ABSTRACT

Adapting strategic ambidexterity enhances the sales performance of financial services that provide support to their employees, especially the sales representatives. Simultaneously providing support aligned to the needs of existing markets and that which is aligned to needs of new markets attracts potential customers to open accounts and undertake policies in banks and insurance institutions, respectively, and encourages existing account or policy holders to save more with their banks or upgrade their insurance policies. Despite strategic ambidexterity’s important role in the relationship between organizational support and sales performance, existing studies in financial services have concentrated on investigating the direct relationship between these variables. These studies have ignored the role of strategic ambidexterity in moderating the relationship between organizational support and sales performance. This study found that there was a positive and significant impact of strategic ambidexterity in moderating the relationship between organizational support and sales performance of financial services in Uganda.

Key words: Strategic ambidexterity, organizational support, sales performance, financial services, Uganda.

Implementing strategic ambidexterity is beneficial to Uganda’s financial services, since it enhances the prediction of the sales performance arising from the support these services provide to their sales representatives. Strategic ambidexterity comprises of exploratory and exploitative strategies, respectively, as its components. Strategic ambidexterity refers to the simultaneous exploration and pursuance of new market opportunities and efficient exploitation of existing markets (Judge and Blocker, 2008). According to O’Reilly and Tushman (2013), strategic ambidexterity enables organizations to sense and seize current and new opportunities through allocating organizational assets’ capabilities and resources. O’Reilly and Tushman (2004) argue that ambidextrous organizations are able to introduce innovative products without destroying existing ones. March (1991), suggests that organizations operating in a dynamic marketing environment ought to align the kind of support provided to employees to the needs of existing and new markets, if they are to improve their performance. Atuahene-Gima and Ko (2001) state that exploitative and exploratory strategies help organizations to increase their sales performance in both current and new markets, respectively (Ocasio, 2011). Ocasio (2011) further observed that organizations which adopt exploratory strategies tend to overcome rigidities since they are forward-looking. These organizations develop new products and seek new markets. Besides, by adopting exploitative strategies, ambidexterous organizations are able to understand their existing customers’ needs and respond to them appropriately (McCarthy and Gordon, 2011).

In this study, we argue that financial services which adapt strategic ambidexterity do not only offer support which is relevant to the needs of existing markets, but also that which facilitates in meeting the needs of new markets. In addition, our view is that adapting strategic ambidexterity compels sales representatives of financial services to direct their sales efforts to existing and new markets, respectively. Hence, financial services which provide support to their sales representatives achieve increased sales, in terms of deposits from, borrowings by and premiums from both existing and new markets, respectively. Such financial services attract new people and organizations to open accounts and undertake policies in banks and insurance institutions, respectively, in addition to stimulating existing account or policy holders to save more with their banks or sign new insurance policies.

However, despite the importance of strategic ambidexterity in improving organizational support’s pre-diction of sales performance, studies on the relationship between organizational support and sales performance, with strategic ambidexterity as a moderator are sparse. Existing studies that have attempted to explain how financial services can increase their performance, especially that regarding sales have concentrated on investigating the direct relationship between organiza-tional support and sales performance. Many of these studies have only considered one or two elements of organizational support. Organizational support is defined as “a set of enduring policies, practices, procedures and tools that diminish the demands of the job and/or assist employees in achieving their work goals and stimulate their personal growth/development” (Babakus et al., 2003). It is said to comprise of supervisory support, training, rewards, empowerment and service technology support (Alpkan et al., 2010; Yavas and Babakus, 2010). Studies by Riggle et al. (2015), Diamantis and Chatzoglou (2012), Holland and Ruedin (2012), Shanock and Eisenberger (2006), and Uba et al. (2013) have found organizational support to be positively and significantly associated with sales performance. Wachiuri et al. (2015) also found existence of a positive, significant relationship between organizational support and sales performance. In Uganda, Mwesigwa and Namiyingo (2014) further observed that organizational support positively and significantly influenced sales performance among commercial banks. Given that many scholars report positive and significant relationships between organizational support and sales performance, the question that needs to be answered is whether strategic ambidexterity enhances the organizational support – sales performance relationship for financial services in Uganda.

The need for an answer to the above question is justified by the world bank (2015) “Uganda Financial Sector Review” survey finding that whereas credit provided by deposit–taking institutions has been growing in absolute terms, the ratio of private sector credit as a percentage of GDP has been increasing at a low rate compared to other developing countries. Moreover, a 2013 World Bank Uganda Country Profile, Enterprise Survey report revealed that only 9.8% of Ugandans had a bank loan, which is low compared to the 36.5% worldwide average. In addition, the Uganda Insurers Association Annual Report (2014/2015) shows that in the years 2010/2011 to 2014/2015, the insurance industry has grown at a decreasing rate. All these findings indicate that there is still room for the financial services operating in Uganda to enhance their sales performance. Our view is that integrating strategic ambidexterity would enable commercial banks, microfinance institutions and savings and credit cooperatives (SACCOs) and insurance companies which support their sales representatives to perform better in terms of deposits received, credit given and premiums received, respectively.

Therefore, we contribute to existing knowledge by investigating the moderating role of strategic ambidexterity on the relationship between organizational support and sales performance, an area where research is sparse. According to Wei et al. (2014), strategic ambidexterity increases an organization’s adaptability to a dynamic environment, which is likely to augment organizational support’s effect on sales performance.

The study was conducted in Uganda, focusing on financial services which included commercial banks, micro-finance institutions, insurance companies and SACCOs. The marketing environment of these services has become very dynamic and competitive, which has led to some of these institutions’ failure to sustain sales performance and in some instances closing business. Expectations of Uganda’s financial services’ customers are high yet they keep changing with time because of growth in knowledge and application of information communications technology. Customers are able to quickly learn of new or better services being offered in the developed world. They expect financial services in Uganda to emulate those in the advanced economies. Besides, new competitors have emerged in the financial services marketing environment. Organizations like Mobile Telecommunications Network (MTN), Uganda Telcom Limited (UTL) and Airtel (formally called Zain) that were not in the main stream financial services have introduced Mobile Money Services in Uganda, adding to the already existing competition in the industry. According to Bank of Uganda Annual Reports of financial years 2006/2007, 2007/2008, 2008/2009, 2009/2010 and 2010/2011, and calendar years 2012, 2013 and 2014, the annual growth rates of monetary deposits and loans and advances offered by commercial banks and microfinance institutions (Credit Institutions and Micro-Finance Deposit taking institutions) in Uganda have been fluctuating. In addition, according to the Uganda Insurers Association Annual Report (2014/2015), in the years 2010/2011 to 2014/2015, the insurance industry has grown at a decreasing rate.

In attempt to fill an existing gap in research, this study investigated the moderating role of strategic ambidexterity on the relationship between organizational support and sales performance, in Uganda’s financial services. In this study context, sales performance is interpreted in terms of deposits, loans and advances, account holders, premiums and policy holders.

The next part of the paper involves review of literature, followed by the methodology used in this study, results and discussion thereof, conclusions, recommendations, limitations and areas for further studies, respectively.

Organizational support: Stakeholder approach

The stakeholder theory posits that support to relevant stakeholders creates superior value for them, which leads to improved performance for organizations (Freeman et al., 2004). Yau et al. (2007) argue that addressing interests of employees, who are one category of organizations’ key stakeholders, makes them feel obliged to contribute to the achievement of organizational objectives, such as increasing sales performance.

Strategic ambidexterity: Paradox approach

Paradox theory offers a better explanation regarding prediction of sales performance for organizations operating in a dynamic marketing environment. Paradox refers to the simultaneous presence of opposites (Poole and Van de Ven, 1989; Bloodgood and Chae, 2010) that organizations can pursue and achieve through strategically shifting between poles of contradictory situations (Bloodgood and Chae, 2010). The strategic ambidexterity metaphor which refers to simultaneously executing exploration and exploitation strategies (O’Driscoll, 2008), therefore, has roots in this theory. Implementing strategic ambidexterity is said to enhance performance, such as sales performance for organizations.

Organizational support and sales performance

In order to carry out the selling function effectively and achieve good sales, sales force may require organizational support. Organizational support provides the tools, means and a conducive environment which enable the successful execution of strategies by employees. Implementation of strategies, such as strategic ambidexterity (Hou, 2008) is necessary for organizational success.

Support provided by organizations to their employees can be in terms of supervisory support, training, rewards, empowerment and service technology support (Alpkan et al., 2010; Yavas and Babakus, 2010).

Bhanthumnavin (2003) observed that support by supervisors to their subordinates motivates employees to work beyond their assigned job specifications. This is likely to lead to improvement of individual and consequently sales performance. Eisenberger et al. (1986) further contends that supervisory support creates affective commitment within employees which makes them reciprocate with greater effort towards achievement of organizational objectives.

Besides, Fu et al. (2009) suggests that committed employees tend to spend more time and put a higher intensity of effort on work, which is likely to result in increased output, such as sales performance. In addition, Noe et al. (2006) argued that acquisition of knowledge and skills through training increases employee capability and enables them to deliver higher levels of service (Dolezalek, 2005). The findings are supported by Caudron (2002) and Kraiger (2003) who observed that organizations which invest more in training and development are comparatively more successful.

Furthermore, Latif (2012) asserts that employee training is linked to improved business results, which could include sales performance. This is consistent with Noe et al. (2006) who state that training facilitates employees’ learning of job-related knowledge, and skills which increases their capability and enables them to deliver higher levels of service (Dolezalek, 2005). Diamantidis and Chatzoglou (2012) observe that training is more vital for organizations operating in dynamic marketing environment, such as is the case with Uganda’s financial services, because it can enhance employee capability to deal with varying customer needs, personalities and circumstances.

Furthermore, Yavas and Babakus (2010) posit that employee rewards through compensation, esteem, status and social identity, and especially monetary rewards induce the employees to deliver high quality service to customers and thus, improved sales performance (Alpkan et al., 2010). Spreitzer (1995) and Spreitzer et al. (1997) also revealed that empowered individuals find meaning in their work role, feel competent to perform their work roles, have a feeling of self-determination with regard to specific means to achieve expected results, and believe that they can have a real impact on organizational outcomes.

Additionally, Schuster et al. (2013) view is that service technology support such as providing computers with internet facilities enables customers to access the needed service without direct service employee involvement and thereby improves operational efficiency and competi-tiveness (Meuter et al., 2005). This is likely to increase sales performance for organizations offering this kind of support. From the foregoing, we hypothesize that:

H1: There is a positive, significant relationship between organizational support and sales performance.

Strategic ambidexterity and sale performance

Strategic ambidexterity is conceptualized as a firm’s ability to concurrently pursue both exploration and exploitation strategies across product, market, and resource domains (Aulakh and Sarkar, 2005). It is also referred to as simultaneously exploring and seeking new market opportunities while efficiently exploiting existing markets (Judge and Blocker, 2008). Firms which exclusively focus on exploitative strategies align their core capabilities to existing markets (Hamel and Prahalad, 1994) at the expense of looking beyond, to future markets, where major opportunities and threats emerge (Leornard-Barton, 1992).

Naman and Slevin (1993) assert that organizations ought to efficiently respond to current markets and concurrently effectively prepare for new market on the horizon through the practice strategic ambidexterity, if they are to be successful. Developing new goods or services for emerging markets and at the same time improving the quality of existing goods or services, basing on current resources and capabilities for existing markets leads to increase in sales for organizations (Li et al., 2008).

Therefore, organizations operating in dynamic marketing environment need to have appropriate strategies not only to exploit current environments but also anticipate future changes and have appropriate strategies in place to apply when changes unveil (Brown and Eisenhardt, 1997), if they are to enhance their sales performance. Based on the literature cited earlier, the following hypothesis is derived:

H2: There is a positive and significant relationship between strategic ambidexterity and sales performance.

Organizational support and sales performance: Strategic ambidexterity as moderator

Strategic ambidexterity creates an environment that enables an organization to respond promptly to market opportunities by generating or reshaping flexible strate-gies (Grewal and Tansuhaj, 2001). Hence, strategic ambidexterity encourages organizations to formulate strategies suitable for new markets as well as those that are geared to addressing needs of existing markets (Li et al., 2008). Adoption of strategic ambidexterity, therefore, enhances financial services’ sales performance, since this compels these employees to reap sales from both new and existing markets. When implemented, it increases an organization’s adaptability to a dynamic environment (Wei et al., 2014), which is likely to augment organizational support’s effect on sales performance. This is in line with Tharenou et al. (2007), who in their meta-analytic study found that the relationship between training, a component of organizational support, and organizational outcomes, such as sales performance is stronger when it is marched with contextual factors. The contextual factor considered in our study is the implementation of strategic ambidexterity by a financial service. We contend that if financial services provide support which is relevant to existing markets and also offers support which is in line with the needs of new markets, they will be in position to cover a wider scope of markets and consequently reap more sales.

This view is consistent with Vorhies et al. (2011) who stated that exploration and exploitation strategies, the components of strategic ambidexterity, interact with marketing capabilities to increase organization’s performance. Organizational support provides capabilities such as having superior information technology tools or relevant knowledge, a capability attained through training. Marketing exploration focuses on applying new strategies such as getting the right product produced and marketed in response to newly identified or changed customer needs. This is done via: (1) development of a completely new initial configuration of market-based resources or (2) the reconfiguration and redeployment of existing market-based resources (Vorhies and Morgan, 2005). Exploitation strategies, on the other hand, involve improving the quality of existing products or delivery processes which is an incremental strategy (Atuahene-Gima, 2005). This can be appropriate for small and medium enterprises or organizations that are new to particular businesses, since it does not require much money to implement. These strategies produce required results with minimum disruption to existing processes and focuses is on efficiency (Leonard, 1995).

Thus, commercial banks and microfinance institutions ought to continue accepting cheque leafs as they open more Automated Teller Machines (ATMs) as outlets for depositing and withdrawing money, to cater for both customers who prefer use of ATMs and existing customers who are comfortable with employing the cheque system, in order to grow sales. This is corroborated with USAID (2007) finding that ease of access to withdrawal and deposit of money were major considerations for choice of the bank with which to open an account.

These arguments and suggestions are consistent with Aulakh and Sarkar (2005) who attest that certain combinations of exploitation and exploration strategies lead to increased sales performance. It is also in agreement with Li et al. (2008) who found strategic ambidexterity to be associated with enhanced sales performance. Thus, based on review of literature earlier, we hypothesize that:

H3: Strategic ambidexterity positively and significantly moderates organizational support’s prediction of sales performance.

This part of the work describes the method that was followed to carry out the study. The areas covered include the research design, survey population, sample selection, sampling design and procedure, measurement of the study constructs, establishing the validity and reliability of the instrument and data analysis.

Research design

A cross-sectional, analytical survey design was adopted. This kind of research design was preferred because it provided a ‘snapshot’ of the outcome sales performance at a point in time. It was, therefore, inexpensive since it takes a short time to conduct, yet it estimated the prevalence of sales performance since the study sample was randomly selected for the population that the researcher focused on.

Population and sample size

The population consisted of 461 financial services. This included 25 commercial banks (Bank of Uganda Annual Report 2010/2011), 25 insurance companies (Uganda Insurance Commission – http:⁄∕www.uginscom.go.ug⁄licensed companies 2011.pdf), 89 microfinance institutions affiliated to Association of Microfinance Institutions in Uganda (Microfinance Industry Assessment August, 2008) and 322 SACCO’s (registered with the Ministry of Trade, Industry and Cooperatives by December 31, 2009). A sample of 299 institutions, arrived at basing on Yamane’s (1973) formula was used in the study. The sample comprised 24 Commercial Banks, 24 Insurance Companies, 73 Microfinance Institutions registered with AMFIU, and 178 SACCO’s, respectively. Yamane’s sample size determination guideline was preferred because it yields a fairly representative sample. However, only 203 financial services returned well filled and therefore usable copies of questionnaires distributed to members of the sample, giving a response rate of 68%.

Sampling design and procedure

The researcher adopted a mixed sampling design. First, we stratified micro-finance institutions basing on tiers, into Tier I, Tier II, Tier III and Tier IV. Then, we obtained lists of Commercial Banks, Insurance Companies, and each of the MFI tiers. The lists were obtained from Bank of Uganda, Uganda Insurance Commission, AMFIU and the Ministry of Trade, Industry and Cooperatives, respectively. Elements in each of these categories of financial institutions were assigned numbers which were used in a lottery process before sampling was done. The assigned numbers were written on slips of paper, which were folded and then inserted in an empty box. The slips of paper in the box were then randomly drawn one by one, until the count reached the agreed sample size. Secondly, we visited heads of marketing/sales department/section in the selected institutions and requested for lists of people, including supervisors and officers, tasked with marketing financial services in those institutions. We then randomly selected one person each from the lists of supervisors and officers, respectively. The head of marketing or his or her equivalent was also given copy of the questionnaire and requested to respond to it. This was done to avoid getting response from only one category of people and thereby cause common bias. The institutions included in the sample were those that had been assigned the numbers on the pieces of paper picked from the bucket.

Data collection

This paper is part of a major study where quantitative data using self-administered questionnaire were collected between mid 2013 and 2014. Copies of the data collection instrument were distributed by the researcher and two research assistants. The target respondents included the head of marketing or sales, his or her supervisor and an officer or sales representative. Furthermore, the variables under study were measured as the following.

Measurement of study variables

Strategic ambidexterity

Items used by Li et al. (2008) guided the development of the items that were used to measure strategic ambidexterity. We dropped item ‘we give close attention to after-sales service’ (Narver and Slater, 1990), because our interaction with some of the practitioners revealed that it was not a common practice in financial services business. Ten items were used for strategic ambidexterity which comprises of exploratory and exploitative strategies, respectively. Items to measure exploratory strategies include statements such as we innovate even at the risk of rendering our own products obsolete, we undertake radical and incremental innovation in the services we deliver to our customers, we have short-term and long-term strategies to help customers anticipate developments, and we anticipate customer needs months or even years before the majority of the market recognizes them. The dimension of exploitive strategy was measured relying on the following items: our strategy for competitive advantage is based on our understanding of customer needs, we constantly monitor our level of commitment and orientation to serving customer needs and we measure customer satisfaction systematically and frequently, we work with lead users to try to recognize customer needs months or even years before the majority of the market, our firm expands services for existing clients, among others. Measurement of strategic ambidexterity was anchored on a five-point Likert scale ranging from ‘1’ Strongly disagree to ‘5’ Strongly agree.

Organizational support

To assess organizational support dimensions, reference was made to the items developed and used in a study by Yavas and Babakus (2010) and that of Alpkan et al. (2010). Yavas and Babakus (2010) scale was adopted because it had been successfully used on a study in banking, which is one of the financial services covered in our research. However, some of these items were amended to suit the study environment. Items that were irrelevant to achievement of the study objectives were discarded.

Finally 20 items, anchored on a five-point Likert scale ranging from ‘1’ Strongly disagree to ‘5’ Strongly agree, were retained in the questionnaire for collecting data concerning organizational support. The items included: my boss strives to have those under him/her get good health services, when they fall sick, my boss is willing to listen to work-related problems, at this institution, sufficient time is allocated for training, our institution allocates sufficient money for training. Other items that formed part of the measurement instrument were: at this institution, training programs are consistently evaluated, employees will be appreciated by their managers if they perform well, employees from every level will be rewarded, if they innovate. Also used were the following items: my promotion depends on the quality of service I deliver, I often make important decisions without seeking management approval, our employees have the freedom and authority to act independently in order to provide service excellence, sufficient money is allocated for technology to support my efforts to deliver better service, among others.

Sales performance

Sales performance was measured based on sales growth, market share (Narver and Slater, 1990; Jaworski and Kohli, 1993), retained customers and new accounts (Zallocco et al., 2009). This study, unlike those of Narver and Slater (1990), Jaworski and Kohli (1993) and Zallocco et al. (2009), omitted profit as one of the indicators to measure sales performance. This is because profits are mainly used as a measure for financial performance which was not the focus of our study; our research was concerned with sales performance; moreover, according to Kevin (2001: 607), if well managed, increased sales lead to increased profits. This meant that by looking at sales performance as measured in this study, one can have an idea on how the Uganda’s financial services were faring in terms of profits. In order to measure sales performance, 5 items that focused on change over a five-year period (2008 to 2012) in market share, number of clients, growth of turnover, among others, were used.

Reliability and validity of the instrument

In order to test the validity and reliability of the measurement instrument, a pilot study was conducted on a sample of 70 institutions, purposively selected from commercial banks, insurance companies, microfinance institutions and SACCOs. Reliability was measured using Cronbach (1970) coefficients. The Cronbach Alpha coefficients obtained for organizational support, strategic ambidexterity and sales performance were 0.92, 0.86 and 0.85, respectively, which were acceptable as they met the minimum value of 0.7 recommended by Nunnally (1978).

However, prior to data collection, following Churchill’s (1979) recommendation that scale items should be reviewed by someone else, preferably experts in practice and academia for their opinion on whether they cover the entire domain of the construct being measured, the researcher administered copies of the questionnaire to 10 experts/professionals for screening. These included two professionals each, from the Marketing, Management, and Management Science Departments, respectively, and four practitioners. The purpose and objective of the study were explained to them individually. The experts/professionals were then asked to rate each item based on relevancy with the following scales: 4 very relevant, 3 relevant, 2 somehow relevant, and 1 not relevant.

The content validity index (CVI) was obtained by dividing the proportion of items declared relevant by the total number of items. The CVIs for organizational support, strategic ambidexterity and sales performance were 81.68, 94.8 and 76%, respectively. The comments of the experts on the suitability of the items and constructs of the study variables were included in the final instrument, as recommended by Neuman (2006).

During the pre-test phase items found to be ambiguous or redundant were amended in order to be able collect data intended for the study. A letter explaining the purpose of the study and assuring the respondents that the information collected would be kept secret was then designed to accompany the final questionnaire.

Data analysis

Correlation and regression analyses were conducted to establish the associations that existed between the study variable and the magnitude of variance that organizational support and strategic ambidexterity separately and collectively contributed to change in sales performance. In addition, a computer-generated Modgraph was employed to assess organizational support and strategic ambidexterity on sales performance of Uganda’s financial services.

Under this study, both correlation and regression analyses were used to test for linear relationships between the variables and predictive power of the independent and moderator variables on the outcome variable.

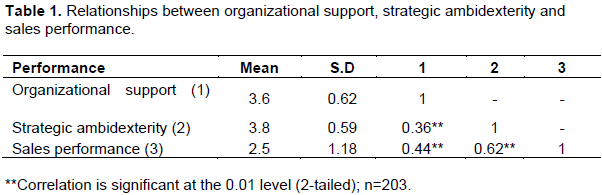

Table 1 shows that the mean scores of the study variables range between 2.5 and 3.8, while standard deviations range from 0.59 to 1.118. This, for a five-point Likert scale, indicates that the concepts in the study were being practiced to a reasonable level. Moreover the standard deviations are small which implies that the study sample is an accurate reflection of the population (Saunders, 2006).

Organizational support and sales performance

The study was carried out to establish the relationship between organizational support and sales performance. The Pearson’s correlation results revealed that there was a positive and significant relationship between organi-zational support and sales performance (r = 0.44, p ≤ 0.01). This means that organizational support has an impact on sales performance. Providing or sponsoring training of sales representatives is likely to increase their efficiency in service delivery which consequently satisfies financial services’ customers. Noe et al. (2006) argued that acquisition of knowledge and skills through training increases employee capability and enables them to deliver higher levels of service (Dolezalek, 2005).

Sales representatives who feel they are getting good remuneration from their employers usually handle customers in a friendly manner and may work beyond the mandatory limits. Customers who are happy with the service tend to not only remain loyal but also do more business with financial services that supply such services. This is consistent with Fu (2009) who contends that satisfied customers are committed to their work and are likely to spend more time and put a higher intensity of effort on work, which is likely to result in increased output and such as sales performance. Customers of financial services with such employees will bank more or undertake new insurance policies, in addition to existing ones, since they are attended to even outside the normal working hours. This finding is in line with Bhanthumnavin (2003) who observed that support by supervisors to their subordinates motivates employees to work beyond their assigned job specifications. This is likely to lead to improvement of individual and consequently sales performance. Eisenberger et al. (1986) further argued that supervisory support creates affective commitment within employees which makes them reciprocate with greater effort towards achievement of organizational objectives.

Strategic ambidexterity and sales performance

Furthermore, the correlation results in Table 1 indicated that there was a positive and significant relationship between strategic ambidexterity and sales performance (r = 0.44, p ≤ 0.01). This implies that strategic ambidexterity influences sales performance among financial services providers. Hence, developing new products such as internet banking and techniques for accessing financial services, for example, introduction of visa debit cards and Automated Teller Machines (ATMs), increases the number of customers and volume of deposits for commercial banks and microfinance institutions. This is because doing so enables busy managers and international businessmen to bank and access money any time from selected banks in many countries across the world. Financial services offering such services also are likely to grow their market share. This is in agreement with Vermeulen and Raab (2007: 1) who stated: “new products are a means to gain market share and ensure the viability of companies”.

This is supported by Naman and Slevin (1993) who argued that if organizations efficiently respond to current markets and concurrently effectively prepare for new market on the horizon through the practice strategic ambidexterity, if they are to be successful. Developing new goods or services for emerging markets and at the same time improving the quality of existing goods or services, basing on current resources and capabilities for existing markets leads to increase in sales for organizations (Li et al., 2008).

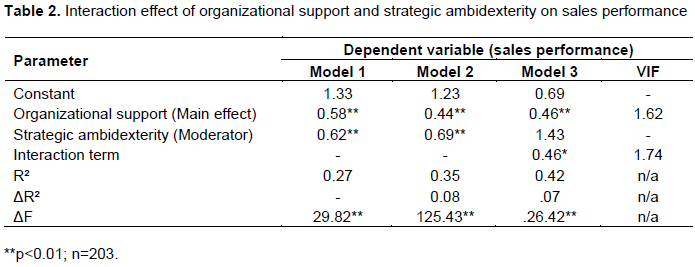

The result from the regression analysis revealed that there was a positive and significant relationship between organizational support and sales performance (β = 0.44, p<0.05). This result supports hypothesis (H1) of the study that states that: there is a relationship between organizational support and sales performance. This result is consistent with Caudron (2002) and Kraiger (2003) who observed that organizations which invest more in training and development are comparatively more successful.

Further, the table 2 revealed that there was a positive and significant relationship between strategic ambidexterity and sales performance (β = 0.66, p<0.01). This result support hypothesis (H2) of the study that states that: there is a relationship between strategic ambidexterity and sales performance. This result is consistent with Latif (2012) who asserted that employee training is linked to improved business results, which could include sales performance. This is consistent with Noe et al. (2006) who state that training facilitates employees’ learning of job-related knowledge, and skills which increases their capability and enables them to deliver higher levels of service (Dolezalek, 2005). Diamantidis and Chatzoglou (2012) observe that training is more vital for organizations operating in dynamic marketing environment, such as is the case with Uganda’s financial services, because it can enhance employee capability to deal with varying customer needs, personalities and circumstances.

Organizational support and sales performance: Strategic ambidexterity as a moderator

The finding from the regression analysis further indicated that the interaction effects between organizational support and strategic ambidexterity is positive and significant (β = 0.62, p<0.01). Therefore, this justifies the fact that the presence of strategic ambidexterity in financial services enhances the influence of their support to sales representatives on predicting their sales performance. The result indicates that the interaction enhances the main effect in explaining variation in sales performance. The inclusion of strategic ambidexterity increased the predictive power of organizational support by 7% from 35 to 42% (ΔR² = 0.07). Therefore, we can conclude that strategic ambidexterity boosts organizational support’s prediction of sales performance by 7%, thus supporting hypothesis (H3) of the study.

While organizational support to sales representatives (for example through training to equip them with knowledge and availing them with tools such as computers) enables them to deliver the selling function efficiently, unless the support facilitates the effort to meet target market needs it may not benefit firms that provide it. It is implementation of strategic ambidexterity that will compel financial services to respond to respond appropriately to both existing and new markets, respectively, and thereby cover a wider scope of markets to deliver sales (Li et al., 2008).

This is consistent with Vorhies et al. (2011) assertion that exploration and exploitation strategies interact with marketing capabilities, like having superior tools and being more knowledgeable, to increase organization’s performance.

In order to confirm existence of moderation we used a ModGraph to generate graphs as per Jose (2008) recommendation. The outcome portrayed in Figure 1 proves that strategic ambidexterity interacts with organizational support since the effect is higher at high level than it is at a lower level. The rule for existence of interaction postulates that the graph should have different gradients and slope, and the lines should not be parallel. Figure 1 abides by this rule.

This implies that changes in strategic ambidexterity do positively and significantly affect variation in sales performance. The result further indicates that the model was non-additive. This supports hypothesis (H3) of thestudy.

The finding is consistent with Aulakh and Sarkar (2005) who observed that combinations of exploitation and exploration strategies are associated with increased sales performance. It is also in agreement with Li et al. (2008) and Grawe et al. (2009) who found strategic ambidexterity to be associated with enhanced sales performance.

The main purpose of the study was to establish the moderating role of strategic ambidexterity in the relationship between organizational support and sales performance of financial service providers in Uganda. The study investigated the moderating effect of strategic ambidexterity in the relationship between organizational support and sales performance. Results of the study reveal that strategic ambidexterity positively and significantly moderates in the relationship between organizational support and sales performance.

This result implies that adoption of strategic ambidexterity improved sales performance of commercial banks, micro-finance institutions, insurance companies and SACCOs.

In addition, introduction of new products and ways of delivering existing products, such as use of visa debit cards and Automated Teller Machines (ATMs) increases the deposits from existing customers since this enables deposit and withdrawal of money from selected competing banks within and outside Uganda.

Besides, adoption of strategic ambidexterity encourages refinement of products and increases efficiency in execution of strategies or techniques used to deliver services to current customers.

The findings further support Aulakh and Sarkar (2005) who stated that strategic ambidexterity, the combination of exploitation and exploration strategies were associated with increased sales performance.

The result from the study indicated that there was an interaction between organizational support and strategic ambidexterity to boost sales performance among financial services providers in Uganda. The result showed that inclusion of strategic ambidexterity increased the predictive power of organizational support by 16% to influence sales performance.

Besides, there was a positive and significant relationship between organizational support and sales performance. Organizational support leads to increase in sales performance among financial services providers in Uganda.

Furthermore, the results also revealed that there was a positive and significant relationship between strategic ambidexterity and sales performance. Use of both exploitative and exploratory strategies by financial services’ providers results into improved sales performance.

Financial services providers should support their sales representatives to enable them execute their duties efficiently and effectively and thereby increase sales for those services.

Organizations operating in dynamic marketing environment should improve on the strategies used to exploit their current markets and also concurrently design strategies that are appropriate for new and anticipated markets, in order to enhance their sales performance.

Financial services managers should incorporate organizational support and strategic ambidexterity as strategies to be implemented in their strategic plans, since the interaction of these two strategies enhances sales performance.

LIMITATIONS AND AREAS FOR FURTHER STUDY

The study used cross-sectional design, therefore ignoring longitudinal study. Thus, there may be need to investigate the same concept over time.

This study was limited to only financial services providers located in Uganda. Future study involving other areas may be viable.

The authors have not declared any conflict of interests.

REFERENCES

|

Alpkan L, Bulut C, Gunday G, Ulusoy, Kilic K (2010). Organizational support for Intrapreneurship and its interaction with human capital to enhance innovative performance. Manage. Decis. 48 (5):732-755.

Crossref

|

|

|

|

Atuahene-Gima K (2005). Resolving the capability-rigidity paradox in new product innovation. J. Market. 69(4):61-83.

Crossref

|

|

|

|

|

Atuahene-Gima K, Anthony Ko (2001). An empirical investigation of the effect of market orientation and entrepreneurial orientation alignment on product innovation. Organ. Sci. 12(1):54-74.

Crossref

|

|

|

|

|

Aulakh P, Sarkar M (2005). Strategic ambidexterity in international expansion: exploration and exploitation of market, product, and organizational boundaries. Academy of Management Best Paper, Proceedings – International Management Division, IM31-7.

|

|

|

|

|

Babakus E, Yavas U, Karatepe O, Avci T (2003). The effect of Management commitment to service quality on employees' affective and performance outcomes. J. Acad. Market. Sci. 31(3):272-86.

Crossref

|

|

|

|

|

Bank of Uganda (2011). Anuual Report (2010/2011).

|

|

|

|

|

Bank of Uganda (2014). Anuual Report (Dec. 2014).

|

|

|

|

|

Bhanthumnavin D (2003). Perceived social support from supervisor and group members' psychological and situational characteristics as predictors of subordinate performance in Thai Work Units. Hum. Resour. Dev. Q. 14(1):79-97.

Crossref

|

|

|

|

|

Bloodgood JM, Chae BK (2010). Organizational paradoxes: dynamic shifting and integrative management. Manage. Decis. 48(1):85-104.

Crossref

|

|

|

|

|

Brown SL, Eisenhardt K (1997). The art of continuous change: Linking complexity theory and time-paced evolution in relentlessly shifting organizations. Adm. Sci. Q. 42:1-34.

Crossref

|

|

|

|

|

Caudron S (2002). Just say no to training fads. Train. Dev. 56(6):40-43.

|

|

|

|

|

Churchill G (1979). A paradigm for developing better measures for marketing constructs. J. Market. Res. 16:64-73.

Crossref

|

|

|

|

|

Cronbach LJ (1951). Coefficient alpha and the internal structure of tests. Psychometrika. 16:297-334.

Crossref

|

|

|

|

|

Diamantis AD, Chatzoglou PD (2012). Evaluation of formal training programmes in Greek organizations. Euro. J. Train. Dev. 36(9):888-910.

Crossref

|

|

|

|

|

Dolezalek H (2005). 2005 Industry report. Training 42(12):14-28.

|

|

|

|

|

Eisenberger R, Huntington R, Hutchison S, Sowa D (1986). Perceived Organizational support". J. Appl. Psychol. 71:500-507.

Crossref

|

|

|

|

|

FinScope (2013). Report on unlocking barriers to financial inclusion in Uganda.

|

|

|

|

|

Fu FQ, Bolander W, Jones E (2009). Managing the drivers of organizational commitment and salesperson effort: An application of Meyer and Allen's Three-Component Model. J. Market. Theory Practice. 17(4):335-350.

Crossref

|

|

|

|

|

Grewal R, Tansuhaj P (2001). Organizational Capabilities for Managing Economic Crisis: The Role of market orientation and strategic flexibility. J. Market. 65:67-80.

Crossref

|

|

|

|

|

Hamel G, Prahald CK (1994). Competing for the Future, HBS Press, Boston MA.

|

|

|

|

|

Holland J, Ruedin L (2012). Monitoring and Evaluating Empowerment Processes: Promoting Pro-poor Growth: the Role of Empowerment © OECD.

|

|

|

|

|

Hou J (2008). Toward a research model of market orientation and dynamic capabilities. Soc. Behav. Pers. 36(9):1251-1268.

Crossref

|

|

|

|

|

Jaworski BJ, Kohli AK (1993). "Market orientation: antecedents and Consequences. J. Market. 57:53-70.

Crossref

|

|

|

|

|

Jose PE (2008). ModGraph-I: A Programme to Compute Cell Means for the Graphical Display of Moderational Analyses: The Internet Version, Version 2.0. Victoria University of Wellington, New Zealand. From <http://www.victoria.ac.nz/psyc/staff/paul-josefiles/modgraph/modgraph.php>

|

|

|

|

|

Judge WQ, Blocker CP (2008). Organizational capacity for change and strategic ambidexterity: Flying the plane while rewiring it. Euro. J. Market. 42(9/10):915-925.

Crossref

|

|

|

|

|

Junni P, Sarala RM, Taras V, Tarba SY (2013). Organizational ambidexterity and performance: A meta-analysis. Acad. Manage. Per¬spect. 27(4):299-312, http://dx.doi.org/10.5465/amp.2012.0015

Crossref

|

|

|

|

|

Kevin JL (2001). "Market share, Profits and Business strategy". J. Manage. Decision. 39(8):608-618.

|

|

|

|

|

Kraiger K (2003). Perspectives on training and development. in WC Borman. DR

Crossref

|

|

|

|

|

Latif KF (2012). An integrated model of training effectiveness and satisfaction with Employee development interventions. Ind. Commercial Train. 4:211-222.

Crossref

|

|

|

|

|

Leornard-Barton D (1992). Core capabilities and core rigidities: a paradox in managing new Product development". Strat. Manage. J. 13(5):111-25.

Crossref

|

|

|

|

|

Li C, Lin C, Chu C (2008). The nature of market orientation and the ambidexterity of innovations. Manage. Decis. 46(7):1002-1026.

Crossref

|

|

|

|

|

McCarthy IP, Gordon BR (2011). Achieving contextual ambidexterity in R & D organizations: A management control system approach. R & D Managemen.41(3):240-258.

Crossref

|

|

|

|

|

March JG (1991). Exploration and exploitation in organizational learning. Organ. Sci. 2:71-87.

Crossref

|

|

|

|

|

Meuter ML, Bitner MJ, Ostrom AL, Brown SW (2005). Choosing among alternative service delivery modes: An investigation of customer trial of self-service technologies. J. Market. (69 April, 2005):61-83.

Crossref

|

|

|

|

|

Mwesigwa R, Namiyingo S (2014). Job resources, employees' creativity and firm performance of commercial banks in Uganda. Int. J. Econ. Commerce Manage. 2(9):1-14.

|

|

|

|

|

Naman JL, Slevin DP (1993). Entrepreneurship and the concept of fit: A model and empirical tests. Strateg. Manage. J. 14(2): 137-153.

Crossref

|

|

|

|

|

Narver JC, Slater SF (1990). The effect of a market orientation on business profitability. J. Market. 54(4):20-35.

Crossref

|

|

|

|

|

Neuman L (2006). Social Research Methods: Qualitative and quantitative approaches.6th Ed Pearson International, London.

|

|

|

|

|

Noe RA, Hollenbeck JR, Gerhart B, Wright P (2006). Human Resource Management: Gaining a Competitive Advantage. McGraw – Hill, New York, NY.

|

|

|

|

|

Nunnally JC (1978). Psychometric Theory. 2nd ed., McGraw-Hill New-York, NY.

|

|

|

|

|

Ocasio W (2011). Attention to attention. Organ. Sci. 22(5):1286-1296.

Crossref

|

|

|

|

|

O'Driscoll A (2008). Exploring paradox in marketing strategy: Managing ambiguity towards synthesis. J. Bus. Ind. Market. 23(2): 95-104.

Crossref

|

|

|

|

|

O'Reilly III CA, Tushman ML (2004). The ambidextrous organization. Harvard Business Review. 82:74-81.

|

|

|

|

|

O'Reilly III CA, Tushman ML (2013). Organizational Ambidexterity: Past, Present and Future. Academy of Management Perspectives (in press):1-30.

|

|

|

|

|

Poole M, Van de Ven A. (1989). Using paradox to build management and organization theories. Acad. Manage. Rev. 14(4):562-578.

|

|

|

|

|

Riggle RJ, Solomon P, Artis A (2015). The impact of perceived organizational support on salesperson psychological and behavioral work outcomes. International J. Manage. Res. Bus. Strat. 4(1):134-147.

|

|

|

|

|

Saunders M, Lewis P, Thornhill A (2006). Research Methods for Business Students FT Prentice-Hall, London.

|

|

|

|

|

Shanock LR, Eisenberger R (2006). When Supervisors Feel Supported: Relationships With Subordinates' Perceived Supervisor Support, Perceived Organizational Support, and Performance. J. Appl. Psychol. 91(3):689-695.

Crossref

|

|

|

|

|

Schuster L, Drennan J, Lings IN (2013). Consumer acceptance of m-wellbeing Services: a social marketing perspective. Euro. J. Market. 47(9):1439-1457.

Crossref

|

|

|

|

|

Spreitzer GM (1995). "Psychological empowerment in the workplace: dimensions, Measurement and validation." Acad. Manage. J. 38:1442-65.

Crossref

|

|

|

|

|

Spreitzer GM (2008). 'Taking stock: a review of more than twenty years of research on empowerment at work, In: Cooper, C. and Barling, J. (Eds). The Handbook of Organizational Behavior. Sage, Thousand Oaks, C.A.

Crossref

|

|

|

|

|

Spreitzer G, Kizilos MA, Nason SW (1997). A dimensional analysis of the relationship between psychological empowerment and effectiveness, satisfaction, and strain. J. Manage. 23(5): 679-704.

Crossref

|

|

|

|

|

Tharenou P, Saks MA, Moore C (2007). A review and critique of research on training. Hum. Resourc. Manage. Rev. 17:251-273.

Crossref

|

|

|

|

|

Uba Z, Sharifai MG, Mubaraka CM, Agaba L (2013). E-Procurement and Performance of Service Organizations in Uganda. Euro. J. Bus. Manage. 5(12):46-50.

|

|

|

|

|

Uganda Bureau of Statistics (2014). Statistical Abstract.

|

|

|

|

|

USAID (2007). Improving access to financial services in Uganda. Research Report.

|

|

|

|

|

Vermeleune P, Raab J (2007). Innovation and institutions: An institutional perspective on the innovation efforts of banks and insurances companies. London: Routledge, 2007.

|

|

|

|

|

Vorhies DW, Orr LM, Bush VD (2011). Improving customer-focused marketing Capabilities and firm financial performance via marketing exploration and exploitation. J. Acad. Market. 39:736-756.

Crossref

|

|

|

|

|

Wachiuri EW, Waiganjo E, Oballah D (2015). Role of supplier development on organizational performance of manufacturing industry in Kenya; a case of EastAfrica Breweries Limited. Int. J. Educ. Res. 3(3):683-694.

|

|

|

|

|

Wei Z, Zhao J, Zhang C (2014). Organizational ambidexterity, market orientation and Firm performance. J. Eng. Technol. Manage. 33:134-153.

Crossref

|

|

|

|

|

World Bank (2015). Uganda's financial sector review.

|

|

|

|

|

Yamane T (1973). Statistics: An Introductory Analysis. 3rd ed., Harper and Row, New York, NY.

|

|

|

|

|

Yau OHM, Chow RPM, Sin LYM, Tse ACB, Luk CL, Lee JSY (2007). Developing a scale for stakeholder orientation. European J. Market. 41(11/12):1306-1327.

Crossref

|

|

|

|

|

Yavas U, Babakus E (2010). Relationships between organizational support, customer orientation, and work outcomes: A study of frontline bank employees". Int. J. Bank Market. 28(3):222-238.

Crossref

|

|

|

|

|

Zallocco R, Pullins EB, Mallin ML (2009). A re-examination of B2B sales performance. J. Bus. Ind. Market. 24(8):598-610.

Crossref

|

|