The objective of this study is to find out the impact of savings on capital mobilization for investment in capital projects for personal economic development and educational purposes. The study used primary and secondary data. The population for the study was basic school teachers within Ho municipality of the Volta region of Ghana. Probability sampling technique was employed in selecting the sample size. From the study it was found out that teachers who save part of their salaries were able to raise financial resources to investment in projects, further their education and acquire movable and immovable properties. Findings from the study led to the conclusion that there is a positive correlation between savings and capital mobilization for other economic activities among teachers in the Ho Municipality of the Volta Region of Ghana.

INTRODUCTION

All over the world, countries, organizations, institutions as well as individuals are able to mobilize enough financial resources for investment in assets and capital projects, and for that matter their personal economic development by saving a portion of their earnings. Most developed countries that are successful have done so as a result of the effectiveness of their banks to mobilize the savings of their citizens into huge resources for the private sector for economic development. In the same way, most successful people in the world have become successful by mobilizing capital out of their savings to invest in physical assets and capital projects in order to generate additional income for the future. It is believed that successful people are people who have defined purpose in life, defined priorities and for that matter mobilize capital towards the achievement of their goals.

The level of ones savings therefore depends on what one wants to achieve in life. This by implication means that one’s future success depends on one’s ability to plan and save towards the achievement of that plan. Many people do not set goals for themselves and therefore do not plan for their future. In the absence of planning, they spend money as they get it. This therefore affects their ability to mobilize financial resources for investment in assets and economic ventures which will generate additional income for the individual and eventually lead to improved standard of living. One’s rate of saving is the percentage of one’s income that is set aside after all bills and taxes have being paid, and this affects how much one is able to mobilize for investment in assets and capital projects. Many savers place that portion of their saved income in a bank savings account or buy stock or invest in stock or bond mutual funds in order to mobilize sufficient funds for investment in assets and capital project which will generate returns and thus result in an improved standard of living of the individual in the future.

Most Ghanaians and for that matter teachers do not save a portion of their earnings and this affects their ability to mobilize financial resources for investment in assets and capital projects that will generate additional income for him/her which in effect will affect his/her economic situation and thus personal economic development. Thus saving has a direct impact on the individual’s ability to mobilize capital for investment in asset, capital projects and personal economic development. One may therefore ask, what is savings? Savings is the denying of oneself from something now, that is, making a sacrifice now, or postponing immediate gratification to enable one to put aside money which will be of more benefit later. According to the U.S Department of commerce, personal saving is defined as personal income minus the sum of personal outlays and personal taxes.

Savings can also be looked at as the willingness and the ability to minimize one’s consumption (expenditure) habits in order to set aside a fractional part of one’s income for future development. When savings is understood in this sense then it is nearly always possible for most people to make some small savings regularly towards future plans. This is because the future offers neither guarantees nor any predictability thus there is the need to restrict one’s current expense on consumption in order to build substantial investment portfolio asset that can provide asset buffers for times of future difficulty, retirement plan and/or to provide for an estate, if desired. How much you earn, spend budget and save are by far the most dominant determinants of one’s long term financial wellbeing. It is therefore important to note that one’s ability to distinguish between consumption needs and wants, and to budget for, evaluate and control one’s current expenditures determines one’s financial success in life.

In order to be able to build up enough financial resources for future personal economic development, you need to consume currently at rates that are sustainable across your life cycle while saving the rest of your income for future development. One need not participate in one of this looming personal financial train wreck in order to raise capital for investment. You can choose to limit your current spending, pay off debts and save at rates that will greatly enhance your future financial security while you are still strong and healthy. Again, short of receiving a substantial inheritance or having unusually good luck in the lottery, all you have to rely upon in life is your personal human capital or your ability to earn, budget and save. There are no other shortcuts. Thus, one should focus the great majority of his/her personal finance time on financial planning efforts that will enhance one’s personal earnings, and therefore increasing one’s personal savings which can then be invested in asset and capital projects leading to an improvement in the standard of living of the individual.

During their lives, the vast majority of people must convert their human capital into investment portfolio assets through their savings. This they must do before their ability to earn slips away with increasing age or disability. This is because everyone has an active working live period and during this period, you have to make sufficient savings that will be invested in projects in order to take care of the old age era. History tells us that economies are cyclical and downturns are bound to occur. So does it also happen in the life of people. When people are not building up personal savings, then they definitely are ill-prepared for these events and this has a negative effect on an economy as well. This is because the more the number of people who are underprepared for an economic downturn the greater the impact of the downturn on an economy. For this reason, many policy makers and researchers have been trying to come up with ways to encourage folks to save. The importance of savings to individuals includes the following:

1. Savings ensures that the saver is financially independent in the future and does not rely on debts (overdrafts, bank or cash loans) or family and friends.

2. Savings avails money for special events such as weddings, baptisms, anniversaries, vacations, etc.

3. Savings enables a person to purchase goods and services in cash, and thus qualify for cash discounts.

4. Money saved can be used as a collateral or security for loans.

5. Savings facilitate the process for establishing and/or expanding business ventures.

Exemplifying the virtue of savings are two characters in black history that saved in notable ways. Born a slave in 1777, Frank McWhorter who was often hired out to other settlers was sometimes allowed to keep some of his earnings. McWhorter had a plan for what he earned and saved: To buy freedom for himself and his family. First, he purchased his wife Lucy’s freedom in 1817 when he was 32 years. Then two years later, he purchased his own freedom. As a freed man, McWhorter used his savings to purchase property in Kentucky. He also produced saltpeter and later developed a farm in Illinois. He sold the saltpeter operations in 1829 to purchase the freedom of his son, Frank, Jr. In 1835, he bought his son Solomon, also out of slavery. By his death at age 67 McWhorter had purchased freedom for all four of his seven children born in slavery, his daughter-in-law, and two enslaved grandchildren. His descendants purchased the freedom of additional relatives after his death. All told, McWhorter’s earnings and savings bought the freedom of 16 slaves at a cost of $14,000, equal to hundreds of thousands of dollars today.

Similarly, Oseola McCarty dropped out of school during sixth grade, never to return. Born in 1908, she made a living, washing and ironing clothes in Mississippi. She lived quietly and frugally, never owning a car and never marrying. In 1995, after 75 years as a laundrywoman, she contacted the University of Southern Mississippi to donate $150,000 to scholarship for needy students. This amount was 60% of her savings, meaning she had accumulated more than $250,000. According to her, the scholarships were a way to help others. McCarty is also quoted as saying and I quote “I can not do everything, but I can do something to help somebody and what I can do I will do. I wish I could do more.”Of the lessons we can draw from these two remarkable savers, two are key.

First, the savings of a single person can impact more than just that person’s immediate family. Beyond the people he freed, McWhorter became the first black person to have found a municipality in the United States, New Philadelphia, created to fulfill the vision of America as a land of liberty and justice for all. On the other hand, McCarty’s scholarship gift was matched by donors and provided scholarship for more students than she originally planned. Secondly, any person in any circumstance can save large amounts. It is hard to imagine tougher starting blocks than McWhorter’s. Buried in 1854, he died when slavery was still legal and yet he saved and accumulated his entire life. His example could be used to put the slave masters to shame. But let us use it instead as an encouragement to save more (Carrasco, 2011).

It is an undeniable fact that many successful individuals all over the world became successful by putting aside a significant portion of their earnings and investing it in businesses, assets and capital projects which generated returns on such investment and for that matter bringing about turnaround in their lives as a result of the income that is generated from these investments thus their personal economic development. This chapter is therefore devoted to reviewing related literature on the impact of saving on capital mobilization for investment in economic and social activities for improved standard of living.

What is savings?

Savings can mean a variety of different things, it could mean insurance, simple savings accounts, capital such as livestock or other tangible assets or could mean putting cash under the mattress. Saving is a sacrifice of current consumption that provides for accumulation of capital which in turn, provides additional output that can potentially be used for consumption in the future (Gersovitz, 1988). In other words savings is the difference between current earnings and consumption. It has also been defined as deferred consumption or part of income which is not spent. Savings is also the denying of oneself from something now, that is, making a sacrifice now, or postponing immediate gratification to enable one to put aside money which will be of more benefit later.

According to the U.S Department of commerce personal savings is defined as personal income minus the sum of personal outlays and personal taxes. Savings is that part of personal disposable income that is not consumed. Income, consumption and savings are all closely linked. Economic studies have shown that income is the primary determinant of consumption and saving (Samuelson and Nordhans, 2001). Savings can also be looked at as the willingness and the ability to minimize one’s consumption (expenditure) habits in order to set aside a fractional part of one’s income for future development. When savings is understood in this sense then it is nearly always possible for most people to make some small savings regularly towards future plans. This is because the future offers neither guarantees nor any predictability thus there is the need to restrict one’s current expense on consumption in order to build substantial investment portfolio asset that can provide asset buffers for times of future difficulty, retirement plan and/or to provide for an estate, if desired. How much you earn, spend budget and save are by far the most dominant determinants of one’s long term financial wellbeing. It is therefore important to note that one’s ability to distinguish between consumption needs and wants, and to budget for, evaluate and control one’s current expenditures determines one’s financial success in life.

Types of private domestic savings

There are basically three types of private domestic savings namely voluntary savings, involuntary savings and forced savings. Voluntary savings relates to the voluntary abstinence from consumption by private individuals out of personal disposable income and by companies out of profit. It depends on ones capacity to save and willingness to save. The capacity to save also depends on three main determinants: the level of per capita income; the growth of income and the distribution of income. The willingness to save also depends, in turn on, the rate of interest the existence of financial institutions, the range and availability of financial assets, and the rate of inflation. Involuntary savings is savings brought about through involuntary reductions in consumption. All forms of taxation and insurance contributions are forms of involuntary saving. Forced savings is savings that come about as a result of rising prices and the reduction in real consumption that inflation involves if consumers cannot defend themselves.

Savings can also be classified into long term savings, medium term savings and short term savings.

1. Long term savings: typical examples of long term savings are pension funds and retirement schemes.

2. Medium term savings: typical example of medium term savings include real estate shares and long term bond.

3. Short term savings: these are savings that can be mobilized for a short period of time (excess liquidity).

Motivation for saving

Motivation is the set of forces that lead people to behave in particular ways. There is not an awful lot of motivation when it comes to ones own long-term savings plan, for that matter one needs a sure fire motivation that will keep ones ‘heels in the mud’ and one’s head above water. Learning about one’s personal motivator for saving helps in developing a hefty savings bundle without the urge to withdraw every dime within the next five to ten years. Usually, main motivators are children. Children give parents a sure-fire reason to always have money on hand; while single individuals are more motivated by, keeping themselves happy in the ‘now’. If you are an individual then this is the time to begin your excavation towards motivation. Recent theories have examined the motivation for saving among individuals. According to Virmani (1986) there are three basic reasons for savings:

1. To undertake future personal consumption.

2. To make provisions for expenditure on children and

3. To leave bequest to their heirs (and others)

Strumpel (1976) saw the motivation to save as dependent on the strength of the goals that are to be served through saving, the instrumentality of savings and the strength of the motivation to spend. Most individuals will actually use the idea of planning for a family as an excellent motivator; visualizing the perfect dream home; planning for a boat or a sports car that costs as much as a boat; a life of world travel and so on also serve as motivators. Everyone has their own personal dream, or motivation, of why they should begin and then stick to the perfect long-term savings plan.

The concept of capital

Capital is that part of wealth which can be utilized for supplementary production of wealth. As per Marshall “Capital consists of all kinds of wealth, other than free gifts of nature, which yield income”. Therefore, every type of wealth other than which assists in additional production of income is called capital. In this way, money, machine, factories etc are incorporated in capital endowed, if they are utilized in production. There is also dissimilarity amidst capital and wealth. That part of wealth which is used for auxiliary production only is called capital. Hence all capital is wealth but all wealth is not capital. For instance, furniture used in the home is wealth but if these are leased then it becomes capital. There is also a substantial difference amidst capital and income. Capital is that portion of wealth which is utilized for additional production of income.

Thus, income is the result of the use of capital. So capital is a stock whereas the income is a flow produced from capital. Capital has its own peculiarities which distinguish it from other factors of production and this includes the following:

1. Man produces capital – Capital is that wealth which is used in the manufacture of commodities. It is the outcome of human efforts.

2. Capital is variable –That is, it can be increased or decreased. If the residents of a country produce more or save more from their income and these savings are invested in factories or capital goods it increases the supply of capital;

3. Capital is itinerant than other factors of production –That is, of all other factors of production, capital is more mobile. Capital can be easily transported from one place to another;

4. Capital depreciates – As we go on using capital, the value of capital goes on depreciating. When machines are used continuously for some time, these depreciate and their value fall.

What is capital mobilization?

Mobilisation is the costly process of agglomerating capital from disparate savers for investment. Mobilising savings involves: overcoming the transaction costs associated with collecting savings from different individuals and overcoming the informational asymmetries associated with making savers feel comfortable in relinquishing control of their savings. Indeed much of Carosso’s (1970) history of Investment Banking in America is a description of the diverse costs associated with raising capital in the United States during the 19 and 20th centuries.

In light of the transaction and information costs associated with mobilizing savings from many agents, numerous financial arrangements may arise to mitigate these frictions and facilitate pooling. Specifically, mobilisation may involve multiple bilateral contracts between productive units raising capital and savers with surplus resources. The joint stock company in which many individuals invest in a new legal entity, the firm, represents a prime example of multiple bilateral mobilizations.

To economise on the costs associated with multiple bilateral contracts, mobilisaton of capital may also occur through intermediaries, where thousands of investors entrust their wealth to intermediaries that invest in hundreds of firms (Sirri and Tufano 1995). For this to occur, “mobilisers” have to convince savers of the soundness of the investments (Boyd and Smith, 1992). Towards this end, intermediaries worry about establishing stellar reputations, so that savers feel comfortable about entrusting their savings to the intermediary (DeLong, 1991; Lamoreaux, 1995).

Financial systems that are more effective at mobilising the savings of individuals can profoundly affect economic development by increasing savings, exploiting economies of scale and overcoming investment indivisibilities. Besides the direct effect of better savings mobilization on capital accumulation, better savings mobilisation can improve resource allocation and boost technological innovation. Without access to multiple investors, many production processes would be constrained to economically inefficient scales (Sirri and Tufano, 1995). Furthermore, many endeavours require an enormous injection of capital that is beyond the means or inclination of any single investor.

Bagehot (1873) argued that a major difference between England and poorer countries was that in England the financial system could mobilize resources for “immense works.” Thus, good projects would not fail for lack of capital. Bagehot (1873) was very explicit in noting that it was not the national savings rate per se, it was the ability to pool society’s resources and allocated those savings towards the most productive ends. Furthermore, mobilisation frequently involves the creation of small denomination instruments. These instruments provide opportunities for households to hold diversified portfolios (Sirri and Tufano, 1995). According to Acemoglu and Zilibotti (1997) show that with large, indivisible projects, financial arrangements that mobilize savings from many diverse individuals and invest in a diversified portfolio of risky projects facilitate a reallocation of investment toward higher return activities with positive ramifications on economic growth.

Capital formation or accretion plays a principal role in all types of economics whether they are of the American or the British type or the Chinese type. Progress is not feasible without capital formation. Capital formation refers to all the produced way of additional production such as roads, railways, bridges, canals, dams, factories, seeds, fertilizers etc. The meaning of Capital formation is that society does not apply the whole of its current productive activity to the needs and desires of immediate consumption, but directs a part of it to the tools and making of capital goods.

The essence of the process is the diversion of a part of society’s current available resources to the purpose of increasing the stock of capital goods so as to make possible an expansion of consumable output in the future.

The relationship between saving and personal development

The level of one’s savings depends on what one wants to achieve in life. This by implication means that one’s future success depends on one’s ability to plan and save towards the achievement of that plan. Many people do not set goals for themselves and therefore do not plan for their future. In the absence of planning, they spend money as they get it. This therefore affects their ability to mobilize resources for investment in economic ventures which will eventually lead to improvement in their standard of living. It is assumed that individuals plan no net-life time saving but attempt to spread their lifetime consumption evenly over their lives by accumulating enough savings during their earning years to maintain the consumption standard during retirement.

According to Farmer (2002) when people fail to spend all of their income on consumption commodities, they channel their funds through the capital market to borrowers who use the money to buy factories and machines for production. The return on investment is then used to better the lot of the individual and his/her family. The amount of income that is invested as opposed to that consumed is therefore an important determinant of economic growth because the more resources people invest now the more commodities they will be able to produce later. This will in effect impact on the standard of living of the household. Hahn (1949) therefore concluded that saving really is a virtue and that those who save indirectly raise the living standards of themselves and their fellow citizens. Hahn (a reformed proto-Keynesian) pointed out that the saver improves his/her own welfare because saving implies the transfer of means for consumption from the present, where his earnings are ample, into the future where his earnings may become scarce through old age and sickness. Furthermore, saving will increase his means through the interest he receives.

In developed countries, people depend on the credit system to be able to acquire properties and make their lives better. However in most African countries and for that matter, Ghana, the credit system is not that effective and so the only means by which people can mobilize resources to acquire properties or invest in projects is through their own savings over a period of time or through borrowing. For instance even in developed countries, like the United States of America because of the economic meltdown in 2007, which was as a result of people buying on credit and not being able to pay for their purchases, the rate of personal savings has began to increase.

Relationship between savings and capital mobilization

The question of mobilizing domestic savings for development has attracted an increasingly greater attention of researchers. United Nations (1951) states that the major source of increased domestic capital formation must be increased savings and that, developing countries should prepare programs to stimulate domestic savings involving the extension of savings institutions and measures involving taxation and in order to ensure that capital moves into the most productive uses. Awareness has grown in this field as a result of international activities. The United Nations Secretariat and International Savings Banks Association (SSBA) has been co-operating closely in the program of action aimed at assisting developing countries. To this regard they have jointly organized series of technical workshops on policies and techniques aimed at mobilising domestic savings in developing countries. Although the workshop have influenced aspects of social mobilization process, they appear to have had the most significant effect on two major aspects of the process namely, the institutional framework and incentive techniques and have been generally instrumental in creating a catalytic effect with regards to savings consciousness at the policies making level in developing countries (Wirmark, 1983).

The role of savings in an economy

Aggregate savings and investment in any economy are dependent on a number of interdependent variables. For economic planning purposes, it is important that economic planners have a true and fair idea about the quantum of savings and investment, the behaviour of people towards savings and investment and the method by which savings can be improved for investment decisions. Economic planners also need to know about the motives of savings and investment in order to frame appeals accordingly. Knowledge about savings and investment preference would also help design and implement savings instruments which effectively stimulate savings. Meanwhile, to formulate or design appropriate theories or policies to boost saving and investment in the economy, it is important for one to better understand and appreciate the savings and investment characteristics of households. Savings, according to Kenneth Davidson is a process by which present goods are transformed into future goods, that is, capital goods that produce a greater flow of consumer goods at some further point in time. According to him, present goods in the form of money are used to direct resources from consumption (the production of consumer goods) into the production of capital goods. He said from this it can be deduced that growth is the accumulation of capital goods.

Gerald (2008) however disagree with this assertion and indicated that this is misleading because it can convey the impression that growth is nothing more than the simple accumulation of capital goods. According to him capital, as Austrian school economists point out, is a heterogeneous structure consisting of complex stages of production and as more and more stages of production are added to the structure it becomes even more complex and productive. Gerald indicated that what was being suggested by Davidson was that this structure can grow faster than savings, meaning growth can occur without any sacrifice of consumption, known as magic pudding economics.

This according to Wicksell (1935) is ridiculous to suggest that you cannot add to the capital structure without sacrificing consumption. Wicksell (1935) explained that when savings take place no drag on prices need arise. The commodities of which the saver forgoes the consumption will not, in a properly ordered system, be produced at all, since the units of labour and natural resources which would have been employed in their production will now be employed in preparations for future production. Apart from some inevitable economic friction everything else will remain unchanged at the moment of saving, but production will have become more capitalistic, that is directed more towards the future, and consequently, as a rule, more fruitful.

Savings is said to be closely related to investment. By not using income to buy consumer goods and service, it is most likely that this income will serve as a resource which can be invested, by using it to produce tangible and intangible capital such as machinery, schooling, on-the-job training, among others. Saving can therefore be vital to increasing the amount of capital available. Meanwhile increased saving is said to be necessary but not a sufficient condition for investment. In many developing economies particularly Africa, saving and investment are necessary engines for capital formation hence economic growth. It has been argued that saving constitutes the basis for capital formation and capital formation constitutes a critical determinant of economic growth. Available statistics however indicate low saving mobilization base and investment in this part of the world.

In Ghana, data on household saving and investment behaviour is hardly available due to several factors including the sensitivity of financial matters. At the national or aggregate level however one can get some data. For instance, between the period 1980 to 2001 saving averaged 6.4% of total national income (Based on data available on the world bank database) the lowest in most developing countries during that period. Savings play an important role in any economy and its role is important at different levels. To understand the role of savings, one must consider who all the savers are and how it can affect the overall performance of the economy.

According to Klause et al. (1990) savings in an economy can assume one of several forms. These include personal or household savings, corporate or business savings and government savings. Of these, the household savings or personal savings has been agreed to contribute a substantial part of aggregate savings in both industrialized and developing countries. The enormous importance of the rural household sector can therefore not be overemphasized. Households save essentially for two reasons: to cover future expenses (such as children’s education, ones own education, buying durable goods, for example a car) and for retirement. Corporate or company savings are simply that part of their profits that they do not pay out to shareholders as dividends, but retain it to finance future investment in the business (the form of expansion of existing facilities and the replacement of outdated equipment).

Government also saves when its tax revenues exceed its expenditures on recurring items (such as wages, social security payments, fuel, schoolbooks, medical supplies for hospitals and others). If government tax revenues exceed these current expenses, it has money left to spend on the building of new schools, roads, bridges, and hospitals. As was observed by Mody (1983), given the present weight of the household sector in total saving, to step up the saving in the economy would require a stepping up of the saving rate in the household sector. Thus, there is the need to carefully understand the determinants of both the household saving rate and the saving pattern.

In the formation of physical assets in every economy, household savings is of utmost importance. The households undertake a substantial portion of the physical investment directly and they also make public and private corporate investment possible by the transfer of savings. The implication is that the household savings behaviour determines to a large extent whether or not investment targets have been achieved. Hence, the volume of savings of the household sector and the form in which it is held is of crucial importance, as consumption reflects the efficiency of investment of savings. The rural household sector is also of utmost importance to the Ghanaian economy in this case not only because of the income generated and the employment potentials of the sector, but also because of the limits set by this sector to the growth of other sectors. When people draw their savings and invest in shares, it usually leads to rational allocation of resources because funds, which could have been consumed or kept in idle deposits with banks, are mobilized and redirected to help companies’ management boards finance their organisations. This may promote business activity with benefits for several economic sectors such as agriculture, commerce and industry resulting in stronger economic growth and higher productivity levels of firms (

http://en.wikipedia.org/wiki/stock_exchange).

Saving which is translated into investment becomes the engine that drives economic growth. For instance savings can be used for on-lending to other people who might need the money for production purposes. The investments would create economic growth and result in job creation. Saving can serve as an answer to the lack of investment funds and dependence on foreign direct investment. Theoretically, when savings are high, investments increase and the economy grows. However, the increase in savings does not always correspond to an increase in investment. If savings are held under the mattress or otherwise not deposited in a financial intermediary like a bank, savings will not be channeled into investments by businesses. Savings should thus be encouraged in order for the funds to be directed to investment. Rostow (1958) in his stages of economic growth noted that during economic take off, the rate of effective savings and investment must rise from 5% of the national income to 10%. Saving undeniably therefore is a strategic variable in the theory of economic growth hence its role as a determinant of economic growth has been emphasized by classical economists like Adam Smith and David Ricardo.

The role of savings in economic depressions

Prior to the economic crisis that began in 2007, savings rates in the United States, United Kingdom and Europe neared record lows indicating that many individuals were using credit instead of cash for goods. These individuals were unable to repay their debt due to low saving rates, which caused extreme stress on many financial institutions in Europe and United States resulting in the economic crisis experienced in 2007. Many people also attributed the beginning of the financial crisis to the collapse of the housing market. While the housing bust indeed plays an important role, particularly in the health and stability of the banking sector, the real problem was deeper. The fluctuations observed across real estate markets over the last decade or so simply reflected sizable macroeconomic imbalances. It was the nature of these imbalances that must fully be appreciated to better understand the economic crisis.

Some comparative analysis

In a study conducted by World Neighbors in East Africa (Kenya and Tanzania) on “mobilizing assets for development” it was established that people can mobilize savings to invest in viable income generating activities for self development. In this study, World Neighbors supported communities to organize themselves into merry-go-round groups with a view to ensuring that these groups grow in size so that the level of financial resources being accumulated increase in order for members to borrow ‘substantial’ amounts to invest in viable income generating activities. The whole idea is to encourage the culture of savings as a prerequisite for building a strong foundation for mobilizing local financial assets within the community.

In this study, women groups of say 10 in a group came together and decided to contribute a predetermined amount of money every month and to donate a portion of it to one or more members every month depending on the amount they are able to collect per meeting and kept the rest as communal savings. Part of the money which they save communally becomes available to be loaned to members who require it. This borrowed portion is repaid with some interest. The beneficiaries of this saving program have been able to use the funds to purchase household items such as kitchen utensils, furniture or even improving on the housing quality.

A study in Tanzania by the same group between 1999 and 2008, in collaboration with Women’s Economic Groups Co-ordinating Council (WEGCC) showed that WEGCC targeted primarily women with a view to improving their economic situations. One of the ways of achieving this was to build on the women’s self help groups so that they can have access to adequate credit for starting up and expanding their small scale businesses. Hence WEGCC initiated a savings and credit scheme using a model which focuses on ‘solidarity group’ approach with emphasis on the importance of mobilizing own savings.

Through this model women were organized into small groups of five to seven members and assisted to establish and/or strengthen existing income generating activities. Each member group joined the scheme by buying minimum shares whose value is determined by themselves depending on the economic factors prevailing in a particular area. These shares formed the initial capital for the scheme. Individual members who qualify for loans then apply for the loans through their self help groups, stating what they want to do with the loan if they are successful. The overall goal of this program was to empower poor women socially and economically through the savings and credit scheme. The loan money was spent in a number of ways and this includes:

1. Starting up small scale businesses

2. Investing in farming activities

3. Expanding the already existing businesses

4. Paying school fees for children

5. Meeting hospital bills for family members

6. Improving the conditions of their houses

From the study discussed earlier one can safely conclude that the impact on the community members as a result of their participation in the savings and credit program are numerous. Some of the key ones are:

1. Empowerment of women economically as a result of controlling their own financial resources. This has given most women a voice within the community and a sense of self worth and respect.

2. The perception of women as mere dependants on men is changing fast as women prove that they can work as hard as men and contribute significantly to the welfare of their families. Women are now able to pay part or whole of the school fees for their children, something that they were not able to do previously.

3. The housing conditions of most families who have participated in savings and credit schemes have improved. Those who were living in temporary structures have improved their dwellings to either semi-permanent or permanent structures.

4. The general well-being of the participating households has improved over time, and they are generally better off than non-participating households.

The impact of saving on the life of an individual and on the growth of an economy can not be overemphasized. The success of many individuals and great nations depend on the contribution of personal savings and private domestic savings respectively. The analysis and presentation of results was done using figures, tables, chats and graphs in a form that is easily understandable. In all, the student researcher distributed sixty (60) questionnaires to the respondents out of which fifty eight (58) of them were retrieved for analysis.

Years of teaching experience by respondents

The respondents were asked to indicate how long they have been teaching so as to enable the student researcher determine whether they have been teaching long enough to be able to mobilize enough savings for investment in a business venture, acquire physical asset, further their education or help other less privileged in society. The data collected in this regard are presented in Table 1. The survey revealed that 48% of respondents have been teaching for between one to three years where. This is an indication that the opinions expressed in the findings of this study is largely skewed towards the views of teachers who fall into this bracket. This notwithstanding, the opinions of the other ‘minority’ groups forming a cumulative 52% of the sampled population cannot also be ignored under any circumstances.

Monthly savings attitude of respondents

The respondents were asked to indicate whether or not they saved a part of their monthly salary so as to determine whether the respondents have the desire to put aside a part of their salary to be able to mobilize enough savings for investment in a business venture, acquire physical assets, further their education or help other less privileged in society. The data collected in this regard are presented in Table 2. From a total of 58 sampled basic school teachers, it was revealed that the majority, forming 52% of the population, do not save anything from their monthly emoluments. It is equally significant to note that 48 per cent however hinted that they did save part of their monthly salary towards personal investments and other relevant causes. This is implicative of the typical Ghanaian attitude towards the culture of personal savings.

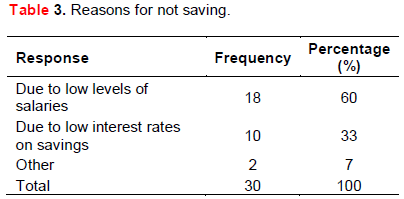

Reasons for respondents not saving

The respondents were asked to indicate why they do not save part of their earnings so as to enable the study determine the reasons for which some teachers do not save a portion of their salaries for investment in a business venture, acquire physical asset, further their education or help other less privileged in society. The data collected in this regard are presented in Table 3. The statistics on Table 3 reveals that the majority of respondents who were not saving blamed their inactions on the ‘meagerness’ of their salaries. They indicated that their monthly salaries are low; a situation that made it difficult for them to cede any percentage of it to any savings scheme or account. The second category of respondents to this question also alluded to the concerns that they were not saving any percentage of their monthly emoluments because of the seeming insignificant interest rates that banks and other savings schemes added to principals saved terminally.

Any other economic activities engaged in by respondents

The teachers sampled were asked to indicate whether they were involved in any other economic activities that yielded added incomes at the end of the month aside teaching (Table 4). It revealed that 69% of the teachers sampled were not involved in any other economic activities aside teaching. This they indicated is a situation that renders them cash trapped each month despite their commitment to their core jobs of teaching. On the contrary, 31% hinted that they were involved in other economic activities aside teaching which earned them additional income to their ‘small’ salaries each month.

Sources of funding for additional economic activities

The study was aimed at examining the sources of funding for the other economic activities engaged in by the 18 teachers who responded in the affirmative to the question on involvement in other economic activities (Table 5). Results of the survey indicate that majority of teachers who engaged in other economics activities to augment their monthly incomes had to borrow from different sources to fund these ‘private businesses’. This situation has always left them in an unpleasant financial situation since they’ve always had to pay very high interest rates on these borrowings. This situation would have been partly ameliorated had they cultivated the habits of personal savings, and other personal strategies of raising funds to start their ventures.