ABSTRACT

Agriculture is both the main sector that is expected to provide employment to large segments of the population and the key to sustained economic growth of the countries. This study presented an empirical analysis of the effect of Agricultural Exports on economic growth of Nigeria. The model built for the study proxy gross domestic product as the endogenous variable measuring economic growth as a function of real exchange rate, real Agricultural exports, Index of Trade Openness and Inflation rate as the exogenous variables. Annual time series data was gathered from Central Bank of Nigeria Statistical bulletin, National Bureau of Statistics (NBS), CBN Economic and Financial Review Bulletin and CBN annual reports spanning from 1970 to 2012. The study used econometric techniques of Augmented Dickey-Fuller (ADF) unit root test, Johansen co-integration test and error correction method (ECM) for empirical analysis. The results of unit root suggested that index of trade openness and inflation rate was stationary at a level while real gross domestic product, real exchange rate and real agricultural exports were integrated at order one. The co-integration test showed that, long-run equilibrium relationship exist among the variables. The findings from the error correction method show that Agricultural Export has contributed positively to the Nigerian economy. The study recommended that, the government reform agenda should be systematic and sustained irrespective of the professional background of the successive presidents of the country and that; Agricultural production should be more desired than other sectors that are exhaustive in nature (oil) evidenced to the recent fall in price of crude oil which has rendered Nigeria in economic shambles.

Key words: Agricultural exports, economic growth, trade openness, Dutch disease and exchange rate.

Agriculture has been the most important single activity in the Nigerian economy, with about 70% of the total working population engaged in it. It is the largest single sector of the economy, providing employment for a significant segment of the workforce and constituting the mainstay of the Nigeria large rural community which accounts for nearly two-third of the population. The proportion of the Gross Domestic Product (GDP) attributed to agriculture holds between 30 and 40% (CBN, 2009). The favourable climatic condition and vegetation makes Nigeria able to provide crops and livestock.

Generally, the rise of agricultural export has been a considerable success story and one that has brought numerous benefits to Nigeria thus, the importance of export to a nation’s economic growth and development cannot be overemphasized since it is a catalyst necessary for the overall development of an economy (Abou-Stait, 2005). It is also a source of foreign exchange earnings since trade transaction among nations are settled in foreign exchange and employment opportunity for the people with the attendant reduction is social costs of unemployment. According to Usman and Salani (2008) a rewarding export drive can turn a hitherto underdeveloped economy into a prosperous activity through its multiplier effects on the level of national income since income earned through exporting will help in increasing the level of demand within the economy.

The Nigerian economy has been and is currently being characterized by a reasonable degree of openness; hence its performance can be enhanced through the development of the external sector. The Nigerian external sector has always been dominated by primary commodities (Agriculture) which have the well-known characteristics of low price and income elasticity of demand, low growth of demand, unbalanced terms of trade and instability of export earnings (Iyoha and Oriakhi, 2002). The decline in export earnings must have been engendered by short fall in production which has forced most developing countries to depend on importation of food. As a result of international specialization, the economic performance of the region over the years had been deplorable and disappointing, and this can be attributed to the growth in expenditure on food import and falling export earnings which has brought with it a deep economic mess and a growing balance of payment deficit coupled with using external debts (FMARD, 2014).

Agriculture, the second largest sector after oil, fell from 48% of GDP in 1970 to 20.6% in 1980 and was only 23.3% of GDP in 2005 (CBN, 2009). The sector’s contribution to the growth of the Nigerian economy in 2012 stood at 39.21 and 41.93% improvement in the third quarter of 2013. This is because agricultural output continued to experience improved production in 2013. The sector recorded growth rate of 3.83% in the fourth quarter of 2012 as against 5.68 in the fourth quarter of 2011. Output in the third quarter of 2013 stood at 5.08%, up from the 3.89% recorded in the corresponding period of 2012 and also higher than the 4.52% recorded during the second quarter of 2013 with a low level of job creation as compared to education, financial intermediation, among others (NBS, 2013). Despite the involvement of Nigeria in international trade, hunger, malnutrition, mass poverty and high income among small groups of businessmen and politicians, unemployment and underemployment, lack of executive capacity, over dependence on petroleum and imports of goods and services continues to take a turn for the worse thereby leading to threat on economic growth in Nigeria. The duo crisis of food and finance around the world had left agricultural export and economic growth on its lowest ebb in Nigeria. These sluggish performances especially the decreased sector contribution from 6.5% in 2005 to 4.1% in 2012 of the agricultural sector and the vulnerability of the external sector thus dictate the urgent need to examine the trend and effect agricultural export on economic growth in Nigeria.

Objectives of the study

The study seeks to:

1. To examine the trend and composition of the agricultural export in Nigeria.

2. To determine the relationship between agricultural export and economic growth in Nigeria

3. To determine the impact of agricultural export on the Nigeria economy.

Scope of the study

The study examined the direction and the transmission channels of the relationship between growth and agricultural export within the period range from 1970 to 2012.

Conceptual framework

Economic growth

This is an increase in the capacity of an economy to produce goods and services, compared from one period of time to another. Economic growth can be measured in nominal terms, which includes inflation or in real terms which are adjusted for inflation. In order words, economic growth can be defined as the increase in the amount of goods and services produced by an economy over time. It is conventionally measured as the percentage of rate of increase in real gross domestic product or real GDP. Growth is usually calculated in real terms; that is, inflation adjusted terms to eliminate the distorting effect of inflation on the price of goods produced.

Determinants of economic growth in Nigeria

Economists regard factors of production as the main economic forces that determine growth. Some of the economic factors are explained as follows:

1. Natural resources: The principal factors affecting growth of an economy is the natural resources or land. “Land” as used in economics includes natural resources such as the fertility of land, its situation and composition, forest wealth, minerals, climate, water resources, sea resources, etc. for economic growth, the existence of natural resources in abundance is essential.

2. Capital accumulation: The second important economic factor of economic growth is capital accumulation. Capital means the stock of physical reproduction of factors of production. When the capital stock increases with the passage of time, it is called capital accumulation (or capital formation). Capital formation is essential to meet the requirements of an increasing population in such economies; investment in capital goods not only raises production but also employment opportunities.

3. Organization: Organization is an important part of economic growth process. It relates to the optimum use of factors of production in economic activities, organization is complement to capital and labour and helps in increasing their productivities.

4. Technological progress: Technological changes are regarded as the most important factors in the process of economic growth. They are related to changes in the methods of production which are the result of some new techniques of research or innovations. Changes in technology leads to increase in productivity of labour and other factors of production.

5. Structural changes: Structural changes imply the transition from a traditional agricultural society to a modern industrial economy involving a radical transformation of existing institutions, social attitudes and motivations such as structural higher labour productivity and the stock of capital, exploitation of new resources and improvement in technology (Abou-stait, 2005).

Agricultural exports

In Nigeria, agricultural export has played a prominent role in economic development by providing the needed foreign exchange earnings for other capital development projects. According to Ekpo and Egwaikhide (1994) agricultural export commodities contributed well over 75% of total annual merchandise exports in 1960. Nigeria also ranked very high in the production and exportation of some major crops in the world in the 1940s and 1950s.

For instance, Nigeria was the largest exporter of palm oil and palm kernel, ranked second to Ghana in Cocoa and occupied a third position in groundnut. Olayide and Essang (1976) observed that Nigeria’s export earnings from major agricultural crops contributed significantly to the Gross Domestic Product (GDP). Similarly, Ekpo and Egwaikhide (1994) observed a long-term relationship between agricultural exports and economic growth in Nigeria.

Theoretical framework

Vent for surplus theory which is propounded by Adam Smith explains the dynamics of international trade. It assumes the existence of surplus and idle human and material resources most especially within the underdeveloped countries. The theory emphasizes efficiency of production methods so that the resultant output exceeds by far the initial input resulting in surplus production. The theory may be underlined by the fact that international trade does not essentially determine factors of production but enhances the output of the surplus resources to be used to meet international demand. When the produce of any particular branch of industry exceeds what the demand of the country requires, the surplus must be sent abroad, and exchanged for something for which there is demand at home without such exportation, a part of the productive labour of the country must cease and the value of its annual produce diminish. By opening a more extensive market for whatever part of the produce of their labour may exceed the home consumption, it encourages them to improve its productive powers, and to augment its annual produce to the utmost, and thereby to increase the real revenue and wealth of the society.

Also, Scholars such as Hirschman, Rostow, Fleming and Singer propounded the theory of unbalanced growth as a strategy for development to be used by the underdeveloped countries. This theory stresses on the need of investment in strategic sectors of the economy instead of all the sectors simultaneously. According to this theory, the other sectors would automatically develop themselves through what is known as “Linkages effect”. The theory argues that a deliberate unbalancing of the economy in accordance with predesigned strategy is the best way to achieve economic growth. “An ideal situation obtains when disequilibrium calls forth a development move which in turn leads to a similar disequilibrium and soon ad-infinitum”. He observes that development has proceeded in this way with “growth being communicated from the leading sectors of the economy to the followers, from one industry to another, from one firm to another”. Development process is a chain of disequilibrium that must be kept alive and the task of development policy is to maintain tension, disproportion and disequilibria.

More so, Corden and Neary (1982) pioneered the theoretical framework of the Dutch disease syndrome in their studies of how small open economies could be de-industrialized after having enjoyed a massively booming primary export sector. The Dutch disease theory states that a resource export boom has an inherent tendency to distort the structure of production in favour of the non-traded goods sector vis-à-vis the sectors producing the non-booming tradable. The impediments of oil revenue to economic growth and development of oil-dependent states is what is cumulatively called Dutch Disease in the literature of development economics (Otawa, 2001). The enormous influx of cash resulting from oil tends to foster, overzealous and imprudent expenditure. High oil revenue raises exchange rates, promotes adverse balance of payment as the cost of imports rises. In short, it kills incentive to risk investment in non-oil sectors, the competiveness of all non-oil sectors such as agriculture and manufacturing industries have been crowded out. The employment of both labour and other resources has been exchanged for unemployment as the government and private expenditure multipliers have been exported abroad. Together, these forces constitute what is called the rentier effect, oil sectors being “rentier states” (Michael 2001). The rentier state theory argues that countries depended on external rent like oil; develop a different bond of relationship between government and their citizens from those that rely primarily on taxation. Such states are less likely to be democratic than those that are tax reliant (Ayodele, 2004).

Theoretical linkage with the research problem

It is imperative and noteworthy to examine whether export growth can enhance growth to help curtail balance of payment deficit and to definitely establish whether the theories reviewed have any linkage to the stated problem under study. Using the Dutch disease theory, it states that the discovery of a natural resource (primary) has negative consequences resulting from any large increase in foreign currency including foreign direct investment, foreign aid or a substantial increase in natural resource prices. The impediments of oil revenue to economic growth and development of oil-dependent states at the neglect of other sectors is what is cumulatively called Dutch Disease in the literature of development economics (Otawa, 2001). The enormous influx of cash resulting from oil tends to foster, overzealous and imprudent expenditure. High oil revenue raises exchange rates, promotes adverse balance of payment as the cost of imports rises. In fact, it kills incentive to risk investment in non-oil sectors, the competiveness of all non-oil sectors such as agriculture and manufacturing industries have been crowded out. The employment of both labour and other resources has been exchanged for unemployment as the government and private expenditure multipliers have been exported abroad. Together, these forces constitute what is called the rentier effect, oil states being “rentier states”. However, in Nigeria, government’s spending went towards the non-traded sectors, not towards agriculture partly as a result of this neglect; Nigeria suffered a severe case of Dutch Disease. Therefore, it is evident that government can at least mitigate the effect of Dutch disease by actively subsidizing their traditional export sectors upon the discovery of oil.

More so, using the surplus theory propounded by Adam Smith which assumes the existence of surplus and idle human and material resources most especially within the developed countries. Under the vent-for-surplus approach, trade does not cause any reallocation of resources (here, labour) but rather assumes that more raw materials will be produced from the available surplus of land and labour. That is to say, trade here induces a ‘vent’ or an outlet for the unused resources (labour and land). Nigeria is using primitive techniques and adopts extensive cultivation of lands to produce more raw materials. But, once supply of land is exhausted, the further growth stops. Again, when prices of raw materials tend to rise because of inelasticity of supply against the rising demand, foreign trade eventually contracts and the country’s growth process is sterilized further.

However, using the unbalanced growth theory, which posit the deliberate unbalancing of the economy according to a predesigned strategy in order to achieve growth in underdeveloped countries in Nigerian situation where oil sector is solely dependent upon has not proceeded its development by the way of communicating it (the leading sector) to the other sectors which agriculture is one of it. There is a lot of confusion of whether the unbalanced strategy of the Nigerian economy is deliberate or not and whether the development in the oil sector is really contributing to the development of other sectors like agriculture, manufacturing among others. This problem has remained the daily crop of tea to the young talented Nigerians who see the future of our economy since the so-called leading sector (oil) is exhaustible in nature.

Empirical review

Oji-Okoro (2011) employed multiple regression analysis to examine the contribution of agricultural sector on the Nigerian economic development. They found that a positive relationship between Gross Domestic Product (GDP) vis-à-vis domestic savings, government expenditure on agriculture and foreign direct investment between the periods of 1986 to 2007. It was also revealed in the study that 81% of the variation in GDP could be explained by domestic savings, government expenditure and foreign direct investment.

Olajide, et al. (2012) analyses the relationship between agricultural resources and economic growth in Nigeria. The ordinary least square regression method was used to analyze the data. The results revealed a positive cause and effect relationship between Gross Domestic Product (GDP) and agricultural output in Nigeria. Agricultural sector is estimated to contribute 34.4% variation in Gross Domestic Product (GDP) between 1970 and 2010 in Nigeria. The agricultural sector suffered neglect during the hey-days of the oil boom in the 1970s. In order to improve agriculture, government should see special incentives are given to farmers, provide adequate funding, and also provide infrastructural facilities such as good roads, pipe borne water and electricity.

Research design

This research work is fundamentally analytical and descriptive as it embraces the use of secondary data in examining the role of agricultural commodity export in the economic growth of Nigeria. Of course, the descriptive tools consist of graphs and percentages, while the analytical tools consist of the econometrical tests specifically, unit root test, causality test and co-integration test.

Kinds and sources of data

The needed data for this research project include; data on Gross Domestic Product (GDP) at current basic prices, data on agricultural export, data on exchange rate, data for trade openness, data for inflation rate, data on real exchange rate. The data covered the period of 1970-2012. The data for this study was obtained mainly from secondary sources, particularly from Central Bank of Nigeria (CBN), CBN Economic and Financial Review Bulletin, CBN Monthly Reports, CBN Annual Reports, and Statements of Account of various years. Data sourced from Publication of the National Bureau of Statistics, Publication from the Internet and other related literatures.

Model specification

The model used for this project work is stated as follows:

Definitional form as:

RGDP = f (RAGREXP, REXR, ITOP, INFL) (1)

Stochastic form as:

RGDP = b0 + b1RAGREXP + b2REXR + b3ITOP + b4INFL + Ui (2)

Where, RGDP = Real Gross Domestic Product (Growth rate); RAGREXP = real agricultural export;

REXR = real exchange rate; ITOP = index of openness; INFL = inflation rate; b0 = constant intercept;

b1-b4 = slope of coefficients of the explanatory variables captured in the model, and Ui = stochastic disturbance term.

Data analysis

The research work made use of descriptive statistical tools. This study also adopted the following test statistics: Stationarity test using the Augmented Dickey Fuller Test (ADF). The ADF formula is thus specified as:

Thus, Granger causality test was employed to determine the causal relationship between the variables under study. It is thus stated as:

for all possible pairs of series in the group. The reported

F-statistics are the Wald statistics for the joint hypothesis: b

1 = b

2 = … = b

l = 0 for each equation. The null hypothesis is that “… does

not Granger-cause in the first regression and that … does

not Granger-cause in the second regression”. The ECM incorporates both the short run and the long run effects. When equilibrium holds

but in the short run when equilibrium exists, this term is non-zero and measures the distance by which the system is away from equilibrium during time t.

Data presentation and analysis

Trend analyses

The above graph represents the level of agriculture (non-oil) export on Nigerian economy. The diagram depicts an increasing trend of non-oil (agricultural) export over time though witness a stagnation as from (1970-1994) and fluctuations. It reveals that (2001-2012) there was an increase. Thus, this may be due to government policies over time to improve the non-oil export (agriculture) and in trying to diversify the Nigerian economy from oil sector to non-oil sector (Figure 1).

Unit root tests

The test results of the augmented Dickey-Fuller statistic for all the time series variables used in the estimation are presented in the Table 1.

These critical values are computed from Mackinnon (1996). If Z(t) ≥ ADF (t-statistic), it implies that unit root exist. If Z(t) ≤ ADF (t-statistic), it implies that unit root does not exist. From the unit test of the variables, both Inflation Rate (INFL) and index of trade openness (ITOP) are stationary (that is,l no unit root) at a level, that is, 1(0) while all other variables viz, Real Gross Domestic Product (RGDP), Real Exchange Rate (REXR) agricultural export (AGEXP) and achieved stationarity both at the first difference, that is, 1(1).

Causality

The results of granger causality are presented in the Table 2. From the Table, it revealed that, Agricultural Exports granger causes Economic growth, real exchange rate granger causes Agricultural Exports and Inflation rate granger causes Trade Openness both at 5% critical level in Nigeria.

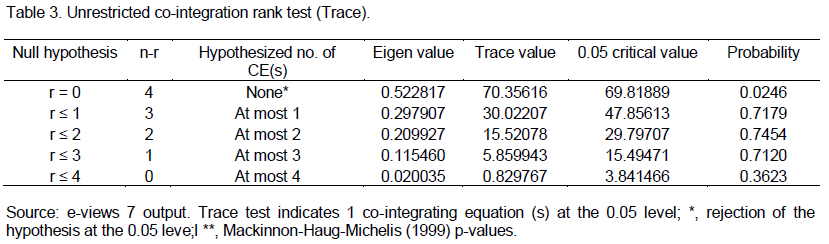

Johansen hypothesized co-integration result

The results are shown in Table 3. From the table, it revealed that there is co-integration among the variables. This is because the trace statistic of 70.35616 is greater than the critical value of 69.81889 at 5% level of significance. We reject the null hypothesis of none* of the hypothesized number of co-integration equations. Thus, trace statistic test indicates 1 co-integration equation at 5% level of significance. For the remaining number of hypothesized co-integration equation (At most 1, 2,3 and 4), we do not reject the null hypothesis as their trace statistics values are less than their critical values at 5% level of significance.

From Table 4, the Eigen value test shows that the null hypothesis of no co-integrating relationship against the alternative hypothesis is not accepted (that is, rejected) at 0.05 (5%) level of significance meaning that there is long-run relationship among the variables employed for the study, since they found that there is one co-integration equation at the given level of at most 1. Though, with these results, we can still conclude that, there is long-run relationship (co-integration) among the variables since both trace and max Eigen statistics shows at least 1 co-integrating equation. This implies that, there is a long-run relationship between agricultural export and economic growth in Nigeria.

The impact of agricultural exports on economic growth in nigeria (Long-run)

The estimated model is stated as:

Standard errors are in parenthesis.

From the model, the estimates shows that holding all other variables constant, the RGDP will be negatively influenced by -16.15516. This is as a result of the increasing population which increases the cost of living among other factors. The coefficient of RAGREXP is correctly signed and is statistically significant at 5% level. This implies that a unit increase in Agricultural Export (RAGREXP) will lead to 15.59997 increases in economic growth (RGDP). Thus, there is a strong positive relationship between agricultural export and economic growth in Nigeria. More so, the coefficient of ITOP is correctly signed being positive, though the coefficient of Index of Trade openness is not statistically significant at 5% level. Thus, there is a strong positive relationship between Index of Trade openness and economic growth however, statistically insignificant. This implies that a unit increase in ITOP will lead to 1.114204 increases in economic growth in Nigeria.

On the other hand, the coefficient of real exchange rate is negative and statistically significant at 5% level. This implies that, a unit change in the real exchange rate will lead to 3.543275 decreases (that is, -3.543275) in Real Gross Domestic Product in Nigeria. Nevertheless, from the result of the normalized Johansen co-integrating equation, the coefficient of inflation rate is negative. This means that, inflation has a negative relationship with economic growth. Thus, any unit increase in inflation will lead to 3.027406 decreases (that is, -3.027406) in RGDP in Nigeria. This implies a long-run relationship.

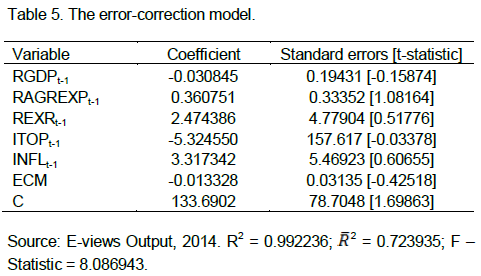

Dynamic model (ECM)

The results are summarized in Table 5. From the results above, the error correction term is -1.33% indicating a very low speed of adjustment (that is, the speed at which the deviation from long-run equilibrium is adjusted slowly where 1.33% of the disequilibrium is removed each period). This shows that, the speed of adjustment to where agricultural export will equilibrate the real Gross Domestic Product in Nigeria is at the rate of 1.33%. More so, the coefficient of multiple determinations (R

2) from the model has a very high percentage contribution of 99.22% which means that, the independent variables were found to jointly explain 99.22% of the movement in the dependent variable with the negative

- adjusted of 0.723935. The explanatory variables include agricultural export, real exchange rate, Index of Trade Openness and inflation rate. The fitness of the model is explained by the F-statistic which is 8.086943. The Akaike information criterion is also indicating how good the model is coefficient of the short-run dynamics shows that real agricultural exports is statistically significant at 5% critical level indicating that, the rate of agricultural exports and economic growth significantly affect growth of the economy in the short-run. This means that, agricultural exports contribute significantly to the growth of the Nigerian economy.

Based on the standard error test, since the value of S(b2) = 4.45636 is less than the value of ½ of b2 (15.59997), this research therefore rejects the null hypothesis and the alternative hypothesis is accepted. That is, agricultural exports impact positively on the economic growth of Nigeria. It can therefore be inferred from this research findings and from the various studies cited in the literature that agricultural exports has great effect (positive) on the economic growth of Nigeria in both long-run and short-run.

Summary of findings

The study revealed that, most of the variables (RGDP, REXP and RAGREXP) achieved stationarity at first difference except Inflation rate (INFL) and Index of Trade Openness (ITOP) that achieved stationarity at level. The information was made with the use of augmented Dickey-Fuller test which implies that, spurious result is avoided. The synergy of some explanatory variables will exert a positive influence on the real GDP while it will exert negatively on other variables.

It was also observed that, the trend of Index of Trade Openness has a serious impact on the GDP of the Nigerian economy. This is because amidst stagnations in the Index of Trade Openness, there was an increase from 1970 to 1974 and continued from 1987 where it took its pick in 1996 and began to decrease continuously with many fluctuations. This is as a result of placement and withdrawal of trade barriers and tariffs. However, even small countries benefits greatly but relatively small in international trade as it opens doors for export of unused agricultural resources and the effect of high prices at the international market. Therefore, trade openness allows two or more nations to trade in other to share their benefits (comparative advantage) as well as increase their foreign reserve.

It was also observed that, agricultural exports are important drive of economic growth at the macroeconomic level and there is a strong empirical evidence of a positive relationship between agricultural exports and economic growth at the macroeconomic level in both short-run and long-run.

The severe reduction in agricultural exports is further indications of the week competitiveness of Nigerian agriculture. Nigeria has lost market share for exports such as cocoa, palm oil and rubber. Non-traditional exports are limited while agricultural exports have strengthened since 2000; performance is still far below the economy’s potentials. This is because Nigeria has clear potential to earn more from agricultural exports both in traditional commodities such as cocoa, rubber, palm produce, Cotton, hides and skins, crafts and textiles and in non-traditional ones. There are also immense opportunities to be tapped from the development of non-traditional exports such as Non-Timber Forest Products (NTFPs) including medicinal plants, snails, mushrooms, cultivated wildlife and so on. Some of these products are in high demand in North America, Europe and Asia where niche markets exist for them. Besides the diversification in foreign exchange revenue for the country, other economic opportunities in this sector include income generation and gainful employment at both production and value addition stages.

From the result of the long-run relationship (co-integration), Johansen hypothesized co-integration (trace test) indicated 1 co-integrating equation however Max-Eigen value indicated no co-integrating equation. Thus, with the revealed co-integrating equation by trace test, there exists long-run relationship amongst the variables.

More so, the study revealed a low speed of adjustment. That is, the estimated coefficient indicates that about 1.33% of this disequilibrium is corrected between one (1) year (since the data is annually) This means that, the speed of adjustment to where the agricultural export will equilibrate the real Gross Domestic Product in Nigeria is at the rate of 1.33%

Empirical evidence from these analyses and results have shown that agricultural export can be as lucrative and profitable as any other sector of the Nigerian economy with respect to returns on investment. Therefore, the discrimination against agriculture and the negative perception and orientation of the average Nigerian about agricultural sector should disabused so that these sectors can contribute optimally to GDP upon channeling investment to agriculture because of the high potentials for employment, food security and exports. More so, since recent shock in oil prices could render Nigeria in economic shambles, much attention is needed in the agricultural sector to overcome such subsequent challenges.

This study recommends that, the reform agenda should be systematic and sustainable irrespective of the professional background of the successive presidents of the country. In the short run, the strategy of the government should be to improve the competitiveness of Nigerian agriculture in domestic and regional markets. As agricultural growth will continue to be led by smallholders’ farmers, policy-makers should take bold actions to:

1. Improve resource and development investment in agricultural research: This is because for agricultural productivity to improve Nigeria’s farmers need access to new technology. Technology alone will not solve the problem of low productivity, but it is a necessary condition. In particular, the government will also need to improve its research and extension services in order to improve the use of genetic materials and purchase inputs.

2. Improve markets, infrastructure and institutions: This is because fair, properly functioning markets and access to both inputs and food at reasonable prices are needed for poor Nigerian farmers to dully capture the benefits from access to credit, productive inputs (especially inorganic fertilizers) and extension services are needed, policies (like taxes and subsidies) that create distortions in capital to small-scale farmers must be removed.

3. Improved irrigation capacity: Productivity in Nigerian agriculture is low, in part because of the low yield levels and the high yield variability associated with rain-fed agriculture that discourage farmers from investing in inputs such as improved seed, fertilizers and crop protection chemicals. Irrigation can serve as a powerful stimulus to agricultural growth by raising biological yield potential and increasing returns to investments in complementary inputs.

4. Strengthen the agricultural input supply systems: there will be no growth in agricultural productivity and exports unless Nigerian farmers increase their use of purchased inputs, especially improved varieties of seed, chemical fertilizers, crop protection chemicals, including pesticides, herbicides and fungicides, and animal health-related products such as vaccines, medications and nutritional supplements. Strengthening inputs supply systems will ensure that these inputs are available in a timely fashion and at affordable prices.

5. Provision of adequate funds for farmers: Government should provide funds to acquire sophisticated farm tools and increase her budgeting allocation to this sector in a consistent manner because of its importance to the national economy hoping that with proper monitoring of fund, it would contribute more significantly to the economy of the country. As effective utilization of such funds is also advocated and all areas of wastage blocked. These actions will go a long way to improving agricultural growth and exports.

6. Diversification of the Nigeria economy: The Nigerian government should make all necessary efforts in dervisifying the economy in order to avoid complete disorder. Thus, much should be invested in Nigerian agricultural sector that has the potentials and high competitive advantage in the international market.

The authors have not declared any conflict of interest.

REFERENCES

|

Abou-strait (2005). "Arc Export the Engine of Economic Growth? An Application of and Causality Analysis for Egypt, 1997-2003, African Development Bank, Economic Resource Working Paper No.76. |

|

|

|

Ayodele M (2004). "The Elusive Curse of Oil Foreign Policy in Focus". Washington DC: Silver City University Press. |

|

|

|

Central Bank of Nigeria (2009). Statistical Bulletin, December. |

|

|

|

Ekpo A, Egwaikhide F (1994). "Exports and Economic growth in Nigeria: A Reconsideration of the evidence." J. Econ. Manage. 1(1):100-115. |

|

|

|

Federal Ministry of Agriculture and Rural Development (FMARD) (2014) "A Report by the Advisory Committee on Agricultural Resilience in Nigeria", Abuja-Nigeria. |

|

|

|

Iyoha MA, Oriakhi D (2002). "Explaining African Economic Growth Performance: The case of Nigeria". A revised interim report on Nigeria, case study prepared for the African Economic Consortium Research. |

|

|

|

Michael R (2001). Crude Oil Politics. Atlantic: Monthly April, Transparency International Corruption Perception Index (2006). World Bank Governance Indicator (2006). |

|

|

|

National Bureau of Statistics (NBS) (2013). "2012 and estimates for Q1- Q3, 2013" Gross Domestic Product for Nigeria, Central business district, Abuja–Nigeria. |

|

|

|

Oji-Okoro I (2011). "Analysis of the contribution of agricultural sector on the Nigerian economic development." World Rev. Bus. Res. 1(1)191-200. |

|

|

|

Olajide OT, Akinlabi BH, Tijani AA (2012). "Agriculture Resource and Economic Growth In Nigeria". Eur. Sci. J. 8:6. |

|

|

|

Olayide SO, Essang SM (1976). The role of Commodity Exports in Nigeria Economic Growth. Niger. J. Rural Econ. Dev. 10:105–22. |

|

|

|

Otawa M (2001). The National Security Strategy of the United States. Washington DC. US Government Printing Office. |

|

|

Usman OA, Salami AO (2008). "The Contribution of Nigerian Export-Import (NEXIM) Bank towards Export (Non-Oil) Growth in Nigeria (1990-2005).

|

but in the short run when equilibrium exists, this term is non-zero and measures the distance by which the system is away from equilibrium during time t.

but in the short run when equilibrium exists, this term is non-zero and measures the distance by which the system is away from equilibrium during time t. - adjusted of 0.723935. The explanatory variables include agricultural export, real exchange rate, Index of Trade Openness and inflation rate. The fitness of the model is explained by the F-statistic which is 8.086943. The Akaike information criterion is also indicating how good the model is coefficient of the short-run dynamics shows that real agricultural exports is statistically significant at 5% critical level indicating that, the rate of agricultural exports and economic growth significantly affect growth of the economy in the short-run. This means that, agricultural exports contribute significantly to the growth of the Nigerian economy.

- adjusted of 0.723935. The explanatory variables include agricultural export, real exchange rate, Index of Trade Openness and inflation rate. The fitness of the model is explained by the F-statistic which is 8.086943. The Akaike information criterion is also indicating how good the model is coefficient of the short-run dynamics shows that real agricultural exports is statistically significant at 5% critical level indicating that, the rate of agricultural exports and economic growth significantly affect growth of the economy in the short-run. This means that, agricultural exports contribute significantly to the growth of the Nigerian economy.