Full Length Research Paper

ABSTRACT

The economic development of any nation is largely dependent on the stability of the nation’s banking industry, because the industry promotes the savings culture of the public, aids capital funding, implements the monetary policy of a country and promotes the facilitation of international trade. Therefore this study examined the effect of bank size on the financial performance of listed Deposit Money Banks in Nigeria (DMBN). Also, the study examined the moderating effect of internal control adequacy on the relationship between bank size and financial performance. The study adopted an ex-post facto research design because secondary data were extracted from published annual reports of 10 DMB in Nigeria, for a period of 12 years from 2006 to 2017. The data were analyzed using descriptive and inferential statistics (multiple regression analysis). Results from the analysis showed that the proxies of bank size (total assets, number of employees and customers’ deposit) had a cumulative effect on return on asset for financial performance. Also, internal control adequacy as a moderating variable enhanced the effect of bank size on financial performance. Hence, the study concluded that, total asset, number of employees ad customer’s deposit as proxies for bank size had a combined effect on financial performance.

Key words: Bank size, financial performance, Deposit Money Banks in Nigeria (DMBN), internal control.

INTRODUCTION

The economic growth of any nation is largely dependent on the stability of the nation’s banking industry, because the industry promotes the savings culture of the public, aids capital funding, implements the monetary policy of a country and promotes the facilitation of international trade (Selznick, 1952). Hence, the financial performance of the banking sector is considered as one of the catalysts driving the economic development of a nation. Thus, financial performance can be referred to as a measure of a firm’s general financial status, using key financial metrics like return on asset, return on equity and other financial ratios criterion, primarily derived from the statement of financial position, statement of comprehensive income and the cash-flow statement (Adam, 2014). Some studies posit that the size of a bank is a major determinant of its financial stability (Salim, 2012; Muhindi and Ngaba, 2018). And the size of the bank has been depicted by various studies using total assets, customers’ deposit, number of branches and number of employees (Varotto and Zhao, 2018; Kasman and Kasman, 2016).

Furthermore, it is important to note that the banking industry is one of the most regulated industries in the economy of any country. Despite the fact the banking industry is one of the most regulated industries in Nigeria and all over the world, there are still recorded cases of bank distress, money laundering and mismanagement and the persistent bank failures over the past decades has heightened questions on the adequacy of the auditing practices and corporate governance practices; for instance, the financial sector scandals account for over 50% of the recorded fraud cases in Nigeria and these fraud cases have similar contextual issue of concealing huge non-performing loans (Akintoye, 2019).

In particular, the case of Oceanic Bank of Nigeria where it was discovered that the managing director approved a huge sum of N747 billion loans to family members (Okaro, 2015). The most recent bank fraud case in Nigeria is that of Skye Bank where the chairman of the bank owed the bank a huge sum of N102 billion for many years (Akintoye, 2019; Okaro et al., 2013).

As a result of the aforementioned challenges in the banking industry, regulators and other stakeholders of the industry are questioning the financial stability of the industry and prior studies (Abubakar et al,, 2018) on the banking industry attempted to investigate the reasons banks are facing challenges, ranging from examining the determinants of financial performance of banks to studying the effect of bank characteristics, corporate governance on the financial performance of banks. Thus, based on the above submission, this study examined the relationship between bank size and financial performance. Similarly, the study also examined moderating effect of internal control adequacy on the relationship between bank size and financial performance.

Finally, the major contribution of this study to the body of literature is the ascertainment of the moderating effect of internal control adequacy on the relationship between bank size and financial performance. It is considered for this study because internal control is the medium through which an organization’s assets, valuables, properties are utilized, controlled, documented and quantified and it performs an essential role in the detection, prevention and protection of the organizations’ resources physically and financially (Rezaee, 2005). Hence the financial performance of the bank is largely dependent on the strength of the internal control system, regardless of the size of the bank.

LITERATURE REVIEW

Resource based theory

According to the resource based theory, organizations that have strategic resources have a competitive advantage over other organizations (Barney, 1991).

Hence, strategic resources are characterized by certain attributes which include the possession of key or important resources that could improve an organization’s effectiveness, while repelling threats to the growth of the organization. It also includes resources that cannot be imitated by their competitors which are referred to as non-substitutable resources or limited resources.

One major criticism of this theory is that, it only lays emphasis on the competitive advantage of an organization rather than the going concern of the organization (Kachumbo, 2020). However, this theory underpins this study because bank characteristics are resources used by banks to achieve their financial and non-financial objectives. For instance, a bank with the largest customer base will have a competitive advantage over its contemporaries.

Empirical framework

Bank size and financial performance

Prior studies on financial performance of banks indicate that there are numerous determinants of financial performance, ranging from banks’ specific variables to macro-economic variables. Thus, this study only focused on bank specific attributes like size and also reviewed extant literatures in that regard.

Most studies on the impact of size on the financial performance of banks operationalized bank size using metrics like total assets, number of employees, number of customers, number of branches, customers’ deposit and capital base (Nyabaga and Wepukhulu, 2020; Kachumbo, 2020). But this study only considered total assets, number of employees and customers’ deposit as a measure of bank size. Also, prior studies (Aladwann, 2015; Jaouad and Lahsen, 2018) operationalized financial performance using proxies like ROA, ROE. This study only used ROA as a proxy for financial performance. Thus, the literature review is based on bank size and financial performance of banks.

Mwangi, Makau and Kosimbei (2014) ascertained the effect of bank size (total asset) on the financial performance of commercial banks in Kenya using the panel data of 43 banks from 2007 to 2016. The results from the study showed that total assets had a positive effect on ROA and ROE. The study also found out that, the bigger the size of the bank, the higher is its financial performance.

Similarly, Raza et al. (2019) examined the relationship between bank specific attributes (asset size, customers’ deposit, loan to customers, capital adequacy) and the profitability of banks. The results from the analysis of data indicate that asset size had an inverse relationship with profitability, while customers’ deposit does not have any significant influence on profitability of banks in Pakistan.

On the other hand, Al-Homaidi et al. (2018) examined the impact of bank specific factors on the profitability of 60 Indian banks using the panel data analysis approach. The findings reveal that bank size represented by asset size and customers’ deposit had a positive impact on profitability measured by ROA and ROE.

Additionally, Kachumbo (2020) examined the determinants of financial performance of commercial Fintech banks in Kenya using capital adequacy ratio, customer size and size of loan advance given to customers as proxies of the independent variable and return on equity as proxy for the dependent variable, using panel data analysis. The result from the analysis indicates that capital adequacy and customer size have a negative and significant relationship with financial performance.

Furthermore, Nyabaga and Wepukhulu (2020) examined the influence of firms’ characteristics on the financial performance of quoted banks in Kenya. The result from the study using regression analysis indicates that capital adequacy and bank size have a positive significant effect on return on equity and return on asset. While, asset adequacy has negative effect on return on equity and return on asset.

Also, Alfadhli and AlAli (2021) examined the influence of bank size on the financial performance of banks in Kuwait. The analysis from the study reveals that, number of employees, number of branches owned by the bank and customer’s deposit have an inverse relationship with financial performance, while, shareholder’s equity had a positive relationship with financial performance.

Internal control as a moderating variable

Another main objective of this study was to examine the moderating effect of internal control on the relationship between bank size and financial performance. Although, a lot of studies considered internal control as an independent variable; for instance, Asiligwa and Rennox (2017) ascertained the impact of internal control on the financial performance of banks in Kenya, using regression analysis to analyze the primary data collected for this study. The findings from the study reveal that internal control had a great impact on the banking industry.

Also, Rapani and Malim (2020) examined the correlation between internal control coefficients and the financial performance of banks in Iraq using a literature review approach. The study compared and summarized papers in reputable journals from year 2013 to 2019. The analysis of the papers reveals that the internal control systems of banks in Iraq are weak when compared with banks in developing countries. The study also found out that, there is a significant association between internal control and the financial performance of banks based on the results of extant studies.

Umar and Dikko (2018) studied the effect of internal control on performance of commercial banks in Nigeria by administering 382 questionnaires to staffs working in these banks. The result from the survey indicates that there is a positive and significant relationship between internal control and financial performance of banks.

MATERIALS AND METHODS

The research design for this study is Ex-post facto research design which lays emphasis on the use of historical data to predict current behavior of the variables considered for this study. The population of this study is listed Deposit Money Banks in Nigeria, which are 17 in total. However, 10 Deposit Money Banks were purposively used for this study due to the availability of data and they are, Zenith bank, Access bank, first bank, FCMB, Fidelity bank, Guaranty trust bank, sterling bank, Unity bank, union bank and Wema bank. The data was analyzed using multiple regression analysis.

Model specification

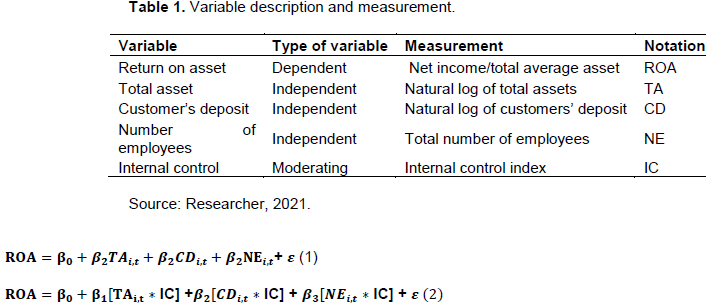

There are two model specifications for this study; model 1 shows the basic relationship between bank size and financial performance. While, model 2 indicates the following (Table 1).

DATA ANALYSIS AND INTERPRETATION

In examining the moderating effect of internal control on the relationship between bank size and financial performance, this study employs multiple regression analysis to test the annual data from 10 commercial banks in Nigeria, and the results are presented in this section. The method adopted also explores the relationship between variables of financial performance and bank size. Furthermore, the moderating effect was analyzed with moderated regression analysis. The independent variables are total asset, customers’ deposits, and the number of employees while internal control is the moderating variable and the dependent variable is ROA. To describe the characteristics of each variable, descriptive statistic was used and the multicollinearity of the model was checked using VIF while the heteroskedasticity was examined using the Breusch-Pagan and Cook-Weisberg test. The results are presented and discussed in this section.

Descriptive statistics

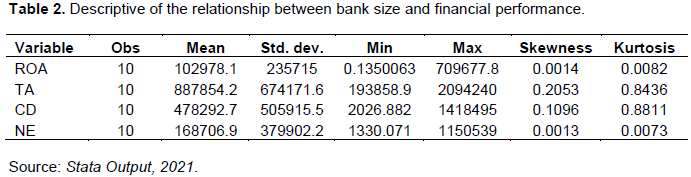

The Skewness, Kurtosis, Minimum, Maximum, Mean, and Standard deviation of all the variables (Return on Asset-ROA, Total Asset-TA, Customers’ Deposit-CD, Number of Employees-NE, and Internal control-IC) of this study were examined. The measures of central tendency, measures of variances, and measures of the normality of the model were illustrated by the descriptive statistics in carrying out the study (Table 2). The standard deviation of return on asset is 235715. It shows the dispersion of ROA for each bank from the sample average. This might be because this study compressed the 12 years’ data of each bank to one by finding the average of each variable. Also, the minimum ROA for the 10 banks is 0.1350063 while the maximum is 709677.8. ROA has a mean value of 102978.1.

In addition, kurtosis in finance is used as a tool to measure financial risk. For investment, high risk is associated with a large kurtosis because it shows high probabilities of extremely small and extremely large returns. A small kurtosis, on the other hand, signals a level of risk that is moderate because there is a relatively low probability of extreme returns. 0.0082 is the value of the kurtosis which is a reflection of the peak of ROA. This indicates that return on asset is platykurtic. This also shows that the mean value of return on asset is greater than the ROA of most of the banks. Thus, it reveals the small outliers in a distribution which means it has a lower tail.

Additionally, the coefficient of Skewness is 0.0014 which indicates that ROA is positively skewed, near zero, and has long right tails. The average value of the total asset is 887854.2 with a deviation of 674171.6 from both sides of the mean. These indicate that from the mean, there is a wide dispersion of the data since the standard deviation is higher than the mean value. Total asset ranges from 193858.9 (minimum) and 2094240 (maximum); the value of the kurtosis is 0.8436. This indicates the peak of total asset and implies the total asset satisfied the assumption of normal distribution. This further suggests that most of the values of the total asset are bigger than the mean value. The coefficient of Skewness is 0.2053 indicating that the total asset is near zero and positively skewed.

The standard deviation of customers’ deposit is 505915.5; it is very large and shows the dispersion of customers’ deposits for each bank from the sample average. Also, the minimum of customers’ deposit for the 10 banks is 2026.882 while the maximum is 1418495. Similarly, customers’ deposit has a mean value of 47829 and 2.7 0.8811 is the value of the kurtosis which is a reflection of the peak of customers’ deposit. This indicates that customers’ deposit is platykurtic. This also indicates that the mean value of customers’ deposit is greater than the customers’ deposit of most of the banks. Thus, it reveals the small outliers in a distribution which means it has a lower tail. The coefficient of Skewness is 0.1096 which indicates that customers’ deposit is positively skewed, near zero, and has long right tails.

The average value of the number of employees is 168706.9 with a deviation of 379902.2 from both sides of the mean. These indicate that from the mean, there is a wide dispersion of the data since the standard deviation is higher than the mean value. The number of employees ranges from 1330.071 (minimum) and 1150539 (maximum); the value of the kurtosis is 0.0073. This indicates the peak of the number of employees and it implies the number of employees conform to platykurtic distribution. Thus, this further suggests that most of the values of number of employees are bigger than the mean value. The coefficient of Skewness is 0.0013 indicating that the number of employees is near zero and positively skewed.

Correlation matrix

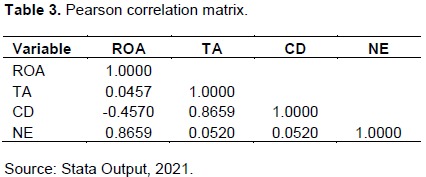

Table 3 presents the relationship between bank size and financial performance variables. The values were extracted from the Pearson correlation of two-tailed significance carried out with Stata.

The extent of association between bank size and financial performance is presented in Table 3. The financial performance is represented by return on asset and bank size is represented by total asset, customers’ deposit, and the number of employees. The results show that the relationship between return on asset and total asset is positive although weak as indicated in Table 3. This implies that when the total asset increases, the return on asset increases. The relationship between return on asset and customers’ deposit is negative and strong. This shows that as the customers’ deposit increases the return on asset decreases, and the relationship between return on asset and number of employees is positive and very strong as indicated in Table 3. This implies that, as the number of employees increases, the return on asset increases.

Multiple regression analysis

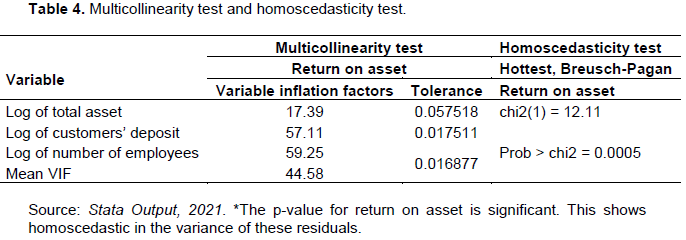

The econometric analysis is employed to carry out this study. According to the objectives of this research, two equations were used for this study; one equation shows the relationship between bank size and financial performance, and the second equation shows the moderating effect of internal control on the relationship between bank size and financial performance. +Ordinary Least Squares (OLS) were used to estimate the two main estimations. To perform the OLS, the multicollinearity and homoscedasticity were examined using Variable Inflation Factors and Hottest, Breusch-Pagan. The results are presented in Table 4.

The result of tolerance and variable inflation factors values were more than 0.10 and less than 10 respectively as presented in Table 4. It can be inferred that there is a problem of multicollinearity among independent variables. To test the homoscedasticity (equal variance of the dependent variable), CookWeisberg or Breusch-Pagan test was used (Breusch and Pagan, 1979) as presented in Table 4. The results show that there is a problem of Heteroscedasticity of the independent variable. Before ordinary least squares regression is used to regress the model, the model was corrected, and the problem of heteroskedasticity was resolved with the use of robust standard estimates (Hoechle, 2007). The multicollinearity problem might be aggravated by the low sample size and corrected by producing orthogonal (uncorrelated) independent variables.

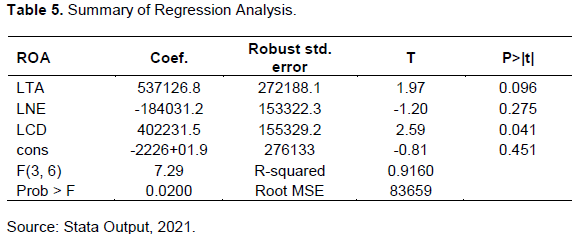

The relationship between bank size and financial performance

The regression analysis of the impact of bank size and financial performance shows that the coefficient of determination (R-squared) is 0.9160. This reveals that 91.60 percent of the systematic variation of the return on asset of Nigerian banks is accounted for by the number of employees, customers’ deposit, and total asset. The F-tabulated of 4.75706266 is less than F-statistic (7.29). This indicates that the study's model is well fitted, and affirms the cumulative effect of bank size on financial performance. The 0.0200 P-value is smaller than 0.05 and this further establishes that the relationship between bank size (Total Asset, Customers’ Deposit, and Number of Employees) and financial performance (Return on Asset) of the banks understudied is significant.

The t-value for total asset measured by the natural log of total asset is 1.97, with a P-value of 0.096 and coefficient value of 537126.8. Comparing the t-value (1.97) with the t-tabulated (2.22813885), it shows that total asset has a positive relationship with return on asset but not statistically significant in this study as presented in Table 5. The study result aligns with the results of Mwangi et al. (2018) and Al-Homaidi et al. (2018), who found a positive relationship between total assets and financial performance. On the contrary, Raza et al. (2019) found a negative relationship between total assets and financial performance.

The t-value of the number of employees is -1.20, with a P-value of 0.275 and a coefficient value of -184031.2 while the t-tabulated is 2.22813885. This implies that the number of employees has an insignificant and negative effect on the return on asset of the 10 Nigerian banks used in this study. The result of this study in this regard conforms to the result of AlFadhli and AlAli (2021), which indicates that there is an inverse relationship between non-audit services and financial performance.

In estimating the individual impact of each variable on return on asset, the t-value for customers’ deposit measured by the natural log of customers’ deposit is -2.59 with a P-value of 0.041 and coefficient value of 402231.5. Comparing the t-value (0.041) with the t-tabulated (2.22813885) shows that customers’ deposit has a positive and significant effect on the return on asset of the 10 Nigerian banks used in this study. On the contrary, AlFadhli and AlAli (2021) found a negative relationship between customer’s deposit and financial performance. Thus, based on the result of this study and other extant studies result (Al-Hoamidi et al., 2018), there is a positive and significant relationship between customers’ deposit and financial performance.

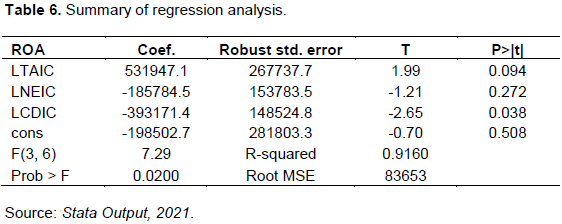

The moderating effect of internal control on the relationship between bank size and financial performance

Establishing the impact of internal control on the relationship between bank size and financial performance is the main objective of this study. Internal control was used to moderate each of the independent variables to give a composite (interaction term). Table 6 presents the results of the regression model after moderation.

The coefficient of determination (R-squared) of internal control on the relationship between bank size and financial performance after moderation remains 0.9160. This indicates that internal control does not influence the financial performance of Nigerian banks.

However, the overall P-value is 0.0200 which is less than 0.05. This implies that the relationship between bank size and financial performance is significant. This finding is supported by the F-statistic value of 7.29 which is greater than the F-tabulated of 4.75706266.

Also, the interaction results of the regression of total asset and internal control on return on asset show that the moderating effect of internal control on total asset is insignificant and positive as the regression results show that t-value is 1.99 less than the t-tabulated which is 2.22813885. This is further supported by the P-value (0.094). The coefficient value is 531947.1. This shows a slight effect of internal control on the total asset of the 10 Nigerian banks used in this study as presented in Table 6.

The t-value for the interaction between the number of employees and internal control is -1.21 with a P-value of 0.272 and a coefficient value of -185784.5. Comparing the t-value (-1.21) with the t-tabulated (2.22813885) shows that the interaction between the number of employees and internal control is not statistically significant to return on asset of the 10 Nigerian banks understudied in this study. These results show a slight effect of internal control on the number of employees of the 10 Nigerian banks. And in estimating the moderating effect of internal control on the individual independent variable, the t-value for the interaction between customers’ deposit and internal control as measured by the natural log of the interaction between customers’ deposit and internal control is -2.65 with a P-value of 0.038 and coefficient value of --393171.4. Comparing the t-value (-2.65) with the t-tabulated (2.22813885) shows that the interaction between customers’ deposit and internal control has a negative and significant effect on return on asset of the 10 Nigerian banks used in this study. This implies that internal control has a moderating effect on customers’ deposits.

Finally, most studies did not consider the moderating effect of internal control on the relationship between bank size and financial performance. The findings of this study attest that internal control has the capacity of enhancing the relationship between bank size (Total assets, number of employees and customers’ deposit) Other researchers whose topics are partly close to this subject matter affirm that a sound internal control mechanism is able to influence the impact of internal control on the financial performance of Deposit Money Banks (Asiligwa and Rennox, 2017; Rapani and Malim, 2020; Umar and Dikko, 2018). Hence, internal control mechanisms can strengthen the relationship between bank size and financial performance.

CONCLUSIONS AND RECOMMENDATIONS

From the above analysis, it is glaring that customers’ deposit drives the financial performance of Deposit Money Banks in Nigeria, since there is a positive relationship between customers’ deposit and return on asset. Also, the analysis revealed the importance of the moderating variable, especially its enhancing effect on the individual proxy of bank size. Thus, it is recommended that banks should offer products that will encourage savings and financial inclusion as this will increase the capacity of banks to give out loans to investors, thereby increasing their financial performance.

Lastly, it is pertinent for the banking sector to strengthen the internal control system of the industry, because the “too big to fail” notion might not hold if the internal control system is grossly weak.

Limitations and recommendations for future research

This study used the data of 10 Deposit Money Banks in Nigeria with national and international authorization, but future studies can consider all the listed Deposit money banks in Nigeria including those with regional authorization.

Also, the study used one measure of financial performance to capture the dependent variable which is Return on Asset (ROA). Other future studies can include financial performance metrics like return on equity, total asset turnover and debt to equity ratio.

In conclusion, this study used only one moderating variable which is internal control adequacy and the result showed that the moderating variable had a cumulative effect and not individual effect on the relationship between bank size and financial performance. Hence, other future studies can consider corporate governance as a moderating variable, just to determine if it has the capability of enhancing the relationship between bank size and financial performance.

CONFLICT OF INTERESTS

The author has not declared any conflict of interest.

REFERENCES

|

Abubakar A, Sulaiman I, Haruna U (2018). Effect of firms characteristics on financial performance of listed insurance companies in Nigeria. African Journal of History and Archaeology 3(1):1-9. |

|

|

Adam MHM (2014). Evaluating the Financial Performance of Banks using financial ratios-A case study of Erbil Bank for Investment and Finance. European Journal of Accounting Auditing and Finance Research 2(6):162-177. |

|

|

Akintoye IR (2019). Accounting: A Mismanaged Concept Requiring Urgent Re-definition. Babcock University Press. |

|

|

Aladwann MS (2015). The impact of bank size on profitability" an empirical study on listed Jordanian commercial banks". European Scientific Journal 11(34):217-236. |

|

|

AlFadhli MS, AlAli MS (2021). The Effect of Bank Size on Financial Performance: A Case Study on Kuwaiti Banks. Journal of Insurance and Financial Management 4(3):11-15. |

|

|

Al-Homaidi EA, Tabash MI, Farhan NH, Almaqtari FA (2018). Bank-specific and macro-economic determinants of profitability of Indian commercial banks: A panel data approach. Cogent Economics and Finance 6(1):1548072. |

|

|

Breusch TS, Pagan AR (1979). A simple test for heteroscedasticity and random coefficient variation. Econometrica: Journal of the Econometric Society 47(5):1287-1294. |

|

|

Asiligwa M, Rennox G (2017). The Effect of internal controls on the financial performance of commercial banks in Kenya. Journal of Economics and Finance 8(3):92-105. |

|

|

Barney JB (1991). Firm resources and sustained competitive advantage. Journal of Management 17(1):99-120. |

|

|

Jaouad E, Lahsen O (2018). Factors affecting bank performance: empirical evidence from Morocco. European Scientific Journal 14(34):255-267. |

|

|

Kasman A, Kasman S (2016). Bank size, competition and risk in the Turkish banking industry. Empirica 43(3):607-631. |

|

|

Muhindi KA, Ngaba D (2018). Effect of firm size on financial performance on banks: Case of commercial banks in Kenya. International Academic Journal of Economics and Finance 3(1):175-190. |

|

|

Kachumbo E (2020). Determinants of financial performance of commercial bank Fintechs in Kenya (Doctoral dissertation, Strathmore University). |

|

|

Mwangi LW, Makau MS, Kosimbei G (2014). Relationship between capital structure and performance of non-financial companies listed in the Nairobi Securities Exchange, Kenya. Global Journal of Contemporary Research in Accounting, Auditing and Business Ethics 1(2):72-90. |

|

|

Nyabaga RMI, Wepukhulu JM (2020). Effect of Firm Characteristics on Financial Performance of Listed Commercial Banks in Kenya. International Journal of Economics and Financial Issues 10(3):255-262. |

|

|

Okaro SC, Okafor GO, Ofoegbu G (2013). Corporate fraud in Nigeria-A two case study. International Journal of Research in Management 6(1):9-17. |

|

|

Okaro CSO (2016). Financial Inclusion and Nigerian Economy (1990-2015). Journal of Policy and Development Studies 10(4):1-10. |

|

|

Rezaee Z (2005). Causes, consequences, and deterence of financial statement fraud. Critical Perspectives on Accounting 16(3):277-298 |

|

|

Rapani NHA, Malim T (2020). The correlation between internal control components and the financial performance of iraqi banks a literature review. Jour of Advance Research in Dynamical and Control Systems 12(4):957-966. |

|

|

Raza H, Saeed A, Hena S (2019). Determinants of profitability in banking sector: An evidence from Pakistan. European Scientific Journal 15(7):35-48. |

|

|

Salim SB (2012). The relationship between size and financial performance of commercial banks in Kenya (Doctoral dissertation, University of Nairobi). |

|

|

Selznick (1952). The organizational weapon, New York, Nyi McGraw-Hill 8:350. |

|

|

Umar H, Dikko MU (2018). The effect of internal control on performance of commercial banks in Nigeria. International Journal of Management Research 8(6):13-32. |

|

|

Varotto S, Zhao L (2018). Systemic risk and bank size. Journal of International Money and Finance 82(1):45-70. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0