ABSTRACT

The main research question here is to address drivers of economic growth in Ethiopia using the time series data from 1970 to 2016 where the complementarity of aid and policy index is critically assessed. The empirical result from cointegration test confirms the existence of long run relationship among the variables entered in the per capita growth equation. In the long run, foreign aid inflow entered alone has a positive and significant impact on economic growth. Again, aid interacted with policy appears to have a positive contribution showing that both aid and policy are complementary to each other. The results of the study calls for devising policies for checking the apparent link and dynamics between population growth and economic growth, capacitating and maintaining institutional qualities, and proper allocation of financial and infrastructural resources to enhance human capital, comprehensible selection and priority for productive public investment for foreign aid to be more effective, putting more efforts to achieve macroeconomic stabilities via use of prudent fiscal, monetary and trade polices used in amalgamations to complement both aid and policy.

Key words: Economic growth, policy index, foreign aid.

In many developing countries including Ethiopia, the prime hub of policy effects is to bring high and sustainable economic growth. Yet, to achieve and sustain a high growth rate, policy makers have to understand the drivers of economic growth. There is a general view that economic growth is illustrated by the trend of GDP over a period of time.The Solow–Swan growth model affirms that per capita GDP is determined by exogenous factors including saving rate, population growth and technical progress. In addition, the model further explained that difference in saving rate is key for countries to have varied per capita GDP (Edwin and Shajehan, 2001).

In previous studies, attention was given to the relationship between foreign aid and economic growth to a larger extent, putting aside other potential factors accounting for efficient utilization of foreign aid. For example, the two-gap theory stressed on the importance of foreign aid in relaxing domestic saving and foreign exchange shortages towards capital formation and economic growth. However, subsequent studies shifted from such aid economic growth relationships to conditionality, effectiveness, the policy environment of the recipient country, etc. (Mercieca, 2010).

For the economies of less developing countries where vicious circle of poverty is availing, the rationale for foreign aid is very straight forward. Basically, capital constraint is the key factor working behind seeking foreign aid. In view of that, there are three gap models radiating from the Harrod-Domar growth models (Harrod, 1948; Domar, 1947) on why foreign aid is necessitated. The saving gap model is the first gap that assumes excess supply of labour constrained by lack of capital. This shortage of capita arises from low domestic saving (constrained saving) which in turn leads to low income incapable of generating adequate amount of capital that helps to achieve the targeted growth rate. The second gap model is the foreign exchange gap where developing countries are constrained by shortage of hard currency to meet the demand for imported capital goods. Here, revenue obtained from export of goods and services is by far less than the amount of payments needed for imported capitals goods used for investment purposes. Thus, such foreign exchange gap is filled by the foreign aid (Chenery, 1966). The third gap model is the fiscal gap model where developing countries are unable to collect sufficient amount of revenue to achieve targeted investment and growth rate (Taylor, 1990; Bacha, 1990). But majority of the studies focus on the first gap model, that is, the saving gap model, leaving the other two gap models. In general, in countries like Ethiopia where there is significant resource gap, the flow of foreign aid must fill the aforementioned gaps.

Keeping the importance’s of foreign aid in the form of capital inflow as it is, the key issue is whether such capital inflow is effective enough to bring the intended results. Thus, the issue of aid effectiveness is the most contested debate in the recent theories of aid and other macroeconomic variables relations in general and aid and saving relations in particular. For example, the most stubborn paradox called the macro-micro paradox of foreign aid-saving relations states the aid-saving relationships at micro level showed the positive impact of aid and contradicts with the aid-saving relationships at macro level that showed no clarity on the impact of aid (Mosley, 1987).

In a nutshell, it is not easy to conclude the impact of foreign aid on macroeconomic variables and there is no conclusive evidence that the foreign aid has positive impact on the economies of the recipient countries:

Results of research on the macroeconomic effects of aid deals with relatively large groups of developing countries, they are ambiguous. The relationship between aid and growth is rather weak: it can be either positive or negative, depending on the country groupings and the time period chosen. The relationship between aid and savings was once thought to be stronger and negative. But the reasons why it was found to be so remain unexplained…” (Cassen and Associates, 1994) as stated by (Mercieca, 2010). In a similar way, White (1992) argued that “we know surprisingly little about aid’s macroeconomic impact’, but adds that ‘the combination of weak theory with poor econometric methodology makes it difficult to conclude anything about the relationship between aid and savings…and aid and growth” (Ibid).It is clear that foreign aid is an important source of government revenue for majority of less developing economies. Thus, the key question here is whether foreign aid has done what it is supposed to do. The effectiveness of foreign aid is conditional in the sense that it produces significance outcome depending on the economic condition and policy of the recipient country at large. Thus, views of aid-growth nexus basically fall into two different categories. These are the unconditional and conditional effects of foreign aid (focus of this study). According to Saima and Temesgen (2016): “The aid debate has moved away from traditional foreign exchange and savings gap theories called the two gap models to the policy and institutional gaps in recent years.” A study done by Burnside and Dollar (2000) pointed out that foreign aid has positive impact on the economy of the recipient countries accustomed and they have good fiscal, monetary and trade policies. On the contrary, for countries with poor economic policies such optimistic impact might not be realized.

According to Guillaumont (2008), effectiveness of aid depends on the specific economic feature of the recipient country basically categorizing the factors into two groups; the first one is issue related to “policy, institution and governance” and the second is factors related to “exogenous economic shocks and structural economic vulnerability”. Thus, foreign aid is more likely to be used rationally, when the policy and institutional environments are good. Again, vulnerability to other shocks like natural calamities or external influences affects utilization of aid negatively. For example, the prevalence of war or political instability in the country worsens the allocation of aid.

In analyzing the drivers of economic growth, it is comprehensible that capital accumulation plays key role in development process and realization of the goal of economic growth. Capital accumulation where foreign aid is one potential source is the main source of economic growth for many developing countries including Ethiopia.

Nevertheless, the key issue is that foreign aid is not succeeded as expected and this poses uncertainty and inquiry towards the effectiveness of aid surging to the recipient countries. Paradoxically, the macroeconomic hardships including unemployment, inflation and low domestic saving, balance of payment deficit, budget deficit, etc. continues to exist significantly side by side.

Thus, the main research question here is to address drivers of economic growth in Ethiopia using the time series data from 1970 to 2011 where the complementarity of aid and policy environment is critically assessed.

Specification of the model

The per capita growth equation specified here below helps to examine the drivers of economic growth by taking into account the relevant explanatory variables used for the study at hand. The aggregate production function (APF) framework which assumes the usual conventional input namely labour and capital which are used in the neoclassical production function, with other unconventional inputs represent other variables like foreign aid and trade openness which may possibly be included in the model to capture their contribution to per capita economic growth (Feder, 1983; Fosu, n.d.)

Thus, the initial step is stating the explicit Cobb-Douglass production function where output is a function of factor inputs.

The growth equation takes into account the vector of explanatory variables (Appendix A) deemed to be the drivers of economic growth through different ways (some positive, others negative or inconclusive footed on earlier literatures). The explanatory variable APIt helps to examine whether the aid-growth relationship is conditional on good policy environment or not. Although, a number of studies agreed with the contribution of good policy in enhancing growth, consensus is not reached as to whether the growth impact of aid is conditional on the quality of the policy environment or not.

Formulation of policy index

Policy index, an important piece of explanatory variables, is a composition of fiscal, monetary and trade policies. Based on Burnside and Dollar (2000) policy index is constructed following the growth equation’s regression result with budget surplus to GDP, inflation rate and trade openness to generate policy index. Thus, the formulated policy index is set as:

As can be seen from the policy index result generated from the GDP growth and aforementioned variables, here, the constant, , is positive and statistically significant showing the value for policy index when budget surplus, inflation rate and openness are all zero.

Budget surplus/deficit has no influence on policy as it is statistically insignificant though its coefficient is positive. The coefficient for inflation rate is positive and statistically significant showing one percent increase in inflation rate leading to about 0.11 increases in economic growth. This goes in line with facts that a lower rate of inflation stimulates production and economic growth. The coefficient for openness is also positive and statistically significant showing that once percent increase in openness leads to 8.75 increases in economic growth. This shows that the more the country follows open door economic policy, the more the economic growth. At the end, series of values for policy index is generated applying values for explanatory variables used above and then used in the main regression model. From Equation 4, the specific outfitted model in an estimable econometric form is set as:

This study analyzed the time series property of the data (test of the unit root on each variable), test of cointegration to assess long run relationship of economic growth and its explanatory variables and vector error correction model (VECM) was used to estimate the short dynamics of the growth equation (Gujarati, 2004; Verbeek, 2004).

Based on the estimation methods explained earlier, this section deals with analysis and interpretation of results. Hence, the test of stationarity of variables via unit root, test for long run relationship among variables via cointegration analysis and test for short run dynamics via VECM are the key issues described here.

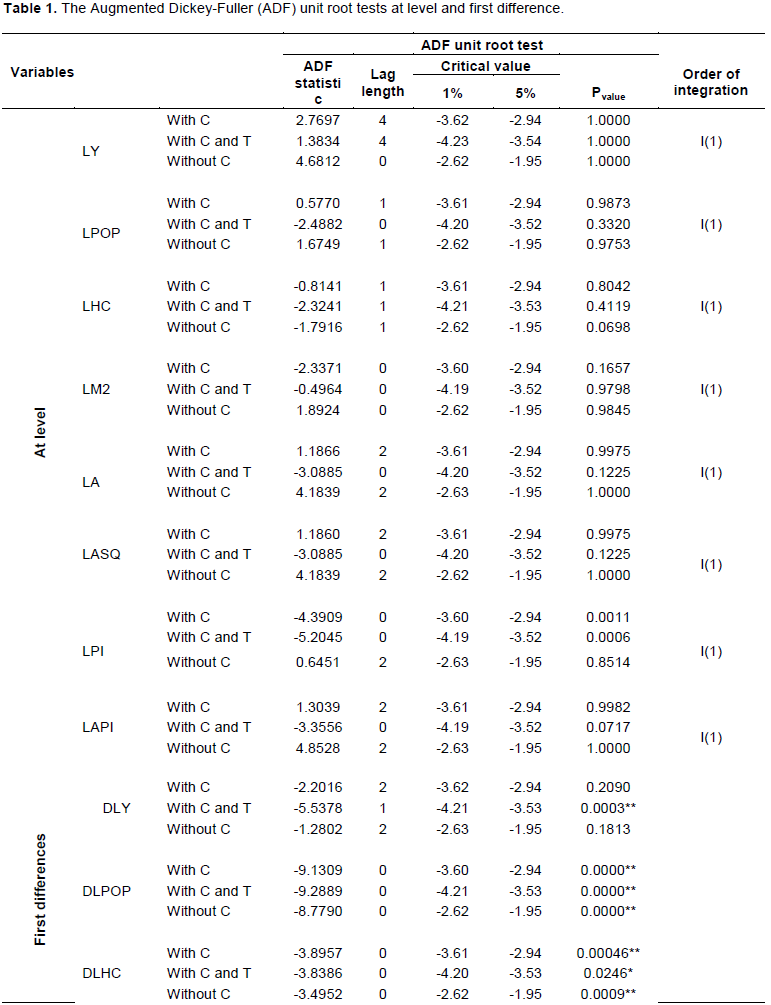

Unit root test

The econometric test of stationarity of macroeconomic variables was carried by the Augmented Duckey-Fuller (ADF) test. Such test helps to solve the problem of spurious of regression. The null hypothesis of the test stated that the data has unit root while the alternative hypothesis states that the series is stationary. The automatic lag length selection uses Schwarz Info Criterion with ADF test type. This taste is done to check whether there is a spurious relation (high coefficient of determination with insignificant coefficients) among the variables.

As seen from the above ADF test, to unit root table, none of the test statistics are statistically significant when the variables are at a level which further explains that the null hypothesis of unit root is not rejected at conventional level of significance. But, when the differences of the variables are taken into account, the ADF test reveals that each are integrated of order one where the null hypothesis of unit root is rejected at 1 and 5% levels of significance for different specifications of no constant, intercept, constant and linear trends.

Lag length selection

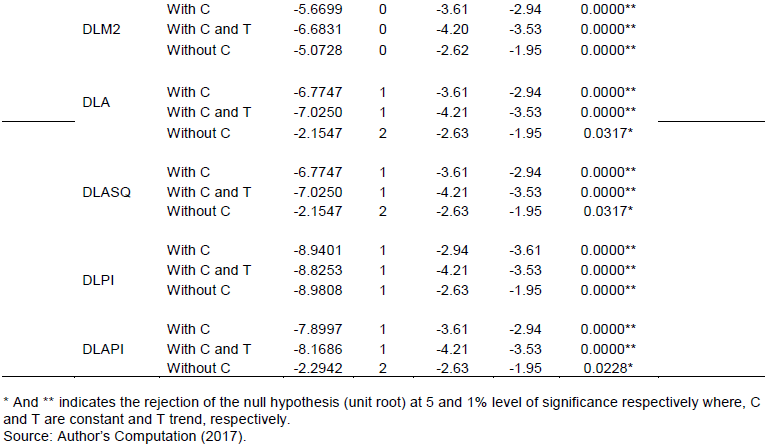

Cointegration test is usually preceded by a test of optimal (appropriate) lag length (Table 2) selection as the result of the test is affected by the number of lags included in the VAR model. There are many tests that can be used to choose appropriate lag length. These are the log likelihood (LL), Akaike information criteria (AIC), Schwarz information criteria (SIC) and Hannan-Quinn information criteria (HIC). The VAR estimate with the lowest lag order in absolute value is the most efficient one. Accordingly, the optimal lag length used in the per capita growth equation is two and VAR (1) is appropriate to carry out the cointegration test.

The Johansen cointegration test

A stochastic trend is a situation when a variable of interest has unit root (non-stationary). Two or more variables are cointegrated when their linear combinations do not contain stochastic trend. The Johansen test of cointegration is a generalized method of ADF test for unit root (integrated of same order or not) where the relationship among variables under considerations are examined with specified number of cointegrating vectors. This forms a long-run equilibrium relationship between the variables (Dwyer, 2015).

Test for null of no cointegration

The residual obtained from the time series regression of cointegrating variables is used for unit root test of cointegration. Accordingly, the null hypothesis of no cointegration (Table 3) is tested against the alternative hypothesis of cointegration. The auxiliary regression of the form is run to check for cointegration in the following manner.

As presented below, the t-ratio is -5.69 whereas the 5% critical value with 41 degree of freedom, for cointegrating relationships with suppressed constant, is -2.021 and so this falls within the rejection region of the test as the 95% confidence interval is within . The null hypothesis of no cointegration is rejected at the 5% level of significance. (Appendix B).

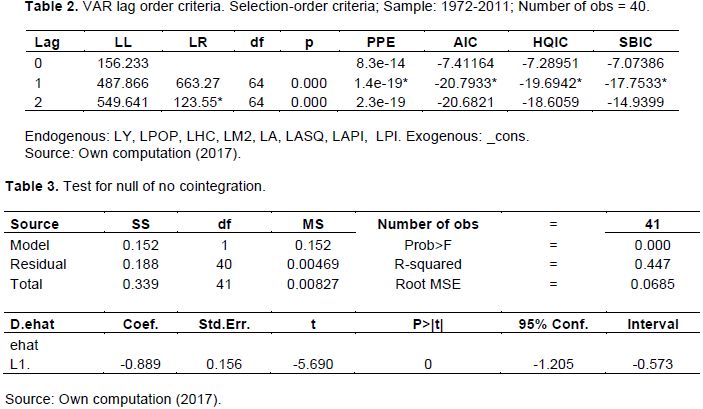

The maximum Eigenvalue cointegration test procedure

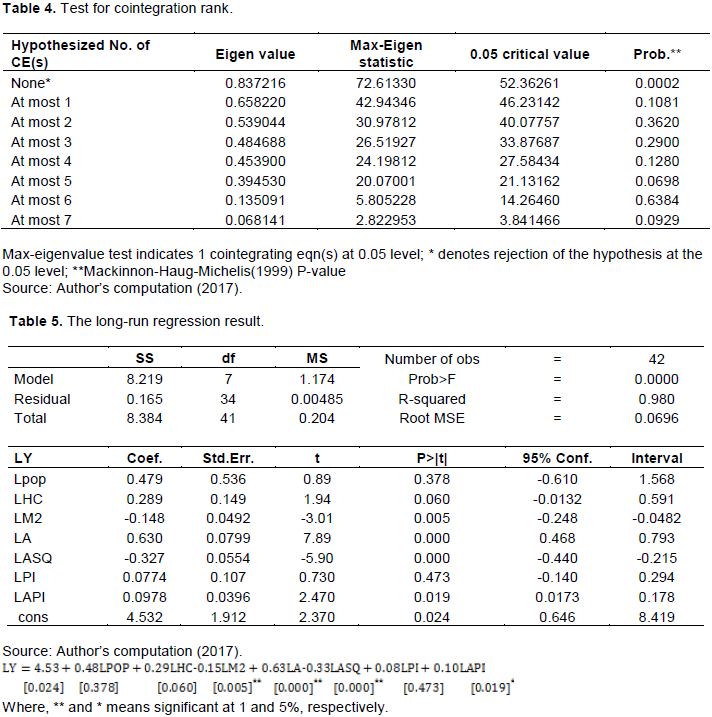

The ADF test (Table 1) shows that all variables are cointegrating of order one (I (1)). Thus, to know the number of cointegrating vectors, a maximum-Eigen value test statistic ( is used. The maximum Eigen-value test, tests the null hypothesis of r cointegrating vectors against the alternative hypothesis of r+1 cointegrating vectors. The test results in one (Appendix C) cointegrating equations at 1% level of significance for this study means that there is one cointegrating equation (Table 4). This means that among the variables output per capita, population growth, human capital, financial liberalization, foreign aid, square aid, policy index and aid interacted policy index, there is one long run relationships. The long run per capita output growth equation (Table 5) indicating the sign and magnitude of parameters with associated level of significance is given as:

In the economies of less developing countries including Ethiopia, there are diverging empirical evidences regarding the impact of population growth on per capita output. Those who support low population growth explains that rapid population growth has an adverse and deteriorating impact on the economic growth of the country in general and puts pressure on the provision of the social services in particular (health, education and other social services).

Other group of scholars state that there is no stable and strong relationship between the population growth and per capita output growth of the country (Jeff, 1994). In poor countries like Ethiopia, rapid population growth have resulted in less living standards where income is still low, human and physical capital are less built up, political and social institutions are less well established and majority of the population rely on the subsistence traditional agriculture. Thus, as seen from the above per capita output growth equation, even though the relationship with population growth is positive, there is an insignificant influence showing that there is no stable and clear link between the two. In econometric sense, impact of population growth (LPOP) on output per worker is small enough to be statistically indistinguishable from zero. It is evident that human capital accumulation is considered as a key determinant in the process of economic growth of a nation.

Foreign aid (LA) independent of the macroeconomic policy environment has sound impact on the economy of the country on the condition that is channeled to productive economic activities. This result is inconsistent with Burnside and Dollar (2000) aid which is dependent on the recipient’s economic condition and is effective when there are good policies at work. But, an empirical study made by Karras (2006) analyzed the association between foreign and per capita economic growth of 71 developing countries constituting aid recipient categories for the period of 1960 to 1997 and came to conclusion that the impact of foreign aid is positive and significant where 0.16% GDP growth rate per capita accounts for an increase in aid inflow of $20 per person. The study further concluded that such positive correlation is at the neglect of the policy environment which shows that the effectiveness of foreign aid is unconditional (non-dependent) of policy at glance. This is consistent with the result of this study. Accordingly, a 1% increase in foreign aid inflow in terms of dollar leads to about 0.63% increase in GDP growth at 1% level of significance.

Human capital (LHC), knowledge and the ability to invent and innovate, proxied by the gross enrollment ratio also insignificantly influence the per capita output. In less developing countries including Ethiopia, there is tremendous sharp rise in years of schooling while the return from such schooling is insignificant, and even negative in some cases showing the impact of human capital is insignificant. This result coincides with Pritchett (2001). Further, the apparent irrelevance of human capital (proxied by average years of schooling) for generation of growth in an economy lies with its level of development. This implies that human capital accumulation cannot assert its productive role in the process of growth until an economy crosses a threshold level of development (Humna and Emranul, 2017). This further elaborates that years of schooling do not spontaneously changes to human capital given poor academic institutions (specially the education policy which needs closer attention) and lack of institutional efficiency. Thus, meaningful positive effect of human capital measured in enrolment ratio can only be secured after the economy passes some threshold level of development. The changing age structure of a population also matters, leading to a fall in the ratio of workers to dependants, that is, a rise in the age dependency ratio Excess money supply (LM2) which is an indicator for financial liberalization influenced the economy of Ethiopia negatively over a given period which further assures that it is only when there is control over other determinants of growth that positive effect is observed. Such negative effects of growth in money supply works through different monetary transmission channels where the general accepted view is the ignite fire of inflation. Increase in money supply leads to increase in aggregate demand for a given aggregate supply (inelastic and sticky AS) and further pushes price up (inflationary trend). Such increase in cost of living further leads to increase in wage in labor market where firms are forced to reduce the workers which further leads to increase in unemployment and decrease in output. Thus, money supply growth affects per capita output negatively over the study period. This study is consistent with that of Dwyer and Hafer (1988) as cited in Brad (2014).

Square aid (LASQ) has significant negative effect on per capita economic growth and the result is consistent with the economic theory explaining that foreign tend to have diminishing returns beyond some threshold points for the economies of less developing countries as they are constrained by the absorptive capacity. And, the result is consistent with Lensink (1999) which also obtained a negative return to inflow of aid beyond some threshold limits. This clearly points out that constant flow of foreign are not endlessly effective which is captured by second order polynomial in aid. Hence, a 1% increase in square aid leads to about 0.33% decrease in GDP growth at 1% level of significance showing that the non-linear effects of foreign aid is noteworthy. The constructed policy index (LPI) has no significant effect of the per capita economic growth of the country over the given period.

On the contrary, when aid interacts with policy, there is positive and significance relationship per capita economic growth. Accordingly, a 1% increase in foreign aid inflow in terms of dollar leads to about 0.10% increase in GDP growth at 5% level of significance. This result further assures that good policy environment favors the effectiveness of foreign aid and it also shows that in the long run, the effect both work together towards enhancing the per capita economic growth of the country. There is complementarity role is boosting economic growth of the country World Bank (1998).

The short run dynamic modelling

The estimation of VECM takes into account both short and long run relationships. The change in exogenous variable with appropriate lag length (omitted here) represent variation in short run whereas the coefficient obtained from error correction term (lagged by one year as time path matters to correct errors) represents the speed of adjustment towards the long run equilibrium.

The significant negative coefficient on ( ) indicates that the per capita GDP growth responds to disequilibrium. The lagged error correction term ( ) included in the model to capture the long run dynamics between the cointegrating serious is correctly signed (negative). This coefficient indicates a speed of adjustment of 52.6% from actual per capita growth in the previous year to equilibrium rate of per capita economic growth (Table 6). This implies that in one year, the real per capita output adjusts itself to the equilibrium by 52.6% and the complete adjustment will take about one year and nine months.

Capital accumulation in diversified forms is a pillar to the development aspect of one’s economy. But, the economies of less developing countries distinguished by low domestic saving cannot meet the expected investment demand and also, the targeted economic growth. Due to this, they have no chance apart from being reliant on external capital inflows notably foreign aid so as to fill the visible resource gaps and achieve the intended development goals. But, different empirical studies suggest that such capital inflow in the form of foreign aid is effective in assisting the development objectives of the recipient given that the country has good macroeconomic policy environments. This is meaningful to aid works where there is good policy on ground. Other extremes recommend that foreign aid is unconditional and simply depends on the way the recipient countries utilize them which shows that it is only when they are channeled to the productive public investment activities that they take part in promoting the economic growth of the country. Thus, the main objective of this study is to examine this diverging views of effectiveness of foreign aid where due attention is given to the analysis of aid and policy complementarity.

The per capita economic growth model is specified by taking into account relevant variables used for the study. The estimation and data analysis employed the time series econometrics mechanisms where the stationarity of the variables are tested using ADF unit root test and all variables are stationary at first difference (which means they are integrated of first order, I(1)). The ADF test is followed by the test for long run relationship among variables and the existing number of cointegrating vectors. The short run dynamics of the analysis is handled by the VECM.

As a matter of fact, the estimation of the result shows that there is divergence between the hypothesized sign and econometric results of variables. But, the results are still supported by existing literatures. In view of that, population growth and human capital are insignificant where as foreign aid positively and significantly affected the per capita economic growth of the country. Further, as the continuous flow of foreign is not endlessly effective, there is absorptive capacity constraint shown by negative and significant impact of squared foreign aid. Further, the empirical result assures that aid interacted with policy also positively and significantly affects the per capita economic growth of the nation, further explaining that good macroeconomic environment complements the working of foreign aid though not conditional as it is also successful without the policy environment. Lastly, policy index is insignificant to influence the per capita economic growth.

Policy implication

The following policy implications are forwarded based on the findings of the study:

1. The country should clearly devise policies of checking the apparent link and dynamics between population growth and economic growth. This should incorporate various measures of working on development challenges posed by population growth pressure on sustainable basis. There should be clear and strong linkages between the dominant sector of the economy, that is, agricultural sector (which contributes the lion share of employment generation and output production) and other economic sectors through policy linkages. The sector should be encouraged where proper provision of rural microfinance as a source of finance for credit, subsidies, mechanization and modernization in farming methods and use of modern inputs are essential to increase the productivity of the sector and check on population growth as majority of the population resides in the rural areas.

2. Human capital is the foundation for invention and innovation of new skills and technologies which are used in production process to attain sustainable economic development. Thus, government should pay closer attention to the institutions producing this skilled man power to check whether the knowledge gained is up to standard and the return from schooling is magnificent. Capacitating and maintaining institutional qualities, setting clear policies and guidelines and proper allocation of financial and infrastructural resources play a major role in solving the associated bottlenecks.

3. Even though a positive effect of foreign aid is observed, there should be tangible donor-recipient policies where by clear selection of capital inflow is made. This means that the policy should adhere to the conditionality whether bilateral or multilateral aids are more effective to support the development programs. And, there should also be comprehensible selection and priority for productive public investment activities (economic sectors) that are to be financed through such development assistances. In another way, there should be a better mechanism of mobilizing domestic resources which has dual objectives. One is financing the investment activities via internal resource generation and the other is making the country to have the absorptive capacity to attract foreign aid inflow. Thus, continued efforts should be made towards boosting the domestic savings.

4. As foreign aid is more effective when complemented with good policy environment, the country should make added efforts to achieve macroeconomic stabilities via the use of prudent fiscal, monetary and trade polices used in amalgamations.

The author has not declared any conflict of interests.

REFERENCES

|

Bacha E (1990). A Three-Gap Model of Foreign Transfers and the GDP Growth Rate in Developing Countries. Journal of Development Economics 32:279-296.

Crossref

|

|

|

|

Balogun P (2005). Evaluating progress towards harmonization, Department for Internaional developement.

View

|

|

|

|

|

Brad S (2014). Money supply and economic growth in developed nations: An empirical analysis. Journal Applied Business and Economics 16(4):41-52.

|

|

|

|

|

Burnside C, Dollar D (2000). Aid Policies and Growth. American Economic Review 90:847-868.

Crossref

|

|

|

|

|

Burnside C, Dollar D (2000). Aid, Policies and Growth. American Economic Review pp.847-868.

Crossref

|

|

|

|

|

Cassen R (1994). Associates. Does Aid Work? Oxford Clarendo Press.

|

|

|

|

|

Chenery AH (1966). Foreign Assistance and Economic Development. The American Economic Review 56:679-733.

|

|

|

|

|

Dwyer PG (2015). Johansen Test for Cointegration. Retrieved from

View

|

|

|

|

|

Dwyer G, Hafer R (1988). Is money irrelevant? Federal Reserve Bank of St. Lous Review .Retrieved from

View

|

|

|

|

|

Edwin D, Shajehan H (2001). Determinants of Economic growth (Panel data approach). Retrieved from

View

|

|

|

Feder G (1983). On exports and economic growth. Journal of development studies pp. 59-73.

Crossref

|

|

|

|

|

Fosu A (n.d.). Export composition and the impact of export growth on developing economies. pp. 67-71.

|

|

|

|

|

Guillaumont P (2008). To move out of the trap-The least developed countries. Pari: Economica.

|

|

|

|

|

Gujarati N (2004). Basic Econometrics (4th edition ed.). The McGraw-Hill comapnies.

|

|

|

|

|

Humna A, Emranul HM (2017). Threshold effects of human capital: Schooling and Economic Growth. Economics Letters 156(C):48-52.

|

|

|

|

|

Jeff K (1994). Where in world is population growth bad?.

|

|

|

|

|

Karras G (2006). Foreign aid and the long run economic growth: empirical evidence for a panel of developing countries. Journal of International Development 18:15-28.

Crossref

|

|

|

|

|

Lensink R (1999). IS there an aid Laffer curve? Credit Working Paper No.99/6 .

|

|

|

|

|

Mercieca P (2010). Aid and economic growth in developing countries: A literature review.

|

|

|

|

|

Mosley P (1987). Aid, the Public Sector and The Market in Less Developed Countries. Economic Journal 97:616-641.

Crossref

|

|

|

|

|

Pritchett L (2001). Where has all the education gone? The World Bank Economic Review 15(3):367-391.

Crossref

|

|

|

|

|

Saima L, Temesgen K (2016). Aid-macroeconomic policy environment-growth nexus: Evidence from seleced African counties. Retrieved from

View

|

|

|

|

|

Taylor L (1990). Three-Gap Model,Problems of Developing Countries in the 1990s. World Bank, Washington Dc, pp. 55-90.

|

|

|

|

|

Verbeek M (2004). A guide to modern Econometrics (2nd Edition ed.). Rotterdam: John Wiley and Sons, Ltd.

|

|

|

|

|

White H (1992). Macroeconomic impact of development aid. The Journal of Development Studies 28(2):163-240.

Crossref

|

|

|

|

|

World Bank (1998). Assessing Aid, What Works, What Does not and Why. Washington DC: The World Bank.

|

|