ABSTRACT

Ineffective tax assessment and systemic deficiencies have been the general perceptions that tax administrators do not remit tax collections, and this is greatly affecting tax revenue generation in Nigeria. Prior studies have attributed these anomalies to lack of efficient information technology and competent tax administrators. Consequently, this study investigated the effect of information technology on effective tax assessment in Nigeria. The study adopted survey research design. The population was 2,857 management and administrative staff of six selected multinational companies in Lagos State alongside the Federal Inland Revenue Services in Lagos offices and Lagos State Internal Revenue Service. Krejcie and Morgan’ formula was used to determine the sample size of 641 based on stratified sampling technique. The Cronbach’s alpha reliability coefficients ranged between 0.88 and 0.96. Descriptive statistics and inferential statistics used for data analysis revealed that information technology had a positive statistical significant effect on effective tax assessment Adj. R² = 0.172; F-Statistics (4, 637) = 35.46; P-value = 0.000. The study recommended that the government should provide enabling tax laws as well as simplifying the ambiguities and complexities in some of the existing tax laws to facilitate effective tax assessment in Nigeria.

Key words: Digital tax, easy filing, enabling tax laws, information technology, tax assessment, tax revenue.

Tax administration in Nigeria and indeed globally is faced with myriad of problems affecting much desired expectations of stakeholders (Price Waterhouse Coopers, 2010). The study of Leyira et al. (2017) also revealed that one of the problems of tax administration is multiplicity of taxes especially in developing nations of the world. According to them, some countries that operate federal, states or regions/provinces and possibly local administrative areas still have the problems of clear cut tax jurisdiction between the tiers of government, causing multiplicity of tax collection between the federal, state and the local government. In addition to multiplicity of taxes, the issue of tax illiteracy, low tax awareness and insufficient tax awareness is predominant among developing nations. The studies argued that some countries are faced with inefficient tax administration as the tax administrators most often focus on trade and petroleum taxes, and inadvertently neglect a whole lot of areas especially the informal sectors of the economy (Edori et al., 2017; Odusola, 2016).

Digitalisation has taken the center stage in the nation’s economic activities and has rendered the existing traditional tax rules and processes ineffective. Consequently, the advent of digital age has been the motivating force of all human activities. Information technology now rules the world giving rise to digital economy, E-commerce, and information technology of tax system which has brought unprecedented speed in business transactions and revolution changing the face of tax administration in countries (Obe, 2019). Tax is the main source of revenue to the government and the administration of tax is the hub for the amount of tax revenue accruable to the government. The essence of information technology is to aid tax administrators’ performance, thereby reducing tax avoidance and evasion, and beyond that, information technology eases faster and accurate analysis of tax data. Taxation is often used by government as a way of influencing social amenities and the social lives of its citizens (Dimitropoulous et al., 2018).

Studies from developing economies other than Nigeria had made some valuable contribution in this regard. Digitalization has played pivotal roles in many countries of the world, such as Malaysia, Japan, South Korea, Zambia, India and South Africa (Perrou, 2018). It has contributed substantially to the success story of these countries and has also brought about revolution of tax revenue and tax administration (OECD, 2015). Digitalization has been widely accepted as the spring board for sustainable economic development and cross boarder tax administration and management. Aside from the fact that digitalization and tax administration have contributed to increase per capital income and tax revenue, they have also created employment opportunities, encourage import substitution, foreign direct investment and multi-national corporations effectiveness and efficient utilization of local and international tax laws synchronization (Leyira et al., 2017).

Ineffective tax assessment and systemic deficiencies have been the general perceptions that tax administrators do not remit tax collections, and this is greatly affecting tax revenue generation in Nigeria (Ganyam et al., 2019). Prior studies have attributed these anomalies to lack of efficient information technology and competent tax administrators. This study became imperative at this time and period as Nigeria is striving to catch up with the rest of the world in digitalization of tax system and tax administration, much more in the ways of improving tax revenue generation through best practices in tax administration for the government. This study is considered significant considering the digital age and the importance of tax revenue generation to the Nigerian government and to any nation, especially at a time of dwindling oil revenue, exponential population growth and the need of the government to perform more on infrastructural development to stimulate business and employment. The corporate bodies and other tax payers are eager to see the possibility of transacting their tax activities seamlessly, considering the time and speed of information technology. Taxpayers would be glad to start and complete their tax transaction, including the filling and payment at the comfort of their homes. To this effect, an understanding of this study will serve as a guide to both taxpayers, tax policy makers and the government at all levels. Therefore, these researchers consider this study appropriate and justifiable for contributing to this body of knowledge and for its originality. Consequently, this study investigated the effect of digitalization on tax administration in Nigeria.

Statement of the problem

Tax administrators in Nigeria are being confronted with myriads of challenges and difficulties adapting to the new information technology, ‘digitalization’. According to Ifere and Eko (2014), tax administrators in Nigeria is faced with the problems of manual computation resulting in inaccuracies and errors, perennial delay in tax assessments, loss of tax revenue generation due to inadequate taxpayers database, and nontax compliance. Similarly, Sunday et al. (2017) documented that the challenges of manual computations and filing of forms in Nigeria among taxpayers are quite disturbing. The challenges of poor tax revenue in Nigeria include: reliance on manual computation, with the associated inevitable errors and delay in form filing, lack of comprehensive taxpayers database leading to poor tax compliance, increasing tax evasions, ineffective tax assessment and returns, high level of professional incompetence and unskilled tax administrators, huge reported unethical sharp practices and corruptions cases (Ayodeji, 2016).

Ineffective tax assessment and syndromic perceptions that tax administrators do not remit tax collections is greatly affecting tax revenue generation in Nigeria (Ganyam et al., 2019). The studies that exist in Nigeria focused largely on tax and their impact on economic growth and/or economic development. Consequently, there was need to fill this gap, information technology of the Nigerian tax administrative system. Unfortunately, there were evident challenges: inadequate staff, incompetent professionals, huge corruption profile and inefficient trained managers to control its administrative activities and the case of putting round hole in square pegs (Abogan et al., 2014; Olaoye and Aguguom, 2018).

Based on the review so far, the need for effective tax assessment becomes imminent, as the Nigerian tax administration is burdened with the following lots of administrative challenges ranging from poor documentation of the information about the taxpayers and their economic activities; inadequate tax laws and legislative capacity (sovereignty) to determine taxpayers obligations holistically; and the presence of low administrative capacity (feasibility) for the efficient application of the legislation (Ganyam et al., 2019). While, Abdullahi (2012) documented that with information technology desperately needed to drive information technology adequate skilled personnel who will drive the technology is imperative, high need of enabling laws to synchronize and consolidate with other nations’ trade relations as it affects taxation. Also, Ayodeji (2016) posited that high level of tax illiteracy, low level of educational qualification of some tax officials, are some of the problems of effective tax assessment, that there has been an endemic high level of corruption and lack of patriotic attitudinal disposition by the tax administrators.

Beyond this, there are gaps existing between the knowledge of information technology required for information technology in tax administration to make the expected impact on the tax administration in Nigeria. Though some literatures do exist in information technology and effective tax assessment, however, there are few of them that had focused the effect of information technology on effective tax assessment in Nigeria. In addressing this gap and extending the frontiers, in the emerging literature in Nigeria, this study sought to investigate the effect of information technology on effective tax assessment in Nigeria.

Tax administration

An effective tax assessment is essentially important in tax administration of countries’ tax revenue drive, as the tax revenue is desired for by all levels of government as major source of government income to meet its financial obligations. From the Nigerian perspective, Federal Inland Revenue Services is given the responsibility, mandated and statutorily vested with powers of tax administration and handle all issues of collecting and remittances of same to the federal government account. Hence, the Federal Inland Revenue Services has the mandate to sanction tax defaulters with the appropriate penalties commensurate to such offences (Sanni, 2019).

Federal Inland Revenue Services was established by the Federal Inland Revenue Service (Establishment) Act No.13 of 2007. Their functions include power to assess and collect revenue accruing to the federation as stipulated in S8 of the enabling Act. Consequently, the Federal Inland Revenue Services is expected to carry out effective assessment of taxpayers, most especially corporation organizations, on their chargeable incomes. It is also their responsibility to ensure accurate collection and ensure enforcement of tax laws. The agency is equally empowered to recover from taxpayers such defaults or accumulated taxes (Salami et al., 2015; Sanni, 2019).

Effective tax assessment

The concept of tax assessment is the process by which the tax payers and/or the tax administrators break down the actual tax liability of each tax payer. According to Section 8(1) of the Federal Inland Revenue Services Act (FIRSA) of 2007, the Federal Inland Revenue Services is expected to handle all federal tax related matters. Whilst the State Internal Revenue Service handles the tax relating to their respective states, the local government tax revenue committee is saddled with all local government tax related matters (Ishola, 2019; Oluyombo and Olayinka, 2018). An effective tax assessment should ensure fairness, adequacy, simplicity and transparency. It is the expectation of this study that proper application and implementation of information technology will significantly enhance effective and efficient tax assessment by the tax administrators in the three tiers of government. An effective tax assessment enables the government to impose accurate tax collections in order to achieve the following objectives of the government:

i) Taxes are the product of tax assessment as levied to cover the cost of administration, internal and external defense, maintenance of law and order as well as social services required by the citizens.

ii) Taxes are instruments used by governments to protect companies in their infant stages. This is done by reducing specific tariffs which will invariably reduce the cost of production relative to imported products that may be substitutes.

iii) Taxes can also be used to discourage the consumption of dangerous/harmful products.

iv) Assessment is done for taxes aimed at controlling the importation, production and consumption of certain goods and services thereby preventing a country becoming a dumping ground of other nation’s production. This can be achieved by increasing tax payable on such goods and services.

v) Taxes are important instruments of government in the area of redistribution of wealth and income among various income earners through progressive tax system. This helps to reduce income inequality.

Information technology

Digital disruptions have significant implications on the organization and functioning of any economy and one of the consequences is their impact on taxation. Information technology is an integration of digital technologies into every life, including tax administration (Warren, 2018). Santiego-Diaz-De (2018) defined information technology as the adoption of digital technologies to modify a business model as it relates to tax administration in all ramification in line with the global trend, with the aim of creating value from the use of advanced technologies, by exploiting digital networks dynamics for the benefit of the improved tax generation and ease of tax payments by taxpayers. Furthermore, Isiadinso and Omoju (2019) submitted that information technology is the process by which companies re-organize their administrative tax work methods and strategies to obtain greater benefits including the implementation of new technologies.

Given the differences in tax laws in different tax jurisdictions and the preferences of countries regarding their tax treaties, this is one of the problems that slows digitalized tax drive wheel of tax administration in Nigeria, the existing tax laws in Nigeria are either faulty or some level of limitations are evidently not put into right perspective at the time of drafting these tax laws (Gurama and Mansor, 2015). The current tax regulations are not adequate for companies operating across borders. Statistics show that today, 9 out of the top 20 companies in the world capital market capitalization are found to be digitalized. It is the biggest challenge in ensuring that digital companies contribute fairly to their share in tax revenues (Juswanto and Simms, 2017; Lipniewicz, 2017). Consequently, we hypothesis that:

There is no significant effect information technology on effective tax assessment of Taxpayers in Nigeria.

Theoretical underpinning

Theory of digital diffusion

Innovation theory was developed by a sociologist Everett Rogers in 1962 in the first edition of a publication ‘Diffusion of Innovations’ in 1962. The theory of digital diffusion is based on the notion that adoption of an innovation involves the spontaneous or planned spread of new ideas. It involves the application of new idea, practice or object that is perceived as new in (Rogers, 1995). The theory stressed that it is the perception of change that is important, if the idea seems new to the potential adopter then it should be considered to be an innovation. The theory approached innovation diffusion by considering a variety of case studies on some topics including controlling scurvy in the British Navy, diffusion of hybrid corn in Iowa, diffusion of new news, bottle feeding a babies in the third world, how the refrigerator got its hum, Xerox Parc and Apple computers, digital economy, black music in white America and the possible information technology of administrations and products (Thomas, 2014). The philosophy of this theory is associated with the independent variable of this study, hence considered appropriate and relevant to the study as the theory contented that a technological innovation embodies information and its adoption acts to reduce complexities as applicable tax related issues in Nigeria.

Empirical review

Ganyam et al. (2019) examined the effect of tax administration on revenue generation in Nigeria with special reference to the reforms introduced by the Benue State tax administration in Benue State, for the period of 3 years (2015-2018). The study employed survey research design using a structured questionnaire distributed to selected respondents staff of the Benue State Internal Revenue Services in the state. The study found electronic tax system having a strong significant effect on tax revenue generation and tax accountability in Benue State. The study equally found that tax administration significantly improved revenue generation in Nigeria at large. The study then recommended that government at all levels should cooperate and support the relevant tax authorities to enable them effectively manage the tax system for the desired result.

Theobald (2018) examined the impact of tax administration on government revenue in Tanzania, a case of Dar-es Salaam region. The study employed structured questionnaire administered to selected 85 targeted respondents. The received questionnaires were analyzed and found only good tax structure backed with effective tax policies, laws and administration positively affecting tax revenue in Tanzania. Chijioke et al. (2018) investigated the impact of e-taxation on Nigeria’s revenue generation and economic growth, using secondary data obtained from Federal Inland Revenue Services and Central Bank of Nigeria for the period of 4 years (2013-2016). The study found federally collected revenue and tax GDP ratio significantly decreasing after the introduction and implementation of e-taxation. The study also found that tax revenue decreased after the implementation though the mean difference was not statistically significant.

Soetan (2017) investigated the impact of tax administration on tax revenue generation in Nigeria. The study used survey research design and deployed a structured questionnaire administered to 126 respondents randomly selected from Benue State. The study analyzed the collected questionnaires using descriptive statistics and with the help of SPSS software. The study found tax administration having positive significant effect on tax revenue generation in Nigeria. The study advised for more tax administrators’ pro-activeness towards boosting more tax revenue.

Animasaun (2016) investigated tax administration and revenue generation in Ogun State, Nigeria. The study adopted survey research design administering questionnaire to 70 staff of the Ogun State Internal Revenue Services. Both descriptive and inferential analyses were employed in the study. The study found tax administration having a negative relationship with the amount of revenue generated.

Ifere and Eko (2014) examined the tax innovation, administration and revenue generation in Cross River State. The study employed qualitative research technique using a structured questionnaire to access data from the three senatorial districts in Cross River State. The study using an analytical statistics of descriptive and regression analysis found significant degree of inefficiency in the administration of taxes in Cross River State.

Abiola and Asiweh (2012) investigated the effect of tax administration on government tax revenue in a developing economy using Nigeria as case study. The study obtained data from 93 respondents using structured online questionnaire, found increasing tax revenue a function of effective enforcement machineries which included among others adequate manpower, information and communication system.

Enahoro and Olabisi (2012) investigated the overall effectiveness of tax administration in relation to assessment, collection and remittances of tax in Lagos State. Data for the study were obtained from a survey method using a structured questionnaire administered to 130 civil servants directly connected with tax administration in five local government of Lagos State (Shomolu, Mushin, Ikeja, Kosofe and Surulere). The study found that tax administration in Lagos State is not too efficient and therefore, tax administration negatively affected tax revenue generation by the government. The study also found a positive significant relationship between tax administration, tax policies and tax laws.

In summary, previous studies have revealed mixed results, some have reported positive significant effect, others reported negative effects. To the best of the researchers’ knowledge, there is still dearth of studies that have considered the effect of information technology on effective tax assessment in Nigeria. In addressing this gap in literature and expanding the frontiers of knowledge in this regards, this study sought to contribute to knowledge proposed and investigated the effect of digitalization on effective tax assessment in Nigeria.

Models specification

Y = f (X)

Yi = β0 + β1Xi+É›i

Where

Y = Dependent Variable: Tax Administration

X = Independent Variable: Information Technology

Models specification

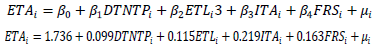

ETAi = β0 +β1DTNTPi +β2ETLi + β3ITAi + β4FRSti + μi.........................Model

Where;

ETA = Effective Tax Assessment

DTNTP = Digital Tax Net of Taxpayers

ETL = Enabling Tax Laws

ITA = Information Technology Acquisition

FRS = Financial Resource Support

β0 = regression intercept which is constant

While β1 = the coefficient of the explanatory variables

i = Cross sectional

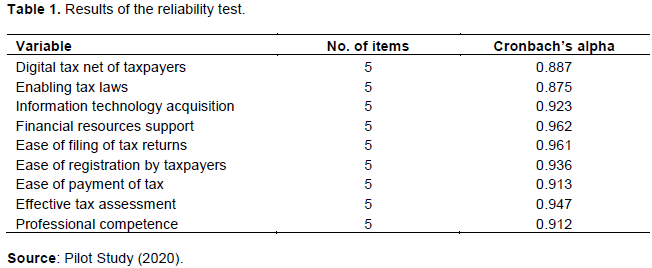

This study employed survey design to examine the effect of digitalization on tax administration in Nigeria. This design was deemed appropriate because a survey obtains stronger data representation and better approximation. The population was 2,857 management and administrative staff of six selected multinational companies in Lagos State alongside the Federal Inland Revenue Services in Lagos offices and Lagos State Internal Revenue Service. Krejcie and Morgan’ formula was used to determine the sample size of 641, while stratified sampling technique was used to determine the sample size of the study. Primary data were used by the researchers. Copies of questionnaire were distributed to the target population. Primary data were preferred because it helped in obtaining raw information from the selected respondents. The data were collected with the aid of six scale structured questionnaires. The justification for using structured questionnaire was because it enabled the researchers to reach large number of respondents in a short period of time and at lowest cost with high flexibility. Data were analysed using Statistical package for social sciences (SPSS) 21.0 software. The result from the respondents was easily analyzed more scientifically and objectively by the researcher with SPSS software. In order to ensure the reliability and validity of the study, the study carried out a pre-test of reliability and validity of the research instrument, using Cronbach Alpha reliability test. The Cronbach’s alpha reliability coefficients result revealed a range between 0.88 and 0.96. The items and structure of result of the reliability test are shown in Table 1. The result of the pre-test carried out by the researcher showed that the scales were considered as reliable because the Cronbach’s alpha coefficient was greater than 0.70 and the manipulation check carried out was valid.

DATA ANALYSIS AND RESULTS

Effective tax assessment

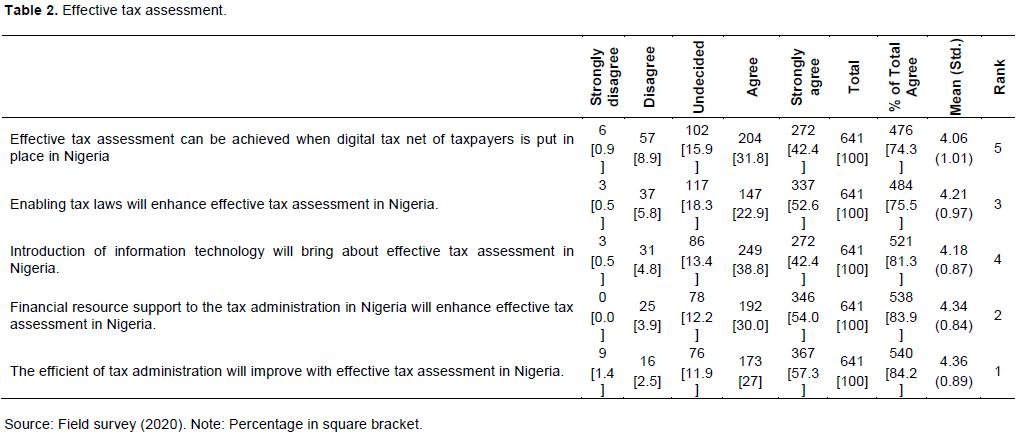

Table 2 shows the number of respondents supporting the statement, ‘Efficient tax administration will improve with effective tax assessment in Nigeria’ {Average Score = 4.36; SD = 0.89}; 84.2% of the respondents that totally agree are on the high side and ranked 1. For the statement: ‘Effective tax assessment can be achieved when digital tax net of taxpayers is put in place in Nigeria’ {Average Score = 4.06; SD = 1.01}, the percentage of respondents that totally agree is 74.3%, which has the least average score. This is preceded by the statement, ‘Introduction of information technology will bring about effective tax assessment in Nigeria’ {Average Score = 4.18; SD = 0.87}; it has 81.3% of respondents that totally agree.

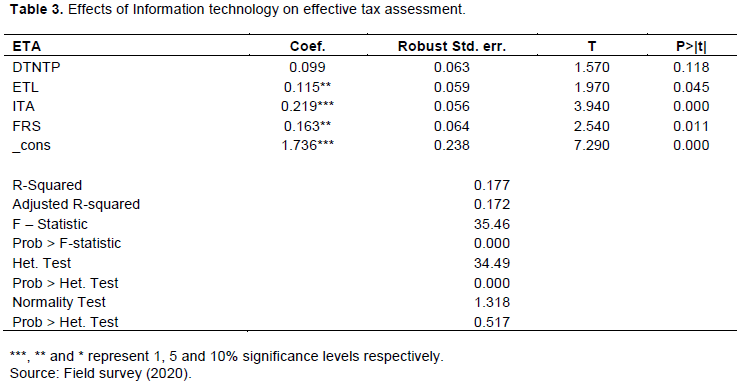

Other diagnostics

To ensure validity, post estimation tests were carried out. From the result of Breusch-Pagan / Cook-Weisberg test for heteroskedasticity and Jarque-Bera normality test for normality in the lower portion of Table 3, the P-value of Jarque-Bera normality test for normality is insignificant at 5% alpha level (P -value = 0.517) suggesting that the error term (residual) of the estimated regression model is distributed normally as expected. Furthermore, the P-value of Breusch-Pagan / Cook-Weisberg test for heteroskedasticity is 0.000 which is below 0.010, depicting statistically significant value at 5% significance level. This strongly suggests that the null hypothesis of homoscedasticity should not be accepted. Thus, the study concludes that the error term of the estimated regression model suffers from heteroskedasticity problem and this explains why heteroskedasticity robust Standard Error regression model is used.

From the result, the coefficients of digital tax net of taxpayers, enabling tax laws, information technology acquisition and financial resources support are positively signed and are consistent with the a priori expectations (β1= 0.099; β2=0.115 ; β3 = 0.219; β4 = 0.163) > 0. Typically, the value of F-statistics in Table 3 stands at 35.46 [P - value = 0.000]; it signifies that the explanatory variables in our model are jointly statistically significant at 5% level in explaining variances in Effective Tax Assessment (ETA). Also, the results show that Digital Tax Net of Taxpayers (DTNTP), Enabling Tax Laws (ETL), Information Technology Acquisition (ITA) and Financial Resource Support (FRS) jointly explained about 17.2% (Adjusted R-squared = 0.172) of changes in Effective Tax Assessment (ETA). Focusing on the estimated coefficients of Digital Tax Net of Taxpayers (DTNTP), Enabling Tax Laws (ETL), Information Technology Acquisition (ITA) and FRS, the result shows that Digital Tax Net of Taxpayers (DTNTP) has a positive coefficient that is statistically insignificant at 5% level (β1 = 0.099, P – value = 0.118). This indicates that DTNTP is not found to be a determinant of ETA.

However, the estimated coefficient of ETL [β2 = 0.115, P – value = 0.045] is found to be positively and significantly related to ETA at 5% alpha level. This means that ETA is caused to increase by 0.115 units given a unit increase in ETL. For ITA [β3 = 0.219, P – value = 0.000], this estimated parameter (coefficient) shows that positive and statistically significant relationship exists between ITA and EAT at 5% alpha level. This infers that 0.219 unit increase in ETA is reached when there is a unit increase in ITA. Similar to the estimated coefficients of ETL and ITA, the estimated coefficient of FRS [β4 = 0.163, P – value = 0.011] shows a positive and statistically significant relationship at 5% alpha level. This suggests that 0.163 unit increase in ETA is recorded when there is a unit increase FRS.

Based on the results obtained from the regression analysis, at a significance level of 0.05, F-Statistic is 35.46; while the P-value of the F-Statistics is 0.000, which is less than 0.05. Consequently, the study rejected the null hypothesis and accepted the alternative, which means that digitalization had a positive statistical significant effect on effective tax assessment in Nigeria. This finding is consistent with the study of Enahoro and Olabisi (2012) who investigated tax administration and its effectiveness in Lagos State. In carrying out this investigation, the study explored the use of survey research design, making use of self-structured questionnaire administered to some selected respondents. Basically, the study was interested in ascertaining the level of accurate tax assessment, collection, and remittances by the tax authorities on behalf of Lagos State government. The study found positive significant relationship between tax administration, tax policies and tax laws. Above all, the study found information technology having a positive and statistical significant effect on professional competence.

Similarly the study of Asaolu et al. (2015) on the effect of tax administrative and tax reform on tax revenue generation in Lagos State of Nigeria, found a long run relationship between tax reforms and tax efficiency and tax revenue generation in Lagos State possibly attributed to incompetence. The study also revealed that the tax reforms had a positive significant effect on the revenue generation structure of Lagos State. The studies of Asaolu et al. (2015) and Theobald (2018) had some similarities with the findings of this study. Both studies were found to be consistent with the result obtained in the analysis of the effect of information technology on effective tax assessment in Nigeria. The results reveal that each of digital tax net of taxpayers, enabling tax laws, information technology acquisition and financial resources support exhibited a positive significant effect on effective tax assessment. Therefore, the study result implied that digitalization had a positive and statistical significant effect on effective tax assessment in Nigeria.

In an effort to carry out the objective of this study, the study investigated the effect of information technology on effective tax assessment in Nigeria. The descriptive analysis effected centered on frequency, percentage, mean and standard deviation. Under this, all sections of the research instrument were considered. The responses of the respondents to all questions were analyzed and the results were presented. Diagnostics tests of correlation matrix, Breusch-Pagan / Cook-Weisberg test for heteroskedasticity and Jarque-Bera normality test for normality were carried out. The results revealed that efficient tax administration improved with effective tax assessment in Nigeria’ {Average Score = 4.36}; it is on the high side and it is ranked 1, unlike the statement that says ‘Effective tax assessment can be achieved when digital tax net of taxpayers is put in place in Nigeria’ {Average Score = 4.06}; it has the least average score. This is preceded by the statement which says ‘Introduction of information technology will bring about effective tax assessment in Nigeria’ {Average Score = 4.18). Additionally, the inferential and regression analysis results revealed that each of digital tax net of taxpayers, enabling tax laws, information technology acquisition and financial resources support exhibited a positive significant effect on effective tax assessment. Therefore, the study result implied that information technology had a positive and statistical significant effect on effective tax assessment in Nigeria.

It is recommended that the government should provide the essential facilities of enabling tax laws, as well as simplify some ambiguities and complexities in some of the existing tax laws in Nigeria. It should provide enabling regulatory and legal framework to reduce tax evasion; it should provide taxpayers’ tax identification number for all taxpayers, and also ensure the provision of appropriate information technology to enable both taxpayers and tax administrators to comply with the digital tax processing and brace up with the rest of the world in the new digital age.

CONTRIBUTION TO KNOWLEDGE

Vast studies have considered effective tax assessment; however fewer of these studies have studied the effect of information technology on effective tax assessment in the Nigerian emerging literature. In addressing this gap, this study had contributed in highlighting the importance of information technology and its many benefits of ease filing of tax returns, ease registration, ease of payment of tax and effective tax assessment. Like in many digitalized environment, taxpayers are favorably disposed to information technology of tax administration in Nigeria. The policy makers can now understand the importance of enabling tax laws and simplification of same to motivate tax compliance in Nigeria.

While the study had made significant contribution to knowledge, there were some limitations as the study cannot claim to have covered all issues on digitalization or tax administration in Nigeria. Like in most prior empirical studies, this research has some limitations; this does not invalidate the relevance of the findings. However, the findings from this study should be used to the extent of the following limitations: The findings of this research are applicable only to tax administration as it affects tax administration in Nigeria. However, the specific tax and the level of compliance that could arise from this study were not covered. Also the findings could only be useful for tax related matters hence it may not be effective to be used in making policies and decisions for others non- related tax issues. The study is also limited to geographical location of Nigeria and had some time constraints. One major limitation was inability to synthesize elaborately using prior studies, as there are sincerely paucity of literature on this topic to enable the researchers align the consistence of the findings with previous findings.

However, the researchers confronted and surmounted the challenges pragmatically, to ensure that the reliability and accurate data are maintained in this study. To the best knowledge of the researchers, the expected standards, quality and validity of the study were not compromised. In the research, five variables were used to measure the dependent variable and four for the independent variable. There are other variables apart from the variables used in the study that could equally be used to proxy both tax administration and digitalization in Nigeria. Therefore, it would be interesting to see future studies exploring other indicators to re-investigate the relationship and effects of digitalization on tax administration in Nigeria. Furthermore, the study could be extended to study the effect of digitalization on other administrations in Nigeria rather than only on tax administration. Given the dynamism of tax administration in Nigeria, it is imperative that study of this nature is repeated periodically and to capture the changes in the environment; considering the complications in tax laws and behavioral attitude of taxpayers, the ability to investigate them and the perceptions of taxpayers could enhance tax compliance.

The authors have not declared any conflict of interests.

REFERENCES

|

Abdullahi HGD (2012). Tax administration in Kano State: Problems and prospect. International Journal of Arts and Commerce 1(3):1-6.

|

|

|

|

Abiola J, Asiweh M (2012). Impact of tax administration on government revenue in a developing economy: A case study of Nigeria. International Journal of Business and Social Science 3(8):99-113.

|

|

|

|

|

Abogan OP, Akinola EB, Baruwa OI (2014) non-oil export and economic growth in Nigeria (1980-2011). Journal of Research in Economics and International Finance 3(2):1-11.

|

|

|

|

|

Animasaun R (2016). Tax administration and revenue generation: A perspective of Ogun State Internal Revenue Service. International Journal of Innovative Finance and Economics Research 5(1):11-21.

|

|

|

|

|

Asaolu T, Dopemu G, Monday T (2015). Studied the effect of tax administrative and tax reform on tax revenue generation in Lagos State of Nigeria. Journal of Management Policy 2(2):98-119.

|

|

|

|

|

Ayodeji OE (2016). Impact of ICT on tax administration in Nigeria Computer Engineering and Intelligent Systems 5(8):26-29.

|

|

|

|

|

Chijioke N, Leonard I, Bossco E, Henry C (2018). Impact of e-taxation on Nigeria's revenue and economic growth: a pre - post analysis. International Journal of Finance and Accounting 7(2):19-26.

|

|

|

|

|

Dimitropoulou C, Govind S, Turcan L (2018). Applying Modern, Disruptive Technologies to Improve the Effectiveness of Tax Treaty Dispute Resolution. Intertax 46(11):856-872.

|

|

|

|

|

Edori DS, Edori IS, Idatoru AR (2017). Tax issues and challenges inherent in the Nigerian tax system. American Journal of Management Science and Engineering 2(4):52-57.

Crossref

|

|

|

|

|

Enahoro J, Olabisi J (2012). Tax administration and revenue generation of Lagos state government, Nigeria. Research Journal of Finance and Accounting 3(5):133-139.

|

|

|

|

|

Ganyam AI, Ivungu JA, Anongo ET (2019). . Effect of tax administration on revenue generation in Nigeria: Evidence from Benue State tax administration (2015-2018). International Journal of Economics, Commerce and Management 7(7):394-414.

|

|

|

|

|

Gurama Z, Mansor M (2015). Tax administration problems and prospect: A case of Gombe State. International Journal of Arts and Commerce 4(4):187-196

|

|

|

|

|

Ifere E, Eko E (2014). Tax innovation, administration and revenue generation in Nigeria: Case of Cross River State. International Journal of Economics and Management Engineering 8(5):1603-1609.

|

|

|

|

|

Ishola KA (2019). Taxation principles and fiscal policy in Nigeria. (2nd Ed). Kastas Publishers Nigeria Limited, Ilorin Nigeria.

|

|

|

|

|

Isiadinso O, Omoju E (2019). Taxation of Nigerian' digital economy: Challenges and proposals. Andersen Tax Review 2(2):1-5.

|

|

|

|

|

Juswanto W, Simms R (2017). Fair taxation in the digital economy, ABD Institute, Policy Brief No.5,

View Retrieved on 10/09/2019.

|

|

|

|

|

Leyira CM, Chukwuma E, Umobong AA (2017). Tax system in Nigeria challenges and the way forward. Research Journal of Finance and Accounting 3(5):9-15.

|

|

|

|

|

Lipniewicz R (2017). Tax administration and risk management in the digital age. Information System in Management 6(1):26-37.

Crossref

|

|

|

|

|

Obe PA (2019). Digitalisation of tax: International perspectives. Institute of Chartered Accountant of England and Wales Journal Review 1(1):1-12.

|

|

|

|

|

Odusola A (2016). Tax policy reforms in Nigeria- research paper No 2006/3, United Nations University-World Institute for Development. Economics Research 2(1):123-136.

|

|

|

|

|

Olaoye SA, Aguguom TA (2018). Tax incentives as a catalyst of tax compliance for tax revenue and economic development: Empirical evidence from Nigerian. European Journal of Accounting, Finance and Investment 1(8):001-014.

|

|

|

|

|

Oluyombo OO, Olayinka OM (2018). Tax compliance and government revenue growthin Nigeria. Lapai International Journal of Administration 1(2):245-253.

|

|

|

|

|

Organization for Economic Co-operation and Development-OECD (2015). E-government for Better Government. Paris: OECD.

|

|

|

|

|

Perrou K (2018). The Ombudsman and the process of resolution of international tax disputes - protecting the "invisible party" to the MAP. World Tax Journal 1(1):99-129.

|

|

|

|

|

Price Waterhouse Coopers (2010). Nigeria @ 50: Top 50 tax issues. Available at:

View Retrieved: 12/9/2019

|

|

|

|

|

Rogers EM (1995). Diffusion of Innovations. (4th edition). The Free Press, New York.

|

|

|

|

|

Santiego-Diaz-De SM (2018). Taxation, information technology of the economy and digital economy Inter-American Center of tax administrations. Tax Studies Research Working Papers 1(1):22-29.

|

|

|

|

|

Sanni S (2019). Nigeria: Basic principles of taxation.

View. Retrieved 11/12/2019

|

|

|

|

|

Salami GO, Apelogun KH, Omidiya OM, Ojoye OF (2015). Taxation and Nigerian economic growth process. Research Journal of Finance and Accounting 10(6):93-101.

|

|

|

|

|

Soetan T (2017). Tax administration and tax revenue generation in Nigeria: taxpayers perspective. International Journal of Latest Engineering and Management Research 2(10):38-47.

|

|

|

|

|

Sunday B, Okosun SE, Giamporcaro S (2017). The appraisal of taxation as a source of revenue to Lagos State Board of Internal Revenue (A case of Lagos State, Nigeria). Research Journal of Finance and Accounting 8(23):46-54.

|

|

|

|

|

Theobald F (2018). Impact of tax administration towards government revenue in Tanzania: Case of Dar-es Salaam region. Journal of Social Sciences 7(1):13-21.

Crossref

|

|

|

|

|

Thomas K (2014). IRS finds U.S. tax evasion $385 billion per year, suggesting tax justice network numbers are right. Middle Class Economist.

|

|

|

|

|

Warren N (2018). Estimating tax gap is everything to an informed response to the digital era. e-Journal of Tax Research 16(3):536-577.

Crossref

|

|