Full Length Research Paper

ABSTRACT

This study reviews the qualitative and quantitative research on the impact of microfinance (especially micro-credit) on the poor in Kenya to enable practitioners, donors and policy-makers understand the nature of the evidence available. Despite a large body of impact studies on the effectiveness of microfinance on the poor in Kenya, no systematic review has been conducted that brings together all these studies and evaluates the nature of the evidence of microfinance's impact on the poor in Kenya. In general, this study discovers that microcredit positively impacts the poor; however, the results are not uniform. The proposition of microfinance as the panacea for poverty and women's empowerment might be flawed. On the other hand, microcredit could cause more harm than good if the amount is spent on consumptive activities rather than investing in the future or if the businesses fail to generate enough profit. The study recommends consideration of both the potential good and the potential harm whilst making policy decisions on microfinance in Kenya. Microfinance impact assessment studies should develop a standardised methodological framework to produce consistent results. Similarly, microfinance should not be considered the only way of rescuing the poor from the chains of poverty; in fact, other structural solutions should be sought for solving structural problems such as poverty.

Key words: Microfinance, micro-credit, Kenya, micro-loans, financial services, poverty.

INTRODUCTION

Microfinance provides financial services to underprivileged and low-income earners who largely lack access to formal banking and financial services. These services include credit, savings, insurance and other primary financial products (Ki-moon, 2008). The concept of microfinance, especially microcredit, is considered to have been pioneered by the Bangladeshi entrepreneur and economist Muhammad Yunus in 1976, which entails the advancement of loans to the poor, often without collateral. His innovative experiments culminated in the foundation of the Grameen Bank. Since then, several models of microfinance have been replicated in different countries.

Grameen aims for poverty reduction, focusing mainly on women's incomes and empowerment (Adams and Raymond, 2008). Alongside women's empowerment, microfinance also targets higher income levels, wealth, fertility, education, and social welfare. Microfinance has been long assumed as a panacea for poverty eradication, encouraging growth and development within the rural sector. However, several studies have criticised microfinances and opine they do more harm than good to the economy (Hulme and Maitrot, 2014; Seenivasan, 2015; Ghosh, 2013; Warnecke, 2014; Onyuma andShem, 2005).

Other studies indicated that the commercialisation of microfinance has resulted in a mission drift from its original target groups of the poorest of the poor, toward profitable and less deprived clients (Brown et al., 2012; Hulme and Arun, 2011; Nair, 2010; Osterloh and Barrett, 2007).

With such concerns amongst academics pertaining to microfinance, several studies have been conducted studying the impact of microfinance on the social and economic status of the poor (Kandie and Islam, 2022; Lorenzetti et al., 2017; Duvendack et al., 2011).

With its origin in Asia in the 1970s, microfinance services became known in Sub-Saharan Africa (SSA) in the 1980s. The SSA is considered one of the world's poorest regions, with every second person living below the poverty line. The Kenyan microfinance industry is considered the most vibrant in the SSA, with approximately Kshs two hundred fifty billion total industry assets as of 2021. Therefore, this study seeks to find whether or not the microfinance innovation has been a success. Despite some existing studies reviewing the evidence of the impact of microfinance in Kenya, to our knowledge, a systematic study of the effects of microfinance services in Kenya does not exist, which brings together all these studies, assessing the nature of the impact of microfinance services on the poor in Kenya, enabling policy-makers, donors, providers, and interested academic to understand the nature of the evidence available. Therefore, this systematic review of the empirical evidence on the impact of microfinance on poverty in Kenya is essential to ensure whether the objective of poverty alleviation is being met.

LITERATURE REVIEW

Microfinance has emerged as an essential tool of development policy and poverty eradication to the extent that (Littlefield et al., 2003) argue that microfinance is integral to achieving the Millennium Development Goals. The basic assumption is that access to more finance will reduce poverty. However, the supporting evidence for such an impact is uncertain and contentious, partly because of the difficulties of reliability and measurement. Hence, the effectiveness of microfinance on the poor is still questionable. Reviewing the studies on micro-credit in Bangladesh (Roodman and Morduch, 2014) conclude that there is little evidence that microfinance improves clients’ lives in measurable ways.

The existing literature on microfinance reveals several studies seeking to evaluate the impact of microfinance programs; however, the results are not uniform across the board. There is a growing concern among academics that the objectives of microfinance are not met (Stewart et al., 2010). As a result, new approaches to assessing the impact of microfinance services have been developed to minimise the methodological problems associated with the studies (Meyer and Nagarajan, 2006). For instance, (Karlan and Valdivia, 2011) employed rigorous research approaches, including randomised controlled trials, to assess the impact of microfinance. Similar high-quality impact assessment studies are found within the literature which compare the impact of having a loan or savings account with not having either (Adjei and Arun, 2009; Ashraf et al., 2008; Barnes et al., 2001).

This non-uniform evidence calls for a rigorous systematic review of the evidence on the impact of microfinance on the poor. Hence, this paper aims to inform aid policy in the region and guide future research by mapping out the literature assessing microfinance across Kenya and synthesising the available evidence of impact.

METHODOLOGY

Criteria for inclusion and exclusion of studies in the review

Studies have been included and excluded under the following criteria:

Region: Microcredit impact assessments conducted in Kenya were included. Studies that included Kenya and other African or developing countries were not included in the review.

Study design: Only impact evaluations which sought to measure the outcomes, results, or effects of receiving microcredit were included. Both qualitative and quantitative data were included. Diverse methodological approaches for impact assessments were included, such as quasi-experimental, econometric and other approaches.

Randomised designs, quasi-experimental designs, regression-based approaches and other studies that met the following requirements were considered for inclusion: (1) Relevant financial or non-financial outcome variables were measured for a sample of microcredit clients. (2) included a qualitative or quantitative analysis of the extent to which changes in those outcome variables could be attributed to microcredit. Purely qualitative studies and grey literature was excluded.

Intervention: This study explicitly discusses the effects, results, outcomes, or impacts of microcredit included. Other microfinance services such as microinsurance, microsavings, or money transfers were not considered for the purposes of this review. Studies focusing on the impact of microfinance along with other microfinance services, such as savings, were not taken into account.

Population: Studies focusing on the impacts of microfinance on the poor were included.

Outcomes: Various financial and non-financial outcomes of microcredit measured in microcredit impact studies were included. Studies that analysed individuals, enterprises and households were included in the review.

Language: Relevant literature only in the English language was considered

Search protocol

To explore the effects of microcredit on poverty in Kenya, a multi-phased process to review the literature was devised. Publications from three online bibliographical databases were extracted: ScienceDirect, EBSCOhost, and Google Scholar.

Key words

The keywords used for the search process for this review have been developed by analysing the keywords found in other similar systematic reviews on the impact of microfinance.

Data were obtained from Google Scholar on August 25th 2022. The search terms were "microfinance" OR "micro-finance" OR "microcredit" OR "micro-credit" OR "microloan" OR "micro-loan" OR "microlending" OR micro-lending" AND "Kenya", which explored the titles of every published document on this database. The exact search keywords were used to identify relevant literature on other mentioned online databases.

Screening studies

The overall search strategy comprised two phases. All search results were screened during the first phase on title and abstract. Next, full-text downloads of all likely studies for inclusions were made for the second round of screening. The inclusion/exclusion criteria on study design, outcomes, and intervention were applied in this round.

All relevant papers were coded using a detailed coding framework which helped characterise the intervention, outcomes, the setting (that is, urban or rural), gender, study design, microfinance provider, and data collection method. Next, a subset of these studies was selected based on the quality criteria for an in-depth review.

Methods for synthesis

Due to the inconsistency of the measurements within outcomes and the diverse nature of the included studies concerning the study design and reporting a thematic narrative synthesis was conducted using the coding framework designed for this review. Findings within this framework were then reported qualitatively.

RESULTS

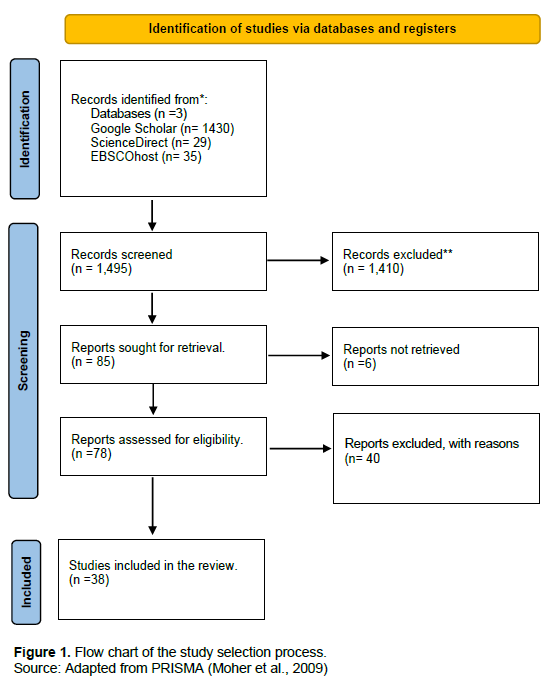

Three online bibliographical databases-Google Scholar, ScienceDirect, and EBSCO were systematically searched for microcredit evaluations in Kenya. The search provided over 1500 results. These were reduced to 85 relevant studies based on their titles and abstracts. The full texts of these 85 studies were downloaded and screened for the second time, applying the quality criteria defined for this review. With this second round of screening using the coding framework developed, 39 studies were identified to evaluate the impact of microcredit in Kenya on the poor. Grey literature on the impact of microfinance in Kenya was excluded from this review since it did not meet the inclusion criteria; however, it should be noted that with the exclusion of grey literature, the results might not entirely reflect the existing evidential base on the impact of microfinance services in Kenya. A summary of the search and screening results is illustrated in Figure 1. Thirty-eight studies were identified to evaluate the impact of microcredit on the poor in Kenya. Of these 38 studies, 22 assessed the impact of microcredit on financial outcomes, 7 evaluated the impact on non-financial outcomes, and 9 on both.

Among these 38 studies, 30 evaluated the impact of microcredit alone, whereas 8 studies assessed credit interventions along with savings or insurance or both. Some studies also assessed the impact of microfinance institutions' financial training and credit interventions.

The units of assessment within these studies varied, with 14 studies assessing the impact of microfinance at the enterprise level, 10 at the household level, 2 at the individual level, 1 at the community level, and the rest 8 evaluating microfinance impact at a combination of these three levels.

Synthesis results

Units of assessment

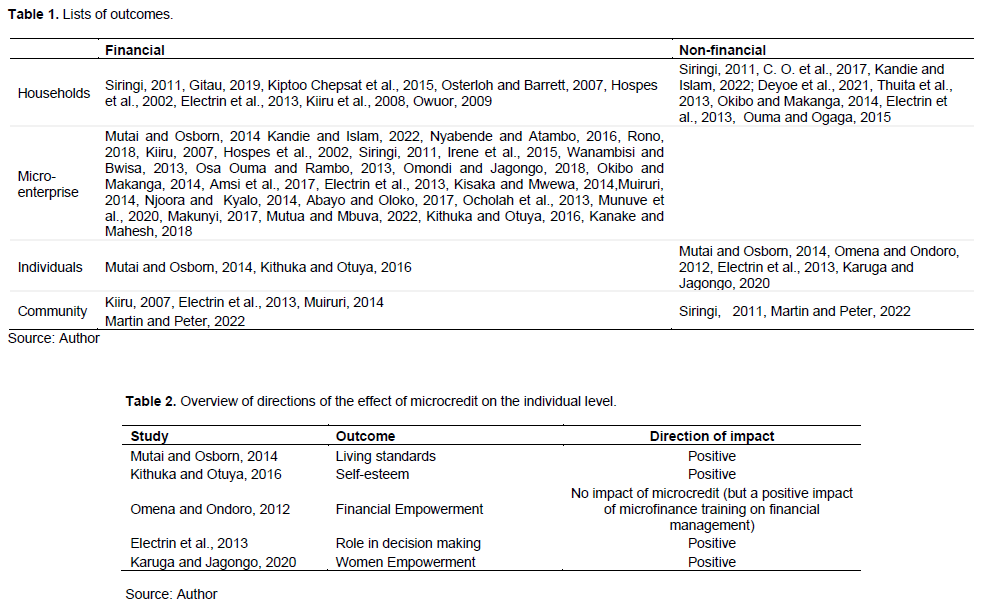

For microfinance impact studies, the most common assessment units are 'the household, the enterprise or the institutional environment within which agents operates' (Hulme, 1997:5). A majority of the studies included in this review focus on the impact of microcredit at the enterprise level; however, some studies have also attempted to present the impacts at several levels (Electrin et al., 2013; Makunyi, 2017; Mutua and Mbuva, 2022; Kithuka and Otuya, 2016). Studies focusing on multiple units of assessments provide a clearer picture of the overall impact. Studies focusing on 'the individual or the enterprise' have drawbacks that could be discredited (Hulme, 1997).

Outcomes

Traditionally, microfinance impact assessments have centred on economic indicators, with changes in income at the heart of the assessments. Other commonly assessed variables for microfinance impact assessments have assets, expenditure and consumption levels. Popular social change and empowerment variables have publication date are given. Full citations are listed in the reference section.

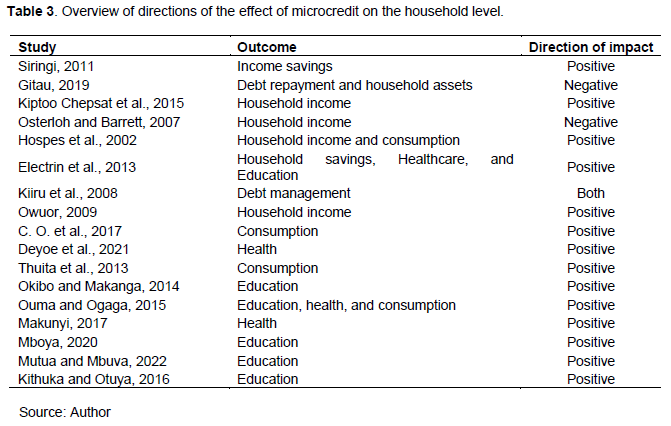

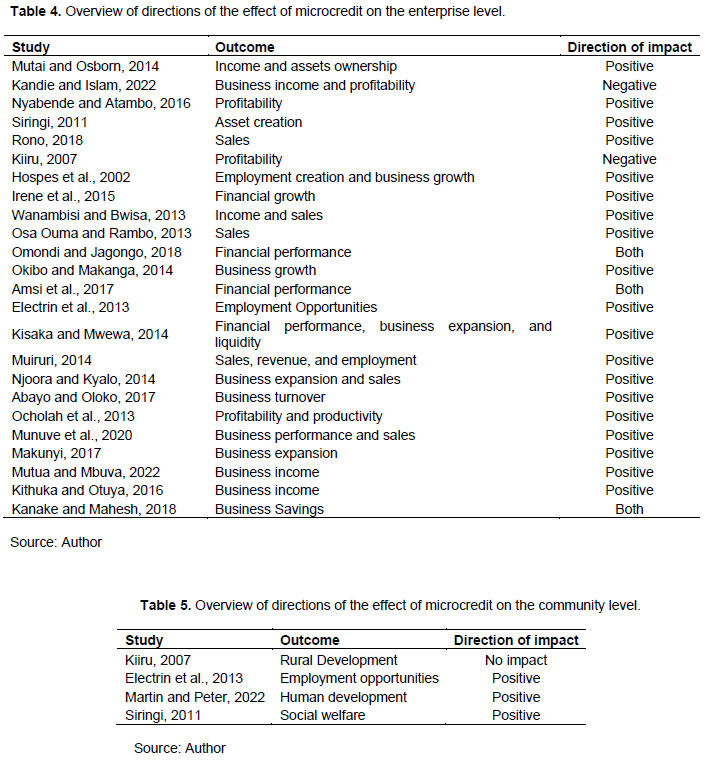

Effectiveness

Below is a summary of the directions of effect (that is, the positive or negative impacts of microfinance), particularly in relation to the outcomes within the units of assessments mentioned earlier. This is followed by a narrative synthesis of the impact of microcredit on the individual, household, enterprise, and community levels. Table 2 shows the overview of directions of the effect of microcredit on the individual level.

A summary of studies included in this review by units of assessment and outcome is presented in Table 1. For education, healthcare access, and nutrition levels. each study, the first author and the leading paper's publication date are given. Full citations are listed in the reference section.

Comparative outcome evaluations measured the impact of microcredit on the poor in Kenya at the individual level

Five studies altogether assessed the impact of microcredit at an individual level. One of these studies reported that microcredit often grant individuals greater leverage in household decisions, especially women. Microcredit significantly expanded the economic role of the receiver, regardless of gender, resulting in a change in their overall status and bargaining position within the household. Other studies also reported that access to loans positively impacted women's economic empowerment. (Omena and Ondoro, 2012), However, one study reported that microcredit had no impact on its beneficiaries; instead, the financial training interventions offered by microfinance institutions positively impacted the clients' financial management skills.

Comparative outcome evaluations measured the impact of microcredit on the poor in Kenya at the household level

Fourteen studies linked microcredit with positive outcomes at the household level. Two studies ascertained microcredit's adverse outcomes, and one found varied impacts on the poor. Broadly speaking, microfinance increased household income, which often resulted in increased expenditures on consumption and an overall reduction in the indebtedness of the house, enabling the household to increase its savings over time. The increased available income was often used to purchase household assets which might generate income. Microcredit also enabled loanees to purchase property and invest in human capital, such as education and skills training.

Comparative outcome evaluations measured the impact of microcredit on the poor in Kenya at the enterprise level

Twenty-four studies explored the influence of microcredit at the enterprise level. Of these, 19 reported positive impacts of microcredit on businesses in various domains, such as asset creation, sales, turnover, profitability, productivity,

and business income. Two studies identified adverse impacts of microcredit. In contrast, three studies highlighted varied impacts of microcredit on businesses. Of these studies, many provided the causal relationship between microcredit and increases in business incomes. However, a few studies also identified the negative impacts of loans advanced by microfinance institutions since many borrowers often fail to repay their loans and end up in a poverty trap, eventually worsening their financial situation.

Comparative outcome evaluations measured the impact of microcredit on the poor in Kenya at the community level

Beyond the individual, enterprise, and household, microenterprise interventions have an impact at the community level, if only through the aggregate effects at another level' (Sebstad et al., 1995). Four studies focused on the impact of microfinance at the community level. Three studies found positive impacts of microcredit at the community level, with net increases in employment and income at the community level. In contrast, one study found no significant impact of microcredit on rural development. The study shed light on potential risk factors associated with microcredit services, such as a 'stressful debt management schedule that could lead to under capitalisation of enterprises as well as threaten the existing social networks' (Kiiru, 2007).

Summary of the evidence of effectiveness

The current evidence from the available literature suggests that microcredit in Kenya has mixed impacts on the poor. Although, generally, it is observed that microcredit interventions have had a positive impact on the poor, however, the effects are not consistent. Osterloh and Barrett (2007) argued that microfinance institutions in Kenya primarily served high-income individuals, and microfinance initiates in Kenya do not appear to be 'pro-poor'. This calls for a careful analysis of the profiles of the borrowers from such institutions.

DISCUSSION

Summary of the findings from the evidence of impact

The diverse nature of the studies included in this systematic review does not allow giving a conclusive statement on the impact of microcredit interventions on the poor. The studies showed no consistency in their study design, outcome variables, units of assessment, gender, and setting (that is, urban or rural). More importantly, only six of these studies reported the impacts of receiving microcredit on not receiving microcredit. The rest were non-comparative outcome evaluations of microcredit which again calls for further analysis. Moreover, most studies did not consider the confounding factors at the sampling or analysis stage.

Despite including evidence from various sources, this review does not include grey literature. Including grey literature could provide a more balanced picture of the available evidence. The findings point out that microfinance services, especially microcredit, might cause more harm than good. It is also evident that microfinance services are often not pro-poor. The commercialisation of microfinance, which results in mission drift, is a significant concern in microfinance. Much attention to serving the poorest of the poor, along with a consistent methodological framework for impact assessments, is needed to arrive at a more informed conclusion on the impact of microcredit interventions.

Limitations of the study

This study tried to make the most of the available evidence in the region to inform decision-making while considering quality standards. However, there were also certain limitations in its review methodology. The evidence from diverse study designs was synthesised together, comparative and non-comparative alike. Similarly, although the study made reference to different study types, no distinction was made between them whilst reporting the findings.

Implications of the study

The evidence included from 38 studies does not fully reflect the profile of micro-credit across Kenya. The majority of the studies included were in urban settings, although they did incorporate a wide variety of providers and various lending models. The current review only focused on micro-credit and did not consider other widespread microfinance interventions such as micro-savings, micro-transfers or micro-insurance. Therefore, careful consideration of the reviewed evidence is required when applying it to specific contexts.

CONCLUSION

In general, this study finds that microcredit positively impacts the poor; however, the results are not uniform. The proposition of microfinance as the panacea for poverty and women's empowerment might be flawed (Onyuma and Shem, 2005). On the other hand, microcredit might potentially cause more harm than good if the amount is spent on consumptive activities rather than investing in the future or if the businesses fail to generate enough profit. Nevertheless, this systematic review suggests that future work in this area is warranted. Given the vast number of microfinance clients using its services in Kenya, donors, practitioners and policy-makers should work together to study the impact of microfinance programs on the poor. Addressing the existing research and methodological gaps will provide improved evidence on the impact of microfinance, with significant implications for the welfare of poor borrowers across the country.

RECOMMENDATIONS

The study recommends consideration of both the potential good and the potential harm whilst making policy decisions pertaining to microfinance in Kenya. Microfinance impact assessment studies should develop a standardised methodological framework to produce consistent results across the board. Similarly, microfinance should not be considered the only way of rescuing the poor from the chains of poverty; in fact, other structural solutions should be sought for solving structural problems such as poverty.

CONFLICT OF INTEREST

The authors have not declared any conflict of interests.

REFERENCES

|

Abayo JA, Oloko M (2017). Effect of micro-credit on growth of small business enterprises: A case of M-Shwari at Kibuye Market in Kisumu County, Kenya. |

|

|

Adams J, Raymond F (2008). Did Yunus Deserve the Nobel Peace Prize: Microfinance or Macrofarce? Journal of Economic Issues 42(2):435-443. |

|

|

Adjei JK, Arun T (2009). Microfinance programmes and the poor: Whom are they reaching? Evidence from Ghana. BWPI, The University of Manchester, Brooks World Poverty Institute Working Paper Series. |

|

|

Amsi F, Ngare P, Imo P, Gachie M (2017). Effect of microfinance credit on SMEs financial performance in Kenya. Journal of Emerging Trends in Economics and Management Sciences 8(1):48-61. |

|

|

Ashraf N, Gine X, Karlan D (2008). Finding missing markets (And A Disturbing Epilogue)?: Evidence from an export crop adoption and marketing intervention in Kenya. In Policy Research Working Papers. The World Bank. |

|

|

Barnes C, Gaile G, Kibombo R, Kayabwe S, Waalwo-Kajula P (2001). The impact of three microfinance programs in Uganda. |

|

|

Brown M, Guin B, Kirschenmann K (2012). Microfinance commercialization and mission drift. Die Unternehmung 66(4):340-357. |

|

|

Deyoe JE, Amisi JA, Szkwarko D, Tran DN, Luetke M, Kianersi S, Lee SH, Namae J, Genberg B, Laktabai J, Pastakia S (2021). The relationship between household microfinance group participation and vaccine adherence among children in rural Western Kenya. Maternal and Child Health Journal 25(11):1725-1734. |

|

|

Duvendack M, Palmer-Jones R, Copestake J, Hooper L, Loke Y, Rao N (2011). What is the evidence of the impact of microfinance on the well-being of poor people? Available at: http://www.ndr.mw:8080/xmlui/handle/123456789/1124 |

|

|

Electrin M, Mosoti JM, George GE, Mandere EN, Jonathan FM, Kagumba AM, Njenga M (2013). An evaluation of microfinance services on poverty alleviation in Kisii County, Kenya. |

|

|

Ghosh J (2013). Microfinance and the challenge of financial inclusion for development. Cambridge Journal of Economics 37(6):1203-1219. |

|

|

Gitau RG (2019). Effects of microfinance on the socio-economic status on loanee households in Limuru Constituency, Kiambu County, Kenya. International Academic Journal of Economics and Finance 3(3):136-147. |

|

|

Gopalaswamy AK, Babu MS, Dash U (2016). Systematic review of quantitative evidence on the impact of microfinance on the poor in South Asia. London: EPPI-Centre, Social Science Research Unit, UCL Institute of Education, University College London. |

|

|

Hospes O, Musinga M, Ong'ayo M (2002). An Evaluation of Micro-Finance Programmes in Kenya as Supported through the Dutch Co-Financing Programme. Steering Committee for the Evaluation of the Netherlands' Co-financing Programme. |

|

|

Hulme D (1997). Impact assessment methodologies for microfinance: A review. AIMS, USAID. |

|

|

Hulme D, Arun T (2011). What's wrong and right with microfinance. Economic and Political Weekly 46(48):23-26. |

|

|

Hulme D, Maitrot M (2014). Has Microfinance Lost Its Moral Compass? Economic and Political Weekly 49(48):77-85. |

|

|

Irene R, Charles L, Japhet K (2015). Effects of microfinance services on the performance of small and medium enterprises in Kenya. African Journal of Business Management 9(5):206-211. |

|

|

Kanake MG, Mahesh R (2018). The impact assessment of the microfinance to financial inclusion and business growth: A study of the micro, small and medium enterprises in Igembe South (Kenya). American Journal of Finance 3(1):1-30. |

|

|

Kandie D, Islam KJ (2022). A new era of microfinance: The digital microcredit and its impact on poverty. Journal of International Development 34(3):469-492. |

|

|

Karlan D, Valdivia M (2011). Teaching entrepreneurship: impact of business training on microfinance clients and institutions. The Review of Economics and Statistics 93(2):510-527. |

|

|

Karuga CW, Jagongo A (2020). The effect of microfinance on rural women empowerment in Kikuyu constituency, Kiambu County in Kenya. International Academic Journal of Economics and |

|

|

Finance 3(5):92-102. |

|

|

Kiiru JM (2007). Microfinance, entrepreneurship and rural development: Empirical evidence from Makueni district, Kenya. Global Poverty Research Group (GPRG) Conference: Oxford University, UK March 18th, 2007. |

|

|

Kiiru JM, Mburu JG, Klaus F (2008). Does participation in microfinance programs improve household incomes: Empirical evidence from Makueni District, Kenya. |

|

|

Ki-moon B (2008). Role of microcredit and microfinance in the eradication of poverty. Available at: https://jstor.org/stable/community.26619843 |

|

|

Kiptoo Chepsat F, Obara J, Makindi SM (2015). Contribution of Microfinance Credit on Poverty Reduction among the Agricultural Rural Women in Keiyo North District, Elgeyo-Marakwet County, Kenya. |

|

|

Kisaka SE, Mwewa NM (2014). Effects of micro-credit, micro-savings and training on the growth of small and medium enterprises in Machakos County in Kenya. Research Journal of Finance and Accounting 5(7):43-49. |

|

|

Kithuka EM, Otuya P (2016). Assessing the Determinants of Women Economic Empowerment: A Case Study of Faulu Kenya Microfinance, Machakos County, Kenya. Journal of Humanities and Social Science 21(2):1-6. |

|

|

Littlefield E, Morduch J, Hashemi S (2003). Is microfinance an effective strategy to reach the millennium development goals? Focus Note 24(2003):1-11. |

|

|

Lorenzetti LMJ, Leatherman S, Flax VL (2017). Evaluating the effect of integrated microfinance and health interventions. Health Policy and Planning 32(5):732-756. |

|

|

Makunyi DG (2017). Impact of microfinance institutions on poverty eradication in Meru South Sub-County, Kenya. American Journal of Finance 1(5):14-30. |

|

|

Martin KN, Peter NM (2022). Effects of Community Microfinance Fund on Human Development in Vihiga County, Kenya. Africa Journal of Technical and Vocational Education and Training 7(1):177-188. |

|

|

Mboya TO (2020). Influence of Micro Credit Institutions on Women Empowerment in Homa-Bay County, Kenya. |

|

|

Meyer RL, Nagarajan G (2006). Microfinance in developing countries: accomplishments, debates, and future directions. Agricultural Finance Review 66(2):167-193. |

|

|

Moher D, Liberati A, Tetzlaff J, Altman DG, Altman D, Antes G, Atkins D, Barbour V, Barrowman N, Berlin JA, Clark J (2009). Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement (Chinese edition). Journal of Chinese Integrative Medicine 7(9):889-896. |

|

|

Muiruri PM (2014). The role of micro-finance institutions to the growth of micro and small enterprises (MSE) in Thika, Kenya (Empirical Review of NonFinancial Factors). Available at: |

|

|

Munuve AM, Githui T, Omurwa MJ (2020). Effect of Microfinance Services on The Performance of Women Based Enterprises in Kenya: Case of Ongata Rongai Township-Kajiado County. African Journal of Emerging Issues 2(7):96-115. |

|

|

Mutai RK, Osborn AG (2014). Impact of microfinance on economic empowerment of women: The case of microfinance institutions' clients in Narok town. Journal of Global Business and Economics 8(1):1-23. |

|

|

Mutua JM, Mbuva G (2022). Microfinance services and poverty reduction in rural areas; A case of Kitui County, Kenya. International Academic Journal of Economics and Finance 3(7):205-221. |

|

|

Nair TS (2010). Commercial Microfinance and Social Responsibility: A Critique. Economic and Political Weekly 45(31):32-37. |

|

|

Ngala CO, Nguka G, Ong'anyi PO (2017). Contribution of microfinance in enhancing food access and coping strategy in aids-affected households in Kakamega County, Kenya. African Journal of Food, Agriculture, Nutrition and Development 17(3):12476-12491. |

|

|

Njoora L, Kyalo T (2014). Effects of microfinance credits on SMEs in Ngong of Kajiado County in Kenya. International Journal of Social Sciences and Entrepreneurship 1(10):395-405. |

|

|

Nyabende I, Atambo W (2016). Role of microfinance institutions on the growth of small and medium enterprises in Kisii Town, Kenya. Available at: View |

|

|

Ocholah RMA, Ojwang C, Aila F, Oima D, Okelo S, Ojera PB (2013). Effect of microfinance on the performance of women-owned enterprises, in Kisumu city, Kenya. Greener Journal of Business and Management Studies 3(4):164-167. |

|

|

Okibo BW, Makanga N (2014). Effects of microfinance institutions on poverty reduction in Kenya. International Journal of Current Research and Academic Review 2(2):76-95. |

|

|

Omena D, Ondoro CO (2012). Effect of microfinance services on the financial empowerment of youth in Migori County, Kenya. Available at: https://www.academia.edu/download/34943973/BMR_2306may312.pdf_financial.pdf |

|

|

Omondi RI, Jagongo A (2018). Microfinance services and financial performance of small and medium enterprises of youth SMEs in Kisumu County, Kenya. International Academic Journal of Economics and Finance 3(1):24-43. |

|

|

Onyuma SO, Shem AO (2005). Myths Of Microfinance as a Panacea for Poverty Eradication and Women Empowerment. Savings and Development 29(2):199-222. |

|

|

Osa Ouma C, Rambo CM (2013). The impact of microcredit on women-owned small and medium enterprises: Evidence from Kenya. Global Journal of Business Research 7(5):57-69. |

|

|

Osterloh SM, Barrett CB (2007). The unfulfilled promise of microfinance in Kenya: the KDA experience. Decentralization and the Social Economics of Development. pp. 131-158. |

|

|

Ouma RO, Ogaga W (2015). Effects of microcredit facilities on the welfare of households. Evidence from Suna East Sub-County, Migori County Kenya. |

|

|

Owuor G (2009). Is micro-finance achieving its goal among smallholder farmers in Africa? Empirical evidence from Kenya using propensity score matching. |

|

|

Rono LDC (2018). Microcredit and its relationship to the growth of small and medium enterprises in Konoin Subcounty, Kenya. International Journal of Advanced Research 6(4):961-968. |

|

|

Roodman D, Morduch J (2014). The Impact of Microcredit on the Poor in Bangladesh: Revisiting the Evidence. The Journal of Development Studies 50(4):583-604. |

|

|

Sebstad J, Neill C, Barnes C, Chen G (1995). Assessing the impacts of microenterprise interventions: a framework for analysis. Management Systems International. Available at: View |

|

|

Seenivasan R (2015). High-interest rates are an amorality in microfinance. Economic and Political Weekly 50(3):75-77. |

|

|

Siringi EM (2011). Women's small and medium enterprises for poverty alleviation in Sub-Saharan Africa. Management Research Review 34(2):186-206. |

|

|

Stewart R, van Rooyen C, Dickson K, MM, de Wet T (2010). What is the impact of microfinance on poor people? A systematic review of evidence from Sub-Saharan Africa (Protocol). Available at: View |

|

|

Thuita FM, Mwadime K, Wang'ombe JK, Thuita FM (2013). Influence of access to microfinance credit by women on household food consumption patterns in an urban low-income setting in Nairobi, Kenya. European International Journal of Science and Technology 2(3):79-88. |

|

|

Wanambisi AN, Bwisa HM (2013). Effects of microfinance lending on business performance: A survey of micro and small enterprises in Kitale municipality, Kenya. International Journal of Academic Research in Business and Social Sciences 3(7):56. |

|

|

Warnecke T (2014). The "Individualist Entrepreneur" vs. Socially Sustainable Development: Can Microfinance Build Community? Journal of Economic Issues 48(2):377-386. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0