ABSTRACT

The study aims to identify the impact of value-added tax (VAT) on Saudi banks, through measuring the impact of changes in the banks before and after the implementation of Value Added Tax (VAT), in all of total assets, total liabilities, customer deposits, retained earnings, total operating income, total operating expenses and net operating income. The study targeted the fourth quarter of 2017 (before the implementation of VAT), and the first and second quarters of 2018 (after the implementation of VAT). The study found that there is a slight decline in total assets, total liabilities, customer deposits and current accounts, in addition to a significant decline in retained earnings, total operating expenses after the implementation of VAT. On the other hand, the study found that there is a slight increase in the total income of operations and a significant increase in net operating income after the implementation of value-added tax. Moreover, the study found that there are no statistically significant differences between total assets, total liabilities, customer deposits, current accounts, total operating income, total operating expenses, net operating income before and after the implementation of value-added tax; while there are statistically significant differences between retained profits before and after VAT.

Key words: Commercial banks, value-added tax (VAT).

VAT is an indirect tax that first appeared in 1954 in France. Maurice Loretta is the one who proposed its concept and puts its main rules. It is a composite tax implemented on the difference between the cost and selling price of goods or services (Osaimy, 2018).

Value added tax was initially introduced to meet the increasing needs for revenues that could not be easily achieved by business taxes. There are many differences in the structure of VAT and the way of its implementation, but there is an international agreement on some of the main issues, such as making consumption the final base of this tax. In addition, it is characterized by a desirable feature which is the tax does exceed the productive potential limits of economy. The 1990s saw a high rate of dependence on VAT; as it is nearly adopted by all countries of economic transformation (which reflects its need to change its traditional revenue resources), and a large number of developing countries (Awad, 2012).

The Kingdom of Saudi Arabia has adopted the unified value added tax agreement of the Gulf Cooperation Council (GCC) under the Royal Decree No. (M / 51) dated 3/5/1438 (the unified agreement on value added tax). Based on the provisions of the agreement, the Kingdom issued the Value Added Tax (VAT) system as

well as the implementing regulations of the VAT system. VAT is considered as an indirect tax implemented on importing and supplying of goods and services at each stage of production and distribution, with some exceptions. VAT is implemented in more than 160 countries around the world. VAT can be defined as a consumption tax that is paid and collected at each stage of the supply chain, from the purchase of the raw material to the retailer's sale of the final product to the consumer, and other taxes.

The percentage of value added tax in the Kingdom of Saudi Arabia along with its partners (GCC countries) is 5%, which is the lowest percentage of value added tax in the world; whereas the rate of VAT in Australia is10%, in Egypt is 13%, in Turkey is 18%, while in Germany it is 19%, in Morocco, UK, France is 20%, and Italy is 22%.

Therefore, the study focused on examining the following question: Has Value Added Tax (VAT) implementation affected total assets, total liabilities, customer deposits (current accounts), retained earnings, the total operating income, the total operating expenses, net operating income? The study aims to identify the impact of Value-added tax (VAT) On Saudi banks, through measuring the impact of changes in the banks before and after the implementation of Value Added Tax (VAT), in all of total assets, total liabilities, customer deposits, retained earnings, total operating income, total operating expenses, net operating income.

In general, taxes are considered as an important tool in achieving the objectives of countries. It is not only one of the main sources of finance, but also it is an effective means of enabling the state to intervene in economic and social life. Sales tax or value added tax represents great importance as a result of the accession of a large number of countries to the World Trade Organization agreement that raise or reduce tariff barriers. That led to the reduction of customs collections in most of the organizations and moving towards sales tax or value added tax to compensate for shortfalls of customs tax (Awad, 2012). The importance of the study is highlighted in the lack of studies about value added tax in the Kingdom of Saudi Arabia, as VAT was just implemented in 2018.

VAT is a major source of revenue in most countries. It is implemented in 51 countries around the world. Its revenues represent more than 52% of global tax revenues. This tax constitutes about one quarter of the tax revenues and about 5% of the total Gross domestic product (GDP). Among 184 member states of the two international organizations (International Monetary Fund (IMF) and the World Bank), there are 118 implied VAT or sales tax (Ibrahim, 2015).

The adoption of VAT implementation as a condition of membership in the European Union has helped in spreading this tax in such countries (as well as non-member countries such as Norway and Switzerland), and has now been adopted in all OECD countries with the exception of the United States. Given the importance of taxation, countries strive to develop it in keeping with the global economic developments which impose integration into the economic system and the modernization of tax structures in the way of the adequacy of legislation and financial and tax regulations to become more compatible and integrated with the new world systems (Awad, 2012).

The study aims to tackle the need to amend the general sales tax to achieve maximum productivity and high economic efficiency. Through the extrapolation of tax systems in developed and advanced countries, where it was found that there is a marked tendency to depend on VAT, because it is characterized by achieving the maximum simplicity and tax neutrality in addition to the abundance of tax earnings. Tax burden also, is less than what is applicable in the form of general sales tax (Mohamed, 1999). The researcher found that VAT implementation would spare more revenue for the state at the lowest possible cost. In addition, Value Added Tax (VAT) system is characterized by the deduction system than other taxes on sales, which makes it neutral in tax and economic efficiency. Moreover, VAT implementation would contribute in improving the administrative efficiency of the tax system at large through coordination with the tax on commercial and industrial profits as well as coordination in the field of indirect taxation among States. VAT also helps in fighting fraud and ensuring effective control over the financiers, because of its high demand of submitting tax cards and invoices, which has helped in fighting tax evasion (Mohamed, 1999).

The study aims to examine the most important legislative problems that stand as an impediment to the process of VAT implementation in Egypt. The research was limited to the scope of general sales tax implementation to review the main obstacles that impede the implementation of value added tax in Egypt, and that is by accessing to legislative texts, previous studies, and scientific references in order to reach the ideal form of value added tax (Mehdi, 2013). The study reached a number of results that include: Tax deduction non-circulation in Egyptian law is one of the main obstacles to access the ideal form of VAT. In addition, the value added tax shall be a flat rate that is to be more simple and easy to implement. The tax examination according to the correct scientific methods is one of the most important steps to determine the correct tax base and to reduce the differences between the tax authority and financiers. One of the most important legislative problems that face tax assessor is the difficulty to define value added concept, and the lack of a fixed method of measuring the tax base, and the problem of treatment of capital assets when determining tax base (Mehdi, 2013).

Concept of VAT value added tax

Value added tax (VAT) is a general tax introduced on business activities that produce and distribute goods and services. Value added tax is introduced on consumption because it is ultimately paid by the consumer, although it is gathered by the importer, producer or distributor (Ibrahim, 2015). Value added tax can also be defined as Osaimy (2018):

Cumulative Tax: Because the customs duty paid on the imported goods as well as other taxes and duties will be included in VAT base.

Comprehensive tax: The implementation of the tax law at a uniform and one rate throughout the state (although some countries apply multiple ratios).

It is a tax that is based on the principle of territoriality tax, the principle of levying tax only within the territorial jurisdiction in the borders of the state.

It is a tax that provides abundant and regular tax revenue, because it is levied several times a year

The tax is considered as an important incentive for investment as a result of the tax deduction. The tax is levied on consumer spending rather than investment spending.

General principles of tax treatment that levied on financial services

In this study, attention is focused on tax treatment that levied on financial services. The following statements illustrate the general principles of the tax treatment levied to financial services (Table 1):

VAT is levied on all financial services in the Kingdom of Saudi Arabia, and it is paid by a taxable person. It is paid as a fee, commission or express trade discount (not implied). The term "express fee" or "express commission" means the amount to be paid for the service, whether this amount is a specific monetary value or a percentage of a certain amount. While the trade discount is a fixed amount deducted from another due amount. The following example will illustrate this: A bank in Saudi Arabia provides mortgage loan to a customer who is a resident in Saudi Arabia. The customer will pay interest to the bank on the basis of interest rates offered by the bank. The bank will also levy an annual fee of 220 SR to the customer as an administrative fee for the bank. Accordingly, the interest received from the Bank is exempted from value added tax, as it is an implicit margin for financial services. VAT will be levied on the annual administrative fee (express fee) .

Financial services sector products

We shall consider hereunder some of the products offered in the financial services sector to determine whether VAT is levied on them or not :

Bank accounts: These include managing, operating and executing operations in bank accounts, whether current or savings account. These services are subject to tax exemption except in cases where there is an express fee, commission, or express trade discount.

Card services: means credit cards, debit cards, store credit cards and cash withdrawals, and these types are taxable services in case of charging any fees for subscription, renewal or using the card. Tax exemption levies on credit facilities that provided if the card services include providing credit services to cardholder and pays the consideration in form of an implicit margin (interest fees).

Money transfer: Financial services for VAT purposes include issuing, transferring, receiving, or dealing with money or any dealing with securities, or any banknotes or orders for payment. Such financial services are exempted from VAT, except where they are in return for service in a form of a fee, commission, or an explicit trade deduction.

Currencies: The profit margin earned by the provider of foreign exchange against currency exchange and deduction on the nominal value of the traveler's checks is considered from implicit margins made as remuneration for providing funds or bonds, so that the implied margin is exempted from VAT. In cases where an explicit fee or commission is levied on activities such as international remittance, these transactions will be subject to value-added tax with the core ratio.

Electronic funds transfer: Due to the commercial nature of modern cash management services and e-banking activities, the remuneration that financial services provider takes often involves a fee or commission (such as transaction charges and electronic payment fees) which is taxable.

Business services: Financial service providers always provide their customers with products like; bills of exchange, letters of credit, guarantees and debt instruments bonds, for the purposes of facilitating domestic and international trade. All these products represent a commitment by the providers of such financial services to meet their obligations. The implicit margin paid for business transaction financing services is exempted from the value added tax such as revenue of nominal value discounts for debt instruments or interest. While any express fees or commissions levied on the Customer for these services shall be subject to the provision of VAT with the core ratio.

Borrowing: providing facilities through borrowing or credit may include the issuance of debt securities and charging interest on it. Such interest or borrowing fees levied as an implicit margin are treated as VAT-exempt financial services.

Syndicated loan: syndicated loan are provided through the partnership of a group of financiers. One of the financiers is the principal financier; he is responsible for the initial arrangement and management of the syndicated loan and collect the payments on behalf of the other lenders. If the principal financier acts on behalf of the other financiers in this way, the share of the financiers of accrued interest is considered as VAT exempt revenue.

Asset financing: Contracts that require transferring possession of goods to the customer with the possibility

of transferring its possession in a time not later than payment date of the consideration of goods. Transferring goods under financing contracts where it is clear that the main purpose of the contract is to acquire goods which are the object of this contract and importing goods. Asset financing contracts generally have two components:

(i) The main component (supply / purchase asset), which is the value of the asset, the object of the contract and

any additional services such as insurance. This major component is taxed at 5%.

(ii) Reimbursement of the principal to the funder is considered to be outside the scope of the tax, while the interest of the loan is payable to the funder exempted from VAT if it is charged on the implicit margin.

Financial Markets / Currencies: Financial markets are the markets in which securities are traded. Issuing and transferring securities by a person acting on his behalf as principal, and the profits earned in the trading of other bonds such as derivatives, options, swaps and future contracts acquired by a person acting on his behalf as supplies exempted from VAT. Money market transactions are also exempted from VAT. The tax exemption does not apply to fees imposed by brokers or intermediaries who do not act as an agent acting in his or her own name. Below are some of the financial services that are outside VAT scope :

Compensation: Where payments are made as compensation for damages or penalties that are not related to any supply by financial service provider outside the scope of VAT.

Third party costs classified as expenses: The financial service provider may collect the payment from the customer directly for a third party supply or cost. If the financial service provider acts on behalf of the customer, it is possible to transfer or charge those fees without adding VAT. In such a case, the financial service provider shall not treat the cost as expenditure incurred or deduct it as an input tax. Some of the products offered by the financial services sector are summarized in Table 2:

Advantages and disadvantages of VAT

The main advantages and disadvantages of VAT can be summarized as follows (Ibrahim, 2015).

VAT advantages:

(1) Its fairness and breadth, as it includes all classes of society and not directed against a particular class.

(2) Not against savings and investment

(3) It works on reducing unwanted consumption because the tax raises the price of goods, which reduces the demand on it.

(4) It works on increasing production in the society for people with low and middle income, where it is necessary to increase their work to compensate to make up the shortfall in their purchasing power.

(5) Neutrality of the tax towards goods and services, whether local or imported or towards the production and circulation stages, and this would avoid double taxation.

(6) Encouraging investment and directing it to the desired sectors.

(7) Sovereign revenues are highly sensitive towards economic changes due to its rapid impact in the term of revenues on the level of general State revenues.

(8) Reduce tax evasion or double taxation.

VAT disadvantages

(1) Price increase and the emergence of waves of inflation in the economy at the beginning of taxation.

(2) Rising prices cause low demand from low-income earners.

(3) It is a semi-compulsory tax levied on most goods and services.

(4) It never achieves social justice, where income is not an effective factor, as it is levied on the rich and the poor.

(5) Its income may not be commensurate with the tax collection costs.

(6) It requires a fairly advanced accounting system knowledge and understanding from companies and institutions.

Osaimy (2018) agreed that one of the disadvantages of VAT is that it is levied on various social strata with an equal percentage and it affects market prices directly or indirectly in addition to the full tax levied on the final consumer.

Registration in value added tax in Saudi Arabia

Types of registration in VAT could be divided into two types : Mandatory Registration and Optional Registration. Registration is considered as mandatory if the total taxable supply within 12 months exceeds 375,000 SR (registration limit). In this case, the person must register for VAT purposes. Supplies subjected to VAT do not include the following: Exempted supplies: such as exempted financial services or tax-free housing rent, purchases that fall outside the scope of the value-added tax in any (Gulf Cooperation Council) GCC member; while registration is optional for those who exceed the total taxable amount of SR 187,500 (optional registration limit) within 12 months. However, if the total taxable supply is less than 187,500 it is not required to register for VAT purposes.

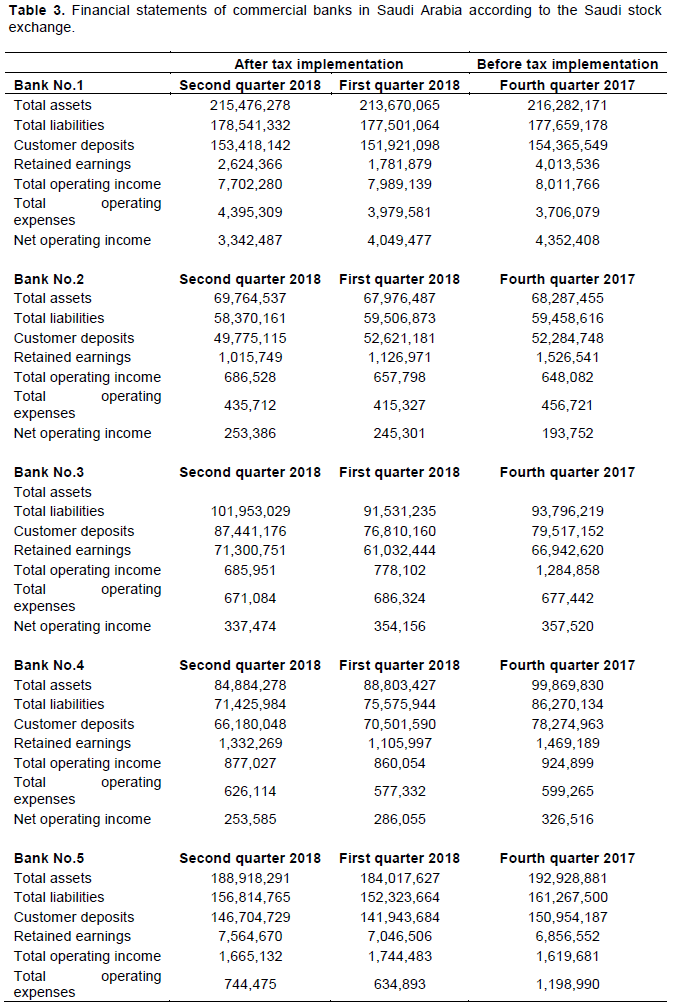

The study is based on the practical aspects of the commercial banks’ financial statements in the Kingdom of Saudi Arabia, which are all 12 listed on the Saudi Stock Exchange, by identifying the following data that exist in financial position (total assets, total liabilities, customer deposits and retained earnings) in addition to the data in the statement of income (total operating income, total operating expenses, net operating income). In order to examine the impact of changes in banks before and after implementation of VAT, the study targeted the fourth quarter of 2017 (before implementation of VAT) and the first and second quarters of 2018 (after implementation of VAT). The reason for choosing two quarters in 2018 is that change needs a period more than 3 months.

Study hypotheses

(1) There are statistically significant differences at the level of 0.05 and below between total assets before and after VAT implementation.

(2) There are statistically significant differences at the level of 0.05 and below between total liabilities before and after VAT implementation.

(3) There are statistically significant differences at the level of 0.05 and below between Total customer deposits (current accounts) before and after VAT implementation.

(4) There are statistically significant differences at the level of 0.05 and below between total retained earnings before and after VAT implementation.

(5) There are statistically significant differences at the level of 0.05 and below between total operating income before and after VAT implementation.

(6) There are statistically significant differences at the level of 0.05 and below between total operating expenses before and after VAT implementation.

(7) There are statistically significant differences at the level of 0.05 and below between net operating income before and after VAT implementation.

The study followed the inductive methodology in the theoretical part, which is the extrapolation of previous researches and studies related to the research subject either in the literature of accounting or in other sciences (Saad and Rahman, 2007). On the practical part, content analysis methodology was followed through analyzing certain financial statements items (Financial position statement, income statement). In financial position statement, the study focused on total assets, total liabilities, customer deposits, current accounts, retained earnings, while in income statement, the study targeted the following data (total operating income, total operating expenses, net operating income) from the data of 12 commercial banks in Saudi Arabia, all listed on the Saudi Stock Exchange. It should be noted that the analysis of the content depends mainly on the quantitative method in the analysis, but is applied for the analysis of different purposes, including comparison (Assaf, 1995), which finds the researcher suitable for the nature of the study. The study aimed at the period of time, namely the data for the fourth quarter of 2017 (before the implementation of VAT) and the data for the first quarter and the second of 2018 (after the implementation of VAT).

Study data

Financial Statements of Commercial Banks in Saudi Arabia According to the Saudi Stock Exchange are given in Table 3.

Statistical tests

The study included all 12 commercial banks in the Kingdom of Saudi Arabia. On the statistical side, the data were analyzed descriptively and testing interrelated samples using the SPSS program.

Data analysis (descriptive analysis)

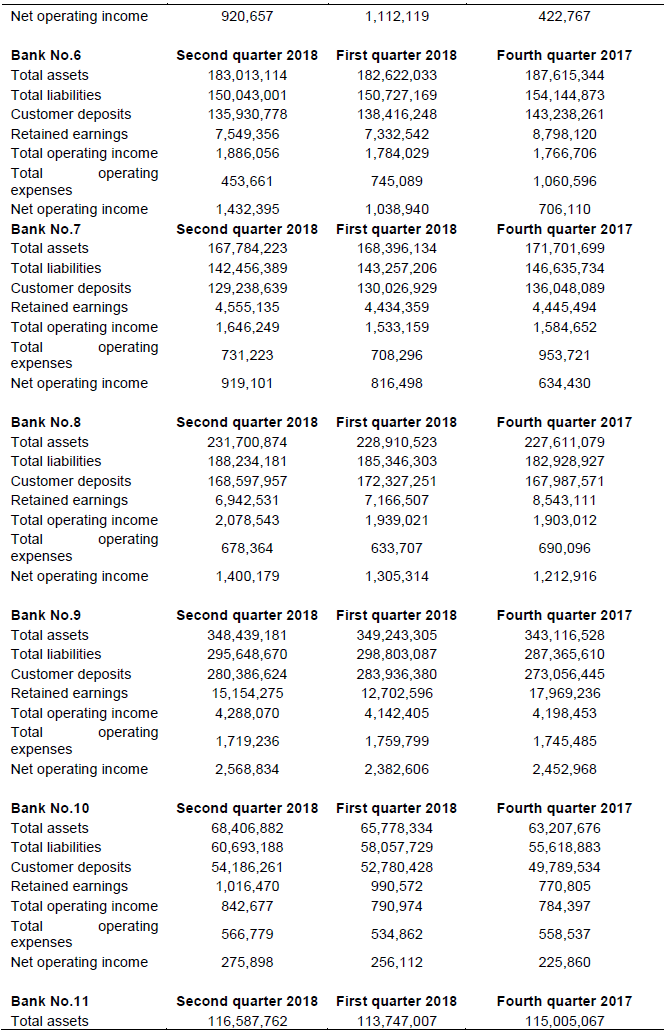

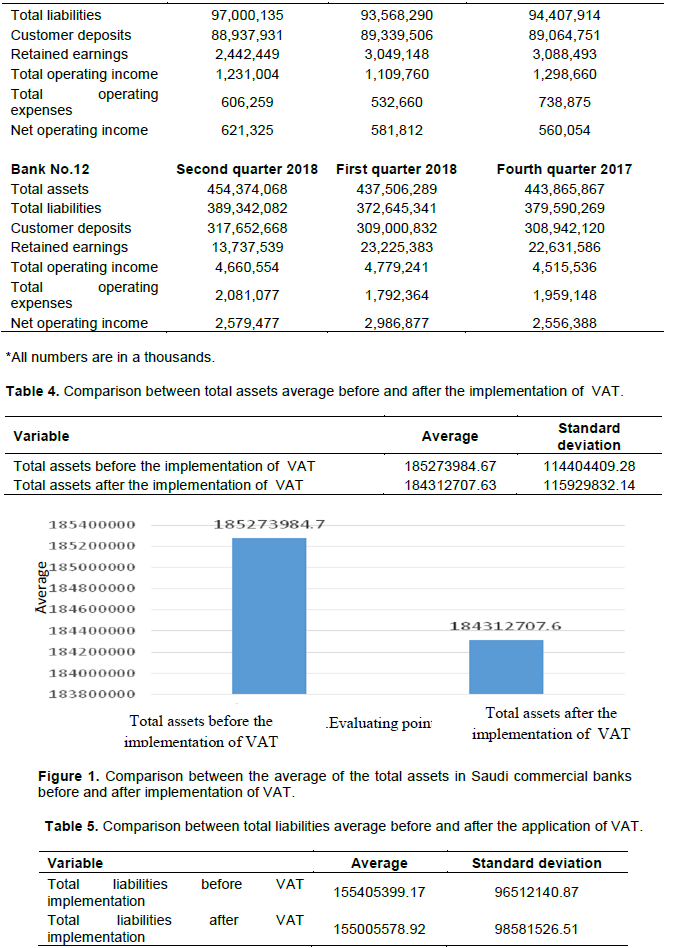

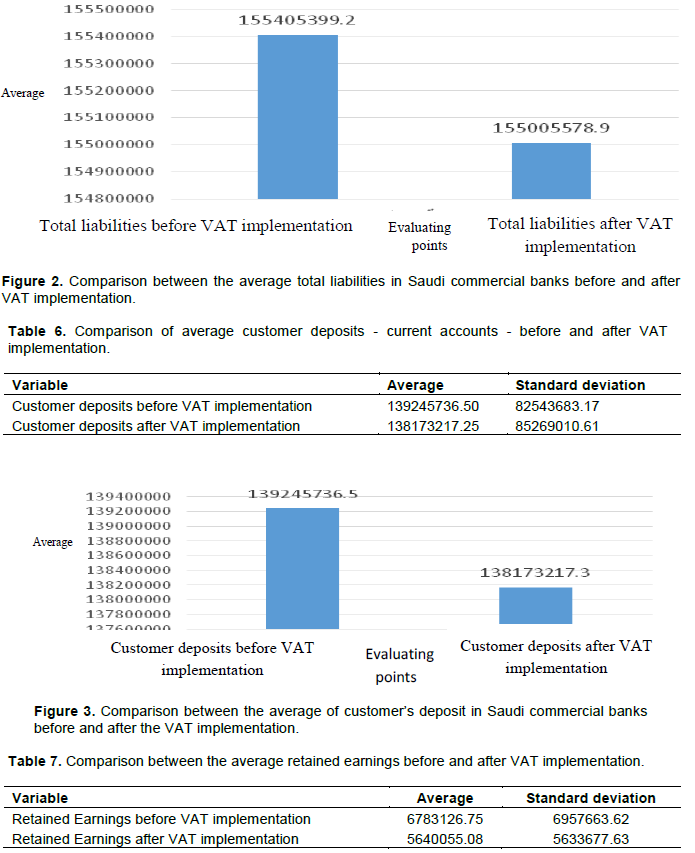

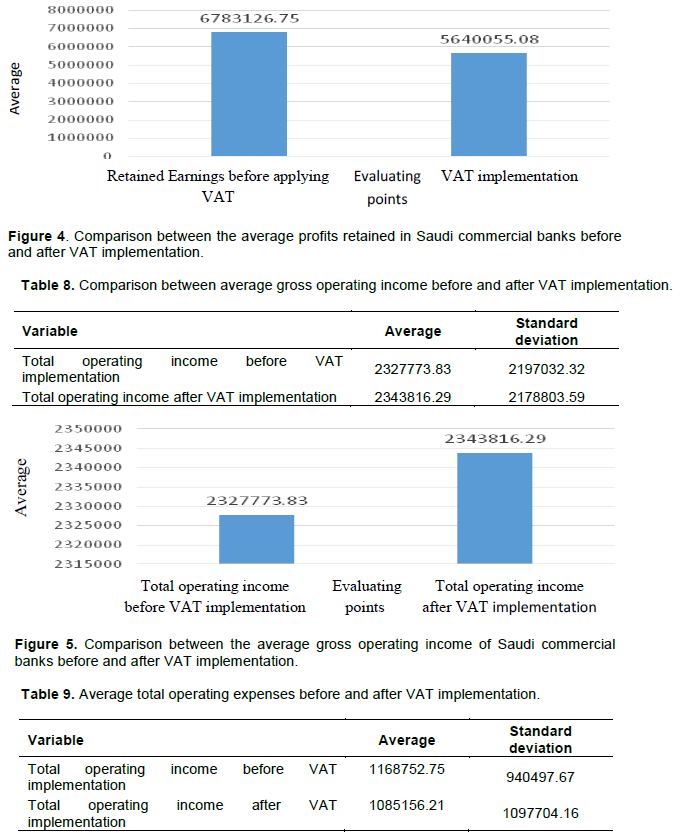

Table 4 and Figure 1 illustrate the results of the comparison between the average of the total assets in Saudi commercial banks before and after implementation of VAT, where the data indicate a slight decrease in the total assets after implementation of VAT. Table 5 and Figure 2 illustrate the results of the comparison between the average total liabilities in Saudi commercial banks before and after VAT implementation. The data indicate a slight decrease in the total liabilities after VAT implementation. Table 6 and Figure 3 illustrate the results of the comparison between the average of customer’s deposit in Saudi commercial banks before and after the VAT implementation, where the data indicate a slight decrease in customer deposits after VAT implementation. Table 7 and Figure 4 illustrate the results of the comparison between the average profits retained in Saudi commercial banks before and after VAT implementation, where the data indicate a significant decrease in profits retained after VAT implementation. Table 8 and Figure 5 illustrate the results of the comparison between the average gross operating income of Saudi commercial banks before and after VAT implementation, where the data indicate a slight increase in the total operating income after VAT implementation. Figure 6 illustrates the comparison between average total operating expenses before and after VAT implementation. Table 9 and Figure 7 illustrate the results of the comparison between the average net operating income of the Saudi commercial banks before and after VAT implementation. The data indicate a significant increase in net operating income after VAT implementation.

Testing the study hypotheses

The paired sample test, which is one of the T-Test tests was used. The T-Test is one of the most famous scientific tests used to compare two groups through their arithmetic mean. For regression analysis; the test determines whether regression line coefficients are statistically significant (Shiraz, 2015:339).

First hypothesis: There are statistically significant differences at the level of 0.05 and less between the total assets before and after VAT implementation

Null hypothesis (H0): There are no statistically significant differences between the total assets before and after VAT implementation.

Alternative hypothesis (H1): There are statistically significant differences between the total assets before and after VAT implementation.

Table 10 indicates that the value of the significance level equals 0.542, which is greater than the significance level (0.05). We accept the null hypothesis which supposes that there are no statistically significant differences between the total assets before and after the implementation of value added tax.

Second hypothesis: There are statistically significant differences at the level of 0.05 and less between total liabilities before and after VAT implementation.

Null hypothesis (H0): There are no statistically significant differences between total liabilities before and after VAT implementation.

Alternative hypothesis (H1): There are statistically significant differences between total liabilities before and after VAT

implementation.

Table 11 indicates that the value of the significance level equals 0.816, which is greater than the significance level of (0.05); we accept the null hypothesis, which is supposed that there are no statistically significant differences between the total liabilities before and after the implementation of value added tax.

Third hypothesis: There are statistically significant differences at the level of 0.05 and less between the total customer deposits (current accounts) before and after VAT

implementation.

Null hypothesis (H0): There are no statistically significant differences between total customer deposits (current accounts) before and after VAT implementation.

Alternative hypothesis (H1): There are statistically significant differences between total customer deposits (current accounts) before and after VAT implementation.

Table 12 shows that the value of the significance level is 0.514 which is greater than the significance level (0.05). Thus, the null hypothesis is accepted that there are no statistically significant differences between customer deposits before and after the implementation of value added tax.

Fourth hypothesis: There are statistically significant differences at the level of 0.05 and less between the total retained earnings before and after VAT implementation.

Null hypothesis (H0): There are no statistically significant differences total retained earnings before and after VAT implementation.

Alternative hypothesis (H1): There are statistically significant differences between total retained earnings before and after VAT implementation.

Table 13 indicates that the value of significance level equals 0.026, which is less than the significance level of (0.05); it means that it is highly statistically significant. Thus, the null hypothesis can be rejected and the alternative hypothesis is accepted which is supposed that there are statistically significant differences between profits before and after VAT implementation.

Fifth hypothesis: There are statistically significant differences at the level of 0.05 and less between the total operating income before and after VAT implementation

Null hypothesis (H0): There are no statistically significant differences between total operating income before and after VAT implementation.

Alternative hypothesis (H1): There are statistically significant differences between total operating income before and after VAT implementation.

Table 14 shows that the value of the significance level is 0.591, which is greater than the significance level (0.05). Therefore, we accept the null hypothesis that there are no statistically significant differences between the total operating income before and after VAT implementation.

Sixth hypothesis: There are differences of statistical significance at the level of 0.05 less between the total operating expenses before and after VAT implementation.

Null hypothesis (H0): There is no statistically significant difference between total operating expenses before and after VAT implementation.

Alternative hypothesis (H1): There are statistically significant differences between total operating expenses before and after VAT implementation.

Table 15 shows that the value of significance level is 0.277, which is greater than the significance level (0.05); we accept the null hypothesis that there are no statistically significant differences between the total operating expenses before and after the implementation of value added tax.

Seventh hypothesis: There are differences of statistical significance at the level of 0.05 less between net operating income before and after VAT implementation

Null hypothesis (H0): There are no statistically significant differences between net operating income before and after VAT implementation.

Alternative hypothesis (H1): There are statistically significant differences between net operating income before and after VAT implementation.

Table 16 indicates that the value of the significance level is 0.323, which is greater than the significance level (0.05). Therefore, the null hypothesis is there are no statistically significant differences between the net operating income before and after VAT implementation.

CONCLUSION AND RECOMMENDATIONS

The findings of the study can be concluded in the following points:

(i) There is a slight decrease in total assets after the implementation of VAT.

(ii) There is a slight decrease in total liabilities after the implementation of VAT.

(iii) There is a slight decrease in customer deposits after the implementation of VAT.

(iv) There is a significant decrease in retained earnings after the implementation of VAT.

(v) There is a slight increase in the total operating income after the implementation of VAT.

(vi) There is a significant decrease in the total operating expenses after the implementation of VAT.

(vi) There is a significant increase in net operating income after the implementation of VAT.

(vii) There are no statistically significant differences between the total assets before and after the implementation of VAT.

(vii) There are no statistically significant differences between the total liabilities before and after the implementation of VAT.

(viii) There are no statistically significant differences between customer deposits before and after the implementation of VAT.

(ix) There are statistically significant differences between retained profits before and after the implementation of VAT.

(x) There are no statistically significant differences between total operating income before and after the implementation of VAT.

(xi) There are no statistically significant differences between the total operating expenses before and after the implementation of VAT.

(xii) There are no statistically significant differences between the net operating income before and after the implementation of VAT.

Finally, the study findings illustrate that banks in Saudi Arabia were not significantly affected by the implementation of VAT, but the effect was very limited.

We cannot also say that this effect was a direct result of VAT implementation. However, other local, regional and international factors, economic and political changes, inflation and deflation shall also affect the banking sector. This opens the way for research opportunities by looking at the factors affecting the banking sector in Saudi Arabia, as well as examining the impact of VAT implementation on different sectors at different periods.

The author has not declared any conflict of interests.

REFERENCES

|

Assaf SM (1995). المدخل إلى البØØ« ÙÙŠ العلوم السلوكية. (Introduction to research in Introduction to Research in Behavioral Science (4th ed.). Al-Riyadh, Saudi Arabia.

View

|

|

|

|

Awad B (2012). الضريبة على القيمة المضاÙØ©: مشكلات ومعوقات الانتقال إليها والØلول المقترØØ©. (Value Added Tax: Problems and Obstacles of implementation and Proposed Solutions). Egyptian Association for Public Finance and Taxes, Egypt. Unpublished, pp. 73-96.

|

|

|

|

Financial Services Sector Guide (2018). First Edition Link.

|

|

|

|

Ibrahim NAR (2016). الضريبة على القيمة المضاÙØ©: VAT التنظيم الÙني - اليات التطبيق - معوقات ومقترØات. (VAT, technical organization - application mechanisms: constraints and proposals).

View

|

|

|

|

Mehdi A (2013). دراسة امكانية تطبيق الضريبة على القيمة المضاÙØ©. (Studying the possibility of VAT implementation). Nineteenth Tax Conference: The Egyptian Tax System and inevitability of change. Egyptian Association for Public Finance and Taxes, Egypt. pp. 1-36.

|

|

|

|

Mohamed A (1999). تطبيق الضريبة على القيمة المضاÙØ© ÙÙŠ مصر: رؤية مستقبلية. (Implementation of Value Added Tax in Egypt: A Future Vision). Fifth Tax Conference (Comprehensive tax reform requirements in Egypt). Egypt. Folder pp. 79-102.

View

|

|

|

|

Osaimy A (2018). ضرائب: التعري٠بالضريبة على القيمة المضاÙØ©. (Taxes: Definition of VAT). Accounting - Saudi Arabia. Year 21. Edition 61. pp. 11-12. Unpublished book.

|

|

|

|

Saad S, Rahman SBA (2007). المراجعة البيئية ÙÙŠ المملكة العربية السعودية: الممارسة الØالية والنظرة المستقبلية: دراسة ميدانية. (Environmental Review in the Kingdom of Saudi Arabia: Current Practice and Future Outlook - Field Study (Exploratory). King Abdulaziz University.

|

|

|

|

Shiraz M (2015). التØليل الاØصائي للبيانات SPSS. (Statistical analysis of SPSS data). Scientific algorithm for publication and distribution. First Edition. Unpublished.

|