ABSTRACT

This study contrasts empirical studies which had focused on listed bank at the detriment of unlisted banks. In other to enhance public confidence in the banking sector and ensure financial inclusion, this study examined the relationship between leverage and performance of unlisted banks in Ghana. This study examined the relationship between leverage, other moderating variables and bank performance by collecting data from fifteen unlisted universal banks in Ghana from 2006 to 2016. The cross sectional time series research design with the quantitative research approach was adopted for the study. The fixed effect panel regression was used to analysis the variables from the data collected. The outcome of the study showed that unlisted banks in Ghana are highly leveraged with more debt to equity. The results also indicated that the level of gearing for unlisted banks has a positive relationship with the bank performance variables which are return on asset, return on equity and rate of profit. This is attributed to the cost of debt and type of debts that are contracted by the unlisted banks coupled with the efficiency in transforming such debts into less risky asset. The correlation and regression result showed a significant positive relation between firm size and bank performance. The study recommends that stakeholders of the banking industry must be concerned with the utilization of debts effectively and efficiently to enhance an optimal leverage ratio that could stand the risk of highly geared bank in a more integrated financial system. To achieve this, the regulators of the banking industry in Ghana must develop policies that seek to inject more equity funds in the operation of banks; guides in asset management and effective cost control in relation to leverage. This will boast the efficiency of the banking industry in their intermediation role.

Key words: Leverage, unlisted banks, bank performance, cross sectional time series, Basel I, II, III accord.

In today’s global industrialization, the financial sector plays a key role in the competitiveness of countries across the globe. The overall economic growth of many countries in the world is influenced by the effective management of the financial system. The two major players of the financial system are the financial markets

and the financial institutions which includes the banks. The banking industry’s performance affects other sectors of the financial system because of the interdependent nature of the system. According to Gatsi et al., (2015), among the factors that drives the performance of the banking industry are; the regulation, the size of the firm, market capitalization, economic growth, inflation, loans and deposits, technological change, deregulation, industry competition, leverage and corporate governance. Leverage is a tool that could be used to manage risk in investment. Leverage permits firms to increase the potential returns on an investment project beyond what would be possible through a direct investment of its own funds (Gatsi et al., 2016).

The business of banking is to raise funds from the surplus spending unit of the economy to the deficit spending unit. In undertaking this primary duty, banks normally engaged in leverage by using customer deposit to acquire more assets. This is typically when universal banks use available customers deposits and transform’s them into credit packages such as car loans and mortgages. The purpose in such leverage transaction is to generate more profit. Most banks expand their statement of financial position to increase their leverage. The decision by many banks to increase leverage appears to have been driven in part by a desire to maintain return on equity (ROE), relative to competitors, even as return on assets fall (Haldane et al, 2010).The U.S Financial Stability Board, FSB (2016) and U.K Financial Service Authority, FSA (2017) have attributed the global financial crisis that occurred in 2007 to 2016 to excessive leverage by banks. The European banks have recognised the economic significance of leverage after the 2007-2009 financial crises. (European Banking Federation (EBF), 2016). The global financial crises had adverse effect on the aggregated statement of financial position of the banking industry in South Africa (South Africa Reserve Bank (SARB), 2016). This clearly shows an adverse effect of leverage on the performance of banks in South Africa. Most banks performances in Nigeria are affected by the risk assessment of client before granting loans (Ebiringa and Ezeji, 2012).

The banking industry in Ghana remained profitable despite declining trends in the industry profitability. A Bank of Ghana (BOG) report (2016) showed a decline in the industry return on assets and return on equity from 2010 to 2016. Thus return on assets; 2010-6.3%, 2011-4.6%, 2012-3.3%, 2013-4.6%, 2014-3.3%, 2015-4.8% and 2016-3.7% (BOG, 2016). Return on equity decline from 33.4 % in 2010 to 22.9% in 2011 and subsequently it increase to 24.1% in 2015 and to 27.4% in 2016 (BOG, 2016). In 2016, the industry’s return on equity decline to 25.8%. The decline in industry profitability was attributed to an increase in average total assets without a corresponding increase in profit levels, as a result of a narrowing net interest spreads. In addition, the effect of expenditure by the banks in respect of Information Communication Technology (ICT), re-engineering resulted in reduced earnings performance (Bank of Ghana Report, 2016). In Ghana, empirical studies (Gatsi et al. 2016; Awunyo-Vitor et al. 2012; Abor, 2007b; Amidu 2007) have established that universal banks listed on the stock exchange are highly leveraged and the degree of leverage influence their performance. On the other hand same cannot be said for unlisted banks because of the absence of empirical literature.

Motivation for the study

In recent times, banking in Ghana has experienced a series of changes from 2000 to 2017. These transformations range from the increasing number of banks, the dynamic operations, ownership structure and good corporate governance, new products development and Central bank policies and regulations. These have contributed to the immense performance of the banking sector as compare to other sectors of the financial System. The Banking sector dominated the financial system with a total asset of 83% as compared with 2% of the security market and 3% of the insurance industry (IMF, 2016). The present impact of regulations on the banking industry shows clearly that the most likely driver of performance in the industry is regulations. A regulator such as Bank of Ghana (BOG) is a foremost driver that could increase the performance prospects of the banking industry. The adaptation of the Basel II accord of risk based capital minimum requirement has been improved by the introduction of Basel III leverage ratio. Researchers have argued that a minimum leverage ratio could help control bank’s incentives of regulatory arbitrage and mitigates procyclical effects because of Basel II risk-based capital requirement (Adrian and Shin, 2010; D’Hulster, 2009; Hildebrand, 2008). The introduction of mobile money banking by tele-communication industry is also yet to be considered as a driver for future performance in the banking industry. The historical background of the banking industry, the present trends of the industry and the performance prospect indicate clearly a positive performance of the banking market and a high growth potential in performance of the industry. This shows a clear need to research about the impact of leverage on the performance in the banking industry. In a conclusion, the banking industry in Ghana has gone through phase of growth in performance. The main drive of performance identified were regulation, increasing number of banks, the dynamic operations, ownership structure, good corporate governance and new products development. Subsequently in the years to come, the main force of drive identified will be keen competition in the industry. This competition could force banks to invest in alternative asset with leverage, which is likely to affect the bank performance hence, the need to establish the relationship between leverage and bank performance especially with unlisted banks since empirical studies have done a great deal of work on listed banks as against unlisted banks.

REVIEW OF RELEVANT LITERATURE AND HYPOTHESIS DEVELOPMENT

This section is devoted to review relevant study upon which the premises of the study is base. The study reviews the trade-off theory and some empirical studies on the topic for analysis.

Trade–off theory

The trade-off theory is a stem of the Modigliani and Miller (MM) theory of capital structure, which has the point of view that the choice of a firm’s decision on how much of debt or how much of equity should be used in financing assets must consider the balancing between cost and benefits. According to the theory, there are benefits of leverage within a capital structure until the optimal capital structure is attained (Myers, 1984). The leverage aspect of the theory states that there is performance benefit in financing a firm with debt. The theory accepts the tax benefits from interest payment if a firm is finance with debt. Under this theory, the optimal leverage is attained when a firm set a target of debt to equity ratio and steadily moves towards the target (Myers, 1984). The existence of the target is what maximizes the performance of the firm. The theory allows adjustment of the target leverage ratio to achieve the set target. The merit of the assumptions under the trade off theory has under gone several reviews. Graham (2003) identifies a gap in the trade off theory based on tax effect. According to Graham (2003), tax effects are more complex than what the theory assumed. The nature of bankruptcy cost is not discussed in the assumption of the theory (Haugen and Senbet, 1978). Murray and Vidhan (2005) raised questions in relation to bankruptcy cost that could affect the optimal leverage; are the bankruptcy costs fixed costs? Do the bankruptcy cost increase with the size of the bankruptcy? Are the bankruptcy costs one-time costs? The implication of the adjustment of the tax shield and bankruptcy cost has led to alternative adjustment cost assumptions (Leary and Roberts, 2005). The several reviews conclude that implication of the trade-off theory for leverage ratios shows clearly that the theory can be settled with existing literature on empirical evidence (Hennessy and Whited, 2005; Leary and Roberts, 2005; Strebulaev, 2004).

Empirical studies and hypothesis development

Many empirical studies have attempted to establish the relation between firm performance and leverage. The findings of the numerous studies vary based on nature of firm, the leverage characteristics used, basis of performances measurement, countries economical difference, and the methodology used. The outcome is dependent on various factors that influence leverage and firm performance. For instance, Gill and Mathur (2011) study 166 Canadian firms listed on the on the Toronto Stock Exchange for a period from 2008-2010 to find factors that influence leverage to have effect on the performance of these Canadian firms. Gill et al. (2009) also sample 300 US firms from the service industry to examine the relationship between leverage and performance. They found out that leverage is negatively related to firm’s profitability. Manawaduge et al. (2011) used both pool and panel data regression to study 155 Sri Lanked listed firms in the relationship between leverage and firm performance. The result demonstrated that most Sir Lanked firms finance their operation with short-term debt as against long-term debt. Ebaid (2009) examine the relationship between leverage and firm’s performance in Egypt using a sample of 64 firms for a period from 1997 to 2005. Using leverage ratios and ROE and ROA as measures of performances, the result of this study indicate that leverage has no impact on the performance of firms in Egypt. The study concludes that capital structure decision has a weak-to-no impact on firms in Egypt. From this backdrop, the first hypothesis is:

Hypothesis 1

H1: There is no relationship between leverage and bank performance

Ogebe et al. (2013) investigated between the relationship between leverage and firm performance for a period from 2000 to 2010. They used macroeconomic variables such as GDP and inflation as key influence on firm performance. They study is quite different from other empirical studies because it classified the samples firms into low leverage firms and high leverage firms by setting up a baseline of above 10% as being a high leverage firms. Using return on investment as measure of performance and panel regression estimation model, the study concluded that there is a significant negative relationship between leverage and performance. The findings were attributed to the finance of business activity with more debt than equity. In Ghana, many empirical studies have sort to examine the relationship between leverage and performance. The most recent publication is one by Gadzo and Gatsi (2016), used the OLS cross-sectional time series regression to conduct a study on the degree of leverage and risk adjusted performance of listed financial institutions in Ghana, their study indicted a an average leverage among the listed Ghanaian financial institutions and also a positive relationship between their level of leverage and variables such as risk adjusted firm performance; firm tangibility and firm growth. But their study did not consider unlisted firms. Earlier, in their bid to concentrate on the insurance sector of Ghana, Gadzo and Gatsi (2013), used the fixed effect panel data regression to conduct a study on the determinants of capital structure in the insurance companies of Ghana, their study indicted a high leverage among Ghanaian insurance firms and also an adverse relationship between their level of leverage and variables such as firm performance; firm size; firm age and firm growth. Prior to the study of Gadzo and Gatsi (2013), Abor (2007a) used a panel date regression to compare the leverage of listed firms, unlisted firms and SME’s in Ghana. The result shows that listed and large unlisted firms in Ghana have a significant higher leverage and SME’s. The study shows that listed and large unlisted firms turn to have higher debt than SME’S. Abor (2005) subsequently study the relationship between leverage and firm performance of SME’s using corporate governance as a factor. The study indicated that most SME’s has low leverage with large board size and its influence the performance of SME’s in Ghana. From these reviews it is the second hypothesis is developed as:

Hypothesis 2

H2: There is a negative relationship between Tier 1 leverage ratio and bank performance

Ongore and Kusa (2013) examine the relationship between Kenya bank performance and bank characteristics. The study indicated that bank specific factors significantly affect bank’s performance in Kenya. The study concluded that the performance of commercial banks in Kenya is driven by management decisions on leverage. Amidu (2007) used a panel data analysis to examine the determinants of leverage of banks in Ghana. Abor (2007a) undertook a cross study in Ghana and South Africa to examine the relationship between leverage and financial performance of SME’s. Using the effect of debt policy and a panel data analysis, the study concluded that leverage influences financial performance positively. The reason was that short-term debt was less expensive and hence more of short-term debts in the capital mix of the firm with low-level interest result in an increase in profit margin. All above empirical studies show opposite relationship between leverage and firm performance ranging from different firm in different industries. The definition of leverage in the above studies differs; while other used the decision of debt to equity, other also used the leverage ratio. None of these studies examine the relationship between leverage and bank performance. Several studies have also been specific to study the relationship between leverage and bank performance. Graf (2011) studied the relationship between leverage and bank performance using European and US banks. The study found out that European banks have a high leverage in which bankruptcy cost was more than the benefits of tax shield.

The research design adopted for the study is quantitative design. The quantitative research design is appropriate because it measures figures and observed facts (Cooper and Schindler, 2006). The study design under the quantitative research design is cross sectional time series (panel). The population of this study is all unlisted banks registered in Ghana. The study focused on a target population of 15 unlisted commercial banks in Ghana. It excludes rural and apex banks. The census sampling technique was adopted to select all the 15 banks for the analysis.

Measurement and justification of variables

The study focused on leverage and unlisted bank performance. The independent variables are variables that measure leverage; short-term debt ratio, long-term ratio, leverage ratio, Tier 1 leverage ratio and firm size. Long-term debt ratio and short-term ratio are adopted because “debt” was review as a variable in the trade-off theory that influence leverage and firm performance. The leverage ratio and Tier 1 leverage ratio are widely used for empirical studies to examine bank leverage. Although firm size is often used as control variables in most empirical studies, this study opts firm size as leverage variable because of its relationship with bank performance from empirical findings. The dependent variables are variables for bank performance include ROE. The control variables for the study include bank variables (firm age, liquidity, number of bank branches) and an economic variable (inflation).

Dependent variables

Return on asset (ROA): ROA is a performance indicator that measures the effect of management capacity to use the financial and real resources of bank to generate profit (Carunto and Romanescu, 2008). It is also known as profit to assets or return to investment (ROI). ROA is the ratio of the net profit after tax to total assets.

Return on equity (ROE): ROE is a significant indicator for performance. It measures the banking management in all its dimensions and offers the utilization of shareholders capitals, the effect of their retainers on bank activity (Carunto and Romanescu, 2008). ROE is the ratio of the net profit after tax to total equity for the fiscal year. The total equity is the sum up of the nominal capital; retain earnings and the reserve funds.

Profit Rate (Rp): Carunt and Romanescu (2008) argue that in the banking area, the profit rate is the ratio between bank income and expenses. The structure of incomes and expenses of banking activity influence the ROA and ROE. Rp is measure as the ratio of the net profit after tax to total income.

Independent variables

Short-term debt ratio (STD)

Abor (2007b) and Ebaid (2009) adopted STD and LTD as tool to measure financial leverage because it determines capital structure of a firm, which subsequently influence the level of leverage.

Leverage ratio (LR): To measure banks leverage that influence their performance, the widely used simple leverage, which is the ratio of debt to equity is used as independent variable. As noted by D’Angelo-Stulz model (2010), bank’s equity is mostly a capitalized value below the central bank borrowing rate or liquidity premium. In this study measurement, debt is the sum up of short-term debt and long-term debt. Equity refers to the book equity or the shareholder’s fund. It includes retained earnings and other reserves.

Tier 1 Leverage ratio (T1L): The T1L is a special bank leverage ratio introduce by Basel III accord to curtail the excessive leverage by banks, which normally result in economic crisis. The new bank leverage ratio as supportive measures to the risk based minimum capital requirement as introduced by Basel III looks at capital reforms, liquidity standards and systemic risk and interconnected ness of the banking industry. The Basel III accord just increased the minimum accepted T1L ratio from 2 to 4.5%. Based on this, the study opts for the accepted T1L ratio as the minimum in examines bank leverage in Ghana. The T1L is measures as the ratio of total asset to Tier 1 Capital.

Firm size: Firm size is adopted as independent variable in this study because bank performances are dependent on how small or large of a bank. Jermias (2008) and Ebaid (2009) argue that larger banks do not necessary mean more capacity and capabilities although it could influence performance. This is possible due to economics of scale and diseconomies of scales associated with large banks.

Model specification

The study employed theoretical model with necessary adjustment variables to test the relationship between leverage and bank performance, the estimation model used by Kuznnetsov and Muravyev (2001) and Awunyo-Vitor and Badu (2012) is adopted.

Yit= αi+ β1Xit + eit

Where; Yit: performance measure indictors (dependent variables) for bank i at time t.

ai: the time-invariant firm specific effects, Xit : the independent variables, β1 : coefficients, eit: a random disturbance.

Based on the above general linear function model the relationship between leverage and bank’s performance are examined using the below models;

Model (1) ROEit = ßo+ ß1LTDit + ß2LQit +ß3T1Lit + ß4SIZEit +eit

Model (2) ROAit = ßo+ ß1STDit + ß2LQit+ ß3T1Lit + ß5SIZEit +eit

Model (3) Rpit = ßo + ß1LRit+ ß2LQit+ ß3T1Lit + ß5SIZEit +eit

According to empirical review, the expected signs of the coefficient of the explanatory variables are as followings:

ß1> 0 < (Abor, 2005; Manawaduge et al., 2011; Gadzo and Gatsi 2013)

ß2< 0 (Majumbar and Chhibber, 1999; Manawaduge et al., 2011; Gadzo et al., 2016)

ß3> 0 (Roden et al., 1995; Abor, 2007b; Awunyo-Vitor and Badu, 2012)

ß 4> 0 < (Ebaid, 2009; Haldane, et al., 2010; Weigand et al., 2011)

ß5> 0 (Huang et al., 2001; Biger et al., 2008).

Model estimation technique

The study employed multiply regression panel data models to test the relationship between leverage and bank performance. Panel data involves the pooling of observation on a cross-section of units over several periods. According to Vong and Chan (2009), panel data is normally used because it gives more information on the cross-sectional basis. The individual variability of the data and dynamic adjustment of the data in easily identified in a panel data regression. Notwithstanding that it also takes into the heterogeneity that is present among the individual data units. Several empirical studies on bank performance have used linear functional form for analysis. In this study, the linear form of panel data model is used. The study used General Least Squares (GLS) panel regression model for the estimation. The estimation of panel data models using pooled ordinary least squares yields inconsistent estimators and heteroskedasticity errors (Baltagi, 1995). To correct this problem, the GLS is adopted. The GLS panel model could be estimated with constant coefficient effect model, fixed effect model and the random effect model. The constant coefficient effect model is used under the assumption that there is no significant difference in both intercepts and slopes. The Hausman test determines whether fixed effects or random effects will be used for analysis in this study. The use of Hauseman test to conclude whether the effects are fixed or random is to use the Hausman (1978) test under the null hypothesis that the pooled regression for the estimated equations is significant. If the null hypothesis is rejected, the effects are measured to by fixed. If the null hypothesis is accepted, we would have random effects, and the model is then estimated by GLS.

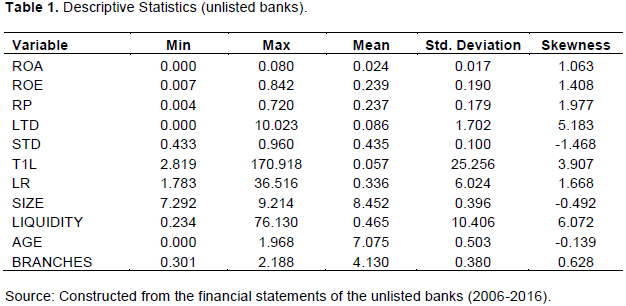

The Ghanaian banking industry is characterized with more than 70% unlisted banks. Most of these unlisted banks are foreign-owned and major players of the banking industry. Table 1 shows a summary of the descriptive statistics of the dependent and independent variables for unlisted banks. ROA of the unlisted banks ranges from 0.00 to 8% with the average of 2.4%. The standard deviation of the ROA for unlisted banks is 1.7%, which suggests majority of unlisted banks have an average ROA of 2.4%. This indicates a bad performance of returns on the utilization of the bank’s asset. This general low ROA of the unlisted banks could be attributed to the loan portfolio quality (LPQ). The profitability of loan portfolio is dependent on the quality of loans and advance been issued out by the banks. This is coupled with the lending practice as well as loan default rate, which are mostly dependent to macroeconomics environment. ROE of unlisted banks ranges from 7 to 84.3%. This implies that on the average, owners of unlisted banks received a return of 23.9% on their investment. This could be attributed to the fact that most unlisted banks during the period of study need to retain earnings to towards meeting the minimum capital requirement so less was invested to generate much return. The rate of profit (Rp) for unlisted banks ranges from 0.4 to 72.3%. It is observed that the average Rp for unlisted banks is 23.7 From Table 1, the averaged LTD for unlisted banks is 8.6% while the STD for unlisted banks is observed to be 43.5%. This shows that the level of debt in unlisted banks. This is due to the capacity of listed banks to raised funds from debt holders as compare to credibility and capacity of unlisted banks.

The record for unlisted banks shows a mean of 5.7% for T1L and of 33.6% for LR. Both T1L and LR indicated and confirm that unlisted banks in Ghana are highly geared. Firm size for unlisted banks as measured in fixed asset recorded a mean of 8.45% while liquidity recorded a mean of 46.5% for unlisted banks. The liquidity level for unlisted is far lower as compare to the industry liquidity level of 68.6%. This indicates that unlisted banks have a high-risk level of liquidity as less than 50% deposit are kept as cash and cash equivalent. The average year of operation recorded as firm age for unlisted banks is 7 years. The average bank branch of the unlisted banks is 4.

Regression of results

From the Table 2, the R- squared, which measures the extent to which the explanatory variables explain the variations in the ROA, is about 62%. Again, from the same table the Durbin-Watson Statistic (D-W Statistic) revealed that the problem of autocorrelation of the errors terms, which is sometimes a challenge in panel data methodology, is not serious in the ROA regression estimates because of the average coefficient of 2.93, which was identified in Table 2. The F-test that shows the global usefulness of the model indicated an appreciable goodness of fit. In other words, the F-statistics prove the validity of the estimated models is statistically significant at 1% as shown by the F-probabilities. From Table 2, SIZE, STD, T1L and LR indicated a p-value less than 0.05 meaning they are all significant at 5% while LTD indicated a p-value greater than 0.05 meaning, it is not significant. There is a positive relationship between ROA of unlisted banks and SIZE, STD, TIL and LTD as indicates on Table 2. However, the coefficient of simple leverage ratio of unlisted banks indicates statistically negative and significance relationship with ROA. From Table 2, the control variables in the model namely liquidity and firm age all exhibited a negative relationship with ROA of unlisted banks and bank branches show a positive with ROA. However, only bank branches exhibit statistical significant positive relationship with the dependent variable.

As Table 3 indicates, ROE of unlisted banks is significantly and positively related to STD, T1L and LR with p-values of 0.0308, 0.0330 and 0.0265 respectively. This means that the relationship is significant at 5%. However, LTD and ROE of unlisted banks indicate an insignificant relationship but a positive relationship. Table 3 also depicts the relationship between ROE and the moderating variables. The results shows that SIZE is positively related to ROE with a statistically significance at 5% because p- value of 0.0437 < 0.5 while firm Age also showed a statistically significant positive relationship with ROE with a recorded p-value of 0.0407 is less than 5%. On the other hand, liquidity (LIQ) and bank branches indicated a negative relationship with ROE but both variables had p-values of 0.9615 and 0.6146 respectively which are greater than the 0.05 hence the relationship is not statistically significant. Table 4 also presents the regression of results of the rate of profit and the various variables. The results indicates that, the rate of profit of the unlisted banks is significantly and positively related to STD, T1L and LR with p-values of 0.0453, 0.0058 and 0.0097 respectively. This means that the relationship is significant at 5%.

However, LTD and rate of profit of unlisted banks indicate an insignificant relationship but a positive relationship. Table 4 also depicts the relationship between rate of profit and the moderating variables. The results shows that size of the bank is positively related to rate of profit with a statistically significance at 5% because p- value of 0.0001 < 0.5 while bank branches also showed a statistically insignificant positive relationship with rate of profit with a recorded p-value of 0.8882 is greater than 5%. On the other hand, liquidity (LIQ) and firms age indicated a negative relationship with ROE but both variables had p-values of 0.9615 and 0.6146 respectively which are greater than the 0.05 hence the relationship is not statistically significant.

This study examines the relationship between leverage and unlisted bank performance. From the results in Tables 2, 3 and 4, the bank performance variables which were measured with ROA, ROE and Rate of profit demonstrated a statistically significant positive relationship with all the leverage indicators which were measured with STD, LTD and T1L. The outcome of the study implied that, the performance of the banks increases whenever there is an increase in the leverage position of the banks. This is the case because an increase in leverage implies management borrowing from outsides source the support their liquidity position and because such liquidity supports comes with a lot of restrictions and convent clauses, management of the banks are encouraged to utilized the funds in such a way that more returns can be recouped from the utilization of funds. Again from the trade-off theory perspective, there is a relationship between the debt providers and management such that management are to utilize the funds from debt providers effectively so as to increase the cashflow in other to meet the needs of the debt providers in the form of paying back borrowed funds with it’s accompanying interest component. From the results of the study the tenants of the agency theory is complied with by the results depicted by the study. From the empirical review, quite a number of studies in Ghana have concluded on the effect of leverage on bank performance in Ghana (Abor, 2005; Gatsi and Akoto, 2010; Awunyo-Vitor and Badu, 2012; Gadzo et al., 2016). Although the year of the previous studies differs for this study, the panel data methodology used is the same. In contrast to the existing empirical studies, which usually examines only listed bank, this study exam the relationship between leverage and performance of unlisted banks. This is important as unlisted banks represent most of the Ghana banking industry. For example, fifteen of the sampled banks are unlisted. Moreover, the funding structure and corporate governance of unlisted banks differs form-listed banks. This difference in the funding structure and corporate governance could affect individual banks undertake operation to improve performance. For instance, listed bank could raise more equity to boast investment whiles unlisted are restricted to solicit funds from the public. On the other hand, the display of performance of listed banks could attract potential investors while performance of unlisted banks is unknown. Contrasting the results to that of Gatsi et al. (2016) whose study identified a negative relationship between leverage and bank performance, they focused on listed banks which is much regulated than unlisted banks. Aside the regulations, with the listed banks, much attention is given to corporate governance structures which presupposes that with weak corporate governance structures, the funds provided for liquidity support may be diverted and could have an adverse effect on the profit of the banks.

The positive relationship implies that long-term debt has the potential to increase returns of unlisted banks if sought for. Probably unlisted banks have not utilized this source because of it availability on the financial market. The result is supported by early findings in Ghana (Abor, 2005; Gatsi and Akoto, 2010; Awunyo-Vitor and Badu, 2012: Gatsi et al., 2016). The control variable, LIQ and bank branches recorded indicated insignificant negative relationship with ROE of unlisted banks while firm age recorded a p-value of 0.0407 and a positive relationship. Bank branches of unlisted banks are insignificant because the bank with the highest bank branches, Ghana Commercial Bank (GCB) happens to be a listed bank. Also, most unlisted banks are new foreign banks, which just entered the banking industry in Ghana and are yet to open more branches. Table 3 indicates a positive significant relationship between firm age and ROE of unlisted banks. This implies that the older an unlisted bank, the higher returns on equity. The reason could be attributed to the fact most unlisted banks has been in operation for a long number of years with experienced staff and loyal customers. Unlisted banks such as Barclays bank and Agricultural Development bank has been operating for a long number of years and with long standing reputation. This increase customer loyalty and hence it will increase incomes thereby a positive ROE.

With respect to the moderating variables, there is a negative relationship between firm age and ROA of unlisted implies that as unlisted bank grows more in age, the returns on asset decrease. This could be attributed to high default risk that could exit in the asset. Most unlisted banks in Ghana are managed by owners and thereby the agency theory that not exited in unlisted banks. As noted by Grossman and Hart (1982), the existence of the agency cost in listed banks brings threat of liquidation. The threat triggers personal losses to managers ‘salaries and reputation. These cause managers of listed banks to take caution in risk assessment of granting loans and advance to client. Unlike the unlisted banks, managers could in increase sales by granting loans with high risk. In the long run, there will be huge asset, which brings no returns because of high debt defaults. The positive significant relationship between bank branches and ROA of unlisted banks implies that unlisted banks with more branches increase the returns on the asset. This could be attributed to the nature of unlisted banks in Ghana.

These foreign owned banks invest huge in opening branches thereby increasing the returns on the asset in the short run. This finding is consistent with a survey conducted by PwC (2016). Table 3 indicates that, ROE is significantly and positive related to SIZE of unlisted banks with p-values of 0.0437. The positive relationship means that if unlisted banks want to increase their ROE values they would have to increase the amount of investment in their firm’s size. The outcome of the study is inconsistent with studies conducted on listed banks, which indicated a negative relationship between ROE and SIZE (Ramaswammy, 2001; Frank and Goyal, 2003; Gatsi and Akoto, 2010; Gadzo and Gatsi, 2013; Gatsi et al., 2015). The reason for the positive relationship between ROE and unlisted banks could be attributed to nature of unlisted banks in Ghana. The unlisted banks in Ghana are made up of foreign banks and local banks. Most foreign banks and local banks invest huge equity in firm’s asset to increase the returns. Most of the huge investment is directed to productive areas of the economy. The finding is consistent with other empirical studies conducted (Gale, 1972; Punnose, 2008). From Table 4, Rp of unlisted banks showed a positive significant relationship with SIZE with a p- valve of 0.0001. This implies that an increase in the bank’s size increases the bank’s rate of profit. This confirms that SIZE influence bank’s performance. Moreover, Rp of unlisted banks are significantly related to STD and T1L and LR but insignificant related to LTD. The reason of the negative relationship between Rp and LR of unlisted could be attributed to huge element of debt in leverage of unlisted banks. This implies a higher debt in the component of unlisted bank leverage turns to reduce rate of profit. As noted Ozkan (2001), short-term debt is more sensitive to profit than long-term debt. Since LTD is insignificant to Rp, it means the debt component of LR is mostly STD. Debt is cheap than equity. Due to this, unlisted banks employ a higher proportion of debt this increase their interest payment consequently increase interest expense to reduce their profit level. The Table 4 indicates an insignificant inverse relationship between Rp of unlisted banks and LIQ. Also, bank’ branches indicate an insignificant positive relationship with Rp of unlisted banks. Only firm age of unlisted banks is significantly related to Rp with p-value 0.0186. The coefficient of unlisted banks indicates a positive relationship while the entire firm’s age indicates a negative relationship. This could be attributed to the fact that most unlisted banks have been in the industry with long years with more skilled employees and more loyal customers. Abor (2007) confirms that firm’s age affect firm’s profit.

TESTING OF HYPOTHESIS FORMULATED FOR THE STUDY

With respect to the hypothesis, the Tables 2 to 4 indicates the p –values for LR in relation to ROA, ROE and Rp as 0.0014, 0.0265 and 0,097 respectively. H1 is rejected based on p-values < 0.05 with positive relationship. This implies that there is a significant relationship between leverage and performance of unlisted banks. The T1L indicated p-values in relation to ROA, ROE and Rp as 0.0190, 0.0330 and 0.0528 respectively with different coefficient relationship. Hence H2 is rejected based on p-values < 0.05. There is a positive relationship between T1L and ROE. Moreover, the relationship between T1L and ROA and Rp is negative. This implies that while leverage of unlisted banks increase, the profit margin in reduced. The negative returns of Rp could be attributed to the management of cost in relation to measurement of the ratio of total incomes to net profit. The total findings of the study imply that the unlisted banks are highly geared and the level of the geared has influence on performance. The level of gearing is dependent on the element of debt in the leverage component. The outcome is supported by the trade-off theory, which indicates that high leverage is optimal for bank (DeAngelo and Stulz, 2013). This is due to adjustment of a target leverage ratio by the trade-off theory (Myers, 1984). Although the significant relationship established in this findings in consistent with similar studies conducted on only listed banks industry in Ghana, the coefficient with the variables of measurements differs (Gatsi and Akoto, 2010; Awunyo-Vitor and Badu, 2012).

CONCLUSION AND RECOMMENDATION

Based on the above summary of findings, the study further concludes on the influence of leverage on the performance of unlisted banks. The level influence was dependent on the various measurement of bank performance in the study. The level of leverage for unlisted banks has a negative relationship with return on asset and a positive relationship with return on equity. This implies that an increased in leverage leads to decrease on returns on asset. This could be attributed to asset management by banks because returns on asset turn to measure the efficiency by which asset are managed by firms. The level of leverage of unlisted banks have a negative relationship with rate of profit. This implies that an increased in leverage leads to decrease on profit margin. This could be attributed to cost control management by banks in relation to debt component in operation. This is because profit rate turns to measure the efficiency by which expenses are controlled by firms in relation to income generated. It is recommended that, Management of unlisted banks should control cost in the use of debt in leverage to better performance. They must also be concerned with utilizing these debts effectively and efficiently. To achieve this, management must use these debt funds to develop less risky asset that reduce debt default rate. The regulators of the banking industry in Ghana must develop policies that seek to inject more equity funds in the operation of banks in Ghana, guide in asset management and aid effective cost control in relation to leverage. This will boast the banking industry to be efficient in their intermediation role.

The authors have not declared any conflict of interests.

REFERENCES

|

Abor J (2005). The effect of capital structure on profitability: empirical analysis of listed firms in Ghana. Journal of Risk Finance 6(5):438-445.

Crossref

|

|

|

|

Abor J (2007a). Debt policy and performance of SMEs: evidence from Ghanaian and South Africa firms. Journal of Risk Finance 8(1):64-79.

Crossref

|

|

|

|

|

Abor J (2007b). Industry classification and the capital structure of Ghanaian SMEs. Journal of Risk Finance 24(3):207-219.

|

|

|

|

|

Adrian T, Shin HS (2010). Liquidity and leverage. Journal of Financial Intermediation 19(3):418-437.

Crossref

|

|

|

|

|

Amidu M (2007). Determinants of capital structure of banks in Ghana: an empirical approach. Baltic Journal of Management 2(1):67-69.

Crossref

|

|

|

|

|

Awunyo-Vitor D, Badu J (2012). Capital structure and performance of listed banks in Ghana. Global Journal of human social science 12(5):21-46.

|

|

|

|

|

Baltagi BH (1995). Econometric analysis of panel data (3rd ed). Asia, John Weley and Sons, Ltd.

|

|

|

|

|

Bank of Ghana (2016). Annual report and account of Bank of Ghana.

|

|

|

|

|

Bank of Ghana (2016). Monetary Policy Report, Financial Stability.

|

|

|

|

|

Biger N, Nguyen NV, Hoang QX (2008). The determinants of capital structure: Evidence from Vietnam. International Finance Review 8:307-326.

Crossref

|

|

|

|

|

Carunto GA, Romanescu ML (2008). The assessment of banking performances- Indicators of performance in bank Area. University of Constantin Brancusi TarguJiu, Romania.

|

|

|

|

|

Chevalier JA, Scharfstein DS (1996). Capital-market imperfections and countercyclical mark-ups: Theory and evidence. American Economic Review 86:703-715.

|

|

|

|

|

Cooper D R, Schindler PS (2006). Business Research Methods (9th ed). McGraw-Hill.

|

|

|

|

|

D'Hulster K (2009). The leverage ratio: A new binding limit on banks, Notes, The World Bank.

|

|

|

|

|

Dasgupta S, Titman S (1998). Pricing strategy and financial policy. The Review of Financial Studies 11:705-737.

Crossref

|

|

|

|

|

D'Angelo H, Stulz RM (2013). Why high leverage is optimal for banks. Journal of Financial Economics 10:70-77.

Crossref

|

|

|

|

|

Ebaid EI (2009). The impact of capital-structure choice on firm performance: empirical evidence from Egypt. Journal of Risk Finance 10(5):477-487.

Crossref

|

|

|

|

|

Ebiringa OT, Ezeji EC (2012). Analysis of effect of financial leverage on bank performance: evidence from Nigeria. The Journal of Public Administration and Governance 2(4):2161-7104.

|

|

|

|

|

Frank M, Goyal V (2003). Testing the pecking order theory of capital structure. Journal of Financial Economics 67:217-248.

Crossref

|

|

|

|

|

Financial Services Authority (FSA) (2009). The turner review: A regulatory response to the global banking crisis. London.

|

|

|

|

|

Financial Stability Board (FSB) (2016). 2016 report of the financial stability forum on addressing procyclicality in the financial system.

|

|

|

|

|

Gadzo GS, Gatsi JG (2013). Determinates of capital structure of insurance companies in Ghana. Global Journal of Finance and Management 5(2):79-86 .

|

|

|

|

|

Gatsi JG, Gadzo SG, Oduro R (2016). Degree of Leverage and Risk Adjusted Performance of Listed Financial Institutions in Ghana. Journal of Business and Management 18(1):44-50.

|

|

|

|

|

Gatsi JG, Akoto RK (2010). Capital structure and profitability in Ghanaian banks. Social Science Research Network pp. 1-69.

|

|

|

|

|

Gatsi JG, Gadzo SG, Anipa, CAA, Kosipa S (2015). Empirical analysis of macroeconomic factors and crude oil prices in Ghana. International Journal of Economics, Commerce and Management 3(9):217-235.

|

|

|

|

|

Gill A, Biger N, Pai C, Bhutani S (2009). The determinants of capital structure in the service industry: evidence from United States. The Open Business Journal 2:48-53.

Crossref

|

|

|

|

|

Gill A, Mathur N (2011). Factors that influence financial leverage of Canadians firms. Journal of Applied Finance and Banking 1(2):19-37, ISSN: 1792-6599 International Scientific Press.

|

|

|

|

|

Graf F (2011). Leverage, profitability and risk of banks- an empirical analysis. University of Konstanz, Department of Economics, Konstanz.

|

|

|

|

|

Graham JR (2003). Taxes and corporate finance: A Review. Review of Financial Studies 16:1075-1129.

Crossref

|

|

|

|

|

Grossman SJ, Hart OD (1982). Corporate financial structure and managerial incentives. National Bureau of Economic Research Working Paper No. R0398.

|

|

|

|

|

Haldane A, Simon B, Vasileios M (2010). What is the contribution of the financial sector: miracle or mirage in the Future of Finance, the LSE Report, London.

|

|

|

|

|

Haugen RA, Senbet, LW (1978). The insignificance of bankruptcy costs to the theory of optimal capital structure. Journal of Finance 33:383-393.

Crossref

|

|

|

|

|

Hausman JA (1978). Specification tests in econometrics. Econometrica, 46(6):1251-1271.

Crossref

|

|

|

|

|

Hennessy CA, Whited T (2005). Debt dynamic. Journal of Finance 60(11):29-65.

Crossref

|

|

|

|

|

Hildebrand P (2008). Is Basel 2 enough? The benefits of a leverage ratio. Financial market group lecture presented at the London School of Economics.

|

|

|

|

|

Huang SG, Song FM (2001). The determinants of capital structure: Evidence from China, School of Economics and Finance and Center for China Financial Research, The University of Hong Kong Press.

|

|

|

|

|

International Monetary Fund (IMF) (2016). IMF report on Africa economy.

|

|

|

|

|

Jermias J (2008). The relative influence of competitive intensity and business strategy on the relationship between financial leverage and performance. British Accounting Review 40(1):71-86.

Crossref

|

|

|

|

|

Kuznnetsov P, Muravyev A (2001). Ownership structure and firm performance in Russia, the case of blue chips of the stock market. Economic Education and Research Consortium Working Paper Series. No. 01/10.

|

|

|

|

|

Lane D (2009). The cost of capital, corporation finance and theory of investment: A refinement. Applied Economic Letter 16(2):32-57.

Crossref

|

|

|

|

|

Leary MT, Roberts MR (2005). Do firms rebalance their capital structures? Journal of Finance 60:2575-2619.

Crossref

|

|

|

|

|

Majumbar S, Chhibber P (1999). Capital structure and performance: evidence from a transition economy on an aspect of corporate governance, Public Choice 98:287-305.

Crossref

|

|

|

|

|

Manawaduge A, Zoysa AD, Chowdhury K, Chandarakumara A (2011). Capital structure and firm performance in emerging economies: an empirical analysis of Sri Lankan firms. Corporate ownership and control 8(4):56-78.

|

|

|

|

|

Myers SC (1984). The capital structure puzzle. The Journal of Finance 39(3):575-592.

Crossref

|

|

|

|

|

Murray ZF, Vidhan KG (2005). Trade off and pecking order theories of Debt. Hand book of Corporate Finance 23(6):45-76.

|

|

|

|

|

Myers SC (1984). Determinants of corporate borrowings. Journal of Financial Economics 5(1):147-175.

|

|

|

|

|

Ogebe P, Ogebe J, Alewi K (2013). The impact of capital structure on

|

|

|

|

|

Ongore OV, Kusa BG (2013). Determinants of financial performance of commercial banks in Kenya. International Journal of Economics and Financial 3(1):237-252.

|

|

|

|

|

PWC (2016). Ghana banking Survey. Retrieved from Retrieved from

View

|

|

|

|

|

Ramaswammy K (2001). Organizational ownership, competitive intensity, and firm performance: an empirical study of Indian manufacturing sectors. Strategic Management Journal 22:989-998.

Crossref

|

|

|

|

|

Roden D, Lewellen W (1995). Corporate capital structure decisions: evidence from leveraged buyouts. Financial Management 24:76-87.

Crossref

|

|

|

|

|

South African Reserve Bank (2016). Financial stability review, Pretoria: South African Reserve Bank. [Online] available on

View [accessed 15 March, 2017].

|

|

|

|

|

Strebulaev I (2004). Do tests of capital structure theory means what they say?, Working paper, London Business School.

|

|

|

|

|

Vong API, Chan HS (2009). Determinants of bank profitability in Macau. Faculty of Business Administration, University of Macau P 105.

|

|

|

|

|

Weigand RA, Irons R (2011). The financial performance of U.S. commercial banks 2001-2010. Journal of Finance 62(3).

|

|