Full Length Research Paper

ABSTRACT

The study explores the impacts of systematic and nonsystematic monetary policy shocks and how they affect the monetary transmission process in Nigeria from 1986 to 2020 using quarterly data. The objective of the study was to improve the understanding of the systematic and non-systematic monetary shocks and how they affect the monetary transmission process in Nigeria. Data on variables such as monetary policy rate, all-share index, exchange rate, private sector credits, and inflation rate were used to investigate the impact of these shocks on monetary transmission channels. The study adopted methods such as unit root, historical decomposition as well as a non-linear Autoregressive Distributed Lag (NARDL) framework to carry out this investigation. The results showed that both the systematic and nonsystematic shocks influenced interest rate and expectations channels, while the negative systematic shocks influenced the credit channel. However, these shocks had no significant influence on exchange rate and asset price channels. The study was concluded by recommending that these channels should be well managed to avoid negative systematic and nonsystematic shocks to improve the monetary transmission process and foster a sound financial system in Nigeria.

Key words: Monetary policy, monetary transmission mechanism, systematic monetary shocks, nonsystematic monetary shocks, non-linear ardl, historical decomposition.

INTRODUCTION

The principal objective of this paper is to improve the understanding of the systematic and nonsystematic changes in monetary policy actions and how it affects monetary policy transmission in the Nigerian economy. The argument starts from the findings of previous studies on systematic and nonsystematic monetary policy. The first arguments are that monetary policy shocks explain very little volatility in output over the long term (for example Rosoiu, 2015; Arias et al., 2017). The second argument stems from the view that monetary policy shocks are endogenous, that is, determined by macroeconomic conditions within the economy (Bernanke et al., 1997; Giannone et al., 2002). Also, formulations of monetary policies and their reactions have been determined within a Structural Vector Autoregressive (SVAR) framework and some studies (McCallum, 1999; Primiceri, 2004; Gertler and Karadi, 2015; Arias et al., 2017) have shown that the nonsystematic portion of monetary policy was also as important as the systematic monetary policies.

Furthermore, some studies such as Cochrane (1996), Bernanke et al. (1997), Clarida et al. (1998), McCallum (1999), and Giannone et al. (2002) have focused largely on the systematic changes to monetary policy and how they affect monetary policy decisions. They argue that nonsystematic changes to monetary policy do not matter. However, other prominent studies such as Lucas (1976), Hoover and Jorda (2001), and Primiceri (2004) were of the view that nonsystematic monetary policy is more effective in dealing with monetary policy shocks. One thing the above studies have in common is using SVAR models to determine monetary policy shocks and how they affect an economy. In principle, policy shocks can be identified within a VAR framework (Giannone et al., 2002); however, measurement problems and uncertainty make SVAR models difficult to interpret according to Christiano et al. (1999). Besides, the VAR literature has largely focused on nonsystematic shocks.

More recently, studies such as Gertler and Karadi (2015), Ramey (2016), Miranda-Agrippino and Ricco (2017), Andrade and Ferroni (2021), and Zhang (2021) have revisited the methodological issues surrounding monetary policy shocks. Ramey (2016) believed monetary policy shocks should have a zero mean and no evidence of serial correlation.

Gertler and Karadi (2015) used the changes in three-months-ahead federal funds futures contracts to highlight monetary policy shocks. Miranda-Agrippino and Ricco (2017) use asset price behavior to disentangle standard monetary policy surprises from information surprises. Andrade and Ferroni (2021) look at the impacts of macroeconomic conditions and news on future monetary policy shocks on the yield curve. Zhang revisited the effects of unconventional monetary policies using a longer-term euro futures measure on monetary policy decisions.

From the foregoing, the study looks at policy rules (reflecting systematic reaction) and policy shocks (reflecting nonsystematic reactions) and how they affect the monetary transmission mechanism within the Nigerian economy. The study deviates from others by focusing on the systematic and nonsystematic nature of monetary policy shocks using a different approach and investigates how this affects the monetary policy transmission process. The reason for accounting for systematic shocks in monetary policy transmission is that the structure of the Nigerian economy makes it more vulnerable to shocks since Nigeria is an import-dependent economy. Another explanation is that the size and frequency of shocks affecting the Nigerian economy can be better managed if we account for nonsystematic shocks.

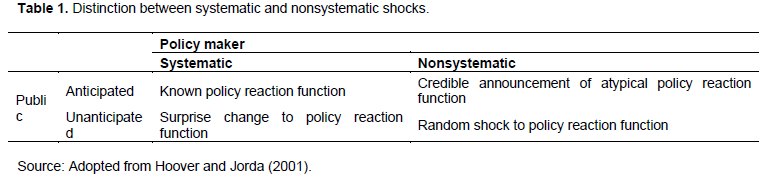

Policy shocks are the random, nonsystematic component of the monetary authorities’ actions. That is, the portion that is not related to the state of the economy (exogenous), while the systematic or predictable changes are endogenously determined (McCallum, 1999). Table 1 explains this distinction between the two kinds of monetary policy actions. It also shows that both the systematic and nonsystematic changes in the economy can be anticipated or not, depending on the policymakers and the public (Hoover and Jorda, 2001:119). Therefore, the study will investigate the impacts of systematic and nonsystematic monetary policy shocks and how they affect the monetary transmission process in Nigeria. The rest of the paper is organized as follows: section two discussed empirical issues, while section three discussed the methodology. Section four analyses and interprets the data while the final section concludes the paper with some policy recommendations.

Empirical issues in the Literature

This part of the study provides pieces of evidence from past works of literature regarding the interpretation of monetary policy shocks and how they affect monetary policy decisions within the economy. The literature on monetary policy shocks begins with an empirical examination of Lucas’ (1972) critique whose study was of the view that the unsystematic component of monetary policy actions/reactions was important in conducting monetary policy formulations within an economy. Rosoiu (2015), on the impact of monetary policy transmission on key macroeconomic variables such as output, unemployment rate, and inflation within a VAR framework, found out that the impact of monetary policy shocks on output and prices dissipates over the long term. This confirms the notion that monetary policy rates cannot be used to influence the real economy over the long term. This view was also reinforced by Arias et al. (2017) whose study examined the effects of monetary policy shocks within the SVAR framework. The study found monetary policy shocks to be contractionary during the period of great moderation, while it also found that increased policy rates led to a reduction in aggregate output.

Herrera and Pesavento (2007) empirically investigated the relationship between oil price shocks, systematic monetary policy, and the great moderation in the US. The result found that systematic monetary policy initially influenced economic activity in the 70s, but this changed as it did not influence the economy of the US after the great moderation. They concluded that the role of monetary policy in mitigating oil price shocks was smaller and that oil price shocks had a more significant influence on output compared to monetary policy. Similarly, Bernanke et al. (1997) also examined the systematic monetary policy and its relationship with oil price shocks. The study found out that monetary policy tightening tends to bring about oil price shocks and not the changes in oil price itself. The study was similar to Zeshan et al. (2019), whose study also examined the relationship between oil price shocks and monetary policy. However, their study found that a monetary policy tightening due to oil price shocks leads to output loss in Pakistan.

Giannone et al. (2002) were one of the early authors to track both the systematic and nonsystematic changes in monetary policy within the same econometric model. Their study revealed that macroeconomic variables within the economy are prone to be collinear and they recommend targeting a specific policy anchor conditional on different systematic and nonsystematic shocks rather than targeting multiple anchors unconditionally. Similarly, Mandler (2010) examined the systematic and unsystematic monetary policy shocks and how they affect the economy of the US. Their results show that the nonsystematic monetary policy shocks differ across different regimes. During high inflationary periods, their result corroborates previous studies; however, during low inflationary periods, the output does not respond to monetary policy shocks.

McCallum (1999) examined the monetary transmission mechanism and the importance of systematic monetary policy. The paper argues that to ascertain the monetary transmission mechanism process, more emphasis needs to be put on the systematic monetary policy. Similarly, Hoover and Jorda (2001) measured systematic monetary policy using a VAR framework. The study found the systematic portion of monetary policy to be very important in formulating monetary policies within an economy. However, Feldkircher and Huber (2018) examined unconventional monetary policies and their transmission into the economy due to shocks reducing interest rate spread. The study found out that reduced interest rate spread boosts lending in the US, while declined interest spreads boost lending via the credit channel.

Finally, the study also found the effect of a contractionary monetary policy to have a distinct pattern on the US economy.

Primiceri (2004) examined the systematic and nonsystematic monetary policy in the economy of the US. The study found that both the systematic and nonsystematic monetary policy changed throughout the study. While nonsystematic monetary policy became less important, especially towards the end of the sample period, systematic monetary policy became much more important during that period, especially against inflation and unemployment. In addition, the study found little evidence of a causal link between systematic monetary policy and high inflationary and unemployment episodes. Lastly, Lenza et al. (2010) examined the lags from monetary policy actions to inflation in UK and US and their study found that it takes over a year for inflation to respond to monetary policy actions within the economies of the UK and the US.

Marcelino (2006) examined the effects of non-systematic fiscal policy in the largest four countries in the Euro area. Their study also explored the impacts of fiscal and monetary shocks and the effectiveness of fiscal and monetary policies in the fiscal policy coordination debate for the effectiveness of fiscal shocks in stabilizing these economies within the Euro Area. The study found that the non-systematic fiscal policy affects these countries differently. Finally, fiscal shocks impact interest rates directly or through the output gap and inflation. However, monetary policy tends to have a lesser impact on fiscal policy, output and inflation.

Apanisile (2017) examined the asymmetric effects of monetary policy shocks on output in Nigeria. The study represented monetary policy shocks using broad money supply and decomposed broad money into positive and negative using the non-linear ARDL framework. The study found out that both the positive and negative shocks have a positive impact on economic output in Nigeria; however, the negative shocks proved insignificant. This result corroborates a work by Goshit et al. (2020) on the asymmetric effects of monetary policy shocks on output in Nigeria.

Ajisafe et al. (2022) also examined the effects of anticipated and unanticipated monetary policy on output in Nigeria and found a long-run relationship between anticipated and unanticipated monetary policy in Nigeria. However, the anticipated impacts were insignificant while unanticipated have a significantly positive relationship with output. The study recommended that the study aligns with the rational expectation theory that only the unanticipated monetary shocks affect the real economy. The results aligned with other authors like Thanh et al. (2019).

METHODOLOGY

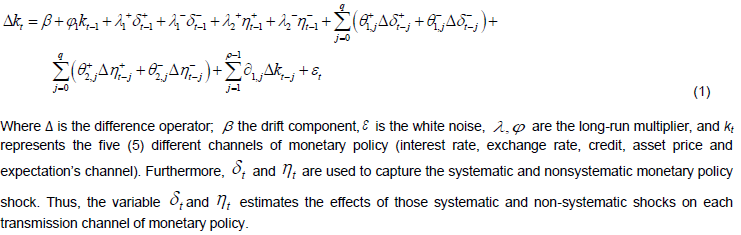

The study adopted two methods to fulfill the objectives of the study. The study first applied the historical decomposition method as designed by Kilian and Park (2009) to decompose monetary policy shocks into systematic and nonsystematic shocks. The Historical Decomposition (HD) methodology is a method of decomposing series into the various constituent shocks. The second applied the Non-Linear Auto-Regressive Distributed Lag (NARDL) model proposed by Shin et al. (2014) to establish the systematic and nonsystematic influence of monetary policy shocks on each channel of monetary policy. NARDL is very useful given the way it models the stochastic relationship between variables of a different order of integration. It also provides better efficient short-run and long-run coefficient estimates (Shin et al. 2014). Based on the linear-ARDL model as proposed by Pesaran and Shin (1999), the NARDL framework models the dependent variable as a function of its lagged variables and lagged variables of independent variables. Thus, the NARDL model is specified for examining the systematic and nonsystematic monetary policy shock on each monetary policy channel as follows:

Analysis and presentation of results

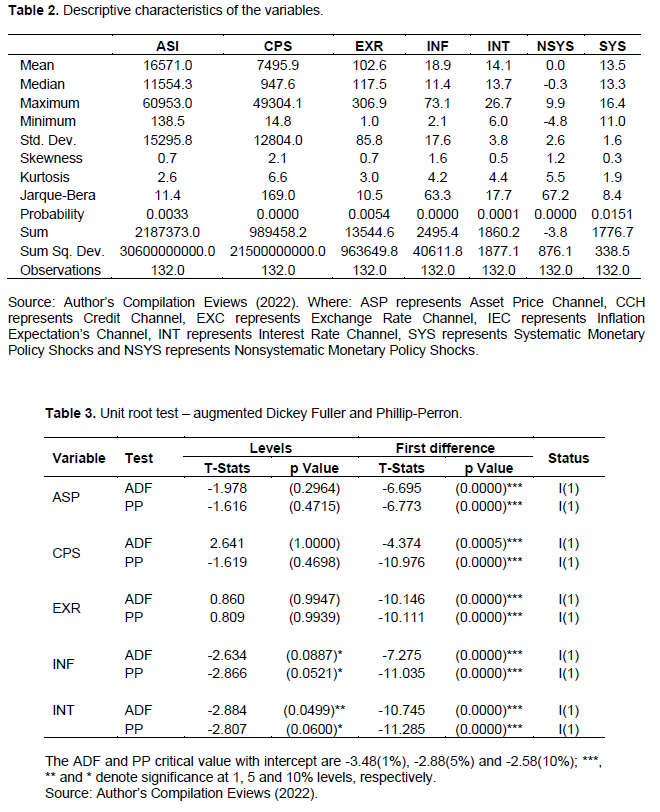

This paper applied quarterly data series from 1986 to 2020 on the monetary policy rate, all share index, inflation rate, private sector credit, and exchange rate. The data were generated from the Central Bank of Nigeria (CBN) Statistical Bulletin (2021). The descriptive statistic results in Table 2 had a good level of consistency with the mean and median values being within their minimum and maximum values, and the values of interest

rates, exchange rate, and both systematic and nonsystematic monetary policy changes being relatively close, which indicates lower levels of variability. The skewness statistics showed that the variables were all positively skewed, while the kurtosis statistic showed that credit channel, inflation, interest rate, and nonsystematic monetary policy exceeded three, meaning that the series follows a leptokurtic distribution. However, all share index and the systematic monetary policy followed a platykurtic distribution, while the exchange rate followed a mesokurtic distribution.

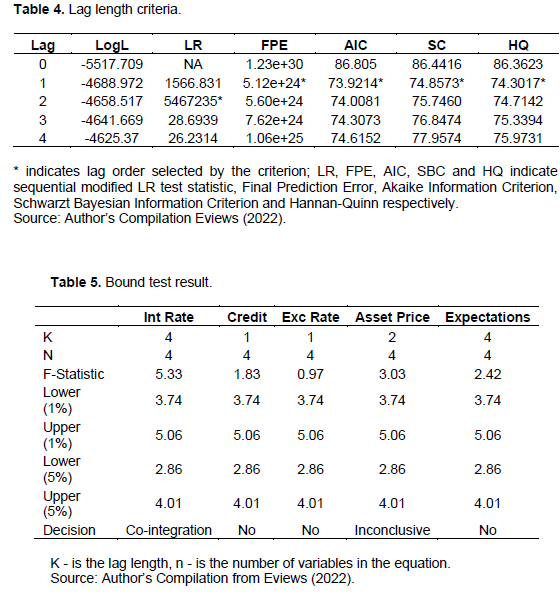

The unit root test results in Table 3 showed that all the variables are in the first difference order, even though the interest rate was stationary at 5% for Augmented Dickey-Fuller test and 10% for the Phillips-Perron test in line with ADF and PP statistics (Dickey and Fuller, 1979; 1981, Phillips and Perron, 1988). However, this was resolved as both tests were stationary in their first difference form at 5 and 1% respectively.

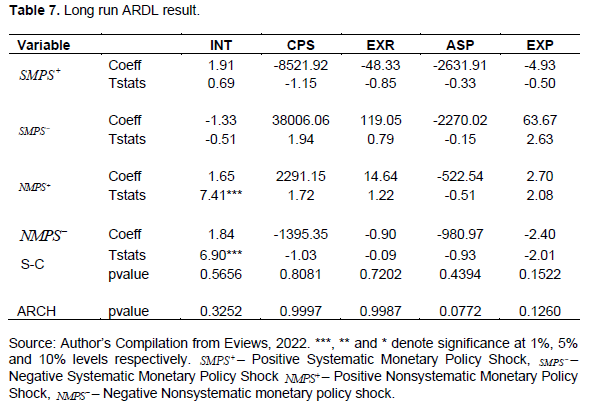

The study chose a lag length of one based on the Akaike and Schwarz criteria in Table 4. Finally, the bound test result in Table 5 showed that the credit, exchange rate, and expectations channel had no long-run relationship, while that of the asset price channel was inconclusive. However, the interest rate channel exhibited a long-run relationship.

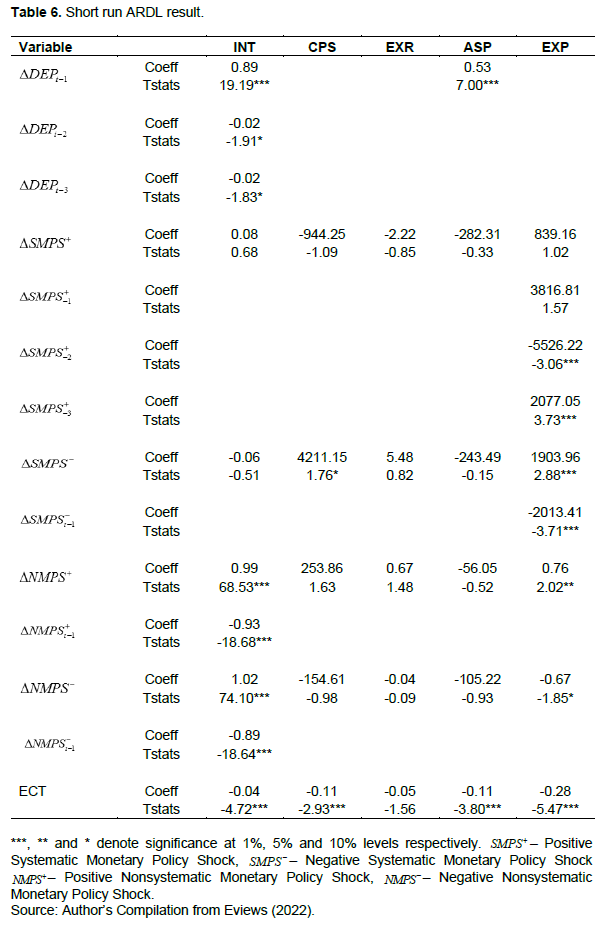

Table 6 analyzes the asymmetric influence of the systematic and non-systematic monetary policy shock on each transmission channel of monetary policy. From the Non-Linear ARDL results in Table 6, it was revealed that interest rates in the previous three quarters significantly affect interest rate in the current period. Furthermore, positive and negative changes in systematic monetary policy shock do not impact interest rates in the current period. However, positive and negative nonsystematic monetary policy shocks in the current period influence interest rates positively in the current period, while in the previous period negative and positive nonsystematic monetary policy shocks influence interest rates negatively. The implication of this for Nigeria is that a change in the policy rate incited by current period nonsystematic shocks, irrespective of the direction of change (either positively or negatively), will improve the interest rate channel of monetary policy in the current period, while a change in the policy rate incited by the previous period nonsystematic shocks, irrespective of the direction of change (positive or negative), will negatively affect the interest rate channel of monetary policy in the short run.

The error correction term on the interest rate, credit, asset price, and expectations channel had a negative coefficient and was statistically significant at 5%, implying that there is a movement from the short run to the long run; while that of the exchange rate channel was negative and statistically insignificant. This implies there might be no movement from the short run to the long run since only one of the two conditions was met. Therefore, 4% of the short-run errors recorded on the interest rate channel of monetary policy are corrected in the long run. For the credit channel, the nonsystematic monetary policy shock (both positive and negative) and the positive systematic shock did not influence the credit channel; while the negative systematic monetary policy shock has a positive influence on the credit channel of monetary policy. This result implies that a change in the policy rate incited by negative systematic monetary policy shocks will positively influence the credit channel of monetary policy in the short run. Finally, 11% of these short-run errors are corrected in the long run at a 5% significance level. For the asset price channel, the systematic and nonsystematic monetary policy shocks do not influence asset prices; however, the first lag of asset prices influenced asset prices positively in the current period. However, these short-run errors are adjusting towards equilibrium at 11%.

For the exchange rate channel, the systematic and nonsystematic monetary policy shock does not influence the exchange rate in the current period. Finally, for the inflation expectations channel of monetary policy, the previous two and three-quarters of systematic monetary policy shocks influence inflation expectations in the current period.

Furthermore, negative systematic monetary policy shock in the current and previous quarter’s influence inflation expectations in the short run. For the nonsystematic monetary policy shock, positive nonsystematic monetary policy shock influences inflation expectations positively, while negative nonsystematic monetary policy shocks influence inflation expectations negatively. This result implies that a change in the policy rate incited by systematic and nonsystematic monetary policy shocks will influence the inflation expectations channel of monetary policy in the short run. The error correction term shows that 28% of these errors are adjusting towards equilibrium in the long run.

In the long run, the interest rate channel was found to be the only channel to be cointegrated based on the bound test result. Therefore, the long-run result in Table 7 will only be interpreted for the interest rate channel. From Table 7, the results showed that negative and positive systematic monetary policy shocks do not influence the interest rate channel of monetary policy; however, negative and positive nonsystematic monetary policy shocks influence the interest rate channel of monetary policy positively in the long run. That is, a percentage increase in positive nonsystematic shocks will improve interest rates by 1.65%, while a percentage increase in negative nonsystematic shocks will improve interest rates by 1.84%. This result implies that a change in the policy rate incited by negative and positive nonsystematic monetary policy shocks will influence the interest rate channel positively in the long run for Nigeria. For the diagnostics in Table 7, the results showed that there is no evidence of serial correlation among the variables and that the model is homoscedastic, that is, the models have equal variance.

DISCUSSION

From the analysis, the short-run nonlinear ARDL results showed that the positive and negative nonsystematic changes in monetary policy influence the interest rate channel of monetary policy. The nonsystematic monetary policy affects the interest rate channel because they are more or less atypical or random shocks to the policy reaction function, while systematic shocks do not significantly influence the interest rate channel in the short run in Nigeria. For the credit channel, negative systematic monetary policy shocks affect this channel. This result is plausible because, during periods of economic shocks, banks are averse to lowering interest rates due to the uncertainty around future economic outcomes. They, therefore, increase their rates to balance the effect of the systematic shocks that may affect their performance.

On the other hand, the exchange rate and asset price channels do not react to systematic and nonsystematic monetary policy shocks in the short run in Nigeria. This result is plausible since it can be argued that monetary policy shocks directly impact bank lending rates (interest rate channel) and their ability to give out credit (credit channel).

However, the expectations channel of monetary policy reacts to systematic and nonsystematic monetary policy shocks in Nigeria. This result is plausible since the reaction of the policymakers to systematic and nonsystematic monetary policy shocks will determine the publics’ expectations of inflation.

The bound test results however showed that the movement, in the long run, was only sustainable in the interest rate channel. The results of the interest rate channel in the long run echoes what was observed in the short run. The long-run results show that the positive and negative nonsystematic changes in monetary policy influence the interest rate channel of monetary policy. This is because the nonsystematic monetary policy shocks are more or less atypical or random shocks to the policy reaction function and these shocks are directly transmitted from the policy rate down to the other interest rates vis-à-vis the interest rate channel.

CONCLUSION AND POLICY RECOMMENDATION

This paper examines how monetary policy channels react to a shock arising from monetary policy. The results showed that systematic and nonsystematic monetary policy shocks had more influence on interest rate and expectations channel, while negative systematic shocks had an influence on the credit channel. However, the results showed that systematic and nonsystematic monetary policy shocks had no influence on asset price and exchange rate channels of monetary policy for the period under investigation. Since the study demonstrated that the systematic and nonsystematic monetary policy changes affected interest rate, credit, and expectations channel of monetary policy, therefore, these channels should be well managed to avoid negative systematic and nonsystematic shocks to improve the monetary transmission process and foster a sound financial system in Nigeria. By implication, policymakers should focus more on nonsystematic shocks and attend to these situations to diminish the degree of their impact on the monetary transmission process

CONFLICT OF INTERESTS

The author has not declared any conflict of interests.

REFERENCES

|

Ajisafe RA, Adesina KE, Okunade SO (2022). Effects of Anticipated and Unanticipated Monetary Policy on Output in Nigeria. African Journal of Economic Policy 10(2):40-55. |

|

|

Andrade P, Ferroni F (2021). Delphic and Odyssean Monetary Policy Shocks: Evidence from the Euro Area. Journal of Monetary Economics 117:816-832. |

|

|

Apanisile OO (2017). Asymmetry Effects of Monetary Policy Shocks on Output in Nigeria: A Non-Linear Autoregressive Distributed Lag (NARDL) Approach. A Paper presented at: Economic Society of South Africa Biennial Conference Paper. Essa_3452. |

|

|

Arias J, Caldara D, Rubio-Ramirez JF (2017). The Systematic Component of Monetary Policy in SVARs: An Agnostic Identification Procedure. Federal Reserve Bank of Atlanta Working Paper Series No. 15a:1-28. |

|

|

Bernanke BS, Gertler M, Watson M (1997). Systematic Monetary Policy and the Effects of Oil Price Shocks. Brookings Papers on Economic Activity 1:91-157. |

|

|

Central Bank of Nigeria (CBN) Statistical Bulletin (2021). Statistical Bulletin. Available at: |

|

|

Christiano LJ, Eichenbaum M, Evans C (1999). Monetary Policy Shocks: What Have We Learned and to What End? Handbook of Macroeconomics, eds. Michael Woodword, and John Taylor. |

|

|

Cochrane JH (1996). A Cross-Sectional Test of an Investment-Based Asset Pricing Model. Journal of Political Economy 104(3):572-621. |

|

|

Dickey DA, Fuller WA (1979). Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74:427-431. |

|

|

Dickey D, Fuller W (1981). Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 49:1057-1075. |

|

|

Feldkircher M, Huber F (2018). Unconventional U.S. Monetary Policy: New Tools, Same Channels? Journal of Risk and Financial Management 11(71):1-31. |

|

|

Gertler M, Karadi P (2015). Monetary policy surprises, credit costs, and economic activity. American Economic Journal: Macroeconomics 7(1):44-76. |

|

|

Giannone D, Reichlin L, Sala L (2002). Tracking Greenspan: Systematic and Unsystematic Monetary Policy Revisited. Available at: |

|

|

Goshit GG, Iormber PT, Jelilov G, Celik B (2020). Asymmetric Effects of Monetary Policy Shocks on Output in Nigeria: Evidence from Non-linear ARDL and Hatemi-J Causality Tests. Journal of Public Affairs pp. 1-11. |

|

|

Herrera AM, Pesavento E (2007). Oil Price Shocks, Systematic Monetary Policy and the Great Moderation. Michigan State University. Available at: |

|

|

Hoover KD, Jorda O (2001). Measuring Systematic Monetary Policy. Federal Reserve Bank of St. Louis 2:113-138. |

|

|

Kilian L, Park C (2009). The Impact of Oil Price Shocks on the US Stock Market. International Economic Review 50:1267-1287. |

|

|

Lenza M, Pill H, Reichlin L (2010). Monetary Policy in Exceptional Times. European Central Bank Working Paper Series No. 1253:1-40. |

|

|

Lucas RE (1972). Expectations and the Neutrality of Money. Journal of Economic Theory 4(1):103-124. |

|

|

Lucas RE (1976). Econometric Policy Evaluation: A Critique. Carnegie-Rochester Conference Series on Public Policy 1:19-46. |

|

|

Mandler M (2010). Monetary Policy Shocks, Systematic Monetary Policy, and Inflation Regimes. Results from Threshold Vector Autoregressions pp. 1-41. Available at: |

|

|

Marcelino M (2006). Some Stylized Facts on Non-Systematic Fiscal Policy in the Euro Area. Journal of Macroeconomics 28:461-479. |

|

|

McCallum BT (1999). Analysis of the Monetary Transmission Mechanism: Methodological Issues NBER Working Paper 7395. |

|

|

Miranda-Agrippino S, Ricco G (2017). The transmission of monetary policy shocks. Bank of England Working Paper No. 657. |

|

|

Pesaran MH, Shin Y (1999). An Autoregressive Distributed Lag Modelling Approach to Co Integration Analysis. Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium, Strom, S. (ed.) Cambridge University Press. |

|

|

Phillips PCB, Perron P (1988). Testing for a Unit Root in Time Series Regression, Biometrika 75:335-346. |

|

|

Primiceri GE (2004). Time-Varying Structural Vector Autoregressions and Monetary Policy. Princeton University. Available at: |

|

|

Ramey VA (2016). Macroeconomic shocks and their propagation. Handbook of Macroeconomics 2:71-162. |

|

|

Rosoiu A (2015). Monetary Policy and Time-Varying Parameter Vector Autoregression. Procedia Economics and Finance 32:496-502. |

|

|

Thanh SD, Canh NP, Maiti M (2019). Asymmetric Effects of Unanticipated Monetary Shocks on Stock Prices: Emerging Market Evidence. Journal of Economic Analysis and Policy 65:40-55. |

|

|

Zeshan M, Malik WS, Nasir M (2019). Oil price shocks, systematic monetary policy and economic activity. The Pakistan Development Review 58(1):65-81. |

|

|

Zhang X (2021). A New Measure of Monetary Policy Shocks. Staff Working Papers 21-29, Bank of Canada. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0