other variables not located in this study.

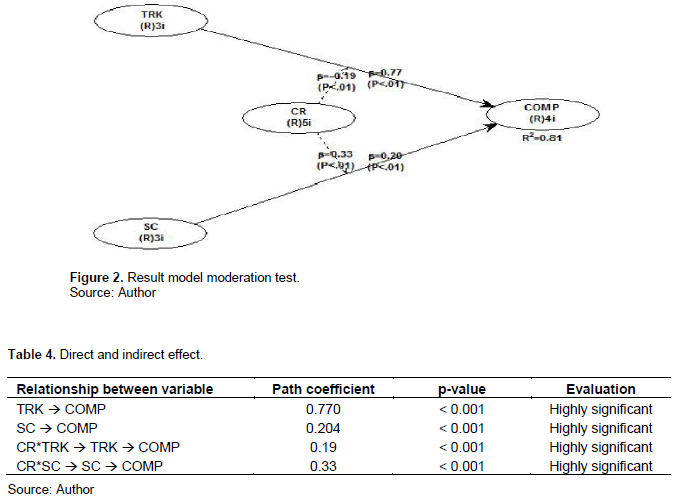

Figure 2 shows the effects of the moderation evaluation used to discovered the completeness of the documents that enhance the relationship of tax relaxation expertise to taxpayer compliance through 19% and p 0.001 ability that some of the completeness of archives understood through the taxpayer tax leisure information. So in a way is nonetheless restrained to the completeness of economic report attachments as a complement to the submission of annual tax returns and transcripts of quotations from monetary declaration elements, whilst the completeness of archives can give a boost to the relationship between tax rest coverage socialisation and compliance. Taxpayers at 33% and p 0.001 skill that as far as taxpayers recognise in the cloth for the socialisation of leisure insurance policies for the duration of the Covid-19 pandemic, taxpayers get new records about submitting tax incentives, about strategies for submitting tax relaxation, the required archives in filing tax rest and the types of taxes that acquire tax incentive amenities. In this case, the function of completeness of documents in submitting tax relaxation is very influential in increasing taxpayer compliance through the Covid-19 pandemic because the completeness of archives is the principal prerequisite for submitting tax relaxation. On the other hand, this discovered the obstacle that SMEs taxpayer compliance in applying for tax rest were only limited by using the completeness of financial declaration documents due to the fact that SMEs had to restructure, obtain instalment extend amenities and the government made it less complicated for them to take new loans capital and the depletion of uncooked substances due to the implementation of restrictions on community activities.

Analysis of hypothesis test

Table 4 shows the analysis of hypothesis test on the direct and indirect effect.

DISCUSSION

The know-how of tax rest (TRK) and coverage socialisation (SC) affects taxpayer compliance (COMP) with p price < 0.001 whilst the oblique effect is that document completeness (CR) as a moderating variable can make stronger the effect of tax relaxation understanding (TRK) on taxpayer compliance (COMP) as well as that record completeness (CR) can reinforce the impact of tax rest policy socialisation (SC) on obligatory compliance tax (COMP) with p-value < 0.001.

Consumer behaviour studfies, study every individual, team or organisational motion in choosing, buying, using and evaluating products to satisfy their desires. Taxpayer compliance has interesting and plausible opportunities (Saad and Abdullah, 2014). The learn about taxpayer conduct can be developed along with improving client behaviour studies. Taxpayer compliance research grew more interesting when the authorities issued a Tax Relaxation coverage aimed at SMEs throughout the COVID-19 pandemic. In theory, the importance of taxpayer compliance in carrying out tax duties by guidelines and laws, however, taxpayer compliance does not only imply being obedient in reporting taxes and paying taxes (Rahayu et al., 2019)but the completeness of archives plays a function in growing obligatory compliance. The inconsistency of this study when in contrast to research (Ambarwati et al., 2021)with the authorities in tax relaxation for the duration of the COVID-19 pandemic and the advantages derived from this policy, taxpayers still comply with annual SPT reporting despite a decline in profits tax revenues that passed off in 2020 due to limit in people’s earnings and purchasing power. However, when it is related to the lookup performed via (Sukesi and Yunaidah, 2020); (Wardani and Wati, 2018); (Saad and Abdullah, 2014), this study helps the lookup performed (Sukesi and Yunaidah, 2020)and (Leong et al., 2020)which conclude that the know-how of tax rest affects SMEs compliance and socialisation of tax rest policy impacts on SMEs compliance.

CONCLUSION

Based on the results of this study, it can be concluded that the know-how of tax relaxation and socialisation of tax relaxation policies affect SMEs’ taxpayer compliance. The completeness of the tax leisure submission file is a moderating variable between the expertise of tax relaxation and its socialisation on taxpayer compliance, which means that the completeness of the file can extend the relationship between understanding of tax rest and policy socialisation on SMEs taxpayer compliance to reap tax rest facilities. Based on the conclusions of this study, the pointers for SMEs and tax authorities are as follows: First, the tax relaxation policy or tax incentives have a deadline for submissions that have to reply to authorities’ insurance policies for the continuity of SME operations, as nicely as the importance of completing enterprise legality and satisfying tax tasks beginning from following and imposing regulations on taxation.

Second, the Tax Service Office wishes to measure the fulfilment of the desires and objectives of the socialisation of coverage starting from resources, communication, bureaucratic structure and disposition, content material of

the policy and the implementation environment heavily influences the success of policy socialisation.

RECOMMENDATION

The results of this study are addressed to the tax service office as an extension of the directorate general of taxes in disseminating every policy product aimed to the taxpayer community should be able to carry out continuous socialisation and carry out widespread socialisation using the media that is most in demand by the public.

CONFLICT OF INTERESTS

The author have not declared any conflict of interests.

ACKNOWLEDGEMENTS

The author would like to thank the perpetrators of micro, small and medium enterprises in Malang City, which are engaged in the culinary business, fashion, tutoring institutions, automotive, agribusiness, Tour AND Travel, Creative Products, tournament organisers, cleaning services, who have been willing to spend time as respondents in this study.

REFERENCES

|

Aladejebi DO (2018). Measuring Tax Compliance among Small and Medium Enterprises in Nigeria. International Journal of Accounting and Taxation 6(2):29-40. |

|

|

Alm J, Blaufus K, Fochmann M, Kirchler E, Mohr P, Olson NE, Torgler B (2020). Tax policy measures to combat the sars-cov-2 pandemic and considerations to improve tax compliance: A behavioral perspective. WU International Taxation Research Paper Series. |

|

|

Amah N, Rustiarini NW, Hatmawan AA (2021). Tax compliance option during the pandemic: Moral, sanction, and tax relaxation (case study of indonesian msmes taxpayers). Review of Applied Socio-Economic Research 22(2):21-36. |

|

|

Ambarwati A, Sobari IS, Kristanto R (2021). The Impact of the COVID-19 Pandemic on the Compliance Level of Annual SPT Reporting for Individual Taxpayers at the Pondok Aren Tax Service Office, South Tangerang City. Ilomata International Journal of Tax and Accounting 2(4):304-312. |

|

|

Budiman NA, Indaryani M, Mulyani S (2020). Dampak Covid-19 dan Pemanfaatan Insentif Pajak terhadap Keberlangsungan Usaha pada UMKM Tenun Troso Jepara. Jurnal Manajemen Dan Keuangan 9(3):276-285. |

|

|

Choi Y, Kim HJ, Lee Y (2022). Economic Consequences of the COVID-19 Pandemic: Will It Be a Barrier to Achieving Sustainability? Sustainability 14(3):1629. |

|

|

Guo YM, Shi YR (2021). Impact of the VAT reduction policy on local fiscal pressure in China in light of the COVID-19 pandemic: A measurement based on a computable general equilibrium model. Economic Analysis and Policy 69:253-264. |

|

|

Kilo AS, Amaliah TH, Husain SP (2022). Potensi Peningkatan Kepatuhan Wajib Pajak UMKM di Masa Pandemi Covid-19 setelah Diterbitkan Insentif PPh 21 final UMKM Ditanggung Pemerintah. Jurnal Pajak 4:44-52. |

|

|

Leong ZY, Lee TH, Teoh MTT (2020). Tax Compliance and Tax Incentive: An Investigation of SMEs During the Covid-19 Period. International Journal of Academic Research in Accounting, Finance and Management Sciences 10(3):451-474. |

|

|

Lestary SR, Yudianto I (2021). The Effect of Tax Fairness , Tax Socialization and Tax Understanding on Tax Compliance?: A Study on Micro, Small and Medium Enterprises (MSMEs) 4(1):87-99. |

|

|

Listiyowati L, Indarti I, Setiawan FA, Wijayanti F, Setiawan FA (2021). Kepatuhan Wajib Pajak UMKM di Masa Pandemi COVID-19. Jurnal Akuntansi Indonesia 10(1):41. |

|

|

Liu L (2021). US Economic Uncertainty Shocks and China's Economic Activities: A Time-Varying Perspective. SAGE Open 11(3):21582440211032672. |

|

|

Müller S, Rau HA (2021). Economic preferences and compliance in the social stress test of the COVID-19 crisis 194. |

|

|

Noviyanti N, Azam SMF (2021). The Impact of Covid-19 Pandemic on Taxpayers' Compliance of MSMEs in Palembang. Widyakala: Journal of Pembangunan Jaya University 8(1):25. |

|

|

Rahayu YN, Setiawan M, Troena E, Sudjatno (2019). Tax Compliance: The Impact of Moderation of Awareness Tax. In Journal of Engineering and Applied Sciences 14(13):4453-4458. |

|

|

Rahayu YN, Setiawan M, Troena EA (2017). The role of taxpayer awareness, tax regulation and understanding in taxpayer compliance. Journal of Accounting and Taxation 9(10):139-146. |

|

|

Saad N, Abdullah N (2014). Is zakat capable of alleviating poverty? An analysis on the distribution of zakat fund in Malaysia. Journal of Islamic Economics, Banking and Finance 113(3250):1-27. |

|

|

Sitorus AA (2021). Disinkronisasi Kebijakan Pemerintah Indonesia Dalam Penanganan Covid-19. Journal Renaissance 6(1):721. |

|

|

Sukesi S, Yunaidah I (2020). The effect of tax socialisation, superior service, and service quality on taxpayers' satisfaction and compliance. Journal of Economics, Business and Accountancy Ventura 22(3):347-359. |

|

|

Utami BSA (2021). Dampak pandemi covid 19 terhadap sektor UMKM di Indonesia. Economie: Jurnal Ilmu Ekonomi 3(1):1-7. |

|

|

Wardani DK, Wati E (2018). Pengaruh Sosialisasi Perpajakan Terhadap Kepatuhan Wajib Pajak Dengan Pengetahuan Perpajakan Sebagai Variabel Intervening (Studi Pada Wajib Pajak Orang Pribadi di KPP Pratama Kebumen). Nominal, Barometer Riset Akuntansi Dan Manajemen. |

|

|

Warsito W, Samputra PL (2021). Potensi Penurunan Pajak dan Strategi Kebijakan Pajak untuk Mengantisipasi Dampak Pandemi Covid-19: Perspektif Ketahanan Nasional. Jurnal Ekonomi and Kebijakan Publik 11(2):93-108. |

|

|

Wijoyo H, Akbar MF, Safiih AR, Prasada D, Yusuf A, Sudarsono A, Widiyanti W (2021). The Effect of Tax Stimulus during the Covid-19 Pandemic in Improving the Performance of Taxpayers. Proceedings of the 2nd Annual Conference on Education and Social Science. |

|

|

Zulfikar R, Widyanti R, Basuki B, Mayvita PA, Purboyo P (2021). Encourage Smes Sustainable Behavior During Covid-19 Pandemic Through Competitive Advantages and Corporate Culture. Serbian Journal of Management 16(2):405-417. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0