ABSTRACT

Agricultural micro-credit repayment has been a thorny issue in Nigeria, and in particular, Niger State. This study therefore assessed the socio-economic characteristics of Agricultural micro-credit beneficiaries under Minna Micro-finance Bank; determined the volume of micro-credit applications and receipts; ascertained the determinants of micro-credit repayments by beneficiaries and examined the challenges encountered by beneficiaries in obtaining and repaying micro-credits. Multi-stage sampling technique was employed to select 180 respondents for the study while descriptive statistics and Multinomial Binary Logit model were employed for data analyses. The study affirmed that substantial proportion of respondents (42.78%) were smallholders owning between 1.1 to 2.0 ha of land. Ironically, 61.67% do not belong to cooperatives. The Multinomial Logit model revealed that sex, membership of cooperatives, loans granted and duration of micro-credit repayment were positive determinants of repayment, implying that these variables were significantly associated with the classification of beneficiaries under the non-repayment and partial loan repayment groups relative to the group of respondents who had fully repaid their loans. In addition, the elastic variables, namely, sex (3.58), cooperative membership (5.95) and loans granted (2.02) connotes that a unit change in these variables will lead to a more than proportionate change in the probability of classifying respondents into the non-repayment group relative to the full micro-credit repayment group. The study further established that repayment increased with the volume of micro-credit received. Majority (68.89%) of the respondents also indicated that the short period of loan tenor, high interest rate (55%) and loan repayment moratorium (54%) were major obstacles to loan access and repayment. The study concluded that agricultural micro-credit repayment performance by beneficiaries of Minna Microfinance Bank was considerable. Policy option requires that efforts be directed at complementing the resource pool of agricultural micro-credit with long term or idle funds, such as, the pension funds. This will guarantee or create room for reasonable duration for micro-credit repayment to the advantage of beneficiaries while not compromising the sustainability and revolving nature of the scheme. Basing interest rates on social and economic considerations will also go a long way in enhancing repayment among small-holder farmers. Channeling micro-credits through farmer institutions and ensuring effective monitoring will also enhance effective micro-credit recovery.

Key words: Micro-credit, repayment, moratorium, cooperatives.

Over the past decades, the contributions of agriculture to Nigeria’s economy has continued to decline; from over 50% of the GDP in the 60s to 23% as at 2014, given the dwindling role of the sector on one hand and the simultaneous expansion of the other sectors of the economy, particularly, the service sector. Aside this, agriculture has been unable to meet with its other traditional roles such as provision of food for the generality of the populace, raw materials supply, foreign exchange earnings and provision of gainful employment (Olatunji, 2004). Agricultural micro-credit has been a key missing link given the resource poor nature of farmers in Nigeria and in fact in most parts of the sub Sahara Africa. Generally, inadequate credit has been seen as one of the main reasons why many people in developing economies remain poor. Usually, the poor have no access to loans from the banking system given the difficulties in putting up acceptable collaterals, high administrative charges among other factors (Hermes and Lensink, 2011; Awoke, 2004). To redress the situation in the country, several projects and programmes were initiated by successive governments including the on-going Agricultural Transformation Agenda under policy measures. Most of these initiatives provided for a credit component and or technical assistance to meet the financial needs of the resource poor farmers. Some of these interventions included the National Acceleration Food Production Programme (NAFPP), Agricultural Development Programmes (ADPs), Green Revolution (GR), and River Basin Development Authority (RBDA), Directorate for Food, Roads and Rural Infrastructure (DFFRI) (Aku, 1981), the Rural Finance Institutions Building Programme (RUFIN) and most recently, the Nigeria Incentive-based Risk Sharing for Agricultural Lending (NIRSAL) which is pushing a simultaneous implementation and alignment of the commodity value chains with the financial value chain. It is worthy of mention that the recognition that agricultural credit is crucial to the development of the farming sector prompted the adoption of several subtle and overt measures to encourage the flow of bank credit to farmers, beginning with the 1972 fiscal year. In this direction, the Central Bank of Nigeria (CBN) used credit guidelines to prescribe the size of credit allocation by Banks to preferred sectors of the economy including agriculture (Nnanna et al., 2004). In addition, the Bank was involved in various interventions to improve access to needed finance for development, through the Agricultural Credit Guarantee Scheme Fund (ACGSF), under which a total of 1,330 small farmers loans valued at N66.5 million ($443, 333) were guaranteed in Niger State in 2005. However, despite the general acceptance of the relevant roles of credit and wide appreciation by most governments of the need for credit, repayment performance has been below par. Numerous researchers have attributed the failures of many government credit programmes to high rate of non-repayment of agricultural loans. Oshuntogun (2007) for instance, observed that most credit institutions in Nigeria were faced with lots of repayment problems, given the weak analysis of borrowers farming operations and repayment potentials. Ajah et al. (2013) further confirmed that credit administration in many parts of Nigeria has not been impressive when placed against their repayment performance. This development therefore prompted the review of repayment performance under Minna Micro-finance Bank. The broad objective of the study was to assess the repayment performance by beneficiaries of Minna Micro-finance Bank. The specific objectives were to: (i) describe the socio-economic characteristics of micro-credit beneficiaries under the Minna Micro-finance Bank; (ii) ascertain the volume of loan applications, receipts and repayments by respondents; (iii) ascertain the determinants of microcredit repayment among beneficiaries of Minna Micro-finance Bank; and (iv) examine the challenges encountered by respondents in obtaining and repaying micro-credits obtained from Minna Micro-finance Bank.

This study is therefore justified given that it will determine how far-off the objectives of micro-credit repayments have been achieved in Minna Micro-finance Bank. In a depressing economy like Nigeria, where several banks and other financial intermediaries have collapsed, many more insolvent, credit control and loan recovery remain a livewire for survival in the money and capital markets (Oyo, 2012). Most importantly, empirical evidence as to what factors determine loan repayment and loan recovery are seldom in Niger State and is yet to be undertaken in Minna Micro-finance Bank, this study has become imperative and will take a step to determine the factors that affect loan repayments with a view to providing necessary information needed to bridge the knowledge gap. The following research hypotheses were tested under the study:

Ho: The explanatory variables included in the Multinomial logit model do not significantly determine micro-credit repayment in Minna Microfinance Bank.

Ha: The explanatory variables included in the Multinomial logit model significantly determine micro-credit repayment in Minna Microfinance Bank.

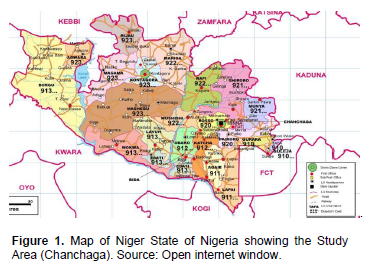

Area of the study

The study was conducted in Chanchaga Local Government Area of Niger State, Nigeria. The State was created in 1976 out of the then North-Western State. It lies between Latitude 8° 21’ N and 11° 30’N and Longitude 3 30’E and 7°20’E in the North Central Geographical Zone of Nigeria. The State is bordered to the North by ZamfaraState to the North-east by Kebbi, to the South by Kogi State, to the South-west by Kwara State while Kaduna State and Federal Capital Territory border the State to the North-east. The State lies in the central Niger Basin. The most prominent features of the State are Rivers Niger and Kaduna which traverse the State in West-east and North-south direction respectively. It has a moderate tropical continental climate. The main features of which are two distinct and pronounced seasons. A dry and wet with rainfall that extend between 5 and 6 months of the year and a steady high temperature. The State has a population of 3,950,249 (National Population Commission, 2006). Of the 7 million hectares cultivable land in the State, only 2.3 million hectares (32%) are under cultivation for production of various food and cash crops (rice, yam, maize, groundnut, cowpea, etc). The State also has 682,000 ha of irrigable land out of which 105,575 (15.5%) have been developed (Niger State Government, 2008) (Figure 1).

Sampling technique

Multi-stage sampling technique was employed for this study. The first stage was the purposive selection of Chanchaga Local Government Area given that most beneficiaries are concentrated in the area. The second stage involved the random selection of 6 out of the 11 benefiting wards, given resource constraint, while the third stage entailed the selection of 180 respondents from a frame of 1,000 beneficiaries (Table 1) using the sample size calculator at 7% precision level and 95% confidence level and p = 5. The formula used in selecting sample size proportionate to the population of micro-credit beneficiaries according to Yamane (1967) is given by:

n= N/1+N(e)2

Where, n = sample size, N = the finite population, e = limit of tolerable error,1 = unity.

Method of data collection

Primary and secondary data were used for the study. The secondary data were obtained from the records of Minna Microfinance Bank Limited while the primary data were obtained from respondents through structured questionnaire and oral interviews. Two types of questionnaires were administered, with a view to collecting relevant information from the Bank officials and the loan beneficiaries.

Method of data analysis

Simple descriptive statistics such as mean,frequency distribution, percentages were used to achieve objectives 1, 2, and 4 of this study. Multinomial logistic model was used to achieve objective 3. The model is appropriate when individuals can choose only one outcome from among the set of mutually exclusive, collectively exhaustive alternatives. The choice of the method was based on the fact that the level of loan repayment (dependent variable) is a categorical variable which can take three levels of classification namely (i) Beneficiary who have fully repaid their loans on what was due; (ii) Beneficiaries who have paid part of what was due; and (iii) Beneficiaries who are yet to pay their due microcredit. The multinomial logit regression model had been used by numerous researchers, namely Budry et al. (2006), Rahji and Fakayode (2009) and Ojo (2013) to express the probability of a farmer or respondent being in a particular category.

In the multinomial logit model, the dependent variable takes the value of 0, 1, and 2. The probability that the respondents belong to the repayment group reduces to:

Where I = 1, 2...n variables k = 0, 1..j groups and B = a vector of parameters that relates X to the probability of being in group j, where there are j+1 groups. The various independent variables included in the final model are as follows:

X1 = Age of farmer (Yrs), X2= Gender (1 = Male; 0 = Female), X3= House hold size (No of persons), X4= Farm size (Ha), X5= Group membership (1 =Membership; 0 = Non membership), X6= Amount of micro-credit received (N), X7= Distance from dwelling to the bank (km), X8= Visit by Loan Officials (1 if visited; 0 if otherwise), X9= Loan Disbursement Lag (Time between application and actual loan disbursement) in months, X10= Interest on loan (%).

To estimate the model, the coefficients of the base outcome are normalized to zero (0). This is because the probabilities for all the choices must sum up to the unity. Hence, for 3 choices, only (3-1) distinct sets of parameters can be identified and estimated. The natural logarithms of the old ratio of Equations (1) and (2) give the estimating equation as:

This denotes the relative probability of each of the other groups to the probability of the base outcome. The estimated coefficients for each choice therefore reflect the effects of Xi on the likelihood of the farmers choosing that alternative relative to the base outcome. The estimation was done using STATA statistical analytical software. The final estimates were selected based on the variables that converged during iteration. The coefficients of the base outcome were then recovered in line with Nmadu et al. (2012).

Where β3 = coefficient of the variable of the base outcome (those who have completely repaid), β2= estimated coefficient of those who have repaid part of the loans received β1 = estimated coefficient of those who are yet to repay. In addition, the partial derivatives or marginal effects and quasi-elasticities of the model were obtained from the software. McFadden’s (1974) likelihood ratio index (LRI) also known as pseudo R, similar to the R in a convectional regression, was computed as:

lnL= log likelihood function, lnLo = log-likelihood computed with only the constant term.

Descriptive statistics analysis

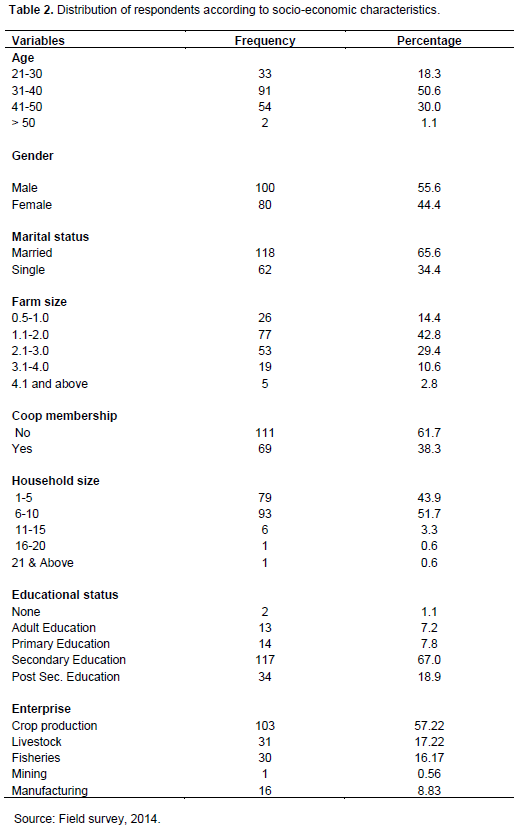

The descriptive statistics analysis result as detailed in Table 2 indicated that majority (50.56%) of micro-credit beneficiary farmers were between the ages of 31 to 40. This is an indication that the bulk of the farmers are within the middle age group, which is in line with the finding of Ngaski et al. (2009) and Tanko et al. (2010). It is likely that this category of farmers will be more active and productive, which may in turn enhance the repayment of micro-credit received. A total of 65.6% of the respondents were married while 34.4% were single. This suggests that most of the respondents will likely make more responsible farm level decisions which may impact on loan repayment. The analysis further revealed that 42.78% of the respondents owned between 1.1 and 2.0 ha of land, which connotes that most of the beneficiaries of agricultural micro-credit under Minna Microfinance Bank are small-holder farmers. Only, 3% of the households covered, owned above 4 ha of land. The result also shows that 61.67% of the respondents do not belong to cooperatives or farmers’ associations. This is an indication that most participants may not have enjoyed the benefits of group cohesion, dynamics, social capital and economic benefits which association participants stand to benefit. Majority (51.67%) of the respondents had a household size of between 6 and 10 family. The Nigerian setting is characterized by large household sizes; while large family sizes could be advantageous in the provision of farm labour. About 67% of the respondents had secondary education, while a negligible portion (1%) was not educated. The level of farmer’s education may likely affect the management, utilization and repayment of credit, given that they would have acquired knowledge and capacity to better appreciate the reasons for proper loan management and repayment, all things being equal. The matrix further revealed that participation in the crop sub-sector overcrowded the other farming sub-sectors, given that 57.22% were involved in crop production. The ensuing development is an indication of the weak diversification base of the respondents, in view of the over-emphasis on the crop sub-sector (Table 2).

Analysis of micro-credit requested, disbursed and repaid

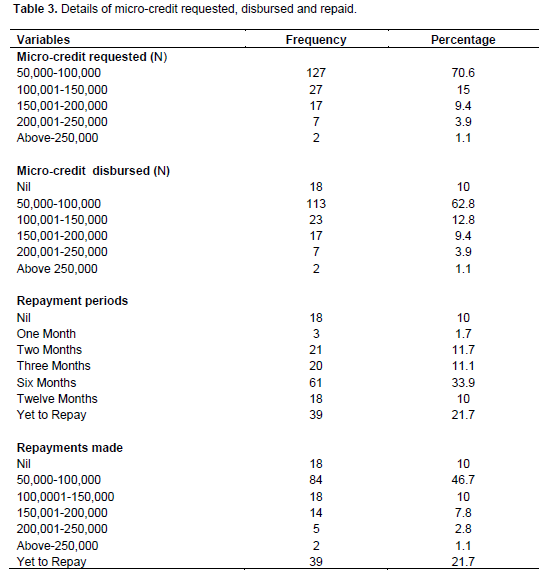

The analysis of micro-credit received and repayment as detailed in Table 3 showed that 70.56% of the respondents requested for micro-credit volume ranging from N50,000 - N100,000, 15% applied for loan volumes of above N100, 000 - N150,000, while only 1.0% requested N250,000 and above (Table 2). Of the total who applied for loan, 90% benefitted, comprising mainly 62.78% who received between N50,000 and N100,000. In terms of repayment, the analysis revealed that repayment increases with the volume of micro-credit received, as 100 and 82% of those who received N250,000, and N200,000 - N250,000 repaid compared to 74.34% of those who received between N50,000 and N100,000. In addition, over 70% repayment performance was recorded when the total beneficiaries who repaid (fully/partially) are placed against the number of beneficiaries. In terms of repayment periods, substantial numbers (33.89%) made repayment after six months 21.67% are yet to pay while 10% are yet to receive funds. The result is close to the outcome of the study on micro credit repayment among women in Tanzania by Tundui and Tundui (2013) which reported loan repayment difficulties among 19.6% of borrowers. The implication of this result is that most beneficiaries are still limited to small loan volumes which may not be able to entirely cover their enterprise scale.

Determinants of micro-credit repayments among beneficiaries

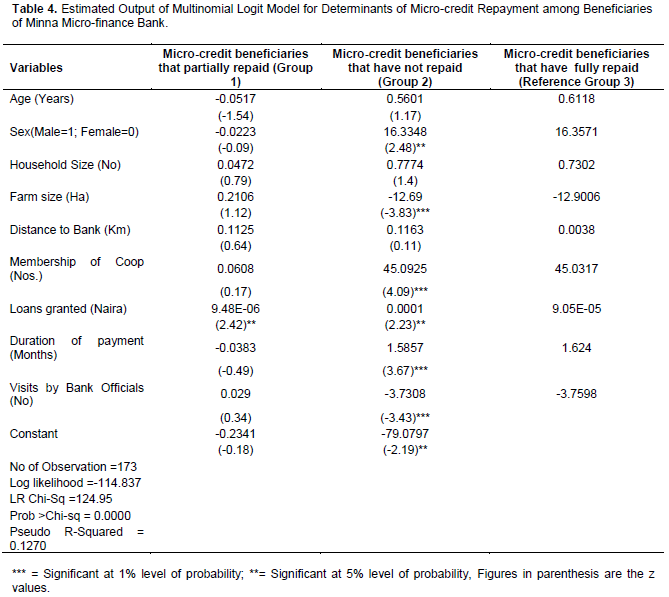

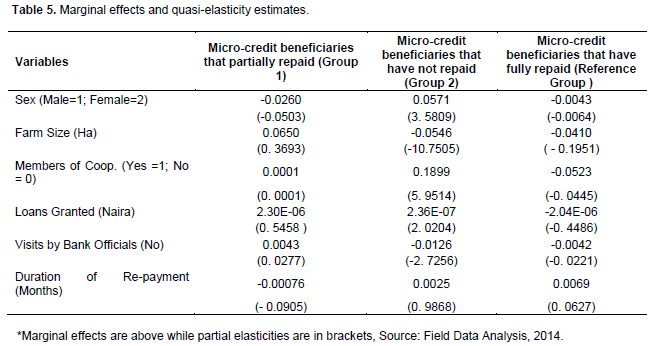

Table 4 shows the determinants of micro-credit repayment status among beneficiaries of Minna Micro-finance Bank. The results reveal that sex, membership of cooperative, loans granted and duration of micro-credit repayment are positive and significantly associated with the classification of the two groups (partial payment and non-payment groups) relative to the reference group. The positive sign implies that the probability of a beneficiary belonging to the non-repayment group relative to the full repayment group increases with respondents’ sex, membership of cooperative, amount of loans granted and duration of micro-credit repayment, suggesting that these are key variables which should be considered in micro-credit interventions. For the positive significant parameter of loans granted under the partially repayment group, it also implies that the probability of beneficiaries belonging to the partial repayment group relative to the full repayment group increases with the loans granted. On the other hand, for variables like farm size and visits by bank officials with negative significant signs, it implies that the probability of a beneficiary belonging to the non-repayment group decreases with these variables. The result aligns with that of Adegbite (2005); Ajah et al. (2013); Dayanandan and Weldeselassie (2009) and Dadson (2012) who established that loan volume disbursed was a significant determinant of loan repayment among smallholder farmers. However, the results run contrary to that of by Tundui and Tundui (2013); Ugwumba and Omojola (2013) and Edeth et al. (2014) who found no relationship between loan size and loan repayment. The conflict arising from these studies, may likely be due to the peculiarity of the study locations and the type of loan under consideration. The outcome of the study confirms the null hypothesis of this study, given the significance of the loan granted.

Table 5 comprises values of the estimated marginal effects and the quasi-elasticities calculated for the significant variables in Table 4. Aside the partial elasticities of respondents’ sex, membership of cooperatives and loans granted which were elastic underthe non-repayment group, the partial elasticities under the other two groups were less than 1 and thus, inelastic. For the variables that were elastic, one percent change in these explanatory variables leads to a more than proportionate change in the probability of classification into the non-repayment group relative to the reference group. For the inelastic variables, the probability of classifying the farmers into any particular group is not greatly affected by marginal changes in these variables, as a one percent change in the variables leads to a less than proportionate change in the probability of classification into the two other groups relative to the reference group.

Challenges to micro-credit access and repayment among respondents

Table 4 shows that the distribution of beneficiaries according to the problems faced in accessing and repaying micro-credit. The results revealed that majority (68.89%) of the respondents indicated that the short period of loan tenor was a major obstacle in loan repayment, closely following were the high interest rate (55%) and loan repayment period (54%). The outcome of the result tallies with that of Ugwumba and Omojola (2013) who established that delay in disbursement, high interest rate and excessive bureaucracy were key issues hindering micro-credit repayment in Nigeria (Table 6).

CONCLUSIONS AND RECOMMENDATIONS

The study concluded that repayment performance among beneficiaries of Minna Microfinance Bank was considerable. Based on the outcome of the study therefore, there is the need for proper financial analysis of beneficiaries’ enterprise needs with the view to effectively ascertaining the quantum of credit required. This has the two edge advantage of enhancing effective enterprise implementation and allowing for prompt and full loan recovery and or repayment. Policy option requires that efforts be directed at complementing the resource pool of agricultural micro-credit with long term or idle funds, such as, the pension funds. This will guarantee or create room for reasonable duration for micro-credit repayment to the advantage of beneficiaries while not compromising the sustainability and revolving nature of the scheme. Basing interest rates on social and economic considerations will also go a long way in enhancing repayment among small-holder farmers. Encouraging cooperative participation and channeling micro-credits through this institution will enhance effective loan administration, monitoring and recovery.

The authors have not declared any conflict of interest.

REFERENCES

|

Adegbite DA (2005). Quantitative Analysis of the Major Determinants of Loan Repayment under the Nigerian Agricultural Cooperative Bank Small Holders' Loan Scheme Ogun State, Nigeria. Asset Series A 5(1):1-12. |

|

|

Ajah EA, Eyo EO, Abang SO (2013). Repayment Performance among Cassava and Yam Farmers under Nigerian Agricultural Bank Smallholder Loan Scheme in Cross River State, Nigeria. Brit. J. Econ. Manage. Trade 3(4):453-467.

Crossref |

|

|

|

Aku PS (1981). Problems in the Implementation of Agricultural Credit Guarantee Scheme Fund. A Case Study of Selected Credit Institutions in Kaduna State. An Unpublished M.Sc. Thesis, Department of Agricultural Economics, ABU, Zaria, Kaduna. |

|

|

|

Awoke MU (2004). Factors Affecting Loan Acquisition and Repayment Pattern of Small-holder Farmers in Ika North East Delta State, Nigeria, J. Sustain. Trop. Agric. Res. 9:61-64. |

|

|

|

Budry B, Curtis MJ, Dennis AS (2006). The Adoption and Management of Soil Conservation Practices in Haiti: the case of rock walls. Agric. Econ. Rev. 7(2):29-39. |

|

|

|

Dadson AV (2012). Determinants of Loan Repayment Default among Farmers in Ghana. J. Develop. Agric. Econ. 4(13):339-345. |

|

|

|

Dayanandan R, Weldeselassie H (2009). Determinants of Loan Repayment Performance among Small Farmers in Northern Ethiopia. J. Afr. Develop. Stud. 2:1. |

|

|

Edeth BN, Atairet EA, Nkeme KK, Udoh ES (2014). Determinants of Loan Repayment: A study of Rural Women Fish Traders in Akwa-Ibom State, Nigeria. British J. Econ. Manage. Trade 4(4):541-550.

Crossref |

|

|

Hermes N, Lensink R (2011). Microfinance: its impact, outreach, and sustainability. World Dev. 39(6):875-881.

Crossref |

|

|

|

Nnanna OJ, Englama A, Odoko EO (2004). Finance, Investment and Growth in Nigeria, Central Bank of Nigeria Corporate Headquarters, Abuja, FCT. |

|

|

|

Ngaski AA, Kamba AA, Senchi ID (2009). Impact of Fadama II Project "pilot asset acquisition scheme" on rural household income and poverty in Yauri Emirate of Kebbi State, Nigeria. Proceedings of the 23rd annual national conference of farm management association of Nigeria, pp. 695-703. |

|

|

|

Ojo MA (2013). Analysis of Production Efficiency Among Small Scale Yam and Cassava Farmers in Niger and Kogi States, Nigeria. Unpublished P.hD Thesis Submitted to the Department of Agricultural Economics & Extension Technology, Federal University of Technology, Minna, Nigeria. |

|

|

|

Olatunji RT (2004). Sources of Credit Facilities among Small Scale Farmers in Ilorin East Local Government Area of Kwara State: Unpublished B. Tech. (Agric.) Project. Department of Agricultural Economics and Extension Technology, Federal University of Technology, Minna. |

|

|

|

Rahji MAY, Fakayode SB (2009). A Multinomial Logit Analysis of Agricultural Credit Rationing By Commercial Banks in Nigeria. Int. Res. J. Fin. Econ. 24:90-100. |

|

|

|

Tanko L, Jirgi AJ, Ogundeji AA (2010) Impact of Fadama II Project on income of tomato farmers in Niger State, Nigeria. Afr. J. Agric. Res. 5(15):1937-1942. |

|

|

Tundui C, Tundui H (2013). Microcredit, Micro Enterprising and Repayment Myth: The Case of Micro and Small Women Business Entrepreneurs in Tanzania. Am. J. Bus. Manage. 2(1):20-30.

Crossref |

|

|

|

Ugwumba COA, Omojola IT (2013). Determinants of Loan Repayment of Livestock Farmers under Agricultural Credit Guarantee Scheme (A.C.G.S.) in Etche Local Government area of Rivers State, Nigeria. Agricultural Advances. |

|

|

|

Yamane T (1967). Statistics: An Introductory Analysis. (2nd ed.), New York: Harper and Row. |