ABSTRACT

The aim of this study is to investigate the relationship between gender diversity and the risk profile of Italian financial institutions during the period 2013 to 2019. The paper examines whether the presence of top executives has any significant effect on corporate risk-taking. A sample of 160 Italian financial institutions was analyzed and a multivariate regression model was developed considering five risk dimensions to verify the effect of gender diversity. The results suggest that female Chief Executive Officers (CEOs), Chief Financial Officers (CFOs) and Chairmans of the Board of Directors (CHAIRs) are considerably less overconfident and less risky than their male colleagues, thus confirming a negative causation between gender diversity and risk-taking. The findings reveal that financial institutions headed by women are more risk averse since they account upper capital adequacy and equity to assets ratios. As credit risk in female-run financial institutions is no diverse from male-run financial institutions, higher capital adequacy does not come from minor asset quality because it is related to the greater risk aversion of female top managers.

Key words: Gender diversity, female directors, female xsass, risk-taking, Italian financial institutions.

The effect of gender diversity on performance and riskiness of a firm has been the focus of a number of studies in economic and finance literature for many years. The literature on board diversity has appealed a growing interest in the last few years as many studies investigated the impacts of women holding leadership positions on corporate performance and corporate governance (Burgess and Tharenou, 2002; Carter et al., 2003; Adams and Ferreira, 2004, 2009; Farrell and Hersch, 2005). Furthermore, many researchers and economists questioned whether growing involvement of women as CEOs or as directors in the board could have limited undue leverage and riskiness in the financial sector. However, the financial literature does not yet fully examine how the presence of female executives could influence risk in financial institutions and this topic has yet to be inspected particularly in financial industry. Gender diversity in boards of directors has turned into a relevant topic particularly in the financial sector since there is a significant gap between the share of women employed in financial institutions and their presence among bank managers. Even though the market of labor is now nearly equal, women have a very limited admission to higher echelons and their representation percentage in corporate decision-making bodies is still small.

The small representation of women in the upper executive positions of European financial institutions is usually associated to the phenomenon known as the glass ceiling. This is typically pictured as a set of difficulties that produces an inaccessible obstacle made up of structures, procedures, power relations, habits or beliefs that confuse the access of a woman to high directive positions (Powell and Butterfield, 1994; Adams and Funk, 2012). These characteristics may signal the presence of a glass ceiling in prior steps of the professional career of female executives, decreasing the number of possible candidates. This would suggest that a limited group of female candidates is available for the selection of a director. In such a context, the stereotypical female risk aversion is found on psychological and sociological studies (Atkinson et al., 2003). Hence, the risk adverse attitude of women is claimed to be one of the reasons why women do not reach top positions compared to men, as achieving a top position within a firm or a financial institution requires a somewhat risky attitude.

The purpose of this study is to examine the effect of gender diversity on risk-taking behavior of Italian financial institutions. The empirical results show that banks with a woman in top management positions [Chied Executive Officer (CEO), Chief Financial Officer (CFO) or Chairperson of the Board of Directors – (CHAIR)] exhibit lower levels of risk-taking variables. We assume that the gender-based behavioral variances between men and women are reproduced in the decisions of top executives and directors, inducing the main financial and strategic decisions of their firms in terms of risk appetite. For a sample of 312 Italian financial institutions, the results show a negative relationship between board gender diversity and corporate risk-taking. These findings state that women are more risk hostile than their male colleagues and especially the presence of female executives negatively impacts on the risk profile of the financial institutions significantly. Moreover, even after using many robustness tests, we find a significant suggestion that a large female representation within the board of directors or in top managerial positions affects the risk profile of the Italian financial institutions.

LITERATURE REVIEW AND HYPOTHESES DEVELOPMENT

Studies in the extent of behavioral finance harassed the possible effect of personal characters like gender diversity on financial results (Barber and Odean, 2001). Regarding the variances in risk aversion between women and men, prior literature is prone to demonstrate a superior risk aversion of women in investment decisions (Jianakipoulos and Bernasek, 1998; Agnew et al., 2003), explaining this conclusion by the minor self-confidence of women than men (Barber and Odean, 2001). Regarding corporate investment decisions, risk-taking behavior may diverge between male and female executives and especially the presence of a female CEO can affect the risk-taking behavior of financial institutions. Nevertheless, the literature is less conclusive since some authors observed a negative relationship between firm risk and the attendance of female directors (Farrell and Hersch, 2005), while others found an opposite result (Adams and Funk, 2012).

Gender diversity and corporate risk-taking

Risk-taking is a significant concern of human behavior as it depends on whether the particular behavior could lead to a specific result and whether some of these consequences are disagreeable or unwelcome (Byrnes et al., 1999). Thus, risk-taking comprises the decision- making of choices that could induce to negative consequences. Differences in gender-based behavioral have been broadly inspected in the behavioral finance and cognitive psychology’s literature. According to numerous researchers in this area, risk-taking is related to behavioral differences between men and women as they act and behave differently. The main agreement of studies on the comparison between women and men in terms of risk preferences displays that men are more likely to take risks than women (Jianakoplos and Bernasek, 1998; Sundén and Surette, 1998; Charness and Gneezy, 2012). The differences are explicated by biological factors (that is genetic differences between women and men) and are related to information processing, diligence, conservatism, psychological and social considerations, overconfidence and risk tolerance. In fact, women are less confident than their male counterparts in general (Barber and Odean, 2001; Niederle and Vesterlund, 2007) as they are less likely to aggressively behave and to take very risky decision in professional situations. Some economic and psychological studies suggest a gender-specific explanation in risk aversion as women are found to be more risk averse, than men, for instance in trading behavior. In prior literature, Sundén and Surette (1998) demonstrated that women are less incline to opt for risky assets, particularly if they are maiden because they perceive higher risks in this case. Likewise, not married women tend to be considerably more risk hostile when they allocate their total household wealth (Jianakoplos and Bernasek, 1998). Anyway, the high risk aversion of women is a gender difference that consistently is highlighted in the literature (Croson and Gneezy, 2009; Charness and Gneezy, 2012). Regarding the presence of women in top managerial positions, Francis et al. (2015) offered a significant suggestion for a greater risk aversion and a upper degree of accounting conservatism of female CFOs compared to men’s colleges. In a similar vein, Francis et al. (2014) suggested that female CFOs are less tax-aggressive.

Also, the effects of gender-based behavioral variances for financial decisions in a professional setting have received growing attention in the literature over the last years (Barber and Odean, 2001; Fehr-Duda et al., 2006; Sarin and Wieland, 2016). Furthermore, prior literature suggested that women are more risk averse and conservative than men since they show less risky behavior in individual investment decisions (Jianakoplos and Bernasek, 1998; Barber and Odean, 2001; Dwyer et al., 2002; Agnew et al., 2003; Watson and McNaughton, 2007). Also in the context of corporate investment decisions there is a huge set of empirical data on whether the presence of women in boardrooms favors risk-taking (Cosentino et al., 2012; Faccio et al., 2016), but literature is still less convincing. The research evidence in literature about the influence of gender diversity on corporate risk-taking is varied and the empirical findings are sometimes inconclusive. These investigations can be shared into two groups: those who show that gender diversity decreases the company’s risk and those who prove a positive influence or no indication of women generating an influence on corporate risk.

Farrell and Hersch (2005), Croson and Gneezy (2009), De Cabo et al. (2012) and Peni (2014) explored the impact of female leaders on investment decisions and on the risk profile of the company. The agreement of these authors is that women are more risk averse in the strategic decisions, reducing the exposure of the company to risk. The main subject in favor of the inverse relation between female managers and business risk is the variances in risk appetite based in gender diversity. Psychological and psychiatric valuations determined that women are incline to be more risk averse than male peers. The fundamental idea in the empirical investigation is that gender-based variances in risk tolerance and overconfidence persist in the professional setting where the managers’ risk preferences impact on the financial decisions of the company. On the contrary, Adams and Funk (2012) affirmed a positive relationship between female directors and firm risk while other studies (Loukil and Yousfi, 2016; Sila et al., 2016) presented no significant correlations between board gender diversity and the tendency to take financial or strategic risk-taking.

Women in top managerial positions and financial risk-taking

A few studies explored the effect of gender in financial institutions and especially about its effect on risk profile, the majority of the literature found that women are less self-confident and more risk averse than men. The main hypothesis is that risk-taking behavior varies between male and female executives in financial institutions as women engage in less risky undertakings, diminishing the bank’s level of risk exposure. Prior findings in literature concluded the risk aversion of the female leaders (Bellucci et al., 2010; Elsaid, 2014; Palvia et al., 2015; Faccio et al., 2016; Sila et al., 2016; Skala and Weill, 2018) and in particular, evidence showed that there is a statistical and economic significant role of CEO gender diversity for corporate risk decisions (Elsaid and Ursel, 2011). Moreover, companies having female CEOs count more steady earnings and lower leverage, so that they are able to better survive during a crisis period than those run by male CEOs. Likewise, Wu and Truong (2014) suggested that the presence of a female executive helps to reduce risky financial decisions. In this regard, two papers focused on loan officers’ gender and they discovered that the default rates of loans attributable to women are lesser than men’s ones (Beck et al., 2013).

On the contrary, a minority of prior studies demonstrated that the attendance of women on board raises the risk of the firms. For example, Adams and Funk (2012) concluded that Swedish women directors are more risk-loving than male directors. Also, Berger et al. (2014) reported that the risk of the financial portfolio rises if the proportion of female executives on the board of directors increases. Berger et al. (2014) inspected the effects of directors’ traits in board on risk-taking in German banks and they documented a positive relationship between female directors in boards of banks and portfolio risk.

Similarly, Zigraiova (2015) studied how the banks’ board composition can impact on risk-taking behavior for a sample of Czech bank. She obtained mixed evidence that the percentage of female directors affects the risk-taking behavior of banks depending on the different forms of Czech banks and the diverse risk variables.

The topic of the study is whether women in top management influence the risk policy of a financial institution since females are more risk avoiding than men according to most cited literature. Since women are usually less prone to take risks and are more conservative, we hypothesize that female CEOs, CFOs and CHAIRs evaluate risks more conservatively, thus holding higher level of equity capital and reducing default risk of their institutions. Hence, the hypothesis is that financial instutions with lower levels of riskiness tend to have more women in top management positions. Based on the literature review, the following research questions are proposed:

H1: There is a negative relationship between female CEO and corporate risk-taking

H2: There is a negative relationship between female CFO and corporate risk-taking

H3: There is a negative relationship between female CHAIR and corporate risk-taking

Data

This study explores the impact of gender diversity on risk-taking in the Italian financial institutions. The sample is restricted to financial institutions located in Italy as they are broadly subjected to similar regulatory and governance backgrounds. The Italian financial system (as those in other states such as Germany, Austria, Switzerland and Spain) has few large internationally active financial institutions and it is characterized by small and medium-sized financial companies. The selection procedures of the population result in a sample of 160 Italian financial institutions that are all geographically localized and active in Italy according to the Bankit bulletin statistics updated to December 31, 2019 for Italian banks. The final sample consists of 1,120 year observations from 2013 to 2019. Different types of financial institutions operate in Italy: brokerage firms (SIM), asset management companies (SGR), leasing companies, factoring companies, payment institutions, electronic money institutions (IMEL). We exclude banks from the definition of financial institutions.

The preliminary data meet the following requirements:

i) it is required that the financial institutions are Italian;

ii) it is required that the financial institutions are active over the period 2013-2019;

iii) balance sheet variables and information on corporate governance over the period 2013-2019 must be available;

iv) the Italian branches of international financial institutions, payment institutions, electronic money institutions (IMEL) are excluded from the sample.

Starting from the entire population of Italian financial institutions, we first remove from the sample the institutions that do not meet these requirements. Doing so reduces the number of financial institutions from 312 to 160 in the final sample. Data of corporate governance were manually collected from annual reports that have been downloaded from the institutions’ websites. This dataset has three main benefits for the study of the association between gender diversity and the risk profile of each institution.

First, the attendance of women in top managerial positions (CEO, CFO and CHAIR) is very frequent in the sample so that the investigation is not influenced by the specific traits of a particular woman in a top managerial position. Second, the sample is large and homogenous as all the selected institutions carry out related financial activities, under the same supervision of Bank of Italy and European Central Bank (BCE) and thus within the same regulatory environment. They are small, medium and large financial institutions predominantly involved in corporate, investment and commercial financial activities. Hence, differences in risk through the institutions are not affected by a specific business model. Third, all the financial institutions have a simple and small management structure so that the impact of female on corporate decision-making is better identified than in compound corporate governance structure where it is harder to separate the role of female executives and their individual characteristics on fundamental decisions.

Variables measurements

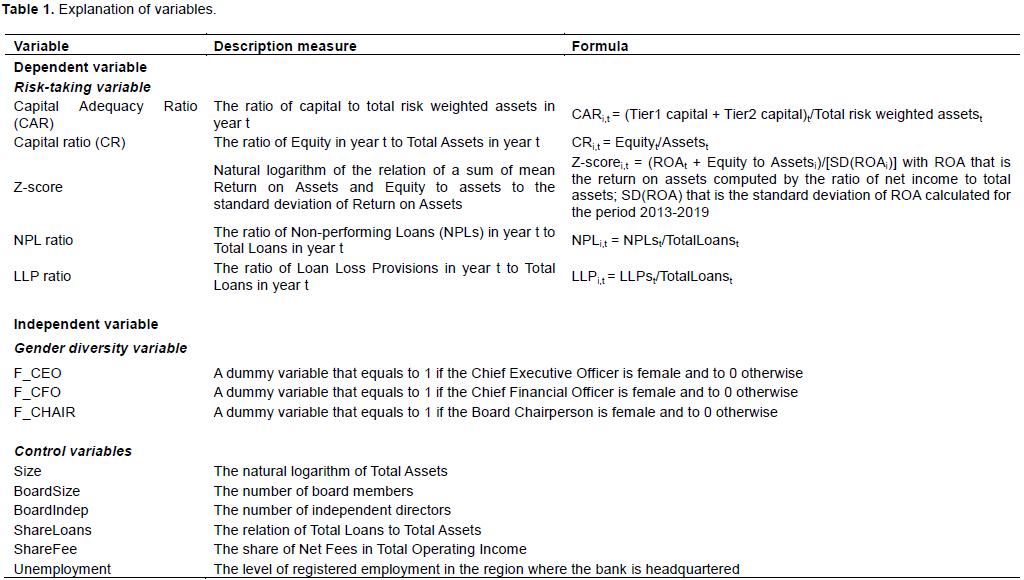

Gender diversity variables

Gender diversity is the independent variable taken into account. We proxy this variable regarding top managerial positions using three measures as follows: (i) a dummy variable (F_CEO) that equals to 1 if there is a women holding the position of Chief Executive Officer (CEO), and to 0 otherwise; (ii) a dummy variable (F_CFO) that equals to 1 if there is a women holding the position of Chief Financial Officer (CFO) and to 0 otherwise; (iii) a dummy variable (F_CHAIR) that equals to 1 if there is a women holding the position of Board Chairperson (CHAIR) and to 0 otherwise. These three explanatory variables are used to proxy gender diversity because they undoubtedly embody the most powerful management positions within the strategic decision-making process of the institution.

The data about the female CEOs, CFOs and CHAIRs are based on a personal background inquiry. To build the research, the profile of top executives was manually extracted largely from the annual reports, web sites and other appropriate sources such as AIDA and news releases. When these sources do not deliver satisfactory information, we switch to other sources until we find the needed information. In this case, the investigation is done through searching for the name of a director in social media such as, Linked-In and Facebook or researching for the name in director databases, according to the availability of required data in a certain database (e.g. Bloomberg, Boardroom insiders, Checkdirector).

Dependent variables

To analyze how gender diversity impacts on risk-taking, five alternative conventional measures of financial risk were applied that is CAR, CR, Z-score, NPL ratio and LLP ratio. The key explained variable for risk-taking is the Capital Adequacy Ratio (CAR) stated by the financial institution. The CAR - also known as Capital to Risk (weighted) Assets Ratio, is the ratio of the financial institution’s capital to its risk and it represents the most comprehensive measure about the maintenance of more or less conservative risk appetite. We also consider the Capital Ratio (CR) that is measured as the ratio of the financial institution's Total Equity Capital to Total Assets. CR is included in the model as an additional and complementary risk measure that explains whether capital is detained based on risk weightings or it is a nominal reserve buffer against adversative events. Then, we keep in mind the Z-score, which is usually expected as an indicator of insolvency risk in prior studies (Berger et al., 2009). Z-score has been commonly applied to examine the determinants of risk-taking and it has been widely used to capture financial stability of companies (Agoraki et al., 2011; Altunbas et al., 2012; Anginer et al., 2014, Lepetit and Strobel, 2015). Z-score specifies the number of standard deviation that the return on assets (ROA) has to go down below the expected value in order to reduce equity. Since Z-score is contrariwise related to the likelihood of insolvency, a high Z-score shows a low probability of failure. We also embrace in the estimations the ratio of Non-performing (Impaired) Loans to Total Loans (NPL ratio) and the ratio of Loan Loss Provisions to Total Loans (LLP ratio) as alternative measures of risk. NPL ratio is a common risk proxy as it is a credit quality measure regarding the operational activity of the financial institution (Yeyati and Micco, 2007; Berger et al., 2009; Agoraki et al., 2011; Schaeck and Cihák, 2012). Non-performing loans are those that have previously defaulted and loan loss provisions account for the related realized losses. LLP ratio is the incurred cost to banks of adjusting the loan loss reserve divided by total loans. Both ratios mirror the existing credit risk, but also the concerns of previous policy led by CEO.

Control variables

To add control variables in the regression model, the literature on the causes of financial risk were analyzed (Berger et al., 2014; Sghaier and Hamza, 2018; Skala and Weill, 2018). The selected control variables are the most common ones in earlier studies on the topic of gender diversity and risk policies of financial institutions. According to previous literature (Palvia et al., 2015; Skala and Weill, 2018), we include in the model the size of the financial institution as a control variable and defined it as the natural logarithm of total assets (Size). As a large board has superior chance of counting female members, board size were taken into account as the number of directors in board (BoardSize) and we also consider board independence as the number of independent directors (BoardIndep). Also, considered the relation of Loans to Assets (ShareLoans) and the business model of the institution, counted by the share of fees within the total operating income (ShareFee) were considered. Then, we finally controlled for the macroeconomic environment and local market conditions using the amount of registered unemployment in the region where the financial institution is headquartered (Unemployment) (Table 1).

The model

To investigate how bank risk-taking (RT) is influenced by gender diversity, the research model can be explained as follows:

Where, i refers to a financial institution; t refers to year and

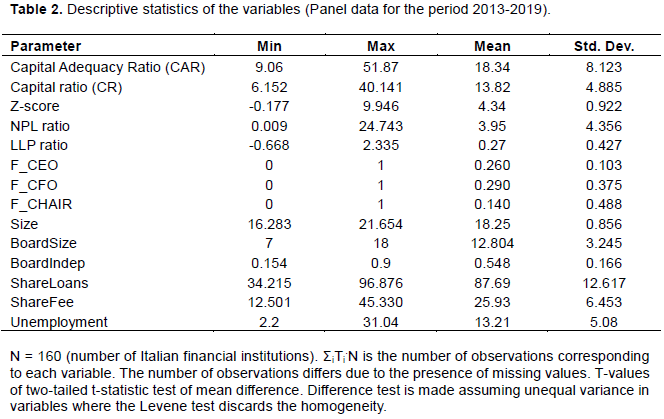

is a stochastic error term. Gender diversity is defined as the described above alternative female proxies: (i) F_CEO, (ii) F_CFO (iii) F_CHAIR. The full list of the alternative risk measures and gender variables are contained in Table 2. To measure the influence of female executives on risk-taking, we also control for the variables that could possibly impact on the bank’s risk appetite. Also these variables are summarized in Table 2.

To verify the hypotheses, we applied a linear regression model using OLS method because of its general quality of minimized bias and variance (Greene, 2004). In line with Baltagi (2001), we used panel data, which give more variability and less collinearity among the variables. The model has a number of predictors and we controlled for individual heterogeneity using a fixed effects estimation with standard errors clustered at the institution level. The choice of a fixed effects model rather than a random effects one has been confirmed with Hausman test (Baltagi, 2001). We also employed the Breusch-Pagan test to check for residual heteroscedasticity. We removed the firm-level heterogeneity through the application of cross-sectional mean deviation data (Greene, 2004). Because of the dynamic nature of this model, the least squares estimation methods produce biased and inconsistent evaluations. Therefore, we used techniques for dynamic panel estimation that deal with the biases of the estimates. To handle issues related to endogeneity, the identification of exogenous changes in gender characteristics is made by applying difference-in-difference estimation techniques as in Berger et al. (2014) to exploit exogenous changes in board composition rising from mandatory executive retirements. Concerning the presence of a causal effect from gender diversity to risk-taking behavior, the reverse causality problem is addressed by the means of instrumental variables methods, hypothesizing that the franction of male directors with board relationchips to female directors could be a valid mechanism for the franction of female directors.

This section inspects the effect of different gender diversity variables on risk-taking. The descriptive statistics of the variables are comprised in Table 3 for the entire sample.

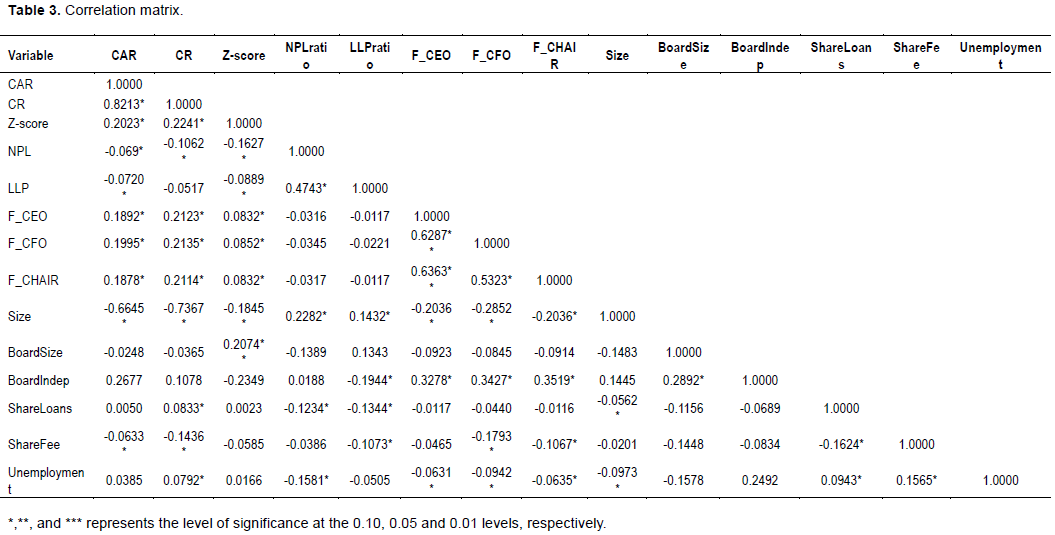

The findings show that the number of women attending on top positions is low in Italian financial institutions. A key remark is that on average the percentages of female CFOs and CEOs of financial institutions are of 29.0 and 26.0% respectively. On average, the proportion of female CHAIRs is even lower as the Board Chiarperson is a woman only in 14.0% of financial institutions. This percentage is small compared to the number of female executives in Italian industrial companies. In this regard, we can claim that women are still missing in top managerial positions. The partial attendance of women in such these working roles can be justified by the phenomenon of glass ceiling, limiting women’s ingress in the influential positions in the hierarchy. We also note that mean age of female and male executives is very similar, suggesting that gender is not influenced by an age variable. We calculate the Pearson correlations to observe the relationships between the gender diversity measures and the explanatory variables. Table 4 portrays the correlation coefficients between the variables included in the regression model.

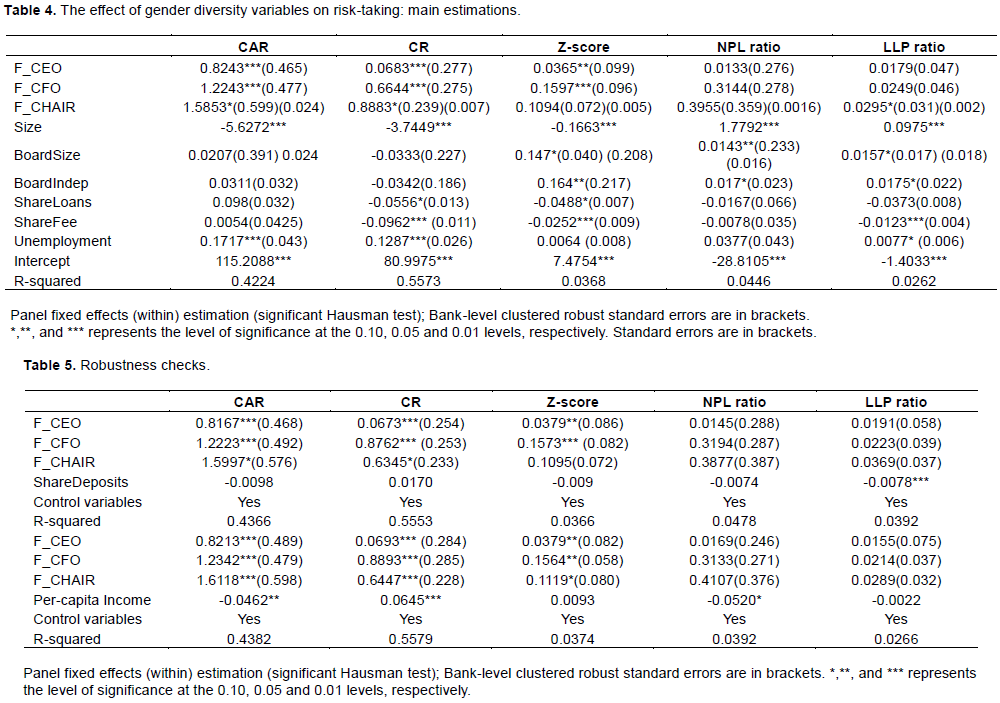

The matrix (Table 3) indicates that the correlation between the variables is not robust. The values display that multicollinearity does not appear to be a severe issue, since it is found far under the critical value. The correlation coefficients confirm that the model is reliable since the correlation between each of the variables is not high and the highest grade of it is very acceptable. We make estimates by by means of the mentioned five risk variables alternatively and we look at the effects of the explanatory variables (F_CEO, F_CFO, F_CHAIR) on risk-taking of Italian financial institutions. The findings are exposed in Table 4.

The results demonstrate that Italian financial institutions handled by female executives, record a much smaller variation in risk-taking than those run by men in top management positions. In particular, female CFOs have a negative and significant (significance at the 0.01 level) effect on risk-taking, supporting the view that women are more risk averse than men in making financial decisions. Also female CEOs and CHAIRs heading financial institutions are related with higher risk aversion contributing to drop amounts of corporate risk (significance at the 0.05 level).

The empirical results reveal that the behavioral differences between men and women may have significant consequences for corporate financial decisions. These findings confirm the hypothesis and converge with those of Faccio et al. (2016), Huang and Kisgen (2013), Barua et al. (2010), Krishnan and Parsons (2008). The conclusions of these prior studies are that female executives are less confident and more risk hostile in making financial decisions than their male counterparts.

The economic effect of gender on capital ratios (CAR and CR) is strong especially for F_CEO and F_CFO, suggesting that female-led financial institutions hold upper levels of capital buffers. The high estimation of capital ratios does not originate from minor asset quality, because no variance is detected for credit risk indicators between male-led and female-led financial institutions.

The outcomes presented in Table 4 attest that no important variances in credit risk estimations occur, as the coefficients of NPL and LLP for F_CEO, F_CFO and F_CHAIR are not enough. Capital is also reserved for balance losses suffered on Non-Performing Loans (NPLs), when loan loss reserves are not satisfactory. In this regard, it is likely that women-led financial institutions preserve higher capital ratios because they have higher credit risk. To exclude this assumption, we expected the equation using Non-Performing Loans (NPL ratio) and Loan Loss Provisions (LLP ratio) and we found no variances in credit risk between male- and female-led banks. Greater capital levels are not reserved to cover likely loan portfolio losses as female executives do not manage financial institutions with higher NPLs or larger Loan Loss Provisions (LLPs). Hence, the attendance of women in top managerial positions is allied with more prudent capital adequacy ratios for the same amount of risk.

Concerning capital adequacy, we note that gender diversity measures have a considerable positive impact on capital ratios. Especially the relation between female top managers (F_CEO and F_CFO) and CAR is positive and statistically significant (significance at the 0.01 level), supporting the view that women appointed to manage financial institutions are more risk unfriendly than their male colleagues. This finding also stands when applying CR as risk measure.

The negative relationship between gender diversity and risk-taking is also confirmed by the results when we contemplate the Z-score as a dependent variable. The coefficients regarding F_CEO and F_CFO are significantly positive (significance at 0.05 and 0.01 level respectively), which corroborating the hypothesis that financial institutions run by female executives are related to lesser insolvency risk.

To handle the endogeneity problem, we fitted the sample including only those financial institutions in which no replacements occurred during the sample period (i.e. the institutions have a male or female top manager for the total period of the analysis. The uses of a restricted sample with no changes in the top management positions provide a further check for the greater risk aversion of female top managers. Hence, these findings support the main estimations because financial institutions with a CEO, CFO or CHAIR modification over the period do not influence the results regarding the complete sample.

Additional estimations were implemented to have an extensive outlook of the relationship between gender diversity and risk. First, we re-form the estimates by inspecting subclasses of financial institutions by size to prove if the main results are verified for all sized institutions. The determinants of risk can change depending on size, consequently the influence of female top managers can change according to this variable. The size subsamples were constructed based on the median of average total assets for the entire time period. Financial institutions above the median size are classified as large institutions, while the remaining ones are ranked as small institutions.

First, we detected the positive impact of female executives on capital adequacy in the both two sub-sample, with a considerably larger impact to CAR from F_CFO in the large institutions. The effect on CR is detected for the large financial institutions only, demonstrating that F_CEOs are more inclined to maintain a high capital adequacy compared to weighted risks, rather than as a simple leverage ratio. Likewise to the principal regression outcomes, gender diversity does not impact on credit and insolvency risks in both size subsamples. This finding proves that upper capital adequacy is not correlated to persistent difficulties on the credit portfolio side.

Second, we contemplate the possible role of the macroeconomic context. Local economic environment can distress the association between gender diversity and corporate risk-taking in several ways. Regions characterized by unemployment under the median are categorized as robust economies, while the residue regions constitute the feeble economy subsample. We re-assess the equation for the two subsamples according to the mean employment over the entire time period. On the one hand, findings show that risk aversion of financial institutions improved under poor economic conditions. On the other hand, men and women respond inversely when they face loan demands because of their diverse sensibility to poverty. The estimations show that risk-taking is not prejudiced by the local economic environment since female CEOs are incline to uphold obstinately higher capital adequacy in financial institutions situated both in healthy and feeble economies. These results attest that the capital buffer is not reserved to gap a lack of heftiness in local economic environments since female-led banks display considerably higher levels of CAR and CR. Once more, credit risk is an unrelated variable in counting capital amounts, as neither the NPL ratio nor the LLP ratio shows a statistically significant coefficient for F_CEO, F_CFO and F_CHAIR. Both sets of data are not presented in a specific table to save space in the paper. In order to check the robustness of the results, we also re-estimate the main model by including two different variables. Table 5 shows these estimates.

First, we comprise the deposits to assets ratio as an explanatory variable. Specifically, this variable can be intended as an important control variable as it represents the set of assets. Since various studies validated this ratio as a measure of corporate risk, we decide to include this ratio in order to test the main estimations. We attain the same results: especially F_CEO and F_CFO are significantly positive when explaining CAR and CR, while they are not important for both credit risk measures. Second, we take into consideration the pre-capita income in the local economy and we define it as the amount of registered income in the region where the financial institution is headquartered. The aim is to comprise an added variable regarding the local economic environment as well as for the companies’ financial situation in every district. The main findings are confirmed for CAR and CR.

In this paper we investigated how gender diversity impacts on risk-taking of financial institutions in Italy. More specifically, we examined the effect of female top managers’ behaviors on risk that we captured by five different risk proxies. In the past decade, the relation between board gender diversity and firm performance has gained considerable attention from numerous scholars, but the association between female executives and risk-taking in financial institutions was unclear yet.

The analysis reveals that there is a negative and significant association between the gender of persons in top managerial positions and the risk profile of the financial institutions. In particular, the results confirm that Italian financial institutions led by female executives show a reliably high amount of capital, identified by capital adequacy (CAR) and the equity to asset ratio (CR). The economic impact of gender on capital ratios (CAR and CR) is positive and statistically significant particularly for F_CEO and F_CFO. The high capital amount does not initiate from minor asset quality, as no variance is detected for credit risk variables between male-run and female-run financial institutions. The suggestion on the greater risk aversion of female executives develops the understanding of risk-taking behavior in financial institutions. It also offers some political suggestions for regulatory authorities within the financial sector. Actions employed to restrict extreme risk-taking behavior of financial institutions should not be limited to capital requirements in order to avoid moral hazard behavior. In this regard, the effort ended by political bodies to encourage parity between women and men in top managerial positions of listed companies and financial institutions proved to be beneficial since the attendance of female directors in boards may contain corporate risk-taking. Hence, regulators could steer the corporate governance of financial institutions by promoting participation of women in corporate bodies. Nevertheless, the only provision of a quota for women is not sufficient. The prominence should be on the selection of women with managerial experience and qualifications on board of directors. The regression analysis in fact demonstrates that the attendance of women in top managerial positions influences negatively the risk profile of the institution since female CEOs, CFOs and CHAIRs tend to take more conservative risk strategies because they choose a cautious attitude to face risky decisions than their male colleagues, in line with Perryman et al. (2016).

This paper aims to bridge the research gap concerning gender diversity in Italian financial sector. In particular, the existing literature shows little empirical evidence converging on the impact of gender diversity on corporate risk-taking in financial sector and the limited studies that explored this topic focused mostly on the influence of CEO gender. Moreover, no study examines this issue in Italian financial industry. Therefore, this study contributes in several ways to the existing literature on how the attendance of women in top managerial positions could impact on corporate risk-taking. Results confirm prior studies by proposing that gender differences in risk appetite and risk tolerance can have significant consequences for business decision-making and governance. Overall, the results recognized that female executives may essentially encourage less risky financial decisions and more conservative strategies, in line with the supervisors’ interests. We believe that the effects of gender diversity on risk profile may have significant consequences for regulators, financial supervisors, depositors and other stakeholders. We can also endorse that the attendance of women in high managerial positions could have a significant impact in gaining a stable financial system eluding the disorder that can be spread to the real economy. Regulators will be able to further reduce corporate riskiness through more regulations about gender diversification. From a public political perspective, the accepted welfares of female leadership for financial stability may be of interest of regulators in setting future policies for stimulating gender equality and the progression of women in business. In general, the progression of women in financial industry may be consistent with the main supervisors’ interests since gender diversity may encompass useful complementary information for assessing the security of financial institutions.

Results must be placed in relation with the limitations of the study. Firstly, although the findings show that female top managers influence risk-taking, this does not imply that only gender diversity does matter at all. As exposed by Adams and Ferreira (2009), the influence of gender diversity in management positions depends on the setting of the firm’s internal corporate governance. Precisely, female CEOs and Board Chairpersons may growth the risk checking ability of boardrooms and thus act as an extra control mechanism in companies with fragile governance structures (Nguyen et al., 2015). Hence, it is remarkable to inspect whether the impact of board gender diversity on corporate risk-taking may be existing in firms characterized by less developed corporate governance structures. This is an interesting starting point for future research.

Secondly, this research did not observe gender diversity by female top managers’ education and demographic characteristics. Would the same or similar findings be found in different gender diversity specifications of top managers? Hence, future research could examine the influence of female management on bank risk profile by these classifications. Another potential restraint concerns the geographical location of the analysis. Would similar results be appreciated in other countries, either developed or developing? Although additional research needs to be done in a developing financial sector where very little is acknowledged about governance structure and its effect on risk profile, this research represents anyway an opportunity for women to progress into the business elite, for financial institutions to improve gender diversity in corporate governance, and for politicians looking for political measures that promote gender diversity in European financial institutions’ boards.

The authors have not declared any conflict of interests.

REFERENCES

|

Adams RB, Ferreira D (2004). Gender diversity in the boardroom. European Corporate Governance Institute, Finance Working paper. P 30.

Crossref

|

|

|

|

Adams RB, Ferreira D (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics 94(2):291-309.

Crossref

|

|

|

|

|

Adams RB, Funk P (2012). Beyond the glass ceiling: Does Gender Matter? Management Science 58(2):219-235.

Crossref

|

|

|

|

|

Agnew J, Balduzzi P, Sunden A (2003). Portfolio choice and trading in a large 410(k) Plan. American Economic Review 93(1):193-215.

Crossref

|

|

|

|

|

Agoraki M-EK, Delis MD, Staikouras PK (2011). The effect of board size and composition on bank efficiency. International Journal of Banking, Accounting and Finance 2(4):357-386.

Crossref

|

|

|

|

|

Altunbas Y, Gambacorta L, Marques-Ibanez D (2012). Do bank characteristics influence the effect of monetary policy on bank risk? Economics Letters 117(1):220-222.

Crossref

|

|

|

|

|

Anginer D, Demirguc-Kunt A, Zhu M (2014). How does competition affect bank systemic risk? Journal of Financial Intermediation 23(1):1-26.

Crossref

|

|

|

|

|

Atkinson SM, Boyce Baird S, Frye MB (2003). Do Female Mutual Fund Managers Manage Differently? The Journal of Financial Research 26(1):1-18.

Crossref

|

|

|

|

|

Baltagi B (2001). Econometric Analysis of Panel Data, 2nd ed.. John Wiley and Sons, Chichester.

|

|

|

|

|

Barber BM, Odean T (2001). Boys will be boys: gender, overconfidence, and common stock investment. The Quarterly Journal of Economics 116(1):261-292.

Crossref

|

|

|

|

|

Barua A, Davidson LF, Rama DV, Thiruvadi S (2010). CEO Gender and Accruals Quality. Accounting Horizons 24(1):25-39.

Crossref

|

|

|

|

|

Beck T, Behr P, Gűttler A (2013). Gender and banking: are women better loan officers? Review of Finance 17(4):1279-1321.

Crossref

|

|

|

|

|

Bellucci A, Borisov A, Zazzaro A (2010). Do Male and Female Loan Officers Differ in Small Business Lending?. A Review of the Literature. MoFir Working Paper No. 47, December.

Crossref

|

|

|

|

|

Berger A, Klapper L, Turk-Ariss R (2009). Bank competition and financial stability. Journal of Financial Services Research 35(2):99-118.

Crossref

|

|

|

|

|

Berger AN, Kick T, Schaeck K (2014). Executive board composition and bank risk-taking. Journal of Corporate Finance 28(C):48-65.

Crossref

|

|

|

|

|

Burgess Z, Tharenou P (2002). Women Board Directors: Characteristics of the Few. Journal of Business Ethics 37(1):39-49.

Crossref

|

|

|

|

|

Byrnes JP, Miller DC, Schafer WD (1999). Gender Differences in Risk-Taking: A Meta-Analysis. Psychological Bulletin 125(3):367-383.

Crossref

|

|

|

|

|

Carter DA, Simkins BJ, Simpson WG (2003). Corporate Governance, Board Diversity, and Firm Value. The Financial Review 38(1):33-53.

Crossref

|

|

|

|

|

Charness G, Gneezy U (2012). Strong Evidence for Gender Differences in Risk-taking. Journal of Economic Behavior and Organization 83(1):50-58.

Crossref

|

|

|

|

|

Cosentino N, Montalto F, Donato C, Via A (2012). Gender diversity in the corporate boardroom: Do women affect risk? Rivista di Politica Economica 2:73-95.

|

|

|

|

|

Croson R, Gneezy U (2009). Gender differences in preferences. Journal of Economic Literature 47(2):448-474.

Crossref

|

|

|

|

|

De Cabo RM, Gimeno R, Nieto MJ (2012). Gender Diversity on European Banks' Boards of Directors. Journal of Business Ethics 109(2):145-162.

Crossref

|

|

|

|

|

Dwyer PD, Gilkeson JH, List JA (2002). Gender differences in revealed risk-taking: evidence from mutual fund investors. Economics Letters 76(2):151-158.

Crossref

|

|

|

|

|

Elsaid E, Ursel ND (2011). CEO succession, gender and risk-taking. Gender in Management 26(7):499-512.

Crossref

|

|

|

|

|

Elsaid E (2014). Examining The Effect of Change In CEO Gender, Functional And Educational Background On Firm Performance And Risk. Journal of Applied Business Research 30(6):1605-1614.

Crossref

|

|

|

|

|

Faccio M, Marchica MT, Mura R (2016). CEO gender, corporate risk-taking, and the efficiency of capital allocation. Journal of Corporate Finance 39:193-209.

Crossref

|

|

|

|

|

Farrell K, Hersch P (2005). Additions to corporate boards: the effect of gender. Journal of Corporate Finance 11(1-2):85-106.

Crossref

|

|

|

|

|

Fehr-Duda H, de Gennaro M, Schubert R (2006). Gender, Financial Risk, and Probability Weights. Theory and Decision 60(2-3):283-313.

Crossref

|

|

|

|

|

Francis B, Hasan I, Wu Q, Yan M (2014). Are female CFOs less tax aggressive? Evidence from tax aggressiveness. The Journal of the American Taxation Association 36(2):171-202.

Crossref

|

|

|

|

|

Francis B, Hasan I, Park JC, Wu Q (2015). Gender differences in financial reporting decision making: evidence from accounting conservatism. Contemporary Accounting Research 32(3):1285-1318.

Crossref

|

|

|

|

|

Greene W (2004). The behaviour of the maximum likelihood estimator of limited dependent variable models in the presence of fixed effects. The Econometrics Journal 7(1):98-119.

Crossref

|

|

|

|

|

Huang J, Kisgen DJ (2013). Gender and corporate finance: Are male executives overconfident relative to female executives? Journal of Financial Economics 108(3):822-839.

Crossref

|

|

|

|

|

Jianakoplos NA, Bernasek A (1998). Are women more risk averse? Economic Inquiry 36(4):620-630.

Crossref

|

|

|

|

|

Krishnan GV, Parsons LM (2008). Getting to the Bottom Line: An Exploration of Gender and Earnings Quality. Journal of Business Ethics 78(1):65-76.

Crossref

|

|

|

|

|

Lepetit L, Strobel F (2015). Bank Insolvency Risk and Z-Score Measures: A Refinement. Finance Research Letters 13(C):214-224.

Crossref

|

|

|

|

|

Loukil N, Yousfi, O (2016). Does gender diversity on corporate boards increase risk-taking? Canadian Journal of Administrative Science 33(1):66-81.

Crossref

|

|

|

|

|

Nguyen T, Locke S, Reddy K (2015). Does boardroom gender diversity matter? Evidence from a transitional economy. International Review of Economics and Finance 37:184-202.

Crossref

|

|

|

|

|

Niederle M, Vesterlund L (2007). Do Women Shy Away From Competition? Do Men Compete Too Much? The Quarterly Journal of Economics 122(3):1067-1101.

Crossref

|

|

|

|

|

Palvia AA, Vähämaa E, Vähämaa S (2015). Are Female CEOs and Chairwomen More Conservative and Risk Averse? Evidence from the banking industry during the financial crisis. Journal of Business Ethics 131(3):577-594.

Crossref

|

|

|

|

|

Peni E (2014). CEO and Chairperson characteristics and firm performance. Journal of Management and Governance 18(1):185-205.

Crossref

|

|

|

|

|

Perryman AA, Fernando GD, Tripathy A (2016). Do gender differences persist? An examination of gender diversity on firm performance, risk, and executive compensation. Journal of Business Research 69(2):579-586.

Crossref

|

|

|

|

|

Powell GN, Butterfield DA (1994). Investigating the "Glass Ceiling" Phenomenon: An empirical study of actual promotions to top management. The Academy of Management Journal 37(1):68-86.

Crossref

|

|

|

|

|

Sarin R, Wieland A (2016). Risk aversion for decisions under uncertainty: Are there gender differences? Journal of Bevavioral and Experimental Economics 60:1-8.

Crossref

|

|

|

|

|

Schaeck K, Cihák M (2012). Banking Competition and Capital Ratios. European Financial Management 18(5):836-866.

Crossref

|

|

|

|

|

Sghaier A, Hamza T (2018). Does boardroom gender diversity affect the risk profile of acquiring banks?. Managerial Finance 44(10):1174-1199.

Crossref

|

|

|

|

|

Sila V, Gonzalez A, Hagendorff J (2016). Women on board: Does boardroom gender diversity affect firm risk? Journal of Corporate Finance 36(C):26-53.

Crossref

|

|

|

|

|

Skala D, Weill L (2018). Does CEO gender matter for bank risk? Economic Systems 42(1):64-74.

Crossref

|

|

|

|

|

Sundén AE, Surette BJ (1998). Gender differences in the allocation of assets in retirement savings plans. American Economic Review 88(2):207-211.

|

|

|

|

|

Watson J, McNaughton M (2007). Gender Differences in Risk Aversion and Expected Retirement Benefits. Financial Analysts Journal 63(4):52-62.

Crossref

|

|

|

|

|

Wu YW, Truong C (2014). Female Bank Executives: Impact on Performance and Risk-taking. Available at:

View

|

|

|

|

|

Yeyati EL, Micco A (2007). Concentration and foreign penetration in Latin American banking sectors: Impact on competition and risk. Journal of Banking and Finance 31(6):1633-1647.

Crossref

|

|

|

|

|

Zigraiova D (2015). Management Board Composition of Banking Institutions and Bank Risk-taking: the Case of the Czech Republic. CNB WP 14/2015, Czech National. Available at:

View

|

|

is a stochastic error term. Gender diversity is defined as the described above alternative female proxies: (i) F_CEO, (ii) F_CFO (iii) F_CHAIR. The full list of the alternative risk measures and gender variables are contained in Table 2. To measure the influence of female executives on risk-taking, we also control for the variables that could possibly impact on the bank’s risk appetite. Also these variables are summarized in Table 2.

is a stochastic error term. Gender diversity is defined as the described above alternative female proxies: (i) F_CEO, (ii) F_CFO (iii) F_CHAIR. The full list of the alternative risk measures and gender variables are contained in Table 2. To measure the influence of female executives on risk-taking, we also control for the variables that could possibly impact on the bank’s risk appetite. Also these variables are summarized in Table 2.