ABSTRACT

Current climate variability is already imposing significant challenge. Therefore, farmers have faced income variability in almost every production season. Problems associated with dependence on rain fed agriculture are common in Ethiopia. Smallholder farmers’ vulnerability from such income variability is also common. Over the years, a range of risk management strategies have been used to reduce, or to assist farmers to absorb, some of these risks. Since insurance is potentially an important instrument to transfer part of the risk, the study tries to assess small holder farmer’s willingness to pay for the rainfall risk insurance and examine factors that affect farmer’s willingness to pay amount. The sample size 161 households using closed ended value elicitation format followed by open ended follow up questions. Logit model was used to estimate the mean willingness to pay in the close ended format in addition with Tobit model to examine factors that affect willingness to pay as well as intensity of payment. Six potential explanatory variables income, ownership of radio, off-farm income, age, number of livestock owning and availability of public and private gifts have negative and/or positive effect on WTP.

Current climate variability is already imposing significant challenge. Therefore, farmers have faced income variability in almost every production season. Problems associated with dependence on rain fed agriculture are common in Ethiopia. Smallholder farmers’ vulnerability from such income variability is also common. Over the years, a range of risk management strategies have been used to reduce, or to assist farmers to absorb, some of these risks. Since insurance is potentially an important instrument to transfer part of the risk, the study tries to assess small holder farmer’s willingness to pay for the rainfall risk insurance and examine factors that affect farmer’s willingness to pay amount. The sample size 161 households using closed ended value elicitation format followed by open ended follow up questions. Logit model was used to estimate the mean willingness to pay in the close ended format in addition with Tobit model to examine factors that affect willingness to pay as well as intensity of payment. Six potential explanatory variables income, ownership of radio, off-farm income, age, number of livestock owning and availability of public and private gifts have negative and/or positive effect on WTP.

Key words: Rainfall risk insurance, contingent valuation method, willingness to pay, smallholder farmers.

Agricultural producers around the world are exposed to a variety of income uncertainties, both market related, such as price variations, as well as non-market related, such as unstable weather patterns. It is well known that such uncertainties induce substantial income risks, and these can be particularly detrimental to poor producers in

developing countries (Sarris, 2002). Due to the scope and diversity of such risks, formal insurance markets are scarce in such settings, and farmers employ relatively sophisticated methods to offset the risks they face (Clarke and Dercon, 2009). Hence, various challenges due to climate variability recognize that adaptation is not an option but a necessity (Thornton et al., 2006) this is because climate change is expected to have adverse affect on agricultural production. Which remains to be the main source of income for most countries (Bryan et al., 2009), farmers have developed several ways for dealing with the various risks they face. According to Stern (2007), adaptation to climate change and variability will be crucial in reducing vulnerability and is the only way to cope with the impacts that are inevitable over the next few decades.

Over the years, a range of risk management strategies have been used to reduce, or to assist farmers to absorb, some risks. These strategies include on-farm measures such as diversification or selecting less risky production methods, as well as strategies for sharing risk with others. Risk management strategies in which risks have shared with others include, among others, farm financing, share-cropping, price pooling arrangements, forward contracting of farm products, and hedge on future markets.

Hence, insurance is potentially an important instrument to transfer part of the risks (Anderson, 2001) the following two basic reasons can be raised as an advantage of preferring weather-based insurance other than crop insurance. First, weather index insurance contracts require less monitoring to control adverse selection and moral hazard (Hazell, 1999). According to (Stefan et al., 2012), risk-sharing and index insurances are complementary, with increase access to one driving up demand for the other, so that providing index insurance may crowd in informal risk-sharing. Even though, index insurance is an unfamiliar and complex product, providing training to farmers about index insurance has been shown to be important in encouraging take-up (Gine et al., 2012). It has been believed that training has a power to increases awareness as a result demand has also increased.

Similarly Stefan et al. (2012), also supports this idea but type of training provided to leaders of indigenous groups has important implications for demand for insurance, the strengthening mechanisms to manage basis risk makes index insurance more attractive to small-holder farmers. The second reason is weather-based insurance can prevent the problem of adverse selection (that is, since farmers know more about their risks than the insurer, the low-risk farmers may pick out, leaving the insurer with only high-risk customers) and moral hazards (that is, when farmers’ behaviors can influence the extent of damage that qualifies for insurance payouts) (Linnerooth-Bayer and Hochrainer-Stigler, 2014).

However, insurances are growing rapidly in the developing world, as part of this growth; innovative new products allow individual smallholder farmers to hedge the risks, for instance, agricultural risks such as drought, disease and commodity price fluctuations (World Bank, 2005). These financial innovations hold significant promise for rural households. According to (Bezabih et al., 2011) crop riskiness at a farm level is highly responsive to rainfall variability and that the choice of high risk-high return crops is hampered by weather uncertainty. Shocks to agricultural income, such as a drought-induced harvest failure, generate movements in consumption for households who are not perfectly insured and at the extreme, may lead to famine or death.

Consequently, the variability is imposing significant challenge (Abera and Manfred, 2009) declare that rainfall has emerged as an important factor influencing household food security. Water and energy supply, poverty reduction and sustainable development efforts, as well as by causing natural resource degradation and natural disasters. In response, the national adaptation program of action (NAPA) for Ethiopia has been prepared, basic approach to NAPA preparation was along with the sustainable development goals and objective of the country where it has recognized necessity of addressing environmental issues and natural resource management with the participation of stakeholders (MoWR, 2007). However, an issue that was not yet addressed is whether there is demand as well as willingness to contribute by smallholder farmers for the new rainfall risk insurance. Therefore, the objectives of the study a) assess current risk management strategies practiced by the smallholder farmers b) identify willingness to pay as well as the extent of payment by the smallholder farmers.

Study area sampling techniques

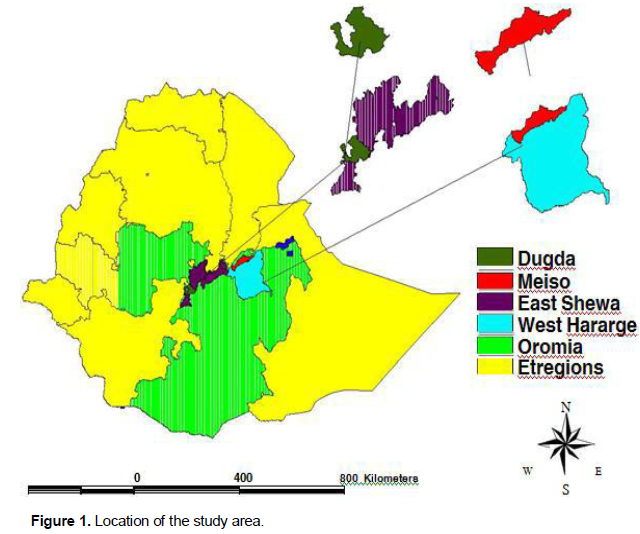

This method was originally designed to elicit the consumers’ willingness to pay for a product that is not yet on the market, is now being widely used even for marketed good that have a substantial impact on the welfare of the society. After designing the draft questionnaire, pre-test was conducted with randomly selected sample households. An openly ended question was used for the elicitation of the respondents’ maximum amount they are willing to pay for the insurance service per hectare. Pre-test was used due to make some modifications in the designed questionnaire and to obtain starting bid values. Based on this elicitation some values were selected as the starting bid values for the survey questionnaire (Figure 1).

A multi-stage sampling technique was used to select 161 sample households. In the first step of the sampling, out of the districts in the Central Rift Valley that have almost similar climate condition, “Mieso” and “Dugda” districts were purposively selected because these areas are most drought prone areas. In the second stage, out of the 36 Peasant Associations (Pas) in “Dugda”,4 PAs were selected randomly and of 36 PAs in “Mieso” district, 3 PAs were selected. In the third stage, the total numbers of households in each PAs were listed and finally a total numbers of 161 sample households were selected based on the proportion of the total number of households in each Pas. Then the bid values were randomly distributed to each questionnaire (161) and interviewed.

The respondents were asked whether they are willing to pay for a given amount or not, if the respondent says yes or no; finally the single bounded dichotomous choice question is followed up by an open-ended follow-up question. The use of an open-ended questionnaire is justified by its advantage indirectly eliciting the maximum willingness to pay and to avoid biases.

Method of WTP data collection

Willingness to pay is defined as the amount that must be taken away from household’s income. The willingness data is collected through contingent valuation method (CVM), this method is also suited to solicit consumers’ willingness to pay for a product that is not yet on the market. CVM is now increasingly used in developing countries (Alberini and Cooper, 2000). In this method, the researcher creates a hypothetical market in a non-market or new good. The values which are generated through this hypothetical market are treated as estimates of the value of new good. After designing the draft questionnaire pre test was conducted with 26 randomly selected sample households. An open ended question was used for the elicitation of the respondents’ maximum amount they are willing to pay for the insurance service per hectare. This is due to make some modifications in the designed questionnaire of the survey and to obtain starting bid values. Based on this elicitation some values were selected as the starting bid values for the survey questionnaire. The bid values were distributed randomly through 161 sample households and the respondents were asked are you willing to pay this amount if the respondent says yes or no, finally the single bounded dichotomous choice question is followed

up by an open-ended follow up question.

Data analysis

The data that had been collected through contingent valuation method has been analyzed using both descriptive statistics and econometric model. Descriptive statistics such as mean, percentage, standard deviation and frequency of appearance was used, whereas, on the econometric approach adopted Probit and Tobit models. The dependent variables are willingness to pay; dummy variable (yes or no) and the maximum amount of money the willing respondent are willing to pay.

Model specification

Tobit model was commonly known as censored normal regression model (Greene, 2003). It assumes that many variables have a lower or upper limit that was known as a threshold value and take on this limiting value for a large number of respondents. For the remaining sample respondents, the variable takes on a wide range of values above the limit. The explanatory variables in the model may influence both the probability of limit responses and the size of non-limit. The two parts correspond to the classical regression for the non limit (continuous) observations and the relevant probabilities for the limit (zero) observations, respectively (Table 1). Based on the above behavior of the model, Tobit analysis is appropriate for this study and the formula for the Tobit model is described as follows; following Long (1997), the structural equation of Tobit model censored from below can be expressed as:

Where, Yi = the observed dependent variable, in this case the maximum willingness to pay the respondent is willing to pay in Ethiopian Birr; YI*= the latent variable which is not observable; Xi = vector of factor affecting willingness to pay.

The model parameters can be estimated by maximizing the Tobit likelihood function of the following form (Maddala, 1997):

Where f and F are respectively, the density functions and

cumulative distribution function of > 0 means the product over those I for which > 0, and < 0 means the product over those I for which < 0.

Maddala (1997), proposed the following techniques to decompose the effects of explanatory variables into the decision to pay and intensity effects. Thus, a change in X (explanatory variables) has two effects. It affects the conditional mean of Yi * in the positive part of the distribution, and it affects the probability that the observation will fall in that part of the distribution. Similar approach will be used in this study:

i. The marginal effect of an explanatory variable on the expected value of the dependent variable is:

Where: F (z) = is the cumulative normal distribution of z; f (z) = is the value of the derivative of the normal curve at a given point (unit normal density); z = is the z-score for the area under normal curve; b = is a vector of Tobit Maximum Likelihood estimates and σ = is the standard error of the error term.

In the logit model of single bounded dichotomous format, are given initial bid value in which they may accept or reject. In the logit model the dependent variable is dummy variable. The purpose of the Logit model is to estimate the mean WTP. Following Gujarati (1999), the Logit model is expressed as follows:

One of the main objectives of estimating an empirical WTP model based on the CV survey responses is to drive a central value or mean of the WTP distribution Hanemann et al. (1991). According to Gujarati (1999) both Probit and Logit models provide similar results thus, for comparative computational simplicity Logit model was used for the estimation. And the mean willingness is formulated as:

Descriptive statistics results

Descriptive statistics such as mean, minimum and maximum values, range and standard deviations were used to describe the major factors explaining farmers’ willingness to pay for rainfall risk insurance. In addition, mean difference for continuous variables and frequency of discrete variables were tested using t-test and chi-square test respectively by using (SPSS V-16).

Perception of risk

Households in the study area perceive that they are exposed to a variety of substantial risks from different sources. Therefore, based on the results obtained from formal survey questionnaire, households define risk in three ways: year when rainfall delays, year when rainfall is inadequate, year when rainfall is high.

Risk management strategies

In order to cope with sources of risks, rural households have developed various risk management strategies which only differ from place to place, and among the farmers. Therefore, sale of livestock in case of emergency is a major risk coping strategy practiced by farmers others, diversification use of improved technology, delay in a sale of crop products and intercropping were also strategies used by farmers which are listed according to their importance.

Willingness to pay analysis

The total sample households were randomly distributed to the four initial bid values (50, 100, 150, 200), each value contains 41, 47, 36 and 37 respondents respectively. Out of the total sample respondents 17(27.2%) responded “no” to the initial bid value. The main reason farmers have refused to accept the service includes they could not afford it, and they did not trust the service very well. But the rest 144(72.8%) show their interest to contribute and gave a “yes” or “no” response to the initial bid value then follow-up values.

Estimation of the mean WTP

The initial bid value was regressed with the dependent dummy variable, the result of the coefficients were showed in Table 2, and willingness to pay for the single bounded dichotomous format is as follows:

Thus, the mean willingness to pay calculated from the single bounded dichotomous format is 183.41 Ethiopian birr per hectare. However, the mean WTP is 129.93 Ethiopian birr per hectare from responses to the open-ended CV survey questions, which is lower than the mean value obtained from the closed-ended Logit model estimates. Thus, the result showed that the respondents were willingness to pay between the ranges of 129.93 to 183.41 Ethiopian Birr per hectare for the proposed rainfall risk insurance service.

Estimating total willingness to pay and total revenue

The total willingness to pay and total revenue at different prices that households in the seven PAs of the two districts (“Dugda” and “Mieso”) were willing to pay as computed. The sampled seven PAs namely, (B/Gusaa, Odd Bokota, Jawe Bofo, S/wakalee, Huse mandhera, Chobi, Burimulu) have a total of 3281 households with a total population of 49,966 households with a total population of 275,307 and the average family size of 5.86. Based on this information and the distribution of WTP by the respondents, it would be possible to estimate the expected total willingness to pay and total revenue for the study area. Table 3 provides the procedure and results of the analysis.

The first column shows the maximum willingness to pay interval, and the second is class for willingness to pay (the mid willingness to pay) of the first column. The third and the fourth columns show the number and the percentage of sample households whose willingness to pay amount falls within a given interval. The total number of households in two districts of the study area has multiplied by the proportion of sample households falling under each category to obtain the total number of households whose willingness to pay lies in each boundary (column fifth). And total willingness to pay (column sixth) has been obtained by multiplying the mid willingness to pay by total number of households willingness to pay. The total household of 49,966 in two districts of the study area was expected to pay ET birr 5,740,244 / year if every household insures one hectare of his/her land.

Therefore, the result shows that the average insurance premium payment was ET birr 114.88 / hectare/ household if the proposed insurance service has implemented. This result is almost similar with an average willingness to pay ET 129.93 / hectare/ household. A column seven and eight represents the number and the percentage of sample household willingness to pay at least the amount in each interval. Similarly, column nine shows total number of households willing to pay at least the amount in each interval and it falls when the mid willingness to pay rises (column ten). Total revenue has been obtained by multiplying the mid willingness to pay amount (column two) by the corresponding total number of households’ willingness to pay at least that amount, (column nine).

Derivation of aggregate demand

The aggregate demand has been derived from the above willingness to pay scenario (Table 3). Any point on the curve shows all the respondents that prefer the insurance service, but do not bid more than the corresponding value on the mid willingness axis. The demand curve is negatively sloped, indicating the fall of the demand for the insurance service as an insurance premium increases, like most other non-market goods other things remaining constant. The area under demand curve represents the gross value of consumers’ surplus if the service is available for free or zero (Figure 2).

Econometric model result

Econometric software called Limited dependant (Limdep 7) was employed to estimate the Tobit and Probit models. Out of the 16 hypothesized explanatory variables, six were found to be statistically significant, four of them were continuous and the rest two were dummy variables.

The variables were age of the household head (AGE), total income from farm (FINC), total off-farm income (OFINC), livestock holding (TLU), owning radio (RADIO), and availability of public and private donations (PAPA). Moreover, the sign of the estimated coefficients were consistent with the expected signs (Tables 4 and 5).

Age of the household head (AGE) is an important factor influences the respondent’s willingness to pay negatively, Earlier studies by Patrick (1988), Gine et al. (2007) the age of the household has negative effect on the demand for insurance. Young farmers are more likely to purchase insurance than elders, as the age of household head increases, the willingness to pay amount decreases significantly.

Therefore, younger household heads are more likely to be willing to pay for rainfall risk insurance compared to older household heads. Thus, it might be explained by the fact that younger household heads have less long life experience on predicting weather conditions, and they are also sensitive to the new technologies than elders. The result shows that for each additional year in age of the respondent, the probability of the willingness to pay for rainfall risk insurance decreases by 0.548%. It also shows that as the age of a respondent increase by one year, the amount of cash he/she is willing to pay for rainfall based insurance decreases by 1.5159 Birr.

Household income from crop (FINC)

This variable is found to have a positive impact on the probability of willingness to pay as hypothesized and the effect is statistically significant at 1% probability level. Those household heads that generate high income from crop production would be more willing to pay for rainfall risk insurance. When the income increases by one birr, the probability of the willingness to pay for the service also increases by 0.002% hence, the income level of the household increase by one Birr. As a result the amount of cash the household could pay increases by 0.0055 Birr, other factors held constant. This is based on economic theory, which states that individual’s demand for most commodities or services depend on income (Mbata, 2006). Vince and Joyce (1994) have found that income of the household has positive impact on the demand for rainfall based insurance.

Ownership of radio by the household (RADIO) is another important factor which affect maximum willingness to pay positively. Information from radio enhances the ability of farmers’ access to improved technologies and risk management strategies. Farmers that own radio may get different information on extension service, credit service, improved seed variety, input prices and output prices than those farmers who do not have radio. This variable also shows that farmers that own radio have 15.218% of possibility to paying for rainfall risk insurance than those farmers who do not possess. Thus, farmers that own radio would pay Birr 42.0637 more than those farmers that do not have radio.

As expected the availability of off-farm income (OFINC) is negatively related to maximum willingness to pay. Households occupied in different off-farm activities reduce the probability of willingness to pay for rainfall risk insurance by 0.003%. Therefore, this expected to have negative influence on farm activity. A study conducted by Sakurai and Reardon (1997) showed that respondents who received high amount of income from other non-farm activities are not interested in participating in drought insurance. The marginal effect of this variable also shows when off-farm income increases by one Ethiopian birr the amount of money households would be willing to pay for rainfall risk insurance decreases by 0.0098 Birr, other factors held constantly.

Public and private aid (PAPA)

PAPA is an important factor that affects the dependent variable negatively. Availability of public and private donations decreases the willingness to pay by 16.233%. Sukurai and Reandon (1997) have also found a negative effect on the dependent variable when farmers have found more donations from governmental or other non-governmental organizations, either in kind or cash therefore this might be explained by the fact that as households become more dependent and less active, and their willingness to pay tends to be less. The marginal effect of the variable shows that those household depend on public and private gifts decrease willingness to pay by 44.8686 Birr than those who don’t have the gift, other variables held constant.

Livestock holding (TLU)

Number of livestock ownership is found to have a negative effect. Each additional unit of livestock (TLU) decreases the willingness to pay by 1.618%. The negative effect implies that income from livestock may encourage farmers to depend more on livestock than farming and results in less effort being give to the crop production. The marginal effect shows that for each additional TLU that possess the willingness to pay amount decreases by 4.4728 Birr, other variables held constant.

It was then concluded that if rainfall risk insurance premium is within affordable range (with this range affected by the above mentioned factors) and households have enough information about it, farm households are willing to pay for the service. However, policy makers need to be aware that socio-economic and institution characteristics that are linked with farm households influence the willingness to pay for rainfall risk insurance.

The authors declared that they have no conflict of interest.

The author would like to thank the Almighty and Merciful God, for His help during the course of this study. Also Dr. Ayalneh Bogale is acknowledge for his intellectual stimulation and professional guidance; families and friends for their love, encouragement and financial support. Also not left out are friends at Haramaya University for their valuable support, Mr Ato Fresenbet Zeleke the Head of School of Agricultural Economics and Agribusiness and finally Ato Negeso and all other enumerators for their valuable help during the field survey.

REFERENCES

|

Abera B, Manfred Z (2009). Using panel data to estimate the effect of rainfall shocks on smallholders food security and vulnerability in rural Ethiopia. Research in Development Economics and Policy, Discussion Paper No. 2/2009. |

|

|

|

Alberini A, Cooper J (2000). Application of contingent valuation method in developing countries. Economic and social development paper. No. 146, FAO, Rome. |

|

|

Anderson DR (2001). All Risks Rating Within a Catastrophe Insurance System. Risk Insu. J. 43:629-651.

Crossref |

|

|

|

Bezabih M, Di Falco S, Yesuf M (2011). Farmers' Response to Rainfall Variability and Crop Portfolio Choice: Evidence from Ethiopia. Environment for Development P. 21. |

|

|

Bryan E, Deressa T, Gbetibouo G, Ringler C (2009). Adaptation to climate change in Ethiopia and South Africa: options and constraints. Environ. Sci. Policy 12:413-426.

Crossref |

|

|

|

Clarke D, Dercon S (2009). Insurance, Credit, and Safety Nets for the Poor in a World of Risk. DESA Working Paper, no. 81. New York: United Nations, Department of Economics and Social Affairs. |

|

|

|

Gine X, Karlan D, Ngatia M (2012). Social Networks, Financial Literacy and Index Insur-ance. Mimeo. |

|

|

|

Gine X, Robert T, James V (2007). Patterns of rainfall insurance participation in rural India. Policy research working paper. P. 4408. |

|

|

|

Greene WH (2003). Econometric Analysis. Fourth Edition, Prentice Hall International, Inc. USA. |

|

|

|

Gujarati D (1999). Essential of Econometrics. Second edition, Mc-Graw hill companies. |

|

|

|

Hanemann WM (1991). Willingness to accept and willingness to pay and how much can they differ? Am. Econ. Rev. 81(3):635-647. |

|

|

Linnerooth-Bayer J, Hochrainer-Stigler S (2014). Financial instruments for disaster risk management and climate change adaptation. Climate change.

|

|

|

|

Long S (1997). Regression Models for Categorical and Limited Dependent Variables. Saga Publications. |

|

|

|

Maddala GS (1997). Limited dependent and qualitative variables in econometrics. Cambridge University Press, Cambridge. |

|

|

Mbata J (2006). Estimating household willingness for water service in rural economy: The case of Kenya, Southern Botswana. Dev. S. Afr. 23(1):29-43.

Crossref |

|

|

|

MoWR (2007). Ministry of Water Resource of the Federal Democratic Republic of Ethiopia. Climate Change Adaptation Program of Action (NAPA) of Ethiopia. Addis Ababa, Ethiopia. |

|

|

Patrick GF (1988). Mallee Wheat farmer's demand for crop and rainfall insurance. Austr. J. Agric. Econ. 32(1):37-49.

Crossref |

|

|

|

Hazell H (1999). Potential Role for Insurance in Managing Catastrophic Risks in Developing Countries. Discussion paper International Food Policy Research Institute P. 12.

View

|

|

|

Sakurai T, Reardon T (1997). Potential demand for drought insurance in Burkinafaso and its determinants. Am. J. Agric. Econ. 79(4):1193-1207.

Crossref |

|

|

Sarris A (2002). The demand for commodity insurance by developing country agricultural producers: Theory and an application to cocoa in Ghana. Working Paper, DECRG and RDV. Washington, D.C.

Crossref |

|

|

|

Stefan D, Ruth VH, Daniel C, Ingo OL, Alemayehu S (2012). Offering rainfall insurance to informal insurance groups: Evidence from a field experiment in Ethiopia. |

|

|

Stern NH (2007). The economics of climate change: The Cambridge University Press.

Crossref |

|

|

|

Thornton PK, Jones PG, Owiyo TM, Kruska RL, Herero M, Kristijanson P, Notenbaert A, Bekele N (2006). Mapping Climate Vulnerablity and Poverty in Africa. Report to the Department for International Development, ILRI, Nairobi. |

|

|

Vince ES, Joyce S (1994). The effect of household characteristics on demand for insurance; a tobit analysis. J. Risk Insur. 61(3):492-502.

Crossref |

|

|

|

World Bank (2005). Managing agricultural production risk innovation in developing countries. Report No. 32727-GLB. The International Bank for Reconstruction and Development. Washington , D.C. |

Current climate variability is already imposing significant challenge. Therefore, farmers have faced income variability in almost every production season. Problems associated with dependence on rain fed agriculture are common in Ethiopia. Smallholder farmers’ vulnerability from such income variability is also common. Over the years, a range of risk management strategies have been used to reduce, or to assist farmers to absorb, some of these risks. Since insurance is potentially an important instrument to transfer part of the risk, the study tries to assess small holder farmer’s willingness to pay for the rainfall risk insurance and examine factors that affect farmer’s willingness to pay amount. The sample size 161 households using closed ended value elicitation format followed by open ended follow up questions. Logit model was used to estimate the mean willingness to pay in the close ended format in addition with Tobit model to examine factors that affect willingness to pay as well as intensity of payment. Six potential explanatory variables income, ownership of radio, off-farm income, age, number of livestock owning and availability of public and private gifts have negative and/or positive effect on WTP.