ABSTRACT

This paper examines the major socioeconomic and demographic determinants of rural households’ saving behavior in Sinana district, Ethiopia. A random sample of 267 rural households was selected from four rural kebeles of the district. The study used both descriptive statistics and econometric model for the analysis of primary data. The result of descriptive statistics demonstrates that 47.2% of the sampled households preferred formal saving, 33.3% preferred informal saving and 19.5% preferred both formal and informal saving behaviors, respectively. Econometric result confirms that the probability of preferring informal saving increases with increase in access to credit and distance from formal financial institution, and decreases with increase in square root of annual total income as compared to preferring formal saving behavior. Similarly, the probability of preferring both formal and informal saving behaviors increases with increase in the tropical livestock holding, and decreases with increase in land size as compared to preferring formal saving behavior. Therefore, these variables need special attention in addition to the intervention of concerned authority if the saving behavior of rural households is to be improved.

Key words: Multinomial logistic model, households, saving behavior, Sinana district.

Saving is the portion of disposable income not spent on consumption and it is recognized as an important factor in economic development as it enables the conversion of resources into capital. For economic development of any country, growth is achieved by investment or capital accumulation and saving (Mankiw, 2001). In the developed countries, income is generated at a higher rate which encourages people to have more savings and push to more investment. But in a developing country like Ethiopia, the income standard is almost uncertain and leads to more consumption rather than saving (World Bank, 2012). The continent of Africa has been identified as having an unsatisfactory growth in saving rates, which slows down capital accumulation. Africa’s low saving rate influences the ability of banks to lend to small enterprises due to the limited availability of capital. Sub-Saharan countries are also facing low saving rate problem (National Bank of Ethiopia, 2011). In order to achieve higher rate of growth with relative price stability, the marginal propensity to save should be raised by appropriate incentives and policies. Also, in an era of international financial integration, for macroeconomic stability, higher domestic savings are essential (Degu, 2007). The household saving in Ethiopia has experienced a variety of changes over the past one or two decades due to changes in lifestyles and consumption models (Commercial Bank of Ethiopia, 2011). Saving in rural Ethiopia is mainly done out of the income from agricultural activities and characterized as seasonal and irregular as the cash flow through sale of agricultural product and availability of work is also seasonal (Dejene, 1993).

Several reasons, including low and irregular income and lack of access to financial services, have been contributing to low saving rate in developing countries. In addition, institutional factors, and higher expenditure patterns have found to be associated with lower levels of saving in sub-Saharan Africa (Beck et al., 2008). In Ethiopia, smallholders’ income is characterized as seasonal and irregular, in these situations, saving is usually less considered. The unavailability or few formal financial institutions in the rural areas of Ethiopia could be a disincentive for formal saving. The saving mobilization and development of saving habits of a given society will have an impact on capital accumulation and thus on economic growth of a country in general and on the financial well-being of the individuals in particular. In the case of Ethiopia, achieving and sustaining the high growth rates set out in Growth and Transformation Plan requires substantial capital formation and associated resource mobilization. Ethiopia’s record in mobilization of saving, access of domestic credit to the private sector as well as the gross capital formation compared unfavorably with the Asian comparators is relatively low (International Monetary Fund, 2014). In Ethiopia, the saving rate from gross domestic product is lowest when compared with that of China, Bangladesh and South Africa which have better saving rates (Commercial Bank of Ethiopia, 2011). The average share of gross domestic savings of Ethiopia during the year 1980 to 2012 was 12.4% of GDP creating the average resource gap of 6.1% during these years (Ethiopian Investment Agency, 2010) as cited by Girma et al. (2014).

Lugauer et al. (2017) argued on the saving behavior of Chinese households and confirmed that households with fewer dependent children have significantly higher saving rates. This result supports the idea that the decline in fertility rate has contributed to the increase in aggregate household saving over time. Study by Curtis et al. (2017) suggests that the decline in the share of dependent children accounts for the majority of the increased saving rates in China and India. On the other hand, the Japan’s saving rate since the mid-1970s is partially driven by the large and growing retirement aged population. Some scholars (Birhanu, 2015; Girma et al., 2014; Dufera et al., 2017; Tsega and Yemane, 2014) tried to explore important factors of household saving behaviors in Ethiopia using different approaches. None of these studies dealt with the preferences of saving behaviors of rural households. Little effort has been made to study the determinants of saving related to the individual’s behavior towards saving within rural sector, specifically in Sinana district (the study area). To achieve higher saving rate in rural areas, both socioeconomic and demographics determinants should be studied. Therefore, the current study intended to fill the mentioned gaps by exploring socioeconomic and demographic determinants of rural households’ saving behavior using econometric approach. The result of this study is informative to the responsible organizations that deal with promotion and regulation of rural savings and credit cooperatives, to cooperatives and their members and other beneficiaries.

This study was conducted in Sinana district of Bale zone which is located in the south eastern part of Ethiopia, 430 km from Addis Ababa (capital city of the country). Bale zone is characterized by rural dominancy and agricultural activity. The topography of Sinana district includes moderate, middle steep and plateaus. The altitude extends from 1700 to 3100 m above sea level. The estimated land area of the district is 163,854 hectare and it is known for its high production potential for crops such as wheat, barley, faba beans, emmer wheat, field pea and livestock such as cattle, sheep, goats, horses and donkeys. Crop and livestock productions are the dominant source of income for the communities of this district. A two stage random sampling technique was used to select a representative sample from the district. At the first stage, four out of twenty rural kebeles of the district were selected by simple random sampling technique. At the second stage, 267 households were selected by systematic random sampling for interview. The sample size was calculated using the following sample size determination formula for proportions (Cochran, 1977):

Where:

is proportion of households who are expected to prefer formal financial saving behavior,

is the value of standard normal distribution at a chosen level of significance and

is some margin of error in the estimation. The value of p is fixed at 0.50 due to the absence of previous study. Setting

, the total sample size obtained was 267 households out of 6010 total households of the selected kebeles. Since the finite population correction is not greater than 5%, it does not need adjustment. Structured questionnaire was used to generate primary data from the selected households. Both descriptive statistics and econometric model were used for the analysis of the primary data. Descriptive statistics such as mean, standard deviation and percentages were used wherever necessary. An econometric model, multinomial logistic model, was selected to identify the major socioeconomic and demographic determinants of rural households’ saving behavior. The multinomial logistic model is a multi-equation model in which a response variable with K categories will generate K-1 equations. The analytical model is constructed based on the utility maximization theory. Suppose that the utility to a household of alternative j is

where

From the decision maker’s perspective, the best alternative is simply the one that maximizes net private benefit at the margin. In other words, a household i will prefer saving behavior j if and only if

. Based on McFadden (1978), a household utility function from using alternative j can then be expressed as follows:

Estimation of the multinomial logistic model

The parameters

are typically estimated by the maximum likelihood technique which is given as:

The parameter estimates of the multinomial logistic model only provide the direction of the effect of the independent variables on the dependent variables. Thus, the estimates represent neither the actual magnitude of change nor the probabilities. Instead, the marginal effects are used to measure the expected change in the probability of a particular technique being chosen with respect to a unit change in an independent variable from the mean. The marginal effects of the characteristics on the probabilities are specified as:

Test of independence of irrelevant alternatives (IIA)

Independence of irrelevant alternatives refers to the situation where the odds in one outcome do not depend on other outcomes that are available or odds are mutually exclusive. In this sense, these alternative outcomes are “irrelevant.” What this means is that adding or deleting outcomes does not affect the odds among the remaining outcomes. This can be tested by the Hausman specification test and the test statistic has the following form:

Descriptive results

The current study was conducted on 267 randomly selected rural households of which 170 (63.7%) were male-headed and the rest, 97 (36.3%) were female-headed households. The distribution of marital status shows that majority of the people in the sampled households were married and account for 216 (80.3%). Regarding the education status, 155 (58.1%) of the sampled households were literate and the rest, 112 (41.9%) were illiterate. The religion categories of the sampled households shows that 166 (62.2%) of the respondents were Muslims and the rest, 101 (37.8%) were Christians (Table 1).

Income and expenditure are among the important variables that highly determine the saving behavior of rural households in any country since the level of household saving is basically reliant on the level of their income. The survey result (Table 2) shows that the average annual total income of the sampled households was 55,260 ETB with standard deviation of 49,020. The annual expenditure of the sampled households was calculated in Ethiopian Birr (ETB) and found to be 18,090 ETB with standard deviation of 14,890 (Table 2). When the income level of the sampled households increased, their expenditure also increased but not as income increased and rural households have a possibility that the expenditure is utilized on productive activities and this can again lead to an increase in savings. The result obtained implies that the annual income of the households in the study area is somewhat high relative to the result obtained by others in other districts of the region. The study explored different types of financial saving behaviors preferred by sampled households and accordingly confirms that 126 (47.2%) preferred formal saving, 89 (33.3%) preferred informal saving and 52 (19.5%) preferred both formal and informal saving behaviors, respectively.

Basic accesses such as access to credit and access to extension service are among the important variables to increase the awareness of the rural communities towards saving. The result of this study confirms that only 69 (25.8%) had access to credit and the rest significant number, 198 (74.2%), did not have access to credit. Regarding agricultural extension service, 167 (62.5%) of the sampled households had access to extension service and the rest, 100 (37.5%) did not have access to extension service (Table 3). From the result, it is shown that majority of the households in the study district do not have access to credit which they may use to purchase agricultural inputs which in turn helps to diversify their income. Distance from the nearest market and from formal financial institution is another important demographic characteristic of the households to determine saving behavior. Accordingly, the result shows that the sampled households are expected to walk 0.70 h on average to arrive the nearest market and the standard deviation was found to be 0.65, whereas the distance from formal financial institution was 1.40 h on average with standard deviation of 1.23 (Table 4). This result suggests that households have to go long distance to access the market and formal financial institutions and this may increase the cost of accessing formal financial institutions to practice formal financial saving options.

Econometric results

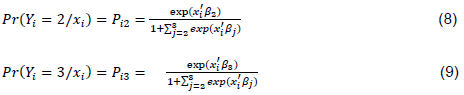

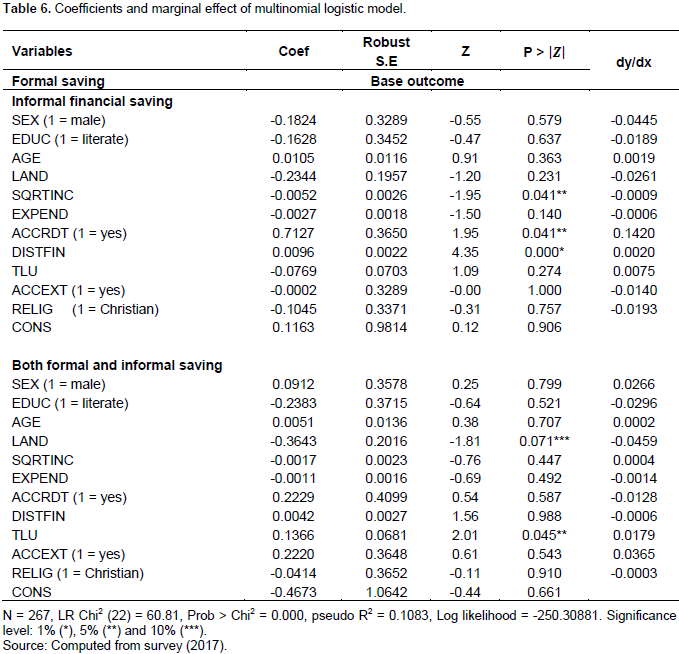

The multinomial logistic regression was used to assess factors affecting saving behavior of rural households with three categories of saving preferences: formal saving, informal saving, and both formal and informal savings. Prior to running parameter estimation of multinomial logistic model, the independence of irrelevant alternatives (IIA) assumption was tested by the Hausman specification test. The hypothesis of difference in coefficients not systematic was tested. Under IIA assumption, no systematic change in the coefficients is expected if one of the outcomes is excluded from the model. Hausman specification test confirms that there is no systematic change in the coefficients when one of the outcomes is excluded. This shows that the assumption is well fitted (Table 5). Table 6 presents the coefficients and marginal effects from multinomial logistic regression on the existing alternatives of saving behaviors. The sign of the coefficient shows the direction of influence of the variable on the logit. The results of the estimated marginal effects are discussed in terms of the significance and signs on the parameters. The results of the multinomial logistic model and marginal effect as well as their possible discussions are as follows: Square root transformation is applied to annual total income to decrease the variance.

Square root of annual total income (SQRTINC) negatively and significantly influenced the preference of informal saving behavior. The finding of the marginal effect shows that, other things being constant, square root of annual total income decreases the likelihood of preferring the informal saving behavior by 0.09% as compared to preferring formal saving behavior. The implication of the result is that households with high income are more likely to prefer formal saving behavior than those with low income. The result obtained is in line with theory that high income leads to high formal financial saving. The result obtained is in line with the result of Birhanu (2015) who showed that as annual income increases, the probability of households to save in formal financial forms increases. Access to credit (ACCRDT) positively and significantly influenced the preference of informal saving behavior. The result of marginal effect shows that access to credit increases the likelihood of preferring informal saving behavior by 14.2% as compared to preferring formal financial saving behavior keeping other variable constant. The household with access to credit may be more likely to prefer informal saving behavior from the credit they accessed in order to pay back the loan. The result obtained is contradictory to that of Birhanu (2015) who found positive impact of access to credit on the savings of households in formal financial institutions. Distance from formal financial institution (DISTINF) positively and significantly influenced preference of informal saving behavior.

The result of marginal effect shows that, other things being constant, distance from financial institution increases the likelihood of preferring informal saving behavior by 0.2% as compared to preferring formal saving. This implies that if formal financial institutions are far, households are more likely to save their money in local informal institutions such as ekub and edir. Land size (LAND) negatively and significantly influenced the preference of both formal and informal saving behaviors. The result of marginal effect shows that other things being equal, land size decreases the likelihood of preferring both formal and informal saving by 4.59% as compared to preferring formal saving. The implication is that as the land size of the household increases, the probability to earn more cash increases and this in turn promotes the probability of preferring formal saving behavior. Livestock holding (TLU) positively and significantly influenced the preference of both formal and informal saving behaviors. The analysis of marginal effect shows that, other things being constant, tropical livestock holding increases the likelihood of preferring both formal and informal saving behaviors by 1.79% as compared to preferring formal saving. The households with large number of livestock have more option to prefer both forms of saving behaviors (formal and informal) than those households with small number of livestock. The result obtained is in line with that of Girma et al. (2014) who found positive impact of livestock holding on the choice both in kind and financial saving forms.

CONCLUSION AND RECOMMENDATIONS

Majority of the sampled households preferred formal financial saving behavior. Basic accesses such as access to credit and access to extension service are not well expanded in the study area. The result of the study further showed that the probability of preferring informal saving behavior increases with increase in access to credit and distance from formal institution, and decreases with increase in square root of annual total income as compared to preferring formal financial saving behavior. Similarly, the probability of preferring both formal and informal saving behaviors increases with increase in the tropical livestock holding and decreases with increase in land size as compared to preferring formal saving behavior. Based on the findings of the study, two recommendations are forwarded: Firstly, development agents should be able to increase the awareness of rural communities on the importance of formal financial saving. Secondly, the interference of government and bank managers is needed to increase the accessibility of formal financial institutions in the rural areas so that the communities can easily have access in their local residence.

The authors have not declared any conflict of interests.

This study was funded by Research and Technology Transfer Vice President, Madda Walabu University.

REFERENCES

|

Beck T, Demirguc-Kunt A, Peria MS (2008). "Banking services for everyone"? Barriers to bank access and use around the world, World Bank Econ. Rev. 22(3):397-430.

Crossref

|

|

|

|

Birhanu M (2015). 'Factors affecting rural households' savings: The case of Gedeb Hasasa District, West Arsi Zone, Oromia Regional State', M.Sc Thesis, Haramaya University, Ethiopia.

|

|

|

|

|

Commercial Bank of Ethiopia (CBE) (2011). Ethiopian annual report, http://www.combanketh.et

|

|

|

|

|

Cochran WG (1977). 'Sampling techniques', (3rd edition), New York: John Wiley & Sons.

|

|

|

|

|

Curtis CC, Steven L, Nelson CM (2017). Demographics and Aggregate Household Savings in Japan, China and India. J. Macroecon. 51:175-191.

Crossref

|

|

|

|

|

Degu A (2007). Household savings behavior and determinants of savings in rural saving and credit cooperatives: The case of Western Amhara Region. M.Sc. Thesis, Haramaya University, Haramaya, Ethiopia.

|

|

|

|

|

Dejene A (1993). The Informal and semi-informal financial sector in Ethiopia: A study of the Iqqub, Iddir and Saving and Credit Cooperatives. Afr. Econ. Res. Consort. Res. P 21. ISBN 1-897621-15-9.

|

|

|

|

|

Dufera T, Shibru T, Girma T (2017). Determinants of rural households' savings: The case of Gindeberet woreda, Oromiya, Ethiopia'. Asian-Afr. J. Econ. Economet. 17(1):111-126.

|

|

|

|

|

Girma T, Belay K, Bezabih E, Jema H (2014). 'Saving patterns of rural households in East Hararghe zone of Oromia National Regional State, Ethiopia. J. Dev. Agric. Econ. pp. 177-183.

Crossref

|

|

|

|

|

Greene W (2000). 'Econometric Analysis', 4th Edition, NJ, Prentice Hall, Englewwod Cliffs.

|

|

|

|

|

International Monetary Fund (IMF) (2014). "Ethiopia's development experience: Issues and comparative analysis with Asian peers". Report No. 14/304. Washington, D.C.

|

|

|

|

|

Lugauer S, Jinlan N, Zhichao Y (2017). Chinese Household Saving and Dependent Children: Theory and Evidence (forthcoming) China Economic Review.

|

|

|

|

|

Mankiw NG (2001). Principles of economics: 2nd edition, Harcart College publishers.

|

|

|

|

|

McFadden D (1978). Quantal choice analysis: A survey. Ann. Econ. Soc. Meas. 5(1976):363-390.

|

|

|

|

|

National Bank of Ethiopia (NBE) (2011). Annual Report for 2010/11, Federal Democratic Republic of Ethiopia, Addis Ababa.

|

|

|

|

|

Tsega HM, Yemane MH (2014). "Determinants of household saving in Ethiopia: The case of north Gondar zone, Amhara regional state". Int. J. Dev. Econ. Sustain. 2(4):3749.

|

|

|

|

|

World Bank (2012). Doing business, Country profile Ethiopia, the International Bank for Reconstruction and Development, Washington DC.

View

|

|

is proportion of households who are expected to prefer formal financial saving behavior,

is proportion of households who are expected to prefer formal financial saving behavior,  is the value of standard normal distribution at a chosen level of significance and

is the value of standard normal distribution at a chosen level of significance and  is some margin of error in the estimation. The value of p is fixed at 0.50 due to the absence of previous study. Setting

is some margin of error in the estimation. The value of p is fixed at 0.50 due to the absence of previous study. Setting  , the total sample size obtained was 267 households out of 6010 total households of the selected kebeles. Since the finite population correction is not greater than 5%, it does not need adjustment. Structured questionnaire was used to generate primary data from the selected households. Both descriptive statistics and econometric model were used for the analysis of the primary data. Descriptive statistics such as mean, standard deviation and percentages were used wherever necessary. An econometric model, multinomial logistic model, was selected to identify the major socioeconomic and demographic determinants of rural households’ saving behavior. The multinomial logistic model is a multi-equation model in which a response variable with K categories will generate K-1 equations. The analytical model is constructed based on the utility maximization theory. Suppose that the utility to a household of alternative j is

, the total sample size obtained was 267 households out of 6010 total households of the selected kebeles. Since the finite population correction is not greater than 5%, it does not need adjustment. Structured questionnaire was used to generate primary data from the selected households. Both descriptive statistics and econometric model were used for the analysis of the primary data. Descriptive statistics such as mean, standard deviation and percentages were used wherever necessary. An econometric model, multinomial logistic model, was selected to identify the major socioeconomic and demographic determinants of rural households’ saving behavior. The multinomial logistic model is a multi-equation model in which a response variable with K categories will generate K-1 equations. The analytical model is constructed based on the utility maximization theory. Suppose that the utility to a household of alternative j is  where

where  From the decision maker’s perspective, the best alternative is simply the one that maximizes net private benefit at the margin. In other words, a household i will prefer saving behavior j if and only if

From the decision maker’s perspective, the best alternative is simply the one that maximizes net private benefit at the margin. In other words, a household i will prefer saving behavior j if and only if  . Based on McFadden (1978), a household utility function from using alternative j can then be expressed as follows:

. Based on McFadden (1978), a household utility function from using alternative j can then be expressed as follows: