ABSTRACT

Corruption is perhaps the biggest challenge to Nigeria’s development and the integrity of the country’s fiscal monetary system. Since independence in 1960, corruption has been a destabilizing factor in the country’s progress. It however gained pronounced ascendancy during the Second Republic, forcing a greater percentage of the country’s population into serious economic hardship leading to the introduction of the Structural Adjustment Programme (SAP). This malignant pandemic has not abetted till date. This paper interrogates corruption and fiscal federalism in Nigeria through an analysis of the federal budgetary process from 1999 to 2016. It adopts the political economy approach as the theoretical framework. The study recommends amongst others that the political elites must rise to the challenges of good governance, by waging wars against corruption through institutional strengthening and patriotism by all citizens.

Key words: Budget, budgeting process, corruption, federalism, fiscal federalism.

Corruption as a term may mean different things to different scholars depending on the direction of the studies. Broadly speaking, it may describe acts that are considered unethical, such as fraud, graft, bribery, stealing, perjury, lying, dishonesty, indiscipline, and such other immoral acts like merchantilization of sex for gratification, as common in some lecturer – students’ relations or awards of contracts in business environments.

Corruption is perhaps one of the biggest challenges confronting Nigeria. From independence in 1960 till date, it has been a destabilizing factor that has distorted the country’s development. This malignant pandemic gained prominence during the Second Republic, forcing a greater percentage of the country’s population into serious economic hardship leading to the introduction of the Structural Adjustment Programme (SAP). Expectedly, corruption accentuated during the regimes of General Ibrahim Babangida and General Sani Abacha. However, in spite of the glaring evidence of assets and physical cash in various currencies of the world owned by General Ibrahim Babangida, no effort has been made to probe his administration. Worse still, General Sani Abacha’s loot amounting to billions of Naira stashed away in foreign bank accounts has not been fully recovered.

Since the advent of the Fourth Republic in 1999, no concrete effort has been made to either eliminate or minimize corruption in Nigeria. Though the regimes of President Olusegun Obasanjo and Umaru Musa Yar’

Adua made efforts to influence the passage of some anti-corruption bills in the National Assembly, but their efforts were not able to stand the wave of corruption in Nigeria. For instance, the administration of President Olusegun Obasanjo saw the enactment of the Independent Corrupt Practices Commission (ICPC) law in 2000 and Economic and Financial Crimes Commission (EFCC) law in 2000, while the regime of President Umaru Musa Yar’Adua saw the enactment of the Fiscal Responsibility Act and Public Procurement Act in 2007. Yet, corruption seems to be waxing stronger and stronger. However, the present government of Nigeria under President Muhammadu Buhari since its inception in 2015 has been carrying out campaigns against corruption but it does appear that corruption is fighting back with a greater vigour. A typical example of this fact was the allegation of the padding of the 2016 budget and the controversy in the passage of the 2016 Appropriation Bill and the subsequent assent by the President of the Federal Republic of Nigeria.

Indeed, a fundamental instrument the Nigerian political elites mobilize to perpetrate and reproduce corruption is through the federal budgetary process. The budget in Nigeria has become a way of legalizing corruption. Onwubiko was therefore right when he observed that in Nigeria, budgetary allocations made for the purposes of implementing government policies in the areas of education, housing, health and social infrastructure almost end up in the pockets of individuals made up of bureaucratic contractors and their cronies (Daudu, 2011: 44).

This paper therefore discusses corruption and fiscal federalism in Nigeria by conducting an analysis of the federal budgetary process from, 1999-2016. To achieve this, the paper adopts descriptive and analytical methods by relying on secondary sources for data gathering. It also adopts the political economy approach as our theoretical framework.

Conceptual clarification

We would explain some key concepts that underline this paper such as: corruption, fiscal federalism and budget.

Corruption

Corruption is a broad term covering a wide range of misuse of entrusted funds and power for private gain. Corruption includes but is not limited to: theft, fraud, nepotism, abuse of power etc. In other words, corruption is a form of fraudulent or dishonorable conduct by a person entrusted with a position of authority, often to acquire personal benefit. Corruption may include many activities including bribery and embezzlement. Government or political corruption occurs when an office- holder or other governmental employees act in official capacity for personal advantage.

Transparency International (2017) defines corruption as the abuse of entrusted power for private gain. It can be classified as grand, petty and political depending on the amount of money lost and the sector where it occurs. To the World Bank Group, ‘a corrupt practice is the offering, giving, receiving or soliciting, directly or indirectly, anything of value to influence improperly the actions of another party.’ Corruption undermines people’s trust in the political and economic systems, institutions and leaders. It could cost people their freedom, health, money and sometimes their lives. Grand corruption consists of acts committed at the high level of government that distort policies or the central functioning of the state, enabling leaders to benefit at the expense of the public good. Petty corruption refers to every day abuse of entrusted power by low and mid-level public officials in their interaction with the ordinary citizens, who often are trying to access basic goods or services in places like hospital, schools, police departments and other agencies. Political corruption is a manipulation of policies, institutions and rules of procedure in the allocation of resources and financing by political decision makers, who abuse their power, status and wealth (Transparency International, 2017). Commenting on the state of corruption in the world, Ugaz (2017) opined ‘in too many countries, people are deprived of their most basic needs and go to bed hungry every night because of corruption, while the powerful and corrupt enjoy lavish lifestyles with impunity.’

The National Assembly of Nigeria in the Corrupt Practices and Other Offences Act 2000 tersely defined corruption as including bribery, fraud and other related offences. This porous definition clearly shied away from portraying corruption in its proper perspective. Alapiki (2015:35) therefore conceptualized corruption as:

the deliberate or inadvertent violation of ethics and codes that are supposed to govern the behavior of a particular profession, public service, private transaction, contractual agreements and actions which lead to selfish and dishonest personal gains to the disadvantage of another person, the system, or society in general. This may include abuse of office, misuse of power and authority for repressive and oppressive purposes, victimization, electoral malpractice, bribery, diversion of public fund, and inflation of contracts, amongst others. Indeed one’s failure to perform his duties also amounts to corruption. He stressed that all these combine to breed discontent, frustration, deprivation, criminality and terrorism. As deduced from the definitions above, we can contend that corruption is:

(1) The abuse of entrusted power and authority for private gain

(2) A form of dishonesty or unethical conduct by a Person entrusted with a position of authority;

(3) Bribery, fraud and other related offences;

(4) A major setback to democracy and the rule of law;

(5) It is extremely challenging to develop accountable political leadership in a corrupt environment;

(6) Breeds discontent, frustration, deprivation, criminality and terrorism.

It is important to note that all the above definitions clearly explain the concept of corruption. However, we are more concerned with political corruption. We therefore adopt in totality, the definition of Alapiki, Transparency International and the World Bank Group on this subject matter.

Fiscal federalism

The basic foundation for the initial theory of Fiscal Federalism was laid by Kenneth Arrow, Richard Musgrave and Paul Sadweh Samuelson’s two important papers (1954, 1955) on the theory of public goods. Musgrave (1959)’s book on public finance provided the framework for what became accepted as the proper role of the state in the economy. The theory was later to be known as ‘Decentralisation Theorem’ (Ozo-Eson, 2005: 1). Within this framework, three roles were identified for the government sector. These were the roles of government in correcting various forms of market failure, ensuring an equitable distribution of income and seeking to maintain stability in the macro-economy at full employment and stable prices (Musgrave, 1959). Thus, the government was expected to step in where the market mechanism failed due to various types of public goods characteristics. Governments and their officials were seen as the custodians of public interest who would seek to maximize social welfare based on their benevolence or the need to ensure electoral success in democracies (Ozo-Eson, 2005).

Each tier of government is seen as seeking to maximize the social welfare of the citizens within its jurisdiction. This multi-layered quest becomes very important where public goods exist, the consumption of which is not national in character, but localized. In such circumstances, local outputs targeted at local demands by respective local jurisdictions clearly provide higher social welfare than the central provision. This principle, which Oats (1999) has formalized into the “Decentralization Theorem” constitutes the basic foundation for what may be referred to as the first generation theory of fiscal decentralization (Bird, 2009). The theory focused on situations where different levels of government provided efficient levels of output of public goods for those whose special patterns of benefits were encompassed by the geographical scope of their jurisdictions (Oates, 1999: 5).

Fiscal federalism is therefore a general normative framework for the assignment of functions to the different levels of government and appropriate fiscal instruments for carrying out these functions. Sharma (2005: 38) perceives fiscal federalism as a set of guiding principles, a guiding concept that helps in designing financial relations between the national and sub-national levels of the government, fiscal decentralization on the other hand as a process of applying such principles

Fiscal federalism is concerned with “understanding which functions and instruments are best centralized and which are the best placed in the sphere of decentralized levels of government” (Oates, 1999: 1120). In other words, it is the study of how competencies (expenditure side) and fiscal instruments (revenue side) are allocated across different (vertical) layers of the administration. An important part of its subject matter is the system of transfer payments or grants by which a central government shares its revenues with lower levels of government (Arowolo, 2011). In fact, it is characterized by the fiscal relations between central and lower levels of government. That is, it is manifest by the financial aspects of development of authority from the National to the Regional or State and Local levels. Fiscal federalism covers two interconnected areas. The first is the division of competence in decision making about public expenditures and public revenue between the different levels of government (national, regional and local). Secondly, there is the degree of freedom of decision making enjoyed by regional and local authorities in the valuation of local taxes as well as in the consideration of their expenditures.

In other words, fiscal federalism refers to the allocation of tax-raising powers and expenditure responsibilities between levels of governments (Akindele and Olaopa, 2002) and it concerns the division of public sector functions and finances among different tiers of government (Ozo-Eson, 2005: 1). In undertaking this division, the emphasis is on the need to focus on the necessity for improving the performance of the public sector and the provision of their services by ensuring a proper alignment of responsibilities and fiscal instruments. In summary, fiscal federalism presupposes the fundamental importance of improved public sector performance geared towards accountability and responsibility with the deliberate intention of improving governance at all strata of government (Arowolo, 2011).

Budgetary process

Business Dictionary (2017) defines a budget is as an estimate of costs, revenues, and resources over a specified period, reflecting a reading of future financial conditions and goals. Also, UNIFEM (2000) conceptualizes a budget as an action plan for a specific period of time covering all departments, functions and facets of an organization and containing targets to be achieved both in physical and financial terms, which serve as important criteria of performance. Specifically, the government budget can be defined as ‘a statement of government’s estimated revenues and proposed expenditures for the year’ (Mwansa, 1999). Accordingly, Egobueze (2018: 54) identified the following features of a budget:

(i) It is a plan, that is, financial plan of operations;

(ii) It is for a fixed or given period of time which is normally a year;

(iii) It contains both estimated incomes and expenditure, and;

(iv) It contains authorizations to collect incomes and incur expenditure once approved.

The budget is thus the most important economic policy tool of government and provides a comprehensive statement of the priorities of the nation (Wehner and Byanyima, 2004). Budgets at the national level are a means to achieve stated government objectives. These objectives are usually stated in government policies and therefore a budget becomes the means by which the policies are implemented. It reflects a government’s social and economic priorities, it is therefore a key instrument for the implementation of social, political and economic priorities over a given period (Centre for Democracy and Development, 2008: 13). Government budgets were initially designed to serve the purpose of legislative accountability. This means that the government informs the public, through their legislatures, about their estimate revenues and proposed expenditures.

A budget has two main components-revenue and expenditure. The Revenue Budget provides revenue forecasts of government over the budget year. It comprises income tax, corporate tax, excise duties, aid flows and other relevant sources of revenue. The Expenditure Budget is divided into +Capital Expenditure and Recurrent Expenditure. Recurrent expenditures are expenditures on goods and services that are consumed immediately such as personnel cost and overhead. Capital expenditures refer to money spent on purchase of goods that can be used to produce other goods and services.

According to Budlender et al. (1998), in addition to legislative accountability, the budget serves three key economic functions namely, allocation of resources, distribution of income and wealth and stabilization of the economy.

In another dimension, budgeting is simply a process of preparing budgets. It refers to the procedures and mechanisms by which the budget is prepared, implemented and monitored. Budget is very crucial for the economic development of any nation. The budgeting process traces the budget in one year from conception through preparation, approval, execution, control, monitoring and evaluation. The budget process can be portrayed as an annual cycle; it relates to all the activities that are carried out before, during and after a budget period. Budget processes all over the world share four common purposes. They provide a review of past economic performances; mobilize and allocate resources; provide for financial management and accountability; and, act as a platform for introduction of new policies (Ngwira, 2000). The modern budgetary process in the public sector is divided into four distinct phases. They are: budget formulation or drafting; legislative review and approval; budget implementation or execution; and budget audit (UNIFEM, 2002; Wehner and Byanyima, 2004).

In order to explain the phenomenon under study, and properly understand the nature and dynamics of contemporary Nigerian politics, a reflection of our historical antecedents to evaluate how Nigerian society has evolved since the advent of imperialism and colonialism and understand the socio – economic conditions of their present material base is significant. This must be accompanied by an appraisal of her contemporary experience (Barongo, 1978).

The nature of political life in a particular society, the types of institutions that are created and sustained and the peculiar patterns of political process are a function of the interplay among three main factors, namely, the condition of the material base of society, the historical experience of that society and the actor’s perception, interpretation and response to environmental stimuli. The role of culture, that is to say, the values of the people, their beliefs and the dominant systems of ideas in shaping the political process and in dictating particular forms of political organization, is by no means being minimized. But the values, beliefs and ideas have their basis in and reflect very fundamentally on the nature of the economic base and relations it creates among the people as well as the historical experiences of society. It is primarily the material environment which determines the formation of cleavages in terms of social groups and classes with competing interests and thereby defines the character and structure of political interaction in a competitive bargaining situation (Barongo, 1978). Nigeria was initially inhabited by various independent ethnic groups, with defined geographical territory that exercised authority over their people. The society was generally a pre-capitalist, but the advent of colonialism fused these groups together and integrated Nigeria into the world capitalist system. Since colonialism did not need to create a capitalist state in Nigeria in order to obtain raw materials for British industries or control and protect the market for the metropolis, it introduced elements of capitalism but not capitalism. Colonialism as a logical extension of imperialism distorted the Nigerian economy, and introduced new relations of production and accumulation.

Worst still, the colonial economy was a racist economy. It was dominated by foreign capital and interest which controlled every sector of the economy. This act inhibited the process of capital accumulation by the Nigerian bourgeoisie during this period and restricted their involvement in the economy to the service sector as compradors. But the indigenous bourgeoisie were not content with this status as it impeded large scale capital accumulation. They therefore sought political power as a means of furthering their economic interests. This culminated in the struggle for independence. To this class the British ceded political power at independence while retaining economic power. Political independence only became possible because the existence of this class guaranteed that the substance of economic domination could continue despite the ceding of the political power (Ake, 1996). So lacking economic base, the Nigerian ruling class since independence is thrown back on what it has, political leverage. It has used political power to amass wealth through corruption in an attempt to consolidate its material base to the extent that political power is now the established way to wealth. Those who win state power through election or coup can have all the wealth they want even without working, while those who lose the struggle for state power cannot have security in the wealth they have made by hard work. The capture of the state power inevitably becomes a matter of life and death (Ake, 1996).

By way of summary, corruption and the attendant contradictions in Nigerian fiscal federalism and the non performing budgetary process could be seen as manifestations of the inherent contradictions in the struggle by dominant ‘power elites’ to consolidate their positions and expand their accumulation base.

The focus of this paper is on political corruption and political corruption is a persistent phenomenon in Nigeria. President Muhammadu Buhari, cited by Information Nigeria (2015), described corruption as the greatest form of human right violation. Since the creation of modern public administration in the country, there have been cases of official misuse of funds and resources. It is instructive to say that the rise of public administration and the discovery of oil and natural gas are two major events that aided corrupt practices in Nigeria (Donwa et al., 2015).

Some writers have tried to explain the causes of corruption in Nigeria. Many blame greed and ostentatious lifestyle as a potential root cause of corruption. Wraith and Simpkins (1963) have argued that some societies in love with ostentatious lifestyle may delve into corruption to feed the lifestyle and also embrace a style of public sleaze and lack of decorum. They also stressed that, the customs and attitudes of the society may also be a contributing factor. Gift giving as expressions of loyalty to traditional rulers may be fabrics of the society. Also, a political environment that excludes favour towards elites or wealthy citizens may also be influenced by corruption. Wealthy elites may resort to sleaze in order to gain power and protect their interest. They further argued that ethnicity is another major cause of corruption in Nigeria. Friends and kinsmen seeking favour from officials may impose difficult strains on the ethical disposition of the official as holding necessary avenues for their personal survival or gain. It is important, however to state that these explanations are mere manifestations of corruption in the society; they do not give a comprehensive explanation. The comprehensive explanation of this phenomenon lies in the Marxist political economic theoretical frame which shall be discussed later in this paper.

During the Pre-Independence and the First Republic, corruption was prevalent in Nigeria but was kept at manageable levels. However, the cases during this period were clouded by political infighting. Dr. Nnamdi Azikiwe was the first major political figure investigated for questionable practices in connection with the African Continental Bank in 1944. Though he was exonerated, but the panel was not very comfortable with the role he played in the scam.

In Western Nigeria, Adegoke Adelabu was also investigated on allegations of corruption against him. The report led to demand for his resignation as district council head. During the military regime of General Yakubu Gowon, corruption was for the most part of the administration kept away from public view probably because of the civil war but was blown into the open in 1975 when there was scandal surrounding the importation of cement which engulfed many officials of the Defence Ministry and Central Bank of Nigeria. When that regime was overthrown, the General Murtala Mohammed/Olusegun Obasanjo’s regime was able to minimize corruption, but the Shehu Shagari administration that superintended over the Second Republic (1979-1983) witnessed massive corruption. The first Executive President of Nigeria, Alhaji Shehu Shagari, had appeared to be a lame duck and helpless in the face of mammoth corruption under his nose (Liman, 2017). The General Buhari/Idiagbon regime that took over the reins of power (December 1983-August, 1985) fought against indiscipline and corruption and convicted some corrupt politicians. This regime was however sacked in a palace coup led by General Ibrahim Babangida. The regime of General Ibrahim Babangida (IBB) that replaced the Muhammado Buhari’s regime could be assumed as a body that legalized corruption. During the IBB’s regime, corruption became a policy of the state. Vehicles and cash gifts were routinely disbursed to earn loyalty, and discipline of the military force eroded. IBB used various government privatization initiatives to reward friends and cronies which eventually gave rise to the current class of novena-rich in Nigeria. From banking to oil and import licenses, IBB used this favour to raise cash for himself and his family and is regarded as one of the richest ex-rulers of Nigeria supposedly with significant investment in Globacom – one of the largest telecom operators in Nigeria, regarded as a front for his empire. The regime also refused to give account of the Gulf war windfall, which has been estimated to be $12.4 billion (Abiola, 2017). The regime of General Sani Abacha revealed the global nature of graft. The French investigators of the bribes paid government officials to ease the award of a gas plant constructed in Nigeria revealed the level of official graft in the country. The investigations led to the freezing of accounts containing about $100 million United States dollars. In 2000, two years after his death, a Swiss banking commission report indicted Swiss banks for failing to follow compliance process when they allowed General Sani Abacha’s family and friends of access to his accounts and to deposit amount totaling $600 million US dollars into them (Ezenobi, 2014: 30). The same year, more than $1 billion US dollars were found in various accounts in Europe. The General Abdusalami Abubakar administration (June, 1998 – May, 1999) was short and focused on transiting the country quickly to democracy; however, the administration was implicated in the Halliburton scandal which is yet to be resolved. It is worthy to note that unconfirmed reports hold that the administration in less than six months squandered over $4 billion saved in Nigeria’s foreign reserve.

From the foregoing, it is obvious that there was massive corruption in Nigeria during the Second Republic and the military regimes of General Ibrahim Babangida and General Sani Abacha respectively. Since the advent of the Fourth Republic in 1999 till date, corruption has persisted. From the administration of President Olusegun Obasanjo to President Goodluck Jonathan, Nigerians’ fiscal federalism has been inundated corruption.

Corruption was not limited to the military era; it also displayed its ugly face during the administration of President Olusegun Obasanjo. Various corruption scandals broke out, including one of international dimensions. The Vice President, Alhaji Atiku Abubakar was allegedly caught with a US Congressman William Jefferson in illegal transfer of millions of USD into United State of America (Sahara Reporters, 2018). Another very celebrated case was the report of the United States Department of Justice on January 18, 2012 which announced that Japanese construction firm Marubeni Corporation agreed to pay a $54.6 million criminal penalty for allegedly bribing officials of the Nigerian government to facilitate the award of the $6 billion liquefied natural gas contracted in Bonny, Nigeria to a multinational consortium TSKJ (United States Department of Justice, 2012). They paid the bribe to Nigerian government officials between 1995 and 2004 in violation of the United States Foreign Corrupt Practices Act. So many other inglorious acts of corruption laid their heads under the watch of President Olusegun Obasanjo. Many Governors, Chairmen of Councils and National and State Assembly Members who served during the period under review had questions to answer for corruption.

Furthermore, President Umaru Musa Yar’Adua’s administration was short but had a fair share of corruption scandals. Yar’ Adua’s acts of political corruption included the use of his Attorney General, Michael Andoakaa to frustrate local and international investigations against his powerful friends like Governors James Ibori, Lucky Igbinnedion and Peter Odili who were alleged to have looted their states’ treasury.

The administration of President Goodluck Jonathan was famous in high level corruption. The regime indeed fanned the embers of corruption. Part of the corrupt cases of the administration was the infamous removal of the then Central Bank of Nigeria (CBN) Governor Sanusi Lamido Sanusi and his replacement by Godwin Emefele over his accusation of the Nigerian National Petroleum Company (NNPC) for non-remittance of the consolidated revenue fund of the sum of $20 billion US dollars which it owed the federation. Upon the release of both the PWC and Deloitte report by the government at the eve of its exit, it was however determined that truly, close to $20 billion was indeed missing or misappropriated or spent without appropriation. In addition, the government of Goodluck Jonathan had several running scandals including the BMW purchase by his Aviation Minister, for over $250 million, security contracts to known militants in the Niger Delta, massive corruption and kickbacks in the Federal Ministries, especially, Petroleum, Malibu oil International scandal and several others involving the Petroleum Ministry (Nairaland Forum, 2016). In the dying days of Goodluck Jonathan’s administration, the Central Bank scandal of cash tripping of mutilated notes also broke out, where it was revealed that in a four days period, 8 billion naira was stolen directly by low level workers in the CBN (Daily Post Nigeria, 2015)

New allegation of corruption has emerged since the departure of President Jonathan on May 29, 2015. Some of the cases are:

(i) $2.2 billion illegally withdrawn from Excess Crude Accounts of which $1 billion supposedly approved by President Jonathan to fund his reelection campaign without the knowledge of the National Economic Council made up of state Governments and the President and Vice President.

(ii) The Sambo Dasuki $2 Billion Arms deal scandal

(iii) Nigerian Extractive Industries Transparency Initiative (NEITI) discovered $11.6 billion missing from Nigeria Liquefied Natural Gas (LNG) Company Dividend payments.

(iv) 60 million barrels of oil valued at $13.7 billion was stolen under the watch of the national oil giant, Nigerian National Petroleum Corporation from 2009 to 2012.

(v) The Nigerian Extractive Industries Transparency Initiative (NEITI) indicates losses due to crude swaps due to subsidy and domestic crude allocation from 2005 to 2012 which indicates that $11.63 billion had been paid to the NNPC but no evidence of remittance to the federation account.

(vi) Nigerian Maritime Administration and Safety Agency (NIMASA) fraud under investigation by EFCC, inclusive of accusation of funding the Peoples’ Democratic Party (PDP) and buying a small piece of land for ₦13 billion naira.

(vii) The Minister for State, Petroleum, Ibe Kachikwu’s alleged accusation of Dr. Baru, the Group Managing Director of Nigeria National Petroleum Corporation (NNPC) of insubordination in the awards of contracts worth over nine trillion naira without due - process.

Corruption is a huge burden to Nigeria’s fiscal federalism and the federal budgetary process. In the year 2000, Transparency International carried out a survey on corruption levels of some countries, including Kenya, Cameroon, Angola, Nigeria, Cote-d’Ivoire, Zimbabwe, Ethiopia, Ghana, Senegal, Zambia, India, Venezuela, Moldova, and others. At the end of the ranking, Nigeria was ranked as the 98 most corrupt only after Cameroon (Transparency International, 1999). Nigeria was the most corrupt country in the year 2000 in Africa. In 2001, Nigeria was ranked as the second-most corrupt nation in the world out of 91 countries, behind Bangladesh. In the year 2002, Nigeria was again ranked as the second most corrupt country in the world after the Transparency International conducted a survey of 102 countries. In 2003, Nigeria received the same ranking, making no improvements from 2003. In 2007, among a total of 180 countries surveyed, Nigeria ranked 147. In 2012, Nigeria was 139 out of the 176 countries surveyed. In 2013, Nigeria was ranked 144 out of 177 countries surveyed (Appendix Table 1).The image of Nigeria as a very corrupt country is public knowledge. Only recently, the former Prime Minister of the United Kingdom, Cameroon, declared in a brief to the Queen of England that ‘Nigeria is fantastically corrupt’ (Vanguard News, 2016). Corruption has permeated all aspects of Nigerian fiscal federalism both vertically and horizontally. Corruption has also affected her infrastructural development. A journey through all Nigerian states, especially the local communities shows dearth of infrastructure at all levels. The political class that hold sway at all branches of government has infamously stolen the wealth of the nation. They corruptly enrich themselves through frivolous contracts awarded to themselves, families and friends or proxies. These infrastructural contracts in the form of roads, drainages, housing units, to name but a few are hardly executed. This accounts for infrastructure deficit in Nigeria.

Corruption is at the core of the crisis of governance and legitimacy, fiscal federalism, the establishment of a stable democratic order, rule of law, development and welfare of citizens. The most pandemic of all forms of corruption in Nigeria is political corruption. There is the marchantilization of the polity for quick access to economic wealth (Egobueze, 2018: 10). Political power therefore is seen as heavens’ gate for economic wealth, thus, in quest for both political and economic powers, the leaders engage in all forms of corruptions, jettisoning due process, which is the gateway to good governance. Corruption is indeed the major explanation for the seemingly insolvable problem of poverty, disease, hunger and general acute development tragedy in Nigeria (Egbue, 2006). Naanen (2015: 44) argued that of all the attributes of resource curse, corruption seems to have had the most profound negative impact on development in Nigeria. Thus, Alemika (2011) posited that ‘Nigerian electoral process and governance system largely rest on the logic and practices of organized criminal enterprises. Organized crime entrepreneurs employ secrecy, cooptation, corruption and violence to promote and defend their interests and organizations. In congruence with the above, Human Rights Watch (2007, 12) noted:

‘Many of Nigeria’s ostensibly elected leaders obtained their positions by demonstrating an ability to use corruption and political violence to prevail in sham elections. In violent and brazenly rigged polls, government officials have denied millions of Nigerians any real voice in selecting their political leaders. In place of democratic competition struggles for political office have often been waged violently in the streets by gangs of thugs- youths -recruited by politicians to help them seize control of power’

Other than the huge development resources that are stolen and laundered locally and abroad, corruption weakens the state and its institutions and undermines the prospects of development. It is estimated that Nigerian elites stole about 400 billion and 600 billion dollars between 1960 and 1999 and that amount stashed in foreign accounts rose from 50 billion dollars in 1999 to 170 billion dollars in 2003 (Naanen, 2015: 44).

FISCAL FEDERALISM IN NIGERIA

One of the most contentious issues in Nigeria is the problem of fiscal federalism. This is because it is characterized by constant struggle, clamour for change and, very recently, violence in the form of agitation for resource control in the Niger-Delta Region and vociferous call for restructuring in general. Today, we operate fiscal centralism instead of fiscal federalism. Calls by lower tiers of government for a more decentralized fiscal arrangement have consistently been rejected by the Federal Government. The issue has, over the years, engaged the attention of various Commissions and Committee, some of which are:

(1) Phillipson Commission (1946): This commission recommended the use of derivation and even development as criteria for distribution of revenue. By derivation, the commission means each unit of government would receive from the central purse the same portion it has contributed.

(2) Hicks-Phillipson Commission (1951): This commission recommended need, derivation, independent revenue or fiscal autonomy and national interests as the criteria for revenue sharing.

(3) Chicks Commission (1953): The commission recommended derivation.

(4) Raisman Commission (1957): This commission recommended need, balanced development and minimum responsibility. Percentage division of 40% to the north, 31% to the east, 24% to the west and 5% to Southern Cameroon.

(5) The Binns Commission (1964): This commission rejected the principles of need and derivation. In its place, it proposed regional financial comparability and percentage division of 42% to the north, 30% to the east, 20% to the west and 8% to the mid-west.

(6) Dina Commission (1969): it recommended national minimum standards, balanced development in the allocation of the states joint account and basic need.

(7) Aboyade Technical Committee (1977): It recommended national minimum standards for national integration 22%, equality of access to development opportunities, 25%, absorptive capacity, 20%, fiscal efficiency, 15% and independent revenue effort, 18%. Other criteria are: 57% to Federal, 30% to State Government, 10% to Local Governments and 3% to a special fund.

(8) Okigbo Committee (1980): It recommended percentages on principles: Population, 4%, equality, 4%, social development, 15% and internal revenue effort, 5%. Percentages for governments: Federal, 53%, States, 30%, Local Governments, 10%, Special Fund, 7%.

(9) Danjuma Commission (1989). It recommends percentages: Federal, 50%, States, 30%, Local Governments, 15%, Special Fund, 5%.

Other laws and decrees on revenue allocation are:

(i) Decree 15 of 1967

(ii) Decree 13 of 1970

(iii) Decree 9 of 1971

(iv) Decree 6 of 1975

(v) Decree 7 of 1975, (Arowolo, 2011).

The establishment in 1999 of Revenue Mobilization Allocation and Fiscal Commission (RMAFC) was a response by the Federal Government to provide for all embracing and permanent revenue bodies in Nigeria. RMAFC is a body that reflects the Federal Character Principle in its membership composition and has enabling laws which empower the commission to carry out its statutory functions. In principle, it is assumed that the tax sharing powers between the various tiers of government are designed to guarantee the equitable distribution of the nation’s wealth in the spirit of true fiscal federalism. Analyzing the roles of RMAFC vis-à-vis the politics of revenue allocation in Nigeria, RMAFC has sustained the notion of fiscal imbalance in the country (Arowolo, 2011).

In 2001, the fiscal body made a draft proposal with this sharing formula, the Federal Government got 41.3%, State governments, 31%, local governments, 16% and special fund, 11.7%. However, this particular proposal was nipped in the bud following the Supreme Court pronouncement on resource control in April, 2002. By the year, 2003, the fiscal body had a new proposal for revenue sharing formula as follows: Federal, 46.63%, State, 33.00%, Local Government, 20.37%.

It is however important to state that the Constitution of the federal Republic of Nigeria, 1999 (as amended) has provided the basis of revenue allocation in Nigeria. Sections 16, 80 and 162 define the character of Federalism in the Nation. Section 16 and 80 are eloquent testimonies of fiscal centralism. For instance, Section 16 amongst others empowers the Federal Government to harness the resources of the nation, promote national prosperity and control the national economy. The other levels of government are not given prominent role in harnessing resources of the nation. This is indeed in error as all the levels of government should have been made to take very active part in the nations’ resources. This is the reason why much emphasis is laid on allocation of resources at the lower levels and not generation. While Section 80 provides that all revenues or other moneys raised or received by the Federation shall be paid into and form one Consolidated Revenue Fund of the Federation (CFRN, 1999).

The main Section that deals with fiscal federalism is Section 162. This Section provides that the Federation shall maintain a special account to be called “the Federation Account” into which shall be paid all revenues collected by the Government of the Federation except the proceeds from the personal income tax of the armed forces of the Federation, the Nigerian Police Force, the Ministry or Department of Government charged with responsibility for Foreign Affairs and the residents of the Federal Capital Territory, Abuja. It also heighted the principles of revenue allocation as those of population, equality of States, internal revenue generation, land mass, terrain as well as population density; provided that the principle of derivation shall be constantly reflected in any approved formula as being not less than thirteen per cent of the revenue accruing to the Federation Account directly from any resources.

Incidentally, the Constitution did not limit the principle of derivation to 13%, but since the adoption of the Constitution, only 13% had been paid with respect to derivation to Oil Mineral Producing States. It is important to state that President Olusegun Obasanjo attempted to deny the oil bearing states of the Niger Delta the 13% when he introduced the onshore/offshore dichotomy before the Supreme Court ruled against Federal Government on that subject on 5th April, 2002.

Sections 7 and 8 as well as 162 (6) and (7) of the Constitution of Federal Republic of Nigeria 1999 (As Amended) subordinated the Local Governments to the States. Indeed, they erode financial autonomy of the Local Governments Councils. Subsection 6 provided that each state shall maintain a special account to be called ‘State Joint Local Government Account’ into which shall be paid all allocations to the Local Government Councils of the State from the Federation Account and from the Government of the State (CFRN, 1999). The implication of this subsection is that there is no direct allocation to the Local Government Councils in the Federation; hence, there is no financial autonomy or independence. The monthly allocation should have come directly from the federation account to the account of each of the local governments. As at now, financial autonomy of the Local Government Councils is a subject of debate. This is because there is undue interference by some state governments on the local government allocation (Ojirika, 2016).

It is very clear from the above, that fiscal laws in Nigeria give more powers to the Federal Government than the other levels of government. States and Local Governments are not given strong fiscal incentives or encouraged to generate revenue internally. In view of this, they are weak financially and depend on Federal allocation, whereas, for any federation to be sustained, there must be fiscal decentralization and financial autonomy. Unfortunately, in the case of Nigeria, there is fiscal centralization.

In analyzing the approximate net allocation to the thirty-six states of the Federation between May 29, 1999 and November 2003 in Nigeria, over two trillion naira was allocated to the States (Appendix Table 2). However, it is pertinent to note that the increment in allocation to states has not provided the needed impetus that will usher in development and growth at the state level. The revenue increment over the years has only further created an avenue for most state governors to loot their treasury. While the revenue allocation has not led to any meaningful development, it is discernible that the federal government is taking more than its fair share.

This arrangement of allocation sharing in Nigeria threatens initiatives, innovation and modern ideas of generating resources, especially money, for sustainable development. The Federal Government, on the other hand, cannot also be divested of this revenue allocation ‘pathology’ since it appropriates and concentrates too much money and power at the centre leading to waste and corruption. Arowolo (2011) argued that ‘the Federal Government lacks a basic plan for the transformation of resources into concrete developments’. This also explains the reasons for the ‘do or dies’ phenomenon in Nigerian politics. Little wonder that despite enormous resources in Nigeria, the country is still rated one of the poorest countries in the world.

It is important to state at this juncture, that the contradictions in Nigeria’s fiscal federalism were sharpened by the introduction of the Richard Constitution of 1946 which divided the country into three regions. This gave the process a political character quite early and tied it with the class formation project of the nationalist elites which were then involved in the competition to inherit political power from colonial Britain. In this way, revenue allocation became central to Nigerian federalism and struggle for power and resources. Another is the rise of oil as the mainstay of the Nigerian economy. The phenomenon of oil exploration placed Nigeria as the seventh largest oil exporter. This made oil the central issue in fiscal federalism. Over-dependence on oil impacted negatively and posed serious challenges to the issues of fiscal federalism in Nigeria. The last is the incursion of military in the Nigerian government and politics which brought about centralization and massive corruption in the Federation.

FEDERAL BUDGETARY PROCESS IN NIGERIA

Nigeria operates a federal and presidential system of government. This provides that the executive arm of government headed by the President should prepare an annual budget for the services of the country while the legislative arm as represented by the National Assembly should authorize expenditure by passing the Appropriation Bill into an Act. Thus, preparation of the budget in Nigeria is a shared responsibility of the Executive and Legislative arms of the Federal Government.

Federal budget in Nigeria starts with formulation. This is followed by a budget summit/workshop which is organized for Ministries, Departments and Agencies (MDAs) of government to discuss issues surrounding the budget for the next fiscal year. Secondly, the Ministry of Finance (Budget office) issues a call Circular to all MDAs. The call Circular describes the objectives of the proposed budget and the strategies to achieving them (Macroeconomic policies). It also provides guidelines to be followed in preparing the budget proposals and the statement of resources projections for the budget period. Third is internal preparation of budgets. In the Ministries, Agencies and Departments (MDAs), the Planning, Research and Statistics (PRS) department is largely responsible for collating budget and plan estimates of ministries. After the call circular is received, the Ministry sets up a Budget Preparation Committee which calls for proposals from all Department and Agencies of the Ministries. It compiles all information received and prepares a budget estimates for the ministry. This is considered by the Ministry’s top management and adopted. Fourth is bilateral discussion/budget defense. Bilateral discussions are held between each MDA and the Budget office where the budget proposals are appraised and defended by line Agencies. The defense is to ensure that the MDAs have complied with guidelines as well as ensure that core projects are emphasized in the budget estimates; and that the budget does not exceed approved budget expenditure limits or envelopes for the MDA. The last is preparation of draft budget. After the Budget defense meetings, the Budget office collates all proposals from MDAs and prepares a Draft Budget which is sent to the Federal Executive Council for discussion and approval. After that, a final draft is prepared and submitted to the National Assembly by the President as the Appropriation Bill (Centre for Democracy and Development, 2008: 16-17).

The second stage of the budget process is legislative scrutiny and approval. The budget is considered separately by the two chambers of the National Assembly in accordance with the legislative practice and procedures. The two houses harmonize their drafts and the recommendations of the various committees are considered and collated with the oversight of the MDAs. The harmonized budget is approved separately by each Chamber of the National Assembly, after which, the positions of the houses are harmonized and presented as the Appropriation Bill to the President for assent. Once the President assents to the Appropriation Bill, it becomes an Act of the National Assembly.

The third stage is budget implementation. The executive arm of government is responsible for budget implementation. Budget implementation is undertaken by various Ministries, Department, and Agencies (MDAs) of the Federal Government. The Ministry of Finance plays a leading role in ensuring that funds are allocated to spending departments in line with the approved budget (Wehner and Byanyima, 2004).

The final stage in the budget process is monitoring and evaluation of the budget. The monitoring is done by the Ministry of Finance, National Planning Commission (NPC), the National Assembly, the National Economic Intelligence Agency (NEIA), the Presidential Monitoring Committee (PBMC), the Office of the Auditor General of the Federation and the Accountant General of the Federation. Oversight is an important and constitutional part of lawmaking, thus, legislators are required to monitor the implementation of budget by the Executive Arm of Government. By virtue of Section 88 of the Constitution, the National Assembly is empowered to conduct investigations into any matter or thing with respect to which it has power to make laws (CFRN, 1999). Finally, the Civil Society Organizations are also important in budget monitoring.

CORRUPTION AND FISCAL FEDERALISM IN NIGERIA: ANALYSIS OF THE FEDERAL BUDGETARY PROCESS, 1999 - 2016

Budget is the most important economic policy tool of government and provides a comprehensive statement of the priorities of the nation. We stated earlier that the objectives of budgets are for legislative accountability, allocation of resources, distribution of income and wealth and stabilization of the economy. Unfortunately, during the period under review, the budgetary process in Nigeria has failed to achieve these objectives. The resultant effect is mass poverty, the elimination of the middle class, concentration of wealth in the hands of privileged few who have access to the apparatus of state power, a large army of unemployed youths, poor infrastructural development and infrastructural decay, the rising spate of insurgency and militancy threatening the corporate existence of Nigerian State. These have made many to describe Nigeria as a failed state. Since 1999, most of the fiscal budgets of the Nigerian government have followed an increasing dimension. For instance, in 2000, the budget was ₦677,511,714,732; in 2001: ₦894,214,805,186; in 2002: ₦578,582,851,520; 2003: ₦699,057,649,979; 2004: ₦889,154,844,588; 2005: ₦1,354,615,243,138; 2006: ₦1,518,877,922,467; 2007: ₦1,880,923,949,983; 2008: ₦2,213,230,236,349; and 2016: ₦6,077,680,000,000 (Appendix Table 3).

The budgetary process in Nigeria is normally very long and cumbersome. From 1999 till 2016, the Nigerian budget had never been passed before the fiscal year commences. Appropriation Bills in Nigeria are passed two, three, or four months into the fiscal year of operation. What this means is that capital budget does not take-off until about five to six months after the commencement of a given fiscal year. This to a large extent defeats the objectives of the budget. For instance, the 2016 Appropriation Bill was presented in December 2015, passed by the National Assembly in March and assented to by the President in May 2016. Political corruption in any country starts from the budgetary process. In a very corrupt country like Nigeria, the budget is done in secret, releases are done in secret, procurement information is not made available to citizens and corruption is guarded and protected (Igbuzor, 2014). Since 1999, the budgetary process in Nigeria has been inundated with massive corruption at all levels of the budget circle; namely - formulation, legislative approval, implementation and audit/oversight.

Heads of Ministries, Departments and Agencies are alleged to collaborate with the officials of the budget office to pad the budget for pecuniary interest. This allegation became obvious in the 2016 budgetary process when it was discovered by President, Muhammadu Buhari that top officials of the budget office and some other MDAs padded the budget. In reaction to this development, the President approved the sack of the Director-General of the Budget Office, Mr. Yahaya Gusau and ordered the redeployment of 22 top staff of the budget office who were involved in the irregularities. Apart from the budget office, 184 senior staff of the MDAs involved in the budget padding were also redeployed. To this end, Senator Babafemi Ojudu, Special Adviser to President Buhari observed: Under previous governments the budget would go through the ministries and the budget office padding, then to the National Assembly and the National Assembly would also add its own padding. They would give highlights of the budget to the President and he signed. As he was signing they were adding more to it and there were billions of naira free out there for people to share (Vanguard News as retrieved 3/1/2018).

Corruption also manifests during legislative review/approval of the budget. As we have noted earlier, the National Assembly of Nigeria is constitutionally empowered to consider and approve Appropriation Bills. Therefore, in the process of consideration of the draft budget, the various MDAs appear before the relevant Committees of the two Chambers of the National Assembly to defend their proposed budget. In that process, some members of the National Assembly ask and receive bribe from some MDAs to increase their budget. A typical example of this was in the 2005 Appropriation Bill in which the then Minister of Education, Professor Fabian Osuji gave to the Senate President, Adolphous Wabara and six other members of the National Assembly the sum of #50 million to increase the budgetary allocations to the Ministry of Education. The then President of the Federal Republic of Nigeria, President Olusegun Obasanjo made this known in a nationwide broadcast to the nation on Tuesday, 22nd March, 2005 and dismissed the Minister, while referring the matter to the EFCC and the ICPC for trial of the culprits (Nigerian Muse, 2006).

A very important stage of the budget process is implementation. Within the period under review, the Nigerian budget has not been implemented up to 50% annually. That is why there are thousands of uncompleted and abandoned projects scattered throughout the country. The report of the Federal Government’s Committee on Abandoned Projects in 2011 revealed that there were 11,889 Federal Governments’ capital projects in the country which would require ₦7.78 trillion to complete. This ₦7.78 trillion required to complete the project is more than 8 times of the actual amount spent on capital projects in 2010. It was also revealed by the committee that billions of naira was lost to dubious contractors and Public Officers through brazen inflation of contracts (Omolehinwa, 2014).

Bulk of corruption that takes place in the budgetary process occurs during the implementation stage. For instance, in August 2015, President Buhari directed the National Security Adviser, Mohammed Mongonu to set up a 13-member Investigative Committee on the Procurement of Hardware and Ammunitions in the Armed Forces from 2007. The committee was set up against the background of the myriad of challenges that the Nigerian Armed Forces have faced in course of ongoing counter – insurgency operation in the Northeast, including the apparent deficit in military platforms with its attendant negative effects on troop’s morale. From the interim report of the committee in January 2016, President Buhari ordered the arrest of former Chief of Air Force, Adesola Amosu and other top officers of the Nigerian Air Force for widespread diversion of funds and fraud. The report also indicted the former National Security Adviser (NSA), Sambo Dasuki, former Chief of Defense Staff, Alex Badeh, and another former Chief of Air Staff, Mohammed Umar. The above mentioned persons are presently standing trial in court. The committee said that some of the award letters contained misleading delivery dates, suggesting fraudulent intent in the award process. The discrepancies are in clear contravention of extant procurement regulations. For instance, contract was awarded by the office of National Security Adviser for the procurement of two used M1-24V Helicopters instead of the recommended M1-35M series at the cost of $136,944,000.00. It was however confirmed that the helicopters were excessively priced and not operationally air worthy at the time of delivery. Indeed, a brand new unit of such helicopter goes for about $30 million. The Committee also established that out of 4 used Alpha-Jets they claimed to have procured for the Nigerian Armed Forces (NAF) at the cost of $7,180,000.00, it was confirmed that only two of the Alpha-Jets aircraft were ferried to Nigeria after cannibalization of engines from NAF fleet. This is contrary to the written assertion of the former Chief of Air Staff, Air Marshal A N Amosu to the former NSA that all the 4 procured Alpha-Jets aircraft were delivered to the NAF (Premium Times, 2017). The brazen corruption was indeed monumental. The difference in price was over $106,000,000.00. How this could be explained. At this juncture, it could be said without contradiction that budget failure is not new in Nigeria. It has always been there. The fact is that since independence, the funds approved for projects for execution of projects have not been judiciously utilized, and the executive, both at the Federal and State levels has hardly complied with budget provisions.

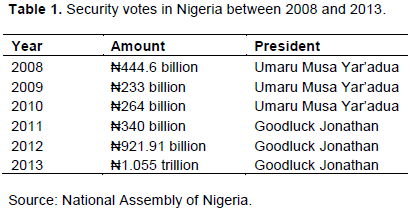

One of the areas corruption manifests so brazenly in the budgetary process in Nigeria is in defense/security. Without mincing words, looking at the billions of naira and dollars that are yearly budgeted and expended on defense/security related matters, one would observe that the huge budget does not justify what is on ground. The poorly equipped status of the Nigeria military is exposed by its struggle and difficulty in the fight against Boko Haram sect and curtailing the general insecurity situation in the country. The issue of transparency and accountability and its importance in Nigeria’s yearly defense/security budgets cannot be over emphasized. Often times what we see is the opposite. The usual language used is that ‘for security reasons’ details of expenditure are not advisable to be disclosed. For this reason the politicians and the top military brass hide under this excuse to perpetrate massive corruption in the military budget. From the year 2008 to 2016, key government MDAs under security and defense got the lion share of budgetary allocations. Table 1 shows the security votes in Nigeria between 2008 and 2013.

Nigeria has joined the league of countries that are known to spend a good chunk of their budgetary allocation on security. Nigeria ranks 57 in the global rating on military expenditure. It occupies the 7th position in Africa while it is regarded as the largest spender in the West African sub region. The ranking was based on Nigeria’s military expenditure in 2009 (Eme and Anyadike, 2013). Defense is a critical sector and has enjoyed favourable consideration in funding; yet, the Nigerian defense facilities are poor. When we carefully consider the huge budget that yearly goes into the Nigerian defense sector, we would understand the need for more transparency and accountability. It is important to state that the key players in the Nigerian Defence industry comprise the President, who by virtue of occupying this position is also the Commander-in-Chief of the Armed Forces. Others are the Minister of Defence and the Defense Ministry, Chief of Defense staff, Chief of Army staff, Chief of Air staff and Chief of Naval staff. It is incomprehensible and disheartening that in spite of these huge budgetary allocations to defense and security, there is high incidence of insecurity across the country. This simply goes to show that the Defense or Security Votes are not properly implemented due to corruption.

Corruption is also perpetrated at the level of budget audit or oversight. This is the last segments in the budget circle. This is mainly undertaken by the Budget Office, Office of the Auditor General of the Federation and the Committees of the National Assembly. At this level, there is a lot of compromise especially from the Committees of the National Assembly. Most times, while exercising their functions, these committees receive bribe from erring or corrupt MDAs and contractors and refuse to expose such corruption. They only expose corruption where corrupt MDAs refuse to compromise. A good example is the case of Farouk Lawal and the subsidy scam in 2012. In January 2012, Farouk Lawan chaired the House of Representatives Committee that investigated the Nigerian government fuel subsidies scandal. The Committee’s report released in April of the same year revealed a huge scam in which Nigerian fuel companies were being paid hundreds of millions of dollars in subsidies by the government for fuel that was never delivered. The scam was estimated to cost the country $6.8 million dollars. In February, 2013, Farouk Lawan was charged with corruption after he allegedly accepted $500,000 dollars from Femi Otedola, a Nigerian billionaire tycoon as part of $3 million dollars bribe Lawan solicited from Femi Otedola (Vanguard, 2016). Femi Otedola claimed that Farouk Lawan demanded the bribe in order to have his companies, Zenon and Synopsis removed from the list of companies that the Committee had accused (Premium Times, 2017). The two companies were delisted during the house debate after the bribe had been received. Today, Senator Farouk Lawal is standing trial in court because of this scandal.

The paper reveals that political corruption has been present in Nigeria right from independence till date but minimal at the earlier stage statehood. Today, it has grown in size and magnitude and almost becoming uncontrollable. Also, it reveals that the entire budgetary process within the period under review was underlined by lack of transparency and accountability with attendant massive corruption. It further argues that the unparalleled corruption has led to consistent poor budgetary performance, mass poverty, poor infrastructural development, infrastructural decay and sub national political revolt as is demonstrated in the ethnic militias and insurgency. The paper concludes that the problem under consideration must be seen as the manifestations of the inherent contradictions in the struggle by the dominant power elites in Nigeria to consolidate their positions, put down challenges to their power and expand their accumulation base.

Arising from the above discourse, the following recommendations are advanced:

(i) The political elites must rise to the challenges of good governance, patriotism, nation building and development by making a conscious effort to fight against corruption at all levels in governance to save Nigeria from being a failed state.

(ii) The political economy must be restructured to break out from the present monocultural economy that depends on crude oil by diversification to open - up other sectors of the economy to reduce quest for political power to control the allocation of the oil revenue at the centre.

(iii) The Constitution should be restructured to give room for true federalism. The present Federal structure in which the sub-national units are politically and economically weak contradicts the principles of federalism. In the current Constitution of the Federal Republic of Nigeria as amended, the Federal Government controls 68 items in the Exclusive List and also dominates the States in Concurrent List which contains only 30 items of lower dimension. This has made the State Governments to depend absolutely on the Federal Government for monthly allocation of revenue which is not healthy for federalism. Indeed, this situation exists principally in fiscal centralism and not fiscal federalism.

(iv) The budgetary process at all levels should be made more transparent and the MDAs should be accountable. The budget of any MDA should not be passed until it shows that the performance of the previous budget is in line with the Appropriation Act. Also, the Appropriation Bill should be presented on time by the President, considered and passed on time by the National Assembly before the commencement of the fiscal year of operation is imperative. Towards achieving this, we recommend that a time limit for the presentation and passage of the budget (Appropriation Bill) be included in the current constitutional amendment.

(v) In order for the MDAs to take capital budget implementation seriously, there should be timely release of funds to them in order to plan and implement their programmes and projects.

The authors have not declared any conflict of interests.

REFERENCES

|

Abiola O (2017). Nigeria endemic corruption, genetic or acquired? in Witness,

View › Opinion. Accessed 2 Jan 2018.

|

|

|

|

Ake C (1996). Democracy and Development in Africa, Washington, D.C.: Brookings Institution Press.

|

|

|

|

|

Akindele ST, Olaopa K (2002). Fiscal federalism and local government finance in Nigeria: an examination of revenue, rights and fiscal jurisdiction, in Omotoso F (Ed.), Contemporary issues in public administration, Bolabay Publications, Lagos pp. 46-64.

Crossref

|

|

|

|

|

Alemika E (2011). CLEAN Foundation: Post – Election Violence in Nigeria.

|

|

|

|

|

Alapiki H (2015). The state and the culture of terrorism in Nigeria: Unveiling the real terrorists, Port Harcourt, University of Port Harcourt Press Ltd, an inaugural lecture.

|

|

|

|

|

Arowolo D (2011). Fiscal Federalism in Nigeria: Theory and Dimensions. Afro Asian Journal of Social Sciences 2(2.2):11

|

|

|

|

|

Barongo JR (1978). Understanding African Politics : The Political economy approach, cited in Ojirika CU (1999). Military Governments in the Third World and the Concept of Legitimacy: The Nigerian Experience being an a thesis submitted in partial fulfilment for the award of M. SC in Political theory and Methodology, University of Port Harcourt.

|

|

|

|

|

Bird RM (2009). Taxation in Latin America: Reflections on sustainability and the balance between efficiency and equity, working paper [0306], Rotam School of Management, Toronto, University of Toronto,

|

|

|

|

|

Budlender D, Sharp R, Allen K (1998). How to do a Gender-Sensitive Budget Analysis: Contemporary Research and Practice, Commonwealth Secretariat, London, UK.

|

|

|

|

|

Business Dictionary. 2017.

View Accessed

|

|

|

|

|

Business Dictionary Budget (2018)

View Accessed

|

|

|

|

|

CFRN (1999). Federal Republic of Nigeria (1999). Constitution of the Federal Republic of Nigeria (Promulgation) P24.

|

|

|

|

|

Centre for Democracy and Development (2008). Gender – Responsive Budgeting and Parliament, A hand book for Nigerian Legislators, Abuja.

|

|

|

|

|

Daily Post Nigeria (2015). EFCC arrests six CBN staff, 16 banks' staff over N8bn scam, dailypost.ng › Metro › Crime Accessed 2 Jan 2018

|

|

|

|

|

Daudu J (2011). Voice of the bar: A compendium of speeches and presentations of Joseph B. Daudu, SAN, 25th President of Nigerian Bar Association, Mutaled Printers: Kaduna.

|

|

|

|

|

Donwa PA, Mgbeme CO, Julius OM (2015). Corruption in the oil and gas industry: implication for economic growth. European Scientific Journal 11(22):1857-7881 (Print) e - ISSN 1857-7431

Crossref

|

|

|

|

|

Dawodu.com (2006). Dedicated to Nigeria's History, Socio – Economic and Political Issues

View Accessed 2 Jan 2018

|

|

|

|

|

Egbue NG (2006). Africa: Cultural Dimensions of Corruption and Possibilities for Change. Journal of Social Sciences 12(2):83-91.

|

|

|

|

|

Egobueze A (2018). Budget and Budgeting Process in Hand book on Legislative Process and Procedure in Local Government, Port Harcourt, A&G Hildian Ltd.

|

|

|

|

|

Eme OI, Anyadike N (2013). Security challenges and security votes in Nigeria, 2008-2013 in Kuwait Chapter. Arabian Journal of Business and Management 2(8).

|

|

|

|

|

Ezenobi B (2014). The Hypocrisy of Corruption Eradication in Nigeria IOSR Journal of Humanities and Social Science (IOSR-JHSS).19(3),36-42e-ISSN:2279-0837,p-ISSN:2279- 0845.

|

|

|

|

|

Human Rights Watch (2007). Election or "Selection"? Human rights abuse and threats to free and fair elections in Nigeria.New York.

|

|

|

|

|

Igbuzor O (2014). Federal Government and zero-based budgeting (1), The Guardian,

View Accessed 3 Jan 2018

|

|

|

|

|

Musgrave RM (1959). The theory of public finance. NY: McGraw-Hill.

|

|

|

|

|

Mwansa CC (1999). The Role of Ngos, Government and Parliamentarians in Engendering Budgets. In Gender-Responsive budgeting and parliament: A handbook for Nigerian legislators, Heinrich Boll: Nigeria SEBN, 2000, New Newsletter of the South East Budget Network of Shelter Rights Initiative, January – March, (Lagos, Nigeria).

|

|

|

|

|

Naanen BBB (2015).The Prosperity and Poverty of Nations: Using Global Models to explain and mitigate under development in Nigeria: An Inaugural Lecture, University of Port Harcourt P 119.

|

|

|

|

|

Nairaland Forum (2016). A documented history of political corruption in Nigeria.

View Accessed 3 Jan, 2018

|

|

|

|

|

Nigerian Muse (2006). Wabara opens up on Osuji bribery December 28,

View Acessed 3 Jan, 2018

|

|

|

|

|

Oates WE (1999). An essay on fiscal federalism, America: Journal of Economic Literature 37(3):1120-149.

Crossref

|

|

|

|

|

Ojirika CU. (2016). Fiscal Federalism and Local Government Financial Autonomy in Nigeria, 1999-2015. Being a seminal paper presented in partial fulfillment of the course: POL 925-Seminar on Nigeria's fiscal federalism, January, Port Harcourt, Department of Political and Administrative Studies, University of Port Harcourt.

|

|

|

|

|

Omolehinwa E (2014). Public Finance management: Issues and challenges on budget performance. A paper presented at ICAN symposium on Federal Government of Nigeria 2014 Budget at Muson Centre, Onikaa Lagos on July, 2014.

|

|

|

|

|

Ozo-Eson, (2005), Fiscal Federalism: Theory, Issues and perspectives. Daily Independent pp. 5-6.

|

|

|

|

|

Premium Times (2017). EFCC set to charge Mr. integrity, Farouk Lawan, for corruptionhttps,

View

|

|

|

|

|

Premium Times (2017). Corruption, Greatest Rights Violation Ever – Buhari

View

|

|

|

|

|

Sahara Reporters (2018). How former US Congressman William Jefferson was jailed, freed Over Bribe Saga in Nigeria.

|

|

|

|

|

Sharma CK (2005). The Federal Approach to fiscal decentralization: Conceptual contours for policy makers. Loyola Journal of Social Sciences 19(2).

|

|

|

|

|

The National Conference (2014). Report of the Committee on Political Restructuring and Forms of Government May.

|

|

|

|

|

Transparency International, Our Organization (1999). FAQs on corruption – Transparency International,

View

|

|

|

|

|

Transparency International (2017). What is Corruption

View Accessed Jan 5 2018.

|

|

|

|

|

Ugaz J (2017). Corruption Perceptions Index 2016: Vicious circle of corruption and inequality must be tackled, Transparency International.

|

|

|

|

|

United Nations Development Fund for Women (UNIFEM) (2002). Women, war and peace: the independent experts' assessment on the impact of armed conflict on women and women's role in peace-building.

View

|

|

|

|

|

United Nations Development Fund for Women (UNIFEM) (2000). Targets and Indicators: Selections from the Progress of the World's Women. New York, UNIFEM.

View

|

|

|

|

|

Vanguard Online (2016). Alleged $3m bribery scandal: 'Lawan caught on video collecting $500,000 from Otedola'.

|

|

|

|

|

Wehner J Byanyima W (2004). Parliament, the budget and gender. Inter-parliamentary Union, UNDP, World Bank Institute, and UNIFEM.

|

|

|

|

|

World Bank Group (2018). Anti-corruption guidelines for World Bank guarantee and carbon finance transactions

View

|

|

|

|

|

Wraith R, Simpkins E (1963). Corruption in Developing Countries. London: George Allen & Unwin Ltd. 1963. 208 and (index) 3 pp. 30s. net, cloth; 20s. net, paper.

|

|