ABSTRACT

The aim of this study was to examine the relationship between capital adequacy and the bank profitability measured by returns on equity (ROE) for Tanzanian large commercial banks during the period between 2009 and 2014. The positive relationship between bank capital and performance may also be explained using monitoring-based theory. The monitoring-based theory suggests that higher bank capitals encourage serious scrutiny and monitoring of borrowers to avoid default risk. The monitoring of borrowers indirectly improves the probability of bank’s survival by eventually increasing surplus generated through the healthier relationship between borrowers and banks, hence, bank performance Furthermore, the study found a significantly positive relationship between bank size and bank returns on equity. This is consistent with a familiar explanation that larger banks accumulate large assets which generate relatively more income and eventually increases the bank’s profitability. The study also reveals a negative and significant relationship between non-performing loans and bank profitability. This relationship shows that accumulation of Non-Performing Loans invites vulnerability to default risk which consequently causes banks’ failure to sustain or increase their investment efficiency. Similarly, lower NPLs are associated with drop in deposits rate which eventually impacts on banks’ operations and profitability. Consequently, the study recommends the banks’ capital regulation to be anchored on a sound system of bank monitoring and the Bank of Tanzania should swiftly and strictly enforce the compliance of the bank capital requirements and review the minimum capital requirement of deposit money regularly so as to maintain the optimal capital level in an attempt to improving bank profits level. The study also encourages bank capitalization to improve performance. More specifically, banks are encouraged to have a habit of retaining more earnings instead of distributing such large sums as bonuses in order to increase the banks’ capital base.

Key words: Capital regulation, performance, returns on equity.

The financial intermediation role in the banking sector is a very crucial process which connects deficit spending units and surplus spending units to ensure the transactions between the depositors and borrowers is successful. In this arrangement, banks take the intermediary role and receive commissions for this intermediation process.

Bank operations are regularly financed by capital procured from various sources including owners’ funds, reserves and share capital. The ultimate profits generated by banks from their operations are guided by some monetary and banking policies set by the central bank of a particular country (Longe, 2005).

In the absence of the statutory regulations imposed by the central banks to commercial banks, the customers would not have the assurance of their withdrawals when the needs arise. Among the statutory regulations imposed by central banks is a bank capital regulation. This is determined by capital–asset ratio which is obligatory to banks’ effective operations.

According to Longe (2005), capital regulation depends on the bank’s level of deposits and capital funds. Normally, customers do put their reliance on the adequacy of banks ‘capital for the security of their deposits. Therefore, the management of bank’s capital adequacy is a very crucial exercise and a mandatory one which improves its image in the eyes of the bank customers and its owners because the bank’s business is vulnerable to the dynamism and uncertainty of the economy as highlighted by Yudistira (2003) and Brash (2001).

According to Brash (2001), maintaining higher capital by banks is usually costly for banks because of the capital market imperfections and tax advantages related to debts. However, the trade-off theory suggests that higher capitals have ability to reduce risk and lower the premium required by investors as a compensation for the bankruptcy costs. It, therefore, follows that capital and bank value are either directly or inversely related in a short-run when banks have not attained their optimal capital ratio. This relationship disappears in a long- run when the banks attain their optimal level of capital ratio.

In this situation, regulatory bank capital requirements exceeds optimal capital ratio and the relationship between bank value and capital becomes negative showing that higher capitals reduce bank value if and only if capital ratios of banks are above optimal level either due to capital requirements or unexpected shocks.

According to Bash, (2001) banks usually raise their optimal capital levels during banking sector down-turns because during such a period, the probability of bankruptcy increases. On the other hand, during stable periods where the condition is normal, banks may either meet their optimal capital ratios, and in this case, the relationship between capital and bank value estimates to zero or go beyond in which case banks increase their values by decreasing the capital ratio and hence taking advantage of tax benefits of debt.

There is a strand of studies such as Hart and Moore, (1995), Leland and Pyle, (1977), Diamond and Rajan, (2001) etc. which have emphasized the possible undesirable effects on performance from banks holding more capital. Two explanations may be suggested for this effect on the bank’s cash-flows. The first explanation, according to Hart and Moore (1995), is based on the disciplinary role of debt. Because employing more debt into bank’s capital structure invites control from market, bank managers tend to avoid more debt and hence increase the level of equity capital as the cushion against market discipline.

In line with this, we also have to remember that there is an informational advantage attached to debt issuance in such a way that managers use the issuance of debt as a signal of bank financial soundness to financial markets as advocated by Leland and Pyle (1977). The study by Diamond and Rajan (2001) also shows that the use of too much capital reduces the level of bank liquidity creation. All these factors contribute to creating additional costs of holding more capital.

The contrasting view to the impact of holding too much capital emphasizes, however, the possible benefits of doing so by banks. According to Calomiris and Kahn (1991) there are two major conduits based on moral hazard between shareholders and debt-holders. Firstly; shareholders, holders of equity capital, enjoy the limited liability where losses are floored but more and more risks taken increases the potential gains. This usually tempts managers to take excessive risks at an expense of debt-holders and other stakeholders. Most often the debt-holders do foresee this habit and characteristically require a compensation for such excessive risks taken by managers. It follows; therefore, that increasing capital may reduce the compensation/premium and increase cash flows. Secondly; the increase in bank capital attracts more attention and stronger monitoring incentives from bank managers which ultimately increases the bank profitability. Following this mechanism, the capital ratio has a positive effect on value of the bank because monitoring affects the payoff from the bank’s loans portfolio (Holmstrom and Tirole, 1997; Mehran and Thakor, 2011).

However, in recent times bank supervisors throughout Africa, and particularly the Bank of Tanzania, call for banks to put aside some level of regulatory capital to cover for the risk they take, and also advise banks to sustain minimum regulatory capital levels so as to prevent the possibility of insolvency and stability of the banking system as advocated by Berger (1995) and Aggarwal and Jacques (2001).

This regulatory pressure brings about a discipline to banks’ managers and therefore improves the risk imposed to customers’ money. The capital regulatory pressure set up by central banks generally entails to improve the value of banks’ shareholders’ wealth. To strengthen the banking sector in Tanzania, according to the Banking and Financial Institutions Act (2014), the bank core capital requirement is set at 12.5% and total capital ratio at 14.5%, significantly above the ratio stipulated in the Basel (I-III).Basel 1-III set the total capital at 8%, tier-1 capital at 4.5% and tier-2 capital 6%. This capital regulations initiative is meant to secure the owners’ capital and improve the performance of the banks by strengthening the soundness and stability of the banking system which is quite crucial to the financial system and ultimately to the value maximizing objective of the bank.

Although the studies focusing on the impact of regulatory capital requirements on bank failure is common (Ng and Roychowdhury, 2014), the impact of regulatory capital requirements on bank profitability is not adequately covered by research particularly for banks in Africa (Barth et al., 2008; Berger and Bouwman, 2013). There is, then, a need to empirically examine the effect of capital regulation on banks’ profitability in Tanzania as a typical African country. Studies which examine the effect of bank capital regulations on performance are limited in developing countries and Tanzania in particular.

The objective of this study is, therefore, to examine the empirical relationship between the capital adequacy and the bank profitability measured by returns on equity in Tanzanian banks. The study, therefore, hypothesizes that; there is a positive relationship between bank capital and profitability because the increase in bank capital ratio through the capital regulations reduces the risk of bankruptcy to banks.

There are extensive literatures which address the effects of capital regulation on bank performance. Some of the studies support the positive relationship while others are in line with a negative relationship between bank capital and performance or profitability. The first group of studies advocates a positive relationship between bank capital and performance. Among these studies include Whitehead (2008) who argues that banks with high level of capital are capable of carrying out greater business expansion due to their large financial resources. Due to the sufficient resources such banks are holding, they may also develop capacity to compete more effectively and improve their technology level. This, ultimately, increases banks’ innovation in developing new banking products and remain competitive. Therefore, according to Whitehead (2008), bank capital is positively related to performance.

Furthermore, Whitehead (2008) suggests also that because sufficiently capitalized banks are more competitive to offer their banking products in wider network coverage, to price their products competitively and to finance a many transactions across sectors, they tend to improve their performance by doing so. Whitehead (2008) also reveals that banks holding sufficient capital tend to issue larger and long-term loans as compared to other undercapitalized banks and this, as a result, strengthens the bank performance. Along the similar line, Aderinokun (2004) found a positive relationship between bank capital base and performance. According to Aderinokun (2004), overcapitalized banks are able to increase their operational scope within the banking industry, decrease risk, guarantee quality asset management and attract a better liquidity position and ultimately increase the bank performance.

Similarly, Bolt and Tieman (2004) cite capital adequacy as a tool of limiting the possibility of bank managers taking too much risk on behalf of banks shareholders with limited liability, hence, encouraging risk sharing between the bank owners and the depositors. As a result, this reduces the risk of bankruptcy. According to the authors, capital adequacy also is considered as a buffer to cover potential bankruptcy costs thereby reducing the probability of bank illiquidity. It should also be understood that overcapitalized banks may offer their services even during financial down-turns and therefore perform their lending functions more efficiently and effectively.

Most papers which examined the relationship between banks’ capital and profitability reported a positive relationship employing different sample countries and different time periods. Among these papers include Angbazo (1997), Demirguc-Kunt and Huizinga (1999), Vennet (2002), Nier and Baumann (2006) and Flannery and Rangan (2008). These results may be directly attributed to the pecking order theory of capital structure.

Furthermore, Beltratti and Stulz (2009) put forward that banks with sufficient regulatory capital ratios perform better because they have sufficient capital to absorb unfavorable financial shocks that would otherwise jeopardize bank profitability especially during the period of financial down-turns. This view is in line with the direct relationship between risk and return in the theoretical literature as highlighted in Campbell (1993), Connor and Korajczyk (1988) and Mandelker (1974). These studies show that banks that take more risky financial decisions to earn more returns would force regulatory capital ratios up to match the level of risks they are taking. This, therefore, implies that banks with higher regulatory capital ratios perform better than banks with lower levels of regulatory ratio.

On the other hand, another group of scholars associate holding more capital with more costs to the banks. For instance, according to Berger et al. (2013) the imposition of higher bank capital requirement limits banks’ competitive pressure as a result of competition which may occur on issues such as loans, deposits and sources of debt and equity investment. Following this effect banks may end up lending less, reduce deposit rates so as to maintain the larger capital base required by the regulators and, as a result, impairing the banks’ operations. Furthermore, when the financial market is concentrated banks with ample capital may think they are “too-big-to-fail” and this may lead to bank failures.

The core objective of any banking business is to maximize the return of the shareholders as previously insisted by Berger et al. (2013). Building on this, Berger et al. (2013) conducted a study of US banks to examine the empirical relationship between banks’ return on equity and the capital ratio. The results of the study showed a significantly positive relationship between return on equity (ROE) and capital ratio. Another study by Abreu and Mendes (2002), using the Europe sample of banks, investigated the factors affecting bank interest margin and profitability and the results showed that banks with higher capital are reported to have lower funding costs with lower likelihood insolvency. This may, therefore, directly be linked with higher profit levels.

According to Nacuer (2003) banks which are adequately capitalized tend to have little need for external funding as the level of the capital they hold is used as the buffer and this increases the ability of such banks to earn more profits. Contrary to Nacuer (2003) claim, inadequately capitalized banks suffer a reputational query in the eyes of the depositors and investors which may result into investors refraining from doing business with these kinds of banks. This may ultimately affect adversely the bank’s profitability. This shows that increasing bank capital directly leads to a corresponding improvement on banks’ overall returns. This positive significant relationship is supported by authors such as Furlong and Keeley (1989), Keeley and Furlong (1990) and Berger (1995).

Data assembly

The data employed in this study is assembled from the respective large commercial banks’ published annual financial reports for the period between 2009 and 2014. This sample period is chosen because Tanzania under BoT issued the amended capital adequacy regulations Act in 2008 and from 2009 the Act became operational; therefore this period is relevant to see how such amendment relate to bank profitability. The sample covers all large commercial banks operating in the Tanzanian banking sector. Large banks are chosen because they control about 80% of the market share as highlighted in the study by Serengeti (2014).

Model specification and variable definition

This study primarily aims at examining how capital adequacy influences the profitability of commercial banks in Tanzania. The model used in this study is used before by Demirguc-Kunt and Huizinga (1999) .The dependent variable in this model is return on owners’ equity (ROE) and independent variable is Capital Adequacy while control variables are bank size, Non-performing Loans and Liquidity.

The model

ROEit = b0 +b1* BSZit + b2* CARPit + a3*NPLit b4* LIQit+ e1it

Where;

- ROE (Profitability) = Returns on Equity shows the effectiveness of management in the utilization of the funds contributed by shareholders

- CARP=Capital Adequacy Ratio shows the strength of banks against the vagaries of economic and financial environment

- BSZ (Size of the bank): logarithm of total assets of the bank. Size can show the economies of scale.

- NPL (Non-Performing Loans) - This is an indicator of credit risk management. It particularly indicates how banks manage their credit risk because it defines the proportion of loan losses amount in relation to Total Loan amount

- LIQ -This is measured as the ratio of Liquid Assets to Total assets

e1it - Error term

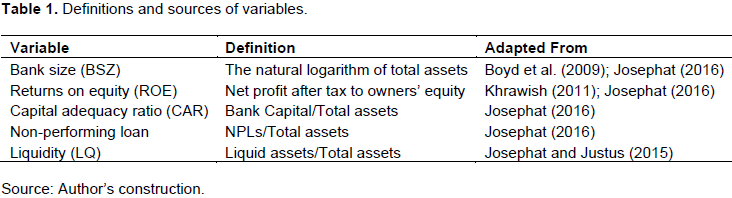

The variables used in this study are summarized in Table 1.

Regression diagnostics

In specifying the model it is understood that the independent variables are able to explain much of what is different about an observation, a bank, or a year, but there is probably some unmodeled heterogeneity.

Usually the heterogeneity which is left unmodeled goes into the error term (e1it). The true problem occurs when some banks (or, less commonly, time periods) share some unmodeled heterogeneity. In this case, we would like to be able to explain everything that makes each bank different, but usually this is unmanageable, so something has to be done to remove this shared and thus systematic heterogeneity from the error term. Because this study uses a panel data, to solve the potential problem of heterogeneity either a fixed effect or random effect regression model should be employed.

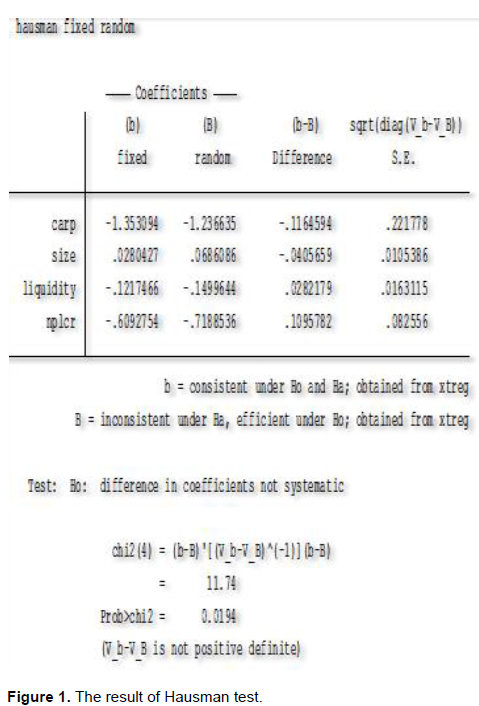

To decide between fixed or random effects a Hausman test, where the null hypothesis is that the preferred model is random affects vs. the alternative the fixed effects (Green, 2008.) is used. The Hausman test shows whether the unique errors are correlated with the regressors; the null hypothesis is that they are not correlated. If the probability of chi squared in the Hausman test output is less than 0.05 fixed effect is preferred otherwise random effect is preferable. When this test was run the Chi-squared is found to be 0.0194 which is less than 0.05 hence, the study chose to apply fixed effect regression model presented in Figure 2. The result of the Hausman test is presented in Figure 1.

Descriptive statistics

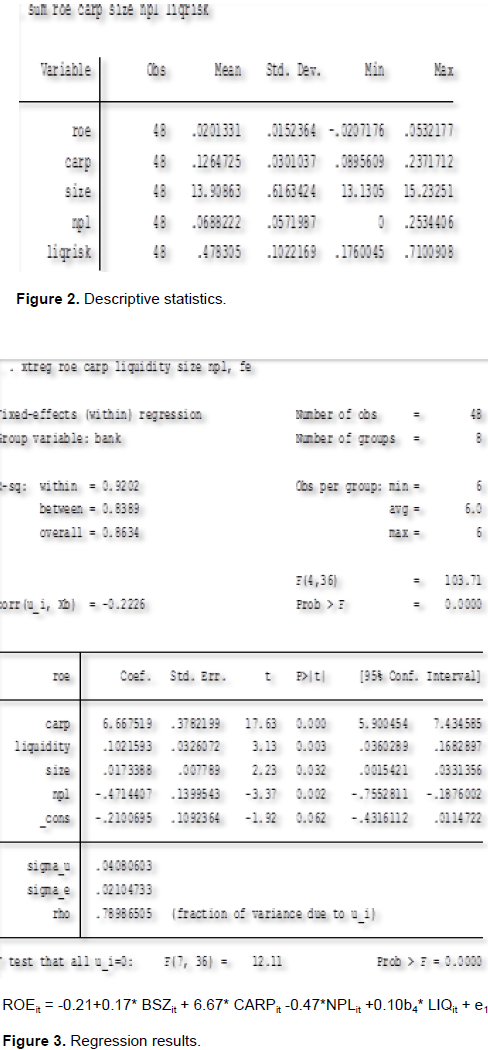

Figure 2 shows a descriptive statistics of the study. The table shows that during the study period, 2009 to 2014 banks’ the capital ratio had a mean value of 12.6% which is at par with the minimum capital requirements by the Bank of Tanzania. On the other hand, the maximum capital ratio is 24% while the minimum stands at 9%. The interesting finding is that even the bank which has not complied with the minimum capital requirement set by BoT has shown to comply with the standard set by Basel (I-III) which shows the minimum total capital ratio of 8%. Figure 3 also shows that bank’ non-performing loans ratio had a minimum of 0% and reached a maximum of about 25% with average (mean) of around 7%. Large commercial banks in Tanzania have a reported average return on equity of about 2% with maximum of 5% and minimum of -2% as shown in descriptive statistics Figure 2. Likewise the descriptive Figure 2 shows that Capital Adequacy is an essential mechanism to protect banks’ solvency and profitability because the banks’ business is among the riskiest businesses in the financial market. Figure 2 also reports an average liquidity of about 48% with a minimum of roughly 18% and the maximum of 71%.

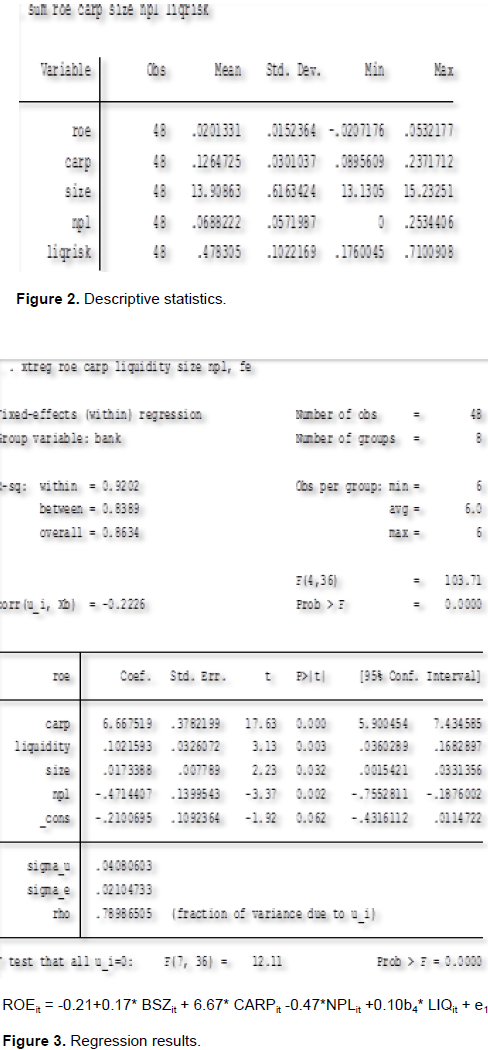

The regression model of this study comprised of bank profitability measured by returns on equity with four explanatory variables namely bank capital adequacy, bank size, non-performing loans and bank liquidity as presented in Figure 3. Figure 3 shows that bank capital has a positively statistically significant relationship with bank ROE at 5% significant level.

This finding supports the results of the famous conclusion of Berger (1995) who found that banks increase the level of their capital by boosting up the level of their capital requirements. The result is further supported by studies such as Flannery and Rangan (2008) who argue that banks with high capital ratios relative to their long-run targets may increase the level of their profitability by raising capital ratios. This study realizes that capital regulatory pressure compels the banks to regulate the structure of their capital in a more flexible manner. This positive relationship between bank capital and performance may further be explained using monitoring-based theory. The monitoring-based theory suggests that higher bank capitals encourage serious scrutiny and monitoring of borrowers to avoid default risk. The monitoring of borrowers indirectly improves the probability of bank’s survival by eventually increasing surplus generated through the healthier relationship between borrowers and banks, hence bank performance. The explanation of the monitoring-based theory is supported by Tirole (1997) and Carletti and Leonello (2011).

The results of this study are consistent with those of Campbell (1993), Connor and Korajczyk (1988) and Mandelker (1974). These studies show that banks that take more risky financial decisions to earn more returns would force regulatory capital ratios up to match the level of risks they are taking. This, therefore, implies that banks with higher regulatory capital ratios perform better than banks with lower levels of regulatory ratio. Concerning the control variables; bank size, liquidity and non-performing loans, Figure 3 show that, the bank size has a statistically significant positive relationship with ROE at 5% significance level. This is in line with a known explanation that larger banks possess larger asset levels generating more income for banks and eventually increasing the bank profitability.

On the other hand, the bank liquidity has a positive significant relationship with bank profitability at 5% significance level. This means that banks which are more liquid assets tend to create the environment of better performance and hence increase the value of shareholders wealth and improves earnings while banks with liquidity problem may amount under-performance and in extreme case this may attract a complete bankruptcy.

Regarding the non-performing loans, Figure 3 reports a statistically significant relationship between ROE and NPLs at 1% significant level. The results reflected in this study demonstrate that commercial banks are often vulnerable to default risk or delayed payment of the loans from the borrowers. Such default is considered by banks as loan losses and more of these losses negatively affect the ability of banks to honor its lending function. The consequence of this is the failure to maintain or increase the efficiency of banks’ investment. Likewise, lower NPLs are associated with decline in deposits rate which ultimately impact on banks’ operation and profitability. This result is consistent with the ones previously presented by Kargi (2011) in Nigeria, Epure and Lafuente (2012) in Costa-Rica, and Ara et al. (2009) in Sweden.

CONCLUSION AND RECOMMENDATIONS

The purpose of this study was to examine the relationship between capital adequacy and the bank profitability measured by returns on equity for Tanzanian large commercial banks during the period between 2009 and 2014.The results of the study show that capital ratio positively impacts banks’ returns on equity.

The positive relationship between bank capital and performance may be explained using monitoring-based theory. The monitoring-based theory suggests that higher bank capitals encourage serious scrutiny and monitoring of borrowers to avoid default risk. The monitoring of borrowers indirectly improves the probability of bank’s survival by eventually increasing surplus generated through the healthier relationship between borrowers and banks hence bank performance.

The explanation of the monitoring-based theory is supported by Tirole, (1997) and Carletti and Leonello, (2011).The fact that bank capital shows a positive effect on bank returns on equity influences the endorsement of bank financial soundness and security.

This study realizes that capital regulatory pressure compels the banks to regulate the structure of their capital in a more flexible manner. Furthermore, the study found that bank size positively and significantly affects bank’s returns on equity. This is consistent with a familiar explanation that larger banks accumulate larger level of assets generating relatively more income and eventually increases the bank’s profitability.

The study also concludes a negative and significant relationship between bank returns on equity and the assets quality measured by the non-performing loans. This relationship shows that accumulation of NPLs invites vulnerability to default risk which is recognized by banks as loan losses and more of these losses negatively affect the ability of banks to do justice to its lending function.

This consequently causes a failure to sustain or increase the bank investment efficiency. Similarly, lower NPLs are associated with drop in deposits rate which eventually impacts on banks’ operation and profitability.

Consequently, the study recommends the banks’ capital regulation to be anchored on a sound system of bank monitoring and the bank of Tanzania should swiftly and strictly enforce the compliance of the bank capital requirements and review the minimum capital requirement of deposit money regularly so as to maintain the optimal capital level in an attempt to improving bank profits level. The paper also encourages bank capitalization to improve performance. More specifically, banks are encouraged to have a habit of retaining more earnings instead of distributing such large sums as bonuses in order to increase the banks’ capital base. This study is faced with the limitations of having no qualitative information which could enrich the quantitative analysis presented. However, the study proposes a further study which may combine both qualitative and quantitative data.

The authors have not declared any conflict of interests.

REFERENCES

|

Aderinokun O (2004). "Market Structure and Profitability in the Banking Industry of CFA countries": The Case of Commercial Banking in Cameroon.

View

|

|

|

|

Abreu M, Mendes V (2002). Commercial bank interest margins and profitability. Evidence from E.U countries", Porto Working paper series.

|

|

|

|

Angbazo L (1997). Commercial bank net interest margins, default risk, interest rate risk, and off-balance sheet banking. J. Bank. Financ. 21:55-87.

Crossref

|

|

|

|

Barth JR, Caprio G, Levine R (2008). Rethinking bank regulation: Till angels govern. Cambridge: Cambridge University Press.

|

|

|

|

Beltratti A, Stulz RM (2009). Why did some banks perform better during the credit crisis? A cross-country study of the impact of governance and regulation (NBER No. w15180).National Bureau of Economic Research.

Crossref

|

|

|

|

Berger AN, Bouwman CH (2013). How does capital affect bank performance during financial crises? J. Financ. Econ. 109(1):146-176.

Crossref

|

|

|

|

Berger AN (1995).The relationship between capital and earnings in banking, J. Money Credit Bank. 27:432-456.

Crossref

|

|

|

|

Bolt W, Tieman A (2004). Banking Competition, Risk and Regulation. Scand. J. Econ. 4:783-804.

Crossref

|

|

|

|

Calomiris C, Kahn C (1991). The role of demandable debt in structuring optimal banking arrangements. Am. Econ. Rev. 81:497-513.

|

|

|

|

Campbell JY (1993). Understanding risk and return.(National Bureau of Economic Research, Working Paper No. 4554). NBER.

Crossref

|

|

|

|

Yudistira D (2003). The Impact of Banks Capital Requirement in Indonesia. Loughborough University, Leicestershire, UK.

|

|

|

|

Connor G, Korajczyk RA (1988). Risk and return in an equilibrium APT: Application of a new test methodology. J. Financ. Econ. 21(2):255-289.

Crossref

|

|

|

|

Demirgüc-Kunt A, Huizinga H (1999) Determinants of commercial bank interest margins and profitability: Some international evidence. World Bank Econ. Rev. 13:379-408.

Crossref

|

|

|

|

Diamond D, Rajan R (2001). Liquidity risk, liquidity creation, and financial fragility. J. Polit. Econ. 109:287-327.

Crossref

|

|

|

|

Flannery MJ, Rangan KP (2008). What caused the bank capital build-up of the 1990s? Rev. Financ Stud. 70:213-227.

|

|

|

|

Furlong FT, Keeley MC (1989). Capital Regulation and Bank Risk-Taking: A Note." J. Bank. Financ. 13(6):883-891.

Crossref

|

|

|

|

Keeley MC, Furlong FT (1990). A Reexamination of Mean Variance Analysis of Bank Capital Regulation. J. Bank. Financ. 14(1):69-84.

Crossref

|

|

|

|

Hart O, Moore J (1995). Debt and seniority: an analysis of the role of hard claims in constraining management. Am. Econ. Rev., b85:567-585.

|

|

|

|

Holmstrom B, Tirole J (1997). Financial intermediation, loan-able funds, and the real sector. Q. J. Econ. 112:663-691.

Crossref

|

|

|

|

Josephat L, Justus M (2015). Assessing the Determinants of Bank Liquidity with an Experience from Tanzanian Banks. Afr. J. Financ. Manage. 23(1&2):76-88.

|

|

|

|

Josephat L (2016). Efficiency of Capital Adequacy Requirements in Reducing Risk-Taking Behavior of Tanzanian Commercial Banks. Res. J. Financ. Account. 22:110-118.

|

|

|

|

Khrawish HA (2011) Determinants of commercial bank performance: Evidence from Jordan. Int. Res. J. Financ. Econ. 5(5):19-45.

|

|

|

|

Leland H, Pyle D (1977). Informational asymmetries, financial structure, and financial intermediation. J. Financ. 32(2):371-387.

Crossref

|

|

|

|

Longe AA (2005). An Overview of the Regulatory Reports on Banks in Nigeria. A seminar paper, CBN Training Centre, Lagos No 3

|

|

|

|

Mandelker G (1974). Risk and return: The case of merging firms. J. Financ. Econ. 1(4):303-335.

Crossref

|

|

|

|

Mehran H, Thakor A (2011).Bank capital and value in the cross-section. Rev. Financ. Stud. 24(4):1019-1067.

Crossref

|

|

|

|

Ng J, Roychowdhury S (2014). Do loan loss reserves behave like capital? Evidence from recent bank failures. Rev. Account. Stud. 19(3):1234-1279.

Crossref

|

|

|

|

Vennet R (2002) Cost and profit efficiency of financial conglomerates and universal banks in Europe. J. Money Credit Bank. 34:254-282.

Crossref

|

|

|

|

Whitehead (2008).Deconstructing Equity: Public Ownership, Agency Costs, and Complete Capital Markets. COLUM. L. REV. 231:244-247.

|

|

|

|

Brash DZu (2001). Proposed new Capital Adequacy Framework. A Paper Presentation to the Secretary General of Basel Committee on Banking Supervision, Bank for International Settlements, Basel Switzerland.

|