Full Length Research Paper

ABSTRACT

This study examined the impact of bilateral and multilateral aid on domestic savings of SSA countries, taking into account the role of institutional quality. A balanced panel data set consisting of 28 SSA countries from 1996 – 2015 was used. Random effects techniques were also used. Bilateral aid was found to have negative significant impact on domestic savings of SSA countries, reflecting a crowding-out effect; while the impact of multilateral aid on domestic savings of SSA countries was found insignificant. When the bilateral and multilateral aid variables were interacted with institutional quality, the coefficient of interaction between bilateral aid and institutional quality was insignificant, while that between multilateral aid was positive and significant, implying that the impact of multilateral aid on domestic savings depends on good quality institutions. Therefore, bilateral aid is a disservice to SSA countries since it crowds-out domestic savings regardless of institutional quality; however, multilateral aid can be beneficial to SSA countries if good quality institutions exist.

Key words: Bilateral aid, multilateral aid, domestic savings, Sub-Saharan Africa.

INTRODUCTION

Foreign aid is widely regarded as an important ingredient of economic development particularly in less developed countries (Tarp and Hjertholm, 2000; Thorbecke, 2000), and one of the development outcomes attributed to foreign aid is domestic savings. However, the idea that aid buys growth through domestic savings is on shaky ground theoretically and empirically, Easterly (2003). Since the 1960s, Sub Sahara African (SSA) countries have been the largest net recipients of foreign aid relative to other aid recipient regions such as East Asia and Pacific, South Asia, Latin America and Caribbean, and Europe and Central Asia for the purpose of promoting desirable development outcomes including enhancing domestic savings. For instance, from 1996 – 2015, Net ODA receipts (% of Gross National Income) averaged 3.635 for SSA countries, 0.1 for East Asia and Pacific, 0.235 for Latin America and Caribbean, 0.72 for South Asia and 0 for Europe and Central Asia (WorldBank, 2017).

Further evidence shows that aid disbursements to the most aid-dependent countries coincide with significant increases in deposits held in offshore financial centers Andersen et al. (2022) while Easterly and Pfutze (2008) discuss best practice for which an ideal aid agency and the difficulties that aid agencies face because they are typically not accountable to their intended beneficiaries. In spite of this, these countries’ savings performance has remained lowest relative to other aid-recipient regions. For instance, from 1996 – 2015, domestic savings (% of GDP) averaged 18.4 for SSA countries, 42.1 for East Asia and Pacific, 19.8 for Latin America and Caribbean, 27.8 for South Asia, and 25.9 for Europe and Central Asia (WorldBank, 2017).

The above conundrum has attracted widespread interest of researchers, who have since sought to study the relationship between foreign aid and domestic savings. However, their findings are largely mixed. For instance, some studies indicate that foreign aid enhances (crows-in) domestic savings (Abu and Karim, 2016; Kapingura, 2018), other studies indicate that foreign aid adversely affects (crowds-out) domestic savings (Lubbad, 2019; Ozekhome, 2017; Sabra, 2016; Ssemanda and Karamuriro, 2020), and still other studies indicate that no significant relationship exists between foreign aid and domestic savings. This implies that the debate on whether foreign aid impacts domestic savings is far from over. It is the author’s considered view that the inconsistencies in these research findings may be attributed to using aggregate foreign aid variables in estimation models, which do not specify which exact form of aid impacts domestic savings. Yet, foreign aid is heterogeneous and can be classified differently according to different parameters, including according to source—bilateral or multilateral. Therefore, there is need for studies that disaggregate aid—say into bilateral and multilateral aid—and examine the impact of this disaggregated form of aid on domestic savings particularly among SSA countries.

Studying the impact of bilateral and multilateral aid on domestic savings is important in light of recent interest among donors seeking to understand the relative effectiveness of allocating aid using these two channels (Biscaye et al., 2017).

Furthermore, such studies are important in light of prevailing counter arguments pertaining to the relative effectiveness of these two aid delivery channels in achieving development goals. On the one hand, supporters of bilateral aid who argue that it leads to achievement of optimal development goals since it tends to promote greater accountability, and focuses on aid that is more strategically oriented (Dreher et al., 2011; Findley et al., 2017). However, its critics argue that it leads to achievement of sub-optimal development goals since it tends to follow more strategic and political considerations of donors (Findley et al., 2017; Rommel and Schaudt, 2020). On the other hand, are proponents of multilateral aid who argue that it leads to achievement of optimal development goals since it is less prone to fragmentation and its consequences and it focuses on initiatives that generate tangible transformation of recipient countries (Addison et al., 2015; Gulrajani, 2016; Nunnenkamp et al., 2017). Such counter arguments can only be put to rest through conducting further empirical studies.

Besides, the quality of institutions existing in aid recipient countries has long been identified as an important ingredient of sustainable development (Abderrahim and Mohamed, 2019). Countries that boast of good quality institutions tend to achieve superior growth and sustainable development because institutions provide mechanisms for ensuring resource allocation efficiency and effectiveness (Xiaosong and Siyuan, 2020). Moreover, recent research has shown that aid effectiveness particularly in less developed countries such as SSA countries is low due to widespread existence of poor quality institutions, characterized by corruption, low government effectiveness, political instability, lack of voice and accountability, and poor rule of law (Hassan, 2021; Iqbal and Daly, 2014; Maruta et al., 2020; Xiaosong and Siyuan, 2020). Burnside and Dollar (2000) attaches the significance of aid on presence of good monetary fiscal and trade policies. While, Abderrahim and Mohamed (2021) emphasize the role of institutional quality for sustainable development.

However, there remains a grey area in empirical literature that needs to be filled, that is, whether the impact of bilateral and multilateral aid on domestic savings of SSA countries depends on the quality of institutions existing in these countries. Thus, the overriding purpose of this study was to examine the impact of bilateral and multilateral aid on domestic savings of SSA countries, and to determine whether the impact depends on the quality of institutions existing in these countries. The findings of this study may benefit donors by enabling them decide on the appropriate channels of delivering aid. Further still, the study findings may alert policy makers in aid-recipient countries pertaining to the kind of institutions they must build in order to maximize value from aid.

The rest of the paper is organized into three sections, one is the methodology discussing theoretical framework and data sets used, the results are discussed in the second last section while conclusions and recommendations presented in the last section of the report.

MATERIALS AND METHODS

Theoretical framework

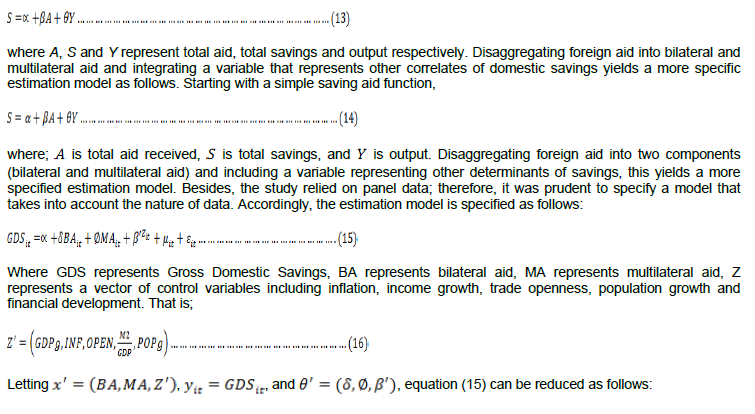

Studying the impact of bilateral and multilateral aid on domestic savings of SSA countries, and determining whether the impact depends on institutional quality was premised on Harrod Domar’s model with its modifications by previous researchers (Shields, 2007; Taslim and Weliwita, 2000). According to Shields (2007) and Taslim and Weliwita (2000), aid serves the purpose of filling the savings gap. Therefore,

From equation (7), the higher the savings rate relative to the product of target growth rate of the economy and capital output ration, the lower the foreign aid requirements. On the other hand, the lower the savings rate relative to the product of target growth rate of the economy and capital output ration, the higher the foreign aid requirements.

Integrating a time factor, investment at time t is becomes:

Equation (12) implies that the marginal savings rate at time t is inversely related to increases in foreign aid, and directly related to increases in income as highlighted by the partial derivatives. In essence, equation (12) is consistent with Shield’s (2007) that foreign aid crowds-out domestic savings and investments particularly in developing countries because it often acts as incentive for promoting rent-seeking behaviors.

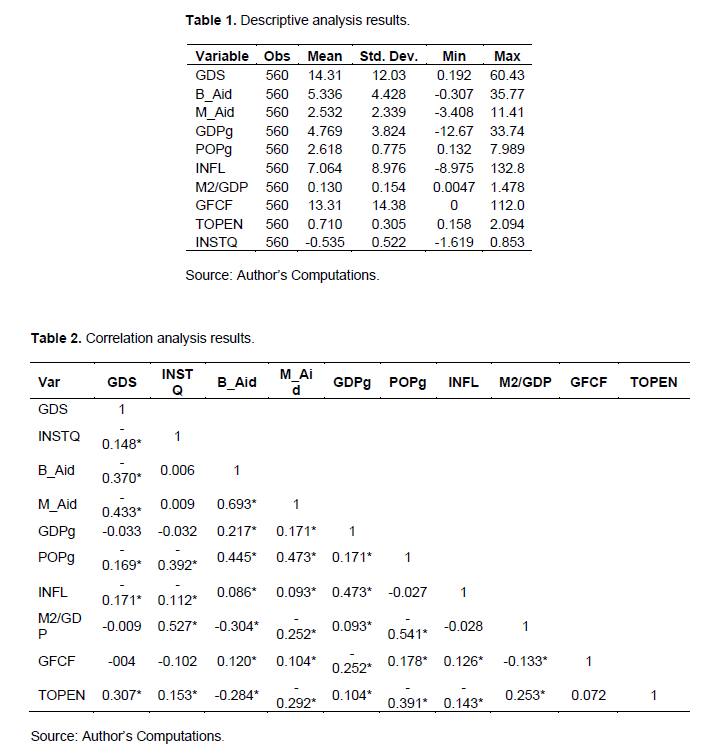

Empirical model

To estimate the impact of bilateral and multilateral aid on domestic savings of SSA countries, the study adopted a savings-foreign aid model from previous research, which was modified to suit the current study. Besides, the adopted model was consistent with equation (12). To begin with,

In estimating equation (17), two major hypotheses will be tested,

which are:

i) Bilateral aid negatively impacts on domestic savings of SSA countries, and the impact depends on institutional quality.

ii) Multilateral aid negatively impacts on domestic savings of SSA countries, and the impact depends on institutional quality.

Definition, measurement and expected signs of variables

Gross Domestic Savings (GDS)

This is Gross Domestic Product (GDP) less consumption expenditure. It includes household savings, private corporate sector savings, and public sector savings. In the estimation model, it is expressed as a percentage of GDP.

Bilateral Aid (B_Aid)

This refers to assistance given by a Government directly to a Government of another country. It consists of net bilateral aid inflows from Development Assistance Countries (DAC). In the estimation model, bilateral aid is expressed as a percentage of GDP.

Multilateral Aid (M_Aid)

This refers to assistance given by a Government of one country and delivered through formal institutions such as the International Monetary Fund and World Bank. It is calculated as the difference between total aid and net bilateral aid inflows from Development Assistance Countries (DAC). Also, in the estimation model, it is expressed as a percentage of GDP.

GDP growth (GDPg)

This is a measure of the percentage growth in real GPD from one period to another. The higher the GDP growth rate, the higher the domestic savings; and the lower the GDP growth, the lower the domestic savings. According to the Keynesian hypothesis, which states that savings is a fixed proportion of income; therefore, an increase in income leads to an increase in savings (Blinder, 2012). Research is also abound to supporting the existence of a positive relationship between GDP growth and domestic savings (Siaw et al., 2017). Overall, the coefficient of GDP growth is expected to be positive.

Inflation (INFL)

It is a measure of the rate of increase in general price level in an economy. The impact of inflation on gross domestic savings is two-way. On the one hand, inflation may increase Gross Domestic Savings since the phenomenon may create uncertainty, which could compel risk-averse consumers to set aside resources as a way of safeguarding themselves against possible adverse changes in future income (Nagawa et al., 2020). On the other hand, inflation may reduce Gross Domestic Savings through its adverse effect on disposable income (Nagawa et al., 2020). Therefore, the coefficient of inflation is expected to be either positive or negative.

Financial sector development (M2/GDP)

It is a measure of the degree of monetization of the economy expressed as a ratio of broad money (M2) to national output (GDP) (Otchere et al., 2017). The ingredients of financial sector development include: availability of financial assets, accessibility to banking services, and accessibility to credit facilities. Gross Domestic Savings may increase with increased availability of financial assets and increased accessibility to banking facilities (Shoko and Dube, 2021).

However, increased accessibility to credit facilities may provide an incentive for increased consumption, thereby reducing Gross Domestic Savings (Shoko and Dube, 2021). Therefore, the coefficient of financial sector development is expected to be either positive or negative.

Trade openness (TOPEN)

This is a measure of the ratio of the sum of exports and imports to national output (GDP). Trade openness may increase gross domestic savings since it provides firms with incentives to innovate, expand production, and improve productivity leading to higher income (Umer and Alam, 2015). Therefore, the coefficient of trade openness is expected to be positive.

Population growth (POPg)

A high population growth rate increases the dependence burden, and this reduces gross domestic savings (Cruz and Ahmed, 2016). Therefore, the coefficient of population growth rate is expected to be negative.

Gross fixed capital formation (GFCF)

It refers to fixed asset acquisitions of less disposals by resident producers. The larger the fixed asset acquisitions which are effectively transformed into productive investments, the higher the income, and ultimately the higher the Gross Domestic Savings (Razack et al., 2015). Therefore, the coefficient of Gross fixed capital formation is expected to be positive.

Institutional quality (INSTQ)

It measures the extent to which a country’s governance systems are of good quality. It comprises of six indicators adopted from the World Bank including: rule of law, government effectiveness, control of corruption, government effectiveness, voice and accountability, and political stability. These indicators are integrated into an index representing institutional quality, with values ranging from -2.5 to +2.5. The movement from -2.5 to +2.5 indicates improvement in institutional quality. Overall, the coefficient of institutional quality is expected to be positive since good quality institutions enhance resource allocation efficiency and effectiveness, while poor quality institutions compromise resource allocation efficiency and effectiveness (Xiaosong and Siyuan, 2020).

Data type and sources

The study was based on data collected from 28 SSA countries for the duration ranging from 1996 – 2015. In addition, the study employed panel data because of its advantages over pure time series or cross-sectional data. Such advantages include the following facts: it considers the heterogeneous nature of individual countries, and besides, it comprises more information and more information variability. Overall, all the data was sourced from the World Bank’s Development Indicators Database.

Estimation procedure

Since the data used in the study contained time series and cross-sectional elements, a panel data unit root test was undertaken to determine whether the panel data attributed to the study variables were stationary. The advantage of using panel unit root tests is that their power is significantly greater than the low-power attributed to standard time-series unit root tests found in finite samples. Two widely applied panel unit root tests were used for this purpose including: Levin, Lin and Chu (LLC) which assumes homogeneous coefficients attributed to study variables; and Im, Pesaran and Shin (IPS) which assumes heterogeneous coefficients attributed to study variables.

RESULTS AND DISCUSSION

This section presents the results of the study followed by their analysis. The analysis of the findings is categorized into: descriptive analysis, correlational analysis, panel unit roots, and panel estimates.

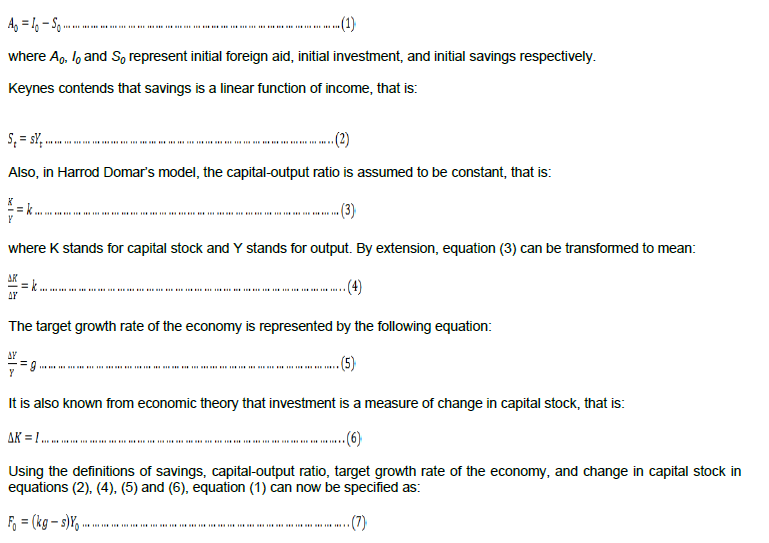

Descriptive analysis

Table 1 presents results of descriptive analysis of selected correlates of Gross Domestic Savings (GDS) including: bilateral aid (B_Aid), multilateral aid (M_Aid), GDP growth (GDPg), inflation (INFL), financial sector development (M2/GDP), trade openness (TOPEN), population growth (POPg), gross fixed capital formation (GFCF) and institutional quality (INSTQ).

From Table 1, all variables except INFL and GFCF had standard deviation values which were less than the corresponding mean values. This implies that the mean values were deemed good estimators of the parameters. The high standard deviations for INFL and GFCF were attributed to existence of outliers in the data series. Inflation registered a maximum value of 132, which was attributed to Sudan in 1996. However, this value is less surprising given that during this time, the country witnessed unprecedented increase in commodity prices, and this eventually led to widespread political unrest.

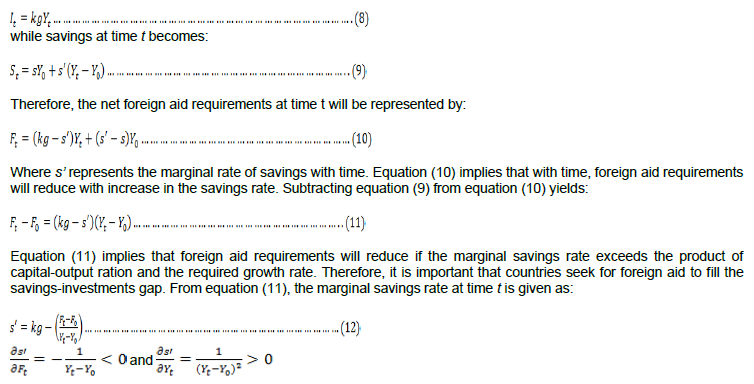

Correlation analysis

Before undertaking regression analysis, it is important to first establish whether independent variables in a regression model are highly correlated with one another (multicollinearity) as this may undermine the statistical significance of the independent variables. This is normally done through subjecting variables under consideration to correlation analysis.

Correlation analysis was undertaken on study variables including: bilateral aid (B_Aid), multilateral aid (M_Aid), GDP growth (GDPg), inflation (INFL), financial sector development (M2/GDP), trade openness (TOPEN), population growth (POPg), gross fixed capital formation (GFCF) and institutional quality (INSTQ). Table 2 presents a summary of results of correlation analysis.

From Table 2, all variables except GDPg, GFCF and M2/GDP are significantly related to Gross Domestic Savings. The results also indicate that the correlation coefficients for all the other variables under consideration are less than 0.8, which according to econometric theory, suggests that muliticollinearity is not a serious problem to worry about (Gujarati and Porter, 1992).

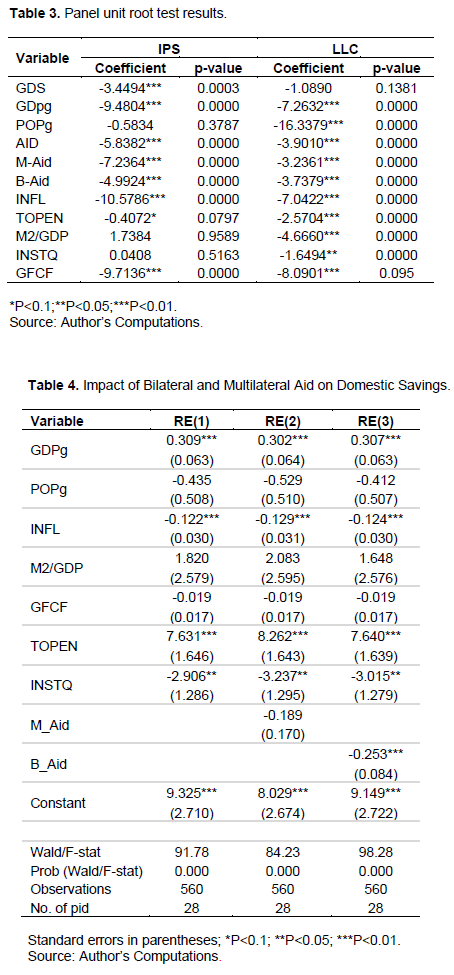

Panel unit roots

The study was executed using panel data. However, before undertaking estimation of the panel data, it was important to examine the data’s stationarity properties in order to determine the correct panel data analysis method. Accordingly, Table 3 presents summarized results of panel unit root test.

The conclusion derived from Table 3 is that all panels are stationary. This is because for every variable, at least, there is one test that indicates stationarity, and this is seen from the p-values which are less than 0.05.

Panel estimates

The major goal of this study was to examine the impact of bilateral and multilateral aid on domestic savings of SSA countries, and to determine whether the impact depends on institutional quality. To achieve this goal, two approaches were used. The study first determined the impact of bilateral and multilateral aid on domestic savings of SSA countries, and then the latter approach examined whether the impact of bilateral and multilateral aid on domestic savings of SSA countries depends on institutional quality.

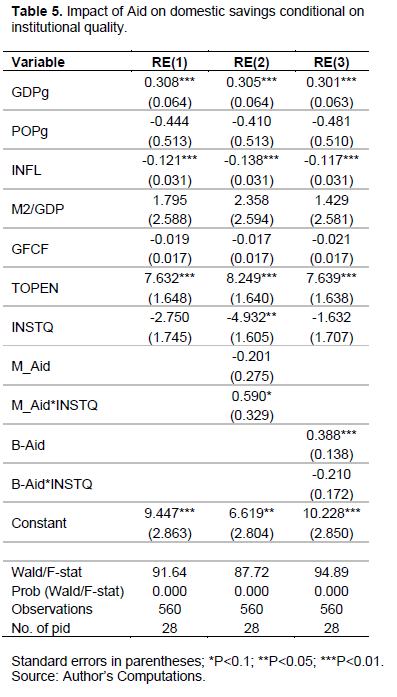

With regard to the first approach for achieving the study’s major goal, it has been established that the panels were found stationary; therefore, the traditional Fixed Effects and Random Effects models were estimated, and the Hausman test was employed in selecting the preferred model. Since the p-values for the test exceeded 0.05, Random effects were identified as the preferred method for analyzing the impact of bilateral and multilateral aid on domestic savings of SSA counties. Table 4 presents summarized results of panel estimation using random effects.

From Table 4, when foreign aid was disaggregated into bilateral and multilateral aid, only the former was found to be a significant predictor of Gross Domestic Savings. The coefficient of bilateral aid in the third estimated Random Effects model is negative, implying that keeping other factors constant, an increase in bilateral aid by 1% point, leads to a decrease in Gross Domestic Savings by 0.25% points. This finding is consistent with the crowding-out notion which presupposes that foreign aid is counterproductive because by nature, it provides an incentive for rent-seeking behavior particularly in developing countries.

Among the control factors, GDP growth, inflation and trade openness were found to be significant predictors of Gross Domestic Savings across the three estimation models. The findings in regard to GDP growth imply that keeping other factors constant, an increase in GDP growth by one percentage point, leads to an increase in Gross Domestic Savings by about 0.3 percentage points across the three estimation models. These findings are consistent with the Keynesian hypothesis, which states that since savings is a fixed proportion of income, an increase in income leads to an increase in savings. The findings are also consistent with the life cycle/permanent income hypothesis, which presumes higher savings for countries with higher GDP growth rates compared to countries with lower GDP growth rates.

With regard to trade openness, the results in Table 4 indicate a positive and statistically significant coefficient across the three estimation models. This implies that keeping other factors constant, an increase in trade openness by one percentage point, would lead to an increase in Gross Domestic Savings by a range of 7.6 – 8.4% points. This finding supports the theoretical argument that trade openness enhances domestic savings since it provides firms with incentives to innovate, expand production, and improves productivity leading to higher income and therefore higher savings (Umer and Alam, 2015). With regard to inflation, the results in Table 4 indicate a negative and statistically significant coefficient for inflation across the three estimation models. This means that keeping other factors constant, an increase in inflation by one percentage point leads to a reduction in Gross Domestic Savings by a range of 0.122 – 0.129% points. This finding supports the theoretical argument that inflation reduces real income leading to a decrease in savings (Nagawa et al., 2020).

To determine whether the impact of bilateral and multilateral aid on domestic savings of SSA countries depends on the quality of institutions, two interaction terms were created, one composed of multilateral aid and an index representing institutional quality, and another composed bilateral aid and an index of institutional quality. These two interaction terms were regressed separately and Table 5 presents summarized results of the impact of bilateral and multilateral aid on domestic savings of SSA countries conditional on institutional quality.

From Table 5, the results in the second model indicate that before interaction, the coefficient of multilateral aid is insignificant, but after interaction, the coefficient of the interaction term turns out positive and significant. This implies that the impact of multilateral aid on domestic savings of SSA countries depends on the quality of institutions. That is, keeping other factors constant, changing the quality of institutions by one percentage point positively changes the impact of multilateral aid on Gross Domestic Savings by 0.59% points. The results in the third model indicate that before interaction, the coefficient of bilateral aid is significant, but after interaction, the coefficient of the interaction term turns out negative and insignificant. This implies that the impact of bilateral aid on domestic savings of SSA countries does not depend on the quality of institutions. As was the case in Table 4, among the control variables, only GDP growth, inflation and trade openness remain robust predictors of domestic savings across three estimated models.

CONCLUSION

Compared to other aid-recipient countries, SSA countries have been the biggest net recipients of foreign aid over the years for use in promoting various development outcomes including promoting domestic savings. In spite of this, SSA countries have performed abysmally relative to other aid recipient countries in terms of domestic savings. While researchers have previously studied this conundrum, their findings have been largely mixed. It is the author’s considered view that this may be attributed to using aggregate forms of foreign aid in estimation models, which don’t show which specific form of foreign aid impacts domestic savings. Furthermore, it has been argued in theoretical literature, that aid effectiveness is a function of institutional quality. However, empirical evidence in support of this notion remains far limited particularly among SSA countries. Therefore, the purpose of this study was to examine the impact of bilateral and multilateral aid on domestic savings of SSA countries, and determine whether it depends on the quality of institutions existing in those countries.

The study findings show that bilateral aid has a negative and significant impact on domestic savings of SSA countries, reflecting a crowding-out effect; while the impact of multilateral aid on domestic savings of SSA countries was found insignificant. However, when the bilateral aid and multilateral aid variables were interacted with institutional quality, it was found that the coefficient of interaction between bilateral aid and institutional quality was insignificant, while that between multilateral aid was positive and significant, implying that the impact of multilateral aid on domestic savings of SSA countries depends on good quality institutions. Therefore, this study concludes that bilateral aid is a disservice to SSA countries since it crowds-out domestic savings regardless of institutional quality; however, multilateral aid can be beneficial to SSA countries especially if good quality institutions exist.

CONFLICT OF INTERESTS

The author has not declared any conflict of interests.

REFERENCES

|

Abderrahim C, Mohamed CS (2019). Institutional Quality and Sustainable Development in Arab Countries: Empirical Study. Magallat al-Tanmiyat wa-al-Siyasat al-Iqtisadiyyat 21(1):7-54. Available at: View |

|

|

Abu N, Karim MZA (2016). The relationships between foreign direct investment, domestic savings, domestic investment, and economic growth: The case of Sub-Saharan Africa. Society and Economy 38(2):193-217. |

|

|

Addison T, Niño?Zarazúa M, Tarp F (2015). Aid, social policy and development. Journal of International Development 27(8):1351-1365. |

|

|

Andersen JJ, Johannesen N, Rijkers B (2022). Elite Capture of Foreign Aid: Evidence from Offshore Bank Accounts. Journal of Political Economy 130(2):388-425. |

|

|

Biscaye PE, Reynolds TW, Anderson CL (2017). Relative effectiveness of bilateral and multilateral aid on development outcomes. Review of Development Economics 21(4):1425-1447. |

|

|

Blinder AS (2012). Keynesian economics. The concise encyclopedia of economics. Library of Economics and Liberty 12(8):45-89. |

|

|

Burnside C, Dollar D (2000). Aid, Policies, and Growth. American Economic Review 90(4):847-868. |

|

|

Cruz M, Ahmed S (2016). On the impact of demographic change on growth, savings, and poverty. World Bank Policy Research Working Paper. |

|

|

Dreher A, Nunnenkamp P, Thiele R (2011). Are 'new'donors different? Comparing the allocation of bilateral aid between nonDAC and DAC donor countries. World Development 39(11):1950-1968. |

|

|

Easterly W (2003). Can Foreign Aid Buy Growth?. Journal of Economic Perspectives 17(3):23-48. |

|

|

Easterly W, Pfutze T (2008). Where does the money go? Best and worst practices in foreign aid. Journal of Economic Perspectives 22(2):29-52. |

|

|

Findley MG, Milner HV, Nielson DL (2017). The choice among aid donors: The effects of multilateral vs. bilateral aid on recipient behavioral support. The Review of International Organizations 12(2):307-334. |

|

|

Gujarati D, Porter D (1992). Essentials of econometrics. McGraw-Hill. |

|

|

Gulrajani N (2016). Bilateral versus multilateral aid channels. Strategic choices for donors. Overseas Development Institute. |

|

|

Hassan AS (2021). Foreign aid and economic growth in Nigeria: The role of institutional quality. Studies of Applied Economics 39(3):10-13. |

|

|

Iqbal N, Daly V (2014). Rent seeking opportunities and economic growth in transitional economies. Economic Modelling 37:16-22. |

|

|

Kapingura FM (2018). Relationship between foreign capital flows, domestic investment and savings in the SADC region. Development Southern Africa 35(4):554-568. |

|

|

Karamuriro HT, Ssemanda EP, Bbaale E (2020). Foreign Aid Inflow and Domestic Savings in Uganda: Error Correction Modelling. Journal of World Economic Research 9(1):51-60. |

|

|

Lubbad MMM (2019). The Impact of Official Development Assistance, Foreign Direct Investment, and Remittances on Economic Growth in Selected MENA Countries Al-Azhar University-Gaza. |

|

|

Maruta AA, Banerjee R, Cavoli T (2020). Foreign aid, institutional quality and economic growth: Evidence from the developing world. Economic Modelling 89:444-463. |

|

|

Nagawa V, Wasswa F, Bbaale E (2020). Determinants of gross domestic savings in Uganda: an autoregressive distributed lag (ARDL) approach to cointegration. Journal of Economic Structures 9(1):1-19. |

|

|

Nunnenkamp P, Öhler H, Sosa Andrés M (2017). Need, merit and politics in multilateral aid allocation: A district?level analysis of World Bank projects in India. Review of Development Economics 21(1):126-156. |

|

|

Otchere I, Senbet L, Simbanegavi W (2017). Financial sector development in Africa-an overview. Review of development finance 7(1):1-5. |

|

|

Ozekhome HO (2017). Foreign aid, foreign direct investment and economic growth in ECOWAS countries: Are there diminishing returns in the aid-growth nexus. West African Journal of Monetary and Economic Integration 17(1):61-84. Available at: View |

|

|

Razack S, Basavanagowda T, Indumathi S (2015). Savings, Investment and Growth in India: An Empirical Analysis. International Journal of Social and Economic Research 5(1):231-242. |

|

|

Rommel T, Schaudt P (2020). First impressions: How leader changes affect bilateral aid. Journal of Public Economics 185:104-107. |

|

|

Sabra MM (2016). Remittances impact on economic growth, domestic savings and domestic capital at the presence of ODA and FDI in selected MENA countries. International Journal of Regional Development 3(2):26-45. |

|

|

Shields MP (2007). Foreign aid and domestic savings: The crowding out effect (No. 35-07). Monash University, Department of Economics. Available at: View |

|

|

Shoko J, Dube S (2021). The relationship between financial setor development and savings mobilization in Zimbabwe (1990 - 2018). JournalNX 6(09):102-113. |

|

|

Siaw A, Enning KD, Pickson RB (2017). Revisiting domestic savings and economic growth analysis in Ghana. Theoretical Economics Letters 7:1382-1397. |

|

|

Tarp F, Hjertholm P (2000). Foreign aid and development. London and New York. |

|

|

Taslim MA, Weliwita A (2000). The inverse relation between saving and aid: an alternative Explanation. Journal of Economic Development 25(1):75-94. Available at: View |

|

|

Thorbecke E (2000). The evolution of the development doctrine and the role of foreign aid, 1950-2000. Foreign aid and development: Lessons learnt and directions for the future pp.17-47. |

|

|

Umer F, Alam S (2015). Trade Openness, Size of Economy and the Saving-Investment Relationship: A Dynamic Analysis for Pakistan. South Asian Journal of Macroeconomics and Public Finance 4(2):233-257. |

|

|

World Bank (2017). World Bank Indicators 2017. |

|

|

Xiaosong W, Siyuan T (2020). Institutional Quality, Foreign Aid and Economic Growth in Recipient Countries. China Economist 15(6):68-83. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0