This study analyzes a firm’s characteristics which affect the probability of financial distress. It takes into account accounting variables, ownership and management characteristics. In particular, it studies the effect of the ultimate controlling owner nature; that is, family or non-family control, on a firm’s likelihood to run into financial distress. This research focuses on a large sample of Italian private family and non-family firms for the period 2004 to 2013, and drawing on the socioemotional wealth framework, studies the effect of family control and influence by the means of different forms of family involvement into the business. It takes into account family indirect influence by ownership and direct influence by the means of a family chief executive officer (CEO) or by the presence of family members on the board. The study results point out that family businesses are less likely to incur in financial distress than non-family firms. Moreover, a family CEO reduces a firm’s likelihood of financial distress. On the other hand, the presence of multiple family members on board increases this probability, but the effect is lower in the first generational stage.

A firm’s financial distress prediction is a relevant issue in accounting and financial studies. Since the 1960s, literature has engaged in the construction of indicators whose score may predict a firm’s financial distress (Beaver, 1966; Altman, 1968).

Later, these studies were extended in order to individuate valuable indicators for the prediction of non-listed firms’ financial distress (Altman, 2000). This field of study continued to develop, resulting in the production of various models for the valuation of a firm’s bankruptcy risk (Altman et al., 1977), its probabilistic prediction (Ohlson, 1980; Zavgren, 1985), and also providing the prediction of different corporate financial status, not only ultimate failure, in order to approximate the continuum of a firm’s financial health (Lau, 1987).

More recent studies have addressed this issue by using data mining methods (Sun and Li, 2008) applied not only to financial ratios but also to information related to board ownership and insider holding (Chen and Du, 2009). These models are mainly based on a dichotomous classification of bankrupt versus non-bankrupt. By contrast, hazard models consider the samples to be drawn from the same population, and can take into account the panel property of financial statements and the common influence of temporal and macroeconomic conditions (Nam et al., 2008; Shumway, 2001).

Some studies have focused on board and ownership structure characteristics, pointing out that weak corporate governance renders a firm vulnerable to economic downturns and enhances the probability of falling into financial distress (Lee and Yeh, 2004). Other studies find no significant relation between board and management ownership and the probability of financial distress (Simpson and Gleason, 1999), but highlight that blockholder and outside director ownership lowers this risk (Elloumi and Gueyie, 2001). Therefore, we know that ownership structure characteristics may affect a firm’s likelihood to suffer financial distress.

The effect of family control and influence on business risk of falling into severe financial difficulties is still a relatively unexplored field. Numerous family business studies suggest that family control and influence is positively related to a firm’s performance (Anderson and Reeb, 2003a; Barontini and Caprio, 2006; Villalonga and Amit, 2006) but some authors highlight the family influence drawbacks (Schulze et al., 2003).

Moreover, empirical literature shows that family businesses use more leverage, both in private and in listed companies (Anderson and Reeb, 2003b; King and Santor, 2008; Setia-Atmaja et al., 2009; Croci et al., 2011). These studies suggest that the family nature of a business could have an effect on its financial distress risk, however research on this issue is still very limited.

Wilson et al. (2013) addressed this issue for the first time, finding that when a firm is owned by a family, and has at least one family-director, it has a lower probability to run into bankruptcy. They do not control if the effect of board characteristics changes according to a family firm’s generational stage. This is a relevant issue because family firms are not an homogeneous group and a firm’s generational stage is a major source of heterogeneity for family businesses (Cruz and Nordqvist, 2012; Le Breton-Miller and Miller, 2013; Arrondo- García et al., 2016).

To the best of the study knowledge, research has not yet addressed this issue but it is of particular interest given the strong presence and the relevant role played by family businesses around the world (Porta et al., 1999; Villalonga and Amit, 2006). In continental Western Europe, the percentage of family businesses is more than 60% (Faccio and Lang, 2002).

We address this gap in literature by studying a sample of 1,137 Italian private firms for the period 2004 to 2013. Drawing on the socioemotional wealth (SEW) concept - which refers to the non-financial utilities that family owners derive from the non-economic aspects of the business (Gomez-Mejia et al., 2007) - we analyze how family ownership control and different forms of family involvement affect a company’s probability of financial distress in different generational stages.

The study analyses combine accounting variables and information related to ownership, management and board composition. Overall, the study findings suggest that family firms are less likely to run into financial distress than non-family businesses. Family control and influence exerted through a family CEO significantly reduces a firm’s likelihood of financial distress, but this probability increases in the presence of multiple family members on the board in later generational stages.

The study contributes to literature on financial distress probability, underlining the relevance of the ultimate nature of the controlling owner. It adds to family firm literature by providing evidence on the determinants of the financial distress probability of family businesses. It also addresses scholars’ calls to pay greater attention to the heterogeneity of family firms (Salvato and Moores, 2010) by analyzing the effect of a firm’s generational stage.

Theoretical framework and hypothesis development

Relatively recent studies explain family firms’ peculiarities, referring to the concept of socioemotional wealth which has been defined as “the non-financial aspects of the firm that meet the family affective needs” (Gomez-Mejia et al., 2007), that is, the part of a business’ value that the owner perceives and that cannot be explained by financial motivations (Zellweger and Astrachan, 2008).

This non-financial value derives from several dimensions which characterize the SEW: family control and influence, the sense of identification of family members with the business, binding social ties, emotional attachment, and the renewal of family bonds to the firm through dynastic succession (Berrone et al., 2012).

Families are particularly concerned with retaining control of the firm they own as it is the means to exert their influence on the business and derive a stock of affect-related values. They feel a strong sense of identification with their firm; a firm is an extension of the family and they protect the company’s reputation because it is related to that of the family itself (Berrone et al., 2012; Deephouse and Jaskiewicz, 2013).

Family firms’ employees who are not family members, with the passage of time, tend to develop a sense of identification and belonging to this extended family. Strong ties characterize not only the relationship between the owning family and its employees, but also ones with customers, suppliers and the local community (Berrone et al., 2012).

Therefore, the business is also the means to develop social bonds that increase the family’s image and influence on the community to which it belongs. The network of ties that the company develops with its stakeholders provides emotional value to the family members as it satisfies their needs in terms of affect and belonging, and fosters their emotional attachment to the business (Astrachan and Jaskiewicz, 2008).

The preservation of the family dynasty in the business is the means to renew the family bonds and transfer the family values to the future generations. The SEW is the “affective endowment” (Cruz et al., 2012), the emotional value (Zellweger and Astrachan, 2008) produced by the interaction between the family and the business and between family members which operate in the business. Therefore, the preservation of the socioemotional wealth, and its dimensions is the main concern for family firms and characterizes their behavior (Gomez-Mejia et al., 2007).

Family control and influence on the firm is a source of emotional value for family members because of their strong linkage and endowment in the business (Gomez-Mejia e al., 2007). As a matter of fact, numerous studies point out that family firms present a higher leverage (Anderson and Reeb, 2003; King and Santor, 2008; Setia-Atmaja et al., 2009; Croci et al., 2011) because families use debt financing in order to preserve their control and influence on the business (Gottardo and Moisello, 2014). The likelihood of financial distress enhances a family’s risk of losing the business and giving up its emotional return.

Gomez-Mejia et al. (2007) studied a large sample of Spanish family-owned olive oil mills who faced the choice of joining a cooperative or remaining independent. The former option implied losing family control and lowering business risk, the latter preserving the family’s socioemotional wealth and enhancing performance hazard. The empirical findings led Gomez-Mejia et al. (2007) to conclude that family firms may be “risk willing and risk averse at the same time”.

The results prove that family firms may put at risk financial performance in order to preserve family control and influence, but when performance is below set targets, they do not assume venturing risk, in order to enhance performance, because bankruptcy would cause the loss of the family’s financial and emotional wealth.

Families see the business, and the related affective stocks, as an asset that must be transmitted to their heirs (Casson, 1999), so they prefer long-term investments, characterized by lower levels of risk (Gallo and Vilaseca, 1996; Croci et al., 2011), and they avoid risky investment strategies as they pursue business stability (Harris et al., 1994).

Families experience a strong sense of identification with the business and therefore, are concerned with their firm’s reputation (Zellweger et al., 2013), they are worried that it may harm their image and reflect on them as individuals (Dyer and Whetten, 2006). Therefore, a firm’s financial distress and the risk of bankruptcy would damage the owning family name and family members.

Financial distress would also put at risk the family ties that hold a firm hold together with vendors, suppliers, employees, and also with the community of which the firm is part as a company might not be able to guarantee employment and other benefits to the local community. Family members derive relevant emotional and reputational returns from these ties (Berrone et al., 2012) and act in order to preserve and strengthen them (Cennamo et al., 2012).

Family businesses, unlike non-family firms, are thus motivated not only by financial, but also by strong non-financial goals to act in order to avoid financial distress. The presence of a family CEO has an amplifier effect because the family exerts directly its influence on the business.

In this case, the CEO’s professional life and personal wealth are closely linked, and the concerns for the consequences of financial distress are higher. The sense of identification between the family and the business increases because the individual who represents the company in dealings with third parties is a member of the family, therefore the reputation of the firm and family image are more closely tied. Some empirical studies on listed firms (Anderson and Reeb, 2003; Chu, 2011; Maury, 2006) suggest that a family CEO enhances a firm’s performance.

The effect may differ according to a firm’s generational stage as this has a moderating effect on the relevance of the SEW (Gomez-Mejia et al., 2011). In the first generational stage, family firms are normally founder owned and run. In this stage, the affective endowment in the business is very high. There is a strong emotional attachment between the CEO and the other family members, which enables the former to resolve possible conflicts between the latter and to resist the family’s pressures that can harm a business’ financial health (Le Breton-Miller and Miller, 2013). In the first generational stage, the family CEO has a clear motivation to manage the business in order to pass on a healthy firm to later generations, thus ensuring the family dynasty (Berrone et al., 2012). Therefore, in the light of the aforementioned studies, our first hypothesis is the following:

H1: The effect of a family CEO on the probability of financial distress is different depending on the generational stage

Previous research has highlighted that family boards are more stable and therefore the firms have a lower probability of bankruptcy (Wilson et al., 2013).

Empirical literature suggests that weak corporate governance enhances the probability of falling into financial distress (Lee and Yeh, 2004); board composition and structure affects a firm’s probability of failure (Daily and Dalton, 1994). Moreover, board ownership reduces the probability of bankruptcy for financially distressed firms because of the implicit, or explicit, incentives it provides (Fich and Slezak, 2008).

Board composition, in terms of the number of family members, power and quality of interactions, affects the “embeddedness” of the business within the family (Le Breton–Miller et al., 2011). In the first generational stage, family members sitting on boards tend to be less conflictual as they have strict kinship ties (siblings) and the business is still under the influence of the founder.

In subsequent generational stages, the direct influence of the founder and his/her moderating effect on conflicts may be absent. With the passing of generations the kinship ties between the board’s family members are weaker, family branches’ interests become prevailing motivations, the conflicts between family members are stronger and identification with the firm lessens (Le Breton-Miller et al., 2011). Therefore, the beneficial effect of a family’s affective endowment on the business falls. Based on the aforementioned research, the study second hypothesis is:

H2: The effect of family board members on the probability of financial distress is different depending on the generational stage

We searched for Italian firms on the Aida Database (Italian Digital Database of Companies), the Italian provider of the Bureau van Dijk European Database, during the period 2004 to 2013 with at least 4 years of accounting data and yearly sales of over €40 million in at least one year. We chose this threshold because for smaller private companies often there is no management data available over the years. We dropped from the sample all firms that merged during the period, since it is not clear, without carrying out detailed checks, to uncover the reasons behind the mergers. Financial firms are also excluded. The final sample contained 999 healthy firms, as of 2013, and 138 firms that underwent some form of financial distress in the period, for 5,949 firm-year observations.

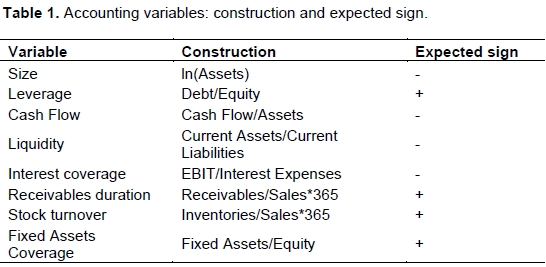

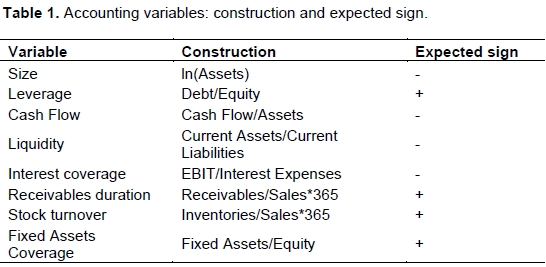

The independent variables are represented by accounting variables and information related to ownership, management and board composition. We chose our accounting variables basing on the relevance pointed out by previous studies on financial distress. The exclusion of these variables from the analysis could potentially generate an omitted-variable bias. They are size (Altman, 1968), leverage (Lang and Stulz, 1992), cash flow (Casey and Bartczak, 1985; Aziz et al., 1988), liquidity (Beaver, 1966; Altman, 1968; Daily and Dalton, 1994), interest coverage ratio (Asquith et al., 1994), duration of receivables, stock turnover and fixed assets coverage (Chen, 2011) (Table 1).

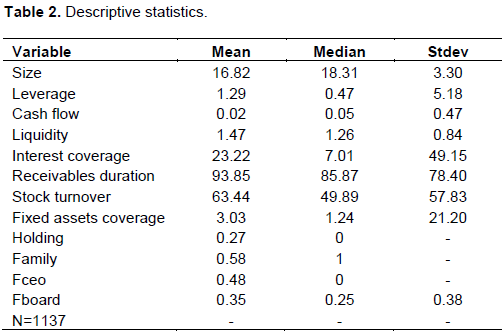

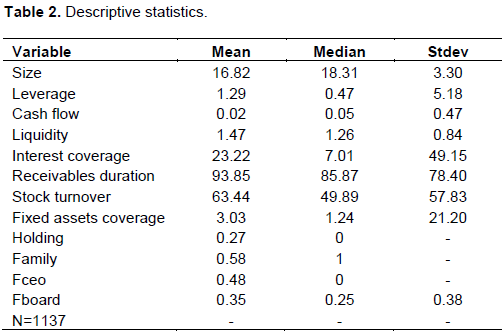

Some dummies identify whether the firm is a family company (Family), the presence of a family CEO (Fceo), the weight of family members on the board (Fboard), and whether the firm is a holding company (Holding). The definition of family firm is based on one where a family is the ultimate owner, assuming a minimum control threshold of 50%. We also use as independent variables two possible SEW moderators based on a firm’s generational stage (Gomez-Mejia et al., 2011), defining a dummy variable to distinguish firms less than twenty-five years old (first generation businesses), from the other firms and then constructing two interaction variables with Fceo and Fboard (Table 2). As Table 2 points out family firms represent 58 per cent of the sample firms, while 48 per cent are firms managed by a family CEO.

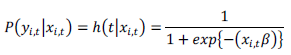

We use a discrete hazard model to account for time-varying covariates using a logistic form, under the assumption that the probability of financial distress is sufficiently small (Nam et al., 2008; Shumway, 2001). Shumway (2001) defines a multi-period logit model as “a logit model that is estimated with data on each firm in each year of its existence as if each firm-year were an independent observation”. He shows that a multi-period logit model is equivalent to a discrete-time hazard model:

where x is the vector of independent variables. This represents a duration independent model with a time invariant baseline hazard rate and is analogous to estimate an exponential hazard model in which the probability of distress does not depend on a firm’s age.

Shumway (2001) points out that using all the stacked data instead of a single period observation will improve the consistency and efficiency of the estimates. The main advantage of this methodology is a better use of the data, as it accounts for all the information related to the time variability in the explanatory variables, information that is lost in a cross-sectional design.

One disadvantage in using non- linear models, like logit and probit, is that they require a careful analysis of the interaction effects when interactions between variables are included in the model as in this case the interpretation of the interaction terms is not straightforward.

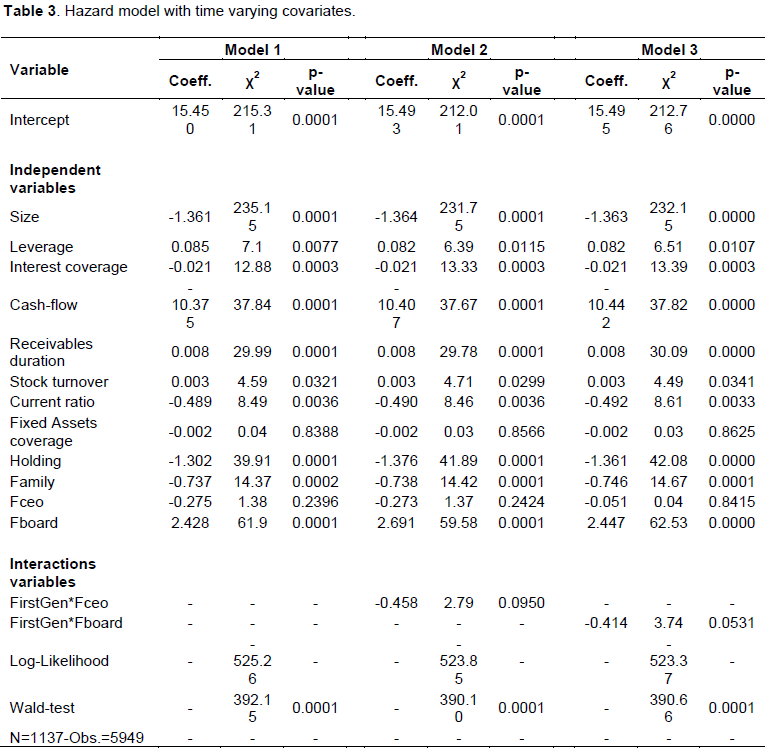

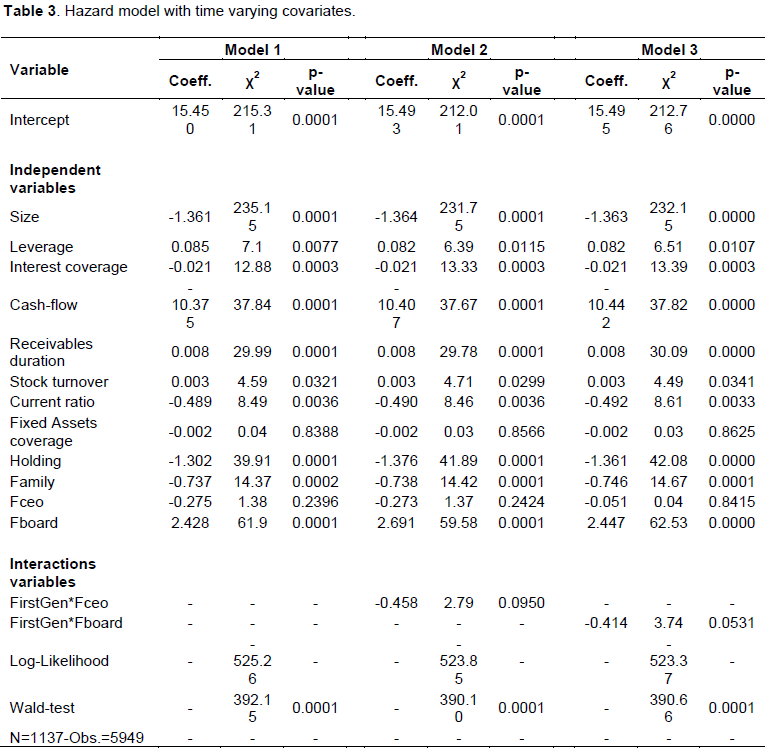

We estimate three models, assuming in all cases that the covariates change over time, to exploit the panel structure of the study database.

In the first model, the explanatory variables include the accounting variables and the dummy variables related to ownership, management and board composition. The other two models incorporate the SEW moderators based on the interaction between first generational stage and the variables that proxy for the degree of family influence, that is, the presence of a family CEO (FirstGen*Fceo) and the weight of family members on the board (FirstGen*Fboard). The two interaction variables have a sizable degree of collinearity and, to avoid any multi-collinearity problems, we do not include both variables in a single model (Table 3).

Table 3 reports three different hazard model estimates. Consistently with previous research, they indicate that larger firms and higher liquidity, interest-coverage and cash flow ratios reduce the likelihood of distress. Larger firms can rely on significant capital requirements barriers (Hall and Weiss, 1967) therefore size has a lowering effect on a firm’s financial distress probability.

Liquidity, as pointed out by empirical literature (Beaver, 1966; Altman, 1968; Daily and Dalton, 1994) decreases a company’s likelihood to get into financial troubles as it generally allows the firm to cope with short-term commitments, but the cash flow effect is stronger as it helps the company to cope with adverse changes in its operating conditions (Casey and Bartczak, 1985).

Not surprisingly interest coverage has a significant lowering effect on the probability of financial distress as literature indicates that profitability is a major source of financial health (Beaver, 1966; Altman, 1968; Daily and Dalton, 1994). The study results point out that holding companies have a lower probability of financial distress as these firms can rely on the availability of internal capital markets and on a relatively cheaper cost of funding (Meyer and Kuh, 1957).

Family firms are less likely to fall into financial distress but a higher weight of the family on the board increases the distress probability. These findings confirm previous research results (Wilson et al., 2013) suggesting that, ultimately, family businesses present a lower probability of suffering financial distress than non-family firms. Family firms’ behavior is guided not only by financial motivations but is strongly affected by the need to preserve the emotional values that owning family members derive from the business.

Family businesses are managed with a long-term survival view in order to maintain the emotional returns that a family perceives, exerting its control and influence on the business. When a family exerts its influence directly, by the means of a family CEO and not by appointing a professional CEO, the affective endowment is higher and, in the first generational stage, significantly reduces the likelihood of financial distress.

In this generational stage, the family CEO normally coincides with the business founder who is highly motivated to transfer family values, by the means of business succession, to future generations. Moreover, the presence of a family CEO means that the company is perceived as the image of the family in the community where it operates and the reputational concerns of suffering financial distress or ultimate failure are particularly high. This would also mean losing the social relationships that the family has built with the community, with suppliers and employees by its involvement in the business. A family’s sense of identification, endowment in the business and the relevance of SEW preservation, declines through successive generations, leaving room for financial goals that result in different strategic behaviors (Gomez-Mejia et al., 2011; Le Breton-Miller and Miller, 2013).

In fact, there is evidence that firms in different generational stages faced the 2008 global crisis with a different attitude towards financial risk (Arrondo-Garcia et al., 2016). Consistent with this trend, the study points out that a heavy presence of family members on the board results in different effects on the probability of financial distress depending on a firm’s generational stage.

In the first stage, it has a moderating effect on this probability. In this generational stage, when numerous family members sit on the board, the links between the founding family and the business are more intense in terms of image, family influence, and family members’ personal investment in the company.

Consequently, the concerns for a firm’s financial distress and reputation are higher. Conflicts between family members, which in this stage are normally are siblings, may occur because the goals of family members as individuals might not be aligned with those of the family unit.

However, the probable presence of the founder can smooth out conflicts and pressure from individual members may benefit the company’s well-being; in the firm’s subsequent generational stages, conflicts related to rivalry among siblings may occur and hamper other initiatives.

Moreover, when a company is in later generational stages, the family members sitting on the board belong to different nuclear families and family members’ sense of belonging and identification with the firm falls. They behave in order to fulfill the particular needs of their nuclear family, thus harming the financial health of the business.