ABSTRACT

This article aims to examine the long and short run relationship between agricultural exports and agriculture share of GDP. Links between series considered are assessed by co-integration analysis using Johansen co-integration technique and ECM-GARCH. Results indicate a positive link in the short and long term between agricultural exports and agriculture share of GDP, as well as co-integration between the pairs of series used. Also it can be found that increases in agricultural exports were followed by increases in agriculture share of GDP. Agriculture exports and agriculture share of GDP elasticities are 0.62. The past shocks and agricultural exports increased agriculture share of GDP volatility.

Key word: Agricultural exports, agricultural economic growth, co-integration analysis, Johansen co-integration, ECM-GARCH.

The Egyptian economy depends basically on agriculture, Suez Canal revenues, tourism, taxation, cultural and media production, natural gas exports and remittances of more than three million Egyptians abroad (mostly in the Gulf State). Agriculture plays a vital role in Egyptian economy. The agricultural sector employs about 30% of the total labor force, contributing about 14.8% of GDP, and agricultural exports contribute about 20% of total good exports, making the agricultural sector a significant national income resource (State Information System, 2012). Agriculture can salvage the prevailing economic situation under instability (Raza et al., 2012; Shirazi and Manap, 2004; Jatuporn et al., 2011; Haleem et al., 2005). Before 2011, The Egyptian economy is evolving and this evolution only appeared on the rich and did not reach the poor, who suffer from poverty and lack of food. According to State Information System (2012), poverty increased by 50%, leading to socioeconomic and political instability. These situations led to the explosion of a popular revolution in January 25, 2011.After two revolutions in 25th of January, 2011 and 30th of June, 2013 (Arab Spring revolutions), Egypt suffers from very bad economic situation characterized by high food and energy prices, high unemployment inflation rates, and decline in economic growth rate in most relevant sectors.

These political events showed the fragility of the Egyptian economy, where the Egyptian GDP growth rate decreased from 5.1% in 2010 to 2.2% in 2014; also the inflation increased from 7.1% in 2012 to 10.1% in 2014 (World bank, 2014). Egyptian food prices increased by 17.7% from the 1st week of January 2011 till the 1st week of December 2013 (Egyptian Food Observatory, 2013). Egypt had before these two revolutions $36 billion of foreign reserves which decreased in 2016 to $16.5 billion (Africanews, 2016). It became necessary that the Egyptian government worked to increase foreign cash flow of by giving more attention to exporting goods, especially agricultural products. Recently, Egyptian economy is suffering from a dollar shortage as a result of reduction in investment in Egypt and demise of tourism, leading to depreciation of currency inflows. Most recent studies assessing the effects of agricultural export on economics have started to gain interest among economists. Many studies found evidence that agricultural export variable has significant effects on economic growth, where it’s one of the most important sources of foreign exchange income that ease the pressure on the balance of payments and create employment opportunities.

Thus agricultural export is considered as a very important one among economic growth contributors. Some economists seem to generally have agreed that exports can have high added value on economic growth, while others did not find much support to the export led economic growth hypothesis. In this paper, the Johansen (1988) co-integration technique based on error correction model was used to investigate the relationship between agricultural exports and agriculture share of economic growth in Egypt. The bivariate models for the pairs of series are modeled by means of a GARCH (1,1) specification in order to allow for time-varying and clustering volatility. This paper is organized as follows. In the next section, a literature review of the effect of the exports and international trade on economic growth using time-series econometric techniques is presented. In section 2, the methodological approach is described. The fourth section is devoted to the empirical implementation to assess relationship between agricultural exports and agriculture share of GDP. The last section in this article offers the concluding remarks and policy implication.

During the last two decades, the role of exports in economic growth has a wide range of literature. A large extent of these empirical researches has been conducted to explore the variable of the effects of export on economic growth rate. These studies have used either cross sectional data or time series data with vary conclusions. Some of these studies have used simple correlation coefficient technique in order to analyze the relationship between economic growth and exports e.g. (Chenery and Strout, 1966); Michaely (1977); Balassa (1978); Heller and Porter (1978); Tyler (1981); and Kormendi and Mequire (1985). They found that the correlation between the growth of exports and economic growth rate was highly positive. The second part of these studies used regression techniques to examine the relationship e.g. Voivodas (1973); Feder (1983); Balassa (1985); Ram (1987); Sprout and Weaver; 1993); and Ukpolo (1994). They found a positive and highly significant effect of the product export on GDP. Several studies have addressed the links between exports and the national GDP by using Granger causality test which examined the causality relationship between growth of export and economic growth e.g. Jung and Marshall (1985); Chow (1987); Serletis (1992); Dodaro (1993); and Jin and Yu (1995). These bulk of studies concluded that there existed some causality relationship between exports and economic growth.

Heiko (2008) examined the links between export diversification and economic growth. He provided a robust empirical evidence of the positive effect of export diversification on per capita income growth. The study estimated a simple augmented Solow growth model and investigated the relationship between export diversification and income per capita growth. The findings of this paper was that the effect of export diversification on economic growth is potentially nonlinear with developing countries benefiting from diversifying their exports in contrast to the most advanced countries that perform better with export specialization. The evidence is strong that export concentration has been detrimental to the economic growth performance of developing countries in the past decades. Rangasamy (2009) used modern econometric techniques within a multivariate framework and attempted to ascertain whether the emphasis on export production is justified. The results showed that there is uni-directional Granger-causality running from exports to economic growth in South Africa. In addition, the gross domestic product (GDP) accounting identity underestimates the contribution of exports to economic growth.

Abou-Stait (2005) examined the export-led growth paradigm for Egypt, using historical data from 1977 to 2003. The study employed a variety of analytical tools, including cointegration analysis, Granger causality tests, and unit root tests, coupled with vector auto regression and impulse response function analyses. The paper cited three hypotheses for testing the ELG paradigm for Egypt, (1) whether GDP, exports and imports are cointegrated, (2) whether exports Granger cause growth, (3) whether exports Granger cause investment. First two hypotheses were rejected, while the third one was accepted that exports Granger cause investment. Most of the previous researches focused on the total exports as the only source of growth, ignoring agriculture’s share to total exports. This happens during the time in which agriculture exports play substantial role in underdeveloped economies. This hypothesis has also been examined by various economists; they argued that rising agricultural exports play important role in economic growth. Mucahit and Murat (2014) investigated the causal relationship between variable of Turkish’s export and the GDP by using Augmented Dickey Fuller test and Granger causality test. The obtained results concluded that there was a unidirectional causal relationship from the GDP to the export. The results revealed that the series were not stationary.

Bulagi (2015) analyzed causality between agricultural exports and its share of gross domestic product in South Africa from 1994 to 2011. The study used Granger analyses to study the relationship between agricultural exports and agricultural GDP contribution. The results of the Granger causality test of this study showed a unidirectional causality between exports and GDP. Gilbert (2013), studying the impact of agricultural exports on economic growth in Cameroon, found that the agricultural exports have mixed effect on economic growth. Coffee export and banana export have a positive and significant relationship with economic growth while cocoa export has a negative and insignificant effect on economic growth. Ramphul (2013) investigated the causality between agricultural exports and agriculture GDP in India by using the Granger causality test. The study has found a unidirectional causal link running from farm exports to gross domestic product of agriculture. This indicates that agricultural products export Granger caused the growth in GDP of agriculture, supporting the export led growth hypothesis. Noula et al. (2013) assessed the contribution of agricultural exports to economic growth in Cameroon. They employed an extended generalized Cobb Douglas production function model.

All variables were non stationary and of an order I, and the Cointegration test was conducted for long run equilibrium. All the variables confirmed cointegration and as such the conventional vector error correction model was estimated using the Engle and Granger (1987)’s procedure. The findings of the study show that agricultural exports have mixed effect on economic growth in Cameroon. Muhammad (2012) explored and quantified the contribution of agricultural exports to economic growth in Pakistan. He estimated the relationship between Gross domestic product GDP and agricultural and non-agricultural exports for Pakistan by using Johansen co-integration technique for the period 1972 to 2008. The finding of this study is that the agricultural exports have negative and significant effect on economic growth while agricultural exports elasticity was 0.58. Moreover there was bidirectional causality in agricultural exports and real GDP. The same results were found by Faridi (2012) who has studied the contribution of agricultural exports to economic growth in Pakistan.

The results showed that the agricultural exports had negative and significant effect on economic growth while agricultural exports elasticity was 0.58; and there was bidirectional causality in agricultural exports and real GDP. Sanjuan-Lopez and Dawson (2010) quantified the contribution of agricultural exports to economic growth in developing countries, and they estimated the relationship between GDP and exports of agricultural and non-agricultural sector for 42 countries using panel cointegration methods. The results showed that a long-run relationship existed; the agricultural export elasticity of agriculture’s share on GDP was 0.07 whereas that of non-agricultural exports was 0.13. Haleem et al., (2005) estimated exports function for citrus fruit in Pakistan. The study result showed the importance of exports in the development of an economy cannot be denied. This is particularly true in case of a developing economy.

Many empirical analyses have been introduced to assess the international trade effect on the Growth Domestic Product (GDP) in developing countries. Most of these studies rely on two main methodological approaches: they are structural analysis that can be assessed by relying on economic approaches, and econometric analysis of time series data that identify empirical regularities in the data. This paper analysis follows the second methodological approach. Analysis of the time-series data requires studying the statistical properties of these data. Most research studies evidenced the presence of a unit root in the time series data and, when related, to share a tendency to co-move in the long-run (Myers, 1994). This analysis uses error correction model by estimating johansen cointegration techniques and generalized autoregressive conditional heteroskedasticity (GARCH) models. Cointegration and error correction models (ECM) have been introduced in the literature (Engle and Granger, 1987) to characterize nonstationary and cointegrated data and inform both on their short and long-run dynamics. Time-varying and clustering volatility, another common characteristic of time-series, is typically modeled through generalized autoregressive conditional heteroskedasticity (GARCH) models.

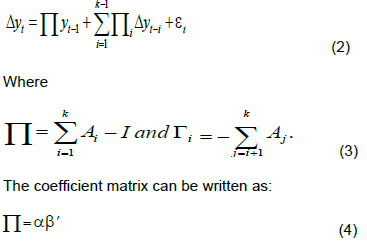

While the use of Johansen cointegration (1988, 1991, 1995) methods is common within the financial economics literature; empirical analysis that uses Johansen (1988, 1991) cointegration to assess the link between agriculture international trade and agricultural GDP is very scarce. The Johansen (1988) cointegration test provides a natural way to measure the relationship between two or more variables where the variables are characterized by non- stationary variables, presence of unit root, and near integrated. The Johansen test is considered as multivariate model and can be estimated by using maximum likelihood method. The Johansen’s methodology based on the vector autoregression (VAR) can be expressed as:

Where yt is an n×1 vectors of integrated variables of order one for k>1, and eI are n×1 error terms. Equation (1) can be re-written as:

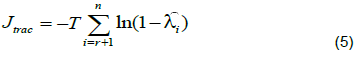

Where a are the adjustment parameters in the vector error correction model or speed of adjustment towards equilibrium and each column of b is considered as cointegrating vector. Where Õ is equal to zero that means the variables tested are not cointegrated, and the variables are to be cointegrated where the rank of Õ ¹ 0, where r is the number of cointegrating relationships, and If the rank of Õ is reduced to be r>n but is not equal to zero, then its determinant is zero. To overcome this problem we can consider eigenvalues to be the estimators of the cointegrating vectors (Sørensen, 2005). Johansen tests were divided into two likelihood ratio tests to assess the null hypothesis of no cointegration against the alternative of the presence of the cointegration of the canonical correlations. These two tests are: The trace test and the maximum eigenvalue test, represented in Equations 5 and 6, respectively. First, the trace was found to maintain equilibrium parity by implementing the Johansen (1988)’s cointegration test. First, the trace test examines the null hypothesis of the rank  coinegrating vectors relative to the alternative hypothesis of

coinegrating vectors relative to the alternative hypothesis of  coinegrating vectors. Second, the maximum eigenvalue test assesses the null hypothesis of

coinegrating vectors. Second, the maximum eigenvalue test assesses the null hypothesis of  relative to the alternative that

relative to the alternative that  (Hjalmarsson and Österholm, 2007).

(Hjalmarsson and Österholm, 2007).

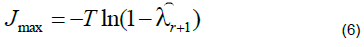

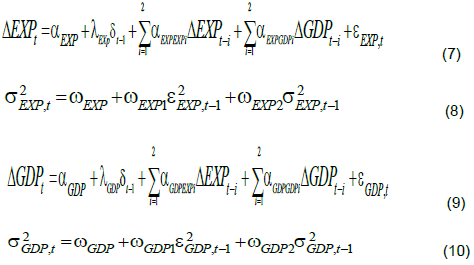

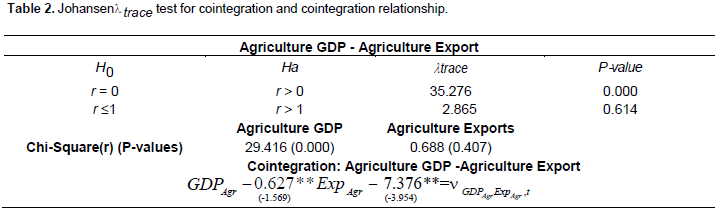

The Augmented Dickey and Fuller (1979), Perron (1997) and KPSS (Kwiatkowski, 1992) tests used to test for unit roots are run on our data. Results support the presence of a unit root in both agricultural export and agricultural GDP. The two variables considered are also found to maintain equilibrium parity by implementing the Johansen (1988)’s cointegration test. The bivariate models for agricultural export and agricultural GDP pairs considered (AgExp, AgGDP) are consequently specified as an error-correction type of model (ECM) (Equations 7 and 9). Model residuals are modeled by means of a bivariate GARCH (1,1) specification in order to allow for time-varying and clustering volatility (Equations 8 and 10). where DGDP and DEXP is the first difference of logged agricultural GDP and agricultural export, respectively. DGDP,EXP are short-run dynamic parameters that measure the influence of past agricultural GDP and agricultural export differences on current differences. The error correction term derived from the long-run equilibrium relationship is represented d1, thus lGDP,EXP measures the long-run agricultural GDP and agricultural export dynamics.eGDP,EXP are normally distributed error terms. The Ljung-Box test was applied to examine that the ECM-GARCH models are well specified.

Empirical analysis

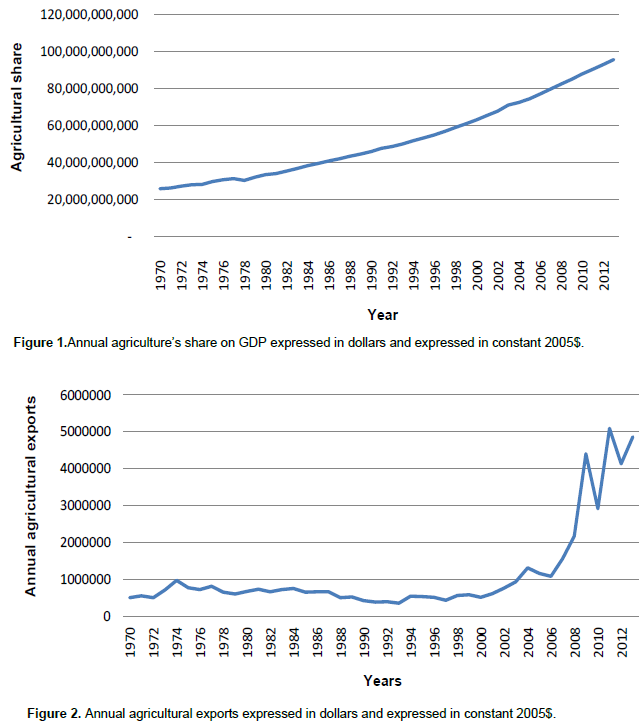

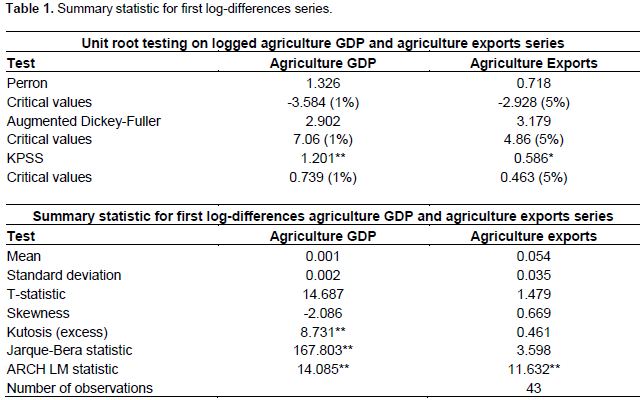

The analysis based on the dataset includes annual Egyptian agriculture’s share on GDP and agriculture exports for the period 1970 to 2013, yielding 44 observations. Agriculture’s share of GDP and agriculture exports expressed in constant 2005 dollars (Figures 1 and 2) data were obtained from the United Nations statistical database (UN database, 2016). Logarithmic transformations of agriculture GDP and agriculture exports series are used in the empirical analysis. Since ECM- GARCH modeling can only be applied to stationary data, the Augmented Dickey and Fuller (1979), Perron (1997) and KPSS (Kwiatkowski, 1992) unit root tests have been conducted and shown that none of the series is stationary and there is the unit root (Table 1). Thus we take the logged agriculture’s share of the Egyptian GDP and agriculture exports series in first differences. Table 1 presents summary statistics for first differenced logged series used in the analysis. We applied the Johansen’s (1988) cointegration to assess the existence of an equilibrium relationship between the pairs of series studied and to drive the error correction term in order to estimate ECM-GARCH bivariate model and evaluate the short run relationship between the agricultural exports and agriculture’s share of the GDP.

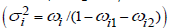

Our findings suggest that there is a long-run relationship between agriculture exports and agriculture’s share of the Egyptian GDP (Table 2). Existence of co- integration suggests the existence of trade flows from agriculture exports to agriculture’s share of GDP. Since series used in the analysis are expressed in logarithms, co-integration parameters can be interpreted as agricultural exports and agriculture’s share of GDP elasticity. Agriculture exports and agriculture’s share of GDP elasticities are 0.62. It is not surprising to find high correlation between agriculture exports and its share on GDP. A chi-square test of weak exogeneity for long-run parameters within the Johansen’s framework indicates that agriculture exports variable is endogenous for long-run parameters, agriculture’s share on GDP is exogenous. This implies that the agriculture’s share of GDP for maintaining such equilibrium by responding to the fluctuations can occur by agriculture exports (see Table 2). As expected, the parameters representing long-run series used links suggest that an increase in agricultural exports will cause an increase in agriculture’s share of GDP as well, which may result in higher acceptance and compatible with Bulagi et al (2015), and Sanjuan-Lopez and Dawson (2010).

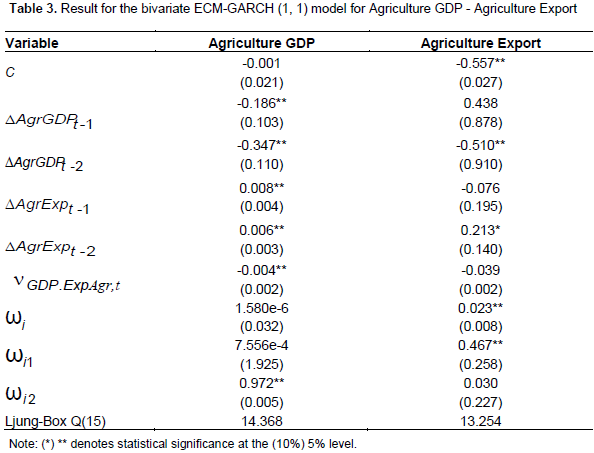

This is not surprising since the agricultural economy in Egypt depends on agricultural exports, especially the European market. Given that rice represents almost 40% of total Egypt's exports, the well-known Egyptian cotton is imported to India, Pakistan and China. The European market is the major absorber of potatoes and oranges; its represents 42% of the country's exports. Results obtained from applied ECM-GARCH (1,1) bivariate model are presented in Table 3. Short-run parameters show that current changes in agriculture’s share on GDP have a negative relevant autoregressive component and also affected by agricultural exports. This supports the results mentioned above that agriculture’s share on GDP is exogenous, while agriculture exports are weekly endogenous for long-run parameters. The speed of adjustment is negative and significant, which implies that in the long run the agriculture’s share on GDP has adjusted yearly by 4%. The conditional variance equation shows that past shocks contribute to increase agriculture’s share on GDP volatility. Since w

1 + w

2 < 1, we can conclude that the GARCH process is stationary, being the unconditional long-run variance

around 5.701e-6.

Current changes in the agricultural exports are influenced by past realizations of agricultural exports and negatively by the deviations from the long - run equilibrium, which indicates that the long run the agricultural exports have adjusted yearly by 4% , while the agricultural exports are not influenced by agriculture's share on the GDP (Table 3). The conditional variance equation shows that past market shocks contribute to destabilize the agricultural exports. The bivariate GARCH (1,1) model process provides evidence of a stationary volatility process, and GARCH parameters lead to an unconditional variance

The Ljung-Box test was done using the bivariate model (ECM-GARCH) and the results do not allow rejecting the null hypothesis of no autocorrelated residuals from lags 1 to 15 at 5% level. This implies that the ECM-GARCH is specified well.

CONCLUSION AND POLICY IMPLICATIONS

While Egypt is one of the African countries exporting agricultural products, but the current direction of the Egyptian government is to pay more attention to industrial exports. This paper studies the contribution of the agricultural exports to agriculture's share of GDP by using the Johansen (1988)’s cointegration technique to examine the relation between agricultural exports and agriculture's share on GDP. The ECM-GARCH bivariate model was also used to assess the short term relationship between agricultural exports and agriculture's share on GDP. This also allows us to evaluate the time-varying and clustering volatility. The analysis was based on the time series data, annual Egyptian agriculture’s share on GDP and agriculture exports for the period 1970-2013. The results indicate that there is long-run equilibrium relationship between agricultural exports and agriculture's share on GDP. The agricultural export elasticity of agriculture’s share on GDP was 0.62. The agricultural exports and agriculture's share on GDP were influenced negatively by the speed of adjustment. This indicates that in the long term the agricultural exports have adjusted agriculture’s share on GDP yearly by 4%. Results also indicate that increases in agricultural exports were followed by increases in agriculture's share of GDP.

The conditional variance equation shows that past shocks and agricultural exports contribute to increase agriculture's share on GDP volatility. Currently, Egypt is experiencing high dollar price against the local currency, which requires increasing exports to provide a strong foreign reserves. According to our findings above, increases in agricultural exports lead to increases in agriculture's share of GDP, and thus increases in the growth rate of the economy as a whole. Therefore the application of some of the policies through the intervention of the Egyptian government or by the relevant bodies to increase agricultural crops exports could lead to the strengthening of the Egyptian economic performance. To implement some of the policies that could be used to increase the export of agricultural products, it is relevant that the problems faced by farmers to export their products be solved. The most important of these problems are the lack of exporters’ commitment to forward contracts; thus these contracts need to be controlled by the government and the application of fines for breach of the contracts.

The authors have not declared any conflict of interests.

REFERENCES

|

Balassa B (1978). Exports and growth: further evidence. J. Dev. Econ. 5:181-189.

Crossref

|

|

|

|

Balassa B (1985). 'Exports, policy choices, and economic growth in developing countries after the 1973 oil shock. J. Dev. Econ. 18:23-35.

Crossref

|

|

|

|

Bulagi MB, Hlongwane JJ, Belete A (2015). Causality relationship between agricultural exports and agriculture's share of gross domestic product in South Africa: A case of avocado, apple, mango and orange from 1994 to 2011. Afr. J. Agric. Res. 10(9):990-994.

Crossref

|

|

|

|

Chenery HB, Strout A (1966). Foreign assistance and economic development'. Am. Econ. Rev. 56:680-733.

|

|

|

|

Chow PCY (1987). Causality between export growth and industrial development. J. Dev. Econ. 26:55-63.

Crossref

|

|

|

|

Dickey DA, Fuller WA (1979). 'Distribution of the estimators for autoregressive time series with a unit root'. J. Am. Stat. Assoc. 74:427-431.

|

|

|

|

Dodaro S (1993). Exports and Growth: A reconsideration of causality. J. Dev. Areas 27:227-244.

|

|

|

|

Egyptian Food Observatory (2013). Food Monitoring and Evaluation System', published by the Egyptian Cabinet's Information and Decision Support Center (IDSC) and World Food Programme (WFP), Quarterly Bulletin, Issue 14, October-Decmber 2013.

|

|

|

|

Engle RF, Granger CWJ (1987).'Cointegration and Error Correction: Representation, Estimation, and Testing'. Econometrica 55:251-276.

Crossref

|

|

|

|

Feder G (1983). 'On exports and economic growth. J. Dev. Econ. 12:59-73.

Crossref

|

|

|

|

Haleem U, Mushtag K, Abbas A, Sheikh AD (2005). Estimation of Export Supply Function for Citrus Fruit in Pakistan. Pak. Dev. Rev. 44:659-672.

|

|

|

|

Heiko H (2008). Export Diversification and Economic Growth. The International Bank for Reconstruction and Development, the Commission on Growth and Development, the World Bank P 21.

|

|

|

|

Heller PS, Porter RC (1978). 'Exports and growth: an empirical reinvestigation. J. Dev. Econ. 5:191-193.

Crossref

|

|

|

|

Hjalmarsson E, Österholm P (2007). Residual-Based Tests of Cointegration for Near-Unit-Root Variables, Manuscript, Board of Governors of the Federal Reserve System.

|

|

|

|

Jatuporn C, Chien LH, Sukprasert P, Thaipakdee S (2011). Does a Long-Run Relationship exist between Agriculture and Economic growth in Thailand. Int. J. Econ. Fin. 3:123-135.

Crossref

|

|

|

|

Jin JC, Yu ESU (1995). The causal relationship between exports and income. J. Econ. Dev. 20(1):131-140.

|

|

|

|

Johansen S (1988). Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 12:231-254.

Crossref

|

|

|

|

Johansen S (1991). 'Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models'. Econometrica 59(6):1551-1580.

Crossref

|

|

|

|

Johansen S (1995). Likelihood-Based Inference in Cointegrated Vector Autoregressive Models. New York: Oxford University Press.

Crossref

|

|

|

|

Jung WS, Marshall PJ (1985). Exports, growth and causality in developing countries. J. Dev. Econ. 18:1-12.

Crossref

|

|

|

|

Kormendi RC, Mequire PG (1985). Macroeconomic determinants of growth: cross-country evidence. J. Monet. Econ. 16(2):141-163.

Crossref

|

|

|

|

Kwiatkowski D, Phillips PCB, Schmidt P, Shin Y (1992). Testing the Null Hypothesis of Stationarity Against the Alternative of a Unit Root: How Sure Are We That Economic Time Series Have a Unit Root? J. Econ. 54:159-178.

Crossref

|

|

|

|

Michaely M (1977). Exports and growth: An empirical investigation. J. Dev. Econ. 4(1):49-53.

Crossref

|

|

|

|

Mucahit A, Murat S (2014). Relationship between GDP and export in Turkey. Annals of the Constantin BrâncuÅŸi. University of Târgu Jiu, Economy Series, Special Issue/2014- Information society and sustainable development.

View

|

|

|

|

Muhammad ZF (2012). Contribution of agricultural exports to economic growth in Pakistan. Pak. J. Commer. Soc. Sci. 6(1):133-146.

|

|

|

|

Myers RJ (1994). Time Series Econometrics and Commodity Price Analysis: A Review'. Review of Marketing and Agricultural Economics. Australian Agric. Resour. Econ. Soc. 62:02.

|

|

|

|

Noula AG, Sama GL, Gwah MD (2013). Impact of Agricultural Export on Economic growth in Cameroon: Case of Anana, Coffee, and cocoa. Int. J. Bus. Manage. Rev. 1(1):44-71.

|

|

|

|

Perron P (1997). Further evidence on breaking trend functions in macroeconomic variables. J. Econ. 80:355-385.

Crossref

|

|

|

|

Ramphul O (2013). Agricultural exports and the growth of agriculture in India. Agric. Econ. (AGRICECON) 59(5):211-218.

|

|

|

|

Ram R (1987). Exports and economic growth in developing countries: evidence from time-series and cross-section data. Econ. Dev. Cult. Change 36:51-72.

Crossref

|

|

|

|

Rangasamy L (2009). Exports and economic growth: The case of South Africa. J. Int. Dev. 21:603-617.

Crossref

|

|

|

|

Raza SA, Ali Y, Mehboob F (2012). Role of Agriculture in Economic Growth of Pakistan. Int. Res. J. Fin. Econ. 83:1450-2887.

|

|

|

|

Sanjuan-Lopez AI, Dawson PJ (2010). Agricultural exports and economic growth in developing countries: A panel co-integration approach. J. Agric. Econ. 61(3):565-583.

Crossref

|

|

|

|

Serletis A (1992). Export growth and Canadian economic development. J. Dev. Econ. 38:133-145.

Crossref

|

|

|

|

Shirazi NS, Manap TAA (2004). Export and Economic Growth Nexus: The case of Pakistan'. Pak. Dev. Rev. 43:563-581.

|

|

|

|

Sprout RVA, Weaver JH (1993). 'Exports and economic growth in a simultaneous equations model'. J. Dev. Areas 27(3):289-306.

|

|

|

|

State Information System (2012). State Information System Your Gate Way to Egypt.

View

|

|

|

|

Tyler W (1981). Growth and export expansion in less developed countries: some empirical evidence. J. Dev. Econ. 9:121-130.

Crossref

|

|

|

|

Ukpolo V (1994). Export composition and growth of selected low-income African countries: evidence from time-series data. Appl. Econ. 26(5):445-449.

Crossref

|

|

|

|

Voivodas CS (1973). Exports, foreign capital inflows and economic growth. J. Int. Econ. 22:337-349.

Crossref

|

|

|

|

World Bank (2014). Egypt Overview. Washington DC. TheWorld Bank.

View

|

coinegrating vectors relative to the alternative hypothesis of

coinegrating vectors relative to the alternative hypothesis of  coinegrating vectors. Second, the maximum eigenvalue test assesses the null hypothesis of

coinegrating vectors. Second, the maximum eigenvalue test assesses the null hypothesis of  relative to the alternative that

relative to the alternative that  (Hjalmarsson and Österholm, 2007).

(Hjalmarsson and Österholm, 2007). around 5.701e-6.

around 5.701e-6. The Ljung-Box test was done using the bivariate model (ECM-GARCH) and the results do not allow rejecting the null hypothesis of no autocorrelated residuals from lags 1 to 15 at 5% level. This implies that the ECM-GARCH is specified well.

The Ljung-Box test was done using the bivariate model (ECM-GARCH) and the results do not allow rejecting the null hypothesis of no autocorrelated residuals from lags 1 to 15 at 5% level. This implies that the ECM-GARCH is specified well.