The main objective of this article is to critically examine the Post-1991 bilateral trade relations between the two countries and Indian agricultural investments in Ethiopia. To achieve the objective of this article, the study used qualitative research methodology. Data were collected from both primary and secondary sources. Available literature was also reviewed. For the collection of primary data, in-depth interviews were conducted with officials from Ethiopian Investment Commission, Ministry of Foreign Affairs, Ministry of Trade, and Agricultural Investment and Land Administration Agency. The findings from data analysis show that the economic relationships between the two countries are in favor of India in trade and agricultural investments. The study showed that Ethiopia has chronically run a negative balance in its trade with India. Ethiopia’s trade deficit can largely be explained by the unequal terms of trade between agricultural commodities (the country’s major exports) and capital goods (the country’s major imports). With regard to agricultural investment, Indian agricultural investments have both positive and negative impacts on local peoples where they are operating. Indian Agricultural investments in Ethiopia created permanent and temporary job opportunities for Ethiopians; it has also increased government revenues and brought foreign currency and technology transfer. On the other hand, Indian investments in agriculture have caused the displacement of smallholder farmers and the degradation of natural resources. In response to trade imbalance, Ethiopia needs to focus on diversifying the composition of its exports and improving the business climate through infrastructural development, building strong institutions and reducing bureaucratic problems. Indian agricultural investments in Ethiopia also need encouragement, support and critical follow-up so that the expected benefit would be insured.

Globalization is a common phenomenon that leads to an intensification of worldwide interconnectedness through trade, investment, finance, migration and diffusion of culture (David, 1999). In the 21st century, the world economy can be considered as a global economic system, which is characterized by international division of labor, internationalization, and integration of production and exchange that operates on the principle of market economy (Tbilisi State University, 2014). In the global economic system, there is a mutual interdependence of the various national economies.

This time, it is difficult to find example of a closed economy and all economies of the world have become mostly open (Vijayasri, 2013). Trade has become a decisive issue largely because countries’ economies are now more open to flows of imports and exports than ever. This has occurred because of technological changes as well as consequent changes in government policies (Milner, 2013). In today’s globalized world, trade is a very crucial activity for states overall development and it has become an important aspect of international relations (Kegley and Wittkopt, 1989)

According to Rourke (1989), “the expansion of trade increased interrelationships between international economic activities and domestic economic circumstances”. Contacts between India and Africa existed since ancient times when Indian merchants conducted relatively extensive trade activities along the eastern coast of the African continent (Raja, 2006).

According to Runoko (2016), “close relationships between Africa and early India have existed for more than two thousand years”. India has close relationships with African countries in terms of historical, cultural, geographical, political, economic and commercial aspects (Manoj, 2010).

Following its independence, India has been playing a crucial role with regard to the struggles against colonialism and racism in the international system. However, there were little diplomatic relations between Ethiopia and India until 1948. After its independence, India quickly established diplomatic relations with Ethiopia and its diplomatic mission led by Sardar Sant Singh was sent to Ethiopia. According to Ethiopian Ministry of Foreign Affairs (2015), “It was in July 1948 that Ethiopia and India first established diplomatic relations at the level of legations. Full Diplomatic Relations were established in 1950 with the assignment of Mr. Amanuel Abraham as the first Ambassador of Ethiopia to India”.

Ethiopia was the first country from Africa which opened its Embassy in India, New Delhi. Ethiopia and India carried close cordial relations during the long reign of Emperor Haile Selassie (Manoj, 2010). The bilateral relations were strong during the Imperial Regime. However, after the overthrow of the Imperial Regime by the military Junta in 1974, the bilateral relations were limited to cooperation in international forums like Non-Alignment Movement.

During the Ethiopian-Somali War, between July 1977 and March 1978, India supported Ethiopia's right to defend itself and told the Somalian government to respect the Organization of African Unity (OAU) charter. After Ethiopian People’s Revolutionary Democratic Front (EPRDF) took power in 1991, relations have gradually improved with increasing diplomatic contacts, trade and investment in Ethiopia’s economy (Embassy of the Federal Democratic Republic of Ethiopia in India, 2011). Economic and Diplomatic relations between Ethiopia and India began with a trade agreement in 1997. Today, through South-South cooperation both nations are cooperating in various areas of trade and commerce. The recent visit of higher officials of the two countries to sign bilateral agreements for fastest economic growth has strengthened the linkages between Ethiopia and India in a multi-dimensional sense (Ethiopian Economics Association, 2009).

India is one of the largest foreign investors in Ethiopia and Indian companies have been playing a prominent role in the area of investment. India’s investment in Ethiopia has now reached over US $5 billion. Currently, more than 600 Indian companies have investment licenses and they are engaging in textiles, mining, leather and agricultural activities (such as floriculture, crop farming, vegetables and fruits (Ethiopian investment commission, 2015).

Currently, literatures are fragmented and no comprehensive document is available on assessing the Post-1991 Ethio-India economic relations with particular reference to trade and agricultural investment. Therefore, this paper has attempted to fill the gap in the literature by providing a comprehensive study on the economic ties between Ethiopia and India.

The post-1991 Ethio-India trade relations

As a part of Structural Adjustment Programs (SAP) in Ethiopia, comprehensive trade reforms for both exports and imports has been carried out since 1992. Among others, reduction of tariff and non-tariff barriers, harmonization and simplification of tariffs, including tariff lines and dispersions, removal of quotas, reduction and gradual elimination of all controls including those on domestic prices, deregulation and liberalization of investment policies were carried out (Hassen, 2008).

Modern economic and diplomatic relations between Ethiopia and India began with an agreement that was signed on March 6, 1997. That trade agreement laid the framework of cooperation to expand the trade relations between the two countries (Tages, 2016). Following the trade agreement, bilateral Investment Promotion and Protection Agreement (BIPPA) was signed in July 5, 2007, to strengthen relations in the economic and investment areas. More importantly, during the first India-Africa Forum Summit in April 2008, India had announced the Duty-Free Tariff Preference Scheme (DFTP) for least developing countries (LDCs) and Ethiopia was among the first countries that utilized the DFTP.

Ethiopia and India also signed Double Taxation Avoidance Agreement (DTAA) on May 25, 2011, during the second India-Africa Forum Summit held in Addis Ababa. Mathews (2016) concluded that despite the total volume of the bilateral trade between Ethiopia and India has been increasing from time to time, the trade balance is in India’s favor because of lack of export diversification on the Ethiopian side.

Ethiopian export products to the Indian market

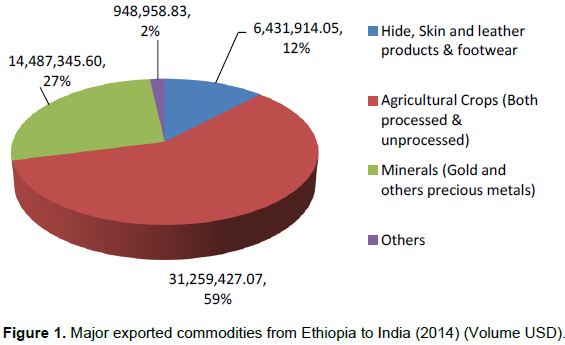

As shown in Figure 1, in 2014, almost all Ethiopia’s export earnings were derived from primary products. From these, 59% of the export is covered by Agricultural Crops (both processed and unprocessed), followed by minerals (gold and others precious metals) which covers 27%. Hide, skin and leather products and footwear cover another 12% of Ethiopia’s exports to the Indian market. Other export items constitute a mere 2%. The export basket of Ethiopia shows that Ethiopia mainly exports primary goods such as food, live animals, vegetables, leather, coffee, tea and cocoa.

India’s export products to Ethiopia

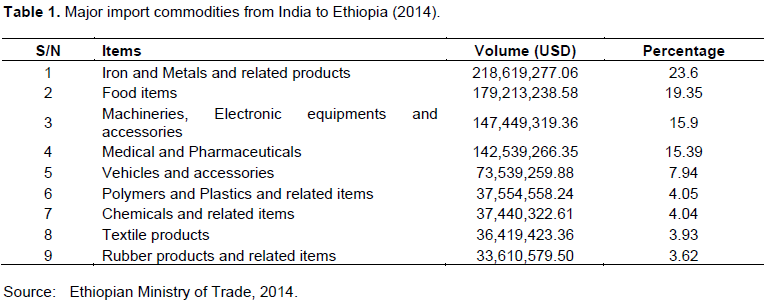

Table 1 shows the top ten import commodities from India. Ethiopia imports iron, metals, related products, vehicles, accessories, machinery, electronic equipment and many other manufactured products. The import basket of Ethiopia indicates that Ethiopia mainly imports manufacturing products like chemicals, machinery and transport equipment’s, iron and steel, pharmaceutical products, vehicles and accessories. The composition of Ethiopia’s imports has been highly dominated by iron, metals and related products.

Summary of trade balance between Ethiopia and India

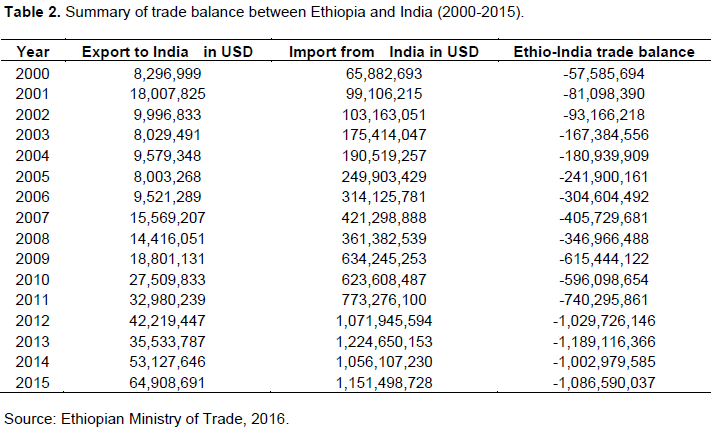

Bilateral trade volumes have risen sharply over the last 15 years and in 2015, the bilateral trade reached a peak of $1.2 billion and India is the second most important source of imports for Ethiopia, contributing 7.4% of all Ethiopia’s import next to China. Following recent agreements, trade between the two countries has increased from $ 74.1 million in 2000 to $1.1 billion in 2014. This indicates that the trade relation between the two countries is increasing starting from 1992 due to the economic policy adopted by EPRDF government (Tages, 2016). Table 2 shows this reality.

As shown in Table 2, bilateral trade volumes have risen significantly over the last 15 years, from less than US$ 75 million in 2000 to over US$ 1.2 billion in 2015. Trade volumes have increased significantly after 2007, when Ethiopia and India signed major agreements, including the Bilateral Investment Promotion and Protection Agreement and Agreement on Establishment of Joint Ministerial Commission (Tages, 2016).

Table 2 shows that the value of imports from India has been growing faster than Ethiopia’s export to India, thereby giving rise to widening trade deficit. For instance, the year 2014 saw the total trade volume of the two Ethiopia accounted for $1 billion; however, its import from Ethiopia was only $53.1 million. Ethiopia’s exports to India were very minimal throughout the 1990s and their relative share has been very minimal, showing very huge gap between imports and exports, resulting in a trade balance that favors India. Despite the fact that the total trade between Ethiopia and India has been significantly improved, Ethiopia suffers significant trade deficit.

In this trade relation between the two countries, the chronic trade deficit has remained the dominant feature of Ethiopia’s external trade with India. Therefore, economic relations between Ethiopia and India are unequal and asymmetrical. The widening deficits in favor of India need the attention of both governments in order to sustain the trade relationships between the two countries. Due to differences in the availability of natural resources and other inputs required for production, some countries specialize in the production of some goods which they produce more cheaply than other countries. The other countries may likewise produce some other goods relatively cheaply.

Hence, countries specialize in the production of those goods for which they are best suited. This sort of international specialization gives rise to the exchange of goods across geographical boundaries of countries. Thus, Ethio-India trade relations are highly explained by the neo-classical economic theory which was developed to answer the question why do countries trade? They argue that trade between countries takes place because traders benefit from it. They further explained that trade is better than complete isolation. For the neo-classical economic theorist, free trade would increase the absolute wealth of all parties, foster bonds of independence and peace of states.

Even if trade between countries usually does not benefit participating countries equally, they expect that trade would automatically have a positive effect on all participants. It is also one of the major driving forces for economic development. International trade can be an important vehicle for promoting economic development (Myint and Deepak, 1996). Developing countries are able to initiate economic development by importing machinery and technical know-how from developed countries. The main conclusions of the neoclassical model of free trade that all countries gain from trade and world output is undeniable. In all relationships, the key question is who benefits more? In economic relations, the one who benefits more will be the one who is more powerful in terms of capital accumulation and the one who has a better bargaining power. Due to this fact, economic relations between Ethiopia and India are unequal and asymmetrical.

There are a number of factors responsible for the weak trade performance of Ethiopia. What is immediately clear from observing Ethiopia’s export profile is the country’s dependence on the export of primary commodities. Ethiopian exports are mainly agricultural products and therefore are prone to price volatility and adverse climate which affects its capacity to export. Secondly, Tages (2016) stated that even if India’s duty-free scheme is crucial for LDCs, Ethiopia is not using the scheme extensively due to the absence of strong institutions in Ethiopia. The third factor that hinders Ethiopia’s trade performance is lack of capacity on the Ethiopian side. Ethiopia has weak export capacity in terms of volume. He further stated that poor production capacity is the major cause of trade imbalance. Due to the above factors, Ethiopia has been experiencing weak trade performance and facing many difficulties in order to meet the import demands of India.

Tages (2016) concluded that, in response to the trade imbalance, Ethiopia needed to focus on diversifying the composition of exports and increase the number of value-added products. In line with this, the Ethiopian government shall work on increasing the volume of its exports through the extensive use of the DFTP scheme which is provided by the Indian government, and attracting FDI in the agricultural sector from India and holding exhibition and trade fair between the two countries. Mathews (2016) explained that if Ethiopia effectively implemented the DFTP scheme, the scheme will minimize the trade imbalance currently existing between Ethiopia and India.

In order to avoid the defects for the bilateral trade between the two countries, the government of India has been providing soft loans, focusing on capacity building and encouraging small and medium scale enterprises in Ethiopia.

Barriers on Ethio-India trade relations

Although, Ethio-India trade relations have increased for the last twenty-five years, there are many barriers that need to be addressed in order to further strengthen economic relations. Major constraints are discussed below.

Infrastructure bottlenecks

Inadequate Infrastructure has been considered as a major hindrance for enhancement of trade between Ethiopia and India. Ethiopia and India score very poorly in transport, telecom, power consumption, financial development, etc. Other major problems include, electricity power consumption, internet penetration and quality of port and health sector development. In recent years, Ethiopia has made significant progress in infrastructure and it has developed Ethiopian Airlines and associated regional air transport hubs (IPE Global, 2014). Additionally, it has launched investment program to upgrade its network of trunk roads and is establishing a funding mechanism for road maintenance. Even though, Ethiopia has made significant progress in some infrastructure, in recent years, infrastructure facilitates, particularly, transport and power have remained major problems for Ethiopia, which directly affects the bilateral trade relations between the two countries (Ibid).

Lower human capital development

The concept of human capital refers to the abilities and skills of human resources of a country. Human capital is one of the fundamental factors for economic growth. Ethiopia is among low human development group. Ethiopia continues to be considered a least-developed country (LDC) in human capital. The country has traditionally been among the most educationally disadvantaged in the world, and the majority of its population has little access to schooling. Different scholars have argued that human capital development is vital for trade development and in attracting foreign investment.

Human Development Index (2013) ranks Ethiopia and India at 173rd and 136th out of 187 countries respectively, indicating poor human capital in both countries. Similarly, Human Capital Index of 2013 ranks India and Ethiopia poorly out of 122 countries. Ethiopia scored very poorly in human capital development which directly affects the bilateral trade relations between the two countries (IPE Global, 2014).

Transportation costs

The profitable sale of agricultural products and the import of finished products depend on an efficient set of integrated transport system. Ethiopia is a landlocked country and relies mainly on Djibouti for access to shipping lines. This coupled with poor infrastructure and long distance from the sea is clearly damaging its trade relations with India; these situations bring additional costs and such costs are a particular burden on Ethiopia. It indicates that transportation and logistics costs are major problems for promoting trade and investment in Ethiopia (IPE Global, 2014).

Indian agricultural investment in Ethiopia

After EPRDF came to power, a liberal investment context has been enacted and the Ethiopian Investment Commission was established in 1992. The Commission has been making relentless efforts to create an enabling investment environment which increased the role of private sector in the economic development of the country (Investment Office of Ethiopia, 1992).

Since 1993, India has invested more than $1.5 billion in the primary sector of which approximately 97% has been directed towards the growing of crops, fruits, vegetables, flowers and beverage crops. The next largest destination for Indian investment, a little more than 1%, was animal farming. Mining and quarrying, the third largest location for FDI attracted $7.3 million. Indian investment has been widely spread over and they have invested about $ 5 billion in different sectors in Ethiopia. From June 2003 to May 2014, close to 632 Indian firms have been operating in Ethiopia.

Indian firms have been active in sectors such as agriculture, floriculture, cotton and textiles, plastics, leather, I.T., mining and health care. The Ministry of External Affairs, Government of India, in a July 2014 note on India-Ethiopia relations estimates that out of the $5billion invested so far, approximately $ 2 billion is already on the ground or in the pipeline. About 48% of Indian companies are in manufacturing and 21% in agriculture and the rest are in the services sector (IPE Global, 2014).

Tadesse (2016) stated that Indians have good experience in the agricultural sector and they are actively engaged in the cultivation of flowers and other crops in Ethiopia. Indian companies identify Ethiopia as a stable country to invest in with sound macroeconomic policies and attractive incentive packages. In addition, the Indian government has certainly encouraged Indian investment in Ethiopia, as well as in Africa more widely, by providing finance through its Export-Import Bank (EXIM Bank).

According to Ethiopian Investment Commission, Indian agricultural investments are crucial in order to bring rapid and sustainable economic development (Ethiopian Investment Commission, 2015). Among many benefits expected from foreign agro-investment companies, the creation of job opportunity for many people is the major one. Various Governments, International Financial Institutions (IFIs) and private investors argue that agricultural investment can create new employment opportunities in rural areas. Land investment has the potential to create significant amounts of employment on farms, whether preparing the land, planting, weeding, harvesting crops, managing facilities, or providing security or other services.

Tadesse (2016) argues that Indian agricultural investment in Ethiopia created job opportunities for many Ethiopians. Daniel (2016) also supports the above argument and he concluded that Indian agricultural investments have been crucial in creating employment opportunities in Ethiopia.

So far, Indian companies categorized under the operational phase created 3,447 permanent and 11,186 temporary job opportunities for Ethiopians.

Secondly, Tadesse (2016) stated that technology transfer is often presented as an important potential benefit of the foreign agricultural investment. Indian Companies indeed played a fundamental role in filling knowledge gaps by transferring technology and know-how to Ethiopians. Daniel also argues that Indian firms have brought know-how and new ideas into the country which led to the improvement of production and productivity in the agricultural sector.

Thirdly, as Tadesse (2016) stated, investment in agricultural sector leads to increase in the capital accumulation of the country which in turn helps it to reach the middle-income level. Fourthly, Daniel (2016) argues, Indian agricultural investments can bring foreign currency for Ethiopia and they are crucial to minimizing the shortage of foreign exchange required for realizing development projects in the country. Lastly, the agricultural investments of Indian firms contribute to increasing the government revenue in different ways. For Tadesse (2016), Indian agricultural investment has the potential to generate significant revenue for Ethiopian government from fees and taxes, which can be used to fund national and regional development activities.

Impacts of Indian agricultural investment in Ethiopia

Henz (1989) described the role of Agriculture in Ethiopian economy as: Agriculture is an important economic activity for employment generation, raising the living standard of the population. It is also a significant solution for the problem of food insecurity, due to the above mentioned facts; agriculture has been playing paramount roles for the development of a given country.

Large-scale investment in land is an important part of the Ethiopian government’s strategy for the development of the country. Agriculture is at the heart of the country’s economy, contributing 50% of GDP, 85% of employment and 85% of exports (Keeley, 2014). Government policy documents suggest that Ethiopia has considerable potential in the agricultural sector that is currently unfulfilled. Large scale agricultural investment is welcomed by the government of Ethiopia because it is essential in terms of addressing food security and poverty reduction objectives, and it is also a core driver of national economic growth and job creation. Large-scale commercial agriculture has to be promoted in the lowland areas of the country, with horticulture, labour-intensive agriculture than in more densely populated agricultural areas, namely, the highlands.

In recent years, Ethiopia has made development strides despite the regular cycle of droughts in parts of the country. Chronic and acute food insecurity is prevalent, especially among rural populations and smallholder farmers (CARE, 2014). According to the Ethiopian government, this food insecurity problem could be solved through agricultural investment.

The government claims that investment in agriculture is important to minimize the problem of food insecurity: rising productivity increases rural incomes and lowers food prices by making food more accessible to the poor (Daniel, 2016). The government argues that these investments will allow for much-needed foreign currency to enter into the economy, and will contribute to long-term food security through the transfer of technology to small-scale farmers. These are the rationales behind leasing huge lands to both local and foreign investors, particularly for Indian firms (Ibid).

Nevertheless, the impact of foreign agricultural investment is still a debatable issue. While agricultural investment plays a crucial role in the economic development, it involves risks and challenges to the host country, Ethiopia. The recent foreign large-scale investments in farmland have been strongly criticized especially by some non-governmental organizations and international development organizations (GRAIN, 2008). Those organizations have mentioned possible negative impacts for the target countries and especially for the local poor. The expropriation of local landholders and the loss of adequate access to land supposedly result in negative consequences for local food supply (food security) and for the environment. Graham (2010), elaborated these challenges and risks as:

Since foreign land acquisition is profit oriented and largely for exports, agricultural investment will foster the introduction and deepen an industrial agricultural mode of production in the host countries. The corporations involved in agricultural investment are also accused of introducing inappropriate types of technology that hinder indigenous technological developments and of employing capital-intensive productive techniques that thereby cause unemployment and prevent the emergence of domestic technologies. In addition, this mode of production is ecologically destructive and not sustainable.

Indian agricultural investment in Ethiopia is a manifestation for the above argument. Various Non-Governmental Organizations like Oakland Institute claimed that Indian agricultural investments have a number of negative impacts (2011).

One of the respondents who requested anonymity concluded that expected benefits are often in the form of job opportunities and infrastructure development, but Indian Companies which are operating in Ethiopia show minimum commitment to benefit the local people and to protect the environment. Thus, Large-Scale Commercial agriculture can impact the biodiversity of an area because it tends to heavily rely on industrial modes of agricultural production.

Large-scale acquisition of agricultural land can have adverse impacts on the host country. These negative effects include the displacement of smallholder farmers, the loss of grazing land for pastoralists, the loss of incomes and livelihoods for rural people and the depletion of productive resources. There is also evidence of adverse environmental impacts, in particular, the degradation of natural resources such as land, water, forests and biodiversity (Pascal, 2014).

Based on the above fact, the following are the major challenges of Indian Agricultural Investment in Ethiopia: environmental impact, food insecurity and displacement of local peoples.

Environmental impacts

The ecological sustainability of agricultural production is an important subject in the context of foreign agricultural investment. Applying intensive agricultural production has an impact on biodiversity, carbon stocks, land, soil and water resources (Mustafa, 2011). One of the most significant concerns about the trend of Indian agricultural investment relates to the environmental impact which includes mechanized mono-cropping farms that are dependent on high levels of water usage, involve heavy doses of pesticides and herbicides that can pollute nearby groundwater, and which can rapidly deplete soil quality (Rowden, 2011).

Indian firms have an interest in cultivating cotton, palm oil, rubber, oilseeds and horticulture. Such sort of products needs a heavy mechanized form of farming that involves concentrated chemicals and mono-culture. Monocultures also demand the intensive use of chemical fertilizers and pesticides that destroy biodiversity, pollute soils, rivers, subterranean water sources and springs, and gravely affect the health of plantation workers and communities. According to Worldwatch (2011), “Investors claim that land grabs can help to alleviate the world food crisis by tapping into a country’s ‘unused’ agricultural potential.”

However, such investments often do more harm than good, disrupting traditional land-use patterns and leaving small-scale farmers vulnerable to exploitation”(Ibid). Some observers point out that in fact, the global land grab is rather a water land grab due to the fact that agricultural investment is pointless without water and therefore only lands with abundant water supply have been targeted by investors.

In addition, large-scale plantations for agro fuels production may be associated with increased soil and water pollution (from fertilizer and pesticide use), soil erosion and water run-off, with subsequent loss of biodiversity (Graham, 2010). As cited in Elias (2011), Fire states that “these fertile lands will lose their trees, topsoil, natural habitats, and rivers, to be rendered barren as a result of exposition to chemicals latent in the fertilizers, insecticides, and pesticides” and that the rivers and lakes that survive “are likely to be poisoned by toxic materials and become undrinkable and health hazard”. Gambella residents said that when Karaturi came, we lost the benefit from the forest because they took the land and cleared all the land (The Oakland Institute, 2011).

Daniel (2016) argues that there is no Indian investor who is engaging in agricultural investment without giving more emphasis on environmental impact assessment. However, he further explained that there is a major problem with regard to the implementation of environmental protection. He also stated the agency has to prepare a code of conduct for environmental protection and it has been working to incorporate the issue of environmental protection into the agreement with foreign investors in general and Indian investors in particular.

Generally, Indian agricultural investment has a negative impact on the environment: increase in erosion and worsen climate change by displacing forest areas and other land use changes, which result in high carbon stock releases. Especially, if fire cleaning takes place, a loss in water availability and quality may be invoked by large-scale water use and use of pesticides and fertilizer, a reduction of biodiversity may be caused by large-scale monoculture production systems, a loss in soil quality can be caused as well by an unsustainable use of chemicals and disruption of the local ecologic systems by introducing plants or species that are not part of the local biodiversity.

Food insecurity

Despite Ethiopia’s considerable agricultural resources potentials, the country has been facing persistent food shortages. Even in years of adequate rainfall, the survival of some 4 to 6 million people depends on international food assistance. Even though Ethiopia is doing its level best to curtail the problem of hunger, food insecurity at the household level could still persist despite the growth of food and cash crop production at the national level (Mustafa, 2011).

Besides, the current land deal which is being made by Ethiopian government with foreign agro-investment companies could have its own impact on the food self-sufficiency of the country. As various writers comment, investment by foreign companies in large-scale farmland could have a devastating impact on the livelihoods of the indigenous local people. Especially, the effect could be significant if the country is not strictly looking after the undertakings of such companies.

FDI in farmland can reduce food security in the target country when food crops are not available for local consumption. This is of outstanding importance in light of the human right to food. As a matter of fact, some of the relevant target developing countries for FDI in farmland are dependent on food aid (The Oakland Institute, 2011).

It is evident that commercial land investment will have an immediate adverse impact on the ability of those already food insecure local populations. There is no clause in any lease agreement that requires investors to improve local food security conditions or to make production available for the local population. Previously, these households were largely self-sufficient with respect to food production, now they will have to rely on assistance from others and will become more dependent on food aid from the government. The Oakland Institute further stated that taking over land and natural resources from rural Ethiopians, is resulting in a massive destruction of livelihoods and making millions of local people dependent on food aids (Ibid). Generally, the acquisition of land by Indian companies in Ethiopia poses a threat to its livelihoods and endangers its chances of achieving food security and improved nutrition.

Displacement of local people

According to Oakland Institute (OI), most of the large-scale land deals were negotiated without the prior and informed consent of the indigenous populations living on the land. In the worst cases, people are forcibly evicted from their land with little or no compensation (The Oakland Institute, 2011). With 85% of the Ethiopian population living in rural areas and being dependent on farming for their livelihood, losing access to arable land, their most crucial asset, will seriously undermine thousands of household’s ability to earn a living produce and purchase sufficient food. According to article 40 of the 1995 Ethiopian Constitution,

“Ethiopian peasants have rights to obtain land without payment and the protection against eviction from their possession. It also asserts that the Ethiopian pastoralist has the right to free land for grazing and cultivation as well as the right not to be displaced from their own lands” (Federal Democratic Republic of Ethiopia Constitution, 1995).

On the contrary, many local peoples are displaced from their homeland due to foreign agricultural investment in general and Indian agricultural investment in particular. More land is forcibly taken from indigenous subsistence farmers for lease to Indian private companies.

Although, Ethiopian officials claim that villagization is a voluntary program, OI investigations reveal that the government had forcibly resettled indigenous communities from land earmarked for commercial agricultural development, rendering them food insecure and fearful for their survival (Ethiopian Investment Proclamation, 2012). The government of Ethiopia failed to secure Free Prior and Informed Consent from displaced indigenous communities, failed to provide affected groups with mechanisms for redress and failed to provide anything approximating fair compensation. According to Fikre (2011),

“The government of Ethiopia argues that Ethiopia has a plenty of uncultivated lands. However, it is a poor argument. A government that cares for the well-being of its people does not give away its natural resources to foreigners simply because it has plenty of it. Every good government should protect its national reserve bearing in mind future generations”.

The lands in which investors have targeted to utilize are not uncultivated lands. They want to take over lands that have already been cultivated by the dwellers. If not, why would they dislocate the native farmers from the places they have farmed and lived in from time immemorial (Fikre, 2011). Generally, the large-scale land transfers to Indian companies give rise to the dispossession and displacement of indigenous peoples in different parts of Ethiopia.

Tadesse (2016) stated that agriculture by its nature is a challenging activity; it requires huge capital, time, manpower and machines. Indian companies took huge land in different parts of Ethiopia. However, within the time frame they put, they could not develop what was expected from them and the level of cultivations is below the expectation of the Ethiopian government.

Daniel (2016) stated that the overall performance of some Indian companies is not effective enough and they are not successfully utilizing the land as per their agreement. He mentioned Karaturi Agro products Plc and BHO as examples, both companies failed to utilize the land based on the lease agreement they signed with the agency. Karaturi has utilized only 1,200 ha from its 100,000 hectares, whereas BHO has utilized 1,103 hectares from its 27,000 hectares of land. Additionally, some Indian companies are not successful in fulfilling their social responsibilities in the area they are operating as the government expected. He also stated that agricultural investment has not been effective to create employment opportunities and to transfer technology effectively as expected by the government.

Therefore, due to its poor performance, the agency has discontinued providing lands to domestic and foreign investors for large-scale commercial farms for the time being. He added that foreign agricultural investment in general and Indian agricultural investment in particular needs critical follow-up and the agency is exerting its ultimate effort in order to solve the above problems. The researchers suggest that, if the Ethiopian government does not take necessary measures and carefully administer Indian companies which are involved in the agricultural sector in Ethiopia, the above challenges may be intensified.

Responsible decision-making and equally responsible investment are crucial in order to minimize the costs and damages assumed to be inherent in land grabbing.