ABSTRACT

This study investigated the relationship between real effective exchange rate and balance of payment in Ethiopia using annual data spanning the period of 1976 to 2015. The analysis was based on a cointegrated vector autoregressive approach. The methodology of the study begins with Augmented Dickey-Fuller stationarity tests of the data and the Johansen cointegration rank test that revealed current account, real gross domestic product, real effective exchange rate, budget deficit, interest rate and inflation rate to be cointegrated with one cointegrated relationship and thus share long-run equilibrium relationships. Empirical results suggest that real effective exchange rates do play a role in determining the short and long-run behavior of the Ethiopian current account. Thus, there is strong indication for the Marshall-Lerner condition to hold in Ethiopia, as the current account improved in the long run in response to depreciation in the real effective exchange rate. The result of the long run relationship from the vector error correction model, together with the outcome of impulse response function signify that, following devaluation in the real effective exchange rate, current account first deteriorates before it later improves, that is exhibiting the J-curve pattern. Accordingly, the major policy implication of this study is the depreciation of the real effective exchange rate by taking the macroeconomic realities of the country into account while advocating export promotion and import substitution strategies.

Key words: Current account, real effective exchange rate, cointegration, vector autoregression, vector error correction model.

Background of the study

A macroeconomic policy set up is primarily aimed to achieve sustainable economic growth, full employment, price stability and balanced balance of payment position. Because countries can achieve satisfactory growth and employment under an environment of moderate inflation and balance of payments disequilibria, price stability and balance of payments equilibrium are regarded as secondary objectives to satisfactory economic growth and full employment. However, continuous balance of payments disequilibria will eventually affect economic

growth, employment, and price stability. This, therefore, justifies the case for considering the balance of payments equilibrium an important objective of economic policy (Bank of Uganda, 2003).

The balance of payments is a macro variable and a statistical statement that systematically summarizes the economic transaction of an economy with the rest of the world for a specific period. It records transactions that give rise to sets of accounts that indicates all the flows of value between residents of one country and the residents of other countries of the world that they enter into economic dealings (IMF, 1996).

Economists and policy-makers are interested in a nation’s balance of payments because it provides much useful information about a degree of openness of the economy, exports and production structure, private transfers and labor market, among others. Above all, the account may indicate whether the nation’s external economic position is in a healthy state, or whether problems exist which may be signaling a need for corrective action of some kind (Dunn and Mutti, 2004).

Many developing countries can face the balance of payment deficit because of persistent deficits in their trade with developed countries (Rehman and Rashid, 2015). Ethiopia, as one of the developing countries has been experiencing large deficits in its current account. According to the data compiled by the National Bank of Ethiopia (NBE), the services sector has shown consistent surpluses, reflecting revenues from Ethiopian Air Lines and to a lesser extent from tourism and shipping services, having risen from ETB 309.8 million in 2002/2003 to an estimated ETB 11,090 million in 2010/2011. Similarly, transfers of funds from official donors and remittances from nationals living abroad have been strong, amounting to ETB 5,147.4 million in 2002/2003 and more than ETB 29,991 billion in 2003 to 2004. These surpluses, however, have not been enough to offset large shortfalls in merchandise trade and debt-service payments. In 2011 to 2012, the current account deficit was ETB 78,778 million. It fell to ETB 78,423.2 million in 2012 to 2013 before rising to an estimated ETB 109,451.1 million in 2013/2014. These deficits have been covered by exhaustion of foreign exchange reserves and by debt forgiveness. This implies that the issue of balance of payment and its determinants in Ethiopia requires an intensive study with a sound methodology so that it may be easy to reduce the deficit.

A continual deficit in the balance of payment may cause a variety of problems. Fundamentally, there is the question of the adequacy of foreign exchange reserves and of what happens if reserves come close to exhaustion. If the deficit persists, all the country's foreign reserves may be exhausted, which could lead to loss of confidence, as the country is declared unable to repay its foreign debts and to make payment for imports. Further, it may complicate the management of monetary policy, distort the domestic price level, and cause macro- economic crises (Dunn and Mutti, 2004). Hence, as long as the balance of payments deficit in Ethiopia is persistent, a critical study regarding the determinants of balance of payments is essential. Theoretically and in fact practically, exchange rate, being the price of one currency (the domestic currency) in terms of another (the foreign currency), is a key determinant of the balance of payments position of an economy.

The recent issue of persistent balance of payments imbalances has led to a renewed interest in better understanding the effect of exchange rates on international trade and thereby balance of payments. In spite of the increasing number of studies on the topic, the actual effect of exchange rates on balance of payments is still an open and controversial question. Therefore, the central purpose of this study was to investigate the short-run and long-run effect of real effective exchange rate on current account of Ethiopian economy by considering major explanatory variables comprises of the amalgam of both monetary and fiscal variables.

Review of related literature

There are numbers of empirical studies on the impact of exchange rates on balance of payment, though with mixed results. Likewise, Drama et al. (2010) investigated the effect of real exchange rate on the balance of trade of Cote d’Ivoire using VEC models with time series data covering the periods of 1975-2007. Estimated results also showed that the real effective exchange rate has a significant positive influence on Cote d’Ivoire’s trade balance in both short and long run. Further, Oladipupo and Onotaniyohuwo (2011) investigated the impact of exchange rate on the Nigerian balance of payments position using the OLS method for data covering the period between 1970 and 2008. The result revealed that exchange rate has a positive and significant impact on the balance of payment position. Likewise, Ogbonna (2011) tried to investigate the empirical relationship between the real exchange rate and aggregate trade balance in Nigeria. The study tested whether the Marshall-Lerner Condition holds for Nigeria or not. The results revealed that depreciation/devaluation improves balance of payment and Marshall-Lerner (ML) condition holds for Nigeria. Moreover, Imoisi (2012), examined the trends in Nigerian’s Balance of payments position from 1970 to 2010. The study carried out a multiple regression analysis using the ordinary least square method for both linear and log linear form. Conform to economic theory, the result discovered the existence of positive relationship between exchange rate and balance of payment.

Contrary to the above empirical evidences, Bahmani-Oskooee and Alse (1994) studied the short run versus long run effects of devaluation for 19 developed countries and 22 least developed countries through error correction modeling and cointegration. They used quarterly data and indicated only for six countries trade balance and real effective exchange rate were cointegrated. For most countries, the two variables were not found to be cointegrated indicating that devaluations cannot have any long run effects on the trade balance. Alawattage (2002) examined the effectiveness of exchange rate policy of Sri Lanka in achieving external competitiveness since liberalization of the economy in 1977. The outcome confirmed that the real effective exchange rate does not have a significant impact on improving the trade balance particularly in the short run. Even though the cointegration tests reveal that there is a long run relationship between trade balance and the real effective exchange rate, it shows very marginal impact in improving trade balance in the long run. Azra et al. (2015) utilized robust ARDL structure to develop the bound testing approach to co-integration and error correction models on data set for 1972 to 2013 to analyze the effect of exchange rate on balance of payment. The result indicated that real exchange rate inversely influences the balance of payments both in the long run and in the short run. Further, Nicholas et al. (2016) observed the effect of exchange rate on balance of payment in Nigeria by using OLS method for data analysis. The result demonstrated that an increase in exchange rate would result in a decrease in BOPs.

When it comes to the case of Ethiopia, few researchers tried to look into the relationship between exchange rate and trade balance partially. Hailemariam (2011) studied the effect of devaluation on Ethiopian trade balance using VAR model; the estimated long run and short run equations have showed that currency devaluation, which is proxied by real exchange rate, has a positive and significant impact on the trade balance of Ethiopia. Therefore, the study confirmed that Marshal-Learner condition holds in Ethiopia. Similarly, Temesgen (2016) examined the short run and long run effect of real effective exchange rate on trade balance of Ethiopia using the autoregressive distributed lag approach. The result revealed that, both in the short run and long run, real exchange rate have positive and significant effect on trade balance of the country.

On the other hand Nega (2015) tried to assess the movement of the real effective exchange rate and external sector development such as export, import and trade balance of Ethiopia using descriptive analysis to incorporate the two major devaluation period from the year 1985/1986 to 2012/2013. The result revealed that the depreciation of the real effective exchange rate improves the export performance however; it does not discourage our import. As a result, even if there is higher growth of export after a depreciation of the real effective exchange rate, since the growth rate of imports outweighs, there is no improvement in the trade balance of the country. Moreover, Fikreyesus and Menasbo (2012) analyzed the effect of Birr devaluation on trade balance of Ethiopian economy using 30 years of time serious data. The results of the OLS estimates revealed that real GDP and real effective exchange rate index were positively correlated with the nation’s trade balance.

In this study, annual data for the period 1976 to 2015 were employed. The data were obtained from the National Bank of Ethiopia (NBE) and the country underwent both current account and government budget deficits during the study period. After the researcher have changed the data for current account and budget deficit into positive, current account (CA) real effective exchange rate index (REERI), real gross domestic product (RGDP) and budget deficit (BD) were transformed into natural logarithms, just for the purpose of removing possible heteroscedasticity and capturing non-linear properties.

The vector autoregressive (VAR) model estimation technique was employed for this study. As Sims (1980) and others argued in a series of high-ranking papers, VARs held out the promise of providing a coherent and credible approach to data description, forecasting, structural inference, and policy analysis. The data analysis was undertaken using the latest version of EViews software that is EViews 9. This model has advantages over the single equation based Engel-Granger two-step procedure in the sense that time series can be modeled simultaneously. Further, the VAR methodology corrects for autocorrelation and endogeneity parametrically using vector error correction model (VECM) specification. In addition, it prevents substantial bias that takes place in OLS estimates of cointegration relations when the Engle Granger two-step procedure is used. Moreover, it has good forecasting capabilities (Ibid.)

Model specification shows mathematical and economic relationships that exist between the dependent and independent variables and stressed the importance of expressing the relationship under study in mathematical form (Dowling, 2001). Both theoretical and empirical literatures propose a number of key variables that have significant effects on balance of payments. Following Iyoboyi and Muftau (2014), this study considers some important monetary and fiscal factors for building the model. This study estimated the following functional relationship:

A unit root test is conducted by employing the standard augmented version of the Dickey-Fuller (Dickey, 1976; Dickey and Fuller, 1979) referred to as Augmented Dickey Fuller (ADF) test to prove whether the variables in the model are stationary or not.

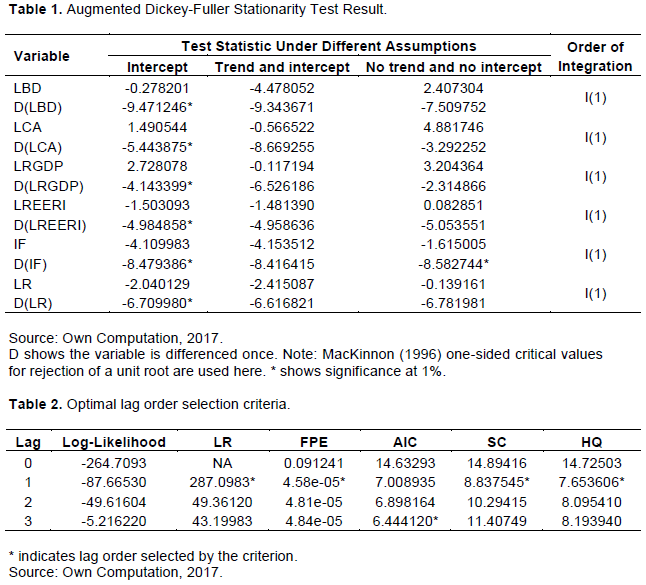

From Table 1, it can be observed that no variables are stationary at level. However, they all become stationary after differencing once implying that they are integrated at order one I(1). The ADF result demonstrates that only an intercept must be included in all variables (LCA, LNBD, LRGDP, LREER and LR) in testing for stationarity, while IF is tested without the trend and intercept.

The optimal lag order is determined with the sequential modified Likelihood Ratio test statistics [LR], the Final Prediction Error [FPE], the Akaike Information Criterion [AIC], the Schwarz Information Criterion [SIC], and the Hannan-Quinn Information Criterion [HQ]). As shown in Table 2, LR, FPE, SIC, and HQ suggest an optimal lag of one, all at a 5% level of significance.

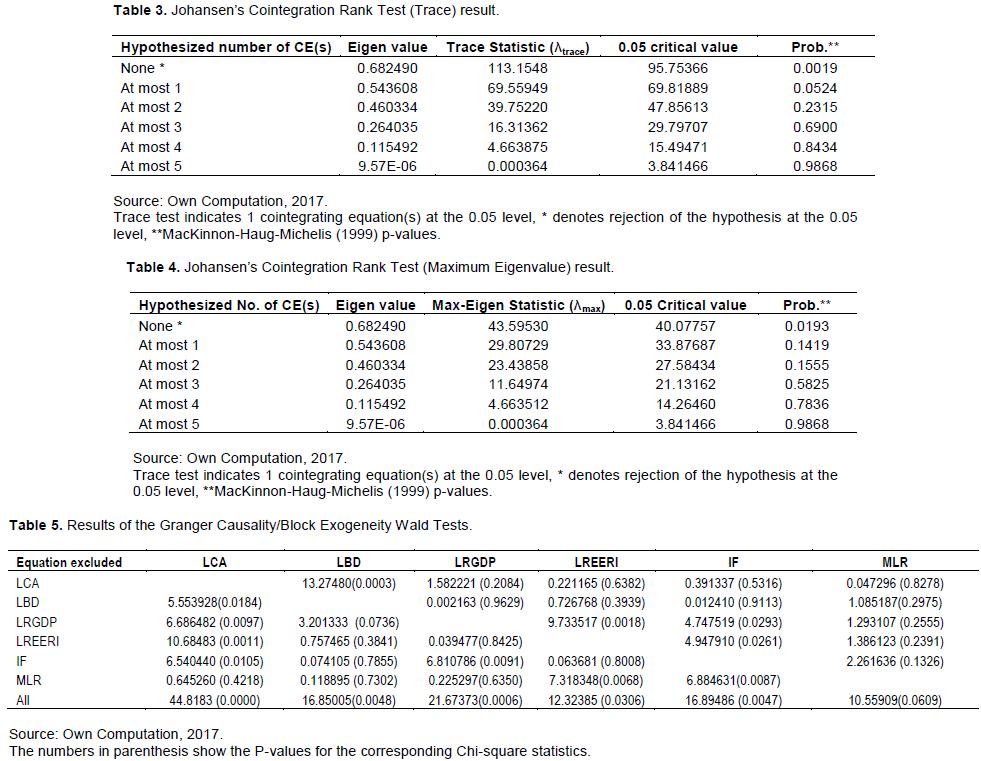

The Augmented Dickey Fuller (ADF) stationarity test results demonstrate that all of the variables are stationary at first difference, and this result can be further strengthened by the Johansen Co-integration test (Table 3 and 4). Thus, the presence and the number of such co-integrating relationships are evaluated with the trace and the maximum eigenvalue.

The study apply Granger causality test among the variables in order to see if one variable is Granger-causal for another, that is, if it contains useful information for predicting the latter set of variables. The outcome of the Granger causality test is shown in Table 5. The result of the test shows at 5% level, the existence of bi-directional causality between current account deficit and budget deficit and real GDP and inflation. This result shows that current account deficit can be used to forecast budget deficit and vice-versa and real GDP can be used to forecast inflation and vice-versa. On the other hand, there is one directional relationship. Real GDP Granger causes current account deficit, budget deficit (at 10% level of significance), real effective exchange rate and inflation. The interest rate Granger does cause the real effective exchange rate and inflation. The real effective exchange rate Granger causes current account deficit and inflation. Moreover, the strong exogeneity (that is the overall causality in the system) shows that the null hypothesis of all the variables in the system (that is RGDP, BD, REER, IF and LR) do not Granger cause CA is rejected at 1% level of significance.

This equation is the long-run equation for current account that relates current account deficit to real GDP, budget deficit, real effective exchange rate, inflation rate and interest rate and upon which the long-run analysis is based. This result shows that in the long run, current account in Ethiopia can be explained by real GDP, real effective exchange rate and budget deficit.

The long-run impact of real GDP on current account deficit is found to be negative and is highly significant, which means that other things remains constant; a 10-percentage-point increase in real GDP will drop the current account deficit by 22.2 percentage points in the long run (Table 6). This finding is in line with the theoretical prediction of the Absorption approach. Hence, real GDP is declared as major determinant of balance of payments. The positive impact of real GDP is a sign of export expansion. Increase in real income will increase the exports and better will be the current account balance. Furthermore, this result is similar with empirical findings of Azra et.al (2015), Adamu and Itsede (2010), Choudhary and Shabbir (2005), Eita and Gaomab (2012), Dhliwayo (1996) and Felipe et al. (2009).

The budget deficit is another variable found to be significant and negatively related with the current account deficit. That is, ceteris paribus, a 10% increase in the government budget deficit will result in a fall in current account deficit by 3.9%. This result is similar to the empirical finding of Kim and Roubini (2003) but contrary to the theoretical expectations of the Ricardian Equivalence Hypothesis (REH) that says that the budget deficit does not affect current account deficit and the Keynesian Proposition Hypothesis (KPH) that states that these twin deficits (budget and current account) are directly and closely linked and the budget deficit causes the current account deficit.

Coming to the major objective of this study, that is, investigating the impact of change in exchange rate on balance of payment of Ethiopia, the coefficient of the real effective exchange rate index, is positive and statistically significant at a 5% level of significance confirming the hypothesis that real depreciation succeeds in improving current account balance of Ethiopia in the long run. The coefficient of real effective exchange rate, 0.53, indicates that other things remains constant, a depreciation of real effective exchange rate by 10% would result in about 5.3% decrease in current account deficit per year. The result also suggests that the Marshall-Lerner (ML) condition holds for Ethiopia. This result is not only consistent with the theoretical expectation but also in line with empirical results of Falk (2008), Anthony (2012), Nawaz (2014), Nega (2015), Dessalegn (2013) and Nazeer (2015) among others.

Short-run relationship

The error correction coefficient shows the speed of adjustment of variables return to equilibrium and it should have a statistically significant coefficient with negative sign. As can be seen in Table 7, the error correction term, which measures the speed of adjustment to restore equilibrium in the dynamic model, appears with negative sign and it is statistically significant at a 5% level, ensuring that the long-run equilibrium can be attained. This guarantees that although the actual current account balance may temporarily deviate from its long-run equilibrium value, it would gradually converge to its equilibrium. The error correction term of -0.6882 shows that 68.82% of the deviation of the actual current account balance from its equilibrium value is eliminated every year; hence, full adjustment would require a period of less than two years. Further, though it is statistically insignificant, the coefficient of the dummy for policy change has unexpected positive sign denying the fact that the economic liberalization improves trade balance.

According to Banerjee et al. (1998), a highly significant error correction term is further proof of the existence of a stable long-run relationship. Furthermore, testing the significance of the ECt-1 is a relatively more efficient way of establishing cointegration.

Diagnostic tests of VECM

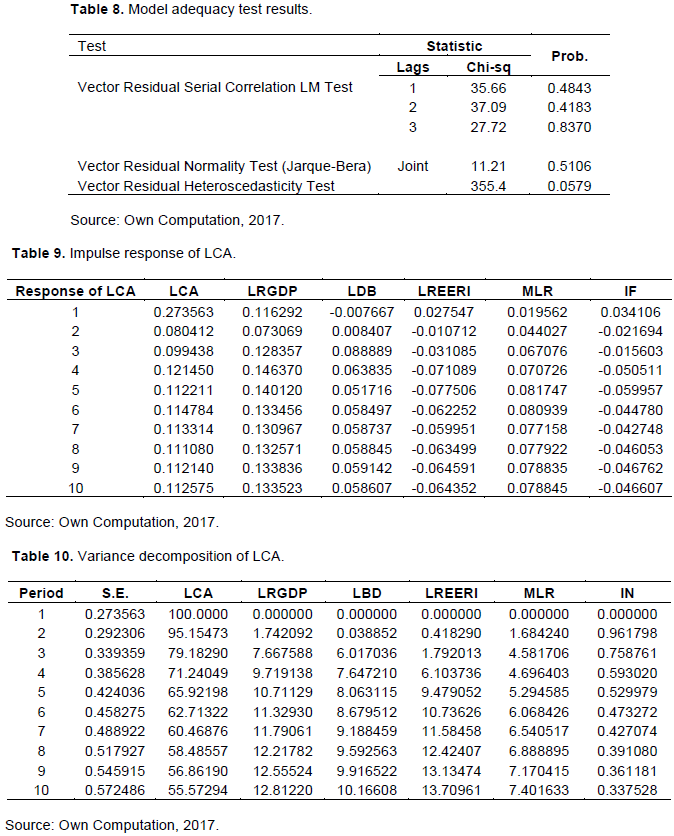

The adequacy of the model was checked by applying the following tests to the residuals such as the vector residual serial correlation LM test, vector residual normality and vector residual heteroscedasticity test (Table 8).

The results of these diagnostic tests, together with the results of the other pretest, suggest the validity and robustness of the estimated results.

Impulse response

The generalized impulse response functions of the current account deficit are depicted in Table 9. As can be seen from Table 9, it is obvious that the effect of one standard deviation shock of real effective exchange rate on current account deficit is negative in the short run almost over the whole period. It can be observed that one generalized standard deviation innovation on REER in the short run does not improve current account balance in the 10-year forecast horizon. Accordingly, the short-run effect of exchange rate depreciation on Ethiopian current account tends to be negative. This result, together with the long-run positive impact of exchange rate on the current account is in line with the economic theory that states that depreciation in local currency will worsen the current account in the short run. That is, the "J Curve effect" on the current account, were following a devaluation / depreciation; the current account gets worse before it improves. This result is similar to that of Abebe (2014).

Forecast error variance decomposition

The variance decomposition analysis indicates how much of the uncertainty surrounding the predictions of one variable can be explained by the uncertainty surrounding the other variables. The variance decomposition (at VEC level) of the major variable of interest that is current account deficit at the end of 10 years horizon alongside with the Monte Carlo standard errors is presented in Table 10.

The result in Table 10 reveals that all the variation in current account is explained by the lagged value of the variable itself in the first period. Additionally, the result suggests that 55% of the variation in current account deficit is explained by its own shocks, with only 14% due to exchange rate. Accordingly, a considerable variation in Ethiopia’s current account is due to changes in exchange rate movements next to a variation in itself. Further, the shocks due to real GDP are mainly informative. This is because it is more than the shocks originating from budget deficit, interest rate and inflation. The innovations in real GDP contribute 13%, budget deficit contributes 10 % while interest rate contributes 7% and inflation contributes almost 0.5%.

CONCLUSION AND RECOMMENDATIONS

The study identified that, in the long run, real depreciation succeeds in improving current account balance of Ethiopia. This result suggests that the Marshall-Lerner (ML) condition holds for Ethiopia. Further, the long-run impact of real GDP on current account deficit is found to be negative and is highly significant which can be justified as a sign of export expansion. Moreover, the result of the impulse response revealed that the effect of one standard deviation shock of real effective exchange rate on current account deficit is negative in the short run almost over the whole period. It can be observed that one generalized standard deviation innovation on REER in the short run does not improve current account balance in the 10-year forecast horizon. Accordingly, the short-run effect of exchange rate depreciation on Ethiopian current account tends to be negative. This result, together with the positive long-run impact of exchange rate, is in line with the economic theory that states that a depreciation in local currency will worsen the current account in the short run. That is, the J Curve effect on the current account. Finally, the variance decomposition of current account balance result has suggested that 55% of the variation in current account deficit is explained by its own shocks, with only 14 and 13% due to exchange rate real GDP respectively. The innovation in budget deficit contributes 10% while inflation contributes almost 0.5% and interest rate contributes 7%.

Based on the findings of the study, the following measures may help in reducing current account deficit in Ethiopia:

1) Exchange rate management in Ethiopia must be seen from the long run perspective rather than short-run effect because depreciation/devaluation improves current account balance of the country in the long run.

2) Government should harmonize monetary and fiscal policies to boost the non-agricultural sectors such as the tourism and transportation sectors and pay more attention to export promotion and diversification strategies.

3) Promoting import substitution strategy through subsidies to the domestic industries to discourage over-reliance on imported goods and substitute their imported inputs and reducing taxes to their imported semi-finished products. This strategy should essentially be implemented based on the law of comparative advantage.

4) Awareness creation in favor of the home-produced substitutes should be made.

Future research direction

This study is limited in the sense that it is not easy to include all of the relevant variables that can determine the balance of payments of the country. This is partly because of the existing of numerous variables that have indirect impact on balance of payments and partly because of difficulties to obtain statistical information for some of these variables. Further, the study did not consider the capital and financial accounts of the balance of payments.

Some directions for future research are suggested in this study. One direction is to use alternative econometric techniques such as ARDL or OLS. Another direction is extending the econometric methodology to a sample of countries. In addition, emphasis should be given to the capital and financial account component of the balance of payment.

The authors have not declared any conflict of interests.

REFERENCES

|

Abebe BG (2014). Exchange Rate and Trade Balance: J Curve Effect in Ethiopia. Journal of Economics and Sustainable Development 5(24):185-191.

|

|

|

|

Adamu AP, Itsede CO (2010). Balance of Payments Adjustment: The West African Monetary Zone Experience. West African Journal of Monetary and Economic Integration 10 (2):100-116.

|

|

|

|

|

Alawattage UP (2002). Exchange Rate, Competitiveness and Balance of Payments Performance. Central Bank of Sri Lanka Staff Duties 34:63-91.

|

|

|

|

|

Anthony II (2012). Trends in Nigeria's Balance of Payments: An Empirical Analysis from 1970-2010. European Journal of Business and Management 4(21):210-217.

|

|

|

|

|

Azra BS, Tahir M, Khan JA (2015). What Determines Balance of Payments: A Case of Pakistan. Sukkur Institute of Business Administration Journal of Management and Business 2(1):47-70.

|

|

|

|

|

Bahmani-Oskooee, Alse (1994). Short Run Versus Long Run Effects of Devaluation: Error Correction Modeling and Cointegration. Eastern Economic Journal 20(4).

|

|

|

|

|

Banerjee A, Dolado JJ, Mestre R (1998). Error correction mechanism tests for cointegration in a single equation framework. Journal of Time Series Analysis 19:267-283.

Crossref

|

|

|

|

|

Bank of Uganda (2003). Policy applications of balance of payments and IIP Statistics. Sixteenth Meeting of the IMF Committee on Balance of Payments Statistics.

|

|

|

|

|

Choudhary AM, Shabbir G (2005). Macroeconomic Impact of monetary variables on Pakistan's Foreign Sector. The Lahore Journal of Economics 9(1):63-84.

|

|

|

|

|

Dessalegn BL (2013). The effect of exchange rate movement on trade balance in Ethiopia.

|

|

|

|

|

Dhliwayo R (1996). The balance of payments as monetary phenomenon: An Econometric Study of Zimbabwe's Experience. African Economic Research Consortium p.46.

|

|

|

|

|

Dickey D (1976). Estimation and Hypothesis Testing in Nonstationary Time Series. Unpublished Ph.D. dissertation. Iowa State University.

|

|

|

|

|

Dickey D, Fuller W (1979). Distribution of the Estimators of Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74:427-431.

|

|

|

|

|

Dowling ET (2001). Introduction to mathematical economics. 3rd edition. The McGraw-Hill companies.

|

|

|

|

|

Drama B, Shen Y, Ahmed A (2010). The effects of real exchange rate on trade balance in Cote d'Ivoire: Evidence from the cointegration analysis and error correction models. Munich Personal RePEc Archive.

|

|

|

|

|

Dunn M, Mutti H (2004). International Economics. 6th edition. Taylor & Francis e-Library.

Crossref

|

|

|

|

|

Eita JH, Gaomab MH (2012). Macroeconomic determinants of balance of payments in Namibia. International Journal of Business and Management 7(3):173-184.

Crossref

|

|

|

|

|

Falk M (2008). Determinants of the trade balance in industrialized countries. FIW Research Report. Austrian Working Paper, No 013.

|

|

|

|

|

Felipe J, Maccombie NK (2009). Is Pakistan Growth Rate Balance of Payments Constrained? Policies and implications for Development and Growth. Asian Development Bank Economics. Working Paper Series No 160.

|

|

|

|

|

Fikreyesus T, Menasbo G (2012). The effect of currency devaluation on the Ethiopian Economy's Trade Balance: A Time Serious Analysis. International Journal of Research in Commerce and Management (3).

|

|

|

|

|

Hailemariam A (2011). The effect of devaluation of birr on trade balance of Ethiopia: A Vector Auto Regressive Approach: A Draft Paper Submitted to the Ninth International Conference on Ethiopian Economy, Ethiopian Economic Association.

|

|

|

|

|

Imoisi AI (2012). Trends in Nigeria's Balance of Payments: An Empirical Analysis from 1970-2010. European Journal of Business and Management 4(21):210-217.

|

|

|

|

|

International Monetary Fund (1996). Balance of payments textbook. IMF, Washington DC.

|

|

|

|

|

Iyoboyi M, Muftau O (2014). Impact of exchange rate depreciation on the balance of payments: Empirical evidence from Nigeria. Cogent Economics and Finance.

Crossref

|

|

|

|

|

Kim S, Roubini N (2003). Twin deficits or Twin Divergence? Fiscal Policy, Current Account, and Real Exchange Rate in the US. Unpublished paper. New York University.

|

|

|

|

|

Nawaz A (2014) Impact of Exchange Rate on Balance of Payment: An Investigation from Pakistan. Research Journal of Finance and Accounting 5(13):32-42.

|

|

|

|

|

Nazeer A (2015). Exchange rate and determinants of balance of trade, its impact on balance of payment. American Journal of Business, Economics and Management 3(1):14-18.

|

|

|

|

|

Nega MK (2015). Assessment on real effective exchange rate and external sector development of Ethiopia. International Journal of Business and Economics Research 4(4):64-70.

|

|

|

|

|

Nicholas IN, Kurah JT, Emerole IC (2016). Effect of exchange rate on balance of payments in Nigerian Economy. Scholars Bulletin (A Multidisciplinary Journal) 2(2):72-77.

|

|

|

|

|

Ogbonna BC (2011). The impact of exchange rate variation on trade balance: Evidence from Nigeria 9(2):393-403.

|

|

|

|

|

Oladipupo AO, Onotaniyohuwo FO (2011). Impact of exchange rate on balance of payment in Nigeria. An International Multidisciplinary Journal, Ethiopia 5(4):73-88.

Crossref

|

|

|

|

|

Rehman H, Rashid H (2015). The balance of payment problem in developing countries, especially in Pakistan. Journal of Commerce pp. 31-52.

|

|

|

|

|

Sims CA (1980). Macroeconomics and reality. Econometrica 48:1-48.

Crossref

|

|

|

|

|

Temesgen T (2016). The impact of real effective exchange rate on trade balance in Ethiopia. Unpublished master's thesis. Addis Ababa University, Addis Ababa.

|

|