Full Length Research Paper

ABSTRACT

This study examined the impact of oil revenue on industrial growth in Nigeria. The data for this study were sourced from Organization of Petroleum Exporting Countries Bulletin, Central Bank of Nigeria (CBN), CIA World Fact Book, and National Bureau of Statistics (NBS), publications such as the CBN statistical Bulletin and CBN Economic and Financial Review Bulletin. ADF test was conducted for stationarity and variables were all integrated at first difference; Johansen co-integration test also revealed a long-run positive influence of oil revenue growth on the industrial growth in Nigeria; VEC estimates show that the coefficient of error correction term is insignificant though with the expected sign and low magnitude of 3.5%. The R2 of 0.9328 and R2 adjusted of 0.8717 collectively show that 87.17% of changes in industrial growth was explained by the movement in the explanatory variables incorporated in the model. The study recommended a sustained policy formulation and implementation in the industrial/petroleum sector of the economy through the involvement of stakeholders. The formulation and implementation of oil revenue should be judiciously used to facilitate infant industries through advanced industrial policies like import substitution, among others. Also, the government should be sensitive of company taxes and interest rates charged on loanable funds as it may scale many investors; it makes Nigeria economy more business friendly relative to other developing countries. Nigeria industrial sector should begin to focus on the production of capital goods while national security should be strengthened and tightened to curb the activities of Boko Haram, armed robbers, kidnappers and ethnic militants so as to protect and encourage investment in the country.

Key words: Industrialization, oil revenue, diversification and company income tax.

INTRODUCTION

The need to promote industrial sector has continued to be a major concern of most developing countries. The reason for this awakened interest in industrialization can be traced to the fact that a significant level of industrialization offers a place in a growing economy. Since Nigeria’s independence in 1960 different administrations have introduced policies targeted at not only diversifying the country’s economy but making industry the engine of economic growth. Some of these policies include the import substitution approach and the indigenization programme. Import Substitution or Resource based Strategy was adopted under the First National Development Plan (1962–1968) essentially to enable the country import capital goods like machinery, tools and spare parts and by so doing, facilitate the assembly of these products within the country, while encouraging the manufacture of consumer goods. Though still largely dominated by low technology light industries (Dare-Ajayi, 2007), the introduction of the indigenization policy as contained in the Nigerian Enterprises Promotion Decree of 1972 reserved certain categories of industrial activity, mostly services and manufacturing, for Nigerians (Ikpeze et al., 2004) which Nigerian shareholders obtained majority shares in companies hardly changed the control of neither the companies nor the relationship with their parent companies. Several policies like Industrial Policy in 1988, Structural Adjustment Programme (SAP) in 1986 can be argued that it further worsened the already difficult situation of Nigeria’s industries. For instance, the liberalization of the foreign exchange regime and the high interest rate associated with the period was to lead to inflation and low purchasing power of consumer. Further, a collapse of basic infrastructures and social services since early 1980s accompanied this trend (World Fact Book, 2013).

Though the GDP composition by sector revealed that industrial growth has a relatively higher sectoral contribution of 43% to the Nigeria economy with the Industrial production growth rate of 0.9% in 2013 (NBS, 2014).The Nigerian economy is heavily dependent on the oil sector, which, accounts for over 95 percent of export earnings and about 40 percent of government revenues according to the International Monetary Fund. According to the International Energy Agency, Nigeria produced about 2.53 million barrels per day, well below its oil production capacity of over 3 million barrels per day, in 2011 (Wikipedia, 2015). The average daily crude oil production in the Second Quarter of 2014 was recorded at 2.21 million barrels per day as against 2.11 million barrels per day in the corresponding quarter of 2013, an increase of 0.10 million barrels per day or 4.7%. In addition, the US dollar price of crude increased significantly from an average price of 104.31 in Q2 2013 to 112.25 in Q2 2014, an increase of 7.6 percent. Thus, oil revenue was valued at ?2,633,328.61 million in nominal terms in the Second Quarter of 2014, compared to ?2,633,328.61 million recorded in the corresponding quarter of 2013. Real growth in the Oil sector was recorded at 5.40% in Q2 2014 (-5.22% quarter on quarter), indicating better performance compared to 16.42% growth recorded in Q2 of 2013(NBS, 2014). However, there is dearth of information about the impact of oil revenue on industrial growth in Nigeria, given rise to the basic question: To what extent does oil revenue impact industrial growth in Nigeria. This study therefore seeks to fill this gap in knowledge by examining the impact of oil revenue on industrial growth in Nigeria which has recently remained unclear. The objectives of the study are to:

i. examine the trend of industrial growth in Nigeria

ii. determine the causal relationship between oil revenue and industrial growth in Nigeria

iii. analyze the impact of oil revenue on industrial growth of Nigeria economy

Hypotheses

H01: There is no causal relationship between oil revenue and industrial growth in Nigeria

HO2: Oil revenue has no significant impact on the industrial growth of the Nigeria economy

CONCEPTUAL FRAMEWORK

Industrialization

According to Oxford Dictionary of Economics industrialization is the process of moving resources into the industrial sector. The total output of all the facilities producing goods within a country’s manufacturing output; the output of all factories in a country is a subset of industrial output. Industrialization is about the introduction and expansion of industries in a particular place, region or country (Obioma and Ozughalu, 2005). Anyanwu et al. (1997) describe industrialization as the process of building up a nation’s capacity to convert raw materials and other inputs to finished goods and to manufacture goods for other production or for final consumption. Industrialization enhances the utilization of productive inputs (labour, capital and raw materials), given the country’s technology, to produce non-durable and durable consumer goods, intermediate goods and capital goods for domestic consumption, export or further production. Thus industrialization could be described as the process of transforming raw materials, with the aid of human resources and capital goods into (a) consumers goods, (b) new capital goods which allows more consumers goods (including food) to be produced with the same human resources, and (c) social overhead capital, which together with human resources provides new services to both individuals and business (Ekpo, 2005). Kirkpatrick et al. (1981) posited that industrialization involves a number of changes in economic structure of a country such as a rise in the relative importance of manufacturing industry; a change in the composition of industrial output; and changes in production techniques and sources of supply for individual commodities

Theoretical framework

It is imperative and noteworthy to examine whether oil revenue can enhance industrial growth to help curtail economic growth and to definitely establish whether the theories reviewed has any linkage to the stated problem under study. Using the Dutch disease theory which states that, the discovery of a natural resource (primary) has negative consequences which results from any large increase in foreign currency, including foreign direct investment, foreign aid or a substantial increase in natural resource prices. The impediments of oil revenue to economic growth and development of oil-dependent states at the neglect of other sectors is what is cumulatively called Dutch Disease in the literature of development economics (Otawa, 2001). The enormous influx of cash resulting from oil tends to foster, overzealous and imprudent expenditure. High oil revenue raises exchange rates, promotes adverse balance of payment as the cost of imports rises. In fact, it kills incentive to risk investment in non-oil sectors, the competiveness of all non-oil sectors such as agriculture and manufacturing industries would be crowded out. If the employment of both labour and other resources has been exchanged for unemployment as the government and private expenditure multipliers have been exported abroad. Together, these forces constitute what Michael (2001) calls the rentier effect, oil states being “rentier states”. The study also reviewed the unified growth theory that is consistent with the preceded Industrial Revolution through the gradual shift in the workplace to larger and more centralized production units leading the industrial growth.

Empirical review

Ekpo (2014) revealed that in a quest for industrialization in Nigeria, different industrial policies have been implemented. The study explores the industrial policies and the performance of industrial sector. The study showed that the policies, identified as ISI, EPI and FPII have not helped Nigeria to attain the required level of industrialization that can produce dynamic change in the economic structure of the country and the performance of industrial sector especially manufacturing had been below expectation. The study revealed that the policies have a common feature of foreign inputs reliance which makes their successful implementation in Nigeria very costly and recommends proper conception and implementation of industrial policy, human capital development especially sciences and technical education for skill development, acquisition of relevant technology in the world, massive public investment in the provision of roads, rail system and electricity, and completion or rehabilitation of industrial core projects especially iron and steel projects.

Riman et al. (2013) had set forth in their study to explore the intertwining relationships that exist between oil revenue shock, non-oil export and industrial output in Nigeria. In achieving the objective the study utilized data spanning the period 1970-2010. This period captured the major era of regime shift (changes in governance) and policy administration in Nigeria. Vector Autoregressive (VAR) model and cointegration technique were used to examine the long run relationship, while the Vector Error Correction Model (VECM) was used to analyze the short-run behavior of the variables. The Johansen cointegration analysis suggests that a long run behavior exists between oil revenue shock, non-oil export, policy/regime shift and industrial output in Nigeria. The short-run result showed that the speed at which industrial output will converge towards long-run equilibrium after experiencing shock from oil revenue is very slow. It therefore would take a very slow process for industrial output to recover from shock arising from variation in oil revenue. The long run result shows that oil revenue shock and policy/regime shift had negative impact on industrial output and non-oil export. The impulse response function and variance decomposition analysis suggest that the major drivers of industrial development in Nigeria are non-oil export, regime shift and oil revenue. Thus innovations from these variables impact severely on industrial growth in Nigeria. The study therefore suggested among other things that the panacea to industrial growth in Nigeria rest on diversifying the economy away from crude oil export and ensuring a stable government in Nigeria that will endure long enough to sustain industrial and other economic policies.

RESEARCH METHODOLOGY

This research work is fundamentally analytical and descriptive as it embraces the use of secondary data in examining the oil revenue and industrial growth in Nigeria. The data for the study were obtained mainly from secondary sources, particularly from Organization of Petroleum Exporting Countries Bulletin, Central Bank of Nigeria (CBN), CIA World Fact Book, and National Bureau of Statistics (NBS), publications such as the CBN statistical Bulletin and CBN Economic and Financial Review Bulletin. Data were sourced from the internet and other related literature. Of course, the descriptive tool consists of graphs, descriptive test statistics while the analytical tools consist of the econometrical tests (e.g unit root test, causality test, co-integration test and error correction test).

According to Sakellaris (2000), the production of gross output in an industry is described by the following equation:

Yt = Ztf(UtKt, LtMt) - - - - - (1)

Where,

Zt is a factor that captures disembodied technological change, Lt is labor input, Mt is materials input, ![]() =

= ![]() +

+![]() is the sum of the capital stock of structures and equipment respectively, and Ut is the rate of utilization of capital in production. The capital stocks are the outcome of past investment decisions by industry firms and of depreciation due to use according to the following equations:

is the sum of the capital stock of structures and equipment respectively, and Ut is the rate of utilization of capital in production. The capital stocks are the outcome of past investment decisions by industry firms and of depreciation due to use according to the following equations:

![]() =

=![]() ,- - (2)

,- - (2)

![]() =

=![]() - - - - (3)

- - - - (3)

It is assumed that investment, I, becomes productive with a lag of one period, that is, there is “time to build". The index q measures the technical efficiency of different vintages of equipment. Note that in equation (1) the study gives the assumption that there is no embodied technological change in structures.

The production function given by (1) is essentially a description of how a mix of inputs, one of them being technology, leads to a certain amount of output being produced. It is generally used to describe operations in a production function. Firms do not usually operate at full capacity but find themselves utilizing only part of their capacity to produce output. This results to lack of information on the inputs; firms would choose if they were to operate at capacity and how much output they would produce as a result of the current levels of technology. Conceptually, the functional form in (1) should describe operations at capacity as well. Thus, the firms in the industry have the capacity to produce according to the following equation.

![]() =

= ![]() f(

f(![]() ,

, ![]() ,

, ![]() )- - - - (4)

)- - - - (4)

Where

Lc and Mc are the levels of labor and material inputs when capital is utilized at capacity. Note that capital utilization at capacity, ![]() , may not be equal to one.

, may not be equal to one.

Capacity utilization is then defined as,

cut = ![]() - - - - - - (5)

- - - - - - (5)

Assuming a linear production function by Cobb-Douglas,

![]() f(K,L,M) =

f(K,L,M) = ![]() - - - - (6)

- - - - (6)

then equation (6) becomes:

![]() =

= ![]() +

+ ![]() + +

+ + ![]() + +

+ + ![]() +

+ ![]() - - - - - (7)

- - - - - (7)

Thus, the model that was estimated in the course of this study is stated stochastically as:

InINGR= b0+b1InOILR+ b2InCTAX + b3InINTR+ b4InREXR + Ui - - - - (8)

Where;

INGR = Industrial Output (growth rate) in Nigeria

OILR = Oil Revenue growth rate in Nigeria

CTAX = Company Income Tax

INTR = Real Interest rate

REXR = Real exchange rate

b0 = Constant Intercept

b1-b4 = Slope of Coefficients of the explanatory variables that

are captured in the model.

Ui = Stochastic disturbance term.

In = Natural logarithm

The paper used both descriptive statistical tools and econometric tools. The study used the Augmented Dickey Fuller Test (ADF) to ascertain the stationary properties of the time series .The ADF formula was specified as:

![]() - - (9)

- - (9)

Thus, Granger causality test was employed to determine the causal relationship between the variables under study. There are four possible outcomes regarding causal relationships: unidirectional causality, bidirectional causality and finally, lack of any causal relationship between variables. It is thus stated as:

yt = a0 + a1yt – 1 + … + alyt – l + b1xt – 1 +…+ blxt–l + et (10)

xt = a0 + a1xt – 1 + … + alxt – l + b1yt – 1 +… + blyt–l + ut - - - - - - - (11)

for all possible pairs of series in the group.

The ECM incorporates both the short run and the long run effects. The purpose of the ECM is to indicate the speed of adjustment from the short-run equilibrium to the long-run equilibrium state. The greater the coefficient of the parameter, the higher the speed of adjustment of the model from the short-run to the long run state will be. Therefore, equation (8) can be represented to include ECM to reflect the short run dynamics as:

![]() =

= ![]() +

+ ![]() +

+ ![]() +

+ ![]() +

+ ![]() +

+ ![]() +

+ ![]() - - - - (12)

- - - - (12)

Data presentation and analysis

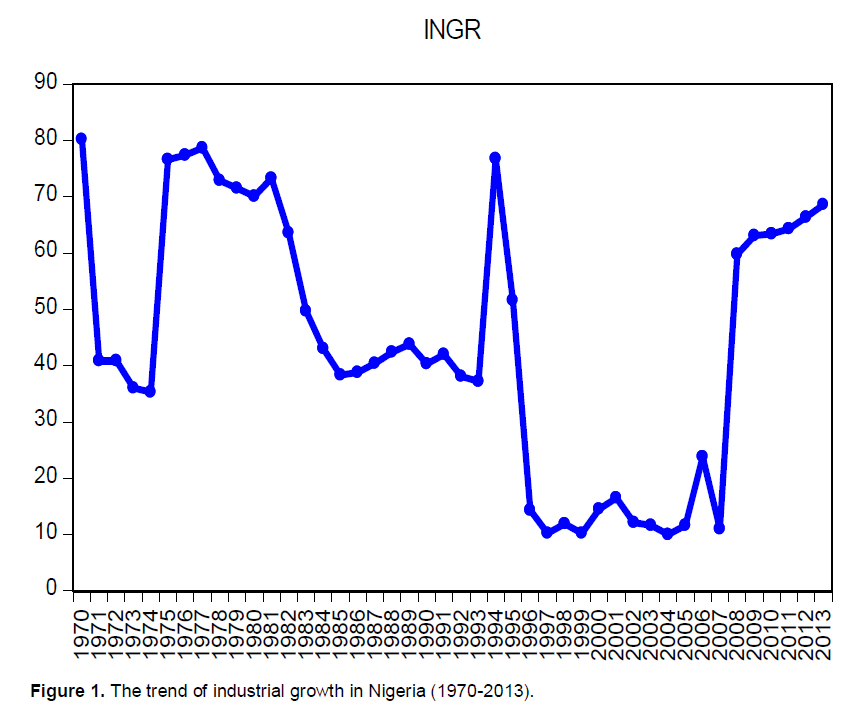

The trend analysis of industrial growth in Nigeria (1970-2013)

It can be observed from the trend of industrial growth (Figure 1) that there has been a downward trend in the growth of industrial output from 1971 to 1974, 1983 to 1993 and 1996 to 2007. Although the trend indicated smooth ups and downs which clearly indicate that there are fluctuations in industrial growth, it is very uncertain whether it is a function of oil revenue until ascertained by its significant impact on the industrial output in Nigeria.

RESULT OF THE DESCRIPTIVE STATISTIC

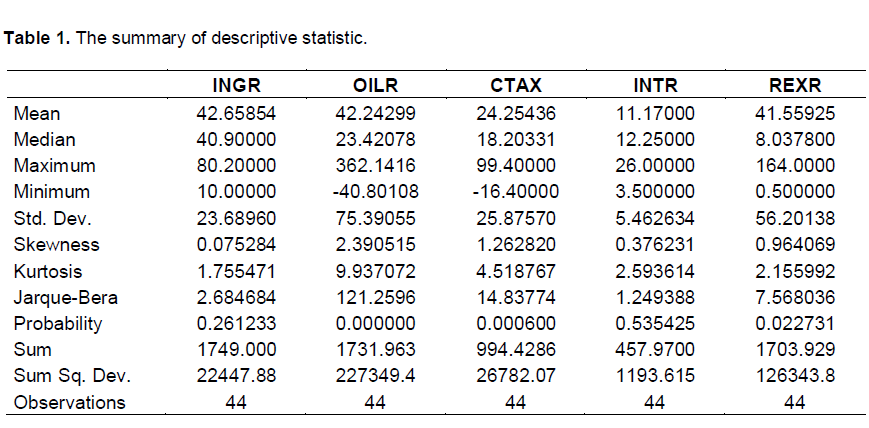

A cursory look at the 44 observations in Table 1 has revealed that, between 1970 to 2013, the industrial growth, growth rate of oil revenue, company income tax, interest rate and real exchange rate averaged about 42.7, 42.2, 24.3, 11.2 and 41.6% and the maximum value of the industrial growth, growth rate of oil revenue, company income tax, interest rate and real exchange rate recorded in 1970, 1995, 1991, 1993and 2013 are 80.2, 362.1, 99.4, 26, 164 respectively; with their corresponding

minimum values of 10%, -40.8%, -16.4%, 3.5%, and 0.5 been captured in 2004, 1998, 1983, 1976 and 1980 respectively. The deviation of industrial growth, growth rate of oil revenue, company income tax, interest rate and real exchange rate showed 23.7, 75.4, 25.9, 5.5 and 56.2 respectively. However, the variables that would have been considered ideal for economic growth were estimated at 40.9, 23.4, 18.2, 12.3 and 8%. It is worthy to note that the total unit of industrial growth, growth rate of oil revenue, company income tax, interest rate and real exchange rate was computed at 1749, 1731.963, 994.4286, 457.97 and 1703.929% respectively. The Jarque Bera test of normality for the variables revealed biasness (for INGR and INTR) and no bias (for OILR, CTAX and REXR) as reported by the high (INGR and INTR) and low (OILR, CTAX and REXR) probability value, as well as high and low skewness and kurtosis statistics respectively.

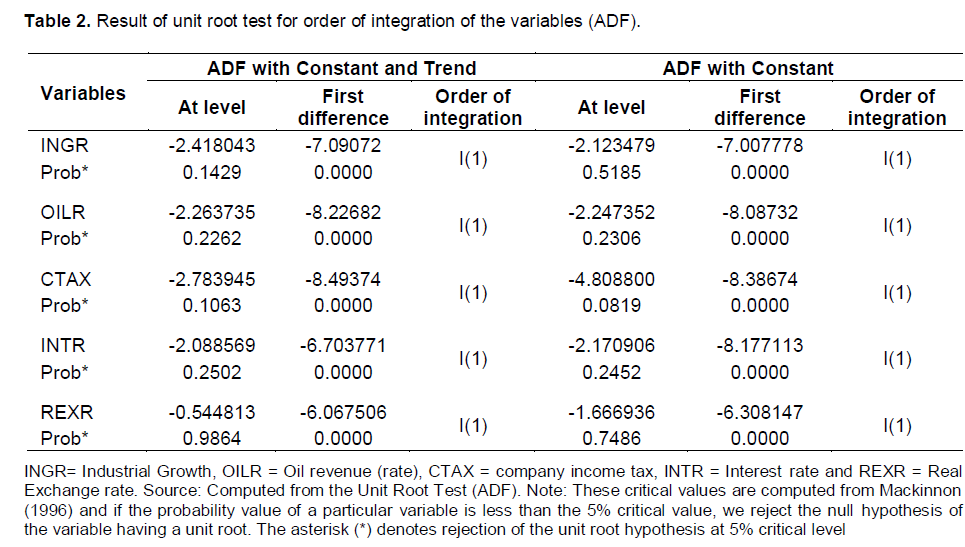

Result of unit root tests

The test result of the Augmented Dickey fuller statistic for the time series variables used in the estimation are presented in Table 2.

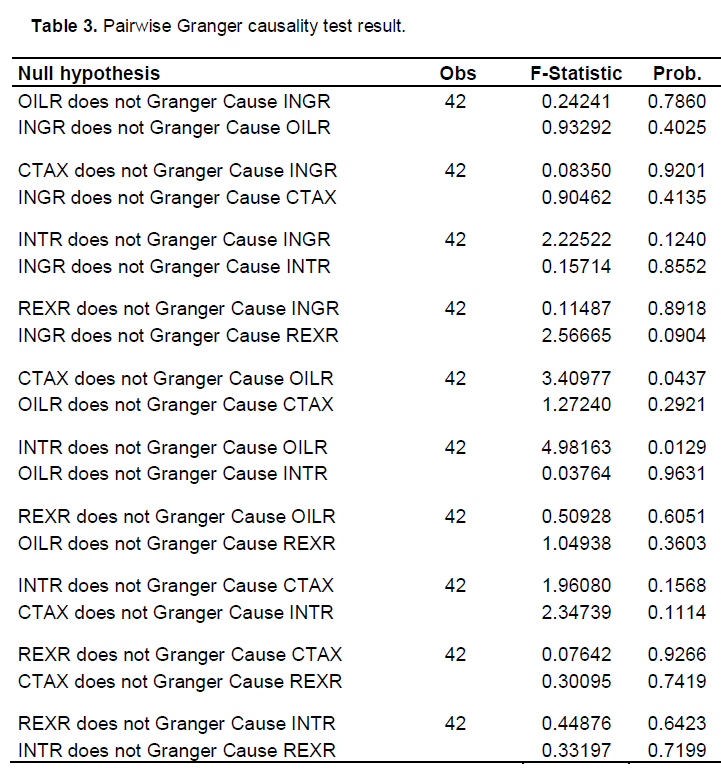

Results of pairwise Granger causality

The results of pairwise granger causality spanning 1970-2013 in Table 3 revealed that there is unidirectional relationship between interest rate and oil revenue in Nigeria running from Interest Rate (INTR) to the growth of oil revenue (OILR) and between Company Income Tax (CTAX) and OILR running from CTAX to OILR all at 5% critical level. Pairwise granger causality reported no causal relationship between oil revenue growth and industrial growth in Nigeria.

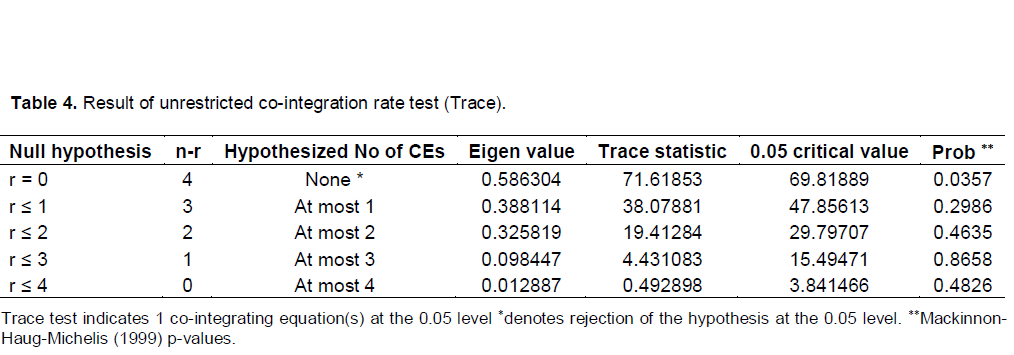

Johansen hypothesized co-integration result

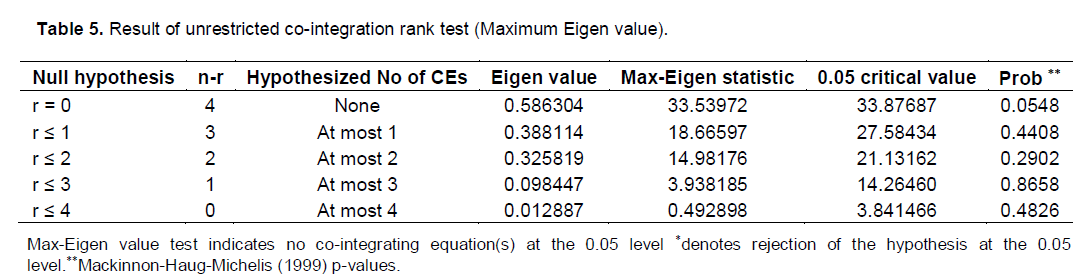

The Johansen hypothesized co- integration was carried out to determine the number of stationary long run relationship among the variables included in the study. It offers two tests, the trace test and the Eigen value test, with a view to identify the number of co-integrating relationships.

From Table 4 it is revealed that there is co-integration among the variables. This is because the trace statistic of 71.61853 is greater than the critical value of 69.81889 at 5% level of significance. We reject the null hypothesis of none * of the hypothesized number of co-integrating equations. Accordingly, Trace statistic test indicates 1 co-integrating equations at 5 percent level of significance. For the remaining number of hypothesized co-integrating Equations (at most 1, 2, 3 and 4), we do not reject the null hypothesized as their trace statistics values are less than the critical values at 5 percent level of significance.

Also, the Eigen value test rejects the null hypothesis if the Eigen value test statistics exceeds the respective critical values. From Table 5, it is revealed that, there is no co-integration among the variables. This is because none of the Max-Eigen statistics is greater than the critical value at 5% level of significance. We therefore do not reject the null hypothesis of any null hypothesized number of co-integrating equations meaning that there is no co-integrating equation reported in the Max-Eigen test. Thus, the numbers of hypothesized co-integrating equations (none, at most 1, 2, 3 and 4) were not rejected since their Max-Eigen statistics values were less than the critical values at 5 percent level of significance. Evidenced from the Trace statistics, there is a long-run relationship between industrial growth and oil

revenue in Nigeria.

The impact of oil revenue on industrial growth in Nigeria (Long-run)

In order to determine the nature of the long run relationship by the reversed coefficients using the normalized Johansen co integrating equation based on the lowest log likelihood.

It is stated as:

InINGR= 0.664497InOILR - 0.378231InCTAX

(0.11495) (0.35555)

+ 0.452815InINTR + 0.462066InREXR

(1.62894) (0.12212)

Note: Standard Errors in parenthesis.

The coefficient of OILR is correctly signed (positive). The coefficient of the oil revenue is statistically significant at 5% critical level. It implies that, any unit change in OILR will lead to 66.4% increases in Industrial growth (INGR). Thus, there is a strong positive and significant relationship between oil revenue and industrial growth in Nigeria. This signifies that, oil revenue growth is statistically significant at 5% critical level in influencing the industrial output in Nigeria in the long run during the time under study. This is consistent with the findings of Riman et al. (2013) who suggested that a long run behavior exists between oil revenue shock, non-oil export, policy/regime shift and industrial output in Nigeria.

More so, the coefficient of CTAX is correctly signed (negative). The coefficient of the company income tax is not statistically significant at 5% critical level. Although, it implies that any percentage change (increase) in CTAX will lead to 37.8% decreases in industrial growth. This finding conform the theoretical underpinnings of the relationship. This may not be unconnected with the behavior of investors towards increase in taxes.

Furthermore, the coefficient of interest rate and real exchange rate are positive which has negated the apriori expectation of negativity and statistically insignificant (interest rate).

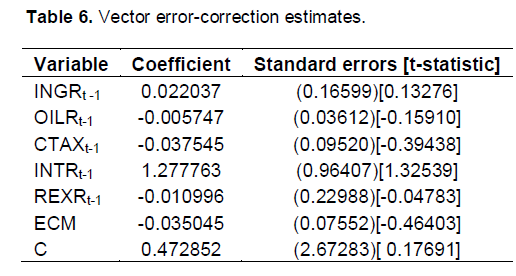

Empirical results of the dynamic model (ECM)

There is long run equilibrium relationship among the variables in the regression model; however, it is the short-run that transmit to the long-run. Thus, error correction mechanism is therefore used to correct or eliminate the discrepancy that occurs in the short-run. The coefficients of the explanatory variables in the error correction model measure the short-run relationship. Thus, the first order specification of the model VAR is selected with a constant and a time trend. The results are summarized in Table 6.

The short run estimates in Table 6 shows that, INGR in the current period (t) is influenced by 0.472852 holding all other variables constant.

The coefficient of INGRt-1 (that is in the previous year) is correctly signed, being positive though not statistically significant at 5% level. This implies that any percentage change (increase) in INGR in the previous year will lead to 0.022(2.2%) increases in the current INGR. (i.e INGRt).

More so, the coefficient of OILRt-1 is not correctly signed being negative. Beside it is not statistically significant at 5% critical level. Thus, there is no strong and significant relationship between oil revenue and industrial growth in the short run. Although it implies that, any percentage change (increase) in OILR in the previous year will lead to -0.0057(0.57%) decreases in industrial growth. The coefficients of CTAXt-1 and REXRt-1 are correctly signed while INTRt-1 is incorrectly signed. Both variables are not statistically significant at 5% critical level.

Furthermore, the coefficient of error correction term is insignificant though with the expected sign but low magnitude (-0.035045). Its magnitude indicates that if there is any deviation the long run equilibrium is adjusted slowly where about 3.5% of the disequilibrium maybe removed each period (that is, each year).

It is obvious from the coefficient of multiple determinations (R2) that the model has a good fit as the independent variables were found to jointly explain 93.28% of the movement in the dependent variable with the R2-adjusted (R2) of 87.17%. The fitness of the model is continued by the F statistic which is significant at 15.15096 which explains the overall significance of all the variables incorporated in the model. Coefficients of the short run dynamics show that, oil revenue is not statistically significant at 5% critical level indicating that, oil revenue does not significantly affect the industrial growth of the Nigerian economy in the short-run.

CONCLUSION AND RECOMMENDATIONS

The study concludes that oil revenue has positive significant influence on industrial growth in the Nigeria economy in the long run. Though oil revenue from the empirical literature reviewed is not efficiently managed evidenced by its insignificant relationship with industrial growth in the short run, continous accumulation of this revenue has positive significant effect in the long run. The study therefore recommends that:

i. There should be sustained policy formulation and implementation in the industrial/petroleum sector of the economy through the involvement of stakeholders at both the formulation and implementation of petroleum policies.

ii. Oil revenue should be judiciously used to facilitate infant industries through advanced industrial policies like import substitution, among others. Import of capital goods like machinery, tools and spare parts should be encouraged as it will help in facilitating the assembly of these products within the country

iii. Government should be sensitive with the level of company taxes and interest rate charged on loanable funds as it may increase the number of investors, and make Nigeria economy more business friendly relative to other developing countries. This would increase invest-ment by private individuals, multi-national companies as it would assist the manufacturing sector to achieve economic growth and development. Thus investment should be encouraged through tax incentives. This would lead to more industries that would lead to more industrial output.

Iv. To sustain industrialization in Nigeria, manufacturing production should begin to focus on the production of capital goods. Government should make conscious and deliberate efforts to negotiate and acquire available technology in the world in specific areas like industrial sector.

v. National security should be strengthened and tightened to curb the activities of Boko Haram, armed robbers, kidnappers and ethnic militants so as to protect and encourage investment in the country. While industrial core projects (ICPs), such as Ajaokuta Iron and Steel Plants, among others, embarked upon by the government should be completed or rehabilitated and make to function properly in the country.

vi. The study also suggests that Small and Medium Scale Entrepreneurs should be encouraged since they are the major drivers of the production of products for non-oil export.

CONFLICT OF INTERESTS

The author has not declared any conflict of interests.

REFERENCES

| Anyanwu JC, Oyefus A, Oaihenan H, Dimowo FA (1997). "The Structure of the Nigerian Economy". Onitsha, Nigeria: Joanee Educational Publishers Ltd Dare-Ajayi D (2007), "Recent Trends and Patterns in Nigeria's Industrial Development", Afr. Dev. 32:139-155 | ||||

| Ekpo UN (2014). "Nigeria Industrial Policies and Industrial Sector Performance: Analytical Exploration", IOSR Journal of Economics and Finance (IOSR-JEF) e-ISSN: 2321-5933, p-ISSN: 2321-5925. 3(4):01-11 www.iosrjournals.org www.iosrjournals.org | ||||

| Ekpo AH (2005). "Industrialization and Nigeria"s Economic Development" in The Challenges of Industrialization : A Pathway of Nigeria Becoming a Highly Industrialized Country in the Year 2015, Nigerian Economic Society, Ibadan, pp.3-26. | ||||

| Hirschman AO (1953). The Strategy of Economic Development, 1st Edition, New Haven. | ||||

| Ikpeze N, Soludo C, Elekwa N (2004), "Nigeria: The Political Economy of the Policy Process, Policy Choice Implementation" in Soludo C, Ogbu O, Chang H (eds.), The Politics of Trade and Industrial Policy in Africa: Forced Consensus?, New Jersey: Africa World Press/IDRC | ||||

| Michael R (2001). "Crude Oil Politics. Atlantic: Monthly April, Transparency International Corruption Perception Index". | ||||

| National Bureau of Statistics (2014). "Nigerian Gross Domestic Product Report, Quarter two 2014", Abuja–Nigeria. | ||||

| Obioma EC, Ozugahalu UM (2005). "Industrialization and Economic Development: A Review of Major Conceptual and Theoritical Issues". In: The Challenges of Industrialization: A Pathway to Nigeria becoming a Highly Industrialized Country in the Year 2015, Nigerian Economic Society, Ibandan pp.63-97. | ||||

| Otawa, M. (2001). "The National Security Strategy of the United States", Washington DC: US Government Printing Office. | ||||

| Riman HB, Akpan ES, Offiong AI, Ojong CM (2013). "Nexus between Oil Revenue, Non-oil Export and Industrial Output in Nigeria: An Application of the VAR Model", Int. J. Financ. Econ. 1(2):48-60. | ||||

| Sakellaris P (2000). "Production Function Estimation with Industry Capacity Data", University of Maryland and Board of Governors of the Federal Reserve System. | ||||

| Wikipedia (2015). "Petroleum industry in Nigeria", www.wikipedia.com. | ||||

| World Fact Book (2013). "Central Intelligence Agency. | ||||

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0