This article intends to find out contributions of microfinance of one coastal NGO in Bangladesh and satisfaction of clients. It is found that 91.51% of microfinance clients are female and majority of the respondents (63.10%) received loans from three to eight times. A number of clients failed to succeed due to adverse effects of climate change and man-made tyrannies like nuisance of pirates at fishing grounds. However, in all, 42.44% of total clients are highly satisfied on services carried out by microfinance. 51.29% of them are moderately satisfied; and 6.27% are highly dissatisfied. This paper concludes that a significant number of microfinance personnel do not receive this program in an interesting way. The management should look into the possibilities of how the program can be made in an interesting manner. If the working situation is monotonous in nature, the quality of the program will never be in good shape.

Bangladesh has an area of 147,570 km2 and a population of about 149,772,364; making it the most densely populated country in the world. It ranked 142th out of 187 countries, of the UN Human Development Index and has been improving over the last decade (United Nations Development Programme, 2014). World Bank (2013) finds that despite population growth, the population of poor households declined by 26% in 10 years. The number of extremely poor people also declined from 44 million in 2000 to 34.6 million in 2005, and down to 26 million in 2010 - a massive 41%decrease.

Bangladesh is justly famous globally for pioneering the growth of the microcredit. Microcredit revolution of Bangladesh is well known internationally. The importance of microcredit for expansion of consumption and asset base of the extreme poor is well established through empirical research (Planning Commission of Bangladesh 2015). The term ‘Microcredit’ and ‘Microfinance’ have different natures in understanding and operations. However, in the areas of microcredit, rules were developed for the Microcredit Regulatory Authority (MRA) in 2010 to properly supervise Microfinance Institutions (MFIs) and protect both the borrowers and the lenders. There are a number of scholarly literatures available on historical evolution, structure, institutional operations, and major roles of microfinance with its prospects and problems. Thus, this paper does not insight on those issues and concerns.

The overview of this article is based on microfinance operations of one renowned coastal NGO in Bangladesh. In this paper, an endeavor is made to pinpoint some issues of lives and livelihoods of coastal communities. Based on primary research, this article mainly attempts to find out contributions of CODEC Microfinance Program (CMFP) and how present clients perceive about quality of services. Specific objectives are: (1) To know major changes of microfinance clients in their lives and livelihoods and experiences of them to deal with such program; and (2) To identify level of satisfaction of present clients on existing services, delivery processes, and accumulate recommendations (if any) for improving quality of services.

CODEC microfinance

Since its establishment in 1985 as a people centered development organization, Community Development Centre (CODEC) has been growing and evolving into efficient and effective non-governmental development organization in the coastal areas of Bangladesh. CODEC has been tracking to a holistic approach towards poverty alleviation in the coastal areas through intensive participation of underprivileged men, women, adolescents and children.In vision, CODEC dreams of coastal communities that earns, enjoys and shares the pride of Bangladesh in becoming a middle-income country by 2021. In mission, CODEC sees its existence for a coastal communities, in which people individually or collectively embrace new and differentiated forms of institutions, utilize their resources for safe and sustained livelihoods and become rights-demanding citizens in a climate change affected physical, social and economic settings. Now CODEC is implementing different multi-donor projects with its 3,560 personnel.

CODEC microfinance program is stipulated and planned to alleviate liquidity constraints, enhance both income and consumption for the poor, socio-economic improvement; thereby augmenting wellbeing of them. At present, CMFP is implementing in eleven coastal districts, that is, Chittagong, Laxmipur, Noakhali, Chandpur, Patuakhali, Barguna, Barisal, Jhalakhati, Pirojpur, Bagerhat and Khulna. It has 116,431 microfinance clients under 94 Branches and four Zonal Offices. CODEC serves different loan and saving packages. For instance, (A) Rural Micro Credit (RMC)-‘Jagoron’, (B) Micro Entrepreneur (ME)-‘Agroshor’, (C) Ultra Poor (UP)-‘Buniath’, (D) Agriculture and Seasonal loan only for RMC members, (E) Apodkhalin (emergency) loan only for hardcore members, and (F) different special projects.

This study adopts a mixed method, applying both qualitative and quantitative methodologies in collecting, assessing and analysis data. Seven districts were covered by this study. Initially, names of all the branches were listed under four zones. Then 15 branches were selected randomly (Table 1).

This study covers three types of clients from above Branches: (A) Rural Micro Credit (RMC), (B) Micro Entrepreneur (ME), and (C) Ultra Poor (UP). A total of 15 clients of RMC, three clients of ME, and two clients of UP were selected from each branch. Respondent selection was done by random sampling from a table listing of respective clients. Total 225 clients of RMC, 45 clients of ME, and 16 clients of UP (Char Gazi, Bobanigonj, Boshurhat, S. Munshirhat, Boalia, Chitalmari, and Rampal Branches not having UP program) were selected randomly from 15 branches for interview. In reality, 15 clients were migrated or displaced to big cities even nearby countries due to different reasons.

A total of 271 respondents were surveyed by a comprehensive set of questionnaire. Questionnaire centered on basic demographics, occupational pattern, types of loan, affiliation with CODEC microfinance, amount of loan, major changes, utilization of loan, profitable scheme, causes of success or failure, comparison between CODEC and other development organizations, behavior and support of CODEC personnel, and level of satisfaction on microfinance services. Open-ended questionnaire was used for the survey (Figure 1; Table 2).

CODEC hired 15 data collectors that completed Higher Secondary Certificate (HSC) from same locality. Out of them, five were males and ten were females. They were trained in classroom so that they can understand the questionnaire and conduct field work independently.

Coastal areas of Bangladesh

Bangladesh has a coastline of 710 kilometers and an Exclusive Economic Zone (EEZ). There are different views on the delimitation of the coastal areas. The conventional view is that the land that is inundated by the high and low tides is called the coastal belt. Coastal zones refer to areas where land and sea meet. Three indicators have been considered for determining the landward boundaries of the coastal zone of Bangladesh. These are: influence of tidal waters, salinity intrusion and cyclones/storm surges. 19 districts of the country are being affected directly or indirectly by some of these phenomena. The districts are considered including all upazilas(sub-district)/thanas (police station). A total of 48 upazilas/thanas in 12 districts are exposed to the sea and/or lower estuaries are defined as the exposed coast and the remaining 99 of the coastal districts are termed interior coast (WARPO 2005). Over the periods, Government of Bangladesh (GoB) realigned jurisdictions and declared some new administrative units. Now 161 upazilas/thanas are comprised in 19 coastal districts (Ministry of Public Administration, 2013; Bangladesh Police, 2013).

Coastal areas of Bangladesh face with several natural hazards like cyclone, storm surge, flood etc. In addition, there have man-made different hazards like arsenic, water-logging and salinity in water and agricultural land. Noteworthy, this zone has diverse eco-systems: man-grove, marine, estuary, islands, coral, sandy beaches, sand dunes and has both 'world heritage sites' and 'ecologically critical areas'. Coastal zone offers immense potential for economic growth. Renewable and nonrenewable energy, marine resources, beach minerals tourism are some of the less explored areas.

Table 3 shows geographical coverage, households and population of coastal districts. It is found that 28.42 percent of total population of Bangladesh lived in coastal districts in 2001. Growth rate of population has been declined due to lack of employment opportunities, livelihood problems and social challenges.

People of coastal areas are still braved and struggling with many odds. Nowadays the threat of cyclonic storm like Sidr, Aila and tidal wave and cyclone of 1970, 1991, 2007 and 2008 has become a permanent phenomenon in their life. The Constitution of Bangladesh bestows special provision for development of disadvantaged areas including remote coastal areas. Moreover, a total of 87 Members of Parliament (MPs) were directly elected in ninth parliamentary election from coastal districts. Despite having potentials, socio-economic conditions of coastal communities remain disappointing and, in some extents, improving steadily.

Composition of respondents

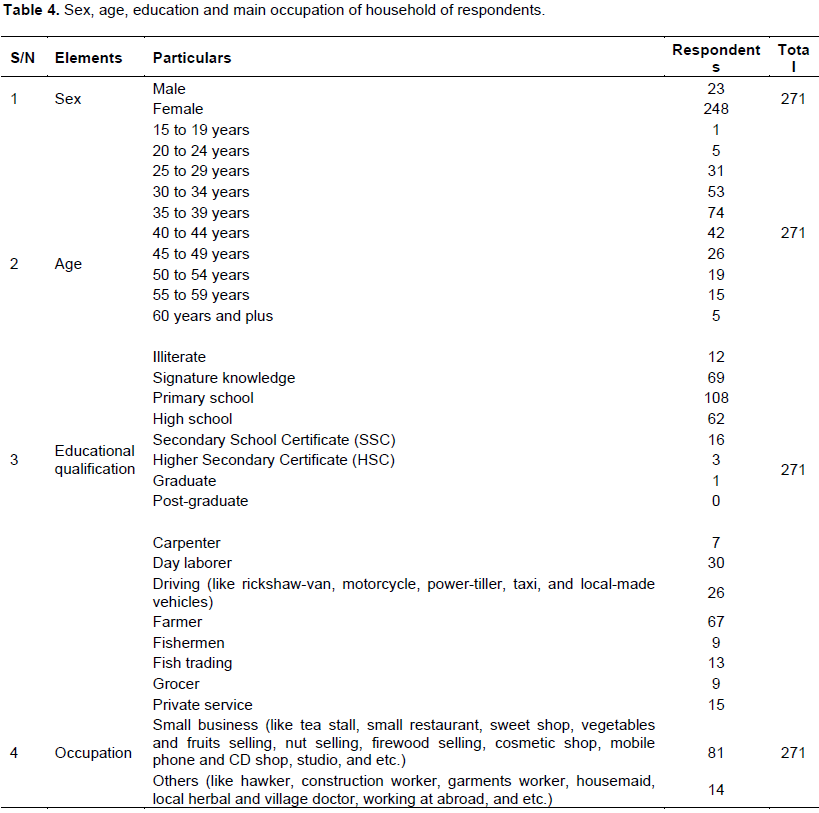

Composition of respondents reveals that 91.51% of microfinance clients are females; whereas 8.49% are males. Remarkably, in Micro Entrepreneur (ME) program; percentage of male respondents is a little bit dominating, 51.11%. Age of majority respondents (62.36%) is between 30 to 44 years. Main occupation of majority households of respondents is farming and small-scale business (54.61%). It is apparent that occupation of respondents and main occupation of respective households is not significantly matching. As for example, 80.81% clients are housewives. However, a significant number of women clients are actively engaged in household development affairs. As for example, they are involved in aquaculture, fish trading, small business, vegetable gardening, handicrafts, cow fattening, road construction, and other activities. A few women clients, especially in Laxmipur-Noakhali Zone, profess that their loans are used by their family members. Table 4 shows biographic characteristics of clients and main occupation of respective households.

Affiliation with CODEC and loan amount

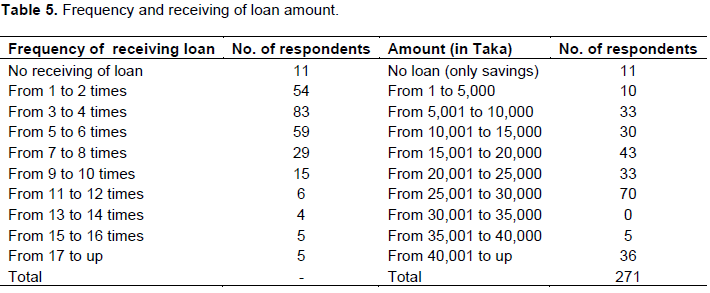

Majority of respondents (63.10%) received loans from three to eight times and affiliated with CODEC. In majority cases, length of affiliation of clients with CODEC is higher than duration of receiving loan. Table 5 shows that a total of 11 respondents did not receive any loan from CODEC. They only continue savings at CODEC. Thus, in statistical representation, 260 respondents will be tabulated to find out their major changes in lives and livelihoods.

Major changes

In re-call method and open-ended questionnaire structure, respondents were asked to find out major changes, that is, comparison between past (i.e. while admitting in CODEC) and present conditions. They answered in different ways on relating aspects of their lives and livelihoods. All answers may or may not be coincided CMFP, but would be useful to analyze their socio-economic aspects in holistic approach. In this study, the following only six elements were measured:

1. Income

2. Quality of food

3. Education

4. Medical treatment

5. House

6. Asset

Before analyzing above six elements, Table 6 shows success or failure of clients in their running schemes and rate of defaulter under four zones.

In Laxmipur-Noakhali Zone, rate of success in existing schemes is highest; and Bagerhat Zone is lowest in this regard. In same manner, rate of defaulter is lowest at Laxmipur-Noakhali Zone; and defaulter is highest in Bagerhat Zone (Table 7a-c). This study does not intend to find out affiliation of clients with other organizations, that is from how many organizations they receive loans. Out of 59 households, 72.88% households have a positive improvement in their income. However, rate of improvement in assets accumulation is low, that is 47.46%. Clients are able to meet food, shelter, education and health (on average: 58.58%).

Out of 67 households, 74.63% households have a positive improvement in their income. However, rate of improvement in house modification is low, that is 52.24%. Clients are able to meet food, education and health (on average: 63.68%). Riverbank erosion in Char Gazi area hampers income of clients and loses assets.

Out of 89 households, 71.91% households have a positive improvement in their income. However, rate of improvement in assets accumulation is low, that is, 42.70%. Clients are able to meet food, shelter, education and health at different rates. Noteworthy, households depend on fishing (especially in Charduani Branch); their income improvement is comparatively lowest (50.00%) due to insecurity at fishing grounds and depletion of fishing resources.

Out of 45 households, 60.00% households have a positive improvement in their income. However, rate of improvement in assets accumulation is low, that is 35.56%. Noteworthy, majority of clients have chicken, ducks, pigeons but those were not considered in asset calculation. Assets refer, herein, land, vehicle, television, furniture, and etc. Clients are able to meet food, shelter, education and health (on average: 49.45%).

Utilization of loan and profitable scheme

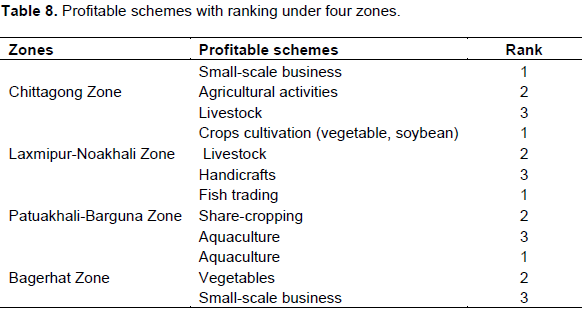

Clients used loans in diversified ways. It varied from area to area; and from client to client. Clients were requested, while data collecting, to state utilization of loans and profitable schemes. In Chittagong Zone, loans were mainly used for small-scale business, agricultural work, fish trading, house construction, livestock, marriage, and education. In Laxmipur-Noakhali Zone, loans were mainly used for cultivation, fish trading, fishing, handicrafts, livestock, land purchase, and bearing expenses for migration at abroad. In Patuakhali-Barguna Zone, loans were mainly used for making nets and boats, fish trading, livestock, leasing land and motorcycle, medical expenses, food consumption, house construction, and share-cropping. In Bagerhat Zone, loans were mainly used for aquaculture, land leasing, vegetable production, fish feeding, livestock, crab fattening, rickshaw-van, drinking water, and medicine. Table 8 shows profitable schemes with its ranking based on frequency.

Causes to be defaulter

This study finds that (Table 6) rate of defaulters is highest in Bagerhat Zone; and lowest in Laxmipur-Noakhali Zone. The major causes, list is not exhausted, to be defaulter are as follows:

1. Lack of proper technical support and supervision by personnel.

2. Lack of appropriate training on particular scheme.

3. Unproductive utilization of loan.

4. Lack of concentration of clients.

5. Lack of employment round the year.

6. Increasing living costs due to price spiraling and inflation.

7. Crisis of transportation due to political unrests.

8. Selling of goods at high volume on credit.

9. Prolonged diseases and fatal accident of family member(s) of clients.

10. To bear money and time for judicial case during long time.

11. Migration of earning member in city; and separation from clients.

12. Stolen of assets (like livestock).

13. Loss in aquaculture due to virus and diseases.

14. Depletion of fisheries resources.

15. Burning of illegal nets by law enforcing agencies.

16. Increasing costs of fishing gears and operating expenses; and deprivation from fair pricing of fishes.

17. Increasing costs of agricultural inputs (like seeds, fertilizers) but price of outputs is comparatively lower (like paddy).

18. Life threatening and torturing by sea pirates.

19. Frequent natural disasters.

20. Gambling by family members of client.

21. Suddenly prohibit to run CNG-driven taxi on highway by government.

Comparison with other development organizations

CODEC started its work for wellbeing of highly excluded fisherfolk in 1985 when some renowned NGOs of Bangladesh did not work with them. Still CODEC is working in remote and hard to reach coastal areas of Bangladesh. However, there are some national and local level NGOs like Grameen Bank, BRAC, ASA, Padakhep Manabik Unnayan Kendra, CARITAS, HEED Bangladesh, Proshika, TMSS, UDDIPAN, SANGRAM, SDF, Nabolok Foundation, MAMATA, PRISM Bangladesh, SAGARIKA, and others in working areas of CODEC.

12.92% of respondents are not able to compare between CODEC and other development organizations. They do not know about activities of other organizations. For instance, majority of ultra-poor clients do not know about other development organizations. 11.81% of total respondents reveal that there is no difference between CODEC and other development organizations. Activities of all NGOs are same. However, 61.25% of total respondents come up with positive attitude to activities of CODEC. They believe that activities of CODEC are better than other development organizations. On the other hand, 14.02% of total respondents remark that activities of CODEC are below standard than other development organizations.

In Chittagong Zone, respondents find out that CODEC provides medical treatment supports, formal and non-formal education for children, vocational training, job placement especially for Jaladas (servant of water) communities. CODEC also provides scholarship, education materials, stipend for higher studies, supports for persons with disabilities, and etc. Clients also repot that CODEC-managed schools and cultural activities are closed. Other development organizations give loan for house building and their amount of loan is higher than CODEC.

Laxmipur-Noakhali Zone clients express that CODEC has diversification in loan products especially seasonal loans for soybean. CODEC established rehabilitation colony and schools for river-bank eroded victims. However, education, cultural events, right-based activities have gradually been closed. Clients also mention that pressure of local NGOs is comparatively highest for collection of installment of loan.

In Patuakhali and Barguna Zone, respondents appreciate CODEC for comprehensive interventions for improving health and nutrition of pregnant and lactating mother and children, aquaculture, homestead gardening, Farmer Field School (FFS) approach, livestock training and vaccination, cash and kinds support to hardcore poor, blanket distribution to destitute, school for children, scholarship support, providing awards to children of clients who obtained excellent grade in PSC and JSC, rehabilitation support after Sidr, Mahasen (natural disaster), providing community legal services, awareness building against early marriage and domestic violence, eye camp, and etc. Respondents also mention that CODEC does not provide solar panel, medicine at free of cost, a significant numbers of CODEC-run school have been closeout, do not give financial and training supports for possible foreign migrants that other development organizations do at working areas.

In Bagerhat Zone, respondents recognize that CODEC established primary school where many disadvantaged children are obtaining education facilities. CODEC is implementing Shonglap (interactive dialogue) program for social and economic empowerment of disadvantaged adolescent girls. Adolescent girls are engaged in different social development activities as a change agent of society. CODEC has special coaching support for drop-out students to re-integrate in mainstreaming education. Children obtain scholarship and education fees. Clients identify that CODEC intensively works for aquaculture, agriculture extension, technology replication, and special support for hardcore poor according to Family Development Plan (FDP). Children of clients receive awards from cultural events of CODEC. Eye camp of CODEC and blanket distribution was appreciated by clients. However, clients also note that cultural activities of CODEC have gradually been closed. BRAC gives legal support and money transfer facilities. CARITAS and Nabolok Foundation provides livestock and goods at free of cost to respective clients.

Behavior of CODEC personnel

90.41% of total respondents reveal that behavior of CODEC personnel is good. On the other hand, 9.59% of respondents state that behavior of CODEC personnel is bad. Defaulting and collection of ‘installment of loan’ is one of the major issues for misbehavior between clients and personnel. A highly significant numbers of clients affirms that personnel respect them; like exchange greeting, asking about education of their children, conditions of health, and use respectful local words i.e. apa (elder sister), bhai (elder brother). Table 9 shows behavior of personnel in study area.

Level of satisfaction

In all, 42.44% of total clients are highly satisfied on services carried out by microfinance. 51.29% of them are moderately satisfied; and 6.27% are highly dissatisfied. Level of satisfaction varies from area to area and context-based. Tables 10 and 11 show level of satisfaction of four zones with its causes.

CODEC Microfinance Program (CMFP) has responsive attitude for wellbeing of its clients. Clients are moderately satisfied on existing services. But CODEC should replicate its best practices to all Zones in same manner. Sustainability of CMFP as well as livelihood development of clients are major concerning issues; as whole program is implementing in highly disaster-prone areas. The management should look into the possibilities how the program can be made in an interesting manner. If the working situation is monotonous in nature, the quality of the program will never be in good shape.

Recommendations

1. In the microfinance program, occasionally it was felt that the program is not interesting among the CODEC personnel. The management should look into the possibilities of how the program can be made in an interesting manner. If the working situation is monotonous in nature, the quality of the program will never be in good shape.

2. To ensure cent-percent easy procedure for quick approval of loan.

3. To ensure proper calculation and writing of installment and saving at passbook in front of clients and regularly update them.

4. To collect ‘installment of loan’ on monthly basis considering nature of scheme.

5. To organize training for personnel (from bottom to top) of CMFP on satisfaction and protection of clients.

6. To establish ‘centre’ for clients at convenient place; that can be a good platform for social activities (like education, health, family planning, early marriage, dowry, arbitration, and etc.) as well.

7. To increase amount of loan based on present inflation, market demand, and nature of scheme.

8. To increase season-based multi-types loan with its amount.

9. To start ‘education loan’ for higher study.

10. To provide award for selected champion clients; and arrange exposure visit for clients.

11. To organize trade-based training for clients.

12. To arrange Deposit Premium Scheme (DPS) in CODEC for clients.

13. To open ‘learning centre’ especially for women clients so that they can earn knowledge on basic arithmetic,

business plan, marketing, and social development issues.

14. To assist clients for replicating adaptive technologies in the field of climate change.

15. Marketing scopes should be facilitated for clients to ensure fair price.

16. To facilitate clients for linkage with social development programs of Government and Non-government organi-zations for sustainability.

17. To accelerate existing initiatives of CODEC social responsibility for human development of coastal belt in a structure manner.