ABSTRACT

This study examines the relationship between Foreign Direct Investment (FDI) and import demand for 11 member countries of the Economic Community of West African States (ECOWAS) during the period 1970-2017. We employ a causality test based on Meta-analysis which considers the issues of cross-sectional dependency and slope heterogeneity among countries. The empirical findings indicate that the causal nexus between FDI and imports is one way running from imports to FDI. The results also reveal heterogeneity across countries in the causal nexus between FDI and imports. There is no evidence of causality between the two variables for seven countries while there is unidirectional causality from FDI to imports for two countries, and from imports to FDI for two countries.

Key words: imports, foreign direct investment, Granger causality, cross-sectional dependency, Economic Community of West African States (ECOWAS).

Foreign direct investment is an important instrument of economic development, especially for the developing countries facing a large resource gap. It enables them to build up physical capital and enhance skills of local labor through transfer of technology and managerial practices. On the other hand Foreign Direct Investment (FDI) help developing countries integrate into the global economy. In this way, FDI inflows affect the balance of payments of the host countries. In this study, we investigate the link between FDI and imports for 11 member countries of the Economic Community of West African States (ECOWAS). The relationship between FDI and imports is a debated topic in the economic literature. On the theoretical ground, there may exist a two-way causal relationship between FDI and imports. First, if imports are viewed by investors as evidence of existence of a profitable market, FDI might be attracted to the host country. On the other hand, FDI can influence imports both at the initial investment and operation phases. At the initial investment phase, FDI industries import capital and intermediate goods that are not produced in the host country. This contributes to increase imports and deteriorate the trade balance. At the operation phase of the investment, if FDI industries use local inputs of production, they may not have significant effect on imports. On the contrary, if they rely on imported inputs to satisfy the quality standards required by the world market, they will increase the demand for imports (Hailu, 2010).

On the empirical side, a number of studies have explored the link between FDI and imports. However, the empirical evidence is quite mixed and inconclusive. Some studies support the existence of a causal relationship between FDI and imports (Liu et al., 2001; Dritsaki et al., 2004; Pacheco-Lopéz, 2005; Iqbal et al., 2010) while others fail to support it (Lin, 1995; Kiran, 2011; Chantha et al., 2018). The empirical approaches examining the nexus between FDI and imports are based on times series and panel data methods. A major problem with panel data analyses is the implicit assumption that countries share common characteristics. This is likely to not be true given differences not only in institutional and economic structures of countries but also in their reactions to external shocks. Another shortcoming of these studies is that they assume cross-sectional independence across countries. This assumption is panel country-specific characteristics. Therefore, in this study unlikely to hold because countries of a panel may be linked one to another. Thus, the estimates from standard data regression methods are potentially misleading because they ignore cross-sectional dependence and we use panel data estimation method that accommodates with both cross-sectional dependence and heterogeneity.

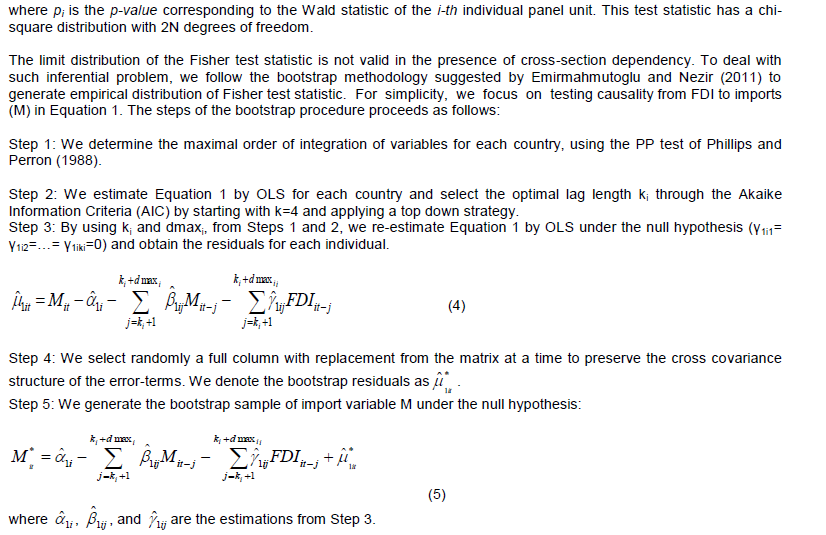

To test for Granger causality between FDI and imports, this study employs the modified-Wald test proposed by Toda and Yamamoto (1995). This method is more efficient in small sample data sizes and is particularly appropriate for time series for which the order of integration is not necessarily the same or the order of integration is more than one. Another advantage is that it does not require the pre-testing of the time series for co-integration. This is important since the unit root and the co-integration tests in general suffer from low power and different tests often lead to conflicting results. The basic idea of the Toda and Yamamoto (1995) causality approach is to intentionally over-fit the level VAR model by extra lags. Thus, the model VAR

to be estimated in this study is specified as follows:

Step 6: Substitute Mit* for Mit and estimate Equation 1 without imposing any parameter restrictions on it and then the individual Wald statistics are calculated to test non-causality null hypothesis separately for each country. Using these individual Wald statistics which have an asymptotic chi-square distribution with ki degrees of freedom, we compute individual p-values. Then, the Fisher test statistic given by Equation 3 is obtained.

We generate the bootstrap empirical distribution of the Fisher test statistics repeating Steps 4-6 many times and compute the bootstrap critical values by selecting the appropriate percentiles of these sampling distributions.

Our methodology has three advantages. It allows the lag orders on autoregressive coefficients and exogenous variable coefficients to vary across countries. Furthermore, it accommodates both for heterogeneity and cross section dependency.

DATA AND EMPIRICAL RESULTS

To carry out the empirical investigation, this study uses annual time series data of inward FDI and imports (M) for a panel of 11 ECOWAS member countries. According to the World Bank, FDI refers to the net inflows of investment to acquire a lasting management interest (10% or more of voting stock) in an enterprise, operating in an economy other than that of the investor and can be further developed as the sum of equity capital, reinvestment of earnings, other long term capital, and short-term capital as shown in the balance of payments in that economy. The data cover the period from 1970 to 2017. Foreign direct investment and imports are measured as share of Gross domestic product (GDP) so as to eliminate the effects of economic growth and prices. The countries under study include: Benin, Burkina Faso, Cote d’Ivoire, The Gambia, Ghana, Mali, Niger, Nigeria, Senegal, Sierra Leone and Togo. The selection of countries and time periods is limited by data availability. Data were obtained from the World Development Indicators of the World Bank. Table 1 outlays the summary statistics for the variables. This table reveals a disparity in FDI and imports among ECOWAS countries. The average import penetration rate varies from 14.058% in Nigeria to 49.128% in Togo. Inward FDI as share of GDP varies from 0.799% in Burkina Faso to 2.870% in Sierra Leone.

Before applying the Granger causality tests, the presence of cross-sectional dependence in the error terms of Equation 1 was tested. It has been demonstrated that neglecting cross-sectional dependence could cause bias and inconsistent results (Breusch and Pagan, 1980; Bai and Kao, 2006; Pesaran, 2006; Kapetanios et al., 2011; Sarafidis and Wansbeek, 2012). The results of the cross-sectional dependence tests are presented in Table 2. This table also reports the results of the slope homogeneity tests based on Swamy (1970) test and the delta tilde and adjusted delta tilde tests developed by Pesaran and Yamagata (2008). The results strongly indicate that the null hypothesis of no cross-sectional dependence is rejected at the 5% level of significance. The cross-sectional dependence tests thereby support evidence of high connection among the ECOWAS countries, which implies that any shock that occurs in one country can quickly be transmitted to other countries. The results also support country-specific heterogeneity, implying that the direction of causal linkages between FDI and imports may differ across countries.

As a second step of our empirical analysis, we test for the order of integration of the series by using the PP test of Phillips and Perron (1988). This step is necessary to determine the maximal order of integration of variables for each country. The test results are reported in Table 3. According to the results all the variables are stationary in four countries while they are integrated of order one for the remaining countries.

Based on these results, the next step is to test for the existence of causal relationships between the two variables. The existence of cross-sectional dependency and heterogeneity across countries makes the use of standard Granger causality tests inappropriate. The results of Granger causality test based on Toda and Yamamoto (1995) procedure are reported in Table 4. They show that both the null hypothesis of “no causality from FDI to imports” and “no causality from imports to FDI” cannot be rejected for seven countries. On the other hand, there is strong evidence of unidirectional causality running from FDI to imports for Ghana and Niger, while the reverse causality is supported for Mali and Togo. For the panel as a whole the results suggest that the causal link between FDI and imports is one way running from imports to FDI.

In this study, we have investigated the causal relationship between inward foreign direct investment and imports in 11 ECOWAS countries. The data set comprises annual data on FDI and imports as share of GDP for a period spanning from 1970 to 2017. The study applied the Granger causality testing approach suggested by Toda and Yamamoto (1995) in heterogeneous mixed panel by using a Meta-analysis. We found that there are strong correlations among the ECOWAS countries. Therefore, we have applied the bootstrap method to generate the empirical distribution of the Fisher test. The empirical findings indicate that the causal nexus between FDI and imports is one way running from imports to FDI. This suggests that FDI inflows to ECOWAS area are attracted by its foreign trade strategy. The results also reveal heterogeneity across countries in the causal nexus between FDI and imports. There is no evidence of causality between the two variables for seven countries while there is unidirectional causality from FDI to imports for two countries (Ghana and Niger), and from imports to FDI for two countries (Mali and Togo). These findings suggest that foreign direct investment would not deteriorate the trade balance of most of ECOWAS countries.

The author has not declared any conflict of interests.

REFERENCES

|

Bai J, Kao C (2006). On the Estimation Inference of a Panel Cointegration Model with Cross-Sectional Dependence. In: Baltagi, Badi. (Ed.), Contributions to Economic Analysis. Elsevier, pp. 3-30.

Crossref

|

|

|

|

Breusch TS, Pagan AR (1980). The Lagrange Multiplier Test and its Application to Model Specification in Econometrics. Review of Economic Studies 47(1):239-253.

Crossref

|

|

|

|

Chantha H, Keo K, Suttiprapa C (2018). An Empirical Analysis of Cambodia's Import Demand Function. Journal of Management, Economics, and Industrial Organization 2(1):1-12.

Crossref

|

|

|

|

Dritsaki M, Dritsaki C, Adamopoulos A (2004). A Causal Relationship between Trade, Foreign Direct Investment and Economic Growth for Greece. American Journal of Applied Sciences 1(3):230-235.

Crossref

|

|

|

|

Emirmahmutoglu F, Nezir K (2011). Testing for Granger Causality in Heterogeneous mixed Panels. Economic Modelling 28:870-876.

Crossref

|

|

|

|

Fisher RA (1932). Statistical Methods for Research Workers. 4th Edition. Oliver and Boyd, Edinburgh.

|

|

|

|

Hailu Z (2010). Impact of Foreign Direct Investment on Trade of African Countries. International Journal of Economics and Finance 2(3):122-134.

Crossref

|

|

|

|

Iqbal MS, Shaikh FM, Shar AH (2010). Causality Relationship between Foreign Direct Investment, Trade and Economic Growth in Pakistan. Asian Social Science 6(9):82-89.

Crossref

|

|

|

|

Kapetanios G, Pesaran M, Yamagata T (2011). Panels with Non-stationary Multifactor Error Structures. Journal of Econometrics 160(2):326-348.

Crossref

|

|

|

|

Kiran B (2011). Causal Links between Foreign Direct Investment and Trade in Turkey. International Journal of Economics and Finance 3(2):150-158.

Crossref

|

|

|

|

Lin A (1995). Trade Effects of Foreign Direct Investment: Evidence for Taiwan with Four ASEAN Countries. Weltwirtschaftliches Archiv 131:737-747.

Crossref

|

|

|

|

Liu X, Wang C, Wei Y (2001). Causal Links between Foreign Direct Investment and Trade in China. China Economic Review 12(2-3):190-202.

Crossref

|

|

|

|

Pacheco-Lopéz P (2005). Foreign Direct Investment, Exports and Imports in Mexico. World Economy 28(8):1157-1172.

Crossref

|

|

|

|

Pesaran MH (2006). Estimation and Inference in Large Heterogeneous Panels with a Multifactor Error Structure. Econometrica 74(4):967-1012.

Crossref

|

|

|

|

Pesaran MH, Yamagata T (2008). Testing Slope Homogeneity in Large Panels. Journal of Econometrics 142(1):50-93.

Crossref

|

|

|

|

Phillips PCB, Perron P (1988). Testing for a Unit Root in a Time Series Regression. Biometrika 75(2):335-346.

Crossref

|

|

|

|

Sarafidis V, Wansbeek T (2012). Cross-Sectional Dependence in Panel Data Analysis. Econometric Reviews 31(5):483-531.

Crossref

|

|

|

|

Swamy P (1970). Efficient Inference in a Random Coefficient Regression Model. Econometrica 38(2):311-323.

Crossref

|

|

|

|

Toda HY, Yamamoto T (1995). Statistical Inference in Vector Regressions with possible Integrated Processes. Journal of Econometrics 66(1-2):225-250.

Crossref

|