ABSTRACT

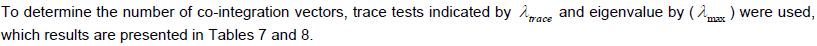

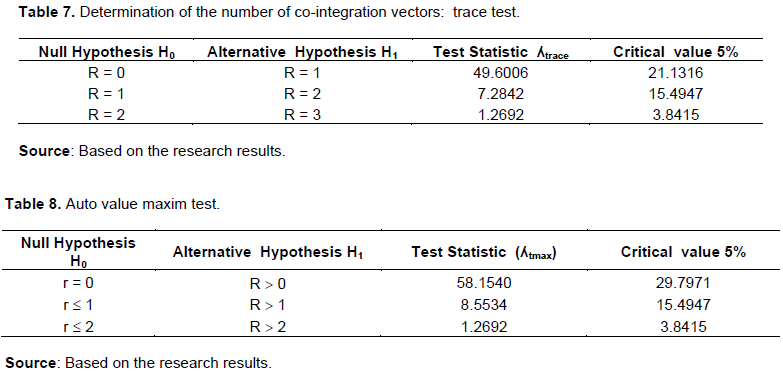

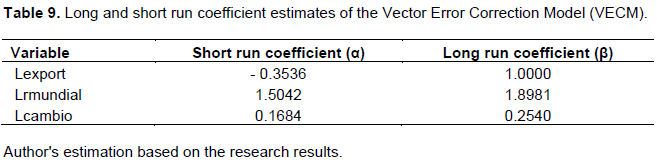

The main objective of this paper was to analyse to what extent the Brazilian agricultural exports responds to changes in the real exchange rate and in the world income for the 2000 to 2014 period (monthly). The results showed that the coefficient of the value of agricultural exports in relation to the exchange rate was inelastic in the long run (0.2540). However, the adjustment coefficient of the exported value in relation to world income was equal to 1.8981 (elastic), which in turn indicates that maintaining the exchange rate variable constant, a 10% increase in world income should increase the exported value in about 19% over the long run. However, in the short run, the weightings set indicated a low speed of adjustment toward the long run equilibrium of each variable, that is, in the event of an imbalance in any one of the variables of the model, its own correction will slowly take place toward the long run equilibrium. In the variance decomposition analysis, the results showed that the world income is more important than the exchange rate in the explanation of the variance error of the agricultural exports.

Key words: Brazilian agricultural exports, exchange rate, world income, co-integration, auto-regression model.

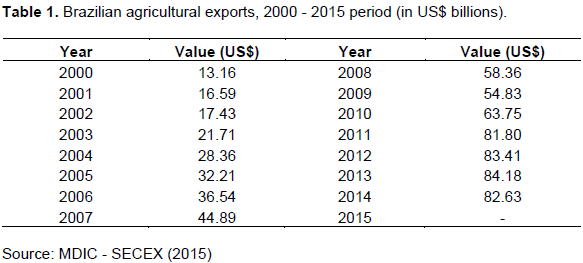

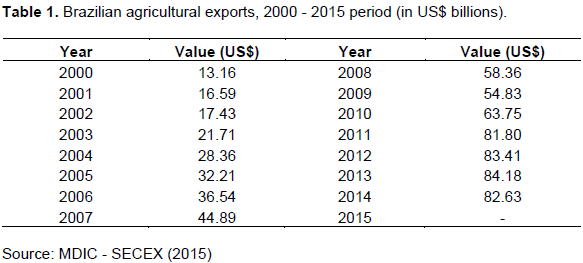

A significant reduction of economic growth occurred in many countries, as a result of the world crisis, which started in the United States in October of 2007. This happens, specially, in the European Union and in Japan, desencouraging international commerce and impacting in a generalized way the balance of payments and the economic growth of numerous countries, including Brazil in recent last years. The evolution of the Brazilian agricultural exports for the 2000 to 2014 period is presented in Table 1. As it can be observed, the total Brazilian exports started to change in value, significantly, from the year 2000, due to the effects of the new Brazilian commercial policy. The growth in Brazilian agricultural exports was notorious and exceeded the value of US$ 20 billion beginning a strong growth tendency. In 2005, when its annual exports was already up to US$ 32.21 billion, it went on into an expansion tendency upto the value of US$ 63.75 in 2010. In other words, a 98.92% increase in only five years. In the 2010 to 2014 period, the Brazilian agricultural exports presented a 29.62% increase.

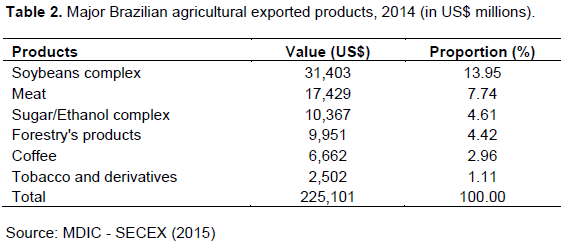

Among the major Brazilian agricultural exported products, in 2014, the soybeans complex with US$ 31.4 billion was the most important item with 13.95% of total exported value. Secondly, meat with a 7.74% participation followed by the sugar/ethanol complex with a 4.61% participation, as it can be seen in Table 2.

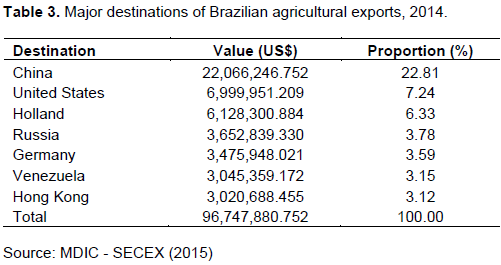

In relation to the destination of Brazilian agricultural exports, China has been Brazil's major commercial partner with a 28.8% participation of the total exported value, followed by the United States with a 7.24%, Holland with 6.33% and Russia with 3.78% participation (Table 3).

Therefore, the major objective of this paper was to analyze the effects of the exchange rate and the world income on the Brazilian agricultural exports for the 2000 to 2014 period. Additionally, its objective was also to verify if the shocks resulted from the exchange rate and world income represented significant oscillations in Brazilian agricultural exports along the study period.

In order to identify and to evaluate major variables that affect Brazilian exports, co-integration tests, as well the vector error correction model (VECM) were used for the short and long run, to verify how they react to changes in the long run equilibrium relations. To analyze how exchange rate and world income variations are transmitted to Brazilian agricultural exports along time a response- to impulse function was calculated, considering a twelve month period.

Major studies done in recent years, related to national and regional exports, in an aggregate manner or by products, giving emphasis to those that used vector auto regressive (VAR) and VECM models were reviewed as those used in this paper.

Castro and Cavalcanti (1998), using a VECM methodology, estimated total export and import equations for Brazil using annual value data (in US dollars) for the 1955 to 1995 period. The estimations were disaggregated by aggregated factor and category use. The authors included in the model, the following explained variables: real exchange rate, a proxy for the world income level, and an indicator for the domestic income level. The obtained parameters results were significant.

Brazilian agricultural products export supply functions were estimated by Barros et al. (2002). In their study, a theoretical model was developed to support the adjusted econometric models specifications for different products for which the export supply equation was derived from supply and domestic demand functions. The models were adjusted by the method of minimum ordinary least squares including the VECM in the case of co-integrated variables. The obtained elasticities presented coherent signs with the defined economic model. The exchange rate resulted to be of major importance for the Brazilian agricultural exports.

Alves and Bacchi (2004) estimated a Brazilian export sugar supply function using a vector auto regressive model with identification by the Bernanke process. The data used are for the October 1995 to the December 2001 period. The specified equation used to evaluate the impact variations on export conditions is fundamental for a theoretical model that assumes to have in part an exceeding domestic market. The integration and co-integration properties of the utilized series in the model were considered in the analysis. The results show that an increase in the export prices and exchange devaluations yield significant increase in Brazilian exports. On the other hand, an increase in domestic income and domestic prices has negative reflexes on the exported quantum. The more expressive effects of a same percent variation on the exports conditions of the sugar exported quantum happen in the case of the domestic income variable.

Resende and Godoy (2005) showed in their study that the developing economies and its investment rates are more sensitive to those type of fluxes. Therefore, their competitive gains and exports would be cycle functions of their international liquidity. It postulates that Brazilian exports are function of international liquidity cycles and of other variables traditionally contemplated in the Brazilian export equation. A Brazilian export equation specified in that way was estimated by the Engle-Granger (error correction mechanism) and Johnson methods. The results do not reject the hypothesis of the existence of a long run relationship between international liquidity and Brazilian exports.

Silva and Bacchi (2005) examined export equations for Brazilian gross sugar, with the objective to identify the export behavior determinants of this commodity. The authors used a VAR/VECM considering the integration and co-integration properties of the series analyzed in the study. The results clearly demonstrated that the Brazilian gross sugar exports depended on Russia's exchange rate, and on the domestic price. The last variable had no significant effect on the exported quantum.

The impact of the January 1999 change in the Brazilian exchange regime, and the following transformations experienced by the Brazilian agricultural sector were evaluated by Ferreira et al. (2006). Their study, specifically analyzed the Brazilian commercial balance in relation to the performance of the Gross National Product (GNP) or the agricultural product, world income and the real exchange rate for the 1980 to 2006 (up to the first trimester). The major conclusions were that the former exchange rate band policy, in the first five years of the Plano Real, had a negative influence in exports and favored imports. After the exchange liberation of 1999, even though the estimates were not statistically significant, the reverse indications of this scenario were positive.

Santos et al. (2010), using an Ordinary Minimum Square (OMS) model, estimated the export elasticity as a function of the world income, exchange rate, international and domestic prices. The results showed that in 1995 to 2009 period, Brazilian exports were significally influenced by the exchange rate and the world income.

Padrão et al. (2010) analyzed the determinants of the export coffee supply of the State of Minas Gerais for the July 1999 to December 2009 period. The econometric model used by the authors was the VECM, analyzing the impulse-response functions, as well as the variance decomposition of the prevision error. The results showed that quantity of exported coffee was affected, basically, by the international price and the real effective exchange rate.

Souza and Ferreira (2013) used a VECM and the Granger causality test in order to verify how the soybean international price and the exchange rate influence domestic price formation in the states of Mato Grosso, Paraná, Rio Grande do Sul and Goiás. The results demonstrated that variations in the international price of the soybean commodity and the exchange rate affected the soybean price in the four states and that the price of Mato Grosso did not suffer any influence from other states.

The study of Monte (2015), using a VAR/VECM methodology, had the objective of estimating the impact of the exchange rate and world income shocks on the exports of the state of Espírito Santo. The results indicated that the variables are co-integrated, while in the long run equation, the world income affected significantly the exports. The exchange rate presented a negative sign and was not significant. In the short run, the "export" variables revealed that short run disequilibrium is quickly corrected in relatively fast way, what does not happen to the "exchange rate" and "world income" variables. In the impulse-response functions, it was verified that a shock in the exchange rate had negative effects on the exports in almost all periods after the shock, as opposed to one would expect from economic theory, and the world income affects positively the exports.

Proposed model

Several papers dedicated to the study of aggregate exports and trade products in an individual matter can be found in the literature of international trade. Among the studies focusing on export functions the most known are Morais and Barbosa (2006), Cavalcanti and Ribeiro (1998), Carvalho and De Negri (2000), Barros et al. (2002), Silva and Maia (2003), Alves and Bacchi (2004), Silva and Bacchi (2005), and Moraes and Barbosa (2006) are most known.

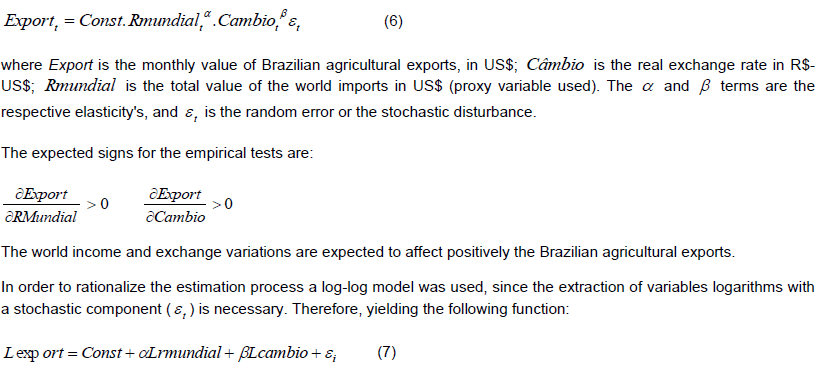

In this paper, part of the proposed model developed by Castro and Cavalcanti (1998) was used. Hence, the export equation can be expressed by:

x = e + y (1)

where x = exports real value; e = real exchange rate; y = total world imports, in real value, as a proxy for world income.

Positive shocks on the real exchange rate and on the world income are expected to yield positive impacts on Brazilian agricultural exports. Therefore, the econometric analysis used to evaluate the existence and the intensity effect among the Brazilian agricultural exports, world income and real exchange income, was done using a Vector Auto Regressive (VAR) model, which the main objective is to analyze variance decomposition and impulse response functions.

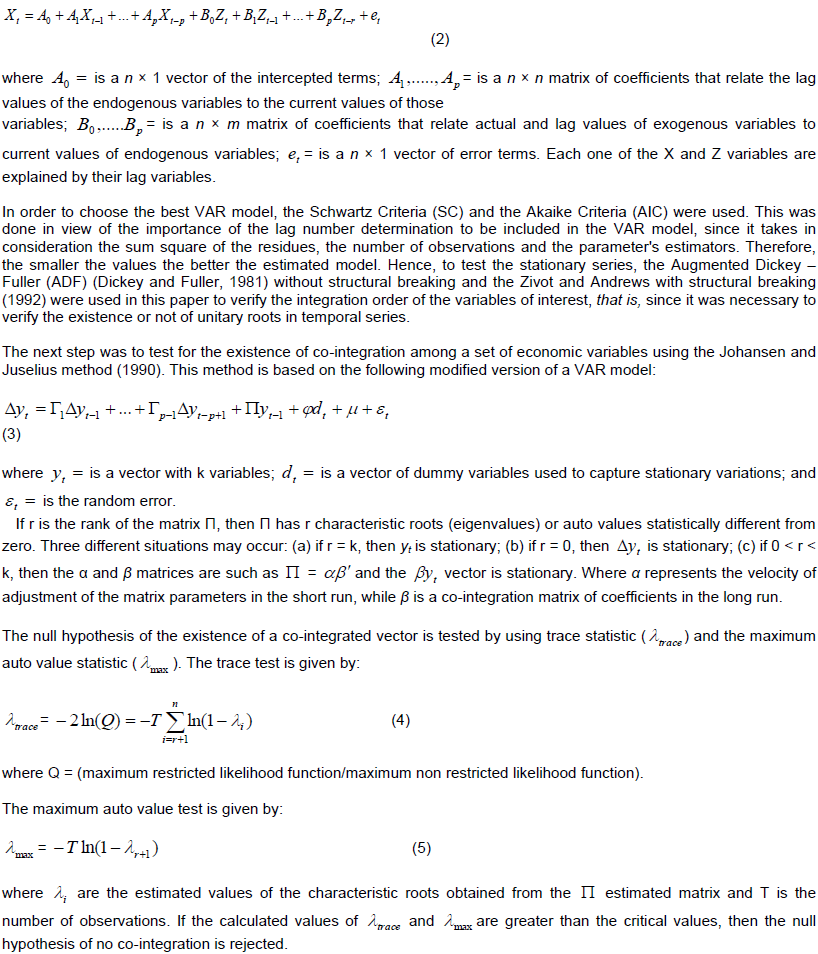

The VAR model can be expressed in the following way:

The upto here described procedures were useful to determine the long run equilibrium relationship among variables. Hence, Engle and Granger (1987) demonstrated that even presenting a long run equilibrium relationship among no stationary variables (in level), it is possible to occur a disequilibrium in the short run, that is, the short run dynamic is influenced by the magnitude of the deviation in relation to the long run equilibrium. The mechanism that conducts the variables to equilibrium is known as the VECM, by which it is possible to determine the velocity that the disequilibrium in the short run are eliminated.

The data

The data utilized in the estimation of the model specified earlier were monthly series for the January 2000 to December 2014 period for the following variables:

(1) Total value of Brazilian agricultural exports (in millions of US$ - FOB), source: Sistema Alice Web do Ministério do Desenvolvimento, Indústria e Comércio Exterior MDIC;

(2) Real effective exchange rate, source: IPEADATA (2015); and

(3) World imports as proxy for world income, source: IPEADATA (2015), with the FMI as the original source.

The EVIEWS 8.0 was used to run the unitary root tests, co-integration and to estimate the VAR model.

Estimation of the Brazilian agricultural exports function

Given the objectives of this paper, the following Brazilian agricultural exports function was initially used:

To capture the world income and the real exchange rate effects on the Brazilian agricultural exports, the analysis was done monthly for the 2000 to 2014 period, generating 174 observations.

EMPIRICAL RESULTS AND ANALYSIS

Unitary root tests

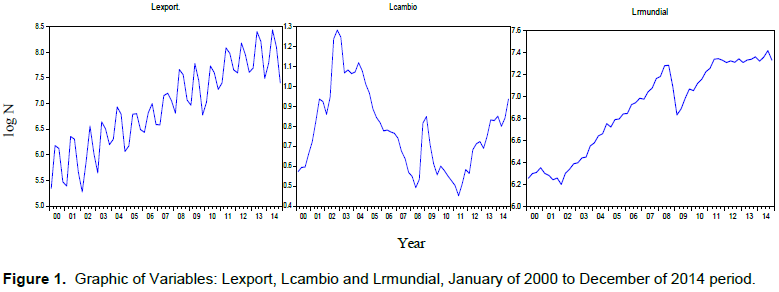

The first step in the time series analysis was to verify how did the present stochastic generator process behaved along time, that is, to identify if the utilized variables are or not stationary. First, a graphic analysis of the series with the objective to verify the existence of a structural break on each variable used in the model was done.

Observing the Lexport variable, it can be verified that its behavior in all interval values follows an increasing tendency with no structural break, presenting a stationary characteristic and with a deterministic tendency behavior (Figure 1).

For the real exchange rate variable (Lcambio), the presence of a structural break was detected, treated ahead when the unitary roots tests for the series were done. During the analysis of the world import variable (Lmundial), defined in the research as a proxy for world income, it can also be observed in Figure 1, that the variable presented a stationary deterministic tendency. However, with the presence of a level change outlier in the middle of the year of 2008, explained by the American crisis leading to an impact on international trade, resulting in a significant drop in world imports.

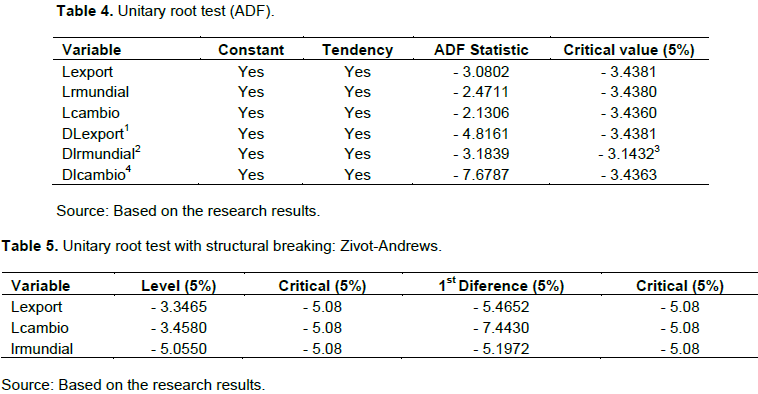

Hence, in order to begin the co-integration tests among the considered variables (Brazilian agricultural exports, world income, and real exchange rate) the stationary of the series was analyzed using the Augmented Dick-Fuller (ADF) test without structural break and the Zivot and Andrews test with structural break, with constant and tendency.

The results are presented in Tables 4 and 5 indicating that for the series in level, the unitary roots cannot be rejected at the 5% level of significance. Therefore, all series have unitary roots and are not stationary, that is, are not integrated in zero order I(0).

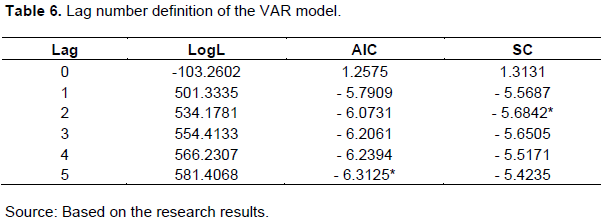

The next step was to determine the lag number of the VAR model using the Akaike (AIC) and the Schwartz (SC) criteria. However, the Schwartz information criteria (SC) detected the smallest value for order two lag. The results are shown in Table 6.

Co-integration tests

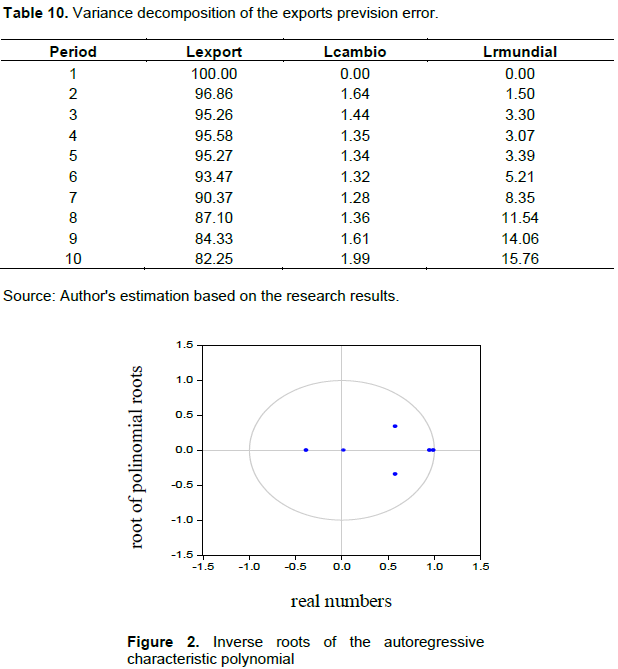

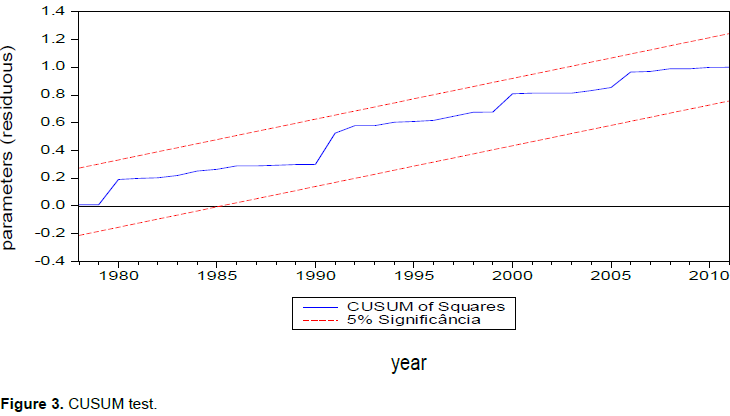

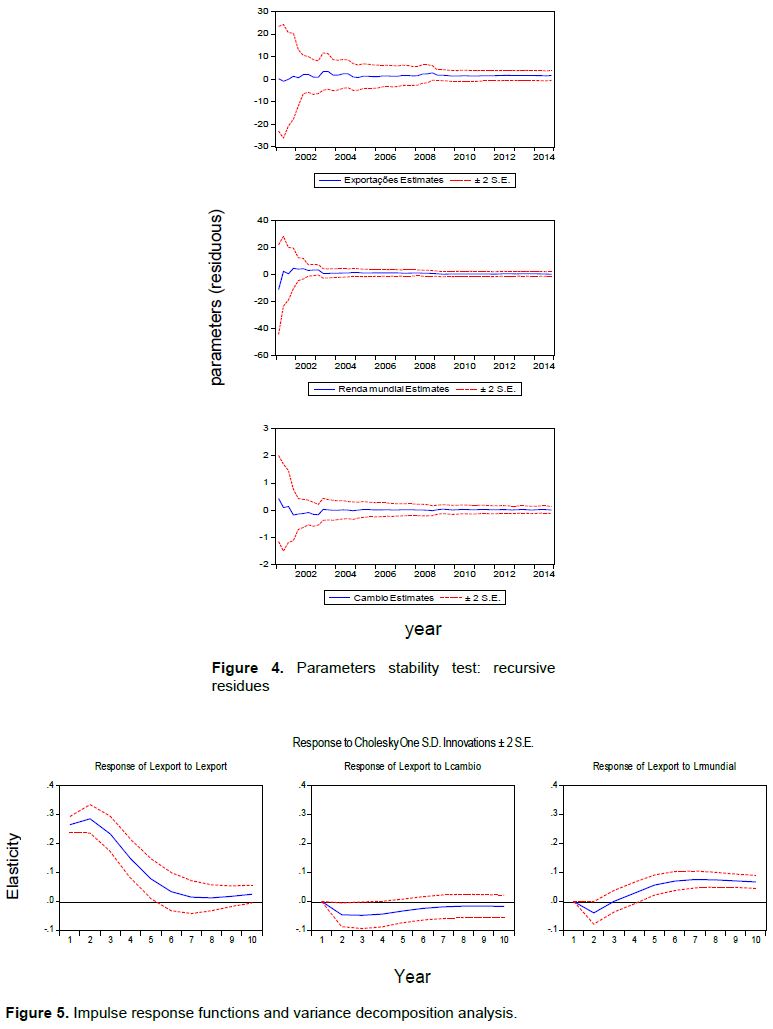

Both tests suggest that the existence of a co-integration vector. The critical values at the 5% level of significance were adopted in realized tests (Tables 9 and 10; Figures 2 to 5).

The results showed that in the long run the coefficient value of Brazilian agricultural exports in relation to the exchange rate was inelastic (0.2450). However, the adjustment coefficient of the exported value in relation to the world income was 1.8981 (elastic). Therefore, if the real exchange rate variable is assumed constant, an increase of 10% in the world income in the long run should increase the exported value in about 20%.

In the short run, the adjust coefficients indicate a slow speed adjustment in the long run equilibrium direction for each variable. In other words, if disequilibrium occurs in any one of the model's variables, its correction towards

the long run equilibrium will occur in a slow way.

The main objective of this paper was to analyze the short and long run effects of world income and effective real exchange rate fluctuations on the value of Brazilian agricultural exports in the 2000-2014 periods (monthly).

The weightings set indicated a low speed of adjustment toward the long run equilibrium of each variable, that is, in the event of an imbalance in any one of the variables of the model, its own correction will slowly take place toward the long run equilibrium. In the variance decomposition analysis the results showed that the world income is more important than the exchange rate in the explanation of the variance error of the agricultural exports. It is interested to note that in the research done by Gonçalves Júnior (2005) the world income was the most important variable to explain the balance of payments outcome of the Brazilian agroindustrial complex with elasticity lightly higher than one.

The major conclusion of this paper is that both the exchange rate and the world income are relevant variables to explain the observed fluctuations values in the Brazilian agricultural exports during the analized period.

The authors have not declared any conflict of interest.

REFERENCES

|

Alves LRA, Bacchi MRP (2004). Oferta de exportação de açúcar do Brasil [Brazilian sugar exports supply]. Rev. Econ. Sociol. Rural 42(1):09-33.

|

|

|

|

Barros GSC, Bacchi MRP, Burnquist HL (2002). Estimação de equações de oferta de exportação de produtos agropecuários para o Brasil (1992/2000) [Exports supply equations of Brazilian agricultural products estimation (1992/2000)]. Brasília. IPEA, March (Texto para Discussão nº 865).

|

|

|

|

|

Carvalho A, De Negri JA (2000). Estimação de equações de importação e exportação de produtos agropecuários para o Brasil (1977/1998) [Imports and exports equations of Brazilian agricultural products estimation (1977/1998)]. Brasília: IPEA, (Texto para Discussão nº 698).

|

|

|

|

|

Castro AS, Cavalcanti MAFM (1998). Estimação de equações de exportação e importação para o Brasil: 1955/95 [Exports supply equations estimation for Brazil (1955/95)]. Pesquisa e Planejamento Econômico, Rio de Janeiro 28(1):1-68.

|

|

|

|

|

Cavalcanti MAFH, Ribeiro MA (1998). As exportações no período 1977/96: desempenho e determinantes [Exports for the 1977/96 period: performance and determinants]. Brasília: IPEA. (Texto para Discussão nº 545).

|

|

|

|

|

Dickey DA, Fuller WA (1981). Likelihood ratio statistics for autoregressive time series with unit root. Econometrica 49(4):1057-1072.

Crossref

|

|

|

|

|

Engle RF, Granger CWJ (1987). Co-integration and error-correction: representation, estimation, and testing. Econometrica 55(2):251-276.

Crossref

|

|

|

|

|

Ferreira LR, Silva CAG, Araújo PFC (2006). A mudança do regime cambial e o seu impacto na balança comercial brasileira [The exchange rate regime and its impact on the Brazilian trade balance]. Rev. Econ. Agroneg. 4(2):123-145.

|

|

|

|

|

Gonçalves R (1996). Globalização financeira, liberalização cambial e vulnerabilidade externa da economia brasileira [Financial globalization, exchange rate liberalization and foreign vulnerability of Brazilian economy]. In: BAUMANN R. (org.), O Brasil e a economia global. Rio de Janeiro, Editora Campus.

|

|

|

|

|

IPEADATA (2015). IPEA – Instituto de Pesquisa Econômica Aplicada. Available in: www.ipeadata.gov.br. Access: March 15, 2015.

|

|

|

|

|

Johansen S, Juselius K (1990). Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxford Bull. Econ. Stat. 52(2):169-210.

Crossref

|

|

|

|

|

Monte EZ (2015). Influência da taxa de câmbio e da renda mundial nas exportações do Estado do Espírito Santo [The exchange rate and the world income influence on the Espírto Santo exports]. Anál. Econ. Porto Alegre 33(63):301-323.

|

|

|

|

|

Morais IAC, Barbosa AE (2006). Equações de oferta e demanda por exportações do setor de calçados, 1985/2003 [Supply and demand exports equations of the shoe sector]. Anál. Econ. Porto Alegre 17(1):67-90.

|

|

|

|

|

Padrão GA, Profeta GA, Gomes MFM (2010). Determinantes da exportação mineira de café [Minas Gerais coffee exports determinants]. In: 48º Congresso da sociedade brasileira de economia administração e sociologia rural, 2010, Campo Grande. Anais eletrônicos... Campo Grande: SOBER . Access: October 15, 2012.

|

|

|

|

|

Resende MFC, Godoy NRD (2005). Liquidez internacional e exportações brasileiras [International liquidity and Brazilian exports]. Brasília. IPEA, February (Texto para Discussão nâ—¦ 247).

|

|

|

|

|

Santos RP, Figueiredo AM, Oliveira MAS (2010). Depreciação Cambial e Expansão das Exportações Brasileiras [Exchange rate depreciation and expansion of Brazilian exports]. In: 48º Congresso da SOBER, Campo Grande, MS. Access: August 15, 2011.

|

|

|

|

|

Silva EK, Maia SF (2003). As exportações brasileiras de café (1961-2001): uma análise usando vetores auto-regressivos [Brazilian coffee exports (1961/2001): an analysis using autoregressive vestors]. In: 41º Congresso da sociedade brasileira de economia administração e sociologia rural, 2003, Juiz de Fora. Anais eletrônicos... Juiz de Fora: SOBER. Access: July 20, 2012.

|

|

|

|

|

Silva MVSS, Bacchi MRPB (2005). Condicionantes das exportações brasileiras de açúcar bruto [Brazilian gross sugar exports conditioned]. Agricultura em São Paulo, São Paulo 52(2):99-110.

|

|

|

|

|

Souza LO, Ferreira MDP (2013). Preço internacional, taxa de câmbio e o preço pago aos produtores brasileiros de soja [International price, exchange rate and the price paid to the Brazilian soybean producers]. Rev. Econ. Agroneg. 11(3):373-392.

|

|

|

|

|

Zivot E, Andrews D (1992). Further evidence on the great crash, the oil¬-price shock and the unit root hypothesis. J. Bus. Econ. Stat. 10(2):251-270.

Crossref

|

|