ABSTRACT

In 2007, an international crisis began due to the dissemination of bad debts, which spilled over to 2008. The global economy is still facing its consequences. This crisis is serious and its consequences are particularly long and painful. In a research of 2011, the economist John Taylor named “the great deviation” as “the recent period when macro-economic policies are based more on interventionist, less based on rules and less predictable”. Taylor’s appreciation of the failure of these policies has long been discussed, but the pain that governments’ and banks’ mistakes have caused us is widely pervasive. In the last years, the American domain has slowed down but no other country seems to be ready to take its place. Hence, it derives a state of continuous economic uncertainty inside the financial markets. One example is the need, in full compliance with the economic crisis, not to deprive oneself of the money supply, but rather to purchase, resorting "to the consumer loan." Indeed, the consumer loan is not only used to purchase goods, but also for obtaining service. This study will examine consumers’ purchases financed by a well-known multinational furniture, Bari store at Apulia region. Descriptive statistics are used to analyze consumption, income and consumption choices by examining the data collected at the time of loan subscription and stored in a special database. Results show that the borrowing is surprisingly higher with higher income levels.

Key words: Consumer loans, finance, Italy.

The recent global and economic-financial crisis, which was certainly very serious, was caused by some important imbalances which no one noticed in time. According to everybody’s perception, it could be solved or will not degenerate into such deep situation. Instead it exploded in the year 2008 in the United Stated with the subprime crisis, producing negative effects; it subsequently spread like wild fire in the world financial system.Globalization means that the economic system is neither national nor continental, but operates on global scale. The banking and financial world has been in a certain way anticipators of globalization phenomenon (Botsch et al., 2010).

In the real economy, the process of globalization is considered as a process of enhancing relationships among economic, legal, social, and cultural systems all over the world. The monetary aspects and their impact on real economy and regulatory activities are combined inside the processes of liberalization of international commerce. The 20th anniversary done during the fall of the Berlin Wall in 2009 represents the “official” beginning of globalization process, though its plan began before now.The process of globalization is the trend of making economy global. The economy has supranational powers, derived from an increasing share of economic activity among geographically distant people. After the second world war the international trade grew constantly at high rates, increasing the degree of international and national economies.

The crisis rapidly increased and as already mentioned, it originated from some fundamental imbalances which neither the financial nor the economic system was able to sustain. An example is the constant growth of the value of some assets, like the American real estate; its aim is to grant mortgages given by banks to allow most citizens to own their houses. Another imbalance, which originated this phenomenon, is the continuous high prices, making mortgagers unable to repay their loans. This is linked also to economic cycle. This led to the first non-fulfillments, so called “default” in technical language (Murray and Rothbad, 2006).

Financial institutions which give out loans found themselves unable to fulfill their own obligations. This crisis exploded very rapidly. The so called real economy was inevitably touched, more specifically production of food, durable assets or family investments which depend on the good functioning of the financial system. If this later gets stuck, the adverse effect on the production of goods and services becomes evident in a short time.

Moreover, companies in every sector rapidly lacked credit, which was diminishing; also there was lower demand for goods and services because consumers, families, citizens, savers, and holders of financial activities found themselves with lower value properties due to the crisis. This affected the companies as well. Consequently, consumers quickly brought down their standard and level of consumption and delayed in purchasing goods after reviewing their own consumption habits. This obviously had a negative impact on the producers of these goods and services. However, due to this crisis, support was given to banks and other financial institutions, and subsequently the real economy.

Offering support to banks is necessary because if they collapse, an unimaginable tragedy would occur, the world economy would stop, including the production of goods and services which form part of our habits and daily needs. Governments have been criticized for not intervening or supporting the banks. This criticism is understandable, because banks’ collapse would mean the collapse of the world economic system (Augello and Guidi, 2007; Soros, 2012).In other words, due to lack of confidence in banks, there has been a blockade of the economic system which has been reset and gradually brought to normal due to massive interventions by the United States, Europe, and single members of the European Union. This is very important, because without these kinds of interventions, the situation would have gone worst.

Later on, intervention in favor of the real economy took place, but in a much modest way. It was hoped that things would become normal. This is due to normal market economy mechanisms, availability of resources in the states, and if the fiscal or budgetary policy problem is the financing of the public deficit. When the crisis broke out, the budgetary policies, normally defined as fiscal, in support of the real economy, had to deal with the state of the public accounts. In some cases, they were already sufficiently compromised, such as in Italy. They were in need of selective intervention. This contributed to the reactivation of the production mechanism, without running the risk of having “rain” intervention, which instead of translating into business applications, could have led to further savings, the only thing they did not need at that time.

Having a good business and supporting the weaker people in the society is a wise choice taking into account that it is necessary to use the few available resources to try to prevent the most damaging effects of the crisis. Nowadays, the situation is not excellent, even if the signals coming from the economy of the world make us think that the worst is past, that it has touched the bottom and that we are going towards economic restoration.

THE NEW GUIDELINES OF CONSUMERS: THE DEMAND FOR CONSUMER CREDIT IN TIMES OF CRISIS

It is important to understand the situation being described in this paper: to define the process of change that consumers have gone through in the current crisis, with regard to the mode of acquisition of the property, as well as the various forms of consumer credit.What emerges is a picture of a consumer with traits showing that he/she is affected by the past: he/she is careful in spending well his/her money and hopes for what the world can offer. But above all, driven by the condition of the economic crisis, consumers combine their shopping bag, differentiated services for price and quality, with a selective spirit and high expectations. Such an approach variously combined of alternatives obliges one to rethink the logic of relational schemes and marketing (Bird and Mc Evan, 2016). So it is possible to outline five types of different consumers in the Great Depression of the New Millennium (Murray, 2006).

Thoughtful neo-consumer

This is a consumer that is not certain, he must weigh his choices for long, thinks, reflects, compares and then takes his decisions convinced that he has taken the best one. The time devoted to reflection in the pre-purchase phase is all gained time. It leads to purchase satisfaction, actual saving, and informed choice. This consumers develops qualities of nomadism, looks, moves (even just online), compares and then chooses the best (Carriero, 2016; Lombardi, 2011).

Expert consumer

The expert consumer is the opposite of the digital native-reflexive consumer. He is a fan of the network, a social addict and might even be called consumer 2.0. He compares himself with the other browsers of web chats and talks online, and asks for the strengths and weaknesses of a service or product he would like to purchase. He is a consumer strongly devoted to relationships even to new digital relationships. Talking about consumption, it is useful to find new friends, meet and grow new relationships (Fabris, 2008; Forum Ania Consumatori, 2017).

Smart consumer

Discounts, promotions, bargain hunting, cherry picking, swapping, and coupling are the clever strategies that are implemented by consumers to circumvent the market, especially in times of crisis. He is the king of smart shopping (Parmigiani, 2010; Puleyo, 2012).

The loyal consumer

This is a consumer that is confused by the flood of offers, promotions, and sales. To reduce all this complexity, he leans on the brands, those brands that he has known for a long time and that have satisfied him. He will faithfully return to buy those brands in order not to commit gross errors. The reflexive consumer, expert digital consumer, and smart consumer oppose the peace and serenity of the consumer loyal to his favorite brands (Cavallo and Paltrinieri, 2010; Villanacci, 2016).

Anti-consumer

The last cluster of the consumer is the ethical consumers; he is a critic, sensitive to environmental and social sustainability (Angelini, 2008). He does not necessarily refer to the market, but to his practices of anti-consumption (consuming less, self-producing, exchanging goods, recycling) (Cariani, 2010; Borghi, 2009; Baudrillard, 2014; Ricotti, 2010).

Having outlined the five types of consumers in the Great Depression of the New Millennium, it is also important to dwell on the key issues on which the marketing professionals are called upon to act. First among these is the reference to the fundamental operation of socio-economic organization, to understand how to redesign the role and powers of the marketing function within it. Markets change and thus the drivers of value, offered to customers. The marketing function is called to redesign its organizational role to reinvigorate and update “natural” connections, first of all production and sales and those “necessary" finance and administration (Mattiacci, 2013; Morini, 2010).

It is important to rethink the organizational roles (and the relative job descriptions) to articulate; brand managers, customer relationship management (CRM) managers, and shoppers are the only examples of the many possible roles on which the function can be based. They are the external interfaces of companies and relate with other entities (Borello and Mannorri, 2007). Another key issue is the understanding of the value for customers. The emergence of the concept of value as a central element in the choice of purchase and consumption is a basic phenomenon, though, is in constant evolution. The proliferation of brands and products constantly shuffles the values ​​promised by the various offerings and, consequently, the expectations of customers. It calls for question through exploratory research and constant monitoring of competitors. The basis of the perceived value of the offering company is therefore necessary.

Returning to the "classical" concepts of discipline, it makes us to escape the trap of marketing myopia, defect of vision that makes us see only what appears usual to us and crystallizes us in the usual best known representation of the world, and therefore more reassuring (Nardone, 2010; Vella, 2010).Another important issue is the creation of value for customers. Digital technology has broken every barrier sector for years, becoming the most dynamic and marked factor cross of renewal; communication tools have multiplied and so their functionality, breaking down old patterns of thought: let us think of the archaic distinction between above and below the line, undermining the effectiveness of the media and changing its role, and so on (Mazzola, 2011; Rinaldi, 2016).

Realizing the ancient prophecy of Nicholas Negroponte (2004), the distribution channels of digitizable products are changing: from physical locations for the transfer of fund-objects (music stores); they become virtual places to facilitate the exchange of flows (iTunes and similar platforms); customers cease to be exogenous and anonymous data, but they are now recorded and made ​​objects of attention in the post-sale service. The transfer of the promise of value inherent in the product by the provider to the customer is more complex than before; technology, as outlined so far, significantly modifies the cash flows; therefore the thought, proliferation, increased number of players and offer alternatives at every level make management more complex and shift the focus on the negotiation skills of managers.

The improvement of new managers’ skills should be related to main issues: first, the linguistic system of business accounts, economic, financial, and also assets. It is widely recognized that decades ago have sometimes seen values ​​of marketing proceed, either those created, or those invested on a parallel track to others. The increased specialization of marketing activities, in fact, required investments in new tools and activities, whose specific yardsticks of effectiveness are often misunderstood by non-technical and, above all, "do not speak" to the system. The current conditions, which require a great foresight in the selection and management of investments, require that you work to build an effective dialogue between the various measurement systems of a company.

This will require, on one hand, the recovery of accounting skills on the part of the marketing manager; on the other hand, a training in languages ​​and typical parameters of the market in favor of the other functional areas (Mora, 2012; Ostidich, 2012). The second issue concerns the techniques of creativity. The word creativity in marketing, has always been the exclusive preserve of advertising; its exercise has been "outsourced" to advertising agencies and then outsourced (Grant, 2009; Foglio, 2008).The much faster dynamics that today affects both the value proposition to customers and the instrumentation for its transfer requires organizations to make a continuous exercise in creativity, because the opportunities for change in the value proposition and in its moving to the valley are more frequent.

This work is based on research methodology questions using SPSS statistical method. It is all about the consumer purchases financed by a well-known multinational furniture store located in Bari (Apulia Region) in 2016. The aim is to measure consumers’ behavior towards purchasing of goods that are not necessary. Based on the data collected it was possible to characterize Bari store consumers’ income, consumption choices and attitude to access to different special sales with particular regards to funding.

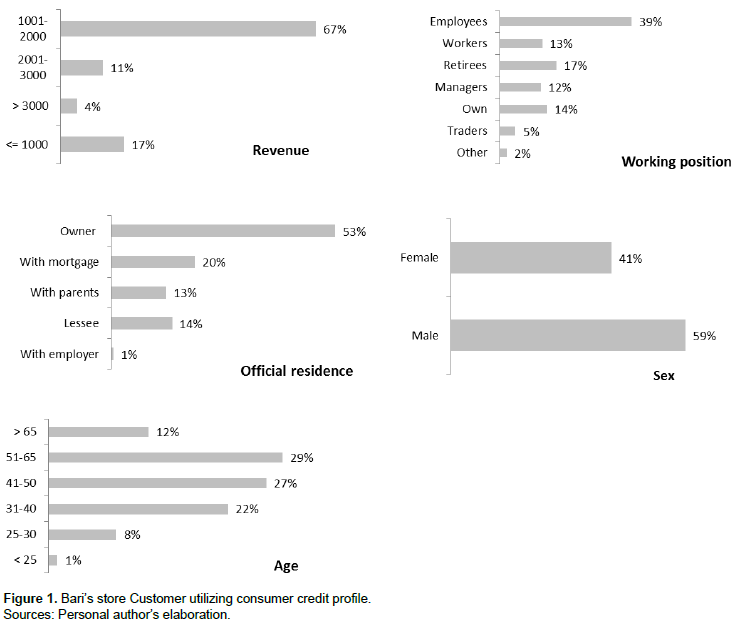

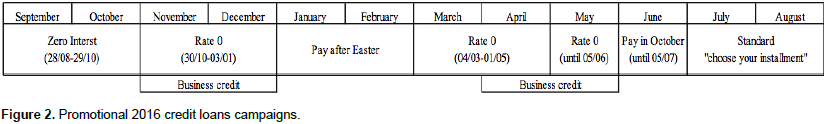

The data are useful to defined Bari store’s customers using different funding systems offered by the company during 2016 consumer loan campaigns (Figures 1 and 2). The results show that the customers utilizing consumer credit have a share of 60%. They are males (approximately 60%), aged between 41 and 65 years, married (more than 55%), home owners (less than 55%) with a monthly income ranging between 1,100.00 and 2,000.00 €/month (more than 65%). The analysis shows that in 2016, more than 2 million Euros (corresponding to approximately 3% of the total business turnover) have been used to finance Bari store utilizing the different credit loans typologies offered during the yearly promotional campaigns.

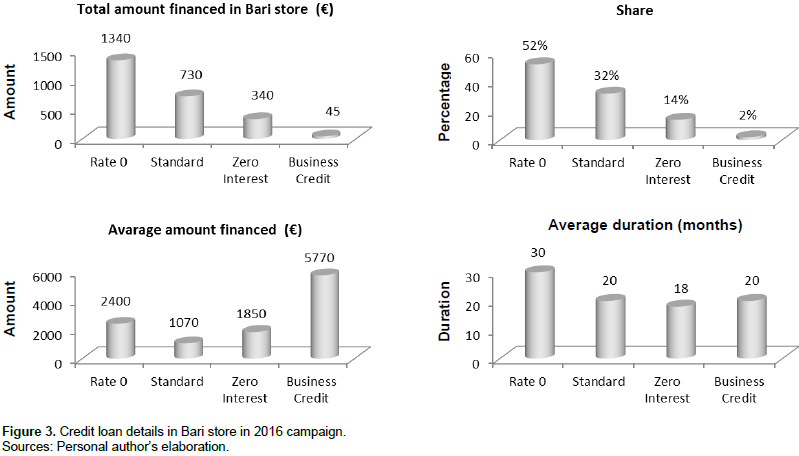

Collected data highlight that (Figure 3) rate 0 is offered three times in 2016; it has no activation costs and it is increasingly attractive. In Bari store, this typology represents more than 50% of the total amount financed; it is used to finance a single customer’s total expenses equal to approximately 2.400,00 Euros, with an average duration of more than 30 months. Standard is the “classic” mode of funding. The customers, paying the nominal annual rate and the annual percentage rate “gain” the possibility to pay the full amount (no cash is due) and to choose how long the loan will be. Offered only once in Bari store, this typology represents more than 30% of the total amount paid. It is used to finance a single customer’s total expenses equal to approximately 1.000,00 Euros, with an average duration of more than 20 months.

From the proposed analysis, it turns out that the consumers from Bari, with their habits and debt capability correspond to the national one. Both types of consumers, finding themselves in tight economic circumstances, have neither stopped consuming nor have changed their culture in relation to the system of goods present in market, as some authors have asserted; but they have adopted a series of strategies and critical attitudes to measure their own monthly outflows, and thus to protect their wallets.

Zero interest is the highest chosen by consumer loan typology even if it has been proposed only once in the year 2016. In Bari store, this typology represents more than 13% of the total amount paid. It is used to finance a single customer’s total expenses equal to approximately 1.800,00 Euros, with an average duration of more than 18 months. Business credit, offered at least twice a year, is the mode of funding granted to companies and it is not different from the standard mode. In order to guarantee the granted credit, this form of financing may be required by companies with at least two years of activities on the same territory and in the same economic sector.

In Bari store, this typology is rarely used. It represents less than 2% of the total amount paid. It is used to finance business activities higher than 5,500.00 Euros, with an average duration of more than 20 months. Usually, the company analyzed offers another typology of consumer credit, credit to young people; it is given to less than 24 years old customers with interest rate lower than that of the standard. In Bari store, considering the average age of specific store customers (41 to 65 years old), it was not included in 2016 annul campaign.

The aim of this work is to describe Bari store customers’ habits in terms of their consumptions, and their life style, in this period of crisis. This is shown in the consumption models adopted by individuals, and to examine the meaning of consumption to them.

The authors have not declared any conflict of interests.

REFERENCES

|

Angelini A (2008). Cambio di rotta. Lo sviluppo sostenibile, Armando, Roma.

|

|

|

|

Augello MM, Guidi MEL (2007). L'economia divulgata. Stili e percorsi italiani (1840-1922). Vol. II- Teorie e paradigmi, Franco Angeli, Milano.

|

|

|

|

|

Baudrillard J (2014). La società dei consumi, Il Mulino, Bologna.

|

|

|

|

|

Bird A, Mc Evan M (2016). I driver della crescita, Franco Angeli, Milano.

|

|

|

|

|

Borello E, Mannori S (2007). Teoria e tecnica delle comunicazioni di massa, Firenze University Press, Firenze.

|

|

|

|

|

Borghi E (2009). La sfida dei territori nella green economy, Il Mulino, Bologna.

|

|

|

|

|

Botsch A, Carlini R, Watt A (2010). Dopo la crisi. Proposte per un'economia sostenibile, Dell'Asino, Roma.

|

|

|

|

|

Cariani R (2010), Ecodistretti 2009. Made "green" in Italy: le politiche ambientali dei sistemi produttivi locali e dei distretti industriali, Franco Angeli, Milano.

|

|

|

|

|

Carriero G (2016). Autonomia privata e disciplina del mercato. Il credito al consumo e la tutela del risparmiatore, Giappichelli, Torino.

|

|

|

|

|

Cavallo M, Paltrinieri R (2010). Consumo sostenibile e progetti nel territorio, Carocci, Roma.

|

|

|

|

|

Fabris G (2008). Societing, il marketing nella società postmoderna, Egea, Milano.

|

|

|

|

|

Foglio A (2008). Il marketing ecologico, Franco Angeli, Milano.

|

|

|

|

|

Forum Ania Consumatori (2017). La vulnerabilità economica delle famiglie italiane. Tra difficoltà e nuovi equilibri, Franco Angeli, Milano.

|

|

|

|

|

Grant J (2009). Il manifesto del green marketing, Brioschi, Milano. Hirsch F. (2001), I limiti sociali allo sviluppo, Bompiani, Milano.

|

|

|

|

|

Lombardi R (2011). Verso una nuova Eco-nomia, Maggioli, Santarcangelo di Romagna.

|

|

|

|

|

Mattiacci A (2013). Idee per un nuovo marketing dopo la crisi, in "Performance & Management", n.26.

|

|

|

|

|

Mazzola EM (2011). La città sostenibile è possibile, Gangemi, Roma.

|

|

|

|

|

Mora M (2012). L'ambiente nell'economia moderna, Libreriauniversitaria.it.

|

|

|

|

|

Morini M (2010). Tecniche per un marketing sostenibile, Riuniti, Roma.

|

|

|

|

|

Murray NR (2006). La grande depressione, Rubbettino, Catanzaro.

|

|

|

|

|

Nardone C (2010). Crisi e sostenibilità, Il Bene Comune, Campobasso.

|

|

|

|

|

Negroponte N (2004). Essere digitali, Sperling & Kupfer, Milano.

|

|

|

|

|

Ostidich D (2012). Quello che è mio è tuo. Il consumo collaborativo e altre forme di consumo relazionale, Il Sole 24 Ore, Milano.

|

|

|

|

|

Parmigiani M (2010). Siamo tutti stakeholder, Maggioli, Santarcangelo di Romagna.

|

|

|

|

|

Puleyo L (2012). La gender equality nell'economia dell'azienda, Franco Angeli.

|

|

|

|

|

Ricotti P (2010). Sostenibilità e green economy. Quarto settore. Competitività, strategie e valore aggiunto per le imprese del terzo millennio, Franco Angeli, Milano.

|

|

|

|

|

Rinaldi E (2016). Perché educare alla finanza? Una questione sociologica, Franco Angeli, Milano.

|

|

|

|

|

Soros G (2012). La crisi globale e l'instabilità finanziaria. Hoepli, Milano.

|

|

|

|

|

Vella M (2010). Oltre il motivo del profitto. Storia, economia, gestione e finanza delle imprese cooperative italiane, Maggioli, Santarcangelo di Romagna.

|

|

|

|

|

Villanacci G (2016). Credito al consumo, Edizioni Scientifiche Italiane, Napoli.

|

|